The gap

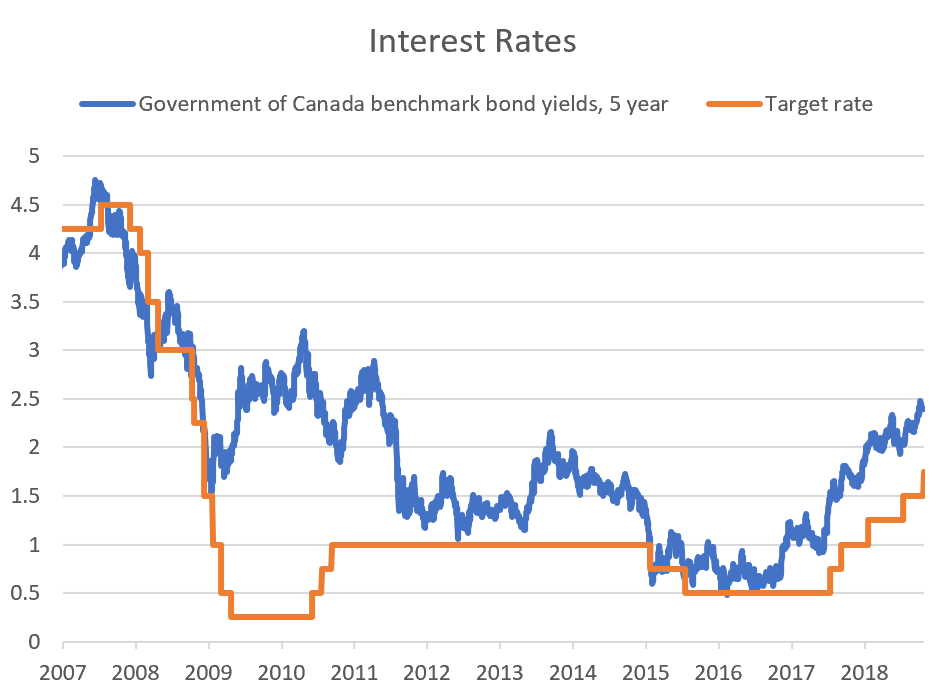

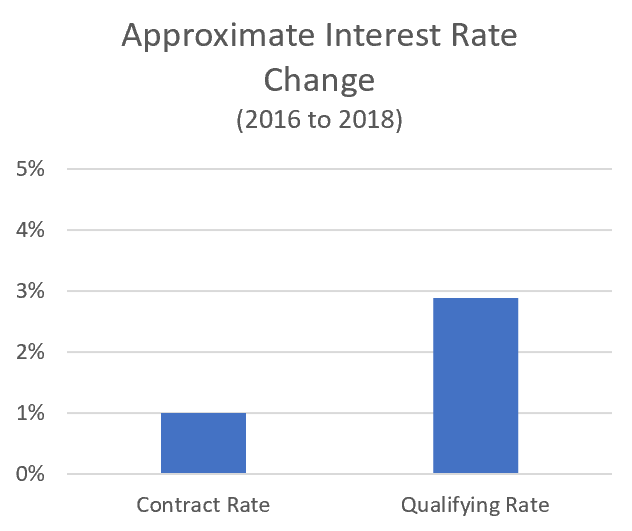

The Bank of Canada raised rates again yesterday, bringing the overnight rate from 1.5% to 1.75% and making this the 5th increase in just over a year from the rock bottom rates of 0.5%. Since 2016 the bond rates (which affect fixed rates) have gone up even more than the overnight rates (which affects variable interest rates) as shown below.

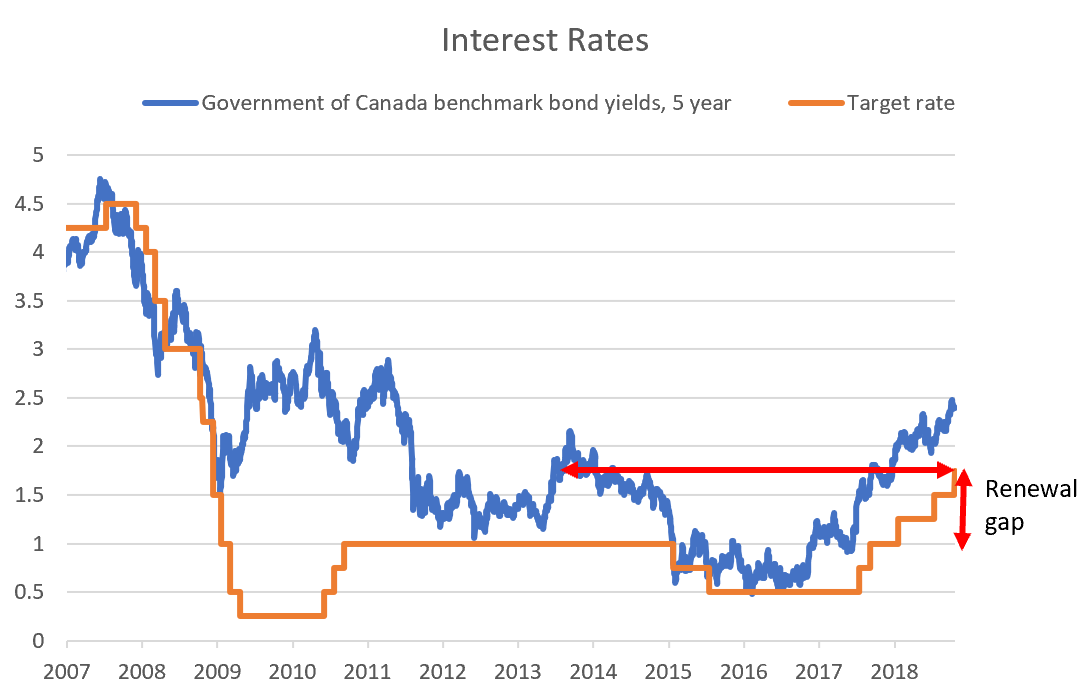

The most common interest rate term in Canada is the 5 year rate, so if we look back 5 years we get the interest rate gap, or renewal gap, which is how much more interest a borrower would be paying if they renewed their 5 year mortgage today. The exact difference of course depends on the discount you got from your lender, but all things being equal the difference would be roughly equal to the change in the underlying rate driver.

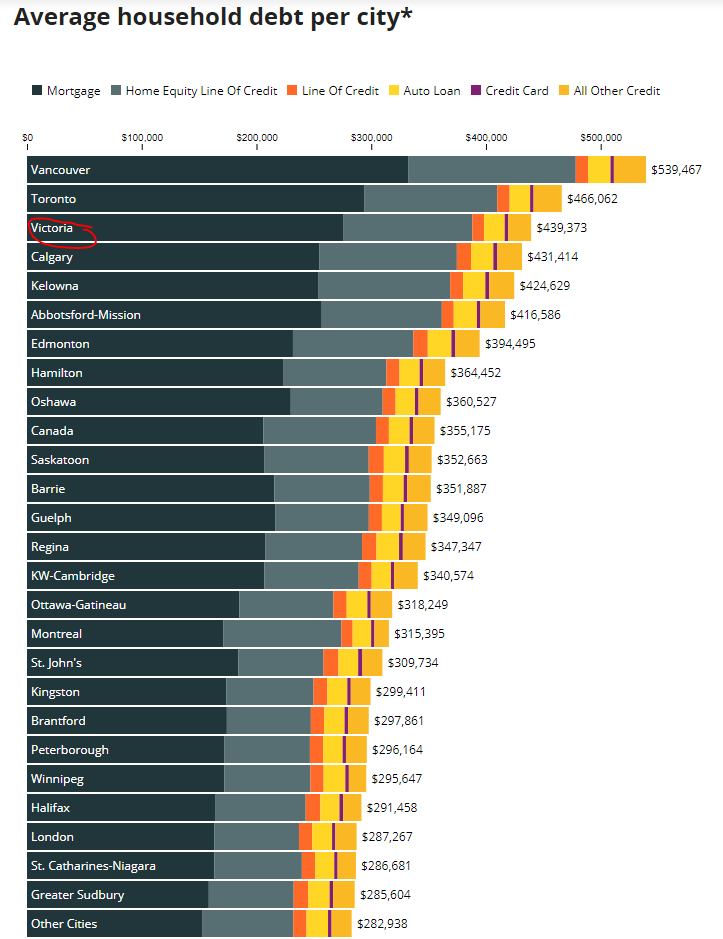

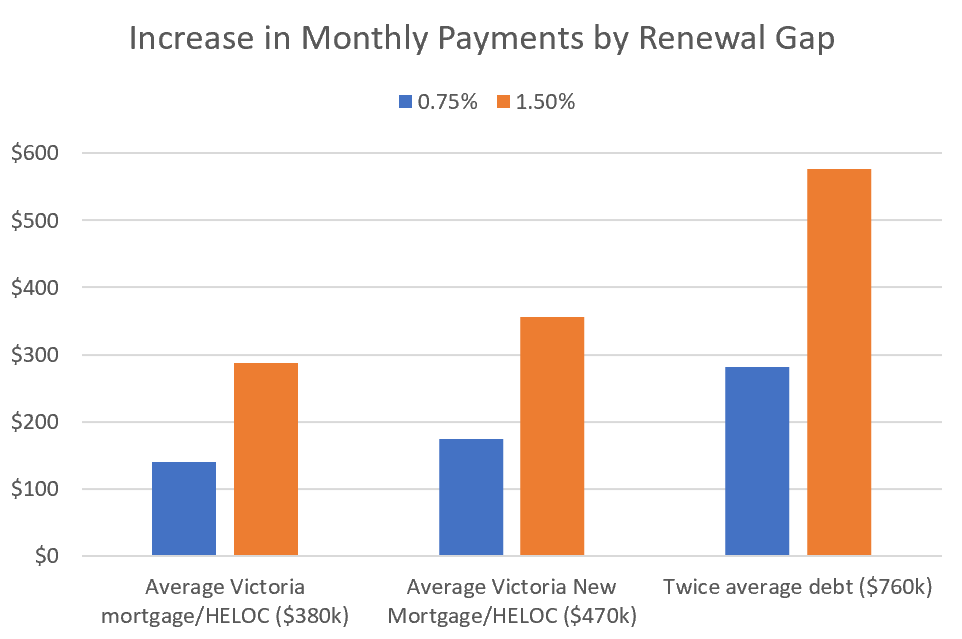

There is widespread consensus (though not everyone agrees) that more interest rate increases are coming both in the fixed and the variable market, with most banks expecting another 3 rate hikes next year. That could significantly increase that renewal gap from the current roughly 0.75% to 1.5%. To put that back into dollars and cents, we can look at the average mortgage and HELOC debt of Victoria households which combined is about $380,000.

Source: CBC

That’s the average debt load, however for new mortgages, loans are significantly higher. CMHC says that the average new mortgage in 2017 was $366,000, which is up some 9% from the previous year (repeat buyers have the highest average mortgage at $423,000 while new buyers averaged $387,000).

We know that Victoria has a pretty high percentage of highly indebted borrowers and we know that those at the fringe are usually the trouble makers, so I’ve also added some higher mortgage loans (twice the average) to the mix and calculated the impact on monthly payments of the current renewal gap (0.75%) and what we might see by next year (1.5%).

Right now someone renewing would not be paying that much more, but those at the fringe that are highly leveraged or those renewing next year could be strained if they had to find an extra $300/month or more. However I am not really concerned about existing mortgage holders. Unemployment is low, wages are up, and if you bought 5 years ago worst case you unload the property for a tidy profit.

The bigger impact comes from new buyers, and so far we’ve only been talking about contract rates. Those are what you actually pay on the mortgage, but before you can do that you have to get approved.

As you know there’s a stress test in effect, which means that what new buyers need to worry about is the qualifying rate. And that’s where the gap really made a jump. 2 years ago there was no stress test and qualifying was close to the contract rate. Now everyone has to qualify at the benchmark rate, which is the average of the posted 5 year mortgage rates (currently 5.34%).

That change is what really took a bite out of the demand side in Victoria and if the bond market keeps going up that qualifying rate will keep increasing and reducing the amount that buyers can qualify for. Victoria is less dependent on first time buyers than the average city, but this does put a big drag on our market. That’s a bummer for ambitious buyers, but in our increasing rate environment it might protect them from catastrophe and better prepare them to face that renewal gap in 5 years.

@Barrister I’ve been told it’s around $1,300 for a 1 bd

Monday numbers: https://househuntvictoria.ca/2018/10/29/oct-29-market-update

Ballpark, what are garden suites renting for in City of Victoria in a good neighbourhood?

Official garden suites in Victoria are max 600 sq. ft.

Irrelevant IMHO.

Yes to all 3. There are separate applications for home-owners doing their own plumbing or electrical. Can’t do gas work. Probably would be some insurance issues around torching your own place too.

If permits aren’t pulled, sure. That’s a liability. I don’t see any issue with permitted and inspected work. Inspectors tend to be much more thorough with homeowner work. Plumbing and most electrical is basic stuff.

Looking for good builder? The resources that we tend to look at for a reputable builder to separate the marketing (fluff) from the substances are:

1/ has the builder won any CARE awards in the last 5 years?

You do realize CARE awards are given out by builders to themselves. It is pure marketing. It is the last thing I would look for when hiring a builder.

@sidekick “Jack of all trades, master of none”. I don’t know if complete Electrical, Roofing and Plumbing work can legally done by home owners but I’m sure the googlers will correct me if I’m wrong. BC safety authority act, municipal regs and the building code may all point to needing certified people but we can all ignore it, I just discount the value I place on a house if permits aren’t pulled and certified people did the work. I know lots of great self taught people just don’t want to trust my largest asset to someone self taught that I don’t know.

Thanks for the current building cost numbers. Thinking of building a large garden suite which will likely be more per square foot 🙁

I’m a fan of Lida Homes for large builds given their systems and size of team, they may come the closest to what you need.

Anyone have recent numbers on large garden suite builds/small homes? 1200sq and less. Can you get a building mortgage partially based on potential garden suite revenue? Is their an roi based on tomorrows rental rates?

Saanich but I am sure most cities are the same. You can spend 200k on a reno and no

permit is required if you do not hit the any of the below, Always check.

Bylaw/BC safety when they see a reno can come in to make sure asbestos material is tested if workers are disturbing it.

If you are planning on renovating an existing building, a building permit is required. Renovation project types include, but are not limited to;

•covered deck

•interior or exterior walls

•exterior changes to windows, doors or cladding

•fire damage repairs

•enclosing a carport to create a garage

•secondary suite

I’ve been told that whenever there is a structural change, of the value of the project is >= $500 you need a permit. I’ve also had a stop work order just replacing some rotted framing (with no change in shape or build).

Material costs are running close to $150/ft2.

https://www.rew.ca/properties/401181/1075-roslyn-road-oak-bay-bc?direction=desc&page=1&search_id=oak-bay-bc&search_type=property_browse&sort=latest

Quite the nice house. Be interesting to see what it sells for. Listed before @ 2.2MM now 1.98MM.

Looking for good builder? The resources that we tend to look at for a reputable builder to separate the marketing (fluff) from the substances are:

1/ has the builder won any CARE awards in the last 5 years?

2/ also surprising how learn when you call New Home Warranty, we used Travellers, and asking the building inspector off the cuff of who was good

You’ll get a few names, and interview them and find out who the best fit is for your family and yourself. In demand builders are charging 300$/ft2 – 350$/ft2++ right now or more. But I think you can build yourself quite a nice custom for 250$ to 275$. Good luck.

Note, the above includes a finished basement.

In general, what kind of renos need permits? I assume something like replacing kitchen cupboards would not, but what about removing part of wall to “open up” the kitchen? I imagine putting in new bathroom fixtures would not, but what about changing the plumbing to accommodate a freestanding tub? Is it different for different municipalities?

Certainly I would look this up if I need more detail, but it is just a general curiosity now. Oh, and what happens if you are a buyer and look up a job that should have had a permit at the municipality and there is none?

No idea on that one. I’m sure you could ask 10 different builders what they consider ‘quality’ and get 10 different answers. I find some of Mike Holmes’ stuff questionable (specifically his love of spray foam). Lots of different angles to the building thing.

Why? It all gets inspected if there are permits. Plumbing has to pass pressure tests/stack tests and electrical gets a pretty thorough inspection when it’s a home-owner doing it.

If I sell my place I have to personally warranty it for the 2/5/10, for whatever that’s worth. Thanks HPO.

Unicorn hunting….

Good to know Marko. It was back in 2004 when this happened. I didn’t know that soil contamination had to be disclosed after remediation is carried out. In that case I am really happy there was no contamination.

@guest_51163 thanks for the links. To each their own but if I know plumbing and electrical work is done by a home owner I pass. A good friend did two complete house lift/stud Reno’s and I love the work he did but he also redid the bathroom floor twice due to water leakage. Yes, there are great artisans out there few know about but I also know the difference between industrial electricians and residential but some contractors/developers don’t care. We were looking at a three suite house that had been reno’d and between some slightly sloppy hvac/plumbing and doing the background on the electrician and the asking price we passed, someone else paid 1.42M for that work, facepalm!

@guest_51192 Yes, learned from our second realtor to do the oil tank scan and found an old burried grounding plate, good to see that was the only apparent short cut. Thank god for good realtors or I might be panicking before the conditions come off tomorrow!

Don’t forget to check for the buried oil tank. The house we had on San Jose had two oil tanks and we had our realtor put a clause in the offer that the seller had to arrange removal of the one we knew about. As it happens there was no leakage but it could have cost dearly had there been contamination of the surrounding land.

I am not a fan of doing it the clause approach for my buyers. When an oil tank is discovered on oil tank scan I prefer to extend the condition of inspection until the tank is fully removed and all the paperwork pertaining to the oil tank is wrapped up. Reason being is if the soil is contaminated the seller can deal with contamination and they’ve fulfilled the clause and you as the buyer still must complete on the purchase. Contamination can stigmatize the property and you must disclose on a subsequent sale.

By extending the inspection subject you can bail on the deal at any time if you are not happy with how the tank removal is coming along or the seller doesn’t want to agree to soil testing, but it is something you want as a buyer. This is always an issue as soil testing is still not formally required (if no visible contamination) and the seller most often doesn’t want soil testing, but I think it is prudent to have done while the pit is excavated.

Also, for high risk properties (built before 1960) it is wise to have two scans done by different companies with different technology. I’ve had three companies in Victoria miss an oil tank so no one is 100%.

Some companies use ground penetrating radar; however, it can have issues when tank is filled with native soil (not sand), etc. Metal detector can have issues with rebar in a driveway, etc.

Time to reflect with debt derivative levels at multiples of last time around.

The banking crisis 10 years on, and the danger of another crash

“Morgenson says that the seeds of the crash were sewn in the boom-years leading up to it. Home prices were skyrocketing, and many believed they would never fall.”

https://www.cbsnews.com/amp/news/the-banking-crisis-10-years-on-and-the-danger-of-another-crash/

Any good resources where people could educate themselves about quality construction? Old and new. I’d love to know more, but not sure where to start

This is a tough one. Either people are trying to sell ratings or sell YouTube views like this guy -> https://www.youtube.com/watch?v=E78S_yQdwSM

I’ve always tried to find even keel information. This guy is good and he covers at lot of basic topics -> https://www.youtube.com/user/MattRisinger/videos

Viola,

I know many millenials that are great kids with similar friends. I even produced a couple. 😉

I taught mine to never think your shit don’t stink cause you got lucky or made a smart move cause one day you could be on the other side.

It’s the pompous arrogant ones that set a bad example. I agree with Cynic tho, there is some serious self esteem issues goin on there, most likely bullied and high chance of divorce in their future.

For us a big part of house shopping was did they pull permits?

I’ve seen some great work without permits and with pretty much 90% of work in Victoria and Saanich not having permits you’ll be skipping a lot of solid houses if you are insistent on permits.

Who were the contractors/trades.

Also, not sure how much weight I would put into this. There are lot of exceptional trades people in Victoria that no one would have ever heard of. The finisher that did my flooring and finishing was 80 yrs. old at the time but I knew him through the Croatian community. Impeccable work. Only worked four to five hours a day but I wasn’t in a hurry.

I’ve also seen places where the owner has done the majority of the work but they are talented and OCD and the work is better than contract quality.

At the same time everyone has seen the disaster DIYs too.

After about 5 minutes in any particular home you get the idea of whether it was done properly or not. 100s of things you can look for. My personal 5 minute gut feel is verified as correct on inspection about 95% of the time. 5% of the time you are fooled but that is what the inspection is for.

Non-visible upgrades are a great sign of a renovation in my opinion. For example, if someone has replaced the drain tiles, sewer lateral, and upgraded the water main from 0.5 to 1 inch pretty much most of the time there aren’t many cut corners on the stuff you can see. But if you see a brand new shining basement suite but original concrete drain tiles…..I start to question it a bit more.

“buy on the way down and hold, just like real estate” – yes! I have a friend in Saskatoon and I keep telling her to buy before it starts going up again!

@Victhunter

Don’t forget to check for the buried oil tank. The house we had on San Jose had two oil tanks and we had our realtor put a clause in the offer that the seller had to arrange removal of the one we knew about. As it happens there was no leakage but it could have cost dearly had there been contamination of the surrounding land.

On some brands” is the giveaway. It’s an interest rate buydown from the car manufacturer. The bank is actually getting a higher rate.

I’ve seen 3.99% on private transaction thoughts. From the Tesla forums…

Scotia bank offering Model S financing at 3.99%

RBC retail banking offered to match the 3.99 but with a variable underpinning. Not willing to go that route as prime will likely move back up in 2-3 years.

Highly doubt Tesla is buying down RBC and Scotia Bank. My guess is those two banks have probably gone down to their bottom line on Teslas due to lower risk (low depreciation), big loans, and possible spin off business.

Also, currently on the Model 3 the rates between RBC and Scotia Bank are different.

RBC on the Model 3 is 4.01% for 48 months

Scotia Bank is at 4.05% for 48 months.

That wouldn’t make sense if Tesla was buying the financing down. My guess is the two banks are competing for the business and they must be making a profit at 4% even if it is small.

@transformer for quality construction have you checked out Homes on holmes on YouTube? I was also looking at this old house but they have a lot of diy tricks videos, not as much quality construction.

Also some realtors are much better than others in knowing about the era of builds that have lots of asbestos and can help you spot sloppy renos. These realtors are few and far between but we switched to one half way through our hunt.

For us a big part of house shopping was did they pull permits? Who were the contractors/trades. Which can be found at the municipality. If it is home renos I discounted it considerably and even with permit I sometimes look up the trade contractor and make a judgment as to if they are a quality residential construction person.

There are horror stories of electrical panels replaced and then running wires a few feet and connecting to knob and tube.

Thank god the days of no inspection offers are gone!

All the talk of timing the market….let me know when it is time to buy index funds you blog smarty pants! Wait save your breath, buy on the way down and hold, just like real estate.

You’ve been saying that since 2015.

Local Fool, do you and Hawk have any articles on British Columbia right before the Great Depression?

With 15 thumbs up, this one could make the year-end top 10! Nice one, Josh.

@guest_51161 and @Hawk

The thing is that guessing the future of RE is like guessing the future of any market, its hard to do because it’s so unpredictable. Just because there were similar conditions in the 80s doesn’t mean we are in for a repeat. That being said I do think that the market is starting on a downward trend. Whatever happens it is sure to be unique for this age and our specific circumstances. I don’t think it’ll be a repeat of the 80s though, but I think it’s possible that in the next 2-5 years there could be significant declines in the value of RE. Declines in general are normal, and so are the increases afterwards. That’s why buying a house that’s a good deal now that is for the long term (20+ years) is probably still a safe move.

@Hawk re: the millenials: I work with a bunch of them and they are kinder and more realistic than people in my generation or older. When I was in undergrad I was the only one of my friend that had to work for money to survive. All my friends had family help. Now, I see these students all the time and many of them work multiple jobs while studying a full course load. They are very hard working, and nicer than people my age. Just by opinion though.

Thanks for posting LF. I wasn’t able to post the whole thing on my phone. It’s a carbon copy including the young and dumb in major denial.

Well this explains your pathetic arrogance which gives your generation such a bad rap. The coming crash will teach you a few very hard lessons in life.

Hey Everyone. The post below is the full text of an article featured in the G&M, just prior to the major bust in 1981, where prices fell in real terms, by nearly 41%. I bolded the text in areas that just talk about housing. Much the same things were seeing now, we saw back then. B.C. was hot – unstoppable. Major investment. World class industry, commercial and residential permits on a tear. No rental vacancy, and very high rents. Debates on rent control versus no rent control. No land available anymore. Foreign cash everywhere. Population rising rapidly with no chance for supply to catch up. Then, almost overnight, it was like a switch was flipped. BC went from the economic darling to being a net-recipient of transfer payments. The more things change, the more they remain the same…

Investment, job creation fuel buoyant housing industry

Featured in the Globe and Mail, Monday, April 20th, 1981

The real estate boom in British Columbia is feeding on a surge of big project investment and an extraordinary level of job creation, which saw more than 60,000 more people employed last year than in 1979 – and estimated 56,000 of them from other provinces.

The pressure they put on an inadequate housing inventory shot up prices and set the housing industry to work. The hotspot has been the Vancouver metropolitan area, where house prices doubled last year, but other areas of the province are also buoyant.

Spending on coal development in the southeast has brought brisk real estate activity to the east Kootney area, centered on Cranbrook. In the northeast, a $2-billion project to open up a new coal region has already led to a rush to buy property in Chetwynd, the nearest service town, and in Dawson Creek.

Prince George, the Province’s third largest city and a forest production center, is growing into the hub of central British Columbia and the gateway to northern development. Nanaimo on Vancouver Island is the site forest product developments valued at $500-million; the area, with generally lower prices than Victoria, is becoming a popular retirement location.

An air of expectation hangs over Prince Rupert and its mid-coast cousin, Kitimat. Prince Rupert becoming a major shopping port for grain and coal, will start to feed the demand for goods, housing and services by next year as construction of a planned $400-million terminal gets under way.

A $150-million methanol plant is under construction in Kitimat, which will contend with Prince Rupert as a possible site of a $2-billion petrochemical complex and a major natural gas liquefaction plant.

The Highland valley, about 200 miles northeast of Vancouver, is becoming one of the world’s major copper mining areas, with one mine started this year and another expanded. Kamloops, as the main service centre for the valley, is also seeing lively real estate activity.

The value of commercial and industrial building permits last year reached $881-million, a rise of 9 per cent. That, along with the $1.75 billion in housing permits, contributed to a record annual $2.95 billion in total permits. Peter Maddocks, vice-president and general manager of B.C. commercial operations for A.E. LePage Western Ltd., said the activity is continuing. Demand is strong for business and industrial space and a lot of developers’ applications are still being processed by the municipalities.

Very little industrial land is available for sale. The industrial parks are leasing, not selling. Most of the unoccupied industrial land is owned by big companies, and the supply within convenient reach of Vancouver is quickly diminishing. “The major industrial developers are long term holders, by and large,” Mr. Maddocks said. Heavy construction is buoyant despite a long cement strike, said William Winckler, chairman if the British Colombia Construction Association.

The British Columbia Hydro and Power Authority’s huge Revelstoke dam is still under construction for 1983 completion, the footings are going in for Vancouver 60,000-seat domed stadium and the Prince Rupert grain elevator is on the horizon. With the mining and energy developments, “we’re optimistic” for the next five years at least,” Mr. Winckler said.

Virtually all of the 12 real estate boards report good residential housing business, according to Ian Dennis, president of the Real Estate Board of British Columbia, which coordinates them. However, consumers’ inability to meet prices is hindering sales in many areas. And continuing high interest rates are not helping, he said. B.C. housing starts last year were a near-record 37,546, up 37 per cent from 1979, and the forecast for this year by Canada Mortgage and Housing Corp. was 38,000 to 40,000. But CMHC economist Richard McAlary said inspection and permit delays caused by a 2 ½-month strike of municipal workers make 35,000 a more realistic figure.

CMHC estimates there is demand for 70,000 units, so supply is a year behind. The provincial Government is under pressure to do more to alleviate what amounts to a housing crisis for some sectors of the community. Government policy is to clear the way as much as possible for the private sector to build the housing and to contribute to making more serviced land available, according to Lands, Parks and Housing Minister James Chabot. The Province has made some Crown land available to the tight Vancouver market and it also provides financing to municipalities to acquire or service land for housing development.

Industry sources say this is too little and too late. They also complain about the time-consuming hurdles posed by the municipalities’ regulatory and application review procedures. The Government provides financial assistance for pensioners and low-income people, but there is evidence its policy of decontrolling rents is causing difficulties because of the zero vacancy rate for rental accommodation, generally, in the province.

There is little sign rental construction will catch up with demand and “a government rental incentive program may be required in the short term due to the very tight rental market,” Mr. Chabot said. He has been after the federal government to extend the multiple-unit residential building (MURB) tax incentive for construction of rental accommodation. MURBs were reintroduced last year, but only for 18 months.

Provincial Consumer and Corporate Affairs Minister Peter Hyndman said the Government will not be swayed from a decontrol policy. The only solution is to increase supply, and decontrol provides the incentive, he said. The B.C. housing crisis is the worst in the country for a decade, said Keith Tapping, CMHC regional director for British Columbia, and with the population increasing by more than 1,000 a week, “the problem is compounding, rather than improving.”

CMHC has responded by raising its loan guarantees to builders to cover up to 80 per cent of construction costs compared with the usual 55 per cent, he said. Of the third who rent, 34 percent pay more than 30 per cent of their income in rent, Mr. Tapping said. He believes purchase prices have peaked, but there is no sign of an increase in supply of rental accommodation that would stabilize prices.

On the contrary, “we have 115,000 rental units in British Columbia. In the next 18 months to two years, a further 80,000 will be decontrolled. This will further exacerbate the problem for many because decontrol has meant rent increases of about 20 percent,” Mr. Tapping said.

Foreign buyers are adding to the real estate inflation. European and Middle Eastern money seeking a safe haven competes for properties with buyers from Hong Kong and Japan. The B.C. Cabinet is currently considering whether the scale of the foreign ownership has become too great; and whether it has any adverse effects. Opinions vary on the foreign contribution to the heady price climate. Though foreigners may be willing to pay more, they generally buy to hold and to not engage in the rapid turnover of property that some developers think is the main factor in the price rises. The Province’s major resort development, the $100-million doubling of the skiing capacity in the Whistler area, and construction of Whistler Village, is heading toward completion at mid-decade.

Despite the adverse effects on the construction industry of various BC strikes, virtually all of the construction tradesman are still working, and some trades are in short supply, according to Cyril Stairs, president of the B.C. and Yukon Territory Building and Construction Trades Council.

News the B.C. construction can use more tradesman in almost every areas but carpentry has been attracting workers from outside the province, including some from Ontario. The construction trades’ contracts are in force until the spring of 1982.

Say someone is moving primary residences. They buy a house and put their old house on the market. While that old house is on the market, will they get dinged by the spec tax? It’s not being rented out. I suspect that would qualify as a “special circumstance”, but I haven’t seen it explicitly mentioned.

“On some brands” is the giveaway. It’s an interest rate buydown from the car manufacturer. The bank is actually getting a higher rate.

That goes for all the “0% interest” and similar deals for other consumer goods too.

$1000 cash incentive and $500 discount. Could be because we were returning a low milage TDI which I expect will be resold. You could be right this offer might not be available to someone not caught in the diesel debacle.

@guest_51163

Also looking for a gp… haha

Any good resources where people could educate themselves about quality construction? Old and new. I’d love to know more, but not sure where to start

Quit measuring your dick in public. It’s awkward.

I’m also a millennial. And I probably have a higher net worth than you, because I didn’t arrogantly think I could time the market.

So true.

That’s not a profit for consumer lending. Nowhere near it.

Seems like RBC and Scotia Bank offer car loans 3.99% on some brands based on some of the car forums I read…..not sure if they would be doing it at a loss?

That’s not a profit for consumer lending. Nowhere near it.

How are pre-sales doing right now? They might be the canary in the coal mine.

Super tough read. Pre-sale prices are astronomical imo. Given the astronomical prices I am surprised how much is actually selling. Even the $10.7 million pre-sale condo as Custom Houses has an accepted offer on it.

There has only been on somewhat reasonable pre-sale, Ironworks, and they are over 80% sold.

Does anyone know of a general contractor that can do really big jobs on time (I know shit can go wrong but I mean show up for the first day of work on the day agreed on)? A good general contractor with fair prices and a stellar reputation for being dependable and trustworthy.

ha ha….good luck. It’s like asking does someone know a competent GP taking on new patients.

We just purchased a TSI VW, used with only 4 thousand kms. Paid cash and received a $1000 discount for cash payment. This was with VW Richmond.

You sure you just didn’t receive a $1,000 discount? Why would the dealership reduce $1,000 for cash payment on a used car…the dealership isn’t providing financing and financing on used cars typically has profit in it (like 3.9% or similar).

We just purchased a TSI VW, used with only 4 thousand kms. Paid cash and received a $1000 discount for cash payment. This was with VW Richmond.

Right… is this so they can buy in here just prior to the market going down?

People who want to live here and are following the market would be wise to rent for a few months/years to allow the market to adjust. Speculators, will not invest in a falling market, unless those speculators want to invest to loose money.

So exactly why would anyone from Vancouver want to buy here right now?

IKEA kitchens are actually pretty good. High quality European hardware and the board stock is good quality as well (I believe a lot of it is also made in Europe). Even high-end kitchens these days aren’t typically made with solid wood, as it has a tendency to warp. Most will be a foam-core panel with wood veneer.

Older houses are not stronger than new ones – at least from a wind/earthquake perspective. The fit and finish and materials used may well be far superior though.

Now is not a great time to be looking for work/contractors. All the good ones are booked up for quite a while (at least that’s what I heard).

@guest_51179

“A lot of the cheaper newer stock isn’t being build very well either.”

This is the issue. To build something that’s well built probably isn’t worth it either, right? For example, we just put in a brand new kitchen. All from IKEA. Much cheaper than real wood, I wouldn’t say that it’s high end/super well built. I think a lot of the building stuff is like that now, prefab, cheap materials. That’s the way to make money, to use that stuff, right?

“Pretty tough to economically bring old places up to the newer seismic standards.”

I thought some of the old houses were built much stronger than the new ones. Anyway, we need the space of an older house. That’s the motivation. Don’t want a 3bd bungalow. We will be looking for our forever house, so has to be big enough for family and two teens.

Does anyone know of a general contractor that can do really big jobs on time (I know shit can go wrong but I mean show up for the first day of work on the day agreed on)? A good general contractor with fair prices and a stellar reputation for being dependable and trustworthy.

Glue + screws. And a steel structural screw is much better than brass (GRK R4, for example).

Great point.

Sure, older places it is probably irrelevant since you’d really be interested in comparing the big ticket items you mention. If you’re shopping for a place built in the last 10 years then you might be more interested.

What? Subfloor is not on the home buyers checklist? /s

I’m of the opinion that this is becoming much less economically viable these days. I’ve seen a lot of significant renos be more expensive than rebuilds. Codes are getting pretty strict, and I know of several renovations that turned into rebuilds once the structural engineer came in and said it had to go. Pretty tough to economically bring old places up to the newer seismic standards.

Definitely. A lot of the cheaper newer stock isn’t being build very well either. Probably won’t be any major issues with them, but they won’t last much past 25-30 years.

@Hawk “All the landlords not claiming income might be losing sleep. EXCLUSIVE: Stats Canada requesting banking information of 500,000 Canadians without their knowledge”

WTF?? If there’s a data leak/security breach, what will the damages be? Whose stupid idea was this? I treat my financial information as highly confidential. I claim all income, but to me this is most private. If the details of my finances/purchases got out because of another (i.e. typical) lack of security/data breach, I would be in the first batch for a class action. Holy cow why would they even want this information?

All the more reason to pay cash, when possible.

Sidekick,

One never truly knows the nuts and bolts of the place until you get into renovating, even with an inspection. Every house I’ve owned had it’s own character and surprises along the way, which made it a great learning experience on each one.

Which is also where one has to be careful so the surprise doesn’t turn into a nightmare. Heard of some real disaster stories the past year and the money being blown out the window is incredible.

Any of you home buyers out there actually ask how your house was made/what components went into it? Would you care? Would someone be able to provide those answers?

We are looking at buying a much older house and fixing it up. From what I can tell it is everything that’s up for grabs. One of the things we are concerned with is plaster walls because if they’re plaster then adding insulation can be a huge PITA. If it’s an oldie with good bones (good electrical, structure, insulation in the walls, plumbing) with mostly only cosmetic issues (no changes to footprint) at a huge discount, then, imo, you’ve hit the golden ticket.

In my area I’m seeing more SFH that were long term rentals (20+ years) creeping onto the market. They don’t seem to sell as fast. I’m admittedly an amateur but it seems to me that this is likely because they predict that house prices will decline as the interest rates go up. Some of these houses look like they haven’t been touched in 50 years. It’s crazy! And, also probably an opportunity for those wanting to buy something that they will keep for 20+ years. We are waiting for spring to see what happens.

I think when it comes time to lock in again we have to be prepared for significant increases in the costs. That’s why those who own rentals should increase the rent to the maximum amount of 2% to prepare and offset some of that. For us, that 2% will mean an extra 70$ a month around per year. So if in 3 years we lock in again then we can take a bite out of the increase by having the rents consistently go up. Although I’m happy that the government reduced the maximum rental increase in 2019 from 4% to 2% (4% is insane in this housing market), I’m not happy about how they did it.

A luxury that most people don’t have. When we were buying 5 years ago we knew our budget would get us either a 50/60/70s box, or a run down 80s place.

I was looking at a few things about the construction but the reality is that was far down the list of priorities. In that vintage you’re looking at basics like are the walls 2×4 or 2×6 or are the windows single pane, or will the house kill you with asbestos or an electrical fire.

The other problem is that no one knows how the place was built either after all that time.

And while you put care into choosing the subfloor, I guarantee no buyer will appreciate that careful effort 🙂

Because people take it as a given that they will be able to sell a house for more than what they paid for it. For cars and other consumer goods they know that all they’re getting for their money is value of use.

Sidekick: If you are screwing down the subfloor make sure that they use brass screws if you are planning to be in the house for a few years.

Sidekick: I have noticed that people all look at the brand of the stove and absolutely nobody looks at the brand of the furnance or inquires much about the heating system. Try asking the listing agent about the brand and rating of the roofing singles if you enjoy the blank stare look.

I am amazed that considering the cost of a house most people spend little or no time in getting to know at least the basics of what they are buying. there are lots of great books out there, written in simple English and quick to read that at least provide the basics.

But you got to admit that people are fascinating little creatures.

And as someone who has recently purchased windows and have just ordered a sub-floor, there is a lot that goes into choosing both of those items.

I’ve always wondered about this. Most car buyers will do some research into what models offer which options and you get MPG and other ‘cost of ownership’ metrics. Things like Carfax for used cars etc.

People seem to take houses, the most expensive purchase, at face value. Any of you home buyers out there actually ask how your house was made/what components went into it? Would you care? Would someone be able to provide those answers?

Hawk: I guess it is smart that we are probably leaving the comforts of a big city to move to a small town of about 80k people. Not sure but I dont think that there is even a Starbucks.

But I am sure that we will somehow manage.

Sweet Home: I agree that the house is nicely finished. One of the things that has repeatedly struck me is the low level of finishing that one generally finds in new builds in Victoria. Dropping a slab of granite on otherwise cheap kitchen cabinets does not make for a luxury kitchen in my mind. I appreciate that it is important to keep costs down to make housing more affordable but I am talking about houses with a two million asking price.

My impression is that most buyers are completely unknowledgable about even the basics of home construction. Marko, when is the last time that you had a buyer ask about the brand of windows used in a house or about the construction of the subfloor.

Great post Cynic. The arrogant daily drivel only makes the coming crash going to be that much more enjoyable to see Intorovert living in the basement, as the millenials upstairs pound out the rap music at 2 AM.

After reading about prices dropping in Regina, I checked out the listings. This is the most expensive house in Regina ($2.4M), and it’s priced at $1M over assessed. I could almost stand living in Regina in a house like that. It is actually quite exceptional to find a newer house with that level of finishing.

https://www.realtor.ca/real-estate/19643371/single-family-2262-wascana-grns-regina-saskatchewan-s4t4k2-wascana-view

I found that buying last years model of a car from a new car dealer often comes with a great discount and basically it is still a new car.

Lots of Vancouver house are currently selling well below assessments. Lots of this $ now heading out of town to places like Victroria where retirement home values are a fraction of the cost of Vancouver.

Foreign buyers in September still down 90% year over year. From 48 to 5.

Sales volume down 92%

Very true. Also, if things become a bit more desperate, you can move into the basement suite and rent out the top floor for even more money.

And, lastly, having a suite (especially a self-enclosed one) is often an important selling feature depending on the location and market segment.

Cynic, are you an underachieving priced-out baby boomer too?

@guest_51159

Thanks for the Regina link. Those numbers are sobering (“sellers only received 70 per cent of the assessed value on 72 per cent of the homes sold in the last 30 days”). The last assessment was done in 2015. It is also a little reality check that, even with a benchmark price of $277K, buyers are pulling out because they can’t qualify under the new mortgage rules.

They don’t want you to pay cash because there’s no kick back for the loan. Just like with the real estate biz.

Have never seen such low cash incentives for purchasing. Usually it is a few thousand dollars.

This was for a Honda Ridgeline I negotiated for my father with a Honda dealer

“Our fleet pricing would be $40,250 plus $125 environmental levies and 12% sales taxes – any additional cost would be yours to add (i.e. warranty or paint/fabric shields). This would be a brand new 2018 Ridgeline Sport 4WD in Silver direct from the Honda factory landing at our store. Total for cash purchase equals $45,220.00.”

Zero mention of cash/financing/lease. Then I replied can you do better if we pay cash? And answer was no, but you can pair this offer with this financing offer or this leasing offer from Honda Canada if you don’t want to pay cash.

You can certainly negotiate (I had a Kelowna dealer offer 3.5k off a brand new Ridgeline but was too lazy to go to Kelowna to pick it up) but for a lot of models beyond the initial negotiation there isn’t a substantially discount for paying cash in addition.

We are talking half decent models here….of course you’ll get a huge cash purchase incentive for a generic Chevrolet product, or a Nissan Altima, or something that no one wants to buy.

and I agree slightly used is the way to go but don’t have the time or patience to deal with that anymore.

Have never seen such low cash incentives for purchasing. Usually it is a few thousand dollars.

Intro,

The insecurity you consistently demonstrate on this board is quite staggering and I can only surmise that it must be owing to being bullied or picked on a lot growing up. To live with such insecurity and have to constantly post about how well you’ve done on an anonymous blog to try to impress people you don’t know in order to make yourself feel better must be a struggle. Whatever happened to you, be it being beat up a lot or being shamed by others truly does take a toll. Should you require it, remember that help is always available.

https://www.healthlinkbc.ca/mental-health

Marko:

How are pre-sales doing right now? They might be the canary in the coal mine.

Right now someone renewing would not be paying that much more, but those at the fringe that are highly leveraged or those renewing next year could be strained if they had to find an extra $300/month or more.

The beauty of a suite for cash flow purposes. If you bought a house in 2013 with a suite renting for $1,000 it is likely $1,350 or $1,400 now so that would offset the additional mortgage.

Or just having a suite in general even if you don’t use it…..if you do eventually become strained it can absorb a decent amount of interest.

I’m guessing a lot of people are underwater on their car. I’d never finance a car longer than the warranty.

The problem is the cash incentives are ridiculous poor on popular models. My parents bought two new cars in the last two years and cash/lease/finance was an option on the table for both and one they went with 60 month finance @ 0.9% and the other one 24 month lease @ 0.9% (financing for whatever reason was 2.9% on that model). Cash purchase incentives were $500 and $0.

Why just not take the best possible deal and be smart with your money? If someone offered me 0% financing for 10 years on a car and there was no cash purchase incentive I would take the financing all day long. Even if my cash is earning 2% it is better than nothing.

The other issue with paying cash for a car is you pay the entire tax up-front. If you lease, for example, and then you just get rid of the car after 2 years you aren’t stuck taking a huge hit on tax as you’ll only have paid tax on the payments and not the full value of the car.

I am not advocating financing a car so you have enough $ to put a downpayment on a boat you’ll finance as well but our society currently doesn’t reward cash payment as much as it should so you have to play the game.

“For example, the average house price in Regina has tripled in that time”

In fact the crash in Regina is already well under way.

One thing to keep in mind is that house prices are not included in CPI and the BoC is mandated to track CPI. If Toronto crashes, that will have a big enough macroeconomic impact to expect some pullback by BoC. But don’t expect anything unless and until that happens.

https://regina.ctvnews.ca/buyer-s-market-in-regina-as-housing-prices-continue-to-drop-1.4102974

Very interesting observation. I hadn’t thought of that. Definitely has been more protracted this time around.

If prices decline here, they will decline in Toronto too, and so on. It won’t just be a local problem. Over the last 15 years, there has been nation-wide housing price escalation far in excess of inflation.

For example, the average house price in Regina has tripled in that time, and the map looks unfamiliar to me now with all the new subdivisions. Vancouver will be the hardest-hit city in Canada, but it will have lots of company. Canadian banks only have so much control, though, even if they want to do something.

There’s a difference all right, in that the BC economy was far less dependent on RE then than now. Also the runup was much faster, which means far fewer bought near the top, and the high interest rates discouraged HELOC’s. It took a major North American recession the following year to really bring prices down.

This time a decline in RE prices will snowball into a local recession in BC. And don’t expect central banks to come to the rescue for a local problem.

Another moronic post but it will be worse than 81. There wasn’t 168% HELOCS etc then. No one had a 70K pick up truck loan working at McDonalds. Your set up is a house of cards about to be a house of pain. You’ve made nothing unless you sold. Zero.

If you’re baby boomer, and haven’t done as well as you should have on real estate, everything looks like 1981 again.

Because a repeat of 1981 would mean you were no longer priced out of this market. It would erase some of the poor financial decisions you made in the past. And, deliciously, it would punish the wicked—people like me, younger people who bought when they could— pre-recent run-up—and held, people who now have very healthy net worths for their age and who are well set up for the future.

Intorovert, you know shit…. as it clearly shows in all of your useless posts.

We’re glad you don’t disclose your financial planning because, from what we know of it, it’s not very good (e.g., sell primary residence at the “top” of the market then prices go up 40%).

Patrick , I don’t disclose my financial planning. Always have some cash ready though for when opportunity knocks.

Interesting article headline from The Globe in April 1981 via Vancouver Housing Collapse Facebook page:

” Investment , job creation fuel buoyant housing market. ”

“The real estate boom in British Columbia is feeding itself on a surge of big project investment and extraordinary level of job creation….”

Sounds familiar.

Cash works.

This would be all done after the RE “Ponzi-scheme-blows-up”. Have you moved to cash already, or do you have a safer hiding place than your high flying stocks?

Son-in-law is a developer in Seattle. Says there are Canadian developers there, putting up expensive condos marketed to high net worth foreigners – who presumably are interested in dodging Vancouver’s 20% property transfer tax.

Cash Patrick, cash.

Intorovert, you’re a bit over sensitive for all the shit you toss out. Again you’re out lunch since I thought you said you were a female on here a couple of times.

CS:

I really think that we need to encourage the bi-cultural nature of Canada and encourage the guillotine rather than hangings on parliament hill.

Good to know you’re a homophobe, Hawk. I’ll remember that.

And when that glorious day arrives, what are you going to do bears? Buy a house for cash, or be first-in-line for one of those 7% mortgages?

This is a great idea. There is no reason to squish everyone into two cities. I think Barrister’s idea of growing Duncan is interesting. Get some new hospitals built…

All the landlords not claiming income might be losing sleep.

EXCLUSIVE: Stats Canada requesting banking information of 500,000 Canadians without their knowledge

http://www.Globalnews.ca

Sometimes I see references to the “worsening BC Housing Crisis”. There is a Vancouver and Victoria housing crisis, but I cannot see the argument for a worsening BC Crisis.

This is based on the following

These 3 items above point to improving conditions BC province wide, including for first time buyers. Perhaps the BC Govt should focus on incentives to encourage people in Vancouver/Victoria to move to other BC cities (e.g. by moving govt jobs to other BC Cities which would free up homes in Victoria/Vancouver).

*CMHC source : https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/cmhc/xls/data-tables/new-mortgage-holders-type-canada-provinces/new-mortgage-holders-type-canada-provinces-2016-2017-en.xlsx?sv=2017-07-29&ss=b&srt=sco&sp=r&se=2019-05-09T06:10:51Z&st=2018-03-11T22:10:51Z&spr=https,http&sig=0Ketq0sPGtnokWOe66BpqguDljVgBRH9wLOCg8HfE3w%3D

I like to stay up to date, like when shit shacks in Van are now selling $400K below assessment

( under a million) when they used to go for $700K over. Beats hyping the flower counts and new projects that will never get built.

Forget 14%, this ponzi scheme will blow up at 7% with 168% household debt levels.

You have a strange obsession with “his ass”. But to each their own. 😉

@Hansel don’t worry the housing market is going to wait for you this time. That’s a great savings rate and with no debt, no frivolous spending puts you in a better space than most people out there. Find the areas you want to live in and look at 2015 prices and keep on saving for a down payment at those prices. The market may not adjust that much but it may get close and you can always adjust your area/must have list.

Getting into a condo in the core in a year or two should be an option if you can live in one for a good holding period 8-10 years, then move up to a house. I recommend getting an extra bedroom to rent/have kids in over a 1 bedroom. Victoria transit/commuting options are not anywhere near as bad as other cities and an electric bike is a good route to go if you are looking at Langford. I think we will continue to see adjustments in home finishing to bring down the price of new builds in Langford/Sooke and fewer house flippers. Lots of house flippers are loosing their shirts right now and once the stories and realities of that game reach the interwebs, homes that need work will be reasonably priced again.

Start working with a good realtor that @Leo S recommends or Marko and be patient if you can!

@ Barrister

“Nor is it that the concepts are too difficult to understand but rather that people find them inconvenient to believe.”

The truth about money, if it were generally known, sure would be inconvenient to the shysters who run the system. It would likely result in hangings on Parliament Hill.

Just read this…nothing new but thought I would share.

https://globalnews.ca/news/4601772/million-dollar-house-vancouver/

Found it interesting that one realtor say to buyer not wait for downturn to buy. Sub one million homes in Vancouver…..buyer market. what is considered a buyers market in Victoria sub….?

Sweethome….Super LOL…I had no idea, thanks for the advice. You have saved me millions when I win the Lotto Max and make a $10M accepted offer on the humber house!

Of course, you are all invited to the house warming BBQ.

Since there may be quite a number of attendees, any preference for the wine and whiskey?

I am a bourbon fan….. but have been known to drink single malt from time to time.

One of the tragic flaws of our educational system is the abject ignorance of our financial systems. Worse, it is the prevalent misunderstanding that is most dangerous.

The vast majority of people including most of our educators really have no grasp what money actually is in reality. What a few notable exceptions most people have little understanding of either modern banking systems or capital markets much less their interrelationship to government regulators and central banks.

Nor is it that the concepts are too difficult to understand but rather that people find them inconvenient to believe.

@ Leo M

The scenario Leo M presents is entirely plausible, even though Introvert may dismiss it with sarcasm. Moreover it is a scenario the emergence of which has been apparent for years. So the question arises, why was such a state of affairs allowed to come about? The answer, I believe, is that we have witnessed total incompetence or criminal complicity by bank regulators.

Banks have created money out of thin air, which means taking money out of the pockets of the people by way of a privately extorted inflation tax. They have loaned this privately created money to all who will take it. The result has been to drive up real estate prices, because large numbers of people will pay as much as they can possible save and borrow to get a home of their own. As a result, large numbers of young people are in danger of being crucified on a cross, not of gold, but of paper, to modify a borrowed phrase.

With responsible financial regulation, money would not have been created with such abundance and housing costs, indebtedness, and the risk of a property crash would all have been significantly lower than they now are.

Hansel, you are doing all the right things. Don’t complain about the stress-test, though. It is protecting you from yourself. I am not a doom-sayer, but I have a feeling things will correct before too long.

Instead of wishing you were older, be thankful you figured out how to be frugal when so young. Don’t rush the homeowner bit…

I’m jotting this down. Thank you, wise older gentleman.

@guest_51119

Don’t look at the house on Humber as costing $15M, look at it as saving millions from the original asking price. From a T-C article in 2013, it was on the market for $28.5M in 2009 and $20M in 2013. Considering how much prices went up since then, it’s a now bargain!

@guest_51107

I do agree with this, especially if your jobs look secure and you plan to stay in Victoria long-term. Had we done this, our net worth would be $500K more and we would have had a better quality of life for many years. There is definitely a risk to not owning your home, which I never appreciated. I also never anticipated how quickly inventory would dry up and prices escalate between 2015 and 2016. So, market timing is pretty tough, although I think I am at least more aware of factors now.

All I was saying is that being able to “afford it”, in the sense of having it paid off in time to also save for retirement (shouldn’t this still be the goal, especially without a defined-benefit pension) has gotten a lot harder in the past 4 years.

Introvert, you really do need a remedial math course. Do you realize that on a recent mortgage amount of $600,000 if the interest rate went to 14% the MONTHLY payments would be over $7000

Stay away from basic math, you don’t have the aptitude.

I’ll bet a loonie Introvert needed a calculator to answer that question!!!

Introvert, you’re such a pretentious moron. OK smart ass, answer this basic math question.

If a first time buyer is buying a $750,000 house and need CMHC insurance, what is the minimum mortgage they will require?

His ass.

Hawk is on all the collapse pages.

In other words, from his ass. He extrapolated based on anecdotes and gossip—how can we quibble with that?

What possible lesson could we take from 1981? That if interest rates hit 14% very bad things will happen? Yes, what an important lesson. Thank you, old-timers.

LeoS said: “Sorry, I’m unclear where you got this data from?”

I should have been more clear. Those numbers are partially conjecture and partially based on my personal experiences from several sources where first time buyers were buying houses in the Victoria core. For example, my family, relatives children, friends of family, friends and acquaintances, and a mortgage banker acquaintance. In all direct cases I know what people paid for their houses and I guesstimated their down payment based on family gossip if I didn’t know the exact numbers. Collecting this information has been relatively easy for the past few years because real estate always seems to be everyone’s favourite topic of conversation. The other thing I’ve noticed from watching and listening intently for the past 6+ years is that the under 40 crowd tend to dismiss any thought that prices will correct beyond 10%. Listening to us older folks talk about the ‘anomalous’ 1981 crash is irrelevant ancient history to them. I hope they are right, several years of stagnation is preferable to a major correction.

Leo S

Looks like fake news.

I have noticed that there are now four different old manor houses, all converted to rental units, that are for sale at the same time. Most years there are none. LeoS, do you think it is coincidence or what?

The popular idea that Americans are the ones borrowing their brains out and Canadians are busy beavering away their savings hasn’t been true for a number of years. But the perception persists.

https://victoria.citified.ca/news/bank-of-canada-raises-lending-rate-to-175-percent-victoria-renters-won-t-escape-impact-of-rising-mortgage-rates/

Headline: Rising interest rates will hurt renters!

Page: 11 different ads for condo presales

I’m sure it’s just a coincidence.

4 more hikes will produce some great deals down there too.

It’s official: California’s housing market experiencing shift

The California housing market posted its largest annual sales decline since March 2014 in September, as home sales fell below the 400,000-level benchmark for the second consecutive month. This indicates that the market is slowing as potential buyers appear to be putting their homeownership plans on hold, according to the California Association of Realtors.

https://www.mercurynews.com/2018/10/26/its-official-californias-housing-market-experiencing-shift/

Joe Blow, it’s the Metro Vancouver Housing Collapse page on Facebook.

Wow, those HELOC percentages of debt are insane. I was really trying to figure out how the some people I know we’re maintaining their lifestyles at incomes far less than mine after they purchased properties that I thought would be crippling to make payments on. I still find it hard to believe that so many use their homes as a bank and count on capital appreciation being a constant to cover expanding debt. In a situation of rising rates is it possible for these people to get really trapped or hammered even if the real estate market just levels out? or if it gives back some value could the debt levels cause a cascade of defaults of those high debtors that need perpetual growth to sustain borrowing?

Sorry, I’m unclear where you got this data from?

Sweethome….if I was so lucky, it would be 3195 Humber Road. However, some of it is really gaudy, so would have to spend a few million to suit my taste 😉

Tammmurabi said: ““Vulnerable” market, huh?” in reference to a Times Colonist article.

The T/C article said:

“Greater Victoria’s housing market has a “high degree of vulnerability,” despite decreasing prices, says the Canada Mortgage and Housing Corp….”

“The region’s high employment rate is pushing wages up and an increase in the number of young buyers in the second quarter are seen as fundamental factors affecting prices.”

The unwritten paragraph in this article should be this:

In Greater Victoria, 25% of well paying jobs are directly and indirectly related to the booming construction sector. When the construction boom ends, a significant portion of those jobs will end; laid-off construction workers will be forced to sell their homes, potentially leading to a downward spiral in home prices and an upward spiral in unsold homes.

It’s getting impossible for any organization to put a positive spin on the real estate fundamentals these days; all leading indicators have negative outlooks.

@ SweetHome

Totally missed my point. The key word was “basically”

I’m not saying things will go back to 2012. I’m not saying things are definitely correcting.

But they are much more affordable than just a year and a half ago. And more to choose from.

I’m saying we could still do it in today’s market!

Yes it would take longer and yes it would be more money. But I make more now, and we saved more and so on…

…prior to 2012 we were looking at market with less money and less pay. Thought we would never find our home. Technically we had been looking at homes since 2004. Figured for the right price we could do it. Wasn’t possible with our savings and what the market was doing then.

But finally pulled the trigger in 2010. Yeah, 2 years of serious looking, trying to keep are budget low.

We thought things were inflated back then. Who knew what was to come (Hello, 2014 and beyond, anyone!).

When you are “ready” to buy a home (not investment) and you can “afford it” and you “researched” all outcomes, then do it.

Hawk said “From the Van housing blog:

“basic East Vancouver shit shack just sold for 775K, assessed at approx 1.2M 3280 E GEORGIA STREET”

Link(s) please? Can’t find the blog nor the listing.

I don’t think the drops have been worse than what they were at the beginning of February.

Anyone picked out the house they would buy if they win $60 million in the Lotto-Max tonight? This one on Beach Drive looks pretty good, but I would look at others, of course. House shopping would be a lot more fun.

https://www.realtor.ca/real-estate/19679890/single-family-3285-beach-dr-victoria-british-columbia-v8r6l9-uplands

One thing thing that I noticed is that nice lots generally come with monster houses. 3000 sq.ft. would be enough for us, but I would want at least 1/2 acre lot. Also, it is kind of amazing how many ugly houses are out there, even in the $2 million + range.

In case anyone is wondering why I posting so much, I am home sick with a bad cold the past couple of days, so this is how I am amusing myself.

Thought provoking blog post LeoS, thanks!!

So, for first time buyers the situation looks like this:

– in 2013 mortgages averaged about $480k

– in 2014 mortgages averaged about $520k

– in 2015 mortgages averaged about $560k

– in 2016 mortgages averaged about $600k

– in 2017 mortgages averaged about $640k

– in 2018 mortgages averaged about $680k

So the reality is this: from 2014 to 2018, house prices rapidly escalated in Victoria and each year as the prices escalated, people purchased with higher and higher, predominantly 5 year, mortgages. Consequently, from 2019 to 2023 people will be renewing larger and larger mortgages at higher and higher interest rates, while house prices are likely declining.

In 2021/22 when the 2016/17 mortgages are due for renewal we are likely to see maximum turmoil when people are faced with going from a 2.6% mortgage to a 6% mortgage on a $600,000++ mortgage, an annual increase in interest payments from about $15,000 to $35,000. After 2021 many of these mortgages might be underwater at renewal time.

The take-away is simply this, for the next five years, mortgage renewals will get progressively more difficult for the homeowners; 2019 will be painful and 2022/23 will be excruciatingly painful.

They aren’t correcting yet (i.e. prices have still not dropped), although it looks like it will go that way. However, I really doubt prices will go back to what they were 5 years ago. So now you could still make the payments with a larger downpayment, but you would be paying hundreds of thousands of dollars more for the same asset (which affect your net worth). Also, if interest rates go up without much of a drop in prices, then even a larger downpayment doesn’t help enough.

@ Hansel

You sound a lot like me (I have posted my frugal story on here).

Oh I forgot to mention that I had a partner now wife that helped…

But timing is not always necessary.

If we didn’t get the house in 2012, we would have still been saving in the mean time. And probably had enough to down pay around 300K (plus+) instead of the 150K we used back then.

So yes, houses were cheaper, but they are basically correcting now and we could still do what we did back then in this new market with more saved 😉

@YeahRight

Haha yes! Working on all of the above. Have a great job at UVic, students loans just officially paid off a few months ago, saving about $2k a month (combined with my partner) but i just can’t seem to catch housing prices. My partner and I even roll car free to save cash (wooo bike lanes in Victoria!). Basically never leave BC for vacation. I’m obsessed with cooking and make almost 100% of our own food (literally, I even make our mayonaisse). Can’t imagine any way to save more money at this point but I’m right on the line to be able to purchase though so hopefully can pull the trigger before the next run up. Will keep at it for sure.

I joke about wishing I was 40 since I’m in my 30s and if i was just a few years older, my timing on purchasing a home would’ve been 2013-2014 instead of 2017-2018 and I’d purchase a home easily. Alas, reality is what it is.

“Vulnerable” market, huh?

https://www.timescolonist.com/real-estate/greater-victoria-housing-market-vulnerable-despite-falling-prices-cmhc-1.23477061

They aren’t strictly related. Posted rates are the 5 yr fixed, so based on the bond market not the overnight rate. However they should be going up soon. Currently 5.34% but I believe it gets re-evaluated weekly and some posted rates have been going up (TD at 5.6%).

@ Hansel

Uh at 36 I was a 1st time home buyer. At 42 I am mortgage free!

Aaaaah yes to be 40, and to have gone through many jobs, and saving, and cutting back and being able to be where I am today.

I couldn’t do it either at a young early age 😛

Thanks for the price Leo. Unreal it sold for that. Happy for the woman who lived there but wow.

Interesting milestone….

Trump Is Now Bad for the Stock Market

U.S. equity valuations are lower than they were before the election.

https://www.bloomberg.com/opinion/articles/2018-10-26/trump-is-bad-for-the-stock-market

…. “the Party’s over” ?

Yep, some deep red in the market these last few weeks, Tesla has saved the day for me though!

Tell me about it Cadboro! Not sure what us youngin’s are suppose to do. Feels like the whole world is financially lined up against us. Aaaah to be 40…

Many of the experts have been talking about 2 years left to go in the cycle. But you look at what has happened this past week in the markets and it’s hard to tell if this is the coming attractions or maybe everyone is trying to get out ahead of time. The loses have been eye popping.

Poloz did an interview yesterday and he was asked, given where we are in this stage of the cycle, how much time is left? And he said (paraphrasing) “we’re in the mature stage .. how much longer can it go? The answer is for a really long time if nothing messes it up. Historically almost all of the slow downs are caused by central banks because interest rates rise faster than were previously intended- if we can anticipate well there is no time limit.” Sounds nice but markets aren’t exactly rational…

CBC Poloz interview (Peter asks some good questions)

https://www.youtube.com/watch?v=b9coSGZUIL0

First time buyer over here. What’s the new stress test qualifying % with this latest rate hike? I can’t find it posted anywhere… pretty sure it’s getting close to 6%. My max affordability on purchase price just dropped a few thousand bucks again… hope prices follow suit as my legs keep getting cut out from under me.

No, no, no, Leo. Haven’t you heard? Recessions can’t happen anymore. We’re in a “rising rate environment” from now until there is a RE crash in Victoria.

Yes good point. I considered that as well but felt that the projection was a bit far out. Who knows what will happen to the economy by then. I suspect a recession will hit us and flip the table by 2020.

Great article. One point of clarification: two factors cause the renewal gap to grow, 1.) rising interest rates, and 2.) decreasing past rates (5 years ago). You’ve calculated the first factor, but I don’t see the second factor. Bond yields moved slightly lower from 2013 to 2014 and much lower from 2014 – 2015. Assuming a 0.75 increase in interest rates over the next 1-2 years, what would the renewal rate be in 2020? Looks like about 2.25-2.50%.

What are people spending all that HELOC money on?!

I have a HELOC just in case (don’t want to pillage investments in an emergency), but have yet to use it.

The car loan portion isn’t a big surprise I guess after reading Long-term loans: The fuel that’s powering Canadian car sales. I think Leo already posted that article or a similar one. I’m guessing a lot of people are underwater on their car. I’d never finance a car longer than the warranty. I can’t imagine being 7 years into an 8 year loan and the transmission goes, so you have a 4K bill on top of your monthly car payment. I guess that just goes on the credit card or LOC.

I thought the whole rolling your negative equity from one car into a new car loan was purely a US thing (since I don’t know anyone personally that has done it).

Looks like any keeping up with the Joneses is being done purely on credit. SMH.

Time to buy stock in Kraft. It’s gonna be a KD night every night for a lot of people as interest rates crank up.

As it becomes increasingly difficult, due to the stress test, for first-time home buyers to over-leverage themselves, any that buy now, or have bought recently, will be in great shape to withstand further interest rate hikes.

As for those who perhaps over-leveraged themselves a few years ago (or earlier), they can always “unload the property for a tidy profit” in the worst case scenario, as Leo points out.

So until wage growth stops and unemployment hits the roof, I have trouble seeing calamity in Victoria’s future.

Prefab is the future. Shoot, I’m still not finished and it’s now more than 80 weeks for me!

Another weekend on the excavator for me though, I shall be a mech warrior!

$805k

Dasmo, you are such a slacker..

TeamMTL wins big at the 2018 #SolarDecathlon China, building an #energy efficient row house from top to bottom in just three weeks! https://t.co/duOlKEMme1

Also, David Rosenberg mentioned $1 Trillion in consumer debt up for renewal at 100bp increase next year.

Looks like reality is hitting Vancouver hard. Won’t be long til it hits here too.

From the Van housing blog:

“basic East Vancouver shit shack just sold for 775K, assessed at approx 1.2M 3280 E GEORGIA STREET.”

Could someone tell me what 1749 Davie sold for?

Thanks for this Leo. I am thinking back to the unusually high number of mortgages handed out in Victoria in 2014 and wondering what this might look like in 2019.

LeoS: Thanks again for a really informative and well written article. Is there any evidence that prices for SFH starter homes are dropping?