Oct 22 Market Update

Well that was an unusually exciting election. Lots of change in municipalities across BC. The key and common issue between them was housing affordability, and those candidates with the most to say about it seem to have walked away with the biggest wins. In Vancouver there is a new mayor that ran on affordability and is planning to triple the vacancy tax, clear the permitting backlog, and build a lot of new affordable housing (as well as pushing through with the recent change to rezone almost all single family as duplex).

In Victoria and Saanich, the elected councilors were almost all running on platforms supporting more affordable housing (not just low income) and infill housing as well. According to the ranking by Cities for Everyone, 6 out of 8 elected Saanich and Victoria councilors ran on this promise. There’s a fair number of new and inexperienced or ideological faces on both councils, so it remains to be seen whether they will be able to turn their promises into results. However I’ll remain cautiously optimistic that local government has finally heard the frustration of the people on this issue and is at least working on it.

Also the weekly sales numbers courtesy of the VREB.

| October 2018 |

Oct

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 151 | 276 | 395 | 664 | |

| New Listings | 232 | 444 | 683 | 979 | |

| Active Listings | 2551 | 2556 | 2567 | 1905 | |

| Sales to New Listings | 65% | 62% | 57% | 68% | |

| Sales Projection | — | 650 | 604 | ||

| Months of Inventory | 2.9 | ||||

The market in the last while has been bumping along with some contradictory signals. On the one hand, there have been more over ask sales on the low end of the single family market (about 11% of properties going over ask in the last 30 days compared to 5% the previous period). No such uptick on the condo side with fewer and fewer bidding wars to be seen. If the effect of the stress test starts to wear off, the lower end is where I would expect to see an increase in activity. However with interest rates going up on Wednesday and the bond market continuing to ratchet up I suspect we haven’t felt the last of the stress test. Prices though are looking quite strong so far this month, with both the median single family and condo price at the highest they have been all year.

On the other hand, sales continue to drop with both single family and condo sales down some 20% in metro Victoria compared to this time last year. Last week was especially slow with sales down nearly 30%. New listings meanwhile are tracking last year pretty evenly. November last year was when we really saw the sales pulled forward from the impending stress test so we will still see some solid year over year sales declines for another couple months at least.

New post: https://househuntvictoria.ca/2018/10/25/the-gap/

New Question: Can one ask for vacant possession of a property that has a month to month tenant upon closing. Or do you have to evict the tenant if you intent to actually use the house for your own personal residence?

On a point of absolute trivia, the Whistler resort started out as a fishing resort besides the two beautiful mountain lakes.

Patrick is right about Nafta, Patriotz is misinformed. There are also provisions for penalties and precedent that the costs be transferred to the province. Should be an interesting court case particularly since the BC Government was clearly nmade aware of this issue prior to passing the legislation. An intentional breach lays a legal foundation for penalties. The lawyers will have fun with this for a few years.

The obvious quick fix is to equalize the tax preferably before it is actually collected from anyone. Note the equalization only has to apply to the US and Mexico. We can tax the hell out of any investors from Yeman or elsewhere.

Yeah, your kitchen looked good from what little I can remember of the MLS listing for your place.

Speaking of NAFTA 2.0, remember how Trudeau’s saving of the Chapter 19 (dispute resolution) clause was so great for Canada? Well, it turns out that we tried to use that mechanism 54 times in the past to not get hosed by the U.S. on something, and we were only successful 7 times.

Food for thought!

https://www.policyalternatives.ca/publications/reports/saving-nafta-chapter-19

@guest_51005 4428 Majestic could definitely use a little tidying up to make it look presentable and the realtor featuring that the hot water tank is 5 years old ($800 item halfway through its useful life) speaks for its self. We definitely would have got in a bidding war if a seller had cleaned out his clutter but ended up buying a nicer home without clutter 2 months later for 100k less!

No kitchen remodel here. It was done before we moved in so still in good shape. Was asking for a friend.

Your mom might be a speculator if:

I should let my mom know that she can’t visit me because she doesn’t own an empty condo in town. I bet she’ll be surprised.

Just bugging you Patrick. The issue of NAFTA compatibility is certainly an interesting one.

No. You’re badly missing the point of what makes a NAFTA challenge.

Provinces can treat non-residents differently as long as they treat Americans like the out of province Canadians. USA states can similarly treat non-residents differently, as long as Canadians are treated like out-of state people .

BC singles out foreigners, and is subject to a NAFTA challenge (the challenge is between USA and the Federal Govt of Canada, as they signed NAFTA)

PEI doesn’t treat foreigners differently than other Canadians, so Canada wouldn’t be subject to a NAFTA challenge. Non-PEI-resident Canadians are disadvantaged too. As I mentioned in my post, US states charge out of staters higher property taxes, but not higher specifically to Canadians so no NAFTA challenge there.

PEI has higher non-resident tax rates too. But that affects Canadians just like Americans, so not a NAFTA issue.

In fact Mike Duffy was caught up in that issue….

https://www.cbc.ca/news/canada/prince-edward-island/5-things-that-make-your-p-e-i-property-tax-bill-go-up-or-down-1.3586159 “One of the issues that contributed to the controversy surrounding Mike Duffy and his status as a P.E.I. senator was his provincial tax status: Duffy was being taxed as a non-resident.”

https://business.financialpost.com/personal-finance/mortgages-real-estate/prince-edward-island-the-one-place-in-canada-where-foreign-property-buyers-must-check-in

“It’s not just overseas investors that are restricted in how many P.E.I. acres they can buy or how much shoreline they can own, the rules apply to Canadians outside the province, too. It doesn’t matter where you’re from, Canadian, American or from the moon, a non-resident can own just five acres of land or 165 feet of shoreline.”

https://www.macleans.ca/economy/economicanalysis/how-the-rest-of-the-world-limits-foreign-home-buyers/

0“Prince Edward Island: Yes, P.E.I. is part of Canada, but when it comes to limiting foreign buyers, it shares more in common with other countries. Non-residents—and this applies to Canucks living outside the province too—are limited to five acres of land or 165 feet of shoreline.”

This reminds me of a house I looked at in early 2015. The rest of the house was vacant, but there was someone living in the basement. There was minimal furniture, so clutter wasn’t the issue, but there was a litter box with cat poo outside of it, and the basement smelled.

The combination of the empty house and the basement made the house seem creepy to me, especially since it was a large, somewhat isolated lot. Now the BC Assessment is over 50% more than what it sold for, as my spouse periodically reminds me.

The owners could have gotten more, and I might have gotten better vibes if it had been staged and there was no tenant. Maybe they didn’t want to leave it totally vacant for insurance purposes, but I think it back-fired on them.

Thank you Anna for injecting a bit of perspective re the “sad” stories of people that may have to pay a bit more to have a mostly empty condo in Victoria (or rent or sell)

Also can we stop saying people HAVE to rent or sell. People can just pay the damn tax if the condo is so damn important. For a BC resident living elsewhere with an empty condo in Victoria valued at 600000 they’d pay a whopping $1000 (3000-2000 credit). Oh the humanity!

The mountains have been around for a very long time. The Resort Municipality of Whistler hasn’t.

PEI has restricted RE ownership by Americans and all other foreigners for decades, and there has never been a successful challenge in the Canadian courts or through NAFTA. It also charges higher property taxes to all non-residents, including foreigners, and again this has never been successfully challenged.

The “experts” who claim that BC’s taxes or possible foreign buyer restrictions violate NAFTA probably know this, but they hope you don’t.

Re: foreign buyers tax, and spec tax

It’s not so easy for BC and Canadian governments to treat foreigners differently than Canadians when they have trade agreements in place with the foreigners’ countries.

NAFTA reportedly guarantees equal treatment for US citizens in Canada in many things including real estate investing. I’ve seen a few TV interviews with Canadian NAFTA lawyer experts, and all of them have said that both the BC foreign buyers tax and the upcoming spec tax may well violate NAFTA (Chapter 11) . Note that this isn’t the same as US states treating out-of-state residents differently for property tax, because they aren’t discriminating against foreigners per-se. Claims have already been filed in court for the foreign buyers tax and will be filed for spec tax too.

If the US claimants win in court, Canada (federally) would have to pay back all amounts paid for foreign tax and spec tax, and penalties.

Here are a couple of articles.

Re: Foreign tax NAFTA complaint

https://betterdwelling.com/bc-foreign-buyer-tax-might-actually-cost-canadian-taxpayers-billions/

“NAFTA Might Be The Most Blatant

The Notice of Civil Claim isn’t a detailed rundown of everything the plaintiff believes is wrong with the tax, but it does focus on what might be violations of NAFTA. The notice uses examples of language in the free-trade agreement that explains equality of foreign investors, real estate as an investment, and prompt compensation for violating these agreements.”

Re: spec tax NAFTA compliant

http://www.victoriabuzz.com/2018/05/bc-government-being-sued-by-other-provinces-over-speculation-tax/

“The law firm also contends that this class action would be of interest to American citizens who own secondary homes in BC, and may claim a breach of NAFTA Chapter 11 if they join the lawsuit.”

Pretty sure the mountains are the reason it exists in the first place. Could be wrong though.

Sorry introvert, you’ll have to enjoy those higher interest rates for me. I don’t have a mortgage.

When I see a lot of clutter in these photos, I wonder how many of these are rental units. If my landlord decided to sell while I was still renting, I wouldn’t be so inclined to clear up & declutter. In fact, I think I’d be leaving the dog food container open each and every time there was a showing. 🙂

All this Whistler talk made me reminisce about my resort adventure…

I used to live on a resort in Alberta (2001-2004). Back then it was called Delta Lodge at Kananaskis. So Isolated. 45 min. drive to either Calgary downtown or Canmore downtown for your basic amenities.

You could live in a Trailer park near buy about a 15-20min. drive away, if available.

There was a portion of land used for Staff accommodations about 5-10 min. walk from the Hotel.

I rented it back then $6 per day. It was residence B and was based on triple occupancy. This is the residence building that most employees will live in initially. This means that you will be sharing your living space with up to 2 other people. The rooms are open concept (no walls dividing beds, or separate rooms). Each room also has a basic kitchenette and full bathroom for you to share with your roommates.

Good thing I was early and 1st to arrive. So I set up in the back where the window was and put up a curtain to divide my half of the room. I let the 2 others arriving in a day or two figure out how to use the other half on their own. (Months later I got into double occupancy Residence A…). Still, noisy and inconsiderate and immature people living all around you from time to time (that you work with).

Staff Cafeteria:

Meals cost $2.50 and you can purchase a meal card when you arrive. You may use the staff cafeteria whether you are on or off shift and it is open on a daily basis. Extra food would come from functions held by the hotel after the event/conference was done. So lots of free food from the buffets (Cheese platters, Veg. platters, Salads, Desserts, Etc.) would be place in the Staff Caf after. And bonus, I worked in the kitchen so I would get 1 free meal off the line if I did a shift. So even though the meal cards were dirt cheap, I never needed one.

Or you could use the expensive General Store located in Residence A. Providing a place where you may buy groceries, rent movies, and sign up for Mountain Experience Activities. The store offers payroll deduction and Interac for all items at competitive prices. This is also where you can find the Employee Experience Reps, who will be happy to help you with anything you need.

I hardly ever used it.

They had a free shuttle every two weeks that went to either Canmore, or Calgary for the day to do some amenity shopping.

I got $13 an hour to start, Fresh out of Culinary Arts School (I think BC min wage was about $8 and Alberta was around $5 then).

So…

Only debt was around $5000 for school. Making about $1K a month. Didn’t do drugs. Didn’t drink too much and/or partied. No Car. And cost of living was phenomenally low.

Saving money was a breeze.

It’s under new ownership now, so a lot of these privileges are changed or gone.

http://livetheadventure.ab.ca/staff-accommodations/

I notice some people have a bunch of clutter in their houses when they are trying to sell them. Now that the market is slower, I think you should consider putting some stuff in storage or start throwing things out before the move. First impressions matter when buyers now have choices. Try to take a step back and view your place as if you were a buyer.

This stood out to me today as an overly optimistic seller. It might have been recently appraised at $875K, but it is only assessed at $728K and does not look particularly above average. Let’s see how long it sits before a price drop.

https://www.realtor.ca/real-estate/20053560/single-family-4428-majestic-dr-victoria-british-columbia-v8n3h5-lambrick-park

I think these are company premises and not homes. I believe that “resident and citizen” would be referring to housing not corporate premises.

I find it absurd that your definition of speculator stops at being local. Foreigner with a bunch of BC homes – evil speculator. BC resident with a bunch of BC homes – hard working successful person that doesn’t deserve to be punished. Hmm…

As far as I know, every single Fairmont is foreign owned. Even Tim Hortons is owned by an American corp. Imagine how much of Whistler is foreign owned. I would support it for metro areas in residential properties but a blanket ban would be quite a bad thing.

@ Bitterbear

Yep. And it’s still not enough. The municipality is in process of building even more and they can’t keep up to demand. Meanwhile, entire neighborhoods sit empty with huge houses with no one in them.

Whistler also has subsidized housing units for people who work there. some units can only be sold with the caveat that they will be rented to local workers at a reasonable monthly rate.

As if every one is an app creator. Why are you here then pumping the failed MER story over and over ? The women I know are doing it to help people and children, it’s called having a soul.

@ patriotz

I think you need to go back and read up on the history of Whistler. The out of town properties are not the reason it exists in the first place.

https://blog.whistlermuseum.org/whistler-a-brief-history/

It’s listed officially as a “resort” – but it’s actually a community filled with local people with local jobs making the place run, just like Victoria is a community that has both local working people and visitors.

The best thing that could happen for Whistler would be to drop the “resort” designation because it gives people the wrong idea, that it’s simply for visitors, and dismisses all of the hard working locals that live and work there every single day, just like any other town.

Whistler already has both in play, and neither are doing the trick.

Why yes it is.

Zing ! Good one Anna. In my day we used to call them couch mooches. 😉

Because it’s a resort. The out-of-town owned properties are the reason it exists in the first place. And yes resort towns tend to have a problem with affordability for local workers since the visitors – whether they own or rent – outbid the former.

No simple solution but rental-only zoning (which BC now allows) and enforced bans on short-term rentals would help a lot.

“It has been decades since women experiencing violence in their homes or relationships have seen any significant investment in their needs. I am so pleased to announce today that women fleeing violence will have access to new safe housing as we get to work on 12 new projects throughout the province.” – Selina Robinson

Whether you love ’em or hate ’em, you gotta admit that the NDP is actually taking steps to get things done.

Marko Juras

How exactly would you do that? Skip RE agent?

Can’t help myself return to amalgamation. I know this is an unpopular opinion here but I’m happy the referendum showed lower support than last time.

I came across another example of why it’s terrible for cities. Winnipeg amalgamated in the 70s and then a few years later made it illegal to walk across the Portage & Main intersection downtown. (Google it, it’s a monstrosity.) They had a referendum this week asking if it should re-open to pedestrians. Former CoW overwhelmingly voted yes but the suburbs/rural communities voted no, finally tally 35% vs 65%.

https://twitter.com/5kids1condo/status/1055503420226920448

If you live in the CoV and value urbanism, transportation alternatives (e.g. bike network under construction), walkable neighbourhoods (e.g. proposed 30km/h traffic calming)… well, don’t be stupid and hand over the destiny of your city to those who don’t value these things.

Anna Edwards…brilliant! Thanks so much for some healthy perspective and a good laugh!

Same here…grandparents and guests got my room and I went to my dad’s “office” in the basement where I got to stay up late with my light on reading a book (that’s a bound collection of paper with words printed on it for those who don’t know). (I’m familiar with books because my first degree was in English.)

Leo, I sure hope you’re not financing your kitchen remodel with a HELOC 😉

Marko Juras “I have no issues with the spec tax. You can afford to keep a place empty….you can afford to pay the spec tax. Then again I am super anti owning boats, recreational properties, etc. Renting is the way to go imo.”

Is this the video where you talk about using your friends’… properties instead of owning or renting one yourself?

Why yes it is.

Thank you totoro and victhunter for remembering the kitchen installer.

@ Patriotz

Foreign owned real estate is hugely damaging to Whistler. The amount of homes that sit vacant is astounding. Meanwhile, most shops have signs up begging for workers, and yet they don’t want to/can’t pay enough to cover the huge rents or the costs to buy. It’s a no win situation. The municipality is trying to build more employee rentals/ purchases but it’s not enough nor soon enough.

Foreign owned real estate is choking a town like Whistler.

Locals should be able to buy where they work, or close enough, and tourists can rent. Even better, would be to have the opportunity for locals to buy and rent to the tourists, that way the money stays in the community. No way should the tourists be buying and forcing the local workers to live in their vans.

I’m curious why you think foreign purchased real estate would be a benefit for a town like Whistler?

In the same article, it was made clear that they want to get to a neutral rate range which is 2.5 – 3.5% as the current 1.75% is considered stimulative.

“Governing Council agrees that the policy interest rate will need to rise to a neutral stance to achieve the inflation target,”

Not a bear pumper here but pointing out that there is a view by the Governing Council that rates are not in their desired range yet.

Definitely seeing that slow down in higher end condos here in Victoria. Our client’s are spending a lot less on their advertising. The Rail Yards project has a lot of for sale signs still and I expected those to go asap.

Sigh – I think some bears should start being called “pumpers” – as in pump the bear narrative. Here’s what they actually think:

“At the same time, Poloz and Wilkins took pains to point out the change in language could also mean the pace could go slower if the data turn sour.”

https://www.bnnbloomberg.ca/bank-of-canada-raises-key-rate-to-1-75-1.1157338

Might have been me. If so, IKAN.

I have no issues with the spec tax. You can afford to keep a place empty….you can afford to pay the spec tax. Then again I am super anti owning boats, recreational properties, etc. Renting is the way to go imo.

My philopshpy -> https://www.youtube.com/watch?v=h49rFXXa_Iw&t=1s

I know two women who are taking their masters one in their early 60’s and one in their late 40’s and both succeeding. Again it’s called ambition.

Write a really good mobile app that gets 2 million downloads. Charge $4.99/download and buy any house in Oak Bay and top complaining about real estate prices. Simple as just some ambition.

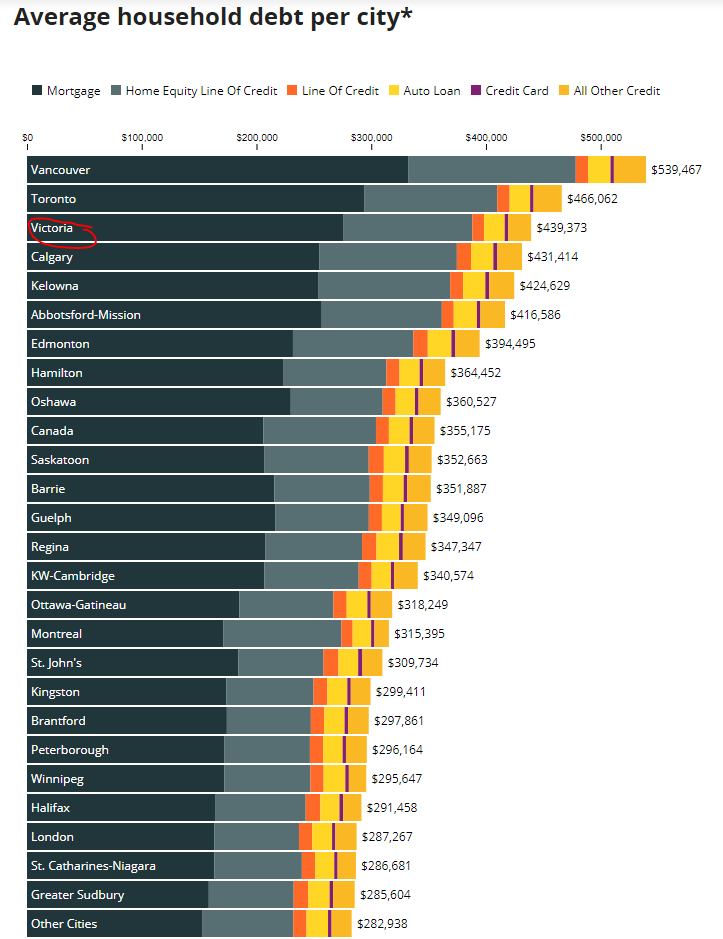

No. That is average household debt and would include households without mortgage debt. Average mortgage for households with a mortgage would be higher. At least that is what I surmise from the title of the graph. Would have to dig into the data myself to verify.

The high levels of debt in Victoria and Kelowna are especially notable given that they have among the highest median ages of Canadian CMA’s.

https://www150.statcan.gc.ca/n1/pub/91-214-x/2015000/section01-eng.htm

Victoria’s average mortgage is well under $300K? If true, there is no cause for concern there whatsoever.

Now, those HELOCs are bad. Why are people taking out HELOCs? Not smart.

It’s not that difficult: pay off your mortgage aggressively and you’ll be amazed at how fast you can save up the cash for that kitchen reno once you have no mortgage payments.

The asset value doesn’t cover the debt in aggregate, because for one household to sell and pay off the debt another has to borrow to buy.

When I was a kid and the grandparents came to stay my parents gave them their bed and my parents took over our beds and we slept on a pullout couch in the livingroom. Oh, the trauma.

Here’s a nice graph from https://www.cbc.ca/news/business/debt-nation-overview-1.4870679

Of course I will pre-empt the response which is that average asset value is also higher in Vancouver/Victoria.

The federal government will not get involved as all 10 provinces consider it to be their prerogative to regulate as they see fit. Nor will any federal party advocate it. And remember that foreign owned RE is an important part of the economy in parts of some provinces, including Whistler in BC.

Like being able to afford a lightly used 2nd residence in Canada’s 3rd most expensive city isn’t fortunate in itself?

Enjoy high prices and higher interest rates, house hunters. Conditions just keep getting better and better for you.

Viola: I tend to perhaps agree with you on preventing foreign ownership. But there will be an economic price to pay and it would be good to at least understand what it will mean in terms of the economy. I also dont have a clear idea, or any real idea as to the amount of actual foreign ownership in the residential market.

I was actually surprised that the spec tax seems to only apply to about 6000 properties owned by non residents considering how aggressively we have been marketing to Americans for the past few decades.

A lawyer friend of mine who specializes in immigration says that the vast amount of money going into BC residential properties is directly linked to the Quebec investor program.

One of my concerns is that we really seem to have no idea who is buying and where the money is coming from.

Victoria housing market continues at high degree of vulnerability, CMHC report says

https://www.cheknews.ca/victoria-housing-market-continues-at-high-degree-of-vulnerability-cmhc-report-says-502144/

Vichunter:

You examples are correct but we also need to look at the other side of the balance sheet.

The owners will have gone from paying three sets of property an d school taxes to just one. The province will still be providing the same amount of medical and school services to this couple but collecting less revenue. There is a certain amount of musical chairs involved in these calculations.

I am not saying that it may not be a net positive but I get leery when people only look at one side of the balance sheet.

What gives me pause is the fact that so much of the BC economy seems dependent on there being a housing shortage combined with enormous amounts of out of province money constantly flowing in.

@Barrister “Perhaps it is an industry that BC is better off without.”

imo, treating housing like stock/creating an open market like we have done is very unwise because in the long term it will create a ton of sht that eventually will have to be cleaned up. People will buy and speculate and do all the things that they do in other markets, which will cause housing to lose its more obvious/needed task – to actually provide housing (as opposed to profits). We are witnessing that now and are starting to clean up the sht that it has caused, albeit in very small ways. What is needed is federal intervention to pass a law prohibiting anyone who is not a resident and citizen/PR from owning property here. imo

Here’s a shocker. 😉

Victoria housing market continues at high degree of vulnerability, CMHC report says

“But the agency finds high evidence of overvaluation for Metro Victoria in the second quarter of 2018 is still being detected.”

https://www.cheknews.ca/victoria-housing-market-continues-at-high-degree-of-vulnerability-cmhc-report-says-502144/

I honestly dont know what the total ramifications of the spec will be at the end of the day.

I am not sure that the government does either.

Lets assume that all 6000 foreigners sell their properties (the object of the tax is not to raise more money but to free up housing). I believe most people see this as a positive. When sppread over Vancouver and Victoria I dont think this will have a major impact on house prices in the long run. But it should have some positive impact which is all to the good.

But there is a negative to this balance sheet as well. This will also mean that there will be 6000 people who are not paying either property or school taxes to the province. It is important to note that this are people that get neither health care nor school services from the province. The theory that they will all continue to come up and rent and visit in BC anyway is hogwash at best. We have talked to a few since my wife is American and we have got to know a fair number. They are seriously pissed and perhaps with some cause considering that the BC government for years promoted BC as a great place to have a vacation property. Clearly there is going to be some revenue lost to the province year after year. Times are good and unemployment is extremely low so maybe it does not matter.

What concerns me is that I am not sure that anyone has really thought through the impact of these changes. What can be overlooked is that one of the big products that BC sells is housing to both foreigners and out of province people. I honestly have no idea how many jobs are dependent on BC selling housing as a product. Perhaps it is an industry that BC is better off without.

Actually I’m thrilled by economic activity of the first example. For the poor visiting family member/mother who must own a 350k-750k condo I am sympathetic but less so since their condo will make room for new employees and families to move here, take jobs and spur the economy. Sorry a mother will have to get a hotel room, paid for by her rental income, but their are worse taxes like the “school” 3 million $ home tax.

There are good people on both sides, but I’m not going to waste my time discussing this when there are 20% of the homeless people in Vancouver who have jobs but no where to live and we likely have the same issue here.

More fraud from the syndicated mortgages I started mentioning back in January. Where there’s a reek, there’s you know what. Isn’t that hole in the ground at Cook and Johnson partially funded by these guys ?

RCMP makes bombshell allegation against Fortress Real

“According to an RCMP search-warrant application, Fortress Real is accused of telling investors in its SkyCity condo project in Winnipeg that the “as is” land valuation is more than three times higher—$18 million in 2013 and $37.3m in 2015—than the $5.92m valuation provided by an independent appraiser the company previously hired, as well as another $11m appraisal the RCMP found in the company’s headquarters.”

“Who were the controlling minds [of the brokerages]? The two principals of Fortress,” said William Vassiliou, president of Toronto chapter of the Association of Certified Fraud Examiners. “They created the four brokerages and they put the people in place and marketed their product. They created the product and they were providing training to the mortgage brokers associations.”

The investors were also advised by Fortress Real’s lawyers—whom they were led to believe were, in fact, independent lawyers—that the developments were safe investments.

“The lawyers weren’t independent,” said Vassiliou. “Fortress was paying them.”

https://www.mortgagebrokernews.ca/news/rcmp-makes-bombshell-allegation-against-fortress-real-249698.aspx

Yes, that does sound like the typical story I hear about too. In your example it sounds like a single woman (mother) visiting Victoria frequently to visit her family. And yes, she has a happy ending, as she is “fortunate” that her son has a bedroom for her to live in. I focus on how “unfortunate” she is to be saddled with a NDP govt that has forced this single mother to “have to rent or sell” (as you describe it).

Many people in the same situation as her don’t have a family member willing to let them live with them. So they will “rent or sell”, which makes many here in the forum giddy with excitement as it means one more property available for them. For the grandmothers who do “rent or sell” and end up seeing their kids in Victoria far less, are you members here “thrilled with this (spec tax) in so many ways” (paraphrase a quote from a speech on the spec tax) , and are you (like LeoS) nonchalantly able to write her off as a “loser” . All so you can free up a “piece of the puzzle” amount (aka insignificant) of inventory?

Note to Govt:

1. Redesign this spec tax so that it doesn’t target mothers visiting their kids. Make it actually target actual speculators, very few of which leave their properties vacant.

2. Stop introducing taxes that are designed to social engineer instead of raising money.

Bank of Canada indicates the word “gradual” will be removed from its interest rate increase strategy. In other words future interest rate increases will likely be higher than the usual quarter point increase or more frequent. Looks like Poloz agrees with Hawk; interest rate increases are set to accelerate. Although Poloz does not say if this means a quarter point increase at each of their eight rate setting meetings or does he mean future increases will be higher than 0.25% at each rate setting meeting. Details are vague, but the strategy change is clear.

https://finance.yahoo.com/news/bank-canada-raises-interest-rates-141447274.html?.tsrc=applewf

Sounds like a real story to me. You need a kid or a dog to loosen your mindset. Life is not always measured in time factors, it’s about ambition to do it. Maybe this person would alter course into a new field part way through, or persevere and be the best pediatrician in BC, you have zero idea.

Her heart must have been it to think so seriously and to shoot it down because of your so called professional financial calculations working at a hospital for a couple of years is extremely lame.

I know two women who are taking their masters one in their early 60’s and one in their late 40’s and both succeeding. Again it’s called ambition.

I’d say the odds are high.

I wonder if anyone told him he was “too old” to be a plumber and is wasting that high priced engineering education ?

Happy to point to a BC example of those 20,000 being hurt by the speculation tax, 4585 Leyns Rd. Owners have at least two waterfront properties on Vancouver Island and at least a third home which they were happy to tell me about in the first few minutes of a conversation while trying to sell privately with no price listed on their sign. They have a very interesting perspective on what others should expect when dealing with them. They just listed again with a realtor at an interesting price point. Their $2,586,700 assessment, will result in $12,934 in additional taxes as BC residents. Hopefully, it is a small motivator to price it right and get it into the hands of new owners who can make it habitable by investing in a reno that helps the economy and free up the new owners’ former residence to be bought by someone else or rented. 2xrealtors win, trades doing reno win, new owners win, renters moving into new owners place wins.

Another example is an out of province mother who visits family in Victoria. They will now have to rent it or sell and fortunately, her son has bought a big place in town with a spare bedroom for her to stay in.

Let’s see the results by revenue. I bet it looks quite different.

Every tax change has winners and losers. If we were to wait for one that had only winners there would never be any change.

I don’t think the spec tax will solve the issues but I think it’s part of the puzzle in getting back to sanity.

That’s very unlike Jefferson’s style (e.g. Declaration of Independence) and in fact it was said by Ben Franklin, who was fond of making such aphorisms (e.g. Poor Richard’s Almanac).

Also it would have been highly inappropriate for Jefferson to have said it, since he was born into wealth, much of which he squandered, and slave ownership.

If one is within the spec tax area and one isn’t, they can declare the former as their principal residence. If both are within the spec tax area, they can damn well pay the freight if they don’t want to rent one out or sell it and take the profits. There are far too many people who can only dream of owning just one.

@Marko

For sure, but you have an interest and an aptitude for that area, so for you it was not as hard as for some people. Also, positive results initially have probably been a motivation for you to keep going (i.e. you haven’t suffered a major loss).

It is not so simple as saying you are “smart” and the people who make ostensibly illogical financial decisions are “dumb”. People make decisions that are rational to them based on what they believe to be true.

What I have found fascinating is all the recent podcasts (e.g. Hidden Brain, Inivisibila, Freakonomics, etc.) and books (e.g. Thinking Fast and Slow, The Idiot Brain, etc.) that are examining how people think and the common pitfalls we face.

I have learned a lot about myself and hopefully won’t make some of the same mistakes again, although there are always factors beyond my control. And, if you think people paying high MERs are dumb, what about someone like me who has a good chunk of RRSPs in one-year GICs because she took heavy losses in mutual funds in 2008? Sometimes emotion is just too strong. However, his past week has not been so bad. I just renewed a GIC at 2.7% (now higher than our mortgage rate) and the markets are falling.

Thanks for posting the excerpt. In the excerpt posted, the spec tax example given is reasonably assumed to be a foreigner subject to spec tax (inferred as a foreigner because that he said they were not paying BC taxes, and had no known source of income).

The NDP have told us that only about 6,000 of the 32,000 properties subject to spec tax are expected to be owned by foreigners, and about 20,000 will be BC residents. It seems odd that he wouldn’t talk about the typical person affected, especially when that person is a BC resident and taxpayer.

Since you posted an excerpt and not the whole speech, I’m wondering if the full speech addressed the many thousands of cases that aren’t offshore millionaires parking money, but are BC people with two homes for family or business reasons.

I find it offensive that he didn’t address these BC non-speculator people, especially when he concluded by talking giddily about his new tax by saying…

How can a politician be thrilled about a new tax when in the same breath he mentions that it will be difficult for some people, and fails to mention that 20,000 BC people are affected and the typical person affected is a BC person, not his offshore millionaire example?

And that speech impressed you LeoS, giving it a “Wow”. Does it really take a politician announcing that he’s “thrilled” to be increasing taxes to impress you?

For what it’s worth, I would say my arts education drastically improved my written skills – especially where clarity and style are concerned. The same applies to other areas that are usually ascribed to talent. For the 1st 28 years of my life, I was convinced I would never be able to draw. My degree required me to take 2 drawing courses. By the end of the second one, the professor encouraged me to pursue a degree in drawing. Later, I taught drawing at a fine arts university. Natural aptitude does exist but most of us would be shocked to find out what we can learn given an amenable environment and some motivation.

@Leo S not me but IKAN?

Purchase agreement done on my house, conditions off the 1st of Nov. Close date is dam tight but Black Friday should happen in the new place.

Fingers crossed but it looks like this HHV is 20% across the finish line.

Sweet Home:

I totally agree that prices have really spiraled in Victoria and not having a Starbucks coffee will not help enough for that down payment.

Being older I faced this same crazy price appreciation in the core only it was in Toronto. I could never catch up to the price appreciations in the core other than buying a condo.There are different factors at work here in Victoria than in Toronto.

Single family homes in the core are definitely priced out of reach of local incomes. While simplistic to me the obvious reason is that most of the SFH in the prime areas are not being bought primarily by locals. Certainly price points are not being set by locals. Dont have a stats for it but my guess that there are more locals moving down the property ladder than up. When sell that Oak Bay bungalow for 1.4 you can afford that Songhees condo for 800k and still put money in the bank.

I am not convinced that the situation is going to get much better any time soon and maybe not in anyone lifetime.

Is it harder for the young generation. Yes and no. A lot harder than it used to be in Victoria proper even ten or fifteen years ago. But probablely not a lot worse than Toronto in my time. People were forced out first to Etobicoke (read West Shore_ and then out to Mississauga and then Brampton (read Sooke). These are areas in Toronto that were considered to be remote even for a farm when my Dad come home from the war.

So I have a lot of sympathy for the younger generation. They are not going to have an easy time of it.

gwac’s blood pressure may have just shot up 🙂

Wow that Eby speech was pretty good. I downloaded the subtitles. Posted here with some edits for brevity.

So many people who wanted to live in those communities coming and saying we could work two lifetimes and never be able to afford to live in Vancouver and when you look at unfairness like that when you look at the unfairness of people buying property not living in it not paying taxes and then the people who live in the community who pay taxes who work hard who want a place for their families they want to stay in the communities they love.

That is what drove a bunch of people to get involved in the election in government and to talk to members on both sides of the house about concerns in the housing market.

No surprise honorable speaker that the opposition opposes this they made their side very

clear in the debate when we were in opposition when I would stand up again and again and say people are being priced out of the real estate market forever that we have communities that are silent that used to be vibrant they’re filled with vacant homes it’s

unacceptable please do something about it. And they did not.

The finance minister addressed the core issue that we faced and I can onlyassume that the members on the other side that have spoken against this do not know what’s been happening in Metro Vancouver. Homes bought by students homes bought by house wives homes bought by numbered companies homes bought by trusts. Transparency international saying that the top 50 most expensive properties in Vancouver owned by individuals with no apparent source of income.

Finally someone will come and say where did the money come from to buy this property how overdue is that. We’re not talking about seniors with lifetimes of paying taxes in British Columbia here we’re talking about the reality of somebody buying a home a multi-million dollar home with no apparent source of income. The most expensive properties in Vancouver. How did that happen?

There are a group of people honorable speaker that will have difficulty explaining how it is that they’re declaring poverty level incomes and buying million-dollar homes and I think

it’s okay to ask the question. So I would like to say to everybody out there and there are many many thousands of people who have spoken out about this. This government has been listening and this is why you contact an MLA this is why you show up to housing forum this is why.

How honorable speaker how do you avoid this oppressive tax?

You rent out the place in a housing market with vacancy rates lower than 1%.

How on earth could you avoid this oppressive tax you rent it out or you live in it and you pay taxes in British Columbia.

I am so thrilled with this in many ways although it will be difficult for some people I acknowledge that. This is an essential ingredient to addressing thehousing crisis. The members on the other side say if you address speculation if you address vacant homes developers will stop building homes. What what they’re building homes only to be held vacant?! This is what the development industry is based on this is what the members on the opposite side are defending? If you tax empty homes developers will stop

building homes because that’s who they’re building homes for?

We want developers to build homes for people to live in we want developers to build homes for people to rent.

Great idea. Some may not make a lot of sense without context but I’ll take a look for sure.

Also the only happy lawyers I’ve met are retired or describe themselves as “recovering lawyers”. I’ve heard it’s a horrible grind to start but maybe that’s not true for everyone.

The last time a plumber came by my house he had a PHd in engineering (not kidding, I knew the guy from when he was in uni) and had decided to change careers.

The going to be a Dr at 31 storyline

I am a counsellor and have seen many people start their quest to be a Dr a pilot what have you post 31. I can tell you some schools put more focus on bedside manner than the hard sciences. People just need to determine what the barrier is for them to become x and then decide whether they think they can overcome it and then of course get at it

It’s like when someone told me it would take 10 years to learn the piano so I said forget it – just so happens that was 20 years ago – if you get my drift

A lot of people focus on why they can’t do something – the successful people figure out how they can. And it’s not always about money being the end goal but being what they want to be

If you can help someone get to where they want to be then good for you – focus on the positive and using the argument of I just wanted to be honest in telling you you don’t have a hope in hell for me would never be the approach I would take.

People who have done poorly in school as a kid doesn’t mean once they know what they really want can turn things around. And just because someone went to school and got a BA in English doesn’t mean they were poor at math BTW

Finally as to the benefits of a BA – in my neighbourhood a while back the guy with the biggest house, fanciest car, truck, ATV. And RV was a carpenter or finishing carpenter something like that so go figure

Like I said previously, progress is progress. And thanks for respecting my trademark. It also appears as though we’re now using the same line to argue. Slowly but surely, I’m sizing you up for a bear t-shirt. It’ll look good on you – bears are cuter and usually, but not always, have better temperaments than bulls.

Marko, I think this quote explains your “luck”

Thomas Jefferson’s famous quote:

“I am a great believer in luck. The harder I work, the more of it I seem to have.”

I’ve heard you work long hours 7 days per week.

“Every time I drive by that Costco gas station I think how can people be so dumb to spend 5-10 minutes to save a few bucks on gas, but they can’t do 5-10 minutes of research to save $10,000 in commission in selling their home or 15 minutes of research once a year to save a 2% MER?”

It must be nice being better than everyone. Are you as self-righteous and smug in person as you are on here?

Australian stock market just closed an hour ago and they are crashing too. All 2018 gains were wiped out. All Asian markets are down too.

The big question is; What will a Trump do next?

By the time I was 16 I learned to never play chess with a Chinese kid, now the greatest match of the decade is unfolding with Trump challenging Xi. Xi is known within China as a strategic Grand Master. Next move goes to Trump.

Meanwhile, Gold is up 4% in the past 10 days.

Very true.

Something tells me that back in 2004 there were still people complaining about Victoria’s high house prices and predicting a correction/crash.

I know, I know … the bears argue It’s Different This Time™—as in, this time prices will crash, not like all the other times when they didn’t.

I think it comes down to hard work + some savvy. You can work as hard as you want but if you are dumping your savings in a 2.0% MER mutual fund because someone at TD Bank with a B.Com says it’s a great investment then good luck to you.

Every time I drive by that Costco gas station I think how can people be so dumb to spend 5-10 minutes to save a few bucks on gas, but they can’t do 5-10 minutes of research to save $10,000 in commission in selling their home or 15 minutes of research once a year to save a 2% MER?

I get the impression that Marko has made a good chunk of his net worth through real estate, in one form or another.

Of course, I made most of my net worth via real estate but instead of buying real estate to accommodate my ideal lifestyle I was buying up cash flow positive properties (even before the rental rate run up) under market value. I did have to put myself in a position to buy these properties by tripling my income which required leaving a secure health care career.

I would like to think it wasn’t all luck, there was some thought involved in my strategies ->

http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

No, it’s not. Hard work is required, but that still might mean never being able to own a house. All those little things like driving an old car and brown-bagging your lunch do not add up to the hundreds of thousands of dollars prices have gone up even just since 2013.

I get the impression that Marko has made a good chunk of his net worth through real estate, in one form or another. And, much of what he does is not that hard, at least not for him (I think he has said as much).

I am a Gen Xer, and my spouse and I were ruthless savers with pretty good incomes. So, we still were able to buy a house in 2016, even after prices went up hundreds of thousands of dollars. Had we not had a large downpayment, a house in the core would have been unattainable (unless there is a crash back to 2013 prices).

While hard work and saving allowed me to have a decent career and amass a downpayment, taking the attitude that borrowing is good and I deserve a nice home is what really would have gotten me ahead.

I could have bought a $200K condo shortly after I moved here in 2001, and my spouse and I could have bought a $400K house as early as 2004. If we would have done that, our net worth would now be around $500K higher. You just can’t make that amount up through lifestyle changes.

It seems many older people can’t grasp how much prices have gone up compared to salaries. It doesn’t mean younger people can’t own anything, but it’s much more likely to be a condo than a house, even with the same amount of work and sacrifice.

What happens 40 years down the road when that condo building has either needed major repairs or is dilapidated? They won’t be able to cash out on a property that has gone up many times (average house price in Victoria in 1978 around $65K) like the baby boomers can today.

Andy7, there’s a simple truth to be seen here. An economy that cannot support a historically nominal rate, is not strong enough to support million dollar bungalows. Further, a housing market that cannot withstand an almost comically low rate of 3.5% is in a dangerous position indeed. As this progresses and finally unwinds, the degree of imbalance we have today will become more and more apparent retrospectively. How anyone can argue in favor of the monster we’ve created nationally in our housing market, is utterly beyond me.

@ Introvert

Here ya go Introvert…

https://twitter.com/francesdonald/status/1055110978218668032

Someone mentioned a while back about an option for a new kitchen that they used and they were impressed at the speed it was done. Can’t find it in the archives.. Anyone remember?

@ Marko

What was her reason for wanting to go into Pediatrics?

The crash is in such slow motion that we’re delving into career counselling to pass the time.

If it’s something she’s very passionate about, then at the very least, it would be worth her while to do her pre-requisites in her spare time to see if she wants to take it further.

31 yr old with an English degree that hasn’t work in a hospital/health care is all of a sudden passionate about pediatrics?….working as a RT in pediatrics at Vic General was the most stressful experience in my life. Can’t even imagine being the doc.

I am passionate about electric cars…doesn’t mean I am going to try and start an electric car company. There is one Elon Musk and than the 99.999% rest of us.

David Eby talks about his strong support for the speculation tax bill in the BC Legislature the other day

https://www.youtube.com/watch?v=l_Sfsnl4Flg

@ Marko

I did an Arts degree and went on to do all my organic chemistry, biochemistry, pathology, anatomy etc courses at a later point. It’s doable.

I don’t disagree with your pragmatic approach in terms of career advice and actually wish I’d been given the straight out of high school career advice you’re spouting on here when I was 18; all I’m showing is the different side to the argument. If it’s something she’s very passionate about, then at the very least, it would be worth her while to do her pre-requisites in her spare time to see if she wants to take it further. She may take one class of organic chemistry and say, “oh hell no”.

I know a couple doc’s that basically worked till the day they died; it wasn’t out of necessity, but rather out of love. They truly loved their work.

I’ll add to the chorus of bad career advice here by saying that a BA is a prerequisite for most decent paying jobs in government. Sure, it might not be the most glamorous career, but work/life balance is pretty good, and the work force is aging so there will be opportunities to advance. Just sayin.

31 is not too old for anything, especially if it pays big at the end of the tunnel. But then again, salesmen know all. Hope she didn’t listen.

The odds of her making it through the necessary pre-reqs such as organic chem are not great given her background is an English degree. The odds of getting accepted into med school in your mid-30s (by the time you get your pre-reqs) are very low. Even if you make it through it all you are 43 by the time you start working which leaves you with a 20 yr working career.

I rather my friends hit me with a dose of reality when I have an idea versus BS dose of “follow your dreams” that puts me even further behind in life.

I knew a mother with a couple kids who went to medical school in her 40s at UBC.

I did my Masters @ UBC with a doctor who was an internist and started the process late in life (29 yrs old). He was getting his haircut in Vancouver and expressed to his hairdresser that he wanted to be a doctor, but he thought he was too old (28 yrs old at time) and it would take him until 40 or so to do undergrad + med school + residency.

His hairdresser said….”you will be 40 yrs old one day whether you go down this route or not” so that comment motivated him to become a doctor.

Yes, there is always the exception feel good story but that is not reality. I feel like I was doing my 31 yr old friend a favor by telling her she is too old. She likely wouldn’t be the exception and would hit a road block in 2nd year organic chemistry or even worse hit a roadblock on getting admitted to a med school.

Look at the UBC intake and the age bell curve. The peak is like 24/25ish yrs. old. A 40-year-old could hypothetically get in but they are 3 standard deviations out on the bell curve.

I don’t make my life decisions beyond one standard deviation.

Patrick I did mean my post seriously but in a lighthearted way also. I didn’t and don’t aim to cause (serious) offense. Do I really think the OP is nothing but a grumpy old man? Absolutely not!

My condolences. The rest of your daughter’s story is triumphant, however.

This is largely true.

Yup.

@ Marko

I knew a mother with a couple kids who went to medical school in her 40s at UBC.

There’s also plenty of ways to get a medical degree, even if you have to finess the system a bit. I know multiple Canadians that have gotten their medical degrees overseas and come back to practice in Canada. One straight out of high school got her medical degree in Australia – she was a doctor at 24. Another few I know got their degrees in Ireland (or perhaps it was England) and another few got their degrees down in the Caribbean. It’s doable; some did it early, others later in their lives.

There’s a saying along the lines of, “The best time to plant a tree was 20 years ago. The next best time is now”

P.S. Marko, I do agree with all your other career advice. I got an Arts degree, biggest waste of time; had to go back for more schooling. Looking back now, I would do a nursing degree first, then take stock of my options from there.

Well said RIP.

They have the choice of ordering or not. Those who have already ordered are stuck with the bill.

I’ve said it before and I’ll say it again.

Learn To Be Financially Literate!

Financial literacy can help to prepare for retirement by building personal savings and other assets, choosing the financial products that best fit needs, planning for and coping with major financial decisions related to life transitions, navigating and understanding how public programs and services can help, and recognizing and protecting oneself against financial abuse.

The earlier the better.

In our culture of the monetary system, You couldn’t give a better gift to your child than that.

Than you can worry about future careers.

…Actually it’s never too late to learn Financial Literacy 😛

So you think. Career Killer Counselor your new side hustle ? She may meet a filthy rich specialist and live happily ever after or get paid twice her pay to go to a foreign country for a new experience. 31 is not too old for anything, especially if it pays big at the end of the tunnel. But then again, salesmen know all. Hope she didn’t listen.

Josh’s post reminded me about the 5 property / $10 mil package I’d posted about 48 days ago. Yes that’s the DOM for those properties and not a penny drop in price. MLS 399219, 399221, 399222, 399223, 399225. Will be interesting to see if they come down at all on these properties or decide maybe it’s time to sell individually. The pricing for each property was high IMO and now with a stagnant market, seem even more out of touch.

I wonder how many of you thought I was talking about money when I said to support your child? Support comes in many forms. And if my child is of the scenario above, I’d still support her (again I did not mention money here for those jumping to a conclusion.) Why? because it’s her life and not mine to live.

As for these “I walked to school in 5 feet of snow uphill both ways with holes in my shoes” stories, realize that each and every one of us has a story as well but may not choose to divulge all here. Imparting one’s life story is great and those experiences are what shaped you and your beliefs. Those same experiences for someone else may not turn out quite the same. As that old saying goes about opinions….

What’s with the double listing of 1041 St. Charles St? MLS 395328 and 394622.

“Seller prefers “Illahie” and 1043 St Charles, the luxury Coach House residence to be purchased together. 1043 is separately titled .1 acre strata Lot 2, sharing common property. (mls#394623)”

AirBnB flop: 211-599 Pandora bought last October for $410k, asking $425k. I haven’t been watching this market segment (small downtown condos) but I’m curious how it will play out in the Spring.

That line was uncalled for, in an otherwise reasonable post. If it was for humor, always better to poke fun at yourself.

Aren’t markets great? All of 2018’s gains, buhbye. The markets desperately need a correction – a familiar theme across a lot of asset classes.

Neither is language or the ability to juggle, but some are inherently more articulate and coordinated than others regardless of education. Curiously, I found the same thing with people who have careers as mediators. I can usually tell the difference between one that is naturally good at it, and one that’s been “trained”. Some of the older ones who were grandfathered in from when advanced education was not required, would blow your socks off at their conflict and issue res skills. I’d hire them before I’d hire someone with 15 PhD’s in DR or related fields. You either got the goods for what you’re doing, or you don’t. Education and experience only goes part of the way…

Jeezuz, you must be a gas at parties. Glad to see there some experts on careers when they are a glorified salesman. Hope your friend doesn’t read this blog…. or maybe ex-friend now.

I told her straight to her face. We are still friends. I am entitled to my opinion.

The reason househunters like to buy houses at high rates is because of regression. If you buy a house when interest rates are unusually low and house prices are unusually high, the probability of regressing to the mean is high such that your mortgage payment will go up with higher rates and the value of your house will go down so you will end up paying more for a house worth less.

when rates are unusually high and house prices are unusually low, regression will mean that rates are likely to come down and your house value is likely to go up, so you will be paying less on your mortgage in the future for a house that is worth more.

LeoM I agree with most of what you wrote but with the caveat that we have to tone down the expectation that you are going to love your job. In most cases you are lucky if you find a job that you love a part of what you are doing. Most jobs include things you have to do that you may not like or even hate. I dreaded my Sunday morning when I had to go through all the office business accounts and double check that all the trust accounts were properly reconcile. Dealing fairly with clients who I personally disliked was also another challenge.

While not directly on point, I do remember my fathers advise when I brought home a particularly bad mark in calculus. I made the argument that I did not see any point in learning calculus since I could not imagine ever using it. (which turned out to be true). My dad sat me down and said that I was completely wrong. He said that I would use what I learned most days throughout my life. I would learn to do something I did not like and I would learn to do it well. My experience was that he was pretty right about that.

I agree with Leo that the focus should be on what aptitude and skills a child has and focusing on what they can do well that can earn them a living.

Jeezuz, you must be a gas at parties. Glad to see there some experts on careers when they are a glorified salesman. Hope your friend doesn’t read this blog…. or maybe ex-friend now.

I disagree in a big way. Writing isn’t not built into people’s DNA. Your sample size of 2 is too small to make a statement like that. Ask any English teacher if they see improvement after grade 10.

What the hell is happening to the crashing stock market?

– Interest rates?

– Trumps tariffs?

It’s gone from euphoric to major anxiety in just a couple weeks.

Your daughter may start off in English but then at school discover a different passion. Happens all the time. Be there for her today, tomorrow and every day after.

And before you know it they are 30 yrs doing a PHd in environmental sustainability with $100,000 in debt, with poor job prospects, complaining how unaffordable Victoria has become in terms of buying a house and starting a family.

There has to be a dose of reality conveyed as well in supporting one’s dreams. I have a friend that is 31 yrs old that all of a sudden decided she wanted to be a pediatrician (has an English degree currently). All of her friends were supportive with all the BS “follow your dreams,” and I told her straight up….honestly, you are too old at this point to realistically peruse it, good luck.

I wish in highschool they actually thought some real life stuff. For me I was lucky enough to work for my father (stone mason at the time) when I was in highschool and that was some real life lessons. Mixing mortar with a shovel and carrying rocks while getting drenched in rain and then some douche bag in the Uplands taking 60 days to pay after you’ve completed all the work. Best motivation I ever received in life and my old man didn’t have to say a word.

Regarding education and future job prospects; to quote an old saying:

“You won’t get hired for your education, you will get hired for your skills.”

If you apply this old saying to an English degree; I’ve worked with people with English degrees and Geography degrees and they have been the worst writers in the organization. The skill of being a clear succinct writer does not come from an English degree, it’s an innate aptitude usually evident by grade 10 and won’t improve much with an English degree.

“Are you good at something because you like it, or do you like something because you are good at it?”

The best advice to a high school student who is unsure of their future direction is to support them with a few professional aptitude tests to explore their innate abilities, then explore jobs and professions where they can thrive and love their job.

Grace: You should definitely be proud of your daughter. I am sure your daughter’s story is not unique but we dont hear this nearly as often as we should. I could never figure out why we dont hold the trades in higher regard in Canada whereas in places in Europe, like Germany, the trades are respected for the trained professionals that they are.

Of all the people I have meet in Victoria the master carpenter who has worked on my house is perhaps the person I hold in the highest regard. It goes beyond just his skill at his profession but I appreciate his honesty, integrity and devotion to his family.Too often we overlook how hard many people work at often unpleasant jobs just to put food on their families tables.

Not a Peter Schiff follower per se but once in awhile he says some things that make sense. Too bad rates will never go back down until it’s too late like every other time.

@PeterSchiff

If the Fed does not cut rates soon real estate prices will collapse. My guess is 20% – 30% down in most markets, and 50% or more in the bubble markets. At that point no American homeowner with a mortgage will have any home equity, making the coming recession that much worse.

Steve Saretsky Retweeted

RateSpy.com

@RateSpy

2h2 hours ago

.@TD_Canada, @cibc and @BMO have all matched @RBC, making it official that Canada’s prime rate moves to 3.95% tomorrow.

But done correctly an English degree can be parlayed into many other things.

You could also do nursing, have an awesome job @ 22 yrs old, and parlay into many other things as well.

Looking back the only thing I would have different is done pharmacy (5 yrs) instead of respiratory therapy (3 yrs). Just a few more options as a pharmacist including entrepreneurial.

The thing about doing something concrete straight out of high school such as a trade or nursing, or etc., is you can do whatever you want once you start making money at 22. You have enough money to go back to school, or go travelling, or save for a down payment, etc., and you always have something to fall back on to should all else fail.

Having a concrete career that was in demand allowed me to work casual, set my own hours, and take off travelling to Europe for 3 months when I was 22 yrs old. I did my masters which was a complete waste of time, but I still had my job at VIHA. When I started in real estate my thought was always well if it is a complete failure I always have my job at VIHA. I didn’t like my VIHA job as health care just wasn’t my thing but it was always there need be.

Trades are also prime imo going forward as seems everyone is focused on university. If you become a plumber, for example, and can always venture into other things like general contracting or become a builder, etc. You always have plumbing and changing out hot water tanks on a day to day basis to fall back on. They don’t teach PHs how to change HWTs so the demand will always be there.

US market down more than 600 points today. NASDAQ in correction:

https://www.cnn.com/2018/10/24/tech/tech-earnings/index.html

Personally I agree with you Barrister(and nice that you’re spelling it out for them w/r to the law profession), but those factory jobs don’t exist here. Best job you can get here for University is server at the keg. Just don’t use up all your tip money on drugs from the kitchen staff.

Oh Imforgotmto add my daughters welding class was 50% female.

Not sure how many stuck with it and became wed,era.

The info meetings at Camosun are great! Well worth attending.

Daughter was never hassled in class either. The guys were envious of her ability.

This was one of the posts of the year, IMO.

Hey, Leo. Maybe at the end of each year, you could post the top 10 comments by thumbs-up number, just for fun. Whaddya think?

Very much agree.

Also, for many people, education is about more than just getting a job. My BA enriched my life tremendously, even though it didn’t lead me to financial riches (I did that by not betting against Victoria RE 🙂 ).

Um, yes they are, since they are all backstopped by CMHC, Genworth, and the like, which are backstopped by the federal government, which can go into near-limitless debt if it so chooses.

It’s because patriotz keeps telling them that high interest rates and low prices is preferrable to the reverse. The one problem being, we have yet to see low prices.

So the house hunters are gonna enjoy a big plate full of high interest rates and high prices!

My daughter is a welding inspector. She got a science degree at UVic but soon realized she would need more education if she wanted a good job in the field. She came home one day and announced she was going to an info meeting about the welding program at Camosun. She had never shown the slightest interest in trades and we were highly sceptical. Long story short she excelled at it and after finishing the program got a great job as a welder in Edmonton. A year in she took the inspector level one course and aced it. Smart, motivated, people can quickly move up the ladder in trades. She will soon be a level two inspector. She works under a female level two at the moment. When she was a welder she was the only woman in the company. She was never, not once, harassed by a coworker. She WAS harassed at a job site by an electrician. Old fart who offered her a mint because he “was going to kiss her”. Shades of Trump. She handled it on her own. Basically told him to F off and to not come near her again. He backed off and she dropped it.

Yes women have to be twice as good as a man..but hey that isn’t hard! Go in and work very hard and put up with no BS and you will be fine.

It has been a real learning experience for us and no one in our family has ever done a trade. We are very proud of our daughter.

Trades are hard work. Only the tough survive but the pay and opportunities are great. Camosun is so affordable and the instructors are great.

She also has to live in Edmonton.

Renter: I am not dumping on anyone here but frankly i would caution people to look carefully before going into law. For a start they are graduating a exponentially increased number of lawyers these days and the market place is pretty well flooded. I know more than one young lawyer that joined the police force because they are paid better. The large firms are generally hiring people with with technical, business or science backgrounds.

Paying for some or most of your education focuses your mind on the fact that this is the real world you are entering and not just a continuation of high school. My dad did not pay for me or any of my five siblings. I managed just fine on grants, scholarships and a factory job during summers and weekends. I hired and mentored a lot of young lawyers in my time and, personally, I was often more interested in what they did with their summers than just looking at their marks. One of the finest lawyers I had the pleasure of hiring was a woman that spent her summers working at Steelco in Hamilton.

I appreciate that times have changed and most students need some financial help from parents but leaving young people in an academic bubble wrap often does not serve them well.

Grant knows his child best and he can do want he wants with my perspective. Going into law is fine but one should at least try to go into it with a firm understanding of the modern realities.

@ Grant

It’s cliche, but she’ll likely do best if she follows what interests her – it’s hard to keep going with something you hate. With an English degree, she could also become a teacher.

And at the same time, the best thing she could do would be to shadow a few people in industries she’s interested in, and even in one’s she’s not, and do some co-op positions if she has the opportunity.

Does your daughter currently have a part time job? That tends to help people decide what they do and don’t want in a job going forward.

As for female plumbers, I know one and she’s done exceptionally well for herself. Also know a guy who got his university degree, realized it wasn’t going to get him the $ and lifestyle he wanted, so he went back to school and became an electrician.

As for getting harassed in the trades, harassement can happen anywhere; in fact, it may be worse on university campuses. If anything, she’ll likely get more positive male attention because she’ll be one of the few females around, especially if she’s getting her training and doing her apprenticeship in an area like Victoria.

This article is worth a read:

http://nymag.com/thejob/2017/04/the-plumber-who-thinks-more-women-should-learn-a-trade.html

I’m not sure who was watching but didnt 2090 Renfrew Rd say they were going to pull their listing if not sold by Oct 15th for good? Looks like that didnt happen.

It was either this place or another one in henderson area but I dont see any others unless it was actually pulled.

Further points about education – generally speaking, university degrees are not for getting a job. We tell kids this lie because workplaces have the luxury of requiring a bachelors because there are so many people running around with bachelors. In reality, the only thing that matters is experience. I don’t have a BCS and I’m constantly headhunted by people looking to fill a job that says I should have at least that. If all you’re after is a job, then for your own sake, go to college. It’s shorter, cheaper, the instructors are from the industry, and they have direct ties to employers. They limit acceptances to what the industry will be hiring that year and the most common experience is getting hired before you graduate.

Go to college if you want a job. Go to university if you want an education.

Seriously Barrister?!? Is there anyone left you haven’t dumped on?

Grant – As a parent with a child in her 3rd year at University, let me say help your daughter with advice but then stand back and support her endeavours. Heading off to school is a huge and daunting prospect because we parents tell our children, they are choosing for the rest of their life. Your daughter may start off in English but then at school discover a different passion. Happens all the time. Be there for her today, tomorrow and every day after.

This has to feel like a poor argument just typing it out. Most people are on fixed-rate mortgages. Rate increases only have an immediate effect on new loans and mortgage growth is almost at a 2 decade low. You know these things…

People I know with an English or Humanities degree are now lawyers, doctors, post-doctorate philosophers and journalists. None of them regret their degree. I, on the other hand, wasted 2 years of my life trying to get an aerospace engineering degree and then got an equivalent computer science degree which I ultimate didn’t need. I can’t say I don’t have some regrets there. YMMV with any degree and it’s all just a stepping stone to something else.

Crashes don’t start because owners can’t pay their mortgages. They start because entry level buyers can’t qualify for a mortgage at current prices and rates.

As long as there’s equity in the house, yes owners will move heaven and earth to make those payments. If and when they get to negative equity, that’s when the will evaporates.

Grant:

Law is a lot more competitive than it was thirty years ago and an English degree is perhaps one of the least helpful undergrad degrees I can think of at this point. Firms are looking for people with engineering, science, accounting or business backgrounds.

All you can do is give her advise but i really hope she is financing her own education if she is determined to do English.

Easy to say when they all have jobs to go to. When the BC economy is more reliant on real estate than alberta is on oil, and that is hitting the skids…

Fear in the markets, so where’s the money going ?

Not Canada

https://stockcharts.com/h-sc/ui?s=$TSX

Not USA

https://stockcharts.com/h-sc/ui?s=SPY

Shiny stuff looks interesting. 😉

https://stockcharts.com/h-sc/ui?s=$GOLD

Yes, definitely seen those numbers.

I think the resourcefulness of people in trying to pay their mortgage will shock us. They’ll cut their cell phones, walk to work, probably eat KD but god forbid they don’t pay their mortgage.

I think this will have wide reaching impact across lots of retail sectors, resulting in job loss, and the job loss will result in mortgage defaults.

Camel, I’d like you to meet Straw..

Famous last words. Rates are now at levels not seen in almost a decade and will keep on climbing. Sales are down and prices always eventually follow low sales down, every market player knows that.

Another 2 points coming to the stress test to 6 to 7% will smoke the market. Do the math on a renewed or new mortgage of $600K. $1000 to $1500 a month increase is not survivable on Victoria incomes. Did you miss the news that one third are afraid of bankruptcy on a quarter point hike ? Guess not.