On stats manipulation and transparency

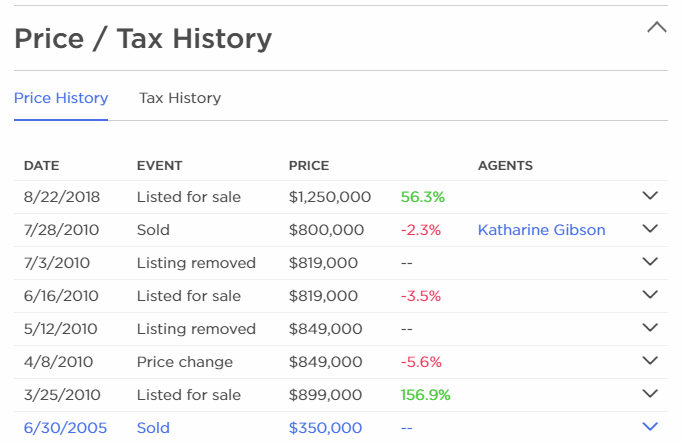

There’s been a lot of talk on this blog and in the media about the practice of relisting. That is when a seller (aka their REALTOR®) cancels the listing on their property only to list it again immediately. This causes the listing to show up as a “new listing” in the portals of thousands of potential buyers, and resets the “days on market” (DOM) counter. When that property eventually sells, its days on market will not accurately reflect how much time it was actually on the market. That means that any statistic based on the DOM will be artificially reduced and not represent how long properties are taking to sell.

I’m somewhat conflicted by this practice. On the one hand, it is clearly underhanded in most cases. Many years ago I was selling some motorcycle gear on UsedVictoria. I wasn’t getting any bites so I cancelled the listing and reposted it to get it to show up at the top of the list. UsedVictoria staff promptly killed the listing and told me to get stuffed in no uncertain terms. So it’s odd that a site where people sell Loverboy albums for a few bucks has higher standards than a marketplace for expensive real estate run by professionals.

On the other hand, say a sellers has a house worth $500,000. They are delusional (many are) and list at $700,000 for 6 months before coming to their senses and dropping the price. When it sells for $500,000 does it make sense that the days on market is recorded as 180? Does that say anything about the current state of the market? No, it only means the listing was mispriced. If they had listed at a realistic price to start with it might have sold in a few days. Completely different DOM for the same property. Would anyone object to that seller cancelling their original listing and re-listing at $500,000?

It boils down to that the actual value of the days on market indicator, like many in real estate, is not nearly as important as the trend. If the average days on market is 30, that doesn’t tell you anything useful about how long a specific property will take to sell. We can only say that if the DOM goes from 15 to 30 days that the market has slowed down substantially. And anyone with a minimally competent realtor will not be fooled by a relisted property when it comes to making an offer.

However it’s inarguable that the practice wastes everyone’s time at best, so I would recommend that the boards require relistings to come either with a substantial (~10%) price drop or a new agent. That would filter out most of the nonsense designed only to deceive buyers, while still allowing the occasional legitimate relist to happen.

This may all be a moot point though as this practice relies on an uniformed consumer and a lack of transparency to even have a chance of working. We will soon (ish) be getting more transparency in listing data via the recent failure of the Toronto real estate board to prevent the publication of real estate sale prices in that market. Zillow has recently moved into Canada and I’m sure with this ruling they will unleash their muscle to bring the price history features from their US site here as well.

The increased transparency is undoubtedly a good thing for the market by making it more efficient and reducing the information asymmetry between agents and the public. Agents whose primary value comes from metering out information from the database to their clients will have to up their game or leave which fits in well with the province’s goal of improving the standards of the industry.

Are there any tools that you are looking forward to once this data is publicly available here?

You’re posting on the wrong thread, Patrick.

If you look at Teranet index for Victoria in October (just released Nov15), you’ll see: https://housepriceindex.ca/#chart_compare=bc_victoria

Victoria (CRD) Prices for October close to unchanged (-0.13%)

Victoria (CRD) Prices up 6.35% YTD

If you own a house, raise a glass.

The idea that Hawk cherry picks comes “somehow” from looking at objective data-indexes of what houses are selling at, and seeing that it (thankfully) doesn’t back up some of what Hawk is saying.

As requested, I didnt “take your word for it”. But I didn’t rush to watch a video by Marko. I instead checked with the Teranet Victoria October 2018 house price index, just released today (Nov. 15). You’ll be happy see that Victoria house prices are stable, near all-time high, not “way down” (current to Oct 31, 2018, based on house sales closing, based on previous sales of similar houses) Prices down a tiny 0.13% (which is $1,300 on a $1m house). And that’s still near an all-time-high.

Here was “hawk” talking in August 2018, when these houses would have been sold that closed in October (and made it on to Teranet)

Hawk: (August 29, 2018) Condo bubble explosion in process. https://househuntvictoria.ca/2018/08/29/on-stats-manipulation-and-transparency/#comment-48392

Hawk: Aug 27, 2018 Golden Head keeps on taking hits. 4563 Seawood Terrace slashed $101K to $1.09 million. New build at 4926 Haliburton Pl slashed twice for $100K to $1.54 million. https://househuntvictoria.ca/2018/08/27/aug-27-market-update/#comment-48114

Teranet doesn’t cherry pick. They look at approx. 200-600 house sales pairs per month in Victoria, to find price changes of similar houses sold in the past.

As a recent transplant from Washington State and a land surveyor I must admit I was completely confused by real estate in B C. Oh …..Did I say was?

What surprised me the most was that I could not find a deed, registered owner or any significant survey information as a matter of public record from any readily accessible public database. And here I thought Canada was such a progressive country. Insert sad face here. I do hope this change is on the horizon.

I am among the possible buyer pool but when I smell the air and judge the feel of the market It feels like deja vu all over again.

So I will wait a bit like many others while looking on the side until my wife says otherwise!

August numbers https://househuntvictoria.ca/2018/09/02/august-wrapup-a-tale-of-two-markets

I’m a firm believer that traditionally rougher areas of the city are still rough. Record house prices, vacancy and employment numbers are window dressing.

A trip to Napa years ago a winemaker at an off the track winery said it best: In good years you could pick grapes off the side of the highway and bottle it and you’d have a 97+ pt varietal.

You pay a premium price for many a good reason.

To cash out and move? Comes down to quality of life. While 3hrs up the track doesn’t seem like much, current friends and family won’t make the trip up as often as one might like. Just my 2c.

Anybody know sold price for 826 St Charles?

@ Totoro

I think we’ll just agree to disagree on this 🙂 Type in 4 bedroom, 3 bath homes, there’s not many in that price range you’re quoting. If you cash out in Vic and move to QB, you’ll probably head up with 200 k in your pocket, give or take a bit, if you want a similar house or nicer. If you’re willing to downsize, then you have more options and more cash in your pockets.

Here’s your classic middle ground house, 4b, 3 bath, 750k, QB:

https://www.realtor.ca/Residential/Single-Family/19748259/466-KNIGHT-TERRACE-QUALICUM-BEACH-British-Columbia-V9K1G2-Z5-Qualicum-Beach

I agree.

Yeah, just depends on your definition of deal I guess.

For someone with a home in Victoria worth 800k or 900k right now they can get a similar quality home, or slightly better, in a nice location in Qualicum Beach for 500-550k. Prices are 40-50% lower. Anyone cashing out a paid-off home here and moving to Qualicum Beach to a similar place is going to have a lot of extra money to work with. Doubt that dynamic will shift dramatically in Qualicum Beach vs. core Victoria over time.

#timestamp

Are there any stats on the dollar amounts of new mortgages? Given the median SFH price in July was $784k, how much of this hypothetical median house was bought on credit (or how large was the down payment)?

@ Totoro

It’s all comes down to location, just like in Vic. I can find a cheap house in a crap location in the Comox Valley; but my neighbors may be dealing crack and all that comes with that.

https://www.realtor.ca/Residential/Single-Family/19760646/857-FLAMINGO-DRIVE-QUALICUM-BEACH-British-Columbia-V9K2B5-Z5-Qualicum-Beach

https://www.realtor.ca/Residential/Single-Family/19859090/1319-POINT-MERCER-DRIVE-FRENCH-CREEK-British-Columbia-V9K2K5-Z5-French-Creek

https://www.realtor.ca/Residential/Single-Family/19424767/3448-CROWN-ISLE-DRIVE-COURTENAY-British-Columbia-V9N9X7-Z2-Crown-Isle

There’s areas of Vic that you can get a house for under 600k, the question is, do you want to be in that area. Same issue arises up island.

https://www.realtor.ca/Residential/Single-Family/19767153/145-Paddock-Pl-Victoria-British-Columbia-V9B5G2-View-Royal

https://www.realtor.ca/Residential/Single-Family/19764324/564-Atkins-Ave-Victoria-British-Columbia-V9B3A3-Mill-Hill

What I’m saying is, the days of getting a screaming deal in the good locations up island are gone.

Idiots and their money parted away, what is wrong with it?

@guest_48260

Ever heard of tulip mania? Ever heard of the IPO for the south sea company? NASDAQ in 1999? Vancouver housing in the mid 1980s? US housing crisis?

Nawwwwww. Mere luxuries to the laymen could justify an investment in any of those situations.

You’re a pompous moron.

Premium products always seem overpriced to layman.

You don’t need them, but you want them. No one needs a waterfront, or acreage, but many people willing to pay the price.

This also applies to Core SFH w/ yards, etc. People want them. Some are willing to pay for their wants, others are bitching and whining about it.

Could not agree more with your comments! I’m from Toronto moving to Victoria, same crap occurs here as well. The only exception is that in the Victoria market agents will hold listings for what seems to be eternity at prices that are unrealistic. Great agents will drop listings or not take them if sellers are living in a bubble.

Good news.

Including my new favorite dump to look at – MLS 397971. Priced at a mere $675k, you too can own a property that you can’t even get access to.

That’s still the case. Just because the prices went up doesn’t mean that half a million for a tear down isn’t over priced.

Way less expensive – like by 40-50% as far as I can tell? You can still buy waterfront in Qualicum beach and area for under one million. A nice 3 bed 2 bath rancher non waterview is about 500k.

Right now, the delta between Victoria and other nice places on VI isn’t huge, that’s true. But that delta expands and contracts, so who knows where it’ll be in 20 years.

And who knows what we’ll actually want to do in 20 years.

There may be some validity to this.

The other day I was walking past a horse carriage full of tourists. Property and how expensive it is seems to be the main topic for those conversations. The horse driver lady (technical term) was very confidently telling the family why Victoria has low incomes compared to property.

“Victoria is very desirable. People here turn down jobs elsewhere and work jobs below their skill level in order to stay here. That’s why we see the disparity between incomes and prices.”

The whole family including the teens had their skeptical faces on. I think at least one of them saw me mouth “wtf” as I walked past. I’m thinking horse driver lady bought within the last few years.

Appreciation doesn’t gauge the accomplishment at all. I like to say I’m blessed even through I don’t believe in gods. Screw lucky. I was lucky I didn’t die falling off a cliff a few weeks back. I’m not lucky to own a house. That’s simply not the case. So sure, having a house that’s gone up in value has nothing to do with ones worth as a person. I’m just saying that buying a house is a huge accomplishment in its own right.

Plus, by my observation, if you’re too smart you are less likely to own 😉

@ Introvert

In terms of your thoughts on selling your house in GH down the road, which I’m just guessing today is maybe valued somewhere between 850k – 1 M, and moving up island with a bunch of cash in hand – that may not work as well anymore as it used to because so many other people have done that in the last few years and driven up the prices.

Sure, Port Alberni is still cheap, but the desirable areas like Qualicum Beach, the Comox Valley, Parksville, and the nice areas in those towns, they’ve all increased significantly in price. And if you want a decent house in a nice, safe area, you’re going to pay a premium for that. You may come in with 200k in your pocket, but you’re not going to be walking in with 1M in your pocket in terms of price differences if you want a similar product. The better choice may be to downsize in Victoria, and stay amongst family and friends, or if you do move, being aware you may need to downsize in the new area as well to capitalize on selling in Victoria.

Not entirely convinced that price appreciation helps you when moving up island Introvert. If Victoria goes up, up island goes up too as we’ve seen in the last few years. So cashing out will likely be quite similar no matter what happens.

I guess that means the accomplishment is highest now since prices are highest. Vancouver buyers may be some of the most accomplished in the world 🙂

Feel free to demonstrate where I said that.

Age-related memory failure is common in your group. Try Ginkgo biloba.

Oh I see we’re back to bragging about fictional stock market returns to save face.

I’m rooting for mass layoffs! I want Canada to be in recession when I renew my mortgage!

Once and future

Your link was too funny – thanks for that

malapropism here malapropism there – remember it’s sunday and I had to get off my taupe butt to write that or did I mean torpor?

Sometimes I can be an enigma, wrapped in a mystery – inside a riddle – or something like that

Anyways have a great day everyone

Nicely done. That reminds me of “The Impotence of Proofreading”:

https://www.youtube.com/watch?v=p_rwB5_3PQc

In case your comment wasn’t 100% clever wordplay, this might be the “torpor” in question:

https://en.wikipedia.org/wiki/Taupe

To be honest until yesterday I thought torpor was a colour. I was at some open house yesterday and there was a couple and their university age daughter and thee guy said he liked the colour of the wall it was like blue grey I don’t know and both his daughter and wife made some fancy dancy comment and said no it’s torpor – my hey hearing ain’t what it use to be so who knows. Plus I only know the most basic of colours

Guess I am getting old, when I went to university fruition was just a couple of thousand dollars a year.

10 points to Gryffindor for appropriate use of the noun “accipter” in a RE blog

I’ve already seen a couple break $2,000/ft for Vic.

Should easily reach the HK/NY $20,000/ft range within 20yrs (inflation, boomers, etc). Soon house owners won’t be able to move up the property ladder to a condo 🙂

It’s a global world dummy and it’s called educating yourself. Did you not notice the majority of your neighborhood is from other places with deep pockets ? They aren’t coming anymore ICYMI. Must be why almost every house in Golden Head has been slashed the past few months.

I’ll keep posting relevant articles of real economic facts effecting the world as well as Victoria and you can keep pumping out your BC tourism brochures of flower counts.

You best pray a NAFTA deal gets done or the shit will hit the fan much faster than I anticipated with mass layoffs.

If you can’t find something interesting to do in Victoria it is probably not about where you live.

Asset values are part of net worth, whether stocks, real estate or other tangible items. The fact that housing is harder to sell quickly and is subject to interest rate and market price changes doesn’t negate the fact that your equity is what it is at a given time.

Comments about gains, or losses, are just facts. No-one though prices were reasonable in 2009. It was seller’s market and then the market stayed flat for what, five years? Didn’t seem like a genius move to have bought at the time.

Maybe we will look back on 2018 in ten years and say the same thing. The next group of buyers will be posting here about about the easy, undeserved windfall buyers back then had.

Funny, you posted on here a few weeks back you bought in 2005. More lies, but what’s 4 years right ?

My gold stock went up over 300% the last month, yep I know nutheen ! 😉

https://www.youtube.com/watch?v=UmzsWxPLIOo

Buying a house and having it appreciate isn’t an accomplishment but buying a house is. I don’t know about the rest of you but my dwelling journey has been full of leaps of faith, strategic thinking, hard work, saving, investing, risk taking, more hard work and luck. So I say the luck portion is insignificant. I have battled for my lot in life and in any battle you need luck, that doesn’t discount a win.

I like your summary a lot better. Buying a house X years ago is not an accomplishment. If it were then our grandparents in Victoria were supergeniuses and everyone has been getting dumber since then.

When you can start to claim credit for smart investing is when you actually invest in other real estate through both bull and bear markets successfully.

Fair points and you’re right it’s not a no brainer.

Poor choice of words. But risk is always present. Divideds may go up, stock price may go up and yes the loan could be called… or it might not be. Do your homework and you should be able to mitigate a lot of the risk.

Until:

– interest rates go up.

– dividends get cut.

– stock prices go down.

– house prices go down.

Remember a HELOC is a demand loan and it can be called or rates changed at any time. Borrowing against one asset at a historic high to buy another at a historic high is not my idea of a no brainer.

“First of all, Victoria is special. A city doesn’t become and stay the third-priciest place to buy in the country unless it’s a little bit special.”

Tell me when this happened because for the first thirty years growing up I never would have picked victoria in the top 10 of anything but torpor

I think my post could be read as bearish, but my real intention was to cast doubt on all our ability to predict the future, or know the inside of everyone’s minds, when it comes to desirability.

It has been an epiphany lately that I can’t predict the future. Intellectually, I know that to be true, but sub-consciously I have been acting otherwise. I find it amusing that some on this blog (Hawk, cough, cough) seem to be hell bent on convincing the world that their predictions are true. Are they? In the words of Mr. Torgue:

“I THINK WE ALL KNOW THE ANSWER!

.

.

.

MAAAAAYBEEEE!!!”

https://www.youtube.com/watch?v=l_SV5yQooVg

Thank-you Jerry. That gave me a good chuckle.

“Victoria is not special.” Well….

About 15 years ago I began shopping for a home in Canada. I looked in Victoria, King County/Caledon, Kelowna/Vernon and Vancouver. Victoria was immediately ruled out because it was rigidly dead and nothing ever happened there. For career reasons the search for a home in Canada was shelved for a decade, but when the hunt was resumed I immediately purchased a home in Victoria because….. it was rigidly dead and nothing ever happened there. Tastes change with age. I am not alone in willing to pay a huge price premium to acquire a location with a history of torpor.

“Luck Is What Happens When Preparation Meets Opportunity”

It is very easy to write off home owners’ sacrifice and years of hard work and call it Luck.

Back in 2014, the market was flat or decline. $500k could buy a teardown in OB, most said it was overpriced. Renters rather live in nicer houses than long term commitment in a nicer location.

Couple years ago, many suggested the core condo would rise to match house price. The price were not out of reach. However, many 1st time buyers are not flexible, they want their first home is their forever home. So, they missed the train again.

I M O, many “house shoppers” are indecisive. Nitpicking and unwilling to compromise. Of course they can put the blames on this fast changing world, HAM, boomers, slumlords, evil white men, etc… and discredit others has done while they are sitting on the fence.

Nice post, Jaleek. I enjoyed reading it.

I’ll tell you something true: not many people thought prices were reasonable in 2009, when we bought.

Nine years ago, we thought we paid a bitchload of money for a house. Turns out, it wasn’t.

Don’t mean to give you the gears, but we bought a house that we could stay in for the long haul and that had enough room for a growing family, because we guessed that selling and re-buying in Victoria would probably be tough and there would be costs.

Planning ahead pays dividends.

First of all, Victoria is special. A city doesn’t become and stay the third-priciest place to buy in the country unless it’s a little bit special.

Our plan isn’t to move away because we, too, can’t afford it here, but because we will be able to buy a lot more house for less money elsewhere on this beautiful Island while pocketing some extra cash for luxuries.

Could we stay in our paid-for Gordon Head house forever, living off our retirement savings, defined-benefit public sector pensions, and optional suite income? I think so. But in 20 years we might be ready for a change. (Or not. We’ll see.)

Bears are feisty tonight.

Finally i’m convinced. Putting my home on the market as soon as I get back into town. Nothing to lose when they’ll practically be giving houses away in a few years.

Here is a counter-rant, perhaps somewhat along the lines of what Just Jack said a year ago.

Victoria is not special. It is boring, the nightlife is absent, locals are afraid of change, and there are lots of other great towns in BC. It is not a “world-class” city is any way. There are almost no super-star employers. The tech industry is bigger in Vancouver and especially Seattle.

Others say:

Price pressure seems to argue against Victoria being boring.

Will it drop. I think so, but I suspect not nearly as much as many people here want it to. Is that a good or a bad thing? I don’t know. Are too many people in debt? Absolutely yes, and I think people need a re-education in debt:

https://www.youtube.com/watch?v=XMo1dRiezaA

However, just because someone likes the fact that their home has appreciated in value, doesn’t make them an evil speculator.

Paper Gains

I’ve been on the board for several months and I notice there are a lot of smart people who are on here that provide a diversity of opinions that I find informative.

There are obviously some astute investors (like Marko) who knows his way around as do some others who have balanced insight. For that I thank you

Then there are others who, let’s say bought a house 3-5 years ago – why because it was the time in their life to buy a house and back then the prices were somewhat reasonable. But basically they just bought a house because they could and did. Maybe it was the gvt’s induces 0% down or the 35 or was it 40 year mortgage – because if it was the ole 25 year mortgage they wouldn’t have had a chance.

Since buying their let’s say $500k house it has doubled in price to let’s say one million.

I equate these people to basically having found a lottery ticket.

They found a lottery ticket and now working backwards are trying to explain how smart they are and how Victoria is the quintessential cultural mecca/metropolis what have you.

They talk about the world coming to Victoria because of it’s specialty – it’s like Victoria was only recently put into a google search engine and until then no one really knew about it.

That it has run out of land.

It art and entertainment is akin to being Broadway’s younger cousin. You name it they have a reason why Victoria is it – while discounting any information about ghastly reasons behind the run up in prices.

More power to them but unless they are some astute investor types they are basically just like you and me – except of course they have a house and i don’t.

But if they have a growing family and need a new house where are they going? Say 5 years ago the next house for them was $750k – well folks it is quite likely that house is $1.5 million – and even with their paper gain and money put down on their mortgage during the lowest rates possible unless they are presently making $200k if not more – it’s quite likely that they are SOL too a prisoner in their own homes so to speak. With a growing family they are not going into a condo – that’s for sure.

So they can pack up all their stuff and move to Chatham Ontario as could I and the difference would be that they can own a mansion while I just can afford a normal house.

At this point in time options are quite limited except for you savvy types. My case in point is someone on here said they are going to take all their paper gains and move to a lower priced jurisdiction – ain’t that a riot – they spend every hour of the day flaunting the special qualities of Victoria – the most specialist place on earth full of rainbows and unicorns but in the years ahead their plan is to move away – that’s because they can’t afford it either.

Now you see it – now you don’t.

I know Leo brought up this phenomenon a month or so back – but more eloquently I am sure.

Again – I realize there are some that invest and are savvy – I am not talking to you – just the regular joes who specialize in giving people the gears

Thanks

Not mocking paper gains… asking a serious question. You seem a bit defensive about that. You’re absolutely right though, there are many options… and opportunities. And the latter, if not acted upon, are lost.

Just looking to see if anyone has utilized the opportunity to further their situations. With such a low interest rate, the fact the interest is tax deductible (if the money is invested properly), and with so many ETFs paying a decent dividend, it seems like a no brainer.

I’d say the buyers are likely quite different between a 600k 1BR condo and a $2M house. Both arguably luxury but I doubt there is a whole lot of cross shopping there.

…and add to that a tightening credit market [rising borrowing costs], less speculation and a departed foreign buyer. The result is, well, you get the picture. The truly “at risk” folks are the SFH speculators who bought within the last 2 years or so. The music has stopped paying and there is no seat for them to sit on. Even worse are the condo pre-sale folks who thought the gravy train would never end. Well, end it has.

Leo S, what say you about the August dismal sales figures – do we have another month of falling sales? May be I am wrong and the last 3 days of August 2018 pushed it up over 1,000 sales which would mean the good times are back !! Happy Days are here again. Here’s to hoping [fingers crossed]. May be Victoria will take a different route than Australia – hey, may be we really are special and entitled like we have deluded ourselves for the past 3 years. May be all those mortgage and refinance rejections were just a late April Fools Day joke, a back to school prank of sorts – those bankers can be such rascals.

The Casinos will turn around, right? The foreign money will be back, right? people still love the drugs, right?

https://theprovince.com/news/local-news/b-c-casinos-claim-revenue-down-because-of-new-anti-money-laundering-rules/wcm/af2e18c1-43de-4c1a-9274-080d33fd732c

“Pump it up, until you can feel it, pump it up” – where is Elvis Costelo when you need him? My friends, “Elvis has left the building”.

Yeah, that’s it. Let’s see……………………..Leo S, the floor is yours.

Note the lower sales month after month of late. Lower sales + rising inventory means less liquidity [it is harder to sell your over-priced home], which means lower prices MUST result. This is particularly true for SFH in Vancouver and we are seeing the precursor in Victoria. If A + B = C; and A + B exists in Victoria, it is not a stretch to say that C is next.

A paper gain is an increase the potential sale price of an asset. Paying off your mortgage doesn’t change the price you’ll get for the house. It is in fact an actual investment in fixed income, since you get a monthly yield equal to the interest payments you don’t have to make.

Him being wrong for years demonstrates he knows nothing. I think he is the definition of a bag holder.

Hawk perfectly illustrates how gathering all the links and graphs in the world doesn’t mean you know anything.

So like… 500 Oswego St. Are they seriously trying to sell a 568 sqft hotel room for $900k equivalent? $300k gets you 1/3rd of the year.

People like to mock “paper gains,” as if house prices don’t go up and don’t tend to always go up.

Another kind of “paper gain” is paying off your mortgage.

Paper gains turn into cash gains when you sell. Tax-free cash gains if it’s your primary residence. Lots of cash gains if you had a spec of optimism about Victoria RE and the means to buy a house five or more years ago.

Paper gains also give you options, options that family friends who live in Merritt don’t have. Options that family living in Saskatchewan don’t have.

I’m not even smart enough or risk-tolerant enough to access all the options my paper gains afford me now and will afford me in the future.

But I know that I have options at my disposal.

Tell that to the Australians where it’s 1981 right fricking now and 4 out of 10 can’t refinance with zero job or income change.

Have you gone downstairs and told your tenant he’s a bagholder too ? No nuts to.

Mortgage rejections skyrocket 1347% as credit crunches

https://www.macrobusiness.com.au/2018/08/mortgage-rejections-skyrocket-1347-credit-crunches/

ANATOMY OF A BUBBLE

https://228main.com/2015/11/23/anatomy-of-a-bubble/

?w=620&h=471

?w=620&h=471

Condo bubble explosion in process. Wait til they all want to sell at the same time. Imagine the holes in the ground this time around.

https://victoria.citified.ca/condos/

You two dummies never heard of the stock market ? It’s this thing called the DOW, TSX etc ICYMI. A couple of insolent babies who can’t handle that the bloated bubble is cracking.

Toronto Sees New Condo Sales Fall Over 52%, Inventory Spikes Over 63%

https://betterdwelling.com/city/toronto/toronto-sees-new-condo-sales-fall-over-52-inventory-spikes-over-63/

Bubble exhaustion evidence all over the place but keep your head up your ass attacking the messenger.

Did Canadian Real Estate Prices Just Make An Exhaustion Move?

https://betterdwelling.com/exhaustion-move-the-reason-behind-canadian-real-estate-price-escalation/

B.C. casinos claim revenue down because of new anti-money laundering rules

https://theprovince.com/news/local-news/b-c-casinos-claim-revenue-down-because-of-new-anti-money-laundering-rules/wcm/af2e18c1-43de-4c1a-9274-080d33fd732c

We’re letting our “paper gains” in equity accumulate slowly, to be extracted in full (many times more than $250K) when we sell and relocate to a lower-priced jurisdiction somewhere on the Island sometime after my partner and I retire in approx. 20 years.

And, yes, the knowledge that this plan is likely to come to fruition makes me feel good, if you really want to know.

I smile a lot in my dream, eat avocado toasts, and post on HHV how SMRT I am! Life is good.

Cheap heloc is a bonus.

And just what is everyone doing with their $250K gains in equity? I’m curious… do you extract it, invest it and therefore deduct the interest and work the spread or is it just a paper gain that makes you feel better about yourself?

But 1981 is relevant. Super relevant.

Hawk, you’re the bagholder, and your bag is missing $250K of equity gains that you lost by selling at the precise wrong time.

So far it’s been what 6 years of bag holders. Just admit you have been wrong and really have no clue what you are talking about.

Last year is irrelevant, everything went up. VREB stats say condo prices have dropped for last 3 months in the core. That’s the only price you need to watch with more units flooding the market over the coming months.

$468,200 $470,500 $475,700

Westshore is flat

$383,700 $382,600 $385,400

They’re called bagholders. Every bubble has thousands of them.

Anyone who wants the BC Libs and Canadian Conservative back in power after turning a blind eye to this disaster has some serious ethics and morals issues.

ANATOMY OF A SCAM: HOW RICH CHINESE GAMED CANADIAN IMMIGRATION

Low-income worker with C$10m in assets

https://www.scmp.com/week-asia/society/article/2159930/anatomy-scam-how-rich-chinese-gamed-canadian-immigration

The voting record of Victoria mayor and council are summarized in this new website:

https://www.victoriarecord.com

Cool website….but just goes to show the stupidity of some of the council members

Former St. Andrews School site — Oct. 8, 2015

A mixed-used of 209 rental units development on the former St. Andrews School at Pandora and Vancouver. The public hearing took two nights with more than 100 people speaking about the six- and four-storey complex that will include 11 non-market rental units.

For: Helps, Alto, Coleman, Lucas, Thornton-Joe, Young.

Against: Isitt, Loveday, Madoff.

This project was held up for many years….and how on earth do you vote against this?

i/ On a lovely block on Pandora where kids get pricked by needless at Mcdonalds. If a developer wants to develop in a crap area that should be considered a gift.

ii/ 209 RENTALS!

iii/ Huge grocery store coming to the ground commercial floor.

iv/ It is a lowrise (should please the anti-height crowd).

Condos are interesting. Bidding wars are almost completely gone (last year it was every third condo that went over ask), but sales not off very much from this time last year. Also August sales are higher than July sales, which is not unheard of, but quite unusual.

Sellers are listing higher so very few bidding wars but the prices are higher. There was a condo listing in Langford for $319,000. Comparble from April in the building is $288,000.

My client wrote unsuccessfully at $290,000 (no counter from seller) and they sold it yesterday from $309,000. Days on market are longer, condos are selling under asking but the final prices are still defintively higher than last year.

Also, the pre-sale condo market in the $1,000 to $1,500 per square foot range is shocking. Bellewood and Customs House are sprinkling a few things on MLS® but I’ve also seen quite a few unlisted pre-sales going over the $1,000/foot mark. I didn’t even know that there was a market in Victoria beyond that barrier.

Capital Park is launching starting at $1,000/foot in September.

Little confused by the strength of luxury pre-sale market as you can’t find re-sales fetching $1,000 a foot with the exception of Janion which is very niche and with a pre-sale I personally would expect a discount to re-sale market.

Would be super curious to know the demographic of buyers dropping these kinds of per square foot prices especially when the luxury home market is softening.

LAP are fine, but the problem is that people who live in a neighbourhood are generally looking to protect their property values, amenities and level of density.

Solving homelessness or affordable housing or even creating bike lanes is easier if it happens in another neighbourhood. People also don’t like to live with the noise and disruption of redevelopment either. LAP community consultation is sometimes useful and brings some added perspective, but not everyone is going to be happy.

We elect people for a reason, to make tough decisions in the best interests of the community as a whole.

What developments were approved that were prohibited by LAPs?

My Tolmie Foothills said:

“Yeah, Local Area Plans do seem to be something of a sham.”

Yes, the LAPs are a complete sham, especially for Mayor Helps, she completely ignores them when voting on new major projects, but ironically she holds them up as a testament to community consultation, a totally hypocritical stance.

As proof of Mayor Helps disrespect for LAPs, just look at her voting record on major projects, many of which were specifically prohibited by the Local Area Plan. The voting record of Victoria mayor and council are summarized in this new website:

https://www.victoriarecord.com

Most definitely Leo. But… one must also take into account suites into “SFH” sqft too.

Wonder how this splits between condos and SFHs. My guess is SFH living space is increasing, while condos are decreasing.

Ok, air is. So far we don’t have to pay for that though.

it isn’t of course. Also note that our dwelling space per capita is at an all time high. We have gotten by for a long time with a lot less, and I don’t mean only the Middle Ages, but the post-WWII era as well.

Good to know. Thanks, Leo.

Condos are interesting. Bidding wars are almost completely gone (last year it was every third condo that went over ask), but sales not off very much from this time last year. Also August sales are higher than July sales, which is not unheard of, but quite unusual.

Meanwhile single family sales down 30%.

Yeah, Local Area Plans do seem to be something of a sham.

3.8%. Slightly higher now because of the data from 2017 and 2018 pulling it up.

The best shelters appreciate at a real annual rate of 3.74% 🙂

BTW, Leo, thanks for fixing the Brief History of Prices page. I see you’ve updated it with that new graph. Is it still long-term 3.74% using the most up-to-date house price data? (Your original calculation was from 2016.)

Not disagreeing with your advice, but I wouldn’t put much faith on these historical patterns repeating themselves under very different credit and demographic conditions. Future declines can definitely be steeper.

Andy,

Fair enough but her emphasis is this is a bubble market and her discussion was on market exhaustion the past year via a Better Dwelling article. Bubble markets could get real ugly. Negative equity would hit many.

Putting $200K profit in the bank in a rising rate environment and waiting a couple of years makes great sense. Piles of taxes saved plus monthly mortgage payments. Probably save $20K a year plus easy by just renting a condo. Just have to get creative and change your mindset that you will never own again. Its all bullshit.

I know of a few experienced developers who have been out of the market a while back. The rookies are still in. Those who are in it to invest read the trends not the hype that it’s different this time. Never is.

Sure, but the curve is 70/10 not 70/40 so it’s still a steep incline…

Don’t play poker with your home. Do your best to buy one yes, maybe play poker so you can, but once you do, hang on to it. Shelter is our #1 need as humans. Without it, we die.

Important to note the bases are different, so the corrections will always look smaller. That 42% decline would have wiped out a 72% gain: (1 + .72) * (1 – .42) = 1.

@ Hawk

While normally I tend to agree with you, on this point I disagree. The smart and rich investors tend to hold for a long time and pass the properties and wealth through generations. Now if we’re talking the speculators, yes, the smart money there exited the market a while back.

Personally, I’ve never been a fan of this woman’s videos. She comes across as very green.

As for advising her clients to sell and try to buy in lower just to get a potentially better price, I think this is really reckless advice if you’re already in the market because the costs of buying and selling aren’t cheap.

As for her advice to put the money in the bank and let it appreciate, you’re not going to be making money putting your money into a bank account these days.

Last person I’d take advice from is a newbie realtor like her with no skin in the game. Although I don’t always agree with Marko, I would take his advice into consideration any day over hers because he buys and sells his own properties and holds rental properties aka skin in the game.

Nice lot just came on the market on Seaview Road [10 Mile Point] – waterfront. Get on it. Only $2.5M [assessed at $1.9M].

Bingo.

Inflation-adjusted cycles from 1969 to 2018 in Victoria:

List of increases have been:

77%, 52%, 100%, 105%, 40%

List of corrections have been:

-5%, -13%, -42%, -12%, -10%

Yep hawk I was looking and still looking. If I find a good deal on a large lot than I will buy. Land is what I am after. Not interested in selling. I like real estate over the long term.

Gwac , we all know you got your first place at 50% off and now you never want anyone else to. Just you.

You’re the 3 year fake buyer but reality is you bet the farm on one horse and the thought of losing even $10K terrifies the shit out of you. What will your kids say when it tanks 50% again? Mine will high five me. 😉

Amazing that two 5 mill properties sold in Victoria in a day. “Properties over $5 million in downtown Vancouver, ….. from June 1 to Aug. 30, 2018, there were just four.” sold.

https://www.thestar.com/vancouver/2018/08/30/owners-of-mysterious-luxury-west-end-tower-go-public-with-plans.html

This may be a bubble but it would have to be in the scale of decades not years. It’s ten years peak to valley but the peaks are 70% and the valleys are 10% for the last 40 years. So it falls outside the individual’s time scale. PUS it’s not a true bubble. Every one NEEDS a place to live. Housing here will never go to zero. Bitcoin is a bubble, In our case we have an over inflated housing market. Big difference.

The “party” of sky-high prices that regular people can’t afford in many parts of Metro Vancouver will continue for a long, long time, perhaps indefinitely. That is my best guess.

I agree.

Alice’s video’s have earned my respect to date, but this last one IMO is not her best at all. What she’s describing is a move you might do with equities if you’re a “day trader” (speculator) but it’s not, and never will be, a good strategy with RE. It’s just not ordinarily a good vehicle for that kind of transactional juggling. I think she’s got a bit of the speccer mentality, which I guess I can’t say I blame her. So many other, well meaning people do too. I do believe she is trying to be honest, and perhaps toot her own horn a bit (as was said, it’s easy to do in hindsight).

I believe you can roughly ascertain a RE market in terms of its cyclical position and at least make defensible moves, but when you’re talking about selling your home and buying it back later, that’s just not what anyone should be doing IMO.

No only you hawk I wish cannot get into the market.

OMG that is the funniest thing I have ever heard. You wish goodwill to everyone. I cannot stop laughing at that. Thanks for the good chuckle.

gwac,

Your Trumpian thin skin shows too much every time you can’t handle being on the losing end of an honest debate. I only wish good will to all and for so many thousands out there and their kids and my kids starting out to be able to get a kick at the can again, which appears will happen at some point in the coming future.

Me I’m fine. But your ultimate wish is that no one else is able to get in this market which is again, despicable and low life, and having to resort to making up childish lies only shows it in spades.

Household debt levels will tank this market in spades. Only those inside the bubble are blind as bat shit. 3 times the US housing crash levels and currently 4 times. Yep, it’s all good, keep buying, your 2% wage hike might cover the cat food bill.

Canada’s HELOC Problem Is One Of The Biggest Risks For Real Estate

Canada’s HELOC Debt Is Over 13% The Size Of GDP

For some perspective, let’s contrast HELOC debt to gross domestic product (GDP). HELOC debt relative to GDP reached 12.89% at the end of Q2 2018, which is a slight improvement from the recent peak. The recent peak in Q2 2017 (a busy time for home equity withdraws) saw HELOC debt relative to GDP reach 13.17%. We know, those percentages mean nothing without context.

Even during the peak real estate bubble in the United States, HELOC use was lower. The HELOC to GDP ratio in the US reached a massive peak of… 4.5% in 2007. Post-correction, the ratio has fallen to just over 3% at the end of Q2 2018. When contrasted, Canadians are using an amazing amount of home equity, for such a small population.

https://betterdwelling.com/canadas-heloc-problem-is-one-of-the-biggest-risks-for-real-estate/

Big Hug Hawk.

I won’t take the lashing out personally. The dream is dead and that has got to be hard.

Yep don’t ever take advice from someone who can see this is a massive bubble with rising rates built on historical debt loads where half of Canada is struggling to pay bills.

You make it sound like you can never find a better deal, a better place, at a better price which is complete bullshit. Tell that to the Vancouver and Toronto sellers who took major baths for hundreds of thousands and still are.

How about the Australians where 4 out of 10 can’t get a refinancing ?

ICYMI the Asians billions have left and the party is over for a very long time.

https://www.myrealtycheck.ca/

Please show me where I ever said that clown. You’re the most despicable POS salesman on here with a very low self esteem. Intorovert is in the same sad boat. Both need to seek help for the sake of those around you.

Anyone convincing people to pay 5-10% over last years prices for condos or even SFH homes over 1M is bordering on negligent. A significant number of the homes we’ve viewed like 3351 Doncaster were bought in bidding wars in 2016/2017 where the owner will take complete baths. Sales history 30-Mar-2017 $1,200,000. Bid up over 200k and the realtor hasn’t even convinced them to take a loss yet. With the lack of maintenance and state of the property, I bet it will lose $250k before it sells next year. DOM matters because if something is priced right it sells.

Besides who goes to Mexico in August? I’d prefer @guest_48287 hand talking videos any day of the week.

Dasmo you are always a breath of fresh air. Tell it honestly even when it’s not pretty.

Can I get your blog again. Lost the link.

James interest rates where lower last year and could have been renewed lower if that person did not sell. This is assuming they had a mortgage. And will have one when they buy again.

Hawk for you it was to buy lower. That is what you have said on here.

Other people with life situation. I feel for. Crap happens and people get punish that is not good. You I do not feel for.

When your financial calculation to sell doesn’t work out so well, claim you sold for other “life” reasons. Stuff you learn in Saving Face 101.

She is still the salesman. All she wants is buying and selling.

Selling your home, moving into a tent city to try and buy back later is not a “buy low sell high” example. It’s a fools move. Transaction costs alone will kill you not to mention inflation. I mean the real inflation not the CPI. You would need extreme luck pulling this move off. You are essentially shorting the market and betting your home on it. Problem with shorting is the downside is infinite… most of us can barely afford to buy a home let alone gamble with it. Leave the gambling to us stock pickers…. don’t take this crap advice whatever you do.

Doesn’t she get commission from the sale?

Sell high, buy low. Yes some very strange advice alright. What a concept, making money and sticking it in the bank til a better deal comes along.

The salesmen here clearly don’t like the common sense being told by the agents with credibility. Bad for business when you’ve been pumping to all your friends and family and the slashes keep stacking up.

BTW gwac, you clearly don’t understand life why some own and some don’t at different times of their life. It’s not always for financial reasons but only a dummy like you and the Golden Head clown wouldn’t get that. But keep making up stories, they’re laughable. 😉

Doesn’t matter when you bought, interest rates are still higher Gwac. And likely going up again in October (or next week).

I am reading the signs and tremors and foresee that the artless accipiter will soon post THE GRAPH. Therefore, a preemptive strike from the other side of the spectrum:

:large

:large

Hey Hawk how has speculating and anticipating a decreased worked for you.

No one really knows what is going to happen. It is just a guess. Selling with the anticipating of buying lower is just

Bad advice.

Ya and on selling last year. Unless you are buying a multi million dollar property. This year you pay more and interest rates are higher. How is exactly is that a good idea and worked out well. Maybe the dog shit Carpet house is cheaper.

Strange advice this week. I usually think her videos are good.

Sell now and live with your parents and hope to buy back in later? Well, we know how that turns out….

If you are going to preaching this you have to execute this personally. Not having parents to live with is not an excuse….renting a basement suite isn’t going to break the bank if you truly believe the market will crash.

Fairfield wasn’t built for the 2%, and neighbourhoods don’t exist in a vacuum. The city is growing so laws that prohibit density essentially mandate that the neighbourhood becomes more exclusive as time goes on. What’s the merit of laws with that outcome? How about, if you buy into a neighbourhood, and then twenty years later it’s become too dense for your liking, you cash out and move somewhere else? What’s wrong with saying that?

What is wrong is logical arguments don’t work with NIMBYs.

bidding insane amounts over ask you couldn’t sell for now

There are individual examples for sure but on average SFHs are up 5% and condos 10% over last year.

I can see why Garth has done so well….just tell people what they want to hear 🙂

She said the smart and rich investors she deals with were selling last year when they were lined up around the block and bidding insane amounts over ask you couldn’t sell for now and before the legislation came in and read the writing on the wall. Funny, that’s what I was saying too. 😉

The only wise thing she said was don’t make emotional decisions. The rest was easy to say in hindsight. Sell a rental that is netting $300 profit after everything in this town??? With renters you like? Keep it!!!!

Sell now and live with your parents and hope to buy back in later? Well, we know how that turns out….

https://youtu.be/rF8k94lVqkw?t=12m30s

“Alice Kluge’s video makes much sense, deals are having financing issues due to higher rates and other valuable info the other (anonymous) agents on here never post. A breath of fresh air I must say”.

How utterly refreshing to hear from a Realtor who is correctly interpreting the data and advising her clients accordingly, rather than what is in her best interest. Thanks, WO. Yes, I true breath of fresh air. That clip earns my respect. The next 2 years will show whether she is right or not.

Why when it comes to earthquakes do we compare ourselves to Christchurch but when it comes to house prices we compare ourselves to Vancouver, Toronto or any other massive city?

Fairfield wasn’t built for the 2%, and neighbourhoods don’t exist in a vacuum. The city is growing so laws that prohibit density essentially mandate that the neighbourhood becomes more exclusive as time goes on. What’s the merit of laws with that outcome? How about, if you buy into a neighbourhood, and then twenty years later it’s become too dense for your liking, you cash out and move somewhere else? What’s wrong with saying that?

Problem is they aren’t affordable and most will still have a car to get in and out of the downtown.

BTW, where is the Youtube vid that Marko pumped last year of Ron Neal screaming at us to buy now because the Chinese invasion is upon us in massive waves ? I miss that one. 😉

Alice Kluge’s video makes much sense, deals are having financing issues due to higher rates and other valuable info the other (anonymous) agents on here never post. A breath of fresh air I must say.

Interesting article on one small “silver buckshot” of a solution to homelessness in Seattle.

https://www.seattlemag.com/news-and-features/how-backyard-cottages-could-help-seattles-homeless-problem

Fair point. Although one might argue that more affordable housing options downtown mean fewer people forced into long commutes

Sellers must be having one hell of a party. 😉

That wouldn’t take much but then again she speaks common sense. Get hosed or make the easiest money of your life. Tough decision.

If you’re for more densification in the core you haven’t driven through downtown traffic at rush hour lately. Half an hour to go 7 blocks. I’d hate to think what will happen down there when any major earthquake hits.

They’re likely not even from Victoria. From what I’ve seen there’s always been a consistent “We’ve moved here, now lets lock this down” sentiment from people. You see it on the board even from Introvert and Barrister.

Looks more like what you see in Songhees than what you saw in Soviet Russia in my opinion.

Interesting re obsession DOM. The only reason we have DOM is the MLS system. In the majority of countries the various real estate brokerages do their own marketing so you don’t even have a DOM metric. Markets still function.

Leo, what is the percentage difference off current list price between sales 90 to 150 DOM and 210 to 270 DOM for properties under $2,000,000.

Christchurch went up only 50cm during the 6.3 magnitude earthquake. Over 10,000 houses were demolished. This is a city the size of Victoria.

I’m in favour of densification but the developer sure chose the hard path with that design.

This company has done some great smaller projects in the past. I think the end product would be fine.

Local realtor advising clients….

She is killing me in views on YouTube 🙂

Yes it should if the developer is seeking a change to the existing zoning. If re-zoning is requested then the project should be denied immediately unless the developer has at least 60% of neighbourhood property owners in agreement with the project.

I am not opposed to this viewpoint whatsoever. If I am buying in the Uplands I don’t want my neighbour subdividing.

I just don’t know why we have to mix anti-development and affordable housing. I am perfectly fine with anti-development as long as I am not getting “affordable housing” shoved in-front of me every single day you can’t have it both ways.

What’s wrong with saying….we want Fairfield to remain SFHs and those SFHs will only be accessible to the top 2% of the population and let’s move on. We will clear cut from Langford to Sooke and the remaining 98% can live there.

Marko Juras which properties were the $5 Million Dollar houses? It would be interesting to see what they were worth in 2014/2015 or if they are development properties. I can’t see the high end of the market holding up with an NDP/Liberal combo in power.

Both residential waterfront. One was purchased in mid 2015 for $5.4 million and just resold yesterday for $7.9 million.

As LF mentioned, anyone can comment on this. However, my opinion in a nutshell is this:

Don’t harm innocent people in the pursuit of bad actors.

I generally support the transparency project but the privacy implications are serious. It should be available to RCMP and CRA but not broadly searchable by the public. The current one-by-one search offered by LTSA is sufficient for any public use. You have to know which property you are interested in and search it, not stalk someone by name wherever they may live in the province.

Identity theft is also very real, and the loss of control over private information is a very current problem that many people are ignoring at their own risk.

I always get a kick out of the pro development crowd on VV painting Mayor Helps as a socialist rabid anti-development anti-business force that needs to go, and then another group sees her as steamrolling local interests in favour of developers.

Kinda makes me think they are striking a decent middle ground.

Yeah I see this as a bit of a different issue. Making you aware of other options to consider can be done without exerting pressure.

Not to say this can’t work but even with significant drops the transaction costs murder you. Very difficult to come out ahead and not advice I would ever give unless there are other factors at work (you need to get rid of the first property anyway). The primary motivation for the move should never be market timing.

@guest_48287 which properties were the $5 Million Dollar houses? It would be interesting to see what they were worth in 2014/2015 or if they are development properties. I can’t see the high end of the market holding up with an NDP/Liberal combo in power. 60ish properties listed for over 3 million in Greater Victoria right now, vs a place like San Fransico with a population, 10X the size just in the core with about the same number of homes over 3 million USD for sale according to Realtor.ca and Zillow.

Viewed Victoria’s newest listed “million dollar” rooming house last night (no pictures on mls). Sure hope no one counts on those rents holding up with the municipal AirBNB crackdowns, the ever-improving Residential Tenancy Act and Tons of multifamily residential coming on the market.

Anyone floating offers 25% under ask price offers right now? The homes I’ve been interested in have been selling or dropping 15% or more.

Local realtor advising clients to time the market by selling now & buying back later (starting around the 12:30 mark):

https://youtu.be/rF8k94lVqkw?t=12m30s

”It shouldn’t take years to get a few townhomes approved on a busy road.“

—————-

Yes it should if the developer is seeking a change to the existing zoning. If re-zoning is requested then the project should be denied immediately unless the developer has at least 60% of neighbourhood property owners in agreement with the project.

Why are local governments pandering to developers by allowing up-zoning when the Local Area Plan forbids that increased density? Local Area Plans take years to develop in a cooperative process between local residents and local governments, but then local governments ignore the Local Area Plan and willingly allow up-zoning for developers. However, if I try to up-zone my SFH in the same neighbourhood from allowing a 3000 sq ft house to a 4500 sq ft house, I will be denied 100% of the time, even though the zoning bylaw has a provision for increased sq ft for slightly larger lots.

Victoria city property owners I know have a real distrust of their city mayor and most council members, and I’d agree with their distrust; mayor Helps track record clearly favours developers over established Local Area Plans.

A bit of brutal honesty. Not the type that pressures you into buying just whatever comes along but one who will tell you if your desires are true fantasy. The problem with the low/no pressure approach is you can end up in an echo chamber and not realize that maybe you just missed the right property for you.

In general: Interview 3 of them, tell them about what you’re looking for, ask them about their approach with buyers, their suggestions/knowledge about the neighbourhood, thoughts on the market right now, etc then pick the one you think is best.

What usually turns people off is realtors not understanding their needs (trying to push the wrong product), not having the basic knowledge of the product in the area, and the high pressure approach that indicates they just want a quick transaction. So I would say in order of importance you want:

Those have been some of my criteria for who I refer to https://househuntvictoria.ca/referral/ #shamelessplug

What do people here think is important?

Because they wanted the listing and were hoping to convince the seller to drop the price later.

I believe Richard once said they do this in Alberta. Don’t see why not here. Easy win for the real estate council to institute this.

Makes a difference to offers for sure. If a place has been on the market for a long time then it is obviously overpriced. That said doesn’t mean it will help you actually get the place for cheaper. If the seller has been stubborn about not accepting a realistic offer for months on end, what makes you think they’ll take a lowball now?

Also really depends if it’s 240 days at one price, or if they’ve been dropping prices, in which case the 240 is meaningless.

https://vibrantvictoria.ca/forum/index.php?/topic/6268-fairfield-rhodo-townhomes-proposed/page-4

A few vocal people in that area are making it impossible for most of the population to live in that area. They have essentially blocked all development over the last 5 years so that there are no townhouses(ie new supply added) that the middle class can buy. I know several 2 professional(nurses, accountants, hygienists, etc.) households that would really like to move into that area but there is nothing they can afford.

https://househuntvictoria.ca/2018/08/29/on-stats-manipulation-and-transparency/#comment-48264

same… been actively looking but always find it hard to pull the trigger due to the lack of information that buyer agents provides

It shouldn’t. but that is mostly the fault of the neighbourhood association NIMBYs.

Which, given the soviet bunker aesthetic I can’t say I can 100% condemn.

I’m in favour of densification but the developer sure chose the hard path with that design.

If I saw a listing that was above my price range, but had been on the market for many days, I would think the seller may be open to a low offer and I would view the property.

DOM doesn’t affect the value or what I’d be willing to pay, though.

Comment from developer trying to build townhomes in Fairfield.

https://vibrantvictoria.ca/forum/index.php?/topic/6268-fairfield-rhodo-townhomes-proposed/page-4

We have resubmitted our 6th revision and are awaiting staff review and then it’s off to Committee of the Whole. We are anticipating this to be post election…

It shouldn’t take years to get a few townhomes approved on a busy road.

Interesting market….two sales over $5 million today.

Chesterman Beach will not get a 20 minute escape window because the multi-metre subsidence will immediately inundate the area with a couple metres of water because Chestermann beach will drop several metres in elevation thereby putting the beach front properties at an elevation of minus 2+ metres; in other words underwater. Then a few minutes later the multi-metre high tsunami will wash over the area. But in the meantime, it’s a beautiful place, especially at low tide.

Add in about 20 minutes tsunami arrival time and the lack of nearby high ground and living on Chestermann Beach doesn’t look quite so awesome.

According to our local expert, Professor Edwin Nissen at UVic, the landmass that is Victoria, will neither rise nor fall more than one metre during the Cascadia megaquake. So, most of Fairfield will be OK, except the old swamp from Cook Street Village to the corner of May and Moss streets where liquefaction will likely occur.

Professor Nissen’s Team does predict a higher probability that Tofino will experience significant multi-meter subsidence, followed minutes later by a large tsunami.

Why did the realtor list in the first place if it’s a delusional price? It’s a fool’s errand at best especially in a slow/declining market. Is it fair to say DOM is 180? Why yes because that’s the ACTUAL number of days that the property is on the market. If we want transparency then these numbers need to reflect the story of the property.

So why not do what is done in many places in the U.S. which is a CDOM – cumulative days on market. Relist all you want and the DOM counter gets reset but if the property hasn’t “rested” by being off the market for at least 90 days, then the counts are added to the CDOM.

Looking forward to August’s numbers 🙂

Which as discussed many times in the past is not limited to just Fairfield in the GV area.

For the record the “bad” parts of Fairfield are listed as moderate risk for liquefaction and high risk for amplification. The “bad” parts are a blob extending west and NW from Moss and May and a blob north of the cemetery between Fairfield and Richardson. These areas are both flat and low-lying.

Likely new structures in these areas are well engineered but older houses here may suffer more than in some other areas.

You’ve both misinterpreted that.

Christchurch didn’t fall into the sea either. The houses sank into the ground.

))) Personally I’d never live in Fairfield. Most of it will sink into the ground in an earthquake, much like Christchurch in NZ.

==v=

The ground fell a max of 3 feet in Christchurch earthquake. https://en.m.wikipedia.org/wiki/2011_Christchurch_earthquake

Most of Fairfield, and Victoria in general is 30 feet or higher above sea level. http://en-us.topographic-map.com/places/Victoria-40188/

Fairfield isn’t going anywhere….

Politics of RE $$$: NDP notes record haul in PPT 2017 / 18, but accepts that “this is the end” [the Doors]:

https://theprovince.com/news/local-news/b-c-maintained-budget-surplus-for-2017-18-despite-increased-spending/wcm/2d35cefd-8a98-43ab-bee0-470dfa149e29

I note that even realtors (I kid you not) are resigned to the fact that sales are falling and prices are following downward in Vancouver [a start] and other BC cities. Best to get on the bandwagon now, I suppose, or risk ridicule later at larger volumes. The various real estate associations, however, seem to be comfortable twisting the data to try and fool the public. The conflict is obvious.

At which point those of us on high ground in Fairfield will have newly created waterfront 🙂 This has been discussed and shared a few times here, but here are the hazard maps for greater Victoria – http://www.empr.gov.bc.ca/MINING/GEOSCIENCE/NATURALHAZARDS/VICTORIAEARTHQUAKEMAPS/Pages/default.aspx

There is a part of Fairfield at risk, but it is hardly the only area of concern in the region.

Sounds about right. Get a realtor to help you cut through the BS statistics created by realtors. 🙂

When Zillow and other start to list price/listing history eyeballs will leave matrix in droves.

I do think information should be available publically so we can avoid “how much did this sell for” questions. The interesting thing with Zillow is it hasn’t changed much in terms of the real estate industry in the US. Mere postings are still far and few between and on average commissions are higher than they are here.

I hate re-listing and I think it should be banned unless re-listing with another agent, but I dislike it moreso from a standpoint of wasted time and effort versus being horribly misleading. If I am a buyer personally not sure if it makes a huge difference to me weather DOM is 120 or 240 on any particular property. I am looking for the best possible deal within the context of the market. Also, if a serious buyer you will know one way or another that is has been re-listed multiple times.

Also, not sure what I do with the info of DOM is Fairfield is 35 versus 40 as I fundamentally believe that you can’t predict the direction of the market.

When I buy pre-sales which is often I don’t go into the showroom and see what units have sold the quickest and assume those units are the best value as the majority of the time they aren’t. I do an anaylsis and complete ignore what is selling quickly and what isn’t and then I buy where I see the best value.

How does one find/identify these ‘good agents’?

The White paper is for public discussion and comment; bloggers don’t need to submit them through a third party.

Anyone wanting to read the White paper, go to:

http://www.fin.gov.bc.ca/pld/fcsp/LOTA-white-paper-june-2018.pdf

Comments are open until the end of the day, September 19, 2018 and should be directed, in electronic form to fcsp@gov.bc.ca or mailed to:

Financial and Corporate Sector Policy Branch

Ministry of Finance

PO Box 9418 Stn Prov Govt

Victoria BC V8W 9V1

So what you’re saying is realtors are justifying their existence by manipulating statistics?

Personally I’d never live in Fairfield. Most of it will sink into the ground in an earthquake, much like Christchurch in NZ.

The British Columbia Ministry of Finance recently released a Land Owner Transparency Act White Paper that asks for public discussion and comment.

The White Paper sets out policy recommendations for a new registry that intends to better identify real estate owners of “numbered companies, offshore and domestic trusts, and corporations” for tax and fraud purposes and is supportive of the Government’s 30-Point Plan for Housing Affordability in BC.

I have been asked to submit my recommendations and now here is your chance to add yours. I will package your responses together and submit them.

Wouldn’t any competent real estate agent identify that for you? Plus if you watched the market for any length of time prior to buying you would see the relisting effect in action.

It’s hard for me to imagine that a pattern wouldn’t arise out of the noise. In a hot market, there’s no real need to re-post. In a cool one, it’s done constantly. The effect is that it downplays a slow market.

RE boards seem to think it does. They hold a low DOM up like a trophy.

I hear what you’re saying LeoS that the average DOM might not change significantly, over the citywide statistics, but most buyers narrow their search to specific neighbourhoods, not citywide.

For example, Fairfield is frequently mentioned as a desirable location and southwest Fairfield is a desirable a neighbourhood due to its close proximity to the beach, park, village, etc.

If a buyer decides to focus on Southwest Fairfield they will see about six SFH currently listed with an average DOM of less than 40 days, BUT the truth is the average DOM is over 110, maybe more. If I was a buyer I might be mislead into believing it’s a hot market in SW Fairfield, but the truth is nearly every SFH in SW Fairfield has been languishing on the market for months.

Looking at the data, I just don’t think the effect is big enough to make any difference. The relisting affects the average DOM at all levels. So if the median DOM is 15, it might “really” be 17. If it’s 30 it might really be 37. If I tell you DOM went from 15 to 30 and if I tell you it went from 17 to 37 does that really change anything? Will it cause you to think differently about the market. It’s also only one of many indicators and not even the most useful one. No matter the DOM, if the MOI is high it’s a buyer’s market and that can’t be manipulated.

I’m not arguing relisting should continue, but I believe the impact is very small. It is certainly not keeping prices inflated by any meaningful amount.

Now they just have to shut down the current pipeline and everything will be good.

LeoS said:

“ If the average days on market is 30, that doesn’t tell you anything useful about how long a specific property will take to sell. We can only say that if the DOM goes from 15 to 30 days that the market has slowed down substantially. And anyone with a minimally competent realtor will not be fooled by a relisted property when it comes to making an offer.”

———-

That’s fine LeoS, but the point is about “manipulation” and by relisting and resetting the DOM counter to zero it is impossible for buyers to determine if ”the market has slowed down substantially”

Any way you look at the practice, it’s manipulation. Maybe that 30 DOM should honestly be 45 DOM.

Don’t get to elated, Government will introduce legislation to push this through as a national interest project. They cannot have this hanging over them for the election. Been so mismanaged. This country is turning into a joke from an investment perspective.

Elated by this news:

Federal Court of Appeal quashes construction approvals for Trans Mountain, leaving project in limbo

https://www.cbc.ca/news/politics/tasker-trans-mountain-federal-court-appeals-1.4804495

LeoS it is a new listing for that agent but not new to the market but it should not change DOM. The fact that real estate agents even begin to suggest that it is a new listing indicates the accepted level of deceptiveness in the industry. The worst part is that it is so accepted by the industry that most agents probably dont even consider themselves as being deceptive.

Not beating you up but the industry wonders why people dont trust real estate agents.

Wouldn’t be surprised if they just add the past listing info to stay competitive. The Victoria board is actually quite progressive with their data.

Active listings basically stay the same, but new listings go up a bit (100 more in September than August typically)

Debatable I suppose. If someone wants to change agents that will have to be a new listing, as you can’t currently transfer a listing as far as I know. Seems like it would happen rarely enough not to be a big issue.

I dont understand why changing a broker should mean that it is a new listing unless you are buying the broker for body parts along with the house?

Stats manipulation and transparency hit the tipping point with these two recent events:

Zillow’s announcement that they are aggressively moving into the Canadian real estate market.

The secrecy and manipulation by real estate associations throughout Canada backfired on the associations by creating distrust of “real estate professionals” amongst both buyers and sellers and thus creating a need for open data, such as provided by Zillow.

I will trust Zillow’s complete data over Realtor.Ca data and their entry into the Canadian market is just in time to record the current downturn stats that would otherwise be manipulated by the real estate associations.

“Are there any tools that you are looking forward to once this data is publicly available here?”

Well here are few tools that would be greatly desired but not covered by Toronto Real Estate decision:

Average age and sq footage of a home type for the community. For example the average sq footage of a 1 bedrm condo in cook street villages is 600 sq ft and 40 years old

Based on the last 3-12 months of sales for the community what the cost per sq ft (per home type) is and what that means to the above average community home type for cost.

I have a question that may or may not be based on proper information. At one point I was considering a condo as an alternative to a house. I viewed a couple of condos and was told that I would be given the condo minutes only after an accepted offer. I felt I was buying a pig in a poke (what the hell is a poke anyway, time to goggle). I dont expect the agent to spend a fortune on xeroxs but there is this magical tool called on line where documents could be available.

Is this still common practice to only provide the condo docs after an accepted offer?

More granular and real-time data. With perfect information I’d want to know e.g. how much can I expect to pay for a 2 bedroom SFH in Fairfield at this moment in time, based on recent transactions and extrapolating from recent trends. (Before all you snobby people laugh – I live in the equivalent size/location in my Ontario city, and it let me be mortgage-free in my 20s. No kids means I don’t need more house, and location is by far the most important thing to me.)

Since I came here from LA I found the lack of information rather upsetting. It also delayed my being able to make a rational decision quickly on a house. At any given time there are a fair number of houses on the market that are over priced by delusional owners which is why they are still on the market.

After dealing with two different agents on two different houses I found myself uneasy about the information I was getting from my own agents. I ran a totally unscientific experiment with a house that I pretty well new was over priced. I had three different agents send me comps on the house. Since I had been here in Victoria and actively looking for over six months I had started to get a feel for the market. All three agents sent me very selective comps (most were not comps in the real sense of the word since this house had major maintenance issues). basically the comps were deceptive. Even I knew of a half dozen recent sales that would have shown this house as really over prized.

I really missed the wealth of information that Zillow provided which would have saved me a lot of time and effort. It also underscored to me that relying on what a real estate agent tells you in Victoria is a really risky business. In fairness I know that there are good ones but when you are new to Victoria it is a challenging situation.

@Victoria Born Interesting on 3190 Norfolk. I noticed it was designed by Zebra Designs, as was my house and it is interesting how quite a few of their designs have this noted at the start of a listing if it is old or new. In shopping for a home it means nothing for those outside of Victoria and likely for 95% of Victorianites.

Maybe realtors should spend their time rather then relisting, re-investing in getting an appropriate listing price from their clients, and getting better pictures and a write up rather then just switching the mediocre pictures order that didn’t sell it in the first price?