Oct 9th Market Update

Weekly sales numbers courtesy of the VREB.

| October 2018 |

Oct

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 151 | 664 | |||

| New Listings | 232 | 979 | |||

| Active Listings | 2551 | 1905 | |||

| Sales to New Listings | 65% | 68% | |||

| Sales Projection | — | ||||

| Months of Inventory | 2.9 | ||||

The figure of 151 sales in the first week of October would indicate that sales are actually up over this week last year when we had 146 reported sales. However quite a few of those sales were sale reports carried over from September that came in on the 1st so this is more an artifact of reporting than a true reflection of the market. 50 single family houses and 35 condos went pending last week which are both down from the 66 single family and 40 condos this week last year. A few more sales will be reported this morning, putting single condos about on par and single family down some 15% from last year.

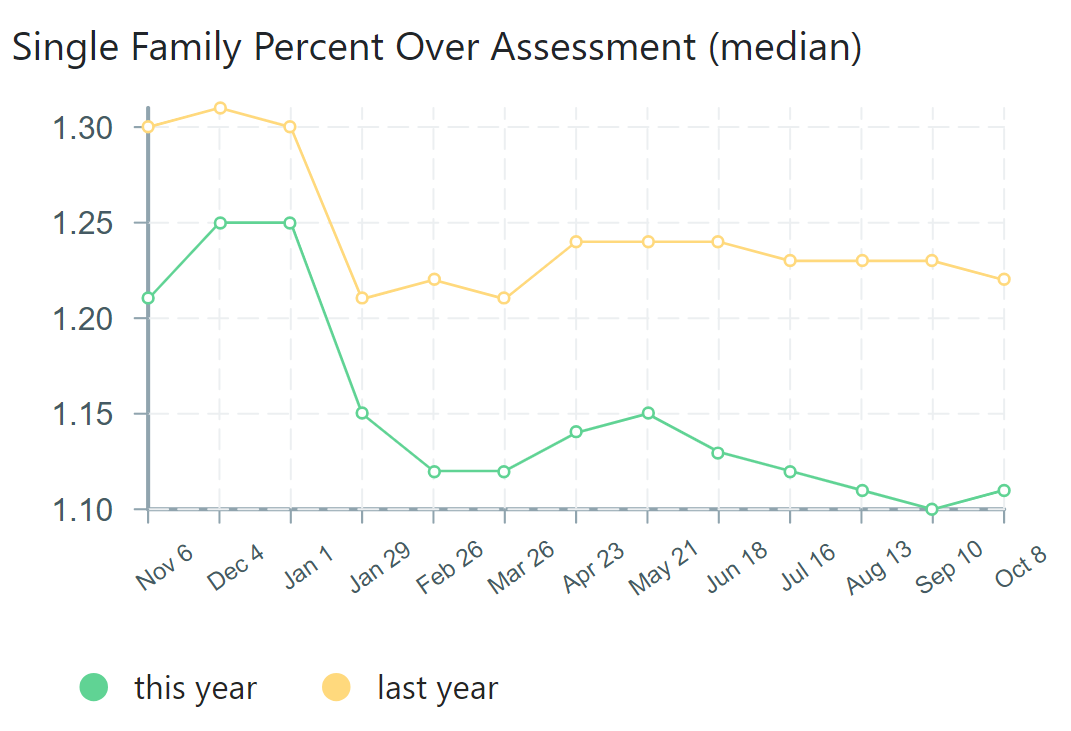

Last October sales nudged up a bit from September, which is relatively unusual and was the start of the sales being pulled forward due to the impending stress test (most of that happened in November). Sales this year should come in closer to September’s total of 533. This market is in no hurry to go anywhere at the moment. The median place is still selling for about 10% over assessment with a small uptick in September that has since settled back down.

When we compare ourselves to Vancouver, they seem to be ahead of us by about a year, with detached properties having passed through a balanced market in 2017 and now in a strong buyers market with prices declining. It makes sense that the stress test and the foreign buyers tax had a larger and more immediate effect over there, given that their prices are that much more out of whack with local incomes.

Here on the other hand we are earlier in the cooling cycle. The overall market statistics don’t tell the whole story since the detached market is significantly weaker than the condo market, but when put into context we can see we are still quite a ways off from a true buyers market like we had in the 2010s and pre-2000.

We’ve got about 3 weeks left of active market before sellers give up and try again in the spring. That might make now a time to try some offers to see what sticks. Last week there were a number of decent under list and under assessment sales accepted. Those houses were still listed over $1M but only by a bit. It’s not only the ultra-luxury market that is seeing softer pricing.

For readers in the city of Victoria interested in their council candidates’ positions on housing, there is the Victoria Council Candidates Forum on Housing on Oct 10th, 6 – 8:30pm at the Atrium at 800 Yates Street.

Overvaluation vs price declines: https://househuntvictoria.ca/2018/10/11/victoria-is-percent-overvalued

Do you know how much real wages would actually have to rise in order to sustain the current prices as they are? I guess I would wonder, at what price point would you be more certain that it wasn’t sustainable?

https://www.timescolonist.com/elections/saanich-council-candidate-profiles-and-positions-1.23455780

You’re not wrong about interest rates being correlated with other factors that are positive for real estate. Interest rates are not the cause of higher prices though.

Interest rates rise if inflation rises and/or the economy is running hot and needs to be cooled down. Both inflation and a hot economy (i.e. rising wages, low unemployment) are good for real estate.

Hard to tell whether the rising wages can counteract the rising carrying costs but I suspect in general not right now due to the high asset prices and associated high debt loads.

Goodbye Toronto, hello Winnipeg: Are Canada’s young giving up their big city dreams?

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-goodbye-toronto-hello-winnipeg-are-canadas-young-giving-up-their/

“I guess the hurdle for them is to then believe that as interest rates (inflation) rise, that real estate could rise …unfortunately they must have always heard that RE immediately falls as rates rise.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I don’t think we have to wait too long. We’ve already seen what OSFI’’s 2% increase in the qualifying rate did to the market.

That kind of increase should have sent the market soaring. Right??

Marco, is part of the discount also because a lot could go wrong before the build and the buyers of the pre-sale contract are far down on the list of creditors to get their money back. It’s a discount based on risk? Basically an RE future.

If the market goes down, the buyer has to complete as long as the project is finished on time. If the market shots up. like the last few years. the builder just slows down and the contracts are terminated.

Just Jack use to fear monger pre-sales as well.

The deposit is 100% protected by legislation; in real life practice these are your two risks to buying pre-sale.

i/ You put down a deposit in an escalading market and the developer doesn’t start construction or similar. You get your deposit back but you have lost opportunity cost.

ii/ You buy for $500,000 and two years later the market value is $450,000. Tough luck.

Developer’s delaying construction/completion on purpose is something I’ve never seen, and I would say 90% or more of the time the final product is better than anticipated.

In all the pre-sales I’ve bought over the years I’ve had nothing but positive variables play out. For example, I was told at the Promontory that my unit would come with a smaller parking spot but than they made all the parking spots the same size so I got a normal spot. I was told the unit would be 430 sq/ft and it ended up being 442 sq/ft.

At Lyra the building code changed so now my unit has an awesome full unit HRV system which is a huge plus imo, but it was never marketed.

Right now, there are no deals on pre-sales but I’ve seen as high as 15% below existing re-sale market in past years.

I can’t explain what is going on right now. Pre-sales are actually selling exceptionally well given there is not discount to market and factoring in how weak the re-sale market is.

Would like to know the details. Would the realtor verbally pass on this information or would bidders get to see all the paperwork?

This is interesting: Ontario Real Estate Association trying to bring in more open bids

“One of the suggestions includes permitting realtors to disclose details about a competing offer to another bidder, if all sides involved agree.

The group says allowing this would result in a more “transparent” multi-offer process that would give buyers more information to make their best offer, and sellers the knowledge that they have received the best offer for a property.”

Would be nice if that was standard practice, not just allowed.

https://www.cbc.ca/news/canada/toronto/orea-asks-ontario-to-revamp-realtor-rules-1.4858582

For $100k more, you can get 1049 Richmond Ave. It’s got back to back open houses scheduled. They seem pretty eager.

CE. You smoked me on that one…

So can you be a buyer without even putting in any offers?

Challenge accepted. Let’s sit and watch. 😀

Michael: Time for a ‘trivrealty pursuit’ question:

yeah Right: d) Buy what you can afford. Live in it. Sell way in the future when the need/opportunity arises. And who cares what the market is doing!

======

Two great posts.

All bears should study michaels posted chart (below) about house prices vs interest rates. Then they will realize that their idea that rising rates cause or are even correlated with falling house prices isn’t supported by the data. Then they can move on with their life by following yeah-rights advice (above).

What we understand is that you have to qualify for a mortgage based on nominal not real rates. Your monthly payment may be a lot smaller after inflation a decade or so out, but that does not make any difference to the maximum allowable debt service today.

1749 Davie listed for 850,000.

It is a wreck.

Or perhaps do what buyers are increasingly doing in Vancouver as well as here, which is not even offering to begin with…

Maybe if Mike grasped that the 65% affordability rates are not at the bottom, they already surpassed the 2008 US housing crash levels and zeroing in on 1981 levels .

Inflation will crash the market this time not pump it higher when fewer buyers can qualify the stress tests with every quarter point hike.

This is a whole new ball game based on a decade of an experiment of massive debt bombs that didn’t exist in previous cycles. You can’t go to the moon with a ball and chain around your ankles Mike. You have it ass backwards. The cycle is ending not starting.

thanks , i am aware, in the end .. its a win for me if they accepted my offer of 100 below assessment with conditions .. if not it is not big deal ..

you should think of it in the shoes of the buyers… when it is a seller market, buyers get discouraged and depressed when every one out bid you .. you don’t get insulted because you under bid

.. why should you care if sellers get insulted? .. its your money ..tables have turned .. market slowing down .. make a low bid offer and see what happens .. I rather have the seller insulted and possibly save 100k on my purchase .. if you dont get the house .. wait for something else to come up

i am not rich enough to care about others feelings

Quit acting like an egomaniac. If you want to put in a lowball to see if the seller is prepared to negotiate, they will counter, otherwise don’t waste anyone’s time. You’re not buying a car on usedvic after all!! Remember a buyer can have a black mark against them just like a home can. A little humility goes a long ways in a crumbling market.

Hey Leo

Would you be able to determine a MOI for the Uplands over time?

Leading indicator in the Vancouver market was West Vans high MOI in 2017. Wondering if there is a comparator for Victoria.

This is probably a case of academic training running against practical reality. Unfortunately, it’s a particular issue in the economics field. If inflation is spiking, why are major global housing markets dropping almost in unison? Shouldn’t people flock to it?

I think people understand that you can use RE to hedge inflation. The early 80’s was a picture perfect example. I think the point you continue to miss, at least as long as I’ve seen you post, is the historically unprecedented levels of debt we are seeing among consumers in Canada, corporations in the US, and globally. People here no longer have the borrowing capacity at current prices to turn the ship back, making it less likely that inflation will drive Canadians en masse to RE. That’s already happened. It will happen again at some point, but were not in that part of the cycle, and may not be again for years.

So I think you’re making a dicey and simplistic academic extrapolation from history, when there isn’t really a precedent to underpin it to. Central banks have never done this before; the world has never seen this much debt before.

And for the love of all things good, don’t come back with, “no problem, just inflate the debt away”. If that worked, and it doesn’t – excess debt would become meaningless. You could do anything and it would always be resolvable by firing up the printing press. Problem with making the debt meaningless, is that it tends to do the same to the currency itself.

We’re not getting out of this, Michael. It’s only a question of how significant this is going to be.

Because inflation rates shot up this week?

@Ian

That’s fine good sir. I was using the direct 5-yr yields, while you were using discounted mtg rates.

I’m simply trying to enlighten people to something they already know. Most people know that interest rates rise due to inflation, and that real estate loves inflation. I guess the hurdle for them is to then believe that as interest rates (inflation) rise, that real estate could rise …unfortunately they must have always heard that RE immediately falls as rates rise. I’m simply trying to show there’s more to it than that. Maybe if everyone understood real interest rates better it would make more sense.

Btw, I should point out that stocks in general don’t like inflation, as some are witnessing this week.

100% agree. I am a long time fan of the TV show “This Old House”, so I understand the great feeling of polishing wood.

Yup. The debate between a Home vs a House, the pound of ownership. I got lucky purchased couple our homes from estates sales, they are dated but feel like a home. Great prices too imo, since their kids wanted to cash out asap.

Careful. If they accept the offer you are on the hook depending on conditions. Better be prepared to buy at the price you offered. Consult a lawyer.

Sellers are human. They can certainly be insulted by an offer and refuse to consider further offers.

The chance of this depends greatly on market conditions. Sellers can well afford not to deal with certain buyers in a sellers or balanced market because there are enough other buyers out there that will make offers. If nothing is moving and someone needs to sell, they tend to become less sensitive to having their feelings hurt.

I remember when we bought our house during the offer back and forth the seller’s realtor responded to one of my emails asking about the nature of work that was done on a renovation and his email had some of the seller’s responses in the history where they had written him a response questioning our seriousness as buyers. Not removing the sellers’ communication from his email could have been a mistake on the realtors part, or a negotiating tactic to piss us off and get us to commit. Either way they were insulted by me questioning the quality of the renovation (which was done without permits) but we ended up making a deal because there were no other buyers out there.

Depends. Anecdotal here but in 2006 when I was trying to sell my house in the U.S. a super lowball offer came in ($250k low). It was quite insulting to me. The realtor asked why I didn’t counter-offer and I responded that when they wanted to come up at least $100k to start, I would consider entering into a conversation. A few weeks later, same family and same lowball and my response was basically crickets. I told my realtor I wasn’t interested if they weren’t serious. They kept coming back and not going up a single penny. Tried the boohoo! I can’t afford anything more. My kids love your house. What an opportunity for you (meaning me) to feel good about a fine family moving in. In the end, I found my own buyers and they are a fine family and we came to a mutually agreed upon price that was not insulting. So don’t be surprised if the lowball doesn’t work out.

I think your best opportunity for a lowball to work is when the party is not “invested” in the property. We renovated the house from top to bottom and loved living in it. So yeah…. easily insulted. I think estate sales may be a better route where the owner is not actively part of the sale process.

US mortgage rates hit 7 year high today. Markets down again. Its time for sellers to get back in the real world and buyers to start low balling.

I had someone do something like this on a dresser from university that I was selling for $30 (which got sold for $30 and picked up within 3 hours of me posting it). I still email them from time to time…

Plumwine: Actually not nearly big enough to be a mansion. Not concerned with getting top dollar just hoping that some developer does not buy it who has horrible luck with his properties burning down. On the other hand there does not seem to be a lot of interest in preserving these old houses in Victoria.

The house was never bought as an investment and I just dont see it that way. Trust me that restoring an old house like this is a grand way to lose money but I dont regret it for a minute.

Interest Rates Are Rising for All the Right Reasons

“The cost to borrow money is on the rise. That is bad news for home buyers and other prospective borrowers. ”

It’s not bad news for home buyers. It’s bad news for sellers and others who already own.

Haha, savage!

Ppl do this all the time on craigslist. Sent out multiple super low-ball offers from multiple email accounts, then a low-ballish offer from their real email. I ran into this when selling my pickup few years ago.

3170 Beach Dr sold @ $2,860,000 between its asking and assessed, DOM 7(!)

It “only” has 4 bd, 4baths. With this sale, I am sure you can still ask for top dollar for your mansion.

No this is extremely rare. There was the case in New West of the builder demanding more money, but the vast majority will complete regardless of the market.

Michael,

According to ratehub.ca, the 5 year discounted mortgage rate peaked at 5.89% in Dec 2007, and bottomed at 2.09% in Oct 2016. House prices went up.

From Oct 2016, it has risen to 3.14% on the chart (and higher lately). House prices went down.

Sorry for ruining the fantasy.

@guest_50372

d) Buy what you can afford. Live in it. Sell way in the future when the need/opportunity arises. And who cares what the market is doing!

I might be missing something but the presale condo contract referred to by Snapginger, seems completely unfair. It is heads I win. tails you lose.

If the market goes down, the buyer has to complete as long as the project is finished on time. If the market shots up. like the last few years. the builder just slows down and the contracts are terminated.

Maybe I am missing something but if this is typical of condo contracts then no one should be signing this type of contract. If the buyer had used a lawyer I have to wonder if there is a possible negligence claim here if the client was not clearly warned of how bad a contract this actually represents.

Time for a ‘trivrealty pursuit’ question:

Referring to the chart below, is it best to…

a) buy when rates are low & prices low?

b) sell when rates are high & prices high?

c) both a) & b)

Patrick,

All that matters is what the banks charge you today , the chart trend, as well as BOC and Fed comments, which is rates are going up for another year at least. A down day or two here and there is not a trend. Keep spinning.

@snapdginger great article to help people to consider when looking at developments, avoid all but most reputable/longest in business builders as we come to the end of the credit cycle.

@guest_50366 do you have another guide other than assessed values to be making the offers?

I’m thinking of making an offer on some homes outside of the Victoria/Oak Bay at well over assessed but well under ask. One concern I have is there is some talk of prices in West Vancouver selling at 2015 levels but in Victoria, there is still quite a bit of demand and well built and maintained homes are selling. Some of the best deals seem to come up after offers collapse.

A good little look at what can happen with a condo project re pre-sales.: http://www.mondaq.com/canada/x/695444/real+estate/The+Perils+of+PreSale+Condo+Contracts

Of note there were more pre-sales than units. Also like you said patriotz, the ones done properly had their money in a trust, but did lose out on the units as the receiver’s obligation was to maximize return regardless of contracts made by the developer.

No. Pre-sale deposits are put in trust and are separate from any assets of the developer. If the project doesn’t complete, the buyers get them back.

Pre-sales should sell for a discount simply because of uncertainty about prices and interest rates upon completion. Remember pre-sales are unconditional and the buyer is legally required to complete even if they can’t get financing.

too late for the first time buyers .. like an aging population … more out flows than inflows… if this keeps up . all you have is old or rich people trading with rich and dying people

going to quote some other great minds on this site .. dont remember who

“sellers don’t get insulted .. they just get depressed about price offered ”

it is time to low ball.. going to get my family to put a 100k below assesment offer .. then if they dont want it . i put a 150k below assessment .. destroy their morale.. got nothing to lose .. i have time

Do sellers really have their feeling hurt on “insulting” offer??

( or it is a myth like those “love letters” to seller may help.)

Anyone here remember Oct. 19, 1987….?

No worries. It’s been puzzling. I’ve had two posters saying that the commentary surrounding rising bond rates is not based on reality, yet that’s exactly what bonds are doing. Guess it depends on how you look at it (such as choosing to look at daily stats rather than trends) but even then, it’s tough to argue that they’re on a falling or stagnant trajectory. The markets certainly don’t seem to think so – and it really is something that effects us whether we have mortgages or not.

CE, you do have an air for comedy, don’t you. It does make me laugh sometimes.

10 year bond at levels unheard of since the dark days of 2014. Winter is coming. Housing bulls get ready to burn your furniture for heat. If you take on a couple of extra jobs, rent your crawlspace to gwac’s family, and sell one or two kidneys you MAY just be able to keep making payments on that big ol’ mortage looming over your head.

Yeah with gwac’s example of monthly payments being the same, the person paying a lower price at a higher rate is always better off.

I wrote about this in detail here: https://househuntvictoria.ca/2017/02/16/equal-affordability-but-some-affordability-is-more-equal-than-others/

@ Local Fool

Nice charts, thanks for posting.

“People… are happy to see interest rates rise. I am sure there is logic”

I’d rather pay for a home with less principal and more interest than more principal and less interest. Near zero interest rates only have one way to go in the future. Sucks to be the guy with higher principal at near zero interest rates, only to see the rates rise and their home value decrease. I’d be happy to see interest rates at 5-7%.

Back then the discussion was about HPM. Hot Parrot Money

https://books.google.ca/books?id=IlIEAAAAMBAJ&pg=PA13&lpg=PA13&dq=&redir_esc=y#v=onepage&q&f=false

That’s exactly what it is. That is also why you don’t see discounts off resale in rising markets. You can essentially buy a condo 2 years from now at today’s prices. If you expect prices to go up in that period it makes sense. In a flat or declining market developers need to offer discounts to compensate for the risk (one of which is prices declining significantly in the mean time).

Developers only scale back if they can’t sell the thing. If it was viable in 2016 then it sure as heck is viable in 2018 with prices up by a third. Would have to be a huge decline for them to decide that it is no longer viable.

Rentals for sure impact the market only indirectly, but pre-sales means either that buyer won’t buy a resale or that buyer will sell their existing property once they complete. Either way there is still impact from increased completions.

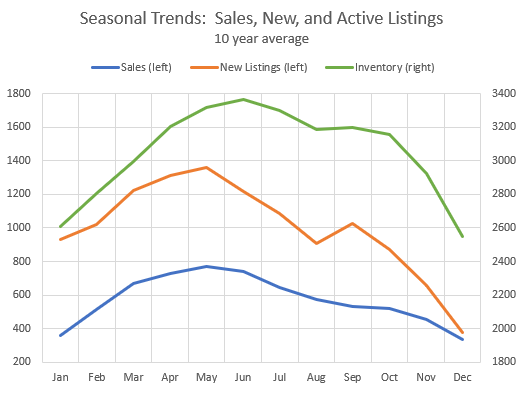

Also consider how much inventory it takes to go from a sellers market to a buyers market. Extreme sellers market is about 400 condos on the market. Buyers market with prices declining like 2010-2012 was 1000-1200 active listings.

So add a mere 500 units to current levels and you are back there.

Sure there’s a lag, but it’s not like developers waited until 2016 to start thinking about building.

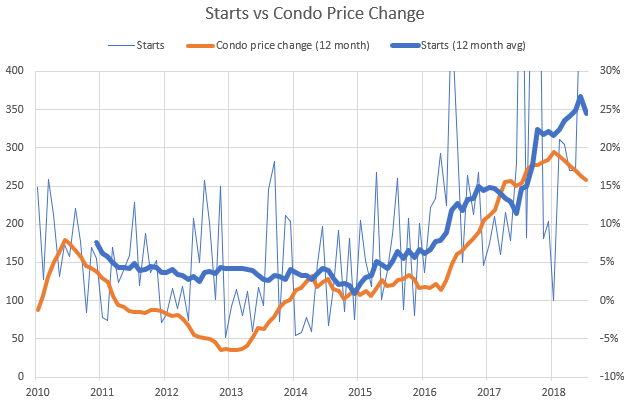

Condo prices stopped declining start of 2014. One year later construction started trending up (early 2015). Starts really exploded up in 2016 along with prices

Leo, why didn’t you approve my comment?

Somebody is getting coal for xmas

Marco “I think the point I was trying to make is in a normal market you have to offer significant discounts on pre-sales to get people to buy as the average person can’t plan 2 years in advance. That being said there are smarter than average owner-occupiers that do plan 2 years in advance and buy pre-sale at a discount.”

————————-

Marco, is part of the discount also because a lot could go wrong before the build and the buyers of the pre-sale contract are far down on the list of creditors to get their money back. It’s a discount based on risk? Basically an RE future.

@Barrister Nice property and looking home on Regents Place listed today for 220k over assessment, looks like your neighborhood. One nice feature the realtor highlights are perimeter drains replaced in 93, which must account for a little bit of that valuation 🙂 . Beautiful looking trees and yard.

Meanwhile several price drops on larger homes we have been interested in, most in the 50-100k range on the heals of previous drops. One sad flip keeps falling partly because they have no record of the asbestos removal they found during the reno. Interesting how many flips/spec builds are sitting for months or even years in the 1-1.6 range. We’ve watched some homes come down $250k.

Going to view a house that has a 48 clause conditional offer, tomorrow. Not sure I understand the ins and outs but conditions might be a good blog topic. Now that the madness is gone from the market what clauses are good and unnecessary these days to buy a home and try to not get caught with two homes in a dropping market.

Thanks for shutting that down @Leo S

))) hawk: 5 year rates just went up almost half a point.

I’m talking about today Hawk. In sync with the stock market fall, 10 year Canada bond yields fell and so did the 5 year https://ca.investing.com/rates-bonds/canada-5-year-bond-yield

US 5 year yield fell as well https://www.cnbc.com/quotes/?symbol=US5Y

This doesn’t fit your “interest rates are going up,up,up” theory.

Forest versus trees. I implied it was bonds that made the market puke, and IMO, that’s exactly what’s happened. Canadian bond yields are actually on a sharp trajectory upwards, all you have to do is zoom out just a little. Here, have a look.

https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

The US Bonds are doing much the same thing. By rebutting me with daily Canadian indicators, you miss the point. And what is that?

One of the principles I mentioned earlier is that of momentum, or an overall trajectory of something. For bonds in the US and Canada, that is upwards. Distinctly. It has been for a while. Mortgage rates have actually gone up several times in Canada due to rising bond yields, irrespective of the Bank of Canada. And that trajectory continues, and now it’s pushing the point where world markets are starting to actually notice.

Discounting what’s going in the US seems to imply no degree of interconnectedness, which experience clearly demonstrates to date that this is not the case. Where the US hikes, Canada doth follow. And we already are. We may not go up at the same pace, but like some people on here with their views, they eventually come along, quietly – or kicking and screaming.

ICYMI Patrick, 5 year rates just went up almost half a point. US bond market determines Canadian 5 years. Mortgage rates are heading up no matter how hard you spin it and won’t be going down in any meaningful way for a very long time.

“BMO hikes 5 year fixed rate from 3.59 to 3.99%.

So the #OSFIB20 qualifying rate would be 3.99%+2% or 5.99%?

Yep.”

))j bonds, bonds, bonds

======

Canadian bond yields fell today as expected. 10 year yield down 4 basis points to 2.54%

https://www.bloomberg.com/quote/GCAN10YR:IND

A falling stock market will likely make Canadian interest rates fall further, keeping mortgage rates low, and hurting the housing-bears that are fully invested in stocks.

Great post LF. The one point of the 81 crash that gets missed is the valuations back then practically doubled within 2 years. This time around it’s been a very long time to pile on the passengers and throw in tons of easy HELOC and credit card debt that wasn’t possible back then. Less people were able to get on the train because prices rose so fast along with rates. The potential for major damage this time is of the multiples.

Throwing out complicated mensa theories is all bullshit. Debt is debt and it has to be eventually be paid back one way or the other.

No matter how smart you are you can’t buy something at a discount if someone else is willing to pay more than you. So I don’t think “smarter than average” helps much.

Not really true. The CoV does not care about overbuilding.

I didn’t mean it in a literal sense. The issue with the multi-year process is when the market is hot you can’t obtain paperwork to get going quickly on a project, so you don’t get a massive influx of starts in super hot markets like 2016. By the time some developments get their paperwork in place the market has started to soften so either the project is delayed or scaled back. Bayview Tower 4, Northern Junk, etc, will all re-valuate the construction starts once they finally have the paperwork in place.

We could have a glut of condo inventory from re-sales, but there just isn’t that much under construction product as one would think given all the construction. Reason being a huge chunk is rentals and huge chunk is already spoken for in terms of sold pre-sales.

I must have misremembered, Marko. I recall you saying people don’t like condo pre-sales because they don’t want to plan 2 years in advance. I must have translated that as “most pre-sales aren’t owner-occupiers” but maybe your point was that re-sales are more common than pre-sales.

I think the point I was trying to make is in a normal market you have to offer significant discounts on pre-sales to get people to buy as the average person can’t plan 2 years in advance. That being said there are smarter than average owner-occupiers that do plan 2 years in advance and buy pre-sale at a discount.

Bonds, bonds…bonds…

That’s what’s governed markets and their cycles for about the last 5,000 years. It’s also why affordability is never constant. It’s always trending with an overall momentum: improving, or deteriorating. Markets don’t flat-line unless they’re at zero. Even if pricing appears flat, there are always variables occurring the background which are shifting and altering that affordability. So if rates are rising, then yes prices will eventually move – but that’s distinct from affordability changes.

Right now we have RBC, several other agencies, and people here, that believe that:

Ya, no.

We have seen empirically in the Victoria market: It responds readily each and every time to unaffordability, by way of greater affordability. It’s a perfect example of the saying, “The solution to unaffordable housing prices is unaffordable housing prices.” Then people take advantage of it – and it becomes unaffordable again.

Crash or otherwise, affordability here is going to be improving one way or another. You can’t will it away, you can’t Totoro it away, you can’t (especially now) borrow it away, you can’t mock it away. It’s perfectly obvious to anyone paying attention that the data is piling up in one consistent direction. It shouldn’t be news, as it’s been seen countless times in countless other jurisdictions over time. Most of them though, didn’t take it as far as we have.

DOW down 831, TSX 336. Nothing to ignore. Will we get follow thru tomorrow or the plunge protection team step in ? We shall see.

Bottom line is it was a major warning shot across the bow that the market topping process is in motion and may well take til spring or next fall to totally play out… or maybe by Christmas. Will be interesting to see how fast this plays out either way.

Being a VREB member I can understand Leo`s need to keep this as tame as possible….I have no issue with your warning Leo and so not to get temped best I just stay away….:) as of now..:)

So either they will sell their current places, meaning more available inventory, or they’ll rent out their current places, main more available rentals, either way, more supply is more supply.

fixed that for you.

Careful Introvert. You might miss hanging out with us lower life forms 😉

Continuing the theme of ignoring variation, I see that you’ve conveniently decided to lump my posts in with gwac’s.

Signals only, please. Noise will not be tolerated today. Every day prior to today it was, but today is different.

Signals only. And the more anodyne the signal, the better. Thank you for your cooperation.

Ok I will penalize myself for a week. Sorry Leo…

Not just you, a number of deletions this morning. gwac fair warning on contentless mocking too. That’s just noise.

On a side note. Photos and videos from Florida look horrible. Hope life loss is minimal and daily life can recover quickly.

Hawk I am confused

Your realistic view missed a 40% increase….I guess I am confused what realism is…Must google. “Disco hawk realism” and see what pops up…

Wrong. Spring is spring, everywhere in Canada. There isn’t much disparity.

We ask that you please refrain from speculating on, discussing, or examining any variations that may exist, lest we offend and potentially repel present or future readers, customers, or advertisers. Thank you.

James

Or sales slow and prices stabilize and do SFA for a few years until affordability increase.

Been there done that many times….

My world is bright and prosperous gwac, unlike your sickness to attack anyone with a realistic view of a massively over valued market. AKA denial. That’s what’s very sad.

DOW kissing 600 down, TSX looking at 300 down ICYMI. Nice to see the pot stocks green today. 😉

Hawk your world is a dark place Very Sad….When`s lawn bowling season start. That should perk you up.

That’s kind of the point Gwac.

When it’s less affordable, prices go down.

Disco sucks gwac, just like your perception of life and how the markets work. Failed economic policies by giving out free money for a decade is going to come to a very nasty ending. It’s not my wish, it’s the right wing powers to be you love so much that paved this road to disaster.

Relative to the rest of Canada – January through May.

Late January is when flowers start poking up and is equivalent to late April in Edmonton

Lol Hawk survive what yet another of your end is near post….I have seen about 500 of these over the years. I seemed to have survive those so I expect the latest will just be another yawn….

You really like the 80`s eh….. life not been so good since than???

Disco Hawk……

Thanks for censoring my post, boss.

You’ll survive dasmo… gwac I don’t know about.

This hasn’t even begun to hit the brain of the average joe yet. Most are still in denial like yourself.

DOW down 500 points, TSX 249 and breaking major support lines. I’d say there is some major fear out there in the money/lending markets.

No, I was practicing my Captain Kirk impression.

Local you make me laugh. I see you in a dark room in the corner. Repeating “its going to crash its going to crash. I am sure of it, I am sure of it. Hawk told me”

So if a recession is looming will the string pullers just let it go? As the article states, spending is going to drop, jobs will be lost etc etc. I don’t think we are over the financial crisis impact yet personally. I think this is a much longer process of edging rates up and then bringing them back down then back up. It feels like we are cresting up from a bottom but if history repeats itself it will take a few decades to get back up to “the norm”. Just pray history doesn’t repeat itself into the 80’s…..

Housing. Markets. Aren’t. Stock. Markets. They. Do. Not. Work. At. The. Same. Speed.

E.V.E.R.

td calculator

For those of you who like higher rates

700k mortgage 2.5 is 3344

600k mortgage 4% is 3341

both 25 years….so be careful what you wish for.

this increase so far has had no impact on home prices on the benchmark

I am not sure the exact calculation but about 15% fall in prices to be whole.

))) Folks, this is why we care what the US and Canadian bond market is doing – which is going up, up and up.

====

If you care what the Canadian bond market is doing, you should be aware of what it is actually doing – and yields are not “up,up and up”.

The Canadian 10 year bond yield is up a whopping 0.5% YTD. Started year at 2.1% and is now 2.6%. https://www.bloomberg.com/quote/GCAN10YR:IND

Nationally there is enough data that you can do YoY comparisons with one month of data.

I have no problem with that.

Makes no sense on a city level as small as Victoria.

People who own homes are happy to see everyone else priced out. I am sure there is logic in that but hey whatever turns your crank.

Hey LeoS. A few other outlets seem to be picking up the housing start data from CMHC’s report. BD wrote a whole piece on it this morning, for better or for worse. Nationally, it looks like a downward trend, as does Vancouver. Toronto appears to be flat. Interesting, the charts go up and down throughout the year. Maybe the series is too zoomed in to see a broader pattern of cyclicality. It does make me wonder what can be gleaned from it, but BD finds it interesting nonetheless.

https://betterdwelling.com/canadian-real-estate-starts-fall-to-nearly-a-2-year-low-heres-why-you-care/

Agreed Triple A. No more on this perverse argument please.

There are many parts of Canada where living is a grind. People work hard and deal with climate extremes we’re fortunate enough to be insulated from.

I’m not going to preach to adults and tell them what is permissible on this website. But those comments on comparing losses of life whether rooted in perception, reality, sarcasm have no place here for me.

I have so much sympathy for the Virk family having to return to the courts year after year and relive the pain of a lost love one. It will take generations within that family to truly heal and move on and forget an event that was beyond their control. If Victoria is lacking anything it’s a sense of community and inclusiveness.

At times this is a Disneyland version of the UK.

We embody the worst parts of British society without realizing how GOOD we ALL have it here. I’m choosing to not read this blog for a week because I’m sick to my stomach this AM.

Just like it’s absolutely not a coincidence that Rena Virk was murdered here in Victoria?

Triple A Rated:

I think you are right to be concerned about the future value of these larger homes. I bought at the end of 2013 and I honestly thought it was overpriced back then. Actually, I have no idea where all the buyers came from in the last five years other than Vancouver.

On the other hand, at least in Rockland, there are actually very few larger historical houses that remain single family. Most have been converted into apartment rentals or condos. A few others are B and B’s. One day i should do a count, there might be twenty or even as few as ten. Of coarse you are also competing with Uplands.

If you are on this site long enough then you realize that trying to predict the long term market is next to impossible. But I think that there is more reason to be concerned than a few years ago.

I don’t think anyone knows whether there is overbuilding in the first place until after the fact, i.e. a price decline. Population growth is a guess and it doesn’t correlate well with demand anyway (I mean demand as in how many people are willing to buy for how much).

People who don’t own homes and want to are happy to see interest rates rise. I am sure there is logic in that but hey whatever turns your crank.

“BMO hikes 5 year fixed rate from 3.59 to 3.99%.

So the #OSFIB20 qualifying rate would be 3.99%+2% or 5.99%?

Yep.”

Thanks Andy, the credit squeeze is in full motion. Markets not liking rising rates, and even Trump is having a meltdown. 😉

Not really true. The CoV does not care about overbuilding. Yes it takes a while to rezone and develop. However despite that construction is going at full tilt so that is not the impediment to building much more.

I believe it was partially because of the financial crisis that we didn’t get as much overbuilding last time. Just at the peak of construction enthusiasm the crisis hit and starts went to literally zero for 9 months and cancelled projects. Even with that we had a lot of condo inventory and the condo market declined more and stayed flat longer than the detached market

My understanding is TD is following suit, which will probably mean the rest of them will soon follow.

Folks, this is why we care what the US and Canadian bond market is doing – which is going up, up and up.

Re: impending condo flip apocalypse has been cancelled

I must have misremembered, Marko. I recall you saying people don’t like condo pre-sales because they don’t want to plan 2 years in advance. I must have translated that as “most pre-sales aren’t owner-occupiers” but maybe your point was that re-sales are more common than pre-sales.

Hawk, this one’s for you…

“BMO hikes 5 year fixed rate from 3.59 to 3.99%.

So the #OSFIB20 qualifying rate would be 3.99%+2% or 5.99%?

Yep.”

https://twitter.com/SteveSaretsky/status/1049790215609507843

Check this out, it’s laid out really well – months of inventory in condo & SFH’s in Van, including various price points:

https://twitter.com/SteveSaretsky/status/1049833648365551616

And more details here:

https://vancitycondoguide.com/months-of-inventory-steadily-climbing-in-vancouver/

I believe Marko has said the vast majority of condo pre-sales are from investors, so we should expect to see a fair number of flips on completion. I wonder how many units will be finished in the next 6-9 months. I’d think that’s a risk to the detached market – would make condos more attractive to first time buyers, and widen the price gap for those wanting to move up.

There just aren’t that many completions and not sure when I said vast majority were investors. Quite the opposite.

Encore is sold out and for the most part owner-occupiers. There might be a few units that come to market because of the spec tax, but won’t be a ton.

Lyra phase 1 is only 39 units and probably 95% owner-occupiers and local. Other than myself I would be highly surprised if anyone tried a flip.

Jukebox might have some flips but it is also the least risk for investors as the units are super small and will be close to cash flow neutral.

Overall, I think the risk from the new builds is very minimal. The real risk is demand drops off the cliff and the market is flooded with re-sale units.

The COV doesn’t allow overbuilding. Takes years to re-zone and getting anything done so it keeps new build supply in check.

I believe it is a generational thing.

It is also a cultural thing in North America. Two car garage, yard, play room, dog, cat, boat, etc.

Really need to wait until spring

If there isn’t a correction in the spring we are in for a 4-5 year flat period imo.

From a real estate perspective: Mar, April, May, perhaps June

https://househuntvictoria.ca/2018/07/27/the-season-for-seasonality/

I couldn’t care less what you think of me, Soper.

Yeah, the people aren’t that great in Saskatchewan.

It’s not just -40 degree weather that makes Regina a shithole; it’s also the off-the-charts number of racists living there. The things I’ve heard over the years in quotidian conversation is nothing short of appalling.

It’s absolutely not a coincidence that Colten Bushie was murdered in Saskatchewan.

Pardon my ignorance but what month is considered ‘spring’ in Victoria?

You stand by your idea of what is a shithole, and i’ll stand by mine.

Starts might be declining, but you would need to look at the longer term trend. Starts in September were pretty low, but would want to see a couple more months of that and the 12 month average decline to really call it a trend.

I’ve been to Regina conservatively eight times, and at least once in each season.

It’s a confirmed shithole.

And some people enjoy eating SPAM.

Thanks for the correction. Won’t be using that metric, at least from them, again. Boooo Bloomberg.

Very little happens in November, December, and January. There isn’t really enough volume to push the market far in either direction. Also not enough new listings to bring up inventory (it drops in November and December quite steeply).

Really need to wait until spring to see the buying mood and see how much of the new inventory that always piles on is absorbed.

Classic case of confusing noise for signal. I expect better from Bloomberg.

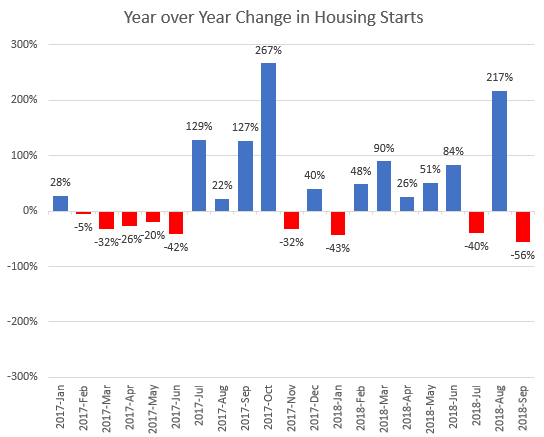

Here is the change in housing starts in Victoria

The great thing about noise is you can write a new hyperbolic headline every month.

July 2018: Starts decline steeply, down 40% in Victoria!

August 2018: Housing starts explode, up 217% in Victoria!

September 2018: The end is nigh, starts down 56%.

OSFI taking new measures to address equity-based mortgage loans

A federal regulator says it will have to take further action to address mortgage approvals by Canadian banks that still depend too much on the amount of equity in a home, and not enough on whether loans can actually be paid back

According to OSFI’s October newsletter, the tweaks were needed after the regulator identified possible trouble spots caused by high levels of household debt and “imbalances” in some real estate markets that could have added more risk for banks.

“Although reduced, there continues to be evidence of mortgage approvals that over rely on the equity in the property (at the expense of assessing the borrower’s ability to repay the loan),” the newsletter said. “OSFI will be taking steps to ensure this sort of equity lending ceases.”

https://business.financialpost.com/personal-finance/mortgages-real-estate/osfi-to-take-new-measures-to-address-equity-based-mortgage-loans

“Are you sure that’s a generational difference, and not just an age issue? Millenials now love car sharing, basement suites, and city living. But maybe they won’t in their 40s and 50s when they have a house full of kids that need to be driven around.”

Good question, yes it is generational as people in there 40’s, 50’s, and older, cars and houses represent something different to them. Where as younger generations those things(even with a household full of kids) isn’t as important and other things I mentioned in the previous post. Now I’m not saying there are people rushing out to raise a family in apartment but townhouses are the new SFH.

Ya Intro, that was a pretty ignorant thing to say. Canada has a lot of beautiful cities and great people, at least in my experience. Funny, Mrs. Fool’s mom lives in rural Saskatchewan and loves it. And guess where she moved from? 😀

Frankly, the only shithole is you. I doubt this is the last time I’ll tell you to shove your holy-than-thou attitude. I sincerely doubt that you’ve ever spent enough time in Regina to even begin forming an actual opinion of the place.

Is true that if you split the segment small enough you get into some nicely high incomes. As far as statscan splits it, the highest income segment is “Couple economic families with children in 2015”. They have a median income of $118,293. There’s only 36,000 of them though.

Regina, like most Canadian cities, is a shithole. Only jobs and/or inertia keeps people living in Regina.

I agree wo but in the case of Fairfield we aren’t building the neighbourhood, it it’s built. But as far as new builds go I came to the same conclusion. I was going to build in Fairfield and eventually designed a side by side duplex. (Life changed so didn’t proceed) My lot worked for it though. Most lots would not.

))) For millennials and GenX’ers those things have much less value. Being close to the city centre, being in a vibrant neighbourhood and less maintenance are important.

Also she could understand why anyone wouldn’t want a car as to her it represents independence, and freedom

======

Are you sure that’s a generational difference, and not just an age issue? Millenials now love car sharing, basement suites, and city living. But maybe they won’t in their 40s and 50s when they have a house full of kids that need to be driven around.

I think I found out why there is such a divide between the gental densification movement and the protect the neighbourhood voice. I believe it is a generational thing. I was talking to my mother in-law on the weekend and she couldn’t understand why someone would buy a townhouse or a condo. She wanted “dirt” and a backyard to maintain and garden. She grew up and bought when prices were reasonable and for her that was important. For millennials and GenX’ers those things have much less value. Being close to the city centre, being in a vibrant neighbourhood and less maintenance are important.

Also she could understand why anyone wouldn’t want a car as to her it represents independence, and freedom. For the younger generation they view the costs(environmental, health(lack of exercise), and monetary(on average they cost $10,000/year)) for a car too high and are moving away from owning one. Instead they would prefer to be close to things so they don’t have to own one.

@Hawk “I have to laugh at gwac’s passionate caring for the homeowner but never the persons/families priced out of a bubble market”

Couldn’t agree more. In 2016/17 when the market was racing upwards gwac posted ad nauseam that “not everyone gets a single family home” and that prospective buyers should shut their mouths and work harder. Now all of a sudden he’s grown a conscience- when it really should still be: not everyone gets a single family home(s). It works both ways. If one finds themselves impacted, I’d recommend working harder.

I have to say I’m growing to dislike suites. It’s a shortcut to density but I’m worried it’s a bit insidious. They’ve pushed up the prices of SFHs, so you now need to be a landlord if you want to own in certain neighbourhoods and not belong to a strata. I’m also concerned about the potential to stratify people into the owner-landlord class and the basement dweller class as time goes on.

If each “S”FH with a owner-occupier unit and a rental unit was instead two semi-detached units, there would be 2 ownership opportunities and they would each be more affordable than the 1 SFH w/ suite ownership opportunity. They could also be rentals if investors bought them, but pricier than a basement for sure. The other problem of course being that you’d have to tear down the SFH, divide the lot, and replace with a duplex (semis). Building row units on wide lots would help offset the high land cost somewhat.

I’m worried we’re going to regret making these neighbourhoods where there’s a literal under(ground) class and an upper(ground) class like some sort of Downton Abbey district. As time goes on, these centrally located SFHs will get more expensive and eventually only be 1%ers owning them and playing landlord (short term corrections notwithstanding).

I reply in 1 hour or it’s free.

Oh wait…

Thanks Leo! Reply in under 15 minutes with a graph. Nice.

About half of the units under construction are rentals, so they won’t affect the resale condo market directly. However they would affect it indirectly by relieving the pressure on the rental market. Uncertainty in the rental market due to private landlords evicting to sell can push people to buy.

The other half that are condos are mostly pre-sold, but there is a lot of debate as to how many of those presales are to actual buyers, and how many are to people that hope to flip them on completion or before. https://www.theglobeandmail.com/real-estate/vancouver/vancouvers-presale-condo-market-reaches-fever-pitch/article34771425/

In general I believe the condo sector tends to overbuild so although we currently are still at low inventory levels eventually we will see a glut of condo inventory that will depress the market longer than the single family side where we don’t have that elasticity.

Completions lag starts by 1-2 years so you can look at the starts and figure out roughly when we are going to see the legs up on completions.

Without going through completions by project, it is clear that we have another major leg up in completions coming up soon, likely in the next couple months.

Leo, any thoughts on if/when we’ll see a flood of listings from the record number of condos under construction?

I believe Marko has said the vast majority of condo pre-sales are from investors, so we should expect to see a fair number of flips on completion. I wonder how many units will be finished in the next 6-9 months. I’d think that’s a risk to the detached market – would make condos more attractive to first time buyers, and widen the price gap for those wanting to move up.

Also Leo you should totally run for council. Save the mayoral run for after a couple terms.

Apparently there are halibuts.

Regina is doing lousy right now.

I’m not just not a black and white guy. So if I had a time machine I 100% would have Fairfield a row house neighbourhood. Plus I would have never pulled up the Tram that went downtown and ran up May street. But, Fairfield is not a blank slate anymore. So I’m not even against upzoning it. I have actually said before I think all of Victoria should be rezoned and do away with this Official Community Plan and spot zone BS that goes on. However, My point is simply that that is not a solution to our housing issues short term. Nor do I think we can even make that zoning a blanket row house everywhere since it will happen one little piece at a time and that might seriously mess what we do have now. Which is actually a fairly dense neighbourhood and mixed. Mixed because it’s a lot of suites etc so there is everything from students to families living there. Basically I find it an excellent area in general so I think it needs to be very gentle in it’s density. Then I look at the possibility that exists with the Westshore and feel that THAT is where the political pressure should be. Tram and row hoses and new-urbanism There. Because there is could happen in a much much shorter time-frame. There are no super well built Arts and Crafts, Edwardian or Queen Ann houses stopping anyone from doing it there. A Tram Link into the West Hills and the West Hills being built like a European Village with Row houses, low rise, a few high rise and multiple commercial nodes and public spaces would be truly amazing. Instead, it’s Kamloops style out there. We even have the rail already running right through the middle of it.

Can someone please define bears/bulls? Are there other animals too? Like Meerkats (who hang out in large groups surveying the field only making a move when it’s 100% safe)?

True Dasmo, we agree on a lot. I wish more people travelled or lived abroad and could see examples first hand of functional cities and best practices.

I’m still trying to understand your opposition to upzoning existing SFHs so that your hood could gradually, over decades or generations, transform as discussed. I’m wondering if it’s one of these:

– You like to visit nice medium density cities but prefer to live in lower density?

– You prefer the uniform architecture and form of your century neighbourhood?

– You’re worried upzoning will go too far and allow more density than ideal?

– You sacrificed to get into your desireable hood and want to reap the benefits while avoiding downsides as the city grows?

Much the same happened same time last year, many expected a big drop in 2018. Overall market did in fact softened in spring. The “super high end” became a buyer market. Maybe, in 2019 the “high end” will turn into buyer market(?). Bears are waiting to buy into the RE, bulls are waiting to move up. How much drop before they will jump in is everyone guess. Or the rate hikes will shattered the confidence in the market, not much movement in the next year(?).

“Yes. It’s funny though. For the latter, 125k+ is generally not too difficult to do, but, you’ll find people there telling you it doesn’t necessarily go as far as you think. If you have two young children, you’re running over two grand a month just in child care. That’s basically another mortgage and that’s presuming you can even get a spot – you practically have to start looking for one the morning after your fun. Throw in a mortgage, a car payment or two, savings, food, and you’re left wondering how the hell people make it at 35k a year. There are also DINKs, but I don’t think that’s a huge cohort, certainly not one that would give a lift to the entire market.”

Don’t forget student loans. At one point our monthly costs for daycare and student loans alone were $2400 per month. Now we have one kid in school and the other starting kindergarten next year. No way we would have more – it’s just way too expensive.

Things have improved massively over time, especially now that the student loans are paid. One thing I wish I had known when I did all this was that it takes time to build wealth.

Also, I think it’s established that capital cities (where there are more government jobs) have more stable housing markets than other cities. I think Victoria will prove to be non-exceptional in this regard. Sure there may be some decreases, but not like Vancouver, Toronto, etc…

BMO hikes 5 year fixed rate from 3.59 to 3.99%.

That is the economic definition of demand.

They also talk about the use of STVRs possibly threatening the principal residence exemption from capital gains. As usual it’s those three criteria that determine whether your principal residence can qualify for the capital gains exemption:

1 your rental or business use of the property is relatively small in relation to its use as your principal residence;

2 you do not make any structural changes to the property to make it more suitable for rental or business purposes; and

3 you do not deduct any CCA on the part you are using for rental or business purposes.

The second one is the the most problematic to prove I would imagine given that many people make structural changes in order to support renters.

Leo for mayor! You’d get my vote! Maybe you can change those stats (is that what everyone thinks going into politics?) I think engineering is the best career and the other two don’t sound very appealing.

Doing the mandatory legal update course.. Module on ethics and the intro is about a survey on how people regard different professions.

Real estate agents regarded 50% positive, same as Lawyers.

Seems like the amount of education isn’t the determining factor there.

https://insightswest.com/news/nurses-doctors-and-scientists-are-canadas-most-respected-professionals/

I have a couple engineering degrees, so I am going the wrong direction on the respect scale from engineer (84% positive) to real estate (50%) to at some point being interested in local politics (24%). 🙂

Sorry Local the increase in population was never meant to be directed at Victoria. Most of the population goes to the GTA/Montreal and some Vancouver. Victoria will see its small share and whatever the impact of retirees is.

My comment was a national issue….

Well, you have me confused. You have told me repeatedly that you do not care about what the Vancouver market is doing – you only care about Victoria. You even referred to the comparison as “bone headed”. Now you’re interested in national immigration numbers versus the national housing stock, with the implication being there will be some sort of perpetual shortage of housing.

Notwithstanding my fundamental disagreement with that premise, I can only presume you’re making a tertiary link between this and Victoria RE. However, the population growth stats here do not bear out a problem – and the level of building here has been explosive the last few years. I’d actually argue that that is more to do with playing catch-up than rapid, real growth. And if the housing bell breaks, national history suggests immigration will fall off as well.

Local

No t shirt. I am just shocked at how fast our population is increasing. Seems we have no plan to deal with the biggest fallout….Housing.

You really don’t want that t-shirt, do you?

Local

Demand is not slowing, ability to afford what they want to buy is slowing.

Short to Med tern no clue where we go…. Longer term 10 years we have a problem

Yet demand continues to slide. What happened to RE nationally, about 1990? And, what happened to immigration shortly after that?

https://www.huffingtonpost.ca/2018/10/09/housing-starts-canada-population-growth_a_23555468/

“Recent estimates from Statistics Canada show the country’s population grew by more than 518,000 over the past year, to 37.1 million. That’s the fastest rate Canada has seen since the late 1980s, and the fastest rate of any G7 country.

In an analysis issued in August, the Bank of Montreal estimated that this new pace of population growth — the result of a boost to immigration levels by the federal government — means the country needs to build more housing than previously thought.”

500k more people the past year/ construction slowing. This does not help in the coming years. This keeps up 5m more people in 10 years. The consequences for the SFH affordability are not good.

I am not sure what the answer is but the cities that people want to live in have a problem in where and how this population increase is going to be housed.

No more land is being made so it better be used better and people expectations are going to have to change.

I disagree with this one. There’s plenty of nature around the netherlands from what i’ve seen. Unless you’re talking about w/in a city, in which case, where is this nature in downtown Victoria? Also aside from Amsterdam right downtown, most places I went to there had natural spots.

Amsterdam is way nicer than Van. Try developing in Amsterdam!

Victoria is nicer than Van. The Netherlands is a great model for density. No argument there. But…. we need to work with what we are now in a pragmatic and real way. So the funny thing is we both share the same view on what makes for a nice city…. The only thing the Netherlands messed up on is not keeping any nature. That’s their problem of their early planning….ours is that we didn’t structure the core neighbourhoods around the row house structure. It’s not too late for the West Shore though.

Barrister,

Some good thoughtful points you’ve made.

In previous posts you’ve made mention of considering selling. We considered buying in your area but chose another that was significantly cheaper, allowed time for inspections. We also wanted no part of a bidding war where in some cases houses were being bought for $400k+ above assessed value.

We’re a family that potentially could be looking at homes in your neighbourhood. Our current home is about the same size as yours, 10 years old, and in a different part of town. What we find is when we discuss the pro’s/con’s of moving, is that these larger homes very well could be reaching peak value and it concerns us that down the road there will be very few buyers that will be able to afford these homes.

With interest rates rising it eliminates one potential buyer. Taxing wealthy foreign buyers is eliminating another. Local incomes as a whole don’t support these higher home values (even the more exclusive ones, by more exclusive incomes)… So it leaves me wondering whom in the future will provide growth in higher RE asset categories?

Usually. Do you think prices will rise come spring?

Could you enlighten me why is everyone waiting for spring to see where RE is going? Some are expecting a crush and call it a bloodbath, but isn’t spring the time when prices usually start rising?

+1. The person who overstretched themselves and bought in the past couple years shouldn’t be protected to the detriment of the new grad just starting their career but now priced out.

I’ve been to Vancouver several times, seen different parts of the metro area. Downtown Vancouver has the same density as Amsterdam Centrum, and the cities as a whole are comparable in population and density. Guess which place is nicer to hang out and linger? Density is more than a number. That is all I am saying.

https://en.wikipedia.org/wiki/Downtown_Vancouver

https://en.wikipedia.org/wiki/Amsterdam-Centrum

Really? because I stated it pretty clearly earlier.

Maybe I was wrong with saying “all those” people, but clearly there are plenty since the majority of Victoria proper rents.

I disagree. I think there’s opportunity at every stage, it’s just which actors in the cycle it favors at a given time. I still think it favors sellers overall; you can still make a killing if you bought years ago and wanted to cash out. You just aren’t likely to buy atm and get capital gains. Then it will be an opportunity for buyers, perhaps a fantastic one.

I just hope the next up cycle isn’t as violent. What’s happened in BC is a tragedy in many parts, and we haven’t really faced the music for it yet.

I have to laugh at gwac’s passionate caring for the homeowner but never the persons/families priced out of a bubble market and being gouged by the landlord. A 10% correction is OK tho cause he wants to buy more right ?

Construction jobs are boom and bust by nature. When you commit to that type of work you accept that is the way the world works. In 81, there was no massive soup kitchen lineups, few families decimated (unless over leveraged), no mass unemployment unless you were in the real estate/construction boom business. People still bought houses all the way down, but at way more realistic prices.

Did families who toughed it out have to tighten up the wallets or get extra work ? Some did, most with a decent job didn’t. According to the pumpers on here everyone makes $100K so if they don’t have savings to tough it out a couple of years then whose fault is that ?

It’s the cycle, nothing goes straight up. Learn and educate yourself and if you are in those jobs, save your ass off for when higher mortgage payments come.

How about 1990 gwac when you got your first condo at 50% off. You didn’t seem to complain about that.

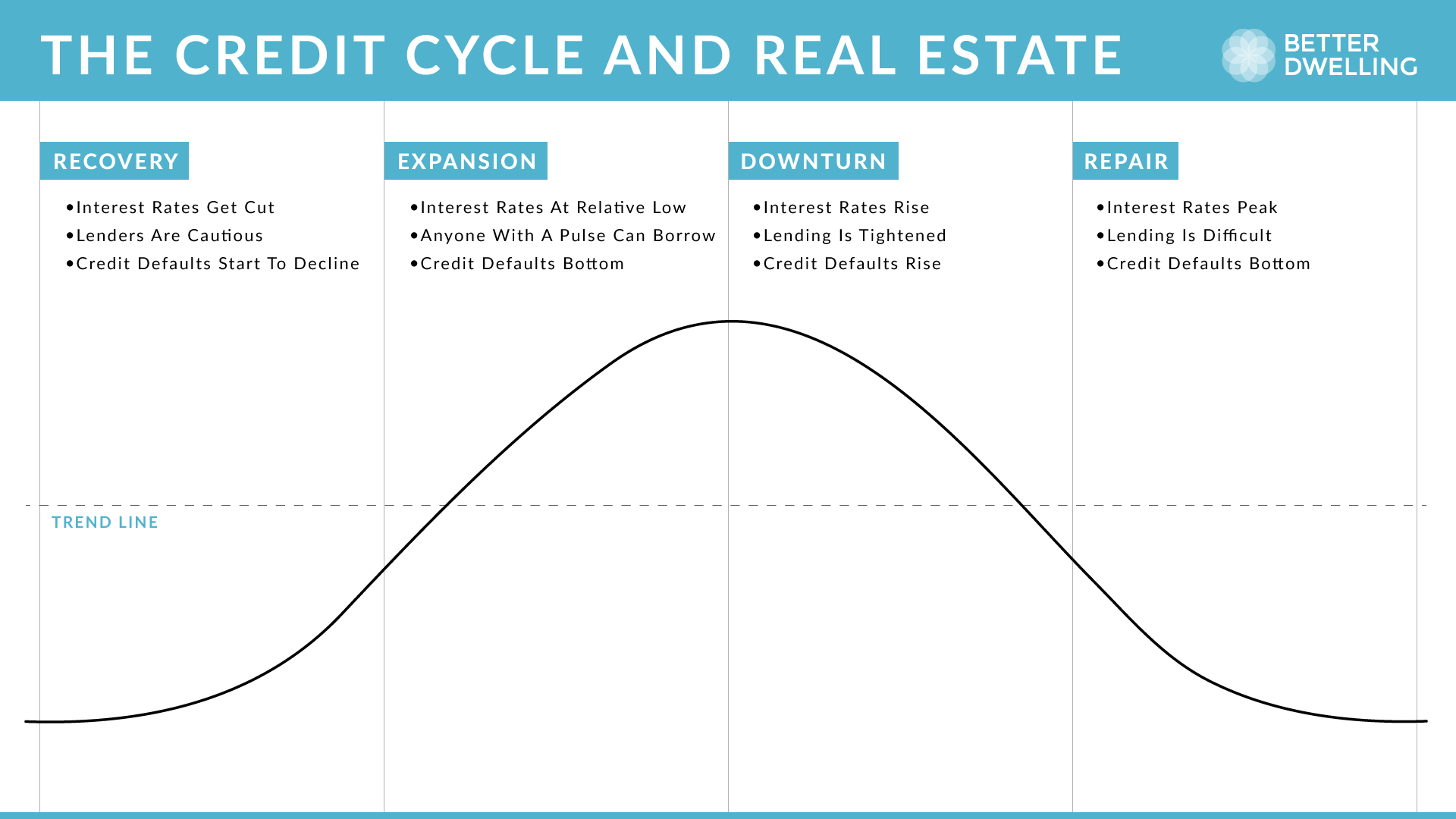

This may have been posted already but it’s not hard to see where we are on the chart. It’s definitely not at the land of opportunity stage.

Understanding How The Credit Cycle Impacts Canadian Real Estate Prices

https://betterdwelling.com/understanding-how-the-credit-cycle-impacts-canadian-real-estate-prices/

Spend some time in Van wo, then you will see what difference it makes….

The worst stat a pumper wants to see. The game is long over, the bag holders will stack up, disappointed they got sucked in by the hype. Happens every cycle but some cycles are far worse than others, like this one will be.

Trades guys come and go. Many trades guys aren’t really trades guys, they have a 6 month training course and learn on the fly or try to fake it. Many will be lowering their prices ASAP to stay ahead of the decline or go back to school for new careers, or move on.

I also doubt most own homes unless you have a proven track record of employment beyond a couple of years.

What the article below means:

Construction activity is slowing. Either the developers are unable to make a profit at current valuations, and/or, they are anticipating a change in the market which is spooking them.

If you would prefer the contrarian view, then you can try to argue that starts are slowing only because they can’t hire enough people to meet demand (a bit like the one that exclaims that sales are only dropping because of low inventory). 😛

Thanks Leo for the update. Here are a couple examples of the under ask and assessment, but anything more dramatic? The selling prices in the core really blow me away.

3067 Oakdowne Rd V8R 5P1OB Henderson-Oak BayMLS#:399373 Sold:$1,165,000 Assessed Value:$1,274,000

618 Harbinger Ave V8V 4J1Vi Fairfield West-VictoriaMLS#:391110 Sold:$1,350,000 Assessed Value:$1,621,000

Housing Starts In Vancouver and Victoria Drop Sharply: CMHC

Canadian housing starts fell to the lowest in almost two years in September, led by a drop in British Columbia.

Builders began work on an annualized pace of 188,683 units last month, down 5.1 percent from August, Canada Mortgage and Housing Corp. reported Tuesday. That trailed all 11 forecasts in a Bloomberg survey.

British Columbia saw the most significant deterioration, with starts falling 43 percent in September to an annualized 25,611 units, the housing agency’s report showed. They dropped 42 percent in Vancouver and 56 percent in Victoria.

https://www.bloomberg.com/news/articles/2018-10-09/canada-housing-starts-fall-to-lowest-in-almost-two-years

The decline in real estate prices is a global phenomenon just like the rapid rise in prices was a global phenomenon.

Local restrictions like the foreign buyers tax contribute to the decline but the fundamentals are global. News articles from any city in the western world confirm that the decline is real, the decline is significant, and the rate of decline is slowly accelerating (it’s exponential). The declines are just beginning in some cities but well underway in other cities.

Pick any big modern western city and read their local news articles related to real estate; most are reporting a steady decline in prices.

Australia:

http://mobile.abc.net.au/news/2018-10-08/australian-housing-market-good-bad-and-ugly/10348856?pfmredir=sm

Seattle:

https://www.seattletimes.com/business/real-estate/seattle-home-prices-drop-by-70000-in-three-months-as-market-cooldown-continues/

London:

https://www.bloomberg.com/amp/news/articles/2018-09-19/london-house-prices-post-biggest-drop-since-2009-in-july

New Zealand:

https://thestandard.org.nz/property-price-decline/

And let’s not forget the copper commodities market is on a 6 month decline. Professor Copper is often the canary in the coal mine; an early indicator of the overall economy direction.

Was walking the dog around nearby neighborhoods (Broadmead) yesterday that I haven’t traveled through in awhile. A couple of things struck me on this trek. There were 2 houses with for sale signs that I didn’t recall being listed on the MLS. When I got home, one for sure isn’t there. The other had a SOLD sign so it may have been listed and I missed it (possible but not likely). Is the realtor hoping to make a sale without having to pay the listing fee? I can’t imagine it’s that expensive to place in the MLS.

The other thing I noticed was the number of truly empty houses. Not just someone’s vacation home but not a stick of furniture to be seen through the window (from the street – I’m not that big a voyeur :-)). Empty houses really disrupt the feel of a neighborhood and these that I walked through were downright dismal. Not a soul to be seen. I wonder if these will be coming to market. Perhaps in the Spring? Time will tell.

James

Did I say the those 2 professions do no. But a lot of trades are right now making more than doctors. I am not sure your point but the people I know in trades. Most own homes.

Like to get to a point where prices stabilize fall a bit and stay that way for awhile. People still do renovations and the whole thing does not go to shit and there is a huge impact.

Yes. It’s funny though. For the latter, 125k+ is generally not too difficult to do, but, you’ll find people there telling you it doesn’t necessarily go as far as you think. If you have two young children, you’re running over two grand a month just in child care. That’s basically another mortgage and that’s presuming you can even get a spot – you practically have to start looking for one the morning after your fun. Throw in a mortgage, a car payment or two, savings, food, and you’re left wondering how the hell people make it at 35k a year. There are also DINKs, but I don’t think that’s a huge cohort, certainly not one that would give a lift to the entire market.

The thing with civil servants, whether policy wonks, firefighters or traffic light technicians, is that that sector doesn’t employ as much of the population here as people might think. I can’t recall the figures exactly, but I seem to remember that it was well under 10%. Construction people are making money the last while, but that’s not a durable economic support for RE – that industry rises and falls with the RE cycle.

The basic point is, most households here don’t make 100k, whether they’re homeowners or renters. The struggle coming from what has happened here is quite real for a great many people.

Home Depot is minimum wage, or near it.

I know some guys at home depot and appliance stores that make more than a doctor right now. Actually no, i don’t.

Barrister interesting take.

5.9x the land area (114.97 km^2 vs 19.47 km^2). Not sure how it changes the picture; big or small a city can be more uniform or less uniform in its population density and building height.

I was talking to a local banker last night of was of the opinion that house prices were not as detached from local incomes as might be believed. he sees a fairly wide split between incomes between jobs in retail, tourism and the service sector ,on the one hand, and government jobs and specialized trades on the other. If you look at a thirty something policeman married to a thirty something teacher than the picture appears different. He was arguing that you have to take retirees out of the mix when calculating affordability.

He said that the stats for income look very different if you focus on the top half of income earners in their thirties where there are two incomes. When pressed he agreed that the housing market will correct but not as much as some people think. But he agrees that the world has changed because you absolutely need two people working and strangers to live in your basement to afford your first house. Like a lot of us older folk there is a bit of perplexity in our voices. He paid for his daugther to get an expensive post graduate degree and in her early thirties she very intentionally found ‘the golden husband” (her term, not his) who can afford for her to have a nice house and just stay home with the kids. Makes one wonder a bit.

Yep they have with lots of work…

The tiler I know makes more than a Doctor right now. I told him to save some of it.

From the last thread.

Gwac, all those people have been affected by the current housing market.

Thanks Harry, fixed.

Correction: “Strong buyer’s market”