Bye bye investors and high ratio mortgages

2018 data is out for the survey that the real estate board asks agents working with buyers to complete after every transaction. The response rate is pretty decent at about 40% so every year we have several thousand survey responses on more or less the same basic questions on buyer motivation and financing. For many years, there was little change to the responses, but in the last few years we’ve seen some substantial changes in both financing and the level of investor interest in the market.

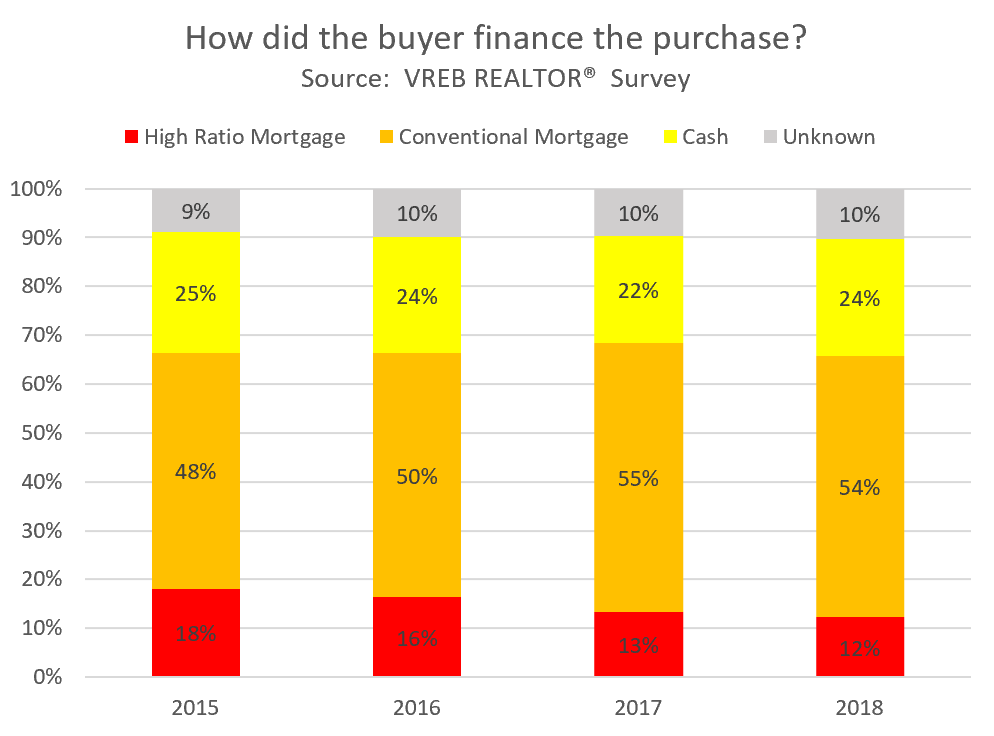

It’s clear that the stress test that was applied in 2017 to high ratio (less than 20% down) mortgages really squished that method of financing down. That combined with higher CMHC fees has made low down payment mortgages unattractive and that trend continued in 2018, when high ratio mortgages were only reported in 12% of transactions. That’s down from 18% just 3 years ago, and most of those have gone to conventional mortgages, possibly with some more help from the parents.

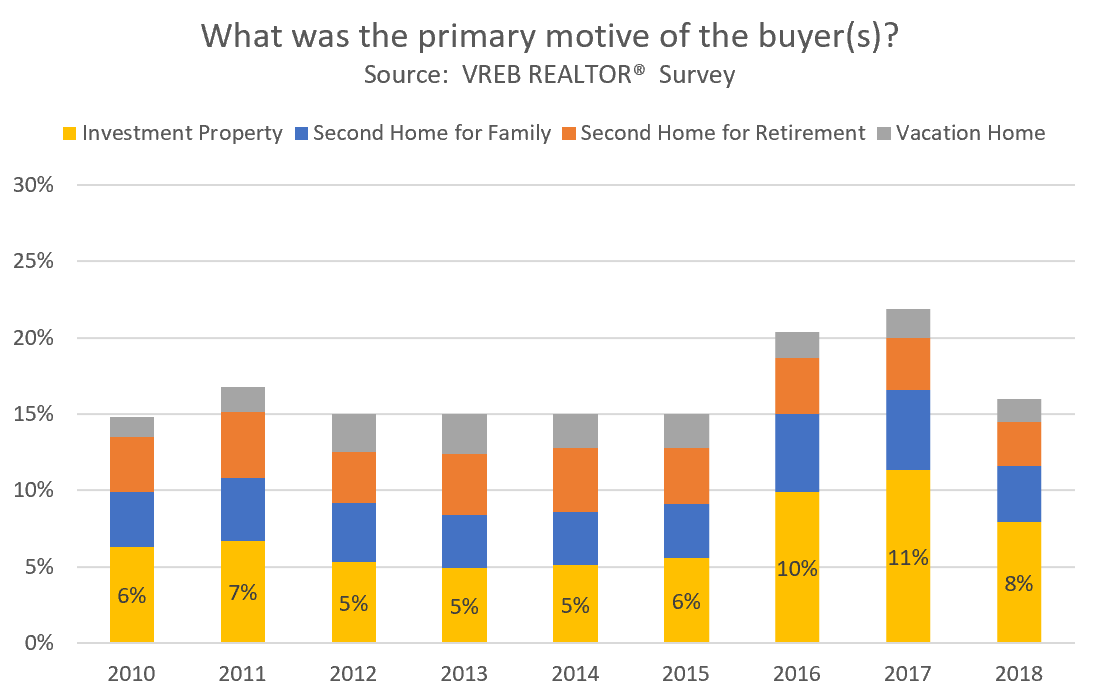

The investors that jumped in when prices were going mad in 2016 and 2017 have also largely retreated in 2018, when only 7.9% cited investment as their primary motivation for purchasing, down from 11.3% the previous year. In fact all second home purchasing was down to more or less pre-boom levels last year.

I suspect investment activity will drop further this year as the prospects of flipping properties turn less and less attractive.

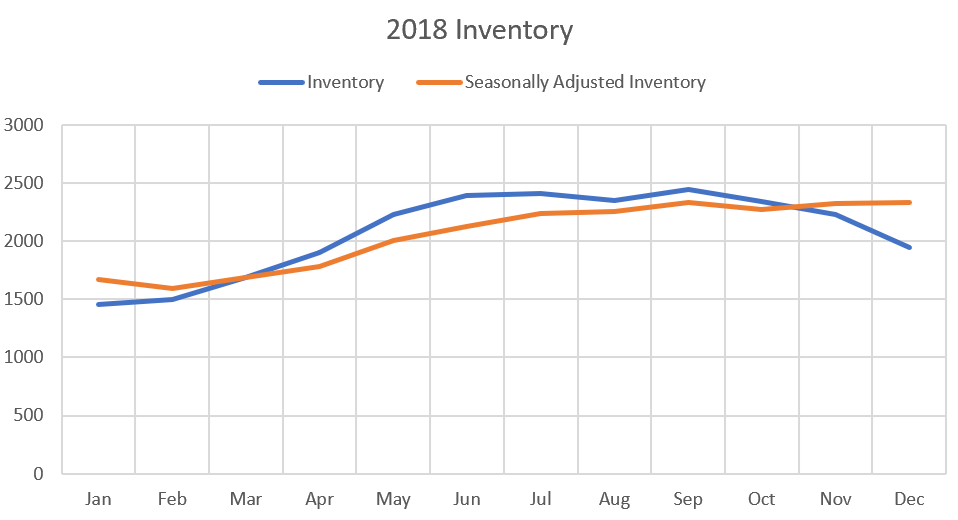

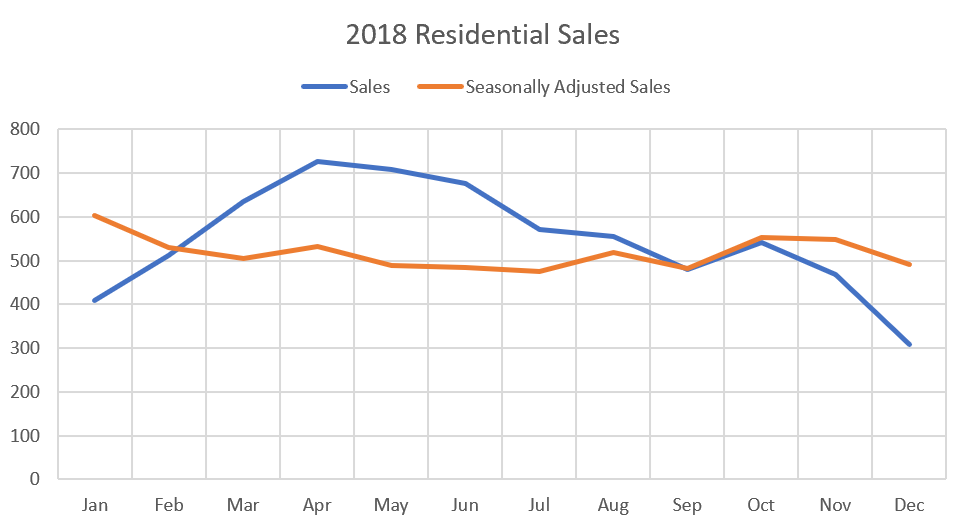

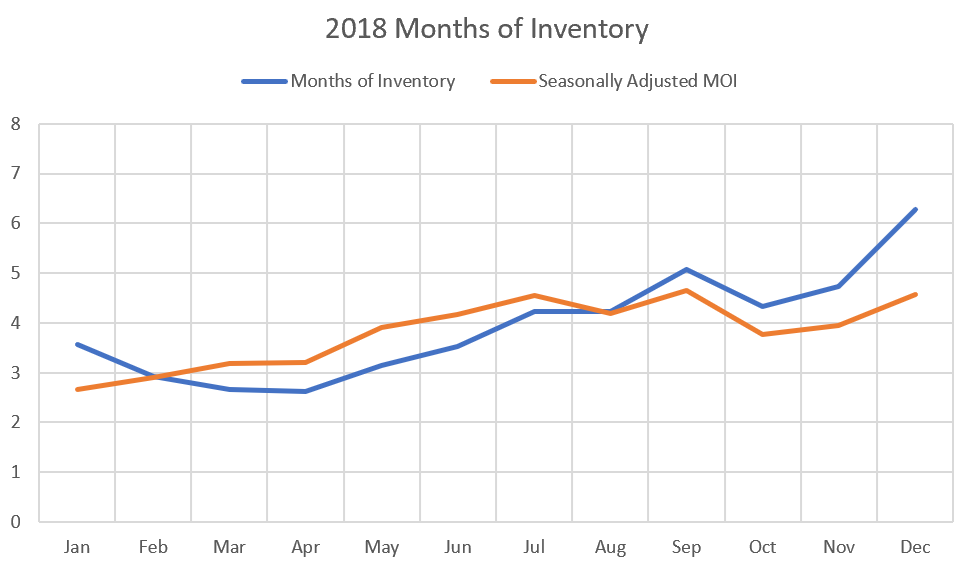

In other news, looking at the December numbers, the trend of the improving seasonally adjusted sales numbers for the past few months was interrupted, with a jog downward again. It will be very interesting to see whether this holds in the more active spring months and months of inventory continues it’s march upwards as it did in 2018.

Inventory was flat when adjusted for seasonality. We gained about 700 listings in 2018 but we’re going to need that trend to continue or accelerate in 2019 to put significant pressure on prices. It will be interesting if any of those increased number of second home purchases in the last few years will end up on the market again this year.

By the way, there’s been a pretty radical drop in government 5 year bond yields in the last few months as traders lose confidence in the economic recovery. That hasn’t lead to drops in fixed mortgage rates yet but it has certainly removed all pressure for rates to continue upward for the time being.

@ caveat emptor#54475

Anyone have a recommendation for a good cabinetmaker?

Is it for your own house or a rental ?

We use IKEA in all of our rentals and they hold up great, we also have ikea in our own house now.

It all depends on how much money you want to spend and if you can get over the fact that you have an ikea kitchen !!!

Most people do not know the difference once they are installed, we put them in a house we flipped in Fairfield and that house was sold for a million 4 years ago ( shoulda kept it as a rental )

Bearkilla, I am not sure if you are using triple-brackets on purpose there? If so, very uncool.

https://en.wikipedia.org/wiki/Triple_parentheses

Monday numbers: https://househuntvictoria.ca/latest

Yes, that’s all fine. So your point of pasting in the twitter post from CMHC wasn’t pointing to possible new rules, just talking about rational for the existing ones. Great! (I guess I mis-interpreted LeoS comments about appreciating CMHC “hard-lined approach” and “cracking down” as if they weren’t finished)

Luckily banks know a thing or two about assessing creditworthyness. You probably don’t need to be concerned for their ability to choose their borrowers.

There are no new rules about down payments. I suppose we can fret about the children under hypothetical new rules that don’t exist, but that seems rather pointless.

@guest_54268

“IMO these suggested stricter CMHC down payment rules would hurt young people (without parental help) the most.”

Housing prices are a function of what the market has been able to borrow. If FTHBs can’t buy at inflated prices, STHBs can’t move up and the gravy train stops.

@Leo S

I really like Siddall. He’s pretty level headed and takes a very pragmatic approach to the problem. He sees record debt levels as the issue and will only take measures to help FTHBs that don’t add to record debt.

Barrister….. my work at the moment has me committed to being on site during the day. However our evenings are usually free so pick a time and we will do our best to meet up at Plutos for a bite to eat or desert if that idea worked for you. Best way to get hold of me is through my web site. Just google my name and my artwork should come up. (I believe that this forum discourages posting our e mails? Not sure…but you can find me easy enough.)

Im not sure what the CMHC tweet was reccomending – hopefully it wasn’t signaling plans to raise the minimum down payment. IMO these suggested stricter CMHC down payment rules would hurt young people (without parental help) the most.

The typical heavily leveraged person is a young first time buyer – it’s been like that forever. You build up equity over the years.

Separating “silly people” from “sensible people” solely on the basis of the size of their down payment doesn’t make sense. How about a 60 year old Walmart greeter with a big (25%) down payment ( set to retire at 65) , vs a 30 year old doctor just out of Med School who has a small (5%) down payment. Is the Doctor a “silly person” and the Walmart greeter “sensible”. I don’t think so.

Down payment should considered, but just one factor among many.

Another point, strategies like Viola’s impressive example (earlier in this thread) of turning a $13K down payment into $200k equity in four years would seem to be another casualty of these new rules, since $13k on a $250k house is a 5% down payment – not allowed if CMHC rules get stricter.

Are young people on this board really happy that the CMHC May be taking away opportunities for young people like Viola found. Violas example was sensible, as the mortgage is serviced by rents received.

It’s getting a little gloaty here.

Introvert requesting a dick pic? I guess we’ve now seen everything on HHV.

Gents – keep it well-buttoned, please.

I didn’t realize bears were for protecting (((borrowers))). That’s interesting. I always thought (((they))) were responsible for high house prices. I’m against the CMHC btw.

Thank you Leo; you are a scholar and a gentleman.

I thought your point was a good one. It is too easy to be deceived into thinking house investments are different somehow from any other kind of investment. Viola’s comment about not borrowing for stock-market investment was also good, but it didn’t invalidate your post.

Yes. In the WSJ article he is responding to, there are a sample of young buyers lamenting about not being able to afford a house under the new rules. Really, it may be (temporarily) painful, but the fact is it is protecting sensible buyers from getting out-bid by silly people willing to over-leverage themselves.

I am not cheering for any kind of crash, Hawk-style, but the credit-hose needs to be tamed for everyone’s good.

Well according to dasmo’s theory we should see asking prices jump up with the new assessments this year.

Passed it on

Well yes. Every winter listings are very low. Don’t worry, listings will come back in February.

Market for single family is not at levels of inventory where we should see pronounced price drops. If you are buying in a few months it will be about the same price as now.

Bought this guys’s book. Will write a review when I finish it.

The other possible answers to the question of “What was the primary motive of the buyer(s)?” are:

To enter the housing market (First time buyer)

Wanted a larger home

Wanted a smaller home

Wanted to move to a different neighbourhood

Wanted to be closer to family

Due to a family reconfiguration

It was a work-related move

Buying a second home for use by family member(s)

Buying a second home for future retirement

Buying a second home for vacation use

Buying a revenue property as an investment

Relocation

Other

I suspect a survey designer should shudder at the construction of that question.

Yeah I’m liking Evan’s hard-lined approach these days. I think he’s got a good approach to this. A lot of people are against the CMHC’s cracking down because they want the party to continue, but it seems Evan is serious about protecting borrowers even if it comes at the expense of CMHC profits.

Tweet from CEO if CMHC a couple weeks ago

“After five years, FTHBs might gain 18% on equity with +10% home value but LOSE 200% with -10% price decline (95% LTV insured mortgage); max leverage can be as high as 82:1 with negative equity after realtor commissions”

https://twitter.com/ewsiddall/status/1077248920756121604?s=21

@tomato Thanks – no offence was taken.

We did have to put up with a place that looked like it never left the 70s for a long time. I remember having a friend over who is a professional from a more upper middle class background – and the look on her face when she saw our kitchen – I wish I had a camera! But, we fixed it up slowly over time. In total probably spent 30k on the updates.

@guest_54291

I’d rather not and get banned by Leo and have to come back as Tomatillo

@guest_54268

I told them that the assumptions in the previous post were wrong in regards to equity investing. I didn’t tell Viola what she should have done.

Viola, sorry I didn’t mean to rain on your parade. Congrats on the gains.

I wouldn’t mind seeing how big Tomato’s dick is. An anonymous online forum is the perfect place to share such things, as we all agree it would be uncouth to do so in normal life.

Maybe this post from Leo took the wind out of their sails:

After all, the bears have been pinning everything on the “rising rate environment” hope.

Did Josh give you permission to steal his line?

(Josh Post #51200)

You told someone who made 20x profit on a RE investment in four years that if they knew what they’re doing, and instead invested in stocks, they would have been much farther ahead vs real estate. That absurd-sounding statement does require some explanation and confirmation that you have actually done such a thing – otherwise it just makes you appear naive and foolish.

It’s best to learn from successful people with experience. In today’s discussion, that would be Viola.

Went to two open house today and was struck by the absence of buyers in contrast to a year ago. Mostly it was nice to get out of the house without being rained on.

@guest_54268

Yeah I’m not here to show you how big my dick is. I’m here to engage, learn and educate.

What’s the point in show boating in an anonymous forum. There’s no point in sharing personal attributes and achievements.

Patriotz “The scenarios at time of purchase and going forward for a would-be first time buyer today are vastly different from one in the 1980’s or 1990’s.”

Affordability has continually worsened but I think the people are the same, now and then. In my opinion, ‘bulls’ tend to be homeowners that would like to see their homes appreciate to validate their choices and hard work whereas ‘bears’ tend to be prospective buyers that would like to keep the door open on being able afford a home. Their views on which direction the market should go are different yet their true interests are exactly the same: they all just want to provide a home for their family and be rewarded for their hard work. Many of the homeowners cheering on home appreciation today likely struggled to purchase when they were younger and many of the struggling prospective buyers today will likely cheer on home appreciation in the future.

I know what you mean Charlie.

I’m surprised by the low number and quality of posts by the bears today. Perhaps many of them have snuck out to open houses, to fulfill a New Years resolution to capitulate and finally buy.

Hey Bearkilla, it is always the dumbest people that like to talk about how smart they are.

I really don’t think anyone would have loaned me 250k to play the stock market just because I had 13k. That’s why real estate is actually attainable for middle class people, whereas creating real wealth from stocks isn’t.

I was in my early 30s and we did get lucky. It was a great property that was on the market for 70 days so lots of people overlooked it thinking something was wrong with it. It was an old lady house – my absolute favourite kind of house. Everything well cared for but very dated aesthetics. Spend a little money updating the look to something we like and increase the value significantly. When we buy again I will look for another old lady house. I saw one in Esquimalt that was fabulous – 525k with a detached garage converted to income residence. Lots of space and good layout, just needed some updating. The financials on that one would have been sweet – but we are not in a position to buy right now. Whoever got it got lucky tho, IMO.

Anyway, we did get very lucky because right after we bought the market started going up.

Unfortunately RE is creeping away from the middle class, which is a real problem.

Tomato, the difference between you and Viola is that she’s actually done it.

She achieved a big profit (200K) based on a 13K down payment. In her 20’s. Wow! I haven’t seen you describe any kind of profit that you’ve actually made from a leveraged stock investment or a real estate investment. I’m wondering if your post just a theoretical “what if” from someone who has been too scared to do any of these investments, and is bitter and envious of anyone who has?

If you want to shut me up, simply describe the leveraged investments and profits you have made.

Until then, it’s a bravo to Viola and a “rotten Tomato” for you!

Luckily for Introvert they seem to know everything

@guest_54256

Hey Viola. Sorry to point out that your assumptions are incorrect.

2012-now have been historical returns in the market so it’s not a 6% return. You can’t compare a leveraged investment to a non leveraged one. If you would have borrowed 250k to invest in stocks you would have been much farther ahead vs real estate. Also, if you did the taxes properly you would be even further ahead because capital gains and dividends are tax preferred vs rental income.

I casually follow the GH market. From the best that I can tell, I don’t think my particular place would have sold for $100K more a year ago compared to today. But the price it would fetch today is undoubtedly lower. I’m not in denial.

Do I wish prices only went up forever? Sure. But I know that’s not the case. Prices are flat-to-declining right now. And that’s fine. For the last 40 years (maybe longer), Victoria prices have been fairly sticky on the way down, so we’ll see if that phenomenon continues. Whatever happens, I think I’m going to be OK. My 2010 assessment to my 2019 assessment still shows a 65% gain, and I’ve paid off close to half my mortgage principal in that time. On track to be mortgage-free in nine years (or sooner).

When did you buy? Where would one “listen to bears” back then?

I bought my first home when I was 23. It wasn’t hard because I paid attention in school and had a good job. That’s the problem with bears. No brains, no plan and no ambition. If I had listened to bears when I bought I’d be a forenter. Lurkers, do not fall into the bear trap.

Anyone heard anything further on the implementation of the speculation tax? Is it in effect yet? Certainly seems to be a quiet topic everywhere.

Hey introvert, those places u listed would have sold for more than 500k back in 2009 and 2013. You can keep lieing to yourself but the fact is your SFH home in Gordon Head would have sold for 100k more a year ago compared to now.

Sorry, the 13k would be worth ~56k after 25years at 6%, according to the calculator.

My property has 2 suites, that’s why the rents are higher.

I was able to buy this property in 2012 for 250k because we had 13k downpayment. If I had taken that 13k and invested it in stocks then, according to an online compounding interest calculator, after 25 years it would only be worth ~111k at 6% interest. Instead I took that 13k and bought a house, which after 25 years will be worth 750k (I think that’s a reasonable guess – not too high/low). Even if it doubles only in 25 years then I’d still be way ahead of if I bought stocks (unlikely since during the hottest part of the market it would’ve sold for 500k and now would sell for 450k). Someone could say – sure, but all that money you spent on the mortgage is lost opportunity – except in my case it’s not, since I have to pay to live somewhere (free housing not available for me) – and actually when I lived in that house it was cheaper than any similar rental available because of the income suite.

So, stocks can be good I think for people who are already wealthy – if they don’t have housing costs (or only very minimal) or if they gave a huge amount to invest in the first place (or both). For everyone else, it is now as true as it has ever been – real estate is the real meaningful way that average middle class people can create wealth over the long term.

Introvert “But pardon me for assuming that it would be difficult to spend anywhere close to her full winnings on travel”

Without trying to get snippy, that’s the problem with you Introvert, you make assumptions that favor your biased opinion. She does not even say she will spend anywhere close to most of it. But yeah, go ahead and try to make it sound like everyone is still rushing into investing in real estate because you want to see your home appreciate further.

“Wolf, you must have been a fun student for your teachers to have…”

That’s rich coming from someone who acts as the grammar police on an internet forum and has issues with reading comprehension. I was a great student back in the day. Because I know how to read.

And yet there were less than 400 sales last month.

Can’t be in Victoria, the place I’m renting for 1900 a month is assessed at nearly $800,000. The place we looked at yesterday on the oak bay border was renting for $2200 a month and assessed at $900,000.

So you can actually pull a grand total of zero reasons out of your ass, but you know for certain that they aren’t the same as the reasons that Vancouver’s went up. I almost feel like applauding, since I didn’t think you’d actually be able to top your usual level of bullshit.

If you’re interested in what kind of returns you can get in the long term check out https://www.firecalc.com/

Yes, that is a good resource. I was referencing the safe rate of withdrawal if you want your money to last. Should have been clearer. http://www.mrmoneymustache.com/2012/05/29/how-much-do-i-need-for-retirement/

It’s Not Just Toronto And Vancouver: A Synchronized Global Housing Downturn Is Here

https://www.huffingtonpost.ca/2019/01/05/global-housing-downturn_a_23634322/

My mortgage renews in late 2019. This is promising news.

Deryk: Are you free for lunch some time this week?

Which is about the long run return on the couch potato passive portfolio https://cdn.canadiancouchpotato.com/wp-content/uploads/2018/01/CCP-Model-Portfolios-ETFs-2017.pdf

Deryk: I suspect that you are right about houses in that price range increasing over the next year. While the employment picture remains steady in Victoria it would appear GVA has added more higher paying government and tech jobs while losing lower paying jobs in tourism. There has been 2000 teaching jobs added. Even with the stress test included I think it will add pressure to the 600k to 800k SFH range.

@guest_54265

If you’re interested in what kind of returns you can get in the long term check out https://www.firecalc.com/

You can reasonably expect 4.5% returns in a large up while leaving an extra 2% for inflation. So total of 6.5% per annum in the long run.

Barrister…. I don;t expect to see that price range drop any time soon. A few short months ago, it seemed that there were more places in the $550,000.00 range. Now it seems everything in that range are at least $600,000.00 or even $650,000.00. So we sense somewhat of an increase is coming overall. I know that seems at odds with what people are saying but that is what I am experiencing. Four of the houses we have looked at seriously ….as well as made offers on……. sold before we got the chance to bid. I’m not making any claims here other than to say it is interesting. (Even one day before christmas, the houses that we were looking at had several people going over them with their agents.)

I can’t believe that the six hundred and fifty thousand dollar price range will drop this spring. Not in that lower range where it is hitting the sweet spot of qualifying for mortgages. The qualifying for the mortgage sweet spot seems to be setting the price on homes that should be worth less to me…because of how shabby and broken they are.

I have no idea though. It’s just my feeling based on our experience.

Local geography question – it seems like someone here should know:

What is the name of the hill whose apex is defined by Revelstoke Place? Every other adjacent lump has a name (Doug, Christmas, Tolmie) but I don’t see anything assigned to what is a fairly pronounced piece of rock. I used to think that it was Cedar Hill (ergo the road running down the east side) but apparently that is just an older name for Doug.

LeoS: I promised CS to buy them lunch; could you forward my email to them so that they can arrange the same. Thanks.

Deryk: Considering your criteria list i am not exactly surprised that you are having trouble finding a house. But neither are you I am sure. What percent of a drop in houses prices in the lower end of the market do you think would have to occur before you think that finding that house would become easy?

Possible rate cut in 2019 https://www.cbc.ca/news/business/interest-rate-hikes-1.4964689

People with one million dollars might want to invest where houses are less expensive than Victoria if they are looking for income rather than the prospect of appreciation. For example: In Moncton you can buy beautiful character 3 bedroom duplexe for $200,000.00 So for one million you can buy five of these duplexes. The rental income from “one” Duplex is $1,000.00 for each unit ….so $2,000.00 a month rental income for the one duplex…..Times five duplexes …equals 10,000.00 a month minus your expenses. (Taxes, property management fees, maintenance etc etc) Tenants pay the heat and electricity and snow removal. It’s fairly easy to find tenants in Moncton as the government is pouring money into art centres, hospitals, schools, universities and convention center, etc. The downside is that the prices in places like Moncton might or might not go up as much as they could in Victoria.

By the way….I keep hearing doom and gloom here on this forum about Victoria ….. but it doesn’t match our experience. Our family has been looking at houses in the $600 range and they keep selling before our eyes. Houses priced right have people circling the block every time. I see so many “pending” labels on houses when we see listings by agents and we also know that many that we have looked at have offers already….. and it doesn’t show yet on the listing sites yet.

We are looking for a 3 bedroom house below $600,000.00 with a good sized workshop shed and within 20 minute bike ride to downtown Vitoria. A suite or potential suite would be a bonus. (Must have a good sized workshop shed or similar option.)

We have been looking for weeks and every time we see one there is an offer already on it.

No they’re not. The scenarios at time of purchase and going forward for a would-be first time buyer today are vastly different from one in the 1980’s or 1990’s.

One million invested well will reliably give you $40,000 a year long-term. $60,000 is possible, but unlikely to last over the long-term. Net depends whether the withdrawals are taxable and what other income you have.

You are probably getting closer to 1800 a month after expenses, maybe less, if you do not have a mortgage. It is taxed at your highest marginal tax rate so your net depends on your other income. If you had two of these you’d paid off you’d get close to the same return as with one million in the market, but with a more work and potentially less tax exempt income. The real windfall in our market is not rental income, but appreciation.

It is a lot harder to save and invest to get to a million in the market than it is to buy a house with financing and rental income. For many, the strategy is to start out owning a rental and sell it after it appreciates and the mortgage is paid down so you can invest it for passive income.

Usually one of the best times to buy.

The Surrey mom was talking about buying a family home which would be a pretty smart thing to do. Wasn’t clear to me that she wanted to sink the rest of the cash into RE.

With that kind of cash you could easily support yourself with ANY investment that wasn’t a scam. Buy the family home for $5M and you still have 34M to invest. Over $1M income per year even at a lowly 3%

Except your forgetting such things, as property taxes, insurance, maintenance or strata fees fees, renovation costs or unexpected costs, these things could easily eat up $800 to $1,000 month, also remember that the income you receive is taxed as interest income which is the highest rate, while an coupe, could make over 90K from dividends and pay no tax vs 15K in annual taxes from a couple earning rental income. For retirees with low income, under 50K dividends vs rental income is a no brainer.

I had a wealthy person tell me that their 1million invested sensibly gives them 60k a year in income (@ 6%). This was in the context of me saying I want to invest in real estate long term. I couldn’t believe that just by having 1million a person could make my annual salary doing nothing. Not that it’s very unbelievable, just that I had never considered it before. The way I look at it it’s the same as investing in real estate. Because, I own a property now that’s worth 450k, and I get 2400 a month in rent for it. If I had two of those properties and they were both paid for I’d have 4800 per month in income, minus some carrying costs. More or less the same. I personally like real estate more because I can see it and control it. And, since the housing market reflects the economy in general and goes up on general over a long period of time (ever increasing upward over a long period), buy and hold with real estate is similar to doing that with an index fund. So it’s just whatever one prefers, IMO. That being said I am no expert.

Hard to see her investing large amounts in a falling market though.

It also means that people will have to start being more realistic when they look for the right selling price.

Also as the assessments go down I believe it may facilitate a gradual reduction in the asking price. Not to say things will plummet.

@guest_54291 it depends on what she travels in… maybe she will invest in a rocket ship to try to make it to the moon. That could take up all the $$

[facepalm]

Wolf, you must have been a fun student for your teachers to have…

You’re right, we can’t know what she will do in the future. But pardon me for assuming that it would be difficult—if not impossible—to spend anywhere close to her full winnings on travel, even if that was all she did for the rest of her life.

CS: When is a good day next week for you? Penny Farthing in Oak Bay?

Leo S can you give CS my email so we can arrange lunch

@ Barrister

“Happy to buy you lunch one of these days.”

That’s very good of you. I will look forward to it.

The slide is happening, nothing was selling below assessment two years ago!

We’ll ignore the massive increase in assessments in the last two years?

The assessment on my personal house has gone up $344,000 in the last two years. Two years ago, I could have sold above assessment, now I would have to sell below assessment; however, that doesn’t mean I am selling for an absolute amount less than two years ago.

Even if prices stay flat half the sales +/- this year will be below assessment. Doesn’t mean prices are necessarily going down, just means assessments finally caught up.

“$39.5M lotto ticket”

She doesn’t say that she’ll spend MOST of the money on real estate. You’re putting words in her mouth. Nobody knows what she’s going to do with most of the money because she did not say.

1884 Hillcrest Ave

Sold: $903,700 – below assed value which is $978,000

4102 San Ardo Pl

Sold: $800,000 – below assed value which is $843,000

The slide is happening, nothing was selling below assessment two years ago!

Mom from Surrey wins $39.5M on a lotto ticket and what does she plan to do with most of the money?

“I want to invest in real estate for our future.”

https://www.prpeak.com/lotto-multimillionaire-from-surrey-b-c-says-jackpot-win-an-amazing-blessing-1.23577632

Property assessments are inaccurate more often than you might think, says author

As many as 20 per cent of all residential property owners in the province should be appealing their property assessments, says the man who has literally written the book on the assessment appeals process.

https://www.timescolonist.com/real-estate/property-assessments-are-inaccurate-more-often-than-you-might-think-says-author-1.23578439

All right, small shot. No one knows all the reasons why Victoria prices have gone up, but we do know what didn’t cause them to go up: unheard of numbers of foreign investors parking ridiculous sums of money into the most desirable neighbourhoods/municipalities.

That bear was Local Fool.

Gwac, don’t ban yourself again, for crying out loud. The leftover eggnog is keeping Leo super relaxed and he’s barely paying attention to these silly back-and-forths (which so far have been benign, I might add).

Some unrenovated places are still selling for decent money:

1884 Hillcrest Ave

Sold: $903,700

4102 San Ardo Pl

Sold: $800,000

But you’re right: the market ain’t hot anymore.

That will be a very high profile example of supply based arguments being full of it.

its not that we need land… Victoria density is so low in world city standards

Barrister: “Nor do I want to see the lower end of the market drop too much because having a lot of young first time buyers loss all their equity in a house is not a good result either.”

I’d expect young first time buyers to be LESS affected by a drop than the middle or higher end. Most young first time buyers that I know plan to hold for 10+ years so they don’t care what happens in the short term (that’s assuming they can withstand the storm of course). I’d think that any pain and suffering would be greater for people a little farther along and/or closer to cashing out their retirement nest egg (i.e. they have to work longer and/or retirement won’t be as lavish as envisioned). It’s a similar reason why older people generally have more conservative investment portfolios; they need the money sooner and do not have time to wait for a loss to rebound. The young have time on their side.

Grace “This board is full of cranky rich people”.

I’ve come to the conclusion that there are two groups of people on this forum. One group has worked hard and sacrificed, has bought the home, is enjoying the benefits, and exaggerates their humble beginnings to substantiate their achievement (i.e. “look what I came from, anyone can do it”). The other group currently works hard and sacrifices, hopes to buy a home, and exaggerates the discrepancy between what they’re able to achieve and their goals (i.e. “look how unaffordable everything is”). The former call the latter entitled and the latter call the former lucky. But they’re all the same, just at different stages of the life cycle.

Victoria solution – more Gulf Islands!

Hong Kong to build four artificial islands to tackle housing crisis.

Check out @business’s Tweet: https://twitter.com/business/status/1081415645110116352?s=09

CS: That is one of the most intelligent posts that I have seen on here for a long while. Happy to buy you lunch one of these days. The housing situation is rarely viewed from the larger context of the economy. There are reasons why I moved all my assets out of Canada fifteen years ago and, with the advantage of hindsight, it was the right move.

@ Barrister

“The official cost of living numbers are about as real as Las Vegas.”

According to this source, Canada’s money supply has grown at an average rate of around 7.5% a year since 1990. Assuming all other things being equal and that the economy has grown at an average rate of 2.5% a year, that implies a price inflation rate of 5% a year (M1 growth less growth in the economy), which would quadruple prices since 1990, or about what has happened with Victoria RE.

Given that Canadians pay more than half their income in tax, an inflation rate of 5% means that one requires a 10% pre-tax return on investment to simply maintain the value of one’s capital. How can you achieve that? For the great majority of people, there is only one way, namely to invest in a house.

However, continued monetary inflation via bank money printing is impossible when interest rates are rising. If the trend to what Info used, here, to call normal interest rates continues, then money supply growth will likely crash and with it, the property market.

That raises the question of what is a “normal” interest rate. I would suggest a BoC rate that is at least equal to rate of price inflation, or 5%. And, yes, that would precipitate a house price crash.

For Gordon head, I would say a home bought at 2009 or 2013 for around 500k, it will probably sell currently for around 770k without any renos done. That same home would have probably sold for 100k more back during the hot bidding war days.

Out of curiosity I used a compounding calculator ( something to be said for the internet) and if house prices increased at a steady 5% a year then there would be a 63% increase.

The real problem might be that Canadians have experienced a drop in their real purchasing power over the last decade. The official cost of living numbers are about as real as Las Vegas.

Ks112 How much do you think Gordan Head is up?

Don’t think Gordon Head is currently up 65% compared to 2009. Maybe your assessment says that but that’s not the market price

I am sorry but I do think think a Gordon Head house is currently up 65% since 2009.

Hold on the interest rate

Hold

… so january 9th .. Boc interest rate announcement .. they going to either raise or decrease interest rates .. what is your guess?

Anyone can claim they are rich on the internet. That said there’s nothing more gauche than bragging about real or fake financial success.

I can see a drop in prices of 10 to 15% being quite possible with a lot of that being concentrated in the top end of the market. I am not a math wiz but a 65% increase over ten years seems like about a 5% increase per year when compounded and that seems a lot less dramatic.

I really do hope that there is not a recession because they cause an immense amount of pain and suffering for a lot of people. Nor do I want to see the lower end of the market drop too much because having a lot of young first time buyers loss all their equity in a house is not a good result either.

Personally what houses prices do in Victoria is not going to really have a impact on my life but there seems to be a callous disregard to what a recession or a major house crash does to ordinary people.

It’s been fun Patrick. Going to take a little break so that Leo does not get pissed. :).

Passing the mantle to you. Lol

The typical bull vs bear debate that goes on here isn’t with someone who can’t afford a house, as they wouldn’t be considered a bear. The bears here could afford to buy but “choose to wait” because they believe they are smarter than everyone else, and they can time the market. Some of them go farther, and also want to see those who have become heavily indebted with mortgages to suffer in the downturn so that their “hubris is wiped clean” (that’s a quote from one of the bears). They want prices to fall by any means, including rising mortgage rates to bankrupt as many owners as possible. Possibly you too, since you own two properties. They also look forward to a collapsing economy with huge layoffs of construction workers – only because that helps their self-serving goal of saving money on a house.

If you want to hear from some of these bears, just try making a sensible post describing the two properties you own, and how you plan on holding them for the long term, and consider it a sensible investment. Our resident bears will quickly set you straight.

Alright big shot, what were the reasons that Victoria prices have gone up, as you’ve said, 65% in the last 10 years?

Bulls are flying today! Great posts gwac and Introvert!

From the current post: “I suspect investment activity will drop further this year as the prospects of flipping properties turn less and less attractive.”

Some of you equate “investment” with “flipping”? Much of the commentary on the blog just snapped into focus.

I’m up 65% since buying. Yes, a 25% decline would hurt. I’ll let you know how it actually feels when we see a 25% decline.

Meanwhile, I’ve paid off a bitchload of my mortgage in these nine years thanks to the basement suite and being focused.

Not unfathomable, but unlikely. Both prices and the reasons for those prices were very different in Vancouver than in Victoria, so I don’t expect the same percentage price declines to visit Victoria.

Cool, can’t wait till we barely enter another one.

Canada barely entered recession.

Currently you’re a bear Gwac.

Can’t exactly buy a house when it’s not possible to be approved for a mortgage, so not likely.

I’ve got plenty of other paradise that I can access because of dual citizenship: Australia, New Zealand, Cook Islands. So when you say that decreasing prices in Sydney don’t matter, at least for me, you’re dead wrong.

</I really like what happened to Victoria RE prices in the aftermath of the last recession, so I’m looking forward to the next one.

I wouldn't get so cocky introvert. The Gordon Head house you bought is probably worth 50% more currently (based on prior discussions for the neighborhood). Let's say you bought for 500k and now it's worth 750k, all there needs to be is a 25% decline and your back right where you started 10 years ago after factoring selling costs. If you look at what's happening in Vancouver and it's surrounding areas, that's not unfathomable.

This board is full of ( with exceptions) cranky rich people who don’t get that some of us have stuff happen in life that means we aren’t rich. We have mortgages in our older age. We may rent. We may not have millions invested in the stock market.

I really don’t fit in here at all but do gleam abit of useful info from time to time. The sniping and personal attacks are very tiresome however.

I don’t think reconciliation is completely off tangent. There are a number of implications in the years ahead and some that are much nearer.

Even before the Oregon Treaty was signed the writing was on the wall that the British were losing ground, specifically HBC territory since it was the acting wing of the dominion of Canada. Prior to 1850 Sir James Douglas was tasked with establishing a Fort on the South end of Vancouver Island in the event that a border was drawn up on the 49th Parallel, that Vancouver’s Island would be protected. In the early 1850’s Douglas got together the different Chiefs and established Treaties. At the time he was offering cash, but the Chiefs favoured blankets and various textiles. There is much debate on whether they knew what it was they were signing away and I recall reading a later Chief around 1920 saying that the treaty itself was meant only short term. That the Treaties were signed between 1850-1855 I think it was could support that. But I believe that the debate today centres on areas with treaties and those without. Victoria from Sooke to North Saanich have. Gulf Islands, and in particular James Island to the best of my knowledge do not. Neither does Vancouver city proper.

If James Douglas hadn’t implemented the measures as above, all of us would surely would be governed under a different flag, probably with another star in it, and perhaps might have had enough popular vote to sway numerous elections, changing the course of history, and we’d be arguing about how to write off mortgage interest against our taxable income, and driving to Seattle across the Haro Strait and Rosario Strait bridges built by the Army Corp of Engineers.

*Footnote: Should the author of this post ever be found to apply for office of any kind, please consider the entire contents, any previous, current and future posts as complete satire for entertainment value only. Eom.

Will be interesting to see if this reverberates across the country. Bow Tower valued at $1.43 billion in 2015 and now $779 million. That’s like losing 750 Victoria median SFHs.

https://www.bnnbloomberg.ca/plunging-calgary-office-values-linked-to-oil-patch-layoffs-1.1193742

I really like what happened to Victoria RE prices in the aftermath of the last recession, so I’m looking forward to the next one.

Hawk difference between you and your supposed neighbors is you are on here bashing the market. Seems you want a house real desperately.

Hawk disappeared last year for a few weeks around this time so I guess it’s vacation time at Arizona trailer park.

Do you promise?

Well that’s factually untrue, but wouldn’t expect Hawk to understand the basics (even though he’s so “old and wise”).

The terms are mutually agreed-upon, last I checked.

Must be some kind of crazy coincidence that so many well-off people are living in the same run-down rental apartment building in the Gorge.

Viola,

The 90 thing was a joke, incase you missed it.

Intorovert’s problem (as well as gwac’s) is they live in some alternative universe where a house is some bizarre representation of success and financial wealth. Owning several houses before, I know it isn’t.

Until it’s paid off or you sell, the bank owns your house, not you. You have an obligation to keep paying on their terms, not yours. When they wake up to this reality they will be in a very rough spot.

My immediate neighbor is a professional who makes $150K/yr for best part of 20 years so he is far from some loser, loaded to the hilt in cash and is probably a multi millionaire a long ways back.

My other neighbors are software developers, nurses, retired doctors and many other very highly paid professions. We don’t need a house to immaturely tout on the internet day in and out how f’n great we are and slag anyone who doesn’t own.

Over and out…. maybe for a long time.

I got it James. You are just the same as the other dozens and dozens of bears on here over the past 9 years. You all think that you can time the market and you all think there has to be a crash after an up market. Guess what you are just like the others and will quietly disappear after you buy a house with no crash or any real correction. Welcome to the Victoria Market and Paradise.

Except you clearly don’t.

Rates going up, not good for people being able to meet the stress test.

Recession, not good for the market in general.

If rates are going down and there is no recession, or rates going up and people can still easily afford the stress test then either are no big deal.

Cuddlier than any bull, that’s for sure!

Did you not at least like the picture of the bear? He looks so friendly.

@guest_54291 there are some who get and stay lucky all through life – if you’re one of them then good for you. For me personally I have been on my own since I was emancipated as a minor at 16. I have 3 degrees, all of which I paid for, including a professional degree. My student loan payments at 29 were 800 a month. I don’t regret the student loans because without them I’d still be a waitress and there’s no way I’d own property and now I own two (with the bank and my partner). Until very recently when my mother died I had no help from family. People like me don’t buy houses in places like this in their mid twenties. If you did it that’s great. Poor Hawk, has probably been thru some real shit if he’s made it to 90. There’s a reason for all the negative predictions about the housing market, to write it off to stupidity is overly simplistic. Plus, he could be right – we don’t know because we can’t predict the future. Anyway, peace to all.

fantastic citation – a real estate “expert” who can’t keep the terms bear market and buyer’s market straight.

gwac buys a condo at 50% off in 1990 but can never happen again in history. Must suck to wake up everyday worrying about every new stat I post about the coming flush job.

Did you miss the earlier news ? We’re now in a bear market where anything can happen from here on in, so quit your whining about my factual posts, it’s getting tiresome.

Vancouver Real Estate Officially Enters A Bear Market For The First Time Since 2013

https://betterdwelling.com/city/vancouver/vancouver-real-estate-officially-enters-a-bear-market-for-the-first-time-since-2013/

Hawk got to be tough to wake up everyday and realize how wrong you have been for so many years…Than the day starts searching for anything to give you hope…

Exactly what the rookies don’t get. No more rate hikes mean the economy is in huge trouble and major job losses coming would crater the housing market worse than imagined. Either way prices are going down. It’s the end of a bubble and that’s always been the bottom line.

?w=620&h=471

?w=620&h=471

https://228main.com/2015/11/23/anatomy-of-a-bubble/

Intorovert would be getting 2013/14 prices with the $100K plus tear down discount. 10 years in one place with zero renos. Must be a real dump.

gwac, this correction hasn’t even started yet as credit has only just begun to tighten the last few months. Meanwhile you continue to squawk about your oh so bold “5 to 10% down” prediction but everytime there is a downward stat you cry like a baby “it’s not happening you loser NDP’ers !!”. You’re a total f’n joke.

Rates up or down are bad for housing Got it. A lot of rules to keep up with to be a member of the housing market crash gang. Its exhausting I don’t think I have what it takes…

LOL. Yes the fears of a recession knocking down bond yields should do wonders for the housing market.

So you did or didn’t pay for your english degree yourself?

Leo bought 5 years later.

Oh dear, the “rising rate environment”—the thing that prospective homebuyers have pinned their every hope on—appears to be on shaky ground.

That’s a tough one.

Someone didn`t get enough handouts from the Liberals and NDP and is a bit cranky. Sorry about that…

Gwac,

Agreed. That’s why I don’t usually engage people who repeat bumper sticker slogans.

Dad sorry no use arguing stupid…

move-up condo sellers are younger group,

a) bank of mum and dad

b) willing to DIY

c) huge jump on their incomes – DINK

If they care enough to move-up, they are willing to pay the price.

If not, just stay put and enjoy their homes.

0.02

“Sorry if I like to pay for my own stuff and feel others should do the same…Novel idea I know”

No doubt then you would favour a completely user-pay system for all public infrastructure including roads, bike lanes and sidewalks. Charge pedestrians by the foot step.

“By now, the typical boomer should have a paid-for property and some money in the bank. If they don’t, then either a whole lot of life hit them, or a whole lot of stupidity hit them.”

Intro If one sold their house in anticipating of buying lower where would they fit in?

(From the previous thread:)

We did manage that. We were 26 and 27, I think. Neither one of us is Doogie Howser. We built up an 18% down payment by living frugally and not shooting ourselves in the foot financially. Leo is also a millennial who bought in GH under similar circumstances. I gather that what we did wasn’t common, but it was doable without major help from family and without a doctor’s salary.

The standard I like to hold Hawk to is the one for his generation, the boomers. By now, the typical boomer should have a paid-for property and some money in the bank. If they don’t, then either a whole lot of life hit them, or a whole lot of stupid hit them.

The damage in defamation, and in this case libel, is to reputation. In assessing damages for libel the courts can look at

Even if 1 is not met, 2 and 3 are available depending on the facts. In addition to the costs of defending against a defamation suit in which the burden of proof shifts to the person making the statement to prove it was not defamatory.

Canada is widely considered to have the most plaintiff-friendly libel laws in the English-speaking world. The United States is widely considered to have the most defendant-friendly libel laws in the English-speaking world. It is way easier to bring a successful libel action in Canada than the US.

This is not about “censorship” of free speech. This is about reasonable limits on the right to free speech in a free and democratic society. That is why there are laws against hate speech and defamation.

It is about truth and fair comment which are so important to reach a reasoned decision and position. You can say whatever you want publicly about someone if it is true – subject to discrimination/hate speech laws. You have an obligation to refrain from making malicious and untrue comments about individuals publicly based on the reasonable person test. This is as it should be for reasons set out by the Supreme Court of Canada:

KS

May be hard for me to sell my GH home….Since I never bought one.

Second of all a crash is not exactly sending prices back to 2017 assuming that is correct. I have stated over and over I expect a 5 to 10 correction which we are nowhere near and are still up from last year according to VREB. Hawk is thinking over 40% like his favorite year 1981.

So Hawk gets the credit he deserves a big fat goose egg…

So everyone is aware we are in Victoria and if you would like to know FACTS about Victoria go to VREB not Hawk but VREB. You can google Vreb…. Vreb has facts which a lot of you would rather not follow.

<'Hawk you are priceless. You have basically listed 50 to 100 things than were going to kill the Victoria market. Still not happened but hey one day you may actually be right…LOL

To Hawk's credit, Gawc if you were to sell your Gordon Head house today you would be getting 2016/2017 prices.

@guest_54265 One of the requirements for a successful tort is to establish damage. Kind of like no harm no foul. I don’t see what the damage could be from that comment. Anyway, the Canadian approach is meant to be more compensatory as opposed to punitive, which is why we are far less litigious than our neighbors to the South. Also, would suck if people were censored to that degree, IMO. All of this is to say – i hope you’re wrong.

@plumwine – fair points, but isn’t it the move-up condo seller buying the SFH? If condos drop, gotta be a related fall in SFH.

Dad

Sorry if I like to pay for my own stuff and feel others should do the same…Novel idea I know,

Hawk you are priceless. You have basically listed 50 to 100 things than were going to kill the Victoria market. Still not happened but hey one day you may actually be right…LOL

The defamatory bit imo is “the culprits were…lackeys” – and possibly the “Red Queen” bit.

Again, in Canada to be fair comment:

I believe a court could find this to be both untrue, and made with malicious intent.

Ironically this expedient but short-sighted solution is imposing large costs on BC today. The unresolved land claims make it difficult to develop anything new on the land base. Plus the crown land base that was formerly available to all will be steadily whittled down by more Chilcotin-like cases. And the government strategy of avoid and delay is not working, the cost of settling keeps going up.

totoro – are you actually saying a comment like the above would/could rise to the level of defamation? I don’t agree with the commenter, I believe they are wrong on the math of the election, and it is not a “polite” comment. But by the standard of what is out there that is a VERY mild comment. It would be very chilling to free speech if a comment on this level were considered defamatory.

Lore’s comment was:

◦about a matter of public interest – YES

◦based on fact; – YES loosely

◦recognizable as comment; – YES

◦reasonable; YES – if your opinion is that things are crazy in Victoria the Alice comparison is reasonable

◦free of actual malice – PROBABLY. IANAL but I doubt if a court would find criticism at this level to be malicious

“HBC actually had pretty good relations with the Indigenous peoples and allowed them to improve their incomes through trade while maintaining their traditional lifestyles. It’s after Sir John A. bought their territory and promoted mass European settlement that things turned nasty.”

This is partly true. Most territory in BC was never bought and is unsurrendered, i.e., stolen. The decision to steal the land, rather than treaty was a made-in-BC policy favoured by James Douglas, mildly racist but pragmatic, who planned to let Indians mark out their reserves and pre-empt land the same as settlers. This was probably because the crown colony was broke. Douglas had treatied in the past.

The vile and disgusting racist, Joseph Trutch, replaced James Douglas and decided pre-emption should be for the white man only and also decided that Indians reserves should be way smaller. Sadly, there is still a Trutch St in Victoria, even though Trutch was a way bigger piece of shit than John A. Macdonald.

The Nisga’a in particular, were not too happy with Mr. Trutch, and lobbied various levels of government. The feds responded by amending the Indian Act to make it illegal to pursue land claims in Court. The amendment stayed in the Act until the 1950s I believe. When litigation resumed, BC fought tooth and nail against recognition of aboriginal title, but the Nisga’a finally had their day in Court in 1996 when the Supreme Court of Canada issued it’s landmark ruling in the Delgamuukw case. This was over 100 years after the Nisga’a started lobbying. The Nisga’a finally got their treaty, and BC got its ass handed to it. Despite Delgamuukw, we haven’t made much progress negotiating other treaties. Most of usin BC still live on stolen land.

Anyway, bit of a tangent there…

Just wondering why you say that months of inventory going from 2.5 to 4.5 is flat?

Also, if the Fed keeps raising their rates, there will still be pressure to raise ours, or have the dollar drop.

Was a joke LF. Keep up your thoughtful and entertaining posts.

Remember when gwac says Australia or anywhere else has nothing to do with BC ? Wrong….again.

It’s not just Vancouver: Property market slump goes global, jolting cities from Hong Kong to Sydney

Rising borrowing costs, increased government regulation and volatile stock markets playing a role, along with dwindling demand from Chinese buyers

While each city in the region has its own distinct characteristics, there are a few common denominators: rising borrowing costs, increased government regulation and volatile stock markets. There’s also dwindling demand from a force so powerful it pushed prices to a record in many places — Chinese buyers.

https://vancouversun.com/real-estate/property-markets-from-hong-kong-to-sydney-join-global-slump/wcm/d52e8846-cfc3-487e-a8f7-c9644748fe26

“gwac, insulting people is all you do on here, read your posts sometimes besides the suck up ones that have zero information.”

He is also a terrific source of BC Liberal talking points and right wing dogma.

90? I don’t know whether to be awe inspired, confused or call you a liar. Pretty sure you’ve said you’re still working. Are you really 90? Is this why you won’t meet with anyone here? An interesting choice to come on here then, and argue with a bunch of relative fetuses. I’d be out doing fun, retirey things…but to each his own.

Heh. Hawk. What a character. Cheers to long life and good health.

Sorry bulls and salesmen, it’s all over but the crying.

Vancouver Real Estate Officially Enters A Bear Market For The First Time Since 2013

Vancouver real estate, welcome to the bear market. Real Estate Board of Greater Vancouver (REBGV) numbers show price declines became larger in December. The drop in prices came with a huge decline in sales, and a surge in inventory.

https://betterdwelling.com/city/vancouver/vancouver-real-estate-officially-enters-a-bear-market-for-the-first-time-since-2013/

I’m surprised the spelling Nazi hadn’t pointed that out…. I am 90 yrs old so I guess I’m out of touch on the spellcheck dasmo. 😉

gwac, insulting people is all you do on here, read your posts sometimes besides the suck up ones that have zero information.

1121 Collinson St slashed $150K to $1.69 million and needs a pile more than that with major renos needed and assessment at $1.1 million. Some major wake up calls coming.

Looks like interest rates will keep going up with the job numbers in Canada and US still pumping higher. The TNX spiked huge 4%. Surprised gwac isn’t talking about that. 😉

It’s butthurt by the way….

HBC actually had pretty good relations with the Indigenous peoples and allowed them to improve their incomes through trade while maintaining their traditional lifestyles. It’s after Sir John A. bought their territory and promoted mass European settlement that things turned nasty.

list of the 5.5 billion in NDP taxes

https://vancouversun.com/news/politics/budget-2018-ndp-powering-its-government-with-5-5-billion-in-tax-hikes-where-the-new-money-will-come-from

Horgan is not the same as Lisa sorry. Horgan is out of control with the spending and taxes. Victoria tax increase was pretty much in line with inflation.

You just love insulting people makes you feel good about yourself I guess…

Super informative post!

That’s hilarious. That’s what Horgan is all about too but I guess he wants lower house prices and that doesn’t sit well with gwac the greedster. Funny how the hypocrites reveal themselves over time.

Is Intorovert all butt hurt again cause his daddy don’t say it ? Not 65 btw junior, but keep on pumping out the Trumpisms whose 70.

Ian, there’s a beautiful road/ferry trip if you drive from Victoria to Port Hardy and then take the port hardy to Prince Rupert ferry via the inside passage. Amazing scenery everywhere on the trip, but magical on the inside passage ferry. BC ferries has a barBQ and beer/wine bar at the back deck of the ferry, and most guests are from Europe! Try to go in summer when it’s sunny and not raining.

“In the age of anonymity on the internet, I wonder how on earth our society expects people to put themselves forward for public office. Those that are psychologically immune from such critiques are going to be few and far between and, imo, may not be those suited to make the best decisions.”

This is how the US ended up with its current head of state. Anyway, I agree and personally would never want to be in public office. Those politicians have a really tough job, especially with the Internet.

Also agree that anonymity should be used responsibly.

Fwiw, I like Lisa Helps and agree with the decision to move the statue. The First Nations were saying that the statue’s symbol was an ongoing sign of colonialism and that it got in the way of moving forward with reconciliation. Those who are serious about reconciliation have to listen. It’s a beautiful statute, and it deserves to be somewhere. I hope it’s moved to a park or something.

I like Lisa. Differently politics than me but I feel she just wants to make the city better. People may differ on the definition of better but that ok. I think she is just a hard working individual trying to do some good.

Council voted 7-1 to remove the statue. Lisa Helps has no power on her own to make these decisions. Decisions of Council are decisions of the City made on behalf of the majority of the electorate who placed them in office. That is the democratic process.

Lisa Helps had 42.6 per cent of the votes, an increase of 5% over her last election win. The three candidates with the next highest number of votes made up 51.9% of the votes. The “absurd” number of candidates had no vote-splitting effect imo.

You know, there is a reason that it is against the law to make false comments, including under a pseudonym, that cast aspersions on someone’s character in a manner intended to bring a person’s reputation into disrepute. Not to mention that it says more about the character of the person making the comments.

In Canada, for something to be a fair comment about an individual, including public figures, on a blog like this, the comment must be based on known and provable facts, must be an opinion that any person is capable of holding based on those facts, and with no actual malice underlying it.

In the age of anonymity on the internet, I wonder how on earth our society expects people to put themselves forward for public office. Those that are psychologically immune from such critiques are going to be few and far between and, imo, may not be those suited to make the best decisions.

Interesting to see only a 40% survey response rate from real estate agents.

You would think they would want to provide their own industry more data to work with…

or maybe not!

Just to be clear, “the town” didn’t turn the statue into an issue and take it down: the culprits were Lisa Helps and her cabal of political-correctness lackeys. The vast majority of Victorians were soundly opposed to the move and still are. Government in Victoria is like Alice’s Wonderland in more ways than one. It’s a bizarre twist of fate that an absurd number of candidates — something like 17 — split the vote and enabled Red Queen to remain in office.

Thanks, Leo, for the writeup. The market is changing. Last summer, houses around Central Saanich used to move within days. More recently, riding my bike, I noticed several sitting for months before being taken off the market prior to the winter doldrum. This spring should be very interesting, particularly if the broad market shows evidence of slowing.

I 100% agree with caveat emptor re: North Island.

The fishing is fantastic and while the ban was in place around Sooke/Gulf Is last year, folks had no problem catching their limit up North. In the Winter it’s a different picture. If you loved the Dec storm then North Island is for you. We’re quite insulated down South. Everyone knows everyone and the community is quite strong. Not a bad thing.

“Really good post; maybe you should be doing the RE column for the TC.”

I think that’s the point. The interaction. Although I haven’t emailed Jack Knox. It’s amazing the Times Colonist can still exist in namesake in a town that takes down offensive statues. But then… HBC still sells its blankets and even books on how “iconic” it is.

Their town festival is called “Filomi Days”. First two letters of Fishing, Logging, Mining. Says it all about the town’s past. The future will be more diverse because it has to be. Mine is gone and logging employs a fraction of what it used to.

Absolutely visit the North Island if you are at all into outdoor adventures. So much up there. Mt Cain, Cape Scott, caves, remote beaches reached via epic logging road approaches, sea kayaking, amazing diving, whale watching.

As a place to live wouldn’t be my first choice. The climate takes a dramatic turn for the worse north of Campbell River. Basically three climate regimes on the east side of Vancouver Island:

1) Victoria and the immediate surroundings. Dry summer and moderately wet winter – precip 500-900 mm

2) Malahat to Campbell River – a bit warmer than Victoria in the summer but significantly cooler at times in the winter. Precip 900 to 1400 mm

3) North of Campbell River – precip 1500 – 2000. More rainy days summer and winter, Summer dry spell less reliable. Cool summers.

IMO Campbell River and the Comox Valley are the sweet spots for accessing all of the Island. Although lets face it – this whole place is close to paradise

Port Hardy exists for fishing and logging. The culture that tends to come with that is party animals with more money than brains, and therefore a lot of drugs. They roast a good pig at Raft Cove though.

Thanks Viola – sounds like it’s trip worthy.

@Ian I have lived in many places and visited even more. It is wild up there – literally a lot of forests and wilderness. Port McNeill seems like a purpose built place with a couple cute restaurants/cafes. It’s super small. There’s a ferry from Port McNeill to Malcolm Island, which is a super cute and awesome little known place. It’s a tight knit community on Malcolm Island with amazing whale watching. They have a small but regular tourist industry and a colourful past as a failed communist utopian built by Finnish settlers. Not sure about Port Hardy, personally I’m curious about Winter Harbour. Malcolm Island has expensive houses because lots of reclusive retirees go there, but it also has some very affordable ocean front fisherman type dwellings in the main town.

What’s the deal with Port Hardy/McNeill? ( I’ve never been past Campbell River)

He just has to change it to a narrative more consistent with Glacier Media’s interests (TC’s parent company). Those guys have a lot of fingers in the local and mainland RE pie…

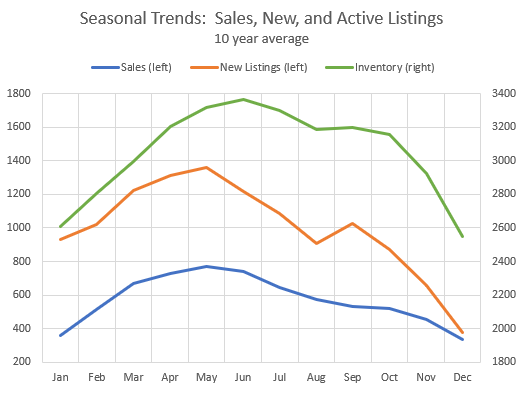

Great post. On the second chart is it correct that for the other 85% not shown the primary motivation is “principal residence”?

The yield curve is now as flat as could be all the way from overnight to 10 years. Seems like the market is currently skeptical of even one rate hike in 2019. Lends credence to a recession in 2019, maybe 2020 in the US

Really good post; maybe tou should be doing the RE column for the TC.

Nice post! Enjoyed reading it, Leo.