Dec 10 Market Update

Weekly sales numbers courtesy of the VREB.

| December 2018 |

Dec

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 129 | 462 | |||

| New Listings | 158 | 441 | |||

| Active Listings | 2211 | 1384 | |||

| Sales to New Listings | 82% | 105% | |||

| Sales Projection | 415 | ||||

| Months of Inventory | 3.0 | ||||

So far we’re starting the month off down some 10% on sales. We have a third more inventory on the market, and while we always shed hundreds of listings in December, if we strip out commercial listings we will likely end the year with some 50% more residential properties on the market than a year ago. That’s an impressive gain but we are coming up from under 1000 active residential listings while 5 years ago we had 3000. The projected 1500 we’ll have in 3 weeks is still only halfway there.

For single family properties, there are fewer over asking sales, and properties are sitting on the market on average 6 weeks before finding a buyer. Those numbers aren’t that unusual for this time of year, it’s mostly the comparison to last year’s active December that accounts for the difference. December is the only month where we regularly see more sales than new listings because it just doesn’t make much sense to list when people are in holiday mode. That means the listings that do come are often from more motivated buyers, so it is worth taking a close look if something interesting does come up.

Much has been made about the dearth of new listings coming on the market, but it seems that problem may not really exist, at least not on the single family side. If we look at the rate of new listings, there was definitely a dearth in the spring, but since then we’ve seen new listings come online at roughly the average rate for the rest of the year. If we see a normal rate of new listings this coming spring we should continue to see inventory build up at a healthy clip even if sales recover a bit from this year.

A friend of mine and his neighbor are considering putting their properties up for sale to the local Victoria development community (the land has been re-designated to 6 stories). Anyone have a great real estate lawyer referral? Looking for someone with lots of experience who could lead negotiations, etc.

How could anyone be bullish on our RE market after carefully studying Beancountet’s graph of Real House Price Index for Canada? That’s the most powerful graph I’ve seen posted on this blog in years. It clearly shows how detached from fundamentals our current RE is now and how the normal cycle dip didn’t materialize at the time when laundered money was being pumped into RE and when wealthy foreigners and speculators were treating RE as an investment commodity.

Australia went through the same pattern as Canada and now Australia’s RE market is on the verge of collapse.

https://www.news.com.au/finance/economy/australian-economy/oecd-warns-australia-to-prepare-contingency-plans-for-a-severe-collapse-in-the-housing-market/news-story/19d35f6461b01ae456162a3208277c50

https://www.dailymail.co.uk/news/article-6486407/Why-Sydney-Melbournes-worst-housing-market-crash-record-no-reason-panic-just-yet.html

New post: https://househuntvictoria.ca/2018/12/13/de-seasonalized-months-of-inventory

I’m already slightly bearish for the short to medium term. My base case would be some sort of decline unfolding over the next two years. I actually agree with a good bit of what you write. Bottom line is that a number of factors that helped drive prices up now seem to be moving in the opposite direction.

Long term I am bullish so I don’t think someone is crazy to buy in Vic now if they have the means to do so without stretching too much and have stable family and employment situations.

There are no guarantees in life, so it it is possible that someone waiting on the sidelines for better prices could get burned by prices started to rise again. But to me the balance of probabilities suggest that waiting 6-12 months will get you at minimum better selection and likely slightly better price.

Funny, I saw that too. He’s coming over; you’re next CE. 😀

Oh oh. The end is indeed nigh if even gwac is turning doomer.

that is the problem with democracy .. you get stupid politicians because you have stupid voters …. it is like giving preschool kids voting rights to education.. ice cream and naps to keep every one happy .. eventually the system kills itself ..

Andy7

The NDP cannot keep taxing and offering more spending regardless of future benefit. If BC economy goes south. taxes will fall quickly and spending will go up and the imbalnce will multiply very quickly. The NDP is doing what the typical Canadian is doing. Not a pretty ending.

On a side note, an interesting watch is Poverty Inc.

https://vimeo.com/109863354

Ok, done with my posting 🙂

@ Gwac

You’re simplifying it too much. You have to look at the costs and benefits for each issue. If it’s a net gain then I’m all for it. If giving people basic dental is going to bring down overall costs from dental emergencies etc and improve the general health of people, I’m all for it. As for free daycare, I don’t know enough about the economics on this, but Sweden does a $300 daycare fee a month I believe – I would imagine that if daycare was cheaper, more women would go back to work, at least part time, and more tax revenue would go into the economy.

@ Leo S

Yep, completely agree. Saw a solid and pretty house torn down to build a total monstrosity that’s now being listed for over $10M. That house that used to house a family is now most likely going to be home to an empty home. Total bs.

Yep why stop there. Free drugs for everyone. Free daycare. Free free. There is an arguement and consequence to not offering each one. Left leaning don’t get is that someone has to pay for it and usually it’s not them that want to pay for it. The tax dollars eventually run out.

Re: whoever posted this one…

Yes, but it’s Nanaimo – Nanaimo has high crime rates – talk to anyone who’s lived there for a while. I’d pick Parksville/Qualicum over Nanaimo any day. It’s the same thing in Courtenay, you have to be careful where you buy.

@ Leo S

Why not build pre-fab?

@ gwac

You do realize the connection between dental health and overall health right? And that when people don’t get proper dental care, they often end up in the emergency and it costs significantly more.

Any updates on sale price vs. assessed value, Leo? I’m seeing many homes in my search range selling under assessed value in the last couple of weeks.

I guess the one thing I’m missing is the desirability of where the property is. I’m still struggling to see a $2500 rent. $2200 yes but $2500 would be harder and with turnover in tenants, it could easily sit vacant for a month or two looking for the next tenant. Staying reasonable will keep it fully rented. One month not rented at $2500 would mean $208 less per month on an annual basis.

I am more familiar with rentals in Broadmead/Cordova Bay / upper Quadra / Royal Oak / etc areas. I watched a couple start out high recently and had to keep dropping as the months empty increased. These are much nicer properties and larger (2200+ sq ft house) and I’m not sure where the rent ended but I’d say pretty darned close to $2500 on at least 2 of them.

EXTRA NOTE: Just went through a list of properties I’m casually watching on the rental market. OK so I have no clue – some high, some low, all over the place for rental rates.

Mix-and-match on those. I’ve seen where tenant pays all utilities & others where tenant pays electric/gas/oil but not water & garbage pickup.

Once and Future:

I truly say this with kindness but you are getting what you voted for in the last election.

Eisenhower got it wrong it is not the military- industrial complex that you have to worry about but rather the bureaucratic- corporate complex that is the real threat. The big developers are salivating over the idea of millions into public housing.

For full house rentals, tenants typically pay all utilities.

Once

Free dental is the next problem Horgan is looking at. Spending is never going to end. When we hit a recession boy its going to hit hard on BCs finances,

https://globalnews.ca/news/4757534/john-horgan-dental-coverage-health-system/

yep or any lost rent. Only other thing is the heat and electricity looked like oil. Who pays those. That is a 200 to 400 dollar bill a month.

Ok so when you factor in these then he is essentially cashflow neutral prior to any maintenance items.

There is a political problem we have here in left-leaning land. For full disclosure, I lean to the left and voted Green in the last election. HOWEVER…

The urge to “fix” every problem through heavier regulation and taxation is pernicious. We are turning into a culture of cowards. The rhetoric about property transparency laws being driven by the 100 most expensive houses in Vancouver makes me very angry. Why should every single land owner in the province be subject to unnecessary loss of privacy, just to catch a few dozen money launderers?

Sometimes, to protect the rights of the citizens, a few “bad people” get away. That is just the world. We try hard, but it is not worth destroying privacy and personal rights to catch every last “bad person.”

Now we are going to remove the rights of every strata in the province to regulate rentals, just because the government has neglected building affordable housing for the last 20 years.

The NDP is going to remove all incentive for individuals to own rentals, just to catch a few bad landlords.

We freak out about terrorism, while 2800 people die every year in Canada in car accidents.

COWARDS!

about that ya.

tax $3000

Insurance $1400

Water $1500

Den 13×7

I woudn’t count it.

KS house was 502K 10k in closing so call it 512k . So best case is 2.25 that is a 385k mortgage for 1700. the other 130k must have been cash….

WTF. This just pisses me off. I can disagree with some of the NDP/Green policies and still think they are better than the Liberals, but it is getting harder and harder.

Yes the record is 2 bedroom however it also states that the finished square footage is 1330 sq feet, so I supposed you can at least call the den in the basement a bedroom when renting it out? Also the home was bought in October of 2016 and he used variable rate, so it could be possible that he put down less than $130k to arrive at the 1700 mortgage?

For the google challenged and your viewing pleasure:

file:///C:/Users/damonlanglois/Downloads/Elliston_Av_3670_V1.pdf

http://www.victoriahomesforsale.com/property-details/369388

$2200 seems right due to the size and yard etc. Maybe $2500 because it’s hard to find a house for rent that has this amount of space. Looks livable just not stylish.

4?

More like 2

http://webcache.googleusercontent.com/search?q=cache:sHFlYQ2JH1wJ:www.victoriahomesforsale.com/property-details/369388+&cd=3&hl=en&ct=clnk&gl=ca&client=firefox-b

The listing record 2 bedrooms. His down payment to get to 1700 mortgage is atleast 130k. Numbers and listing do not lie. Marko can tell what the value is but it is not much more than lot value. Maybe he spent some $ on the unfinished basement and added 2 bedrooms. Without any maintenance it is a breakeven at 2200 at best.

Sold: 2016-10

Charming older home on private sunny lot in Quadra area. Origally built in 1915, this home was moved in 1969 to it’s current location and placed on a new foundation/basement. Yes, the home needs updating but it is very livable as is – tenants have loved and cared for this home since 1970! This could be an great opportunity for a first time buyer or an investor looking for a great rental or holding property. Close to all amenities including Uptown Shopping Center and Mayfair Mall. Floor Plans Available

Real Estate Type:

Single Family Detached

Layout:

Main Level Entry with Lower Level(s)

Bedroom(s):

2

Bathroom(s):

2

Finished Sq. Ft.:

1336

Unfinished Sq. Ft.:

450

Taxes:

$2,680.00 (2016)

Year Built:

1915

Elementary School:

61 Lake Hill

Junior School:

61 Cedar Hill

Senior School:

61 Reynolds

Interior Details

Main Level:

Level 2

Fireplace(s):

Bedroom(s):

2

Bathroom(s):

2

Basement Height:

7 ft – 2 in

Basement Description:

Finished – Partially,Full

Interior Features:

Appliances Included:

F/S/W/D

Building Details

Building Style:

West Coast

Building Warranty:

0

Accessibility:

Materials:

Frame Wood 2×4

Exterior Finish:

Stucco,Wood

Foundation:

Concrete Poured

Roof:

Asphalt Shingle

Heat/Air:

Forced Air

Fuel:

Oil,Wood

Leased Equip:

Exterior Features:

Fenced Yard/Part,Storage Shed

Faces:

E (front) – W (rear)

Lot Information

SqFt:

6240

Acres:

0.14

Frontage:

52

Depth:

120

Lot Shape:

Rect.

Water:

City/Munic.

Waste:

Sewer

Zoning:

Residential

Parking Spaces:

Attached

Driveway:

Blacktop

Parking Type:

Driveway,Garage Single

I know BC assessment says it is 2 bed but he claims it is actually a 4 bedroom house. Basically he is saying that all he did was put a down payment down and the house will pay itself off with rental income (I haven’t been in the house so I have no idea what the market rent for the place is). So that along with property appreciation makes it a good investment.

What do you guys think that house will go for if it was for sale today?

Leo, I happened to see you crossing Tyndall on bike the other morning, which got me wondering.

Renter check out the photos on google image to help with the 2500 probability.

House is listed on BC assessment as a 2 bed / 1 bath. Even if he squeezed in another bedroom, I doubt the $2500 number given property, location. Now if he allows pets – then you can generally garner a bit more but that $2500 seems a bit iffy to me. I’ve been known to be wrong though but just based on what I’ve seen on the rental market, I’m skeptical.

ks

taxes including garbage 3k /insurance 1k and water/sewer 1k. Other upkeep. Place is older it probably has ongoing issues. Utilities???? IMO including upkeep that would be 600 or 700 or 7 to 8k. More if he pays electricity.

Insurance, tax and water is $500 a month?

On the investment properties, I agree that it’s hard to make the numbers work for a decent return.

To me, baseline return is a REIT stock like XRE which returns 4.65% dividend from a composite of REITS.

Now that dividend is taxed favourably and about equivalent to 6% income fully taxed. And of course a REIT is hands-off, just like a stock. (No tenant hassles).

Of course there are scenarios where investment properties would beat that REIT handily. It just raises the bar for considering investment properties.

No, I was talking about being happy if prices fall after you buy, showing that the walking/talking affordability agenda you are voting for is working.

1700 mortgage and 2200 rent still not making money after taxes/insurance/water/other upkeep costs.

350k mortgage at 3% for 25 years is about 1700 dollars. So he must have put up 150k. So basically getting 0 return on that 150k except for potential capital gains.

370k mortgage at 2.75% or 130k down

another 10k in closing also

It was bought for $500,900. You can try out scenarios on a mortgage calculator. Picture below.

https://www.bcassessment.ca/Property/Info/QTAwMDBIUE1DMg==

I’m going to continue voting in people that talk and walk the affordability agenda if that’s what you mean. You can afford to not be a hypocrite if you’re only after a principal residence and you don’t over leverage yourself.

I’m more of a pour-over kind of guy. Wife started at the hospital a while ago. (Once again…) I’d be happy to live anywhere south of Mackenzie, but all the affordable condos tend to be in James Bay and Cook St village.

There were 1 or 2 places we could have pulled the trigger on this year but it seems a bit stupid to buy immediately before we the spec tax in action.

I don’t know how this works either as it doesn’t make sense in my mind, which is why I am asking the folks here if it is possible. Please see my post below on what someone I know was telling me.

Ok, so I know someone who bought 3670 ELLISTON AVE in late 2016 and claims that he rents the place out for $2,200 and his mortgage is $1,700. He also claims that the fair market rent for that place is at least $2,500 and he can get that no problem.

https://www.usednanaimo.com/classifieds/house-rentals

returns looks better but still not great

why not just buy a place in a different city then? I am sure there are more attractive CAP rates in other parts of Canada

Leo

When the government starts Subsidizing, things magically get even more expensive to build. 🙂

Basically not enough attention is paid to the problem of how to drive down construction costs to create affordable housing. Seems like the main approach is to just subsidize it more but build just as expensively as market units

I think this is a lot of it. The government talks about not wanting affordable housing to be just the old stock but the reality is modern building is expensive.

Especially once you add in all sorts of other requirements for energy efficiency and respectful design for all kinds of groups it all adds expense. I’m for consideration of those elements but maybe not when the goal is to create affordable housing.

It occurs to me that the government finds itself in a funny position on the issues of renoviction and building codes and permits.

Municipalities force builders to abide by the building code, along with local bylaws, in order to get a residential build permit. This is justifiable in the name of of safety, environmental, and neighborhood (aesthetic, etc.) concerns.

So incentivizing owners to renovate older buildings to meet current standards should presumably be a goal as well; again, in the name of safety, environment and neighborhood character. Why is this not a priority?

Instead, cheap rentals that clearly do not meet any current standards (unsafe, inefficient, and often eyesores) are seen as socially valuable, because they are affordable to vulnerable citizens (disabled, mentally ill, unemployable people, etc.).

Perhaps the real issue is that no one except the professional class and up can afford to live according to current building and bylaw standards. We have ‘standardized’ ourselves into an impossible situation with respect to housing.

Thoughts?

Rent in Nanaimo and area as a reference and the benchmark of 550K for those interested in investing in their housing

https://www.usednanaimo.com/classifieds/house-rentals

returns looks better but still not great

I ran the numbers on a number of properties in the CRD last year and could never make them work without a very large down payment (like minimum 40%) for SFH. Some of the rentals I followed, it was clear that even a single month empty would void any potential profit. There are a couple I’ve watched turn over about every 6 months and the advertised rate stays the same – mind you these are instances where I think the owner lives in the basement.

The only way I could justify buying a SFH in the last say 2 years and rent it out was to hope for solid appreciation. And that of course is a paper gain which means nothing until sold.

The smart people have large piles of cash and buy something in Nanaimo. I know a retired couple that were planning to move there so bought a place in Nanaimo (for cash) but got offered $4000/month to rent it. So they stayed here and became landlords. I didn’t ask what they paid for it but it sounds like it was somewhere under $500k.

Even I would go for that. I just don’t have piles of cash and don’t want to be a landlord!

KS112: Can you explain how the math on that works? I dont fall into the class of savy investors but i am curious about how the smart people are doing this.

KS

I find that hard to believe unless they paid a very large amount of it in cash. Even than the return is not so great. Not my cup of tea…

800k house

rent 2500 so 30k

30k/800K= 3.75% without expenses so add on a mortgage and everything else. That 30K disappears. No way no thanks.

Oh interesting! All I hear from the people I know are how much of savvy real-estate investor they are and how they are renting an entire house out at below market rates and it still covers their mortgage and then some (this is from people that bought within the last year or two)

acreage just land if prices fall. No house…I would never become a landlord with the rules out there. I know too many nightmares of tenants causing massive damage before the months it took to get them out.

gwac are you planning to buy another house?

5 year bond rates are approaching 2% from 2.5%. That will help in negotiating the 5 year rate.

Wholly shit I just saw Hawk`s biggest drop headline, Wow it is huge. Wait for it. Are you ready. Here we go, Toronto prices dropped 1.4% year over year. Yes they plugged 1%. Watch out below.

https://www.bnnbloomberg.ca/toronto-new-home-prices-post-biggest-12-month-drop-since-1996-1.1182853

FWIW, here is the REMAX 2019 housing report.

Full PDF

https://www.dropbox.com/s/ejnctd38ev84d0m/Remax_ReportTemplate_2019_DEC12_BLEED%20New.pdf?dl=0#101983522

2 minute summarized video

https://www.youtube.com/watch?v=qEXZqEskOWU

Toronto and Vancouver most ‘vulnerable’ to interest rate hikes as personal debt soars, CMHC warns

For every dollar of disposable income, Vancouver residents owe $2.42; in Toronto, it’s $2.08

Canadians living in two of the country’s largest cities may find themselves more “vulnerable” to interest rate increases as personal debt levels in Toronto and Vancouver continue to hit record-levels, warns a report by Canada Mortgage Housing Corp.

The housing agency says the debt-to-income (DTI) ratio for those living in Vancouver climbed to 242 per cent in the second quarter, which ended June 30.

CMHC says this could lead to a ripple effect if households begin defaulting on their loans, and banks begin scaling back on the loans they give out.

https://business.financialpost.com/personal-finance/toronto-and-vancouver-most-vulnerable-to-interest-rate-hikes-cmhc

Interesting how the real estate companies/agents are trying desperately to keep the failed pump alive.

The fake news

https://www.greaterfool.ca/2018/12/12/the-fake-news-2/

Full list of task force recommendations:…

10. Maintain rent tied to the renter, not the unit.

Another one bites the dust…

In an immediate sense, but these kinds of policies could be double-edged swords. Longer term implications could actually be worse for renters, but we’ll have to wait and see. Plenty of “theories” out there on whether it’s good or bad policy, with the divisions probably along renter/owner lines.

Personally, my pet theory is that so much of this stuff they’re trying to “correct” are symptoms of an out of control RE market, not the reason the RE market is out of control. Does that make sense?

I’m glad I’m not a landlord! Good news for renters. Next up you should be not able to kick out if selling….

Great news on the rental task force, keep those slimy building owners from pushing people out for no reason other than a money grab.

Rental task force recommends ban on renovictions, not allowing stratas to restrict rentals

The province’s rental task force is calling for an immediate ban on renovictions, a province-wide rent bank for low income British Columbians, and the elimination of a strata corporation’s ability to ban owners from renting out their units.

“One of the most frequently mentioned challenges from renters was unfair evictions, including renovictions and other evictions, based on false claims,” the report reads.

“They told the task force about how stressful it was to live with the constant threat of being forced from their home with too little time to find alternative housing in a challenging rental market.”

https://globalnews.ca/news/4755107/rental-task-force-calls-for-banning-renovictions-banning-stratas-from-restricting-rentals

Damn those price slashes.

Toronto new home prices see biggest 12-month drop in more than two decades

Toronto’s PTT is authorized by provincial legislation. The article below gives some background. Interestingly the RE industry blamed it for falling prices, i.e. improved affordability, in 2008.

I doubt the BC government would authorize a PTT for any BC city. I believe however that they have said they will allow a Vancouver-style empty home tax for any city that wants it.

https://torontoist.com/2015/12/torontoist-explains-the-municipal-land-transfer-tax/

This is something that is troubling me as well. So, the millennial has their condo paid off by the time they’re 55. Just in time for major work on their building. How many years are buildings like the ones going up now expected to last? They don’t seem like they are going to go for even 20 years without major issues, let alone 50. I have not travelled much, so how is the longevity of large multifamily dwellings in other countries?

At least with a house, the tradition has been that the value of the lot has increased, along with overall prices, and that makes it worthwhile to either do the major renovations required after 50 years or tear it down. Plus, how do you downsize and live off the difference in retirement if you’re already in a condo? I guess you go down to about 400 sq.ft., but that’s not much better than a nursing home room.

I think a lot of the moralizing that’s going on right now really misses the point that it’s not housing that is suddenly out of reach – it’s single family freehold houses. As Marko and others have mentioned, this is likely part of the growing pains of a small, dense city remaining desirable as it further densifies. Condos, townhouses, etc. will be the future for many. Maybe that’s a new thing for Canada, but it’s not really all that rare worldwide.

Patrick :“It is my “position” that the arguments presented by many here in this forum are just dressed-up to be principled “positions”, and are actually just self-serving statements made to try to make-a little-money. Maybe someone will prove me wrong, by still maintaining your “positions” and advocating for these lower house prices after you buy one… but I doubt it.”

Could it be possible that it’s a self serving statement to continue pumping and justifying housing price increases if that person owns a house?

Of course I’m sure you don’t own a house so that mustn’t be the case.

The problem with that question is that it leads to an endless, exhausting amount of rabbit holes. Fall to how much? Benefit society how? Whom? Should everyone regardless of income be able to afford the type of shelter they want, wherever they want it? Yes? The pure application of that is communism. No thanks.

But nonetheless, right now for my tastes, too many people can’t afford homes in any neighbourhood, not just the nicer ones. Someone else might go, screw them, this city is for the rich now. Except it isn’t, and history repeatedly says folks that think that are dead wrong – and it’s illogical anyways. Endlessly rising home prices that leave incomes in the dust are actually the opposite of prosperity. I want to live in a prosperous place, and see others prosper.

So if I bought, a downwards leg generally wouldn’t bother me, because I wouldn’t buy if I wasn’t prepared to accept that possibility. I say generally as if a drop was really extreme – for example, if I bought at 650k and 3 months later it’s 350k and stays that way for 20 years, then I’d be lying if I said I wouldn’t kick myself hard for buying too early. Who wouldn’t? But that’s being human and quite distinct from “I don’t want it to fall because it doesn’t serve my needs”. And that’s part of buying, the acceptance of whatever choice you’ve made.

More than likely after I buy, my interest in discussing the RE market will wane as I will find something else to discuss or engage in. But I’ve always enjoyed the subject of psychology. Markets are the ultimate expressions of that, so my interest in eventually buying and psychology keeps me interested.

Done on this topic for now.

Well you’re dancing around the basic question, with a long complicated (albeit thoughtful) answer that I can’t quite follow.

But I really wasn’t asking you for a position paper on interest rates,

I was just interested in an answer to this basic question..

The basic question being…

You want to see Victoria house prices fall now, for a myriad of reasons, that would be beneficial to society (and you)

If you end up buying a house, and those “myriad of reasons” persist, would you, after your purchase, want to see Victoria house prices fall further, to continue to benefit society (but not you) ?

Am I the only one surprised to learn that Toronto charges a municipal property transfer tax?

I suppose Victoria and Vancouver are next.

It seems all levels of government have lost the ability to manage our tax dollars and to live within their means.

https://www.theglobeandmail.com/canada/toronto/article-real-estate-slowdown-to-cost-toronto-nearly-100-million/

Calculator

https://www.ratehub.ca/land-transfer-tax

You’re very sure of yourself. It’s not deserved, IMO. If I make the choice to buy, I am implying that I am doing so in accordance with my tolerance of risk. That means I would have to already have a sufficient degree of confidence in the market. The only way your scenario could be true would be if I bought from a position of impulse and desperation, which is completely antithetical to myself and partner’s personality.

Choosing to buy or not to buy is always a risk. It would be true to say that when I buy, my perception of risk in the market would have to be lower than it is right now, but that doesn’t mean I have to think there is none. I could (and in fact quite possibly will) buy when I expect prices to go lower still. That’s not always the end of the world if you have a good capital base and we’re talking about a principle residence.

It also doesn’t mean that I will think that excessively low interest rates should stay that way while imbalances in the economy grow and create unlivable communities and debt crises. Not everyone thinks only of themselves, and if you believe they do, I would say that’s more of an indictment of your own cognitive processes and world construct than it is about anyone else.

Again, no. Most prospective buyers right now would probably want them to fall, not rise. They hate the stress test as much as the brokers do. I think rates should be at a level where it doesn’t contribute to economic imbalance. I actually don’t know where that is. Alarmingly, neither does anyone else. As for “government lowering house prices”, that is almost exactly the opposite of what I’ve said on here. Where I have endorsed their involvement it’s to attack fraud, criminality and promote transparency. Government involvement in market pricing, to the contrary, usually magnifies and distorts cyclical movements.

You will cling to that attempted-professorial “position” until the moment that you buy your house, then you’ll instantly forget about it. The rest of us, thankfully, have the luxury of ignoring it from the get-go.

Yes, so when is that intellectual “some point” where your “position will inevitably change”, and you will cease to be a bear.

To me, that “point” is easy to predict, to the minute ,when you will stop being a bear. It’s the moment after you sign the final papers to buy your house. Not only will you cease to be a bear, but your “positions” on all these issues you’ve fought against will also flip 180 degrees in a flash.

Suddenly your “positions” like “interest rates need to rise” or “the govt needs to do more to lower house prices” etc. will vanish before the ink dries. The position will now be “yahoo… time to start making some paper profits, let’s see the Victoria house prices light up!”

It is my “position” that the arguments presented by many here in this forum are just dressed-up to be principled “positions”, and are actually just self-serving statements made to try to make-a little-money. Maybe someone will prove me wrong, by still maintaining your “positions” and advocating for these lower house prices after you buy one… but I doubt it.

Penguin: Josh actually works from home online. Two hour commute to get his special latte. In fairness I believe his wife is planning to work at the hospital (if i recall his earlier posts). There are properties within a reasonable commute to the hospital that he could afford. he just likes James Bay.

Sorry Josh, obviously 2000 square feet; thanks for pointing out the error. Forced to walk miles barefoot in the snow to downtown.

I hope Josh buys a nice place in core-Victoria in his price range. I want everyone to be happy. And that someone else, who want pay less, can buy in Langford.

After Josh does buy, based on his principaled arguments here, I’m sure he will stay committed to the “cause” of lowering Victoria house prices further, on behalf of all his friends here.

I apologize for that cryptic question. Did you choose an out-of-catchment school?

lol .. nit picking data points … its affordability .. that is the problem — 100% increase for 100k … big deal… 50% on a 400k home BIG DEAL!

Josh how dare you not buy a house in Langford because you don’t want to commute 2h a day! You are just an entitled millennial therefore there is no housing crisis.

Good to see some people understand basic economics and housing bubbles. Easy money has left the station a long time ago and the coming fallout is just now being realized.

200 sqft? Did you also have to walk uphill both ways to commute to downtown?

All we need is people to slow down moving here and the shit will hit the fan at a much faster rate than it is with all the new builds not selling. Imagine when they start leaving here.

Did gwac miss last months numbers ? Median, average down 7% and benchmark down as well. Don’t look like a Happy New Year to me for the pumpers.

The run up in Victoria has been less than the run up for Canada in general since 2006. If Vancouver money was the source of “much of” Victoria’s rise, why wouldn’t Victoria have risen as much as, say Winnipeg? (According to Teranet indexes). Vancouver Foreign money isn’t likely getting parked in Winnipeg, yet Winnipeg is up more % than Victoria since 2006.

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/economic-news-teranet.pdf

If an economy has become unduly dependent on building overpriced housing with borrowed money, some people are going to be negatively affected when normality is restored. Which is inevitable anyway.

I seem to recall some people on this forum making fun of the bears’ calls of half a dozen years ago. If all buyers had taken heed, there would be no price crash to worry about.

Just to add to the debate; I paid 4.3 times my salary for my first house a 1930’s 200 sq foot house in Toronto. Actually not in Toronto but an hours commute out from downtown.

Could not afford to buy in the city itself.

From 1971 to today the population has increased by almost 60% and we have packed most of it into a handful of cities and people wonder why the prices have gone up.

No concern about newcomers, we’ll build just as we always have. That’s a separate issue from home price inflation.

Bean

Agree and what is feeding the Victoria Market and keeping it from falling right now is the wonderful tax raising big spending NDP. Jobs and spending for everyone. Victoria will fall if the tax money runs out and the spending is curtailed here. That will impact people moving here.

Local just welcome the new comers it is not going down anytime soon.

Yes, that’s the graph. You can see the effects of the larger recession on immigration. It’s not a perfect correlation in each time period, and I am presuming that recession is the dominant factor. We haven’t really had a sustained nationwide downturn since about 1990, when the housing market went sideways.

BTW according to Dasmo’s definition, I’m not a bear, since my position will inevitably change at some point (I didn’t think that detail mattered). I think Victoria’s market is currently at risk, even dangerous. Victoria as a market though, is a different story altogether.

Theoretically possible, but I doubt immigrants en masse, or even an outlying portion of them are thinking “Let’s immigrate to Canada because we can strike it rich in housing due to demographic trends”. Millennials as buyers are a huge group, but of course, Boomers will also be net sellers. There is QUIIP, mind you. But that program is a fraud, IMO…

StatsCan 2016 Census, and the correct value is actually $94,400.

Beancounter, your posts are visual and intellectual ecstasy to me…

Are you serious?

Residential real estate has become a parasite. Period. For the economy to become fundamentally sound and for average people to feel some financial security (see graph above) it has to end and the end will be painful unfortunately. The parasite is beginning to feed on its own organs. This goes for both owners and renters. No one I know on my street has any desire to move, especially the older folks. So how do these ridiculous prices benefit those of us with no desire to move other than to raise property taxes? To realize a gain I have to trade down or move to Duncan? No thanks. I happen to like Victoria. And what if I want to die in my home?

There is a theory out there that inventory is low because people are afraid to sell because of the nosebleed conditions. You think? They’re terrified. There is a reason that even with this run-up in prices people do not feel very secure (see graph above). Knowing the occupations of most on my street, there isn’t a single household I can think of who could come close to affording what a house would go for on this street were one for sale today (and they were just entering the market). What does that tell you?

Technology seems to have completely short-circuited long-term memory. And I’m not talking very long. Short story: One of my in-laws passed away a few years ago, and left her place in OB to my wife. Summer of 2015 she put it up for sale and got one ridiculous low-ball offer on it. In 6 months. We took it down until the following spring 2016 and within 48 hours had 3 offers on it, all over ask. This being consistent with the mania that has played out since then. I’m scratching my head to recall, but for the life of me can’t remember some economic miracle happening in that time frame. What does that say about market drivers? Fundamentals or mania?

RE the Lower Mainland, the source of much of this nonsense, there is only one piece to the foundation of prices and that is foreign capital. Anybody thinking otherwise needs their head screwed on straight. If that spigot is shut off, you are going to see a major cratering of price support. The local economy has been completely disconnected from RE values for some time. There is not one sensible argument anyone could make otherwise to justify the current state of affairs. Without that source of cash, it’s nothing more than painting the tape and a complete house of cards with respect to price support. Income statistics tell it all.

Here’s another interesting and humorous graph put together by Robert Shiller, just for the Canadian market:

Who told you that the average homeowner household income is only $91 k? Only 61% own, so you’d need to take the highest 61% of incomes as the average.

Also, 5yr fixed are 3.49, not 3.89%. Mortgagearchitects.ca

Don’t count on immigrants being in an indefinite simply/prudently waiting state for house buying like you. Most see that prices (price/income) are dramatically lower here (including Victoria) than their home country.

Fulfilling a dream of home ownership is a major reason people come to Canada.

They may also pay attention to demographics, and notice the big population bulge of Millenials just starting to enter the prime home buying years, and want to buy ahead of them, not after them by “waiting”

Ya I posted that and than Leo did a write up on that. Middle no idea how to do the graph only. BTW way love ya Local. You are one of the good bears.:)

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016006-eng.htm

There’s one from statscan that goes back 100 years+. I’ve seen it posted here, just a bit busy multitasking atm sorry

local

Looks pretty stable to me

https://www.statista.com/statistics/443063/number-of-immigrants-in-canada/

Only way to pay for our social programs with the amount of people retiring and our shitty birth rate. Immigrations needs to keep going higher and higher. All Canadian government parties know that regardless of whose in power.

They can aspire to anything they wish, immigration levels are also affected by economic performance. If the economy is hot, it’s easier to find people to move in. When it sinks, that can be more of a challenge.

It’s not a matter of “twirling” anything, it’s just saying growth now versus before is not experiencing anything unusual.

It won’t make much difference.

Yes, if it can be done in a way that largely restricts the pain to paper-losses of existing homeowners. I don’t want it if this means high unemployment, bankruptcies and surge in youth unemployment. Do you?

Let’s try this again. I entered into an affordability calculator using what I understand are the average homeowner incomes in Victoria, to see what kind of home price tag they could qualify to borrow on. From there I presumed no debt and a 150k down payment, and what I presume are average tax and heating numbers. Quite a glaring result, and that doesn’t even account for the b20 stress test, which would make that number even lower. This number doesn’t control for things like existing equity (ie, the effects of the property chain), but degree of the disparity is nonetheless enormous…

I personally would like to see house prices crash just to watch the back and forth between hawk and gwac.

On the topic on what % of people are home owners and what % are renters in Victoria, I wonder if any distinctions have been made for people that own multiple homes, I know quite a few people whom own multiple homes. Those people depend on rental income to pay the mortgage, so if rates were to rise rapidly or if rents were to come down then they would be under pressure to liquidate.

Well then, just get the average price in Vic down to $316K and the problem is solved! Are you OK with that?

Also agreed. Vic population growth should also be above avg

Local whatever.

1971 22m

1990 27m

2010 34m

2018 37m

I always assumed when numbers go up its increasing but maybe I am wrong.

300 to 400k is the immigration target right now. 1%. Been around that along time. Twirl that anyway you want it . Our population will be 41 to 42m by 2025 and they ain`t moving to Newfoundland.

No it isn’t. In fact, it’s been trending down for decades. What has changed, is the source of that growth.

Pat

It is supply vs demand. It has nothing to do with robbery. Population in Canada is increasing fast and everyone wants to live in the same place. Duncan, Youbou and Lake Cowichan you can pick up a place for 300k or less. Why because less people want to live there.

SFH home prices as I mentioned are not going down over the long term in the desirable cities as you add 300 to 400k people a year.

Agreed!

deleted

Dasmo just not norm for an average sfh in a desirable area over the past 50 years here in the core.

Not doubting anything. You and your family did well…. Non Victoria/Vancouver/Montreal/Calgary and Toronto certainly where below 4 to 1 and probably much below. Parts of Newfoundland you can pick up a house for 25K right now lol

What can I say, VicWest was highly undervalued in the early 2000s. If you doubt my dad’s story look up rural Edmonton House prices in the 70s and upper-mid level Lawyer salaries at the same time. I’ll bet you it’s 1:1….

The housing bubble is not some sort of natural phenomenon. It is the result of government policies that have, at least to some degree intentionally, inflated the price of housing. Everyone understands now that the US housing bubble of a decade ago was brought about by government policy, the current bubble in Canada is no different.

People are being robbed by this and people are certainly owed the right not to be robbed.

Do you know that when the Toronto market nosedived in 2017, that well publicized Mattamy homes complex where the buyers closed at peak, ended up owing, in some cases, hundreds of thousands they couldn’t pay due to the declining value?

They tried GoFundMe. They were very explicit: “We don’t want a hand out, but…”

“But” yes you do. You simply wanted the developer, or the general public, to reimburse you for, IMO, not paying attention. Had you closed on the house and the market somehow doubled during the closing-possession period, would you be receptive to Mattamy requesting from you the difference they would have gained, had they simply sold it to you 3 months later? I bet they wouldn’t be.

That market was rising at a rate 4 standard deviations above the norm. If that doesn’t scream trouble to a buyer, I don’t know what will.

Sorry, was this for me? Not sure what the question is.

1 to 1 or even two to 1 I find that hard to believe in any major city in the past 50 years. 4 or 5 to 1 is my bet as historical norm.

Ok let’s use math. House prices over yearly wage.

Dad: 30k/30k 1:1 awesome! But wait that’s in Alberta so not bad!

Me: 192k/80k 2.4:1 in paradise too. not bad!

Random millennial: 690k/100k = 6.9:1 not good

“But none of these generations played the victim like now”

Patrick I am not sure you can narrow this down to a generation. I think a lot of people of different ages think they are owed something by the government or others now. Social Media I think is partially responsible for this.

GoFundMe is a perfect example of how people feel others should pay for their shit and it ain`t just millennials that use this.

Yes, and your dad could have bought a nice house in Uplands for $20K.

And his dad could have bought all of Ten-Mile Point for $20K.

But none of these generations played the victim like now.

Very roughly:

The “Greatest generation” – 1904-1924

The Silent Generation aka the Lucky Few – 1925-1944

Boomers – 1945-1963

Gen X – 1964-1980

Millennials – 1981-1996

There doesn’t seem to be any widespread agreement on any of these dates. Some carry the boomers on to 65. also apparently the generations are getting shorter as authors and marketers can’t wait to declare the existence of a new generation.

Gen-X myself FWIW.

Those articles are meaningless. The facts on the ground are that I could by a fixer upper for 192k at 4.5% that dropped to 2% over a decade. What I make hasn’t even doubled and that same house would probably be $690k now. Most likely with rates slowly going up over the decade or at best flat. Not to mention the costs to fix it up are much higher. Wage inflation is greater but as I have said before and as someone pointed out earlier that is really was initiates rates to rise. Add to that the simple fact that SFH inventory is going to reduce over time and the boomers will want to stay in their houses. It’s simply not a great setup and life is short.

A simpler way of looking at it is this. The boomers, now age 55-75 are owning the nicest houses. That’s because the 76-95 year olds have “moved on” to a nursing home or “elsewhere”

So when the Millenials are 55-75, how could they not be in the same position? The boomers are long gone by then, as are most of the 76-95 year old Gen-Xers.

Someone has to be always owing/living in these nice houses. In 30 years, who else will live in Uplands but old Millenials? (getting morning avacado toast delivered by self-driving electric cars)

In short, Millenials, your day will come!

btw, in my recent post, the references to 1960s-1970s should be more like 1960s-1980s to encompass all of the boomers. And note that the adage.com article is based on 2010 US census data, and uses a wider-than-typical age range for Millenials. Not sure if any of that is material though.

Shit I had a paid off house but I screwed myself and built a new fancy one. I hope my son will pay it off by the time he is 50….

millennials have a lot going for them but affordable housing isn’t one of them. They will have their condo paid off by the time they are 50, that’s the difference….

Gen-X I guess…

We didn’t buy a home until we were 36 and 40. Basically saved for 10 years prior and almost had a down payment of half. Now at 42 and 46 we have the home paid off.

So 16 years basically to get a home.

We are super savers.

You can do it as well. It just might be a little longer.

I’d say if we did it today like before, it would maybe take us about 20 years for a home.

Millenials are in good shape now for their age group. At least in similar shape how to the young boomers were in the 60s-70s. I expect (and hope) they will be in similar or better shape than the old boomers are now when the Millenials are 55-75 like the boomers.

Boomers were in their twenties in the 1960s-1970s. They weren’t all buying houses, they were more into psychedelics and more likely to say “never trust anyone over thirty” than to say “I think the BOC is going to go +0.25 at the Jan. Meeting”

Moreover, if you look at what the various generations spend on things in their twenties it is remarkably similar https://adage.com/article/adagestat/stat-day-generations-spent-20s/233684/

This is comparing what young boomers were spending in the 60s-70s to what young Millenials are spending now (adjusted for inflation)

“What this data shows is that on average Baby Boomer and Millennial households ages 25 to 34 spent very close to the same total amounts in 2010 dollars: $45,465 for Boomers in 1990 versus $46,617 in 2010 for Millennials, only 2.5% more. But Generation X spent the most: $49,300, but because of their smaller number of households their total aggregate spending was the smallest.”

So, unless you consider that article above “bunk” or “fake news”, we have a good news story for the Millenials. They may not be as well off as the old boomers are now, but they are in roughly the same shape as the young boomers were back in the 60s and 70s.

As to your question about where the Millenials be when they are 50. I think they’ll be in great shape, probably well-off, house paid-off home owners, and (I hope) criticized by the younger generation that follows them.

Thanks for clarification. Not a fan of that index at all. Seems too frankennumber for me, even if it works in some ways.

Leo, out-of-catchment school, about the same distance?

Another kick in the nuts for the bulls.

Nearly half of US CFOs fear a 2019 recession

https://www.cnn.com/2018/12/12/economy/recession-economy-cfos-duke/index.html

Very different:

– price change based on repeat sales

– covers all dwelling types, not just SFH

– price data comes from closings at land titles. Thus a time lag from REB “sales” data

– 3 month moving average creates additional lag

Barrister, ever wondered if they are just empty container boxes ? Some don’t even look fully loaded.

JustRenter,

Thus gwac’s LOA, he’s having a tough time coping with median and average prices both down big. Throw in the Phil Soper flip flop and I’d say the bulls just got neutered. 😉

I have been mulling over Sweet Home’s last post and a couple of thoughts struck me. While i have noticed inflation I really have not felt any impact because we are running on American dollars. The question arises, how much of the fact that people are feeling poorer is simply because the country itself is actually poorer. The fact that Ontario’s manufacturing sector has been seriously gored seems to just produce a shrug here on the West coast. I am watching a container ship go by this morning and I am wondering how we are paying for all this stuff. Is it possible that we are consuming more than we are producing?

JustRenter,

Teranet reports based on their (probably different) metrics, Victoria as being flat. Interesting press release from them, actually. Canadian RE is making some odd moves, ie declining in November which is apparently rare.

https://housepriceindex.ca/2018/12/november2018/

I see on VREB that the average price for Single-Family-Greater-Victoria is down -7.6% for November compared to October and -5.7% compared to November last year. This is huge, about $70,000 down in just one month!

A very rare discussion of the statistics behind the job numbers and how rough they actually are. https://www.cbc.ca/news/canada/calgary/labour-force-survey-monthly-versus-long-term-trends-1.4941107

Way too much energy gets expended by talking about the normal swings in noisy data series.

Yes, two professionals can still afford to buy a house in Greater Victoria, but when I moved here in 2001, a single professional income would have been enough. The majority of workers did not have incomes go up anywhere near the percentage that food, clothing, and shelter have gone up in the last 15 years.

If I am not mistaken, no one who is alive and reading these posts has seen housing affordability so bad at such low interest rates. People used to have their houses paid off by age 50 or so, which gave them enough time to save for retirement. How many millennials are going to be able to have their houses paid off in time to save for retirement (which they will have to do because defined-benefit pensions are disappearing)?

I agree, the other metric was just the first that flipped. Who knows when/if the others will.

And sure, be happy to get together and chat. Leo, could you send him my email?

Local Fool. Can I buy you a beer? I will only take up as much time as it takes for you to drink it.

Local Fool-Spread between Canadian 2 and 5 year yields has been closing and has inverted as of today

Definitely noteworthy. I’ll be watching the 1s2s and 2s10’s a little closer as they are better indicators of what could be ahead.

back in you days, a diploma is like a masters … now a masters is a dime a dozen … there are some working at a local starbucks

Prices of Vancouver Detached Homes Descending Rapidly

In South Granville, single-family-home prices were off by 15.5 percent; in the Arbutus area, they were down 12.3 percent; and the price was off by 12.1 percent in Oakridge.

Detached home prices were also down in every single East Side neighbourhood. They include South Vancouver (-10.8 percent), Knight Street (-8.3 percent), Main Street (-8 percent), Collingwood (-7.9 percent), and Fraser Street (-6.2 percent).

https://www.straight.com/news/1176056/detached-home-prices-are-descending-rapidly-vancouver

Do you guys recognize the name Phil Soper? From Royal LePage – always authoring these breathless predictions of continued, rapid price gains in apparent defiance of what the market was clearly already showing. Per S.S.’s Twitter, he’s sure changed his tune…

All this talk about boomers vs millennials is missing the elephant in the room – how much things have changed over the decades due to the impact of the ever widening disparity in wealth. Admittedly this is much more of an acute issue in the US than Canada but we’re still feeling it here too:

The NY Times has an opinion piece from 2017 which really illustrates how things have drastically changed in the last few decades. Paraphrasing from the article:

To me it’s a bit ridiculous to argue about who was more entitled or harder working. We don’t allow racist generalizations, so why allow this one? Especially when it should be obvious that there are much more compelling reasons to explain why things are so much harder now than they used to be.

Sources

https://www.nytimes.com/interactive/2017/08/07/opinion/leonhardt-income-inequality.html

https://www.conferenceboard.ca/hcp/Details/society/income-inequality.aspx

Back to housing…. 19 out of 21 house sales in Saanich East since November 28th were below list price. The bidding war days are in their final gasps. “Low ball” will be the new catchphrase for 2019. 😉

Great comic. One could apply that to the generations. No one bought the boomers condos while they went to university…

It’s useful to know and admit your privilege even if its a subtle edge. I bought my first house with my own money but the bank would not have loaned me anything if my dad didn’t threaten to yank their savings and business from the bank. I had just started my business so privilege helped me get my mortgage. Or at least one that was preferential to me.

Absolutely brilliant comic Penguin. Thank you for posting that. Now can we get back to housing and off the pissing contest? I think I’m going to start visiting open houses again – it’s been a LONG while. I drove by a couple nearby this weekend and they were DEAD not like what it was just a couple years ago. I’ll be intrigued to see how the spring goes.

+1

Good comic Penguin.

Now we can count down 3,2,1 to someone posting their own school of hard knocks, boy I had it tough, pulled myself up by the bootstraps story that TOTALLY disproves the entire concept of privilege.

I wanted to post the other day in response to someone but got distracted. This comic is great at explaining privilege. I think most of us have it pretty easy compared to some can we all agree? Why the competition about who had it easier? What right do we have to say there is no crisis based on some generic, cherry-picked stats that don’t show the whole picture?

https://www.boredpanda.com/privilege-explanation-comic-strip-on-a-plate-toby-morris/?utm_source=google&utm_medium=organic&utm_campaign=organic

Millineals who actually got an education or trade have the opportunity far exceeding of boomers by moving up the ladder much faster as the boomers retire in massive waves. Increasing your income potential by 40% or more without doing a thing was not a boomer option, especially a late boomer like me where move ups in seniority were like pulling teeth. You have the opportunity to be multi-millionaires at very young ages with the technology /internet boom, easier credit, and much better education options hands down.

OK let’s “think about it”

If millennials want, we could get back to 1980 university conditions that you’re envious about.

We would need reduce tuition down to 1980 levels and reduce enrolment by 45% PER CAPITA.

About half The Students, but they pay less.

There. I thought about it. Bad idea.

Btw) unemployment was more than double back then. Worse among the young. Not better opportunities. Just less whining.

It seems like Alberta is just flailing at this point.

Alberta looking to build a new refinery in face of ongoing oil price crisis

https://calgaryherald.com/news/politics/notley-to-announce-new-made-in-alberta-energy-strategy/wcm/7e0ea052-2494-4f7a-a5ce-22b81caed9ed/

That is why going to university got the boomers a lot more bang for the buck than the millennials. It’s also a big reason whey boomer high school grads had better opportunities. Think about it.

No. University opportunities are dramatically better today than for boomers. There are almost 1.8X as many people now in university in Canada PER CAPITA than 1980. ( see details and source below) . Much fewer spaces back then so many people didn’t get accepted and just found a job. Uni enrollment per capita has been increasing and is at all time high now. Largely funded by taxpayers.

Btw) 1980 unemployment was much higher as was inflation check out the “misery index” that got Reagan elected in USA in 1980 and same thing existed in Canada.

Yes, buy a house with a 12% mortgage. Cheap?

Details of calculations .,,,,,,

Today there are 800k unit students for a population of 37 million 1/46 of population is in uni

In 1980 there were 300k students for 25 million population. 1/83 population is on uni

That’s 1.8x as many students per capita now

Page 7 https://www.univcan.ca/wp-content/uploads/2015/11/trends-vol1-enrolment-june-2011.pdf

See what I mean?

Boomers had it much easier going to university or college – tuition was lower, student aid was better, and job opportunities both during and after school were a lot better. Many were able to get good jobs right out of high school. Oh and they were able to buy a house not long after they finished, even in Vancouver or Victoria. Boomers had it better right across the board.

The single case of your father says nothing about differences in life situation or opportunities between generations.

https://www.youtube.com/watch?v=ue7wM0QC5LE

(Monty Python)

They want the opportunities but not the difficulties. My dad live in a family of seven kids. There was some beatings, You had to be aggressive at the dinner table, teachers hit you with rulers, he lived in a closet at university and paid his own way entirely, and lived in Edmonton most of his life. Sure he could actually pay for his university by working, starving and living a notch above a homeless person. Sure he could buy a house with one years wages but that was in Sherwood Park Alberta!

This is the heart of the beef between the two generations. Neither one really looks at the whole picture. The Millenials typically focus on not being able to buy a house with a years wages but are they willing to live in Alberta for 20 years? The Boomer just focuses on them whining about not being able to buy a house and having it easy and not really considering that they need ten years wages to buy a house.

Boomers, in general, surely had it better in some important ways.

One of my favourite stories from my boomer father-in-law is how, with the income earned from one summer job, he could pay for that year’s tuition and books at the U of C, with enough left over to buy a used car.

We should keep in mind, however, that the vast majority of the wealth amassed by the boomers will eventually be inherited by us millennials.

And before you argue that all of the boomers’ money will be eaten up at the end by extended nursing home stays, the average length of stay in a long-term care facility is about 18 months, according to the Canadian Institute for Health Information.

Even if Granny stays at the Berwick: $5,000/month x 18 months = $90,000.

https://www.theglobeandmail.com/globe-investor/retirement/long-term-care-costs/article26913111/

Well, I wasn’t trying to kill you. At any rate, I get it. I’m a pretty hardcore ISTJ.

There’s a bumper sticker that says, “The more people I meet, the more I like my dog”. Don’t think that applies to Chihuahuas, though.

Time will tell. The young people are just starting to make their dreams come true. Sometimes you need to look back to appreciate what opportunities you had. Life’s opportunities are more than “house prices”. I see lots of young people making great things happen already.

I don’t buy that. Young people today just want the same opportunities their parents had. Prior generations wanted, and got, better than their parents. In the case of the boomers, in spades.

That’s a very kind offer, one I would surely take you up on were I an extrovert.

Very truthfully, I actively try to avoid meeting new people. I’ve met more than enough people for one lifetime.

Local Fool, have you not noticed that some people are here simply for the discussion/debate? Surely that’s fathomable to you.

That’s a decent observation.

Thanks, Leo. You’re probably not a strong introvert, or you wouldn’t have made that offer (let alone gone for beers with a whole whack of HHVers at the Penny Farthing).

Every generation thinks that the proceeding generation is somehow worse than their own. Less capable, less motivated, less intelligent, less moral, more decadent etc. It’s a developmental right of passage as you get older.

Kind of like the stereotype of the “rebellious teen”, who doesn’t realize that their striving to be unconventional at that age, makes them quite conventional in important ways. Ha, people.

So, real estate. In Vancouver and as of November, a person buying a home a year ago has paper losses averaging $107,000. In West Vancouver, that amount is approximately triple. People actually locking in those losses are sometimes losing less, sometimes more, and a few others are losing close to 7 figures.

One way or another, prices are definitely starting their journey downwards, and we’re probably on that same journey here in Victoria. Short and fast, or long and protracted; that is the question. All eyes on the fed, bond market, BoC and mortgage originations…

https://betterdwelling.com/city/vancouver/vancouver-detached-real-estate-prices-drop-the-most-since-the-great-recession/

Patrick, not sure who else you were referring to but apology accepted.

We didn’t have to burn coal in our stoves, tho we burnt oil in a stove in our second house for a short bit as a small kid in a very nice area of town too. Those with parents who could get them jobs through their connections had no prob, the rest of us boomers I grew up with had to work our ass off and sacrifice living in some pretty shitty places/leave Victoria to be independent at a young age and mom wasn’t there with an ATM HELOC to dish out thousands or buy them cars etc at 16 on every whim.

I know good millenials too who work hard but they have a much easier shot at multiple opportunities for education/careers and ability to finance that we didn’t have. I also see some real sad cases too who pampered the kid and are very messed up adults for life.

Tho I accept that as what Dasmo stated, it’s society’s progress.

https://www.theguardian.com/business/2018/dec/11/imf-financial-crisis-david-lipton

Hold onto your hats!

Agreed, and that’s well said Dasmo. And the term entitled there is used in the best sense of the word, as in “fortunate”.

And it’s not just a generational thing. Everyone alive today, regardless of their age, in aggregate is more “entitled” (aka fortunate) than society of 20 years ago. Advances in everything including living standards, health, literacy, reduced worldwide poverty and hunger make it a better world than it was. Not for everything of course, but overall. https://www.forbes.com/sites/stevedenning/2017/11/30/why-the-world-is-getting-better-why-hardly-anyone-knows-it/#48753c577826

This idea is summed-up by a protest sign at a rally that said “A lot of things are going pretty well”

@guest_53234

I agree that is a good article and one anyone considering getting into the housing market should read. Not that it would stop anyone buying but it may open their eyes to the reality of what they are buying into.

https://www.vice.com/en_ca/article/43ejdm/canada-has-a-broken-housing-system-and-it-has-fucked-over-millennials

Some did, some didn’t and the latter are still living in their parents basement.

Millenials are still handing out the participation trophies and ribbons so I guess they didn’t get it either.

A growing share of millennials are living with mom

https://www.cnbc.com/2018/05/10/nearly-25-percent-of-millennials-live-with-their-mom-.html

Hi Hawk,

I wasn’t referring to you, and didn’t use any name in the description. I’m sorry to hear about your curveball, and hope things go well for you in future.

God this forum has become a torture to read. ( besides Leo’s opening post.)

There are assholes and wonderful people in every age group. I know many Millenials and am super impressed by them. Us boomers did have it pretty damn easy. We should own it and support and cheer on the generations behind us. They and their children have a tough road ahead even as we advance as a society.

I would say getting a ribbon for showing up isn’t a bad thing since that’s the most important thing really. Can’t win if you don’t play. Can’t get lucky if you don’t show up…

Every generation is more entitled than the previous. That’s a side effect of progress.

No, I said that specifically the Genforth study’s findings are bunk, which they are. The numbers are way off as has been shown. A 50-100% error is not “close enough” by any stretch of the imagination.

As for whether or not there is a crisis nationwide, it’s basically pointless to even discuss nationwide real estate markets when they range from very affordable to extremely unaffordable. The average affordability is meaningless to those in every market.

But let’s go with your point that it’s only a crisis in the big cities. Given that 85% of BC residents live in cities and the two biggest cities have severely unaffordable housing I’d say yes it’s a big problem.

What an inane point. So I’m to be blamed for the participation ribbon a Boomer handed me when I was 10 years old for playing a sport? We all threw those in the trash, by the way, and thought it was ridiculous. You guys literally came up with that shit and then can’t seem to stop bringing it up.

We also had 1st, 2nd and 3rd place for those that were exceptional, just so you know, and those actually meant something.

For a guy who spends his whole day on here pumping and bubble denying (for his personal business/financial well being I’m sure) he sure can’t spend a second to actually read others words. I said several times I wasn’t even seriously interested in the housing market until the last couple of years as life had taken me on a different journey. You cushy assed boomers with their perfect orchestrated lives will one day be in for a very rude awakening when life throws you a curve ball.

Last month median and average prices were down in Victoria, Westshore developers cutting back projects 50%, refinancing being turned down resulting in forced sales, agents scrapping for real. I’d be very worried with Vancouver heavily bleeding for months now. The finger in the dyke must be getting very sore.

https://www.myrealtycheck.ca/

You mean the group who grew up getting an award and a ribbon just for showing up ?

Absolutely true. Lots of entitled boomers out there, probably more than Millenials. What I haven’t seen is boomers freaking out en-masse if someone writes the phrase “some entitled boomer.” You’ll notice that the phrase I said that made you “die a little” was “some entitled Millenials”. I have never said or thought that even a majority a millennials are “entitled” .

Some people act entitled and they can be from any generation.

That “entitled” behavior that can be said about any person who is asking for something that they haven’t earned, and expect it just because of who they are. Many in the boomer (and any) generation fit that “entitled” definition, and as you say they are the worst offenders. But not the only ones.

Try this thought experiment….

If John Doe (age unknown) comes to this site and says he’s moved here from Saskatoon, and “wants a SFH in James Bay, but can’t afford it, and this is an outrage and a crisis”, and NO he is “not going to buy a condo or move to Langford.” And “is-it-too-much-to-ask” that he could move here and buy a SFH in James Bay?

Before replying to him, must you find out his age before you decide if he is indeed a victim (and part of a crisis group)? What if he’s 65 – he’d just be told “sorry pal, Victoria is an expensive city, it ain’t Saskatoon, and you best look at Langford”. Would he be one of the hordes of “entitled Boomers” to you? If he is 28 should we treat him differently?

To me, John Doe’s attitude could be labeled “entitled”, regardless of his age. Do you agree?

A little bit of me dies every time I read snide remarks about “entitled millennials” written by old before their time boomers aka the most entitled generation to walk the earth since the Lower Cretaceous.

The interview with Dr Kristjana Loptson is worth the read here.

“My research was initially looking at housing security. I wanted to understand why housing was becoming so unaffordable, and why governments weren’t doing anything to deal with that in a more effective way. It increasingly became focused around about home ownership, and examining what’s changed in terms of the political and economic significance of home ownership. And the more I got into it, the more I was like, “oh my God!”

https://www.vice.com/en_ca/article/43ejdm/canada-has-a-broken-housing-system-and-it-has-fucked-over-millennials

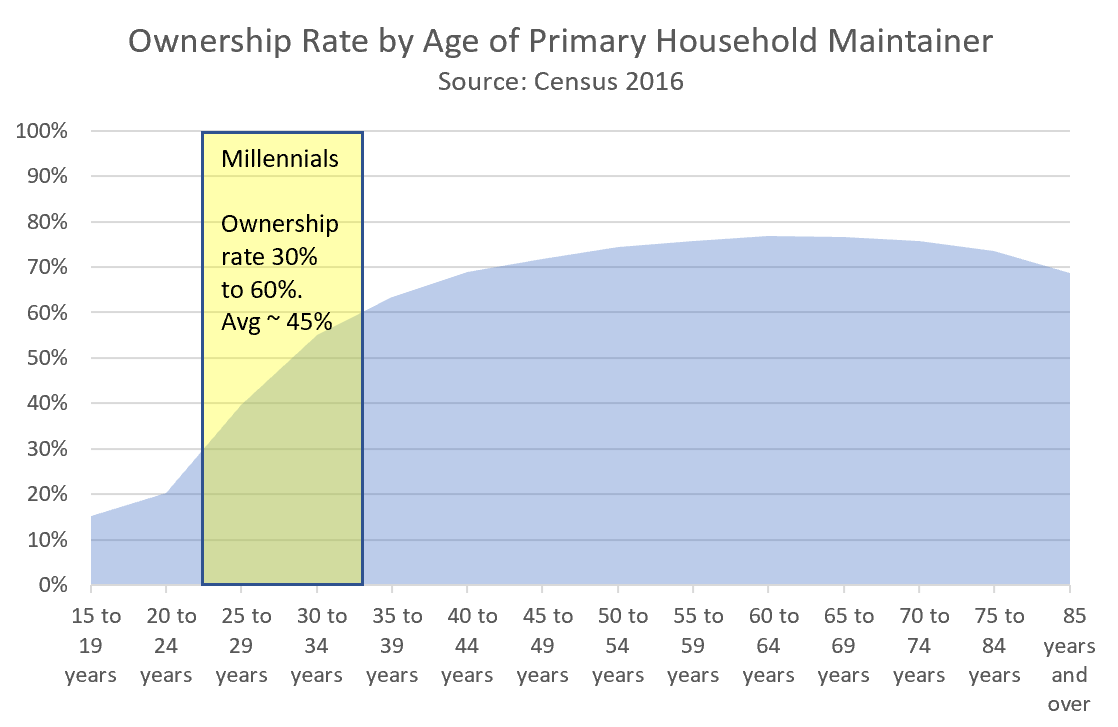

choosing a group of people borned in an era is dumb way to look at statistics .. it is a moving goal post ..similar to saying old people will eventually die…

people should look at rate of ownership in specified age groups .. such as 20 to 30, 31 to 40, 41 o 50 … etc

Awesome! Thanks LeoS.

I said the same thing at the start of this whole thread yesterday, and got skewered by every bear, and even LeoS calling it “fake news”. Typical reply was just hysterical laughing (Josh)

But now LeoS has said it (admittedly much more politely than I did), and the bears will now accept it. No millennial housing crisis Canada wide, just in the high-priced cities!

Here’s what I said that started this whole mess..

https://househuntvictoria.ca/2018/12/06/what-to-buy-in-a-downturn/#comment-53127

Patrick: “The millennial housing crisis in Canada seems to be over. So do we all agree, that there’s no Canada-wide housing crisis for Millennials, and the remaining “crisis” is just for some entitled Millennials in high-priced cities like Victoria that don’t want to commute to work?”

The graph itself doesn’t really tell you anything in isolation. If you want to figure out whether things have been getting worse for millennials you have to compare ownership rates over time.

We know both that home ownership rates have been declining amongst those young people that leave the home to form their own households, and that fewer young people are leaving the home at all. https://www150.statcan.gc.ca/n1/daily-quotidien/171025/dq171025c-eng.htm

Do those worsening home ownership fortunes add up to a crisis? Nationally probably not but you have to remember the national statistics includes places like Saskatoon and Moncton. In our high priced cities I would say yes.

Thanks Leo!

$440k

@guest_53156

Yes good point thank you. Although the ownership rate by household head is seemingly how stats canada talks about ownership rates in general so I believe that this is the correct definition: https://www150.statcan.gc.ca/n1/daily-quotidien/171025/dq171025c-eng.htm

However home ownership if you counted those living in other households would appear to be even substantially lower than the statscan numbers. That would likely explain HSBC’s estimate of 34% ownership rate for millennials.

Yes, if they can afford it and/or if they get enough money from their parents to do so.

Funny, that implies that the following month, the average month to month will fall by 100k, presuming no other outliers.

Moving average or not, I really don’t like the average price for anything. Case in point, the average price of a condo jumped by $100,000 due to one big sale last month. Median prices are better. Here is that:

Standing offer to go grab a beer or a coffee. From a fellow introvert, I won’t out you.

@ Patrick

It’s wise not to put words into other people’s mouths.

Just like the real estate market, there were signs and trends that started to form before it turned; you may want to pay attention to these.

Yes, one outlier month (October 2018) in an otherwise normal year. Maybe nothing, or maybe the first sign of the apocalypse. Time will tell. Anyone interested can just look at the numbers, you don’t need a Yahoo headline writer tell you what to think http://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br04020.html#tbl2

Andy7, are you hoping for bad bankruptcy news like this? Why?

@guest_53182

Just in case you were wondering: to get quotes and the coloured text to appear, just put a “>” in front of text you want to quote.

@ Patrick

The article was very clear that it was comparing Oct 2018 to Oct 2017. “It’s the largest number of consumer insolvencies for the month since at least 2010.”

Take this into consideration: “The insolvency numbers include both bankruptcies and consumer proposals, an alternative to bankruptcy that has become popular in recent years.

Bankruptcy vs. consumer proposals

The latest insolvency numbers show consumer proposals are becoming an increasingly popular alternative to bankruptcy. More than 55 per cent of all insolvency filings were consumer proposals in the year ending in October, up from around 52 per cent the year before.

Consumer proposals are an alternative to bankruptcy ion which troubled debtors strike a deal with their lenders to pay back some portion of their debt over five years. Creditors will often accept these proposals because they can often get more of their money back than with a bankruptcy.

It’s also easier to keep your house under a consumer proposal. Under bankruptcy, consumers are often forced to sell their homes.”