Goodbye 2018: Forecast Time

Every year we make predictions on this blog for the housing market, and every year at least some of of the pellets of our shotgun approach more or less hit the target. Call it wisdom of the crowds. Or something.

It’s been 368 days since our last prediction thread, so time to examine how we did this year and throw out our predictions for 2019. Winner of the HouseHunt Crystal Ball last year was Michael, for guessing the sales within 1% on sales and getting closest on prices for the year. We don’t yet have the final numbers, but the estimates for price will be close enough that it won’t change the result.

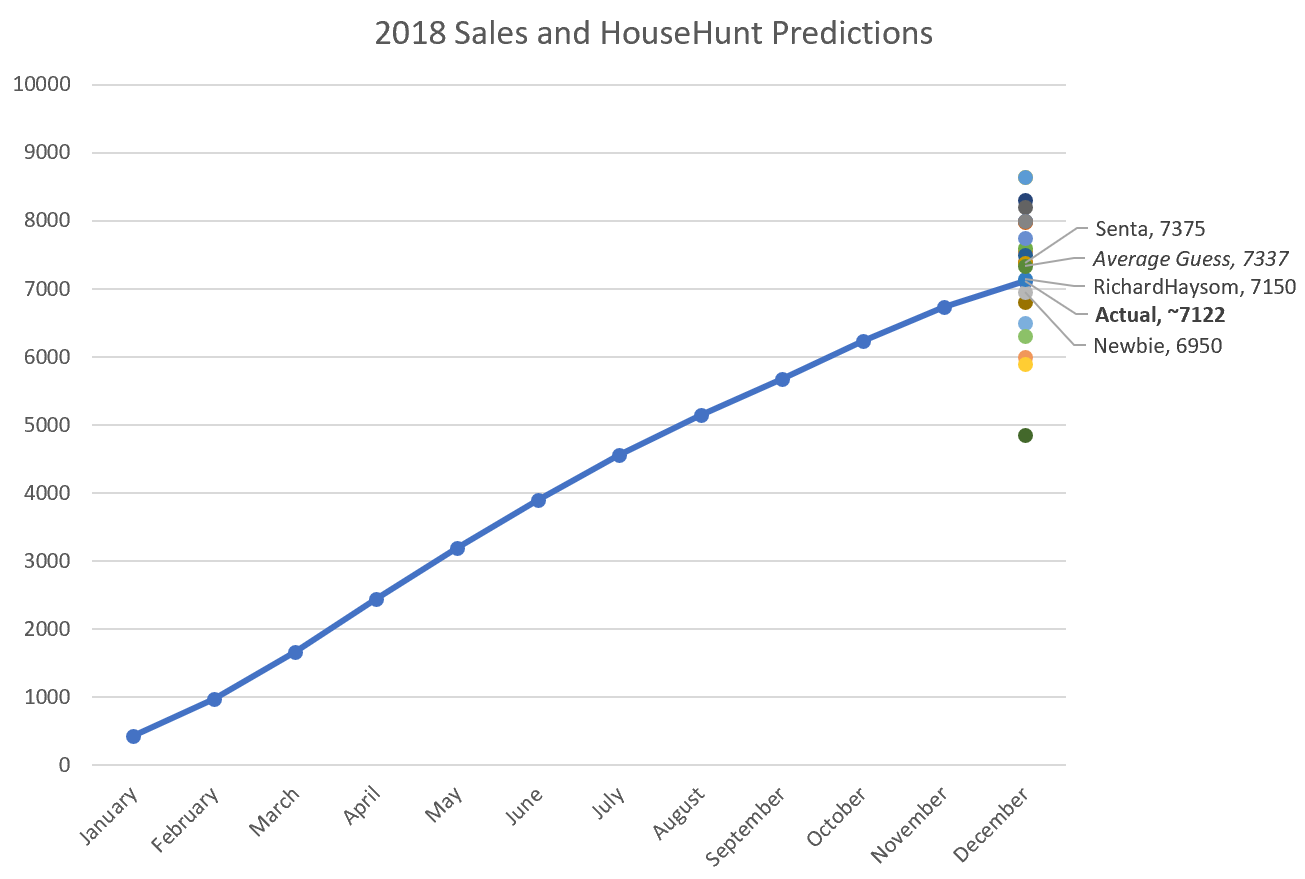

Sales

Sales predictions ranged from 4850 to 8650 for the year. We’ll end up with around 7122 for the full year which is close but less than the 7550 I expected. Richard Haysom will be the winner with a guess of 7150, off by only half a percent. The average guess of 7337 was pretty decent as well.

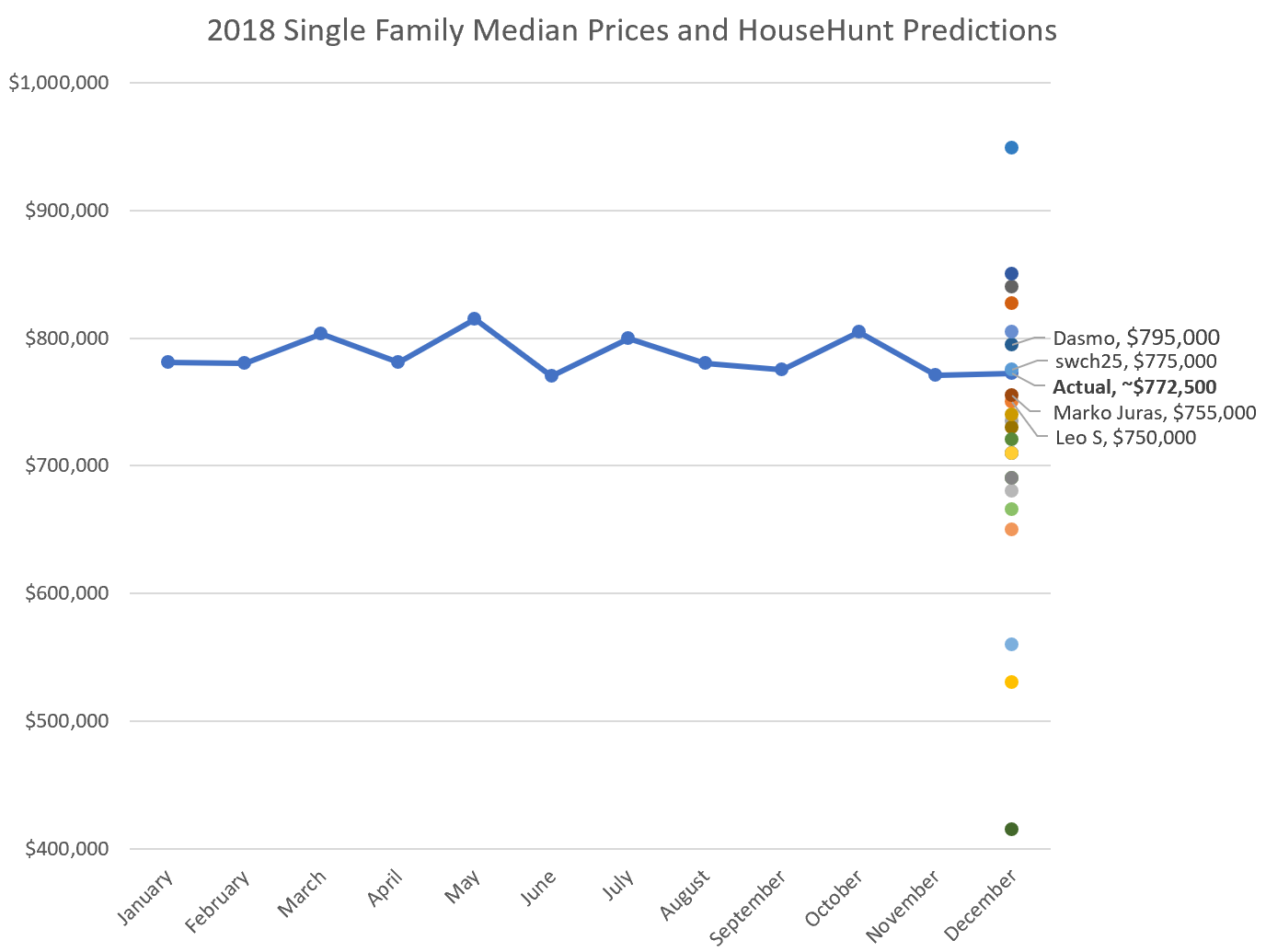

Prices

This year we took a different tack on prices, predicting the median price for December which is a little more concrete than the average price for the whole year which everyone always had trouble with. The average guess for single family prices at $720,000 was more bearish than reality, where prices for December ended up around $770,000. Monthly median prices are relatively volatile, so I’d say any guess between $750 and $800k got this one but swch25 was the closest to the real value.

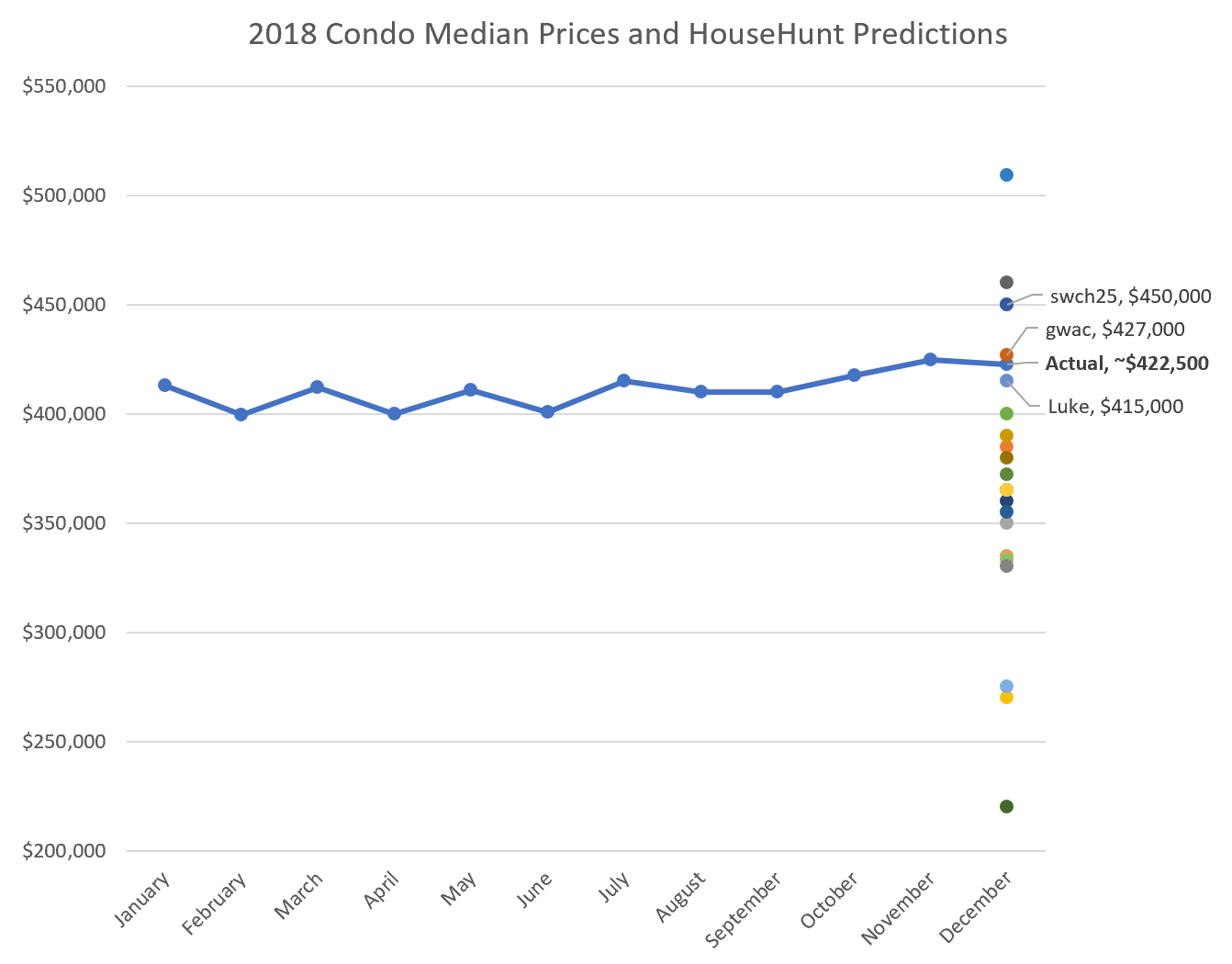

Condo price predictions were a pretty solid miss overall. After flatlining for the first 9 months, prices have eeked out some gains in the fall whereas the consensus estimate was a drop. Gwac hit the nail on the head on that one. I can’t recall why exactly I thought condo prices would fall more than they did given they were in a stronger market than single family. I think I was expecting the stress test to take a bigger chunk out of that market, but it seems buyers were pushed more out of the expensive single family properties than condos.

With rates, the Bank of Canada raised three times this year to 1.75%, versus a consensus of two increases. Barrister, Michael, LeoM, and Underachiever got that one correct.

No clear winner this time around with a different person in each category. However I ran the numbers and on a percentage basis for sales and prices, the winner is Luke whose predictions were within 5% of the actual numbers, with runners up Senta and myself. Congratulations to Luke for taking home the coveted HHV Crystal Ball award for 2018!

Here are all the predictions we made a year ago for 2018.

| User | Annual Sales | SFH Median | Condo Median | BoC Rate |

|---|---|---|---|---|

| Leo S | 7550 | $750,000 | $385,000 | 1.0% |

| Caveat Emptor | 8000 | $735,000 | $350,000 | 1.25% |

| Cadborosaurus | 8650 | $530,000 | $270,000 | 3.0% |

| swch25 | 8650 | $775,000 | $450,000 | 1.25% |

| Local Fool | 7600 | $690,000 | $400,000 | 1.5% |

| Barrister | 8300 | $710,000 | $360,000 | 1.75% |

| Marko Juras | 7400 | $755,000 | $365,000 | 1.25% |

| Michael | 8200 | $840,000 | $460,000 | 1.75% |

| AG | 6800 | $730,000 | $380,000 | 1.5% |

| Dasmo | 7500 | $795,000 | $355,000 | 1.25% |

| oopswediditagain | 4850 | $415,000 | $220,000 | 1.25% |

| Luke | 7750 | $805,000 | $415,000 | 1.25% |

| LeoM | 6000 | $650,000 | $335,000 | 1.75% |

| Newbie | 6950 | $680,000 | $365,000 | 1.25% |

| Penguin | 5900 | $710,000 | $365,000 | 1.25% |

| CS | 6500 | $560,000 | $275,000 | 3.0% |

| Underachiever | 6300 | $666,000 | $333,000 | 1.75% |

| plumwine | 8000 | $850,000 | $450,000 | 1.5% |

| gwac | 7989 | $827,000 | $427,000 | 1.50% |

| Irregardless | 8000 | $690,000 | $330,000 | 1.5% |

| Senta | 7375 | $740,000 | $390,000 | 1.0% |

| RichardHaysom | 7150 | $948,975 | $509,150 | -- |

Numbers aside, I’m generally happy with my forecast from last year where I projected “increased inventory, and hopefully no more price increases in the short term. While I don’t believe that the stress test and NDP actions will lead to any significant price declines, I do believe the impact will be large enough to shock the market into balanced territory for most of the year”.

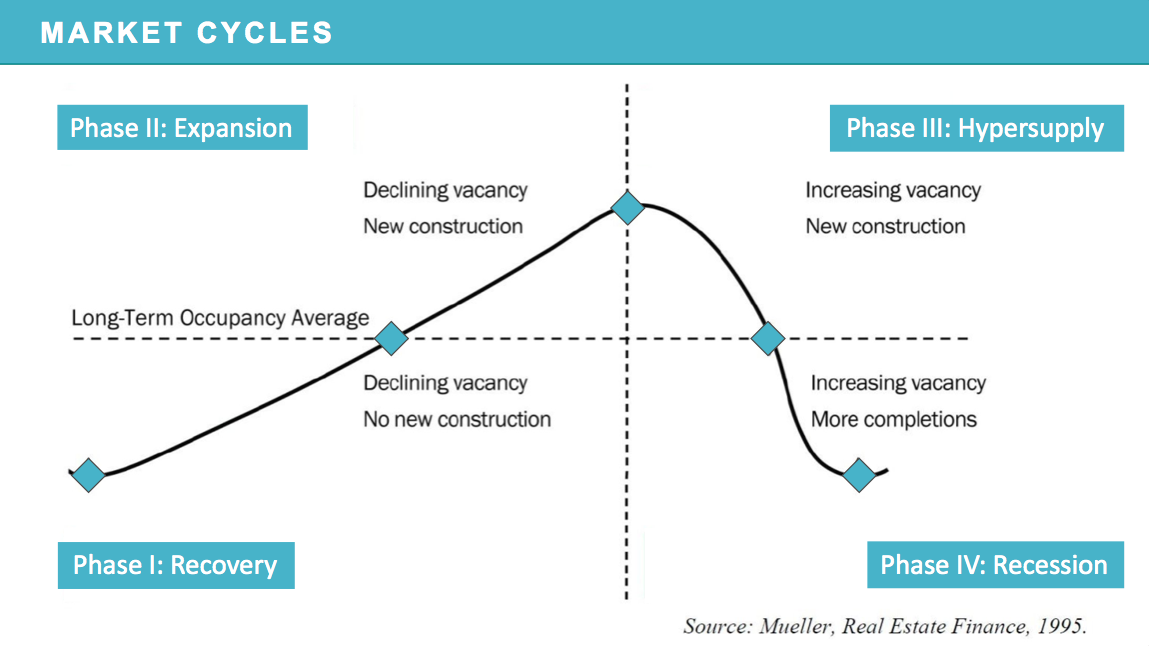

Next year seems much murkier to me. There are no big policy changes on the horizon. We may see some impact from the speculation tax as people start getting those letters in a couple months, but other than that I suspect the province will take a wait and see approach to housing policy. The feds as well may tinker on the sidelines of the rules but probably won’t make any major changes. The economy as a whole is looking shakier, and the case for continued interest rate increases doesn’t seem as clear anymore. I’d say we’ll be lucky to escape a recession next year as this bull run seems to have run its course.

2019 will be all about market sentiment. Will sellers crack and start reducing prices? Or will buyers come back out of the woodwork and prop up the market? Will the rush of completions push down condo prices or rentals?

Personally I think sales will decline a little bit more, but not by a lot. I believe the cooling trend will continue but the stress test sucked a bunch of the sales decline forward so we won’t be seeing as dramatic of year over year numbers in 2019. Perhaps an additional 5%.

Prices I believe will drift downwards for single family, but I don’t expect anything too dramatic here either. We know that prices are quite sticky in Victoria and I believe it will take a signficiantly worsening of the economic situation in Victoria to see steeper price declines. That may come when construction dries up but we have a least a year in that tank. Let’s say a 4% decline. I’m going to stubbornly stick to last year’s bad prediction and say condos will decline more than single family, at about 6%. I think the spec tax bills coming in the mail will liberate some more listings, and increased completions this year should help supply.

I believe the Bank of Canada will run out of steam on interest rate increases, but sneak one in at some point to end at 2%.

Annual Sales: 6700

SFH Median Price (Dec 2019): $744,000

Condo Median Price (Dec 2019): $395,000

BoC rate (Dec 2019): 2.0%

What’s your guess?

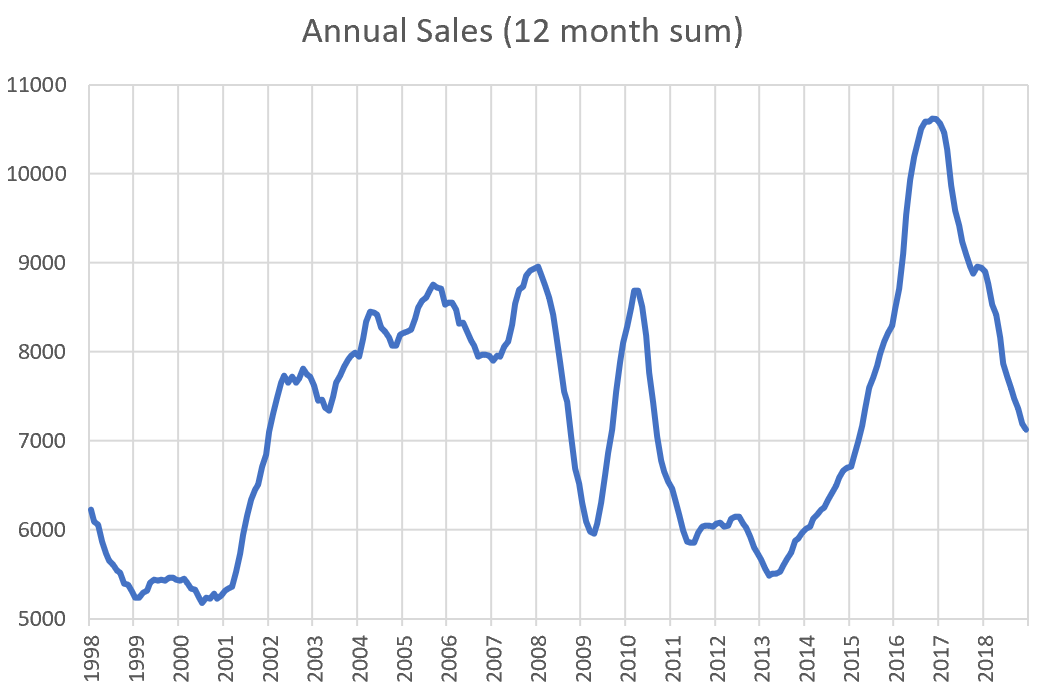

Here are some current charts to help you make your guesses. Sales range from a low of about 5500 in the slowest, to a high of 10,500 in the most active years.

The market is approaching overall balanced but still much more active than the slowest years.

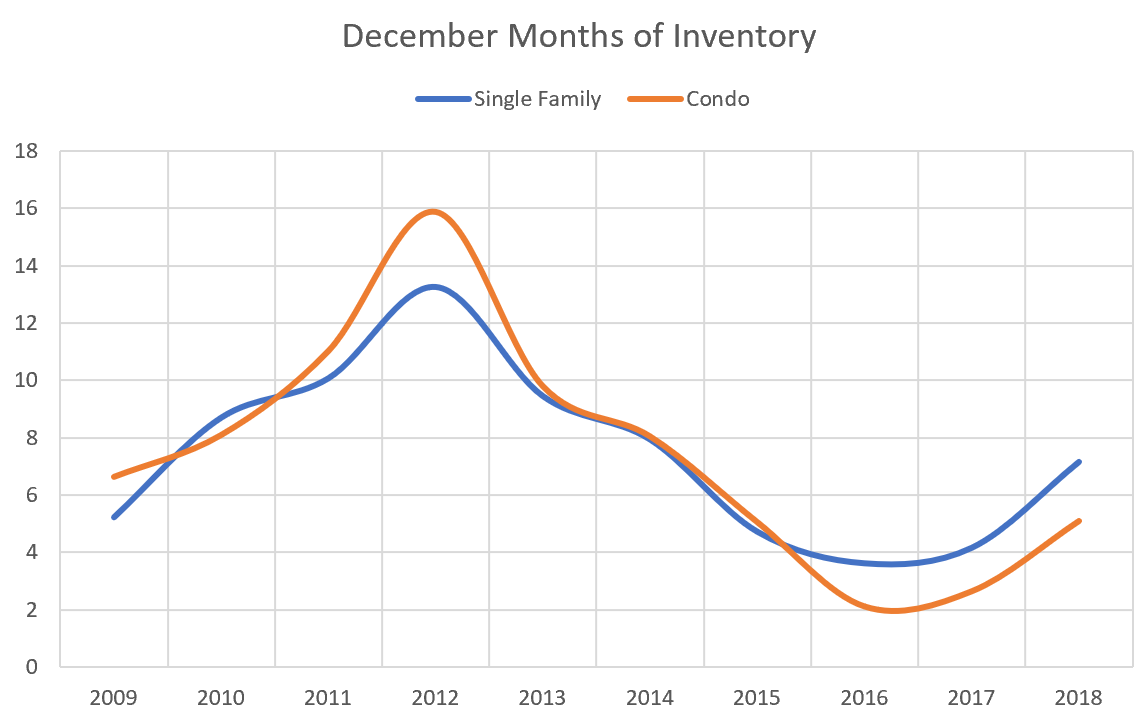

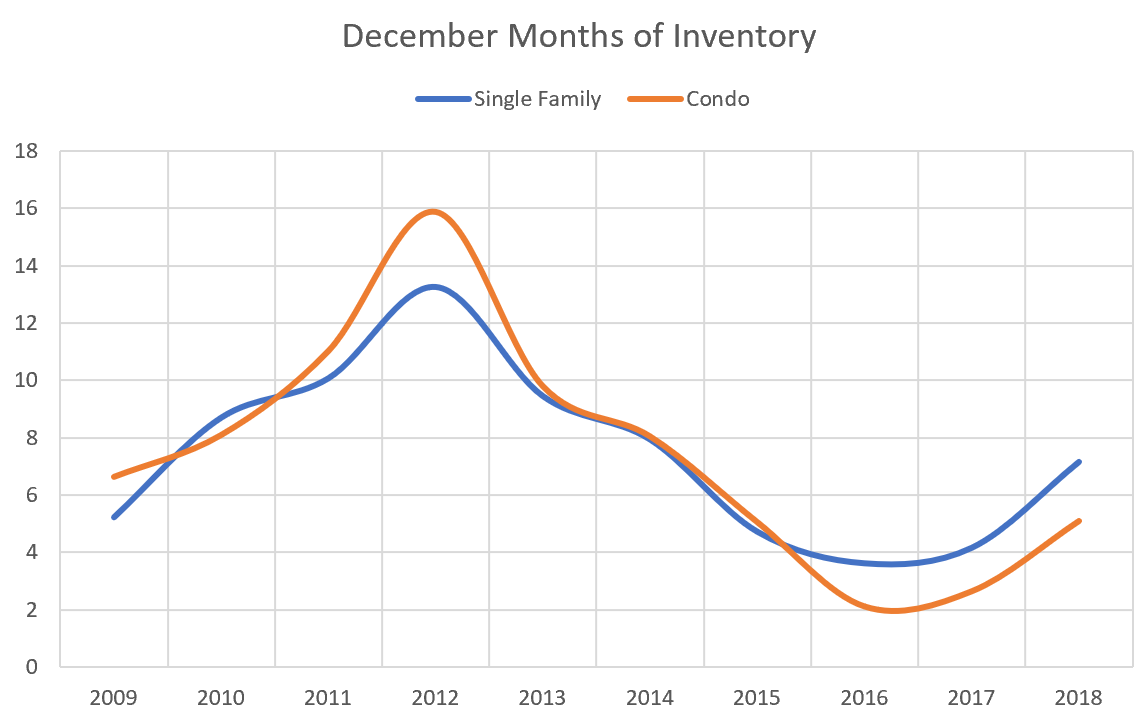

Months of inventory for December is back to around 2014/2015 levels.

There are four times as many apartments (condos and rentals) under construction and almost twice as many single family houses as there were in 2015. We are definitely going to see a large uptick in completions in 2019.

What’s going to happen in 2019? Let’s hear it.

Update: Here are the predictions so far:

| User | Annual Sales | SFH Median | Condo Median | BoC Rate |

|---|---|---|---|---|

| Leo S | 6700 | $744,000 | $395,000 | 2.0% |

| Caveat Emptor | 6596 | $735,000 | $380,000 | 1.75% |

| Penguin | 5900 | $710,000 | $365,000 | 2.00% |

| Renter in Paradise | 6250 | $725,000 | $395,000 | 2.25% |

| Marko Juras | 6750 | $750,000 | $385,000 | 2.00% |

| Mt. Tolmie Foothills | 7400 | $800,000 | $400,000 | 2.00% |

| Jamal McRae | 7000 | $750,000 | $370,000 | 2.50% |

| LeoM | 6500 | $710,000 | $375,000 | 2.25% |

| Michael | 7550 | $815,000 | $440,000 | 2.25% |

| DuranDuran | 6625 | $785,000 | $390,000 | 2.00% |

| gwac | 7428 | $825,000 | $452,000 | 2.25% |

| Triple A Rated | 6250 | $695,000 | $355,000 | 2.00% |

| plumwine | 6869 | $767,000 | $385,000 | 2.25% |

| Gate | 7200 | $790,000 | $425,000 | 1.75% |

| Vic RE Newbie | 7250 | $780,000 | $430,000 | 2.50% |

| Matthew | 6975 | $735,000 | $390,000 | 2.50% |

| Robin | 5750 | $745,000 | $405,000 | 2.25% |

| Patrick | 7500 | $840,000 | $375,000 | 2.25% |

| Dasmo | 6100 | $760,000 | $380,000 | 2.00% |

| Cadborosaurus | 8250 | $579,375 | $253,500 | 3.00% |

| yvr-yyc-yyj | 7500 | $820,000 | $400,000 | 1.75% |

| strangertimes | 6550 | $730,000 | $375,000 | 2.50% |

| Ian | 8000 | $690,000 | $330,000 | 1.50% |

| Hawk | 9020 | $525,000 | $275,000 | 3.50% |

| The Underwriter | 6666 | $735,000 | $410,000 | 2.25% |

| inreallove | 6810 | $749,000 | $437,000 | 1.50% |

It’s Not Just Toronto And Vancouver: A Synchronized Global Housing Downturn Is Here

https://www.huffingtonpost.ca/2019/01/05/global-housing-downturn_a_23634322/

A bit late to the list, but I’ll stick with my last year’s guess, except interest rate.

6300 sales

660k SFD

330k condo

1.5%

10 MOI

-Beach Dr waterfront by the RVYC, $2.3M (iirc) dropped from $3M+, it takes too long and too much to build / maintain a mansion. (Trades $$$)

-New condos are all sizzle, no steak.

-core SFH. People don’t want to commute will pay for the premium, same as every big/small cities in Canada/World.

@Leo, mean median mode, eeny meeny miny moe

the curve will become more asymmetrical, shift to the left.

I feel a teensy bit sorry for you

New post https://househuntvictoria.ca/2019/01/03/bye-bye-investors-and-high-ratio-mortgages/

Thanks for the concern, but that’s not going to happen to us unless he randomly dies and is somehow replaced by a complete stranger (that wouldn’t happen either). I attempt to do my lodging like I do my career. Be indispensable, make people’s lives easier, solve/prevent issues and appear to do it all with effortless, mindful intention. They tend to want you to stay. I don’t live under rental stress at all, thankfully. But for those who do – change is coming, with an avalanche of new rental supply coming online soon. 🙂

@guest_54083 If you bought in 2009 – and you’re a millennial – that means that you were, at most, 28 years old when you bought your sfh in Gordon Head. I don’t think most people in your generation manage that at 28 (or even younger) – unless they have help from family or they’re Doogie Howser (even in 2009). To hold other people to that standard doesn’t seem particularly charitable to me.

The next year will prove to be exciting. At least, I’m looking forward to seeing it unfold.

You should preserve those rental arguments as you may need to show them to persuade your landlord. Let’s hope he doesn’t follow the recent trend (last 3 months) in Victoria rents which is an 11% explosion upward.

Victoria has moved up from 7th highest rents in Canada to 5th highest in the last 2 months . 1 bdr rent in Victoria up 11% since October!

1 bdr Rent rose from $1250 (oct) to $1390 (dec) up 11% in 2 months

In the last month in Victoria….

“Victoria, BC moved up a spot, outpacing Barrie, to round out the top five markets. One bedroom rent here [Victoria] jumped 5.3% to $1,390, while two bedrooms grew 4.9% to $1,510.”

https://blog.padmapper.com/2018/12/13/1899/ (December data)

October data

https://vancouversun.com/news/local-news/vancouvers-average-rental-price-for-one-bedroom-apartment-jumps-to-2100

Butt hurt?

What 65-year-old talks like this?

Are those the ones that still aren’t selling for months now? Must be a good reason why. Shoeboxes by looks of it.

Yes James, regurgitated fake news by the pumpers just like Trump feeding his toothless deplorables when their sad story is looking worse by the day.

Intorovert is all butt hurt his tear down is in the minority that went down after yapping it up for a year how his $100K paper windfall was now an annual event. Wrong.

Gwac is just plain butt hurt because it’s his nature to be saying he’s loaded with gold when infact he owns a highly diluted penny stock.

Yes Caveat you are indeed a loser dropping your last 2 years gains in a month. Buffett you ain’t. He sold all his Home Capital junk mortgages cause he knows what’s coming. One nasty global recession.

Janney: that interesting since mine went up 4.8%. They did say that the average increase was 8%.

My B.C. Assessment shows a 13.7% increase of my sfh. I live in North Jubilee and others on my block show a similar increase. I find this stunning but realize this valuation is from July 2018.

What I am hoping to determine is the median % change of sfh from July to now.

I am relying on your expertise … thanks & Happy New Year!

Remember he makes it all back with the 400% annual stock market returns while the rest of us losers make 7-10% a year. By now I am sure buying a Victoria home would just be a rounding error to his portfolio

You’re the idiot who knew it was going to go up and didn’t buy a second place.

Also pretty sure hawk has said about a dozen times now that you’re making that ^ up.

@plumwine, what is your theory for Uplands dead, condos dead, but core SFH kumbaya?

GWAC Waiting for the wife to make the call, there is some crap going on with one of her kids, so the timing is a bit in the air. I am okay with whatever.

I am not sure that people value the presence of these old homes and the fact that they actually contribute to tourism. We seem lose about one a year,

Yikes. My unprofessional, layman’s view of the above is that that represents a breathtaking ignorance of markets and history – rivalling Bryan Yu’s recent “market is about to rise” report.

At core, their argument is, “unaffordability is now a perpetual dynamic and the forces that drove it will remain unchanged henceforth”, in glaring defiance of every single market cycle we’ve ever seen including this present one.

In reality, rents don’t rise on collapsing sales volumes, shrinking liquidity and falling prices. When the latter dynamics happen, that means demand is dropping, supply is rising, the velocity of money in the region is slowing and drying up, people aren’t flocking to the area in question etc. I remember in 2012, some landlords here couldn’t rent places where they gave first and last free. Then you may recall, in a short period of time, how violently that pendulum switched. That is not organic growth at work.

True, there is theoretical support for a brief pop in rents just after a market peaks, when would-be buyers hold off and opt to rent instead. I haven’t seen it in practice, though. Our bellweather market, Vancouver, saw rents beginning to crest last summer.

God forbid these people actually take a look at financial metrics, or perhaps even what the old timers used to call a “history book”.

I was in Vancouver on Sunday driving around and today I decided to look up some places that caught my eye….and damn, Vancouver could drop 30-40% no problem.

I thought these townhomes I drove by on Oak St would be in the $1.2 mill range but $1.75!! Similar townhome on Shelbourne $699k and you can swing a 25 min walk to downtown. Not sure about Oak to downtown Vancouver.

https://www.realtor.ca/real-estate/20205438/3-bedroom-condo-6036-oak-street-vancouver

While I am quoting Buffett, this also seems appropriate:

“Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

As a counterpoint, here is Warren Buffett:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

and

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth — for a while.“

https://www.pqbnews.com/news/four-properties-in-pqb-region-make-list-of-highest-valued-on-island/

My home didn’t make it on the list!

On the topic of predictions, I started tracking FX and bank rate predictions in early 2018 and most of the big banks have been wildly off on their USD/CAD FX predictions (most said ending 2018 at 1.2, today we are around 1.35, closest was CIBC at 1.31). However they were mostly accurate on BoC rates as that is a little easier one to predict. I’m predicting a continuing slide in financial markets in 2019, ramping up in speed after Brexit is finalized.

Locally I say sales will be off ~5%, SFH prices dropping by 5%, condos flat, BoC at 1.5% and pointing lower after hitting a high of 2%.

6750 sales

SFH $733K

Condos $425K

BoC 1.50%

Edit: Rentals.ca 2019 Rental Market Predictions From Experts Across Canada

https://rentals.ca/blog/2019-rental-market-predictions-from-experts-across-canada

No, but you did constrain your prediction pretty well. It was on that basis I made the comment. Migration is also generally affected by economic realities. People will flock to a booming economy, not so much to one that is experiencing a recession. Proportionally in Victoria, not many people are actually employed by the government.

“Hawk selling his primary residence before prices shot up 40% is a case in point. Then he makes fun of the “buy and hold” crowd. It’s quite a thing to behold”

Quote of the year so far…

Barrister burn it down. Lot is worth double. LOL

R u moving to Switzerland?

Interesting that some assessments in Gordon Head has gone down 2%, I can verify this with another home owner I know. So given that in 2019 it is likely that overall homes will probably sell for slightly less than the current assessment, this coupled with the fact that Gordon Head already has a lower assessment compared to 2018, I would assume this will put further downward pressure on prices in this area.

I recall in previous discussions, a few posters have verified that some SFH homes in Gordon Head are currently transacting at 2016/2017 prices. I wonder if in 2019 we will see 2015/2016 prices. Thoughts?

GWAC: The house was actually designed as historic by the city which is different than applying for a historic designation. But i am okay with a high rise designation, Suspect that change might bump up the value a few dollars.

Sometimes Victoria doesn’t get mentioned in RE articles or columns because it’s too close to Vancouver and journalists choose to focus on the somewhat geographically spread out major metros (i.e. Vancouver, Toronto, Montreal, and occasionally Halifax).

Older does not necessarily mean wiser.

Hawk selling his primary residence before prices shot up 40% is a case in point. Then he makes fun of the “buy and hold” crowd. It’s quite a thing to behold.

Millennial me buying in 2009 when, as Leo attests, everyone thought things were downright scary has—we can see now—turned out to be a very wise decision.

</Canadian average equity in home is 74%. (Average mortgage is 24% of house value) (source statscan/RBC). This is not surprising because house prices have risen in Canada. So what about if prices fall?

If Canadian house prices were to crash 35%, would this destroy the average equity % we have in our homes?

Answer is, no. Because Canadians have such a high equity ratio in their homes to start with (currently 74%), a fall by 35% would only drop the average equity % Canadians have in their homes from 74% to 60%. Is 60% equity considered a reasonable number? Well 60% is the average home equity % now in the USA.https://fred.stlouisfed.org/series/HOEREPHRE

( calculation details. If they start with $740k equity in a $1m home, they owe $260k and have a 74% equity, after a 35% fall, they owe $260k and have $390k equity in a $650k home, 390/650 = 60% equity ratio)

The analysis above is flawed as the average home equity quoted includes areas where there isn't a housing bubble/affordability issue. I would bet that if there is a 35%, or even a 20% correction in home prices in the Vancouver, Victoria region, there will be enough people with negative equity which will further drive accelerated price declines in these areas.

“Okay then, so to determine this, we need to look at the migration data and ascertain whether it currently supports this prediction or not.”

Naw, it’s kinda like Warren Buffet saying to buy and hold index funds. It’s just a prediction based on general principles. Because, there’s no way to actually predict the future, even with solid data. Especially on a macro scale.

Okay then, so to determine this, we need to look at the migration data and ascertain whether it currently supports this prediction or not.

I predict that December 2019 will see an increase of 1% in price of sfh in Victoria.

The mass migration into bigger centres has been happening for a very long time. Doesn’t matter that we aren’t as big as Vancouver etc.. were the biggest on an island, the economic center of the island, and a government town. The prices in the core will go up, up, up, even if only small, even when there is decline elsewhere. Anwyay, don’t attack me personally for thinking that – after all, none of us actually know what is going to happen, all we can do is guess.

Hawk I love how you insult me brings a huge smile to my face.

Patrick seems to think equity will save the housing market even with 35% decline ? You’re not older nor wiser Patrick. You’re a duck standing in the middle of the freeway.

Just like gwac’s “it’s only Apple and their stupid I-phones” head up his ass theory, he’s clueless that this is a global recession setting up of massive proportion across all Fortune 100 companies. Consumers are stopping buying everything.

“The Dow Jones Industrial Average fell more than 600 points on Thursday as the biggest drop in more than a decade in the ISM U.S. manufacturing index added to nerves over slowing global growth sparked by a revenue warning from Apple.”

Local its all in the definition of unsustainable. While you may think it is other may not.

Anyways a tad surprised that our housing market held up so well this year. Starting to think that interest rates are not going any higher. Starting to think the world economy is in for some hurt in 2019. Not sure how that fits in with a government town and an NDP government that loves to hire and spend. The pieces of that equation is making me scratch my head on what 2019 will bring to the Victoria real estate market.

2019 is going to be interesting and challenging for the world economy.

I like utilities and gold and booze.

A whole generation is totally clueless to what a real housing crash looks like and feels like.

This guy in West Van does.

Purchased April 2016 for $3,000,000

Listed for sale Aug 2016 for $3,980,000 (WTF??)

Listed for sale March 2017 for $3,199,000

Listed for sale Feb 2018 for $2,899,000

Listed for sale Oct 2018 for $2,280,000

Now reduced to $2,180,000!

We aren’t a large center. We don’t even always get mentioned in Canadian press when they’re talking about real estate across the country, because we’re too small.

It will be more like, can I acquire the amount of credit from the bank to cover the sellers request, and can I service that debt for the next 25 years.

A few here seem to think that the core of this city is now for the rich only (in perpetuity). IMO, it’s a goofy proposition.

Sustainable price inflation in densifiying cities is a real phenomenon that affects relatively large, economically important cities. The examples are easy to find and plentiful. But densification itself is not enough – there are a number of cities in Canada that are denser than here but with far lower RE prices. Vancouver’s prices are not the result of being a large, economically diverse city (the opposite is actually true, globally speaking). IMO, Vancouver is nothing more than a RE bubble set about by factors already beaten to death on here.

Comparatively, Victoria is far smaller still with an economy to match. It doesn’t have the size, economy, or clout to demand its prices. We’re a spillover, secondary market to Vancouver, the latter which is starting to bleed profusely. If you think the market here will be forever senseless and unsustainable, you might want to think again.

Also on your quote comment below, something that is perpetually unsustainable is a contradiction in terms.

SFH in Victoria will never be sensible and sustainable, It will more like can I somehow justify this and afford it with out selling a kidney.

I don’t think “most” is likely to be true. I think the bulk of hold-offs are just waiting for something sensible and sustainable. Some may behave in a more obstinate and demanding way, for instance refusing to buy unless prices drop by XX percent. Probably not a good strategy, but then again choice is beautiful.

To be fair though, obstinate buyers aren’t going to be the only ones scrambling…if you know what I mean. In fact, plenty of sellers in BC are already doing that and losing upwards of a million dollars in the process. And to think – we haven’t even gotten to a market panic yet.

I read some article by an RE guy in Vancouver (Saretsky?) advising to sell now, buy at the end of 2021 (or was it 2022?) and expect the increases by the end of 2023. Maybe he was just reciting the 5 year cycle. Anyway, I have a new goal, which is to get $1 million in the bank in the next 3 years so I can buy a house cash in the core. My partner said I better start buying lottery tickets, so I bought one for the first time in years and didn’t win. Instead i will try to make money the only way one can make real money (without going to med school or having family $) and start a business.

I’m here because (a) I like RE a lot, and (b) I’m bored.

Also agree with Marko, it’s part of globa trends that the cores of large centres are increasingly unattainable. Inevitably will happen here at some point. Unless there’s a wild card in our future – some impossible to predict macro event that triggers a large change in the status quo.

REBGV data is out (Vancouver). From their report:

REBGV reports that residential home sales in the region totalled 1,072 in December 2018, a 46.8% decrease from the 2,016 sales recorded in December 2017, and a 33.3% decrease from November 2018 when 1,608 homes sold.

The benchmark price of detached homes in the region declined 7.8 per cent over the last 12 months and 7.3 per cent since June 2018. Apartment homes increased 0.6 per cent over the last 12 months and have declined 6.4 per cent since June 2018. The benchmark price for townhomes in Metro Vancouver have increased 1.3 per cent since December 2017 and have decreased 5.3 per cent over the last six months.

http://members.rebgv.org/news/REBGV-Stats-Pkg-December-2018.pdf

In other words, the second half of 2018 contained the bulk of the downward momentum. For people thinking that “equity” or VanRE will save the market here, you might want to think again.

In (somewhat) related news, the grand-daddy of hot, speculative Different This Time™ real estate, Hong Kong, is now experiencing a virtual collapse in demand. According to their government’s land registry, home sales there fell 53.7% YOY in December, to HK$24.1 billion, compared to HK$52 billion one year earlier. Looking at the apartment segment specifically, it was even worse, down 61% YOY. Prices are now beginning to follow, with some units seeing nearly 40% price reductions as speculators rush to get out and transfer the bag to someone else.

Once again, this is called shrinking liquidity, folks. It’s not magic, and it certainly isn’t mysterious. What we’re seeing here in Victoria is part of a much larger and rapidly emerging trend in global RE markets, and our wee lil’ market isn’t likely to be unfazed by it all. RE remains local, but are nevertheless affected by macro & international realities – this one being one of the largest credit inflations, in absolute terms, in human history.

Patrick been pretty tame here the past 10 years. Still a core group that posts. Info was the best though. He was Hawk but on steroids.

Marko and that is what will happen this time. Most will not get the decline they imagine/desire and will be left scrambling.

I do think SFHs in the core sooner or later will not be attainable for 95% of the population but tough to say whether this happens in 10 years or 50 years. Not sure I would rush out to buy a SFH in the core just because one day it won’t be attainable.

For the great discussions about RE. I couldn’t name a better site. For example, IMO this site is far better than greaterfool. LeoS posts are better, and the comments are better.

Most Internet comment sections are inane. Not this one!

I have also learned one hell of a lot about people and the real-estate market here. It is very interesting to see people justify paying 100k more than the previous year when the market is moving away from them. People would rather pay more in an up market than less in a market that may still go down.

Hmmmm…….interesting way of looking at it. People fear buying in a down market and the house dropping another 50k, for example, but on the upside 100k more than the previous year no problem. Heard mentality.

When you look at the best buying opportunities (early 2009, or 2012/2013) the sale volumes have been very low.

It sounds like we agree on this point. And I’m no longer alarmed about it 🙂

In case there’s anyone in this forum that’s looking to buy a SFH in core Victoria, but first is waiting for price falls, I guess they too shouldn’t be alarmed that we aren’t “adding SFH to core Victoria”.

I have also learned one hell of a lot about people and the real-estate market here. It is very interesting to see people justify paying 100k more than the previous year when the market is moving away from them. People would rather pay more in an up market than less in a market that may still go down.

Nice Game gwac!

I am here to:

amuse myself

to learn

Yep Townhomes and Condo will takeover SFH lots. Look at Shelbourne. SFH gone and townhomes appear. Good change. Only going to continue as population grows and land is not available.

Barrister house should be torn down and multiple modern units put up maybe even a large story condo…LOL Sorry barrister I had too..

Why are you alarmed? It makes perfect sense that we wouldn’t be adding SF to core Victoria. In fact eventually I would expect a decline as the city grows.

Patrick, be fair to Leo, he is making sensible statements and you make broad pronouncements without specific data all the time. it might be pointed out that most of the new builds that I see posted also have a suite which partially adds to affordable housing in the core.

Everybody keeps screaming that they want growth in Victoria but then act surprised when the predictable consequences hit the core. Saw the same thing in Toronto and most other major cities. This not rocket science.

Patrick

Feel free to ignore Hawks and I’s post. BTW you cant talk about the same shit day after day. Pointless. “Market going to crash” “No market not going to crash” 10 years of the same shit. Thank god for Leo and his analysis. If you go back to 2010 or 2011 or 2013 and post it now you would not see 1 difference.

Some are here to latch on to the crash…

some are here to get business

some are here to amuse themselves

some are here to learn

some are here to protect their paper profit

some are here believing their posts impact the market.

Why are you here Patrick?

I am here as Leo stated because I am bored. 🙂

Please, no more mining penny-stock posts. Anything relevant to RE would be more welcome than that – even a price slash in Chilliwack.

Like others, it seems like you’re estimating at all those numbers, such as the number of new subdivision homes in Core Victoria vs tear-downs. (I’ve italicized the estimates in your statement). Usually you are a data guy, not an estimator. Census numbers show alarmingly few net SFH added to Core Victoria. If anyone has found actual data on this, please post it!

Housing Bust in Sydney & Melbourne Gains Momentum Sydney down 11% and accelerating.

It really is not a significant factor. Of the ~800 SFHs under construction right now, the majority are in the west shore. Of the remaining couple hundred, some are infill as you said, and others are new supply due to subdivision. Of the infill some of it might replace an “affordable” house but some of it replaces an unliveable tear down.

New construction even of single family is good for affordability by adding supply. The mistake people make there is looking at the new house and concluding that because it is expensive it is not contributing to affordability

Canadian average equity in home is 74%. (Average mortgage is 24% of house value) (source statscan/RBC). This is not surprising because house prices have risen in Canada. So what about if prices fall?

If Canadian house prices were to crash 35%, would this destroy the average equity % we have in our homes?

Answer is, no. Because Canadians have such a high equity ratio in their homes to start with (currently 74%), a fall by 35% would only drop the average equity % Canadians have in their homes from 74% to 60%. Is 60% equity considered a reasonable number? Well 60% is the average home equity % now in the USA.https://fred.stlouisfed.org/series/HOEREPHRE

( calculation details. If they start with $740k equity in a $1m home, they owe $260k and have a 74% equity, after a 35% fall, they owe $260k and have $390k equity in a $650k home, 390/650 = 60% equity ratio)

Slowdown in high end does not affect the median much at all. High end sales were always just a few and losing half of them won’t shift the median significantly.

100% agree.

SFH “construction” in core Victoria typically involves a tear-down of an existing SFH. It removes an affordable SFH and replaces it with a high priced SFH. Anyone here looking for a low-priced SFH in the core should consider this tear-down build as “affordable SFH destruction”, and not “SFH construction”. But when discussed here, bears have typically dismissed this phenomenon as “meaningless”.

James Soper-

Except that those are overwhelmingly either condos, or sfh’s in the west shore. I agree condo prices look precarious with all that inventory. But houses in the core? Where are they going to build them? Houses and owned land will increasingly be in demand as more of the population shifts to high density.

@Ian, the high end market is dead. Nothing is moving over $2M, thus the median will drop like a stone. However, average bear will only see small “discount” on average SFH in the core, which they still feel too expensive, and wait for yet another year.

That was my first thought, too.

That’s cute but if my goal was misdirection, why would I publish my lowered assessment?

Those areas had large increases in the past — it could be the others are catching up now.

I thought so.lol.

Everyone up here tells me the market in Qb is very steady.No huge ups or downs although of course it follows treads.

@Grace

Yep, same as Dec 2017.

Qualicum/Parksville SFH sales:

Dec 2018: 28

Dec 2017: 28

Dec 2016: 24

Dec 2015: 36

Dec 2014: 41

Dec 2013: 32

Dec 2012: 22

Dec 2011: 24

Dec 2010: 29

Dec 2009: 29

Dec 2008: 14

Dec 2007: 45

Dec 2006: 20

I don’t normally look closely at the sales for Qualicum/Parksville, but pretty interesting, especially 2008.

So the “winning” communities in the Victoria CRD assessment sweepstakes were Sidney and Gulf Islands at up 13%. “Loser” was Saanich at up 4%.

Who knew!

… and hard to imagine that they spend much time on coming up with these numbers.

So does 0% for Qualicum Parksville mean sales were the same as last year?

Hawk my money my risk. You may be right I may be right. We will find out. I believe beta has a few move 50m finds.

Gwac said NO to a 7 bagger. What an idiot. You’ll be waiting alright… years and years to see $1 plus again. Mine start ups suck big money and always take longer to be profitable.

And check these stats out:

Up island SFH sales got clobbered for the most part this Dec 2018.

SFH Sales:

Campbell River: -55%

Comox Valley: – 49% (*lowest SFH sales in 10+yrs – considering the population growth in the area, I’d say this is fairly significant)

Cowichan Valley: -48%

Nanaimo: -62%

Parksville/Qualicium: 0%

Port Alberni: -12%

Source: Page 17: http://www.vireb.com/assets/uploads/12dec_18_vireb_stats_package_64515.pdf

In case it’s of interest, per VREB Stats, Dec 2018:

SFH sales: Down 27% and lowest level of sales as far back as I can go (2013)

SFH Active Listings: Up 61% from 403 Dec 2017 to 648 Dec 2018.

For comparison:

SFH Sales:

Dec 2018: 147

Dec 2017: 202

Dec 2016: 199

Dec 2015: 209

Dec 2014: 169

Dec 2013: 162

SFH Active Listings:

Dec 2018: 648

Dec 2017: 403

Dec 2016: 344

Dec 2015: 578

Dec 2014: 814

Dec 2013: 946

6000, $645000, $352000, 2.25%

It doesn’t take big inventory to force prices to decline. A lack of buyers will definitely put price pressure on those properties on the market that need to sell.

Hawk its at 48 cents no debt and money to invest in both beta and Quebec. I have the luxury of waiting it out…

Whoa, plumwine cutting forecast even more than Michael – down $87K!. Even gwac trimmed a couple thou. One year of a flat matket’s got some bulls a little spooked..

RNX is in major debt and was about to go under except for the lucky find. Speculators drive markets and make the big money, “investors” in highly diluted stocks always lose. Penny stock rule #1.

Specs have left the housing market with no more big money to made only lost. RNX is now a cult stock like GGI was. The worst kind.

RNX I am looking for the longterm hawk. Beta could be huge and they own 28% of the largest potential nickle mine. I invest not speculate.

Hawk you are so full of shit….triple this triple that. OMG you do make me laugh.

The 7% was November numbers gwac. Median flat , benchmark down again. This house market’s on its last legs. Grasping for straws with your bullshit is pathetic to watch.

You didn’t sell RNX near $1 with 500 million shares out ?? What a bozo. I took my RNX triple then put it in my tech stock for another triple. That’s the way you do it. 😉

James

Yes. That’s how it works. 🙂 Just like here (in fact, much more so) Vancouver is sitting on a huge amount of incoming supply. Those buying pre-sales in the last 2 years might wish they made a different choice.

Doesn’t even matter when we’re getting an abnormally large rate of new builds coming available in the next year, and then more the year after. Inventory will be a non story starting in about 2 months.

For what it’s worth and for those of you who recognize it, this is continuing to follow Vancouver’s pattern of decline; it’s just lagging the typical 5 to 6 months behind. As was indicated here regarding Vancouver’s declining metrics in August 2018:

“What’s interesting is that inventory spike isn’t being entirely caused by a surge of new listings. In fact, sellers have pulled back their listings by almost 25% YOY, in a move similar to what we’re seeing here in Victoria. But the scale of the sales drop-off is so much larger in Vancouver, that’s it’s overwhelming that listing deficit and causing inventory to rise anyways.”

And now, that phenomenon has finally reached us from across the Georgia Strait – seeing sales drop off here to an extent that inventory is now starting to rise regardless of listing pullbacks. Inventory is still too low IMO for downward price pressure, but my guess is, if this follows “standard” cyclical dynamics…that’s coming. 🙂

Sydney down 11% – “don’t matter, not here.”

Vancouver down 10% – “don’t matter, not here.”

Gordon Head house down 2% – “.. hey folks, look at $AAPL would ya”

Real Estate’s in trouble in BC.

So sure to happen here.

apple problem is it has one product that generates the bulk of the revenue and they have grown revenue by coming up with more and more expensive phones that are no better than previous year models. Consumers have woken up to this finally. This has no impact on any other Fortune 1000 companies. Blackberry all over again but in slower motion. Apple needs to get its act together. Better phones and cheaper out there.

I have 15% in a well diversified portfolio of 1 stock. RNX. bought it at .15 after the big announcement and have kept it even though it has grown into a large % of the portfolio. Its a hedge against squat…

https://finance.yahoo.com/news/apple-cuts-first-quarter-revenue-214529525.html

If you got lots of gold than you’re a fake housing bull. That means the US dollar will tank, along with economy and bringing on major recession up here as well if not worse.

More fake Hawk news.

Average way up/ median up 5K…HPI down .5% over previous month. 70k I have no idea where you dreamed that up.

SFH greater Vic

Average 900k/ median 775k last year 850 and 746K. HPI 751 vs 715. I mean if this looks like a crash. Go for it Hawk.

Funny how real numbers don’t back up your BS. Another painful year for the housing speculator… I actually feel sorry for you if you weren’t so annoying.

https://www.vreb.org/pdf/VREBNewsReleaseAndSummary.pdf

Exactly patriotz, and not to forget government intervention, which is always the last sign the bull is long over.

Renters are winning and saved $70K just last month. Imagine 5 more months out of the next 12 were 7% down. That would make my price prediction bang on….with a pile of sniveling and whining bulls afraid to post on here. 😉

Thanks Andy, some hard DD in the right sector will make the next group of winners a pile of cash while the “buy and holders” continue to get smacked down.

Anyone have any theories as to why Saanich (SD61)’s increase was smaller than the others? I see that Oak Bay’s increase is also relatively low.

It’s actually really easy: you just point to anywhere in the world where RE is in trouble and then declare how the same thing is sure to happen here.

Sure it is. Just compare prices and debt against incomes. If our prices are as high relative to incomes as theirs, and we are as indebted as they are, then our problem is as big as theirs. What enabled them to get that high isn’t that important – it doesn’t help people to pay the loans back.

There’s a lot of difference in mortgage practices between Australia, Canada, the US, and other countries. What busts in all of them have in common is excessive prices and debt.

Leo under property information and trends. They have an interactive map and PDF that has the info there. Seen some discrepancies between the pdf and interactive map so not sure if one is last years.

I think the pdf is the previous years

http://bcagis.maps.arcgis.com/apps/MapSeries/index.html?appid=ba3d56fb4c144727896b25989bdf00d2

There’s been mention of the Aussie RE crisis in this blog. While I haven’t researched it to a great extent, it seems that the problem lies with their banking/mortgage system that was allowed/willing to extend interest only mortgages for a fixed term (perhaps multiple years before the switch was flipped to a fixed term principal plus interest repayment schedule). I recall reading an article that said up to 40% of all mortgages were structured that way in the last few years.

I’m no expert, but that kind of scheme would make me a RE speculator overnight….rents on investment properties to cover interest payments in the short term, so no wonder it blew up. I don’t recall having that option when we bought our home in 2015….

Granted that there are multiple reasons why the Canadian RE market might be in a pickle in a macro sense, but it’s not quite that easy to compare the Aussie issue with ours when looking at domestic regulations, etc.

Not really sure where they get that data. Have not seen it from BC Assessment. Maybe they get it direct

Hawk, this one’s for you:

https://www.cbc.ca/news/canada/ottawa/pov-millenial-pot-stocks-house-1.4947080

@Leo S

Thanks for the update! Nice to see those active listings increasing.

China going after rich, worldwide income – BC real estate affected some more?

https://www.bloomberg.com/news/articles/2019-01-02/china-s-rich-brace-for-tax-raid-on-24-trillion-wealth-pile

sorry I did not realize that was times colonist..

Leo that is amazing can you do up island?

https://www.timescolonist.com/real-estate/vancouver-island-sees-jump-in-assessed-property-values-1.23570472

Prediction:

6810

$749000

$437000

1.5%

We appealed years ago and sorta won.

My take. It does Dick!

Who was smirking at Australian prices only down a piddling amount earlier? Sydney now down 11%+ from peak.

https://www.cbc.ca/news/canada/british-columbia/bc-property-assessments-drop-value-detached-single-family-homes-metro-vancouver-1.4963171

2019 estimates are as follows:

Sales: 6666

SFH price: $735K

Condo price: $410K

BofC: 2.25%

These interest rate estimates are predicated on the BoC following the fed on their revised estimate of two hikes in 2019 which will reduce mortgage affordability for a segment of the market.

I think 2018 sales were partially boosted by some people front running the stress test (with mortgage pre-approvals running out in Feb/March of 2018). The current slowdown in the lower mainland will reduce the number of out of town purchasers/retirees coming to Victoria in 2019.

I think we are late in the macro cycle but I anticipate a more mild recession once the cycle turns…that being said, many Canadian households are highly levered which could exacerbate and lengthen a potential down-cycle. I think a recession will impact the Victoria real-estate market in later years (2020/2021) more than in 2019. I estimate that a segment of those that took out mortgages in 2015/2016, fixed at all time low interest rates, may have trouble meeting higher mortgage payments upon refinancing in 2020/2021. This may further increase inventory levels and put downward pressure on housing prices.

Total value Assessed as of 01-07-2018 : $702,000

$58,000 more than last time. Wow, did they find oil on my property or something…

I highly doubt that I could sell it for that price in today’s market (If we were considering to sell)!

NOISE!

You could dispute it just as others do now. By comparing to a neighbour. Or by comparing to their own history. Why is my house valued at 250 Housecoins and my neighbour is only 200! There would probably be less disputes because it would only boil down to the tax and not pride. I’m sure there are fools out there who dispute if they think they are too low.

AHHHH I can’t stop myself!!!!

Following Penguin’s lead (waddle?) I am doubling down on last year’s picks. 8000/690/330/1.5. I wasn’t wrong, I was early…

I note with interest Michael’s 2019 SFH # is $25K LESS than his 2018 #. Fellow HHV’s, does that make him an honorary bear?

Checked out the assessment on the rental I’m in. Up 7.7% (Broadmead/Sunnymead) on top of last year’s increase of like 20% (going from memory). What I found odd was that the house value went up on the assessment as did the neighbor on one side but other neighboring homes of similar age went down in house value.

If the assessment is to represent what the home would have sold for on July 1, 2018, it’s off and if I owned this property I would definitely appeal. The design of the house is such that it can’t be suited and it’s not an overly large house like many around here. I doubt the owners will actually appeal as they didn’t on last year’s increase and that was out of touch as well.

Final December numbers:

375 Sales (down 19%), 384 new listings (down 13%), 1988 active listings (up 44%).

Pub night anyone ?

Good point. Loss of transparency and accountability if you move away from prices. Don’t like your assessment? Good luck arguing the index.

6550

730K

375K

2.50

This real estate analyst in the video below makes some good points for the market in 2019. If we see a resurgence of buyers in the spring that could stall price declines this year but I just don’t see where these buyers are going to come from at this point unless sellers start seriously lowering prices.

https://www.youtube.com/watch?v=5gXKdnRy-Rk

YVR

Welcome….I like the way you think.

Hi. Leo,

I am new to your site and really appreciate the information you put out!

My predictions

Sales: 7500

SFH price: $820K

Condo price: $400K

BofC: 1.75%

Federal election: Scheer

BC minority government gets dissolved

A formula could be divide by 10 and remove the dollar sign and call it housecoin. I’ve never seen the use in the $ number. Any loan or other real need requires an actual assessment anyway. I’ve sold two houses one 30% over assessed and one 12% under.

It’s practical use is to establish relative property tax rates not to inform everyone their house is worth 20% more because a handful of properties nearby sold for something like that. It’s a form of ratcheting the market up. Anyway, I don’t care that much to get the picket sign out, so carry on…

Sales: 8250

Mainly people dropping secondary properties

SFH Median: $579,375

30% correction

Condo Median: $253,500

40% correction

BoC Rate: 3.0%

To keep up with the Kardashian’s / USA imploding

I predict the Prov. will abolish the PTT and the Feds will increase capital gains tax %.

Is that the purest form of litigation? To appear to not argue the facts nor appear ready to table pound?

I honestly am having trouble making any predictions this year.; more so than other years.

6100

$760k

380k

2%

rehab eh Hawk. I will go for that sunny Mexican beach instead. I like your gold call. I have lots of that… Nice predictions on the housing market. LOL

Looks like 2020 and beyond are going to be renting years for you…

You haven’t given a formula for this “index” on which taxation is supposed to be based. Can you come up with anything that is easier to understand than the estimated price at which the property would have sold on the previous July 1? Everyone understands this and if they feel it’s inaccurate they can appeal. How is anyone supposed to get a feel if your “index” is accurate?

But it is cooked up anyway. It’s algorithmic assessments. But, you are right. It’s easier to tax someone more if you tell they are rich first.

The longer sales history would be more for the transparency and interest in relation to the index value. Three years might as well be three months.

They could use the same system they use now and just run a filter on it at the end to get rid of the dollar sign. Make it likes 🙂

Outliers? Here ya go:

Sales: 18,000

SFH: 4.8 million

Condo: 115,000

BOC: -.50%

You have to include my prediction…if you don’t it’s straight to the naughty list for you

Sales: 7500

SFH price: $840K

Condo price: $375K

BofC: 2.25%

If BC Assessment used some sort of index value rather than a dollar value, people would just think it’s been cooked up to make them pay higher taxes. The purpose of a dollar value is transparency.

Assessments are not based on sales history of the property. They are based on comparable sales near the assessment date (now Jul 1, 2018). They could provide a longer sales history than three years which may be informative to some people, but it has nothing to do with the current assessment.

What is happening in Australia shows just how fast house prices can fall when the slide starts.

https://www.theguardian.com/australia-news/2019/jan/02/australian-house-prices-falling-at-fastest-rate-in-a-decade-data-shows

My guesses:

Sales: 5750

SFH: $745k

Condo: $405k

BoC rate: 2.25%

Happy New Year!

I think you have a very good point, Dasmo, but I think any alternative is going to be very awkward. Using “market value” is the simplest and most easily understood measurement at the moment, even if I don’t really like it either. It will be one of those things where “this is the worst solution, except for all the other ones”. Keep working on the details, maybe you can figure it out!

Do you know anywhere that uses a different method?

Go for it. Give me the twisted pleasure of laughing at my prediction in a year, or conversely, to recoil in horror in the event of its accuracy.

What I am most confident of is that affordability this year is going to improve. I suspect that will be from price movements, but I’m not sure we’ve seen the limit to what central bankers may try to pull. They do have a tendency to about-face with little notice.

Sales: 9020 Thru the roof as sellers dump and knife catchers bleed green month by bloody month.

SFH: $525k

Condo: $275K

BOC: 3.5%

Gold: $2000

Silver: $50

Gwac: Committed to local rehab via court order.

I’m recording that as your official guess local fool unless you give me another one!

Assessment down 2% this year (Fairfield SFH). I actually thought the 2017 value was stupidly high. Would have appealed but life was too busy then. 2018 value probably still above what we could sell for.

We haven’t seen many drops. An official letter to every household telling them their house is worth X amount has a lot of power. It sets the floor of the asking price across the entire market. Yes buyers need to buy but we know the ones that don’t. They are here. Then there are the ones that do buy at what is still on average slightly above ask. It wouldn’t irritate me if the same gov wasn’t talking about a crisis and trying to come up with solutions. This is an obvious one. What purpose does it serve to have a dollar value? Just have an index value and track sales history. It should also have a longer sales history not just the last three years.

China blows to hell, Fed drops rates:

Sales: 8800

SFH price: $1.1M

Condo price: $605K

BofC: .25%

😀

Tight field of predictions this year. We need some outliers!

I’m not entirely against your theory that it gooses asking prices, but I don’t think it really moves the market. In the end the buyers need to buy the places and we’ve seen last year that buyer’s didn’t think much of the inflated asking prices and only bought after significant discounts.

If it moved the markets, how would we tell? And wouldn’t it then also exacerbate downward price movements as people see drops in assessment and try to get ahead of the market?

I’m going to repeat that the biggest impact on house prices comes from BC Assessment. It’s ridiculous that this crown corporation continues to operate in this fashion. It’s bigger market manipulation than rates even! It should be an index value so that property tax is relative. It would be less expensive over the long run and wouldn’t continually goose the market.

Here’s my guesswork:

Sales: 6975

SFH price: $735K

Condo price: $390K

BofC: 2.50%

Hawk I don’t see your prediction.

When you do I expect you to add Gold, Silver, WTIC, AECO, TSX, S&P, VIX

A credit crunch in China will reverberate around the globe. Foreign buyers from past few years may be the ones who tank the market before the over indebted. I know , reality sucks but somebody has to be honest around here.

China faces industrial slump as ‘credit crunch’ deepens in Asia

31 DECEMBER 2018

“China is sliding into a manufacturing recession as a wave of bond defaults sweep through the corporate sector, signalling yet further trouble for the battered global economy.

The official PMI survey for December slumped below the boom-bust line to 49.4. New export orders slid to crisis levels of 46.6 last seen in the depths of the Chinese currency scare of 2015.

“The worst is yet to come,” said the Japanese bank Nomura. An autumn boost from Chinese exporters is fading: they have already front-loaded shipments to the US to beat a possible jump in tariffs by the Trump administration.”

Taking a stab at the prediction thingy..

Sales: 7,250

SFH Median: $780k

Condo Median: $430k

BoC: 2.5%

Annual Sales: 7200

SFH Median Price (Dec 2019): $790,000

Condo Median Price (Dec 2019): $425,000

BoC rate (Dec 2019): 1.75%

Months of inventory back to around 2014/2015 levels.

Annual Sales: 6869

SFH Median Price (Dec 2019): $767,000

Condo Median Price (Dec 2019): $385,000

BoC rate (Dec 2019): 2.25%

I predict nothing much will happen on prices in 2019. Both Bear and Bull are the winners!

Bull – yes, the worst is over. Time to trade up /down /sideways!

Bear – yes, the wait is well worth it. My investment went up XXX%!

More sales under assessment; 50s boxes in OB / 70s boxes in GH will under pressure, trades are too expensive for major reno; Westshore and townhouse sales increase.

Happy 2019 HHV!

Jamal,

Justin ain’t perfect but he’s a breath of fresh air from the anti immigration and defending racists conservatives. Scheer is another weakling like Wilkie who would be clueless standing up to foreign leaders. Like Trump he’d cower when the going gets tough. I prefer my leaders to be intelligent with some class.

Justin tried to help Alberta and even bought the frigging pipeline but courts ruled against him. So should he tweet storm like idiots Trump and gwac to try and get his way ?

Probably true. I supported Trudeau a lot more 3 years ago. No fatal flaws, but somehow it’s just been a bit blah. Outside of pot legalization it doesn’t seem like much happened. Conservatives have a good chance to capitalize on the general malaise but Sheer just doesn’t seem like the guy that will take advantage. Needs someone with a stronger character and more of a platform than being vaguely against whatever the Liberals do.

Gwac drinking heavily again. Probably got kicked out of the levee at Government House today for slagging Lisa Helps and dragged screaming “Christy got robbed !!!” . 😉

https://youtu.be/WbrjRKB586s

Annual Sales: 6250

SFH Median Price (Dec 2019): $695,000

Condo Median Price (Dec 2019): $355,000

BoC rate (Dec 2019): 2.0%

SFH MOI: 9 months

Trudeau re-elected, Slim majority

I am usually on your side of views Hawk,,, but i believe trumpism can only arise from trudeau type govt… far left and far right does not help .. people need to cater toward the middle ground…no point of winning a golden turd

Bla bla bla. Still no prediction just more horse manure.

Lol 2019 another year for Hawk to be renter and pay someone else’s bills. Lol. Yes I know you only pay 2 dollars in rent.

Only needs to work once gwac and last months $70K plus kick in the nuts has to hurt and just a start. Global recessions and credit squeezes can be very nasty.

Poor Alberta blew their stash of oil cash, not my problem according to your theory of life right? They should have saved for a rainy day like you right ? 😉

Down down down has not worked for many years Hawk. Try some real numbers. Come on grow a pair and put 4 numbers down.

I would love alberta to separate and stick it to this province and rest of the country. :). Alberta has been treated like trash in confederation

I already did gwac, it’s down,down, down. Just like last months 7% you are having a hard time dealing with and can’t even talk about. Wait til spring. You’ll be crying like a baby.

NDP will be there for 7 more years, get used to it. They help people unlike Libs who raped the province coffers to balance the books and let money launderers get away with murder. No one wants Wee Weakling Willie with the personality of a sack of bricks.

Justin will get in again. Who wants red neck Albertan populist Cons running the country cause their one trick pony is in the tank for years to come? Trump set the table for racist right wing governments to be sacked for good.

Caveat

I can buy my own pony. NDP can kiss my ass and stop increasing taxes. My bonus prediction. NDP gone in 2019 and Liberals gone in Ottawa. These 2 things will make this country a hell of a lot better off. Maybe stocks will go up than and businesses can create good jobs.

Hawk no balls again this year. Won’t make predictions. Lol

7428

825k

452k

2.25%

Sales: 6625

Dec 2019 median sfh: 785,000

Dec 2019 condo: 390,000

BoC rate: 2.0

Trudeau is re-elected.

Frustrated by the Dem-controlled Congress, Trump accomplishes less and less; behaviour becomes increasingly outrageous, erratic and unstable. US continues to stagnate, enters recesssion in early 2020.

Annual Sales: 7550

SFH Median Price (Dec 2019): $815,000

Condo Median Price (Dec 2019): $440,000

BoC rate (Dec 2018): 2.25%

Annual Sales: 6500

SFH Median Price (Dec 2019): $710,000

Condo Median Price (Dec 2019): $375,000

BoC rate (Dec 2019): 2.25%

SFH MOI: 7 months

I think MOI will become a main topic on HHV in the latter part of 2019 for several reasons. First, there will be a huge number of new and used condos coming onto the market and secondly I think there are hundreds of local SFH owners who will be listing their houses with expectations of top dollar but buyers won’t pay above assessed value and that will cause a stalemate in 2019 resulting in spiking MOI, lower sales, and lowers values.

I still think 2020 will be the interesting year, 2019 is just the beginning of a downturn. The stock market and over-extended credit might be big news too, which will start to compound the downturn next winter, leading to 2020 as the year to watch.

Predictions for 2019:

Sales: 7,000 (slightly bullish as more condos comes on market )

SFH Median: 750,000 (bearish as Chinese and inter province movement grinds to a halt)

Condo Median: 370,000 (more supply less people migration – construction boom slowing project starts slows , young trades worker /manual laborer less in demand )

BOC Rate:2.5% (either rates goes up or CAD goes down)

bike lane and random speed limits added to bay street (i just want to see the world burn)

What makes you so bearish on condos Marko? I figure even my prediction at $10k higher is relatively unlikely to come to pass.

I don’t think we are really at 422.5k right now…likely some noise pushing it to that number. 400k is really where we are at with my gut feel plus I think the pre-sale market will take a shit kicking this year so you’ll see fewer of those sales reported and pretty much 100% of presales with exception of some studios pull the median up.

SFHs I think they will be difficult to sell but prices will hold in there +/- especially in the core.

What makes you so bearish on condos Marko? I figure even my prediction at $10k higher is relatively unlikely to come to pass.

Predictions for 2019:

Sales: 7,400

SFH Median: 800,000

Condo Median: 400,000

BOC Rate: 2%

Lisa Helps: Renames Beacon Hill Park to something unpronouncable as Canada Day surprise

Tent cities: Clover Point, Summit Park

There’s still time to sell but you won’t because your shack needs $100K of renos and would go $100K or more under assessment so take away 20% at least of your 65%. AKA a tear down. 😉

Calling exact numbers is liking buying lotto tickets. All you need to know is this pig is going down bigtime. 😉

Annual Sales: 6750

SFH Median Price (Dec 2019): $750,000

Condo Median Price (Dec 2019): $385,000

BoC rate (Dec 2018): 2.0%

Our 2019 assessment is down 2%. Hawk, should we sell? 😉

Up 65% from when we bought.

Deeper than what? Well, he says:

“B.C. resale transactions are predicted to rise by 0.6 per cent in 2019, 3.8 per cent in 2020 and 2.2 per cent in 2021.”

OK, so let’s translate:

“For the BC RE market to do anything less than rise from here-on-in, you would need serious global trouble. All of the economic or sales metrics locally are strong, the economy is sound. The threat can only be external, which of course, we don’t see any threat there either.”

Yuh huh. Of course not. Sounds like every other, “nothing to see here” piece written in the last 150 years. And as usual, the threat is not external at all. The threat is ourselves and how we chose to treat RE.

While a global economic recession definitely wouldn’t help, that hasn’t prevented our RE market from kerplunking all on its own previously. In fact, we’ve seen our major markets languish and even decline with the north american economy booming. All it takes is a marginal portion of the population to overbuy and over-leverage the local market, and the rest is markets 101.

With what credit are we going to drive the market from its current price points, despite virtually every national statistic showing credit growth, mortgage originations and sales volumes going in exactly the opposite direction? Yes it will go back up at some point, but the unwinding has to occur first. That hasn’t happened. Mr. Yu should try out for an episode of P&T’s “Fool Us”.

That piece is a great example of why I suggest one pay attention to the data and not these perpetually rosy or “nothing to see one way or another” forecasts by analysts and economists – many of them, like Mr Yu, who are in the business of selling mortgages. There will be countless more of them coming, regardless of how mildly or badly things go south.

Happy new year everyone!

Isn’t RE now BC’s biggest industry? Was the crash in the US caused by a recession, or was it the other way around?

https://www.timescolonist.com/2019-real-estate-market-outlook-a-forecast-summary-1.23569157

Is Bryan Yu attempting to build confidence with this statement or is he in denial?

Hope everyone had a safe NYE, happy “recession proof” 2019!

Guess I’ll give this a whirl:

Sales – 6250

SFH Median – $725,000

Condo Median – $395,000

BoC – 2.25%

Yeah I’m a bit bullish on BoC rates. I know that politically that one is a hot potato but I think BoC will try to get closer to their goal neutral range of 2.5 to 3.5 by year end.

New bc assessment values are out: https://www.bcassessment.ca/

Our place is up by a surprisingly low 1.5%. Should be good for taxes since I suspect the average increase in Saanich is more than that

I’m going to reuse my 2018 predictions and go with:

Sales – 5900

SFH median – 710,000

Condo median – 365,000

BoC – 2.00

A broken clock is right twice a day. I think I jumped the gun on last year’s predictions but I think we’re going to see some real changes in the market next year.

Sales – 6596

SFH Median – 735,000

Condo Median – 380,000

BoC – 1.75

Bonus predictions:

Hawk buys in Gordon Head, new neighbour to Introvert.

Government gives gwac a free pony and he learns to love the NDP

Local Fool and Patrick settle their debate for once and for all with an epic thumb wrestling bout.

VREB says there has never been a better time to buy or sell Victoria real estate.