May Market Update: Sales make a small recovery

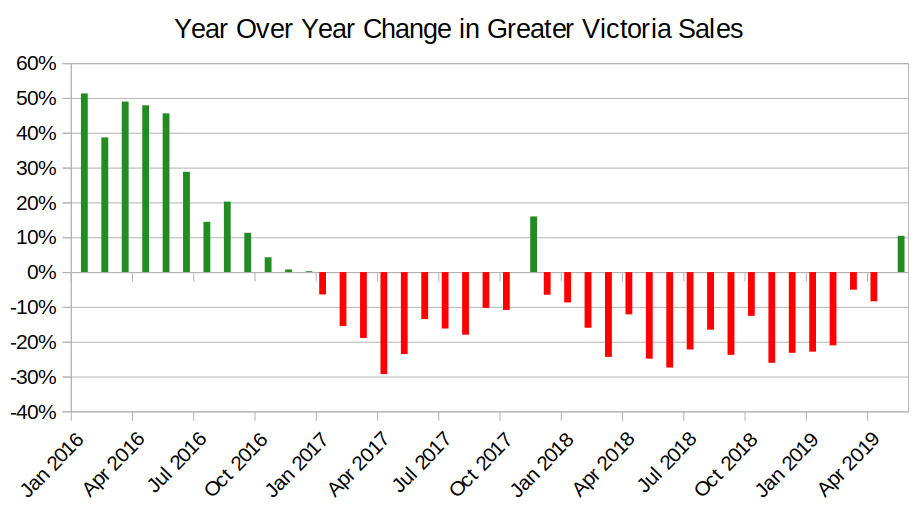

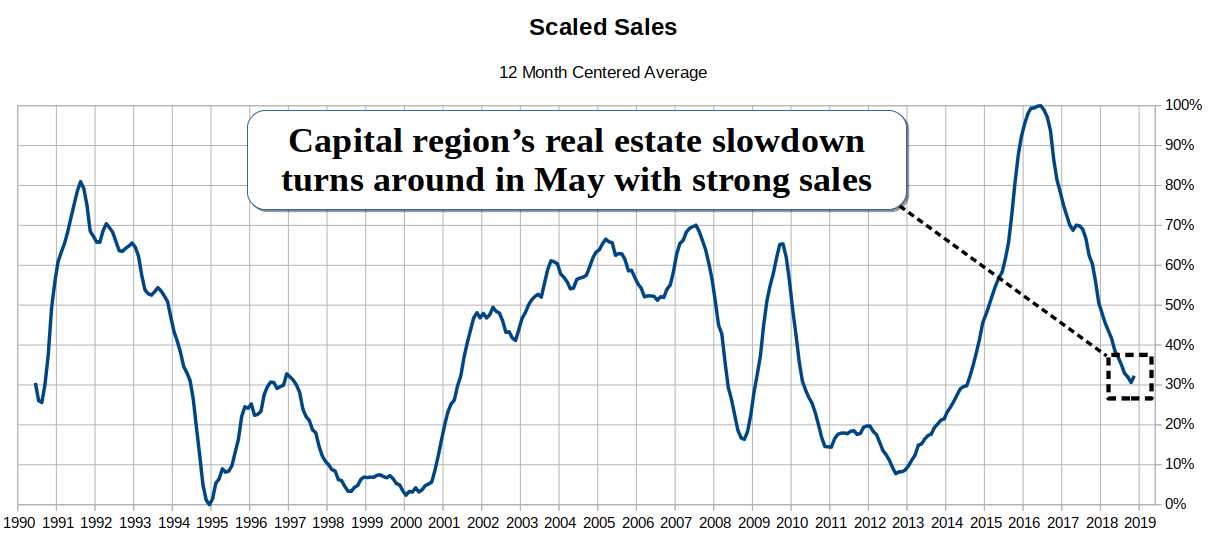

May numbers are essentially in, and the big change this month is that after nearly 28 months of year over year sales declines, May residential sales for Greater Victoria came in around 10% higher than last May.

Does it mark a turn in the market? Is the correction over already? I don’t think so, but it’s worth a closer look so let’s dive in. First, let’s split the data into detached and condo sales.

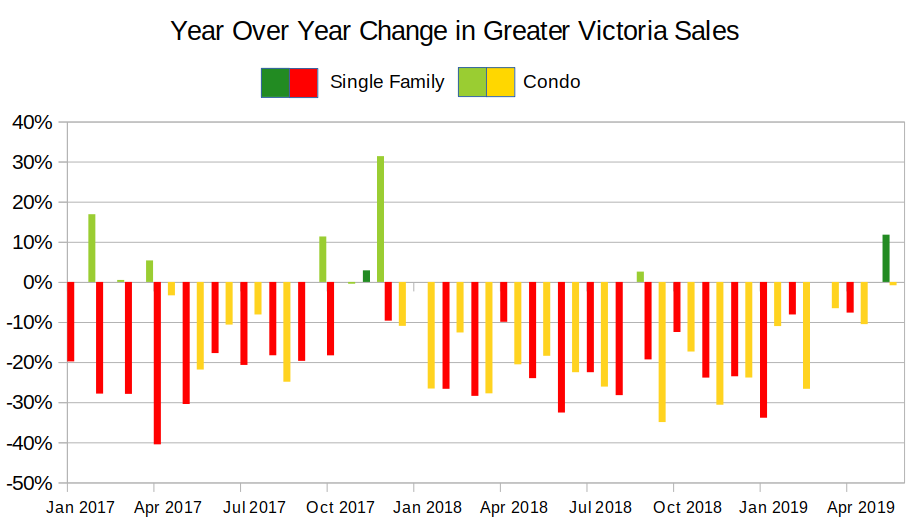

Now we can see that the sales increase was entirely from the detached side, while condo sales were approximately flat year over year. However it certainly appears that year over year sales declines have been dropping in recent months, from the -20% YoY range late last year to the teens and single digits early this year, to straight up sales increases this month.

It’s not really unexpected. Since January I’ve been expecting a month of sales increases compared to last year, and was so far surprised that we continued to see decreases, despite the extremely weak sales in early 2018 when the stress test was starting to take effect. Finally it happened in May, but will it continue? Let’s take a look at the actual sales levels.

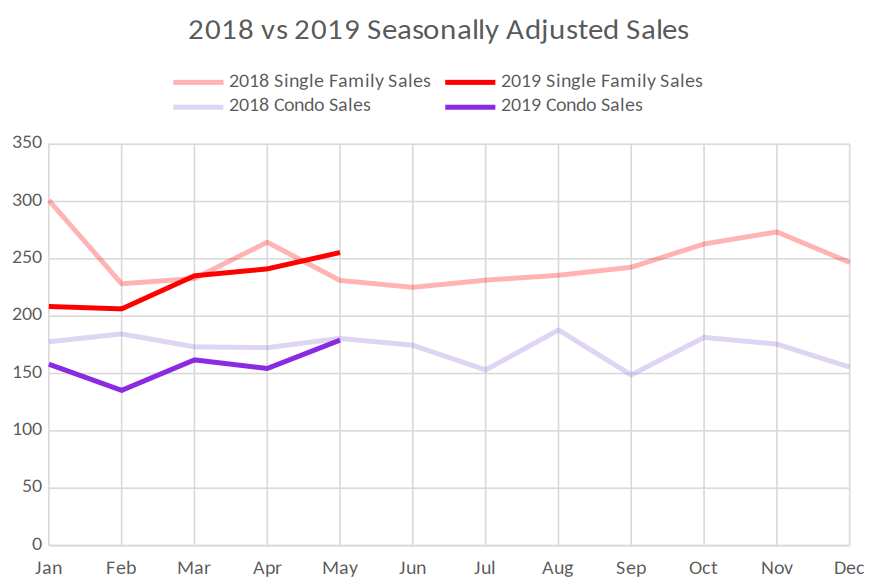

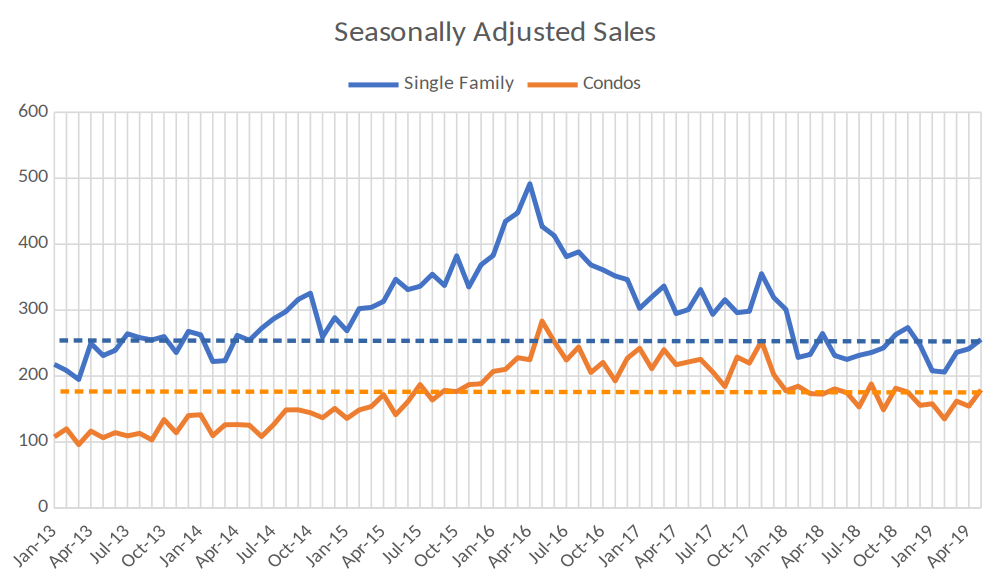

You could either look at that and say that detached sales are on an uptrend and will continue rising, but I’d say it’s a little too early to tell. So far this is well within the range that we’ve seen sales bounce around in for the last year and may just be a small bump based on the better interest rates we’ve seen recently. Don’t be surprised if detached outpaces this time last year for much of the summer though. When we zoom out we can put this into context.

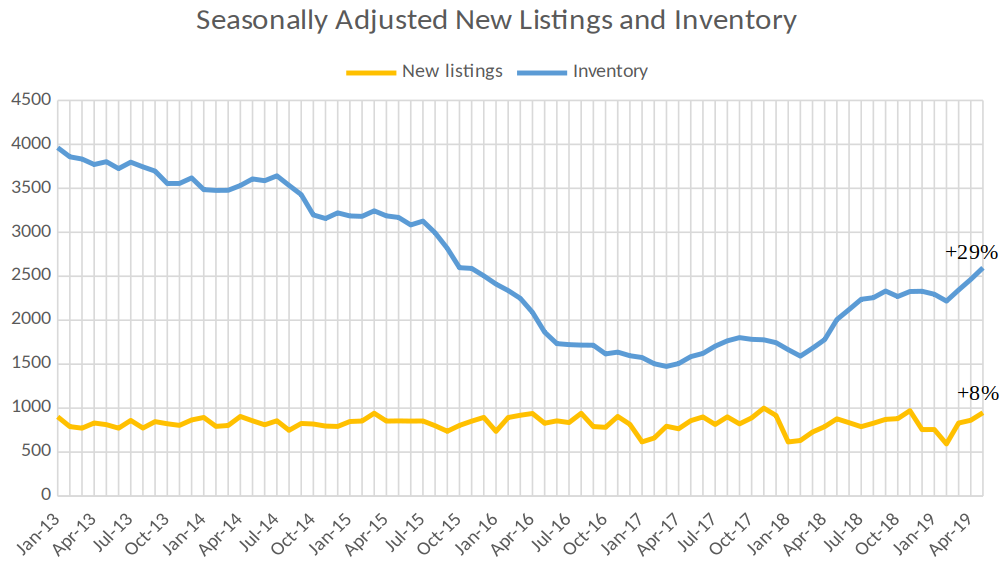

There are about 29% more properties on the market compared to this time last year, and encouragingly new listings are also up by 8%. That combined with sellers that are now adjusted to the new reality of the market and more willing to drop prices to make a sale makes it easier to be a buyer now than any time in the last few years.

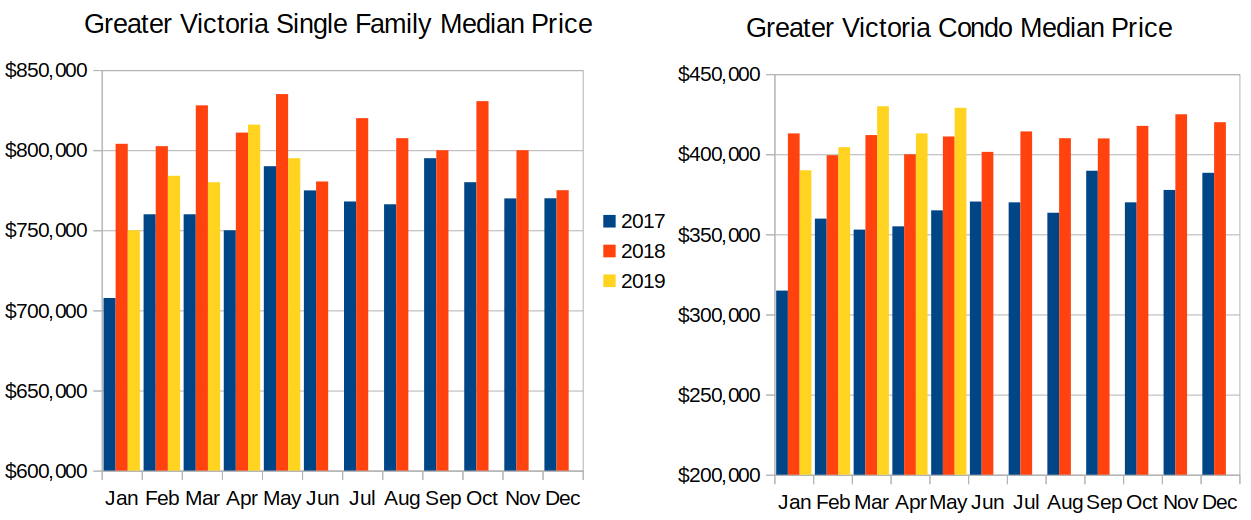

Prices are roughly unchanged from last month and have now been bouncing around relatively flat for a year on the detached side while condos are still posting small year over year increases.

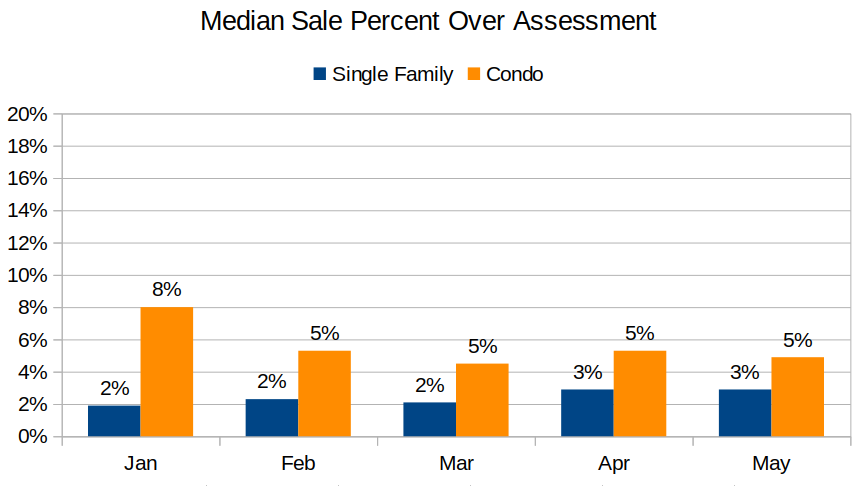

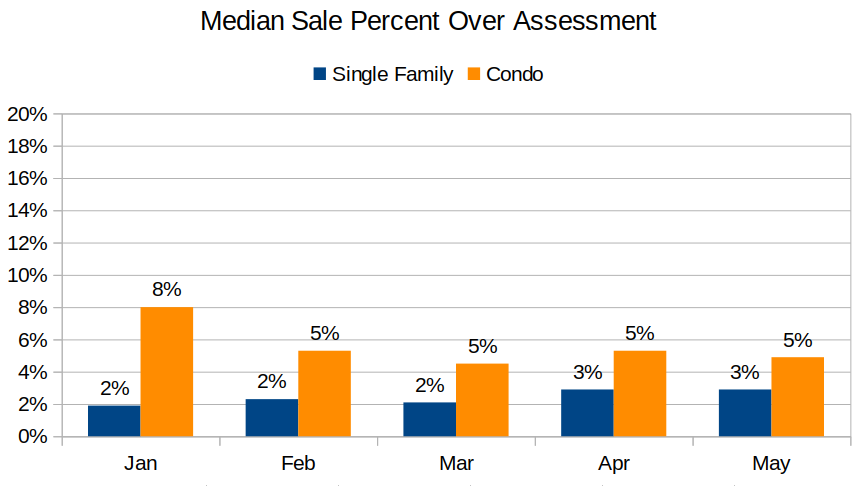

Another way to look at prices is with the poor man’s repeat sales index, which is the median sales price compared to assessment for each month.

That measure confirms again that prices have been essentially flat, with the average house going for 2-3% over assessment, and the average condo about 5%. The average quality of house always deteriorates somewhat in the fall, so I expect that we will drift down to houses selling at or below assessment once the summer is over, when a greater percentage of homes sold are the ones in non-showroom condition.

In the news, what’s interesting is the coming to light of various forms of fraud in the real estate market. No surprise that this was found in the lower mainland. The frothier a market is, the greater the likelyhood of shady dealings, and there was no frothier market than Vancouver a couple years ago. Some brokerages in the lower mainland allegedly ran a scheme where houses were recorded as sold for much less than their actual sale price to avoid PTT and bypass foreign capital controls. Meanwhile, FICOM uncovered a massive mortgage fraudster, and unlike the money laundering WAG at the dollar value of that impact, they have actual documentation of a staggering $500 million in fraudulently arranged mortgages. It’s a big fish, but I suspect there is a lot more where that came from.

Why is all this coming to light now? Perhaps it is more people paying attention, perhaps it is some of the recipients of those mortgages finding themselves no longer so happy about it when the underlying asset is declining instead of appreciating. The tide (at least in the lower mainland) is clearly going out, and I suspect we will find all sorts of other interesting things washed up as it does.

Well that sheds some light on the subject “Ash”!

A fire sale!

https://www.timescolonist.com/real-estate/fire-sale-beach-drive-property-up-for-1-4m-1.23363803

Adjusted for inflation that’s slightly over a 2% appreciation after 5 years. In fact, after transaction and any carrying costs…that’s probably a loss.

Nice, lot at 57 Beach Drive sold for 50% of 2018 assessment. Check out MLS 407300. 2018 assessed is $1,440,000. Final sale price is $710k. Real estate only goes up.

Sold in 2014 for $640,000 and at that time the assessment was $1,445,000.

Nice, lot at 57 Beach Drive sold for 50% of 2018 assessment. Check out MLS 407300. 2018 assessed is $1,440,000. Final sale price is $710k. Real estate only goes up. 🙂

Barrister,

You’ll likely love Lugano, and I agree the train travel around Europe is great (especially since airports/flying is so miserable now with extra security/delays). Malibu is a nice plan B! You should watch “Escape to the Continent” on Netflix, w/ lots of retired UK couples buying places around Europe.

“Asking price: $1.125-million. Selling price: $1.01-million

Previous selling prices: $848,000 (2008); $675,000 (2006); $432,000 (2004); $320,000 (1992)…

The retired Albertan owners sold the unit because of the new empty homes taxes, listing agent Ian Watt says. They had used it for 11 years as a vacation home, but were looking at about $26,000 in extra taxes.”

That figure does not make sense. Vancouver empty home tax is 1% and spec tax is 0.5%. On $1,327,000 assessed that’s $19,905. It would appear that Watt or the “reporter” (who regularly pumps RE) is assuming 1% spec tax.

https://www.theglobeandmail.com/real-estate/vancouver/article-new-empty-home-tax-moves-retired-albertans-to-sell-condo/

Historical note: This development (Pennyfarthing) was the site of famous confrontations between union workers and the non-union developer.

Leah: Sorry, but I don’t know why the VYR Pulse website doesn’t include Langford or Colwood. I have seen price reductions for Duncan, Sooke and other nearby places on this site, so why they are not reporting Langford and Colwood is a mystery. Perhaps, the owner of the site has a big, threatening brother-in-law who is trying to sell his house in Langford and does not want to alert the public about the impending collapse out there (ha ha).

Aren’t you one of the complainers whenever anyone says something not about Victoria housing? Also notice you consistently bring up mountains (proximity to Whistler etc), which is a little odd for someone who hates snow, and people.

Josh: You have been actively looking for a quite a few months now; have prices gone down any or are they just flat? Or possibly up a notch or two?

Just another entitled boomer looking for a handout from the government. Maybe if he got fewer participation trophies (read: pension / gainful employment out of high school), he would have an idea about how the real world works.

Ya, cash out of inflated Victoria and move to dime-a-dozen west shore Vancouver. Sounds like a good move.

Villa Madrone up in Lands End is up for sale again. Assessed at 7.5 million and asking 6 million. Do not know if it actually sold the other times or just taken off the market.

The Gonzales Hill site is the driest Environment Canada site on the coast. There might be even drier locations in the school weather network.

This climate talk reminds me of the former frequent poster who called Victoria “the rainiest city in North America”. LOL.

Give Soper a little time there and I’m sure he would find it mediocre at best.

Most of which falls in big downpours. You won’t get days of drizzle there typically. I think many people would find the climate of Ticino or surrounding Lombardy quite lovely.

Patrick: yeah I know which is why we would only spend part of the year there and the rest in Spain or elsewhere. Once in Europe it is easy to get around and I have always been rather partial to trains. If it is too annoying then back to Malibu although I did not love LA. I spent most of my life settled in Toronto so getting about a bit at this stage in my life is not a bad thing. Like I said Victoria is a nice city and if you are building a career and family a great place to be. The main draw for Lugano is the extended family which is there.

Fun facts! – 6 month (apr-sep) “summer” rain totals for

In the “money is no object” fantasy, taxes like these can easily be absorbed 😉

Introvert: summer house great idea as long as you dont mind dealing with the spec tax and empty house monster.

Patrick: Or you can check Malibu, Moro Bay or San Diego for sunshine and days of cloud.

It might be my perception but there seems to be more listings of pretty regular houses that are listing near the two million mark. I look at the listings and I have trouble believing that they are even worth a million. I guess I should not complain because we will be selling in the next year but at today’s prices I definitely would not have bought in Victoria.

This era of cheap money may well end up being a curse for a whole generation. But now I am sounding like the old man that I am.

West Vancouver’s heavy rainfall would be a negative. Summer house, perhaps?

Growing up out east, I’ve had my fill of cold, cloudy, wet weather, and love our sunny, dry summers here in Victoria.

Here are some annual rainfall numbers…

If you’re interested in dry, sunny weather in Victoria from the Olympic Rain Shadow , make sure you live in the south-east part, (south of royal oak, downtown Vic, along the coast on east is best) as shown on this map http://www.olympicrainshadow.com/olympicrainshadowmap.html

@guest_60386, you’ve posted info from YVR pulse – do you know if the Westshore is excluded from their stats?The site has Victoria, Sidney, & Sooke listed as regions. When I look at the price drops listed under Victoria, it never shows Langford addresses – and I know houses in Langford are dropping their prices because I can see them on Realtor.ca

Gotcha. Did that place you posted sell?

Marko. what is the return on equity generally if you rent one of these condos these days?

Thanks patriotz for the response. The listing / offering sounds like what could be a very messy deal. All that without the fun bits and at a premium to current assessed value (30% of property for 40% of assessment).

One last question. Would a transaction like this trigger any provincial taxes? No I’m not considering this at all – just curious.

Hey Marko, if places like that(house is 3 years old) are going for 1.6, I don’t think that place in Burnaby you posted last month for 1.3 is gonna sell anywhere near that.

I am familiar with the hood as a girl I dated when I lived in Vancouver lived one block over. It is not the most desirable location being so close to Cariboo Rd. This is a $2 million-dollar home in North or South Burnaby.

The problem of current pre-sale is the current price of the pre-sale.

Didn’t Marko say that, in regular/balanced market , their price should be about 10 to 20% lower than market price to make up for the wait time (and other unknowns. Note there is also GST).

I don’t know about 20% but certainly up to 15%. I bought a unit from Bosa @ Promontory in 2011 for $193k and it was worth approx. $225k on the re-sale market.

Right now, nothing makes sense in the pre-sale market. Look at the per square foot prices at the Hudson on 15th floor, for example, and then compare with sale of this unit for $720k yesterday -> http://www.pembertonholmes.com/listing/85m9

It will be interesting to see what happens when a few of these projects are completed with a large number of unsold units and the rental market weakness due to all the rental inventory coming on board.

I have lived in West Van for a couple of years.

Although pleasant area, view wise. The rain finally got to me when friends living in Vancouver would call me to come and enjoy the beautiful day, while I was looking out at low clouds and rain. Also on the odd snow day it is not fun walking home because the hills are too steep and icy to make it up even in an all wheel drive.

I have enjoyed living in Victoria but I dont think I will miss it either when we move to a smaller town. Overall Victoria is a nice city but perhaps less nice than five years ago. But that is just my opinion and others see it differently.

Greater Victoria Single Family Benchmark house prices for the last 1.5 years:

Jan 2018: $702K

Feb 2018: $710K

March 2018: $724K

April 2018: $733K

May 2018: 738K

June 2018: $745K

July 2018: $741K

Aug 2018: $766K

Sept 2018: $768K

Oct 2018: 765K

Nov 2018: $755K

Dec 2018: $752K

Jan 2019: $742K

Feb 2019: $739K

March 2019: $741K

April 2019: $742K

May 2019: 756K

As you can see, there has been some recent improvement in prices since the beginning of this year, but prices are still about $10K below the all-time peak which was Sept 2018.

So I decided to take a look at “when” the price peak hits in each of the last several years. Here are the results, for what it’s worth:

2014: June 498K

2015: Dec 521K

2016: Dec 625K

2017: July 701K

2018: Sept 768K

2019: May (so far) 756K

The only thing I can make of this information is that in 2015 and 2016 prices hit their peak in Dec because they were basically rising each and every month for those two years straight. But in the other years (more normal years for price growth) prices seem to hit their peak way earlier in the year (June 2014, July 2017and Sept 2018). So I think that (because this is a more normal year) prices might go up a bit in June 2019 (say to $760K) but then they will fall each month thereafter all the way until Dec 2019.

Here’s a place that actually sold in West Van.

I dunno Introvert… are you still day dreaming after this conversation has developed? Do you own a small dog?

Sounds like lil’ house on the western frontier over there.

Southern exposure be dammed. The least of your problems may be bungie cording your trash can.

Probably time to start the next topic?

I may have to conceed to you on this point! I have been attempting to establish the northern limit of the racoon population. And your answer was very similar to one I heard from a First Nations person from Prince Rupert!

Racoons = no predators, garbage and the lack of firearms in the truck.

Poor bandits dont stand a chance otherwise!

The raccoons don’t stand a chance against the bears and cougars, and it won’t be long til grizzlies make their way down from the Stein Valley/Squamish area, too. On the bright side, the grizzlies should solve the park over-crowding!

Sold Out…..What about the Racoons? Are West Van racoons more crafty than Stanley Park/West End racoons? I think not!

I always judge a neighborhood by the quality and intelligence of it’s racoon population.

I think it should be on the home disclosure form!

I’ve spent quite a bit of time in West Van, went to high school there, lived there for a few years, worked and recreated there over a period of 25 years, or so. IMO:

– rains about 5X as much as Victoria, due to being “nestled” by the mountains

– they roll the streets up even earlier than OB

– all North Shore/Howe Sound parks are too popular for their own good, everyone from Metro area heads for your local park on the weekend

– scariest place to ride a bike, lots of entitled, elderly drivers

– plenty of good jobs in the municipality, no one can afford to live there and no one wants to commute there due to distance from other suburbs, poor transit and bridge choke points, locals are too old or independently wealthy

– if you haven’t spent much time on the mainland and think traffic is bad here, you ain’t seen nothin yet.

– good local ski hills nearby, not far to Whistler if you are a fan

I don’t know what Oak Bay does, but Saanich does a pretty good job explaining it on their property tax notice. Very simple table showing your increase in assessment vs average Saanich increase and what that means for taxes.

Sometimes I daydream about where I might want to live in B.C. if money were no object.

West Vancouver seems like a top contender—quiet; south-facing; nestled between beautiful blue ocean and the majestic North Shore Mountains; recreation opportunities galore on your doorstep; easy egress to the Sea-to-Sky Highway, making a trip to Squamish or Whistler no big deal; and close to Horseshoe Bay ferry terminal, linking you to Vancouver Island and the Sunshine Coast.

Anyone here ever live there, or spend a lot of time there?

A 1981 letter-to-the-editor article in the TC from a (presumed) angry renter telling folks we shouldn’t feel sorry for homeowners’ exploding mortgage payments – after all, homeowners are now all rich because of their massive equity gains!

When I was a Vancouver homeowner I used to get a flyer with my tax bill explaining how property taxes are calculated. Do they do that in the Victoria metro?

Apart from the proximity, not much.

Different from a condo you mean? Very much so. Of course it’s very common for two people to own a property, but it’s usually joint tenancy. In this case it’s a given % of the property – I mean a given % of all of it, not all of a given part of it. One title means one mortgage and one tax bill. It also means that both owners are exposed to any claims against the property no matter which owner incurred them.

Come to think of it, it’s a bit like being married, without the physical side. 🙂

Those are all listed at or near assessment. Doubt they’ll sell at those prices.

Also see the Deal st house is assessed at 1.3. Seems like they’re living in fantasyland.

Prop 13 also gutted education funding in California, leading to a system that barely produces a sub-remedial level of basic education.

The effects are best summarized by the interdynamics of Mr. Hand and Jeff Spicoli in that wonderful film about fast times, a true story!

My guess is Oak Bay Steve probably doesnt care.

Oak Bay Residents and Density: Fearing the destruction of the Tweed Curtain since time immemorial…

History jaunt again…

This was the first recognition I saw of the Times Colonist contemplating that we might be in a housing bubble. June, 1981.

Notice how “inflation psychology” is the focus of the blame game here, but the actual underlying theme of mania and panic is virtually identical to every other housing bubble seen.

Introvert: Regarding your comments about the house for sale on “Not Such a Good” Deal Street: This is a tight little street very close to a busy golf course (to the south). There are two rather large-sized high rise apartment/condo buildings directly to the east (within 1/2 block) of 910 Deal. They would most probably block out any sunrise viewings or glimpses of the ocean. And there is a parking lot at the base of the nearest high rise that would no doubt add to the noise level on Deal Street. Then, there’s the nearby Oak Bay Beach Hotel which would probably also add to the noise and (possible) traffic congestion issues on Deal Street. We once went to the Oak Bay Beach Hotel on a busy Friday night for supper and could not find a parking spot at the Hotel or anywhere on Beach Drive. So we had to park on a side street. It may have been Deal Street or maybe Margate. Anyway, the next door neighbour’s driveway appears to be about 5 feet away from the south wall of 910 Deal, as well. And there is no hedge or fence offering privacy between these two close-together homes. So, I don’t think it would be as peaceful and cozy as you suggest. So you see, anyone can critique any property that’s for sale and find flaws.

The point I am making is: if you can now purchase a nice home in West Vancouver for about the same price as a comparable home in Oak Bay, Victoria, that’s gotta have an overall deleterious affect on Victoria prices.

By the way, there are plenty of single family homes in West Vancouver (not backing on to the highway) that are for sale today for around $2 Mil or less. See the enclosed for example:

https://www.realtor.ca/real-estate/19847456/4-bedroom-single-family-house-5658-westhaven-road-west-vancouver

https://www.realtor.ca/real-estate/20360577/6-bedroom-single-family-house-5789-westport-road-west-vancouver

https://www.realtor.ca/real-estate/20626756/5-bedroom-single-family-house-2675-skilift-place-west-vancouver

And remember, $2 Mil (or less) is merely the “asking” price for these homes. When nobody is buying in West Vancouver anymore, who knows what these properties will eventually sell for. $1.7Mil? $1.5 Mil? Who knows?

Yet, there are still people in Oak Bay (and other places in Victoria) asking for top dollar (close to $2 Mil) for their very basic single family homes. As I have said before, I can understand that sellers are looking for maximum dollar. But I certainly question the people who buy these dressed up $2 Mil bungalows. They must not be following what’s happening in West Van. My guess is that this Deal Street price is going to have to be reduced a few times in order to get a sale.

Finally, there were 21 price drops in Victoria today as follows:

https://www.yvrpulse.com/d/price_drop_1_days_ho?fbclid=IwAR3EtW1hJ8-Wh4pOjApRRuqxIDlavqmn-dEnBRNweS1B0kdMaT6GmdGFTcg

Interestingly, 910 Deal Street is one of the price drops.

Click the word “Region” at top left of site and the houses fall in to order by City.

Because they have done a poor job of education. Having a dollar amount on the assessment that is approximate fair market value (give or take), takes away from having to understand the underlying process.

Just saw a property show up on the MLS that I find odd. MLS# 411857 which is listed as 1456 Begbie St. They do say it is a fractional ownership (30%) of the property. BC Assessment doesn’t have a separately numbered property as 1456 Begbie – the main house itself is 1454 Begbie. So this has me wondering. Would this be like owning a condo? Are there different rules surrounding fractional ownership?

He just wants you to pay for his share of property taxes. Can’t see what’s unfair about that!

Also the cities must love that no one understands how property taxes work. Instead of being mad at council for raising taxes he thinks he’s paying more because of speculators driving up the value of his property.

Interesting that the Oak Bay senior pushes Cal prop 13 as a solution. That is a band aid approach at best and pits various groups against each other. In fact, there will likely be a referendum coming up in California to start chipping away at prop 13.

So he wants to pay a penny in property tax but it’s A-OK for everyone else to pay a dollar. Doesn’t want any of the available solutions out there – sell the house, take a reverse mortgage, get a job. Property taxes are part and parcel part of property ownership responsibilities. I’d say it’s time that Oak Bay grow up.

My empathy went to negative -100 after I read his letter. The “problem” he has identified is basically that he has to pay taxes at the same rate as everyone else. And deferring taxes at near zero interest is just not good enough.

I hereby give permission for my kids to give me a big kick in the ass if I ever grow into an entitled old man like this guy.

I agree. In most discussions about affordability, fixed-income pensioners are inevitably mentioned and we’re always supposed to be so concerned for them.

Well, sorry, if you can’t pay your property taxes on your fixed-income then you obviously didn’t save enough for retirement. That’s an oops on your part.

If you want to stay in your million-dollar house, you could get a job at Home Hardware to make ends meet. You could borrow from the bank of Son & Daughter. Or you could move to a lower-cost jurisdiction, like Langford.

“1.2% loan…..compounded”

Here’s a little more oil for the non-sympathetic and geezer-hating stormtroopers: the loan costs are NOT compounded, just an annual accrual of straight interest.

Thank-you for your contributions to the GT3 tire replacement fund. Brutal wear and tear on these things.

No sympathy here either.

Avg 2018 Oak Bay taxes were $6,015

20 years of taxes at that rate: $120,300

1.2% loan on 20 years of $6,015/yr, compounded: $144,310

So that’s $24k interest on a sale of a $1MM+ house

I don’t think that someone who has enjoyed the benefit of the maximum HOG and the PTD program deserves much sympathy. The ownership of their home has already been subsidized by tax-payers. If we accept that the purchase of a SFH is not a human right, then neither is the continued ownership of one. It’s no different than if a homeowner suffered a loss of income that rendered them incapable of meeting the mortgage payments; there’s no tax-payer subsidized program to let them keep their house, nor should there be. Senior citizens are granted a long list of benefits due solely to their reaching an arbitrary age milestone; if the old geezers want more goodies, let them be means tested.

I lol’ed at “straight outta Oak Bay”. But lols aside, I don’t know how hard I can empathize with this guy. No one likes the idea of old people being priced out of their home, but are we supposed to pretend that selling their $1m+ house and renting and living like a king for the rest of their days isn’t a reasonable option?

A letter to the editor straight outta Oak Bay: https://www.timescolonist.com/opinion/op-ed/comment-property-tax-idea-from-a-b-c-senior-1.23843909

I couldn’t find the stat for Canadian own US RE, but according to the Huntington Post. “Canadians spent $19 billion on real estate during the surveyed year, second only to Chinese buyers, who spent $31.7 billion.”

https://www.huffingtonpost.ca/2017/07/20/canadians-are-taking-over-u-s-real-estate-at-record-speed_a_23039582/

For many years, I refused to believe the Canadian academic studies of the late 80s that claimed more than 80% of Canadians are closet racists, but the current situation proved I’m wrong. Hence, it is no surprise that it is in vogue to blame the foreigners for the current RE condition.

The problem of current pre-sale is the current price of the pre-sale.

Didn’t Marko say that, in regular/balanced market , their price should be about 10 to 20% lower than market price to make up for the wait time (and other unknowns. Note there is also GST).

Where are their price now compare to the market?

I notice that listings are rising every month, but we are still shy of the 10 year average by 25%. May 2019 did produce over 800 sales, which is surprising to some, me included. Likely this is not a sign of the reversal of the cooling, but just a sign of the traditional “spring market”. June will be interesting to watch, as we head in to the lazy summer months.

A total of 848 properties sold in the Victoria Real Estate Board region this May, 12.3 per cent more than the 755 properties sold in May 2018 and a 21.8 per cent increase from April 2019. Sales of condominiums were up 3 per cent from May 2018 with 244 units sold and were up from April 2019 by 20.2 per cent. Sales of single family homes were up 9.6 per cent from May 2018 with 445 sold.

There were 3,019 active listings for sale on the Victoria Real Estate Board Multiple Listing Service at the end of May 2019, an increase of 9.7 per cent compared to the month of April and a 26.1 per cent increase from the 2,394 active listings for sale at the end of May 2018.

“May sales have ranged from a high of 1,289 in 2016 to a low of 441 in 1990, which is the year our detailed records began,” adds President Woolley. “This month with 848 sales we are very close to the ten year average for overall sales in May, which is 813 properties. We are off from the ten year average in May for active listings, which is 3,838, with 3,019 active listings last month. The lowest number we’ve tracked is from 2017, when May of that year saw 1,896 active listings.

Has the weakness in SFH in Vancouver translated into a correction for townhouse and condo prices there?

Pre-sale marketing has really ramped up recently. Lots of promotions out there at the moment as developers get a bit more keen to capture a bigger slice of the smaller pie of buyers. Also getting more reverse prospecting inquiries mentioning extremely motivated sellers. Problem is many are still listing too high for the market so looks like they will have to get a little more motivated.

For sure—I’m going to wait till the last minute to renew. Also, starting three months before renewal, you can lock-in a rate and be guaranteed to renew at that rate (or lower).

Sniff… is that a passive aggressive tone I smell in this reply?

It applies to the purchase of property because of the obvious fact that most agree property is an investment. And like any other investment or financial transaction, both buyers and sellers often want protections, restrictions or regulations in place. NAFTA’s Chapter 11 covers enterprises, debt/equity of enterprises, real estate or other property, contracts for sales of goods/services etc. Excluding property would be… bizarre.

Anyone here ever venture a guess as to how many Canadians own property in the US or Mexico? I tried googling and didn’t quickly find any stats on this, but anecdotally I know of multiple places in Mexico that are full of nothing but Canadians and Americans. Typically they are also right on the coast, which is supposed to be explicitly exempted, because the Mexican government didn’t want foreigners coming and buying all the prime coastal real estate. However, they’ve created loopholes whereby Mexican trusts are created that allow coastal real estate purchases via the trust.

So it’s an interesting contrast – many Canadians are upset that real estate is becoming harder to attain, and they attribute a lot of this to foreign purchasers. Mexicans I’ve talked with on the several times I’ve been in Loreto BCS are for the most part very gracious towards foreigners and the money and jobs they bring into the region.

All a matter of perspective.

Hey Marko, if places like that(house is 3 years old) are going for 1.6, I don’t think that place in Burnaby you posted last month for 1.3 is gonna sell anywhere near that.

As people were saying before (which you ridiculed I might add). If the interest rates aren’t going up, it means the housing market is crashing. Vancouver yoy detached home prices were down 13.6% in May. Early days yet… I’d push off you renewing if you can.

Hey Grant. Since you’re an expert. Why does a chapter on investing apply to the purchase of property?

I’m not saying there isn’t a substantial price correction occurring there, but your West Vancouver example listing backs directly onto Highway 99 / Trans-Canada Highway.

Whereas your Oak Bay example listing is located on a peaceful cul-de-sac a block or two from the ocean.

Regarding the discussion on foreign ownership and taxes, NAFTA and other treaties:

&

&

https://www.straight.com/news/746041/trade-lawyer-alleges-bc-tax-foreign-buyers-housing-violates-nafta

From the Globe and Mail’s Rob Carrick:

The hammer of high interest rates may never drop on struggling borrowers

https://outline.com/XY5qKn

Presales down 70% in Vancouver. https://vancouversun.com/business/real-estate/developer-postpones-pre-sales-for-high-rise-towers-in-burnaby-and-coquitlam

However does anyone know if this is accurate? “By law, according to the provincial Real Estate Development Marketing Act, developers have to complete pre-sales within nine months. After that, they must cease marketing.”

Never heard of that limitation and can’t find any mention of a time limit in the act: http://www.bclaws.ca/civix/document/id/consol16/consol16/00_04041_01

Thx for digging that up, @Leo S!

The Pacific Cat Clinic on Ravine Way also frequently has adoptable kittens, they also take a wait list, not immediate gratification, but when times are tough…and kittens are scarce., it is an option.

Look up Foster Kritters on facebook. They are a volunteer rescue outfit from Duncan. We adopted a very sweet kitten from them a few years ago. Caring folks who often have kittens up for adoption. They may have some available now.

Been super tough to find kittens for years now. We got ours by stalking the spca, getting insider intel, and showing up super early when they were scheduled to get kittens – and we were third in line. I recommend checking the Duncan SPCA, or, even more likely, the spca near where your parents are. Much less competition in the interior.

Some people have two or more cats – that’s the problem. Why not heavily tax second pets or people who fail to declare pet data on time each year? And collars should disclose beneficial owner data, no more hiding behind cute pet names! 🙂

Remember when Realtors were saying “All you have to do is sell your Vancouver home for $2 Mil, buy a nice home in Victoria for $1 Mil, and pocket $1 Mil for retirement?”.

OK, so I am wondering how that works when houses like this one are selling in Victoria for just under $2 Mil:

https://www.realtor.ca/real-estate/20643431/5-bedroom-single-family-house-910-deal-st-victoria-south-oak-bay

but you can now find comparable houses in West Vancouver like this one for about the same price:

https://www.realtor.ca/real-estate/20502865/4-bedroom-single-family-house-3525-westmount-road-west-vancouver

I’m not sure that the “Sell for 2, Buy for 1 and Retire in South La La Land” slogan applies anymore with the substantial price correction going on in West Vancouver these days.

Might be a wee bit early to call, but you know the Times Colonist, they are eternal optimists.

https://www.timescolonist.com/real-estate/capital-region-s-real-estate-slowdown-turns-around-in-may-with-strong-sales-1.23844025

they took away bunny island by Victoria general hospital …so sad .. 🙁

Word is that maybe the kitten market will loosen up in the late summer or fall, there could some deals out there!

But right now I concur, they go unconditional before you can arrange a viewing…way worse than the housing market.

Canada Sees Big Jump In Consumers Going Bust

Consumer insolvencies in Canada jumped by 9.3 per cent in April, compared to the same month a year earlier, according to data from the federal Office of the Superintendent of Bankruptcy. The number includes both consumer proposals and bankruptcies. Consumer proposals are an increasingly popular alternative to bankruptcy, where the debtor works out a deal with creditors to pay a portion of their debt.

The 11,785 insolvencies recorded in April are the highest for the month since 2010, when Canadian consumers were still recovering from the Great Recession.

https://www.huffingtonpost.ca/entry/consumer-insolvencies-canada_ca_5cf6c4d7e4b059c99ebe9997?

You should see all the baby bunnies we have hopping around the forest over here. Just adorable. The temptation to snatch one and take it home is palpable.

But I haven’t. Yet. 😀

As anyone noticed the dramatic increase of crazy cat ladies in Oak bay?

That’s crazy! I thought I saw BCSPCA put out a “we’re in kitten overload” message just today.

No just looking to adopt a kitten. 10 years ago we just walked into a big room at the SPCA and pointed at one of the bundle of kittens rolling around. Now there’s an island-wide shortage.

Is this a joke referencing the kitten that got stuffed in a garbage at Hillside mall somehow? if not, likely, that kitten…

I agree. Falling home prices almost never occur at the moment sales volumes decline. For prices to fall, the sales declines have to be pervasive enough, as well as persistent. No real set rule for how much time that persistence entails, but 6 months certainly seems reasonable.

Here’s a reposting of a graph I put together showing this at work in the USA a decade ago:

The top graph represents new home sales, the middle graph represents existing home sales, and the bottom indicates prices. Have a look at the red line I put in through all 3, right as the market started to see a decline in sales volumes.

https://househuntvictoria.ca/2018/05/04/musings-on-future-affordability/#comment-43223

Anyone got a line on any kittens to adopt? Forget the housing crisis it’s a kitten crisis out there. Bidding wars, kittens gone within hours.

I’ve seen it take 6 months or so for prices to adjust after a decline in sales. Late summer or fall could present opportunities.

Re Comox Valley, we have been looking here for over a year, even with the disastrous spring monthly yr/yr sales numbers, generally pricing has remained surprisingly resilient.

Because of the increased prices here, in the spring we started looking down Island at areas we like (North Nanaimo, Langford, Colwood…..), and we found similar value for a similar price.

Although the Comox Valley is very scenic, we found for us personally, outside of the summer season the airport is under serviced, plus the 1+30 drive to/from the Nanaimo ferry terminals is getting tiresome.

Our biggest complaint is, during the late fall/winter/early spring there are quite a few residents with older wood burning appliances, so the sooty particle pollution (PM2.5 count) can get pretty bad. For example, last December half the evenings in our area you would not have wanted to go outside for a walk or open a window, with many evenings having counts in the “unhealthy range for sensitive groups”, so with my spouse being asthmatic, the Comox Valley is no longer on our house purchasing radar.

Glad to hear you’re waiting too Josh. I got really excited about house hunting 2 months ago but after a few weekends of open houses I’m really not impressed with the quality of SFH in my price bracket (<600k Langford) and I do like a lot of homes that are 50-100k out of reach. I don't want to waste my time with offers that far off from asking price right now but I think I'll feel better about making those offers in the fall or next year as the market takes further hits. Who knows, maybe seller's will wake up and smell the coffee and set their prices in a more realistic zone so I won't even be that far off from list price.

More allegations of fraud from a few months ago by brokers in BC

B.C. financial authorities have identified a woman accused of acting as a ‘shadow’ mortgage broker by feeding altered tax documents to licensed professionals on behalf of dozens of people who wouldn’t otherwise qualify for loans.

The province’s acting registrar of mortgage brokers claims investigations into three brokers identified 44 files containing documents that were either completely fake or altered to misrepresent borrower incomes.

The probe has already resulted in one Surrey mortgage broker being barred from the profession for 10 years. Hearings are pending against two other licensed individuals.

Although officials won’t speculate on amounts, the fact dozens of mortgages in the Lower Mainland have been compromised means tens of millions of dollars are involved.

https://www.cbc.ca/news/canada/british-columbia/mortgage-broker-vinita-lal-1.4955003

Updated article on the case from a few days ago

“I guess to me what’s remarkable is the widespread apparent — there’s no word for it really other than ‘corruption’ — of licensed people,” says Ron Usher, a professor of property law at Simon Fraser University.

“To me, that’s a bit breathtaking.”

Usher, who is general counsel for B.C.’s Society of Notaries Public, says both cases are revealing for what they show about the desperation of people to get into the housing market.

And who is — and is not — able to get money without a little document doctoring.

“I suspect the bulk of this is going to be fraud for shelter,” he says. “People who don’t quite qualify in our tight market, who just need a ”tune-up’ to somehow fit new lending rules.”

Usher notes that Blueshore Financial, the credit union that blew the whistle on Chaudhary, says none of the loans in question have resulted in loss or delinquency.

These are customers who are able to make the payments on a mortgage — they’re just not willing to tell the Canada Revenue Agency where most of their money comes from.

https://www.cbc.ca/news/canada/british-columbia/mortgage-fraud-real-estate-corruption-1.5160842

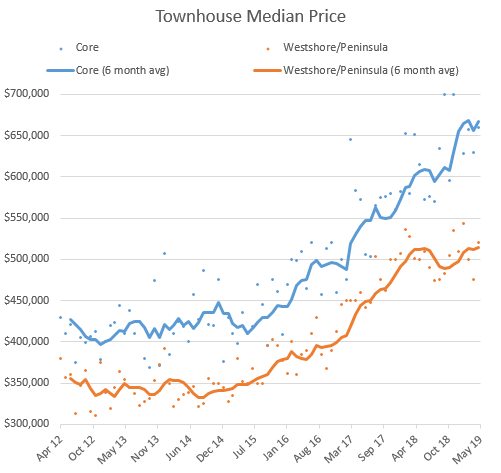

Thanks for the nice chart.

Core townhouse looks up 9% over last year. Westshore townhouse about flat.

How’re SFH prices looking in the core vs Westshore?

Core townhouses have been strong. Westshore/peninsula hit a bit of a wall price wise.

Anyone have median/avg price numbers for townhouses in the core or westshore?

Caveat – thanks for the reply. The numbers here are a bit crazy (given local incomes) – yes it’s a desirable retirement destination, but I’m guessing most retirees aren’t interested in SFH’s that need $$$ to modernise.

It’s a growing community though, so you may be right – but the only people who can afford to buy here are either earning six figures or have a fat down payment. Or both.

That May figures were below April appears quite telling to me. I’m also seeing lots of reductions in the $450 – 600k range.

montyb – i’d expect some weakness to start developing in the Comox Valley at some point. It was late to the party on the way up so could be late on the way down.

That said I don’t expect the Comox Valley to return all the way to previous levels of affordability. IMO it has now achieved a veneer of desirability that it didn’t have before.

Looks like someone is having second thoughts on their recent purchase. 3110 Richmond Ave. purchased Sept 2018 for $1,070,000. Assessed at $981,000. On the market today (MLS: 411715) for $1,049,000.

They want 2 mil. for 910 Deal Street; seems just insane to me.

Hard to convince anyone to drop their price when the neighbour around the corner just got top dollar a few weeks ago,

Or maybe buyer & seller couldn’t agree on a fair market value for the property.

Sales down 32% YOY in Comox Valley for May and lower than April sales total.

Yet the SFH benchmark price has gone up again and is now $165k higher than 2016.

Meanwhile the average sales price has dropped 5%. Median still at $585k .

Does this all point to significant price drops? Or am I missing something?

Well that’s true.

Or you apparently didn’t want to buy.

Josh: Sorry to hear that you could not make that one work for you. My impression is that in some parts of the inner core the inventory is still pretty low. Rockland only has four houses for sale at the moment. Asking prices in James Bay do not seem to have budged at all nor has Oak Bay. This is just my impression and not a scientific count.

Are you still looking mostly in James Bay or have you widened the net?

Yes and no. It got real close there in a counter-offer volley but they apparently didn’t want to sell. Despite the higher inventory it still feels like there’s virtually no choice right now. And so we wait.

Josh how is the house hunt going?

Hey Josh. Are you still HHing?

Gotta feed that confirmation bias somehow.

What Marko is saying is that most people aren’t like introvert. Only a select few will still regularly go on a house price forum after “owning” a house for over a decade without any intention of being active again in the market just so they can troll the bears.

Patrick: I have not lost sleep but I was single and in a very secure job situation which is not the case for a lot of people. Maybe they are not worried but considering the divorce rate in the first seven years of marriage perhaps they should be a bit nervous.

I’ve seen one where it was purchased last year for $1.5 million and then sold this year for $1 million. That hurts.

Yeah people do get a little excited when their assessments go up and they start itching to upgrade with all their new found wealth. Just like with amateur stock pickers they get mighty quiet about their losses

Have you had any sleepless nights in your life because of paper house price declines? (I haven’t)

I imagine that a lot of first time home buyers in Vancouver who bought in the last few years must be having real fear at this point.Watching your equity evaporate can make for some sleepless nights.

I don’t know…most first time buyers I represent de-activate the automated search system as soon as they go unconditional. People are too busy with dogs, kids, hobbies, to follow the market on a month to month basis.

The big drops are in the luxury homes and if you can afford $2-$4 million as a first time buyer you are probably doing okay despite the 500k loss in equity.

If anything loss of equity will prevent people from upgrading.

2015 Sales: 905 Inventory: 4043

2016 Sales: 1289 Inventory: 2406

2017 Sales: 1006 Inventory: 1896

2018 Sales: 755 Inventory: 2394

2019 Sales: 848 Inventory: 3019

We saw escalation in prices in the above years….and here are a few years where the market was +/- 2% each year.

2011 Sales: 572 Inventory: 4,857 SFH Prices -2.55%

2012 Sales: 659 Inventory: 5,015 SFH Prices -1.72%

2013 Sales: 659 Inventory: 4,783 SFH Prices -0.77%

2014 Sales: 714 Inventory: 4,672 SFH Prices +1.79%

I imagine that a lot of first time home buyers in Vancouver who bought in the last few years must be having real fear at this point.Watching your equity evaporate can make for some sleepless nights.

But it has been a beautiful day and I had a great walk along Willows beach.

>

This just in: Slowest May sales in Vancouver for 19 years, according to Steve Saretsky on Howestreet.com (comment made at 11 minutes and 18 seconds into the interview)

https://www.youtube.com/watch?v=swrltkec6hw

Thanks for the links. The “breaking news” for the “Youtube RE Gurus” devotees here is that he also says Van. sales down only 8% YOY, and calls it a “bottoming process [for sales volumes]”. It’s worth a listen, and defintely not as bearish Vancouver commentary as from many here ….

This just in: Slowest May sales in Vancouver for 19 years, according to Steve Saretsky on Howestreet.com (comment made at 11 minutes and 18 seconds into the interview)

https://www.youtube.com/watch?v=swrltkec6hw

The US Fed is likely planning a rate cut for the purpose of increasing inflation. https://www.bloomberg.com/news/articles/2019-06-03/fed-s-bullard-says-may-need-rate-cut-soon-amid-trade-tension

That’s a gift to home owners, at the expense of savers. With lower rates, homeowners mortgages get cheaper on renewal, first time buyers qualify for more, and the higher inflation rises wages while mortgage payments stay constant (prior to renewal). All good news for homeowners. A simplified way to look at it is the govt is trying to insure inflation is around 2-3% (typically increasing nominal house prices by 2-3%)

The point here is that this is something that central banks do on purpose to keep the system going – reward debt holders and punish savers. Of course it’s “not fair” and easy to be opposed to on principle, and to can conclude it’s a “legal Ponzi scheme”, but given that these central banks can set rates, and also “print” (or withdraw) fiat money, there’s little you can do about it, other than take advantage and buy a home at tiny interest rates and make money via the inflation. There’s a famous saying “don’t fight the Fed” because it’s typically a strategy to lose money.

I bet it won’t. Mortgage rates are already falling and have been for a while, yet RE in BC continues to slip, and badly.

It’s not so much about propping up the market as it is trying to rope as many remaining buyers in as they can at the highest prices possible, while grabbing a bigger piece of a shrinking pie. The lenders aren’t trying to help you, they’re trying to help you help their shareholders.

Let them. It doesn’t stave off a correction, and in fact, housing markets usually are in a state of decline while rates are going downward. This is not a boon for the market at this stage, and they know this better than anyone. This isn’t something unusual. It’s yet another cyclical dynamic and banks do it every single time.

Your jokes are about as funny as mine. 😛 Most readers will know it’s nothing more than a point of interest. Incidentally, copper is taking a beating as well…another construction commodity. But that lumber chart was too juicy to pass up, so up it went.

I don’t generally focus on this market as a basis for commentary. Others do that, and some of them do a fine job.

Definitely good for new construction costs but I’m not sure if that was mirrored in other basic inputs for housing. The ramp up in materials has definitely jacked costs and blown budgets in the last few years

How much of the ups and down in lumber prices are caused by domestic demand vs US demand and softwood lumber disputes?

While definitely interesting I don’t think this is going to help the Victoria house hunter too much.

Or is there a rule of thumb here? “Never buy Victoria RE when lumber is above xxx per thousand board feet!” 🙂

what do you mean ? we hit bottom .. buy now .. maybe… i dont know .. everything is fine right?

I am seeing a lot of price drops and now homes being removed from the market because they won’t sell after lengthy times on the market with 3 or 4 price drops. A good example is 2805 Beach Drive – was massively over-priced, now it is vacant, 3 or 4 price cuts and now taken off the market after listing $500K below assessed value. I delved in deeper and see that for this [and all Victoria homes] home’s assessment tax value jumped 35% in 2017.

I reviewed a sample of listings and, sure enough, the vast bulk of the jumps were 35 to 40 % in 2017 and then 15 to 20% in 2018. The municipalities have been hiking property taxes like mad from 2013 to date. It is insane and homeowners now believe their shacks are actually worth that – but no will pay it.

These over-priced and over-assessed luxury homes are primed for large price re-evaluations. Local incomes, even the best paying jobs, can’t afford them. Without the foreign money and mainland buyers, sellers are out to lunch. The peak was 2016-17, but no one told the cities.

A house of cards built on debt:

https://betterdwelling.com/canadian-mortgage-debt-hits-a-new-record-1-56-trillion-outstanding/

Canadian mortgage debt sits at a new record. A recession is around the corner and people are lured in to borrowing away their futures. HELOC borrowing is said to be slowing, but is because all of the equity has been borrowed – there is only debt that is left. The bond market yields are falling, mortgage rates will fall, stress test is alive and well, will this prop up the market and up, up and away we go again?

Principal commodities used in construction of homes, continue their declines.

Growing demand for these commodities inflates material and construction costs, while shrinking demand does the opposite. Below is the current benchmark index for lumber.

Notice anything about the pattern?

May statistics for the last 5 years for Victoria:

2015 Sales: 905 Inventory: 4043

2016 Sales: 1289 Inventory: 2406

2017 Sales: 1006 Inventory: 1896

2018 Sales: 755 Inventory: 2394

2019 Sales: 848 Inventory: 3019

Average 5 year Sales = 961

Average 5 year Inventory: 2752

2019 Sales are about 12% below the 5 year average. Second lowest in 5 years.

2019 Inventory is about 10% higher than the 5 year average. Second highest in 5 years.

The month of May 2019 was also notable for a drop in interest rates, which should lead to lower 5yr mortgage rates soon. Canada 5yr bond fell from 1.6% to 1.3% during May. This yield was 2.5% in October 2018.

The five year yield is the benchmark used as the basis for long term mortgages like the 5-year. This should result in further falls to mortgage rates, just in the last month. Typically the 5-yr rate is 1.5% higher than the 5-yr yield (lower in some cases). So that would drop a 5yr mortgage expected rate from 3.1% (May 3, 2019) to 2.8% (June 3, 2019).

That difference in rates would lead to a 10% cut in mortgage interest payments – just in the last month!

You can see a chart of the collapse in 5 yr bond yield here…

https://www.ratespy.com/5-year-canada-bond-yield

https://www.youtube.com/watch?v=q4iDurCE3Yk

LF, great shit analogy. Thankyou. I had almost forgotten. I expect a confused response from the prudes on this blog.

To quote the late Jim Lahey of the Trailer Park Boys…

“Do you know what a shit barometer is? Measures the shit pressure in the air. When the barometer rises, and you’ll feel it too, your ears will implode with the shit pressure. I tried to warn you, Bubs, but you picked the wrong side! Beware, the Shit Winds are a-comin’.”

“Tick tock tick tock, shit clock’s tickin Rick.”

We’ll see how the rest of the year goes. 40% drop in sales with 26% more listings is nothing to sneeze at. I can’t imagine that’s because of the stress test at that price level. Most likely foreign buyers tax + big drop in Vancouver buyers + downcycle waryness from luxury buyers.

Thanks LeoS, it is stronger than I thought.

848 final reported sales for May.

Up 12% from last May

New listings up 7%

Inventory up 26% at 3019. Last time we had 3000 inventory was November 2015

Pretty similar to how they were a few weeks ago 🙂

The market is much much slower than it was 3 years ago (1/3 of the activity) but not entirely dead yet only due to the 6 sales in May which kinda pulled it up.

Jan – May Sales:

2014: 7

2015: 10

2016: 25

2017: 23

2018: 23

2019: 14

There are about 100 properties listed in GV for 2.5 million plus. I keep hearing the theory that the top end of the market will crumble first. LeoS or any other number guru, how many sales have there been of SFH over 2.5 so far this year and how does that compare with last year?

Fraud in BC; unheard of, I am shocked.

More RE fraud uncovered as this bubble continues to implode…

$511 million in mortgages set up by unregistered Vancouver broker who cooked books: FICOM

An unregistered Vancouver mortgage broker may have arranged over half a billion dollars in loans, many of which could be based on falsified income records, according to a cease and desist order issued by the Financial Institutions Commission (FICOM) May 30.

Chris Carter, B.C.’s acting registrar of mortgage brokers, says the enforcement action should serve as a reminder to the public to check the FICOM website to ensure the broker they are dealing with is registered.

Still, unregistered broker Jay Kanth Chaudhary’s alleged illegal work between 2009 and 2018 was facilitated by registered brokers and licensed firms, Carter noted, and this should put the industry on notice, he said.

“The order makes reference to industry complicity,” said Carter, who leads one of many government agencies tasked to shore up regulatory oversight of Vancouver’s distorted real estate market.

https://www.westerninvestor.com/news/british-columbia/511-million-in-mortgages-set-up-by-unregistered-vancouver-broker-who-cooked-books-ficom-1.23840766

i like this Eby AG more and more

For those of you who remember my posting of that article saying that luxury retailers would be hurt without Chinese money and laundering…Our Attorney General decided to rather openly make fun of it.

https://twitter.com/Dave_Eby/status/1135023038682914816

Yes, and USMCA hasn’t been ratified by anyone yet, and only Canada appears ready to ratify it soon. US/Mexico need to sort out their problems first. So NAFTA is still law. They didn’t add a exemption for BC to have a foreign buyer tax to the USMCA, if that’s the question.

I think the biggest feature of USMCA is that it’s not called NAFTA. Hence most people calling it by what it still is.

So, NAFTA discussion. Hasn’t NAFTA been repealed? We should be talking about the USMCA, no? I have no idea what RE provisions happen to be in the new treaty. Perhaps someone does.

Good analysis and data assembly – really appreciate it. But I miss the box showing the weekly sales, listings and comparing it to last month. Perhaps an omission that will be corrected. If so, thank you.

That said, there is danger is relying on the aggregate. If one were to delve deeper, I wonder if these “increased” sales are in the core or outside the core; east side or west side of Victoria; and lop-sided to low and middle vs. upper middle and luxury. I follow the sales, breaking them down in to 4 segments (SFH): (a) under $1M, (b) $1M to 1.5M and (c) $1.5M to $2M and (d) $2M and above. To me, the geographic sales and price-breakdown tells a different story than the aggregate and leaves one challenged to conclude that the “correction” is by-gone days.

I believe that corruption is all around the RE industry. Bubbles, which this is, lures criminal activity. Victoria is not immune. Nanaimo is not immune. Campbell River is not immune. I could go on but you get the picture. It may be on a grander scale in Sin City [Vancouver], but these prices here tell a similar story when they are so out of touch with incomes. Here are really good discussions [the second includes a nice interview with Eby]:

https://www.youtube.com/watch?v=4QnpN3laWjc

https://www.youtube.com/watch?v=7sBODIIZcOE

The third is a great discussion with Bill Ferguson:

https://www.youtube.com/watch?v=pSjoi_v013c

Interesting and though provoking.

“In Canada, Parliament and the provincial legislative assemblies may pass legislation in areas where they have jurisdiction under the Constitution of Canada. This division of legislative power is provided for mainly in sections 91 and 92 of the Constitution Act, 1867. As specifically stated in the 1937 Privy Council decision in Labour Conventions, this power also extends to the implementation of international treaties concluded by the Canadian state.(30) Whenever a treaty or part of a treaty concerns an area of provincial jurisdiction, the relevant provisions may be implemented only by the provincial legislative assemblies.”

http://publications.gc.ca/Collection-R/LoPBdP/BP/prb0004-e.htm#PARTICIPATION%20BY%20THE%20PROVINCES(txt)

Yes I agree. One big cause of the current housing crisis that is not often talked about is how many people are living in houses that are far bigger than they need. I have pointed out previously that the number of SFH in Victoria is actually bigger than the number of households with >= 3 people. The claim that there is some kind of physical shortage of SFH just isn’t true.

The current property tax system encourages this. The most obvious and absurd feature is the property tax deferral system which allows anyone – regardless of income or net worth – over 55 to defer taxes at well under market simple interest.

Luckily we do have annual property taxes. In Croatia there are none and whenever a party mentions it they are quickly voted out. Problem being home ownership is 88%.

It costs me less than $1,000 CND/year to keep my condo (comparable to a high-end condo in Victoria) in Zagreb vacant. No property transfer tax. No spec tax. Strata fees are $60/month and includes the porcelain tiled parkade polished once a week.

Here similar condo would be in excess of 10k a year to keep vacant so taxation is fairly progressive here I would stay. I don’t think tax deferral is absurd.

StrangerTimes: The Federal power to enter into treaties overrides provincial constitutional property rights if I remember my Constitutional law classes.Not my area of law but I believe that is clearly settled. If anyone can cite cases otherwise I would interested in seeing those.

I’d say the same thing about people cherry picking individual sales over ask or over assessment.

Cherry picking any individual sales in an attempt to support ANY broader market narrative is useless at best and delusional/manipulative at worst.

I have no story. I have no idea where Victoria RE prices are going. In 5 years we could be up or down 50% of current values.

I’m not a constitutional or NAFTA expert but wouldn’t NAFTA violate the Canadian constitution which states property laws fall under provincial authority. Section 92(13) of the Constitution Act, 1867, also known as the property and civil rights power, grants the provincial legislatures of Canada the authority to legislate on: Property and Civil Rights in the Province

https://en.wikipedia.org/wiki/Section_92(13)_of_the_Constitution_Act,_1867

The US State Department

Real Estate: Primary responsibility for property law rests with the provinces. Prince Edward Island and Saskatchewan put limitations on real estate sales to out-of-province parties. Government authorities can expropriate property after paying appropriate compensation. British Columbia began a 15 percent tax on foreign buyers of residential real estate in the Metro Vancouver area in August 2016. In early 2017, the province announced that foreign buyers with work permits would be exempt from the tax.

https://www.state.gov/reports/2017-investment-climate-statements/canada/

“

Gotta love the double standards…quick to point out any news that fits your story,…

This is the same case, because it is a class action on behalf of for foreigners from many countries, including USA, China, and 20 more (against the BC govt) citing the various trade agreements with the countries (like NAFTA). I would presume that this case is a first step, and if they lose they will go to the next steps, which would be a direct NAFTA challenge (described here https://www.nafta-sec-alena.org/Home/Dispute-Settlement/Overview-of-the-Dispute-Settlement-Provisions ). But Canadian courts should have jurisdiction to decide if a province is violating a Federal Trade Law (NAFTA), and enforce it against BC.

You can read the statement of claim here that confirms that …

https://www.scribd.com/document/331818916/Notice-of-Civil-Claim-BC-Foreign-Buyer-Tax

Quoting from the claim…

A.

22. For example, Article 1102 of NAFTA provides that:

1. Each Party shall accord to investors of another Party treatment no

less favourable that it accords, in like circumstances, to its own investors

with respect to the establishment, acquisition, expansion, management,

conduct, operation, and sale or other disposition of investments.

2.Each Party shall accord to investments of investors of another

Party treatment no less favorable than that it accords, in like

circumstances, to investments of its own investors with respect to the

establishment, acquisition, expansion, management, conduct, operation,

and sale or other disposition of investments.

3.The treatment accorded by a Party under paragraphs 1 and 2

means, with respect to a state or province, treatment no less favorable

than the most favorable treatment accorded, in like circumstances, by that

state or province to investors, and to investments of investors, of the Party

of which it forms a part.

Point of No Point

It sounds like you are making rational decisions. I grew up in Toronto and was faced with the same quandaries as to housing at your age.

When I was in my twenties I also found the high density of downtown Toronto appealing. There is a tendency, as you age, for many people to dislike high density. Notice I said many and not necessarily a majority.

Patriotz: Hate pointing out the obvious, but what is allowed in terms of foreign real estate ownership, really depends on the individual terms of the trade agreement. Even multi-country agreements do not necessarily have identical terms for each signatory.

These are all separate agreements between the two countries, with specific clauses that can say whatever they want as long as both countries agree.

I’m talking about existing Canada agreements with various countries. So to your question, Singapore can ban foreign ownership and still sign a free trade agreement with EU if the EU agree to that. But Canada signed a free trade agreement (NAFTA) with the USA and agreed to treat Americans like Canadians when it comes to owning real estate. So B.C. must treat an American the same as an Albertan (or any other Canadian outside BC). And Florida (for example) must treat a BC buyer the same they do as any (non-Floridian) American.

Some people here argue that PEI treats foreigners differently. This is because there is a specific exemption in NAFTA to allow PEI to do this “… the only explicit exemptions under NAFTA for real estate are for nonresidents of Prince Edward Island and for real estate within a certain distance of the Mexican coast owned by people who are not citizens of Mexico.” https://theprovince.com/business/real-estate/b-c-property-law-vulnerable-to-challenge-says-constitutional-law-expert . BC has no such exemption under NAFTA.

Sales under assessment are not as interesting as price reductions. Assessments are often high or low depending on many factors such as recent sales or improvements etc. I find the price drops more interesting. May figures on this site for the Victoria area shows 156 prices moved down, while 2 moved up.

https://www.myrealtycheck.ca

Some of these are multiple changes so the reality some sellers are having to adjust their expectations. Good news for the bears.

Then how come many countries are able to have both foreign ownership bans and trade agreements? Singapore, for example, bans foreign ownership and has just completed a free trade deal with the EU. Mexico bans foreign ownership in some areas yet this has never been brought up by the US or Canada.

You have talked about this many times but have never given any reference. Compare to the lawsuit against the FBT launched by a Chinese citizen which has received a good deal of media coverage.

@Leo S

Thank you for the informative post, you do an amazing job on here! Have the final sales/listings figures for May been posted?

just realized I misunderstood the Sales over Assessment graph. Sorry Leo and ignore my last question as it is already answered!

Great point Patrick! I’ve long said that the cherry picked price drop/below assessment posts are useless at speaking to the market as a whole.

Only by looking at data in aggregate can any sort of useful analysis be made.

I guess if it makes people feel good to have a skewed grasp of reality then great, but I’d rather have my perception of the world accurately reflect the way things actually are 🙂

In prior post, that should say….

I expect B.C. will need to return all the FB tax and 75% of the spec tax paid to BC by Americans when the NAFTA cases are settled in a few years.

Foreign RE ownership is a two-way street. Canadians also own lots of foreign real estate (e.g. snowbirds). If Canada prohibits foreigners from owning Canadian RE, other countries would prohibit Canadians from owning their RE. This would result in reduced economic activities in both Canada and the foreign country, and be a “bad idea”.

Many existing trade agreements (like NAFTA and 30 other countries https://betterdwelling.com/bc-foreign-buyer-tax-might-actually-cost-canadian-taxpayers-billions/#_ ) don’t permit banning foreign ownership anyway according to experts. I expect B.C. will need to return all the FB tax and spec tax paid to BC by Americans when the NAFTA cases are settled in a few years.

Yes I agree. One big cause of the current housing crisis that is not often talked about is how many people are living in houses that are far bigger than they need. I have pointed out previously that the number of SFH in Victoria is actually bigger than the number of households with >= 3 people. The claim that there is some kind of physical shortage of SFH just isn’t true.

The current property tax system encourages this. The most obvious and absurd feature is the property tax deferral system which allows anyone – regardless of income or net worth – over 55 to defer taxes at well under market simple interest.

you are not .. some people listens .. me on the other hand finally pull the plug on staying

… i came to the island a few years ago .. fresh grad , housing price was still cheap.. salary wasn’t bad .. dont have much savings .. bubble starts .. hopes lost .. no point on staying .. Like Leo’s last article .. i can either stretch thin and buy a 1 bed condo for 400k and be enslaved to a box , or 2 bed condo that might lead to challenging times in the near future .. or get my parents to cosign and buy a 600k 2 bed tear down in non ideal places .. ..

I look around for housing here .. doesn’t make sense .. why i would sign my life away on a tear down apartment in Victoria with insane strata .. i could get same hospital work in surrey and purchase brand new condo at the same price .. some of the guest here love their acreage of lands .. but not all people feels the same … some older folks call it tranquillity ..younger folks call it isolation.. most people don’t mind crowded cities

I had 2 options move back to Vancouver and convert one of my parent’s basement suites and build up saving and buy in 2 years or just stay here and enslave my self to the system with time ticking away

when i was 25, five years doesnt seem much .. now 30 – every year is wasted waiting for salary to catch up and while housing price stagnates

@ QT

You need to spend more time in places like Van. They’ve lost large amounts of nurses, teachers, doctors, trades etc, all decently paying jobs, because of how expensive housing is. Not everyone’s willing to commute hours per day and not everyone wants to pay $2,000+/mo to live in a 1 bedroom shoebox or give up their pets. Some stick around and choose a different lifestyle such as living in an RV. 73k per year in a city like Van is not a lot, especially after taxes.

There’s been a lot of published articles on this issue, a quick Google search will bring them up; maybe take a look because I feel like I’m talking to a brick wall.

https://bc.ctvnews.ca/10-nurses-in-bc-children-s-hospital-er-resign-over-unaffordable-housing-union-1.4223207

solution found .. but expectation stays .. expectations forced to be acknowledge .. but policy delays progress

@Leo S

I think taxing people on CG of PR is a bad idea. Even exempting up to 500k could cause issues. It would discourage people from moving out of a residence that no longer meets their needs. Especially households where the kids have moved out and where they may have already reached their maximum CG allowance, which is more likely for older people. Now SFH may be tied up with empty nesters that are discouraged to downsize to a condo. It would make the housing market less liquid and discourage people from moving. We already have property transfer taxes that discourage selling and buying. I don’t think we need more taxes to gum up the market

If your skill trades people can’t make due with $73,125 a year in BC, then there are more underlying problems than the jobs providing foreigners buying RE.

https://neuvoo.ca/salary/?job=Journeyman%20Plumber

For anyone enjoying some of my history posts, here’s a link to a fascinating Maclean’s article, written by Tom Hopkins in March of 1981. RE was soaring away from people’s ability to afford it, a phenomenon viewed as the new normal. Here’s some quotes from it. My favourite one is by the brooding baby boomer…

–

–

–

–

–

–

“I am the baby boom,” he says. “We weren’t as worried about the future as we might have been and we sort of got skunked.”

–

“CMHC estimates that up to 34 per cent of Vancouver tenants have already passed the affordability red line and are paying more than 30 per cent of family income for shelter. Of these, 10.9 per cent are paying 50 per cent or more.”

–

“the only option is to refuse to play by the rules and to ignore old guidelines about what they can afford. The trick is accounting sleights of hand encapsulated in the phrase “creative financing.”

–

“I would like to see the people speculating in Vancouver behind bars because they’ve effectively taken what should be a basic human right – adequate shelter – and put it out of the working person’s reach.”

–

“Expectations will have to be lowered; higher density in-fill housing, smaller lots and factory-built housing will be the norm.”

….and then…Kaboom. But will history repeat itself?

https://t.co/gd5VMSfRgS

@ Barrister

Barrister, we have to take it back 10-20 years ago…

We didn’t see the scope of what we’re seeing now with housing issues in BC. 10-20 years ago, skilled trades could still find work, and could afford a place to rent and/or buy within a reasonable commuting distance. A working class family could afford to buy a house in East Van. Doctors etc could afford to buy on the West side. Now they can’t.

If we sell off our homes to people that don’t live here or earn income here (of course there are exceptions), we make our housing and rental stock more expensive not only in the main cities but also as people spread out (trickle down effect) and that also trickles down to higher costs of living and more work hours needed to make ends meet for the people that do live and work here. It’s completely counterproductive.

We need to think beyond short term gain to long term sustainability and the Ponzi scheme that’s been going on in our real estate market in the last 10+ years just isn’t sustainable.

Will there be an adjustment period if we crack down on these type of issues? Likely. Will we need to be creative and think up solutions? Likely. But will it lead to greater benefits for our population in the long run? Most likely.

With all due respect, this isn’t simplistic thinking, but rather, realistic thinking.

Sales

2015- 8295

2016- 10622

2017- 8994

2018- 7150

Jan-May 2018- 3193

Jan-May 2019- 2911 (approximately)

Even with an increase in population of at least 20k since 2015 we will end up well below those sales numbers.

Andy7: While you have a point, if we did not have an industry of selling homes to foreigners it might be that those plumbers and carpenters would be unemployed and living in their RVS.

Canada has a long history of “exporting” houses to foreigners; actually an industry that is worth billions a year. Maybe we should stop doing it, and there are some good policy arguments to support that view, but we also need to answer the question of how we makeup the shortfall in trade and how do we pay for all our imports.

The people who sell you your Iphone, TV, or Volkswagen all expect to get something in return. One of the things we have been selling them is houses in Canada. I am not saying that controls or restrictions should not apply but I am saying the simplistic view that there are no consequences is dangerous to hold.

How are the sales doing for luxury homes over 2.5 million?

Great stats, just a quick question. Where do sales for this May sit compared to the 10 year average?

4641 Vantreight Drive, Vic

Asking…..2.975

Assess…..3.465

@ QT

All I can say is omg. That example I gave is from one neighborhood (one street actually) – it’s a real life example. And you’re saying it’s okay – And those people living in RVs are not unemployed or low income; they are carpenters, plumbers etc. Give your head a shake man.

disagree .. can’t use a fix number for an inflationary currency .. great for this generation .. in a decade … 500k does not worth as much

thank you Leo for your great charts, especially re. percentage sold over assessment. Any chance we could find out what the median amount over assessment was? As in, median 3% or 10% over assessment…

All those charts you’ve posted showing “real” prices (inflation adjusted), and now you want to tax nominal house price gains, which might reflect no real (after inflation) gain at all?

Great post Leo! Nice to see the rising sales for 5 months (on a seasonally adjusted basis).

Also nice to see the 5 months of stable sale price over assessment at +4% over assessment. That means that all the anecdotes we’ve heard here for the last 5 months about Victoria sales (e.g “sold 15% below assessment”) were just cherry-picked and not representative of the overall market. Great, and may it continue!

Afropuffo, your post reminded me that my partner and I sent to see a CFP recently. They told us nobody discloses their rental income, and implied we would be fools if we did. All in all it was an interesting, if disheartening, conversation.

$375,000 price drop today in Victoria/Gordon Head. Location: 4641 Vantreight Drive. Previous asking price: $3,350,000. Now: $2,975,000:

https://www.realtor.ca/real-estate/20464352/2-bedroom-single-family-house-4641-vantreight-dr-victoria-gordon-head

A total of 16 price drops in Victoria today (courtesy of YVR Pulse):

https://www.yvrpulse.com/d/price_drop_1_days_ho?fbclid=IwAR3EtW1hJ8-Wh4pOjApRRuqxIDlavqmn-dEnBRNweS1B0kdMaT6GmdGFTcg

Click the word “Region” on top left hand corner of the website and the properties will line up by the City

From previous thread:

More than just a dynamic okay…An absolutely Yes!

Taxes are still collected on properties that aren’t using cities services. And, it provides residential maintenance employment opportunities for the homeless and RVs dwellers.

@guest_60383 yeah I would support a lifetime cap on principal residence capital gains exemption. Let’s say $500k should do it.

Increasing taxes on the law abiding is never the answer as the ones who can see through complex tax laws always evade.

I am concerned about the T2091IND (That was introduced in the peak of 2016) principal residence exemption.

We Victorians have had the luxury of justifying how our rental suite incomes are not taxable for many decades. Not all but MOST.

“It’s not taxable income if it goes directly into my Mortgage”

“I have been doing this for years and never had any issues”

“Everyone on my street does it”

“I’m doing the world a favour allowing my suite to be rented, where else would these people live. ?”