August Wrapup: A tale of two markets

August numbers are in and the overall picture is of market that is diverging more and more between condos and single family. Single family sales continued to slow down as expected in August, down 30% compared to last year, while condo sales actually increased a bit from July and are at almost the same level as last year. This is relatively unusual, having only happened once in the last 10 years (in 2014). It reinforced the difference between the condo and single family market, which is perhaps best illustrated by the difference in sales compared to historical norms (past 10 years).

Single family sales are languishing near the bottom quartile, while condo sales are near the top for August. The same picture is in play when looking at months of inventory, where single family properties are at double that of condos. The bump in condo sales meant an interruption in the cooling trend in the overall market on a seasonally adjusted basis.

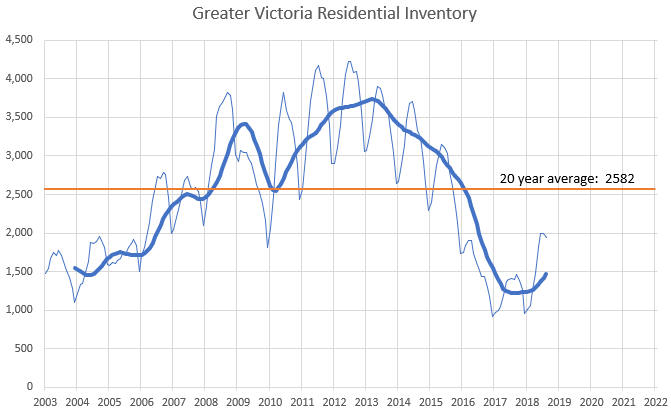

Inventory is still climbing when adjusted for seasonality, but more slowly than before.

If we want to dig ourselves out of this hole, it’s going to have to go faster than that. Again, the situation is quite stratified, with only 12% more condo inventory on the market while there were 33% more single family properties. One of the reasons for the scarcity of condo listings is that new listings are down 26% for condos in August compared to last year. I would have thought that the looming spec tax and AirBnB regulations would have brought a lot of investment condos out of the woodwork, but so far that is not the case at all. Historically speaking, we still have very few properties on the market.

Before we hear in a certain press release that the increase in inventory is limited to high end properties and won’t do the ordinary buyer any good, let’s put that myth out to pasture. Despite single family prices having risen from a year ago, inventory in every category including the lower end is up. The middle of the market is still the most active of the bunch with the high end the most sluggish.

Prices are flat for the month, which makes it 8 months of absolutely no change to the median prices. In January I said single family houses have probably peaked while condos may have a few more months of gains in them. SFH did stay flat which makes some sense given the market balance, but I’m surprised that condos didn’t pull off a few more months of price increases. Despite the low inventory and decent sales rate, it seems that condos have not been able to pull ahead this year.

In September we will see a bit of a bump in new listings, usually about 100 more than in August, however both sales and inventory will keep drifting downwards towards the end of the year as only the serious sell and speculative listings are pulled to try again next spring. By that point some of the initial impact of the stress test will be absorbed through higher wages, however we can likely also look forward to another bump or two in interest rates which will suck that credit right back again. It remains to be seen whether the policymaker’s dream of an orchestrated soft landing is to come to pass. So far in Vancouver it looks like it is getting pretty bumpy.

Monday numbers: https://househuntvictoria.ca/2018/09/10/sept-10-market-update

That only 39% of people own their home in Victoria, really surprised me. It’s pretty low compared to other cities including Calgary who is at the top with 71%.

https://www.huffingtonpost.ca/2018/09/08/canadas-tradition-of-homeownership-is-at-risk_a_23520973/?utm_hp_ref=ca-homepage

Anyone visit 1524 Cedarglen, what was the quality?..could be a contender for the flip of the year? 01-May-2017 $717,500 Just relisted for 100k less at 1.59

El Serano a similar total rebuild flip sold for 1.42 but had a much bigger lot.

https://www.zolo.ca/victoria-real-estate/1524-cedarglen-road

How millionaire migrants duped Canadian immigration

https://globalnews.ca/video/4436342/how-millionaire-migrants-duped-canadian-immigration

Back to the Victoria (Not Victoria Australia, not the mortgage foreclosure blog). What is a view worth? 807 Sea Ridge Pl V8Y 2T5SE Cordova Bay-Saanich EastMLS#:391887

$1,825,000 https://www.remax.ca/bc/victoria-real-estate/807-sea-ridge-pl-wp_id208092039-lst

I know it says bring your offers, Vancouver seems to be coming in at or below assessment but we still want a 350-500k premium,$1,457,000 assessment. Not a 10% adjustment in price to find buyers but the drop is substantial. 111 days on market.

I personally would need a drop to below assessment to go view it and watching view property on island view road, it might not sell for 222 days on market.

But a real friend is there for you in hard times.

Easy to find a friend in good times. But…

https://www.youtube.com/watch?v=0b-OHZI1Q5w

Counterpoint: my dad sued Deutsche Bank after he lost a significant sum in the financial crisis due to a misleading prospectus and unethical sales practices. He won and they had to refund his losses.

A point worth making again and again. What matters are the people at the margin. Most home owners were perfectly fine in the US crash and just kept paying their mortgage as before and stayed in their house. They were also completely immaterial to house prices.

Perhaps the bank of mom and dad is getting bigger in Canada due to the lack of inheritance tax. And, could it be a contribute to the run away housing price in Canada?

https://www.cbc.ca/news/business/canada-wealth-high-net-worthy-1.4814907

Usually people end up in foreclosure for a reason. There is bad luck foreclosure (health, etc.) but for the most part it is poor decision making.

Totoro is right…there are always options but I’ve yet to show a foreclosure where the upstairs main part of the home is rented and the owner is downstairs in a two bedroom suite renting out the second bedroom to a homestay student…..probably because someone willing to go to those measures wouldn’t end up in foreclosure.

I’d suggest that those two things are not linked in this manner and that rental income may not cover all your costs but may allow you to cover enough of the costs to keep your home. For me, this would be worth it in most circumstances to retain a house in this market during a downturn or hard times.

Unless it works. Which in some circumstances it does. I can see that this would not work for you, but I’ve co-owned property successfully with a friend. There are co-ownership mortgage products these days and co-ownership template agreements.

This is why meeting with a non-profit credit counseling agency is the best first step before deciding to consolidate debt, file consumer proposal, file bankruptcy or hang on. Googling file bankruptcy Victoria may direct one away from the non-profit agencies that are willing to help without being motivated by greed.

People should also remember that one half of surplus income for I believe a period of twenty one months is turned over to your creditors, assuming that I remember my bankruptcy law correctly (not my specialty so I might be a little off on the details.) The threshold for surplus income is set on a formula that is amended each year.

While an option, one has to weigh things very carefully before declaring bankruptcy. There can also be hidden costs. In my experience, it is not totally uncommon for a trip to the bankruptcy trustee to be shortly followed by a trip to the divorce lawyer.

Great conversation on the Canadian and Australian housing bubbles…

https://www.youtube.com/watch?time_continue=1778&v=0lrdxpKPocY

Watching the bulls sweat is hilarious. 😉

(1) “You are incorrect. Marko is correct. Your bank does not have to apply the stress test to renewals of existing mortgages and typically will not if you have been making payments”.

That is not what I stated. You are not subject to the stress test if you stay with the original lender – that is common ground. You succeeded to miss the point. If the borrower has negative equity – do you think the original lender is going to give that borrower the best rate for their best clients? Answer: no. The lender is at risk and will seek to contract for a higher rate, if they do at all, or make demand. If the borrower doesn’t like it, they can go to a different lender and THEN face a stress test. Either way, the borrower is paying more. The original lender is not stupid – they look at income, other debt, job security, amount of default risk, valuation [loan to valuation ratio], etc.

(2) “I don’t think that’s actually the argument. It’s more what the bank will do if come renewal, you owe more on the house than it’s worth”. You get it. Imagine if we are past the peak of the cycle and the borrower has other consumer debt. The bank’s initial mortgage is not secured by equity in the home. Lending in a sliding market by way of mortgage security where there is no equity makes no sense.

(3) “In reality at 30% under water a lot of people would stop making payments even if they could afford it and then the bank would foreclose on them. You get kicked out, you find something to rent and you move on. But that is not the argument here, the argument is you could be 50% under water but if you are making regular payments the bank doesn’t really have any better options than continue to let you make payments”. In the USA some states prohibited personal covenant on a mortgage, in Canada there is a personal covenant on 100% of mortgages – so, you don’t get to walk away – you jet judgment against you for the shortfall plus costs at Scale A under the Tariff to the Civil Court Rules.

(4) “Victoria Born’s post is fear mongering, and talk out of his arse”. Funny. Just put yourself in the shoes of the bank – would you loan $1,000,000 for a home that is worth $900,000 – no security – to someone who has $50,000 in other debt and prices are sliding? This is capitalism, not a commune where they sit around singing songs. Think of all of those US bank employees who were fired for making the mortgage loans you are saying, “oh, no problem, as long as you pay they will loan it”. Until you can’t pay it. Someone’ head is on the block.

(5) “OSFI has put fairly strict rules in place to protect the banks interests. Only the banks interests”. Enough said – so correct. This is why Canadian banks survived and the Regulations were tightened even more since.

You seem to all (most of you) forgotten what happened in the USA in 2007 through 2009. History. You also forgot about our stricter banking regulations. Further, personal judgment for the shortfall is a real thing. This is all part of the credit liquidity drying up as sales volumes drop and prices [which is happening right now] peaked months ago. This is not fear mongering – this is risk analysis – plain and simple. If you think bankruptcy is a cake walk – think again.

If you could pay the mortgage by renting the place out there wouldn’t be a downturn in the first place.

Bringing a whole new meaning to “greater fool”.

@guest_48781

I have a friend whom was sued by a bank, he fought the bank for years because he kept getting judgements in his favour. The bank always appealed the decision and banks have very deep pockets and hate presidents being set.

In my opinion he was foolish to fight the bank but as he watched his assets disappear and he turned to friends and family to carry on the fight his determination grew. As suspected by everyone with the exception of himself it exhausted all his resources.

The bank eventually beat him down and he declared personal bankruptcy. Yes banks do sue and do get sued but it is a hard battle to win.

In most circumstances this is very poor advice. Bankruptcy will stop you from getting another mortgage for at least six years and then you’ll need to rebuild credit. A smarter move in our market is to do what it takes to keep your home if you can and ride out a downturn. Rent rooms or the whole place out. Sell half to a friend. Given the history of the market you are setting yourself back substantially if you declare bankruptcy due to a mortgage.

If you have been way out of control with consumer spending and have no assets bankruptcy might be advised.

What I find curious is that while Van, Victoria and the rest of the island seems to be in a sales freefall for SFH, Parksville/Qualicum and the Comox Valley rebounded for the month of August after a few months of low sales. Curious to see if this is a dead cat bounce or if it will continue; If it doesn’t follow Van and Vic’s lead of downward sales, then perhaps there’s another factor at play…

In the Comox Valley, SFH inventory is still at record lows, and below last year’s numbers; again, has not yet followed Van/Vic SFH patterns for rising inventory.

What I have also noticed is Victoria appears to follow a much more consistent trend – ie when sales turn downwards or upwards, they tend to continue on that trend, while up island sales seems to bounce up and down quite a bit before showing a consistent pattern; not sure what would cause this but interesting to watch.. What surprised me though was after 3 months of falling sales, that parts of up island rebounded back up. We’ll see what September brings…

August:

http://www.vireb.com/assets/uploads/08aug_18_vireb_stats_package_64515.pdf

July:

http://www.vireb.com/assets/uploads/07jul_18_vireb_stats_package_64515.pdf

GWAC: “Well if it’s happening in Seattle must happen here.”

<<<<<<<<<<<<<<

That was actually for Introvert, my friend. There was a post by introvert a couple of days ago referring to the Seattle housing market going up by 100% over the last 6.5 yrs.

I'll try to stay current for you. Lol

It’s not cooling in just Seattle, not just in Toronto, not just in Vancouver, not just in Victoria, not just Sydney Australia, not just in England, not just in Shanghai, not just…(pick your city…). It’s a global cooling trend, just like the rapid price escalation from 2012 to 2017 was a global trend. It’s not a global crash, it’s just a global cooling. No one knows where we are heading, we are all just guessing. My guess is for an accelerating house price decline for the next 18 to 24+ months, exponential; but I’m just guessing, just like everyone else; but it’s indisputable that a decline is underway that has chilled all major real estate markets.

Most house owners will not be affected by a downturn, most of us consider our house our home, and we all need homes. The decline will be driven by a small minority that are forced to sell and there are only a few reasons why someone will be forced to sell for either material reasons or psychological reasons, for example:

1. Mortgage renewal time but can’t afford to renew due to higher rates, or insurance requirements, or bank reluctance due to underwater mortgage,

2. Change in personal circumstances, death, divorce, unforeseen major expenses, health, etc

3. Investment property expenses far exceed revenue. Any rental property purchased since 2015 will be in this category.

4. Major repairs are needed, but the owner can’t afford the repairs. I’ve seen people forced to sell due to a flooded basement when they couldn’t afford to have the perimeter drains replaced.

5. Employment; either laid off or moving to a new location for a better job.

6. Disillusioned with Victoria; some people just want to move away.

6. Panic, fear of losing paper equity

These reasons happen over time, not suddenly. Conversely, an increase in house prices is heavily influenced by ‘lemmings’, everyone suddenly jumps onto the ‘bandwagon’ of house buyers, so prices spike quickly. On the downturn, it rarely a crash because the reasons for selling don’t create a lemming effect, rather it’s a gradual decline.

Sure, but I’d rather not live in a pile of shit.

In our society one often hear bravado statements such as “I’ll sue you!” Or in the case of this thread people being sued by the bank.

-But will they?

An important thing to remember when suing someone is to know that they have the money to pay you. You can sue someone that is bankrupt but why would you?

You won’t get any money and you’ll have to pay legal fees.

Claiming bankruptcy is not as socially stigmatized as it once was. Today you will find most of the younger generation immediately claiming bankruptcy. While generations in the past would have tried to solve their financial problems by cutting back on their expenses and paying their bills. And in my opinion since the younger generation with debts in the hundreds of thousands have it right. If I were 26 years old and facing a mortgage debt of $500,000 that I could no longer pay, not only would I walk on the loan – I’d run. Recourse or Non-Recourse.

Well if it’s happening in Seattle must happen here.

The deperation of the bears is amazing. I am sure there is a pile of shit out there that is a bargain.

…. and meanwhile in Seattle … whoops

http://www.seattletimes.com/business/real-estate/seattle-home-prices-drop-by-70000-in-three-months-as-market-cooldown-continues/

“Looking just at the city of Seattle, the change is even more pronounced: The median house last month sold for $760,000, a drop of $45,000 in just one month and $70,000 in three months.”

We’re debating on whether it makes more sense to

a) look at 2nd property

b) sell and upgrade to our last house

I don’t believe PM’s exist here. Perhaps you have some advice on what you would do if you were back to a similar fork facing us and/or could do it all over again.

Would need way more info like could your current house become that 2nd property now or down the road, the price range of your last house and whether it would have a suite or not, etc. Not a black and white question.

That’s not what I’m talking about, ie full recourse vs non. I was talking about non recourse vs personal bankruptcy. If you’re in a full recourse jurisdiction, bankruptcy will discharge the homeowner’s obligation on the shortfall remaining, after the bank forecloses on their home.

They can seek legal action all right, the bankruptcy will just limit their take to your existing assets, split with any other creditors.

I agree with LF here, you could walk away and claim bankruptcy in BC so your mortgage lender would not be able to seek legal action for shortfall. In Alberta, there is no recourse for non high ratio mortgages and many borrowers have been walking away to capitalize on this.

I just got woken up by the earthquake.

https://calgaryrealestatereview.com/2012/03/04/lender-refuses-to-renew-owners-face-foreclosure/

The article notes that major banks generally won’t do this, but it’s the most stretched borrowers who are most likely to deal with the other lenders.

Time to debunk this fallacy again. Only about 1/4 of US states are no-recourse. The others are full recourse just like here. For example Florida, which had one of the biggest crashes, is full recourse. Also, the no-recourse states often have limits. In California only the original mortgage used to purchase the property is no-recourse. Any re-fi, 2nd mortgage, or HELOC is full recourse.

The stress test is not mandatory if you renew at your existing bank.

http://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20_dft.aspx

Barrister, here is some midnight reading for you on the OSFI expectations.

http://www.osfi-bsif.gc.ca/Eng/Docs/b20.pdf

The Loan to Value Ratio (LTV) seems very important at all times to the mortgagee governed by the OSFI rules.

Banks have few options when confronted with high LTV ratio applications, but two options are: insist on mortgage insurance and secondly, charge higher interest rate commensurate with increased risk.

The mortgagor on a high LTV mortgage application has few, if any, options, especially if they can’t qualify due to the higher monthly payments incurred by the higher interest rate at renewal, not to mention the difficulty of obtaining mortgage insurance at renewal.

The LTV ratio of all mortgage holdings held by a bank, seems to be an overriding assessment point used by OSFI in determining a banks compliance with OSFI.

The bankers practice of refusing to renew high LTV ratio mortgages was common practice in the 1980’s after house prices declined.

@guest_48535

Do you really think we are going to be going up in the next 12 to 24 months?

I see slashes happening all over the map for properties 800k+. Do you really think we are going to see a increase in median prices within the next year or 2 or do you agree that we are starting to see this run up hit its peak (for now) and we are now flat lining and going down?

I think that there has been a good question asked about what regulatory rules apply when the mortgage is renewed by the same lender. Not my area of expertise so I dont know the answer and I hope someone here actually knows.

In law I dont believe that there is any such creature as a mortgage renewal and each renewal is a new separate mortgage. It is possible that the bank regulatory rules provide exceptions of applications upon a renewal but I have no idea if such exceptions exist.

For example, if one wants to renew a mortgage does one have to qualify under the stress test? Are the banks limited by regulation as to what percentage of a house’s fair market value that they are allowed to lend.Do the regulations prevent a mortgage for an amount above the said limit upon a renewal.

We have a number of new regulatory changes so past bank practices might not be reflective of the new situation.While it might be sensible from a business point of view for a bank to renew a mortgage that is underwater rather than foreclose, the question is whether the new regulations prohibit a bank from renewing.

Does anyone here know for sure?

@AAA

“a) look at 2nd property” make more sense, but we did “b) sell and upgrade to our last house.”

Dollar and cent are not the most important for us, we like to live more comfortable, F+F visits, and hate to pack and unpack boxes again.

Sorry, my response rise more questions than answer.

I’d need more information to understand your goals and hoped for standard of living and age of retirement.

Generally a second property is going to be a longer-term, cash-flow negative investment in our market with the ROI coming from appreciation maybe seven-ten years into the future. If you are renting it out the costs will be somewhat offset but you’ll also become a landlord. Some are suited for it and some are not. When you sell you pay capital gains tax on the proceeds. In addition, although your costs might be set off by rental income, you will likely pay some additional taxes on the principal pay down portion. Financing terms are not as good as with a primary residence but you will be able to borrow more because the rental income will also be counted in the qualification process. If you want to leverage as much as possible a rental property helps you achieve this.

If you buy your last house this is going to be a really long-term investment that may only pay off for your children if you are adverse to HELOCs used for investments along the way. The plus side is you get to live in a great space now and the gains will be tax exempt. The negative is that your greater carrying costs are borne by you alone unless you have a suite to offset some of them.

For most people in our market the wisest long-term financial decision is likely to be the best primary residence they can afford with a suite to offset risk. For you this might not be the case depending on your views on suites and future ability to weather interest rate hikes and risk tolerance.

You might also want to look at the Canadian Couch Potato investing advice. Just because you’ve filled up the tfsa and rrsp doesn’t mean that you might not benefit from additional investments. Also, if you have a business that is making money I’d focus on how to do some tax planning within the company and how to sell the business when you want to exit.

@oops – IN THEORY, the bank can come in your home and if they are not happy with its condition, they can call the loan anytime.

It never happened, same as foreclosure on houses with good payment history.

VB is wrong. Instead of just admitting his mistake, he repeated his misinformation. Why is it so hard to admit that he is wrong?

Totoro/Marko/Leo,

You have my highest respect financially on this blog, so I’m throwing a couple questions your way.

We’re thinking though our options for the future and require some financial planning that goes well past our local bank. Business has been very good for us in the last 4 years and we’ve managed to save a good amount net of all expenses. We have also managed to max out our RRSP’s and TSFA’s. Age wise I’ll just say we have a long ways to go before either of us will consider retirement.

We’re debating on whether it makes more sense to

a) look at 2nd property

b) sell and upgrade to our last house

I don’t believe PM’s exist here. Perhaps you have some advice on what you would do if you were back to a similar fork facing us and/or could do it all over again. Anyone else in a similar position feel free to chime in without passing judgment (which seems like a provincial passtime)

Plum wine: “Victoria Born’s post is fear mongering, and talk out of his arse.”

<<<<<<<<<<<<<<<<<<<

Not necessarily Plumwine. OSFI has put fairly strict rules in place to protect the banks interests. Only the banks interests.

You see, Marko was probably right regarding a homeowner’s strategy if they were 30% underwater on the mortgage.

The problem for Mr. junior bank representative is that he watched the banks collateral sink because “they always made their payments”.

Now, go to OSFI and explain that you didn’t apply their rules because you assumed that the homeowner would continue payments and nobody could have anticipated a 30 – 40% price drop.

….. now the bank is not only screwed on the collateral but they are fined by OSFI.

The banks are very forgiving as equity is driving up year after year. The bank supervisory body is anything but on the way down.

And I thought I was wasting my time, looking at Vancouver stats hopeful for a minor correction here.. Australia has 0 relevance to Victoria BC Canada. Go post on their blogs. If we want to read about irrelevant things we’ll go to reddit or google it. Don’t copy and past crap here. Get a sailboat off usedvic and take it down to Australia and buy your chunk of the South Pacific cheap at the end of their slow 5 year slide, but please leave now!

Meanwhile, down in Aussie land, the credit squeeze continues and buyers wait out the sellers. Victorians would be wise to do the same.

Buyers wait for bargains as Australia’s housing market hits long slide

It’s not a credit crunch, it’s a credit squeeze

Pete Wargent

Prices across Australia fall for 11th month in a row and while it’s bad news for investors, first home buyers are biding their time

“Five years ago banks were “falling over each other” to give out loans says the Sydney-based IT executive Karl Sice, who bought his first investment property 15 years ago. He currently has six properties in his portfolio across Sydney, Melbourne, and northern Queensland.

But after roughly six years of uninterrupted, breakneck growth, Australia’s housing prices are falling, and the noises from the lenders have changed. The difference between now and five years ago, Sice says, is like “chalk and cheese”.

Sydney and Melbourne, the twin engines of Australia’s house price boom, are finally spluttering – thanks mostly to financial regulator Apra’s tightening of lending and the fallout from the banking royal commission.

And while it may not be a crash, it seems set to be a long slide. This week, Capital Economics predicted the coming fall would be the “longest and deepest” housing slump in Australia’s modern history.

But while it is bad news for Sice and his fellow investors, it is good news for hopefuls trying to buy their first home. Where once the market was driven upwards by buyers’ fear of missing out, now they can afford to wait and see.

Rhi, who lives in the Illawarra region of New South Wales, south of Sydney, works in construction. She says she plans on biding her time and “snapping up” her first home when the market hits rock bottom.”

https://www.theguardian.com/australia-news/2018/sep/08/buyers-wait-for-bargains-as-australias-housing-market-hits-long-slide

Hey, all you owners and realtors out there dropping your asking price by less than 1%…fuck you.

Re: minuscule price drops…

I’m not ready to buy yet, partly for personal reasons (moving from Ontario, need to find and settle into new job, etc.) and partly because I think the market is insane. I do find it amusing though when sellers drop the price to $1.03M after the market says $1.05M is too much. Looking at you, 59 Moss and 615 Moss.

Good to know 🙂

In conclusion, the bank won’t kick you out if you keep paying them.

Victoria Born’s post is fear mongering, and talk out of his arse.

I think that’s the whole point as Marko stated… (ie. being current with mortgage payments). I also worked for Scotiabank for 5 years (my only banking experience) . When times are good and mortgage payments are being made, no complaints!

The branch manager where I trained always said, “Banks aren’t in the business of owning property”. True then and true now….just imagine the expenses related with foreclosing on a borrower. Our daily loan reports were completely focused on late payments, not valuations, etc. If you could get a borrower current, yipeee, then move on to loan origination. Only when the delinquency was so extreme, we would then have to pass on the file to our “recoveries” specialists. Collateral is ultimately the “back door” to under performing loans, not the primary focus.

That’s if you still have a job.

Right, that makes sense. Thanks.

Aside, unfortunately a lot of people in Canada think that people here cannot walk away from their mortgages as in the USA. “That can’t happen here.” In fact you can – different process, different name, but the end result is the same.

What happened down south benefited some and devistated others but it didn’t work out in the banks favour in any case. I have a friend that lived for a year in their condo without paying their mortgage after paying 200k for it and the unit next to them sold for 50k. The banks stopped kicking people out because they couldn’t manage all the vacant properties and the problems they created. Then he declared bankruptcy and his wife bought a SFH for the same price as the condo… hardly an example to follow for the banks. Make your payments and nothing will happen….

If you owe 30% more for example, would the bank still just “hope”?

In reality at 30% under water a lot of people would stop making payments even if they could afford it and then the bank would foreclose on them. You get kicked out, you find something to rent and you move on. But that is not the argument here, the argument is you could be 50% under water but if you are making regular payments the bank doesn’t really have any better options than continue to let you make payments.

If the mortgage has been bundled up in a mortgage-backed security and sold on to another party, who forecloses? In the US, foreclosure proceedings were instigated by parties other than the banks that people were paying. Even people who were paying their mortgages got foreclosed because the MBS holder wanted their money out.

also, I heard that credit unions aren’t required to register second mortgages against the title so how would a person know if a second mortgagor has a lien on the property?

I know people say our industry is better regulated but I have never seen anything that explains how. Any references in this regard appreciated.

It was not a big success for the banks down south so I’m sure they don’t want to repeat that…. if you are paying the mortgage then do not disturb.

I don’t think that’s actually the argument. It’s more what the bank will do if come renewal, you owe more on the house than it’s worth.

Something I’m not sure about, but there has to be a limit to when the bank stops saying yes. If you owe 5% more than what it’s worth at renewal, perhaps. If you owe 30% more for example, would the bank still just “hope”? What about 10%? 20%?

Something would have to give – millions upon millions of homes were foreclosed in the US when their bubble popped, and I wouldn’t think the bank’s logic or sense of risk balance would be that different here vs there. Thoughts?

Victoria Born, after working in a bank for 5 years I have to side with Marko.

“If the price goes down and their mortgage comes up for renewal and the bank wants an appraisal (normal) which comes in lower than the mortgage – and they can’t come up with the $$ to bring the equity to the bank’s requirement – then what?”

First of all that is not normal. In my time at Scotiabank i processed hundreds of renewals and I never once did an appraisal as it wasn’t a requirement unless they were refinancing at the same time. Even if it was a weird circumstance and I thought the place was worth less than the mortgage it didn’t matter. Even if it was for a place somewhere in Nowhere, BC where I didn’t know valuations we would never check. As long as payments were made we didn’t care. IF the place was valued less then what they bought it for then they would more than likely be CMHC insured which meant it really didn’t matter to us either way. Granted i never went through a 20% correction, I can’t see it making a large difference unless its a complete doomsday scenario. And then what? There is a writeup in our credit agreement that says the bank can request equity top up it if valuations drop to a level they find unacceptable but how much would that be? I mean Toronto dropped 20% in 3 months last year and I haven’t heard of people needing to top up their equity – Alberta house prices dropped when oil prices crashed and again that wasn’t the case.

What LEO S said is correct though. If the banks suspect you can no longer qualify to move your mortgage elsewhere they won’t be flexible on rates. Which is unfortunate given the new mortgage rules.

You are incorrect. Marko is correct. Your bank does not have to apply the stress test to renewals of existing mortgages and typically will not if you have been making payments.

No, Marko – you are totally wrong, I am afraid, and giving misinformation. The bank legally cannot refinance in that situation unless the owner coughs up more dough [come up with $200K or redeem the mortgage]. Go to another lender, but they won’t touch them with a 100 foot pole – they are radioactive. If the home goes in to foreclosure, with no equity, the bank gets conduct of sale and sells it. The owner gets judgment against them for 100% of the shortfall and get’s their wages attached, cars executed against, etc. – that is the personal covenant on every mortgage. If it is a CMHC insured mortgage, the bank is covered for the shortfall, so they will get out of it. Bankruptcy may be the owner’s only hope, if not. This is how the real world works – adult style. People are stretched far too thin, too much debt and they can’t service it even with a quarter point more on the coupon rate of interest.

“The best bet for the bank is to refinance and hope the owner can continue to make mortgage payments at the rate they offer the home owner”. Yeah, “hope” will ease the pain of the larger default down the road. Risk management dictates no refinancing [period]. The banker will be looking for another job at Tim Hortons if they refinance.

The banker is not there to wipe the borrowers nose – they are not the social assistance office. So, Marko – would you loan them the money at the prevailing mortgage rate? If not, what makes you think a bank would? I can guarantee you that the bank will not and can not. OSFI would have a hay-day with your approach.

Liens or judgments on title – Do an online LTO search. Costs $12. Here is the link – anyone can do it:

https://ltsa.ca/property-information/search-title

Does anyone know how one can see if there are any court judgments or liens on a property?

Go down to BC Land Title and pull the title on the property.

Does anyone know how one can see if there are any court judgments or liens on a property?

Marko – you misunderstand. The bank won’t force you to sell, I agree. The bank just won’t finance the renewal and the owner can look elsewhere for financing: alternative lenders or loan sharks.

It is the exact same thing. If the bank won’t refinance they have a foreclosure on their hands. Loan sharks aren’t stupid, and the home owner isn’t stupid enough to go refinance at 8% in a negative equity situation. The best bet for the bank is to refinance and hope the owner can continue to make mortgage payments at the rate they offer the home owner.

The bank requires security – the bank will not remortgage for $1M on a home that is appraised for $950K. This is particularly so where, as now, sales are dropping and prices are softening. CMHC will not touch this borrower as well.

Yes, they will or they have a foreclosure on their hands and they are losing 100k+ after commissions, etc. If they refinance the home owner their odds of avoiding a loss are much higher.

If you are renewing with the same bank where the CMHC come into play?

This must be the 15th time we are discussing this on the blog. If you are making regular mortgage payments the odds of the bank touching your are slim to none.

Steve Saretsky interviewed David Eby before the last election and asked him some good questions about direction and the intention regarding price:

https://www.youtube.com/watch?v=7yRczBxZBhs

Clearly, the NDP’s aim is to reduce RE prices in BC. That is the ultimate goal (and increase supply) of all of these policies. So, if you intend to paint your wall blue and you go to the paint store and you buy blue pain, you take it home and open it and use a brush and roller and put that blue paint on that wall and, lo and behold, you get a blue wall – don’t complain that the wall turned out to be blue. That was the intention. If you run out of blue paint – you drive back to the store and you buy more blue paint and repeat. If the paint is too light, you go back and add blue tint – viola – the wall is a darker blue. Some will get the point.

The government told you what their intention is, they have unleashed 30 measures to achieve it and are ready to do more – so, don’t be surprised if house prices fall and, I suspect, it will be a hard landing.

Read the comments at the bottom of the screen – fascinating.

And that is not Santa Claus – the hat is blue.

And Josh – you are probably paying far less than what you would be paying for a monthly mortgage [at these inflated and deflating prices], property taxes, water, sewer, garbage, maintenance, insurance…………bank it, earn some interest in a high interest savings account [Ex: EQ Bank] and let this play out. Better days are ahead for you.

Hey, Leo. Can you please explain why first-time homebuyers are so important to the RE market? We hear this all the time and I would like to understand it better. Thank you.

Seeing what seems like an increasing instance of vacant Vancouver homes mysteriously burning to the ground. Curiously, a number of them had recently been issued demolition permits. Lucky coincidence I guess, as it must be expensive to hire a crew to tear down a house.

My landlord kept prices the same for 8 or 9 years before I moved in, then raised it by the maximum every year. Pretty sure they’ll do it again this year. Still, we’re paying hundreds less than comparable apt listings.

Steve has it right – focus on the credit bubble – housing is in line with this:

https://www.youtube.com/watch?v=d63E1WUk5kE

Great summary of current status in Vancouver [I firmly believe that Victoria is in line with this]. Peak home, auto sales, jobs – all in the rear view mirror.

Opportunities forming. Shut out the noise. Follow the data so you are positioned when the bubble bursts:

https://www.youtube.com/watch?v=7pkr86X8VBo

…and it will.

Marko – you misunderstand. The bank won’t force you to sell, I agree. The bank just won’t finance the renewal and the owner can look elsewhere for financing: alternative lenders or loan sharks. Surely, you are not suggesting that the bank will violate Regulation just because the owner paid the mortgage on time for 5 years. It does not work that way. The bank will not share the owner’s risk to that degree. The bank requires security – the bank will not remortgage for $1M on a home that is appraised for $950K. This is particularly so where, as now, sales are dropping and prices are softening. CMHC will not touch this borrower as well.

Hate to burst your warm and fuzzy admiration for the banks – they are in the business of making money and they protect their shareholders. Why would a lender share the risk? Negative equity does not a loan get. Further, if they can’t meet the stress test, a banker can’t look the other way. Also, there is no Santa Claus.

Not sure it’s a great argument for a new house. Bit of a fluke that just the right stuff failed. A different combination of things can fail in any house.

Just an example of one of the many things that can go wrong in an older house.

Sorry, Marko, but that fact doesn’t jibe with the doomsday narrative. Try again.

Or you get a new tank without an expansion tank like we did.

Not sure it’s a great argument for a new house. Bit of a fluke that just the right stuff failed. A different combination of things can fail in any house.

Yeah stress test is a gift for the banks for any marginal borrowers. They can extract more spread out of those people that can least afford it. Just the type of ethical move that the banks love.

If the price goes down and their mortgage comes up for renewal and the bank wants an appraisal (normal) which comes in lower than the mortgage – and they can’t come up with the $$ to bring the equity to the bank’s requirement – then what? They have to sell.

We’ve talked about this to death over the years on the blog. The bank is not going to force you to sell if you’ve been making regular mortgage payments. Why would the bank take the huge loss of a foreclosure when they can just continue collecting your payment until you come back out of negative equity or your foreclose years down the road when the principal is lower?

If you are in negative equity you are stuck with a crap rate the bank offers you as you cannot switch banks but as long as you can make payments you aren’t losing your house not because the banks are nice but I just don’t see how it would benefit them to be forcing negative equity foreclosures.

I’m afraid you still haven’t found the issue. $600/year is equal to ~1200L per day. There is no way an expansion tank failure can lead to that type of water use unless there is actually a system leak.

The issue was resolved when we cut off the expansion tank.

i/ City meter spins very slowly, stops (with a super small flicker in the reverse direction), then spins again very slowly, this cycle occurs 24 hours a day.

ii/ We turn off the water at the main shut off at the house meter does not spin which would mean the “leak” is inside the house not between the meter and the house but we can’t see a leak,

iii/ We have the City of Victoria inspect the meter, functioning correctly.

iv/ We isolate a bunch of things (toilets, etc.) and the meter still spins slowly. Then we isolate the hot water tank and the meter doesn’t spin, but the tank isn’t leaking. We then cut off the expansion tank (not physically leaking) and the meter does not spin, problem solved.

Only theory I can come up is the failed expansion tank was causing an inflow/outflow of water but city meters don’t count backwards.

The reason the problem is so super rare is newer houses have PRVs and expansion tanks were only brought in <5 years so a bunch of things have to line up. You replace your old tank without expansion tank with a tank with an expansion tank, that expansion tank happens to fail, and your house doesn't have a PRV.

RenterInParadise asked: “…but I wonder if fundamentals have changed enough to make this type of investment cash-flow positive? Or even just break-even?”

Not even close!! House prices need to drop at least 30% before you could buy an average house in Victoria and rent it out for a break-even monthly rent that covers mortgage and property taxes and maintenance costs.

Download this great mortgage App and do “What if…” scenarios to show yourself the folly in buying a property to rent out these days.

https://canadianmortgageapp.com

I’ve noticed that as prices seem to be sliding just a bit that a few more investors are buying properties to put on the rental market. I had noted in a previous post awhile ago how it felt like investors were on the sidelines as I wasn’t seeing as many properties go from sale to rental as before. Now it’s not a flood of these types of transactions but I wonder if fundamentals have changed enough to make this type of investment cash-flow positive? Or even just break-even?

“Point is most people don’t sell a house because it may go down. They have the common sense to not spec and realize over the long term owning a house in Victoria is a good thing”.

That’s Wack Gwac.

If the price goes down and their mortgage comes up for renewal and the bank wants an appraisal (normal) which comes in lower than the mortgage – and they can’t come up with the $$ to bring the equity to the bank’s requirement – then what? They have to sell. Or, if rates rose (as now) and their income can’t pass the stress test – then what? They sell.

There are countless other “real world” scenarios that debunk what you are saying.

And your theory about the US housing market crash – well – with respect, read a book my friend. You are so very wrong. Before you employ the common “Gwac-Attack”, do some research on speculation and sub-prime lending.

On another note – I have been seeing a large surge in new listings over the first 7 days of September 2018. Plus, loads of price cuts. Many now below the inflated tax assessment values. Sellers appear anxious. The next 12 to 18 months will be fascinating.

Hawk – thanks for the link to the multiple mortgage article – wealth (?) built on debt on top of debt.

@guest_48686

I’m afraid you still haven’t found the issue. $600/year is equal to ~1200L per day. There is no way an expansion tank failure can lead to that type of water use unless there is actually a system leak.

GWAC, I was told that they don’t bother with pre-approvals because once you make the offer subject to financing they have to go through the whole vetting process again anyway. I thought the point of a pre-approval was avoid having to do that within a short time-frame. Incidentally, we were also told we would be contacted by a “mortgage specialist”. That was 2 weeks ago and no one has bothered to call. Looking elsewhere now.

Could it be that the bank thinks it has more leverage on you if you have put in an offer such that they can talk you into less than satisfactory terms because you have your heart set on that white picket fence?

Or maybe, as a self-employed person, I’m too big a risk and they are trying to gently move me out?

It’s true, history does not repeat. However, inflation has been with us since time immemorial, whether achieved by clipping coins, exploitation of new sources of gold and silver, or by the simplest means ever, central or private bank money printing. So confidence that “insane” inflation will not return seems a dubious proposition. Indeed, the 350% rise in Victoria’s mean house price since 2002, shows that we have just been through one of the most insane bouts of monetary inflation ever, though the chief consequence for prices has been manifest in asset, including RE, markets.

So the question is not whether inflation has been eliminated, but why it has manifest itself chiefly in asset prices, and how it will manifest itself in the future as money supply growth continues its merry way far in advance of wage growth.

The chief reason that the inflation of the 21st century has had only a muted effect on the cost of living is that (a) folks cannot readily buy groceries, cloths, cars and holidays with a 25 year mortgage, and (b) because off-shoring of manufacturing to Asian sweatshops has radically cut the cost of manufactured goods from computers to car parts, and shoes and shirts.

So will the trends in asset prices and consumer goods prices continue in the future?

That seems unlikely. The recent “insane” reduction in the cost of manufactured goods is being reversed in the US through a radical revision of trade policy. In future, Americans will be buying more and more stuff made not by people in electronics factories in China with anti-suicide nets, or collapsible garment factories in Bangladesh, but in high-wage US/Mexican factories. So look out for much higher consumer goods price inflation, unless Canada goes it alone on an anti-nationalist, and globalist, course. Moreover, don’t be too sure of continued rapid money supply growth through private bank lending, now that Canadians are maximally loaded with debt and interest rates have only one way to go — that being up in line with the rise in consumer goods prices. And if that is how things turn out, we could see air pockets developing in the Gordon Head RE market as loss avoidance, not affordability becomes the determinant of house prices. Only crazy central bank money printing can save RE now, but even that is likely to fail as home buyers will simply not be able to service ever larger mortgages, while dealing with rising consumer price inflation.

@guest_48636 Given the location and size of the property? I’d be tempted to buy it now with a little bargaining, can you get natural gas on Francisco Terrace? I have access to lots of trades people and it doesn’t look like it’s been home renod a bunch of times like lots of the stuff at a Million!

For the trolls out there, no one is getting rich in this market. http://hybridrealestate.ca/mylistings.html/listing.278829-1815-francisco-terrace-victoria-v8n-4w2.12653247

James, narcissists don’t need to learn because they know everything. Working in a library all day stacking books automatically makes one an automatic Mensa member. 😉

LeoS, your new chart completely blows up Mike’s 70’s theory he constantly applies to today’s market. Prices would now be collapsing as rates started to rise and surpassing affordability limits hit like they are now.

In the end we went with a home built in 05.

Not a whole ton has changed since 2005 in terms of the actual construction (a ton has changed in terms of additional paperwork/bs).

You argument is more along the lines of buy a quality newer houses versus old house and you can assessed that quality better with something that is slightly used which is solid logic.

Only thing to keep in mind with used modern homes >2000 yr built (9′ ceilings, etc.,) is that age is starting to creep up. A 2005 is going to feel similar to 2018 (not as much change as from 1992 to 2005) but your roof, for example, is on average at half lifespan.

I don’t get it. Which of this was caused by the old house?

A new house would have a PRV so unlikely the expansion tank would fail and if it did you wouldn’t end up with a water bill $600 higher than normal because of the PRV.

As for the correction in the 80s, it was very unusual. Housing markets don’t generally go from declining to +25%/year for a couple years and then immediately erase all those gains in another 2 years. That was a symptom of the insane inflation and economic measures used to combat it and is extremely unlikely to be repeated now.

I think the actual correction would have looked more like this if the economy had been more stable

A 23% correction over 9 years.

As always though, a time with increasing interest rates is different than a time with decreasing rates. Looking at the past is interesting, but does not say much about the future.

Oh, I think I get it now. So then 12% down is greater than the 100% up that came before it.

First, you normally always say something, Soper. It’s your shtick.

BTW, I seldom correct people’s writing on here anymore (and that’s not because the writing is perfect).

That’s amazing. So how’s your net worth looking, Soper?

AZ…..pretty bad when a realtor is unable to corectly spell words in the selling discription. Quite the stretch getting to “PRING” from “price”. I guess it does not matter, the house will sell itself in a market as HOT as Victoria’s.

Victhunter…..I have not gone to look at 1815 Francisco. IMHO, still overvalued by 300K.

It is. In fact 97% of original asking price is the current median sales price for single family homes (98% of last asking price). Not accounting for re-listings so real numbers slightly lower.

@guest_48491 It was enough to get your attention and then have me a google it, so there is some point to it. More importantly to me it indicates at least some motivation to sell on the part of the seller and realtor.

Maybe it is time to start putting out low ball offers (or reasonable offers in any other city in the world of the size and quality of Victoria).

I don’t think it’s true. Maybe one bank is being cautious but if this was a widespread thing it would have been covered as that would be a huge change. I reached out to a mortgage broker about it to see if they heard anything.

$1.999M

Anyone know how 2075 Neil St. sold for? Seems like a recent sale. Thanks!

Is there a point to a 2% or 3% price drop? (Just saw that 11 Oswego went down today.) Isn’t say 97% of asking a fairly reasonable offer? If you’re not getting those offers, shouldn’t you drop more? I guess this is what chasing the market down looks like.

Thanks Leo for the clarification. What could be the answer to no pre approvals. I can’t figure out what else may stop that. Income is income before or after.

Thanks Marko and Leo.

@guest_48636 did you go look at it? Could be an easy reno for someone wanting a great house at the 1 million price point. The tale of two sellers, just down the street: 1880 Francisco Terr V8N 6J2SE Gordon Head-Saanich East MLS#:399292 $1,149,900. Nicer lot/house in some peoples minds but by that much?

That’s always been the case. Just because you have a pre-approval doesn’t mean you will be approved on a specific property. The bank still needs to confirm that they will lend on that amount on that specific property no matter what you were pre-approved for.

What, you wouldn’t have bought when I said it was not a bad time to buy in Feb 2016?

https://househuntvictoria.ca/2016/02/22/why-it-might-not-be-the-worst-time-to-buy/

Granted 2013, 2014, and 2015 were even better times to buy, and I remember a lot of regular blog readers did buy during that time.

I don’t get it. Which of this was caused by the old house?

You can also bail on financing because the condition says financing “on terms and conditions satisfactory to the buyer”. Doesn’t make sense to leave out condition to inspection of course since you need to actually access the property to inspect it.

We bought without a financing condition despite requiring financing.

I can’t see PRING coming down anytime soon…

Seems like prices might be coming down.

$799,900MLS® : 391889

Last Update: New $ Chg

1815 Francisco Terr V8N 4W2

SE Gordon Head-Saanich East

Single Family Detached, 4Beds, 3Baths, 7,383SqFt Lot, 107DOM,

Originally$888,000

HUGE PRING DROP!!

I’ve had 1 rental increase ever. It was a total of 35 dollars a month.

BS on the US housing market meltdown. I guess you haven’t read any of the links I posted previously? So let’s keep it simple shall we? From the St Louis Fed – 30 year mortgage rates 2008 to present.

https://imgur.com/mAzyycd

Now to the more complex – The meltdown in the US housing market was a multi-year event beginning with a slowdown in mid-late 2005. It picked up steam in 2006 as the excessive fraud in some markets started to take a toll (see my previous post on that). Then there was the robosigning, foreclosure debacle where companies fraudulently took homes from people.

Now leading up to 2005/2006 there was quite a bit in the news about how someone could flip a house for tidy profits. The FOMO was incredible and people loved swapping stories about big over asks, line ups around the block for properties, etc. because on paper they looked like geniuses for their real estate investments. Guess what? With distrust in the stock market and financial markets post-dotcom, money flowed heavily into real estate speculation. Lots of people lost property to foreclosure because they overextended themselves. When you have 3, 4, 5, 6, or so many more properties and rental income doesn’t cover, you have to punt.

Lots of people didn’t lose their homes and could easily manage that 30 year fixed mortgage. And as rates decreased through 2013, lots of refinancing occurred to lock in those low rates.

While some did ‘jingle mail’, most that I read about were those who had overextended themselves on investments and not because of interest rates.

Mine was zero again this year.

Re: old home vs new home

We seriously considered a new build in Mill Bay, I even hired an inspector to view it while it was still being built – at drywalling stage. The inspector raised a concern over the backing being used in the tile showers.. a gypsum product that was brand new and attractive for builders because it could be scored and cut like drywall. But this stuff was relatively untested in the real world and had to be installed exactly according to manufacturer specs or it could leak. Lo and behold I t wasn’t getting installed correctly so I walked away. (And whoever buys this place isn’t going to know about this possible problem). The inspector also said, “otherwise the house is being built according to code” but really that just meant it was being built “to pass” using materials that developers use to keep costs low. I think a rule of thumb is the building must have good quality products where it’s important AND you, or better someone you really trust with building knowledge, needs to be onsite frequently to ensure things are getting done correctly. Generally houses built during boom times should probably be avoided – there’s so much rush or other possible labour problems you can almost be guaranteed of some corners being cut or things not getting done correctly.

In the end we went with a home built in 05. During the inspection of this house I asked our inspector (a different guy) if he would rather deal with an older house or have a new one. He said almost always the older one as you can see how it has settled, how the house breathes etc. You know exactly what you’re getting. For instance on a new house, even a well built one,you won’t know how air moves in the attic (and whether mold might be a problem) until at least a year or two afterwards. Of course there is “old” and then their is really old like Marko talked about with his parents house… those kinds of places I’d personally avoid unless it was some incredible place and I was prepared for major reno work.

That’s the right answer. And they have to take whatever is offered.

Max rent increase 4.5%

Highest in many many years.

Bitter probably because they want an appraisal first on the house to make sure it is worth what is being paid for.

Pat

People sell because they have to. Job/ down sizing or other reason not because prices may go down.

People in the US in 2008 walk away or sold because they could not afford the jump up interest rates structure. We do not have that here. The mess lead to job losses with lead to more housing issues.

Tell that to the 7 million US homeowners that got foreclosed on gwac. I guess you’ll be out buying that property you keep saying you’re buying for years now. You must be maxed out on credit.

No pre-approvals ? Banks know what’s coming.

My bank is telling me that no one gets pre-approved anymore. Is that right?

That’s true everywhere, all the time. So why do crashes happen then? Hint: what % of houses are on the market at any given time?

People don’t live in Enron and Nortel Hawk.. People need a place to live. it does not cost 9.95 to sell a house. Point is most people don’t sell a house because it may go down. They have the common sense to not spec and realize over the long term owning a house in Victoria is a good thing.

Sounds just like the Enron and Nortel pumpers the last few years before the credit fraud was exposed.

Imagine how all those new investment mortgage holders in Victoria will be paid back with new condos a year behind schedule, and 2 years if you’re looking for a leaker fix on your mistake purchase. Victorians late to the party as usual.

Victoria multiple mortgage holders up 20% a close second highest in Canada. Yikes !

Over 1 In 10 Mortgages Issued In Canada Are On An Already Mortgaged Home

Percent Change Of Multiple Mortgages Issued Across Canada By Market

https://betterdwelling.com/over-1-in-10-mortgages-issued-in-canada-are-on-an-already-mortgaged-home/

Only if you actually have no idea how math works.

42% down is greater than the 52% up that came before it.

I normally wouldn’t say anything, but you clearly show no appetite to learn what is something so trivially basic. Maybe if you spent less time on spelling…

Wow, the bubble deniers are working overtime. I just noticed the slashes have doubled since this morning so I guess the sellers are clearly seeing through the bullshit.

Australia debt loads same as BC/Canada, same major Asian investment that drove markets now cut off for a long time, and implemented a stress test/new mortgage lending rules like Canada reducing borrowing power by a huge amount. Credit is credit no matter where you live. And you call yourself educated ? Dumb as a sack of bricks.

Mortgage hikes show the dancing is nearly over at Australia’s credit party

Higher rates, tighter lending and falling house prices are a flashing red signal of increased stress in the $1.6tn market

https://www.theguardian.com/australia-news/2018/sep/02/mortgage-hikes-show-the-dancing-is-nearly-over-at-australias-credit-party

How $8 billion in added mortgage costs will squeeze Canadians and the economy

https://www.theglobeandmail.com/business/briefing/article-how-8-billion-in-added-mortgage-costs-will-squeeze-canadians-and-the/

What do you think the likelihood pod offering 50 or 75k less at either eagle Hurst or Polo village would have a shot at being accepted?

Both developments are for the most part out of the woods so highly unlikely they are willing to negotiate 50 or 75k.

Eaglehurst has 100 lots and let’s say they are 375k each. That is $37.5 million plus they have to finance construction to get started….that is a huge outlay of investment to start the development and at that point the situation is the riskiest. At over 50% sold they’ve retrieved $18.75 million in sunk lot costs plus another 5 to 8 million in improvement profit depending on what their margins are on the build out. Basically, you take on huge risk by not selling the lots but benefit is if the build out is selling you are making money on the lot development plus the build out; therefore, at 50% sold you are actually in much better shape than if you had just sold 50% of the building lots to builders.

Polo Village went $849,900 on three carriage homes. Those sold quickly and now the next two carriage homes they have upped to $889,900.

For whatever reason, financing or risk, they wanted to see some unconditional contracts and now they are willing to let construction catch up to sales (they’ve sold more than they have actually finished building).

info:

As for interest rates… Mark Carney recently said that rates will be moved higher soon. However, even if rates stay where they are or move a bit lower (they will not), it will not stop the 30% price/income ratio correction that has already started in Canada.

December 30, 2012 at 3:26 PM

Its been a wild 9 year ride on here for me. Good memories. I had another name on the old board. Forgot my password so had to change it. No idea what it was.

If I read this board the past few years as a new comer I would not have bought property in Victoria….Easy to get swept into the negativity.

Absolutely. You represent the well reasoned bear viewpoint

I hope I have never mocked anyone for being a renter on here.

My pet peeve on here is folks in my generation who criticize those lazy, entitled, avocado chomping millennials.

Do you really want a newer house? The houses seem to be made out of cardboard these days, and will not last. You can find older places with solid wood construction, among other perks.

Among other perks includes asbestos, knob and tube or ungrounded wiring, cast iron plumbing which corrodes from the inside, concrete or clay drain tiles that typical fail in November when you are on vacation and flood your basement suite, poor insulation, crap foundations with no footings, plus a million other things.

I just spent two months helping my parents diagnose a leak at their house. Old house, new hot water tank with expansion tank (code in last 5 years) installed last year. Expansion tank failed so as the pressure fluctuated (no PRV as old house) the expansion tank would absorb water (city meter reads forward) but then it would push the water back (city meter does not read backwards). There was no actual leak….after cutting the drywall in a bunch of places to check for leaks. Joys of an old home.

I think Victhunter meant their offer was subject to financing.

There isn’t a huge difference between making an offer subject to inspection+financing versus just inspection. The bigger factor is the length of the conditional period. Subject to financing+inspection for 5 business days would likely be a more favorable offer than subject to inspection for 8 business days reason being you can bail on the home inspection subject even if the inspection is perfect.

I would say less than 20% of buyers waiving the financing condition actually have cash. The 80% are just super confident they will secure financing prior to completion.

It’s always good to distance oneself from crazy.

Well it wasn’t the homeowners arguing that Greece would destroy Victoria RE.

Introvert: “Just for fun, let’s check in with what’s happening just across the pond (the Juan de Fuca Strait, that is):”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

…. and just for balance, let's see what's happening in the center of the universe. lol.

https://neuvoo.ca/salary/construction/toronto/

"The average Construction salary in Toronto, ON is $82,552 per year or $42 per hour. This is around 2.5 times more than the Median wage of the country. Entry level positions start at $58,000 while most experienced workers make up to $116,000. These results are based on 850 salaries extracted from job descriptions."

http://www.heavyliftnews.com/news/toronto–city-with-the-most-cranes-in-north-america

Toronto, city with the most cranes in North America

RLB Crane Index

20 August 2018

For the third consecutive reporting period, Toronto has the highest number of cranes in North America. This indicates massive development in the city.

For the third consecutive reporting period, Toronto has the highest number of cranes of all the cities according to the recent Rider Levett Bucknall Crane Index: 97, which is an increase over the last count of 88.

With this number Toronto rises above the number of cranes in Chicago (40), San Francisco (26) and New York City (20). Seattle is second on the list with 65 cranes total.

86% of the cranes in Toronto are for the residential sector. The remaining cranes are for mixed-use and commercial developments, followed by education, healthcare, and hospitality.

Total number of counting cranes per city:

Toronto: 97

Seattle: 65

Yes, info: a carbon copy of Hawk, but with ASCII graphs. Remember those? Weren’t they fun?

I also remember info’s constant refrain: it’s all because of these “temporary, emergency, unprecedented” interest rates.

Oh, yeah. And remember Greece? Greece’s insolvency was always about to destroy the Victoria housing market, the renters told us. Kinda like how Hawk thinks Australia’s woes have something to do with us.

Such fond memories!

Did you know that on Venus, the sun rises in the west, but from the surface you wouldn’t be able to tell? Retrograde rotation is unique to that planet. Also, the day there, is longer than its year?

The problem with the Hawk-baiting is it seems to dominate the debating between everyone, especially from those with bullish sentiment. It’s almost like what he thinks is what every other person who happens to think that what we’ve seen is unsustainable, thinks. And it’s not necessarily true – his unique brand of perspective is his only, like everyone else’s.

People who are expressing their viewpoint aren’t necessarily cherry picking, spinning, intransigent, or raging, destitute renters. That broad brush is not only childish and simplistic, it erodes critical thinking and degrades the ability for others to learn if they choose to, IMO. I’ll get off my high horse now, just felt like saying, not everyone is the same.

That’s exactly the nonsense I’m referring to.

Here is a good one from 2015. Should have listened to Marko about what he was seeing. Was different than 1980

Blogger LeoM said…

Marko said: I think I’ve received more phone calls about purchasing investment properties in the last month than the previous 5 years combined.

Deja vu 1980…

I know, I know… “It’s different this time…”

March 27, 2015 at 4:15 PM

That was INFO back on the old one.

It only feels that long!

As far as I can tell, Hawk never posted anything on the old HHV 1.0, which ceased operation May of 2015:

http://househuntvictoria.blogspot.com/

Ah, the sound interpretations of FHawk’s News.

Caveat 2 post below I spit my coke out in laughter. Well done.

Hawk keeps posting that graph that depicts a crash. If reality corresponds to that graph we would drop to well below 2013 price levels in less than a year. That would meet most people’s definition of a crash.

Just for fun, let’s check in with what’s happening just across the pond (the Juan de Fuca Strait, that is):

It’s undeniable that the market has cooled and is cooling in Victoria. So far that hasn’t amounted to much on the price front though. I personally believe some weakening of prices is in the works though it may well take longer and amount to less than the bears hope.

Why do people hawkbait? Hawk has been posting more or less the same stuff (including THE GRAPH”) for about six years and continuously predicting a crash that has yet to happen. For many people that sort of prediction record might be cause for some reflection about their analytical framework. Aside from general wrongness there is the humorous tendency to interpret every story as implying a Vic RE crash.

Interest rates going up – prices are going to crash!

Interest rates holding steady – means economy is tanking – prices are going to crash!

Alberta economy strong – – everyone is going to move back there – prices are going to crash!

Alberta economy weak – no more rich Albertans coming here – prices are going to crash!

Trump says something stupid – prices are going to crash!

Trump says something smart (yeah right!) – prices are going to crash!

Sun rises in east – prices are going to crash!

There is no such thing as the mean in house prices. Even in the most sedate market, house prices are expected to track inflation which means they exponentially increase in nominal terms.

What a lot of people forget is that the first phase of the stress test rolled out in 2017. High ratio borrowers had to pass the test starting then.

Yes, cycles.

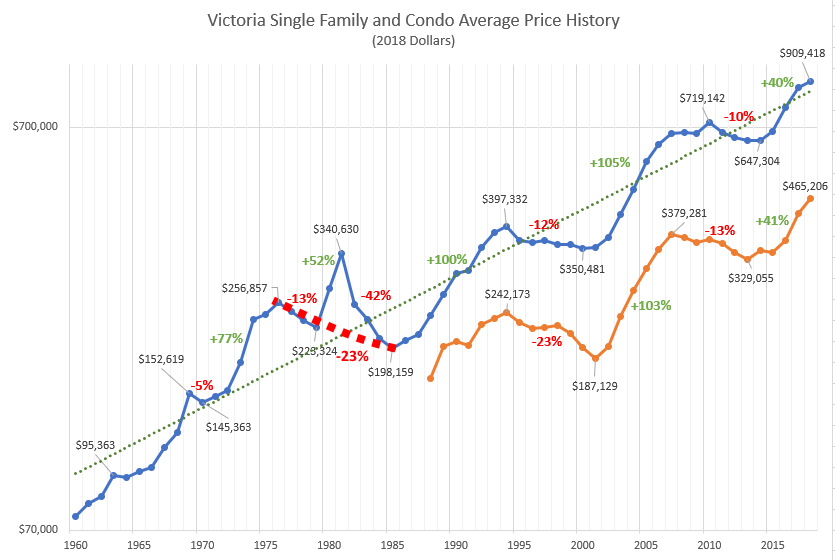

Victoria’s inflation-adjusted cycles from 1969 to 2018:

List of increases have been:

77%, 52%, 100%, 105%, 40%

List of corrections have been:

-5%, -13%, -42%, -12%, -10%

As anyone can see, the increases always clobber the decreases.

Could the downturn that we seem to be heading into be the mother of all downturns, the likes of which Victoria has never seen?

It could. But I doubt it.

Been interesting watching this board the last little while. For some time, you could easily see the change in tone from most of the posters that are typically “bullish”. They were sounding a bit more open to the idea that a downturn is coming, or at least had stopped declaring that this lull is just a brief wait to the next, massive leg up in the market. It was refreshing, and entirely fair to do.

Now it seems as though it’s gone back the other direction, some even openly mocking the idea that anything of significance could happen to this market. Perhaps some of it is just a tit-for-tat response to Hawk’s style of posting, but really I don’t think there’s much basis for a turnaround in sentiment, or to disregard what is becoming plainly obvious.

“Ya, ya, you have nothing until and if the prices ever change.”

Well no, that’s not true. RE markets work in cycles, and each correction moves through pretty well defined stages. Price movement, especially substantial price movement, is one of the last stages of the correction. I’m not going to guess how much a correction could be here, but to giggle it off as well as disregard what is becoming a broader global downturn in RE is just plain ignorant.

Let’s pretend there will be a crash like what “the graph” shows. What is % price drop for SFH’s to reach the mean?

Thanks Josh, the Greed, Delusion, and New Paradigm phases are now long gone. Only the “I’m such a fricking idiot” phase is left before the real kick in the cajones. 😉

As of 2 years ago we were neck and neck with Australia. Bubble deniers need group therapy. 😉

Boy, both graphs match pretty closely, except for the part on the real-life graph where prices have yet to crater. Should happen soon, though—right, bears?

“4 out of 10 Aussies can’t get refinanced

Dear god! The implications of this for Victoria, B.C., real estate cannot be overstated.”

Maybe hawk thinks our Victoria is in Australia.

The run-ups in Cordova Bay were pretty steep given location and the slide down is not unexpected. As for which areas are better, location is always debatable and depends on one’s priorities at that point in their life.

But that’s not what I said. Sure metro population will increase. But will metro population increase more simply because Langford allows a greater increase in housing stock? No. Which means more supply meeting a given demand.

Some people think newer is always better. Some people are oblivious to the fact that land represents about 80% of a property’s value in Victoria. And some people buy brand new cars mainly because of the killer five-year warranty.

I’ll let the reader draw the overlaps on that Venn diagram.

Because supply, in this case, is apples and oranges.

Oh boy, the graph is back. The really important-looking graph with lots of words on it and a big red line going down.

Our friend seems to be pulling it out with more frequency of late. Maybe the fact that all those slashes haven’t amounted to much is starting to make someone a little nervous.

Dear god! The implications of this for Victoria, B.C., real estate cannot be overstated.

Hawks dream come true:

https://betterdwelling.com/toronto-real-estate-prices-literally-look-like-the-textbook-chart-for-asset-bubble/

Broadmead and Cordova Bay are really sliding [prices] down. It is quite noticeable. I think these are better areas than the Western Communities of Colwood and Langford. But you are a ways from decent shopping / entertainment.

The jobs numbers are not quite as bad as the headline indicates. We still added a little over 40,000 full-time jobs. One would not expect big job numbers when the unemployment rate is only 5.9% – we are at capacity – employers can’t find skilled workers. Wilkins said the BOC Board debated about removing the word “gradual” [rate tightening]. The yield curve is flat to almost inverted [it is actually flat]. This all tells you one thing. Incomes (wages) are not rising inline with long term averages, though.

The data from Vancouver is very scary indeed. The stress tests, foreign buyer’s tax, spec tax, money-laundering crack down, fentanyl crack-down, ….. It is all taking its toll. Leo says the market has been cooling for 18 months – likely true because the stress test pushed forward purchases for 2017 which skewed the data. The big run up in Victoria was mid-2015 through to early-2017. It was unsustainable. Wages are not rising and can’t provide a foundation for these high-prices. No one is predicting a crash, not that I have read here, though someone keeps attributing that word to others. We are in a correcting phase in Victoria. I define a “crash” as 20 to 30%. I do not see that happening here in Victoria, but do see the risk of that in Greater Vancouver.

Some don’t even see softening in price here in Victoria. To each their own. With eyes wide open, it makes sense to move to the sideline until the spring, unless you find that dream home and you can afford it. If I were a buyer, I would rent and save – as an example [probabilities favour this], a 10% drop in price, plus a larger down payment, should outstrip a 50 to 75 basis point increase in mortgage financing such that you will pay off the mortgage years and years sooner, savings thousands and thousands in the process. Just do the math.