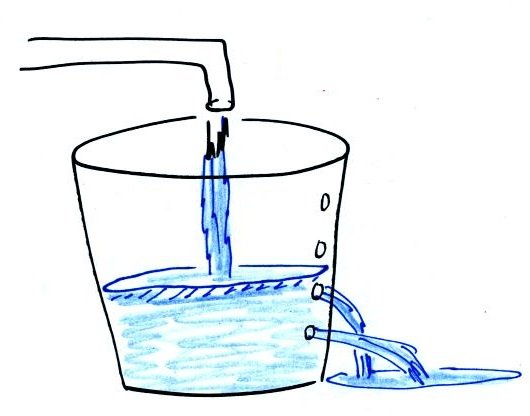

The leaky bucket

Over the years we’ve talked about how important new and out of town buyers are to our real estate market. To understand why, we have to first remind ourselves that not all buyers and sellers are equal from the point of view of their impact on the market. If you have a local owner selling their house and then buying another one, they hardly impact the market at all. They add one property to the market, then promptly take one away again for a net effect of zero. A seller that dies or moves away is different. They create supply, and that supply must be bought up by a corresponding buyer that creates only demand.

Think of the market like a bucket with holes in it. The water running out the bottom are the sellers not to return, and the water pouring in are those new buyers coming to the market, whether those are out of town buyers, local investors, or first time buyers. The water in the bucket might swirl around more or less actively, but the only thing that changes the water level is what’s going in and out.

In most markets, new buyers are the dominant force, making up around 45% of home sales nationally based on mortgage industry data. Victoria is quite atypical in this respect, with an average of only 22% of sales going to first timers according to VREB surveys.

This means that overall in Victoria, first time buyers have a smaller impact than in other markets, and likely have an impact roughly equal to out of town buyers (around 25% of the market). We don’t know how many out of town buyers are also first timers, but I suspect given how expensive Victoria is, that Venn diagram won’t overlap much.

What is also fairly unique to Victoria is our older population. With an average age of nearly 45 and the highest proportion of population over 80, the city is much older than other Canadian cities (Edmonton’s average age is 38). If we look at our demographics and apply mortality tables, we can see the approximate effect of that. This is the primary reason why people become net sellers of real estate after the age of about 70 – 75.

This means that the holes in our housing bucket are bigger than those of other cities, and as the population ages it will require more water coming in to replace that which is leaking out. For the market to remain stable or increase, we will need to continue to attract those out of town buyers with money, as well as have first time buyers continue to buy and in greater numbers. We’ve seen the pullback this year when part of that first time buyer tap was turned off, and it illustrates how changes in our neighbouring markets can trickle down to us.

How’s that for a euphemism? Too dark?

they are not so sure about how friendly the people here are.

So true. Schooled behind the tweed curtain, and then went out to see the world and still for the most part outside of Vic. What other posters have written is true; Vic and OB in particular are very cliquish and even inbred to a certain degree! Unless you have been in the neighborhood for decades or generations and/or someone vouches for you, there are challenges in terms of being accepted. I don’t golf anymore, but try fitting into the boy’s club at the Victoria Golf Course haha!

Through my decades of working in different location, the only other place I’ve seen this is in London England. Perhaps we owe it to our British ancestry? haha? Who knows.

The nicest people we’ve met in our neighbourhood is not surprising…people from Alberta, Prairies, and Toronto. The new money from Vancouver is not much better in their Lululemon attire!

For those interested, there is even a newcomers club in Victoria. We attended one of their functions last Christmas and it was a blast! To my fellow Victorians, try to smile a little bit more and say hi to a stranger next time you go for a stroll! It will make you feel good and we can do our own small part in making our home a better community!

1236 Oscar is interesting. Just listed for 18% under assessment. Legal duplex but informally a triplex — looks like the owner-occupier lives in a basement suite that only has a kitchenette.

Is the asking so off base from assessment due to the dated interior? I wouldn’t expect a bidding war for this property.

Jaleek, my house was in the $250k-$300k range when I bought in 2012. When I bought it, my salary was close to the median salary. When I quit my job last month, my annual compensation was in the range of my original house price. (My partner’s has salary has stayed close to median.)

Patrick, my house closed last week. I’m staying with the parents for a few weeks until I can find an apartment in Victoria. I’m also taking a few months off between jobs. This does make me timing the market.

If I go SFH, it will be under $1m, and in the area of James Bay/Fairfield/etc. For example, something like 615 Moss (obviously haven’t seen it in person, but the photos look reasonable to me). I think it’s overpriced by virtue of sitting on the market for 2 months. Personally I think by at least 5% but I haven’t consulted an agent (maybe Leo or Marko can chime in).

That’s because we aren’t. I lived in the US bible belt for a year and as a result when I returned the difference was very striking. I had never noticed it until then.

To me returning, people here came across as cold, disinterested in you, untrusting, cliquey and very snooty. You go to a gas station or McDonald’s down there and they’re delighted to see you, like you’re their long lost friend or something. You stop and sit next to someone on a park bench there, within 15 minutes they’re telling you all their secrets – and are delighted to give you the shirt off their back if you need it. You pull over on the side of the road, and car after car stops to offer to help you or give you a lift.

Good luck with any of that here. It’s really palpable and actually quite a shame. I don’t usually notice it any more but I will say it was unequivocally, a nasty culture shock when I came back.

Deb – no matter how bad this is, it surely doesn’t compare to the trains of RVs clogging the mountain parks routes, all around western Alberta and eastern B.C., every summer. Our tourist traffic is blessedly non-vehicular, with a lot of cruise ship, bus tour (Butchart anyone?) and ferry day passengers compared to increased cars. In fact, outside the downtown core, Victoria is quiet in summer, with locals off camping or whatnot.

@RenterInParadise > There’s a big divide between want and do.

Totally with you on this. We spent 12 years working in Calgary, renting there and owning here. We have so many friends from Alberta who have visited us at home here in Victoria and talked about living here. A few have even looked at properties. However, when push came to shove they decided that they could not leave friends and family behind and start a new life here.

One comment I hear all the time is that it is lovely to come here for a holiday but they are not so sure about how friendly the people here are. I don’t notice any difference in that aspect but I accept that the locals do get a little snippy during the busy tourist season. Drivers can be particularly frustrated when stuck behind a tourist sight seeing at 15 km on busy roads.

“On top of that, CARP report suggests 1/4 of Albertans want to retire in Victoria! Wow!”

Keep in mind that article was written in 2011 when prices were much more affordable. Try asking those same people now how many plan to retire here at current home prices and you get a completely different story. If so many planned to move here from Alberta or other Canadian provinces we would see much larger population growth. The past year has actually seen a major decrease of people from other provinces moving here although international immigration is up. 12862 people moved to BC from other Canadian provinces in the first quarter of 2018 yet 12066 people left BC for other Canadian provinces for a net gain of 796 people. This was a decrease of 78% from the first quarter of 2017. Fewer people came to British Columbia from Alberta and Ontario compared to a year earlier contributing to the decline. Victoria population growth is middle of the road and grew only 10% from 2010 to 2017. On the other hand Calgarys population in that same time period grew by 29%, Kelowna 18%, Vancouver 15%, Edmonton 27%, Regina 25%, Toronto 17%, Moncton 16%, Halifax 11%, Saint John’s 17%, Winnepeg 14%, Saskatoon 32%. If I only read this blog I would think that everyone in Canada are cramming on the ferries to move here yet our population growth compared to other Canadian cities clearly demonstrates that desirability plays a minor roll when compared to things like family, affordability, and job opportunities

Which then goes back to the leaky bucket, does it not?

On a different note… just saw 1016 McClure St posted (MLS 399761) for $1,150,000. Last sold for $1,090,000 in July 2017. After paying PTT on the buy and then assuming realtor fees on the sale side, I’d say they are hoping to sell and break even at best. The buyer gets an updated older home straddled by apartments & condos… yeehaw!

I’m with patriotz on this one. There’s a big divide between want and do. Pretty much all my Alberta neighbors & friends said they want to retire here in Victoria. Not a single one has and I doubt any will. The pull of deep roots of family, friends, & community make moving a very hard proposition.

According to the 2016 census, 21.2% are over 65.

https://www12.statcan.gc.ca/census-recensement/2016/as-sa/fogs-spg/Facts-CMA-Eng.cfm?TOPIC=2&LANG=Eng&GK=CMA&GC=935

Putting aside the issue of just how many of these people there are, don’t just about all of them already own?

How many will actually do it? Victoria is much more expensive than Calgary, which is the most expensive city in Alberta.

Incomes not only determining factor, don’t forget about wealth:

1/ from 2014 TC

https://www.timescolonist.com/news/b-c/b-c-has-canada-s-highest-inequality-of-wealth-report-1.1352802

Indeed, Statistics Canada data suggests Canadian couples in their 50s have about three times the net worth of those in their 30s.

2/ Avg Net worth Victoria 2017

https://www.huffingtonpost.ca/2017/09/05/millionaire-cities-abound-in-canada-as-household-wealth-hits-record-high_a_23197541/

avg net worth 1.05MM$

3/ Seniors over 65 made 16% of population in 2004, now with boomers, I expect they make up at least 30% of the population in the CRD

http://www.health.gov.bc.ca/library/publications/year/2004/profile_of_seniors.pdf

4/ Doing the math, simple algebra, 30% of the population of the population have a net worth of $2.3 to $2.5 MM, concentrated 50+ years old.

Within this 30% group, you can put it to a standard deviation.

The simple point is that there are lots of wealthy and older people here, where income is not the determining factor in buying a house.

On top of that, CARP report suggests 1/4 of Albertans want to retire in Victoria! Wow!

http://www.carp.ca/2011/10/06/boomers-eye-retirement-in-victoria/

@Leo

Thanks for providing the insurance link. Earthquake insurance increased quite a bit this year from last year (e.g. 30%+). Just wanted to take a quick look @ other posters notes. Thanks again!

))) MHI is $70k in Victoria

No.

Not for “couple families” (ie two adult) . You’re including one adult families to get a low number like $70k. Obviously a family with one adult is way lower than a family with two adults, so most stats just count two adult families.

The Wikipedia data is correct, and is sourced from stats Canada.

Canadian press article says the same thing ($86k Victoria) also sourced from stats Canada ..

https://www.narcity.com/ca/on/toronto/lifestyle/the-surprising-average-income-in-each-major-canadian-city

And here it is on stats Canada $97k median family income for Victoria two adult families … $97k

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110001201&pickMembers%5B0%5D=1.37

Thise 3 sources are quite close in range $86k-$97k. Some variability is expected as they are referring to different regions of Victoria, or a different year etc.

So why the difference between stats Canada saying $97k in my link and stats Canada saying $70k in local fools link….?

If you use two adult households it is $97k. (That as 2016, likely close to $100k now )

If you blend them all together, so you’re counting one and two adult households you get about $70k as in local fools link.

That’s stats can link has interesting info. Such as the median family income of the peak house buying age (45-54) in Victoria is $122k for a two adult family in 2016. More like $130k today.

Patrick makes a good point. The bottom 1/3 income band is probably not purchasing a home here unless they have significant family help or equity.

In addition, the more expensive sub-areas have higher medians.

In Victoria when you narrow the band to two or more income households, the median income was $92,513k in 2015, which was $80,121 after taxes.

Not sure where the stats are on incomes of non-retired purchasers of homes for Victoria are, but they’ve got to be higher than the median.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=12&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

The shit may be starting to hit the proverbial fan in Australia…

https://www.news.com.au/finance/real-estate/buying/experts-warn-of-debt-bomb-as-housing-downturn-worsens/news-story/6006ca1cc5771c53e3bfac1c07dbd176

Josh is correct, to be precise, MHI is $70,283 across the CMA. Wikipedia is not a valid primary data source.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/hlt-fst/inc-rev/Table.cfm?Lang=Eng&T=102&S=88&O=A#

I don’t know what your deal is on this site, but you seem very eager to push this. Just stick with the data and not acrobatics.

))) Josh: Median income in Victoria is ~70k

Wikipedia says $89k for metro Victoria https://en.m.wikipedia.org/wiki/List_of_Median_household_income_of_cities_in_Canada Moreover, you shouldn’t use median income. That includes the lowest incomes which are not buying houses. Only 62% of families own a house in Victoria. A reasonable assumption is that this is the richest 62%. The median among that group would be relevant, and it would be about the 69% percentile (100-(62/2)=69), not 50th percentile like you use. I’d take a wild guess and say if the 50th percentile is $89k that the 69% percentile would be about $100k (average income of family buying a house $100k), …. which leads me to my next point.

You complain that my example was of a family income of $200k. But I also provided an example of one with $100k, which I estimate to be average family income. C’mon Josh, two teachers are going to have a family income of $130k or so.

))) Josh: $200k downpayment (on $1 million house) is only the top 5%

My examples were a $1m house and a $1.5m house. The rules for minimum down payment in Canada for a house $1m or more is 20% http://bridgewellgroup.ca/blog/minimum-down-payment-bc/

I provided an example of a couple with $100k family income buying a $1m house. So why ignore that, and only talk about my other example which had a higher income?

One main point that I am trying to make is that the $20k of mortgage payment that is paying down principal (for a $80pk mortgage over 25 years) is forced savings, so shouldn’t be counted as an expense. Yes, you have to pay it, but you can borrow from it (in future years,as a HELOC) and you can avoid RSP and TFSA contributions so you can help you pay for the mortgage.

A lot of our furniture (sofas, mattresses, also curtains, etc) is soaked in flame retardant chemicas. That stuff is toxic to anyone on a daily basis, but its especially bad when exposed to heat. Thus high cancer rates in firefighters.

wow.

I find it hard to commiserate with that doctor. Woe is him for having to rent for a few years like the rest of us plebs before he can afford a SFH in a city.

Your casual example is already talking about a household which is in something like the top 5% of local incomes. Median Victoria income is ~70k. As in both people. It’s no wonder you have difficulty seeing why people can’t afford Victoria when that’s your go-to example.

$800k @ 3.34% / 25 years is $3,936.67/month * 12 = $47,240. That is a lot more than $26,720. I think you were considering the principal to just be “forced savings”, but it’s still a monthly expense and isn’t dismissable. They could still afford it but we’re talking about a couple who is objectively wealthy. If you talk with a local broker, I think you’ll find your $200k for a downpayment example is also something like top 5%.

@Victoria Born Thank you for that first link. Take a look at 20:22 what Canadians think

https://www.theglobeandmail.com/opinion/article-bless-this-house-why-canadians-put-so-much-faith-in-the-housing/

“…..And yet, seen dispassionately, all this good news may actually be bad. Think about it. A house produces nothing. It’s not a factory, it’s not a farm, let alone a new technology that will enjoy widespread application or transform the economy. Moreover, the jobs created by housing lie mostly in sectors of the economy where productivity growth is lowest. When the housing boom ends, there won’t be much left to show for it.”

It gives you an appreciation for the service that firefighters provide the community, and the risks they take to give that to us.

The study you link is from Hamburg and commissioned because of the differences in fire suppression in Hamburg which they felt might invalidate the results of other international studies showing serious health impacts. The study I posted was from BC. Basically the hugely increased rate of cancer in firefighters is thought to be linked to chemical exposure from burning modern building materials – maybe Teslas! This finding is the same in the US. Shift work is not good either and there is lots of research on that. I’m not hoping that my kids become firefighters despite the easier path, free time, and relatively early retirement age.

Credit Bubble is here:

https://www.youtube.com/watch?v=0lrdxpKPocY

SS’s latest video is a good one too:

https://www.youtube.com/watch?v=nETfpACoSlY

Not worth the risk imo

Odd study as they don’t even mention shiftwork which has shown to decrease life expectancy which would be a huge confounder.

Doing a quick Google search a variety of research results on the topic ->

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1601953/

I would think going forward there would be less and less exposure to fires with modern supression systems but who knows what you will be inhaling putting out Teslas on fire.

Not worth the risk imo.

Marko, a place not selling after a sufficient exposure to the market means it was overpriced. Yes it’s tough to value properties, that doesn’t change the facts of that example where they clearly got it wrong.

If they priced a 800k home at 999k then yes it is wrong. If they price a 820k at 899k in a market like we are currently in (difficult to read at times) I don’t see that as wrong. Perhaps they thought 850k +/- 50k and went in on the higher end of the range. Drop the price to 849k and it will move for 820k.

I run a lot of different things when trying to come up with pricing.

Obviously you will look at comparables but I’ll do a bunch of other stuff like the HPI Index for that neigbourhood. If the house was purchased for 700k and the HPI index has gone up 44% since that time I’ll go 700k x 1.42 = 994k (problem with this being they may have overpaid or underpaid at time of purchase, improvements, etc.)

You can do price per square foot and a million other things.

Not matter how much analysis I do a big part of it comes down to gut feel on pricing, within reason of course.

Med school for the average GP’s is a gigantic economic waste of time. Remember that at $75/hr, an MD GPis probably making less than a firefighter when you account for opportunity cost (years of school and debt), benefits, and pension

The odds of getting a position as a firefighter is likely less than 5% if that? But yea if you could reliably get a job as a firefighter financially it would be way better than going the GP route.

GPs need to be average of 200k after expenses with two standard deviations being 150k to 250k/year.

1) Each individual doctor is not working as many hours now as they used to due to: work/life balance desired in newer doctors

I think this is huge. I meet a lot of people through my occupation and I’ve yet to meet a newer family doctor (let’s say less than 10 years out of school) with their own practice.

Either they go for the work/life balance (walk-in clinic, they get a salaried job ~ Uvic, private school hire docs, or large clinic with multiple doctors and they only work 2-3 days per week, one of my tenants from two years ago is now working at a cosmetics clinic in Van injecting botox, etc.)

and if they go for $ they will work in a northern community somewhere and fly back and forth to Victoria and then here during their time off they might pick up a shift or two at a walk-in clinic.

There seems to be zero incentive to open your own clinic. Either you want to spend time with your kids or you want to go climb machu picchu and both are difficult if you have the responsibility of your own clinic. If you are at a walk-in clinic you just take a month off and go climb machu picchu.

Marko, a place not selling after a sufficient exposure to the market means it was overpriced. Yes it’s tough to value properties, that doesn’t change the facts of that example where they clearly got it wrong.

The agent just mispriced the listing because they didn’t understand the market, or used the wrong comps, or some other mistake or

You guys make it seem like all of Victoria is like a condo tower or the Westhill subdivision.

I’ve been involved in negotiations where both the buyer and the seller have the same comp to justify their position (one will view a comp as inferior and one as superior).

There are some properties even under a million where I am like this could be anywhere from $900k +/- $50,000. This is after reviewing all the right comparables.

When you go above a million it can be like $1.5 million +/- $150,000.

In the case I was referring to, it was the realtor, not the sellers that was setting the high price. The sellers were really disappointed the realtor got it so wrong.

What is there to be so disappointed about? Simply lower the price, no big deal.

It isn’t like the REALTOR® was wrong by pricing too low and money was left on the table.

BUT in my past I’ve used realtors twice who made a suggestion just exactly as you stated, but I insisted on adding 5 to 10% to their highest suggested price

but I know in the case that I was referring to, the realtor came in and gave them a price point that was above what they were expecting the house to be worth; they were delighted and went with it. The house didn’t sell. This is a very experienced realtor.

There are all sorts of scenarios but for the most part the seller sets the price in a market like this where we don’t see many properties underpriced and set up for bidding wars.

Mt Tolmie,

Affordable rentals are based on income.

Gwac, are you posting one of “those” articles again? Coming soon to Victoria.

Introvert: I moved here because it was nice and house prices seemed only a little bit overpriced. (Honest, that was my thought at the time). But that was five years ago and my house has almost doubled in value. From my own personal point of view (note my emphasis on personal so lets not start a war over this) Victoria is not nearly as nice as it was five years ago in a lot of ways. Would I have bought here under today’s conditions? Hard to say but probably not. That does not mean that Victoria is not a desirable location for a lot of people; obviously it is considering what people are willing to pay for a house here.

W0: Just because I can buy something doesn’t mean I consider it reasonable, such as a house that leaves me house poor. In such case I would say I can’t afford the house.

W0: “Now I’m on HHV to learn about the market. I’m only interested in a couple of neighbourhoods and inventory is low, especially for the type of housing I want, so I’m going to rent and take my time to buy”

======

You say you’re renting, and looking in a couple of neighborhoods, but it sounds like you’re waiting (“take my time”) until you find something “reasonable”.

How about some numbers? Are the prices you’re seeing now close to what you consider reasonable, and if not how much would they need to fall for you to buy? Or are the prices OK, but you’re taking time to find the right home for you?

Nonsense. The rented properties are not on the market. Landlords with properties for rent are competing only with other landlords with properties for rent.

Also, given the high average turnover rate of rental properties, I dispute that the “majority of rental properties” are receiving artificially low rents in the first place.

It’s not realistic for those trying to buy well beyond their means, sure.

I think it’s closer to $4700/mo with RRSP tax savings. Maybe a little better if there’s a company match.

But in any event, a bank shouldn’t be loaning $800k to someone with that income level anyway.

@ Leo S

This might not cover everything, but here are my theories:

1) Each individual doctor is not working as many hours now as they used to due to: work/life balance desired in newer doctors and many semi-retired doctors (40% of practising physicians are at or approaching 65 years-old)

https://vancouverisland.ctvnews.ca/b-c-doctor-shortage-to-worsen-as-more-physicians-near-retirement-study-1.3717312

2) Older patients with more complex care needs require more time. For example, in 2012, nearly two-thirds (65.9%) of seniors had claims for 5 or more drug classes, and more than one-quarter (27.2%) of seniors had claims for 10 or more drug classes.

3) Low per-visit MSP payment means doctors only spend 10 minutes or less for each visit, so patients generally have to make a separate visit for each issue. It would likely be more efficient for a doctor to see a patient for 20 minutes at a time, but that’s not how the payment works.

7 visits per year is only around hour. That’s how much time you should spend for preventive care at your dentist’s office per year, and they are just dealing with your teeth!

4) Overall medical knowledge has advanced, meaning more tests available, more procedures, more medications, etc.

5) Our modern times are making people sick: too much stress; too many chemicals in the environment and food; technology addiction; fear of global environmental and political issues; shrinking middle class in Canada; etc.

wo

I like your story – but could you use numbers

i.e. You only put 5% on your house – paid it off in 5 years while maximizing contributions buying a car. – furniture – paying for an apartment – I can only assume you are renting out the house or did you buy the apartment – any school debt

Like any math problem we can probably figure things out if we have a number – so what was the price of the home

Thanks

Oh for sure. Hell, the founder of HHV (it’s not Leo, if you can believe it) moved to cheaper pastures a few years after starting this fine blog.

It’s funny, though, because had he stayed and bought a house here, in all likelihood today he’d be far better off from a net worth perspective—and be living in a “nice” place.

People also move away from here, because it’s affordable and jobs pay squat & require a phd. Multiple people have called back my work and said they won’t take the job after all because they finally took a look at housing here.

Looks like we have yet another one of those improbable, deep-pocketed out-of-town buyers, who will—of course, because it makes perfect sense—probably be tallied as a “local buyer” because s/he rented here for three months plus a day.

And we’ll continue to hear the constant refrain: “Buyers must be signing up for $800,000 mortgages because no one here has that kind of money.”

Dude is from Ontario and moved specifically because it’s “nice” here. Same with Barrister. Same with me, but I’m from Calgary.

Victoria is a thing.

Very surprising article for me

https://business.financialpost.com/news/economy/rpt-insight-millions-of-americans-still-trapped-in-debt-logged-homes-ten-years-after-crisis?utm_term=Autofeed&utm_campaign=Echobox&utm_medium=Social&utm_source=Facebook#Echobox=1537006496

))) Leo: What are your thoughts on why there is such a shortage despite per capita numbers being up?

Good question.

IMO, Canadians have too many Doctor visits. 7 visits per person per year, vs 4 in the USA.

https://www.statista.com/statistics/236589/number-of-doctor-visits-per-capita-by-country/

The visits are free, and unlimited, and often for trivial things like routine prescription renewals.

The fact that the average Canadian gets to see a Doctor 7 times a year should be a good indicator that we don’t have a huge shortage. If they reduced that to 5 visits per patient per year, then there would be room for 2/7=28% more people with no Doctor visits to see a Doctor 5 times over year!

The population is aging, and older people have more legitimate reasons to see the Doctor. So things will get worse, despite increasing Physician numbers per capita. If it gets worse, we’d need to think of things like user fees (to deter non-essential visits) or nurse practioners (as they have in the USA).

Interesting. Thanks for the data. I can not reconcile it with the experience on the ground of not being able to find a doctor and what docs are saying about the economics of being a family physician.

What are your thoughts on why there is such a shortage despite per capita numbers being up? Was it always worse than this and everyone just has rose coloured glasses or did something else change?

I never said anything about expecting to be house rich. Patrick, you don’t know my motivations and yet you keep putting words in my mouth. Since Introvert picked up on this I feel like I should respond.

I bought my first house in Ontario when I was still fresh out of university. I got my first tax refund after a full year in the workforce, and it was in the low 5 figures. I didn’t have any other savings. (That year I had to buy a car for commuting, furniture for my first real apartment, got a puppy, etc.) It was just enough to make a 5% down payment on a house in my preferred neighbourhood.

It was worth it. Five years later, I paid off my house while still in my twenties, all while maxing out RRSPs & TSFAs and then some. I was approaching my prime earning years as a software engineer with no bills to pay other than property tax, hydro, and water. I was on the cusp of financial independence.

However, I decided there was no need to wait until my mid-thirties to retire to somewhere nice. So after 6 years I sold my house and collected a big fat cheque yesterday.

Now I’m on HHV to learn about the market. I’m only interested in a couple of neighbourhoods and inventory is low, especially for the type of housing I want, so I’m going to rent and take my time to buy.

Even though I could work for decades to come and make millions, it’s not how I want to spend my time. I’ll be financially independent with a paid off home in my thirties, all without needing to sign up for an $800k mortgage.

An admirable goal, but I think not realistic for most.

Say a very good income of $100k

Minus $25k in tax

Minus $18k RRSP

Minus $5.5k TFSA

Leaves $51,500 or $4300/month.

Subtract your living expenses, then property tax and insurance, and you won’t have a lot left for a mortgage payment.

I think it’s reasonable to expect that most people will have to pull back on their investing to afford to buy something for the first 5 years at least.

Yeah, sorry I didn’t mean to imply your specific story was not true. In that case I can think of two scenarios:

An experience realtor should not be doing either, but who knows.

))) leoS: We are hearing that an MD billing out $250,000 but taking home $150,000 with huge student debt is not particularly enthused about opening up a practice and work themselves to death while still struggling to afford a house. They can do it, it’s just not fun, so they don’t.

=v=v=

“They (MDs) can do it, it’s just not fun, so they don’t.”

It sounds like you’re implying that high house prices are causing Family Physicans to avoid opening up practices in high house prices cities like Victoria or Vancouver.

The problem with that statement is that it isn’t supported by the data.

The number of family physicians per capita everywhere in Canada has been steadily increasing, and more so in the big cities.

For sample. BC has 100 family docs per 100k people in 1986 and now has 124. An increase of 24% and rising faster than the population. And this is Per capita, and occurring during the big housing price rise in Canada.

https://www.cma.ca/Assets/assets-library/document/en/advocacy/14-FP_per_pop.pdf

There are similar rises per capita for Vancouver and Victoria physicians.

So for you to present the narrative that a rise in house prices in Vancouver and Victoria has resulted in less doctors opening practices is just plain wrong, since there’s more of them per capita than ever before.

Furthermore, physicians (per capita) like to live and work in big cities (with high house prices) , and are found in much smaller numbers in small towns (with low house prices) . The problem with Family Doc shortages is much worse in small towns (with low house prices) than it is in Big Cities (with high house prices).

https://secure.cihi.ca/free_products/Geographic_Distribution_of_Physicians_FINAL_e.pdf

“For example, 38.7% of all physicians can be found in urban communities with 1,000,000 or more inhabitants, including Montréal, Toronto and Vancouver, where only 33.6% of the total Canadian population lives. The converse occurs for rural and small town Canada.”

So true.

I was house poor in the beginning—I’ll admit it. But it was worth it: in <10 years my mortgage will be paid off; I'll be sitting on a $1M+ asset; and I'll be 45, entering my prime earning years with no bills to pay other than property tax, Hydro, and water.

Yes, I agree. Instead of raising your rent, they evict you, then get the rent the market will bear from the next tenant. In the meantime you’re forced to go elsewhere – where your new LL can charge you market rent. Over time, it disincentivizes rental stock as well as the maintenance of it, adding more pressure on exiting stock and voila.

Rents will never durably go past what the market can afford. Not nearly as elastic as home prices.

$21.1 million investment to subsidize 21 apartments. They must be luxury affordable units.

True enough, though having the majority of rental properties (the rented ones) at artificially low prices will constrain what landlords can get for their “free market” properties.

At least in the short term.

In the long term rent controls would be expected to increase rents.

Re: MD incomes. A good way to estimate hourly wage for a typical 40 hr week is to divide the annual income in 1000’s by 1/2. So a GP taking home (after expenses) $150K = $75/hr. Now ask yourself: is the long journey, competitive academic path, and big student debts worth a measly $75/hr?!! It’s a joke. Med school for the average GP’s is a gigantic economic waste of time. Remember that at $75/hr, an MD GPis probably making less than a firefighter when you account for opportunity cost (years of school and debt), benefits, and pension.

@Leo S

Then perhaps the realtors simply don’t have a clue about where the market is at price wise today which considering this is a successful, experienced realtor, is even scarier. Incompetence over dishonesty is not a great alternative. In the case I was referring to, it was the realtor, not the sellers that was setting the high price. The sellers were really disappointed the realtor got it so wrong.

I don’t think that’s it. Misleading the client is completely against an agent’s best interest. If the place doesn’t sell they get nothing. Realtors in general are always trying to set a realistic price, but often the sellers have an inflated idea of what their house is worth. Then the question is do you walk away from the listing or hope that the seller will come to their senses after it doesn’t sell for some time.

With open borders and free travel that may be the case, but given the world is not like that, a complete equalization is likely a few hundred to a few thousand years away.

No not really. I think one of the things that people making that much money have trouble with is why they are in the top 5% of income earners in Victoria and yet can only afford a relatively run of the mill $1M house.

That is not what we are hearing at all. We are hearing that an MD billing out $250,000 but taking home $150,000 with huge student debt is not particularly enthused about opening up a practice and work themselves to death while still struggling to afford a house. They can do it, it’s just not fun, so they don’t.

@guest_49080

Re: rents in Boston, Patrick is correct. Downtown Boston prices for 1 bed are mostly $2700+. You’re probably looking at greater Boston.

Rent control is a flawed concept. First, why should the government decide how much a landlord can charge for rent? I own the asset and I should be able to rent it at whatever the market will give me. Second, there are tons of evidence that it doesn’t help to increase housing supply. It’s a desperate attempt by a government to appease low income voters.

I never understand why people believe that having a particular type of housing in a specific area is somehow a human right. Living in Victoria core or downtown Vancouver is a luxury you work for, not an entitlement. For example, why should we house the tent city folks in desirable parts of town? Their work ethic and non existent societal contribution doesn’t give them any right to demand housing in a good area.

One thing I hope we all can agree on is that’s it’s nice to have seen the end of that Crazytown house market of last year with bidding wars for houses with no inspection allowed. Hopefully the market slow down allows people more time to make their decision regardless of what happens to prices.

Andy: Where are you getting 4k USD for a one bedroom apartment in Boston?

————

From personal experience. A nice 1 Bdr in a nice new-ish building was $3,500 usd. And parking was an outrageous $400. So that’s $3,900 I rounded up to $4,000 usd.

Of course on this forum only “medians” are acceptable . So I looked it up and the median 1 bdr in Boston is $2,300. Usd. Add $200 for parking and that’s $2,500 usd median which is $3,300 cad.

That’s 3300(Boston)/1210(Victoria)= 2.7x as expensive to rent in Boston as Victoria for a median 1 bdr.

—/////

Here’s more info ..,,

https://www.google.ca/amp/s/boston.curbed.com/platform/amp/2018/5/1/17304070/boston-rents-may-2018

The median one-bedroom rent in Boston is $2,300 USD a month, and the two-bedroom median is $2,700 USD. Both are more than roughly twice the national medians of $1,185 for a one-bedroom and $1,422 for a two-bedroom.

http://dailyhive.com/vancouver/average-rent-canada-december-2017

Back on the west coast, Victoria, BC, take fifth place with one bedrooms dropping 4% to $1,210, and two bedrooms seeing prices fall 5.1% to settle at $1,490.

@guest_49080

Or perhaps with the price drops, the next 12 months present a fantastic buying opportunity for those who are thinking of entering the market.

It’s extremely hard to time market bottoms. So with any significant downturn of let’s say 15-20%, it’s usually a great opportunity to pick up an asset.

Whether you love him or hate him, Ross Kay sums up the current Van market at 19:40…

https://www.howestreet.com/2018/09/10/vancouver-home-buyers-turning-up-their-noses-as-fall-beckons/

))) Whatever floats your boat, Patrick. (I assume you own a boat, given your blasé attitude towards HELOCs and other forms of debt.)

======

Woah, I may come across as a jerk and know-it-all, but I’m assuming the discussion here is like a high-school debate, where we are merely debating the future of house prices. And tough debate is fair game. No need to get personal about whether I own a boat or not.

@ Marko

I know a lot of sellers have pie in the sky expectations, but I know in the case that I was referring to, the realtor came in and gave them a price point that was above what they were expecting the house to be worth; they were delighted and went with it. The house didn’t sell. This is a very experienced realtor.

@ Patrick

Where are you getting 4k USD for a one bedroom apartment in Boston? I just checked Zillow and 2 bedroom apartments are going from $1,900-$2,400 USD/mo. I saw a 3 bedroom for 4k.

Are you seriously advocating housing as a sole investment strategy?

If I couldn’t afford to buy a house while also maxing out my retirement accounts — at a minimum — I wouldn’t do it. That only seems prudent to me, but maybe I’m old-fashioned.

If home ownership were sufficiently important to me, I’d move somewhere affordable where such a compromise were not necessary. Otherwise, I’d just rent.

There no controls on rents for properties that are actually for rent.

https://www.zillow.com/boston-ma/apartments/

Here’s an interesting news story. A partially built 5 story condo development in Cook Street Village just got a fat cheque from the federal government to abandon the idea of selling the units as condominiums and instead rent them out as affordable housing at less than market rent for 15 years with the Feds subsidizing the project.

https://www.vicnews.com/news/cook-street-village-condo-project-to-become-rental-building/

Oh goodness, that says it all right there…I’m not sure even Michael would go that far. 😛

))) patriotz: There is of course a connection – if the median house is way out of reach of the median income or buying is much more expensive than renting, how sustainable is the price?

=====

You can’t assume that the disparity between low rents and high house prices will correct by falling house prices.

Rents are very cheap here. Compare to Boston for example, where a one bedroom apt. rents for $4k USD = $5,200 CAD per month. So the thing that might not be sustainable here is how low the rents are. Note that Boston has no rent controls so its rents reflect market prices. We have rent controls, so rents are likely suppressed from market value.

Doesn’t matter too much what you assume when you have to qualify for the whole mortgage payment, not just the interest part.

Whatever floats your boat, Patrick. (I assume you own a boat, given your blasé attitude towards HELOCs and other forms of debt.)

But everyone has their own priorities. You seem to be arguing that the doctors are wrong for not sharing yours. That’s silly and won’t solve the shortage. And I never said I was here waiting for the apocalypse 🙂

Marko said: “It it hilarious that people think that REALTORS® set the prices.

It is more along the lines of “I think you ideal list price would be $874,900 up to perhaps max of $899,900” and seller comes back with “let’s try $924,900”

————-

Marko, you’re a reasonable realtor and I’d trust you, BUT in my past I’ve used realtors twice who made a suggestion just exactly as you stated, but I insisted on adding 5 to 10% to their highest suggested price because in both cases I suspected the realtor was more interested in a quick sale for his commission rather than maximizing my return. In both cases my houses sold for my asking price, once within 24 hours and the other with 3 weeks. I think this is a likely reason why sellers often add 5+% because they are not usually in a hurry to sell, whereas realtors are often in a hurry.

))) Just because I can buy something doesn’t mean I consider it reasonable, such as a house that leaves me house poor. In such case I would say I can’t afford the house.

======/vvvvv

Maybe the day after you buy the house you will consider yourself house poor.

Maybe…. Five years down the road using examples in my post you will have paid off $100,000 equity in the house. Your yearly income will have risen with inflation from $100,000-$115,000, making mortgage payments easier. The house will likely have risen in value with inflation from 1,000,000 to $1.1 million, adding another $100,000 to your equity giving you $200,000 equity. Your mortgage payments will have stayed the same and not risen. You’ll wonder if you should take a $100k HELOC and go a world cruise with your family.

Then you get to ask yourself the question again “am I house poor?” And you’ll probably say “hell no I’m house rich!” And you will have had five years with your growing family, living and loving the house you bought, visiting Home Depot on the weekends and fixing it up etc. etc. And not visiting this site hoping the Apocalypse is at hand.

The problem I see with your reasoning therefore is that you expect to be house rich the day after you buy the house and it doesn’t work that way.

So you should rephrase the question as “will I be house poor in five years if I buy this house?” If you don’t, in my opinion you may never buy a house in Victoria as prices have been high here forever.

I think pretty well everyone here could afford to buy something. Rather the question is whether this something is a good buy at today’s price. Anyone can buy 100 shares of almost any stock, but that doesn’t mean it’s a good buy at today’s price.

There is of course a connection – if the median house is way out of reach of the median income or buying is much more expensive than renting, how sustainable is the price?

Define “affordable.” Your definition seems to include being house poor. To me, if you need someone to co-sign or you need to commit fraud — sorry, use “creative means” — then it’s probably not affordable. There’s lots of other factors you are ignoring, such as level of risk and opportunity cost.

Just because I can buy something doesn’t mean I consider it reasonable, such as a house that leaves me house poor. In such case I would say I can’t afford the house.

It it hilarious that people think that REALTORS® set the prices.

It is more along the lines of “I think you ideal list price would be $874,900 up to perhaps max of $899,900” and seller comes back with “let’s try $924,900” and then you spend the next two months trying to get them down to where they should be.

)) No unreasonable assumption, but the problem is it’s an arbitrary analysis.

==v=.

It wasn’t an arbitrary analysis. It was using an above average family income ($100k) to purchase an above average Victoria family home ($1m). It isn’t hard to get to $100k family income (husband/wife @50k each). And the post showed that this is do-able for a couple like this, assuming you consider the principal payoff to be forced savings, and not an expense.

We are hearing on this forum that a MD making $200k per year can’t afford a house in Victoria. And those statements are just accepted, and “what can we do help the poor Doctor.” Why don’t you tell those posters that their statements are an arbitrary analysis?

I think that many realtors have never faced this sort of market and so don’t even know themselves how to properly price a property. As much as the realty boards tout the professionalism & wisdom of realtors, at the end of the day it’s all just a guess as to where pricing should occur.

))) In your $100k/yr scenario, filling RRSPs and TFSAs would eat a huge chunk of the remainder by itself.

======= vvvvvv

Why on earth would you not buy a house so you can instead fill up a RSP or TFSA? With your mortgage, you’re going to be paying off principal on your house, about $20k per year forced savings.

))) For (1), the family qualifies and could make the payments. But renting the house will be much cheaper, especially when you factor in all expenses (property tax, insurance, maintenance).

=====.

The question wasn’t is renting cheaper than buying. The issue in this forum is that people say that they can’t afford to buy, which is what I’m questioning with the numbers I posted.

Qualifying for a mortgage is something many people achieve through creative means. Such as getting a family member to co-sign. I wasn’t addressing the issue of if you qualify for the mortgage, it was whether you can afford the house.

True, but from a cashflow perspective you need to have it in your calcs.

))) I don’t think you can ignore principal. That effectively doubles the your costs of mortgage servicing, even if it is towards equity.

=====

Yes, you should add about $20k per year for paying off principal on the mortgage. But that isn’t an expense, it is forced savings, just like buying an RSP or stocks. The old guys/gals here on the forum who have been forced to do this for the last 25 years now own $million dollar homes outright. This is how it works!

You should think of principal payoff like savings, where you are building an asset. Just like an RRSP. This makes the whole thing different than renting. You can also borrow against it (HELOC) in future years.

I’m hoping that someone renting would for forcing themselves to save just as much as someone who is paying off principal in a house,

@ Marko

Spoke with a seller who’s house was overpriced and wasn’t selling; their experienced realtor had given them the number to price it at (overpriced by at least 50k IMHO) and so they got their hopes up and when it didn’t sell (they need to sell) they were disappointed and frustrated. They re-listed it for cheaper but it’s still overpriced. I think a huge issue here is the realtors are not being honest with their clients about where the market is actually at.

We’re not anywhere near equalization in housing affordability within Canada and the US themselves, and if anything we’ve been moving away from it, so I don’t see any reason to expect it to happen globally.

I don’t think you can ignore principal. That effectively doubles the your costs of mortgage servicing, even if it is towards equity.

Marlko

Please stop this reality stuff. People just do not want to accept it. 1981. Lol

The SFH is going to keep getting out of reach. Land use in uplands and broad mead are examples of not understanding the future and adding to the problems now.

For (2) and (3), the family income isn’t high enough to qualify for the mortgage. The bank refuses to lend. (I used this calculator: https://my.coastcapitalsavings.com/Calculators/MortgageCalculator/)

For (1), the family qualifies and could make the payments. But renting the house will be much cheaper, especially when you factor in all expenses (property tax, insurance, maintenance).

Aren’t you brushing aside or ignoring a lot of important costs, like:

– Property taxes

– Maintenance

– Utilities, phone, internet, tv, …

– Children (they’re super expensive)

– Food

– Entertainment

– Sports / Hobbies

– Travel / vacations

– Cars

– Insurance

– Retirement savings

– Other, liquid savings

– Strata fees (possibly)

. . .

In your $100k/yr scenario, filling RRSPs and TFSAs would eat a huge chunk of the remainder by itself. As might the cost of having kids.

A $1m house on $200k of income isn’t insane. Hasn’t the age old rule of thumb been 3-4x gross annual income? With lower interest rates 5x may be perfectly reasonable.

At $100k, though? Strikes me as much dicier. Some major compromises would have to be struck.

You really need to drop this Croatia = Canada comparison. It doesn’t make any sense historically, socially, economically, or demographically.

I think long term with globalization Canada and US will go towards the mean in terms of worldwide housing affordability. I just can’t see a programmer in India living in a shack while a programmer in Canada is in a 2,500 sq/ft house.

No unreasonable assumption, but the problem is it’s an arbitrary analysis. You could throw any income number out there to tell whatever story you wanted, and it’s perverse if one simply supposes that if medical doctors can afford housing (and by implication, people below that cannot), then all is well.

To demonstrate the arbitrariness issue, I could just as easily say, it would be very terrible if families earning over 400k a year couldn’t afford homes, and my analysis here (insert numbers) shows that in fact they can. So that’s a good thing. Or 500k. 1000k. Or infinity K.

Or, I could take the SJW route and suppose whether reasonable shelter is affordable for people on disability incomes – as it would be very terrible if it wasn’t. My analysis here indicates…they cannot. Okay, so?

What matters in a general sense, is the amount of money the home buying population brings in on average. And in 2018, that’s not 200k – it’s not even half that.

The government should give all new doctors a $750,000 gift card redeemable on any RE transaction in Oak Bay. That’ll get those doctors on their feet. Poor things!

Percentage-wise, I’m sure you’re right, Leo. But even a very small percentage of 35 million people retiring here is a statistically significant absolute number of people for a medium-size metro area like ours, especially because these individuals are disproportionately wealthy and tend to buy in only a select few neighbourhoods (e.g., Oak Bay, Cordova Bay, Cadboro Bay, Fairfield, North Saanich).

Are Victoria houses unaffordable to families with family income >100k?

I’ve read on this forum that there are people with family income of $100k-$200k Per year that are unable to find a suitable house in Victoria. That would be a terrible situation indeed.

Since I am a numbers guy, I would like some help in seeing why this is true.

Consider a couple with two incomes, $100k each so family income of $200k.

According to tax table https://simpletax.ca/calculator, they will pay $26k tax each (assume no child deductions). Total tax is $52k so $148k after tax income.

Now let’s assume they want to buy a $1 million dollar house and have a $200k down payment.

They need a mortgage of $800k. They can get a 5 year for 3.34% http://www.mortgagearchitects.ca That is $800k*3.34%= 26,720 of mortgage interest. So they are left with $148k-26720= $121 k of income after paying taxes and mortgage interest. that seems like a lot to me.

Could someone explain what part of this analysis is wrong, and is it really hard for someone with $200 k family income to buy a $1 million dollar home in Victoria?

Running the same numbers on a $1.5 million home, we have a 20% down, ie $300k down payment, so a $1.2 m mortgage and $1.2m * 3.34 = $40k interest. That leaves them $148k-$40k= $108k of income after paying taxes and mortgage interest. that seems like a lot to me.

Running the same number with $100k family income ($1m house, $800k mortgage), there is $21k tax to pay, so $79k after tax income. They need to pay $26,720 mortgage interest so have $52k left over after taxes and mortgage interest.

So please tell me what I’m missing.

Otherwise, If these three statements below are correct, are Victoria houses really unaffordable to families earning >$100k?

What is the unreasonable assumption in these calculations?

“Canada’s Housing Market Ranked 3rd-Riskiest In World”

https://m.huffingtonpost.ca/2018/09/15/riskiest-housing-markets-canada_a_23528163/?utm_hp_ref=ca-homepage

Except for Victoria. No risk here. Definitely not overvalued and easily affordable (sarcasm).

And what does Oxford Economics know anyways… pffftttt.

The power of family and friends and familiar environments. Also the reason that not many Canadians are going to move across the country to retire to Victoria. Weather doesn’t make up for not seeing your grandkids for most people. Vancouver -> Victoria yes, but not much past that.

7440 VEYANESS RD new build in 10 home development in Saanichton slashed $80K to $719K

Another 17 slashes past 24 hours, most in very nice hoods and nice places. 44 in last 3 days.

You really need to drop this Croatia = Canada comparison. It doesn’t make any sense historically, socially, economically, or demographically. Economically, you might use countries with similar GDP/PPPs to your country like Turkmenistan, Panama, Luthania or Serbia.

It would be like your Croatian cousin saying he’s got a friend that lives in the southern Sudan, is an oncologist, and lives in a plywood shack with 10 kids. I guess it’s true that on some level it tells you how lucky you are in relative terms, but the comparison is a total non-sequitur otherwise.

Thank you @guest_48983 I always appreciate your answers.

A doctor who never heard of birth control ?

With a combined income of $340K for one doctor and the wife making even half of that, the story sounds like BS. You could have moved to the Toronto suburbs and been a doctor out there and let the kids play outside in a safe way in a nice hood. This Croatia comparison is so far past the point of lame.

FYI. “But children taken by strangers or slight acquaintances represent only one-hundredth of 1 percent of all missing children.” Washington Post 2013

I’d say it’s more the agent’s fault not the seller. The seller relies on the agent to get them the quickest sale at the best price and uses their judgement to what the market will bite on. It’s the agents that need a wake up call as the slashes have been going on for months now, this is no new trend.

I know a couple people who thought they would get the quick sale and let the agent fill their head with big shot buyers still out there. One pulled their house off the market after a couple of weeks realizing the glory days are gone and the other one refuses to drop their price cause the agents pumped their heads they would get a bidding war and got zip action tho it is a nice place.

Yeah it’s just a concrete measure of the number of price changes out there. Seller mispricing. If the market was more constant it would help sellers price more realistically.

There has been a lot of talk on this board about what doctors earn for a living. There are 4 main sources for their revenues: (1) MSP, (2) WCB, (3) hospital billings and (4) medical-legal work (assessments for insurance companies and personal injury lawyers). The vast majority of their billings are to MSP, particularly family physicians. Want to know what every doctor in BC was paid by MSP. It is public record:

https://www2.gov.bc.ca/assets/gov/health/practitioner-pro/medical-services-plan/blue-book-2016-17.pdf

Scroll down. Specialists earn far more than general practitioners. However, bear this in mind: the over-head cost of a doctor’s private practice is about 50% (or more) of billings [staff, practice fees, insurance, office space, supplies, etc.]. Some doctors make a very good living doing medical-legal work for ICBC. Here is ICBC’s financial statement for 15 months:

https://www.icbc.com/about-icbc/company-info/Documents/Statement-of-financial-info-2017.pdf

Scroll down and you can see what they paid every doctor, law firm or employee for salary. WCB has an equivalent public record.

@ Leo S

What’s the matter with these people. As undergraduates they’re mad to get into Med school, then when they get there they start complaining that an average of $240,356 from the government in fees for service — that’s for all physicians, including the fresh out of schoolers and the three-day-a-week female doctors — is inadequate. If they want more money, why don’t they switch to selling houses or something?

Sale price to original ask trend in single family not looking too great so far this year. Granted september is only half over so perhaps it will recover somewhat.

My impression is sellers are going in at optimistic prices and then when they don’t receive many viewings they are more motivated to work with whatever they do get.

Buyers are still paying more than April 2017 in terms of absolute numbers but psychologically they feel better paying 4.5% less than over asking.

This is why you use a lawyer or notary to convey the property. They have to make reasonable inquiries about this and if the seller is a non-resident they need to get a hold back from the sale proceeds that remains in trust until the seller can provide the Buyer with a Certificate of Compliance from CRA confirming that the taxes with respect to the sale have been paid.

Also wise to add a clause to the offer along the line of

“The parties agree and acknowledge that they each shall provide, provide to the Completion Date, the information

necessary for the Buyer to compete the Property Transfer Tax Return, including, but limited to, the Seller signing a

residency declaration in the form provided by the Buyer’s solicitor or notary.”

Doubling salaries is politically difficult, but the government buying up some office space and providing it rent free and managing all the admin/booking/billing/legal support wouldn’t force every doctor to be an entrepreneur too.

Half the ophthalmologists salaries and few other specalities and increase family practice. I do like the idea of free rent and managing admin/etc., then doctors can focus on being doctors versus dealing with staff turnover, etc.

they still make over $100K a year. Tax payers pay doctor’s salaries, so there is a limit as to how much higher they can be than average salaries.

GP is 10 years of school. Nurses pull in close to 100k with a few overtime shifts and that is in-hopsital. When I was a respiratory therapist I would literally leave the hospital and have NOTHING to worry about or do on my days off and I would get my autodeposit into my account. Totally different when you are running a small business like a GP practice. There needs to be compensation for schooling + headache/stress of a practice. I think net @ 40 hrs per week should be minimum $150k-$175k so that 50-60 hrs per week gets you to $250k net (after expenses, before taxes).

This is true. Doctors have traditionally been top earners, and when top earners can’t buy a house, then housing costs have detached from local incomes. That is a messed up situation.

My cousin is an oncologist in Croatia and he lives in a condo with 4 kids! Interestingly enough after working in Toronto for two years and ending up with a job offer of $340,000/year salary he went back to Croatia. Despite the condo overall a much better lifestyle (more family time, people let their kids out in Croatia without fear of them being kidnapped, etc.). His wife is a doctor too I am sure they could have bought a solid house in Toronto but it isn’t all in the housing.

I always thought this would be the easiest step to take now. Doubling salaries is politically difficult, but the government buying up some office space and providing it rent free and managing all the admin/booking/billing/legal support wouldn’t force every doctor to be an entrepreneur too.

Definitely. It’s the lending institution that matters, not the broker. So note it’s all your GIC’s from (say) Royal Bank together that are insured for $100K, even if they are split among ITrade, Royal Bank itself, etc.

Also note that RRSP’s and TFSA’s each have their own $100K per lender limit, independent of non-registered deposits.

This is true. Doctors have traditionally been top earners, and when top earners can’t buy a house, then housing costs have detached from local incomes. That is a messed up situation.

Dream on, Medical Student! I have looked at the provincial “Blue Book”, and most family physicians bill between $200 and 300K a year. Even if you very generously say that half of that goes to staffing and other overheads, they still make over $100K a year. Tax payers pay doctor’s salaries, so there is a limit as to how much higher they can be than average salaries.

However, I am all for some form of student loan forgiveness if a doctor practises family medicine for a specified number of years. Maybe looking at something like setting up large clinics where the facility costs are paid by the province would also work (individual practices seem inefficient). There are many other ideas that could help. I also think there is too much of a gap between specialists (many billing over $400k a year; some even $1M) and GPs.

This family physician shortage needs to be addressed. When doctors have more patients than they can handle, they are incentivized to not take on or even to “fire” more complex patients that take more time, and those are the patients who need a family doctor the most. Doctors who see a high volume of patients are also more likely to suffer from burn out, and that has direct impacts on the quality of care they provide.

This is why you use a lawyer or notary to convey the property. They have to make reasonable inquiries about this and if the seller is a non-resident they need to get a hold back from the sale proceeds that remains in trust until the seller can provide the Buyer with a Certificate of Compliance from CRA confirming that the taxes with respect to the sale have been paid.

If this doesn’t happen and you use a lawyer/notary you can make a claim on their insurance.

More discussion of the negative effects of high prices: https://www.reddit.com/r/VictoriaBC/comments/9ftlnj/the_primary_care_situation_in_victoria_is/

Medical student here.

I would love to be your family doctor in Victoria. Unfortunately the thought of not even being able to afford a house while working 80 hours weeks with call shifts put a damper on that idea. We all want to work hard, provided the rewards are there — but going through 8 years of schooling and 2 years of residency only to struggle doesn’t seem worth it. It’s not just the amount of work, either. The responsibility is enormous, and at the end of a day when you’ve had to deliver particularly bad news you don’t really want to come home to a one bedroom condo with 2 kids.

I think pay for primary care physicians should be pretty much doubled. It just hasn’t kept pace with the cost of living. There should also be a bonus for working in expensive cities. I never even considered primary care in Vancouver, for instance. I would be living out of the city and commuting 3 hours and would never see my family.

Something is messed up if a doctor cannot afford the cost of living in a city.

Funny that it was a packed house at today’s VREB training session for proper procedure and strategies in multiple offer situation and yet everyone agreed that multiple offers really aren’t happening in today’s market.

@guest_49001

Thanks for your answer. Suppose the GIC’s are CIDC insured, I’m just worried about the fact that they will be bought from the same trade account. What do you think?

JustRenter- I don’t know the answer to your question, but I do know that not all accounts are insured, so ask someone at the bank and get it in writing.

@guest_49001

Would GICs at different banks (but bought through a single ITrade account) be each insured for 100K? Thank you.

Correct. Actual amount somewhat lower when you include relists (which I have no good way to do).

That is why this measure tends to bottom out about 5% under original list. If it hasn’t sold by then most people will just pull the listing and try again later.

For example we bought our house after it was on the market for 87 days at 7% under original ask. But it had been listed twice before then, once for 39 and once for 45 days. Taking into account all the listings, we bought it for 14% under original asking price.

Wow – not what I expected. The visual is stunning. Question: is it safe to assume that this Original Ask is only for the current listing and not taking into account cancellation/relist?

Sale price to original ask trend in single family not looking too great so far this year. Granted september is only half over so perhaps it will recover somewhat.

For some context, the lowest this measure has been is 93% in Dec 2008. Generally it does not go below 95%.

Buyer Beware

Now that foreign buyers and speculators might be ready to sell their ‘investment’ properties, it’s an opportune time to consider the potential consequences for the purchaser.

Here is fair warning to all purchasers of real estate that you, as purchaser, may be responsible for paying the Capital Gains tax for the seller, if the seller is deemed a non-resident by the Canada Revenue Agency. Even if the seller signs a statutory declaration stating they are not a non-resident, you as the purchaser will still be liable if the non-resident seller refuses to pay the tax.

In my small neighbourhood alone, there are at least 6 Americans who own houses. They also own property in the USA, so under our tax laws they might be deemed non-residents. One of these Americans currently has their multi-million dollar house for sale, so imagine the tax bill the purchaser will be liable for if the American moves stateside with their Canadian cash; a minimum of $250,000 will be due to CRA from the purchaser.

https://business.financialpost.com/personal-finance/taxes/buyer-beware-how-purchasing-property-from-a-non-resident-of-canada-could-leave-you-with-a-hefty-tax-bill?utm_campaign=Echobox&utm_medium=Social&utm_source=Facebook#Echobox=1536333419

Leo have you tried this WordPress plugin? https://wordpress.org/plugins/relevanssi/

The reviews are pretty good for it and it has the requisite free side that we all love. My WP sites don’t allow comments so basic search works fine but for a site like this one, a replacement plugin could be in order.

Perhaps you didn’t read Luke’s posts when he was here. I had wondered what his gig was. He argued the immunity factor with the ferocity of someone getting paid for it, but it was so over the top and eccentric I figured it didn’t represent his compensated time. Maybe West Vancouver has hired him for PR/damage control.

Speaking of West Vancouver and damage control, we’ve seen a few people here comment on the relevance of price drops on the high end of the market – it’s usually written something like,

“So what if it had a 2 million dollar price drop? So now that 10 million dollar house might become an 8 million dollar one. It’s not like that’s your market, so give it up!”

For those of you who have paid any attention to Daniel Formafist’s videos, he just described why the top end of the market places pressure on all the segments under it – just as it did on the way up. Here’s a link if anyone wants a 101.

Why Should We Care About Multi-Million Dollar Price Drops?

https://www.youtube.com/watch?v=XOga-lxjuc8

“As well, Langford’s plan for trees is basically: if you see some, cut ’em down and build something on top, because trees can’t pay taxes and are therefore freeloaders”

Funny but sadly very true….

As well, Langford’s plan for trees is basically: if you see some, cut ’em down and build something on top, because trees can’t pay taxes and are therefore freeloaders.

I don’t think anyone has ever, in the history of this blog, argued that. But OK.

Hey, if you want to go all doomsday prepper with your cash, go for it.

The only doomsday prepping I engage in is having a decent earthquake kit that includes two weeks’ worth of water and food.

Just tell Justin you’re an oil pipeline owner and he’ll bail you out real fast.

I think we’ve had a few of those over time. Anything in particular you were looking for?

https://househuntvictoria.ca/2018/06/18/june-18-market-update-listings-approach-2500/

In general, the site search is not your friend when looking for comment threads.

What you want to do is go to google.com and enter “earthquake insurance site:househuntvictoria.ca” Or whatever you are searching for.

Michael

U around?

@ LEO

sorry, can’t seem to be able to SEARCH the site for the earthquake insurance thread from a little while back. Can you kindly post a link? Thanks in advance.

Introvert, I’d rather have my warchest intact to weather those bigger problems. Financial institutions can and do fail. From cdic.ca: “Since its creation by Parliament in 1967, CDIC has handled 43 bank failures, affecting more than 2 million depositors.”

During the last financial crisis, the Icelandic bank Icesave collapsed, which had become popular in the UK. The British government ended up bailing out depositors, but I’d rather not leave the better part of my life savings to the whims of politicians.

Interesting, thanks for the tip LeoM.

How are the buyer and sale price determined?

They build 48 structures with the money if I read this correctly

Affordable Housing Program

Since 2004, the City of Langford’s Affordable Housing Program has provided families with lower-income housing in Langford’s many new housing developments. Generated through Mayor and Council’s consultation with industry and stakeholders, Langford’s progressive – and successful – “inclusionary zoning requirement” program won the 2008 Canadian Mortgage and Housing Corporation’s (CMHC) Housing Award. This Program currently includes 40 single-family dwellings and 8 multi-family condo units. These existing homes come up for resale periodically and the City maintains a waitlist of qualified buyers that wish to have the opportunity to purchase one of these homes. Local realtors provide services free of charge for the buyers and sellers, while credit unions, mortgage brokers and insurers (including CMHC) streamline mortgage pre-approvals for new buyers.

Council Policy was modified in 2012 to allow a choice between providing a $1,000 contribution for every single family equivalent dwelling unit created by rezoning to the City’s Affordable Housing Reserve Fund or constructing one new affordable home for every fifteen single-family lots subdivided. Council uses the contributions to the Affordable Housing Reserve Fund strategically to provide grants to new non-profit housing projects within the City. Council’s support to provide these grants and waive other financial charges such as application fees and development cost charges lowers the overall cost of the non-profit housing project and allows the housing provider in turn to lower the rents for their residents.

If you wish to apply to the Affordable Housing Program, please visit the Application Form page where you can find additional information, including the application package and eligibility criteria.

Anyone know what Langford has done with their housing affordability fund? $1000 per unit is something but I imagine it doesn’t add up to a lot as far as building affordable housing

Why should it be in general revenue since it was cooked up as a way to stop speculation on housing in 1987?

What they are saying and what they are going to do are 2 different things.

PTT has always gone into general revenue. If you take it out of general revenue you have to make up the shortfall by increasing some other tax or cutting services. Playing shell games with existing taxes does not create new revenue.

The NDP has said that revenue from the spec tax, which is new revenue, will go into a Housing Affordability Fund.

The point is that no location is immune from price declines.

Perhaps the government be enlighten by Langford and use the property transfer tax money for rental and low income housing instead of dumping it into their trough.

Personally, I don’t think this is necessarily a bad thing. People have to learn to work together across different party issues. Nothing worse than a government with a big enough majority to just ram legislation through for a full 4 years.

As much as I didn’t like Harper’s social and scientific values, his years leading a minority govt had some advantages over Justin, even though his social values are a heck of a lot better.

I’ll say one thing when it comes to new buyers entering the market. As a potential buyer with a gross household income in the $150-200k per year range, we still can’t realistically afford to buy a house large enough to house our family of 4 in the vast majority of areas. That tells me a lot of the buyers must be people moving up from condos/cheaper houses and capitalizing on their newfound equity or buyers coming from other markets where they already have equity.

Investor interest seems to be dropping off again in Victoria. Down to being the primary motivator for only 5% of purchases from 11% at the start of the year.

Sold $1.51M

Langford’s housing plan for rentals is basically: if someone is trying to build rental housing, get out of their way.

Very simple and seems to work

https://www.cheknews.ca/langford-builds-hundreds-more-rental-units-compared-to-other-cities-data-shows-488528/

Not sure what your point is.

West-side Vancouver experienced unimaginable gains in a relatively short period of time. Even after any correction it experiences is over, prices will likely still be many times more than the average family can afford.

Sure, core Victoria has less demand than West-side Vancouver, but West-side Vancouver is arguably the most desirable location in the country. And core Victoria is no slouch: it’s probably in the top five most desirable areas in the country, and this is borne out by high prices.

Fixed demographics chart. Sorry about that and thank you Patrick for pointing out the error.

The original one was the demographic projection for the year 2041!

Huh.. You know when I graphed that something seemed off about it.. Let me check data on that one. Does not match up with my demographics explorer https://househuntvictoria.ca/demographics-explorer/