Province collects first foreign buyers tax in Victoria

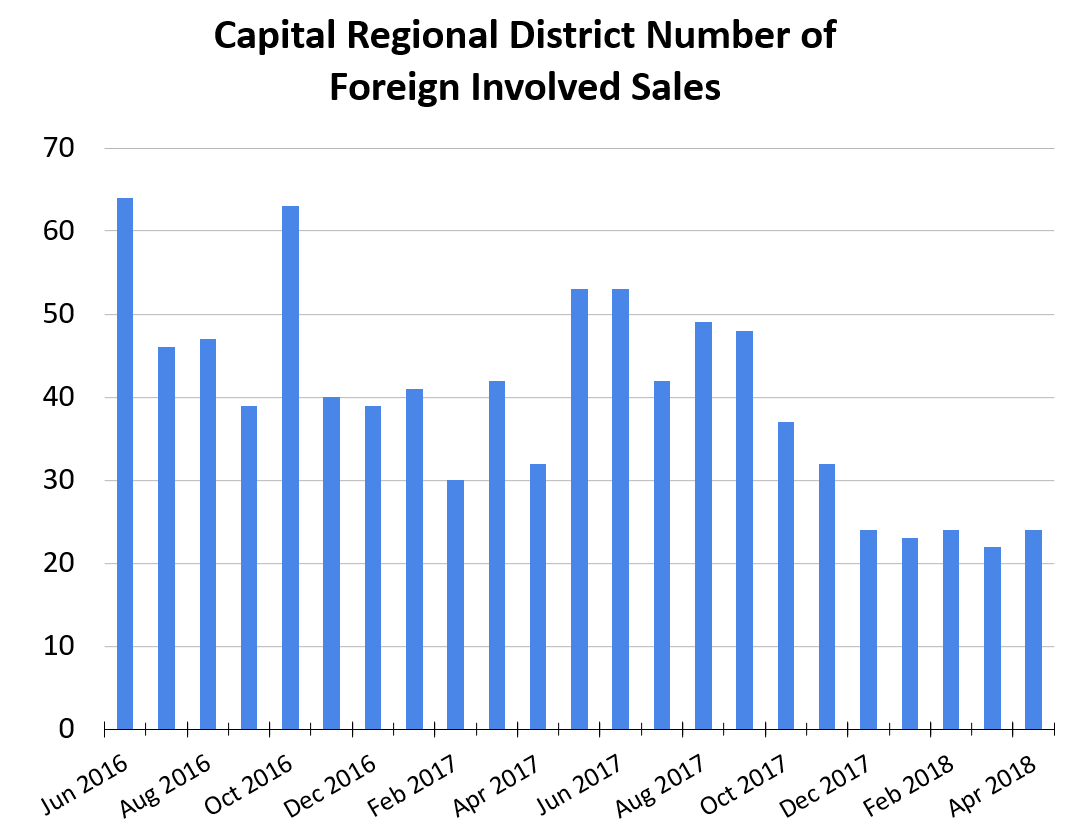

Foreign buyer data has been released for April, and it shows the first month of property transfers that were hit by the foreign buyers tax in Victoria which affected deals that went unconditional after February 20th and closed before May 18th. Of the 23 residential transactions that involved a foreign buyer in April, it appears a grand total of one of them valued around $880,000 was hit by the foreign buyers tax, and the province collected an extra $176,600. Going forward, we should expect most of the transactions in May to be subject to the tax and all transactions after that May 18th deadline.

This means two things going forward:

- Most sales going forward will be affected by the new 20% tax and revenue for the province will increase

- If the tax is going to discourage sales, we should see the number of transactions decrease starting with the May data (to be released end of June).

What’s interesting is that sales to foreign buyers have already been down even before the tax. Year to date there were 93 foreign buyers vs 145 in the same period last year. I would expect the foreign buyers tax to take perhaps another third off that number. Not enough to make an impact on the overall market but who knows if the other measures the government is taking to decrease other flows of money into the real estate market will have additional effects.

Also the weekly sales numbers courtesy of the VREB.

| May 2018 |

May

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 133 | 295 | 491 | 638 | 1006 |

| New Listings | 335 | 670 | 973 | 1255 | 1451 |

| Active Listings | 2109 | 2218 | 2255 | 2320 | 1896 |

| Sales to New Listings | 40% | 44% | 50% | 51% | 69% |

| Sales Projection | — | 734 | 744 | 754 | |

| Months of Inventory | 1.9 | ||||

A pretty consistent month for sales which have been down about 25% throughout. Just over one out of every 5 single family houses are still going over ask, but only one out of every 7 condos is (and dropping). Condo sales for the spring peaked 4 weeks ago and have been dropping since then. We’ll see if that’s the end of the spring market or if they will recover. Inventory continues to creep up slowly, now at 21% higher than this time last year.

Hi Morgan. Thanks for your comment. I suppose the counter to your point is that refugees are very unlikely to have the means to buy before they get permanent residency and immigrants are not subject to the tax as soon as they get their PR as well. Before they get their PR they aren’t really immigrants

Some people might argue that the foreign buyer’s tax is a bit unjust as most of those people are immigrants or refugees. SO putting this much tax on them is kind of unjustified.

“With NAFTA about to implode, Canada will not be able to afford to raise rates much longer, hence prices will not crash.”

vs

“If it does, and that’s a big if, that’s hardly a supportive metric for the housing market. Who knows what a bilateral trade deal would look like with the USA. Trump isn’t kidding when he says, “America First”. A kaiboshed NAFTA could drag further on Canadian exports which to date, have remained somewhat anemic despite the low interest rates. Lower rates, especially against a rising FED, could chew our little loonie down to the nub.”

I bet Trump will pull out of NAFTA before the G7 summit, so we’re about to find out….

Introvert said “…but here’s LeoM confirming what we all know:”

Introvert, leave me out of your childish vendetta against Hawk; your continued immaturity is proving Hawk right about your personality traits.

PS: my words you quoted “confirmed” nothing, contrary to your assertion.

Barrister, how’s your garage sale hunting with your lovely wife??

TL:DR – Victoria RE is peaked. But starter SFH in the core are still too much for local. Chinese are the newest boogeyman, NDP lighted the torch. Bears think price @ 2014 are fair, Bulls think price will hold. OB piglets sold at crazy level, but all the renters here hate OB. Electric cars are cool, biking in spandex are cooler. The bridge is done, so we talks about railroads.

The topic of global warming is fun, everyone loves to talk about the weather.

Month end preview: https://househuntvictoria.ca/2018/05/31/may-market-wrapup/

That’s probably enough off topic global warming talk though.

How about keeping it to the Victoria housing market. Vibrant Victoria is a great place for all the other topics.

Uplands turning into a trailer park now. Is he same idiot taking bitcoin for his house when it was $14K?

“It’s as important as anything else on this blog—that is, it isn’t.”

But it is to you Intorovert and is some sick OCD obsession. Maybe you need some more therapy. People own for many reasons and dont own for many reasons. Who the fuck cares either way other than you wasting blog space.

Best perhaps and even that is not particularly convincing. On Steven Chu he says “he was bought by the global warming people”. Indicates his talk is driven by conspiracy theories rather than science. His claim of no heating since 1998 is also not true: https://www.skepticalscience.com/global-warming-stopped-in-1998.htm

Turns out that a lot of old people get a little off track even if they were very strong in their field. Good talk though, not the usual completely nonsensical argument you hear.

still my favourite comic on climate change.

This is the best non-crazy “Global Warming is Hoax” video I watched.

https://www.youtube.com/watch?v=SXxHfb66ZgM

I’m just amused that you can’t find any post of Hawk saying he cashed out. 🙂 I just looked through the first comments from May 2015 and couldn’t find anything. I don’t remember a Hawk from the old blog but could have been a name change. I only remember some guy with the alias something “oak” as the person who said they sold at the previous peak expecting a crash.

I am sure Hawk and his bears will love this ad.

http://www.usedvictoria.com/classified-ad/Oakbay-Vacant-Lot-for-Storage-Parking-Boat-Trailer-Truck-Bin-_31571152

The market crashes so hard, even Uplands turns into trailer park!

No, no. I’m sure Soper from Gordon Head knows better than 97% of climate scientists.

My last global warming post this thread:

https://journals.ametsoc.org/doi/abs/10.1175/JCLI-D-13-00262.1

http://science.sciencemag.org/content/353/6296/242

This is not yet at the level of scientific certainty but the best evidence indicates:

1) No definite trend to more or less tropical storms

2) Increase in the observed maximum intensity of the strongest storms. These observations accord with theoretical predictions

3) Poleward expansion of the area in which tropical storms can form – this one is a simple consequence of an increasingly large area of ocena where temperatures are warm enough to support tropical cyclones

Coastal BC and the US NW are some of the best places to be in a warming world as the effects of climate change will be tempered for quite a while by the massive ocean to our west.

Viable skiing on Vancouver Island will be an early casualty of global warming (first world problem), almost certainly within my lifetime

It’s as important as anything else on this blog—that is, it isn’t.

This is just part of the ongoing HHV soap opera, an element of the blog about which I know you aren’t especially enthusiastic. And that’s OK, Leo.

I agree. I like how you did the window trim. Great found objects, too.

Sorry – meant James.

I don’t know Josh. I was just in California doing looking at place in the desert. Did a lot of research and my conclusion is that climate change made it a bad idea for my children. It is not a modelling kind of thing when there are catastrophic visible changes – drive through the desert and up through Northern California – and when there is a bill that mandates water restrictions and cites climate change as a primary factor – not to say the agricultural overuse is not an issue as well.

SB 606 requires water districts to set targets for water use by 2022. The targets will include a daily allowance of 55 gallons per person for indoor water use, and calculate outdoor water allowances based on regional differences in climate. Beginning in 2027, districts that exceed their annual budgets will face fines of $10,000 per day during drought emergencies. The indoor allowance is set to drop to 50 gallons per day by 2030. In addition there is the Sustainable Groundwater Management Act. And it seems likely to me that water is going to pass through mandated reductions to severe restrictions.

When National Parks have information signs on their exhibits indicating that climate change is going to create a huge impact on the ecosystem that has already started I tend to believe that the science has made its way past the theoretical and into practical application and accepted common usage. But if you feel it is just more faulty modelling then that is up to you.

http://www.climatechange.ca.gov/adaptation/water.html

Numerous people are under the impression that Hawk tried to time the market and sold a few years ago:

Also talking about computer modelling josh.

I’d argue the opposite makes you a hypocrite, but go on.

Meaningless. We’re talking about climate science.

That just means you’re a hypocrite.

… okay.

Severity sure this one was more severe. was the mid 2000s one more severe? no.

Frequency & duration:

1917–21

1922–26

1928–37

There’s a total of 2 years without drought in a 20 year period there. They’ve had these “whiplash events” before, in recorded history. The 1864 drought was preceded by massive torrential flooding.

This is kind of the point; the models have been wrong, consistently. We are in the worst case scenario, CO2 emissions have doubled from 1990, and we’re on track for better than the best case scenario w/r to sea level rises and temperature increase. — sea level increases would have to quadruple their “historically high rate” just to get to the 20cm increase by 2030 that staying at 1990s levels was supposed to bring.

Climate change may increase the likelihood of more severe drought in California, but I’ve seen these kinds of articles before, like when Hurricane Katrina hit, and there would be more powerful hurricanes hitting the U.S in greater frequency because of global warming. 13 years on…

Also do you remember peak oil?

So, as someone with a computer science degree, who is pro-transmountain pipeline, and also voted green and bikes to work every day. I will believe the models when I actually see it.

James – you can’t just look at the evidence of past droughts. It is not just about duration, but also frequency and severity and overall precipitation levels and snow pack.

California experienced its worst drought in recorded history between 2011 and 2016, and climate models unanimously project increased drought in the American Southwest, including a growing risk of “mega-droughts” that last more than two decades.

There is evidence that global warming caused by human emissions has most likely intensified the drought in California by 15 to 20 percent, and that future dry spells in the state are almost certain to be worse than current as the world continues to heat up.

Maybe read this information first and see the declaration that California state has made on the impact of climate change on hydrology before making these statements.

https://www.nytimes.com/2015/08/21/science/climate-change-intensifies-california-drought-scientists-say.html

https://www.ucsusa.org/global_warming/regional_information/ca-and-western-states.html

https://www.usatoday.com/story/news/nation/2018/04/23/california-drought-floods-worsen-climate-change/541822002/

We are just fortunate to have more a less arid climate to start with.

Drought has been over for a year now. the 2016-17 winter was the wettest on record.

Sure, but California also has a history of long drought periods, ie:

1917–21

1922–26

1928–37

1943–51

1959–62

1976–77

1987–92

28-37 was 3 years longer than the last drought for instance.

The climate denialist bit is a little absurd considering I’ve never actually said anything of the sort. All I’ve asked is where are the catastrophic consequences that we’ve been promised? We’re nearly 30 years on from the first IPCC report on Climate Change, and we’ve put more C02 into the atmosphere than the worst case scenario and each of them has predicted more and more dire consequences, none of which seem to be really coming to fruition. Yes Global temperatures have gone up, glaciers have receded(except in New Zealand for some reason), Arctic Sea Ice levels have shrunk, but the speed of these things hasn’t increased at all. Based on worst case Scenarios, we should be in shit creek right now, and we’ve surpassed all of the worst case scenarios w/r to emissions.

Anyway, this whole thing was:

INTROVERT. How can you still believe considering that none of the massive consequences have occurred in 30 years when you can disparage Hawk about being wrong for what… 6 years? I mean, in your words, even if you are right, it’s only because you’ve been saying it for so long.

Yes – agricultural water use is an issue but it is the severe long-lasting drought that has caused massive overdrafting on water supplies in California. There is evindence the severity and duration of the drought is caused by climate change. You can google find the scientific reports.

Same reason spelling became important on the blog.

Neurosis.

Most of that is farming stuff that they shouldn’t be farming there though, like Almonds.

50% of California’s water usage apparently goes to “outdoor ornamental landscaping”, so really is the problem increased temperature? or just an insane use of resources.

I bike to work every day, our family has 1 car, and puts less than 10,000 km a year on it. Totally with you on that.

Yeah that is enough nonsense about climate change denialism.

As for Hawk cashing out, I didn’t remember that and neither apparently has anyone been able to find the comment with him saying it so may as well leave it at that. Not sure why this is suddenly so important

Who has denied any of those things so far?

I’ll deny this one now though:

Even James Hansen has previously said that there’s no link.

When was the last time a Category 5 hurricane hit the mainland United States?

I can’t imagine how angry Barrister is at this thread right now.

Yes, and yes.

Google Advanced Search –> site: househuntvictoria.ca –> all these words: Hawk cashed out

Two minutes.

There you go again Intorotroll. Making up shit due to your low self esteem and lack of understanding of real life. Quoting someone else’s words are fact now because you wasted a whole morning trying to dig up something that doesn’t exist ?

It’s a good thing you don’t have kids, they would be very psychologically messed up for life having such a despicable asshole for a parent.

The slashes keep stacking up today, Golden Head, Broadmead and Oak Bay all under the axe. This is how Vancouver West Side started. NAFTA war starting, spending cutting back due high gas and oil prices. Down she goes.

Canada’s growth misses expectations as housing slowdown weighs

Investment in housing fell 1.9%, the biggest drop since 2009

http://business.financialpost.com/news/economy/newsalert-canadian-economy-grew-at-a-1-3-per-cent-annualized-pace-in-first-quarter-2

We are just lucky here with enough water for now and a not too hot climate – although the link to increasing wildfires has been made for BC too:

https://www.theglobeandmail.com/news/national/climate-change-contributed-to-extreme-nature-of-wildfires-in-alberta-bc-professor/article36681658/

https://www.scientificamerican.com/article/climate-change-fingerprints-are-all-over-california-wildfires/

If you head down to the national park deserts in California you’ll see signs that state they are expecting temperature increases of 5-10 degrees by the end of the century caused by climate change. Enough to wipe out many existing species and whole ecosystems. Water shortages everywhere with some communities having to cut use by 70% or the state will step in and do it for them. Some of that is overdrawing from aquifers, but climate change is a big part.

I’d agree though, no point in having a conversation when science-based evidence from places like NASA and various think tanks is something you can brush off.

https://climate.nasa.gov/evidence/

https://www.ucsusa.org/our-work/global-warming/science-and-impacts/global-warming-science

Oh, and I am a fan of changing how we operate in our ecosystem. Downsizing and one car per family where possible are a start. Have no idea why we still water our gardens with drinking water and mix sewage and grey water. And cutting down on meat is not that hard.

Yes the climate is doing pretty much EXACTLY what scientists have predicted.

Average global temperatures increasing – check

Sea levels rising – check

Vast majority of glaciers receding – check

Arctic sea ice shrinking – check

Tropical storms more intense but not more numerous – check

Increase in forest fires in continental interiors – check

More record warm than record cold temperatures – check

Whether or not you view this as “catastrophic” the evidence that it is happening is clear. Denying that puts you up with the anti-vaxxers, 911 truthers, chemtrail conspiracists, etc.

Go on.

Well, other than all the evidence that we are actually in the middle of catastrophic global warming, that is? If you are so wilfully blind to clear evidence, I don’t think there is any point in having a conversation.

What deep thinking?

I’m just observing that you and your band of misfits have been flat out wrong on how catastrophic global warming has been for decades, and yet you persist? Emissions have increased, and yet here we are, no massive sea rise, an actual decrease in storms, greenland hasn’t melted, Antarctica actually had the largest ever recorded sea ice extent a couple of years back, the Arctic still doesn’t have ice free summers, and the Atlantic “conveyor belt” is still pumping along. At one point do you just say hey, maybe the housing market is just gonna go up forever? errr…

Um, he clearly did not give himself that.

I bet the main “family reason” that you got out of the real estate market was that you thought the market was at the top.

We all remember it.

Needles in haystacks are easier to find than specific comments on HHV, but here’s LeoM confirming what we all know:

Soper, is the deep thinking you’ve applied to the earth’s climate similar to the deep thinking you’ve applied to the Victoria real estate market?

It’s looking that way.

You’re agreeing with me.

asking for a friend, any recommendation for a designer please? some renovation and addition work needs to be done.

Thanks

Bizarre rebuttal. Nothing is around the corner. Global warming is ongoing. The effects for Canada are not likely to be “catastrophic” for quite some time, but they will steadily increase.

Somebody did. Note YoY is down almost 50% from peak in May 2017. Also since Teranet uses closing rather than “sale” dates, and has a 3 month moving average, it lags the market by quite a bit.

https://housepriceindex.ca/#chart_change=bc_victoria

Don’t be so quick to disparage Hawk or the information he posts. Hawk isn’t an economist (neither am I) so he might not use the proper economist terminology, but he is making reasonable observations about the SFH price rate of increase, which is slowing rapidly since mid-2017. Granted the YOY price changes for most SFH is not into negative territory yet for most houses, the trend clearly supports Hawk’s premise that our SFH prices are not escalating as in the previous 4+ years.

If someone could create an interactive yearly Rate of Increase graph for Victoria the result might surprise a few bloggers on this site.

In 2005 the Economist Magazine published this article (link below) about rising house prices worldwide and the bubble. Reading this article is like déjà vu because it’s happening again but the trends are being ignored…again. We all know what happened after this article was published in 2005 and judging by the graph link I’m posting below, we are in a worse position now than we were in 2005.

https://www.economist.com/node/4079027

I’ve posted this interactive graph before, but it’s worth repeating for newcomers to this blog. If you adjust the graph to show the time from 2007 to 2016, Canada was in extreme bubble territory by 2016 and it’s worse now after the insane buying panic during the spring of 2017 with even higher price increases.

https://infographics.economist.com/2017/HPI/index.html

@introvert, I find it funny that you’re always harping on Hawk for being “wrong” year after year, and yet you still think catastrophic global warming is just around the corner, despite them being wrong for decades…

Hindsight is always 20/20. By renewing early, you gave yourself peace of mind which for many is priceless.

House progress is looking great by the way Dasmo.

Anyone that wants to renew their mortgage and can early, the competition is cutthroat and there will probably continue to be lots of deals as mortgage volumes drop and banks are desperate to catch the biggest slice of a shrinking pie.

https://www.canadianmortgagetrends.com/2018/05/variable-rate-war-heating/

We left a couple thousand on the table by renewing early. Damn.

I’m just saying what I remember Hawk. Sorry but if we were sitting around a table blabbering about this I would say BS! I’m not saying that as an attack. Anyway I’m not going to harp on it. I do believe in the right to forget so I retract my request from the past post fairy….

U.S. preparing to implement 25% tariff on all on imported Canadian steel and 10% on aluminum

President Donald Trump announced in March that the United States would impose tariffs of 25 per cent on imported steel and 10 per cent on imported aluminum, citing national security interests.

He granted exemptions to his North American Free Trade Agreement allies and the European Union, but those all were set to expire June 1.

[Commerce Secretary Wilbur] Ross said Canada’s and Mexico’s exemptions were linked to the progress of the NAFTA negotiations, which “are taking longer than we had hoped.” But he did allow some leeway, saying the U.S. could be flexible.

“We continue to be quite willing and indeed eager to have further discussions,” Ross said.

Prime Minister Justin Trudeau was scheduled to address the incoming tariffs around 1:30 p.m. ET. When it comes to potential retaliation, Foreign Affairs Minister Chrystia Freeland has said Canada will defend its industries and jobs.

http://www.cbc.ca/news/politics/trump-steel-deadline-1.4685242

I don’t necessarily disagree with you but 13 years encompasses barely more than one cycle in the market. Prices didn’t decline much in the down cycle because rates were dropped drastically.

Doesn’t mean prices will drop this time, but just because something happened in the last cycle doesn’t mean it is an enduring characteristic of the market

1940 Casa Marcia, listing cancelled but indicates accepted offer. No sale price yet.

I’ll unpack the IP theft issue. Yes the US should be doing something about it. However IMHO the way to do it is to form a united front with other Western countries, not to declare war on them. As the rest, see below and many others like it.

http://www.industryweek.com/trade/how-trump-wrong-about-trade

https://www.bloomberg.com/view/articles/2017-06-27/trump-is-wrong-about-aluminum-imports

Finally, one of the Rockland listings has sold. What I am not seeing is any price reductions in the other listings. I am wondering if it is going to be a quiet summer.

Sure Dasmo. Another story teller. People have multiple family reasons for being in and out of the real estate market. You pumpers narrow paranoid minds spend too much time on me. The market is bloated and about to do a major correction/tanking. That should be your focus.

So, Hawk is highlighting all the slashes… Can someone post how much 1940 Casa Marcia (in Gordon Head) sold for? Asking $850K; it sure didn’t last long.

I remember Hawk saying a few times he had sold in anticipation of a crash and that he had done it successfully before. Was it Michael with the uncanny ability to dig up old posts? That is definitely needed in this case!

Dude, for years now I’ve been making fun of you for cashing out and you’ve chosen today to question that assertion?

You’re so desperate and full of it.

Jerry. Alcohol,meds. Bad combo.

Hawk. Ambien.

Enough said.

@ Patriotz

“… his [Trump’s] “America” is on the way out, and the policies he promotes will handicap the economy of the future.”

Could you unpack that a little? Trump is seeking to rebuild America’s manufacturing sector using tariffs and revised trade deals; promote the US resource industries through protective tariffs and less restrictive regulation; protect the IT sector from intellectual property theft; and encourage investment by cutting corporate taxes. How does that handicap the US economy?

“Where did I say I cashed out dummy?”

If you never cashed out, you were never in or still in. Or some other alternative.

Damn. So much for affordability. Every time Hawk posts that chart the market goes up by another few percent.

The horror, the horror; the chart, the chart is back.

Patriotz

Haha. 😛 I wasn’t assessing the efficacy of his policies or their implementation.

Actually he is kidding, because his “America” is on the way out, and the policies he promotes will handicap the economy of the future.

Intorovert,

Where did I say I cashed out dummy? Just because your head is so far up your ass you can’t see the sales in Golden Head and Broadmead are selling close to, at, and below assesment at the hottest time of the year is no reason to keep regurgitating this bullshit story. Better go check the crime pages for more garbage theories , as your miserable life must be so pathetically boring.

No one left in the pool to keep the food chain going. Pity.

Most millennials have already bought a home: study

Perhaps to the surprise of many, the majority of adult Canadians between the ages of 23 and 38 have already bought a home, according to study from Genworth Canada.

https://biv.com/article/2018/05/most-millennials-have-already-bought-home-study

The sage who cashed out right before prices rose 40% is giving me advice on when to cash out.

This will be known as The Fraud Bubble. So many lied to get in and the banks were party to it. The pain on the way down will expose it even more when they don’t requalify.

CMHC Finds Millions Worth Of “Ineligible” Mortgages At A Canadian Bank

A routine audit is leading a Canadian bank to repurchase their “ineligible” mortgages. Montreal-based Laurentian Bank is agreeing to buy back over $125 million in mortgages. The agreement is the result of a routine audit from the Canada Mortgage & Housing Corporation (CMHC). This comes while the bank is trying to improve borrowing standards, after a different third-party audit revealed similar issues.

https://betterdwelling.com/cmhc-finds-millions-worth-of-ineligible-mortgages-at-a-canadian-bank/

“As the bubble nears its peak, wise investors quietly pull out as it becomes clear that the price is unjustified and unsustainable. Latecomers with little understanding of their holdings invent new explanations to rationalize the extreme overvaluations the bubble has created. They believe the old rules no longer apply and the inflated price is the new “normal.”

?w=620&h=471

?w=620&h=471

Cartoon from late 2016. Prescient.

as regards real estate, I believe there has not been a generation that bought a primary home which did not appreciate significantly in value. (If your plan is to flip, this is not the market.) Even a 10% drop in values (not seen in the 13 years I checked) would still put the average sales value at above the 2016 average price. I have no horse in this race- just my observations. (My area is hot hot hot right now with sales going well over ask, but we are not on the market)

If it does, and that’s a big if, that’s hardly a supportive metric for the housing market. Who knows what a bilateral trade deal would look like with the USA. Trump isn’t kidding when he says, “America First”. A kaiboshed NAFTA could drag further on Canadian exports which to date, have remained somewhat anemic despite the low interest rates. Lower rates, especially against a rising FED, could chew our little loonie down to the nub.

Secondly, we import slightly more than we export, meaning that the implication of a lower CAD cannot be ignored. With a consumer that’s tapped out and a housing market that is in the process of downshifting after becoming such a huge part of GDP, the last thing the CB is going to want is excess inflation due to imported consumer goods that we cannot afford to buy.

Lastly, that reasoning seems to ignore not only the current messaging of the central bank, but also the reality of rising bond rates. Poloz controls less than you might think in terms of rates and where he does, his hands are essentially tied either way. We’re going along for this ride whether we like it or not.

Many more times to come. Sorry it hurts your feelings, but the last year has been your chance to cash out like no other time. The town crier job may help as a second job, or maybe your only one.

This isn’t economists saying it, it’s the BOC whose saying it, if you’re going to live in la la land you might as well be telling clients the facts, not that some economists got it wrong so keep on buying. But salesmen have a tendency to spin the reality when things are looking so bloated.

Bank of Canada Lays Ground for More Rate Hikes

Canada’s central bank is paving the way for a new round of rate increases in the second half of the year as the nation’s economy runs up against capacity constraints and inflation hovers at the highest in seven years.

https://www.bloomberg.com/news/articles/2018-05-30/bank-of-canada-drops-cautious-language-as-it-holds-rates-steady

What goes up… must go up forever?

Average selling prices in Victoria:

’04 $359000

’05 $445000

’06 $490000

’07 $535000

’08 $569000

’09 $556000

’10 $600000

’11 $611000

’12 $623000

’13 $603000

’14 $612000

’15 $651000

’16 $801000

’17 $905000

only twice in the past 13 years has the average sales price gone down y o y, and one was in 2009 during the crash -by only just over 2%- when the S&P had tanked 50% since 2007. With NAFTA about to implode, Canada will not be able to afford to raise rates much longer , hence prices will not crash. They may dip but the fact remains that BC is a desirable retirement destination for Canadians, so demand will remain-unless the NDP figures out how to install Canadian winters and remove the mountains, ocean and the trees.

How many times have we heard that?

And how many times have we heard “bagholders,” “look out below,” and “lipstick on a pig”?

One of the things I know I have to keep reminding myself is, no matter how sure I may be of something, it’s only a feeling. Like a work in progress for me, I guess. I know, some statements really are foolish, they ignore or cherry pick data, or use arguments which history repeatedly demonstrate as spurious. But too often statements like the quote second above simply mean “anyone who disagrees with my perception is [derogatory]”. It’s exactly the opposite platform from enticing and respecting debate.

There’s plenty of people smarter than you and I put together that will have different views than us. It doesn’t inherently mean they’re fools or have no credibility.

That’s the issue. It wouldn’t be the end of it, and nothing would be resolved by it. It’s all just delay tactics.

“In 2007, Kinder Morgan reported to the National Energy Board that it valued the Trans Mountain pipeline system at $550 million.”

https://thetyee.ca/Opinion/2018/05/29/Canada-Dirty-Pipeline-Bailout/

Yeah, teachers are stupid.

Hey, do you remember when $3.1 billion simply went unaccounted for under economist PM Harper?

https://www.theglobeandmail.com/opinion/where-the-hecks-that-31-billion-wheres-the-fury/article15503778/

This scenario seems plausible.

Make taxpayers shoulder 100% of the cost overruns/risk of the pipeline getting stopped altogether via court challenge (the Indigenous-led one, not the “is it constitutional?” one), then buy back the project, for pennies on the dollar, if and when it’s fully built and operating risk-free and guaranteed highly profitable.

If there were any doubts that big corporations actually run the show in Canada (and in many other countries), they have been put to bed.

But the signal for future hikes is loud and clear. If you are variable, take a close look. A July 2018 hike is now an almost certainty. Then one more in the fall – may be 2.

Even if these rate hikes play out that are “certain” just like Garth was certain in 2009 that interest rates would be 5, 6, 7% by 2014 you are still ahead after three hikes as the spread right now is almost an entire point.

There was a BoC move a couple of years ago that the 19 economist polled before the announcement all got it wrong.

4105 Alberg Lane new build in Mt Doug/Golden Head slashed $251K to $1.9 million. I’d say prices are going down.

3473 Henderson Rd slashed $90K to $1.09 million.

851 Sayward Rd major reno slashed $200K to $1.75 million.

Rich dudes have gone AWOL at the hottest time of the year. Stick a fork in it.

But prices aren’t plummeting. Far from it.

Market is slowing but year prices are holding thus far….property in Rockland just sold for $1.4 mill this morning with a 2011 purchase price of $830,000.

Classic example of “sweep a bunch of statements into a giant pile then stand back and say, ‘See, my conclusion has to be right!’ ”

The trouble is, ever since you started posting on HHV a few years ago, all your conclusions have been wrong.

No one, and I mean no one who is credible, expected the BOC to raise rates today. But the signal for future hikes is loud and clear. If you are variable, take a close look. A July 2018 hike is now an almost certainty. Then one more in the fall – may be 2.

Pipeline – Trudeau gave Kinder Morgan a virtual blank cheque. In the pipeline industry, due diligence to value such a project would take over 12 months, but Trudeau is so gifted that he can pick a number [$4.5 B] out of the air in 2 days time. Kinder Morgan is doing a dance and the tax payers have been taken to the cleaners by our failed-drama-teacher PM. No one will buy this white elephant from the Feds – with government cost over-runs, this project will end up costing the tax-payer $50 B, if not more. We need a change in government at the federal level, first he attacks small business with this ridiculous tax to prevent passive income being generated and now this pillaging of the tax payer, all so Trudeau and thumb his nose at Horgan. Trudeau should have put on his big-boy pants and dealt with the reference question in court at the SCC on an expedited basis. There the issues raised by all including the Indigenous peoples would have been resolved once and for all.

Oh, and if you want to use Petro-Canada as a flag for your argument, it is Suncor [and their shareholders] who reaped the benefit, not the tax payer. The same will happen here – once the tax payer spends and spends, some corporation will get the deal of a lifetime – perhaps Enbridge or Trans-Canada or Interpipe or Keyera or Pembina………..it won’t be the tax payer, thanks to Trudeau-2.0

We all get that the market isn’t red hot anymore.

But prices aren’t plummeting. Far from it.

Dear Captain Pumper,

You wouldn’t know it with all your tourism and pumper posts deflecting the obvious in total denial like most fools who have never experienced a real bear market.

It all starts with the current price slashes at close to assessment and below in prime areas like Golden Head and Broadmead so in essence they have already started to fall but keep on the blinders.

Toss in rising rates for the first time in a decade with massive household debt that will never get paid back and will result in many bankruptcies and foreclosures. Thanks for coming out.

Wait til the taxman goes after all the flippers that think they got away with it or were planning to.

Canada’s taxman becoming more aggressive with real estate tax evasion in hot Vancouver and Toronto markets

“The penalties can be harsh, Golombek said: in a recent case involving a Toronto realtor who bought a pre-sale condo contract, but then sold the unit shortly after building completion, a judge ruled the condo buyer had never intended to live in the unit or hold it long-term. In addition to having to pay capital gains tax on her $103,206 profit, Golombek said, she also had to pay an additional fine.

In August 2017, the CRA reported it had prosecuted Harjinder Dhudwal of Surrey, B.C., for failing to report business income and capital gains from buying and selling real estate, and failing to report rental income. Dhudwal was fined $129,750.”

“Canada recently signed an taxation information-sharing agreement with 60 other countries, which will come into effect this fall.”

https://www.thestar.com/vancouver/2018/05/29/canadas-taxman-becoming-more-aggressive-with-real-estate-tax-evasion-in-hot-vancouver-and-toronto-markets.html

Still not everyone, because of the credit from provincial income tax paid. Also, it doesn’t apply to anyone renting out their property long term for 6 or more months a year.

And following on that – I don’t think most of these “vacation” homes are primarily used as such by the owner. I think they’re mostly being used as illegal short term rentals. And that’s what the government is really after, not just the handful of cases where the owners can actually afford to leave the property empty.

Dear Captain Obvious,

We all get that the market isn’t red hot anymore.

But prices aren’t plummeting. Far from it.

It is funny that the current level of oil tanker traffic through the strait is exactly OK, but an increase will be a disaster. As well as all the tankers serving Washington, there are already export tankers sailing out of Burnaby and of course fuel barges going this way and that all over our coast

The good ole variables days are coming to a close as well. Lock it or sell it.

It has been ending since I purchased my first place in 2009. The principal re-payment just making regular payments has been significant on my properties. In the low 2s you start off with essentially half of every payment going towards principal and only improves from there (i.e. more than half start going towards principal).

At some point in my life there is going to a 5-year variable on one of my mortgages that will do worse than a 5-year fixed, but I’ll have had a lot out performing 5-year variable terms before such happens.

If you commit to a lifetime of variable I can’t see how you possibly go wrong.

https://www.theguardian.com/commentisfree/2018/may/29/justin-trudeau-world-newest-oil-executive-kinder-morgan

How many container ships going in and out of the seattle harbour and vancouver harbour for years? Why has boat traffic never been “profoundly damaging” before?

What the actual fuck Seattle and Vancouver?

Thinking about it more. There are 5 refineries currently in Washington State, which actually source most of their oil from Alaska (58%), 21% from the Oil Sands, and 8% from Russia, the rest comes from other origins that are tankered in. They’ve been THE major source of oil tanker traffic through the strait for decades. HOW COULD YOU WASHINGTON!?! Where’s the outrage for the Orcas?

))) As if “everyone” owned a spare house or condo in Vancouver or Victoria.

Well no, I didn’t say everyone owns a vacation home in Vancouver or Victoria. The “everyone” refers to the tax applying to everyone who does, regardless if they are BC (.5% tax), Canadian (1% tax) or foreigners (2% tax).

For example, a Doctor in Chilliwack who has a condo and a boat in Sidney. Or a teacher in Alberta who inherited a Victoria condo and plans to retire here. Or a business person who owns a Victoria home and moves to LA for a few years.

True speculators won’t get caught by this tax, because they have no personal attachment to the property, so they can rent it out. The examples above are the people that get caught in the spec tax.

))) Also exactly what I said in the article above: “Not enough to make an impact on the overall market”. However we saw where doing nothing got us.

So now we are supposed to see what doing things like foreign buyer tax that “won’t make an impact” will do. Isn’t the answer already stated by you, it “won’t make an impact.”?

Do you think we should consider other proposals that “won’t make an impact”?

If you’re looking for a new approach, how about considering things that will make an impact :

1.- increasing supply. Wait, that’s starting already, with a huge supply coming (4,000 units on your graph, (labeled as wacadoodle high, btw thanks for nice graph!).

2. increasing interest rates. Wait, that’s happening as well.

Those will make a difference, increasing supply and reducing demand.

So my advice at this point to the govt…. stop with the new taxes that “wont make an impact”. Instead, do nothing, watch the huge coming supply and rising interest rates take care of the problem.

A bit surprised to see that 912 Newport sold for 124k over asking and in four days. At 1.871 million this seems a fairly strong price level. Obviously there is still money out there.

1441 Myrtle Ave in Oaklands relisted and dropped a whopping $50. They’ve even given up using the lucky 8’s.

Even prime Golden Head waterfront 4565 Duart Rd for $2.1 million isn’t selling and has to slash a bit to get attention. I thought Christies says we’re the hottest luxury market ? BS.

The good ole variables days are coming to a close as well. Lock it or sell it.

Bank of Canada signals future rate hikes

The Bank of Canada leaves its benchmark interest rate at 1.25 per cent, but removes some cautionary language seen in previous statements. It now says it will take a “gradual approach.” The dollar is up 69-100ths to 77.48 cents US after the announcement.

BoC keeps rates at 1.25%…..Leo looks like you are off to a good start with your variable 🙂

If TD is advertising 2.45% 5-yr variable there must be 2.2 to 2.4% products out there from low thrills online outlets which is kind of still ridiculously low.

As if “everyone” owned a spare house or condo in Vancouver or Victoria. Give us a break. Do you by the way?

Inslee calls Canada pipeline ‘profoundly damaging,’ fears for orcas in surprise deal

https://www.seattletimes.com/seattle-news/inslee-calls-canada-pipeline-profoundly-damaging-fears-for-orcas-in-surprise-deal/

To paraphrase, Washington State’s reaction is, “What the actual fuck, Canada.”

Left wing analysis? More like basic common sense. Some foreign buyers will be discouraged by the tax, others will keep buying and pay it. I assumed that it will discourage about a third of transactions. The rest will be subject to the tax. Do you have some more plausible outcome?

Also exactly what I said in the article above: “Not enough to make an impact on the overall market”. However we saw where doing nothing got us. The Liberals did it for 16 years and kept saying the problem wasn’t this or wasn’t that to justify looking the other way on housing. Well now things are being done. Let’s see where it gets us.

@ Intro

Absolutely. So who’s for getting rid of the family car; never taking another trip to Hawaii, Europe, Hong Kong, wherever; downsizing from the two, three, four-thousand square feet family home with however many bathrooms and settling the family in a four hundred square foot condo; switching from hamburger and french fries to rice and vegetables, etc.

And without exporting natural resources, that’s about what we’d have to do.

Although it’s true we could make an effort to use resources more efficiently. For example, as driven by a heavy carbon tax. Urban densification would also help through energy savings from reduced commuting costs; higher energy-use efficiency in multi-family buildings; exclusion of cars from congested downtown streets; etc.

Yeah, like Bangladesh. They make it work by working for pennies an hour in collapsible garment factories.

))) They’ll collect about $1M in May, and $2.5M per month after that.

Typical left wing analysis. Start off with the premise that a foreign buyers tax will discourage foreigners from buying, and once implemented, assume that they will mostly continue to buy, generating tax-the-rich revenue, and provide little relief for buyers. Look at the tiny number of foreign transactions, about 200 per year. So we stop 100 of them, yippee, that frees up a whopping 100 units – and there are 4,000 new units built per year. Taxes are a really great and powerful tool here.

So let’s think of another tax to add, that won’t help with the housing shortage, just add to the tax burden.

Let’s see, we’ve taxed foreigners buying, and everyone’s vacation home in desirable areas. Can’t we think of some new taxes -like full taxing of capital gains, or PST on all sales or something else?

Saw this listing, “PRICED BELOW ASSESSED VALUE! ” in West Van.

Assessed 2,516,000

Listed 1,995,000

https://www.realtor.ca/Residential/Single-Family/19006713/3841-BAYRIDGE-AVENUE-West-Vancouver-British-Columbia-V7V3J3

So, we’ve seen houses in the 3M range being listed for under assessed, also seeing it hitting the houses in the 2M’s it appears, next stop is perhaps the assessed homes 1-2M?

Steve Saretsky posted this today: “Probably not a surprise detached sales are at 30 year lows, since you know, incomes and affordability.”

http://vancitycondoguide.com/national-bank-of-canada-vancouver-worst-affordability/

Do you remember PET at all? He was an economic nationalist, and created Petro-Canada among other things, and got called a communist and worse for it.

Leo S – there is also demographics at play here which is very powerful. One need simply read the first edition of “Boom, bust and echo” to see how powerful demographics are. We now see the baby-boomers starting to downsize and sell their homes where they raised their kids [this is long overdue] and where are they looking – condos [less maintenance]. At the same time, the first time home buyer can’t afford a detached SFH – so, they look to buy condos. Now, the 2 may not be buying the same type of box in the sky, but we see construction shifting from SFH to condos, not just due to lack of land. This “density” creation has many “demand side” explanations. When I first read “Boom, bust and echo” I bought shares in mutual fund companies because baby-boomers needed a savings vehicle and fund companies were flooding the market with mutual funds [I bought shares in the management companies: Trimark, Mackenzie Financial, Saxon, Investors Group and CI Fund Management – I did exceptionally well]. As we turn the page, the Boomers will not be the leaders as they spend less, except on health care [the next profitable frontier], but we need to turn to the Millennial cohort. Another good book is “The Pig In The Python”. But I digress.

We have 2 competing buyers for Condos developing. But, less attention to SFHs – so, less demand “should” result in price adjustments.

Oil: we need to refine our own oil and sell a refined product. Stop exporting jobs and value added products only to buy them back for more money. Stop being a branch plant. Trudeau and his father never showed leadership on this.

I agree with Introvert the civil servant here. Everyone should just stop being so industrial and stuff like that. Just sit at a desk and shuffle paper like oh my god.

Sure, start with turning off our coal and forestry exports, then do vehicles exports, and then dairy, then come back to oil. Why isn’t anyone in Victoria protesting the boat building industry?

Perhaps we could try to be a climate leader and set an example for other countries.

Or we could just keep not doing our part to limit climate change because money.

Plus, I’m sure all the current/future wildfires, droughts, ocean die-offs, drinking water shortages, coastal city diking, and so on, won’t cost too much money.

Somehow dozens of other countries with comparatively few exportable natural resources make it work, but Canada couldn’t possibly.

Well, any bottom can’t be too deep; it’s still Vancouver after all. It’s not Saskatoon.

On a different note—Leo, could you please add another thing to the to-do list? I’d love to get back the helpful editing countdown timer when composing comments.

Yes, in short, increasing density or put another way, a greater percentage of condos. Think about it this way, the income data is for the entire population. However the percentage of the population that purchases single family houses is steadily decreasing.

Pulling numbers out of thin air, let’s say in the 80s in Victoria 75% of purchasers bought a house vs a condo, now it is say 55%. So those with lower incomes are getting into condos and those with higher incomes/wealth are getting into houses. However the affordability measure is tied to all incomes. That is where the upward trend comes from which indicates gradual decreasing affordability.

I bet if we had data for the affordability of single family houses which used the income of the people buying houses rather than that of the population as a whole, there would be no deterioration of affordability in Victoria over the last few decades. We would only see the 12-15 year cycle between times of good (2013)) and poor (now) affordability

Can definitely happen, Vancouver being the obvious example. But it needs to be an avalanche of foreign money to move the whole market so will not happen nationally. Also personally I would not buy in a market like that. Way too risky. When the taps are turned off who knows where the bottom is.

Move up equity is not an important factor when removing the influence of outside money. Moving up always requires the first timers without equity to buy into the bottom rung of the ladder. If the first timers can’t afford it the whole system collapses

Maybe that is what we should be focusing on.

“I’m looking forward to the right-wing free-marketeers’ thoughts on this massive nationalization of a risky private business venture.”

In Canada, it appears that pipelines cannot be built without government intervention, They are, therefore, outside the domain of the free market.

However, in nationalizing Kinder Morgan, Trudeau is apparently intent on trashing his pre-election stance on the rights of indigenous peoples, and the rights of communities to grant or withhold permission for such developments. Hopefully, this won’t improve his party’s re-election chances. Indeed, if we had a reasonable alternative to the Liberals, Canada’s future would look pretty good.

What will be interesting to see is how Trudeau deals with first nations and municipalities opposed to K-M. Will he, if faced by implacable opposition, emulate his father’s “just watch me” brute force mode of action, and if so, which side will most Canadians support? Beating up on Quebec nationalists was one thing. Beating up on Indians and the Mayor of Burnaby may be seen as something altogether different.

But Trudeau has no other course, since to failure to provide means to ship bitumen in a safe and efficient manner would cost the Canadian economy tens of billions a year over the life of the tar sands, and that’s just from existing production capacity.

Some people will say shutting down all further development of the tar sands would be a good thing. However, there is an abundance of oil in the world. If Canada does not extract and sell it, others will, so there is no net gain to the world’s environment in blocking K-M, but a huge loss to Canada, which has little to offer the world in exchange for most of its imports other than raw materials, plus video games, and tourism.

They don’t even say the word flip?

You’re basically agreeing with the person while saying that they’re slandering… ??

Exactly what part of what I said and you quoted do you disagree with? His employer, his advocacy of RE investing, or his defense of those who made money from the bubble?

http://www.remonline.com/author-sales-rep-owen-bigland-defends-lazy-real-estate-millionaires/

I like Owen Bigland. So far he’s a decent balance to keep my own slants in check, whether I agree with all his points or not.

What a steaming pile of bullshit. Have you even LISTENED to his youtube videos? If you have, you’re knowingly slandering the guy. If you haven’t, well everyone can draw their own conclusions about that.

Owen is a long term real estate investor. Surprise! There’s nothing wrong with that. He does NOT advocate flipping. In fact he advocates buying and holding for decades or longer. Ergo, he’s not a pumper. He’s got multiple videos where he specifically states we’re in the last stages of a historic run up in prices. He specifically states that to address some of the systemic issues with the inflation of BC real estate prices is to properly address the foreign money coming in. He says the foreign buyer tax as it is will. not. work. The guy is a straight shooter and very valuable resource for those who are interested in BC real estate.

Liberals to buy Trans Mountain pipeline for $4.5B to ensure expansion is built

http://www.cbc.ca/news/politics/liberals-trans-mountain-pipeline-kinder-morgan-1.4681911

A local economist’s tweet this morning:

I’m looking forward to the right-wing free-marketeers’ thoughts on this massive nationalization of a risky private business venture.

Letter to the editor:

Re: “Pressure’s on to fix the Malahat,” May 26.

The powers that be are considering building a bridge to help alleviate gridlock on the Malahat, which could cost more than $1 billion, but a rail system is out of the question because it would be too expensive. Have I got that right?

http://www.timescolonist.com/opinion/letters/bridge-too-pricey-consider-rail-system-1.23316664

Local redneck takes it too far:

Knife-wielding man arrested at Brentwood Bay ferry terminal

http://www.timescolonist.com/news/local/knife-wielding-man-arrested-at-brentwood-bay-ferry-terminal-1.23316399

Thank you, Leo S. Great job again and thank you for the objective commentary.

Richard – yes, if you are a repeat flipper you run the risk of being deemed to be operating a flipping business, so the “profit” becomes “business income”, not capital gains [where 50% is tax-free]. I posted a link previously to a story where CRA went after a realtor and her daughter – the tax court agreed with CRA.

On the foreign buyers issue – I believe that many of these purchases go unreported or a scheme is used whereby a local family member buys it in their name using the foreigner’s cash. The next chapter will be investigations and prosecutions in to that fraud.

Barrister – good point. Our government sells citizenship to the wealthy foreigner who distorts our RE market making it almost impossible for locals earning a working wage to afford a home. The Federal Liberals don’t see a connection. Instead, they use our tax dollars to buy a pipeline expansion project when they should be addressing the constitutional question in the reference action.

Year-round tourism is becoming norm for Victoria

Tourism is increasingly becoming a year-round industry for Greater Victoria, bringing more money and more jobs to the region.

There isn’t one magic bullet driving this evolution. It is a result of work on many fronts as tourism officials promote the region and respond to international events and trends.

http://www.timescolonist.com/news/local/year-round-tourism-is-becoming-norm-for-victoria-1.23316831

Richard:

You are right that a lot of people are surprised. Even more people cheat by claiming it as a principle residence when it never was.

I know it is in the news but can we not do the pipeline debate here since it is a real estate forum.

It’s possible. But…I wanted to comment on this point because it reminds me of something. If you recall the dot-com bubble, what gave life to it was initially a sound premise:

Businesses were suddenly unconstrained by physical location and the local population’s ability to patron them. Any business anywhere, selling almost anything, now had instant access to a global market. It was (and is) truly a new dynamic that had never been seen before.

As a result, anything attaching a “dot-com” to its name went almost immediately to millions. It didn’t matter how long they’d been in business, whether they had a strategic plan, or even if they were pulling in a profit at IPO. Because of this new dynamic, those principles were thought to either not apply, or applied much differently than before.

As it turns out, profitability actually did matter and when that became apparent, the edifice collapsed.

Right now, there’s plenty of folks out there looking at the housing market, supposing that just perhaps, affordability doesn’t matter anymore, or perhaps matters less. Is it true? I’m not convinced it is, especially since unlike stocks, we’re talking about a core human need across multiple social stratas that must be paid with incomes.

“Property flipping is not illegal; Canadians have the right to purchase and sell property for a profit. However, the income resulting from these transactions is considered business income and must be reported to the CRA,” the agency says.”

The key words are “business income” as opposed to capital gain income which might surprise a few people.

Wow, Italian interest rates – 2 year government bonds yielded negative 0.30% at the beginning of the month, this morning +2.52%…

RE: Rook:

Rook makes an interesting point about the number of very well heeled immigrants that we are bringing in every year. In turn, that has made me wonder about exactly how much of a bubble that there actually is in the real estate market.

Typically the extent of the bubble is measured by a comparison to local incomes. But if we continue to bring in a steady stream of multi-millionaires into Canada (about half of whom settle in B.C.) for the next twenty years then do we really have a bubble in the market or are we miscalculating purchasing power by only focusing on local incomes.

At this point, someone will point out that 75% of purchases are to locals which is true but one has to wonder how many of those purchases are locals simply moving down the property ladder having sold their properties to “new money”. The picture in Victoria is perhaps harder to define because a lot of this movement down the property ladder are Vancouver transplants who sold to the new money and resettled here. Basically, the way to visualize this is that Victoria is a few steps down the property ladder. It is where you go after selling your house in Vancouver for 3 million.

As long as this housing market is being feed by a steady stream of newly arrived millionaires then it seems possible that the bubble is a lot less than some would believe.

LeoS: Thanks once again for the numbers but, equally, thanks for the insightful commentary. I am not sure that everyone here truly appreciates how much work must be involved in doing this each week.

Bigland works in a West Side Vancouver realty (Macdonald) that specializes in selling expensive houses. He is also a big time RE pumper and apologist for those who made money from the bubble. So keep that in mind before granting him any objectivity.

http://www.remonline.com/author-sales-rep-owen-bigland-defends-lazy-real-estate-millionaires/

The foreign buyer is a bit of a misnomer when it comes to the massive change in the social structure we see in BC right now. the The Immigrant Investor Program and the Quebec Immigrant Investor Program on the other hand has changed the affordability of homes for anyone who hasn’t purchased prior to the massive run-up in Vancouver, and subsequently Victoria.

I’m not sure if anyone has posted this video by what seems to be a prominent realtor in Vancouver, Owen Bigland but he has some true things to say regarding the numbers.

This one quote really floored me at around 6:30:

“In the last seven or eight years I think I can count on one hand the number of detached homes I’ve sold to anyone except a Chinese buyer”

https://www.youtube.com/watch?v=dPXn53ip0UY&t=409s

Oh ok. Thanks!

Because the other 22 went unconditional before the Feb 21 deadline and closed before May 18th. Those were the two criteria for deals to escape the tax. Going forward, likely about half of the May transactions will be subject to the tax and all transactions closing after May 18th will be.

WAG: They’ll collect about $1M in May, and $2.5M per month after that.

Sorry I’m so slow, but I don’t understand this. Why was only one of the 23 foreign purchases assessed the tax?

Re 2160 Bartlett Ave

Sold for $1.385 Million!

Purchased Mar 31, 2016 for $760

Assessed Value 2016 $851,600: Land – $821,000; Building $30,600

Assessed Value 2017 $968,400: Land – $888,000; Building $80,400

Compared to the Sample Sold Properties on e-valueBC, the price is out of whack. Even with “some significant improvements”, the numbers don’t add up – must be ‘new math’.

One can only conclude that these sellers asked for the moon and received it from a buyer who could afford to not

bother doing their homework. Curious where the purchaser came from.