The Islands off the Island

One of my favourite bumper stickers I see in Victoria says “relax, this isn’t the mainland”. That idea of our laid back approach is probably what a lot of people enjoy about Victoria, however it’s also a quality that will slowly slip away from us as the city grows. If you’re looking to escape into a locale even further away from the mainstream and you’re not burdened with pedestrian concerns like requiring a traditional job, you may have considered buying on the Gulf Islands. The last time I was on Saltspring I met a couple that used to have high end jobs as graphic designers in Vancouver but moved to Saltspring to escape the rat race and become glass blowers. You tend to find a lot of Vancouver refugees there.

The southern gulf islands

The southern Gulf Islands are a part of the VREB trading area, however it really is a wildly different market than the rest of their service area, and recently I have moved towards focusing on statistics that exclude the Gulf Islands because it has very little in common with metro Victoria. However a reader asked me to take a look at what is going on there, so here is a little overview.

The smaller islands are largely a recreational and vacation property market, a fact which the province recognized when they lifted the speculation tax from the area after an outcry from vacation property owners there (a group which likely includes a lot of politicians). Saltspring is a bit different though, with many more year round residents and thus the upswing in house prices and reduced availability has caused a housing crisis there as well. Local businesses are having to resort to providing staff housing to attract and retain workers because there simply is nowhere to live.

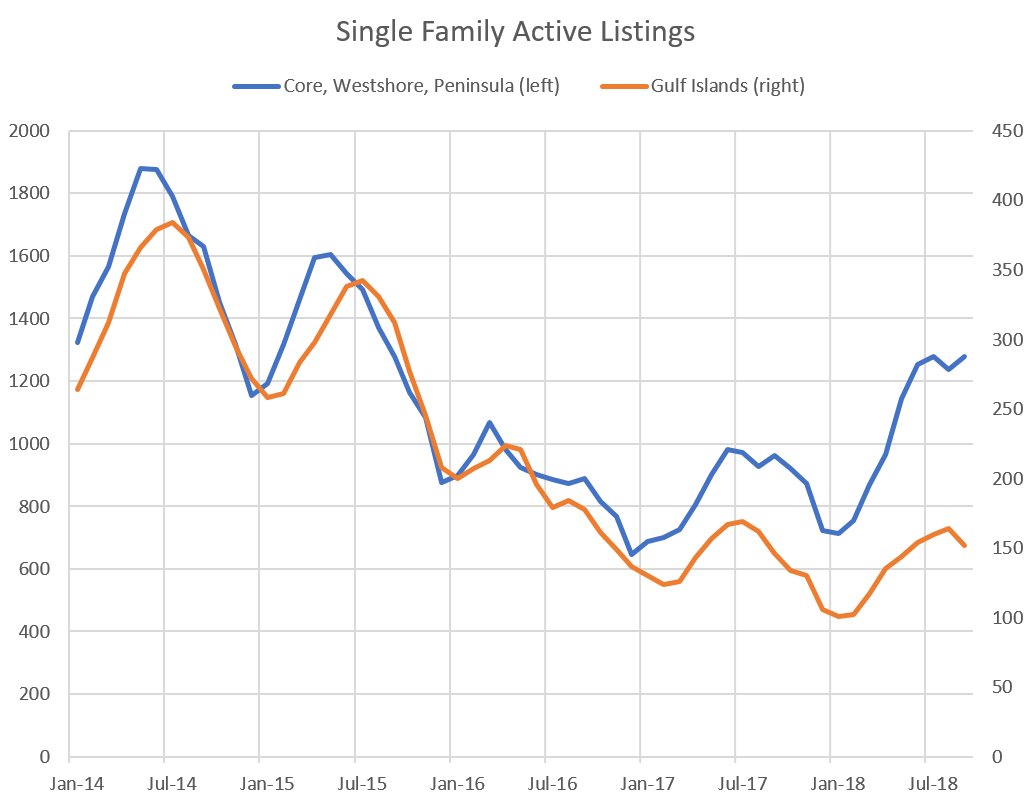

Housing inventory is almost 100% single family, with only a few townhomes scattered about. New building is severely restricted due to water and land use restrictions so supply grows only very slowly. Consequently population growth on Saltspring is slow, increasing by only 3% from 2011 to 2016 to a total of 10,500 people.

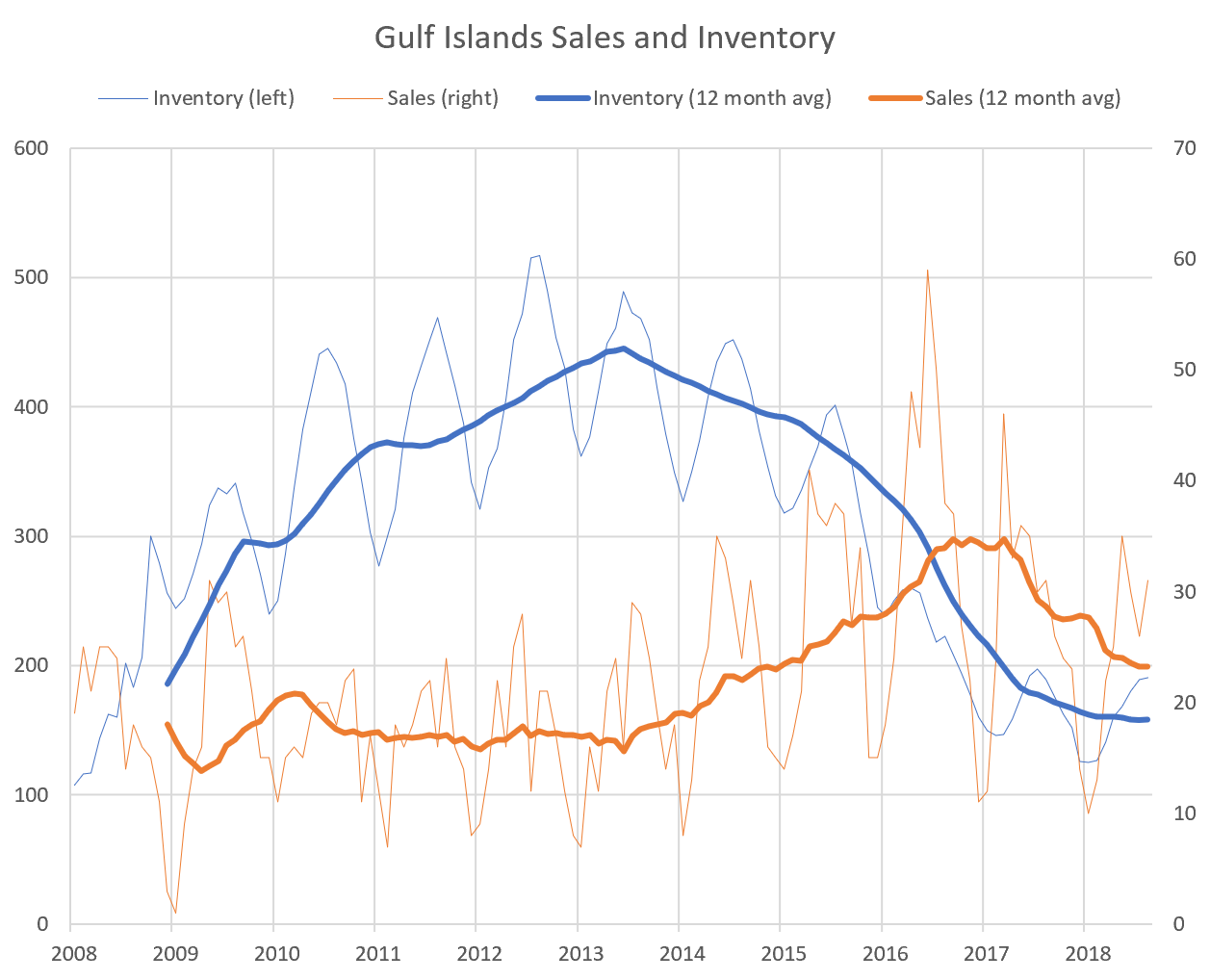

Despite being quite a different market, sales on the Gulf Islands have behaved much like on the big island, retreating dramatically from the recent highs in 2016/17.

The difference is that unlike here, inventory has not started to recover yet, and is still at decade lows. One reason is that the Gulf Islands don’t have a Langford to build new supply, but another is that new listings have been quite depressed this year and last, down by a quarter from the levels of a few years ago. This has kept inventory low despite slower sales and the overall market conditions remain in favour of sellers. Keep in mind that for the islands a “hot” market means the average place sells in 3 months. There just aren’t the same swarms of buyers like you get in larger centres.

What did the uptick in activity do to prices? Well there really are two markets on the Gulf Islands: Saltspring, and everything else. Saltspring is more expensive, with the median sales price of $750,000 in the last few months getting you either a decently updated older home on an acre or two, or a larger acreage with a cabin on it to build on. Prices on that kind of property are up around 50% in the last 3 years or so and seem to have continued to appreciate over the summer.

A three quarter million dollar view on Saltspring

The markets on the other islands are a bit cheaper, and there are a lot of 1000-1500 sqft cottages so it’s not necessarily easy to find a more traditional house to buy. A nice cottage on an acre or two on one of the smaller islands like Pender will set you back about half a million. On the cheaper side you can get a half acre + small cottage for just over $200,000 whereas the cheapest listings on Saltspring are approaching twice that.

The speculation tax which is winding its way towards implementation will not apply to the islands so that won’t solve the supply issue. However despite much of the market being second and vacation properties there, it is interesting how sales patterns have declined along with the bigger markets in Victoria and Vancouver. It’s unlikely that many of the factors like the stress test have as much effect where there are fewer first time buyers, but it seems the larger real estate cycle is still being felt.

Anyone here considering buying on the Gulf Islands?

Monday numbers, a pretty slow week for sales but prices are the highest they have been all year.

https://househuntvictoria.ca/latest

The province sets the rate, not the school board, and the money goes into general revenue. In these respects there is no difference between the “old” school tax and the “new” one.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/school-tax

The new revenue stream I’m referring to is taxing assets (wealth) with revenues going to general provincial revenues, rather than to schools.

The old school tax has been around for decades and is based on your local mill rate and the budget of your local school board. (Board 61 for Victoria). Money you pay there ends up at your local school board (allocated by province based on number of pupils in your district) and then how it is spent is is determined by the local school board approved budget.

The new wrongly named “school tax” is a NDP creation – is an asset tax based solely on the value of your home, and only affects people that “own” homes above $3 million, regardless if they have huge mortgages on them. It is wrongly named because it doesn’t go to school districts, it goes to Provincial general revenues. Your local school board doesn’t get any more money because you pay the extra school tax.

The new “school” tax levy should have been called “wealth tax”, as it has nothing to do with schools. Taxing perceived wealth is a new and exciting revenue stream for our NDP govt.

Between the earthquake, the crappy weather, the baseless economy and the boring city why does anyone want to live here?

CBC running a series on debt in Canada this week. Starting with rising rates https://www.cbc.ca/news/business/cbc-survey-rising-interest-rates-household-debt-mortgage-1.4864965

FYI the “school tax” has been collected by the province for decades, so there’s nothing new about provincial taxation of property in BC.

Reuters is reporting it as a 7.0. The question is always whether this is the main quake or a pre shock,

Update 2: A 6.5 hits same spot 6 mins later. Yike!

Nunavut not looking like a bad idea. 😉

Update 3: A 4.9 hit same spot 14 mins later. This is getting dodgy.

ICYMI , 6.6 magnitude earthquake tonite off west coast of island. No tsunami yet.

Update: A 6.8 just hit in same spot 45 mins later.

I want my municipality to opt out of provincial income tax and sales tax.

Is that so much to ask.

The Greens and the munis wanted that, but NDP refused, and the Greens caved, and the munis have no opt-out. It was that event that got me thinking that an important part of this was control for the NDP- that they could get their hands on a Provincial Property tax stream, and hence the beginning of my “slippery slope” argument.

Last I heard, every municipality had the ability to opt-out. I don’t find anything arbitrary or non-sensible about the spec tax.

I find the “slippery slope” argument to be a poor one here. But you know what.. why should they ever remove this tax in the future? Affordability might improve in the future, but why remove it? It’s a broken aspect of our society that people can make a living off of short-term trading a non-productive asset, especially if it’s a home.

You seem to live in some kind of stratospheric wealth bracket where people can buy half million dollar condos willy-nilly because it’s slightly more convenient for them. I am never going to buy a “getaway condo”. I’m going to buy what I can manage to afford, and live in it.

Edit: I actually think that letting municipalities opt-out would be the only arbitrary aspect of the spec tax and I don’t support it. Especially for the CRD.

So there we have it, a concise definition of a “speculator”. Who cares if it doesn’t make sense, actually target true speculators, free up more housing units, or raise much tax revenue.

The important (and scary!) thing about it from the govt perspective is….

The BC Provincial government is now able to collect a type of property tax directly, independent of the municpal government. Unfortunately, the government becomes addicted to new types of taxes like this. Over the years, expect this “spec” tax to get increased, repurposed, renamed, expanded in scope etc.

Years in the future, when you do buy your Victoria house or buy your getaway condo, expect to see a standard “Provincial component” on your property tax bill, that likely began as this spec tax years previously. Just like income taxes have Provincial and federal components.

Wow, that was not close. Goes to show that only contrarian turds comment on VictoriaBuzz.

https://twitter.com/CityOfVictoria/status/1053890872570331137

Good post Andy. Yes, this trend of increasing density is likely to also make Victoria SFH more expensive and more rare. But more duplex and multi-unit housing should become available and they are more affordable than SFH.

I think reasonable legislation is what we already have. If you own a non-primary residence in a place that doesn’t have a spec tax exemption, in a building that doesn’t have a spec tax exemption, you get the spec tax. The second scenario of applying a spec tax to a renter for not fully occupying the space they’re renting is virtually impossible to enforce and also virtually unheard of. You can’t really apply property related tax to renters in any capacity.

^ exactly.

There is now a fourth house with multiple rental suites on the market in Rockland. Is it coincidence or is there a real change in the market?

So you don’t want to go property-hunting with me at Mt Cain next weekend, is that what you’re telling me?

RIP,

I used to live on that beach once, very long stairwell carrying furniture down so I know it well. Wether it’s 7 meters or whatever, it’s very steep, the houses are all built into the hillside or into the cliff top and are extremely susceptible to a tsunami and earthquakes, only an imbecile would think otherwise.

When a tsunami wave smokes the foundations kiss your ass good bye as many are built down to just above high tides in the winter. My front lawn area was littered with logs right up to the front door after a storm.

Saying “it’s never going to happen” are famous last words. Ask the Japanese and Indonesians.

Ya know Hawk – I always get a chuckle out of your postings. This one though is a head-scratcher. I walk this beach with my dog in the off-season all the time. Major steep cliff? Not at this particular area where the house in question is located. Sure heading towards Gordon Head it gets pretty steep also heading north (see the slope hazard ratings chart in the link below). Tsunami risk? Yeah sure properties along the water line are but before one cries ‘wolf’ be aware that one only needs to be about 4 metres above sea level to be considered in the safe zone. I checked on this property in question and it’s about 7 metres above sea level.

http://www.saanich.ca/assets/Community/Documents/Emergency~Program/tsunami_brochure_2018.pdf

https://www.daftlogic.com/sandbox-google-maps-find-altitude.htm

http://www.empr.gov.bc.ca/Mining/Geoscience/SurficialGeology/VictoriaEarthquakeMaps/Documents/composite_map.pdf

If you have concerns about earthquakes & tsunamis, move to Nunavut.

http://pcs.marsh.com/ca/en/insights/thought-leadership/earthquake-risk-canada.html

Thanks. By your “pay attention” comment I suspect that you’re not trying to be rude, and that you are trying to teach me something, and I appreciate that.

Let’s see if I’ve understood your position by interpreting two examples using your principals outlined above.

A “NO SPEC TAX” payable example

A Victoria condo that is owned by a UK investor/speculator and rented out 12 months to a tenant from Seattle (actually using it 3 months )should and will draw no spec tax because it is rented out 12 months lease . Here we have an “evil speculator” and not one but two “foreigners”, but you’re OK with that

A “YES, SPEC TAX” payable example

A Victoria condo owned by a NDP/Greens member from out of Victoria for use during the govt work whose spends about 3 months at the condo is considered (by the law he/she voted for) to have a vacant second property (because it is not a principle residence and they are there less than 6 months) , this MLA is considered by patriotz to be a speculator and will and should pay the spec tax.

Interesting times – check out the education/career background of the newly elected Vancouver mayor, Stewart Kennedy, as well as his platform for affordable housing. This will be very interesting to watch going forward. He also wants to TRIPLE the empty homes tax that is currently at 1% of the assessed value. That’d bring it up to 90k/yr on a 3M house.

https://www.kennedystewart.ca/housing

My entire academic and professional career has focussed on cities and housing. I’ve worked in the City of Vancouver planning department. My PhD from the London School of Economics was about cities. I’ve written books and taught about cities as an SFU professor. I’ve provided policy advice to municipal, provincial, and national governments and the United Nations.

Triple the empty homes tax. Homes need to be used for housing people, not sitting empty as speculative investments.

Protect between one-third and one-half of all new homes from foreign speculation. Uncontrolled foreign capital investment has driven up housing prices in cities all around the world. I’ll make sure we’re building homes for local people and families, not foreign investors.

Providing homeowners more opportunities to develop their own properties

I’ll expand opportunities for more ground-oriented housing in our least dense neighbourhoods, including expediting the construction of triplexes and fourplexes on standard lots and removing barrier to converting large homes into multi-family residences.<

In regards to the last issue, this may result in making SFH properties even more expensive/valuable though. On the other hand, at some point you do have to increase density in a growing city.

I know a number of speculators and all of them rent out their spec properties. Almost by definition it is properties that are used for either vacations or part time business residences that are not left vacant.

If the real estate market does crash, and I think that is only 50/50, then this could end up being a very interesting unholy mess.

That’s not what it says.

An owner can rent out a property to 6 different tenants in any 6 months of a year and qualify.

Pay attention to the name, Speculation and Vacancy Tax. Why would an owner leave a property vacant in the first place? Because the owner is hoping to come ahead on appreciation, i.e. is a speculator. A renter who leaves a property vacant is not a speculator, just someone throwing away money. Are there enough of such people to be worth going after?

But I think a lot of “vacant” properties really aren’t vacant, rather they are illegal short term rentals, and these are the real target.

NDP/Green MLAs who will be voting to enact this vacancy tax should be asked to clarify if MLAs could be specifically reimbursed from paying it, via a reimbursement from the “Capital City Allowance” that may be paid to them on second properties that an MLA may own in Victoria.

Out of town MLAs can receive an allowance for all 12 months of the year, for ownership or rental of a second property in Victoria. The house only sits about 2-3 months, but it is assumed they may need a place for all 12 months for govt business.

The reimbursement outlined below states that MLAs get reimbursed for most add-ons to ownership, including “property taxes”, so the question is will and should they also get reimbursed for the spec tax that they would have to pay if their principal residence is elsewhere and they don’t spend 6 months or more at this place in Victoria?

Here is the info ….

http://members.leg.bc.ca/mla-remuneration/salaries-allowances.htm#capitalcitylivingallowance

“Capital City Living Allowance

All Members whose home base is outside the Capital Regional District (CRD) are expected to have accommodation in the Victoria area so they may attend sessions of the Legislature, participate in the work of assigned parliamentary committees, and undertake other MLA duties, as required.

The Capital City Living Allowance provides funds for a Member living outside the CRD to have a second temporary accommodation while serving as an MLA.

Ownership Options

A Member whose principal residence is outside the CRD, and who owns a second residence within the CRD to use for the purpose of fulfilling his or her duties as a Member, is eligible for one of the two options below. Members are required to complete the Capital City Living Allowance form for either option.

Ownership Option 1:

The first ownership option available is for reimbursement to a maximum of $19,000 per year for:

* Furniture rental

* Insurance

* Parking

* Property taxes

* Strata fees, if any

* Basic telephone and internet service

Members may authorize Financial Services to pay expenses directly to a property manager or strata council. All other expenses will be reimbursed upon the presentation of receipts.

Ownership Option 2:

The second ownership option available is to claim a flat rate of $1,000 per month to a maximum of $12,000 per year. As this amount is less than the maximum payable under the first ownership option, Members are not required to provide any supporting documentation. No further reimbursements will be paid to Members choosing this option.”

Patriotz, it’s not just Renting, your govt link also says that the tenant must be “occupying” for 6 months. It says “Rental exemptions are available for homes occupied by tenants. To qualify for an exemption, the home must be occupied for at least six months of the year in increments of one month or longer”

Well how about answering the questions anyway. Which were:

Since that person is using up two houses (owning in Prince George, renting in Sidney), should they also be penalized by the vacancy tax, or should the fact that they are renting give them a “free pass” to use up two (or more) houses in this time of a housing crisis.

is the Sidney Landlord (owner) subject (under the proposed legislation) to paying the spec tax anyway, because his 12 month leased tenant doesnt in fact occupy the place at least 6 months.

Only if they knew Helps is back !!

Oak bay really want those deers dead. Voted out the best mayor. I am surprised by it is the tweed curtain embraces the change out of all the municipality.

Those places on Cordova Bay are on a major steep cliff. If you have any concern about earthquakes and tsunamis you’d be running the other way.

Meanwhile down in the US the early signs of the 2006 crash rear their ugly head.

The Housing Market Is Raising Serious Red Flags

Despite a robust U.S. economy, at least as measured by gross domestic product, real home price growth is locked in a cyclical downturn. If that’s not bad enough, it will likely get worse based on the same approach and factors that correctly flagged the housing bust — in real time — in early 2006.

https://www.bloomberg.com/view/articles/2018-10-20/housing-market-is-flashing-warning-signs-opinion

That’s one of the nicest sections of beach in Cordova Bay. Perhaps they are afraid of all the construction that will happen across the street. That house is directly across from the new mall/condo development going on.

I’ve noticed that it’s definitely taking longer for beachfront Cordova Bay properties to sell. Houses on Parker just a couple years ago would sell fast & for big $$ but not now. I think to sell, that house either needs to come down more or be fixed up. Lots of work that needs to be done for something that only has 2 baths.

Note that renting by the month for a total of 6 months exempts a property from the spec tax.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/exemptions-speculation-and-vacancy-tax#rental

The only reason I could think of someone doing that would be if they were loaded and having an affair. Why not airbnb or stay in a hotel that offers a monthly rate?

No, I’m not. In the fanciful thought-experiment where I’m loaded, I mentioned buying a(n existing) ski shack because it’s the only recreational property I can see myself actually getting. Not an actual plan and we can all drop the Mt.Cain scenario now.

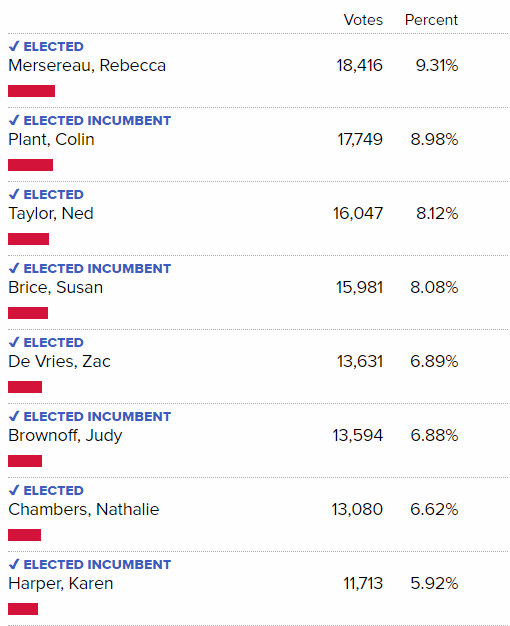

Gonna be an interesting one for Victoria. Almost everyone that was elected is very pro affordable housing for all income levels, but I wonder if they will demand too much from developers and slow down the pace of construction. Hopefully not and they can really push for a continued high pace of construction.

Also something that occurred to me is that in a push for “missing middle” (townhouses, lowrise, etc) housing I wonder if they will neglect the construction of new high density condos. Missing middle is necessary for sure but we need both. We’ll see.

Yes, Barrister.

According to this report, real estate + the construction industry account for 25% of BC’s GDP – a higher number than oil and gas represents to Alberta:

https://www.cbc.ca/news/canada/british-columbia/breaking-down-the-b-c-economy-s-risky-reliance-on-real-estate-1.4653589

The problem for the BC government is how to lower real estate prices without crashing the whole economy at the same time. A banker friend of mine, and I dont know if I agree with him, basically said that the standard of living in BC is simply not supported by what BC produces. No idea if that is true but it is an interesting question.

Looks like Lisa Helps has held on to the Victoria mayor seat.

At least Madoff is finally gone. Ben with the most votes.

And Killdeer rd isn’t even in Oak Bay!

There is a big difference between unable and unwilling. The provincial government has unlimited powers to tax RE and full jurisdiction over property rights. This means it has the power to take RE prices all the way to zero. The obstacle is not foreign money, it’s the unwillingness of BC property owners – who are the majority of voters – to support radical measures to bring prices down. And, as mentioned below, the economic dependence on the RE industry. You need only look at the blowback against the modest measures the NDP has taken to date.

Shifting gears from election issues, I found that article interesting as well. The thing that stood out to me was the prediction that (long-term) all provincial measures would not stand up to the relentless influx of money from Asia. I think we may see some corrections short-term, but this was an interesting long-view.

Haha. I think the contraceptive idea has some promise and don’t generally like the idea of culling deer. However, urban wildlife is a real issue and people in greater Victoria tend to be paralyzed with guilt when deciding what to do about it (remember the UVic bunnies?). As long as the deer are dealt with respectfully and culling is a last resort, at least someone wants to actually address the issue.

I think that environmental issues are something west-coast communities are going to have to address head-on. There are lots of good intentions that turn out to be a nightmare for city staff to actually implement. I lean heavily in the green direction, but managing a city (or province) takes some realism and compromise.

Bad election result for Oak Bay deer

Looks like Lisa Helps has held on to the Victoria mayor seat. It sounds like a lot of the “controversy” around bike lanes etc was a smaller (vocal) part of the population.

Results page:

https://bc.localelections.ca/election_results/114_2018_results.html

I have some hope for this council. It is certainly an interesting mix, with more youth and women elected.

Basically everyone in the pro-affordable housing category is in. Hope this means more supply for saanich being approved. https://househuntvictoria.ca/2018/10/04/the-politics-of-housing/

Interesting. I hope Fred does a good job. My opinion of Atwell dropped quite a bit over all the slate nonsense and spurious “handbook”.

That looks quite promising so far for Saanich.

Ha! Aren’t you the guy who plans to build a cabin in Mt. Cain that you would only occupy a few weeks per year?

Anyway, there are lots of reasons someone would rent a full year and occupy it for two months. Note that might mean every second weekend for two days (total 52 days per year). Or whenever he feels like it, and he wants to have it all setup when he arrives.

How about all the NDP and Green MLA’s? Do some of them have principle residence outside Victoria but they rent a place in Victoria full time, because they are here at various times (but less then 6 months). Ifmso, are they occupying two houses during a housing crisis?

Initial reports that Lisa Helps is way ahead. But have not seen actual numbers.

It’s looking like Haynes will unseat Atwell as mayor of Saanich, if early unofficial numbers are any indication:

Also, the amalgamation study question results don’t look as lopsided this time (in Saanich, anyway).

Check out Colin Plant’s Twitter for polling station results like this as they come in: https://twitter.com/ColinPlant2018

We did that once, before the run-up. Just as a get-away place. Certainly wouldn’t do it now. The LL loved it, and we thought it was awesome. 🙂

False dichotomy. No one in their right mind would rent for 12 months and only occupy for 2.

Are rented properties exempted from spec tax if they are “vacant”? If so, why?

I have a spec tax question for the “social engineers” here on the forum. These are the people that are able to justify something like the spec tax by showing how the vacancy tax is helpful to our society as a whole, and specifically helpful to the housing crisis. I have no problem with this argument,

I’d just like your opinion on how it relates to the following hypothetical example. …

Dr. Jones is a doctor who owns a house in Prince George. He owns a condo in Sidney which he uses when he visits Victoria on holidays, for recreational purposes.

I’ve described examples just like this here in this forum, and have been told by the social engineers here why this person should pay spec tax on his Sidney condo – because he is taking up two houses, and there is a crisis, so sorry he has to pay a spec tax and this is fair.

OK, how about Mr. Smith… the renter!

mr. Smith also lives in Prince George, but he full time RENTS (12 month lease) a furnished condo in Sidney for his recreational use. He is actually only there about 2 months per year, so the Sidney condo is vacant the other 10 months, but rent paid for all 12 months. Mr Smith is also using up two houses, and there is a housing crisis.

So the questions are:

should mr. Smith (or his landlord) have to pay a vacancy tax on the Sidney condo he rents? Or does he get to use two houses with no consequences? I should add that Mr. Smith’s landlord bought the condo on spec with intention of renting it out and making a big profit on it as it appreciates in resale value.

Second question ; according to the spec law language, is Mr. Smith’s landlord in fact liable for paying spec tax because his tenant only shows up 2 months of the year?. Here is the bill https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/41st-parliament/3rd-session/bills/first-reading/gov45-1

IANAL, but section 38 says the landlord doesn’t have to pay spec tax if the property is tenanted and is “at least 6 months in the calendar year, occupied by an individual” . So is it considered occupied even if it is vacant and the tenant isn’t there for 6 months ? (mr. Smith is only there 2 months)

Toronto and Vancouver are the obvious markets but I don’t understand them that well so I’m hesitant calling them set up for a crash. Unlike Victoria where we’ve seen a pretty regular pattern based on affordability, Vancouver doesn’t seem to have any metric that exhibits a pattern other than up so I have a hard time coming up with a plausible theory of prices there.

I imagine it will be closer to nine before all the polls finally close.

Which markets? Of those markets, what proportion of the Canadian population lives in or near them?

Rhetorical question only, of course.

In that case no nationwide crash. Some markets likely will.

Nm found the live results for

Victoria: https://globalnews.ca/news/4166547/victoria-bc-municipal-election-2018/

Saanich: https://globalnews.ca/news/4166386/saanich-bc-municipal-election-2018/

Langford: https://globalnews.ca/news/4163709/langford-bc-municipal-election-2018/

Oak Bay: https://globalnews.ca/news/4166057/oak-bay-bc-municipal-election-2018/

Check in with your heart, to determine whether you are a speculator.

Thanks for the chuckles, patriotz!

This is probably now true, but in the olden days there were budget places to ski such as Forbidden Plateau (closed 1999) and Green Mountain (closed 1984) near Nanaimo. There was also Mt Arrowsmith (not sure when it closed).

Correction: 10% – 29%

Crash: 30%+

Heading for trouble.

5135 Cordova Bay Road.

Purchased 1.85M on May 15, 2017.

Listed Sep, 2018 for 2.3M

Reduced recently to 2.1M

Assessed in 2017 for 1.5M

The house needs a lot of work. Maybe some minor renovations have been done since purchase. I guess they hated living on the beach. If it sells for the current ask they will come quite close to breaking even. But if they have to drop the price further…

Where will the vote result be posted first?

Correction yes, crash, unlikely. Depends on your definition of crash though.

Not sure why the yellow highlighting, but:

Source: weatherstats.ca

Certainly showing instability, but it hasn’t really started to crash yet. Will it? Very likely, but nothing is ever certain until we see it in action.

Polls close tonight at 8pm. Go vote or you’re not allowed to complain about what city council implements.

Really long line up to vote down in Fairfield. Took us well over an hour. Anyone else getting a sense of how voter turnout looks?

I have asked the following question before a couple of times over the past year….

Is there anyone on this blog who does not think that the Canadian Real Estate market is currently experiencing a correction/crash?

Bank of Canada hike rates next week.

Found Bloombergs take on Vancouver interesting. While not the main focus of the article, a significant point is that Vancouver and to a large degree BC itself does not have a sound basis underpinning its economy. If accurate then it is really worrisome.

Question for ya’ll…does anyone here think the Bank of Canada will not hike rates next week? If not, why not?

High end rents tanking in Vancouver. Won’t be long til it hits here.

High-end house rents plunge up to 20% as inventory spikes: experts

Slowdown of detached home sales, speculation-tax avoidance, Airbnb rules bring flood of high-end houses onto rental market, creating “desperation” as owners slash rents

https://www.vancourier.com/real-estate/high-end-house-rents-plunge-up-to-20-as-inventory-spikes-experts-1.23470074

Huh? The Mt.Cain cabin thing was a hypothetical scenario where I had enough money for a recreational property. I’m not considering living in a mountain shack full time.

Poor people xcountry/backcountry ski, cost no more than hiking and better excersise!

Bloomberg’s take on Vancouver.

https://www.bloomberg.com/news/features/2018-10-20/vancouver-is-drowning-in-chinese-money

You are speculating if your reason for buying an asset is that you expect to sell it for more than you paid for it.

You are not speculating if you buy it for some other reason, regardless of what eventually happens to the price of the asset.

REALITY CHECK : East Coast verses West Coast price comparison:

Beautiful home on acreage, near the ocean, in Summerside PEI for $335K

https://www.realtor.ca/real-estate/19850951/single-family-41-camp-road-lot-2015-3-miscouche-prince-edward-island-c0b1t0-miscouche

Very basic, run-down home, on a relatively small lot that, if you want to take a big risk, you can subdivide, for $1.1 Million

https://www.realtor.ca/real-estate/19734039/single-family-1520-pembroke-st-vancouver-british-columbia-v5r1v8-fernwood

A loaf of bread, a litre of gas, a steak, a dozen eggs, a movie, a home utility bill, a car repair bill, public transportation, all these things cost about the same in both places. Also, in both places you get free health care. That’s Canada…

So where would you want to retire? Or better yet, where can you “afford” to retire?

The consumer debt bomb is going to come unglued in the new year. I expect to see Xmas retail sales pull back leading into the inevitable downturn.

Rising rates and slowing economy expected to push Canadian delinquency rates higher by early next year

“We are starting to see interest rates have an effect,” he said.

According to Johnston, about 43 per cent of all non-mortgage debt is lines of credit, much of it home equity lines of credit, which is variable rate. Every time borrowing costs rise by 25 basis points, “your monthly payment changes. We’re starting to see that flow through a little bit, because people are still using a lot of lines of credit.”

There’s also a “lag effect” of about 3 months to 6 months between when credit growth slows and when delinquency rates rise, he said.

https://business.financialpost.com/personal-finance/debt/equifax-sees-rate-hikes-pushing-canadian-delinquencies-higher

No, not that I’m aware of. I asked Leo for this functionality a long time ago, but it must be very low on the priority list.

Leo, please also add an editing countdown timer (like we had before). That would be nice. Thanks.

Josh:

Your wife might be down for a few weeks a year but you will be increasingly miserable for the rest of the year. Best case scenario, you will be heading up there alone while the wife and kids are off to Aspen. Having kids in your life changes your priorities overnight. Possible that you might be the exception but I would not count on it.

Well of course it does. I mean, if you with all your manifest and elevated probity are not able to condemn other people's choices, who will?

None of us gets too many opportunities to indulge in guiltless gales of derisive laughter, so it is always nice when the left makes another foray into meddling in other peoples lives.

The Greens…. First adopt a name that adopts the moral high ground. Despite having no visible personal virtue, you can signal that you are better than everyone else becauseyoucaresodeeplyfortheenvironment. Then you may feel free to cheat on your taxes, bully your partner, be contempuous of religous beliefs all the while damning other peoples delights and successes as 'extravagant and unnecessary'.

Name a policy with a lie…… The "Speculation" tax. It's difficult to see how any of the progenitors can say that word with a straight face. Difficult, unless you've had occasion to read what happens after calling someone a "wrecker", "Trotskyist", or "kulak". Manufacturing a target class out of a group of individuals who have nothing in common ends in blood. One thing is certain, not one penny of tax will be collected from anyone who is a speculator. It will be collected from people have innocently had some form of success in their life. Why?

Envy and impotence…… Both Orwell and Koestle identified that these are at base the drivers for the left, and by no means is it motivated by any true considerations for the underprivileged or disenfranchised. They did that 70 years ago, but old and modern examples of that fact are legion. Which brings us back to the top of the page.

That’s about what I figured. An OSFI regulated lender acquired the debt causing the spike of debt on the books, but the amount of reverse mortgage debt didn’t increase, it merely shifted from a less-regulated to a federally regulated lender.

A little off topic, but I’m a little confused on this… If you’re registered to vote in general, do you automatically get a package in the mail for the referendum on electoral reform, or does one need to register online for that?

LeoS, is there any way to delete one’s comment via the edit function?

Better Dwelling got back to me about the cliff that was in that reverse mortgage debt graph.

BetterDwelling:

The slope of the graph is misleading due to acquisitions and how a big chunk went from unreported to reported. But the amount is real.

She would be very down, for a few weeks of the year.

Is your wife on board with this idea ? 🙂

It’s very interesting—the tension between homes in aggregate (should we build more? how many are sitting empty? who is living in them?) and individual homes, each the private property of an autonomous owner, who in theory ought to be able to do (or not do) with the home whatever s/he wishes.

No power, but lots of powder.

Looks like Marko got his wish.

Here we go again with speculators profiting at the expense of locals, this time in Kitimat:

“Dos Santos says a lot of the buyers she has worked with have been out-of-town investors who are hoping to secure property that they could then use as rentals for the coming boom. “We don’t have a lot of locals,” she said. “I think in all of the sales I saw last week I only saw one offer come from another agent from a local buyer, a first-time home buyer.” … Kitimat might end up facing issues with vacant housing if buyers simply use property as an investment instead of living in them or renting them out. “There could be something in place where you could ensure people buying houses were going to be living in them,” Germuth suggested.”

There could be something put in place. Spec tax, vacant home tax, you name it. Hit the speculators with everything you have please before Kitimat becomes a microcosm of the larger BC real estate market.

Some of the bulls here must be just itching to scratch their FOMO.

https://www.cbc.ca/news/canada/british-columbia/kitimat-real-estate-sizzles-after-lng-announcement-1.4869168

This argument manages to ignore the fact that homes are made to be lived in. I don’t know about you, but I can’t ignore that. You can’t live in a pile of stocks.

How much of this spec tax will find its way back to Victoria.

Answer… Not much…. $14m per year to Victoria. That’s the cost of about 14 houses.

That’s $40 per person in Victoria or about $100 per family.

Does anyone this $14m is going to make a significant difference. Usually the Provincial Govt can just make a few accounting entries to “deem” that much money has been transferred to Victoria, by using money that was allocated anywya, so we may not see anything like that in new money.

========= how did I get to the number $14m ? =================================

Well, first the govt said it would raise $201 million total https://www.vancourier.com/real-estate/opinion-will-the-speculation-tax-proceed-or-fail-this-fall-session-1.23448652

… but then Weaver talked them into reducing the rest of Canada to 0.5% rate, so that made it $30m less (source https://globalnews.ca/news/4569070/bc-speculation-tax/ )

… so now we have $171 m expected tax. But that’s if noone actually gets around the tax by selling, renting, or other exemptions. So assume that 20% get around it, and now we have 171 x 80% = $137m tax. Let’s say the govt is super-efficient in collecing it and it costs them $7m overhead, so we’re down to $130m.

Now how much of that $130m finds its way to Victoria (population 350k) ?

The spec area total population is about $3.3m (details Victoria (350k pop)+ Vancouver (2.4m) +Nanaimo (110)+Kelowna (140)+Abbotsford (140)/Mission (50)/Chilliwack (90))

So that means that Victoria’s population is 350/3300 = 10.6% of the spec area

So we should expect ABOUT 10.6% of $130m to come to Victoria from this spec tax. Thats $14m per year

==============================================

Josh, just because you are living in the house does not take away the fact that you are also speculating on the property any more than owning a cottage or vacation property.

Some areas like James Bay are targeted for speculation by people who choose to live there. Sorry Josh but you do tend to drip self interest but it is amusing.

Then again it is easy for me to be amused since I dont have to live with the fallout of some of these policies.

US and state tax systems are biased against foreign owners of RE. For example, the deductibility of property taxes and mortgage interest benefits the locals but not foreigners. The biggest snowbird state, Florida, charges non-residents far higher property taxes than locals. Also Washington State has no state income tax and as a consequence has high property taxes. Non-resident property owners get the short end of this.

AMEN! When you have to factor in fixing all the poorly thought out “upgrades”, it makes it harder to want to pay someone’s asking price.

Thankfully the Americans are more level headed than you on this Leo. It is one reason the US economy outperforms Canada (30% higher GDP per capita for Americans vs Canada).

Canadians can and do own lots of snowbird properties in the USA. Americans are very welcoming, appreciate the Property tax that the Canadians pay, and the other money Canadian snowbirds spend on improving the US economy. Too bad BC will lose out on all that money flowing the other way from US->Canada.

I don’t think this is correct Leo. The BC Govt website says what you are saying only applies to 2018 and 2019. She would pay spec tax starting in 2020 and their only option would be to sell or live in it.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/exemptions-speculation-and-vacancy-tax#rental-restrictions

All owners of a property where a covenant or a strata bylaw prevents the property from being rented out in a manner that would allow a rental exemption are exempt for the 2018 and 2019 tax years, if the rental restriction was in place on or before October 16, 2018.

Units in strata hotels are exempt for the 2018 and 2019 tax years

======================

Has been an uptick in over ask sales in the detached market. 12% in the last 30 days. Up from merely 5% in the previous 30 day period.v Over asks mostly in the lower end of detached ($600,000 range)

Still a shortage of half decent normal houses that haven’t been chopped up. Literally 80% of houses I walk through under $1 million I scratch my head as to what people were thinking when they carried out upgrades over the last few decades.

I don’t like the fact that non-rental stratas are exempt from the spec tax. This is the majority of buildings in Fairfield and Oak Bay. Apply the spec tax to non-rental stratas which would force them to amend the bylaws to allow rentals which actually might increase rental inventory.

Thanks, missed that

Har har. I can’t help but notice you didn’t refute any of my points.

That’s the spirit! Primary residences or gtfo!

Weaver didn’t get it, it was right in the NDP election platform. What Weaver got was a reduction in the tax from 1% to 0.5% for out-of-province Canadians.

Most likely this scenario was made up in the first place.

I have noticed that two of the converted Rockland manor houses which house rental apartments are now up for sale. Be interesting to see if either of these properties sell.

Most likely her strata prohibits rentals and she does not have to pay the spec tax.

And if she does, I’m not even sure it it’s so horrible as you are making it out to be. Lots of other options for this person. They can get a hotel, they can buy into a timeshare, she can get together with her parents and buy a bigger condo so she can stay over, she can get an AirBnB, etc.

Edit: If I owned a condo in Seattle I would not be surprised if the city or state or country decided to tax me extra as a non resident owner. In fact I understand this is extremely common in the US. But somehow as Canadians it’s just envy if we prioritize local owners over out of country ones?

Edit 2: In fact the more I think about it I don’t give a toss about the ability of this hypothetical american to own property here. If they like it so much they can move here and become a PR.

Actually. I think there should be a special tax on every ski property. Rich people ski.

We also need a a much higher tax on coffee shops. If you can afford Starbucks then you have too many bucks.

Maybe a really big tax for all those in the overpaid technology sector as well.

This is a big win actually and good on Weaver for getting it. It deflates the argument that the spec tax is just a tax grab for general coffers. The additional PTT and foreign buyers tax should have been 100% dedicated to affordable housing as well.

Virtually every property on Mt.Cain is a short-term rental. It’s a village that only sees use in winter. Can you seriously not see how a property like that is outside of consideration for a tax designed to ease a housing crisis? I never said it wasn’t extravagant or unnecessary. Remember, in this hypothetical situation, my business took off and I’m rich ;).

It sounds like you’re misinterpreting.

====

Got it. But your Mt. Cain ski- getaway cabin, with rights to airbnb it, is not “extravagant and unnecessary”, and it sounds like you consider it an entitlement.

None of that is an example of a recreational property.

I’ve said before that I don’t think speculators are the devil, but it’s pretty undeniable that the effect they have on the market is detrimental to those living and working in a society experiencing a housing crisis. Spending half a million on a small condo for the sake of a serving as a short-notice hotel suite strikes me as extravagant and unnecessary, and is precisely the kind of use this tax is designed to target.

I would expect Mt.Cain properties to roughly keep pace with inflation. Again, no power, no running water and the logging road is often impassable to all except 4×4 with chains. It’s not like I would be taking a domicile away from a local working family, and I would short-term rent it out as everyone else on the mountain does.

It’s not that it’s at odds, it’s more how much time effort and money did we as taxpayers pay for the spec tax under the premise that it will help affordable housing?

Yes.

How about someone who lives in Seattle, but spends lots of time in Sidney visiting her elderly parents who live in another small condo, and bringing her kids to see their grandparents. She owns a $500K condo in Sidney so her kids and her have a setup vacation home to stay in. They travel to Sidney throughout the year, often on short notice for family/health reasons, so renting it out for 6 months is not possible.

She pays property tax of about $2,500 , but now will have to pay ($500k x 2.0%) = $10,000 extra spec tax. She is one of your evil speculators Josh, and you are expressing delight at the prospect of people like her getting slammed with this tax.

Whereas your future plan to build on Mt. Cain (home of VI’s best power ski/snowboard resort) should be expected by you to be exempted from this tax. Have you ever heard of property close to a ski resort going up in value?

“Government will meet with mayors annually to assess impact of spec tax, money raised will be used for affordable housing in communities where tax is in place, rate of 0.5%* for Canadians who reside in and outside of BC. ”

If communities keep those funds in their community for affordable housing, that’s decent. Whistler needs that.

Leo: You might be right but my experience is that governments always find it easier to expand a tax than to introduce a new one.

Empty-homes tax prompts sale of Vancouver condo and a local couple bought it.

https://www.theglobeandmail.com/real-estate/vancouver/article-empty-homes-tax-prompts-sale-of-vancouver-condo/?utm_source=facebook.com&utm_medium=Referrer%3A+Social+Network+%2F+Media&utm_campaign=Shared+Web+Article+Links&fbclid=IwAR0pFlIYBATEMjwU-MCC24osDDZ2w1adl7yRzk8kcDlbB1irAY7PSwP155c

It’s not like the spec tax is at odds with your plan. I’d support both.

Spec tax is BS and is a pure political play to appeal to millennial voters. it is no solution to affordable housing that is for sure.

A real solution to our problem, as I stated before, is to build the infrastructure first and then promote the creation of new neighbourhoods that support smart density and livability in short order.

When my business takes off and I’m able to buy a recreation property, I’ll happily pay the speculator tax if it applies. I doubt however that a cabin with no power or running water on Mt.Cain would have a spec tax on it.

Can you honestly come up with a case where a property is legitimately used recreationally and is also non-speculative? A condo in downtown Victoria does not fit that bill.

About Saltspring’s water, I know someone that worked at MB Labs and dealt with a lot of islanders getting their water tested. There’s a lot of natural bacteria and arsenic in their water and a lot of ignorance about how to properly filter that water. It being Salt Spring, they also have a higher than normal population that dedicates themselves to scientific ignorance with things like healing crystals and “raw water”. As far as I know, there isn’t an issue with the volume of water available on the island. Pretty sure a lot of people there have the option of getting by like rural Australians by just capturing and treating rainfall.

Josh, when your business takes off, and you’re able to buy a recreation property, that turns out to be in the spec tax area, will you take that same attitude as you join the ranks of the evil speculators – that you are just taking millions and giving nothing as you state above.

Congrats VH. Good luck with everything.

The Saltspring thing brings to light an important part about increasing density. The infrastructure should be in place to support it first. Unfortunately we don’t have money pipes gushing dollar bills out of the ground like the Middle East. (They burn those dollars to make their water.) So forget about Saltspring. But we do have a tram line from the WestShore already mostly done for us….

Yet we never broach the question of how many people is too many for Greater Victoria. Or any other city, for that matter.

Are cities in Canada gonna grow forever? Is that the plan? Bad plan.

Congrats VictHunter. I hope that works out well for you and your family.

Of course, that’s well known and talked about in the Salt Spring article. The question I’m raising is what have the governments/trust over there done to improve the water supply? Have you heard of any mega-projects to catch/divert and retain more rain water to store in the lakes? You’ve certainly heard lots about them fighting global warming.

And then they make a casual comment like they may have to limit the number of people that can live on Salt Spring Island, and you seem to accept that because they have a “problem with potable water”. Lots of places have problems with potable water – look at the Middle East for example. They don’t “limit the number of people that can live there”. They work at it, with desalination plants and conservation etc.

There’s lots that can be done to improve water supply on Salt Spring and elsewhere. For example, look at the quote here from a Salt Spring Island trustee “Some of the other southern Gulf Islands have legislation in place that demand property owners actually harvest rain water and store, and maybe we need to do that on Salt Spring too,” he said.” https://www.cbc.ca/news/canada/british-columbia/salt-spring-island-prepares-for-future-with-less-rain-1.3583576

What? There are no condos on Salt Spring? But, golly, Premier Notley said, “Maybe on Salt Spring Island you can build an economy on condos and coffee shops, but not in Edmonton and not anywhere in Alberta.”

Gee whiz, this has got to be the first time Ms Notley has been wrong about something…

Maybe her mentioning Salt Spring in her speech was deliberate, in light of the fact that many on that island are turning away from her province’s top export:

Salt Spring Island lays claim to unofficial title of ‘electric car capital of Canada’

https://www.cbc.ca/news/canada/british-columbia/salt-spring-island-lays-claim-to-unofficial-title-of-electric-car-capital-of-canada-1.4150568

There is certainly risk. If you live in Canada there is always the risk that tax policy can be changed at any moment and that tax policy can seriously disadvantage you.

Is there more risk right now compared to at any other point in time? Well given the problems with affordable housing there is certainly more risk that the government will intervene than in times when there is no acute problem with affordable housing.

However in this specific case (spec tax for gulf islands) i would say the fact that the government has specifically exempted them means the risk is decreased, not increased.

There’s a certain amount of political fearmongering at work here.

I don’t know anyone who has a problem with people who bring millions into the province, if that’s what’s actually happening. When people speculate in BC housing, it’s the other way around – we’re bringing them millions and getting nothing but rich realtors out of the deal.

Patriotz, I think that you make my point for me. Leo, there is risk is all that I am saying. Whether discouraging people who bring millions into the province is a good or a bad idea I will leave to another day.

Feel free to post it here once it’s listed. Maybe some house hunters here are interested.

Thanks Leo and Barrister. Purchase price was reasonable so it isn’t contingent on selling our place.

We will be selling and hopefully porting our fixed mortgage from last year but my broker is wheeling and dealing.

Now the tricky part, pricing so it so sells! It will be well under assessed value and less than the brand new ones that sold on our street earlier in the summer.

You mean people who can afford to own a property in one of Canada’s most expensive markets and leave it empty, while families can’t find decent housing. Well I say bring it on and so will a lot of other people.

LeoS:

I think that special Victoria laid back quality is evaporating faster than many think.

Congrats! contingent on selling your house or not?

Vichunter:

Congratulations on finding a home that you seem to be thrilled with and meets all your needs. Hopefully we will get regular updates on how you are faring.

LeoS:

I think you might be wrong as to whether a future government would extend the envy tax.

I suspect that any new tax would come in a different format but with the same target. This government certainly has an appetite for raising taxes. Should the next election provide a large NDP majority I would not care to predict what would be targeted by way of new taxes.

The reason that buying a vacation home is a real risk is because the tax situation is at best unpredictable.

Rates still heading up choking out more buyers

Weaker than expected economic data not seen delaying Bank of Canada rate hike

https://business.financialpost.com/news/economy/wrapup-weaker-than-expected-canadian-data-not-seen-delaying-rate-hike

Meanwhile the global bubble shows all the classic signs of a repeat of 2008.

Growing corporate debt risk has ‘echoes of last crisis,’ Bank of England warns

https://business.financialpost.com/news/economy/corporate-debt-warning

Patrick:

The gulf islands have a ,major problem with potable water which effectively restricts the population size on the islands.

Supply is the number of properties on the market at a given price. It is only loosely related to housing stock, which is what I think you’re talking about when you say supply.

Sounds like you are focusing on a minor risk rather than the big ones. You know, something like rising interest rates. And falling house prices in Vancouver, which is not a risk but something already under away.

Also, “envy tax” has a “let them eat cake” sound to it, something the member for Vancouver Quilchena doesn’t seem to have noticed.

The (stated) reason that housing supply is severely restricted is because of limited resources on island, especially water. Any increase in population needs to be supportable by the islands.

That ship has sailed. I doubt there is any chance they would extend it again.

Good point, I meant mostly the smaller islands. Saltspring is different. Updated wording.

I just spent a few days on Mayne Island last weekend and in the past spent time on Pender. Great options for people who are not too social and can work remotely. The winters can be really quiet on the gulf islands. Met a couple of Chinese Medicine Doctors who commute to White Rock with their family to work a few days a week. For retirees, it is a good option until one’s health declines and there are lots of Canadians in great shape who won’t need much health care until they are in their 80’s. Selling in that market is not easy, especially if Ferry service declines and Vancouver/Vic property appreciations slows.

Speaking of selling, we are listing Monday. Got an accepted offer last night with our 3rd kick at the can on a nice home on a double lot in Glanford. One of the best maintained homes I have ever been in and more than enough room for 5 plus 1 in the future if we lucky. The suite is roughed in and there is room for boat parking and building a detached office/garden suite when Saanich passes their new rules.

We’re listing our newer 3 bedrooms (1 has no closet for the lawyers on here) 3 Bath house on Cadillac for sale on a half lot and hope not to get heckled too bad by HHV regulars. 10 years of great times including hosting our 100 person wedding party and bringing our son home. Pricing is going to be a challenge in this market but being well under the average should help.

Thanks @Leo S and everyone….10% of the hard work is done. Gulp….

It is too risky to buy a vacation home anywhere in BC now with the risk that the envy tax will come to that area.

=== vvvv

These articles point out a valid problem of lack of affordable housing.

They then lose me when they assume the cause of the problem is some Airbnb rentals, or some vacant vacation homes. We can close all those down and that’s a one time fix, and there will still be shortages, because the problem is bigger than that,

The government has the tools to facilitate more affordable housing. Zone increased density housing, build housing for homeless people -this is what we expect and pay taxes for our government to do.

Instead, we have to watch the government blaming rich people (vacant vacation homes) and social innovations (Airbnb) for the problems.

In that article, just read what that salt spring trustee says….

https://vancouversun.com/news/local-news/salt-spring-islands-housing-crisis-pushing-out-longtime-residents

(Salt Spring trustee said) “he supports the idea of putting a cap on how many people can live on the island.”

So there you have it. A giant “NO MORE PEOPLE ALLOWED” sign to be placed on Salt Spring Island is your NIMBY government ideas in action. People who care about the issue should demand the government take some action to INCREASE HOUSING SUPPLY.

All the people who actually live there might argue with you. I would think this should be phrased “The islands have a large proportion of recreational and vacation properties.”

This is a good point for all the buyers complaining when Victoria listings don’t drop their price after a week. Sometimes sellers just have to be patient.

This article takes a good look at how bad things have gotten with the housing market on Salt Spring

https://vancouversun.com/news/local-news/salt-spring-islands-housing-crisis-pushing-out-longtime-residents