What to buy in a downturn

There’re two types of sellers out there: those that want to sell, and those that have to. In a hot market like we saw in 2016, there is really no difference between them. The people fishing for a fanciful price sold in a few days at asking price while the serious sellers sold in a bidding war $100k over ask. When inventory is at rock bottom levels and panicked buyers outnumber sellers, there are no deals to be had. Everything goes at market value or above and you can only hope the market keeps going afterwards.

Now it’s different out there. While I would hesitate to call it a buyer’s market, buyers and sellers are more or less on equal footing and that makes house hunters a lot pickier. Two years ago even the houses that consisted of leaky oil tanks cobbled together with asbestos and aluminum wiring sold with unconditional offers, while now buyers can afford to sit back and think before acting.

The thing is, a house in the core in decent condition with a suite remains in high demand. Even though the market has shifted, you shouldn’t be surprised when that place still sells in a couple days or even attracts above-ask offers (~10% selling above ask recently). Even five years ago when the market was much slower we still saw the most desirable places sell quickly. There are fewer buyers out there, but there are still enough wanting the perfect places to ensure they sell without a discount.

However the sellers that need to sell are also still out there. In fact their numbers are likely growing with a lack of house price appreciation, increasing carrying costs, and an aging population. Those that need to sell also rarely have those high demand perfect houses that have been recently renovated and suited. Instead they are disproportionately selling those houses that are a little bit flawed. Maybe they are on an undersize lot. Maybe they aren’t in the best neighbourhood or the yard is overgrown. The deck might be sagging or the addition is shoddy. The walls are cladded in wood veneer and there’s a model train installation downstairs. The basement is underheight and the fixtures are brown and avocado. I’d stay away from those with serious flaws like being on very busy roads, but there are a lot of minor factors that can deter skittish buyers.

How do you know the seller needs to sell? There’re the obvious signs like a vacant house, as-is where-is descriptions, estate sales and foreclosures, and when agents cling to your leg at open houses. But often it is less obvious and that’s where you need to do your research. Elderly owners? Usually they don’t do a lot of voluntary moving. If the place has been re-listed multiple times at lower prices it’s a sign. Especially this time of year there tends to be a higher proportion of must-sellers still listing as the opportunists have pulled their properties to try again in the spring. Don’t be afraid to ask around with the neighbours to see if you can scope out the reason. Did the owners buy a place and are asking for a specific closing date? Get your agent to do some digging, sometimes there are clues in the detailed listing documents. In the end, the proof is in the pudding and that is how the sellers react to a lower offer. Most sellers are pretty stubborn about their asking price and aren’t likely to take a low offer, but if they are getting worried because they’re moving out of town they are much more willing to negotiate.

The downside of a fixer upper is that you have to, you know, fix it up. And unless you can do that yourself, it’s a heck of a bad time to be doing major renovations as the trades are so busy you will be paying top dollar if they even have time to show up. One strategy that I like is finding a house that is flawed but workable right now. Maybe it’s a 50s box that needs new windows and a kitchen or a house with potential drainage issues. If you can hold off on renovations until the construction business slows it will be less stressful and you will have more options to get it done.

It’s hard to tell what’s going to happen with the overall market. Vancouver looks to be cratering while Toronto might be stabilizing. Interest rates are going up up up or now they might not be. Prices very well could be lower next year, but in the meantime you may want to keep your eyes peeled for those hidden gems. The tricky thing is, they won’t look like gems at first.

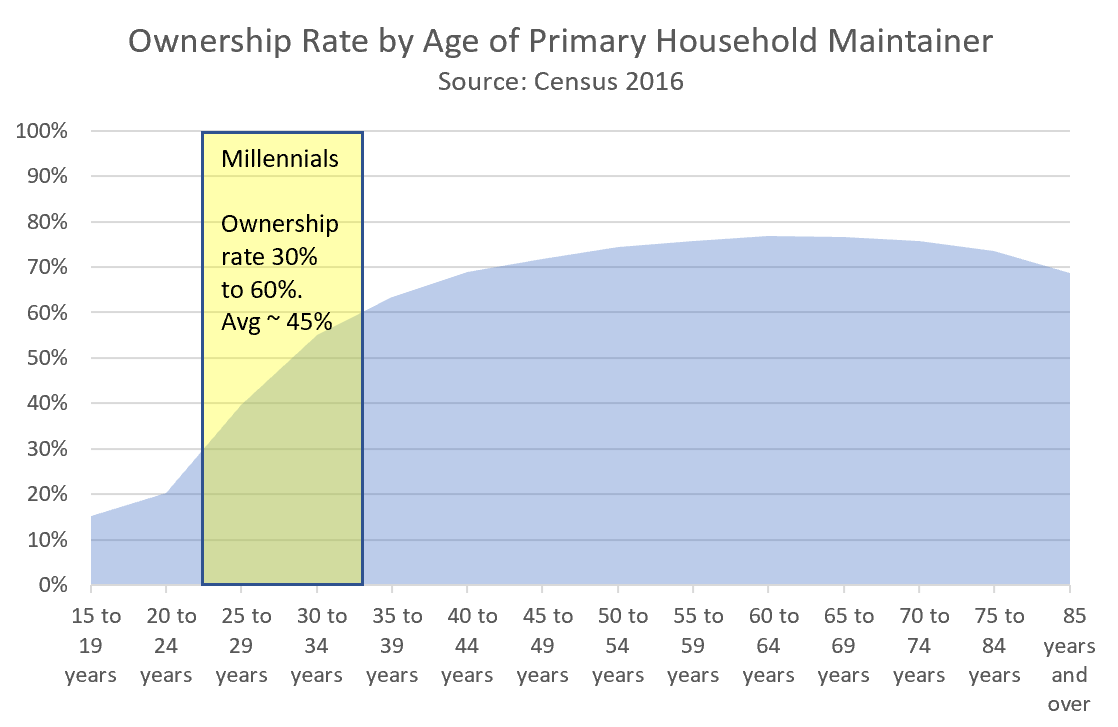

I am not a stats guy, but the thought struck me that the 2016 survey refers to the primary household maintainer. While less common today than before, women do still tend to marry men that are older and, often, but far from always, earn more. If you included all millennials regardless of their spouses age this might significantly change the ownership rate.

Like I said I am not a stat guy.

Monday numbers: https://househuntvictoria.ca/2018/12/10/dec-10-market-update/

Data doesn’t work like that Patrick. What you are saying (ownership rate for millenials jumped from 45% to 60% in 2 years) is completely impossible. There is no point discussing this further if you think that is a plausible scenario.

“There is no data on the future though.”

US 2/10 year and Canadian 2/5 year yield curves are now negative – first time since 2007. Some economists take this as an indicator of recession coming and investors seem to agree: the Dow will slip below 24,000 shortly unless it recovers from today’s start.

The only data you present is old data (a 2016 graph) to dispute this new Genworth 2018 data. Instead why not present fresh data?

The data you present in the chart is from 2016. The Genworth data is from 2018, and specifically references a remarkable change in the data from 2016 to 2018, specifically for millennials.

Note the title of the Genworth article “Millennials are the Engine of the Real Estate Market”

http://investor.genworthmicanada.ca/English/media/news-releases/news-release-details/2018/Millennials-are-the-Engine-of-the-Real-Estate-Market/default.aspx

“. Among those who own their homes, three in ten (30 per cent) millennials bought their first home or a home that was not their first in the past two years [2016-2018], compared to just 9 percent of older Canadians. And over the next two years, among non-owners another 30 per cent of millennials plan on making their first home purchase, making them the engine of the real estate market.”

Factual data is history, so it’s useful in the sense that we can see where we have been. There is no data on the future though. The data Patrick is so vehement about is akin to “65.9% of fortune tellers think the housing market will go up.” Come to think of it, I think Patrick’s startup is selling tarot cards on Etsy….

Sure. We could get into a long debate about whether national statistics reflect the housing situation in Victoria, or whether an ownership rate really says anything about the existence of a housing crisis.

However in this case your argument seems to rest on the Genworth survey, so I’ll just take the Trump approach and say: fake news.

They say “millennial” but the first red flag is they never define that. Who did they judge to be “millennial”? Who was the survey sent out to? Isn’t it odd that 60% of millennial apparently own when the national ownership rate is only 67%?

Millennial aren’t a fixed group, but let’s use the definition of birth years from 1981 to 1996 which makes them between 22 and 37. So now we look at the data.

So facts are, ownership rates for millennials cover a wide range from 30% to 60%, with the higher only describing the oldest millennials (37 years).

So the statement “six in ten (59 per cent) millennials have already achieved their homeownership dreams” is complete nonsense and Genworth should be ashamed of themselves.

https://www.cbc.ca/news/politics/tax-evasion-proceeds-of-crime-1.4937176

Rental property income evasion. This should send a message.

Marko: I believe that they dropped it down to 1.75 after accepting my conditional offer which had a a bit of a window on it.

I don’t mean to be an ass but the home was never listed at $2.8 million. It started at $1.98 million. When you purchased for $1.65 million it wasn’t listed at $2.1 million but at $1.75 million for a total of 116 days at that particular price, so unless your conditional offer had conditions longer than 116 days the price wasn’t dropped during the conditional period.

It is okay, because literally every single person exaggerates how great of a deal they got on their purchase which was my point in that referencing the original asking price as the amount you got off asking price is complete non-sense.

I had lunch with a friend a few days ago and he says, “my friend just bought a house and they wrote a long letter to the seller about their young family and the seller flexed $150,000 off asking price.”

me, “what’s the street so I can look it up in my system?”

friend, “xxxxx”

me, “hmmmm, looks like they only $50,000 off asking price” (house well over a million)

friend, “ohhhh, must have been fresh to market.”

me, “nope, 46 days on market, 3% off asking price, must have been an amazing letter.”

In reality they got the house at market value but they are telling people they got an amazing deal because of a letter and then everyone thinks how letters work.

That’s your problem Patrick. You tell millenials to buy now but you have zero to worry about. Fuzzy logic.

BTW more millenials are delaying marriage,kids etc more than ever. Most are priced out already so saying they should buy at peak of the bubble is ridiculous and dangerous. Waiting a couple years to see how this plays out is smart financial advice. But I’m not desperate for clients like you. 😉

My arguments are, I hope, data driven, and not dismissable by when I bought my house. You’ve made some data driven arguments too, and I expect you want them dealt with on their merits, and not responded to by personal slurs.

You can ignore anything my posts that strikes you as schtick, and just respond to the Genworth data (link below), such as 59% of Canada millennials are now home owners. Is that something that has been discussed here previously, and if not, is this explained by any data you’ve presented?

http://investor.genworthmicanada.ca/English/media/news-releases/news-release-details/2018/Millennials-are-the-Engine-of-the-Real-Estate-Market/default.aspx

I dunno. The “i bought my house decades ago what are you whining about” shtick is not particularly convincing.

Interesting on CHEK tonite how the upcoming China backlash will have a big effect on the local VI tech industry as well as tourism. No wonder Silicon valley listings have flooded the market and prices are down while slashes have sky rocketed.

They obviously see more than what we want to admit that the party is long over and it’s time to bail ASAP. No fear, Patrick’s here to save us with some nonreality stats.

Oh no, I conflated correlation coefficients with probabilities! Yes, this definitely means I don’t know how to code and should instead try my hand at selling cross stitch on Etsy. Thank you for showing me the light Patrick.

The artsy startup was a good zinger….

Man, Patrick is an absolute pit bull! (Pun intended.) He’s chasing all these bears up a tree, and doing it with verve.

Gwac and I are going on vacation…

HAAAhahahahahahhaa

Oh gawd. Don’t they teach any stats to millennials?

Correlation coefficients range from -1 to 1.

0.00 would be a coin flip.

https://en.m.wikipedia.org/wiki/Correlation_coefficient

I hope your “tech startup” is something artsy.

From the link you provided:

“On average, intentions are positively correlated with purchasing (average frequency weighted r = 0.53 in one study that looked at a wide range of general behaviors and 0.49 in another that focused on purchase-related behaviors). However, the magnitude of the correlation varies considerably (in the first study the correlations ranged from 0.15 to 0.92; in the second they ranged from 0.13 to 0.99). ”

First, 0.53 is basically a coin flip. Second, that average was not indicative of the group given the variance. Third, those surveys were not about real estate. The survey that got 0.99 correlation with follow through must have been conducted in the cashier line-up at a grocery store.

By calling you a “waiter”, I was not referring to a restaurant waiter. I was referring to you “waiting” 10 years already to buy and advising people to “wait” another two years before buying. Was your “dumbo” reference to me also a pun?

Yes, based on how you used it.

“It’s always darkest before the dawn, means “just before the dawn”, not “at some time before the dawn”.

Similarily, when patriotz says “In fact, buyer intentions are always the highest before a crash” I’m reading that as a “just before a crash”, and not 3-4 years before a crash as I demonstrated.

But if you’re claiming that you meant to say “In fact, buyer intentions are always the highest 3-4 years before a crash”, then we are in total agreement!

Perhaps you can clarify what you meant. Until then, I’m surprised that you didn’t challenge the substance of my post, and are hiding behind this definition argument to imply that you agree with me.

Is “before” inconsistent with “precedes” in your native language?

The millennial housing crisis in Canada seems to be over.

From what I see, the data tells us that there was a “millennial” housing crisis in Canada, but the situation has dramatically improved over the last two years.

The “millennial” housing crisis was the condition that houses were unaffordable for millennials, and they couldn’t enter the market.

I am basing all this by the simple metric of % of millennials in Canada that own a home. I’m sure I’ll be set-straight by our resident millennial renter-bears here about what a useless metric that is, but I am all ears for that, because that metric does seem like a direct measurement of how millennials are doing at finding and buying a home.

OK, let’s have a look at Millennials, and their desperate struggle to own housing in Canada.

Genworth did just that, (May 2018)

http://investor.genworthmicanada.ca/English/media/news-releases/news-release-details/2018/Millennials-are-the-Engine-of-the-Real-Estate-Market/default.aspx

And found out… (quoting from the article)

– “six in ten (59 per cent) millennials have already achieved their homeownership dreams. “

– “Among those who own their homes, three in ten (30 per cent) millennials bought their first home or a home that was not their first in the past two years,”

Now only 61% in Victoria own homes period. And 59% of Canadian Millennials already own a house somewhere. Amazing! Congrats to the hard-working, risk-taking Millennials out there that have bought homes equal to the home ownership rates in Victoria.

So why are we expected to believe that it’s so hard for millennials to buy houses in Canada, when 59% already own a home!

Turning to our resident renter-Millennials, have I missed something here? Aren’t you too proud of your fellow Millennials that have achieved home ownership throughout Canada at such a high rate?

So do we all agree, that there’s no Canada-wide housing crisis for Millennials, and the remaining “crisis” is just for some entitled Millennials in high-priced cities like Victoria that don’t want to commute to work?

@guest_53022

hahaha .. love it 🙂

I didn’t make this, but here’s another great picture illustrating a dynamic:

https://imgur.com/a/KDcgmmh

(Leo no longer allows this one to be directly posted, but don’t let that flip-flop suggest to you that he’s capricious.)

@guest_53015

great illustration .. the graph is very accurate .. except it is missing out the last part on credit tightening .. that graph did not show what happen to the 2million dollar home .. as you can see .. in a credit tightening situations .. high end houses slash prices and mid end houses/condos follows .. no point of buying something that is worth 1.5 mill if some one selling something worth 2mil for the same price .. only down side is the low end housing .. they stay the same because some one can always afford it

Now now Patrick, you seem to have clearly gotten rattled and fallen off the tracks resorting to saying I’m a waiter. I probably make more than you. Nothing wrong with waiters tho as they can make great money in the right place.

I’ve said many times I haven’t even been interested in the housing market until last couple of years. Experience tells me this is the worst time in history to buy so I’ll gladly wait and stash more cash than a house would drain versus going bankrupt/underwater.

Appears the market facts are messing up your story book. You must work in a real estate related biz and just dumped a few hundred K on the kids downpayment to put up such a faulty defense. Bummer.

PS I don’t have a lease dumbo and many don’t.

These kind of fact-free, faux-academic speeches are pointless drivel, and sub-standard for this site. They may impress the surrounding tables at Mayfair food-court, but here you should state some actual facts or link to articles. Otherwise you’re just blowing hot air and wasting people’s time.

“(April 2018) “After a winter of depressed sales volumes in most markets, millennials are at the forefront of an overall increase in buying intentions across the country, according to RBC’s annual homeownership poll.”

Intentions are one thing but I’d rather hear what millennials are actually doing

The number of new mortgages taken up in Canada in the second quarter of the year fell by 3.4 per cent compared to a year earlier, according to credit agency TransUnion, and younger borrowers seemed particularly discouraged from entering the housing market..

There was a decrease of 18 per cent in millennial borrowers (aged 24 to 38) and 22 per cent in Generation Z borrowers (aged 18-23), TransUnion found. The number of Generation Z mortgage holders is small, but more than 11,600 fewer millennials either applied for new mortgages or renewed a mortgage in the quarter.

https://www.cbc.ca/news/business/transunion-mortgage-credit-report-q2-1.4828616

I don’t

know how to quote but we have a few reasons for moving. We realize we are at the stage of life where home owning just doesn’t thrill us anymore. We also miss our kids.

A few other reasons but life is not bad here…but a wee bit boring. Time to resettle for old age and not move again.

I do have trepidations about apartment life which is why we will be picky. If anyone has any building recs I am all ears. As quiet as possible but close to amenities is the goal. IF we sell. I never count on anything.we won’t just give the house away.

I agree. There is also the concern that the attitude “I will make more money at my job and pay someone else to do it” just results more in sitting around watching TV and reading Facebook than actually earning that extra money. Learning to do things yourself pays many times over.

Great picture, illustrating a dynamic that some people are asking about…

“Vancouver condo prices have turned negative for the first time since October 2013.”

– Steve Saretsky

No. That type of indicator doesn’t peak with house price peak. It precedes it by a few years, making it a valuable predictor.

Gallup has measured this for many years. They’ve asked people for 40 years if it’s a “good” or “bad” time to buy a house. This co-relates very highly with buyers intentions. (Which Gallup has only measured for last 5 years, but co-relates very closely. People who say it’s a “good time to buy a house” correlate closely with people who “intend to buy a house”)

Look at this long term graph of public assessment good or bad time to buy a house in USA. They peaked in 2003, 3-4 years before USA House market started to fall.

https://news.gallup.com/poll/162752/housing.aspx

This future looking indicator was an exquisitely accurate future predictor of the US housing crash. The graph I posted shows you… If you see public assessment of good/bad time to buy a house start to fall, you have about 3-4 years to expect prices to start falling.

Another basic principle: people chase after that which is rising in value. They run away from that which is falling. Perceptions of a particular market are dependant upon the time in which you’re measuring that perception. During the depths of a major correction, sentiment of a market may be badly damaged, but during a massive run up, by definition that sentiment is reversed. Back and forth it goes, throughout time.

No, because I do weigh actual market activity more than stated intentions of future activity. I don’t think I quantified the weighing in that statement and I’m perfectly content with what I said. Anyways, if you prefer to use surveys to gauge a market, all the power to you. Over and out.

Patriotz, Sort that out with Josh. He’s the one that questioned me about it.

intention to buy is not the same as able to buy .. if 89% of the millennials are able to buy then there won’t be enough house to sell. Intention surveys differs from object to object.. If the report say 89% millennial want to buy and Iphone .. then i know iphone sales will go up because that is the price range of most average millennials.. if 89% of millenials want to buy in a ruruals area . .. then that is believable .. but if 89% of millenials want to own a home in cities .. well that is just wishful thinking .. .. majority of the millenials or other work forces does not earn enough salary to own properties in this city

OK, you’re now backing off your previous statement “surveys that ask people about wants or future intentions are all well and good, but do virtually nothing to predict market trends”

So now you seem to accept buying-intentions as a factor and will weigh it in with your others. Fine with me. You can weight the factors any way you want. Hopefully you will weigh it higher than one of your YouTube RE agents sitting on a hotel bed somewhere giving an off-the-cuff market report.

Since most households have historically bought residences, it’s hardly a surprise that there’s a positive correlation between intending to buy one and actually buying one. That means nothing with regard to supporting current prices. In fact, buyer intentions are always the highest before a crash,

Glad you asked.

Because this (co-relation between intentions and purchasing) has been well studied, and is used by marketing and sales people in all fields. As you can see below in this journal review, the average co-relation between intention and buying is 0.5 which is a significant positive co-relation. In all studies that reviewed there was a positive co-relation. Note that the RBC/Ipsos April 2018 study showed not only HIGH house-buying intentions (highest since 2010), but also showed an INCREASE in buying intentions, which is a separate bullish feature. And millennials like you Josh are the biggest group of would-be buyers!

http://www.msi.org/articles/how-well-do-purchase-intentions-predict-sales/

“On average, intentions are positively correlated with purchasing (average frequency weighted r = 0.53 in one study that looked at a wide range of general behaviors and 0.49 in another that focused on purchase-related behaviors).”

I’m not, and neither is anyone else here. It’s pretty basic stuff, actually. I don’t think it’s controversial from a market analysis standpoint to give more weight to actual buyer behaviour, rather than surveys of people asking them what their future behaviour might be.

I always appreciate disconfirming data. I learn that way. Other people, it doesn’t seem to make a difference; the contradiction is immediate and automatic regardless of how basic the principle or observation is.

The smart ones started out buying somewhere they could afford without a restriction that it also has to be close to work. It’s called commuting. They already own a house and you have to pay higher to get yours now.

He hasn’t said that he is – just that surveys about intentions have no real connection to the market. And they don’t. How is it that you believe these intention surveys are worth anything at all?

How are you a credible authority on what factors predict market trends?

Sorry, but I and others would need some type of supporting data (link?) to back that statement up. If Warren Buffet said it, OK.

But you’ve told us your track record, and the sum total, over the last several years, of all your sources (YouTube heroes, Mayfair food-court chatter etc) failed to give you a BUY signal, and you’ve sat-out a 40% rise in Victoria house prices. Maybe it’s time to turn off YouTube and pay attention to some objective indicators, including that April 2018 Canadian house-buying intentions rising and being the highest since 2010 (FP link in prior post)

wanting to own a home is not the same as wanting to buy a house .. Interest to buy a house is not the same as able to buy a house. Able to buy a home in rural area is not the same as able to buy in an urban center… able to buy a home in an urban city is not the same able to buy a house in an urban location

Check out @SteveSaretsky’s Tweet on Vancouver condo prices. https://twitter.com/SteveSaretsky/status/1071859622837813248?s=09

You have to also be careful with your recommended type of data, as it’s all backward looking. You’d find that people bought Blackberry phones. Buying intentions are forward looking.

For example, I haven’t read much on this site about the 2018 surge in buyer intentions and interest from Canadian millennials, but here’s an article all about it.

https://www.google.ca/amp/s/business.financialpost.com/personal-finance/mortgages-real-estate/millennials-behind-surge-in-home-buying-intentions-with-a-little-help-from-family-poll/amp

(April 2018) “After a winter of depressed sales volumes in most markets, millennials are at the forefront of an overall increase in buying intentions across the country, according to RBC’s annual homeownership poll.

One third of Canadians say they are very likely or somewhat likely to buy a home in the next two years — an increase of seven points from last year and the highest level since 2010, according to the bank’s survey of 2,000 Canadians conducted by Ipsos.

Millennials showed the strongest intention to buy, with 50 per cent of those aged between 18 and 34 saying they were very or somewhat likely to purchase within the next couple of years.”

This is precisely correct and exactly where you want to look. Like I say it’s a data driven question; surveys that ask people about wants or future intentions are all well and good, but do virtually nothing to predict market trends. Like the maxim says, don’t listen to what they say, watch what they do.

Yes, this is true. In fact, that cohort is one of the largest we’ve ever seen, now entering their prime buying years. But they also have to be able to afford the prices where they live and work – currently, few people here in that cohort can. If that wasn’t an issue, we wouldn’t have RE demand in BC tumbling despite growing populations and one of the best job markets in decades. So yes, the longer term prospects are good in terms of population numbers, but the shorter term ones would appear to be less promising. As the cycle rolls over, the market will be more dominated by FTBs as opposed to the participants you see in peak market dynamics.

“But the largest transfer of wealth in history will occur with boomers retiring”.

Yes, but so much of that is locked up in housing, and that means they have to sell it to someone younger who’s willing to pay that price – and eventually, somewhere down the property buying chain, a buyer must access credit to fund the purchase. And it always comes down to that – this is why in a free market system, home prices that gallop in front of what the economy can support, experience corrections. It’s a natural and healthy aspect of the market.

I am careful with those surveys. If you can point out any un-careful statements I made, let me know. At least it tells us that millennial attitudes are aligned with the rest of the generations in wanting to own a home, if/when they can afford it.

“I’m thinking more of bigger DIY projects where most people are likely better off getting it done and putting the energy into figuring out how to earn more, or into quality leisure time rather than banging around at something you aren’t qualified to do in an attempt to save money.”

Not sure I agree. Bigger projects aren’t necessarily more difficult, they just take more time.

For someone like me working a 9-5 job, “figuring out how to earn more” would mean changing careers, which I don’t really want to do because I mostly enjoy mine, or moonlighting which sounds like hell.

It makes much more sense for me to do my own work, learn from my mistakes, and pick up new skills which can be applied when we move to our next place.

Patrick- you have to be careful with all those surveys, studies, etc. stating what people think they will do with their money. In economics, studies asking people how much they would pay (for all sorts of things – a product, or to save an endangered species, green space, etc.) are never very good because people are either dishonest with the surveyors, or sometimes even with themselves. “Yes I would pay $1,000,000 to save the polar bears”, as soon as I get $1,000,000 in disposable income…

Much more realistic results come from looking at where people actually did spend their money – basic supply/demand market research, or looking at techniques like travel cost methods or the results of fundraising efforts.

So if 89% of millennials intend to buy a house, that’s interesting, but we already knew ownership was desirable. Putting their $ where their mouths are is a different matter for many.

Isn’t that two more years of waiting on top of the ten you’ve waited so far? When listing your occupation on your rental lease, do you write “waiter” ?

Right, but aren’t you also describing a build up of would-be buyers, shut out of the market, but still there waiting to buy in the future? That seems to be a bullish sign for the future, or at least limit the “loss of momentum” (drop in prices) that will take place. If those shut out signed a “buyers waiting list”, there’d be a long waiting list for buying a Victoria house. Likely the first name on it would be Hawk, with faded ink from 2008. And many names from this forum would also be on that list.

For example, in the US, 89% of millennial want to buy a house. The main thing stopping them is they can’t afford it, YET. They need to first pay off student loans, and build some equity. But still plan to buy.

We’ve heard here that millennials house buying interest might be lower than other generations, but studies like this show that “89% of millennial plan to purchase a home in the future” https://www.cnbc.com/2018/12/08/student-loan-burden-barring-millenials-from-home-ownership-study.html

Depends on what you mean by DIY too. I’ve done little things around the house like replacing plugs, light fixtures, switches, sealing cracks, painting, installing a garage door opener, demossing the roof, minor plumbing repair, tiling a backsplash, etc.

Those are all minor things that I’m happy doing myself after watching some youtube videos and the cost to get someone in is exorbitant for the time.

I’m thinking more of bigger DIY projects where most people are likely better off getting it done and putting the energy into figuring out how to earn more, or into quality leisure time rather than banging around at something you aren’t qualified to do in an attempt to save money.

So true.

Hawk knows a thing or two about losing money!

Since missing out on hundreds of g’s by selling at the precise wrong time, I’m certain Hawk’s relationship with the Mrs. has never been better.

You’re the last person who would know where the market top is.

Marko: I believe that they dropped it down to 1.75 after accepting my conditional offer which had a a bit of a window on it. but i am not sure if you are thinking of the same house. I have no idea of how long it was on the market but I am sure it was at least eleven months since it was one of the first five houses that i looked at in January of 2013.

I suspect that it has gone up, along with everything else, since I bought but I doubt that it is worth much more than 2.5 or pretty close to just under assessment. Rockland does not command the prices that the Uplands seems to command. the only way it might be worth more is if the buyer managed to demolish the house.

I will give you a call Marko whenever we are ready to move although we are unclear when that will be (my wife is going back and forth on it again).

My point is that I believe that I paid a fair price and that what is a fair price is not connected to whatever it was listed for. Nor is it a particularly good investment once we convert back to US dollars but it has been a real delight to live in and enjoy the house.

Which goes back to an earlier point that a house needs to be looked at for its value as a home and not just as an investment.

I see your point and agree that DIY is not always workable when it takes away from family time and adds to stress.

The thing is that your main profession might be m-f 9-5 and you aren’t able to earn additional income outside of these hours at your professional rate and if you have just purchased a home you don’t have extra at the end of the month to pay a lot for renos anyway. Plus you are paying for help with the home in after tax dollars – so add your marginal tax rate to the cost if you want to compare it to putting your own labour in.

I’m not too handy, but I’ve been able to do many of lower skilled aspects of DIY, plus the planning and organizing. When we were starting out and didn’t have a lot of extra income, it was worth it to buy a less than perfect home, learn many of the DIY skills, and spend the time on this.

I know you’ve written that you prefer Victoria but is it really so bad up island that you would give up what seems to be a nice house to move back to an apartment here?

Two lots around the corner from us in gordon head have been unsuccessfully marketed for quite a while, eventually down to $599k. Looks like they gave up and now developing it themselves.

Real estate is not an efficient market, so market value especially in slow times cannnot be exactly determined. You may have gotten a deal because no one knows exactly what market value really was on that property. In slow markets there may only be a single buyer and no competition at all. Combine that with motivated sellers and you can buy under market value.

That is why the definition of market value is not simply what a property sells for, but is quite complex and conditional if you ask appraisers.

“The most probable price (in terms of money) which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby: the buyer and seller are typically motivated; both parties are well informed or well advised, and acting in what they consider their best interests; a reasonable time is allowed for exposure in the open market”

An under appreciated aspect of DIY for sure.

For many people DIY is not the answer because their time is more valuable doing their main profession. What would you pay a tradesperson that doesn’t know what they’re doing? You are likely better off earning the money at a much higher rate in your job and having it done professionally. DIY only works if you enjoy it or are skilled at it already.

About 15% under ask and half that under assessment.

Similar for us. Could have just jumped in in 2010 or even 2008 if we stretched but I don’t regret waiting at all. Lower rates, somewhat lower prices, and much better market conditions when we bought.

The question of whether you will regret buying or not buying depends largely on what happens in the market. I always tell people to imagine the place dropping 10-15%. If visualizing that doesn’t cause them sleepless nights or undue stress then go ahead.

US is not stopping their rate hikes which will effect Canadian 5 year mortgages which effects new buyers and the stress testers. They are afraid to stop less the markets tank more and recession kicks in. If Canada has to halt rate hikes and can’t even handle a measly point then the economy is on the edge of the abyss.

Fed Still on Track for Interest Rate Hike After November Jobs Report

Investor bets on Friday put the probability of action above 70 percent, according to interest-rate futures. Failing to hike could alarm financial markets that policy makers are more worried about the economy than they’ve let on.

http://fortune.com/2018/12/08/fed-interest-rate-hike-2018/

That article is from 2012 – I think quite a bit of changes have or are occurring since then. Housing bubbles attract foreign money. The same thing happened in Vancouver in ~1914 when european hot money poured in on a proportionally larger scale than it did in the early 1980s or now, and it generally disappears once the bubble bursts.

The argument of “buy what you can afford” is fine, but the problem is the vast majority of the population in certain metro areas cannot afford to do so, or, can do it only with extreme indebtedness (kind of the same thing). This is why the market is losing its momentum…

So the high chance of buying at the top of the biggest bubble in history should be ignored with most economic/ global factors looking very shaky ? Not to mention a US government on the eve of the largest legal/criminal upheaval in history ?? Lest we forget the high chance a China tade war may impose massive tariffs on US/Canada creating major price increases on most everything we buy, except food.

Meanwhile Canadians hold historical debt levels far exceeding the US ? Interesting logic to say “buy your ass off” while most experts are pleading extreme caution. I’d choose waiting two years versus going bankrupt/underwater thanks.

Taxpayers also victims of ‘hot money’ behind Canada’s condo bubbles..

https://business.financialpost.com/diane-francis/taxpayers-also-victims-of-hot-money-behind-canadas-condo-bubbles?fbclid=IwAR0Cf0zAS5qfszFbFZ7Lag3tlD4N40LLMEWdfDTeka0lAKVyK2UJuRcMvA0

wonder how much of this articles applies to victoria

Marko, with all respect, I am not sure that the whole idea of getting money off the price is correct. My house was listed originally at 2.8 and ten months later after three price drops it was listed at 2.1 and they accepted my offer at 1.65. (back in 2013). I didn’t save anything or get a deal because I basically paid what its true market price was at the time. The list price was simply not connected to reality.

The $1.65 million Rockland sale in 2013 which seems to match the house you’ve described over the years on HHV was listed at $1.75 million.

Re unconditional offer these are my personal thoughts having attend 250+ inspections, 100+ drain tile inspections, etc.

Pretty rare that I am surprised by an inspection. If I think the house is crap or the house is solid usually the inspection finds the same 90%+ of the time. Oil tank aside pretty rare the inspection results exceed 50k or more in repairs beyond my initial expectations. The vast majority of the time it is below 10k of initial expectations. What I mean by initial expectations is if the roof looks like it should have been changed 5 yrs ago then I am already building that into the offer. If the home has a 60 amp panel and 2-prong outlets I am already factoring in electrical work.

If I feel the conditional offer will carry 25k worth of weight, for example, I will personally take the risk that there is a small chance that there is 25k of additional work beyond my initial expectations.

It is kind of like variable mortgages. If I commit to a lifetime of variable mortgages I will lose out on 5 terms but I will be ahead on the other 50 terms.

As I said not something I would suggest to the average buyer.

Just thinking…we saw house, after house with issues that we could see ourselves. Renovations in which support walls had been taken out, mouldy smells indicating water damage, stains inside the house from leaking roofs, spongy backyards, dry rot around the window frames, biker neighbours playing their stereo for the open house to give a sample (at least they were up-front). All of these houses eventually sold. Do people not notice these things, or do they just not care as long as the house actually doesn’t fall down?

@Barrister

That’s actually much less than I thought, even assuming it’s higher now. In 2016 we paid $500 for a general home inspector and $225 for a drain scope, and neither of them were particularly useful. The drain guy was trying to drum up business. Even though the drains were clear and functioning (I guess that was good to know), he said they were old and could go at any time, especially if we get an earthquake. (: The estimate he gave us was also super high.

That real estate agent who said you were ridiculous was just bitter that you weren’t a sucker, and she couldn’t get paid her commission as soon. Houses sliding down hillsides or cliffs is not unheard of here. Here are some examples of the houses we saw within a few months when we were looking:

1) Cordova Bay on a sloped lot: one window had a 1″ gap at the top because that part of the house had sunk (i.e. the window would not close fully).

2) Also in Cordova Bay: backyard crumbling into a ravine (trees could be seen to have recently fallen so actively sliding).

3) Broadmead with an architectural design in which a small part of the house overhung the lower level and was supported by posts. The support for the posts had slid down the hill, and there was a dip in that part of the floor. The owners had stabilized the post, but left the floor sloping (probably because full repair would have been expensive).

Yes, that’s what I’m saying, because that’s the worst outcome you can think of, and that possible “worst case” applies in everything in life.

Would it be a good idea to get married and have kids, if both you and your wife then get sick, lose your jobs and go bankrupt?

In life you are “up to bat”, and just once. You can’t just look at every pitch, hoping you’ll get a walk. If you want to get anywhere, you’ve got to swing-for-the-fences. At least that’s my philosophy.

Sweet Home this was about five years ago, drain scope will do the perimeter drains today for about 200, the engineer was the most expensive at 400; the electrician was another two hundred and the plumber was about 135. The furnace guy ran about 65; the roofer was free with an estimate to do the roof. All told a bit over a thousand. The chimney specialist (four chimneys was about 90. Also had an oil tank sweep.

One listing agent actually told me I was ridiculous to my face. I had the joy of presenting her the engineering report with an estimate of anywhere between 800,000k to 1.9 million to fix the foundation (house was four stories, a hundred years old and 9000 square feet perched on a crumbling cliff. I also reminded her that she had the duty to disclose to any future buyer (doubt if she did). Better ridiculous than stupid.

So it’s a good idea to lose money , have an underwater mortgage where you can’t refinance and then go bankrupt. Solid advice for young families starting out.

I’ve never said don’t buy if you can stomach a ten year down turn and have lots of equity you don’t mind losing. Most relationships don’t weather that storm.

2 out 3 millennials has buyer regret. Wait til prices really start to drop. The lawyers are waiting with baited breath.

I just think the condos are irrational compared to even what oceanfront or view SFHs are in Victoria. I guess the lock-and-leave aspect is appealing to people who are only going to be here part-time. Still, I would rather buy a house for $5M and pay a caretaker. Of course, there is the security aspect one has to consider. Gee, once one starts thinking like the ultra-rich, maybe it’s not so irrational. Assuming the fact that there are people whose condo fees are more than many people can afford for their entire month’s rent is not crazy in the first place.

It would be called a market that appeals to ultra-high net worth individuals (net worth more than $40m CAD).

Canada has over 10,000 of such people and a few hundred are in Victoria.

Canada is # 5 country in the world for numbers of such people. Canada has more than U.K., France, Italy, Switzerland or HongKong.

https://www.cbc.ca/news/business/canada-wealth-high-net-worthy-1.4814907

The “irrational valuation” is you thinking you know how the RE market works, and valuating high-end properties like that based on the average family income in Victoria.

I wonder what kind of market phenomenon that would be called, where prices are completely divorced from any real sense of rational valuation? 🙂

Just doing my survey of $2M+ properties for when I win the LottoMax on Friday.

I found two condos that do make me wonder about what kind of world creates people with enough money and the circumstances where a purchase like this would make sense. One in Shoal Point for $8.9M and one in the Promontory for $6.8M. Do they realize this is just a slice in the sky? I wonder if there will be any takers at these prices?

https://www.realtor.ca/real-estate/20114657/2-bedroom-condo-1201-21-dallas-rd-victoria-james-bay

https://www.realtor.ca/real-estate/19393198/3-bedroom-condo-2002-83-saghalie-rd-victoria-songhees

@Barrister

Was it easy to find an engineer, electrician, etc. to do inspections for you? I imagine they don’t get called that often for residential sales. Also, can you give a ballpark of how much the cost was? When you consider the cost as a proportion of what you are buying, or even a proportion of a potential $100K+ undetected remediation cost, it’s probably not that bad.

My RE is paid-off long ago, and I have no plans to sell.

FYI, My hopes/prayers have never involved interest rates, housing prices or anything financial.

I do encourage renters, with a family and long-term plans to stay in Victoria, to buy what they can afford now, and not wait for the “perfect time.” Owning a family home is different than owning an ETF or a TFSA. It’s s good idea to own a family home even if you lose money on it, and if you believe that, you can buy without fear.

That is a good question. It is right across from a decent park, 2 blocks from the corner of Mt. Tolmie, 2 blocks from shopping, and 3 blocks from UVic. Maybe the location has something to do with it?

That Kisber house is a nightmare. Obviously a tear down. 575,000 for a lot?

Looks like we will be selling in Qualicum and moving back as renters to Victoria. Anyone want a lovely rancher, completely updated, mountain view, and on a beautiful .4 acre lot for much less than that property?

When we do sell I will back in a terrified state looking for a nice rental apartment, professionally managed , concrete building in Oak Bay, Fairfield,or Cooks St village.

We aren’t listing until late February.

Wow, what a wreck! The washing machine in the kitchen is a nice touch. And the one photo of just a blackberry bush. Nothing says care and pride of ownership like an overgrown invasive species in your back yard. I’m surprised the realtor didn’t include a photo of a happy rat.

Hawk, is this place in your price range?

Is there a website yet that displays sold prices and cuts for Victoria prices?

Think Leo linked Zealty (Vancouver Only) and it works great.

True, if those numbers are realistic. But it was specifically the “good insurance in the event of a downturn” that I didn’t understand. Why in the event of a downturn would I want to further leverage myself into my house?

Hawk, painting with such a wide brush makes you very few friends.

Says the pumper in the 70’s dump in need of $100K in renos and worth $100K under assessment, with a stranger in his basement.

Better not jack up the rent for the first time in 10 years, could be hazardous to your health.

https://www.nydailynews.com/news/crime/tenant-accused-killing-landlord-30-rent-increase-article-1.3863199

Patrick,

ICYMI, what happens to the rates over a few days does not dictate the future when it comes to rates. Many times charts move up and down along the way. We are in volatile times where big moves are made over a few days to a few weeks. Poloz just said rates will have to go up still if the numbers keep coming in strong like they did yesterday. Don’t believe him ? Then why aren’t you buying another house or two ?

You best pray they go up to show the economy is doing well or the next recession will be a very nasty one where low rates won’t save anyone especially when credit will be tightened multiples of today and they don’t have a job.

Once,

What’s comedy gold is you pumpers with their heads in the sand. Alex the Californian was just saying Canadians learned nothing from the US housing crash, and now the US housing is beginning to crack at much lower debt levels goes to show how so many of you are clueless what’s to come.

http://www.macleans.ca/wp-content/uploads/2014/03/debt_income_canusa.png

“They surged 20 percent from a year earlier in British Columbia”

BC the highest in Canada. So we have mortgage growth at 1982 levels when there was much lower population and transactions ? Wow, sounds like a blood bath coming.

Consumer Insolvencies increase by 20% in British Columbia, Mortgage Growth Drops to 1982 Levels

“Still recent declines in residential investment and car sales suggest the higher borrowing costs are already having an impact, with the bulk of the effect still to come.”

https://www.bloomberg.com/news/articles/2018-12-07/consumer-insolvencies-climb-9-in-canada-amid-higher-rates

Marko, with all respect, I am not sure that the whole idea of getting money off the price is correct. My house was listed originally at 2.8 and ten months later after three price drops it was listed at 2.1 and they accepted my offer at 1.65. (back in 2013). I didn’t save anything or get a deal because I basically paid what its true market price was at the time. The list price was simply not connected to reality.

I strongly recommend that multiple inspections be carried out on any older house. I had two accepted offers prior to this house where both houses failed the inspection of their foundations by the engineer that i had hired. In addition one of the houses had major electrical issues according to the electrician and also the inspection of the perimeter drains was a disaster in the making. I walked away from both deals, I am sure that I pissed off more than one real estate agent.

Personally, i dont believe that i was being anything but prudent. The house I bought had a number of minor issues which is what one expects with an old house nor did i try to renegotiate because of these minor repairs. Hundred year old house are not perfect. But i had a clear picture of what was required and managed to get things fixed within a year.

The money I spent on the earlier inspection was money truly well spent. I also question whether most “home inspectors ” would have caught the major foundation problems clearly identified by the engineer.

For example, this is not your average fixer upper. 🙂

https://uplist.ca/h/BobbySparrow-1734-Kisber-Ave

It is a pending sale at what looks like $575K, which doesn’t seem bad for lot value. I assume the house will be torn down.

I understand why this could work for Marko, but I would be wary of making an unconditional offer. Someone has to check the roof, attic, etc. If you can’t do it yourself, then try to find the best person to do it for you. Home inspection can be a joke, and some problems are harder to detect, but going in without at least trying to get a measure of the condition of the house could lead to huge regrets. Over the years we were able to spot many things ourselves at open houses, and I often wonder who bought those houses and if they were inspected.

Also a caution about a fixer-upper. I think, in general, people who let the inside of their house deteriorate also let the exterior of their house deteriorate. It is important to determine the difference between cosmetics and deferred maintenance. Once it deteriorates to the point of water damage, for example, it becomes more than most people should handle.

I think a good strategy for getting a “deal” is to wait until a price drop and then go for it.

For example, if a house is listed for $650,000 having the seller accepted $570,000 the odds are slim; however, if they drop to $599,900 and then you come in at $570,000 psychologically has a much better chance with the seller.

What drives me nuts all the time is everyone references the amount they got off the original asking price, not the last asking price….for example, someone will say “we got $150,000 off our house,” but really it was listed at $1 million. Three price drops later it came down it $875,000 and the person picked it up for $850,000. Really you got $25,000 off, not $150,000 but everyone is trying to convey that they got a “deal” to family and friends.

Also, the last six buyer deals I’ve been involved in on five occasions we’ve been able to re-negotiate the price after inspection/due diligence. Nothing major, from $2,500 to $7,000 but none the less better than nothing. Not sure if there was a single buyer deal in 2016 where we were able to re-negotiate.

In terms of fixer uppers being a buyer, personally, I would scan for an oil tank, check and title, and then hit the seller with a low ball unconditional offer. When the market is slow and if the seller is motivated an unconditional offer can do wonders. Reason being if they sign it as is it is a done deal, if they counter they can’t go back to the original offer to accept without the buyer accepting too so you can catch a seller that is just too nervous to counter. Would not suggest this strategy to my clients, but it is what I would personally do.

That all being said not sure if I buy the advice of buy a fixer upper and learn how to do things yourself. I just changed my rims to my winter set and instead of paying $40 I decided to jack up the car in my garage and sure enough I stripped one bolt head and cost me $200 to repair 🙂 Even really simple things are no so simple sometimes when you don’t do it for a living.

Notwithstanding the generally valid advice about too much debt, this post is just comedy gold. I read it in this voice:

“Hello miserable forum persons! I am a person from [fancy far away place] and I have family in [your dumpy local city]. You know nothing about your local housing market! I am wealthy and good looking so you should listen to me and go to [random website] to learn real knowledge. Good luck with your miserable lives!”

LeoS with an awesome Fermat reference! Serious math street-cred there. (Wait, well… just imagine that such a thing exists).

So stop wasting your life.

Hawk lives in run-down rental building in the Gorge.

Well no, Canadian bond yields fell today for both

– 5 year bond (-0.01) https://tradingeconomics.com/gcan5y:ind

– and 10 year (-0.02) today https://www.bloomberg.com/quote/GCAN10YR:IND

Moreover, Canadian 5-year bond yields have been in free fall since Nov11,2018 from 2.45% to 2.01% today. You breathlessly reported every tick up, but of-course fell silent during this fall.

Anyway, the bond market and BOC is telling you that rates aren’t going to rise soon, but you know better. Good luck with the “waiting”… I’m sure you’re used to that.

That’s funny Patrick, Leo just posted this the other day. Rates will go up as jobs keep going up like they did today. No need to get reality in the way of a good BS story eh?

There’s no life like it ! 😉

LF,

I’m much too nice a guy for that career. Living in regret over a house in Victoria is a total waste of life. That’s a fact.

“I see the arrogant pumpers are out of control spreading fear mongering stories of regret. Its 4 walls and a roof with a temporary value. If you base your success in life on that you are of very shallow character.”

Hahahaha, coming from the guy who brags about beating the stock market and renting a penthouse in Oak Bay.

Josh,

What I mean is you are in better shape spending $500k on a house and $25000 in renovations that you do yourself, than paying $600k for the same house that somebody else renovated.

Fair enough if you don’t have the time or cash to do it.

I either don’t get what you’re saying or don’t agree. If I bought a fixer-upper now, I would:

1. Not enjoy the place I’m living in

2. Not have the time to do the work required

3. Not have the cash to do the work required, because I just bought

4. Drive my wife insane with even more unfinished projects

In the event of a downturn, I’m not going to think “well thank goodness I have granite countertops even if I don’t have a job”. I would instead wish like hell that I had the cash to weather the downturn.

Is hope of rising interest rates your best hope? My goodness, you’re hanging by a thread.

The BOC would have been aware 2 days ago of the jobs report to be released to the public today. And it was only 2 days ago when the BOC made a deliberate statement to let the markets and public know that the brakes are being applied to rate increases.

I think everyone got the message but you. This is confirmed by the markets, as the CAD still down at 0.750, almost 1% lower than where the CAD was (0.756) before the BOC announcement. https://finance.yahoo.com/quote/cadusd=x?ltr=1

Mayfair’s post was not out of control or arrogant. It’s decent advice to live by, I’d think. Doesn’t mean it works for everyone at every given moment, obviously.

I kind of wonder if you’re a debt collector by profession. You seem like the type. “You owe my client money. Pay up now or I’ll beat you with a stick and hang you by your toes from my penthouse balcony.” 😛

https://www.thesun.co.uk/archives/news/851270/britains-scariest-debt-collector/

Grant,

If rates don’t go way up then the recession will hit faster and harder than you could imagine with a debt bomb of historical proportions. Save your hundred bucks, you’ll need it it more than me.

Mayfair Man

I wouldn’t buy a house expecting to earn more in the future – illness, divorce, job loss etc can all hit in 5 years time. Rather, if you choose to buy a home, buy a house you can comfortably afford at the income you make now, and even better if it has a suite so you can hold onto it if something goes sideways.

I see the arrogant pumpers are out of control spreading fear mongering stories of regret. Its 4 walls and a roof with a temporary value. If you base your success in life on that you are of very shallow character.

This shit show is just getting started. Silicon Valley is finally getting it. Imagine a tech meltdown in Victoria. It will be ugly. Don’t be a “regretter”, and grow a pair.

BTW did you see the markets the last few days ? Trump is going to blow the whole thing up before all is said and done.

3 charts suggest housing ‘bubble trouble’ with a tech meltdown ‘yet to come’

“It’s high time to unload houses and condos in Silicon Valley and San Francisco,” Richter wrote. “Sellers are now flooding the market with properties.”

https://www.marketwatch.com/story/3-charts-that-suggest-bubble-trouble-in-housing-with-a-tech-meltdown-yet-to-come-2018-12-04

Great advice, and great post! How many people have become successful in life by waiting?

Mayfair man, my story is similar. I started looking in 2013 for a fixer-upper and waited and waited because I thought for sure the market was headed for a long overdue correction. Ended up missing out on some great deals (852 Reed St comes to mind).

Went to an open house in early 2015 that was absolutely packed, thought “oh shit haven’t seen this before”, and decided to put an offer on the place. Got outbid. The fomo kicked in after that and the lady and I bought the next decent place that we could reasonably afford. That was April 2015.

I regretted it at the time because I thought we overpaid.

My advice to someone on the fence about buying in this market is to look for a fixer upper and learn how to do your own work. It’s not a lot of fun, but you get to convert your labour to equity which is good insurance in a downturn.

Are we allowed to know how much below in terms of percent?

Lovin’ that Kierkegaard has made onto HHV. Nice touch, Local Fool.

Coming from 2008 and starting to look at homes to buy in 2010.

2012 is when we bought the house.

I thought the market would go down or plateau for years to come.

….Boy Was I Wrong!

Mayfair

Great post.

Mayfair Man,

Let me rely on others’ wisdom to reduce your post to a single sentence.

“Life can only be understood backwards; but it must be lived forwards.” – Soren Kierkegaard

In life the time to do something will never “be right.” There will always be reasons not to: ask that girl out, apply for that job, take that course, buy a house, have kids and the list goes on. But to do them it requires a little faith in your own ability and the that that future will be better then it is today. Every long term bear has been dead wrong and anyone who proclaims they can “predict” the short term is a fool. When we were going to buy our house I made the mistake of listening to negative people(who proclaimed they knew everything) and I waited and waited, I was blessed with an amazing wife that forced us to buy in 2013(when I felt stupid for doing so because I thought the top had hit and things were going to crash). Buying a house is scary, but so is doing anything worthwhile in life. My advice: if your want to own a house someday, take a leap of faith in yourself(you will get promoted and make more in 5 years then you do today) and the future. Buy a house that you can afford and stop listening to negative people(they will never say we have reached the bottom and it’s time to buy).

Agreed. Well if you wanted to argue that Toronto could go a different way than Vancouver, you could comment on the comparative diversity of the economy and its relative wealth. Vancouver just doesn’t have that in absolute or proportional terms. Assuming equal overvaluation in both areas, I’d say Toronto would have more intrinsic support underpinning, especially in the metro core.

Now having said this, that city is subject to the same macro factors Vancouver is and in fact, has a more established (almost symmetrical) boom bust pattern going back many decades. I don’t think I’ve seen a case where one city had a substantial correction and the other didn’t have something within a year or two. I could be wrong on this last point, but I’m too lazy to look it up.

Decent article out of Squamish. Considering that Squamish took off after Van and before Vic, I think it’s worth paying attention.

https://www.squamishchief.com/real-estate/reality-check-in-squamish-real-estate-1.23522243?fbclid=IwAR2rT8HDHGOgPvQFY73FjeRFPlRdhI_oJRDVJP-tvDFAXBW_iXaNXWJgJpA

I have a truly marvellously accurate prediction of house prices which this comment form is too narrow to contain.

Hard to tell. Toronto dived hard after their rule changes in 2017 but has been stable since then. Also huge difference in market conditions between the two right now.

http://www.chpc.biz/uploads/9/7/9/5/9795010/chart-compare-vancouver-toronto_27_orig.jpg

Home assessments rising 5% to 10% in Greater Victoria

https://www.timescolonist.com/real-estate/home-assessments-rising-5-to-10-in-greater-victoria-1.23522011

500 affordable homes for Langford and Sooke

https://www.timescolonist.com/news/local/500-affordable-homes-for-langford-and-sooke-1.23522017

Affordable housing prescribed for Fairfield bout of ‘affluenza’

Isitt noted that the Aragon proposal calls for significant densification in a neighbourhood that’s afflicted with “a distinct case of affluenza.”

“I think a healthy remedy to that condition would be a property that was entirely purpose built de-commodified housing. I think that would be an amazing addition to the neighbourhood, to have a non-market building,” Isitt said.

But Helps said telling Aragon to come back with an all-rental proposal at this point would not be good governance.

https://www.timescolonist.com/news/local/affordable-housing-prescribed-for-fairfield-bout-of-affluenza-1.23522013

From three days ago:

North American markets plummet on sign of potential recession ahead

North American markets plummeted Tuesday as a bond market move signalled a potential recession ahead, prompting declines in the key industrials, energy and financial sectors.

Historically, an inversion of those notes typically occurs six to 12 months ahead of a recession.

“So this partial inversion doesn’t necessarily mean that the clock has begun ticking as of yet,” he said in an interview. “It’s a potential signal for what could come.”

https://business.financialpost.com/pmn/business-pmn/energy-financials-and-industrials-weigh-on-tsx-u-s-stocks-also-lower

You also have too much ego to write a decent comment.

LeoS,

Number details please?

This post inspired by a friend that recently got an accepted offer well below ask because of a highly motivated seller.

@Hawk

Hawk, let’s put our money where our mouths are. I’ll bet $100 that in 2019 rates will not be “goin way up.” In Canada, at the end of 2019 I wager the BoC’s overnight rate will be at 2.25% or below. If it’s higher than that, you win. If Leo agrees he can be the arbiter and hold our money in trust. You’re always so cocksure Hawk, so this should be easy money for you, right?

BTW, one your most helpful posts to date, Leo. Well done.

It’s almost as if circumstances and conditions vary from city to city across Canada.

My take on gym hygiene etiquette is that, if you’re sweating, post-use machine disinfection is mandatory. Otherwise, it’s optional.

Thanks, random desperate renter from California, for pointing me to some random desperate renter in Arizona who runs a bubble blog and is soliciting donations from PayPal, but I think I’ll pass on that “education.”

If this is one of your top recommended sources of information, no wonder you’re not winning.

RE Toronto, doubt it. So far it looks more like they’re trailing Vancouver’s path. Mortgage growth rates nationally have been slipping fast, along with auto sales. At the moment, that trajectory continues unabated. If it turns around then I would say that strengthens the case for stabilization but until then I’m pretty skeptical. Their prices are still too high, although not as skewed as Vancouver.

I also maintain that the “growth” in Montreal is probably that city entering its final run up, if you could call it that. We know from previous Canadian examples and the more recent American example that different cities enter their peaks and valleys at broadly similar, but still slightly different times (give or take a year or two). The credit rollover is national, in fact, it’s international.

In case someone missed it:

Alex#53014

Wow. This thread. I’m a Californian with family in Victoria that we visit regularly. The mania up there is ridiculous. Of course you didnt have a correction, BOC followed the Fed to zero. You guys have low down loans all over the place courtesy of your government, which you all put waaaaay too much faith in. You learned nothing from our mistakes and even doubled down on them. I have too much money to make to enlighten any of you with reality, but there is good data from the housing skeptics in this board. For any other lurking critical thinkers here, you can further educate yourselves at housingbubble.blog, where Mr. Jones has been reporting on this everything bubble since 2006. You should absolutely be looking at this as a global bubble, fast deflating. For more broad-based education, Wolf Richter at wolfstreet.com will help you understand what’s going down. I hope all of you have little to no debt because this next downturn is going to RIP off faces. Good luck and godspeed.

Hello all,

Looking for a name. I am being renovicted out of my office downtown and I am looking for someone to provide legal advice. Any suggestions?

Your comment reminds me of this one time when I was at the gym, and finishing up with a machine – I took the cleaning spray and wiped it off, as per standard practice.

An older guy came up to me and said, “It’s nice to see someone from your generation actually taking the time to clean up after themselves.”

Kind of stared at him in silence for a sec. Um, thanks?

Unless they back off for too long and miss the dip. It’s like any peer pressure. If you are a bear you abandon your people and buy you are a sell out. Waiting for the crash is simply a life style choice.

Canada rates are goin way up after that jobs report. US rates will be up several more as well. Look for more house listings to be well below assessment with the new increase. Sales/slashes don’t justify it. Smells like a pure tax grab to me that will come back to haunt.

As per buyers in the wings, there always is, always was until they see prices drop then the smart back off and let the desperate catch the falling knife.

Debt levels will be THE story of 2019. Developers cutting back means only one thing…. way lower prices.

Great post Leo!

Another gem posting. Thanks Leo for your insight