August 19th Market Update

Weekly numbers courtesy of the VREB.

| August 2019 |

Aug

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 205 | 375 | 594 | ||

| New Listings | 371 | 608 | 972 | ||

| Active Listings | 2914 | 2876 | 2519 | ||

| Sales to New Listings | 55% | 62% | 61% | ||

| Sales Projection | — | 671 | |||

| Months of Inventory | 4.2 | ||||

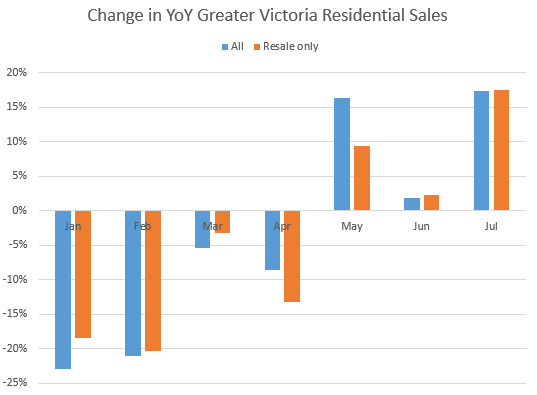

It’s deep into the summer and many are on vacation but the market has stayed relatively active these last few weeks. Condo sales are coming in roughly at the same level as last year, but single family sales have picked up, increasing around 17% over the last three weeks compared to the same period last year. Sales overall are currently on pace for a 13% increase over last year, but if we have more weeks like the last one it will be more than that. At this pace we would end up at just above the long run average for August sales. Not fantastic, not dead slow either. Just.. well.. about average. The problem there is that inventory right now is about 22% below that same long run average, so the middling sales levels are still resulting in a relatively active market. Why? A combination of substantially reduced mortgage rates from last year, a few people that have managed to improve their situation enough in the last 18 months after the mortgage stress test to qualify again, some increased inventory (+13%) and more pricing flexibility from sellers.

However the more important reason is that regulators cut short the market rally and consumers aren’t weary of housing yet. The market has cooled drastically in the last 3 years but buyers are still lusting after houses, and consumer sentiment has not turned to apathy yet as it does in downturns. I believe it will take a shift in that consumer sentiment or a substantial downturn in the economy to weaken prices further. Right now the economy is looking increasingly worrying in the medium term but no one knows when exactly it might turn downward. There are some worried incumbent politicians on both sides who are praying it holds out to at least this fall and next. Despite some easing in house price growth, I would still classify this as a high risk time. Not necessarily high risk to buy as everyone has different means, but high risk to overleverage yourself. In times like these, you want to make sure you have the buffers to withstand a downturn.

Thanks for the update and having a comments section – very helpful since I plan on moving to buy a Sf in Victoria in the next few months

What if one’s property value is 80% land and 20% building? How would that influence the decision to spend money on improvements if one were approaching it from a purely economic standpoint?

New post: https://househuntvictoria.ca/2019/08/23/this-time-for-real-construction-eases-in-victoria/

if you sold then you have no stake in that strata – dont see a problem there .. its like buying stocks .. if divined increased on the stock you sold .. does it matters?

Typical banks, trying to intervene when people are acting responsibly with their money – just so they can get more fees.

knowing 2 people who bought in the last 4 years units with strata fees, I can say they definitely looked at the strata reserve and the evaluation (forgot the name for the doc) that outlines upcoming big repairs. Their real estate agent spent hours pouring over the documents to give them a picture of the financial state of the strata. That info absolutely influenced their decision. Now to what extent that influence overrode a presumably higher price tag (in the case where a strata is in good financial state) I of course can’t tell. But, based on a measly sample of 2, it is clearly a thing.

Actually 40k to update a kitchen would likely be classified as an improvement, maintenance would be repairing it ie. fixing broken things and perhaps replacing counters and flooring. CRA has made a lot of determinations on this issue. Basically, and among other things, you don’t have to do improvements to continue use, you need to maintain to prevent deterioration or make repairs.

Lack of maintenance usually devalues a property a bit, improvements often increase value. Sometimes when you maintain you also improve with a replacement item so it is a bit gray. I’d say that if you are improving your home this can be an investment rather than a pure expense as it can raise a devalued property up to market and provide an adjusted cost base for appreciation ie. you make money on the money you put in.

Barrister, so what you are saying is that the bigger the reserve then the bigger the sale price. So if you have two identical units in two identical buildings then the unit with a bigger strata reserve will fetch a higher sale price? I suppose I can buy that in theory but I bet that relation ship is not linear.

KS112: The amount of reserve that a strata has accumulated is theoretically factored into the sale price of a unit. The problem is that a lot of buyers never really factor the size of the reserve fund into their purchase decision. When that special assessment for new windows rolls around a lot of people go into shock.

Just put a rate hold on a 5-year fixed that is lower than my current 5-year fixed which is ending this fall. Kind of stunning, really.

Also, I’ve been doing full double-up mortgage payments lately, and the bank was like, “have you considered investing your money instead, to make a better return?”

Yes, I’ve considered it. But I’d rather pay off my 35-year mortgage in 15-18 years, thank you very much.

It’s looking like it’ll be closer to 15 years with interest rates like this.

Good points.

I always wonder what happens to the excess strata fees if big ticket maintenance and repair items never happen. Do owners ever receive any type of reimbursement? I suppose the strata could decrease the fees going forward but that would suck for those whom have sold already.

Say a 80 unit condo with an average monthly strata of $300, that equates to $288k a year. say general maintenance (carpet cleaning, garage wash, grounds keeping etc.) cost 100k, that leave $188k for the big ticket (structural) items. so after 10 years if those big ticket items never (if in a new building they should be covered anyways) happen then you got around $2 million extra in the strata with interest earned. I think Marko sits on a strata, maybe he knows.

My GH rental house has costed about 10k in total maintenance in the 6 years I have owned. Sure the drive way could use a repaving but meh.

That’s why when I was looking to buy in 2013 a condo or townhouse just didn’t make sense. With that $500 strata you can buy a SFH that costs approx $100k more.

Patriotz is correct in that the condo strata fee does not include any repairs or upgrading in your unit.

Whether or not you consider it maintenance, that kind of improvement is not included in condo fees, which is what the comparison is about.

Most people underestimate maintenance because they don’t consider things like $40,000 to update a kitchen as maintenance, or $15k to rip the carpet out and put in hardwood. They file that under improvements because it is better than what was there before, when in fact most of the money is just restoring the kitchen or floors to a new and stylish state that it was in 25 years ago (when carpet and white veneer cabinets were the stylish options).

So people only count the small things like replacing dishwashers and the occasional roof.

Of course it also depends a lot on what you do yourself. We have spent less than $1000/year on our house, but if I outsourced every little job it would be double. In a strata you don’t have that option, so the maintenance costs are higher in $ terms.

Tomato: I have not paid anywhere near 6000 a year for maintenance on my house and it is a hundred years old. Admittedly we do our own gardening. And yes I am including a reserve for things like roof replacement and painting.

“I doubt a $900k sfh will cost 6k a year to maintain annually”

Just bought a house in that realm. Trust me. Definitely does if you want to do it properly like most stratas do.

I am also amazed at the condo fees ppl pay. For a new 2 bedroom dowtown condo the strata fees are around $500. I doubt a $900k sfh will cost 6k a year to maintain annually

Why would anyone pay 700-800k for a townhouse in regatta landing when they can get one the same size but 7 years older on Dallas road

B-Grade film that looks like it was shot mostly or entirely in Victoria in 2002. Fans of the now demolished Memorial Arena may rejoice, fans of good movies may not.

https://www.youtube.com/watch?v=AfnUq4msdx8

been watching the newer ones in Downtown Victoria, hitting 400k+ for one bed room

Barrister-

I haven’t followed what’s in the Songhees, but I see the two-storey townhouses of the Railyards (Cent. Spur rd, Regatta landing, etc) with private garages, 2 bed 3 bath setups, etc going for $700-800+ while the multi-storey condos on Tyee rd are more like 1 bed, 350-400k.

Obviously a 2- bed condo at 800-900 ft2 is going to be almost twice the cost of a 400-500 ft bachelor or 1-bedroom.

Interesting that the Comox Valley has a greater percentage of out of province buyers than Victoria does.

Last year the Comox Valley saw 9.2% of buyers coming from Alberta ALONE, which doesn’t include the other provinces such as Ontario. And obviously that likely doesn’t include those that may rent in the area before buying which would make the figure even larger.

Here’s an article in the Calgary Herald advertising the lack of spec tax in the Comox Valley:

“And while other parts of the island — including Victoria, Nanaimo and Lantzville — have been hit by the annual 0.5 per cent speculation tax on vacation home values held by people who are not full-time B.C. residents, the Comox Valley is exempt… Last year, despite its economic downturn, 9.2 per cent of Comox valley purchasers were from Alberta.”

LeoS, who would I contact to find out out of province buying figures for the Comox Valley? I’d be curious to know what the whole thing adds up to, similar to what you put together in your article below… Thank you!

https://househuntvictoria.ca/2017/03/16/whos-buying-in-victoria/

https://calgaryherald.com/life/homes/rec-properties/the-three-cs-of-vancouver-island-comox-courtenay-cumberland?fbclid=IwAR1TjADxbwowY4KGlXEHJy69GER15kWURs7q5MVH88ZMwcyd-YpdUdBCwEY

Duran; I was referring to Songhees and Vic West; 2 bedroom; not penthouse going in the high sevens to low nines.Not townhouses either.

Barrister- those are townhouses aren’t they? Unless you’re talking about the fancy penthouse condos. Those are for urban elites who have downsized and pay big $$ for those awesome views. Not representative of average buyers I think.

To quote myself, that doesn’t look very crashy to me.

Thanks. I think that’s a very helpful indicator for househunters, especially with such up to date data like that. Because it takes care of the issue of price changes being skewed by more expensive or cheaper homes, as the assessments are already reflecting that.

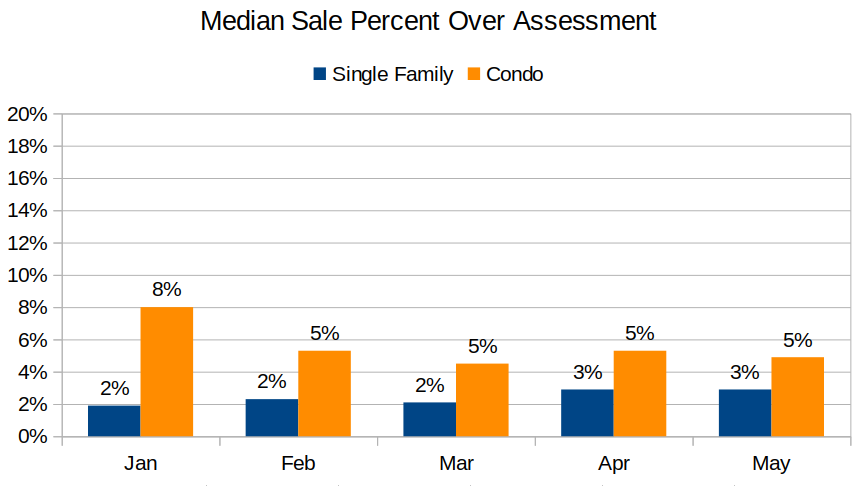

Updated values for this. Resale (non-new) median selling price / assessment for August to date:

Single family: 1.8% over assesssment

Condo: 3.5% over assessment

Generally condos do worse in downturns than single family, and turnover is higher, so more people need/want to sell before values recover. Unless you’re staying for a long time, I think buying a condo in a time of poor affordability is a mistake.

$1.225M

Duran: I was more wondering who is paying 800k or 900k for a condo in Vic West.

Does anyone know what 8657 Lochside Dr went for? MLS 412763

What’s supporting condo prices: you can afford $400-450k and are a single person or couple who want to live in the core. What else are you going to buy?

Speaking of condos, I have a friend that bought a 2bdrm pre-sold on the two new towers nearing completion on the corner of Johnson and Vancouver. Shes is trying unload now and her realtor apparently said last week she may make $10k after all commission and fees.

Chinves: You are not alone in wondering about what is supporting the high per square foot price of condos in Victoria. Yet, people keep buying them.

I wonder how is the condo market going to fair here .. i can see some 1 bed apartments siting at 500k ish in van near sky trains .. dont see how victoria condos can go around the same price .. same prices.. but i dont see same vaules

Hard to say. I think the bounce in 2017 was the aftermath of a market shock. In 5 years we’ll all know, I guess. Vancouver needs two things to get roaring again.

Or, more simply, a great deal of liquidity needs to chase VanRE again. That is the opposite of what is currently happening both locally and globally. It’s no surprise to see the volumes pick up somewhat – they have to. Prices though, are another matter.

China has to keep outflows contained to some degree if they want to have an economy, or a country for that matter. They won’t stop all of it, but as we might suppose by looking all around us, they don’t have to.

In 3 short years VanRE went from about the hottest RE market on Earth, to, in some upper segments, among the worst performing in the developed world. I won’t be surprised if we see that same analogue applied to Canadian RE writ large. If trees can’t grow to the sky, then the houses made from those trees can’t likely do it either…

RIP Hawk.

If there’s one place that should make a shape like that it’s Vancouver. Will it? We’ve already had the bounce in 2017 after the foreign buyers tax dipped the market briefly, so one would expect this should be the downward leg. But Vancouver has continuously surprised and will likely surprise again. I’ve given up trying to predict it because I’ve seen just about everyone on both sides fail to do so for some 15 years.

Now that’s a good idea!

Patrick now you have diverted from the delta between peak pricing vs current selling price to assesment vs current selling price. In addition you have translated what someone said about the listed price they are seeing between last year and currently into current houses selling for 10% less than assessment.

Those notwithstanding, like I said before, you quoting these terenet indexes is like the bears posting the asset bubble graph. Everyone has seen enough of it and no one really gives a crap anymore so might as well just give it a rest.

I’m referring to the entire region. I’ll be surprised if there are many bears who agree with your graph that median selling prices are 3-5% above July 2018 assessment.

Entire region vs GH (or other sub-segments) as already mentioned. You think there is a conflict here, but there isn’t.

Well, just looking at the last few messages, this is the first one that comes up…

“Q. How much cheaper do you feel house prices are from last year at this time. A. Impressions only, at least in the segment and location I am looking, about 50k.“

Are you willing to accept LeoS graph as accurate, that average selling prices are 3-5% above assessment? If not, what do you think they are selling for? And what do you think median Victoria prices are in relation to peak, since you seem upset with Teranet number of -1% from peak?

https://mobile.twitter.com/SteveSaretsky/status/1163972961935622144/photo/1

Patrick and just exactly who are the bears that are convinced prices are selling for 10% below assessment?

I guess the bears here that are convinced prices are selling -10% below assessment aren’t buying LeoS (May 2019) graph that shows otherwise….

There’s a place for both. If you want to get a sense of the entire market, use Teranet it is pretty good (still considering it is seasonal and lagging). If you want to zoom in onto one neighbourhood you use the bigger trend as a baseline but you will want to look at individual sales over time as well. That’s when you tend to notice things like what happened in GH where due to a combination of extreme scarcity and big demand a couple years ago, many sales were actually going for above market value in bidding wars. Doesn’t mean that fair market value is down 10%, but FMV goes out the window in that kind of environment. Hopefully the people that overpaid for those places can afford it and are holding long enough to make it less important.

An example of what houses are actually selling for is 3995 Arlene which Herpa derp was asking about. Selling price $640,000 house assessed at $654,000.

That’s a lot value property. This (and some actual repeat sales) show how much lot prices have fallen in the expensive metro Vancouver core areas.

And that’s the rebuttal to those claim that expensive house prices in the core are due to expensive lots. It’s the other way around.

Yes, because I’m more impressed with Teranet methodology (repeat sales https://housepriceindex.ca/about/our-methodology/ ) as an accurate measure of price movement than people spit-balling about what they are “seeing”, which are often cherry-picked, self-serving, inaccurate or not reflective of the whole market.

I don’t see LeoS quoting your price observations in his posts, and he seems to use a lot of statistics and indexes too.

What I’m seeing is the 2M + houses are selling for 15-25% off peak. The 1-2M houses are selling for 10-15% off peak. 700-1M below that is basically flat, +/- 5%. And below 700k is probably up YoY.

So it’s quite a calamity for the luxury market, with some screaming deals for the well-heeled. For most family-home seekers and those looking for starter homes, it’s not earth-shattering either way.

I haven’t been following condos or townhouses, so I don’t know what those are doing.

Patrick, you cite Terenet indexes as a direct rebuttal to those whom say that the home prices they are seeing have gone down by more than the 1% referenced.

Victoria real estate board prices are about -5% from peak, compared to Teranet -1% from peak. They are measuring different things with different methodology, so the small difference isn’t surprising in a small city like Victoria.

https://www.timescolonist.com/real-estate/greater-victoria-real-estate-sales-slide-prices-slip-as-stress-test-cools-market-1.23650994

People househunt differently. You’ve spent years tracking Gordon Head prices, so are an expert on them. Somebody else might just show up and buy one. I find the indexes like Teranet and Vic-reb helpful, but feel free to ignore them.

This is my impression as well given tracking sales in the area.

Gordon head went through a real mania with many sales quite irrationally high in that period and now it is back to earth.

Patrick, the assesment for a lot of gordon head houses has gone down year over year by 2%. My point is that those terenet numbers you keep quoting are generally useless for people who are actually house hunting.

3995 Arlene went for $640,000

Who knows what the high water mark was for Gordon Head houses, noone measures it. Stats are kept for cities, and Victoria CMA.

Victoria CMA assessments went up 5-10% on the July 1, 2018 assessments. https://www.timescolonist.com/real-estate/home-assessments-rising-5-to-10-in-greater-victoria-1.23522011

LeoS has posted data here showing that prices realized for the last 6 months have been consistently 1-3% above those assessments.

What is your Gordon Head house assessed at, and wouldn’t you expect to be able to sell it 1-3% higher than assessed value like the typical Victoria house is getting?

For a different take on the Vancouver market:

The first link is a local newspaper article from 2017 that calls the subsequent YVR decline. The second is the most recent market update. The author prefers to use average prices, rather than benchmark, to come up with some compelling data.

https://www.vancourier.com/news/greater-vancouver-home-prices-to-drop-21-per-cent-by-2019-analysis-1.23054072

https://www.eitelinsights.com/marketupdates

Patrick, I am positive that neither my house nor Introvert’s or Leo’s house can sell for 99% of the all time high. I am pretty sure that I am down about ~$70k or ~10% from what I could have sold for in 2017/18 which is what I think was the all time high for gordon head houses.

Any one know what 3995 Arlene pl was sold for?

The article is a good analysis of the Teranet release from yesterday, not different data. Yes, Vancouver is worst performing market in Canada. That said, Vancouver prices (Teranet) are still only 6% from the outrageous high peak prices they saw last year. All areas of Canada (Teranet 11 city composite, including Victoria) are at or within 1% of all time highs (except Vancouver, Calgary and Edmonton) .

Here is a nice national sales and price analysis from Better Dwelling. It then breaks down 4 markets [Toronto, Vancouver, Montreal and Calgary] – the west is declining and continuing to do so. The east is going in the opposite direction.

https://betterdwelling.com/national-bank-canadian-real-estate-price-deflation-hits-with-smallest-rise-in-10-years/?utm_source=Better+Dwelling+Website+Signup&utm_campaign=6cbb16e222-fras_jan_112018-3094981_COPY_01&utm_medium=email&utm_term=0_bde8feedee-6cbb16e222-309139209

Vancouver is the worst of the 11 largest markets. At best, Victoria is flat. We are likely at the end of the lag between the 2 markets. This is “put up” time – either Victoria is truly an Island of its own, or…………..

0.3%, or 1 out of every ~262 Canadians have declared insolvency. Run for the hills, collapse is imminent – the end is nigh!

You’re right it was 2.99%. My bad

It was 2.99%, no?

2058 Russet Way, West Vancouver

Sold for $1,575,000

2017 Assessed: $3,326,000

2018 Assessed: $2,820,000

There are definitely markets that are collapsing.

LeoM: One wold think that equity home lines of credit would usually only be used in very specific and limited circumstances. Considering how foolishly some people use credit cards perhaps it is not surprising that lines of credit are equally misused.

Wow, 5 year fixed now available at 2.49%. Crazy

https://www.ratespy.com/motusbanks-launches-barrage-of-rate-specials-082010427

Back in my day when the first banks released 3.99% mortgage rates the finance minister called them irresponsible in a press release. Get off my lawn with those crazy rates.

The collapse is unfolding so slowly that it might not be collapsing.

“Slow motion collapse” ….Huh?

If you look at the data for bankruptcies, there are no no signs of “collapse” (worsening). Especially for greater Victoria homeowners with mortgages/HELOCS, where the “collapse” is the other way (improving), with falling bankruptcies to the almost zero level where only 1 greater Victoria homeowner per month files bankruptcy.

The article makes no mention of the data that bankruptcies are down YOY.

– specifically greater Victoria bankruptcies (2019-Q2) are down -11% YOY, and Vancouver bankruptcies are down -1% YOY. Canada down -3% YOY.

– Victoria proposals went up YOY from 61 people per month to 65

– Victoria bankruptcies dropped YOY from 30 per month to 27.

https://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br04118.html#tbl7

“…consumers with home equity lines of credit use it like an ATM machine.”

Insolvencies/bankrupt/underwater…

the only surprise here is the slow-motion collapse, although I predicted a few months ago the collapse would take 18 to 24 months, I’m still surprised how slowly the market is reversing, I suppose that’s the power of low interest rates.

Home equity lines of credit will be a major factor causing underwater mortgages during this cycle.

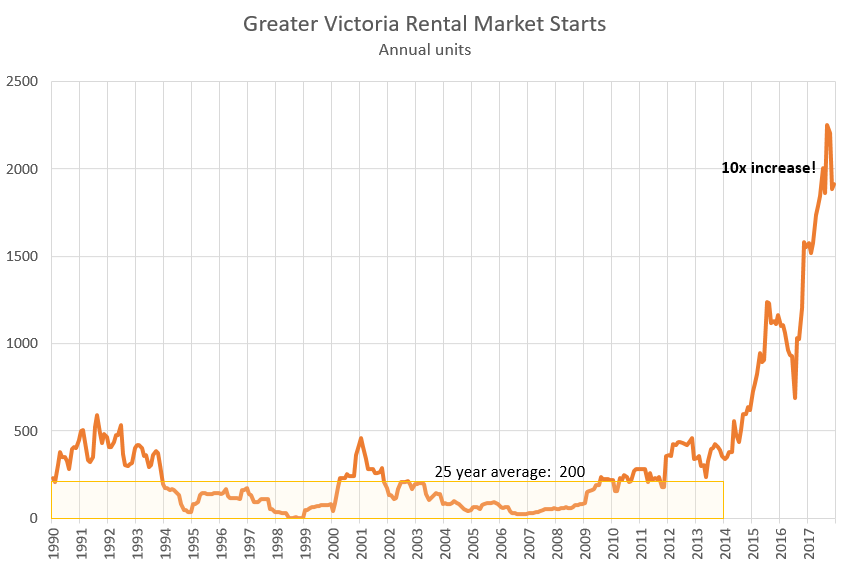

I didn’t say it would cap prices. Rental construction doesn’t really connect to prices. More that the increased rental supply will put a damper on rent increases if that’s what they’re hoping for.

“…consumers with home equity lines of credit use it like an ATM machine.”

Insolvencies/bankrupt/underwater…

the only surprise here is the slow-motion collapse, although I predicted a few months ago the collapse would take 18 to 24 months, I’m still surprised how slowly the market is reversing, I suppose that’s the power of low interest rates.

Home equity lines of credit will be a major factor causing underwater mortgages.

Guessing that insolvencies reached a cyclical bottom late last year.

https://www.cbc.ca/news/canada/british-columbia/consumer-insolvencies-go-up-1.5254141

British Columbia experiences jump in consumer insolvencies

“Hannah says one concerning practice is how some consumers with home equity lines of credit use it “for all intents and purposes like an ATM machine.”

I’m actually in a diversified portfolio for retirement. What I was commenting on was the prices for SFHs and how difficult it is to justify the investment return numbers given what these properties rent for. One has to take into consideration more than just the opportunity costs for a large downpayment and include wear & tear, insurance, taxes, large item maintenance (heating, roof, drainage tiles, etc). There is a rental coming on the market soon (so the sign says!) nearby that I’m eagerly waiting to see what they ask for it. I know what the house sold for and unless it’s broken up into quite a few suites, I’m not sure that the return will be advantageous.

Definitely, most presales are not listed as I mentioned.

There were 445 “New” units available on MLS in July. Hard to match that to total new construction since presales happen throughout the pre-construction and construction phases, but given there are about 3000 non-rental units under construction in the region, we can be certain most are not listed.

Note 445 is up from 179 2 years ago. So with increased construction we do see more new listings advertised on MLS as well.

RenterinParadise: if you want the equivalent of a DB pension, consider an annuity: indexed or not, single or joint. Lots of options.

A question, I haven’t noticed hundreds of MLS listings for every single unit in a new apartments building, is that an indication that most of them never see the MLS?

Capital Economics believes that the worst is behind us and prices are set to rise once again for a return to the “good old days”.

https://www.livabl.com/2019/08/canadian-home-prices-rise.html

5 year promotional mortgage rates are down to 2.65%. However, they {see attached) see Canada’s market as a homogeneous market, which it is not. There are pockets of extreme lack of affordability like Toronto, Vancouver and Victoria where prices bear no relationship to local incomes. And, in those markets, what is selling is the middle market and without much in the way of “bidding wars”. My PCS shows sales below asking and below property tax assessments. All positive signs and supporting higher sales. I applaud that activity. As one expects, it is the “luxury” market that remains in a bear market. It is good to see “Sold” signs up in middle class areas near schools and recreational facilities.

It’s a bit of both. Completion is not when the sale happens, so it doesn’t match up like that, but with increased construction two things happen:

Not entirely sure when the land title office registers the sale of a new unit.

I bet many thought the last comparable rental boom that started in the 1960s would also cap prices, but recall how Vic (in green) went up 10-fold well after the multiple boom was already underway.

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2015007-eng.htm

I’ve been told (by some knowledgable members here) that many (if not most) of the new units sold are not counted as MLS sales, and if that’s correct, the actual total number of sales (MLS + non-MLS) would be higher than we expect by looking only at MLS and estimating non-MLS using a constant from previous years data. If so, that’s a ‘bigger sales bump” that we’re seeing.

For example, if there were 600 MLS sales in a month, I recall that Leo is estimating that there would be about 120 non-MLS sales, estimated based on past data. But based on James data about numbers up to 513 new completions, that might be many more than 120 non-MLS sales. Also, larger numbers of non-MLS sales would tend to depress the MLS sales totals that we’re seeing here, making it more difficult to use only MLS sales as a reasonable proxy for total (MLS + nonMLS) sales.

Not a huge difference if you look at resale only although some months can definitely shift if you take out the new construction sales.

I wonder how much of the bump up in sales in the last few months is just increased completion rate then?

Yeah it will be interesting to see the 2019 CMHC vacancy numbers in October. We shoudl get a pretty good jump as the first wave of dedicated rentals hits the market.

What CMHC classifies as “completion” is pretty close to occupancy. Hard to say exactly the delay but they say “a Completion is defined as the stage at which all the proposed construction work on a dwelling unit has been performed, although under some circumstances a dwelling may be counted as completed where up to 10 per cent of the proposed work remains to be done.”

Given occupancy is often granted with some minor work remaining to be done I suspect it lines up relatively well.

Not consistently no. Pre-sales vary quite wildly as to whether they are listed on MLS. Often it is only a couple listings on MLS to bring people into the sales centre, so most initial sales are not counted. MLS sales capture about 80% of real estate transactions, with the remainder being pre-sales and private sales/transfers

https://househuntvictoria.ca/2017/11/10/dark-sales/

18-26 Months depending on scope of building and misc delays

Last three month (May, June, July) completions:

390 460 513

Which (aside from 400 completions last December) is the most for any month since 2010.

I wonder how long after “completion” do the units generally become occupied? Also, Leo are these counted as a sale?

Patrick: It might be easier and more accurate to simply look at how many units are actually close to completion. (within six months). I might have read somewhere that it is somewhere around 2500 units but dont hold me to that number. I am sure that someone here has a fairly accurate number.

In addition to the purpose built rentals there are a lot of condos reaching completion and some percentage of those will end up being rentals.

Link to site saying 1-1.5 years to build apartment block throughout the USA. I expect it’s slower in Victoria, but does anyone know how long it takes to build apartments here?

http://newsletter.rismedia.com/news/view/80518/

It looks like the construction rental boom started at beginning of 2017, which is 2 1/2 years ago. Presumably we are already absorbing increased rentals from the units that took less than 2 1/2 years to build.

This site says it takes 1-1.5 years to build an apartment, not sure what the Victoria time is, but 1.5 years after the mid 2017 peak on this chart would be about 6 months ago.

Victoria’s 3 month price gains for repeat sales not too shabby.

(attaboy hawk!)

July 0.64%

June 2.07%

May 0.69%

I retired 3 years ago so that makes it easier for sure. We look after grandkids in Colwood so still commute quite a bit. Still it’s 25 to 30 minutes to Colwood. For most of us with limited resources and not wanting to be in deep debt Sooke may be an option. I figure the same house on a 4400 sf lot in the core is at least $200,000 more, probably more than that. We had a 6000 sf lot in Gordon Head but comparatively speaking it’s better value.

The $50,000 valuation is what I’m thinking too. The variant in neighbourhoods is a little bit crazy too. Oak Bay is hundreds of thousands more than Gordon Head which also carries a premium (and I used that). There are good reasons for some of that but it can be excessive.

Are you commuting to Victoria?

It’s definitely somewhat variable by area. Definitely Gordon Head came down from some of the completely irrational purchase prices a while ago. The neighbourhood just got ahead of itself.

I can’t see this as being a great strategy with all the rentals coming online in the next year. There is going to be quite a bit of new supply. Unless we start demolishing all those old 60s buildings there should be a jump in vacancies.

Good points. The fees charged in Denmark add up to about 1.5% of the balance being the net cost of the mortgage per year (despite the negative interest rate). Central banks may be reckless enough to lend money out at negative rates , but banks aren’t (so far).

For those who don’t click the link:

Post Category: Monthly Reports

Share on:

August 20, 2019

Smallest 12-month rise in almost 10 years

“In July the Teranet–National Bank National Composite House Price IndexTM was up 0.7% from the month before. As in the two previous months, the gain was not really a sign of countrywide market vigour, since the 21-year average for the month is 1.0%. As in May and June, it was only because of seasonal pressure that the index rose at all. If this pressure were taken out by seasonal adjustment, the composite index would show retreats of 0.4% in May, 0.5% in June and 0.1% in July.

The unadjusted index was held down in July by a 1.0% decline in the Vancouver index, its 12th month without a rise. Vancouver was the only metropolitan area surveyed whose run of declines continued in July. Indexes for the other 10 markets of the composite index were all up on the month: Quebec City 0.1%, Edmonton 0.5%, Victoria 0.6%, Calgary 0.7%, Toronto 1.3%, Hamilton 1.3%, Halifax 1.6%, Montreal 1.7%, Ottawa-Gatineau 2.0% and Winnipeg 2.9%.”

Vancouver numbers down over 6% from peak now – starting to trend the same way as the median and average have been for a while… median and average in Victoria as of last month are down 10% from peak. I wonder if the teranet will start to reflect this in the coming months or not. Time will tell.

Victoria Teranet house index up .64% for the month of July. Only 0.05% from all time high. Victoria up 0.54% YOY.

Many other markets in Canada up as well, and are now at all-time-high, including Canada composite. Exceptions are Vancouver (-1% for month,-6%from peak), and Edmonton and Calgary (-6% from peak).

https://housepriceindex.ca/2019/08/july2019/

Banks in Denmark do not pay mortgage borrowers. This is based on a misunderstanding of the terminology they use. Over there the bank’s borrowing cost is called “interest”, and the difference between that cost and what the borrower pays the bank is called “fees”. The total is positive.

Over here that difference is called “spread” and is not explicitly broken out, and the total of what the borrower pays the bank is called “interest.”

wow .. the house on Cadillac street finally sold .. chased the market all at the way down from 700k to the low 508k

@RenterInParadise

Great observation. When someone wants to some sort of income security for retirement and doesn’t have a defined pension there are not too many choices. A corporate bond portfolio is paying less than 2.0% annually right now with considerable downside. An equity portfolio always outpaces inflation, but what if you are 60+ years old, if the market takes a hit, you don’t have 20 years to wait for it to bounce back.

Having a decent rental property close to an education facility/hospital/etc… is not such a bad thing if you can come with a sizeable down payment IMHO. Yes, there is supreme aggravation in renting it out, but if you do it right, you can still achieve a decent cap rate on your investment of 4-5%.

House prices and mortgage rates?

What would happen to Victoria’s prices if the bank PAYS YOU to borrow money?

Might want to track what is happening in Denmark right now.

Considering that 25% of Gov’t bonds are negative yield right now, and the economy as per Leo is starting signs of distress, wouldn’t be surprised to see rates going down to under 2% for a 5 year mortgage.

My guess if no government intervention in terms of property restrictions; RE will still have robust climb up until there is social upheaval (e.g. Hong Kong). We don’t want that to happen, so the government better be very careful in crafting their policies.

https://themortgagereports.com/53781/negative-mortgage-rates-will-they-come-to-the-us

Local Fool: What price range are you talking about. Are we talking a 5% drop or a ten percent drop.

Impressions only, at least in the segment and location I am looking, about 50k. Could be a bit more, could be a bit less. Also more to choose from, but that’s only relatively speaking.

Rock: I suspect that you are right that the cost of living is starting to increase. Even Cosco coffee has gone up 10% recently.

Congradulations on getting a new home may it be a harbour of peace and joy.

Local Fool: How much cheaper do you feel house prices are from last year at this time. I dont have any real way of gauging the drops other than a rough general sence not based on any real data.

Long time looker First time commenter

I just bought in Sooke. I didn’t plan to buy but my wife wants to own. Sold a 1350 sf 1959 Gordon Head rancher in April 2018 for close to 3/4 of a million dollars. Bought just under 1700 sf 2 story 2 year old quality home in new subdivision for more than 200 grand less.

We rented a house in Langford for $2500 imbetween.

I believe house prices need to come down due to a variety of circumstances but there is a lot of competition especially at the lower ranges and finding rental accomadation can be difficult as the population increases. A lot of people living on stretched debt and low interest rates hoping that nothing catastrophic happens as prices of necessities continue to inflate.

Nice write up, Leo.

In my area of interest, I am seeing some more listings which are getting closer to our strike price, but it’s not there yet. I suppose the question is, will it get there? Certainly looks like it, but sometimes I wish the market would just hurry up and get it over with! 🙂

Might take a few more months before the pool of new buyers coming in on the basis of lower rates is exhausted. Very curious to see the August and September numbers for Vancouver. That, and the markets, inversions everywhere…what an interesting show.

Definitely not crashing, but I’m pretty sure it’s getting cheaper. Certainly seeing that on my PCS.

Whatever else the market is doing it is not crashing or getting much cheaper at the moment. Has there been a drop off of out of town buyers and, if so, are prices actually reflecting local incomes contrary to theory.

What a perfect day out there today, hope everyone has a moment of joy to appreciate it.

I have noticed an uptick in SFH purchases that immediately come on the market as rentals. I’m surprised at the current home prices that anyone believes rentals are the way to go for an investment. If you’re living in the house and looking to subsidize the mortgage, that’s one thing but that isn’t what I’m seeing. There seems to be a bit of a spread- those who want top rental $$ so offering fully furnished or paying all utilities; those who are catering to students as the per bedroom price sums up to more than a whole house rent; those who divvy up the house into suites to maximize monthly income; and those who clearly believe the market is at bottom and willing to subsidize the rentals looking for long term appreciation. Should be interesting to watch.