November numbers

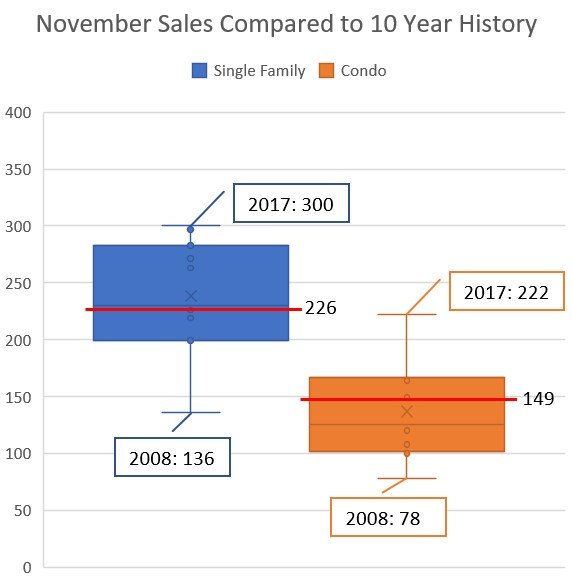

November is done and from a sales perspective it was much like October. Single family sales somewhat below average, while condo sales a bit above average for the month. The big drops from last year (single family sales down 25% and condos down 33%) are really about the extraordinary sales back then rather than the very ordinary level of activity this year.

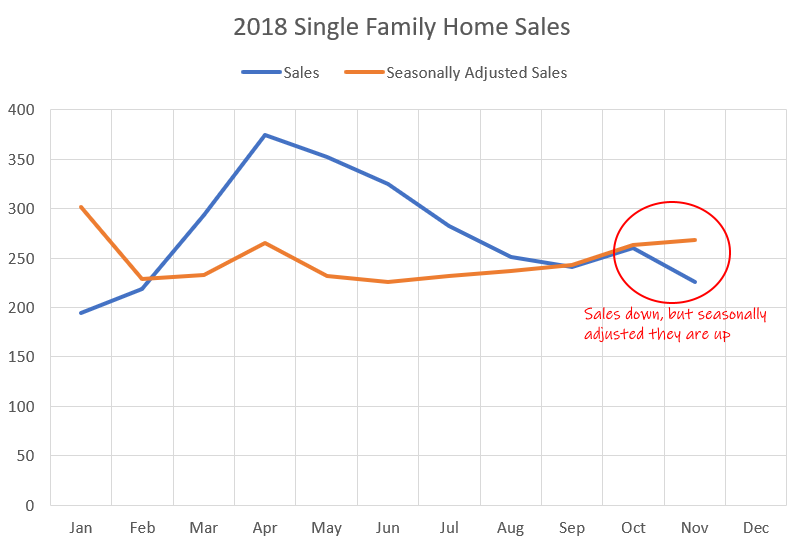

For single family properties, we continue to see a very gentle increase in seasonally adjusted sales levels, which have now been drifting upwards for 5 months. Disregarding last year’s abnormally active November, single family sales are down about 10% from pre-stress test levels. Condo sales do not show a strengthening trend, and have been bouncing around more or less flat for the year.

Note: A small (~3%) but unknown number of November sales are yet to be reported

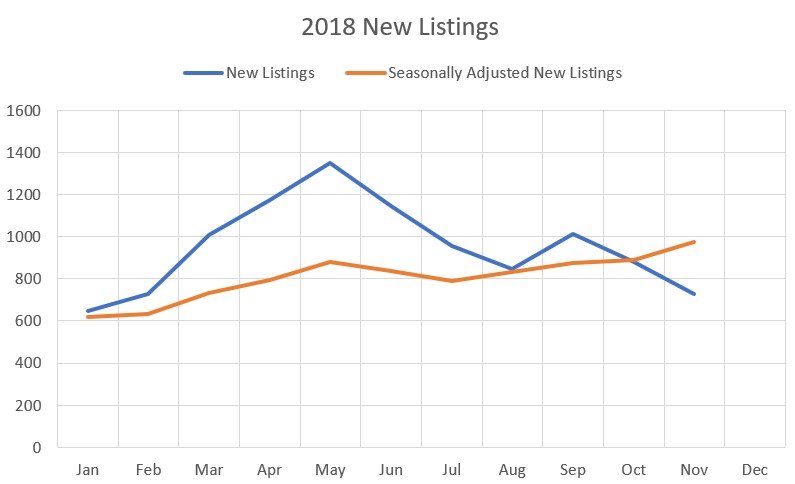

The good news is that new listings are looking relatively healthy and have been on an upward trend in 2018 while inventory is more or less stable on a seasonally adjusted basis.

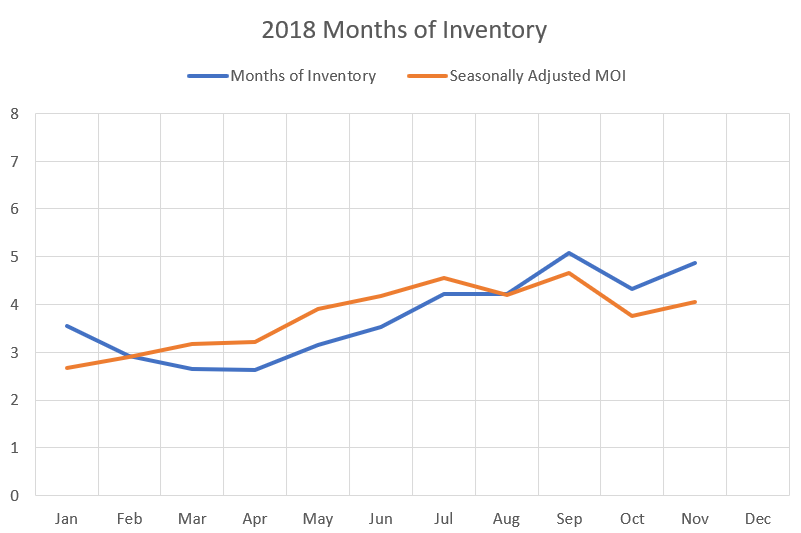

However months of inventory, which is the best measure of balance in the market, has not continued to increase. After a fairly strong cooling trend in the first half of the year, it has been pretty stable since June, at a level just below what is normally considered to be a balanced market. That is a combination of the single family side which is roughly balanced, and the condo side where we are still seeing sellers market conditions.

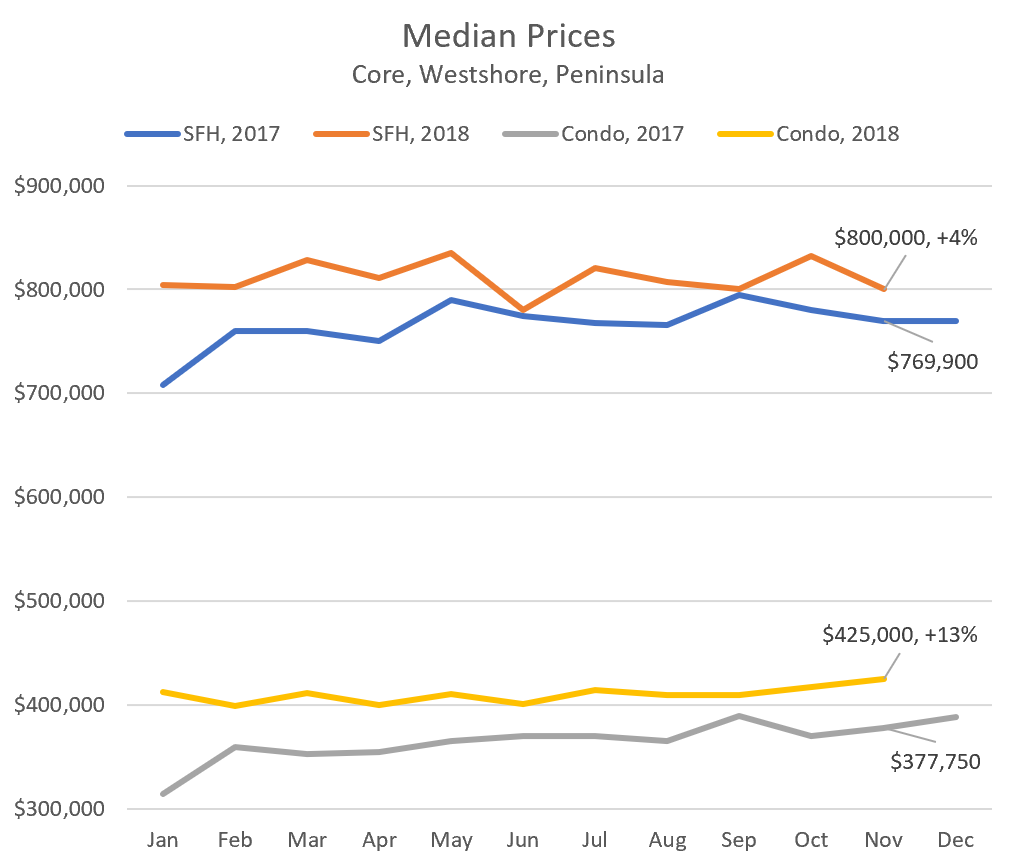

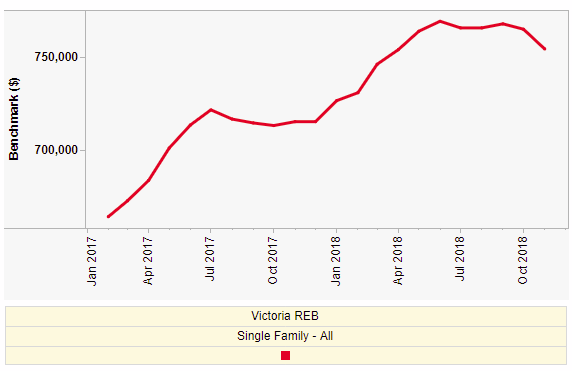

Prices have behaved roughly in line with those market conditions, with condo prices appreciating more in the past year than single family. It’s a bit surprising that single family prices stayed as flat as they have, given the market still spent much of the year with very low inventory, but it seems the large shock of the stress test kept both the single family and condo markets more subdued. Unless something changes we should be at about zero year over year gains on the single family side come January.

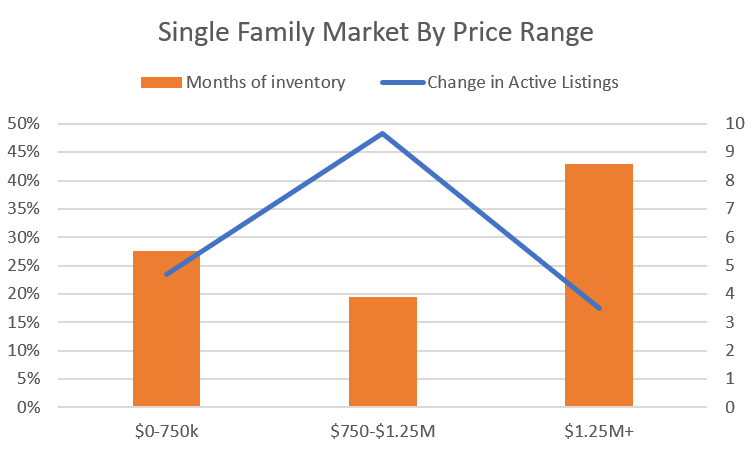

If you break the single family market down by price, we can see that the middle of the market is still the most active. Despite a nearly 50% increase in properties for sale between $750,000 and $1,250,000, that segment is still the most active with the low and high end both overall slower and having cooled down more from last year. The good news is there is more selection and less competition in every price range, so don’t believe it if someone tries to tell you the regulatory changes have only slowed down the luxury market.

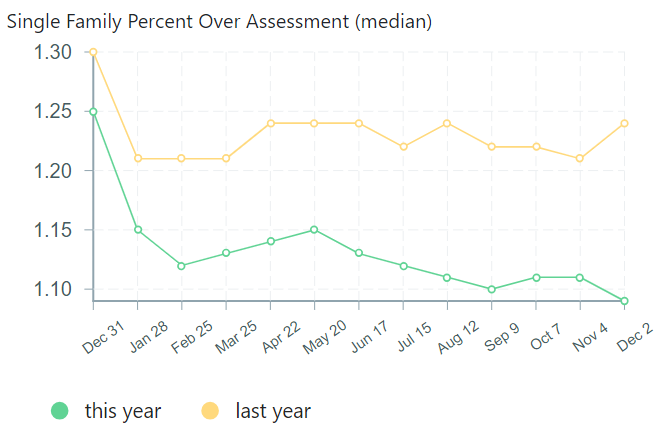

Comparing single family sales to their assessed value, it’s been pretty stable, with perhaps some slow downward drift after April of this year. However as we get into the season of fewer sales this measure can get a little more volatile (see last year) so I would like to see a more sustained drop before calling it a trend.

The market dashboard looks quite similar to the one in October. As a reminder, an up arrow on a metric means it is putting positive pressure on prices, while a down arrow is the opposite. The trend shows where the metric is going in terms of market impact. So for example, condo months of inventory is in sellers market territory (positive for prices so up arrow) but has increased from last year (slowing market, negative for prices, down arrow).

| Market Impact Dashboard | ||

| Metric | Current Reading | Trend Impact |

| Condo Sales | 149 | -33% |

| Single Family Sales | 226 | -25% |

| Condo Months of Inventory | 3.8 | +2.0 |

| Single Family Months of Inventory | 5.6 | +2.3 |

| Active Listings | 2225 | +31% |

| Sales to new list ratio | 63% | -19% |

| Local Factors | ||

| Unemployment Rate | 4% | -0.2% |

| Affordability | Very Poor | |

| Out of Town Buying | Elevated | |

| Apartment Rents | 7.5% | |

| Macro Factors | ||

| Wage Growth | 5.0% | +3.3% |

| Interest Rates | Stimulative | Increasing |

As you can see, despite cooling for two years now, current conditions are still mostly pushing up on prices or at least supportive of them. The trend is broadly negative, but that will only change current conditions if it continues for longer. I expect further weakening but so far it has been remarkably stable, especially in recent months. I wonder if the regulatory changes have capped what would have been the final year of appreciation in this runup and have turned the peak into a plateau, at least for now. No one knows if it will continue to hold, but it does seem more and more that the stress test was implemented at a smart time when at least the Victoria market could absorb the impact.

Wow. This thread. I’m a Californian with family in Victoria that we visit regularly. The mania up there is ridiculous. Of course you didnt have a correction, BOC followed the Fed to zero. You guys have low down loans all over the place courtesy of your government, which you all put waaaaay too much faith in. You learned nothing from our mistakes and even doubled down on them. I have too much money to make to enlighten any of you with reality, but there is good data from the housing skeptics in this board. For any other lurking critical thinkers here, you can further educate yourselves at housingbubble.blog, where Mr. Jones has been reporting on this everything bubble since 2006. You should absolutely be looking at this as a global bubble, fast deflating. For more broad-based education, Wolf Richter at wolfstreet.com will help you understand what’s going down. I hope all of you have little to no debt because this next downturn is going to RIP off faces. Good luck and godspeed.

New post: https://househuntvictoria.ca/2018/12/06/what-to-buy-in-a-downturn/

I am one of the biggest bull (and bullshiter…) here, but I think it is possible.

Less than 5 years ago –

2030 CARNARVON ST VICTORIA V8R 2V3 24-Jun-14 $495,000

2173 FAIR ST VICTORIA 30-Jun-14 $492,058

2218 BOWKER AVE VICTORIA V8R 2E4 25-Jun-14 $478,000

2574 EPWORTH ST VICTORIA V8R 5L1 30-May-14 $475,000

Epworth is small but a well maintained family home. 200amp and on-demand hot water.

(the owners have 2 teenage kids. They shared 1 bath, it is doable)

The market can crash after X’mas if French protests spill over, Trump / Xi showdown (google: huawei cfo) etc etc

As long as the buyer is flexible, willing to DIY, there will be deals out there. Good luck.

Is pretty interesting to see Toronto and Vancouver going in opposite directions right now though. Vancouver inventory up 40% while Toronto down 10%. Vancouver seems to be the weakest market in the country at the moment.

Vancouver schools losing teachers due to ‘impossible’ housing market, low wages

Rick Appel is torn about leaving Vancouver, a city where he built a 17-year teaching career, to move his family to Comox, B.C.

B.C. has lowest starting wages outside Quebec

https://www.cbc.ca/news/canada/british-columbia/bc-teacher-shortage-vancouver-housing-students-school-short-staffed-1.4708831

This letter gave me a good laugh today

” I know first hand that a “rental” condo development that was to be built this year has now stopped. This has created once again a horrible environment for B.C. real estate investors.

Investors require approximately a nine-per-cent return or more in real estate and most say that would never happen. Well, typically 2.5-per-cent rental increase plus 1.5-2-per-cent annual inflation hike, plus equity growth which one would hope for 4-5 per cent. There is now no equity growth and no rate hikes so no investor will come to B.C.”

https://www.burnabynow.com/opinion/your-letters/letter-burnaby-real-estate-investors-hate-horrible-environment-1.23520689

Annualizing from one month of housing data is completely invalid. I eventually just went there for the dog pics but even those are suffering lately…

From the greater fool..

You would think someone who has been writing about real estate for over a decade would know about seasonal patterns.

Annualized 5%? So 0.4%?

I doubt they would reverse course on the stress test that quickly. But I could see them bringing back the 30 year amortization. I don’t see that as an issue if you have been stress tested. We have a 30 year and it makes for a slightly more flexible product.

Still marveling at how many prospective buyers there seem to be out there, who are patiently (and impatiently) waiting to jump into this market whenever they see fit.

@guest_52957

Not entitled, but unrealistic. I’m not sure what the prices are in Langford, so maybe you have a chance there eventually. However, I had the $500K price pegged for a house in the core in 2009, but as others have said, even then nice houses in good areas had exceeded that mark. I have repeated my story here several times, so will just say that by the time we bought in 2016, we ended up paying around $175K more than the house would have been in 2013, and the idea of $500K was blown out of the water.

Prices are on their way down now, but I wouldn’t count on more than a 10% drop (granted, that outlook could change). Five years from now, though, I would be surprised if prices were lower than they are now, and think they will likely be higher. In the long-term, I think prices will continue to climb, unless there is an earthquake. All I’m saying is the day might never come when the price you think houses should be based on your income lines up with what they actually are.

Oh, and the $150K commuter discount to Royal Bay is already built into the price, isn’t it?

LeoS yes we considered offering on our rental but budget is 500k and a similar house I asked about on here a little while ago sold for much higher so I doubt we could afford it. It’s also 100+ yrs old and needs work. We will likely be Langford bound but even the prices in the boonies are awful… I told a rep at the sales center for Royal Bay I wanted a 150k commuter discount or a ferry running to downtown.

This is good news for mortgage holders…

As oil falls and a potential U.S-China trade war threatens the global expansion, investors are fully pricing in just one more increase from the Canadian central bank over the next two years. It would only take a small disappointment — economic growth falling slightly below 2 percent, for example — to eliminate even those chances.

“My bet is the BoC is done, period,” David Rosenberg, chief economist and strategist at Gluskin Sheff + Associates Inc., told clients in a report this week.

Year-End Economic Progress Report: Financial Vulnerabilities in Focus

Excerpt of BoC Governor Stephen Poloz year end speech.

“That said, it seemed clear to us that the price growth was being magnified by speculative activity, particularly during 2016–17. Some buyers were accelerating their purchases, motivated by fear that they would be priced out of the market if they waited. Others, primarily investors, were buying real estate on the assumption that prices would keep rising. This is significant, because when speculative activity drives prices unsustainably higher, an economic shock can prompt a sharp decline.”

“Anyone who remembers the housing market of the early 1990s in Toronto and Vancouver will recognize this point. And the impact of such a drop is magnified when the homeowners are highly indebted.”

https://www.bankofcanada.ca/2018/12/year-end-economic-progress-report-financial-vulnerabilities/

Come to think of it, I don’t want any more houses or density on my street, but I don’t mind it elsewhere. That makes me a textbook NIMBY. So I accept eviction from any occupied moral high ground on this issue.

https://www.bloomberg.com/news/articles/2018-12-06/why-it-wouldn-t-take-much-to-end-the-bank-of-canada-s-rate-hikes?srnd=premium-canada

Rents rising despite more supply in Metro Vancouver and rest of B.C.

In Vancouver, roughly 800 units of rental housing were added between October 2017 and October 2018, increasing the vacancy rate to 1 per cent from 0.9 per cent last year. Yet the average rent among all unit sizes reached $1,385, up by 6.2 per cent — more than the typically allowable increase of 4 per cent set for this year.

The survey shows that the average two-bedroom rent sits at $1,600. For a three-bedroom unit, it’s $1,900.

https://www.thestar.com/vancouver/2018/11/28/rents-rising-despite-more-supply-in-metro-vancouver-and-rest-of-bc.html

Makes sense based on sales to assessments/ 5 to 15% increase.

https://vancouversun.com/business/real-estate/b-c-s-property-assessments-more-moderate-in-2019

B.C. Assessment says some Metro detached single-family homes were showing decreases in value of five to 10 per cent over last year, including in areas of Vancouver, the North Shore, South Surrey, White Rock, South Delta and Richmond.

The rest of the province can expect increases of five to 15 per cent for single-family homes. This includes the Fraser Valley, Vancouver Island, Okanagan and the north.

If thats the worst to be said about another poster here, I’d say that LeoS runs a pretty high-class joint.

Ever considered buying your current house privately from the landlord and building an addition or lifting it down the road?

I wouldn’t call my consumption standard anywhere near decadence, but the houses that I looked at in 2004 under $480K in the core mostly were fixer upper or poorly updated. I ended with an unconditioned purchased at $500K, and God forbid it weren’t anywhere near Oak Bay/Fairfield/James Bay.

Meanwhile in Langford…

MLS 402206 and 402228

I won’t call you entitled, BUT….

Even back in 2008 when I was house shopping 3 BR places that were in the core and under 500K mostly had warts (busy road, immediate upgrades/repairs needed, crappy layout). At that point, what I considered decent places in nice neighbourhoods started at 600K and what I considered really nice places (not luxury, not newish, but well laid out houses, not in immediate need of repairs or upgrades on nice lots in attractive core neighbourhoods) started at 700K.

To get an ample selection of decent quality 3BR places in the core at sub 500K we’d need to fall at least to 2008 prices and probably further. While I fully expect some decline in prices I don’t think a fall of that magnitude is the highest probability outcome.

That’s all of Patrick’s posts.

Exactly Cadborosaurus! At this point it’s not worth the financial risk to me either for a crappy place. And if the prices continue to climb I think I have come to peace with the fact that we may rent for a long time. There are perks to renting too! It’s more and more obvious to me every day that there is no hurry to buy. You can still have a home and happy family without owning your home! Having a bunch of money invested makes me pretty happy and stress-free too!

Penguin we are in the same boat. 2 adults 1 kid and likely 1 more next year. We’ve been renting our “cheap” $1600 2 bedroom small house in town for years… was hoping to push it for a bit longer as asking prices make me sick, but our landlords told us they want to sell so the clock is ticking. I suspect our housing market is not sustainable at the current prices and something will have to give next year. If not we will likely be moving to and renting in the boonies while waiting it out, which will suck… but it won’t suck as much as overpaying for a house in a declining market, or settling for something less than what we want. We have a lot of peers in the same situation, have the down payment but are scoffing at the prices. Some friends bought last year and 2016 because the sky was falling and they didn’t want to miss their chance at owning or needed it now because they were expecting. But that crowd has come and gone and what’s left are those waiting.

I didn’t think I was being too picky wanting a 3 bedroom, 2 bathroom home for less than a half million but call me entitled haha.

If we were to “solve” this housing crisis, there would be another housing crisis in short order due to never-ending population growth (the value and sustainability of which I always question, by the way).

So, naw, I’m gonna continue to be a proud NIMBY and advocate for keeping nice neighbourhoods nice. Leave it to Langford to “solve” the housing crisis, as it arguably has been doing—and wants to do.

100% right.

We already have this.

Leo, you fool. The real deals will come when prices crater! Just give it a little more time.

[Insert graph on cycles, debt, bonds, HELOCs, 1981, Vancouver, Australia, Las Vegas, inflation, deflation, boomers dying, millennials living, etc.]

Find a divorce on a nice high end home. Reminds me a lot of 2008 to 2009 right now.

Great advice Leo… Especially a bit of a fixer.

Some decent under asks lately. This is definitely the time to locate those sellers that actually need to sell and are not just fishing. That’s where the deals are.

Australia: Rate cuts and more QE remain policy options:

https://www.businessinsider.com.au/rba-interest-rates-cuts-are-an-option-qe-2018-12

Love these kinds of articles.

https://victoria.citified.ca/news/bcbusiness-victoria-identified-as-bc-s-biggest-loser-in-annual-employment-ranking/

Headline: Victoria identified as B.C.’s biggest loser in annual employment ranking

“The City of Victoria’s 2019 employment outlook is in a literal free fall…”

Oh my god, what happened to Victoria? Are we plunging into recession? What is going on?

Read some more…

“The magazine does admit, however, that a contributing factor to Victoria’s decline was a de-coupling of the city-proper from the entirety of the south Island’s Capital Region in order to place a greater focus on the municipality itself”

Oh, so in fact very likely nothing actually changed and a change in definitions lead to a reshuffling of the rankings.

But of course “Change in study methodology ranks Victoria lower” doesn’t get as many clicks.

This is only true if we presume that housing is hermetically sealed from the rest of the economy, and, that buyers and sellers are stagnant (ie an equity based market where people already in the market just trade homes back and forth to each other at higher and higher prices). By this mode of thinking prices could be at any valuation no matter how high, and it wouldn’t matter, because the effects upon the have nots would be countered by the haves (ie the net effect societally and economically would be of little macro significance).

But that’s not the case. House prices that gallop ahead of what the economy can support sooner or later cause the kinds of issues we’re already seeing: unprecedented consumer debt levels that are strangling central banks and consumer spending, hollowed out neighborhoods, poor employee acquisition and retention, and reduced economic competitiveness. If that continued unabated, then the notion of “city” as a habitat for its residents breaks down. If the entire area was economically accessible only to the very rich, the city infrastructure itself would be in trouble. We need rich people and worker bees, and everything in between.

Fortunately, things never get that bad. Corrections eventually come along and to at least some degree, restores that balance. Right now, this is beginning in BC, at varying stages depending on the region and degree of overvaluation. This phenomenon has been the case in Canada since its inception, and as far as I’m aware, every other North American market as well.

I’m struggling to imagine a city where that is not the case. If you expand to “Greater” anything then two working professionals can afford a house in even the most expensive cities in the world. So the bar is not really a meaningful one.

Who is the you that is referred to here in the phrase “you have a crisis”. Not all of Victoria, because 61% own.

How about if you could have bought a house 10 years ago, but thought you were smarter than everyone buying, and waited and are still waiting for the price fall that never came? Now you have a crisis. The buyers have a nest-egg. Don’t try to drag others into your crisis – you made it yourself.

The spec tax raised is general revenues for the govt, not “expressly committed” in the legislation you referenced to anything including affordable housing. For example, they can spend it on health care, and not be offside with the legislation.

But both the NDP and the Greens have promised that it will be spent in the “communities” and “taxable area” it came from, but that’s a political promise, not part of the legislation.

The Greens promised this when announcing their final support for passing the bill in October 2018 ….

https://www.timescolonist.com/news/b-c/b-c-greens-back-housing-speculation-tax-assuring-its-passage-1.23468864

“The second will require the provincial government to spend any money it collects on the speculation tax on affordable housing in that community”

And the NDP (Carole James) promised it when announcing the passage of the bill “the new legislation introduces a requirement that all funds raised for affordable housing will be used to build homes in the taxable areas” listen to Carole James say that Oct 28, 2018 when she announces the final bill (0:28 into the video here https://globalnews.ca/news/4569070/bc-speculation-tax/

When the govt has their annual meeting with the mayors for consultation on the the tax, by legislation, it won’t be with mayors of Prince George or Chilliwack, because they are not in the spec tax area. Because the legislation restricts the consultations to mayors from the spec tax areas.

If it takes two full time highly paid jobs to buy a house in a metro of under half a million, you have a crisis.

In other words, you were wrong. But thanks for taking the time to read the legislation.

Looks right to me. Where the money is going will have to be specified in the next budget.

In spite of everyone screaming that there is a housing crisis in Victoria one does have to wonder about that when a 30 year old fireman married to a thirty year old high school teacher can actually afford to buy a house in Greater Victoria.

I also get a bit suspicious when people throw out the average family income stats for Victoria because they often include students and retired people in their groupings.

These days everything seems to be labelled as a crisis.

Go Saanich North!

Last day to return your vote is friday!

https://elections.bc.ca/referendum/how-to-vote/

Hahahaha I didn’t even know what that place was called. We went there tonight actually. I like their brisket, but their pickled lemongrassy stuff I don’t care for. We just stop there as it’s on the way home from the places we work.

Your time will come for a place. A lot has changed in the market as you know, it just needs to persist for long enough to move the market from end of cycle participants (speculators/investors) to start of (FTBs). I doubt I’ll try to wait till the next upswing if we do jump in. Don’t care too much about buying at the “bottom”, just need the market to be sensible – and have some selection.

In 1921 OB population was 4,000. Thankfully they didn’t have the same attitude as modern OB, and allowed the population to (gasp!) grow to where it is now, 20k. No one has asked OB to grow like Langford, but there is no excuse or “pardon” for zero growth when part of a metro area with a housing crisis.

At least the OB mayor elect agrees with me. https://www.murdoch4mayor.com/policies

“This includes changing from depopulation to community growth, creating ownership and rental options for all life stages”

Local fool pho boi sucks! Go up quadra to Vietnam house it’s not bad and not in a food court! Not that I ever go out to eat anymore either but it’s not because I’m thrifty it is just too much effort these days with the little ones taking up every last ounce of energy.

Anyway I’m in the same boat regarding graduating/being born. Dang if I was only born 3 years earlier! At least my rent is ridiculously cheap but I am going to have children living in closets because I can never move. 2 bed 1 bath 2 adults 2 kids…how long can we make it? Move out into a place with an extra room and rent goes up 1-1.5k. Buy or rent? I’m sure many people are dealing with the same thing and landlords who want them out to jack up the price!

The house on Gorge (Yes… the one I have been talking about, is on Earl Grey) does need a lot of work but it has good bones. It’s Not for everyone. I believe that the drain that runs along under the concrete floor in the basement might need dug up and replaced….possibly including the stretch going out to the city line as well. I come to this conclusion, and it is only a guess, because it seems odd that they would not have simply plugged into that drain stack …but instead….they chose to run the pipes outside into the perimeter drains as a back up. (One of those lines is from the washer! ) If the drain pipe under the floor was working well then why would they have chosen to send the water out to the perimeter drains?

Anyway. The house has at least five offers to date and so one has to think that there is still serious interest in Victoria for buying houses…even at this time of year.

Pardon Oak Bay if it doesn’t eagerly wish to transform itself into the poorly planned, dense, ugly, treeless craphole that is Langford.

This scheme reminds me of the BC Liberals’ “Home Owner Mortgage and Equity Partnership program.” Remember when Christy Clark came out with that before the election? Such a bad idea.

Also, if the world’s oil requirements ever sharply wane, Calgary is one of those places that is gonna be screwed. Wouldn’t want to be holding a lot of real estate in Calgary if/when that happens.

and

Thanks for the positive feedback. It can fun (and sometimes instructive) to glance way back!

A bit presumptuous, Patrick. I was just finishing my undergrad then. Started looking at things at the end of 2015, just as the cyclical run up was beginning. Certainly wasn’t in the position I am now. Decided to continue to save and contribute more to investments. It’s worked out fine, it’s just a matter of unfailing discipline.

Waiting is not always a matter of greed and/or wanting 50% off. For us, we don’t buy new cars, we maintain and fix what we have. This computer is 5 years old and has a smashed corner coming off the bezel. We have staycations (heh this year we had some fun elsewhere though). I’ll re-dye faded pants before throwing them away, and eat plain oatmeal and PB&J sandwiches daily. We go out for dinner, but that’s almost always at the Mayfair food court. Opa and that new Vietnamese place is pretty great. In short, we spend where we need to spend and in a manner that is sensible. Jumping in and blowing everything when everyone is panicking to get in to RE just isn’t our game.

There’s no guarantees anywhere. There’s obvious risk to buying, or to sidelining – as you so continuously demonstrate on the latter. Just a question of priorities and what’s right for someone at a given time. Things out there don’t feel right to me right now. Doesn’t mean it’s not for someone else. Maybe I’ll eat it as a result. Maybe I won’t. That’s the simultaneous risk and beauty inherent in the power of choice.

Yes, but in the record books, with house prices measured year to year, it was less than a 1% loss, as measured by the authority on this (vreb) .

https://www.vreb.org/media/attachments/view/doc/ye782017/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

Average SFH Victoria price…..

2007 $563k

2008 $583k

2009 $580k

2010 $629k

….

2017.. $858k

Was that little 2009 blip enough to scare you out of the market for, what is it, 10 years now?

It’s always interesting to look back at history to see what people were saying. It shows the repetitiveness of everyone’s arguments, which is because the psychological underpinnings of markets never change. Just a question of which side the pendulum things are swinging.

The housing market did tumble after that, and Victoria’s prices dropped in real value by about 10%; the bare minimum for a price correction. The rest of the affordability issue was mitigated through interest rates dropping to the floor.

Now, the housing market has made up for the lower rates and then some; it will be interesting to see what will happen now with far more leverage in the system, and proportionally less tools among the central bank to deal with it. I’m not buying anyone a beer at this point, but then again, not buying a house either. 🙂

I can read, and especially enjoy reading those old comments from “patriotz” in Dec. 2008 about housing prices being too high and about to fall (posted earlier by introvert).

Are you the same patriotz, and have you been consistently bearish since then. House prices have risen 60% since dec 2008, with no significant downturns, but I guess you know that 🙂

There are no restrictins in the bill period on how the govt can spend the spec tax raised. It likely all goes into govt general revenue. No guarantee that any or all of the spec tax raised in Victoria finds its way back to Victoria.

The annual meeting with mayors is mentioned in the bill, but no accounting required by the govt of if/where the money got spent. Just a general chat on housing affordability issues.

I see this spec tax as just another general GreeNDP tax grab, though this one breaks new ground as it taxes The “spec tax areas” like Victoria/Vancouver higher than other areas of BC, with no guarantee of any of that money coming back here.

Patriotz – I had only a cursory look. But it looks to me like there is nothing committing the money to any particular purpose (like affordable housing). This is just going to be general revenue AFAICT and the government’s commitment to spend on affordable housing is purely a political commitment. Is that your take?

MLS 402182 – 3054 Earl Grey St — is this the house being talked about? Interesting that there would be 5 offers on it. Definitely needs some work. Cute but …

The comments from 2008 are great. There was real fear in the air then and the bears were loving it. Unfortunately not so many took advantage of what was in retrospect a good buying opportunity.

We were lucky to buy in late summer 2008. Already then the market was slowing from Spring 2008 when we started looking. Still we were probably six months too early for the best deals of that market dip.

Langford is lucky as they have great proximity to nature in the form of provincial and regional parks (Goldstream/Mill Hill/Thetis Lake/Mount Wells/Sooke Hills). The actual amount of park that Langford has created is trivial and less as a proportion of municipal area than Oak Bay or Victoria.

Here’s the map – https://www.langford.ca/assets/Maps/Things~To~Do/ParksandTrails.pdf

Langford is basically a freeloader in this sense. Maintaining very little park area and benefiting majorly from the parks that the rest of us pay for. Mind you I am glad that the CRD and the Province control that land as otherwise Langford would find an excuse to pave it over.

Who takes the hit if the property is sold at a loss? Not a hypothetical question in Calgary these days.

Here is the text of the Act as passed 3rd reading, Royal Assent Nov 27. I challenge you to find anything in the Act which mandates the government to spend the money in any particular location.

https://www.leg.bc.ca/content/data%20-%20ldp/Pages/41st3rd/3rd_read/gov45-3.htm

https://attainyourhome.com

Calgary has always been on a back burner for us if we cannot afford a home here. Someone showed me the attainable homes program they have there, I find it really interesting and thought I’d share. For only $2000 down (recently slashed from $2500) you can buy a new home in the program, with the city making up the difference for the down payment. You have to pay back the city loan and they maintain some equity in the home pending how long you live in it on a sliding scale. The most equity you can keep is 75% if you live in the home for 5 years or longer and then sell. They reinvest their equity portion into helping other new buyers.

Seems cool on the surface but there are some pretty nice homes in Calgary for 400k and the qualifications for this program are pretty lenient. Max income for a family 103k… if you can’t come up with 20k down at that income should the city be making up the difference? No property transfer tax there either.

There’s also a $1000 cash bonus for referrals right now… if the social housing program is so lucrative why do they need to push sales like that?

@ Introvert, you are such an asshole! Haha

Have some mercy on the bears, X’mas is around the corner.

Why not post the near the Gorge house MLS# or address rather than keeping it a “secret”?

Went through the house near the Gorge yesterday….I figured it would be popular with the unfinished basement.

I am surprised to see a house near the gorge with “Five” offers on it. I thought things were supposed to be slowing down!! It will be interesting to see what it sells for.

It’s a cute little two bedroom with an unfinished high basement. It has already had an inspection done on it by the sellers. I found it interesting that a number of mistakes were made on the inspection report. (It stated several conflicting opinions on the attic space for example) The report also missed the fact that two interior drain pipes had simply been directed to the outside perimeter drains…which is likely not even close to legal. (It’s one of the reasons I can’t stand these kinds of inspection reports. One is better off getting an electrician to inspect the wiring and a plumber etc….. in my opinion) I see this kind of thing all the time and yet the banks and agents seem to love these reports.

Interesting though that the house has five offers so far. I would likely buy the house as it is because it seems to be priced right.

No, Nick, no!

The author of this comment, Ryan, was surely our version of Local Fool back then.

Oh my.

I think vg should have bought in 2008. “Reality bites.”

https://www.blogger.com/comment.g?blogID=7123542260692860177&postID=315842482625950645

It doesn’t matter how you slice it. Langford have much more more parks within it border and even a much greater area within it proximity than Oakbay.

Oak Bay saving grace is because of it proximity to fast growing Westshore. With out a young population nearby Oak Bay infrastructure would be in ruin. There wouldn’t be shops/stores/working professionals to do all of the menial work that required to support an aged population. Worst of all, price of goods would go up dramatically while pension shrink, because there aren’t enough working people to pay for the social services.

There are more than twice of the nearly dead (65 and older) than youth (14 and under) population in Oak Bay.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CSD&Code1=5917030&Geo2=PR&Code2=12&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All

Thunder Bay population at 14 and under is roughly the same as 65 and older, and they are facing economic difficulty due to lack of population growth.

City stalled; Stagnant growth, aging population present economic challenges.

http://www.chroniclejournal.com/news/city-stalled-stagnant-growth-aging-population-present-economic-challenges/article_eb321b84-eed9-11e6-b9ee-a36fdd56ee68.html

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=POPC&Code1=0935&Geo2=PR&Code2=35&Data=Count&SearchText=Thunder%20Bay&SearchType=Begins&SearchPR=01&B1=All&GeoLevel=PR&GeoCode=0935&TABID=1

Add:

That bet I proposed a while back still on if anyone care to remember.

I proposed that I would pay for a pint each at the local bar for everyone on this board if there is a drop in the local housing market of 10% or greater. And, the bears who predicted of 10% or greater drop would pick up the tab if it is less than 10%.

Well you’re wrong.

Under the legislation, all of OBs spec tax collected goes back to be spent in OB, for affordable housing, which is what I said, and what I oppose. If Langford (or somewhere else) has no spec-tax homes to begin with , they wouldn’t get any money, even if they build lots of affordable homes. So clearly the money is going back to the munipalities that have the vacant properties.

This “return the spec tax money to the community that collected it”was an amendment insisted on late in the game by the Greens. Here’s a TC article about it, and notice the phrase “in that community” which means “in the community that had the vacant properties to collect the spec tax”, which makes your statement above false.

https://www.timescolonist.com/news/b-c/b-c-greens-back-housing-speculation-tax-assuring-its-passage-1.23468864

“The second will require the provincial government to spend any money it collects on the speculation tax on affordable housing in that community”

I can understand that many here are likely in a foul mode today given the BOC decision to slow-down or cancel rising interest rates, but there’s no need to get personal.

“Now when a place like this comes down to the low 300’s, and it will”

The very next comment (boy were bears optimistic!):

https://www.blogger.com/comment.g?blogID=7123542260692860177&postID=622847465088187053

Mmm, no. Compare Langford’s land dedicated to public parks against golf courses. It’s shameful.

Can’t you read? That is NOT the way it works. The money goes to where the affordable housing is built, not to where the vacant properties are.

Foreclosures aren’t actually common in Canada, and when they do occur my understanding is they aren’t as easy to spot as in the US (no parading it on the listing, or on the yard sign etc). Regardless, any downturn sees foreclosure activity increase.

It’ll be interesting to see what Leo’s annual “guess the price in a year” game will net from folks. I’ll be guessing downwards, but not sure I’ll go with 50%. I’d be worried about Mrs. Fool or I losing a job if things got that bad. On the other hand, Vancouver…

I would change the method of funding so that it goes mostly to development cities like Langford. I see no reason that OB should get all its spec tax money back if they “expressly commit” to build a few affordable housing units. Why reward a city that has lots of vacant homes by sending them back more spec tax than a city that has few vacant homes?

Hey patriotz, I think the party didn’t get started…

https://www.blogger.com/comment.g?blogID=7123542260692860177&postID=7672624890869847735

Just checking out what people were saying on HHV 10 years ago:

This prediction didn’t pan out…

https://www.blogger.com/comment.g?blogID=7123542260692860177&postID=7672624890869847735

az

Greater Victoria SFH…

nov 2018 average 851k/ median 770/ hpi 755k

nov 2017 902/750/ and HPI 715k

average is total sales vol/amount of sales

Like I said, upzone all of OB and you wont see much change.

What gives you the idea that any spec tax money will be given without conditions to municipal governments. The money is expressly committed to funding affordable housing.

BC doesn’t need to explain it to OB so that OB agrees. Just like BC didn’t need to convince Victorians or foreigners that they should pay spec tax (whereas Prince George homes don’t need to pay spec tax)

The GreeNDP should apply a NIMBY tax/disincentive to deadbeat NIMBY cities like Oak Bay that are doing nothing to help with the housing crisis. A start would be that no spec tax money is sent from B.C. to OB until housing has actually been built in OB, not talked about. Next would be grants to cities like Langford that are doing-the-heavy-lifting (literally) by building the units needed.

And OB gets to keep doing nothing, just pay more tax. And there’s one thing NIMBYs hate more than seeing new housing built in close “proximity” to them. Thats paying more tax.

Those waiting for interest rates to rise before buying should note this news about the BOC slowing down (CAD immediately dropped 1%, indicating this was unexpected)

https://www.google.ca/amp/s/www.poundsterlinglive.com/cad/10479-the-canadian-dollar-today-bank-of-canada-interest-rate-decision-and-outlook-in-focus/amp

@guest_52902

Thanks for that article.

Is it correct? Are they talking about mean, HPI, etc? That’s a decent drop if true.

Greater Victoria real estate market slows and prices dip

https://www.cheknews.ca/greater-victoria-real-estate-market-slows-and-prices-dip-514272/

@guest_52854

God introvert you’re such a moron.

You lack intelligence, and clearly have a limited understanding of the world. I’d love to see what kind of shitty job you work.

There are ~2,300 active listings for sale right now. You’re welcome to buy something. There’s no wall.

“What a horrible idea.

Oak Bay doesn’t need more people. Nor does Greater Victoria.”

Introvert has their house already so fuck everyone else! Build the wall.

I’m sorry, but Langford’s parks are few, tiny, and shitty.

And I like how Langford counts Goldstream and Mill Hill Regional Park as its own to make itself look better. No, Goldstream wasn’t created by Langford and it would have been paved over by now with a sardine-can housing development if it didn’t belong to the province. And Mill Hill is a CRD park, so same.

What a horrible idea.

Oak Bay doesn’t need more people. Nor does Greater Victoria.

Populations and economies can’t grow indefinitely. The sooner we wrap our heads around that, the better.

It’s not OBs responsibility to build housing. Explain why it should be.

Of course Langford is pulling the weight. It has vacant land. It just lacks vision…

Oak Bay during the census period 2011-2016 created zero net new housing units. Actually a negative number, but may as well call it zero. I blame OB NIMBYS for that.

Langford created thousands of new housing units, pulling 4X their weight based on population. Plenty of parks in Langford. https://www.langford.ca/EN/main/lifestyle/parks-trails/parks.html and for the record Beacon Hill Park isn’t in OB so you should tell OB to build their own Beacon Hill.

Not rubbish. Up zone all of OB and you would not see dramatic change in your lifetime. Plus you are talking about sky, not land. We have infinite sky. But it’s time consuming and costly to build up in established neighborhoods. Don’t blame OB, Blame Langford for being too short term still. They should be pushing for the rail link and building their own Beacon Hill Park and walk-able village with high density living in the West Hills. Row housing, condo towers, Tram, pedestrian village. This could happen in our lifetime because it’s on bare land. They have already nuked the ecology of the area so that’s not really an issue anymore….

@Barrister

Sales history (last 3 full calendar years)

22-10-2018 $649,000

https://www.bcassessment.ca/Property/Info/QTAwMDBIUDJHQw==

Total value Assessed as of 01-07-2017

$498,100

It’s listed on the BC Assessment website as a sale on Oct 22, 2018.

It’s a pretty non-descript tiny, older house. I thought the Oct. purchase price was too high. Perhaps purchased without conditions or a thorough review?

Rubbish. We just have morons in government. Take a walk down Oak Bay Avenue: the most boring futile street in the world — in Victoria, anyhow. Allow ten story apartment buildings with commercial space on the lower floor(s) from Oak Bay at Fort Street and down Newport to Windsor road, and you could double the population of Oak Bay and the adjacent area of Victoria, while vastly improving the look and economic potential of the street.

AZ Are we sure that 621 Lampson actually closed on 10/22/18 and that the deal had not just fallen through? If it did close it makes you wonder what the new owners found to make them try to sell less than two months later?

Sure it did. The fear-based decline surrounding the financial crisis; that was felt here as well.

But that’s not what we were talking about. Josh pondered why in Victoria the market was flooded with listings in 2010-2011, and probably contributed to the local decline in prices during that time (which was not felt in Vancouver). I offered a theory related to local cuts in employment.

Flip to watch, don’t think they will be coming out without a loss. A bit confused as the description is identical to the one that sold in Oct.

621 Lampson St.

Asking: $669k

Purchased: 10/22/18 for $649k

Interest rate steady as expected but they are still planning to increase it.

“Weighing all of these developments, Governing Council continues to judge that the policy interest rate will need to rise into a neutral range to achieve the inflation target. The appropriate pace of rate increases will depend on a number of factors. These include the effect of higher interest rates on consumption and housing, and global trade policy developments.”

Vancouver fell about 12% from spring 2008 to spring 2009. Note the peak was months before the financial crisis in fall 2008.

It’s December!! Only 3 months to go until the Spring rush begins.

The13 year low for new listing is likely because most people contemplating selling are waiting for Spring before listing. Marko, don’t book any Spring vacation, I think you’ll be very busy.

No. Only the most recent listing is counted.

Hmm.. Looking at my predictions I’m pretty happy with my summary where I predicted “Sales down some 15% from this year, prices mostly unchanged with condos up a notch, and interest rates unchanged.”

Sales will be down just over 15%, single family will be mostly unchanged, and condos are up, although more than I expected along with interest rates.

Annual Sales: 7550 (pretty close to actual of ~7100)

SFH Median Price (Dec 2018): $750,000 ($770,000 right now so I could get very close here!)

Condo Median Price (Dec 2018): $385,000 ($420,000 so way off on this one)

For sure, the theory sounds good, bu the results don’t seem to be any better than just the bare prices.

DuranDuran:

This was my prediction from last year:

“I don’t think there are going to be many price drops until quality properties stop selling and sit there for a while. I think maybe in the fall when properties aren’t moving is when we will start notice the price decreases. And then the sentiment will change and we will start to see a small drop in prices (10%) nearing the end of the year. Spring 2019 will drop even further as inventory continues to rise. I think the list of fomo people willing to do anything for a house has reached the end. Slow melt.

Annual Sales: 5900

SFH Median Price (Dec 2018): $710,000

Condo Median Price (Dec 2018): $365,000

BoC rate (Dec 2018)”

Hmm drop in prices was wishful thinking I guess. I definitely didn’t predict the price increase this year/last fall. Maybe I’ll copy paste last year’s prediction into next year’s prediction…

Also I miss just Jack’s posts. And I also wonder…did Barrister and Just Jack ever get that beer?

Your dashboard has come a long way in a year Leo!

To be a little more precise, they have been flat. Whether they are now falling is to be determined. Prices are certainly down in November. But one month is no trend.

Only the people that buy matter.

I like this!

Interesting link, Hawk.

Loved this line.

“…it has little to do with new taxes and other cooling measures imposed by various levels of government.”

“The market had topped out on its own volition. Then we had government change, then we had stress tests, then we had foreign buyers’ tax. We had everything kind of thrown on it, so it was almost like kicking a lame dog. The dog was hurt anyway. You didn’t have to throw these exponential factors in.”

I couldn’t agree more. By the time “government” comes in to “fix” the problem, it’s probably already too late. Having said that, we really need more transparency and enforcement. That’s always a good thing IMO, regardless of where we are in the RE cycle.

They have been recently, but with the new regs coming in surrounding HELOCs (ie, your affordability calculation presumes automatically that you’ve maxed it out, even if you haven’t) as well as the stress test and higher rates, it’s pretty unlikely that train will keep running. And with buyers beginning to bulk en masse, that may have already stopped.

Many of them pulled out their “bubble equity” to front that cash, and could now be facing declining values. The kicker is, most of the declines are likely to be in the places where that kind of fronting was most common. Leverage is an amplifier – both on the way up, and the way down.

As I have asserted and debated with others – an equity based real estate market is completely unsustainable and always was.

The market psychology has now shifted for a very long time. Like I’ve said when you take away the speculators the market will tank. Vancouver numbers look ugly. Saw one stat saying prices down 7% in the detached.

I am happy my new tech stock pick was up double digits today tho with all the blood letting. 😉

You can substitute Victoria in this headline.

Analyst says real estate speculators no longer interested in Vancouver market

A local real estate analyst, who correctly predicted the average price of detached homes to significantly drop last year, is expecting the trend to continue.

https://www.citynews1130.com/2018/12/04/real-estate-speculators-vancouver-market/amp/?__twitter_impression=true

While partially true, I don’t think that’s the main story. The Campbell & Clark governments laid ff hundreds of government & Crown Corp. employees, teachers, and other workers. Cuts were disproportionally felt in Victoria (why Vancouver housing did not drop at all at this time).

If anyone is feeling particularly idiotic today, they could pick up a townhouse at 1770 Rockland Ave for 1,675k. Alternately you could pick up a full house with 3 units for a similar price at 550 Harbinger Ave.

This has been another episode of “What were they smoking!?”

“We need new walkable / bikeable / electric rail cities.”

Justin Trudeau is apparently betting big taxpayer bucks on artificial intelligence. Lets hope it pays off and we can apply some of the resulting product to the design of communities, which should be not only walkable and bikeable but genuinely livable, without all those wires, boxes and dongles hanging from wooden poles (Musk’s Boring Company could surely play a role making possible underground services for all) ; and without the dangerous and distracting intrusion of motor vehicles in living, recreational or shopping areas. The key will be density, landscaping of public spaces and lots of indoor as well as outdoor public space.

Speaking of Gordon Head and Oak Bay

“According to Elections BC, the four ridings with the highest return rate in the province all come from Vancouver Island. Coming in at number one is Saanich North, with a 47% return rate. Meanwhile, Parksville-Qualicum holds a close second with 46.8%, while Oak Bay-Gordon Head sits in third with 43.2%. Courtenay-Comox rounds out the fourth highest with 41.8%.”

http://www.victoriabuzz.com/2018/12/the-four-highest-return-rates-for-bc-referendum-ballots-come-from-vancouver-island/

Question for a realtor?

Does sell Price/List Price data, take into account if a house has been re-listed?

Example – original list price 800k, then re-listed 750k, sold 735k. So this house would show as selling for 98% of list price, correct? (not the actual 91.9% of original list)

This made me think of Gwac vs Hawk or Introvert vs Hawk:

It is a bit sketchy. Leo S. and Introvert live there after all.

When I moved here in 2001, I could not believe the difference in house prices between Gordon Head (around $275K) and Oak Bay (around $350K). In Regina, there were some bad neighbourhoods with high crime, so I assumed Gordon Head must be one of Victoria’s bad neighbourhoods. Now Gordon Head is definitely in the core, but spending the $75K more in 2001 for a place in Oak Bay would have totally been worth it not just because real estate went up, but Oak Bay went up more proportionately.

Average prices 2001/2017:

Saanich East: $283K/$1M

Oak Bay: $386/$1.45M

Yay, Keep it up Tariff Man. I have money waiting for this sale!

It’s,

“Look out below, suckas 😉 ”

PS Hawk, where’s your graph? Haven’t seen it in months.

Metro Vancouver homes sales down across all property types

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales totalled 1,608 in the region in November 2018, a 42.5 per cent decrease from the 2,795 sales recorded in November 2017, and an 18.2 per cent decrease compared to October 2018 when 1,966 homes sold.

Last month’s sales were 34.7 per cent below the 10-year November sales average and was the lowest sales for the month since 2008.

There were 3,461 detached, attached and apartment homes newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in November 2018. This represents a 15.8 per cent decrease compared to the 4,109 homes listed in November 2017 and a 29 per cent decrease compared to October 2018 when 4,873 homes were listed.

[Note above how sellers are attempting to ride out the slump, but in the next paragraph, you can see this behavior is being overwhelmed by the sheer scale of the buyer drop-off. Sellers refusing to sell is not, and never has been, a durable backstop to prices in the event of extended buyer fatigue]

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 12,307, a 40.7 per cent increase compared to November 2017 (8,747) and a 5.2 per cent decrease compared to October 2018 (12,984).

For all property types, the sales-to-active listings ratio for November 2018 is 13.1 per cent. By property type, the ratio is 8.9 per cent for detached homes, 14.7 per cent for townhomes, and 17.6 per cent for apartments.

[Note how condos, previously holding their own against the failing detached market, are now starting to weaken and fall. Victoria, IMO, is on a similar path, albeit delayed and likely less severe]

Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,042,100. This represents a 1.4 per cent decrease over November 2017 and a 1.9 per cent decrease compared to October 2018. [Consider this information in context – imagine how this would have sounded in mid 2016. Impossible – unconscionable. And if the market does not experience rapid growth quickly, this number will inevitably grow.]

https://www.rebgv.org/monthly-reports/november-2018

As Hawk likes to say, Look out below!

Front page of Yahoo this morning. But yes, yes, I know, Vic is separate from Vancouver and Vancouver’s path has no effect on Vic… (Leo, would really love that face palm emoji on here)

https://ca.yahoo.com/finance/news/vancouver-home-sales-plunge-42-184400352.html

@ Caveat Emptor

One thing to consider about this is Kits and Point Grey are both on desirable ocean waterfront; Kerrisdale wins by proximity. Surrey and Burnaby aren’t waterfront suburbs; if they were, their prices might reflect it.

And we don’t even build them when we have an existing rail line running right through the middle of one that is in the middle of being created. Cough cough WestHills cough cough….

Oil hit all time highs and big money was to be made elsewhere. So people moved.

Does anyone have any insight into why inventory ballooned locally in 2010-2011?

*We need new walkable / bikeable / electric rail cities.

Easy. Build a city where there are no existing “backyards”.

Alberta, Manitoba, New Brunswick, Quebec, Saskatchewan, Yukon.

8 Canadian Towns Where You Could Get Land For Free

True north strong and FREE.

https://www.narcity.com/ca/on/toronto/lifestyle/8-canadian-towns-where-you-could-get-land-for-free

For you macro folks, here’s the most updated auto-sales data for Canada. During a cyclical roll-over where credit markets begin their contraction, spending on larger ticket items begins to decline – the most visible of these are houses, and automobiles. True to form, here we are – auto sales have been falling now for 9 consecutive months.

As for the HPI Benchmark, I thought it was all about eliminating the ‘skew’ factor, the noise in month-to-month prices that arises from varying sales in the different communities (e.g. more sales in Sooke one month, more in Oak Bay the next month), as well as due to different sizes of properties (ie, more 5000 ft houses one month, more 1200 ft houses next month).

Recall, back in the quiet days of the old blog and the declining market….we cared about skew for a few months in 2013:

http://househuntvictoria.blogspot.com/2013/08/skewmorphism.html

Does anyone have any long-term data to support this?

The runners-up to this motto were:

• Land of Shit-All

• Land So Undesirable We Literally had to Give It Away to Settlers*

• It’s a Dry Cold

*Even today, Saskatchewan still has to do this: https://www.cbc.ca/news/canada/saskatoon/one-dollar-lots-prince-albert-1.4193068

Absolutely true.

How can we create new cities if the NIMBYs protests economic and infrastructure developments at very turn?

Cities aren’t built on empty land, because people need jobs and economic opportunities to live.

The funny thing is, one year ago the sentiment was probably more negative – a plateau was upon us, and the market was either aiming for a ‘soft landing’ or else an all-out collapse.

December is often my favorite time on the blog. Around Christmas, even combative HHV’ers put aside their bear/bull/halibut differences and are kind to each other for a day or two, while we all get to revel in our success and failures at predicting the past 12 months of activity.

I’m not sure it’s fair to make predictions at the start of the month, but I kind of feel like the market has been more resilient than most owners feared (buyers were hoping for). Certainly there were quite a few predicting big drops from last year, drops that have not come to pass.

Sneak peak at last year (scroll down for predictions for 2018):

https://househuntvictoria.ca/2017/12/28/magic-8-ball-says-predictions-are-difficult/#more-3249

We’ll have to leave Leo to calculate the actual, because I think the prediction for 2018 was for the 3-month median (not the December average). Time to sharpen pencils for 2019? Maybe too soon.

The problem is the new ones are basically strip malls and suburbs. This is functional and easy but it only drives up the “proximity effect”.

We’ve come full circle, again. We need new cities.

Fair comment Dasmo, thanks for putting that out

We do have plenty of land. We are just out of the land that is a 15 minute walk to town…. or a 15 minutes bike ride, or a 15 minute drive. We are running out of the land that is a half hour drive. The equation would be different if the WestShore took some European influence and was building a walkable core but it’s not. New infrastructure is also getting more and more outrageous cost wise. Anyway, I’m not saying this will lead to infinite house prices. Im actually mildly bearish right now. I’m just pointing out the flawed observation that “we have plenty of land so that’s not a valid influence”….

Consumers/mortgage borrowers clearly tapped out and it isn’t even a recession yet… or is it ?

Canadian Household Debt Growth Has Never Fallen This Low Outside Of Recession

https://betterdwelling.com/canadian-household-debt-growth-has-never-fallen-this-low-outside-of-recession/

No need to ban yourself gwac, if you could just learn to not post attacks on me everytime I post something. It’s your own self control to not to be able to handle an opposite opinion when the laws of economics are clearly stacking up in favor of a major correction/recession coming.

Sure – former suburbs become the inner ring and are eventually considered part of the core. But they rarely catch up or exceed the valuation of the desirable neighbourhoods of the original core. So the shortage of proximity that Dasmo identifies is real.

Surrey and Burnaby are filled with great amenities but don’t hold your breath waiting for neighbourhoods there to upstage Kitsilano, Point Grey or Kerrisdale.

Land of Living Skies. No pesky trees or mountains blocking the view.

I have to agree with Dasmo comments that we are running out of land and the bank of mom and dad are part of the equation. Addition to the conversation: many educated/wealthy immigrants feels that they have the traditional obligation to give their offspring an education and a home.

https://en.wikipedia.org/wiki/Chinese_Canadians

You kind of implied that last night. Trying to see if I’m ticklish this morning? It’s so early and I haven’t had my coffee yet.

Anyways. No they aren’t the same market, but they are responding to the same macro trends. As they do, it will be especially visible in the overvalued markets, whereas markets like Calgary, Winterpeg, and Dartmouth not so much. And this isn’t a matter of debate; it’s already plainly visible in the market activity data. The overvalued cities continue to see the largest (by far) drop in RE sales activity.

More locally, Victoria typically lags Vancouver on gains or losses. Having said that, Vancouver stands to lose much more than here, but I don’t think we’ll be unaffected – and indeed we’re not. A RE market doesn’t go from crazy gains to crazy losses overnight. The fact that the market is currently flat is a testament to how dramatically it’s changed from a year ago, but those changes roll out at the speed of a RE market, not an equities market.

We here it goes from there is the matter of debate. I say down, you appear to say “mid-cycle lull”. So now we wait.

Perhaps proximity, but that changes over time as new infrastructure in new areas are built (ie over time, “downtown” as it is today may not be as relevant when there are other hubs elsewhere). There is so much buildable land to the west of here and all the way up island, we could grow out for the next few centuries. “Running out of land” often presumes that the area within a defined city limit is built up, without considering the notion of altering those limits. That was one of the underpinning themes of people in Vegas saying there was no more room. But that’s an impetus for a city to grow out. Remember when Langford was its own town? Now that line is starting to disappear – but that took many decades to even do that. We ain’t short of land either now or in the foreseeable future. We’re going to be fine.

Ironic that you complain about “conflating” one city to others, where are you doing just that in-the-same-breath by attaching Victoria to Vancouver, so you can talk about “both markets” experiencing correcting house prices, when ours are flat.

It’s not about land It’s about proximity. We are running out of proximity.

Well, yes, but we don’t have a lot of land with beautiful scenery, near amenities, and in a moderate climate.

One can buy a new house on 1/2 acre 16km outside of downtown Regina for roughly the same as Victoria’s median price. Have a look at the pictures, though, of what your view would be. Also, Regina will have a high of -11 C tomorrow and a low of -20 C on Wednesday.

https://www.realtor.ca/real-estate/19831136/3-bedroom-single-family-house-221-spruce-creek-st-white-city

The average Victoria home on LeoS chart is $800k, not $1 million. If that too seems ludicrous to you, buy a below average-price home or an average-price condo ($425k).

There aren’t enough SFH in Victoria/Saanich for everyone that wants to buy one, which is why SFH prices are ludicrous, and IMO likely to stay ludicrous.

We know how many people want to sell their house, because they list it for sale. We don’t know how many people want to buy, as no stats capture that. I think it’s a lot of future buyers, and includes most of the people here.

There are not enough of these higher income families here to support these prices and the sales prove it. Saying that our market is in good condition because sales are now at average levels from years ago is not very reassuring considering our population has increased since that time. We are still at close to record low inventory levels and prices should be going up in this kind of environment. If current prices were sustainable you wouldn’t be seeing all of these homes selling below assessment right now. It is not just affordability. With speculative activity decreasing I think a lot of people in BC are finally thinking like most other people would who are not living in a housing bubble. Mainly that paying a million dollars for an average home is ludicrous.

This has been true for at least 60 years. All cities won’t have the same priced housing.

If you’re talking about Victoria prices, they are flat, not falling. Read LeoS post above ….

“It’s a bit surprising that single family prices stayed as flat as they have, given the market still spent much of the year with very low inventory, but it seems the large shock of the stress test kept both the single family and condo markets more subdued. Unless something changes we should be at about zero year over year gains on the single family side come January.

Victoria’s price to income is substantially above the national average, and Vancouver is much worse. This is also why both markets are starting to experience a correction.

Conflating one city to a national index is like saying that ISIS is not a violent group as they only cause 0.0000000000000001% of global deaths.

You don’t need a big income when mom and dad pay for your school and your condo….

The average family isn’t buying housing. Only 61% of families are owners. The median of that “owner” group would likely be about the 70th percentile of overall income, more like $130k for Saanich.

Sustainable by what metric? Price/income for housing in Canada is among the lowest in the world, compared to other countries. Canada is 9th cheapest country to buy housing out of 91 countries, measured by price to income https://www.numbeo.com/property-investment/rankings_by_country.jsp

Most of the few “cheaper housing” countries higher than Canada are in the Middle East, with the notable exception of USA, the cheapest housing country in the world.

All you have to do is look at our average incomes here to figure out our current prices are not sustainable. Look at the city of Victoria in the link I posted below. The average household income is 74K. For millennials under 35 the average household income is 52K. The city of Victoria has the lowest average income for people under 35 of any cities on the list. Saanich does a little better with the average being 108k while the under 35 household income is 72k. Combine the municipalities and the average incomes are still weak here considering the cost of a home or rent. A housing market can’t survive on people with homes trading for other homes. You need a lot of new buyers to enter in this equation. With foreign buyers wiped out, first time buyers priced out or many choosing to sit out, vancouver buyers dwindling due to record low sales there, FOMO history, and speculators running for the exit the pool of buyers is drying up fast.

https://www.bcbusiness.ca/Best-Cities-for-work-in-BC-2019

The “not enough land” argument usually appears in a housing run-up, whether there’s merit to it or not. At the peak of the US housing bubble, people in Las Vegas actually raised that claim. Last year in Toronto it was the same (ie, the “greenbelt”).

@ Viola P:

“too many people not enough land thing…”

You kidding? The second largest country in the world with only one half percent of the world’s population. Land is the one thing we got lots of.

No self-flagellation required. Folks were in town last week so I wasn’t paying much attention but discussion seemed relatively civilized.

Leo I banned myself till next year due to the complaining about Hawk and I. I posted that last week

As I said a few times. I expect hpi to go Down 5 to 10%. I expect the low end most likely. Makes sense since the sales to assessment is at its low end in a few months.

Great analysis sir. Hopefully this kind of stuff leads to bigger and better stuff for you. You deserve it.

Back to banning myself.

Gotcha.

Well it is less volatile month to month which can be nice. But the way it has been behaving lately it seems that it sometimes seems to “wander” off course and then have to spend several months correcting to get back to reality.

I’m sure there’s some very sophisticated reason for that but the end result is that I think it is best case no better than the median price at tracking the market. And why all the complexity if the end result is not an improvement?

The other thing I realized is that it is, as they say, a measure of the estimated value of a “benchmark” home. So if the high end or low end declines, it could well leave the benchmark completely unaffected. Of course eventually that would drag down the benchmark as well but that would be quite delayed. I much prefer the case-shiller index which tracks the upper, middle, and lower thirds of the market and thus you can see how each segment is doing rather than just one exact type of home

I see lots of houses stagnanting around here and price cuts. Also, there’s this article:

https://househuntvictoria.ca/2018/12/02/november-numbers/#comment-52850

Perhaps there is some over-regulation happening. Interesting to think about what will happen over the next year for sure. Although, really big picture, the trend should be upward given the very simple too many people not enough land thing happening.

@guest_52850 #52850 You will almost certainly be chowing down on the alphabet one day…

My daughter wants to be a ballerina or a fairy, so I’m all in on the one that’s possible, since that’s a win in my books 😉

Leo, you just pickin’ on him. 😉 He’s having a tough time accepting the more you slash, and the lower it sells near/at/under assessment that the prices go down. Most Benchmark Victoria Single Family municipalities are down this month. Funny how that works.

Things looking shaky down in Silicon Valley and Frisco. Median price drops, slash increases and listings up 102% in November. The flood to the exits can happen at anytime.

Slashes increase and prices eventually drop, what a concept.

Bubble Trouble: Silicon Valley & San Francisco Housing Markets Head South

https://wolfstreet.com/2018/12/03/bubble-trouble-silicon-valley-san-francisco-housing-markets/

Leo, what is your opinion of Benchmark values? I don’t really like them personally, I’ve always preferred median. Why might someone prefer the benchmark?

Hey gwac. Usually when I post these market updates you eagerly point at the benchmark price which is sometimes up when average prices are down. Why not today?

Oh yeah: Benchmark in November was “$865,200, lower than October’s value of $881,000.”

By the way, for all the talk about how the benchmark is some highly sophisticated measure that is way better than the median price, it sure is extremely seasonal. Or does anyone believe prices actually behave this way?

Meanwhile in the real world, consumers are tapped out and up shit creek. The coming recession could be an ugly one. Prepare now.

Canadians Are Eating Into Their Savings To Stay Afloat, StatCan Data Shows

Consumers are taking on debt faster than they’re paying it off, and that “can’t be sustained forever.”

https://www.huffingtonpost.ca/2018/12/03/savings-rate-canada_a_23607263/?utm_hp_ref=ca-homepage

4350 Woodcrest Pl only had to slash it $122K to get it after putting in high end renos.

2287 Greenland Rd had a pool plus high end renos too. Pools always take longer.

4386 Wildflower Lane sold $336K below assessment for $1.2 million and it’s a nice place at end of culdesac in prime Broadmead.

Recent sales in Gordon Head…

Wow, patience paid off for this seller:

2287 Greenlands Rd

MLS#:397941

Sale Price: $1,138,200 ($182K over assessment)

DOM: 92

Typical boring ’50s house:

4428 Majestic Dr

MLS#:401102

Sale Price: $850,000 ($122K over assessment)

DOM: 38

I like many of these houses that back onto Mt. Doug Park:

4350 Woodcrest Pl

MLS#:400227

Sale Price: $1,020,000 ($185K over assessment)

DOM: 63

To be fair, not all recent sales have been above assessment. So it’s still a bit of a mixed bag out there.

Mike needs to put parody account in his nick. After the GE guaranteed call at $30 and Deutsche Bank at $12 I think one has to see he’s running out of jokes. 😉

Nice post! I agree.

Seller’s strike?

re buying condos for your adult children:

Seems like we have arrived back at the “control” motivation that I fingered in the first place. Maybe I’ll eat my words but I am going to assume that my children when grown up will make sensible choices on education without me having to dangle carrots*

*Other than the big fat carrot of the RESP that I have contributed to.

Not really. The “market is off the hook and people are scared to list” was such a logical one I’m loathe to give it up!

I’ve looked at past new listing behaviour in the past and it seems to be quite random. No connection to price gains and no pattern that I can see.

I doubt you believe a single thing you post.

Haha. 😛

from previous thread:

That’s different, and that I agree with. For example when we bought we talked about a private mortgage extended from my parents to us for the purchase at market rates. Didn’t end up doing it, but it makes sense if parents have the capital to keep the interest expense within the family rather than paying it out to a bank.

ICYMI Mike, we’re at year 14. You have your cycles ass backwards.

Per Saretsky email:

“It is therefor worth considering if the Canadian housing boom was fuelled by an inflow of foreign capital and domestic credit which helped spur the job growth, wage pressures, and population inflows? All of which reverse when credit and housing contract…

Domestically, the annual pace of Canadian mortgage credit growth is now at it’s weakest pace of growth since June 2001. Meanwhile, consumer credit is rising at the slowest rate in any non-recessionary period in the past 50 years. “

Wait til the spring flood. For the Monday morning salesmen, this is just getting going. If you haven’t been paying attention, you might want to listen to Steve Saretsky’s video out today on Facebook. It’s a global deleveraging beginning, the money supply is declining and is pressuring credit lending world wide.

Victoria doesn’t get special preferential treatment because we have nice scenery. Maybe they don’t teach this basic economics fact in the real estate course.

And with all the hubbub about the speculation tax and the industry trying their damndest do get it repealed it seems it has been a big nothingburger.

Yea forgot about that…all the Albertans were supposed to be unloading.

Talk about a premature conclusion…

Don’t know about other parts of BC but having served on strata councils and owning units in multiple buildings there just aren’t that many units sitting vacant. A know a few Albertans that will use a service like this -> http://premieresuitesvictoria.com to rent out their places when they are not in town.

Leo, any personal theories on why we are at a 13 year low on new listings?

Yeah, surprisingly resilient with everything thrown at it. Leads me to believe this next run will be peppy. We should remember that UK, US, Aus, Can, et al, have all been in their mid-cycle slowdown for a year or more. Others also refer to this next phase we’re entering as a peppy (explosive) one, and the pervasive bearishness is definitely a clue that our mid-cycle dip is ending. Btw, nice work above.

*so far

Talk about a premature conclusion…

And with all the hubbub about the speculation tax and the industry trying their damndest do get it repealed it seems it has been a big nothingburger.

Added the sales/assessment median for single family.

The good news is that new listings are looking relatively healthy and have been on an upward trend in 2018 while inventory is more or less stable on a seasonally adjusted basis.

Will we finish the year with the fewest new listings since 2005. When you adjust for population/overall housing stock new listings are really low.

A theory by many has been people are afraid to sell because they don’t think they will easily be able to make the subsequent purchase, but with the market slowing down this year not sure if that makes sense anymore.

You would also think the trend in interest rates would have flushed out more new listings.

Australia following the downward path as they continue to tighten credit lending. If it works there, it will work here, and maybe more so. Patience is needed at this crossroads.

It’s taken 18 months down under with their interest rates going up more too. Didn’t know those Soviet style tactics have invaded the entire world now. 😉

Off a cliff: House prices alarmingly close to record-hitting territory

“It’s probably fair to say that Sydney house prices have now officially fallen over the cliff and Melbourne looks to be not too far behind. It has taken almost 18 months for the decline to move into overdrive but we are now getting alarmingly close to record-hitting territory.

It is now overwhelmingly a buyer’s market.

The November property monthly price falls in Sydney are the largest since the peak of the market in July 2017 and have taken the overall devaluation to 9.5 per cent over that period.

The decline in property prices has been the result of a staged managed effort by the prudential regulator to take the heat off a market that had been inflating at a dangerous rate.