Foreclosures in Victoria

There are a lot of websites advertising lists of foreclosures or court ordered sales in Victoria. The premise being that you can have access to a secret list of houses that only the insiders know about and thus get an amazing deal. Don’t believe it though, this is mostly just marketing to sell you access to the list or generate leads for marketing other properties.

The reality is, when a bank forecloses on a property, it is interested in getting the maximum amount for the property and unless the bank has a flood of foreclosures on their books they need to dump quickly, they will act similarly to any other seller. So you could get a deal, but it’s certainly not guaranteed. Also court ordered sales need to be properly exposed to the market, which means that they will be listed on MLS just like any other property and will not be set up for multiple offers in order to sell in a day. Generally foreclosures tend to sell for cheaper mostly because they are often in very poor condition, and are sold in “as is where is” condition which means they may be further damaged upon possession. That said, at least you can be sure that a foreclosure represents a motivated seller, while at the same time the properties exclude many buyers that don’t want to go through the hassle of the court process.

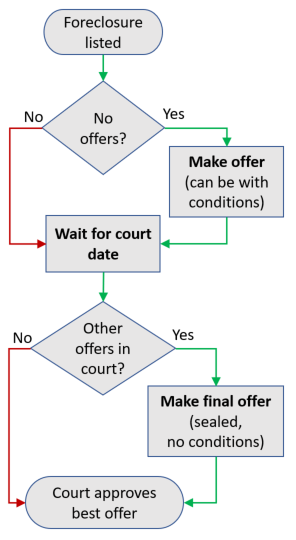

That process, somewhat simplified, usually goes like this:

Note that the court can also decide not to approve the best offer if the lender or owner deems it to be substantially below market value. So there are limits to how much of a deal you can get in a court ordered sale.

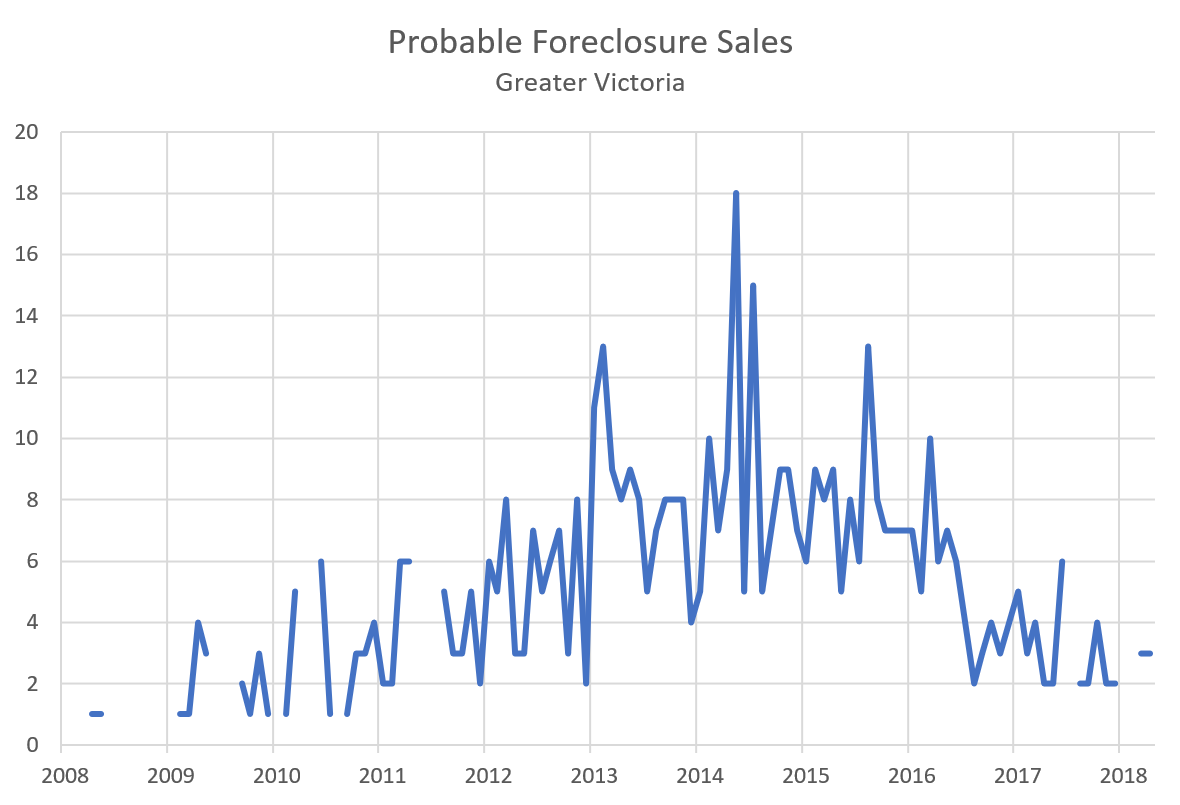

In recent years there haven’t been many foreclosures in Victoria. The answer why is simple: when the market is going up, most owners that can’t afford their houses simply sell before they are forced to sell. The currently low unemployment rate also helps. If we look at the pattern of foreclosure listings in the last decade, it’s clear that they do rise somewhat when prices stay flat or decline, and fall when prices appreciate. Note that it takes quite a while (6+ months) from when an owner stops paying the mortgage to when a sale is ordered by the courts so foreclosures are always a lagging indicator.

Are foreclosures really a good deal compared to just buying a regularly listed property? I’ll try to investigate this further in a future article.

Searching for foreclosures in MLS is not an exact science. There isn’t a simple “Foreclosure” check box, so it is up to the listing agent to describe the property in a way that makes this clear. After some requests for this I’ve set up a search that seems to be quite good at hitting the foreclosures without too many false positives. If you’re interested, just fill out the form below to be added to the foreclosures portal. Be warned though, it’s not that exciting, with currently only a few active listings of court ordered sales. As always, I won’t ever email you for any other purpose.

[contact-form-7 id=”3847″ title=”Foreclosures Access”]

Anyone here ever bought a foreclosure? What was your experience?

@ LF

You quote Business Week:

““The recent collapse is the climax, but not the end, of an exceptionally long, extensive and violent period of inflation in security prices and national, even world-wide, speculative fever. This is the longest period of practically uninterrupted rise in security prices in our history… The psychological illusion upon which it is based …”

But there was no illusion. There was, and still is, virtually free money, i.e., loan capital available at interest rates below inflation. Under those conditions, simple-minded savers are robbed, corporate borrowing and real estate loan costs fall with a consequent increase in profits and prices, respectively.

So no illusion and no certainty til it happens that there will be a meaningful increase in interest rates. The Government of Canada is spending money in excess of revenue and the BoC, I suspect (does anyone know) is covering the deficit largely with printing press money. Meantime the C$ continues to trend down in value confirming that the devaluation of the currency continues.

The present regime of currency debasement could continue for years. In which case, don’t expect an a major RE or stock market crash.

Almost certainly there will be no major monetary tightening in Canada before the 2019 Federal election when, if they lose, the liberals will pass the monetary tar baby to the Conservatives.

Would strongly suggest any buyers looking at foreclosures to look-up sec 116 of the income tax act. CRA penalizes the buyer to up to 50% of the purchase price if the residency status of the original owners are not known or not available. CRA could have penalized the banks putting up the property for foreclosure but instead they choose to penalize the buyers. Weird?

Monday numbers: https://househuntvictoria.ca/2018/05/28/province-collects-first-foreign-buyers-tax-in-victoria

We are just back from visiting friends in Eugene OR. Their new house is simply stunning. 2800 square feet on a beautiful 5 acre piece of land with the most incredible forested valley view. The house is warm and welcoming and everything is top of the line. The garden and outbuildings are also top notch. They paid about 1 million for it.

Hard not to think of that when you look at that Bartlett Ave house.

I know it is silly and irrelevant to compare but since we just got back I can’t help but do it.

Bloomberg has an interesting articles today about the next recession in Canada, predicted to slowly begin soon, but gain momentum as the housing boom subsides.

Also, another good article today about rising Canadian interest rates, also at Bloomberg.

https://www.bloomberg.com/news/articles/2018-05-25/-unprecedented-reliance-on-housing-fuels-canada-recession-call

@ Barrister

LeoS, I would love to see the weekly total for SFH sales as well. Thx 🙂

@ Barrister:

Re 2160 Bartlett Ave, the house had some significant improvements beyond a simple ‘lipstick’. But, I agree, the price is rich.

Grace: I have also been in the open house and I agree that it is certainly near the top of insane prices.

Local Fool – the wealthy and super-wealthy care. That is why they are the wealthy and super-wealthy. No one dreams of over-paying. It hurts just as much, if not more, for them to over-pay [means buying and then seeing a sizable drop in asset value] as it does for us mere mortals.

We are all entitled to our own opinions and, for those that dare, to exercise the discretion to share the opinions with others at the risk of being discovered. Some feel it is best not to speak and be thought the fool, than to speak and remove all doubt. However, if we respect everyone’s views and right to express them we are all better and more knowledgeable for it.

I have been in that Bartlett Ave house.

I think that tops the list for the most insane price grab in the city this year. Absolutely crazy.

But doesn’t help explain why people are buying now if they get a semi reasonable price? They see sales like that and panic.

Funny how the taxonomic name Homo sapien means “wise man”.

“The recent collapse is the climax, but not the end, of an exceptionally long, extensive and violent period of inflation in security prices and national, even world-wide, speculative fever. This is the longest period of practically uninterrupted rise in security prices in our history… The psychological illusion upon which it is based, though not essentially new, has been stronger and more widespread than has ever been the case in this country in the past. This illusion is summed up in the phrase ‘the new era.’ The phrase itself is not new. Every period of speculation rediscovers it…During every preceding period of stock speculation and subsequent collapse business conditions have been discussed in the same unrealistic fashion as in recent years. There has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have changed, that old economic principles have been abrogated… and that the expansion of credit can have no end.”

The Business Week, November 2, 1929

The Illusion that “Old Measures No Longer Apply”

https://www.hussmanfunds.com/wmc/wmc161024.htm

Indeed, but I think many if not most buyers today are denying that risk exists in the first place, i.e. they simply don’t believe prices can go down.

Patriotz,

Holding time, if you’re buying at the peak, can affect your ability to break even or, come out ahead. Someone buying now should IMO, not expect the same returns moving forward, at least for several years. Anyways, not the point.

It’s up to the title holder to determine whether price variation is a risk they care about. For those on average incomes, first time buyers, 5% down, stretching to the max with 2 kids possibly in the future – there is an elevated risk to buy right now IMO. For others, a drop in asset prices of 20, 30, or 50% isn’t a death knell or perhaps even a concern.

I have a friend in Toronto who is quite a bit my senior, so she has seen these booms and busts in TorRE before. And, she’s busy buying herself a condo as we speak. She knows full well what’s going on, and she couldn’t care less. Then again, she could buy me a few times over at this stage of her life. For those people, who cares?

2160 Bartlett Ave, in Oak Bay just sold for 1.385 million. To me that is an insane price for a tiny wartime house that has had lipstick put on a piglet. Where is the money coming from and what fool bought this place. Sorry, but sanity seems to have left this marketplace from my perspective.

Had a interesting discussion, over wine of coarse, with a neighbour where wee were trying to figure out the implications if house prices dropped back to 2013 levels. Before I get blasted I am not predicting that they will go down that far. Rather what the impact on the economy here would actually look like for first time buyers and for various types of businesses.

Holding long term does not change the variation in return (i.e. risk) associated with variation in the purchase price.

https://www.talktoaryze.ca/ interesting to see if we get more of this closer to the election. Also if we start to see scorecards for current council members.

I don’t agree that this is universally applicable, or that anyone who buys now is simply a fool. Somebody with considerable amounts of money, or, someone using an equity based trade could make a purchase now just fine without a whole lot more risk than any other time especially if they are holding for a long time.

People that are speculating short term is another matter, or overstretching because it’s different here™ – are the ones that are going to cause, and suffer, from a pullback.

A lot of people don’t get that or, they think regulators will somehow protect against spikes. It’s unfortunate, as people have better, faster and more complete access to information on these topics than at any other point in human history.

It demonstrates Georg Hegel’s somewhat famous assertion, “We learn from history that we do not learn from history.”

Grant – cocksure = confident. And, I eat my own cooking too. The time will come to pull the trigger and buy Victoria RE, but that time is not now. I am confident in that, but please don’t let me get in your way – accumulate RE at your leisure and to your hearts-content [and peril].

Local Fool – ultra low / emergency interest rates are what got us here [and attracted the foreign speculators], combined with regulatory slack, and rising interest rates are what will cause the demise. The BOC has stated over and over that they lose sleep over the thought of raising rates in light of the monumentally high household debt. But, truth be told, those statements are of no moment given the bond market action [global rates are rising].

I see that another tent City has assembled in Nanaimo. It is reported that “working” people can’t afford rents even with 2 jobs – they are looking to depart for the east coast where an average wage can put a roof over ones’ head. Home prices and rents are escalating just like in Victoria to the point where median incomes cannot keep people off the streets. These are not drug-addicts or the mentally ill. Working people sleep in their cars. More sellers cutting the selling price on their homes, I note, as the trend continues. As Leo reports, at the peak of selling season, sales down 25% and active listings rising.

The dye is caste. Awaiting the official SFH stats.

Deryk

You can get the same thing in Detroit for 10K

Amazing house prices in Moncton NB

https://www.kijiji.ca/v-house-for-sale/moncton/178-180-park-st-moncton-new-brunswick/1357640851?enableSearchNavigationFlag=true

LeoS. I suspect you are waiting for month end for all the stats. But, just to give us something to chew on, what was the weekly total for SFH sales.

New article later today…

Month to date stats:

638 sales

1255 new listings

2320 active listings

Sales down 25% compared to this time last year. Should end the month around 760 or so.

As if borrowed money didn’t have to be paid back with interest resulting in lower disposable income in aggregate. Not surprised that some people don’t get it, but to see a majority think this way is depressing.

Poloz’s holding pattern on rates can’t last much longer, economists say

It’s no longer an issue of if, but when the Bank of Canada raises interest rates.

After the current pause, which came after three rate increases, most economists are expecting the Bank of Canada will return to a hiking path in July, followed by one more increase at the end of the year.

“It’s all about the timing,” said Jean-Francois Perrault, chief economist at Bank of Nova Scotia in Toronto and a former central bank researcher. “From our perspective rates are going up there’s no question about it, but it’s just when will they go up.”

The Bank of Canada’s announcement will be a shorter one-page statement — as opposed to the one in July, which will be accompanied by fresh quarterly forecasts and a press conference — and any new language on trade tensions, the housing market and economic slack will be important clues for assessing a July increase.

But the law of economics will eventually prevail, with plenty of signs of a resilient economy that needs higher rates, economists said. Unemployment is at record lows and executives are telling Poloz they remain largely unscathed from policy uncertainty emanating from the Trump administration.

https://www.bnnbloomberg.ca/poloz-s-holding-pattern-on-rates-can-t-last-much-longer-economists-say-1.1083693

Indebted Canadians spread blame amid ‘depressing reality’: Survey

Canadians are spreading the blame around for their indebtedness, a survey released on Monday shows.

Forty-five per cent of respondents to the survey conducted on behalf of MNP said they blame themselves for the amount of debt they’ve incurred. Meanwhile, 20 per cent blame others, including their spouse, the government and the Bank of Canada.

Nearly six out of every 10 respondents (58 per cent) said their household income would have to rise substantially in order for them to survive without debt; on average, respondents said their household would have to see a 37 per cent surge in income in order to shake their debt habits.

https://www.bnnbloomberg.ca/indebted-canadians-spread-blame-amid-depressing-reality-survey-1.1083672

LeoM, where the hell did I say the Chinese own the land? “Property” is a very broad term and need not imply ownership of the land.

From Wikipedia

“The law does not change the system of land tenure by which the state owns all land. However, in formalizing existing practice, individuals can possess a land-use right, which is defined in Chapter 10 of the law. The law defines this land-use right in terms of the civil law concept of usufruct.

https://en.m.wikipedia.org/wiki/Property_Law_of_the_People%27s_Republic_of_China

So the original point stands. If you own property that sits on land the Chinese government wants to expropriate for some ostensibly greater good you will be at the whim of the government’s decision:

“The Chinese government, while liberalizing its property laws, has still preserved its right to reclaim any property from an individual, as long as there is a public policy consideration. In 2004, it amended its 1982 Constitution to include that the Government has to pay the person compensation for expropriation (征收) or requisition (征用). However, the article neither provides, either in the constitution or in any subsidiary legislation, for the quantum of the payment, nor does it stipulate that the payment must be proportional to the size of the land. This has led to abuse by government bodies, especially in rural areas.”

https://en.m.wikipedia.org/wiki/Chinese_property_law

So perhaps save your ignorance shaming for the person in the mirror.

Here I agree with Patriotz – holding up China as a model of how to do things is seriously misguided if not downright idiotic.

https://www.ndtv.com/world-news/number-of-deaths-in-construction-accident-in-china-rises-to-74-1629956

Plenty more like that. China is a Communist dictatorship that treats local residents and migrant workers as cannon fodder in its quest for growth. I don’t think it’s any more of a role model for us than Stalin’s USSR was in the 20th century.

@LeoM

Getting stuff built is breathtaking. There are a few holdouts, as there are lots of individual rights. This is the way you literally get around it. Eventually they sell out 🙂

http://www.chinadaily.com.cn/china/images/attachement/jpg/site1/20170919/b083fe96fac21b2a9ebf01.jpg

Grant, your ignorance is showing. In China the government owns all the land. People occupy buildings on land but the people don’t own land, they only effectively own a temporary leasehold to the building on the land. But this is all irrelevant to the point of discuss; China focuses on end results, not belabouring the process with endless process oriented activities.

What a textbook example of being cocksure.

Very true, but note that it comes with a price. Do you own property where they are going to build that infrastructure? Haha, tough luck, you are SOL. Forget NIMBYism, people there have very little recourse when it comes to the government getting its way. Efficient but harsh.

A fascinating chart on US dollar adjusted figures for net income by country:

https://howmuch.net/articles/money-people-take-home-after-taxes

I have often wondered about the disconnect in housing prices in some areas of Canada and net income. Too many years of easy, cheap money has fueled the FIRE industry to the detriment of those starting out.

Victoria Born— your posts are long, but easy to read, and interesting. Keep them coming. And, thanks for that link the the Financial Post article about CRA cracking down on tax cheats. Tax cheats deserve to be caught and fined; in fact I might help the Tax Authorities a bit by sending a note to CRA and IRS about my braggart neighbour who is hiding income from both CRA and IRS.

Simple. Rising real wages until about 1980. Rising labour participation rate for women starting around 1970, now topped out for some years. Historically low interest rates since 2001, now reversing.

Home equity is money that the person you sell your house to has made.

Those two lanes happen to be a de facto freeway called the Airport Parkway which will soon be expanded to four lanes. The bridge connects a neighbourhood with the South Keys rapid transit station.

To start and only if they don’t have family help. Plus they will shift from SFH to condos as we have seen so SFH prices are not constrained by this entirely. Unless, of course, you are including home equity in the “money they made” – but I understand you meant income earned from employment?

I wish we could directly reply to a post.

If you see this AK..Victoria neighbourhoods still have a sense of community. Just hope it lasts!

Which is why I love that graph of yours, Leo. I don’t understand why it isn’t the common way of examining housing markets.

Regarding that graph, do you have hypotheses or data on why there’s a clear multi-decade uptrend? Is it simply more demand? Are people buying more house over time (does the trend hold for land value as well)? Perhaps over the 30-year bond bull market people have adjusted to taking on increasing amounts of debt beyond what lower rates would account for?

Without a clear understanding of that trend, it strikes me that buying in Victoria and expecting abnormal appreciation has to be considered speculation rather than investment.

Caveat Emptor inquired about credit ratings in the context of intentionally defaulting on a mortgage to entice the mortgagee / lender to issue demand and then paying off the mortgage. At the time of paying it off, no legal action is commenced [it can’t be started until the mortgagor has been given a reasonable opportunity to redeem. The law states that there can be no “clog” on the equity of redemption. The contract will have a clause that says where the borrower defaults the lender may make demand and, when that is done, the mortgagor has (for example) 30 days to redeem] so once the mortgagor pays it off – the debt is paid in full [penalties are avoided] and the pristine credit rating of the borrower is in tact.

Local Fool writes, “market run-ups resolve, absolutely without exception, regardless of whatever government does”. Our failed-drama-teacher Prime Minister, who pillages the tax-payer to fund his lavish vacations and sullies our country on the world stage, once famously said, “Budgets balance themselves”. To allege that government action cannot influence the RE market is simply not evidence based. What a property sold for 2 years ago IS irrelevant today because economic conditions and policies have changed [and a deep pockets buyer has exited or must pay more]. I have said it before and will say it again, rational RE prices are based local median incomes. If I want to buy a Spalding NBA regulation basketball [on sale today at Coscto for $19.99 plus tax] and I have $15 in my jeans [be it cash or remaining limit on my only credit card] – guess what: I will not be leaving Coscto with the basketball in hand legally. Make sure you watch game 7 tonight and tomorrow night.

Money laundering, drug money, foreign money evading tax in their native lands, …. call it what you want. History will show that the speculation and criminal element in BC [as Sam Cooper revealed] has skewed this market so much so that a generation of young people may never recover – renters for life, basement dwellers………call it what you want. The baby-boomers will soon not be the largest demographic cohort – the Millennial generation will soon [within 2 or 3 years] be the largest demographic cohort and they don’t own a house. Baby boomers are finally starting to downsize and that means selling their homes – but they want 7 figures. The available buyer does not have access to 7 figures and the foreign buyer to whom many are trying to market to have left the building [with Elvis]. CRA is continuing to crack down in speculation – which is not illegal, but hiding it from the tax man will net you prosecution and a 50% penalty. Not convinced, take a look [OUCH] at what a Realtor and her daughter got caught doing [and they committed perjury too]:

http://business.financialpost.com/personal-finance/taxes/if-you-sell-real-estate-expect-the-taxman-to-take-a-close-look-in-continued-cra-crackdown

Why is this significant: IMHO this is yet another demand-side deflator [speculators thinking they could make a tax-free profit have to think again and weight the “after-tax” profit as their spoils when considering the risk of investing in a bubble environment]. We are seeing increasing inventory, albeit still not at equilibrium, and price-drops at a frequency that we have not seen in many years. Recall that in 1999 to 2000 some were still buying Nortel believing that was the secret to the good life – a bubble by any other name is still a bubble.

Matthew: I genuinely enjoy reading your posts. Not just because you write well but because you are right. Plain and simple: we are looking at a real estate bubble in BC in many regions – for us: Vancouver, Victoria and even Nanaimo. The peak of the market was surely 2016 and the pop [which is causing that “hissing” sound as the bubble deflates] occurred in 2017 and the gaping hole that some of us now see was the tear caused by the NDP policies. As I noted previously, I have been focusing in on the luxury market, long before that foolish article by Christy’s, to see what the so called “smart money” is doing – it is on the sidelines waiting – cash is king.

I agree with what another poster stated: only a true fool would buy in this market. But I will go one step further – only a true fool would buy in this market be it for a home to live in or speculation. In my humble opinion, and I am entitled to it, a buyer should wait 12 to 18 months. If all buyers followed this, what do you think would happen? Johnny could move out of his parents’ basement, buy a home, have a family and build up the tax base. This is the aim of the government regulations. If they don’t work – they will pile on more and more until it works. And…………it will………..eventually.

Enjoy the sun !!!!!

Using the existing track from Esquimalt to Langford is not such a stretch. A station could be constructed in the new roundhouse area and the walk into town would only take a few minutes over our new bridge. The tracks would need work but there are existing lights and controlled crossings.

How about really thinking outside the box and going for a solar-powered/electric train: https://understandsolar.com/solar-powered-trains-future-of-public-transportation/

A train running every 45 minutes back a forth could make a big difference to the number of commuters in the crawl. It’s only 15K and 5/6 stops would make it very practical.

I was aware. I meant that CP could maybe get back into the game once the tracks were fixed. There’s also Southern Railway of Vancouver Island, which wants to get back into business, I bet.

Trains of every kind eventually stopped running because of ever-increasing deferred track maintenance that no one involved wanted to pay for.

I hope we can pressure government(s) enough to pay for it.

The uninterrupted right-of-way from Courtenay to Victoria is something that, if lost, we will never get back (at least not for anything approaching a reasonable price).

Why would government want to encourage and financially support B.C. residents to go solar—so that each household could supply itself with 25-50% of its electricity needs—when instead we could build another mega dam and ensure the vast majority of residents are deeply dependent on the government for nearly 100% of their power requirements?

The one-track problem (which isn’t that serious of a problem) is remedied by using—and adding—sidings (locations where the track splits into two tracks, so trains can pass one another).

As for the terminus being in Vic West, I’m sure some sort of dedicated bus or other shuttle service could be created.

But what about when one’s house jumps in value due to market forces driven in part or largely by outsider capital?

Suddenly, one can “afford” to move laterally to a different now-very-expensive home, or even move up slightly to an even more expensive home, because of that giant down payment in the form of equity from one’s previous home?

Comparing to the US:

http://www.canadianbusiness.com/wp-content/uploads/2017/04/Castaldo-price-income.png

Someone mentioned a “reversion to the mean.” With the long-term average being 100, we are clearly at altitude right now.

If affordability is what we are trying to track long-term, I don’t think a Case-Shiller index is as important from the angle of the homeowner or potential homeowner as the price-to-income ratio:

http://1.bp.blogspot.com/-FKkQRVy_fwI/UquL_DCniuI/AAAAAAAADRQ/4DggBdzIpvo/s1600/price+to+income+ratio+canada.JPG

From the graph affordability mirrored the US run-up, then clearly diverges following a small dip continuing on an upward trend after the GFC of 2008. We all know the funny money narrative of the last 10 years. Where we go from here will be interesting to watch.

Leo’s said: “Other places can do this stuff. We used to be able to do this stuff too. Why is it suddenly so hard?”

Leo, it’s because people in Canada and the USA are different now than they were in earlier generations. I’m old enough to have known people who were born from the 1890’s onward, I’ve had friends, family, and colleagues who fought in two world wars and built the infrastructure that you refer to and I can tell you the current crop of adults and politicians can’t get anything completed, on budget, on time, as happened in earlier decades. Today the process is more important than the results. The endless consultation results in committee built infrastructure rather than engineer built infrastructure. Much of the consultation and environmental protection we have today was needed, but the process has evolved to elevate the process as the key deliverable rather than the product. Consequently lots of projects get started but few get completed. Those projects that eventually get completed leave everyone shaking their heads wondering what the hell happened?!?! Compare our system of infrastructure development to China and the difference is clear; they focus on end results while we focus on the development planning process. I’ve personally witnessed how fast and efficient China builds both intracity and intercity infrastructure; their focus on timely results is nothing short of incredible. We used to focus on end results too in past decades. That’s the difference that makes it so difficult here.

I am also starting to see a lot more slashes in the under 800K range (thats what my realtor sends me). Actually it reminds me of last year just before the feds announced the timeline for the new b-20 guidelines. Slashes were coming left and right and that month (Sept or Oct?) and single family house prices dropped 3%. I remember thinking this is the start of the cooling off. Then the next month the b20 changes were announced and prices jumped back up. Another couple weeks of slashes and i will be comfortable saying we are in the cooling off period again and i hope to see 10% decline or more just based on the environment… but I don’t have a mathematical reason for that amount – thats why it’s a hope haha.

695 Darwin – MLS 390355 – original price was 695K, then slashed to 665K and now slashed again to 649K.

Seems like a good deal given the area and look of the home. For all us potential buyers lets hope more of the same for the rest of the year.

Yes. I firmly believe in the trend line around affordability. In the end, people need to purchases houses with money they made.

4937 Eagle View Lane in Cordova Bay is prime example of what I am seeing daily now. Slashed twice, $110K the first whack, now on #2 for another $80K down to $1.199 million below assessment of $1.278 million. Nice place, large lot.

So you think they should spend billions and ten years to build a China train system that will need two tracks, not one, and they are crying they can’t afford to widen it for electric buses which could be done in a year or two ? Not logical.

The existing train has one track and no where to drop off the passengers in town then make them walk a mile or have to pay to catch another bus into town where there is no viable bus hub. Big hassle.

You need a two way track system to make it work China style or any style for that matter and that will take billions. Maybe people should stop moving here and that may solve part of the problem.

Maybe you’d find an interest-rate adjusted trend line. Affordability must have some limits. Therefore, one would expect that at least for normal homes (i.e., excluding Uplands-type foreign-owned trophy or investment homes) prices fluctuate around some ratio of carrying cost to income.

Site C has a failing retention wall and is already going over the already over budget estimate before it gets rolling. But honestly, we knew that would happen.

Other places are bad at it too. Montreal has multi-decade problems and lawsuits that involve mob owned construction companies that built crumbling overpasses. Driving into Montreal is a joke, it looks like dystopian futurama. Ottawa built a pedestrian bridge over two lanes. It’s one of the smallest bridge projects you could have, but because someone died trying to cross traffic there and because it’s the first landmark you see driving in from the airport, they designed a big stupid $5m suspension bridge. It went over budget by more than a factor of 2 and was delayed by years. Pedestrian bridge. 2 lanes. The Vimy Memorial Bridge is another over budget over deadline bridge project in Ottawa from around the same time period that almost didn’t get finished.

I honestly think the reason it happens is that construction companies have better lawyers than the city councillors signing these contracts. The spokesperson for the company that built the bridge here said it himself. He flaunted the fact that the city would have no choice but to keep paying and paying until it was built. The Ottawa pedestrian bridge was constructed with the wrong concrete, demo’ed, then constructed again. That’s way more profitable than just building it once, and the city had no legal recourse. It’s infuriating.

@ Hawk

“Trains are nostalgic and not practical to carry mass loads of people.”

Well, in 2014, passenger traffic on Chinese trains totaled 1,160.48 billion passenger-km or almost 1000 km for every citizen of China.

The problem we have with train use here on the Island is a lack of trains. And the problem we have with the lack of trains could be that we lack of enough people to make trains viable. However, we do have some rights of way that will likely prove of immense value as the population of the Island grows, quite likely in the order of ten-fold over the next 100 years.

In the meantime, we should keep those rights of way in being and take a close look at available technology to see if there is any rail-type transportation that would work on the Island now. Currently, maglev technology is too expensive (up to a coupla hundred million per km). The terreplane, a lifting body tethered to a rope, sounds cool, and cheap and would be very fast, but unfortunately it is insufficiently well developed for immediate deployment.

Perhaps someone could interest Elon Musk in the E@N. He could surely figure out something amazing in moments between organizing a Mars colony and fixing the brakes on the Tesla Model 3.

Thanks, I wasn’t aware of that. The charts I’ve seen always draw a straight line as the trend rather than the gently sloping exponential one it should be.

Also mixed up the case Shiller 20 for cities (which is above pre-boom levels) with the national index which apparently isn’t.

It does indicate that if there is a long term price trend it only works at the national level

Cannot speak as to other areas but of the ten houses up for sale in Rockland only one has sold so far this month. In fairness, the asking price for a number of them is fanciful at best.

Looks like another beautiful day and we are off to garage sale. Two of the neighbours kids have gotten their own places so we are armed with a fun wish list.

Leo,

I haven’t looked for Canada. I know we have the teranet index, others have quoted just the average national price. There would have to be data to which you could draw a trend line through average prices or indexed. My issue is I’m not sure exactly what the case-shiller method is and if we use the same methodology here, or even if we do whether it would be useful. The reason I said asset class and not homes, was to discuss the principle of reversion to the mean.

Nevertheless, I believe it would hold for homes. The chart you posted certainly tells its own story, but I don’t know what it’s saying well enough to agree or poke holes in it. It doesn’t even appear to show the same shape as mine. The one I posted does show that reversion more or less, of course the reflation that happened afterwards is another story.

Low interest rates and a market flight to durable goods will hinder a reversion especially if the graph is showing current dollars, which is also why I like that chart you posted demonstrating portion of incomes going to housing over X period of time. Kind of sidesteps those other things and demonstrates the connection our market has had so far, to its economy.

A commuter train tram revival has never been tried. Running a vintage bud car the wrong way, for tourists was idiotic. The only reason anyone would have done that would be for s tax write off combined with proving rail won’t work. Rail would work because it is a greate way to move people. Need more capacity? Add another car to the end. Shoot we have already upgraded all the road crossings to Langford. It’s a dedicated artery that would allow for high density in the West Hills and beyond. A bus lane? Puke….

But it did really, didn’t it? Shiller himself noted that between 1890 and 2014 there was a roughly 0.3% yearly real appreciation in the national index. If we take the national market bottom in 2012, we’d expect the index to be at 100 x 1.003^(2012 – 1890) = 144. But apparently it was below 130. (According to Wikipedia.)

It’s gone up quite a lot since, but doesn’t seem especially bubbly to me at a national level. The Bay Area is completely insane, but when every tech bro is making $200k/year straight out of school, it’s not without some foundation.

Given the enormity of monetary stimulus, I’m surprised it isn’t worse. I wouldn’t be surprised if a major reason for this were the psychological impact of the crash. To use Shiller’s language, I think it really changed the narrative in the states.

I’m not sure how meaningful raw prices are, though. I’d be more interested in total cost of ownership relative to incomes. Other factors like property taxes can have a huge impact on real ownership costs. In New England, for example, houses can look quite cheap ($500k US goes a very long way outside of major cities), but one can end up paying several times that over their lifetime when steep property taxes are taken into account.

You are apparently unaware that this essentially happened back in 2006. CP donated the tracks to the Island Corridor Foundation and a shortline railway took over the freight operations.

You haven’t hung around with many people who come from non-European countries? Sentence construction takes work and second-language skills are not consistent. If you have read QT’s past posts, his language skills are exactly where you would expect a Vietnamese-Canadian to be after being in the country for many years. No mystery.

Local Fool:

Thanks for the apology. I accept it.

I challenge you to find that trend line for the Canadian housing market. I would assert it does not exist.

It didn’t really though. If you look at the case shiller index, they were projecting it to return to the mean. It never did and now it’s back above bubble values. Something is different now.

http://ritholtz.com/wp-content/uploads/2008/12/case-shiller-chart-updated.png

Agreed. But isn’t it weird that we are so catastrophically bad at building infrastructure? What is it? What went wrong? We barely managed to build a teensy tiny bridge. We are struggling to build one interchange. We will probably never build that pipeline and who knows about Site C.

Other places can do this stuff. We used to be able to do this stuff too. Why is it suddenly so hard? Or is that just because the problems elsewhere and in the past are forgotten and we have rose coloured glasses?

I noticed that too.

Some are, some aren’t. I spoke to a well connected Fort Street business owner. His take is that there is both support and opposition for the lanes among business owners. The complainers get the most press. He personally supports the lanes, but said construction has been a pain and may have caused a dip for his business. Parking was a non -issue for him. Basically said that “If my only customers were from the two cars that can park in front of my store I would be in trouble.”

Yep, gotta consider that millenials are becoming (or already are) the largest voting block. Their participation rates are likely lower, but relatively soon every political party will be putting most of their efforts into that camp rather than the boomers.

Oy

Not picking on immigrants. I is one.

I was suggesting that if a post includes a first paragraph in perfectly phrased English followed by a paragraph in Charlie Chan pidgin it would imply that the author is being disingenuous.

I promise to dial the irony down in future for those of us in the Baldrick camp.

Blackadder: “Baldrick, you have no concept of the meaning of irony”

Baldrick (defiantly): “Yeah, I do! its like ‘bronze-y’ or ‘gold-y’ but it’s made out of iron”

When a bubble bursts, mean reversion to the asset’s long term trend is generally what occurs. When the US housing bubble burst, the national price index generally dropped back to a level in line with its long term trend despite the US government’s best efforts. I posted the US Home price index recently, which showed this phenomenon pretty clearly.

They are not powerless to effect change, quite the contrary. As I said, beyond force and fraud prevention, government getting into the market often has consequences that are ancillary to what their objective was, or it magnifies or distorts its trends. QE is a picture perfect example. The Liberal government politically had little choice with the FBT. People, including homeowners, were starting to surround them with pitchforks. In the end, that coupled with the NDP capitalizing on the crisis cost the Liberals the election. Horgan’s policies may cause the correction to be more intense and investor sentiment to sour, but it won’t stop a correction from happening – which was my point.

Trains are nostalgic and not practical to carry mass loads of people. It’s like saving the blue bridge. People can’t let go of the old world. Electric buses is the only logical move. Time to move into the 21st century.

Looks like Fort St business owners are pissed and rightfully so. View St was the prime street for bike lanes but idiots at city hall think it’s Europe on every main drag. Lets do mass building of streets and sidewalks during a boom when construction workers are non-existent.

http://www.timescolonist.com/news/local/fort-street-businesses-demand-redress-for-new-bike-path-opening-sunday-1.23315131

My guess is no.

Boy, the optimism is burning bright today!

Fully agree.

Apparently, only roads are allowed to be heavily subsidized; rail is out of the question.

And we should return to moving freight on the E&N. Why the hell not?

If CP Rail doesn’t want to do it, then maybe the government should create its own railway, like it did with BC Rail, which was owned by the public as a crown corporation and ran successfully in this province from 1918-2004.

We could call it Island Rail.

They are relevant, within the context of how prices move in the timeframe of 2 years. We’ve seen that prices can increase 15% or even over 20% YoY in extreme years, in extreme places, but it’s no one is just inventing the cost of housing out of thin air. Interest rates move in small increments, expectation plays a huge role in pricing, and that expectation is based on what similar properties fetch in similar markets recently. “The government” doesn’t have their knarled hands hovering over a vast knob labelled “house prices”.

Hey Matthew.

I think you’re getting a bit too worked up over what I wrote, and taking it much too personally. I’m sorry, it wasn’t personal attack. I had found the analysis (not you) to be simplistic and seemed to put emphasis on factors or contemplate scenarios that in a free market economy, aren’t likely to occur or be the dominant actor. Perhaps that wasn’t obvious. Ya I can be verbose, but it’s just the way I usually write unfortunately. It’s not meant to make it more convincing, condescending or intimidating. I know, that’s easy for me to say when I’m not on the receiving end of my “BS”, and I know it can be annoying and tiresome to some people.

I’m about as clueless as everyone else on here even if sometimes I think I’m not. It’s not even that hard to tear lots of what I say down. And people do. That’s kind of the point of these discussions, and bowing out entirely on the basis that you felt personally attacked or belittled by one anonymous user calling himself a “Local Fool” would really be a shame. That wasn’t the point at all, but at any rate I’d just skip my posts if you must.

Incidentally, I’ve read and enjoyed most of your posts so far and I’m probably not alone. You’re doing just fine as is. 🙂

Jerry, are you this much of a dick in real life? Picking on an immigrant’s English skills is pretty crass.

CS,

I agree

@ QT:

“I once took the train from Victoria to Nanaimo … I think there were only 3 other riders in my car”

Yes it was expensive, unreliable and slow. The time we took it, it broke down in Parksville and we had to continue, after much delay, by bus. And to have a faster rail service would be difficult with so many crossings to negotiate.

A monorail along the E&N right of way would be unimpeded by crossings and might therefore offer an attractively rapid service. But whether there would be enough people ready to pay the full cost of the service is open to question, although rail would likely be cheaper than air travel and more convenient.

Monorails have been constructed for as little as $20 million per km, and since we already have a right of way, a line from Victoria to Courtenay might come in at under a billion. Depending on the capacity, such a service could do a lot for Island economic development.

Dear Jerry,

I’m sorry that my and other older immigrants English are weak, because ESL classes wasn’t available at the time we initially immigrated to Canada.

Perhaps we can communicate in Vietnamese or another language that you are comfortable with.

@ Patriotz

“That’s $194 million/km” (not $194 thousand/km)”

Right, but what’s a coupla hundred million in government spending when the Feds can splash $600 million to host the G7 thereby ensuring:

“the opportunity for seven allies to gather in a less formal, more relaxed setting, surrounded by beautiful landscapes and a warm welcome, to talk about real issues — it’s extremely important,” Trudeau said at the Fairmont Le Manoir Richelieu hotel, which will host the summit.

Dear QT:

Could you please choose an English language ability and stick with it? It was somewhat confusing when it went up and down from one post to the other, but now it varies from paragraph to paragraph.

Any particular persona you wish to adopt will be fine if it amuses you but us older folks have difficulty with the segues.

Revived the old train was a novel idea that was tried in the past and the tax payers ended up footing the bill of millions per year to service a couple of dozens riders on a good day, and that doesn’t include the initial cost (of around $20-30 millions if my memory serve me correctly).

The final nail in the coffin for the train at the time was that the tracks and bridges are old and unsafe and required crucial repairs well north of $30 millions. I imagine now it would cost at least $100 million or more to get the train back running.

I once took the train from Victoria to Nanaimo to see what it would be like, and my conclusion is that there is no place for passengers train on the Island. It is a bit hazy now but I think there were only 3 other riders in my car, and the other car had roughly the same number of riders as our. The fare is roughly twice the cost of fuel for my car for the same traveled distant. It was a bumpy ride and wasn’t a comfortable ride as I envisioned and it took roughly 3 hours to get to Nanaimo from Victoria.

Local Fool:

You said “I think I would invite you to look at the histories of market run-ups and how they tend to resolve”.

I would invite you to NOT make presumptions about what knowledge other viewers possess. What I have written on this blog (over the last few days) is my opinion, which I have a right to, and I purposely make it simple because, well, I think the issues are simple.

If you want to know, I have been following the west coast real estate market very closely for at least five years. I found Leo’s site about two years ago, but did not want to make a comment because I don’t like to be insulted by people like you. I do not react well to it.

And I’ve come to learn that that inevitably happens whenever you give your opinion about anything on the anonymous internet. Some jerk gets on there and suggests that you are stupid, or simple, or you haven’t read as much about the subject matter as they did. These people have a tendency to be crude mostly, but sometimes it comes in the form of a person trying to persuade others that they are very intelligent people. They use big words in long sentences to try to fool you into thinking that they know more about the subject matter than you do. They invite you to read up on the subject matter like they did because you don’t know what you are talking about and they do.

I have watched pretty well every YouTube video that Steve Seretsky, Hilliard MacBeth, Mike Martins, Formafist, Owen (whatever-his-name-last-name is) from Vancouver, the Canadian Libertarian, have made for the last three years. I have read Hilliard’s book “When the Bubble Bursts” from beginning to end which goes into detail about the history of market run ups and bubble bursts. So, I think I know something about the formulation of bubbles and how they burst and what is occurring in the west coast real estate market.

In my opinion, there is a clear bubble which has been growing for at least three years on the mainland and in Victoria. It will burst dramatically unless the Gov’t takes steps to help ease it. And this is exactly what they are trying to do. I also believe that both the BC Gov’t and the Feds have heard the cries of the average Canadian Citizen and they genuinely want to step in and take some action to help lower house prices. Inventory needs to come up before prices can come down, I agree. Hopefully, with the help of Gov’t, there will be a soft landing on all this. In my opinion, anyone who buys a home in Victoria at this time is a fool. Prices are higher than there have ever been before, but that does not mean that they will continue to rise. There comes a point in time where buyers wallets are exhausted and they cannot pay more. Even Ali G knows that intelligent people “sell high and buy low” but he mistakenly thinks you must get stoned in order to sell.

In conclusion, I have decided that this will be my last post. I have said what I wanted to say and the fact is, whatever I would say in the future would probably be just a reiteration of what I already said. In closing, thanks for the comments especially from Victoria Born, Leo, Barrister and Hawk and some others. Matthew Out.

Actually the shortest point just south of the ferry terminal to John Dean beach area is just over 2 km. It is completely do able since current technology bridge span is up to 1.9 km, and the beaches on both side of the crossing are relatively shallow. If the crossing at Willis Point and south of Bamberton it would shorten the bridge span to a more manageable length of 900-1000 m.

IMHO, a bridge that join the peninsular to Hwy 1 is the only logic solution. The reason is that the NIMBYs will never let any progress happen in Victoria, specially if the Hwy have to be widen or bypass through “theirs” specious Goldstream park/ watershed.

That said, the bridge would cost billions to build if we have the same decision makers as the Johnson bridge.

Local Fool:

Here’s an article from about a year ago outlining the choices Government has to control or influence the real estate market.

https://www.theglobeandmail.com/real-estate/toronto/what-can-governments-do-to-cool-torontos-housing-market/article34637684/

But you say “market run-ups resolve, absolutely without exception, regardless of whatever government does”.

I didn’t know that. But if that’s true, why are the governments bothering to do anything at all? I mean, if they are powerless to help effect change, why don’t they just stand back and let the problem resolve itself?

Local fool:

“market run-ups resolve, absolutely without exception, regardless of whatever government does”.

Oh? You remind me of the personal injury law firm that says “we get results”. They don’t bother to tell you what results they get, they just get results.

So what do you mean by “resolve”?

I put it to you that if banks raised the interest rates to 10% on Monday morning, the entire Canadian real estate market would collapse by Tuesday. If Gov’t imposed a 50% transfer tax, a 50% speculator’s tax, and a 50% foreign buyers tax, the same thing would happen.

But according to you, “market run ups resolve regardless of whatever government does”.

Oh yea, and do you have special knowledge about what would have happened in the US back in 2010 if the Gov’t did not put in billions to help influence the RE market? Maybe there would have been a bigger collapse. But you said the money didn’t do a thing to help. How do you know that?

Local Fool:

Watch this Steve Seretsky video dated May 26, 2018, and then tell me that Banks (and Gov’t) do not control or influence real estate prices.

https://youtu.be/L7_ZNWwBaxE

Local Fool:

I stand by what I said.

House prices in Victoria can be “controlled” by Banks and Gov’t (if they want to do it).

Prices a year or two ago are not relevant today because of the measures taken by the Banks and the Gov’t to cool prices in the last while. Therefore, sellers and buyers today should not expect to receive or pay what previous sellers/buyers even 6 months or a year ago did.

Blacks Law Dictionary defines “control” in a couple of different ways. One says it means “to dominate over, to counteract, to overpower”. The next sentence says it’s “the ability to exercise influence over something”. That was what I meant.

So, you went on for paragraphs using a bunch of big BS words like some disconnected Professor at a University would do to basically say the same thing that I said, which is that Banks and Gov’t can “exercise influence” over the housing market. If you are not saying this, then you’re living up to the name you chose for yourself.

Local Fool, that is some kick ass blog commenting lately.

You’re ignoring the elephant in the room, which is that housing bubbles happen because governments want them to. Of course crashes come eventually, but the calculation is that they will happen after the next election and perhaps when a different party can take the blame. Or even governments can kid themselves that this time it’s different, or it’s different here.

You have not qualified that dismissal. It certainly isn’t irrelevant, in fact buyer and seller sentiment are the core dynamics that influence any market cycle in any asset class anywhere, regardless of which stage of that cycle we’re in.

If it were as simple as that, you wouldn’t have damaging housing bubbles, market manias, huge crashes and other deleterious market dynamics, as they would simply use policy to address them. But beyond measures to control force and fraud, it’s never worked in any example in history, that I am aware of. The trillions the US spent to try to stave the bleeding 10 years ago did nothing for house values. The best support I could give your assertion is that housing prices are a function of what banks are willing to lend, but what they’re willing to lend follows market sentiment under the broader auspices of economic constraints. Yes, governments can influence market dynamics, but those effects are typically felt as distortive or magnifying, not stabilizing. For instance, the market in Vancouver began rolling over as of early 2016. It had nothing to do with a FBT, rising rates or empty homes taxes. Yet when those policies were implemented, they magnified the market dynamics either temporarily or ongoing. But it is a mistake to simply say they “control house prices”.

“Controlling house prices” has almost nothing to do with why interest rates move one way or another in any advanced economy I’ve ever heard of. As for ramping up other policy measures from where we are now, I think I would invite you to look at the histories of market run-ups and how they tend to resolve. They do resolve, absolutely without exception, regardless of whatever government does. Government knows this, which is why most of their polices so far have either nibbled around the edges of the issue, or are called “speculation taxes” when the practical implications don’t really target speculators. Aggressive policies to actually stamp out the housing market would be foolish, as then when you’re successful, not only will you be blamed for causing a horrible recession, you’ll have to backtrack on the policies you implemented to get things going again – a bit banana republic-ish, IMO.

Remember a while back we spoke about the Comox Valley and the crime issue?

Here we go again. So important to know your neighborhoods and why I think it’s so wise to rent first, whatever town you choose to buy in.

https://www.comoxvalleyrecord.com/news/police-presence-at-courtenay-neighbourhood/

There is a lot of talk about how sellers do not want to lower their asking prices because they watched their neighbours get $1 Mil for their shacks a year or so ago, so that’s what they expect now. But the same logic could be applied to potential buyers like me. I saw a house in the Uplands at the north east-corner of Landsdowne and Midlands sell for under $900K a few years ago (yes, I should have bought it). So I expect to pay the same kind of price today.

Both arguments are flawed and totally irrelevant.

Governments and Banks can control the price of a house. They can raise the interest rates, slap on taxes and penalties, they can discourage foreign buyers, they can charge speculators with tax evasion, in a cumulative effort to lower the price of a house.

Or they can raise house values by decreasing the interest rate to next to nothing like they did for the last 6 to 8 years.

A bank can tell a potential buyer “we don’t care what sellers are asking for, we are only going to lend you $600K”.

This is exactly what Banks/Gov’t is doing now. So home prices are bound to come down. It might take a year or two, but it will happen. And if it does not happen, they will continue to increase interest rates, they will impose a 30% foreign buyers tax, and make it a 5% speculators tax, because average Canadians cannot buy a home anymore, and they got the message and are prepared to act. This is one of the biggest reasons why Horgan got elected.

A bridge would just make traffic down the peninsula brutal. No thanks. I don’t even live up there but I’ll join them in chaining myself to something to stop such nonsense. Get the railway going again. WTF is wrong with people. It’s right there. Not crossing the bridge is not a spike in the heart. The VicWest side is not that much farther back and has more room to host a hub. This would be a reliable and safe commuting option for those living Malahat and North. Park and ride….

Haha. I tracked down the original 2007 report that weighed the options.

https://www2.gov.bc.ca/gov/content/transportation/transportation-reports-and-reference/reports-studies/vancouver-island/malahat-study-2007

The Bamberton-Highlands bridge cost the most, but solved the most “problems.” However, I don’t know why they routed the “new” section of highway down the most brutal terrain (and parkland) to Langford rather than just following West Saanich Rd. Seems unnecessary, on top of the huge price for the bridge.

The route from North Saanich would require re-building the Pat Pay Hwy to a much bigger standard. Remember that new highways destroy the character of all the neighbourhoods they go through. Plan carefully or you end up with an industrial wasteland.

At the end of the day, we just don’t have the population to justify spending over 2 billion on a bridge so people can commute from Mill Bay and Duncan more easily. For people who complain about taxes, this should be an immediate red flag.

Bridge across Saanich inlet:

Using various submerged shoals you could probably build a suspension bridge with a central span of 2.2 km. A couple hundred metres longer than the world’s longest suspended span. So that would be at the limits of engineering feasibility and insanely expensive. Not likely to happen in our backwater. Floating bridge would be more feasible albeit still expensive.

Cost aside, NIMBY/BANANA sentiment would make it hard to build a bridge or a new inland highway. Upgrading the Malahat to four lanes throughout is probably the most feasible option for improving linkages to the north

An Evergreen bridge at $4.75 billion US dollars would never happen. Might as well build a highway thru the hills for that kind of bucks.

Don’t see Brentwood wanting a freeway thru their town nor Mill Bay. Plus there would be expensive tolls forever that drivers would avoid like the plague like they did on new Vancouver bridges.

It cost US$$3.69 billion over 19 km. That’s $194 million/km over a maximum depth of 18m.

That’s $150k under their original ask back in late 2017. Still way too much if you ask me. It’s not actually 3 bedrooms and there’s a bunch of better options for less in James Bay.

A Brentwood bridge sounds like a bad idea. This town ain’t so good at making bridges.

The most dangerous words in investing are being thrown around here: “it is different this time” OR “it is different here”. In my opinion, the so-called bubble has been popped and the air is slowly being let out. It may take 12 to 18 months, but the millennial living in their parents’ basement will have a chance to buy a home.

I will expand a bit on the foreclosure process in BC.

The first Court appearance in a foreclosure is the Order Nisi, which is actually considered a final order in the foreclosure. Generally, the lender will seek personal judgment against the borrower at the Order Nisi hearing, based on the personal promise to pay [this is the personal covenant contained in the initial mortgage documents. This is what separates us form the USA where many states do not permit a personal covenant so the borrower can just walk away and the bank gets left with the home]. The lender will also seek other terms of the Order, such as the length of the redemption period [usually 6 months if there is equity], the amount required to redeem and legal costs. Legal costs are usually ordered at the lowest level of Court costs in BC, particularly for unopposed Foreclosure proceedings [here it is scale A].

The redemption amount is the amount of the principal, interest and expenses that the borrower will need to pay the lender to payout the mortgage and stop the foreclosure. The usual length of the redemption of a residential property will be set at six (6) months, unless the lender can show risk to its security that would warrant a shorter redemption period (such as insufficient equity in the property to repay the lender in full, abandonment or waste).

If the borrower does not redeem before the end of the redemption period set at the Order Nisi hearing, then the lender may elect to return to Court to seek either an Order Absolute or an Order for Conduct of Sale. In a relatively recent development in foreclosure practice, a lender can now actually obtain conduct of sale at the Order Nisi hearing that will be effective at the end of the redemption period without the necessity of a further court application.

An Order Absolute basically involves the property being transferred to the lender as the new owner. Usually the borrower or subsequent lenders will oppose the Order Absolute if there is convincing evidence of equity. However, if an Order Absolute is granted and there is a shortfall for the lender, then the lender will not be able to try to recover any shortfall on the personal judgment from the borrower after the Order Absolute. In addition, the lender will have to pay the property transfer tax on the transfer of the property to the lender. In many cases the lender will not elect to seek an Order Absolute. some cases where such an order absolute is sought is, for example, the borrower leaves the jurisdiction and can’t be found, their is little equity or no equity, the security is in jeopardy [homeless have taken over and there is no insurance], the mortgagor is in the process of bankruptcy, etc.

When the lender decides not to pursue an Order Absolute, then the lender can still apply to the Court for an Order for Conduct of Sale at the end of the redemption period. An Order for Conduct of Sale allows the lender to list and market the property through a realtor. The borrower will be ordered to cooperate with the listing. The lender will be able to entertain and accept offers, subject to any accepted offer STILL requiring Court approval. The usual practice is for Offers to have a schedule attached to the Contract of Purchase and Sale specifying that the property is being purchased “as is” without any warranties as to the condition of the property. At an application for Court Approval of Sale, the Court will need to be satisfied that the offer before the Court reasonably represents fair market value in the current market at the time of the application. If the sale is approved, then the dates for completion and vacant possession will be set out in the order. A certified copy of the Order Approving Sale will serve as the transfer document at the Land Titles Office, as opposed to a Form A transfer signed by the borrower. After the sale completes, the lender will report to the Court on the funds recovered from the sale. If the amount of the lender’s legal costs cannot be agreed, then the lender may apply to have the Court assess legal costs owing. Any surplus will be paid into Court, unless otherwise agreed by all parties. If there is a shortfall for the lender, then the lender will be in a position to try to recover the balance of any judgment against a non-bankrupt borrower.

Thanks to Grace, Underachiever, Leo, Hawk, Barrister, Leif and everyone else who shared their thoughts on the current state of Victoria from a couple posts ago. Its interesting to read how peoples perceptions of Victoria’s problems are so different.

Grace, what you wrote about in regards to the changing tone of the city is what I fear too. Hopefully the wealth effect created by increasing real-estate prices hasn’t created the same class divide and narcissistic attitudes I see in the Lower Mainland. There is no sense of community where we live, and from speaking to others its the same across other neighbourhoods in the LM. It would be very sad to see this same thing happen in Victoria.

In regards to the homeless population, mental health and drug abuse issues in the core, when I left in 2010 these issues were starting to really become apparent. Certainly the cost of living in Vancouver, and gentrification of Vancouver’s DTES has pushed some of the residents to nearby communities, including Victoria. Ironically enough, its because of the drug abuse/homelessness problems that I have an opportunity to move back to Victoria. I work in healthcare in the Mental Health/Addictions field and would be working in the DT core.

@ Hawk

“Brentwood bridge will never happen as it’s far too deep”

That’s why I said build a floating bridge.

Washington State just completed the 4.75 km, mostly floating, Evergreen Point Bridge for $4.75 billion.

@ Leo S

“Nice idea. But shortest straight line distance is about 3km. Sadly I have zero faith we could pull this off within any reasonable cost.”

Get the Russians to build it. They just completed the 19 km Crimea bridge for US$194,000 per km.

But the benefits may not justify the cost, however cheaply a bridge might be built. There would be a saving in gas. For example if a bridge reduced the distance from Victoria to Mill Bay by, say, seven kilometers, and the daily traffic count is 22,000 vehicles, there would be a yearly saving in fuel of, I think, about 20,000 tons — a rather trivial amount in terms both of cost and CO2 emissions.

There would also be a saving of several million hours of travel time, but even at the average hourly wage of $33.00 that might not justify the expense of a bridge.

Still, when the RE crash comes, we might want the jobs that bridge construction would bring.

Well if anyone is looking for value take a look at 1423 Walnut St. It’s of similar value to 1484 Lang St.

That’s more an academic observation. It’s true theoretically, but not usually how humans work in practice, especially if a market is facing a significant correction. That’s why I referred to sellers chasing a market down – and there have been a few posters here that were around in the early 80s that can tell you all about that.

If your neighbour sold his house for 1200k two years ago, but the market will now only bear 750k …and you want to sell your similar home, would you try to price it “appropriately” at 750k? People hate the idea of leaving money on the table, no matter how realistic that concern is. That’s why in those cases, houses sit for months at a time, in some cases longer.

I wonder if in a year or two, a meme will develop: You say to a person you don’t like, “go buy a house”, to mean something similar to “go take a long walk off a short pier”. Kind of funny to contemplate, realistic or not.

LeoS said: “A bit odd that the comment ID is cumulative and not just on this post though. Will raise as an issue to the devs.”

That’s not a bug Leo, that’s a feature!!

Leave it as a cumulative number Leo, that’s a great feature for referencing back to a post from weeks or months or years past.

The winds of change. Don’t be a bagholder. No specs means no profits for a very long time.

Via Steve Saretsky:

The number of condos bought and resold within a 24 month period fell 36% year over year in April. That trend is continuing through the month of May.

This means a few things. Sales are slowing so there are overall fewer buyers and less liquidity. Weaker sales and slower price growth ultimately discourages speculators. Without speculation it’s nearly impossible to experience rapid price growth. In other words, this is a much different market than we’ve seen over the past few years.

This trend is more pronounced in the detached market where home flipping hasn’t been this low since November 2008.

Condo Flipping is Dying in the Vancouver Real Estate Market

https://www.youtube.com/watch?time_continue=1&v=MHoJiVgJvvU

Brentwood bridge will never happen as it’s far too deep and the costs would be insane even if it was possible. Build a highway up through the bush above Goldstream. Just like they did with the new highway around Nanaimo.

Nice idea. But shortest straight line distance is about 3km. Sadly I have zero faith we could pull this off within any reasonable cost.

Much easier to upgrade the roads a bit and just double or triple the ferry schedule to make that a practical way to go up island.

But they don’t need to know. As long as they recognize it’s a different market that’s enough to price appropriately, and that they would be hearing from their realtors. Whether they believe that is another matter.

I’m with Leo in regards to price slashes. Very optimistic and delusional sellers out there.

Sweet home I’m looking in the low end of this range (<850k) and the high asking prices have put me off into waiting mode. The sellers seem to think they can just ask for whatever and they will get it and I just don't think that's true anymore. Anyway it is just not worth the cost to me to buy something I'm not completely happy living in for such a high cost. If selection improves I don't mind spending the money but not for a 850k hunk of junk.

This is may be true on a micro-level, but I don’t think it’s true with the market as a whole. Many folks don’t even know what B20 is or are only vaguely aware of it, unbelievable as it may seem to regulars on here. What we know on this site isn’t actually common knowledge among the general population.

Sellers don’t usually capitulate quickly, which is what makes RE prices sticky. In some cases it can take a few years, as sellers actually chase the market down. And for now, there are still lunatic bids going on, and so some folks are still hitting jackpot. That’s just too much for a seller to pass up. These are early days yet.

@Barrister:

“Horgan is thinking about a bridge to Mill Bay”

Good idea. A floating bridge across Saanich Inlet, and a floating city to go with it. With zero land cost, a New-World Venice could provide some of the lowest cost housing in BC.

” It doesn’t move, and they cut prices a few times and sell for $900,000. Still up, just not matching sellers’ crazy expectations.”

Which is how corrections/crashes begin. Sooner or later they start going at assessment or under which is happening in Vancouver, Toronto, and now here in Broadmead, Golden Head and other prime areas. We’re at the hot time of the year and this is happening. Wait til summer/fall when 5 year rates keep climbing, Trump gets indicted or put in a straight jacket and the global debt problem begins to show it’s ugliness.

Moody’s warns of ‘particularly large’ wave of junk bond defaults ahead

https://www.cnbc.com/2018/05/25/moodys-warns-of-particularly-large-wave-of-junk-bond-defaults.html

The paper is saying that Horgan is thinking about a bridge to Mill Bay. Sounds more like a five year study of the idea and one more multi-million dollar report to file.

“Consequently, the smart ones (who really want or need to sell) have done what they need to do to get a sale: lowered their asking price. That’s my theory anyway.”

I see that there are now 21 houses for sale in Gordon Head (north of McKenzie, east of Blenkinsop) in the $750K – $1M range. That is the range we were looking at in 2016, plus I added $100K for price appreciation since then. Certainly that is more houses than were for sale at this time in 2016, 2017, and probably 2015. They generally seem to be priced slightly above assessment.

I haven’t been tracking the sales closely (I only get update every month or so), but I do see some houses sitting for weeks, which is a weird phenomenon. For sale signs seem like animals that have been almost extinct for years and are now returning due to repopulation efforts. I guess it’s both because sellers aren’t psychologically prepared to lower much yet and buyers have dropped off, or at least are in no rush.

I would be picky if I were buying now too, since the whole dynamic has changed from 2015-2016 when houses we were looking at were going up $10K a month. Also, I would want to at least get our transaction costs plus a little appreciation if we sold, so I wouldn’t be too quick to slash the price either. So, there are those two opposing forces playing out.

It would be interesting to hear from anyone looking to buy now in the core to get their impressions of the market, particularly under $1M.

It is the weekend and we are coming to the end of the spring market. It will be interesting to see if the Uplands houses start to slash their prices. Frankly, I think that most of the houses listed are seriously overpriced .

@ Leo

“Price slashes. I believe the main reason there are so many of them is that the general public still thinks the market is crazy hot ……….”.

Interesting theory Leo, but I respectfully disagree. In my opinion, the main reason Victoria sellers are slashing their prices is because they are very aware of the fact that there has been a real slowdown in sales (in what normally is the busiest season for RE sales). The slowdown in sales has been caused primarily by the fact that buyers have been cut off by the money lenders, so they simply cannot raise the large amounts of money sellers have been asking for and receiving in the past. And the reality of the situation (especially in Vancouver) is now beginning to creep into the minds of the sellers. Consequently, the smart ones (who really want or need to sell) have done what they need to do to get a sale: lowered their asking price. That’s my theory anyway.

@Victoria Born You can now reference comments by number by putting a # in front of it like #44073 . You can also reference users by putting a @ and then starting to type their name.

A bit odd that the comment ID is cumulative and not just on this post though. Will raise as an issue to the devs.

“unread-comments-shaded-in-blue”

has not worked for me since the changeover. MacBook.

Not a big deal, just so you know.

Price slashes. I believe the main reason there are so many of them is that the general public still thinks the market is crazy hot. All media coverage has still been about low inventory and rising prices. So Joe Seller sees their assessment as $850,000 from last year and thinks they should be able to get $1,000,000 by now. It doesn’t move, and they cut prices a few times and sell for $900,000. Still up, just not matching sellers’ crazy expectations.

Thank you very much Victoria Born for providing the details. You say that “In some rare cases, the bank or mortgagee may seek an “order absolute for foreclosure” where the bank takes title to the home”. What are those cases?

Everyone needs a hobby 🙂

$845k

Yeah… Slowly getting better. The plugin devs are working on it. Will give them more feedback. It still has issues.

Thanks it’s on the list.

Same here. Up $25. That’s OK.