The forest

On this blog we talk about trees a lot. No, not that kind, I’m talking about the down in the weeds aspects of micro-movements in the market, changes in week to week sales and metrics, and the details of houses that are selling right now. That’s fun, and the reality is that when you’re house hunting, you’re going to want to spend a lot more time thinking about what neighbourhood to buy in, what school you want to be near, how much it will cost you to commute, and what your bid should be based on current market conditions.

In other words, you spend a lot of time thinking about the actions that you’ll want to take for your house hunt, and less about the overall strategy. That’s a good thing. After all you can have the best strategy in the world but if you buy a bad place you’ll still be miserable.

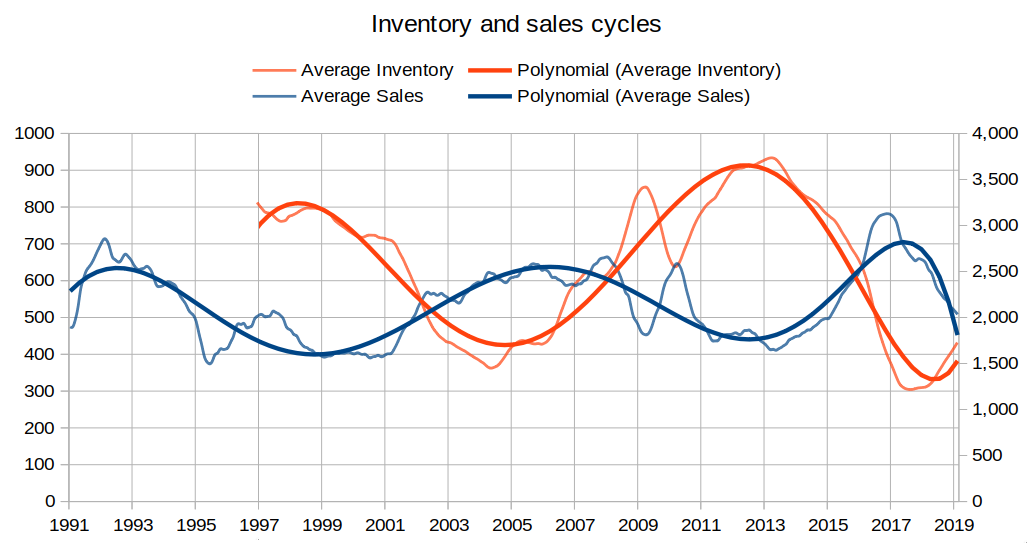

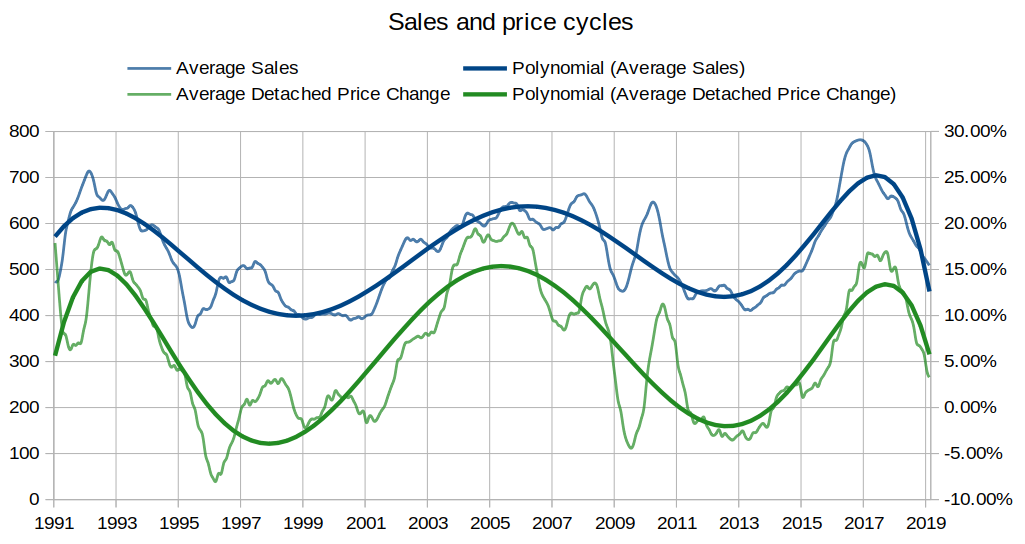

However once in a while it’s good to poke your head up and remind yourself of where we are in the bigger cycle of the market. A few weeks ago I pointed out the large cycles of sales and inventory, as well how those relate to house price appreciation.

It shows that the large cycles take around 12-14 years to complete with the last two down cycles lasting about 7 years. Because the cycles are so long, what lets us down a little bit here is that we only have two complete cycles in the sales data. Based on two cycles I wouldn’t imply that this represents some sort of rule for how long these cycles will always last or that they will go on forever. The last runup was especially steep and petered out in only 4 years when prices hit an affordability wall and the sales drop has been similarly steep so it’s quite possible that the whole thing is becoming more compressed. However after only 2.5 years since the peak I suspect we still have some room to run.

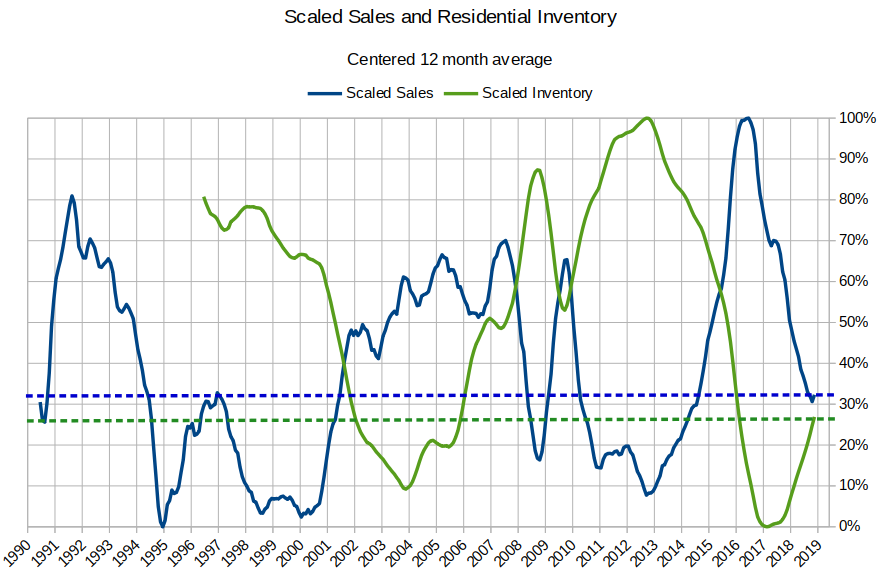

Another way to look at this is to scale the data to the historical ranges. That shows us more easily where are currently in relation to the normal range.

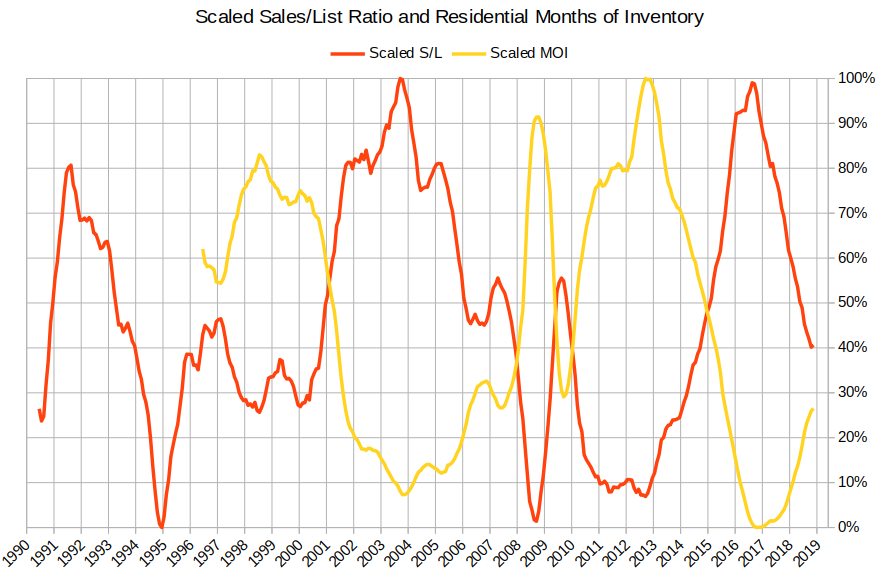

You can also look at the derived indicators like sales to new listing ratio and Months of Inventory which essentially tell us the same thing (balance between buyers and sellers) but inverse.

This gives us a few takeaways:

- Sales have already declined to not too far above where they are likely to bottom out. At 32% of the historical range, they will likely fall some more percent but due to population growth we aren’t going to revisit the absolute lows from 1995, so might bottom out around 15-20%.

- Inventory is still very low. We are only at 27% of the historical peak and it is very likely that inventory will continue to grow for years to come. Easy to forget how long it takes to build inventory but the good news is that as a buyer a time of building inventory allows you to make a decision without the feeling that the type of house you want will be sold never to return. Keep in mind though that seasonally peak inventory is in June, so although inventory is building over the years, it will start dropping for the year after this month.

- The path is not smooth. Because the cycles are so long, sometimes you get several months of reversing trend where sales increase for a few months during downtrends and vice versa. If you look at sales you see many instances of that in past cycles (2011, 2005, 2002, 1995, etc). Given the increased regulatory interventions in this market I wouldn’t be surprised to see even more of that in this market as it gets pushed around by various demand and supply levers being fiddled with.

- We’re not there yet. I’m always hesitant to make definitive predictions about real estate because although Victoria seems to be primarily driven by some semi-predictable large scale fundamentals (how’s that for weasel words?), I’m also well aware that we are right next door to the much less predictable Vancouver market where many unexpected things can and have happened. However I believe it’s a pretty safe bet that the market cooling is not over. With months of inventory at only 27% of the historical range, there is a lot more room for the market to slow further. Although the Times Colonist was pretty excited about the year over year increase in sales – calling it a turnaround – I doubt that we are anywhere near what will amount to the true bottom of the market.

Although no one can accurately predict where the market will go the market is not fundamentally predictable, the macro picture can help you think probabilistically about what might happen to prices and buying conditions during your buying window (i.e. are they likely to improve or deteriorate in the next year, and how likely is that?). It can also help to decide what to do (buy, rent, invest, flip, hold, ladder, etc) and when to do it. More on that later.

They’re up: https://househuntvictoria.ca/latest

Lets see if the Monday numbers surprise us; up or down or more of the same?

There are at least 300k Canadian citizens in Hong Kong, most are ethnic Chinese. A surprising fact about them is that 85% of them were born in Canada. (Amazingly, that 85% is higher than the overall figure of 80% Canadians being born in Canada!). That makes it more likely that they will return if there are restrictions added in Hong Kong.

Remember, Canadians in Hong Kong have no foreign buyer taxes or other issues when they decide to move to or purchase in Vancouver. And there are no capital controls in HK currency (that only applies to the yuan, which is the mainland currency).

About 1500 come from Hong Kong to Vancouver/Toronto per year, and this number increases each year https://www.scmp.com/comment/insight-opinion/hong-kong/article/2150836/call-canada-why-hongkongers-are-leaving-second

But it is a much smaller number than the 25k that come to Canada from the mainland of China.

Eeeeh I doubt it, and if it does, I doubt even more that it would last very long. The inflationary drivers of Chinese money into international RE was just that – Chinese money.

It’s still subject to pretty crushing capital controls, even if it comes through Hong Kong. Domestically, HK has seen political crises before, and there was a lot of cash chasing BC leading up to its secession from British rule in 1997. Not much happened here then, and it was far easier then for market and policy reasons to drive up BC RE prices than it is now.

Just because 1, 2, 3 or 500,000 people there have a Canadian passport, that doesn’t mean they will all move or even if they did, have the means to buy giga-mansions or even average BC homes. Also the extradition law (I don’t think) has actually gone through yet, though it sounds at the moment that Ms. Lam is feeling rather unmoved by the protests.

As it stands, I am far more interested in hearing some of the talk coming from the Fed about more QE, more aggressive QE, QE squared etc. That’d be far more inflationary for RE than Hong Kong could ever be.

One has to wonder if the happenings in Hong Kong right now are going to have a knock-on effect into the real estate in B.C. and elsewhere. Currency will be tanking and money/business fleeing. There are a lot of Canadian passports in Hong Kong right now that might want to become more Canadian at the moment. Thoughts on this?

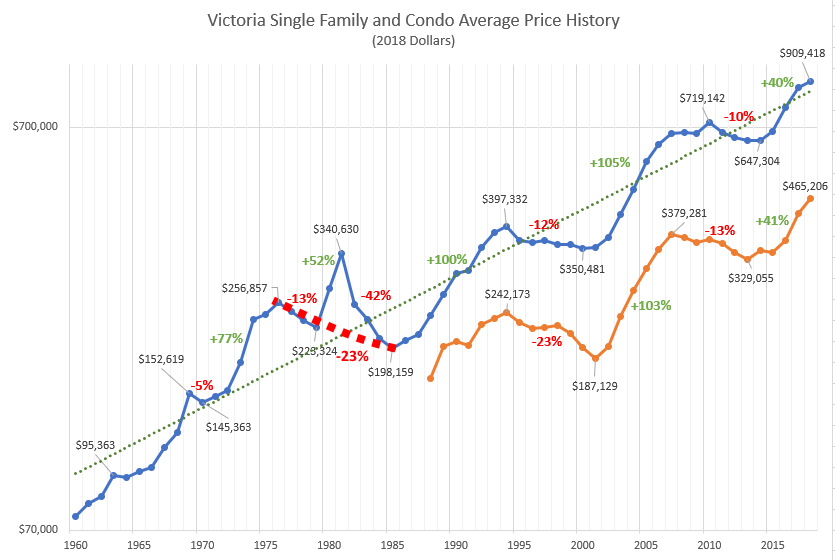

I wouldn’t say so. It is unusual in the fact that prices are higher than they have ever been in Victoria. It is not unusual that prices sometimes rapidly appreciate in Victoria. In fact you may even argue that it is unusual that this time prices stalled out after a mere 40% increase rather than the 100% that we have seen several times in the past.

Quite probable yes. I would say we’ll be at flat +- 1% for the region’s detached assessments.

I would say 2 years is the absolute minimum.

Don’t be silly.

Was LeoS deliberately attempting to mislead us when he introduced the “forest” topic above as referring to “houses”, when it actually is referring to all dwelling types …. when he says “I’m talking about the down in the weeds aspects of micro-movements in the market, changes in week to week sales and metrics, and the details of houses that are selling right now…A few weeks ago I pointed out the large cycles of sales and inventory, as well how those relate to house price appreciation.”

Answer: Of course not, because he uses the term house like everyone else here, as applying to all dwelling types.

ps. LeoS, we need a new post, to put this recent discussion out of its misery,

The RBC report was careful to use the term “home” not “house”, so that it would be understood that they meant all dwelling types. Their data source, StatsCan, is also clear about this. To pseudo-quote it as “According to RBC , 43% of millennials under 35 already own a house in a Canada” has the appearance to me of a deliberate attempt to mislead.

As for the context in this forum, this thread like most others largely comprises discussions of the merits of houses versus condos. Posters don’t use the former to include the latter. Well almost all posters.

Stultus: I think you are being harsh on this house thing; I find it hard to believe that anyone on this blog would not correctly interpret the broader use of house within the context as also meaning condos. There is lots of spin on here but not in this case.

and i do appreciate your stats on pop.. i was surprised with the numbers too ..

leo’s usage of “house” has no context that requires it to be stated as house or home or dwelling ..

you are referencing your finding on a report that clearly identify as home not house

we know you are bullish .. but people fact check B.S and they will call you out on it .. dont get mad .. and enjoy the beautiful sunshine

looks like we got a trump here

either you are unable to mentally identify a house vs home or you are just a over zealous bull spilling b.s

Patrick: Thank you for the stats on population. So we go back to the question of why less dwelling ownership here than Vancouver (note I changed it to dwelling to avoid the word police), Any theories out there?

There’s nothing misleading about using the term “house” to refer to any type of housing (detached SFH, condo etc).

You need to be able to learn interpret the term “house” properly when used in RE conversation, as it doesn’t mean detached house.

Let me help you…

1. Start out with this site name “house”huntvictoria.ca which of course applies to looking for SFH or condos etc.

2. Next, read Leos post up top and notice 5 uses of the term house, and none of them are applying to detached houses only.

So next time you read that someone is on a house hunt or 43% of millennials in Canada own houses, or house sales rose 10%, don’t assume they are talking about only detached houses. Because they’re not.

It look like a good portion of millennials are buying houses in the great unwashed Langford area instead of renting in Victoria or compete with Oak Bay boomers.

Victoria:

Total Population 85,792

Median Age 42.7

Median Household Income $53,126

Employment Rate 63.6%

University Education 43.0%

Number of Renters 27,720

Number of Home Owners 18,045

Most Popular Dwelling Size 1 Bedroom or Less

Least Popular Dwelling Size 4 or More Bedrooms

Oak Bay:

Total Population 18,094

Median Age 53.6

Median Household Income $93,529

Employment Rate 51.9%

University Education 56.6%

Number of Renters 1,830

Number of Home Owners 5,905

Most Popular Dwelling Size 4 or More Bedrooms

Least Popular Dwelling Size 1 Bedroom or Less

Langford:

Total Population 35,342

Median Age 38.3

Median Household Income $80,331

Employment Rate 68.5%

University Education 22%

Number of Renters 4,310

Number of Home Owners 9,870

Most Popular Dwelling Size 3 Bedrooms

Least Popular Dwelling Size 1 Bedroom or Less

Home does not equal house – please dont mislead with your information

When the predicted correction doesn’t materialize in Victoria after one year, people will seamlessly switch to saying the lag is 1.5 years. Then 2 years. Whatever it takes.

Victoria has the same % (7%) of age range 30-34 of total population as Canada overall (7%). https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=01&Data=Count&SearchText=Victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

That satisfies me that Victoria has the same % of millennials as Canada. I didn’t include age range 15-29, because those include uni students that might be temporary. But if you do that, you also get similar values for age range 18-35 in Victoria and Canada (25%).

In terms of university students, I am not a stats genius but should one not be looking at what percentage of millennials are students in any given city as opposed to what percentage compared to the city population?

Happy to be corrected but I thought that millianials made up a much smaller percentage of the population in Victoria than average in Canada.My back of the napkin math would suggest that if they are a smaller percentage of the whole population of Victoria (compare to Toronto) but they are a equal percentage of students than the percentage of millianials who are students must be higher.

Cannot speak for BC, but while Toronto has a lot of students most of the students in the rest of the province would move to Toronto for jobs after school. I have no idea if this accounts for some of the difference between Victoria and Vancouver but I suspect it does in part.

This also means that those who don’t feel the “must buy now” pressure have the luxury of getting settled into a career that they really want in an area they really want to be in. Halifax could be it as could Calgary or Victoria or any other number of cities. Buying a property can lock one out of career opportunities in other locales as moving becomes more difficult.

The cities most attractive to millennials are, objectively, those with the highest % of them in the population. These include Calgary and Edmonton.

There’s less pressure in the cheaper cities to “buy now or be priced out forever”. So in Halifax they may just be waiting a bit longer and then buying a house rather than buying a condo now in the hope of trading up later. That results in a lower ownership rate among the under-35’s, but they are actually getting more house when they do buy.

Personally I’m amazed by the stories I hear about people in their early 20’s buying (invariably condos with parental help) in Vancouver, which used to be virtually unknown. Not to mention parents buying condos for students. I think this is a significant factor in the price bubble.

Leo says: “This is not an argument based on technical analysis. My theory that the overarching factor here is affordability which drives all this. Sales will be slow and inventory grow not because of any past performance, but because affordability is poor and it has to improve before the market can sustainably recover”.

I subscribe to that view as well. However, the underpinnings of affordability stems from mundane factors such as [not intended as a comprehensive list]: (a) local incomes, (b) interest rates, (c) immigration [foreign capital flows and live bodies that raise demand], (d) demographics (aging population, millennial demand, mortality, life expectancy, etc.), (e) economic growth (wealth created by GDP growth that leads to lower unemployment) and (f) exogenous shocks (like trade wars, hurricanes, etc.).

My thesis is supply and demand is the economic base or foundation of affordability. What we have experienced for the last 5 to 10 years is unusual. And municipalities have fed in to it and taken advantage of it. Just look at the property tax assessment values for 2016 to 2018: they have raised them between 40% and 60% in 2 years. This has perpetuated the problem because sellers become intoxicated by these “equity increases” and adopt an approach that property values only go up. Strangertimes contribution is a great article:

https://www.scmp.com/comment/blogs/article/3013288/scared-falling-home-equity-and-war-money-laundering-vancouver-tough

Owners / sellers now complaining of their “loss of equity”. Like those values are a guarantee and how dare anyone offer less. Well, take a look at recent sales – what I see is sales below assessment values 75% of the time – when was the last time we saw that? Here are some examples of resent sales:

I could go on – I have a list of 20 recent sales on my PCS over the last 2 weeks – all sold below assessed and below ask. 1 to 2 years ago, this was unheard of. We are 1 year behind Vancouver [lag] – it is happening right here right now. some on this blog won’t be honest about it or just won’t look at the data. I bet you a snickers bar that the next assessment value roll out will show an almost across the board cut. This is a secular trend, not a blip, not a correction………..the prices we have seen over the last 5 years are not supported by fundamentals. Affordability is returning, but we have a long way to go. I would not be shocked to see a grind down that takes 2 years because of the seller refusal to see what is there to be seen.

If you look at the cities with high under-35 ownership, they are all of the “yah, I could buy a house there, but no thanks” type. Calgary, Edmonton, Saskatoon , Regina, Winnipeg, St. John’s. St. John. (Halifax is an outlier with low ownership).

Ironically, the cities likely most attractive to millennials (tech, growing, culture…”yah I could live there!”) seem to have the lowest under-35 ownership rates in the RBC chart in previous link (Victoria, Vancouver, Toronto, Ottawa, Montreal, Quebec City )

Maybe something to do with income of millennials?

(Con’t) …and Winnipeg has a 45% millennial (ie under 35) home ownership rate compared to 27% in Victoria, despite having similar % of uni students.

So how to explain Vancouver at 35% vs us at 27% and much cheaper Halifax at 27%?

You see kitchens that are less than 10 years old come up for sale all the time on usedvictoria….people renovating based on taste, not function.

LeoS,

I don’t think the uni students are that big a factor, because every city on the list also has lots of uni students. Victoria has 22k uni students which is about 6% of population. Canada has 1.32m uni students so we expect 1% of them in Victoria (by population) so that would be 13k not 22k. But universities are all in cities in Canada, and I think they’d be about equally affected. Winnipeg (for example) has 40k uni students which is also 6% of its 650k population.

https://www.univcan.ca/universities/facts-and-stats/enrolment-by-university/

Good point. ReStore: https://www.habitatvictoria.com/restore.html

I wonder what percentage of renovations are actually because the kitchen is end of life? Likely very few.

Zero to none 🙂

Interesting theory. Any thoughts about why millennial ownership would be higher in Vancouver than here?

Could it be that a higher percentage of our millennials are attending university and thus not owning? Or is it that there are more millenials with offshore money in Vancouver as we’ve seen in the headlines of students owning multi-million dollar properties?

There seems to be little correlation between prices and millennial ownership rate. Look at Halifax and Victoria, same percentage at 27%, vastly different house prices.

I’d like to look at this data from 25-34 year olds to take out most of the students.

Fair enough. To be clear I am not arguing that the pattern of sales is somehow driving the market. There is no rule that downturns must last a certain number of years, or that just because sales have been declining they must continue to decline.

This is not an argument based on technical analysis. My theory that the overarching factor here is affordability which drives all this. Sales will be slow and inventory grow not because of any past performance, but because affordability is poor and it has to improve before the market can sustainably recover.

Actually I see a lot of those items being offered up either for sale or free. Cabinets, appliances, anything being removed. Hang out on some of the Victoria freecycle / resale sites and you see these items all the time.

Yeah the early 80s bubble was pretty strange for Victoria. Basically just a couple years extreme panic in the market followed by a collapse the following 2 years.

I’m somewhat partial to the theory that the bigger downcycle was actually from ’77 to ’86 with the interest rate driven panic a mere distraction in the middle

Excellent point. Especially in a condo where you have a turnover every 5-10 years. What are the chances that the third owners will be happy with the 15 year old kitchen?

I wonder what percentage of renovations are actually because the kitchen is end of life? Likely very few. Sadly much of what is getting ripped out and landing in the dump is perfectly functional.

5-year interest rates dropping again. Seeing as low as 2.69%.

The quality of the kitchen in a condo is worth discussing? What about the idiocy of buying a condo in the first place?

SFHs are clearly a better longer term investment; however, that component aside I personally quite prefer condo living for many reasons. I have actually found peace, quiet, and privacy to be better in condos. Up in the elevator and into your unit. No need to discuss where to place the fence with your complicated as can be neighbour.

Not to mention from a society standpoint so much more beneficial to pluck 300 people onto a parking lot downtown versus clear-cutting to create for 100-150 building lots and then having everyone commute in for Sooke 2 hrs per day. At the end of the day people need to live somewhere and there isn’t enough SFHs in Oak Bay to accommodate everyone.

Sales numbers. The charts are all 12 month centered rolling averages. So the last data point is for November 2018 using data from June 2018 to May 2019.

It can, I just don’t think it will. Trends can definitely overshoot, and they are more likely to do so if the market is more volatile and the momentum is higher. Vancouver has definitely been more volatile than our market, which has been cooling almost at the exact same pace for 2.5 years now (May 2019 data excepted).

It is possible that market conditions push peak inventory back or pull it forward by a month or so. In a strongly cooling market sometimes the September inventory is a smidge higher than June peak (this happened in 2017 and 2018) but inventory essentially always drops in the late fall. The one exception is the great financial crisis in 2008 where inventory jumped in October/November. That kind of black swan event is about the only thing that can derail the normal seasonal trends.

If you’re in debt already, or planning to borrow, borrowing below market makes sense. For you I mean. It’s that simple.

$1,070,000

Yes. That’s why it’s been surprising to see that prices have flatlined, even declined a bit when that shouldn’t have yet happened. Even in a balanced market (which single family in most areas and price ranges is in), prices are expected to still rise with inflation.

I believe it’s partially the shock to the system from regulatory changes which temporarily boosts the percentage of “need to sellers” in the market, and some irrational exuberance in sales prices over market value during the really hot periods that makes the comparison look negative now that places are selling for market value again.

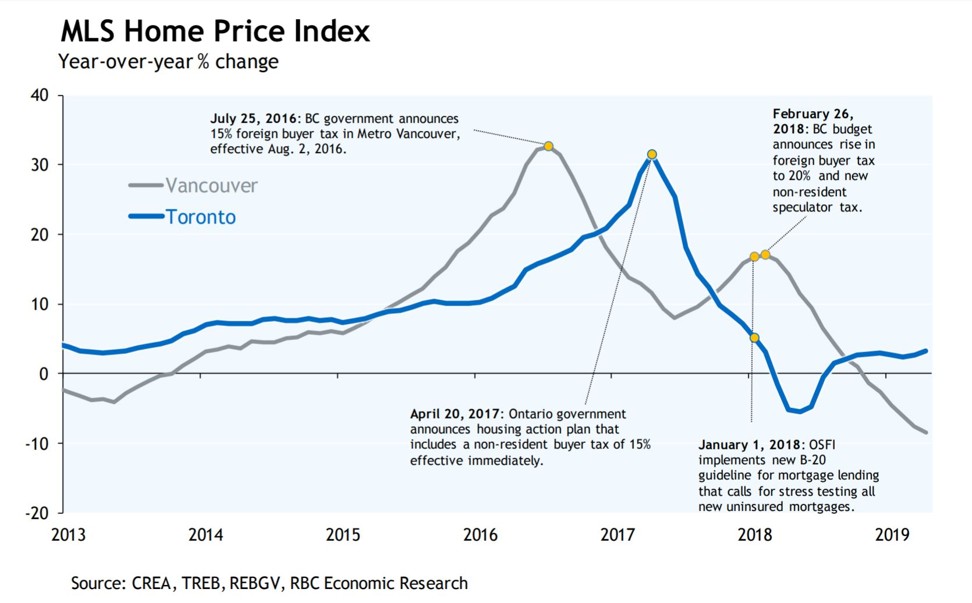

Thanks, good article. I especially like this chart. Although it wouldn’t line up quite so beautifully for us.

@Patrick

IMO, there shouldn’t be any tax deferral schemes, or government incentives for buying or upgrades, because it would be better for the economy with less government meddling.

Great looking graphs Leo S.

@RenterInParadise

The comment below so far is your best that I’ve seen, and I wholeheartedly agree that Oak Bay resident is being entitled. To go a step further everyone should be grateful to be living in one of the world wealthiest country and to be fair the retirement age should be at least 70 for men and 71-72 for women.

At least if they’re going to troll, put some effort into it. That was just sad.

Deferred B.C. property taxes are also available for millennials and anyone who is:

-families with at least 1 child under 18 https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/defer-taxes/families-children-program

– Surviving spouse (any age)

– Disability (any age)

Interest rate for seniors (>55) is 2%. For other deferees it is 4%.

In years with young kids at home, expenses are high, so deferring taxes may make sense, as you don’t have to make payments until you sell.

Another op-ed comment in Times Colonist in response to the Oak Bay tax deferment letter:

https://www.timescolonist.com/opinion/op-ed/comment-looking-to-the-future-not-the-past-with-housing-issues-and-property-tax-1.23847768

It is appalling that student loans have higher interest rates than do deferred tax loans. One is with the goal of upscaling a skill set and earning more income and the other is non-productive.

But the best line in that commentary is this one:

“How do you even find this enjoyable?

What a low effort garbage troll”.

James – you are not the only on that feels that way about the troll. You are in good company, my friend. The Troll’s posts offer no insight, add nothing to the discussion and are aimed at provoking angst. Grow up, Troll !!!

Stranger – that was an excellent article on falling Vancouver equity / prices. Thank you for sharing. The graph showing the impact of the foreign buyers tax is beyond reproach.

Matthew – good eye – what’s up with that price discrepancy is the lag. Vancouver’s price correction is one year ahead of Victoria’s. You will note that Vancouver luxury listing rose and prices started to fall one year before it started in Victoria. Take a look at the luxury home market in Victoria – very few sales and price slashed galore. Now, in Vancouver, we see the “bench mark” home price falling. We will see the same in Victoria with the lag. The owners of Victoria luxury RE are bemoaning the loss of “equity” just like their West Vancouver friends.

LF – I will miss Pluto’s. Density has its price.

Isn’t Victoria ALWAYS the city that has the lowest % of young people home ownership, thus the reputation as a city full of “newly wed and nearly dead”? 😉

Also just saw this news “Oak Bay on verge of approving its second duplex”: https://www.vicnews.com/news/oak-bay-on-verge-of-approving-its-second-duplex/

Oak Bay is so “old” and so slow in moving forward with the least population increase and older people complaining about property value increase and rejecting legal suites and duplexes. And yet, before Leo took over this web site, the most discussions here were about “house hunt Oak Bay” rather than house hunt Victoria.

They didn’t say “house”, they said “home”, i.e. any kind of dwelling. They didn’t do a breakdown of dwelling types, but simply looking at the % of SFH out of total stock and relative prices then and now, I would say the boomers had much higher ownership rates of houses on the West Coast. I bought a detached house in the City of Vancouver on one income. Who could hope to do that now?

Also note, of course, that Canada-wide figures are of little relevance to affordability in the country’s most expensive markets.

We bought at around the previous peak. And people back then were saying prices couldn’t conceivably go higher. Sound familiar? (Maybe this time they’ll be right. But maybe not.)

Really glad we didn’t do the easy thing, which was to stay and buy in Calgary. Seems as though Calgary house appreciation has been pretty anemic compared to Victoria over our owning time frame. (Not to mention, living in Calgary takes more years off your life than living in Paradise 🙂 )

I also wouldn’t be surprised if Calgary prices continue to stall going forward. The oil and gas sector is going to lose a lot of jobs in the coming years from automation* and from decreased oil demand. And neither Calgary nor Alberta is nearly as economically diversified as prudence would dictate.

*https://globalnews.ca/news/4000125/suncor-union-outcry-automation-oilsands-jobs/

Leo, I agree with some of what you say and disagree with much of it. A macro-historical view tells us what factors influence house prices. The central features [though there are peripheral ones as well] or factors are (a) incomes, (b) interest rates, (c) immigration [foreign capital flows], (d) demographics, (e) economic growth and (f) exogenous shocks.

From a historical data view, (a), (b) and (e) are really the keys and the ones that policy makers focus on. I would encourage a look at this video which provides a summary from 1990 to the present which concretely shows the link between these 3 factors and RE prices:

https://www.youtube.com/watch?v=4pd8kPXOzns

It is simple, visual and solid.

Hope all is well – HAPPY FATHER’S DAY to all.

But you are in the business of selling condos to buyers so lets agree to disagree.

But part of your livelihood is selling condos.

You keep bringing this up but I would think that as a lawyer you would have enough common sense to realize that I am not as dumb as Info or Hawk……my opinion on the direction of the market or desirability of condos on this blog has zero cause and effect both in terms of the overall market and my personal business performance. It is an incredibly weak argument on your part.

According to RBC , 43% of millennials under 35 already own a house in a Canada. That’s the same rate for boomers had at the same age. The issue is that Victoria has the lowest rate of millennial home ownership in Canada, at 27% (vs Calgary at 50%). That’s because boomers love Greyer Victoria too. You can complain about it (LF), buy elsewhere or buy a Victoria home (Introvert) . The lowest rate of millennials owning in Canada being in Victoria (27%) is bullish for housing here, because they want to and eventually will buy, so it makes sense to buy ahead of that.

RBC (Feb 2019) http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/Home_Ownership_Feb2019.pdf

“We take issue with the notion that Canada has a home owner-ship problem in the first place. On average, more than 40% of Canadian households under 35 years of age own their own homes. And the proportion of all Canadian households who own a home is one of the highest among advanced economies. Even Toronto and Vancouver—the least affordable markets in the country—rank near the top of global cities on home owner-ship and have home ownership rates that are about double cities like Paris and Berlin. “

That bubble only lasted a few years. After it collapsed the boomers (including me) had the better part of two decades to buy at reasonable prices – and declining interest rates once they’d bought. Not in any way comparable to what young people face today.

Jerry is on the right track. Settle for nothing less than full allodial title to your land.

Victoria prices compared to West Vancouver prices:

Victoria House: Built in 1952, very large 28,000 sq ft property, 2854 sq foot house, basically original condition but some renovation work completed, presented to the potential buyer as a tear-down, asking price is $2,400,000:

https://www.realtor.ca/real-estate/20407413/5-bedroom-single-family-house-2538-nottingham-rd-victoria-uplands

West Vancouver House: Built in 1992, large 19,000 sq ft property, 3683 sq ft house, nicely renovated, asking price is $1,990,000:

https://www.realtor.ca/real-estate/20610440/5-bedroom-single-family-house-5426-keith-road-west-vancouver

$400,000 less for (what I think many would agree is) a nicer home in West Van. Hmmm …

Actually nowadays new Ikea kitchen can be a upscale upgrade. My neighbour just got theirs done, all Ikea, designed and installed by local company, very upscale and nice.

Jerry: You pointed out the obvious about condos. Maybe I should not have just picked on kitchens when the flooring is even poorer. Windows are also a delight to replace. But at 700 or 800 a square foot you cant really expect anything to last and besides you should be tossing money in to keep it looking modern. It is the Mercedes price for the Ford Pinto quality that is the real problem.

Marko: I am kind of partial to my one hundred year old mahogany kitchen; the carved details are still works of art. But tastes change. Wonder how long the new kitchens will last, I would not bet on all that long considering the model kitchen already had chips in the finish. But you are in the business of selling condos to buyers so lets agree to disagree.

Amen to that one Jerry!

There’s nothin’ like a Jerry tirade. Can’t say I disagree with this one.

The quality of the kitchen in a condo is worth discussing? What about the idiocy of buying a condo in the first place?

In an earlier discussion Marko had posted a link to a condo that was priced at 750k or so. Seven.hundred. thousand. dollars……

The same price as a true detached home but for which you get:

-no identifiable and inviolate piece of land

-no access to the inflationary rise in the value of that land

-no privacy

-no peace

-no quiet

-no control over your immediate environment

but

-pay city taxes at the same level as the owner of real property

-pay ever-increasing strata fees for an ever-declining aesthetic

-enjoy the daily challeng of identifying which of your immediate humans prefers sauerkraut and which prefers curry

-step out from your threshold into a puddle of urine

I am agog. Do none of these people own calculators? What could possibly induce you to pay good money for such dreck. Dementia?

@LF. I don’t disagree. Just giving a shout out to Max. Buying a house always has been and always will be difficult because it’s an investment that anyone can make and requires no skill. Many do it because they don’t have the skill to invest elsewhere.

I guess I’ll just be the contrarian today.

While I’m sure that comment will resonate with lots, I’m not sure it’s an accurate picture. You might recall my post from a few days ago from the early 80’s, with “Boomies” (now called “Boomers” ) bemoaning the cost of housing.

They had good reason to complain, too. An entire generation of buyers was being shut out of the housing market due to crushing interest rates and ruinous inflation. What was thought to be temporary in the 1970’s (inflation) was by the early 80’s, deemed to be permanent. But that wasn’t just prospective buyers looking to start families – it was young people already in the market, who faced interest rates going up so high and so fast, it knocked scores of them out of the market and when the market finally crashed, they had lost everything.

Here’s an excerpt from an article just before the bust 35 years ago, when boomers were our age now:

“As prices rise, however, the train is becoming increasingly difficult to board for first-time riders. There are an increasing number of “outs”—young first-time buyers or the working poor who can only watch angrily as the Canadian dream of a detached house with a white picket fence fades. Dan Mothersill, 32, is a communications specialist with Calgary-based Esso Resources Canada Ltd. who is in danger of losing his recently acquired first house due to high interest costs. “I am the baby boom,” he says. “We weren’t as worried about the future as we might have been and we sort of got skunked.””

Notice a familiar sentiment?

I’m not arguing that the present day’s challenges aren’t real – they are. However, I want to draw attention to the human tendency to perceive the present day as a permanent dynamic moving forward. History shows us repeatedly that this is not the case.

While we don’t know exactly what the future holds, we do know that these inter-generational concerns are omnipresent across all time periods, and when millennials are ready to go meet their maker, I suspect that on the whole, things won’t appear as unbalanced as they seem to be right in this moment.

PS in both cases – central bankers were the primary cause of the problem. Toss some blame at President Roosevelt and later, Nixon too.

How do you even find this enjoyable?

What a low effort garbage troll.

Thumbs up to Max, if you’re out there. In response to the fella in the Times Colonist complaining about property tax deferment.

https://www.timescolonist.com/opinion/letters/letter-to-the-editor-baby-boomers-are-the-lucky-ones-1.23847732

“Previous generations, after suffering through two World Wars and the Great Depression, set up programs in all areas of life (healthcare, education, and housing, for example) to ensure that their boomer children would never undergo similar hardship.

Western boomers are the luckiest generation in human history and hide from the fact that their children are materially worse off in almost every way by fantasizing elaborately about “entitled” millennials who can’t afford to buy houses or raise families or start businesses because they buy too much avocado toast.

Can anything be more entitled or more shameless than receiving a massive windfall and trying to pass the burden of paying services for an aging population onto a generation that has already been crippled by boomers pulling the ladder up after them?

Regardless of whether the writer continues to take advantage of below-cost loans to stay in his home or elects to sell his property and move into a condo, he has it better than a good number of the young working people he expects to pay for his roads and healthcare. Maybe he should think about how to leave something for the next generation instead of looking to the U.S. for new ways of pandering to pharaonic greed.”

Marko: Different strokes, but not my choice of materials that will last. But part of your livelihood is selling condos. In terms of need one could make do with a tent and Coleman stove.

I go into 80s/90s homes and the crappiest melamine kitchens are still functional. Is there any purpose of a kitchen lasting 50 years? People don’t walk into 50/60s bungalows with original kitchen and note “wow, great quality.”

Because Victoria RE enjoys snubbing you too much.

Marko: Different strokes, but not my choice of materials that will last. But part of your livelihood is selling condos. In terms of need one could make do with a tent and Coleman stove.

To quote my wife the model kitchen makes Ikea look upscale. Amazing what crap people are willing to pay top dollar for.

I like the Hudson Place One kitchens personally. What more do you need?

Last night went to the Hudson One presentation center (free food and drinks is hard to turn down) To quote my wife the model kitchen makes Ikea look upscale. Amazing what crap people are willing to pay top dollar for.

You could be right, but it may not be so easy. This whole thing takes years to progress. Watch for inventory spikes in attached dwellings; detached will probably lag but generally follow albeit to a lesser degree.

Sellers in Vancouver for example, have really begun to fight back. As the downturn metastasizes, inventory keeps getting constrained as sellers balk at the market conditions. That’s the inevitable stickiness in prices we see in any downturn.

There is still an element of confidence among people that southwestern BC is just one season away from its next major leg up. At some point if the buyers still don’t bite, what remains of that confidence will be lost and the inventory will grow more readily. Panic will become more obvious. That’s not happening quite yet.

I would say many sellers have little idea what’s actually unfolding in BC. Some think the falling rates will turn it around. I suspect they have a wee surprise coming their way.

Wait till the legions of leveraged pre-sale buyers from 2016-2017 have to close…

Vancouver sales have bottomed out passed the 90s lows the last few months despite being much bigger. Why can’t it happen here?

I’m willing to bet that won’t be the case this year.

Anecdotal tidbit of the day from up island… my realtor dropped this morning by to say Hi and I asked him how things are looking in the market (this would apply to Cowichan Valley).

He said things have cooled from last year – instead of multiple offers or selling immediately for list or over list, now houses are taking on average 30-60 days to sell. Less frantic, more time to breathe, but prices are relatively sticky.

Pluto’s restaurant on Cook St is about to be no more…

Making room for condos. I like Plutos. Sometimes I’d go and just order a milkshake (so many flavors), much to the annoyance of the servers. Had one roll her eyes at me once.

https://www.vicnews.com/news/longtime-downtown-victoria-restaurant-gets-renovicted/?

@guest_60578

Great ideas.

I hope whatever career you have you can utilize your innovation to its fullest potential.

Do you mean sales numbers or prices? Numbers maybe?

I don’t think I understand the sales and price cycle graph. Is the plot point measure YOY taken at a certain month?

Is that the house that had its own tennis court just below it?

Whenever bears find an owner who’s probably lost money it gives them such a tingle! Tee-hee!

@ Barrister

<

As I am sure you know, governments rarely create jobs that pay for anything. On the contrary, they mainly create jobs that burden taxpayers and discourage productive investment.

At best, government can create conditions under which others will instigate wealth-creating activity that supports high wage employment.

Here are some suggestions.

(1) The Province could invite China to build its next ghost city here in BC, on free land provided by the crown. For us it would mean continuation of the construction boom while the domestic housing market cools, for the Chinese it would mean a safe offshore haven for investment in what Chinese investors seem to like best, empty apartment buildings.

(2) The Province could negotiate a deal with GM or another company to assembly dinky (ca. US$10,000) electric cars here in BC. The incentive would be (a) progressive expansion of electric-only car zones in urban centers, (b) a guaranteed five-year extension of the BC electric car credit.

(3) Creation of high density, tech-centric, new cities engineered for minimal environmental impact and maximum livability, and linked by high speed transit to the downtown of existing major urban centers. Thus, locally, we’d have compact new settlements probably in (a) Saanich, (b) the Sooke Hills and (c) somewhere over the Malahat.

(4) A transformation of forest management in BC, with up to 10% of the Province’s 50 million hectares of commercial forest land privatized under a Forest Practices Act that would compel sustained yield forestry. The result would be many new jobs relating to forest management, including fire suppression and silviculture, plus an addition of something like a billion tons to our forest carbon reserve, equivalent to about 15 years worth of current provincial CO2 emissions.

I could go on, but others surely have better ideas and it would be good to hear from them.

PS: I think, Leo, your market analysis is superb.

Looking at the chart it is no mystery why prices aren’t cratering.

The inventory levels (or MOI levels) where we are currently sitting have in the past been associated with strong price gains not falls.

That said if the current trends continue sales will fall and inventory will climb and within a few years we will be back into a high inventory / low sales market that has in the past been associated with falling or stagnant prices.

Deals are starting to appear, but the storewide 20% off sale is still a few years out IMO.

Strangertimes: Good article and I like his references to the other side of the coin. Now that BC seems to be getting out of the business of selling really overpriced real estate to foreigners (which is possibly a good thing), the government needs to deal with the other side of the coin. What export jobs and industries is the government going to create to pay for all those lovely imports that we insist on having? That seems to be the other side of the coin that nobody even wants to talk about. We need to figure out a way to replace billions of dollars worth of exports since we are no longer “exporting houses” to foreigners. Sorry but that is the other side of this coin.

The good news is that this is your coin and not mine.

Does anyone know what 1749 Davie street sold for?

It seems as though the outrage over lost equity in Vancouver is starting to overshadow the conversation on housing affordability even with the average detached home price in the Metro at 1.4 million and the city still remaining the most unaffordable in North America. The title to Ian Young’s new column couldn’t put it any better. “Scared of falling home equity and the war on money laundering in Vancouver? Tough luck, and get a grip”

https://www.scmp.com/comment/blogs/article/3013288/scared-falling-home-equity-and-war-money-laundering-vancouver-tough

That’s one great post. Thanks Leo

That’s the ticket! Love it.

From the street at any rate it seems to be a difficult lot to build on to say the least unless there is access from behind. If I was looking at it I would wonder if it might be virtually unbuildable with the new bylaws and building code requirements. I have no idea if that is the case but just looking at it from the street raises some real question marks.

Great Stats as always.

Re 57 Beach Dr in comments of the last post. The house has been burned twice by fire (in 2013 and again in 2018) and an abandoned property, so it is a special “tree”, not a good representation of the “forest”. Note its 2006 sold price was $1.49M, and it has been sold twice already since the fire for same price of $640K.

See:

https://www.timescolonist.com/news/local/major-fire-at-vacant-oak-bay-house-on-beach-drive-1.23323662