The politics of housing

Municipal elections are coming up, and for many people that invokes a giant yawn of boredom and an associated abysmal voter turnout come election day. However amongst all levels of governments, your municipal government likely has the most direct and largest impact on local housing issues. No matter how much money is allocated to new supply by the feds or the province, in the end it depends on municipalities to actually make land available, approve zoning, and decide how neighbourhoods should evolve. You only need to look at development in Victoria, Langford, Saanich, and Oak Bay to see how much impact the municipality has. Whether you believe that local government should remove obstacles from development or set strong parameters around it, the impact they can have is huge.

The problem is that I’ve always found it quite difficult to compare the platforms of politicians running for office because most of the time the press doesn’t bother to cover them much. To that end, I wanted to summarize the housing positions of the leading candidates in Saanich and Victoria in order to give a bit of context as to where they stand on housing, especially on constructing new supply.

However, before I got a chance to do that, Todd Litman at Cities for Everyone beat me to the punch, publishing a very detailed article on the housing positions of local candidates for Victoria, Oak Bay, and Saanich.

Cities for Everyone bill themselves as a community organization that supports more affordable housing, so when they rank a candidate as focused on “comprehensive affordability” that means the candidate supports infill housing suited to low and moderate incomes, while someone supporting “low income affordability” is focused on low-income housing affordability, and those that are running on “protecting neighbourhoods” are against significant neighbourhood change or increased density. Below is their ranking of candidates, with those without a clear position on this issue removed and incumbents marked.

| Comprehensive Affordability | Low-income Affordability | Protect Neighborhoods | |

|---|---|---|---|

| Victoria Mayor (one) | Lisa Helps* Michael Geoghegan | Rob Duncan David A. Johnston | Stephen Hammond Bruce McGuigan |

| Victoria Council (eight) | Marianne Alto* Laurel Collins Sharmarke Dubow Anna King Grace Lore Jeremy Loveday* Sarah Potts Andrew Reeve Charlayne Thornton-Joe* | Steve Filipovic James Harasymow Ben Isitt* Randie Johal Jordan Reichert Ted Smith | Marg Gardiner Pam Madoff* Geoff Young* |

| Saanich Mayor (one) | Fred Haynes Rob Wickson | Richard Atwell* | |

| Saanich Council (eight) | Benjamin Allan Trevor Barry Susan Brice* Judy Brownoff* Zac de Vries Rebecca Mersereau Shawn Newby Teale Phelps Bondaroff Colin Plant* Ned Taylor | Nathalie Chambers Vernon Lord Art Pollard | Kathleen Burton Karen Harper* Ian Jessop Cory Montgomery Rishi Sharma |

| Oak Bay Mayor (one) | Kevin Murdoch | Nils Jensen | |

| Oak Bay Council (six) | Andrew Appleton Anton Brakhage Isabella Lee Tara Ney* Andrew Stinson | Cairine Green Hazel Braithwaite* Eric Zhelka* |

Please see the comments below for a clarification on the assessment of Richard Atwell’s position from Todd.

The full article gives more detailed rationale as well as complete answers from a survey that was sent to the candidates. I would encourage you to check it out, as well as their Victoria affordability backgrounder which I found quite well reasoned.

What do you think? Will the election change housing policy in Victoria? Can local government significantly improve housing affordability or is this all just talk?

Plumwine says: “After months of bitch and whine @ pumpers, REALTOR®, landlords, rich Chinese, dirty Asian, boomers, selfish seniors with big houses, white old men, foreigners non-island people, bogeyman, and now it is not polite to call out a spade. Very adorable”.

For the record, never, ever, did I make the statements of which you attribute to me. Never did I “bitch and whine” at or to pumpers, landlords, any ethnic group, seniors, white old (or young) men, foreigners……..your list is never ending and purse fantasy. It appears that you [Pumwine] and the truth are not even on speaking terms. Never, ever did I make any of those hate-filled comments and you should be ashamed of yourself for even suggesting that. Shame on you !!!!

Gwac – I am not Hawk or anyone else. We sold our home near the top of the cycle because we could. As I stated, it makes no sense to sell and buy in the same market. This market will not be the same in 18 to 24 months. We have every expectation of buying a home again and know the exact neighborhood in which it will be – those areas have already dropped a sizable % since we sold. I don’t expect you to understand because you have displayed such a strong bias and lack of knowledge that it would be fruitless to explain economics to you.

We vacation annually in the Caribbean and whether we sold our home or not, we would be going there again this year. Business is very good, the family is healthy and investment income is accruing for our next home purchase. I am confident that we made the right decision and I am confident that you are making the right decision by not buying now – you speak a good game, but your actions scream the opposite as you refuse to put your money where your mouth is.

Waiting for new numbers for a break in this off topic debate. Hawk and GWAC should really go for coffee and enjoy each others endless argument. No one wants the sky to fall, we just want more houses on the market and people to stop listing the house you bought in 2016 for a 30% premium since it is a waste of realtors and buyers time. I don’t know about you but I’m happy every-time I drive by the private for sale sign on Leyns Road, knowing the speculation tax will hit the owners and hopefully motivate them to participate fully in the market and start to help correct the supply issue.

PS According to our Mortgage Broker if you ever see a listing with B&B/AirBnb like 15 Wellington Ave, it makes it quite difficult to get financing. My guess is the listing will get pulled in a few months and relisted as a home for a much lower price in the spring.

True, but it sure makes it easier now with how bearish everyone is (and that they don’t understand interest rates).

Monday numbers: https://househuntvictoria.ca/2018/10/09/oct-9th-market-update

Vancouver is 25% more dense over 12x the land area so that changes the picture somewhat….

Far more drool with anticipation of working people being permanently unable to buy. As for me, no I don’t want to see anyone lose their personal residence. I would like to see a lot of speculators lose their shirts.

Hawk and a few others positively drool with anticipation at the thought of folks losing their homes.

We must secure the existence of affordable housing and a future for Victoria residents. Heil Housing.

Wolf like I said during turbulent times my industry is busier and I owe nothing now so I can assure you I will not be impacted. The damage a 30 to 50% correction would cause to this city and people are not something people really want that have any compassion for their fellow man. People lose jobs… People lose homes. Families struggle. It is not just people who bought in the past couple of years that are impacted. It could be people on here wishing for a crash.. It is the tiler, the plumber, the person who works at the appliance store. The home depot guy.

How am I being prophet. I see a max 10% correction to the benchmark. If its more and something big happens I will take advantage but I do not wish and certainly would not day after day trash the market hoping that a huge crash happens knowing the damage it really causes.

Anyways enjoy. What people say on here has zero impact out there. So why should I care I guess.

Alright, can someone explain the deal with this city and nazis? First came the V1488 apartments on 1488 Cook St. Now we have 15 Wellington Ave for sale at $1488k…

https://en.wikipedia.org/wiki/Fourteen_Words

The short term future of real estate is never a certainty. Don’t listen to someone who tells you it is.

“So that everyone understands a crash will have zero impact on me. My job will actually be busier.”

That’s what a lot of people say until it happens and they find out they were wrong. You’re likely not the prophet you think you are.

“Neither just someone that does not get off on seeing others suffer to make a buck.” and “I would use the opportunity the buy land.”

Sounds like you would try to ‘make a buck’ at the opportunity. Just because you count the gains on your land years later when everyone has recovered doesn’t mean you didn’t make the buck at the time of the downfall at others expense. Incredibly hypocritical.

I have little sympathy for those that drank the Kool-Aid and find out they’re in over their heads when things sour. Nobody forced anyone into buying a home.

Simply not true. The City of Vancouver is only 25% more dense than the City of Victoria.

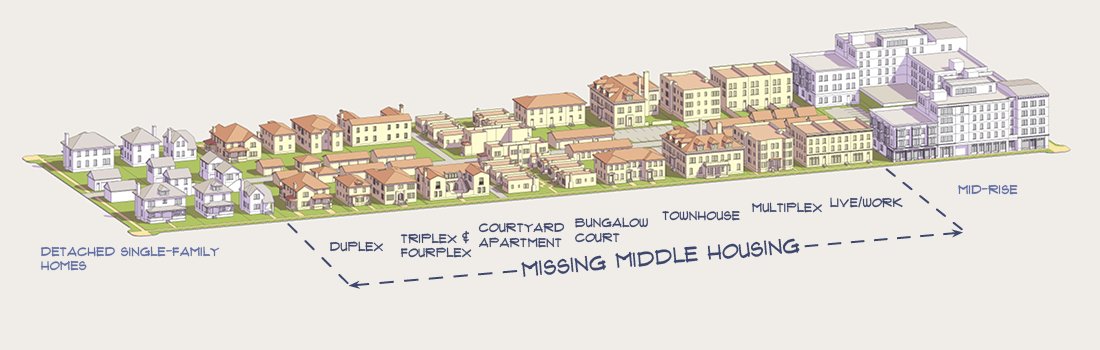

If Vancouver feels 7x dense, and this is almost always a negative sentiment, then that’s an argument to caring how density is achieved and not just the number. Density is quantitative and qualitative. Cramming people into towers downtown and along arteries while leaving swaths of SFHs doesn’t feel as nice as spreading out people more evenly, which I think Victoria does a better than average job. The City of Victoria is going to keep growing whether you like it or not. If you don’t want it to become Vancouver (full of towers), then upzoning SFHs to gentle density is the only option.

People per square kilometre, Vancouver vs Victoria

City: 5,492.6 vs 4,405.8

Metro: 854.6 vs 528.3

https://www150.statcan.gc.ca/n1/daily-quotidien/170208/t001a-eng.htm

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/hlt-fst/pd-pl/Table.cfm?Lang=Eng&T=201&S=3&O=D

The Assessment Act actually has an exemption for property owners of over 10 years in this situation, allowing the assessment to be held at pre-rezoning levels.

https://info.bcassessment.ca/Services-products/property-classes-and-exemptions/section-19-8-of-assessment-act-special-assessments-for-certain-long-term-residents

If your property qualifies for assessment relief under section 19(8), it will be valued based on its current use. The value will be established using sales of comparable properties with no development potential. The value of your property will be determined each year and may change if the market values of the comparable properties change.

Nobody should make any investment, never mind one at historically high prices and historically low carrying costs, unless they can deal with the consequences of the former going down and the latter going up.

Don’t go pointing fingers at the bears – they are the ones who have advised people not to get into this situation.

“Any thoughts on the likelihood that Victoria goes the way of Vancouver by upzoning to duplex and the effect on prices for those properties?”

If property is up-zoned to higher density (duplex, triplex, etc) then the land instantly becomes more valuable, BC Assessment increases the property value, and annual property taxes increase. When the property is listed for sale (because the owner can’t afford the higher property taxes) , developers buy the property for a higher price and then build-out to maximum size with maximum dwelling units.

Vancouver has roughly 7 times the population density of Victoria. I don’t think we’d have any need for that on a wide scale, for the foreseeable future.

Any thoughts on the likelihood that Victoria goes the way of Vancouver by upzoning to duplex and the effect on prices for those properties?

Fernwood/Oaklands already has a few blocks with some nice front-back duplexes (e.g. 2600 block cedar hill rd, 2400 block Victor st). Seems like a reasonable course of action without totally destroying the neighbourhood.

Jamal

Neither just someone that does not get off on seeing others suffer to make a buck.

modern day Jesus or slimy devil?

Plumwire very nicely put.

If someone wants to spec on their home. Ok your life

It’s the crap he said as he bashed the market. Him and Hawk are no different.

Someone who is a first time buyer and struggling. I feel for but people who spec and bash are just not a group I have any time for. You are wishing for a crash which will cost a lot of people jobs and their house potentially. Sorry that is not something I see any positive in.

So that everyone understands a crash will have zero impact on me. My job will actually be busier. I would use the opportunity the buy land. To me it’s not worth it because of the job losses and impact on people. That is my position

@QT “someone tell me to go back to my country or where I come from.”

I don’t mean to cast shadow on the apparent racism but I’ll point out that I’ve also been told this in Victoria, and I’m Caucasian. Part of it is very likely as you suggest but another component may be related to how competitive it is in Victoria. It seems like there’s a lot of people here (not all) that don’t like when out-of-towners arrive and snatch up good jobs (being able to afford a house jobs) or nice homes. That distaste from some, I think, is reserved for all who are not already here ‘waiting in line’ regardless of ethnicity.

VB is very confident and bragged about playing his home as stock market. I am not kicking a man when he’s down.

After months of bitch and whine @ pumpers, REALTOR®, landlords, rich Chinese, dirty Asian, boomers, selfish seniors with big houses, white old men, foreigners non-island people, bogeyman, and now it is not polite to call out a spade. Very adorable.

( FFS, our kitchen and tables had harsher words than those PG13 words this weekend. There were kids here too. I am glad we are not sensitive bunch.)

I really like your confidence. Enjoy the trip, what a great way to enjoy the profit with your family.

Definitely for those without kids a lot can be done with just a few shared car share spaces and fewer parking spots.

Agree that the free market can handle the parking issue. If you don’t want parking you save yourself the cost. If you do you get a more expensive unit with parking. If you buy a cheaper unit without parking and then later realize you want parking or it’s tough to sell without parking that’s your problem.

Chinese slaves built our railway so they are probably more Canadian than me! VicHumter, I think you confused me with Victoria Born.

Vancouver and Toronto are two of the world’s five largest bubble risks. Interesting data in this:

http://www.visualcapitalist.com/biggest-real-estate-bubbles-2018/

Victhunter

I found your claim is amusing. I also purchased my house with my Asian wife and I’m Vietnamese that was born in Vietnam, and the last time I checked Vietnam still is in Asia. And, I would be rich if I get a dime for everytime someone tell me to go back to my country or where I come from.

I have observed many people on this board who blame Asians/foreigners for the present housing ascent, and they tend to focus on the dirty money instead of focus how Asian positively contributes to Canadian economic and society. But, they have no qualm with reaping the profits from Asians/foreigners.

I lived here in Victoria long enough to witness how many Canadian blame foreigners for their own hardships and downfall (including people who posts in this forum. Not in the exact following words, but the meaning is pretty much the same), such as “those dirty DP who come here and take our jobs”, then it became “those Boat People who come here and take our jobs”, it then lead up to “those rich Hongcouverites who buy up our land”, now it is the dirty Asian Money who drive us out of our birth place.

275 Cadillac

710k

does any one know what 275 Cadillac ave is sold for?

205 -1030 Meares St looks like you need to join the Guild of Calamitous Intent before purchasing.

No need to get upset about randoms on the internet? I’ve never understood that. This blog is actually quite tame.

@guest_50059 You are in a class with one of the richest and smartest guys I know in Victoria who also sold his house privately when someone approached him last year and he believes a US crash is coming. As far as the Dirty Asian $ comment, the person who posted is an ignorant racist and like others on here really don’t even need their post acknowledged as that is the best slap in the face we can give them. I shop for homes with my Asian Canadian wife and know that some people are viewing us that way, who have no understanding of how Canadian dirty money has played a huge part in all of our history including on Vancouver Island.

On to happier things, have a wicked vacation and thanks for reminding to this house hunter not to overspend on our upgrade so we can afford another vacation!

@Leif Not sure if my numbers are correct but one is about to have the conditions come off tomorrow and if it completes I’ll post it, if not I’m heading to see it. The other is still very much on my radar, going to run some numbers and go by it again this week. One property was incorrectly listed by the realtor, missing a full bedroom, and the other was hiding a garden suite that was not listed but showed in the floor plan, due to being illegal. Do you or does anyone else have a great Canadian rental/cash flow calculator/spreedsheet? I use the Canadian Mortgage App on my phone but the old website I used to use is shut down.

Marko, I find your advice always very prudent. So perhaps we should refer to you as

Juris prudence (sorry could not resist).

Why not call them Ben and Jeremy? (Ben and Jerry’s, perhaps.)

Why do I refer to Madoff as Madoff instead of Pam? I don’t think it is gender based.

I’ll call Elon Elon (Elon Musk that is) and Trump Trump. I think Elon is a genius and Trump is an absolute moron piece of crap human being. First or last name is not a gender or respect type thing for me.

Personally, irrelevant of where I am in life I hope people keep referring to me as Marko (I also accepted Marlo, Mario, Marco, Mark, Marc)…….Juras would just make me feel old and stale.

I am noticing a number of price drops but I have no idea if that number is unusual for this time of year.

My secret source at the Oak bay library says she has really seen the number of new people from Vancouver drop off dramatically over the last few months. Not scientific but interesting all the same.

The federal Liberals made a lot of promises.

Welcome, future “local buyer” (as the VREB will classify you), who didn’t bring any money from elsewhere to purchase here!

Lisa.

Why not call them Ben and Jeremy? (Ben and Jerry’s, perhaps.)

And again.

No gamble, eh?

And… here we have the gamble.

Leo let’s everyone be a part of it, so you’re welcome, I guess.

It should be, and is, open season for anything that anyone posts on HHV. Can’t handle the heat? Stay out of the kitchen.

Plus, we’re all anonymous here (and those who aren’t made that choice), so we don’t need to light our hair on fire at the occasional personal remark or instance of rudeness, IMO.

Victoria Born: We dont always agree but I respect your opinions. The comment made reflects badly on the writer. Having read all your thought on the sale it seems to have been both a logical and appropriate decision in your unique circumstances.

Generally it would be a risky move for a lot of people.

Why leave? The people that hurled insults at you tend to speak that way almost every time they post. If it wasn’t you it would be someone else, if it wasn’t for the “I sold my house” reason, there’d be another reason…

Yes, I agree with Dasmo, stick around VB, your posts get people thinking and some people react; and their reactions are more related to them than to you.

Bah! Don’t say goodbye. Personal insults are over the line yes but you threw it up here so it’s of course going to be torn apart and debated. It is a controversial concept and It’s the internet.

Plumwine: “If ASSHOLE is too strong for you, then how about Greedy Bastard who Gambled on Family Home”.

Your retort is almost unintelligible. Well actually, you have it reversed. The “greedy” person is the one who is sitting on out-sized returns expecting the trajectory to continue. We were not marketing our home – an interested buyer came forth and made an offer to buy – we negotiated and we obtained a price likely 10% above fair market value. So, we sold – you will find this difficult to understand but there is no gamble. It would be foolish to sell and buy in the same market at the same time – so, we invested the funds [yes, we made a very, very good return and do not apologize for that] because what is taking place in the market was foreseeable. So, the “greedy bastard” is the one who looks at you in the mirror thinking that prices will continue to rise and a greater fool will magically appear when it is time to sell. Jealousy is one of the 7 deadly sins

QT: “It is the dirty Asian/foreigners money that forced you out of your home?

Or, was it your missed calculation in 2017 that you are now trying to spread FUD so you can jump back into the market, because you speculated and sold your house?”

The racist language notwithstanding, no – we sold for a price that exceeded fair market value because the buyer wanted the home and we wanted to move on. We did not have a mortgage, so no prepayment penalty. We also avoided real estate commissions because it was a private sale to someone who expressed interest in the home 10+ years ago – it was not the right time for us to sell then – 2017 was the right time for us personally and market-wise. No “missed calculation” – it was not an investment, it was our home. We are very happy with our decision. What is to come is not speculation – it is a certainty, just like 2009 [BUY] was with the stock market [which we are now also selling selectively] – if you missed that, little hope is left.

Leo S: “I certainly don’t understand the hate at someone stating what their plan is and that they have put their money where their mouth is. Are we not all free to make our own bets? Bizarre all the name calling at someone exercising their right to do what they wish with their investments”.

I neither. On the one hand, some espouse capitalist rhetoric and it seems deep down they are socialists. On the other, they harbor considerable ill will toward foreigners [whom they describe as unwashed or unworthy, but then cling to immigration as the underpinning of these high prices] and those that have successfully executed the thesis of their convictions. I shared with all of you what I interpret from the data and what we have done (walk the walk) – it was the right time for us to sell and the price was just too good to pass up. We are very happy in our decision and as the dividend and interest cash flow mounts, we are enjoying what the City has to offer. Business is good and our health is excellent. Eventually, we may buy a home here but don’t expect that to happen for 18 to 24 months. Our family is just fine and happy – planning a winter getaway to the Dominican Republic for 2 weeks, just bought the tickets last night. Life is good.

Stay well, all. This has been an interesting place to spend some time. Thanks for having let me be a part of it, LeoS.

@Victhunter

“There are now houses in good condition that are starting to show cash flow if you were to rent them out and not use a property manager (ie don’t value your time or opportunity cost and ignore depreciation/maintenance costs). Things are looking up and maybe the name calling will stop on here :).”

Can you show some examples? I haven’t seen anything cash flow positive except the odd places that has been converted into 3-4 suites and even those didnt always make sense.

@RenterInParadise I think 1098 Willow St (MLS 400520) is just a change of life plans for the owners. My brother’s family lives on that street and loves it and gave me the heads up that it was going on sale. If it doesn’t sell within a few days we are really in for a correction since it will qualify for rental income when applying for a mortgage, is in an area that should receive garden suite approval and is one of the most central spots in all of Victoria.

@guest_50159 and @guest_50174 wish there was enough incentive for you guys to be on council, few people are as engaged and knowledgeable about development housing (although most of us are out of touch with low income).

I’m voting based on this post, one terrible dinner with our mayor (more interested in browsing BMW motorbikes than talking with people) and the terrible transition when he took over.

Happy thanksgiving and good luck house hunting in the coming weeks.

No way around it, parking minimums are forced purchases. Impractical and silly to push stratas into business of selling public parking. Let the free market do it as Marko said.

Driving/parking downtown is only going to get less convenient. Sooner you accept that, sooner you can embrace alternatives. Oxford really impressed me with how they solved this problem. They’ve pedestrianized their core but have park and ride lots all around the city. Frequent buses shuttle people every few minutes from the parking lots into the core. The core was bustling and carefree, really lovely city and magical experience.

wo

I’m not advocating forcing people to buy a parking, but I’m advocating building enough parking for business and residents.

Perhaps a condo buyer can opt out of a parking stall, and it can be sold to other condo buyers, or the strata can buy it and rent it out to help with the strata fees funding.

anonymous vitriol on social media.

+1, plus for the council positions the pay sucks. Anyone that can hold a pencil and has some common sense probably can’t afford or doesn’t have time run for council.

I’ve watched a lot of the meetings online in the last 12 months and they are painful to watch. Most of the council members don’t comprehend simple law, economic, design, etc., concepts. The old guy with the PHD in economics in Harvard or whatever starts arguments with “I bought a house in 1970 in James Bay for $11,000,” and then talks in a circle. That is great that you bought a house for $11,000 but no way relevant to the rental building the developer is proposing. Isitt and Loveday not sure if they would be employable at Walmart with the logic they present (no offense to anyone working at Walmart).

Lisa in relation to others is actually not too bad. I am not down with all of her policies but looking at the crop of other poor candidates I would probably vote for her again.

Lisa helps has said that they have brought down development approval times significantly from multi year to many in 6 months (unfortunately no statistics available on that).

Do you think the current mayor/council has made any improvements on getting developments approved faster (compared to 4 years ago) or not?

Remember when Lisa and the city came out and said they removed the re-zoning requirement for garden suites? But decided to not comment on the owner-builder exam applied to garden suites.

A building permit application for a new residential build should take less than 7 business days but in the COV it takes 3-4 months. If they can’t figure out a system for a simple building permit the development approval times are going to be disastrous as well.

Literally today I ran into clients who are trying to build a storage shed that is larger than 110 sq/ft in the COV. COV wants drain tiles around the shed which have to be pumped up to the city storm (lot slopes down) and a bunch of other crazy stuff. They’ve just given up.

The reason so few garden suites are being built is the city makes it economically unreasonable when people actually investigate the process.

Re parking why can’t the free market dictate how much parking is required in new condo developments? My tenants at 834 Johnson and Promontory both don’t have cars. They work downtown and one of them uses Modo from time to time. It is 100% doable.

Prove is in the pudding.

Lisa Helps appears to help developers to build luxury housing. Where is all the affordable housing?

So the 200+ rental units Bosa is building on Pandora with Save on Foods as the commercial tenant, on a site that did not have any housing before……how would you classify that? Is that luxury housing to you?

Just one rezoning she spearheaded to approval in Cook Street Village saw the destruction of about 20 affordable housing units which were replaced by 50 luxury units.

How are 50 wood-framed minimum building code rental units “luxury units?” This project was super super contentious but I wouldn’t call it luxury. It is basically a Langford wood-framed box in a nice location.

Oddly enough, a true luxury building (concrete condo @ $1,000 sq/ft) two blocks away on Heywood not one peep from the public and passed no problem.

Happy Thanksgiving Monday, HHV!

Picked up the missus from YYZ after she successfully secured an apartment. Never a fun drive. I’m thankful today to be leaving behind this province with its awful infrastructure and embracing the island lifestyle 🙂

QT, you get what you build for. I only got my license and bought a car after university. Lived downtown in my city (pop ~150k), got a job downtown next city over (pop ~350k), separated by only 20km. Lived and worked just a few minutes walk from two central train stations. Well, the boomers stopped running the trains in the 90s and the bus service was almost nonexistent (technically there’s a bus that gets you in after rushhour). Moving wasn’t an option since my partner was in school locally. I had no choice but to buy a car.

That article wasn’t about student housing in the sense of provided by the universities. Just a neighbourhood sandwiched between two universities where lots of students want to live. See, not everyone needs a car, for example students, and yet the parking minimums still applied. So the developers found workarounds by building 5 bedroom apartments (which is absurd).

Forcing people to buy parking is halfway to forcing them to buy a car. Housing in or near the downtown means you don’t need to drive downtown, so that TC article about parking drying up for suburbanites is not relevant.

All those promises from the federal liberals about green infrastructure spending. This would be perfect but not a peep.

Yup. The province and the feds need to pony up some money to at least get the tracks from Langford to Vic West fixed, so that we can get some sort of passenger trains going.

The E&N goes right through Westhills for god’s sake! How great would it be if you lived in Westhills and worked downtown?

The Vic West terminus would be no big deal; the 5-minute walk across the new Johnson St bridge is a delight. If it’s raining, bring an umbrella. People in Seattle make umbrellas work. It’s possible.

After trains from Langford to Vic West get going, we could upgrade the rest of the E&N section by section over 5-10 years, eventually using it for passengers and freight.

In essence, we need to build the infrastructure first. Otherwise we are always in the makeup game. We have it before our very eyes. The E&N. It even has a finished bike lane done already. Could build much higher density along it without adding to the car commute.

TC has mayor and council profiles for the entire CRD https://www.timescolonist.com/elections

wo

Student housing is not the same as housing for the rest of the public. Often student housing do not have or a real need for parking as in the case for most if not all Canadian universities.

At the present Canadian are buying bigger and more vehicles, because self driving unicorn taxis still remain elusive now and for near future. And, if parking isn’t an issue then we wouldn’t see resident parking signs within 1.5 kilometer radius of the hospitals or downtown Victoria.

https://www.timescolonist.com/news/local/jack-knox-the-long-and-short-of-victoria-s-parking-crunch-1.7442542

Amalgamation will only happen if somehow forced by the provincial government.

century . .. that is wishful thinking .. i will settle for the next millennia

Are you arguing that combining two solutions cannot result in an even better one? There are many strategies for traffic calming and often it takes more than one to get best results. In winter parking is forbidden overnight on the street, so people tended to move their cars onto the other side streets; the humps were he only protection in winter besides bad weather. The street in question was parallel to the main street and I presume had problems with rat runners before the speed humps were in place.

That sad and disturbing anecdote doesn’t make a statistic proving your argument. Inexperienced and careless drivers can take their cars to any street. Traffic calming is never 100% effective. I’ve been the victim of two careless drivers smashing into me in my parents’ neighbourhood, where the roads are wide, people fill up their 4-car driveways, and there’s no speed humps. Kids play road hockey on my old street. No one dares linger on my parents’.

I’ll refer back to an article I posted earlier, it touches on the benefits of lower parking minimums.

https://medium.com/@m_druker/how-a-waterloo-suburban-neighbourhood-is-becoming-urban-804042c32a3e

Well that should be sorted any century now!

Mayfair man

IMHO, it is part of doing business is to make sure that a resident is safe and have adequate parking. If we going to cut costs then we could one day delete sprinkler systems and fire alarms, because it increase construction costs that unlikely to ever have a fire.

http://www.edmontonjournal.com/living+small+parking+critical+condo+projects/10811766/story.html

wo

Let me ask you a question here. If your old street were safe due to park cars that rendered it into a single lane, then why would it need speed humps?

Perhaps it give you the sense of safety, however from my personal experience it is not because a neighbor/family friend lost their son who crossed the street with his sister (an inexperienced teen drove around parked cars that obstructed his view, whom collided his car front end into a 6 year old boy and smeared his brain all over the road).

So step one is amalgamation, step two is build the Tram stations from Langford to VicWest, step three encourage building mixed use, community orientated development along that line. Zoning of the core is a distraction from the real issue and solution. The dreaded A word.

Street parking makes residential streets safer by calming traffic. My old street was very safe because, in addition to speed humps, the on-street parking made it impossible for opposing cars to pass each other. People drove slowly and were alert at all times.

Forcing people to buy underground parking can increase costs up to ~10% and discourages people going car-free. Pushing more people into more cars makes streets unsafe.

When you really open your eyes and ears you can see and hear the difference in the way men and women in leadership roles are treated.

Doubly hard as a woman. Women receive more verbal abuse, online and off, not to mention far more death threats.

Over the years, I’ve also noticed the subtle disrespect many talk radio callers pay Mayor Helps when they refer to her as “Lisa.” Just Lisa. No last name. No title.

Don’t recall Dean Fortin being called simply “Dean” in public discourse very much. Don’t hear many calling Richard Atwell “Richard,” in the same belittling way.

I’m more of a low risk/medium-high reward kind of person.

Leo, worried people are going to name-call you when you buy that speculative investment property someday? 😉

QT…. I agree that there needs to be some parking, but providing parking is very expensive. There is a saying when building/designing something: good, fast and cheap…pick 2. If a commercial builder is going to be able to make a hybrid(affordable/low income) housing project work they will need significant variances in density and parking(unless the tax payer is will to subsidize it, but good luck on raising taxes). The idea would be that people with low income would rely on public transit vs. costly car ownership. Also in 10 years people will most likely not own a car but pay a rental service for an attonomous driven car to take them on short trips.

My point is in an ideal world it would be great to be able to provide lots of parking for a low income project, reality is that sacrifices are needed or nothing will get built.

Hey Leo –

Do you think the current mayor/council has made any improvements on getting developments approved faster (compared to 4 years ago) or not?

Unfortunately, I would say no. Though I should also state, we have not had to go through any re-zoning. We have avoided this because everyone that we talk to about it says the same thing – it’s a nightmare, and requires deep pockets. My partner and I have used either a building permit to add a suite or the House Conversion Regulation to improve the use of single-family dwellings to 3/4 plex’s. This should be a much easier, quicker process. But what we’ve seen over the last few years is a major increase in the cost of site servicing and delayed timelines for approval.

If we look at the progress of other development projects in Victoria, I would be hard-pressed to find any examples of projects that went ahead in 6 months in the City of Vic.

Thanks for posting Queen E.

Lisa helps has said that they have brought down development approval times significantly from multi year to many in 6 months (unfortunately no statistics available on that).

Do you think the current mayor/council has made any improvements on getting developments approved faster (compared to 4 years ago) or not?

Mayfair man

I despise NIMBYism, but I must agree with parking issue. With out adequate parking the street will be unsafe because it will be clog with cars parking on roadside.

Leo S

Kudos to those who make the best out of their investment. However, I have a problem with those that spew blames and hatred of others (Asian/foreigners) for driving up RE price, and then brags about how they made money from the artificial run up that was caused by the dirty Asian money.

A househunt reader who prefers not to post emailed me this:

I would refer to the Homeowner Interest Assistance Act of 1982.

http://www.bclaws.ca/civix/document/id/91consol15/91consol15/82070

I believed they secured an interest free mortgage on your home to cover the full amount that you may be eligible to receive in interest assistance over time.

Geez bored??? I guess maybe. I do enjoy myself here though. Can’t have only bashers here dominating. 🙂

Folks – if you feel passionately about these issues, this coming Wednesday there is an event you should attend: Victoria Council Candidates Forum on Housing – Oct 10th, 6-8:30pm, the Atrium at 800 Yates Street.

On another note, I keep hearing this idea thrown around that “affordability is an arbitrary term” as Mayfair Man stated, but this has come up in other conversations as well. While affordability varies from one person to another, affordable housing is defined. In the context of this conversation, as stated in the Cities for Everyone article, “Solving this problem requires local policy changes which increase development of affordable housing types (secondary suites, multiplexes, townhouses and low-rise apartments)”.

These are the policy changes that we need to push for with our municipal governments. As a local builder/investor, albeit “small-time”, our hands are often tied by ridiculous timelines, permitting requirements, limited resources, misinformation, low-staffing, the list goes on. All these delays come with a high price, which directly effects the affordability of these properties. Not to mention the fact that the various NIMBY (not-in-my-backyard) and CAVE man (citizens-against-virtually everything) groups wield far too much control over whether or not these projects go ahead.

My point in all this, don’t get caught up in the terms used to identify these problems, but instead focus on the problems we’re facing, and resolve to do something about it.

Flip or Fail? 1098 Willow St (MLS 400520). Fully tenanted per the write-up so purchased as an investment. Last sold for $760,000 in Oct 2016. Listed at $779,000 today.

With all the rate talk lately, thought I’d post the 25yr breakout of interest rates (inflation) for viewing pleasure.

I also quickly threw in Van price behavior during the rate updrafts. Btw LeoS, I really liked your ‘double-edged’ explanation a couple posts ago on rates (who knows, maybe this time is other edge, but so far they seem to be rising for right reason).

Thumbs up anyone who thinks rising rates maybe possibly might be a positive signal for real estate …yeah didn’t think so 🙁

I believe there is a 3rd option here. Life changes. As kids grow up & move out, one’s need for housing changes.

No I was referencing the apparently bored gwac and suddenly very aggressive plumwine. Sorry for confusion.

Yes.

I don’t think it’s that they will stop raising rates to keep people in their houses, it’s that if people are losing their houses due to rates the economy will have cooled to the point where they won’t be raising rates anymore. Every time the interest rates increase it sucks some consumer spending out of our economy. With the combination of a consumer spending driven economy and high debt loads that is quite a strong lever.

LeoS, I certainly was not espousing any hate towards VictoriaBorn!! My apologies if that’s how my post was interpreted.

I’m certainly not a fan of RE speculators, but they’re not the devil. There’s an argument to be made for the calming effect that shorters have on a market. If they sell when they think it’s too high and buy when they think it’s too low, they help stop the market from over-inflating and save it when it’s crashing. Entirely theoretical though – as we know, timing the market perfectly is something almost no one does successfully. Most RE pumpers hurt on the way up, but help on the way down, and are often their own worst enemy.

I certainly don’t understand the hate at someone stating what their plan is and that they have put their money where their mouth is. Are we not all free to make our own bets?

Bizarre all the name calling at someone exercising their right to do what they wish with their investments.

Affordable housing and luxury housing are arbitrary terms. What is adorable to me may be luxury for someone else. There have been lots and lots of affordable housing added with this counsel. There are many duel income earners that have regular jobs that have household income over $100k. Now if you are talking low income housing that is a different story. That comes at the hands of the federal and provincial government through special loans and cofunding. Also I know of a few mixed projects(low income/affordable) that were shut down by NIMBY groups for having lack of parking and what they wanted made the projects unfeasible.

Also I am hearing complaints about affordable housing from people in luxury areas who are against rezoning. I’m sure if they allowed a high rises in Fairfield they could make it affordable, but the people there complaining about affordable housing wouldn’t be for that kind afforability.

I would never short my principal residence ether, but the reward would be crazy high in the scenario of upsizing with a 30% drop (running with that number, assuming post-inflation…)

If you had perfect timing and the goal was to upsize from a paid off residence to one worth twice as much, then you could:

– Buy and sell at top for no discount on the delta.

– Buy and sell at bottom for 30% discount on the delta.

– Sell at top and buy at bottom for 60% discount on the delta, minus difference in rent and property tax + maintenance + insurance, minus an extra move, minus a bit of inflation on proceeds (tax on savings account).

In the last scenario, those extra costs may not add up to much if the delta is quite large, like upgrading from a $1m house to a $2m mansion for only $400k plus a few tens of thousands.

High risk, high reward.

I’m not a fan of gambling the family home in anticipation of falling prices and then buying again after prices decline; however, VictoriaBorn has a good strategy that will probably work out well for him. He sold at the peak in 2017, so he likely sold for top dollar; he can now invest his cash in a high interest savings and get at least 3% risk free, and his goal seems to be to re-purchase a luxury home in a couple years. Luxury homes are currently declining fast in popularity and in price. So, with patience and cash, VictoriaBorn has a high probability of success with his plan. His plan is focused on a narrow segment of the market and if luxury RE repeats past performance, then places like Uplands will decline faster, in terms of both speed and %decline, than the middle market. Too much anxiety for me, but VB seems comfortable with his plans.

Would tend to agree in almost every case. Even in the best case your transaction costs and non-monetary costs of moving twice will negate most gains. The only exception would be if you are either on the edge and can’t handle interest rate increases, or if you are planning to leave in the next couple years. I have seen people trapped by houses where they couldn’t take risks, move for another job, or re-educate themselves for long term gain because they didn’t have enough buffer.

Also good point on the difference between overvaluation and the amount of any eventual drop. Will write a short piece about this next week.

I think 2017 was probably the best time to sell. But I think the pot odds are terrible trying to time selling your home to buy back in at a lower price later. You are rolling the dice with your family life, your home, your financial foundation for a maximum gain of what? Outside of the financial theory this is not a simple transaction of buying back what you sold. Inflation is working against you especially with construction costs. So buying something that needs work five years from now is going to cost a lot more to fix up. They won’t be building a lot of SFHs anymore either. It’s now townhouses. Plus the political pressure is there to upzone the core so that alone will push prices of SFHs up. You have no idea what the climate is to create the crash needed to make this move worth it. It would not be worth the remote possibility of even making a few hundred thousand to suffer the constant looking at the market, hoping for the chance to be right and win big but never quite getting there all the while rent is eating your cash, the stock market is deflating your investments and inflation is draining your reserve at ever increasing amounts but you can’t bring yourself to buy back in at a loss because you fear that will be the point the market crashes etc etc….

I can’t wish you luck because I can’t wish for a 30% or more crash due to whatever else that means. I can only wish for wage inflation which will make houses imore affordable but not cheaper….

I agree that blank slate is way easier and faster, but I don’t agree that the core munis should just shrug their shoulders and say “well langford will solve housing for us”. The chance of Langford building what you depicted in your second picture is about zero.

Both approaches are necessary.

Lisa Helps seems okay to me. It must be ridiculously hard to be an elected official these days subject to such a mountain of anonymous vitriol on social media. Going to be harder and harder to find reasonable, skilled people to run for these positions as a result imo. We are going to be left with those with personality disorders who are immunized from this by internal dysfunction. This generally is not conducive to great decision making. Also, council makes decisions by quorum. Means if u r unhappy with a decision blame the majority of council – not one person. Scapegoating needs to be called out more.

Plumwine: In fairness you might want to tone it down a bit if for no other reason that you are beginning to sound (and I know you are not) like some sort of bitter loser that is screaming that life is unfair.

I would not recommend selling your home on the gamble that the market prices are in a total bubble but it is his gamble to make. It could turn out well or simply be a disaster.

Nor is this really a trend amongst baby boomers since there seems to be lots of millennials who have used RE as a gambling casino.

I think you have some good points to make that are interesting but they get undercut by the harshness of how you express them.

Anna said: “Lisa Helps appears to help developers to build luxury housing. Where is all the affordable housing?”

Lisa approved many rezoning applications from large contractors which allowed the demolition of affordable housing which was replaced with luxury condos for the upper middle class purchasers. Just one rezoning she spearheaded to approval in Cook Street Village saw the destruction of about 20 affordable housing units which were replaced by 50 luxury units. Many other examples from Lisa over the past four years of affordable housing being demolished and replaced with luxury units. Meanwhile she has not built any affordable housing projects.

VB, re-read my post.

I do not care you will move in to Barrister’s mansion or share bunk bed with Hawk next year. You pumped and dumped RE and made tax-free profit, that’s the fact. This is the exact action “millennial” and 1st time buyers scream bloody murder and most hated upon. If ASSHOLE is too strong for you, then how about Greedy Bastard who Gambled on Family Home.

Feeling better now?

For those who wish to enter the market after the crash*: VB is the type of buyer you are competing with – sitting on cash and waiting for a lower price. Unlike most 1st time buyer, the rate won’t affect them much. The higher rate goes, the bigger advantages they get.

LeoS said: “Construction employed 17,700 in Greater Victoria in September, up from 14,500 in the same month last year.”

LeoS, is there any way to correlate the occupations of purchasers with the huge rise in construction jobs in the last 6 years? For example, are construction workers buying real estate at a higher rate now than in 2012? Is there a trend? Anecdotally I’ve seen and heard there is a trend, but I haven’t seen anything definitive.

For every construction job there is at least one job in the construction related industry; lumber yards, plumbing wholesalers, cabinet millwork shops, etc

When the construction boom is over, I know a couple families that will have trouble making mortgage payments, I wonder if it’s a widespread situation.

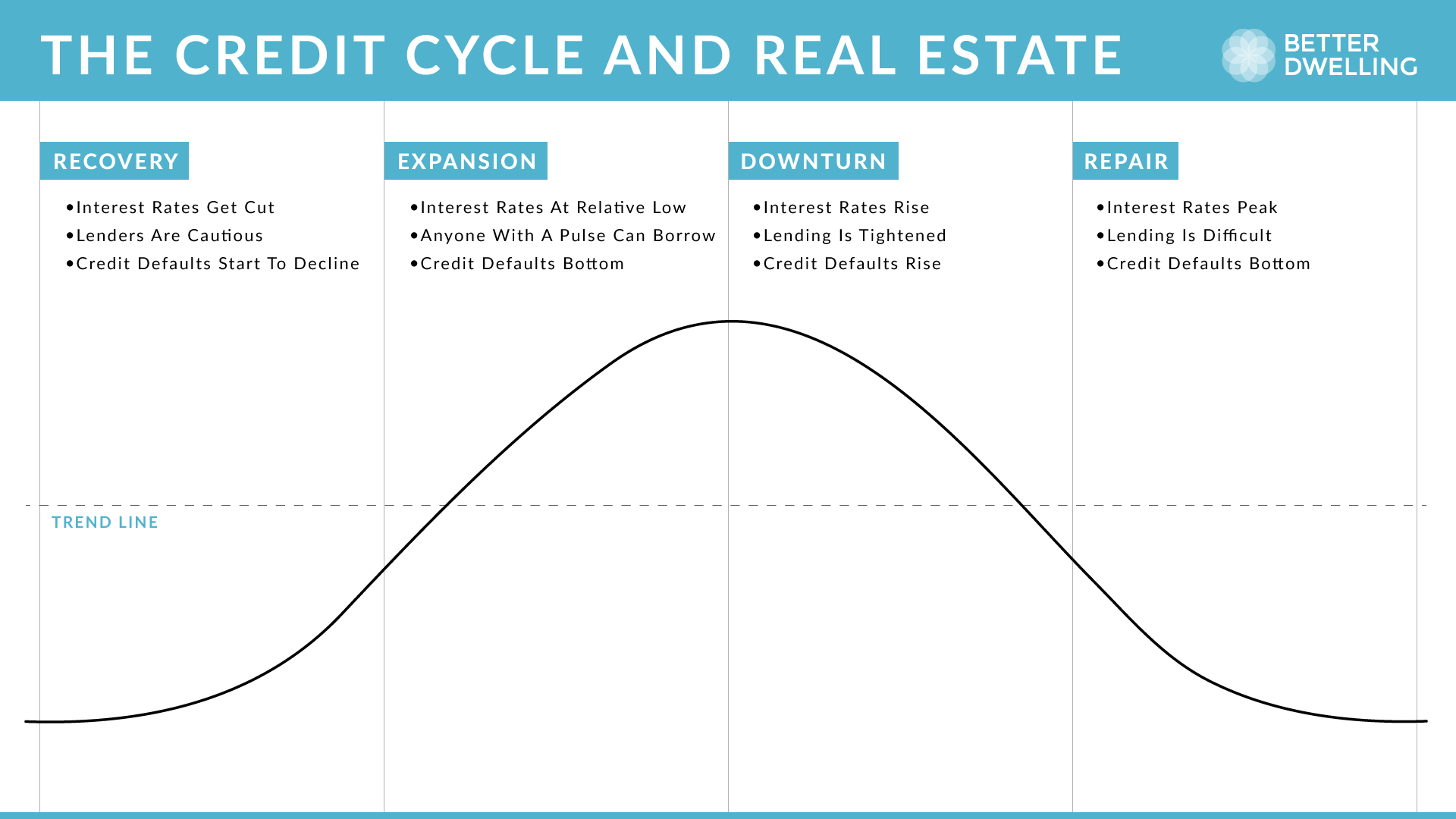

As the market cycle matures, people approach maximum confidence in an asset class. Demand rises rapidly, and prices follow suit. As the cycle rolls over, the asset no longer performs to expectations. Confidence begins to fall, and eventually turns to fear. Demand drops while financial weakness and excess are typically exposed and/or expunged from that market.

What’s to hate? People can come to this knowledge by their own willingness to look at what’s going on in the world around them, or they can come to it by force of circumstance. One of the things I’m sure you’ve realized is, none of the basic premises are complicated at all. All credit rolls in cycles. All RE rolls in cycles. Things that enter disequilibrium continue on that path until it becomes mathematically and/or circumstantially impossible for it to go on. The only points of controversy are precisely when, how much, and over how long a period of time the change will be. Then we do it all over again.

We love to polarize via this silly “bears and bulls” division, but it’s really about to what extent and how you apply your own logic models and perceptions to what you see happening around you. There’s a reason in your mind you’re feeling a need for caution today, and it’s not like that’s going to be, or should be, some kind of permanent position.

God…I hate to say it, but I am a baby bear at this point. Myrealtycheck.ca is red arrows in Vic and Vancouver, plus Steve Saretsky’s videos about the Vancouver market are quite sobering in terms of how rapidly the market is correcting on the mainland given big macro economic/regulatory factors.

Long run…different story..

“Construction employed 17,700 in Greater Victoria in September, up from 14,500 in the same month last year.”

That’s a huge gain.

https://www.timescolonist.com/business/construction-health-care-jobs-fuel-big-employment-in-capital-region-1.23455258

Victoria Born

It is the dirty Asian/foreigners money that forced you out of your home?

Or, was it your missed calculation in 2017 that you are now trying to spread FUD so you can jump back into the market, because you speculated and sold your house?

The data from VREB (https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf ) suggests that it would take roughly 16-17% drop in average SFH in greater Victoria for someone to break even to get back into the market if they sold their house a year ago (one must include selling and closing costs).

))) I too was a long time owner and bull. Mid-2017, I happily sold and pocketed a great return.

Day trading your family home. Not for me thanks.

It’s all making sense now.

For once, I agree with an entire Local Fool post. Full moon?

VB tl/dr

Prove is in the pudding.

Lisa Helps appears to help developers to build luxury housing. Where is all the affordable housing?

Oh, yeah, it might trickle down to us in some 50 or so years.

I see that Steve is seeing the same for Vancouver:

https://www.youtube.com/watch?v=iCoJ78LLg-s

So much for the “the owner of the multi-million dollar Vancouver home will sell easily and bring that buying power to Victoria and pump up the prices and still have a few million dollars left to retire on” dream. It certainly was a factor – but that is over now.

Alice Kluge’s latest video is also a sober look at what is happening in Victoria.

Gwac – so much for “taking the weekend off”. Throw those insults around like they are going out of style [the Gwhack-attack, as I call it]. Enjoy. I am immune because the facts and laws of economics support me, but not you, and the facts that you can’t understand what is going on is really the foundation for your angst. Not speculating and not investing – that was the time to sell and this is not the time to buy. I am not trashing the market – the market is a beautiful thing to watch right now – the leaves are falling off of it and the owners are de-listing all at the same time with the same strategy of re-listing in the Spring – all at the same time. It truly is a beautiful thing. Between now and then the only thing that will be pumped is the mortgage rate making is even more difficult for a buyer who did not save to take advantage. Mortgage growth is so impotent right now that one is hard pressed to see how it could revive when the coupon rate is 100 to 200 basis points higher [plus the 200 basis point stress test] in the Spring. However, I believe that we are 12 to 18 months [perhaps even 24 months] away from the next entry point.

Things I am looking at are mortgage growth, the bond market warning us of impending inflation, listings compared to historical averages, sales as a % of new listings [as you can see, I am most interested in the demand / supply disequilibrium], absence or growth of foreign buying, the introduction of the full speculator’s tax, the deflation of in the ridiculous property tax assessments (which is a lagging indicator and we won’t see the full effect until mid-2020), just to name a few. As long as the NDP’s housing affordability measures stay in place and household debt stays elevated, the Dominoes are lined up.

Again, I was a bull 18 months ago, but not now. I am not speculating. I speak only for me: this is not the time to be buying. This is the time to be saving and raising cash. Yes, I am a joke – hope that makes you feel better. If not, just reach for the soother. Teething can be annoying and cause one to lash out. The rest of us are just not worthy of your eloquence.

Plumwine – nice language on a family friendly site. Tsk, tsk – what would your mom think? You don’t know when I bought or my circumstances for selling. It was, personally, the right time for me and my family. We have no regrets. Yes, I am 100% to blame for the RE bubble. Feel better? At least you have acknowledged that it is a bubble and admitting it is the first step to recovery.

I agree with you Josh. Hawk – yes, the bond market dwarf’s the stock market, and that is where mortgage rates are set, so watch the yields and the yield curve. LF, my friend, this is not my first rodeo – I am confident that I got this and have put my money where my mouth is. If you are a bull, like Gwac, buy everything in sight. I get the concrete sense, from reading your posts, LF, that you are far, far smarter and intelligent than that and you see that the foundation of this bubble, as I do, is frail, weak and illusory. The Victoria luxury market has already dropped more than 10% [look at 3190 Norfolk Road – listed for $4.3M in late 2016, assessed at $3.5M in 2017, sold for under 2.9M, just as an example]. I have over a dozen examples.

“Houses aren’t meant to be played with in this manner, you can only really do that in a bubble and even then it’s extremely dangerous. I’d never do it. Once I’m in, I’m in. Forget the RE market after that”. We are in a bubble, LF. That’s the point. Now, it is the supply and demand fundamentals at play using local incomes, massive debt, bond market fretting and regulations designed to pierce the bubble.

We are all entitled to our opinions and are just sharing them on the Board. But we are not entitled to our own facts – the data are the facts. I just don’t see the need to insult and use profanity. It is just beneath me.

Stay well, everyone. Be Thankful, I am.

No one likes a short, even if they are right. This is one of the big morals of the movie The Big Short….

I continue to think it’s a horrible idea to dump your primary hoping to buy back in later, cheaper. If it was sold a year ago it was probably timed well, but you have to also have buy back in at the right time too. Much harder to do than you think. Knowing a RE cycle is very helpful, but it doesn’t usually let you play a game like this.

Plus, you’d need quite a substantial drop over a relatively short period of time to make it worth it. If it drops 10% over a year, then it’s a complete waste. Even if it was more than 10%, it would just be excess stress for very little potential gain unless you get a once-every-other-generation-crash on top of your perfect timing.

Houses aren’t meant to be played with in this manner, you can only really do that in a bubble and even then it’s extremely dangerous. I’d never do it. Once I’m in, I’m in. Forget the RE market after that.

So, you pumped and dumped. Good for you.

For those who thinks Vic RE is too rich, VB is the asshole you should hate. He speculated housing market and treated homes as tax-free stock market. Now, he is singing the song with bears, acting like your best buddy. Hoping to rinse and repeat, flip flop both sides, move into luxury market.

It’s in the ‘click here’ stats at the bottom. Here’s the direct links:

https://www.rebgv.org/sites/default/files/REBGV-Stats-Pkg-September-2018.pdf

https://www.rebgv.org/sites/default/files/REBGV-Stats-Package-September-2017.pdf

Easiest to scroll to the end of the pdf and you’ll see the prices on the graph.

Very good video from Alice Kluge again. Great to see the younger generation keep an open mind to what’s happening in the big global financial picture. We’re more globally effected then ever. Liquidity and credit squeezes are coming home to roost as I have been saying.

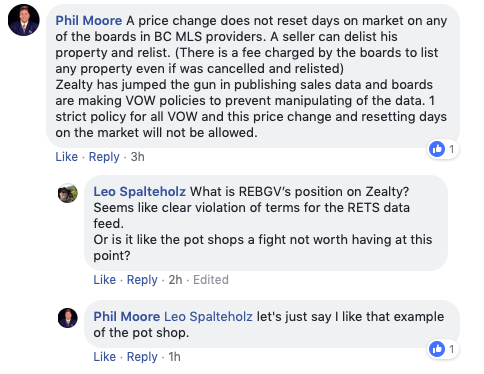

Interesting Alice’s mention of realtors scrapping it out behind the scenes. I guess the wink and a nod deals are on the decline and low balling may be the new game in town.

Meanwhile in China the buyers are revolting and getting violent too.

“Country Garden cut the selling price at one of its residential developments by 1/3. Those who paid full price smashed the sales office. Similar incidents had happened before, and will again. It’s impossible to remove “the guarantee of principal”(刚性兑付)in China.”

https://twitter.com/polarmcbear/status/1048473629015465984

Happy fall and thanksgiving everyone. Little picture from my morning stroll today…

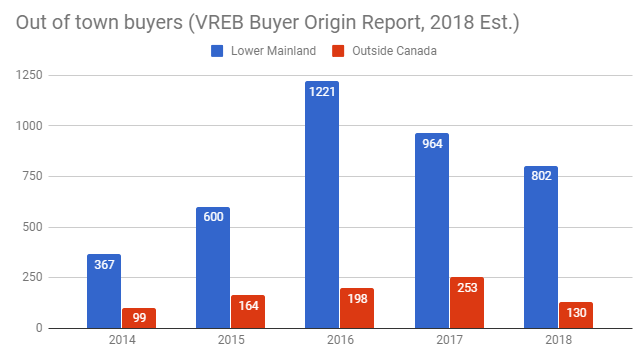

No big impact from the threat of spec tax yet. Still 90% BC buyers.

A few less from outside of Canada which matches the data from the province on foreign buying activity.

Michael: “The actual Vancouver detached avg price is essentially flat y/y.

(1,666,284 last year is now 1,629,896)”

<<<<<<<<<<<<<<<<<<<<<<<<

Hey buds, I was checking your link and I don't see any reference to average price at all. Here are the benchmark prices though.

https://www.rebgv.org/monthly-reports/september-2017

"The benchmark price for detached properties is $1,617,300. This represents a 2.9 per cent increase from September 2016 and a 0.1 per cent increase compared to August 2017."

https://www.rebgv.org/monthly-reports/september-2018

The benchmark price for detached properties is $1,540,900. This represents a 4.5 per cent decrease from September 2017 and a 3.4 per cent decrease over the last three months

It’s interesting how since 2016 we’ve had about 10-11% of buyers from the lower mainland and the number went up and down as sales went up and down here. You wouldn’t think that the number of vancouver buyers coming here would be so dependent on the total number of sales.

Q3 data is out, and we’ll have fewer Vancouver buyers this year than last, but still quite a lot more (double) than in 2014.

Gwac just can’t quit ya. What a way to spend your whole Friday and now Saturday defending the bubble. Wake up dude, money is leaving real estate by the billions. The party was over a year ago.

The bond market is worth multiples to the stock market and the former is saying inflation and risk to lend is going much higher. Over valuations of everything needs a major reset. The references to 1981 is in all the major financial news the past week.

Canadian Bonds Join Rout, Poised to Underperform as Rates Jump

“Investors in Canada’s C$700 billion ($540 billion) government debt market are bracing for additional losses, possibly outpacing U.S. declines, as Bank of Canada Governor Stephen Poloz gears up for several rate increases over the next year.”

https://www.bloomberg.com/news/articles/2018-10-04/canadian-bonds-join-rout-poised-to-underperform-as-rates-jump?srnd=premium-canada

The difference between people who think we’re going to experience a flat market vs a 30% correction is in how speculative the run-up in 2015-2017 was. So why was the run-up so big during that time? Money has been easy since 2009. Unemployment was improving during that time but unemployment lowering a few notches doesn’t really explain a more than doubling in a few years. We know real estate fever was very real during that time. The FOMO was palpable and RE agents marketing techniques during that time reflected this. Vancouver was exploding and we’re just a hop away.

Does anyone have any factors that are backup-able to account for the run-up other than a speculative fever fueled by low rates and FOMO? In order for that run-up to not be largely speculative, it would have to be some kind of awakening to the “true value” of Victoria. I know there’s certainly a lot of people that want to believe that, but it just doesn’t add up to me.

Victoria Born is another house speculator on here trashing the market in order to make their mistake look less stupid

No credibility my little trasher. What a joke you are.

Back to fishing

Well, you aren’t going to find the perfect house in James Bay for $750 anymore. That wasn’t around even in 2011. I was shopping for the “perfect house” in Fairfield then for that price and they didn’t exist. I was constantly irritated that they would all need work of some sort. So instead I bought the crappiest house in Fairfield…. worked out well in the end.

Interesting hearing Alice Kluge talking about how disconnected home prices are from incomes in Victoria

https://www.youtube.com/watch?v=j7xfYq-8E44

It was Steve Saretsky.

The actual Vancouver detached avg price is essentially flat y/y.

(1,666,284 last year is now 1,629,896)

https://www.rebgv.org/monthly-reports

Victoria Born, kudos for taking the money. I hope that bold move pans out for you. What’s your strategy for re-entering the market? Are you holding out for a particular % drop? Or you’re just waiting to see who’s desperate to sell as 2020 plays out?

I think it’ll have to be a different cute house for many to want to plunk down that much money. We discussed this particular property way back on August 1.

Interesting as I didn’t realize it’s still on the market. I know they tried to rent it for too much and then chose to relist it. Should be interesting to see where this one goes.

Victoria Born,

Yep.

Make an offer of $750 and see what happens! Officially a cute house in James Bay: https://m.realtor.ca/Residential/Single-Family/19844949/252-Superior-St-Victoria-British-Columbia-V8V1T3-James-Bay

I too was a long time owner and bull. Mid-2017, I happily sold and pocketed a great return. Why 2017? Come’on, look back with your unbiased eye and you will see that this bubble was just past the peak which I submit happened in early 2017. No chance that local incomes supported those prices, then and now. Low interest rates and foreign money pumped this up – remove that and sales fall 25% in Victoria – 43% in Vancouver. A foreign buyer came along and, like many here, had that “blue sky” investment feeling. It has been almost 18 months, and everything is falling in to place. This is not my first rodeo.

“My head is exactly where reality is”. If you spend the time and do your homework, you will see what is really happening instead of sitting on your head. As we write, mortgage rates rose this past week because of macro events [the US 10 year treasury topped 3.2%] – some 84 lenders across the country hiked lending rates.

I have been very interested in the luxury market for RE in Victoria as a guide for the rest of the market. The reasons are simple and the cracks are more than visible. Some talk a lot, others stand by their convictions. This credit cycle really is the key to unlocking this and understanding what has happened and where we are going. Once you realize that, you will see that it is unsustainable. Cheap money brought us here and liquidity is drying up [evaporating] – the rest is just noise. This bear is ready for hibernation.

These tax assessment values are a mirage – built on quicksand. The government has loved it as they have collected huge tax revenues rising every year for the past 5+. Well, we pragmatists know that is over. But, homeowners smiled along the way (as I did, but I knew I was hitting the eject button) thinking this was a never ending path to wealth. Nope. I am prepared to be proven wrong, but the data does not lie. The drop in sales volumes is the first step. Then sellers take their homes off the market thinking this is just seasonal and better times are ahead (spring) – a mere blip. But that is what they all think and listings drop. So, come spring they all list again, along with the normal spring sellers – supply outstrips already declining demand. This disequilibrium results in an increased pace of falling prices. This is simple economics: price on the Y axis and quantity on the X axis. The supply curve (positive slope) shifts to the right and the demand curve (negative slope) shifts to the left. The mathematical result is falling prices. This is exacerbated by higher mortgage rates, the stress test, speculation tax, school tax and all of thees wonderful affordability measures that are designed to achieve this result.

Sure, I could be wrong, but I placed my bet and this is playing out just as I had hoped. Maybe this is a “V” pattern and the rocket ship is about to take off. If so, where is the fuel? The tank is empty and the refueling trailer is likewise empty.

We secured a pet-friendly apartment in James Bay for November 1st. Hooray for purpose-built rentals that aren’t discriminatory. Will be making the drive out from Ontario at the end of October, hopefully before snowfall. I just hope Alberta plays nice.

Assuming we both settle into our new jobs, no layoffs or whatnot, we’ll assess the market and see what our approx. half mil down payment gets us next year. What kind of condo could we buy outright? What kind of SFH can we get with a mortgage that would have been considered reasonable before the mania (say, <= $300k)?

So, yes, I'd definitely consider a cute $1m James Bay house near Dallas Rd if it becomes $750k. A SFH within walking distance to Dallas Rd and Downtown is a luxury that will never again be affordable to the masses.

I spoke too soon – the floor is cracking. Little 615 Moss St dropped to $950k overnight. Original $1.024m, assessed $1.069m. Already more than 10% below assessed.

I’m a long term owner (>20 years) with no plans to buy/sell. And I think buying a SFH (and holding long term) in Victoria for your family is a great idea at any time, including now (if you can afford it).

Anyway, I’m assuming that most bears in this forum who are now renting are planning to buy a property when the price is right. So how much do prices need to fall for you to pull the trigger? If that cute $1m James Bay house with a short walk to Dallas Rd. becomes $750k are you going to keep renting or will you buy?

@guest_50053 “But surely Fairfield commands a million, no?! /s” I think the psychological floor are their assessments 1.05ish for 59 moss and similar for most of fairfield and what something went for in the spring of 2018. I think the problem with the Psychological floor and ceiling is they are easy to break both ways. On the way up all it takes is a few people cashing out of vancouver/toronto, moving money from overseas, or laundering drug money to raise prices as an extra 100k is easy to come up with. On the way down all it takes is a divorce, making an offer on that dream house up island or dream condo to get things listed and selling lower to help attract the few buyers left out there that can access mortgages and down payments. As long as the seller didn’t pay the few inflated prices in 2016/2017 they will sell at a reasonable price and still have a great ROI. I saw lots of good deals in 2016/2017 but some people including realtors think people deserve a 20% increase now that we are in 2018. Once people have made an offer on their next place and must sell their house to get their new mortgage they are basically at the whims and the mercy of who is left out there. Others carrying two mortgages are basically in the same boat with today “difficult” residential tenancy rights making renting a difficult option. Have you run the numbers on a Million $ mortgage? 5% down gives over a 5,000 mortgage, $5,390 in taxes every year. That’s a lot for a 3 bedroom 2 bath. There is a new floor coming to Fairfield, despite the 1.7M glimpses of waterfront just listed this morning.

There are now houses in good condition that are starting to show cash flow if you were to rent them out and not use a property manager (ie don’t value your time or opportunity cost and ignore depreciation/maintenance costs). Things are looking up and maybe the name calling will stop on here :).

One way to see price changes is to “heart” houses as you look at them and then search. All the price change ones will show Orange and the Red’s are those stuck on their list price until and offer comes out which could change everything.

https://www.tripadvisor.ca/LocationPhotoDirectLink-g47412-d736067-i73114458-Angel_Rock_Waterfront_Cottages-Cape_Vincent_New_York.html

More like this local and it ain’t rented. 🙂

My head is exactly where reality is.

Hmm don’t bother if I lose the existing functionality, thanks. Since I’m only interested in a small region it’s fine the way it is.

I have noticed some drops recently. It’s interesting that sellers in Fairfield seem to have a psychological floor. “Best buy in Fairfield” 59 Moss at $999,999 was taken off the market this week. There’s now 4 other SFH just under a million, but one has a suite. I’d think the others need to drop to be competitive. But surely Fairfield commands a million, no?! /s

Have a good weekend, and don’t forget to come up for air from time to time.

Nice shoes, by the way.

I will be taking the weekend off. Bears you all have fun. Let’s find as many nonsense articles as possible, maybe some price slashes and whatever else feeds your fantasy/dilusion of the big crash. Lol

Jason

Don’t live in Vancouver. Don’t know don’t care.

Wolf we get you are talking out of your ass. Lets move on.

Good old reactionary Gwac. Waiting for someone else to digest the data in a straightforward manner that he can understand. Perhaps if you put your boots on the ground and actively watched properties instead of sitting in your ivory tower you’d become enlightened before the several months elapse between the time something occurs and the time the VREB reports on it. 🙂

I Can set it up to only show price changes if you like. Not that that will tell you a lot

That was some imposter posting about the 25 percent decline in Vancouver.

Hey Gwac, in your world, has average selling price for SFH in Vancouver already corrected 25 percent from peak? Just curious.

Wolf if it’s already happened. I guess VREB numbers are wrong and yours is obviously right. 🙂

Another bear talking out of his ass. Wow you guys are really on a roll this week.

Is the list of price declines only visible to agents? I signed up for Leo’s matrix portal thing, but I can’t find a way to sort by price changes (only date listed or current price). Tedious to randomly look at listings and see if they have slashed asking.

The crash rhetoric is really heating up… I thought the unwritten rule was to never make predictions except during December 🙂

“Wise words. 20-25% correction locked”

A 10% correction is virtually locked when 2018 assessments come out in December. I’ve noticed many homes recently selling at 2017 assessed value whereas homes were selling around 10% over 2017 assessed value when 2018 assessments were made in July 2018. In December assessed values will go up but the market won’t be able to follow.

But of course this 10% decline has already occurred in the last 3 months. Another 10% doesn’t seem out of the question.

Lots of news articles after the week’s stock market declines. The grist of the gist goes like this:

** All the Nightmares for Stock Investors Start in the Bond Market and All the Nightmares for Mortgage Holders Start with the Bond Market.**

Just checked my PCS – price drop frenzy in Victoria this week – WOW. Where have all those buyers gone? Part-time job growth gains [$16 per hour], immigration at record levels and yet buyers are passing up an opportunity to bag gains of 40% to 50% in short order as someone just posted here today [as he sits on his or her wallet / purse]. The informed buyer reads, watches and listens: the credit cycle is dictating all of this and I subscribe to the view that people will make very different decisions when fully informed by knowing what took place from 2008 to 2015, and 2015 to the end of 2017. There are a number of important factors such as interest rates, foreign money flows, money laundering, stagnating wage growth (local domestic incomes do not support these prices), lack of monetary liquidity and the massive amount of new regulation aimed at moderating [deflating] this asset bubble. Too much household debt – people could not resist.

I do not see a soft-landing with this bubble, though – too many sharp objects to navigate and the Lion (Vancouver) has already succumbed. May be Victoria is so special that it will sidestep the laws of economics – yeah right, LOL – it appears to have already begun with rising listings vs sales, rising active listings and falling sales. I was a hard charging RE bull until early to mid-2017, but that was then, and this is now. 2016 was the year of out-sized euphoria. Times, they are a chang’in and it is right in front of your eyes, particularly with SFH.

Barrister:

Not according to Stats Canada.

“According to demographic projections, the proportion of seniors is expected to increase rapidly until 2031, when all the baby boomers will have reached 65. Seniors could represent between 23% and 25% of the total population in 2036.”

As a percentage of the population, senior citizens are projected to stay at a pretty stable 23-25% of the population well out to 2060s.

All data from Stats Canada:

https://www150.statcan.gc.ca/n1/pub/11-402-x/2012000/chap/seniors-aines/seniors-aines-eng.htm

“Wise words. 20-25% correction locked”

Nothing is locked except you guys being wrong for so many year.

WO Actually the point is not to make it boot strap onto an existing city since you are right that it would just be a suburb. The whole point is to develop a new stand alone community. That does mean building infrastructure, hospitals and moving some government jobs to kick start the process.

Wise words. 20-25% correction locked.

AZ

Yep sorry.

Just for clarification…

A 40% drop in core prices for SFH would take us back to the selling prices in the spring and summer of 2015.

I doubt we will see a 40% drop, but on the other hand, I would not be shocked or surprised either.

atwell seems like a puppet for wealthy people