Victoria is percent overvalued

We regularly see articles in the news claiming real estate in Canada or any of our cities are overvalued by some percentage (56%, 173%, 30%). There are many ways to determine whether a market is overvalued and by what amount: price to rent, price to income, growth rates, affordability, debt loads, and so on. As we can see from the above range of estimates for Canada, the choice of method will give you radically different answers, and if we look back at predictions from 5 years ago we see that those predictions also haven’t lined up well with subsequent house price movements.

I’m not taking a position in this article that Victoria is overvalued by a particular percentage, but just want to point out the difference between a real estate market being overvalued by some amount and what it would actually drop by. Back in 2008 if we measured by monthly mortgage payments you could argue that the single family market was 25% overvalued. At the bottom 5 years later, people were only willing to spend three quarters of what they had been willing to spend per month in 2008 for the same house. Selling prices didn’t budge because declining interest rates did the work of removing the overvaluation.

However let’s say the market is again 25% overvalued as measured by affordability (please choose whatever number you think here). Does that mean a 25% price drop?

Clearly not. How fast then do markets actually move? Well the upper limit is probably the complete meltdown we saw in 2008/09, where single family prices dropped some 11% in 9 months.

In the downturn of 2010-2013, prices dropped about 3% per year. Barring another black swan event, prices in a normal decline are more likely to drop relatively slowly over several years at a rate of a few percent annually. This means that income gains (assuming they exist) and inflation can take care of some of the overvaluation. If a decline takes 4 years, 3% annual income gains would take care of about 10% of the overvaluation which would leave some 15% left to come from price declines. So a 25% overvaluation in affordability ratios would be taken care of in 4 years of 4% annual drops.

I want to be clear: this isn’t a projection for Victoria. It’s only an example of how a certain overvaluation can be resolved over time, and that because real estate markets move so slowly, absolute price declines tend to be lower than the overvaluation at any given point.

Of course, any number of things can and will change in real life (interest rates!) to cause the final price we reach to be different than a simple model like this. 4 years ago the market was radically different than today, and 4 years from now it will be different again.

I looked at the pictures. What’s up with the basement walls and floor in the laundry room? Looks like possible water damage (efflorescence, peeling paint, a lighter area that has maybe been redone).

@50498 – Wow! I didn’t even know there was such a thing as a mega-basement until reading that article. Anyone seen Panic Room with Jodie Foster? Sub Panic Mega Basement for the London Elite.

@Queen E – thanks for that post. I am a newbie landlord and have a clause in my lease saying additional occupants incur additional fees. Because, they do!

Queen E, I couldn’t agree more with you about picking appropriate tenants. But as you said, the RTA is biased in favour of tenants and getting rid of bad tenants can be a nightmare. My point is simply that smaller one bedroom suites are easier to manage because larger suites invite problems; so for a newbie landlord with their first house and a 3 bedroom suite could be a inviting huge problems. You obviously have years of experience that a newbie would lack.

Leo M, in response to your comment:

“A 3 bedroom basement suite would be a nightmare for the landlords .. been there, done that, never again!!!

Under the Residential Tenancy Act you would be surprised to learn the tenants can invite their friends to stay for extended periods without you being able to increase the rent, or the tenants could hookup with a new ’partner’ and you can’t evict them, and many other horrific scenarios. A three bedroom basement suite could start off as three people and within a month grow to 10 people.”

I must politely dispute these comments. My partner and I have 13 rental units here in Victoria, 4 of which are basement suites. Two of the basement suites are 2BR, the other 2 are 3BR. Point being, we have experience with that level of density in one unit and these properties are multi-units (2, 3 or 4 unit buildings). We have had phenomenal experience with our units. I will say, we use a rigorous tenant screening process, as we have learned over the years, these extra measures on the front end save a lot of hassle in the long run.

Aside form that, the Residential Tenancy Act DOES protect landlords against tenants inappropriately allowing additional people to reside in a unit & from guests staying for extended periods. I will address each in turn.

Re adding people. The Residential Tenancy Act does allow a landlord to limit the number of people to a unit. In fact, per the RTA Section 47(1), a landlord can issue a notice to end tenancy, if

(C) Landlord’s Notice: Cause

there are an unreasonable number of occupants in a rental unit.

Now that said, I am not suggesting this process would be easy. In fact, the RTA is so heavily weighted to the tenant, and the dispute resolution process is a nightmare, and can morph into to applying for an Order of Possession and hiring a bailiff, etc., but the limitation is there. And the onus is on the landlord to prove the tenancy is “unreasonable” (which according to prior proceedings is somewhat tied to bedrooms & beds), but again it is there.

Another great resource that speaks to this is the Guide to the RTA (https://www.rentingitright.ca/sites/default/files/pictures/act_english.pdf). This states (under Additional Person(s) Joining the Household):

“The tenancy agreement can indicate the number of people permitted to live in the rental unit. If the landlord plans to increase the rent when more people move in, the amount must be written in the tenancy agreement at the start of the tenancy.”

We always add this to our agreements, among other addenda, to ensure we would be protected in such a scenario.

Further, a landlord can add addenda to the Tenancy Agreement that identifies what constitutes a guest vs. an additional occupant. There is no clear wording in the RTA that defines the length of stay, however common practice is 14 days. Further to this, it is important to understand that you can add addenda to your agreement that specify such limitations, with a few exceptions: they cannot discriminate (based on age, race, sexual preference, etc.) and they cannot contravene the Act. Under such circumstances, the addenda would be null and void.

Deleted/moved to new thread

Everyone have a good weekend? Amazing time out camping at French Beach. What weather for October!

Monday post: https://househuntvictoria.ca/2018/10/15/october-15-market-update-and-the-vancouver-ratio

True, I may be dilusional on the rental scenario but 10,000 square foot lot, 2,700sq foot is a ton of space in my mind given the location. If you don’t have a big family, add home stay student or UVic students and they have no tenant rights, beyond what you give them. Mostly what I was saying is the sellers are motivated and it is one of the better priced houses in the neighbourhood, fairly close to town and the water. PS it doesn’t need any of those upgrades unless your a spoiled Victoria house shopper like me!

Get used to it. Prices will fluctuate somewhat, but this town is always going to have lots of suites and high prices. Just part of being the nicest place in Canada.

Patriotz: If rates are higher – simply at historical norms – people won’t be able to buy regardless of liquidity.

=======m======

… which is why the interest rates would, in another financial crisis, be lowered again by the bank of Canada from “historical norms” to near zero. In addition, the banks would receive similar supports that they received in 2008-09 (liquidity, buying mortgages). The bank of Canada will not be acting to bailout Hawk.

Over-leveraging is in the eye of the beholder.

Pay a million in a medium sized city and have someone living in your basement. That pretty well sums up the madness.

Because it happened at the same time as a huge drop in interest rates. That’s what turned the market around – lending available at low rates. If rates are higher – simply at historical norms – people won’t be able to buy regardless of liquidity.

Good article in the Guardian today, how embarrassing Canada: https://www.theguardian.com/world/2018/oct/15/canada-money-laundering-casino-vancouver-model

Enjoyed this read this morning. “The battle between the haves and the have-yachts”

https://slate.com/business/2018/10/london-iceberg-home-megabasement.html

VictHunter said: “…add 20k for a suite you could build a 3 bedroom suite down…”

A 3 bedroom basement suite would be a nightmare for the landlords .. been there, done that, never again!!!

Under the Residential Tenancy Act you would be surprised to learn the tenants can invite their friends to stay for extended periods without you being able to increase the rent, or the tenants could hookup with a new ’partner’ and you can’t evict them, and many other horrific scenarios. A three bedroom basement suite could start off as three people and within a month grow to 10 people.

I took my tenants through the RTA process to remove people not in the tenancy agreement and the RTA mediator was a lawyer, and she basically told me these are families and families grow, so piss-off landlord because the tenants have the right because your basement suite is their home.

And the reason they are scrambling to raise rates is so they can lower them in the next coming downturn. It’s a slow jagged path back to the norm.(Whatever that is)). It’s not a straight incline….

))) hawk: Should have happened in 2008 but Harper secretly bailed out the banks creating today’s world leading household debt based on a real estate bubble.

=======m===

Any Canadian govt would do the same thing for the next downturn. The Canadian 2008 “bailout” (ie liquidity support) was a big success. You must recall the Canadian banks being praised worldwide. http://www.nber.org/digest/dec11/w17312.html “When European and North American banks teetered on the brink of meltdown in 2008, requiring bailouts and extraordinary central bank intervention, Canadian banks escaped relatively unscathed.”

What Canadian govt would look at that recent history and say NO next time?

@Wolf Renfrew looks like it has a way to go but maybe there is someone who wants to build a monster home with no view for 2M. I think the number of people like that is shrinking as the stock market stutters and the options for lots like 2620 Bowker Ave are numerous as several developers sit on expensive unsold homes. Still a lot of developers hot for duplex lots these days in Esquimalt but will we see Duplex zoning for large areas of Victoria and other areas passed in 2019? We may be a few years away from “affordability” in the core but there are 749k freehold new homes being built in Saanich, be nice if they could crack the $699k and Townhomes $599.

Went and looked at 4568 Montford Cres yesterday. The Pool House they describe has the pool inside it so currently no yard but it’ll be interesting what it looks like after they tear it down and “fill”? The Garage/suit is only a 1 bedroom. I can see it taking a long time to sell since they “are doing a lot of work on the yard” but beautiful location, cul-de-sac and trail across the street to a park and 4-minute walk to one of the nices coves in Victoria!

Hit the 1949 Ferndale open house. Estate sale, nicely staged and gracious realtor. I would estimate 50k for new windows and HVAC and you would have an amazing place. Offer 900k do the windows, HVAC and add 20k for a suite you could build a 3 bedroom suite down and be laughing through any pullback. Unfortunately, I’d be divorced before the reno was done if I tackled it!

Lots of 50-150k drops over the weekend in the large house segment as my search area broadens. I think we can afford a @guest_50453 style Tesla if we skip Oak Bay, Gorden Head and Cordova Bay, but all those areas are seeing some large corrections. Going to relook at one in Glanford tonight and decide if we want to make an offer to adjust expectation. How are those low ball offers going?

Thanks @Leo S and @guest_50453 for the insight on the on the 48-hour clause. Given the condition on the house, I’ll wait and see if the deal collapses rather than get the seller excited.

Come on. You could be a bit more insightful and compassionate. I confess there’s an element of justice you might feel in seeing a greedy person losing their shirt, but that’s only one part of the picture.

The phenomenon of suicide rates linked to severe housing distress including evictions and foreclosure, was well documented by the CDC in the US a decade ago. Housing bubbles literally have a role in killing people. Yes, they need to burst for the reasons you mentioned, but it’s not without some pretty tragic downside for some families who simply thought they had no other option but to over-leverage if they wanted housing security. We can’t all be market and finance gurus who “see the writing on the wall”.

I would. No one died in 81. Excess greed and debt was flushed out and a new cycle began. Should have happened in 2008 but Harper secretly bailed out the banks creating today’s world leading household debt based on a real estate bubble.

With Saudis now threatening $200 barrel of oil if they want to mess with their murderous ways, the global bubble has only one way to go.

“some neighbourhoods will experience more of a decline than others.”

Agree. For example, 2090 Renfrew Rd. in Oak Bay on a 0.39 acre lot now asking $135K under assessed (-10.5%), and it looks decent. Just my opinion, but I think Oak Bay and Fairfield are due for a large drop. Homes there went up the most in 2016/17 because there weren’t many homes available and people like those neighborhoods. People still like those neighborhoods but won’t be willing, I think, to pay inflated prices when you consider the general condition of the homes and comparably priced homes in other areas. Of course, someone else will read this and have the alternative view that because people like those areas prices won’t drop as much. Time will tell.

I tend to agree with Dasmo, a number of renters would jump in before we reached the 28% decline.

What is perhaps more important to Josh is the likelihood that some neighbourhoods will experience more of a decline than others.

Which is why it’s so hard to get there….

Only 28%? I would be entirely ok with “only” 28% and would jump into the market.

I prefer looking at how much prices have risen rather than how much they would need to fall. If we say 2005 is a benchmark for reasonable prices, how much are we past that baseline? The title of Leo’s post is “Victoria is [X%] overvalued”, after all!

I’m getting slightly different numbers but same range. From June 2005 to June 2018, Teranet increased from 100 to 208. Inflation was 26%. In real terms prices increased 65% or equivalently would need to fall 39%.

208/(100×1.26) = 1.65, i.e. increase of 65%

(100×1.26)/208 = 0.61, i.e. decrease of 39%

Teranet for Victoria: https://housepriceindex.ca/#chart_compare=bc_victoria

Bank of Canada inflation says 25%, but I’ll take your 26% from FRED: https://www.bankofcanada.ca/rates/related/inflation-calculator/

@guest_50427 Interesting, as houses languish I believe they will fall in price significantly but it is sure slow to happen. Not far from me, I have seen a nice house drop 200k but it is still at close to a million with no heat other than electric and no suite. I calculated 100k in investment needed, not to mention the hassle. Realtor’s think sweat equity is free!

The move from busy core to quite suburbia/rural peninsula is an interesting one. I think people are still overvaluing suites, given the number of rentals coming on the market and we may have a huge switch in zoning to duplex/garden suites lots here shortly. You are bang on at 100k but someone I was talking to Friday said they are worth 300k….they need to spend a little bit more time with a ROI/CAP rate calculator! I bought at the last peak as well so I’m trying not to repeat the cycle and at least find a place we can live in for 20+ years.

))) 36% is approaching 1981 levels of debauchery. No bread lines, but a major, major ouch.

Agreed. I wouldn’t want to see that.

I’m not going to verify your math, but say for the sake of argument that’s correct. A 28% fall in price would hardly feel like an “only” – that’s starting to get into the big leagues. Detached homes would fall by literally hundreds of thousands of dollars each, and condos would probably fare worse, proportionally. That would crush the housing market and its bloated spin-off sectors and cause quite a wide scale and significant recession. By no means am I saying that couldn’t happen, because I think it’s very possible it will.

But in short, it’d be ugly. Then there’s Vancouver. A 28% fall would do little to help affordability on a practical level, meaning a larger one would be required. If that happens, then we potentially face the knock off effect from there too…

36% is approaching 1981 levels of debauchery. No bread lines, but a major, major ouch.

Correction on previous post, Teranet was 100 in 2005, so that would be a 36% fall required to get to 2005 levels (inflation adjusted).

Really off topic but people here are in the know on all things RE right?

Seriously considering areturn to Victoria in the spring. Yay! We will be renters which will be new after 40 years of home ownership. We would really love to live in Sidney. It suits us perfectly. It seems like there is very little for rent there even in the best of times.

Figure it would be a good idea to connect with a property management company. Does anyone know a company out that way?

And this is the flip-side of low interest rates. QE meant that the hunt for return went to other asset classes which affected housing markets. QE adversely affected a large portion of retirees who are normally risk-averse. Adding this class of buyer into the mix meant more competition in the housing market. It will be interesting to how rising interest rates will affect the decision process of this class of owner.

The other thing to remember about that senior buyer is that we have long memories and recall when housing dipped. Transforming paper profits into cash to put into a bank instrument that now yields more than it did a few years ago would look like a sound investment decision for some.

https://www.investopedia.com/articles/personal-finance/022916/4-reasons-low-interest-rates-hurt-retirees.asp

))) All of BC is plagued by ridiculously high prices. I don’t have any theories other than mass speculation and mob mentality collective insanity.

=======m=v===

Most people would consider 1999 the “good old days” for buying a house in Victoria. We are told by some younger members here how it has become so much harder to buy homes due to insane prices. how true is this? It might surprise you to learn that prices would only need to fall by 28% to return to the levels they were at in 1999 (adjusted for inflation).

The Teranet index which goes back to the year 2000 helps to understand that Victoria prices are not “ridiculously high” and the result of “collective insanity”.

If you accept that Victoria prices in the year 2000 were “acceptable, and not insane”, then a simple look at the Teranet index will tell you that today’s prices would only need to fall by 28%* to return to those same levels (adjusted for inflation). a fall of 28% would be significant, but is hardly the level of “collective insanity” and mania. Somebody planning to wait for prices to fall 28% before buying is asking the market to return to where it was in 1999 adjusted for inflation.

=vv=v

* how do I get to the number 28%?

Teranet Victoria was 100 in 2000. Inflation alone would have taken if to 146 in 2018 (Source gdp deflator Canada https://fred.stlouisfed.org/series/CANGDPDEFQISMEI)

Teranet Victoria is now 204. It would need to fall by (204-146)/204= 28% to get to 146 where inflation would have taken it based on 1999 prices to today.

Re #50466, I had meant to say we sold April of ‘17, not ‘16 as stated.

Despite the name Teranet covers all dwelling types, not just houses. Houses clearly started the decline in Vancouver and they may have already peaked in Victoria.

))) rook: Out of curiosity, when was Victoria’s peak? Spring 2017?

====v====/

If you’re asking about the peak in Victoria house prices, it is at an all-time high now, so hasn’t peaked yet. (Source is teranet Victoria House price index, at all-time high price for Sept 2018 https://housepriceindex.ca/2018/10/september2018/ )

The peak in the “sellers market” indicators like months of inventory, and bidding wars was around spring 2017.

Hello? If nominal declines are bigger than real declines, that means CPI is declining, i.e. general deflation. Are they predicting a depression or Japan-style long deflation for Oz, or do they just not know what they’re talking about?

Anecdote of the Day: Average Joe neighbour in Ontario who wants to retire soonish to Nanaimo has changed his tune. This Summer he was talking about buying while he can still afford it (FOMO to a third-tier city in BC!?). Now he’s all “what’s going on with BC real estate? Are prices dropping?”

More news from Australia:

https://www.smh.com.au/business/the-economy/australia-s-property-downturn-will-be-the-longest-and-largest-since-the-1980s-says-morgan-stanley-20181011-p5091w.html

I see 950 McBriar finally sold – anyone know what it sold for? Thanks!

Here is one reason, one of many, why global real estate has nearly doubled in price during the past five years.

I’m older than most of the posters on this blog so my cohorts are also mostly older. When interest rates dropped to the lowest level in our lifetime, and the lifetime of our parents, suddenly our savings stagnated in our low risk bank accounts. To my generation, real estate represented security, so many people took their savings and bought a second house or a couple condos as rental properties. The strategy was a good financial decision, far better than 2% on savings in the bank.

I think a large percentage my cohorts, in all western countries, are now thinking of selling their investment properties to realize their paper equity.

And that brings me to my second point:

LeoS – your Sept 24th post and the graph ‘Monthly New Listings’ got me thinking about my 12 to 24 month prediction. If my prediction for a slow motion, but accelerating decline in SFH prices over the next 24+ months is right, then I would expect the ‘Monthly New Listings’ to start accelerating over this coming winter. In other words I’m expecting the ‘Monthly New Listing’ to slowly accelerate over the average, each month from now until next May, and probably well beyond May.

For the next 8 months I’m expecting to see a similar pattern as your graph shows from about November 2009 to about June 2010, although not as dramatic; after that I’m expecting a continued increase in both ‘Monthly New Listing’ and ‘Active Listings’.

Question: Do you have a graph you regularly update with both ‘Monthly New Listings’ and ‘Active Listings’ that has a link? Also, you have produced dozens of excellent graphs over the past couple years; are these graphs available at a specific web-link, rather than search through dozens of past blog posts?

Josh, I have no idea as to the the prices in Victoria and when I look at Van it is just a mystery to me.Still somebody is buying even if it is slower.

After all the market watching and article reading of the last 4 or 5 years, I have to admit that this is still my biggest question. All of BC is plagued by ridiculously high prices. I don’t have any theories other than mass speculation and mob mentality collective insanity.

I always find it interesting to spend a little time on Zillow looking at what can be bought in the States.

What I can’t figure out is, aside from New York, San Fran/LA- San Diego, Hawaii and little pockets here and there, the States in general is so affordable. Most major cities in the US are cheap compared to here. They also have 10x the population and significantly more wealthy people.

I for the life of me can’t figure out why Van & Vic are so expensive; the only thing that makes sense is perhaps there’s significantly more foreign money and money laundering going on in our markets than we’re aware of.

Active listings for detached homes in the core has not been declining. That’s not what typically happens at this time of the year. There is usually a steady decline in listings in the late fall and winter . This could turn into a glut of core house listings this spring as we are still adding 2.3 new house listings for every one that sells in the core.

And I’m guessing here but I think it’s because people are willing or they have to list their current homes before buying. And I say have to sell their existing home because the lenders have seriously tighten up on qualifying for a mortgage that makes it very difficult to have more than one mortgage.

That’s different in the years before when people would keep their existing home as a rental. That option might be very limited with these new lending regulations.

For example the down payment is now 5% on the first 500k and 10% on the remainder and 20% for properties over one million. Rental properties now have a minimum of 20 to 25% down payment as opposed to zero in the past. Income from suites are 100 percent added to income now. As opposed to when 80% of the rents were offset against the MORTGAGE PAYMENT. That’s a big impact on what today’s buyer can finance. For the typical Victoria house that could be a difference of 200K to 300K in reduced financing.

The impact on Victoria is that it has slowed annual appreciation into the low single digits along with increasing supply. And that’s going to continue and make it tougher on contractors as they are making less money and are not moving their houses quickly. Those starter homes or tear downs in Victoria that contractors need to build are not flying off the shelves like they use to.

There are some surprising deals in the Westshore. We’ll see in the stats if it’s more than anecdotal but it seems that the prices falling in less desirable places first theory was correct. Some of the places you can get for $700k in Langford make paying $600k for a 2-bed condo in the core seem insane. Fingers crossed, that’ll translate to drops in that segment.

Side point: What the hell is wrong with Langford city planning? They’ve got all these lakes and hardly any public spaces beside them. And 4 golf courses. That’s gross.

Rook, I’m not sure when the exact peak was but we sold our house in Oak Bay in April ‘16 in 2 days. Our realtor said things were a bit hotter in February and then things seemed to heat up again in May and June. It was soon after that that I noticed listings lingering on even though prices continued upwards. Just my personal experience…there was the ‘peak’ due to people buying anything not tied down, but also the peak of prices that occurred later.

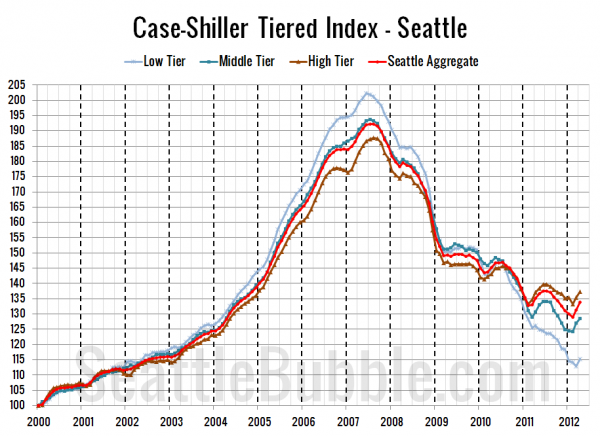

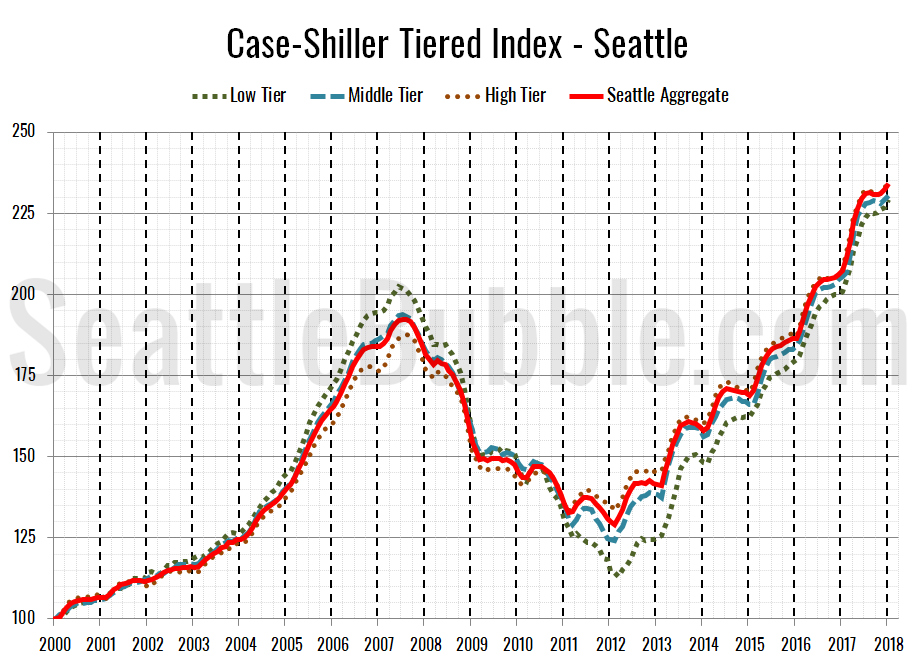

Leo S- Seattle took about 5 years peak to trough.

Out of curiosity, when was Victoria’s peak? Spring 2017?

Sechelt sinkholes leave homeowners with potentially worthless homes

“We moved here to live in our dream home and now we can’t even go inside,” said Ross. “We are still paying a $450,000 mortgage and property taxes.”

They can’t even walk away from the house and leave it to the bank without being stripped of their business assets.

https://vancouversun.com/news/local-news/sechelt-sinkholes-leave-homeowners-with-worthless-houses

Circa 2009 many condos were being liquidated at below pre-sale price. Also 2010 and later at the Olympic Village. For example:

https://www.remonline.com/condo-liquidation-sale-largest-in-canada/

Huh, this new Civil Resolution Tribunal is pretty cool. Online small claims (<$5000) and strata property dispute resolution. Anyone used it?

https://civilresolutionbc.ca/

Speaking of presales, the Quay is offering 5% deposits. Here is what the developer says

“One of the things we keep hearing from individuals walking into our presentation centre is how challenging it can be to put together 15% as a down payment given Victoria’s real-estate prices. When you’re purchasing a unit valued at $750,000 or above, 15% represents over $110,000. If we can bring that down by two-thirds that gives a purchaser additional time to build a larger down payment or keep their investments in place longer” Price says

https://victoria.citified.ca/news/5-percent-down-other-incentives-launch-as-westbay-quay-condo-reaches-sales-milestone/

Not entirely sure it’s wise to buy a $750,000 condo if you can’t scrape together more than 5% down, but heck, no point in worrying about that until later.

The primary reason that they sell pre-sales is for financing though, not because they are betting prices won’t go up.

It is an interesting point though. Are there any well capitalized developers that build and sell large condo developments on completion instead of doing pre-sales? You would think in a rapidly rising market that would make sense if they can get the capital together somehow.

@ Marko

Or perhaps they’re worth the same as what they bought them for, I dunno. But you can’t discount those 30%, that’s a pretty big number.

This drop in pre-sale completion value happened in Vancouver a while back as well. I don’t remember the year anymore as the conversation about it happened a few years back with a guy in the industry (not a salesman), but the point of that convo was pre-sales come with risk. In a rising market it tends to work out great, and if that market turns, perhaps not so much.

Lowball of the week: House in the westshore went for $300k under ask ($25%) ~8% under assessed.

Over ask of the week: $50k over in Esquimalt (8%), 17% over assessment.

Hi. I always enjoy reading your articles and comments from readers. I have been watching closely the Victoria real estate market and the spike in interest rates.

I will share my experience about the real estate market in Ottawa Ontario in 1981. At that time I bought a condominium when the interest rate on a 6 month open mortgage had climbed to around 21 %. No one was buying at those rates and the market was nearly dead. I figured it was a good time to buy a condo at rock bottom prices. Interest rates could not go much higher.

I bought a property for around $40K. 9 months later the interest rate was down to about 9.75 %. I sold about 1 year later for $66K with no renovations etc. That should give you an idea of how quickly a market can melt with high interest rates and how quickly it can rebound from a 11% drop in interest rates. As you probably know the real estate market in Ottawa is normally rock solid. I think a similar event could occur in Victoria.

The recent global interconnectedness of housing markets is quite apparent.

Public anger in China spreading as property prices drop

“As home ownership has remained the most important channel of investment for urban households in China in the past decade, price cuts have become increasingly unacceptable and a cause for social unrest.”

https://www.scmp.com/news/china/society/article/2168025/public-anger-china-spreading-property-prices-drop

That’s a great point. It comes down to the attitude and expectation of locals there about RE, though. My understanding is that the “it can never go down” is even more intense there than here. So the idea that it could happen at all, could be almost unconscionable.

Seems silly, but it is what it is.

In regards to the convo on here re: pre-sales, this may be of interest. It’s in regards to Australia, but I wouldn’t be surprised if we see some of this here in time.

Why would it be a surprise whatsoever? Right now, there are pre-sales going for $1,000+ per square foot. If they were worth $900 sq/ft two years from now on completion I certainly wouldn’t be surprised.

Also, if 30% of buyers in Australia are moving into apartments that are worth less wouldn’t that mean that 70% are moving into apartments worth more? Seems decent. You can’t expect to be ahead on a pre-sale 100% of the time otherwise the developers wouldn’t sell pre-sales. They would sell everything on completion.

but reserves the right to give the buyer 48 hour notice to remove conditions if they get another offer they prefer?

If you dig into the fine print the second offer has to go unconditional before the 48-hour time clause can be called on the first offer.

It sucks for the second offer. You remove conditions and invest time and cash into inspections, financing, etc., and then you don’t know for 48 hours whether you get the house or not.

That makes more sense now.

Thanks, that jives a bit better. Actual 10 year avg in constant dollars is .99%.

It can, but that would require a very drastic change in the employment mix to pull it very far in either direction.

This is actually the average weekly pay. It can change without any change in anyone’s pay rate by a change in employment mix.

In regards to the convo on here re: pre-sales, this may be of interest. It’s in regards to Australia, but I wouldn’t be surprised if we see some of this here in time.

“30% of Sydney buyers are moving into new apartments worth less than what they paid for”

https://www.businessinsider.com.au/sydney-melbourne-buyers-off-the-plan-apartments-losing-value-2018-10

@Leo S

This a tough one, because a lot of workers in the private sector do not get yearly raises.

In fact, that’s not true. Price gains in recent years have put a smile on my face and a bounce in my step!

Do you suppose that, when Hawk’s stocks perform at their usual 400% growth rate, it doesn’t put a smile on Hawk’s face?

And I could ask, Do you frown when your portfolio goes up?

Just because RE gains are less convenient, more time-consuming, and somewhat more costly to realize does not mean they are any less valuable in terms of actual money they can produce.

It’s just an example. That said there is wage pressure this year.

See average weekly wage rate: http://www.bcstats.gov.bc.ca/Files/68316f41-5683-42e1-9f29-a188a979fb15/EarningsandEmploymentTrendsData.xls

Average YTD wage rate increase is 5.4% for BC.

10 year average is 2.3%

It’s funny – when you perceive Leo to “agree” with you, it’s a final, authoritative say. When he contradicts you, you almost always remain silent, or become persistently flippant and sarcastic.

And the answer is still no, especially when we’re talking about a primary residence. You cannot live in a stock, gains in RE are realized in specific circumstances which can also carry large transactional costs, liability costs and potential lifestyle costs. This is why RE is not usually or historically an investment of choice.

The gains you’ve seen on your GH home since 2009 have not affected you one iota, and won’t unless and until you plan to cash out, assuming you have any real gains. Stocks can be bought and dumped for gains at a moments notice with little to no effect on the liquidator. Also, you can’t “spend” your equity – you borrow against it. It’s not free money.

Bingo…

No. Money is just that. The dividends my stocks pay are money. The increase in my stock portfolio is an unrealized capital gain. If I realize the gain, i.e. sell the stocks, that’s money.

That makes sense, then.

I personally intend to spend my RE equity gain someday, but not for quite a long time (I’m only 35 🙂 ).

Oh we see now that it was.

I’ll ask again. Where did the 3% yearly raises come from?

You got me there.

Thinking about it now, I believe the difference is that I do intend to spend the proceeds of my stock portfolio. I do not intend to spend my equity. That’s what I should have said instead of “I didn’t work for it”

Always happy to hear your input, Fool. In Leo’s post, he continues:

When Leo’s stocks go up, he didn’t work for it, so…

That is not a valid comparison, and it’s one that’s been debunked to death on this site.

Do you also not consider it real money when your stock portfolio increases in value?

Intorovert,

You think Joe Average who maxed out his HELOC and credit cards is going to get bailed out by the government? Dream on. Household debt is up 70% from 2008 and half live cheque to cheque.

Most government programs never covered realistic losses in any past market corrections and won’t this time too. Just like the leaky condo program.

If the lenders are scrutinizing borrowers based on income not equity like I have heard first hand accounts just last week, then any bail out would come long after the damage is done and be minimal.

Take away a third of the 20000 new construction jobs the past few years and you have a serious crisis. EI is only for 40 odd weeks. You really need to grasp reality.

Are you referring to the time clause for selling the buyer’s house? i.e. the seller has accepted an offer contingent on the buyer selling their house, but reserves the right to give the buyer 48 hour notice to remove conditions if they get another offer they prefer?

See example here: https://www.recbc.ca/psm/time-clauses/

There’s now 6 homes in Fairfield under/at $1m. I don’t think there’s been that many since I started watching earlier this year. One expired and then relisted a week later, maybe they got cold feet about Spring. Curious how this plays out over the Fall/Winter.

No it’s not. There are graphs of C-S adjusted for inflation but the index itself is not. It really has to be nominal to fit in with their methodology – particularly given the index is computed for individual metro markets where the national inflation rate may not be relevant.

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-scotiabank-becomes-first-big-bank-to-hike-fixed-mortgage-rates/?cmpid=rss&utm_source=dlvr.it&utm_medium=twitter

I spent way too much time Googling this and didn’t come up with a satisfactory answer as to what the “canonical” index is.

I am no Harper fan, but he did more or less exactly the right thing in the wake of the crisis. The fault lies later in not addressing lending standards post crisis until prices had really started to inflate.

Teranet numbers for Victoria (Sept 2018, based on sales that closed in Sept).

https://housepriceindex.ca/2018/10/september2018/

Victoria up 2nd most of all 11 cities measured, up 0.51% for the month over Aug. 2018

Up 5.14% year over year. Prices at all time high.

Since these are sales that closed in Sept 2018, these numbers reflect sales activity from 2-3 months ago. It does indicate to me that the drop in sales numbers we had during the summer didn’t hurt prices.

A classic example of the argument that the “bears have been perfectly right all along” (except for all the stuff we totally missed) that has been posted on HHV a thousand times.

Classic.

Of course if/when the market finally does fall Hawk will be crowing about his predictive genius.

Victhunter I’ve been looking for a house for a couple years mainly focusing on saanich/peninsula up to 8-850k (with suite) or 750 without. I am starting to see places that 1-2 years ago would have sold very quickly now just sit there. Usually these ones are priced slightly too high or have something undesirable about them but some of them seem fine. The interesting thing is that inventory in this range is still so low so the fact that some of these houses are sitting there is suprising to me. Buyers are getting more picky (or priced out). Often sellers let the listing expire without much of a price drop. If I was selling an undesirable house (busy road usually) I would try to sell it asap because in a year it may be impossible to sell so I guess I don’t quite understand the hold real estate through a downturn idea. It may be too late for those sellers but in a hot market I would be trying to offload my Burnside special that I overpaid for 10 years ago. It may be a while before that opportunity arises again.

It is not surprising your friends house hasn’t sold and I think it will be common place conversation soon. I have also noticed in Sidney more price drops and houses not selling compared to a year ago/houses closer to town. I have no data to back this up but I assume Langford is similar. People that had to buy out in Sidney/Westshore 2 years ago can now buy closer to town due to less competition. It’s all downhill from here in my opinion but would be interesting to see some stats on sales/price changes vs distance from core or less desirable neighborhoods. I guess it may be tough to analyze because there are pockets of fancy neighborhoods on the peninsula that are just as desirable as Victoria.

Leo you sure are rocking it with your blog posts! Thanks so much!

In one fell graph, Leo eviscerates Hawk’s hopes and dreams.

Classic bear naiveté. Any party holding power in federal government will always bail out the banks. This will be true for as long as capitalism continues.

Secondly, I don’t think household debt levels have increased by “multiples” since 2008. That’s an exaggeration.

Reality.

We’re only in a rising rate environment until we enter a recession, and no one knows when that will be.

Fully concur.

This is why many sellers drop their price by only 1%: it’s because many sellers wouldn’t mind selling now, but only if they can get close to the price they want. If they can’t, they’d rather not sell and will try again in the future.

Not Victoria specific, but I sincerely doubt we’re even close to 3%.

“However I suspect most people are more protective of their equity and do not want to lose it even if it came from market appreciation.”

If they’re on the brink of retirement and have treated their home as an ATM and/or a substitute for retirement savings, they are definitely more protective of their “equity”. These are the sellers for whom a realistic return over what they paid is insufficient for their expectations/needs.

I’m pretty sure the average Victoria family income hasn’t increase by $10,000 in the last 5 years. So where does this number come from?

Pretty sure Case Shiller Index is already inflation adjusted… Not sure why that chart you posted lives on the wikipedia article for it though. “Historic prices are inflation adjusted September, 2018 dollars.” http://www.multpl.com/case-shiller-home-price-index-inflation-adjusted/

Not an indicator of anything as much as it’s a curiosity:

Rural SK home assessed at 2.6 million sells for 550K

The bidding came in fast and furious, with all but one bid placed over the internet. But once bidding reached the $500,000 mark, the action slowed right down. “We tried to squeeze out any more pennies out that we could, but that was the max anyone was willing to spend,” Fritshaw said.

https://www.cbc.ca/news/canada/saskatchewan/kinistino-mansion-auction-sold-1.4859360

Yup, that’s what I mean. Good graph. It also shows the speed of a RE market – even in a big correction, you’re still looking at a year or two to trim most (not all) of the excess off.

Leo, is that Seattle graph real or nominal? This graph suggests in real terms US prices dropped to 2000/2001 levels in 2012.

Yes. Good point.

It’s also good to remember that the 2010-13 decline really only happened in Victoria, and may have saved us from even sharper bubbling in 2016-18. I’m not sure that it’s been well documented, but I believe it was caused primarily by prov. gov. layoffs across many ministries.

Yeah personally I don’t think of the equity gained from market appreciation of our house as real money. If it was gone tomorrow I wouldn’t be too concerned. I didn’t work for it so I am not attached to it.

However I suspect most people are more protective of their equity and do not want to lose it even if it came from market appreciation.

In downturns I believe most of the sales come from those that need to sell while others do their best to hang on, whereas in the run ups you get a lot of people buying and selling even though they don’t need to.

That’s why I believe for really substantial declines you do need to see an increase in the “need to sell” category, which usually comes from an increase in the unemployment rate.

Seattle took about 5 years peak to trough.

They also hit levels of affordability earlier but undershot because of the foreclosures triggered by the earlier decline.

This is where they are today:

Thanks Leo, I’m definitely seeing listing price corrections in the 15% range at the mid-market around the 1M dollar mark. I’m starting to get a little concerned at the 700-900k mark as a friends house on a couple acres in Langford is sitting at 700k.

Do you think the fast run-up in prices may make it easier for prices to decline? My theory is most paid nowhere near the prices being asked so may be ok with real returns when they sell and not paper losses.

Right. I only pointed to 2008 to show an extreme slide in values still is not that fast. I completely agree that if interest rates had not been decreased prices would have declined more.

That said, it is logical for the government to step in if there is a precipitous decline that threatens financial stability. Expect them to do the same the next time around. Of course at current rates they don’t have nearly as much buffer but they will still take action if it is large and nationwide.

Nice article. On the “markets don’t work like this” part, it can be quite useful to have a look at what some of the west coast cities did in the US a decade ago, when prices fell. You can see the principle you’re referring to at work – even ones that in retrospect were quite overvalued, took a fair bit of time for them to come back to earth. I noticed that in most cases, the declines were fairly symmetrical with the run-up. Of course, this was also in a falling rate environment; quite different than today.

You forgot to put an arrow showing where Harper bailed out the banks for $113 Billion that saved tens of thousands of mortgages getting called in and dumped on to the taxpayer via CMHC. 2008 to 2010 should have been a 30% plus correction.

Now the debt levels far exceed those levels by multiples and no government will do secret bail outs of the banks this time around. The perfect storm indeed.