What’s going on with prices?

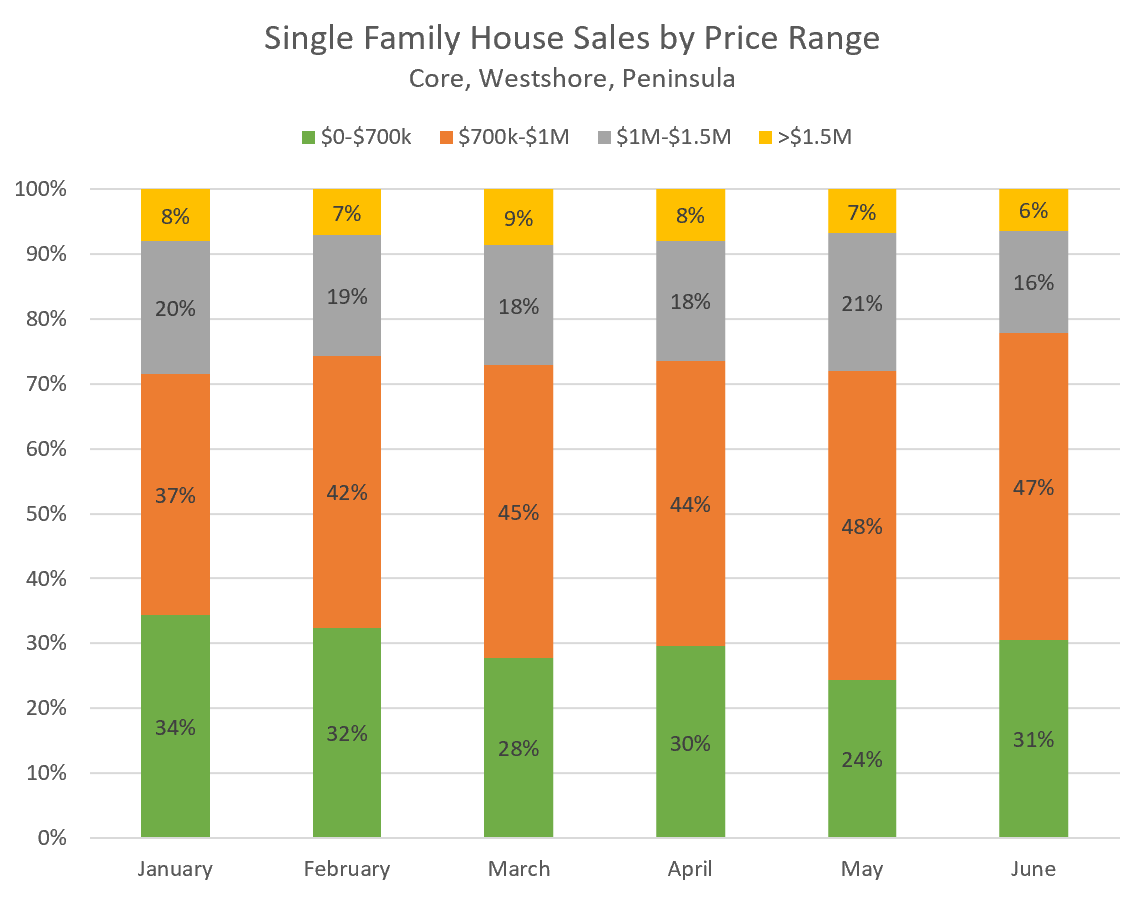

Given the large sales slowdown in single family in June, I wanted to take a closer look at what contributed to the drop and which segments really took a dive. Is it broad market or is it just certain segments that are cooling off? Usually these kind of price comparisons are tricky because of the change in the average price when comparing year over year sales distributions, but this year the price of single family homes hasn’t moved much so I took a look at how those sales have broken down.

This graph isn’t the clearest, but to me, it shows the following:

- In June compared to May we saw:

- a significant reduction in sales over $1M compared to May (91 to 66 sales).

- an increase in sales under $700k (79 to 91 sales).

- sales in the middle of the range stay flat.

- This big shift in sales mix explains much of the big drop in median sales price we saw in June. It should be clear that prices of comparable homes didn’t actually drop that much in one month.

- Like I pointed out several weeks ago, the slowdown is most pronounced at the top end of the market with the middle still moving along quite well.

According to sales price to assessment ratios, prices may be slowly drifting downwards. Median single family sales price was 13% above assessment in June compared to 15% the three months before.

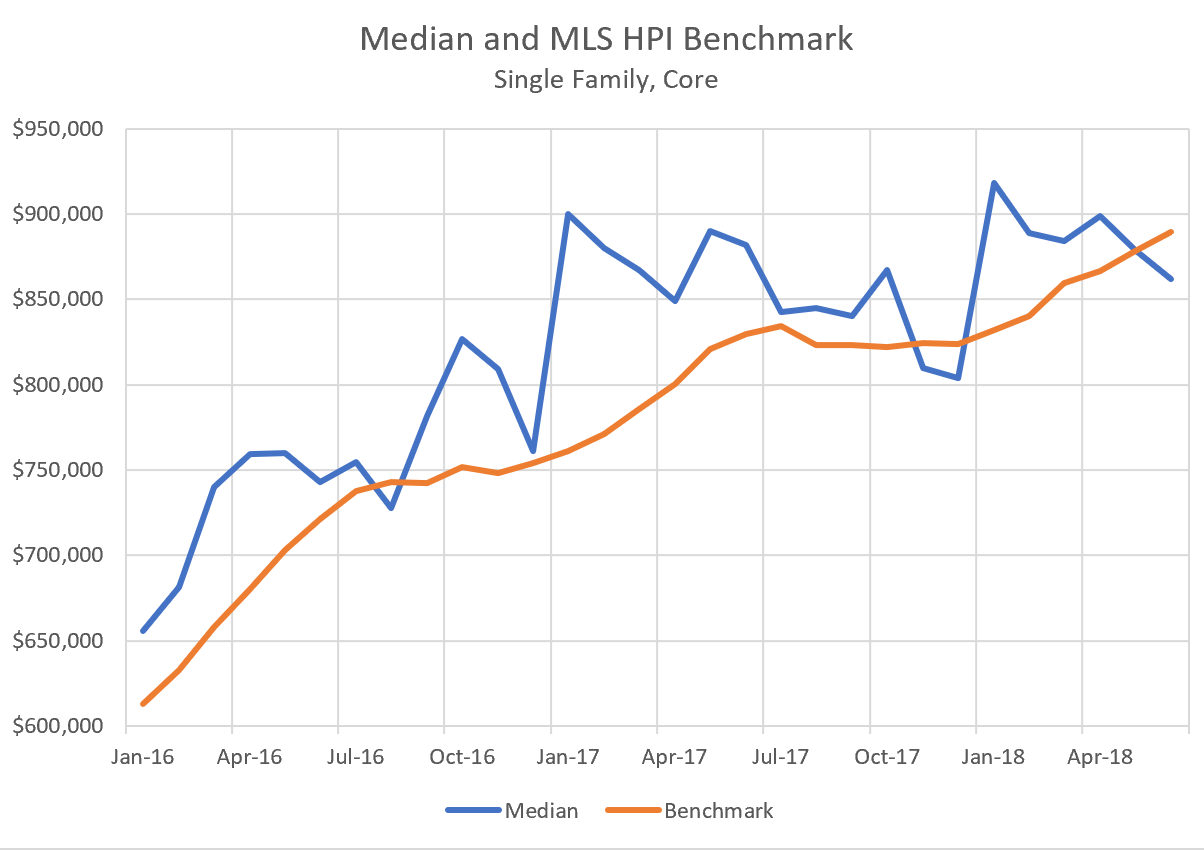

However, what should we think about the benchmark prices? Media coverage focused on the $11,000 monthly increase in the price of the benchmark detached home in the core as evidence the market was just as hot as ever. It seems like a contradictory message, but if you zoom out the various price measures don’t disagree as much as it seems.

Here are my takeaways from this chart:

- The MLS HPI Benchmark is quite seasonal, with strong gains in the spring/summer and a pullback in the fall/winter. It will very likely flatten out or give up some gains after July for the rest of the year.

- The measures don’t really disagree very much. According to the HPI, single family prices increased by about 8% in the last 12 months. According to the sold price/assessment, they increased about 10%. Close enough.

- The benchmark estimates the price of a home that is considered to be typical of the area, and that price is smack dab in the middle of the best selling segment of homes. A slowdown or price declines at the top or bottom of the market would not be reflected in the benchmark. In other words, if the value of a $1.4M property declines to $1.3M you won’t see a change in the benchmark $900k property until that slowdown propagates down through the market.

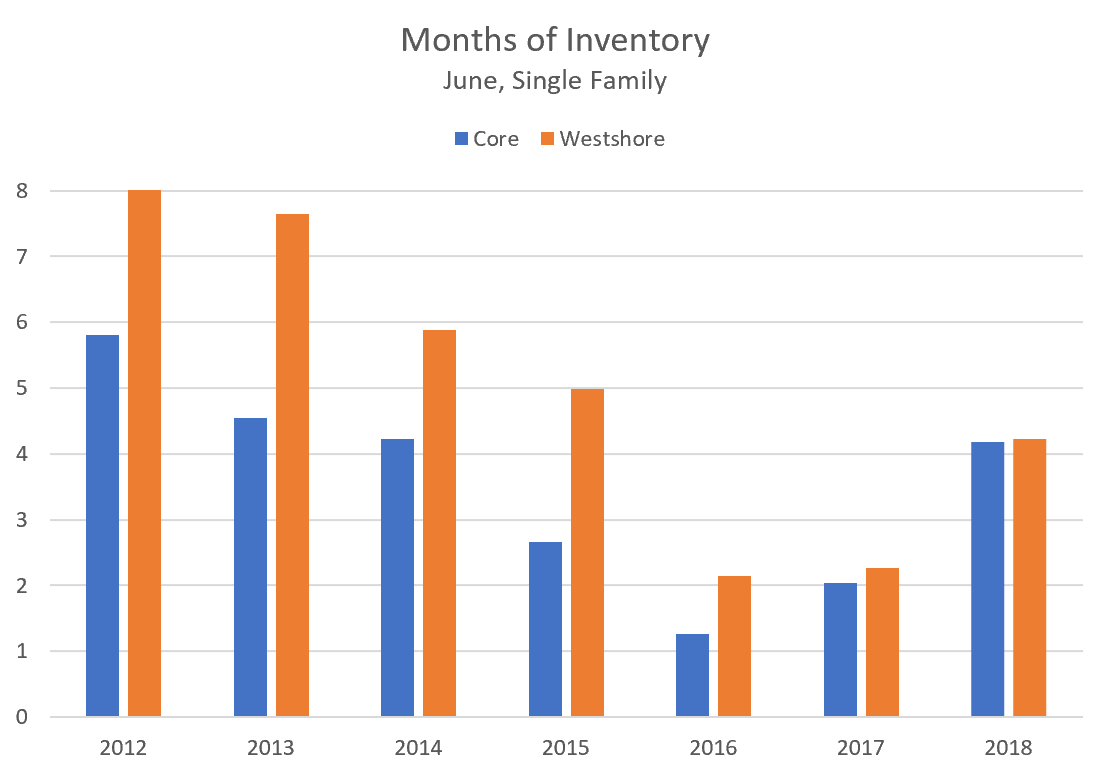

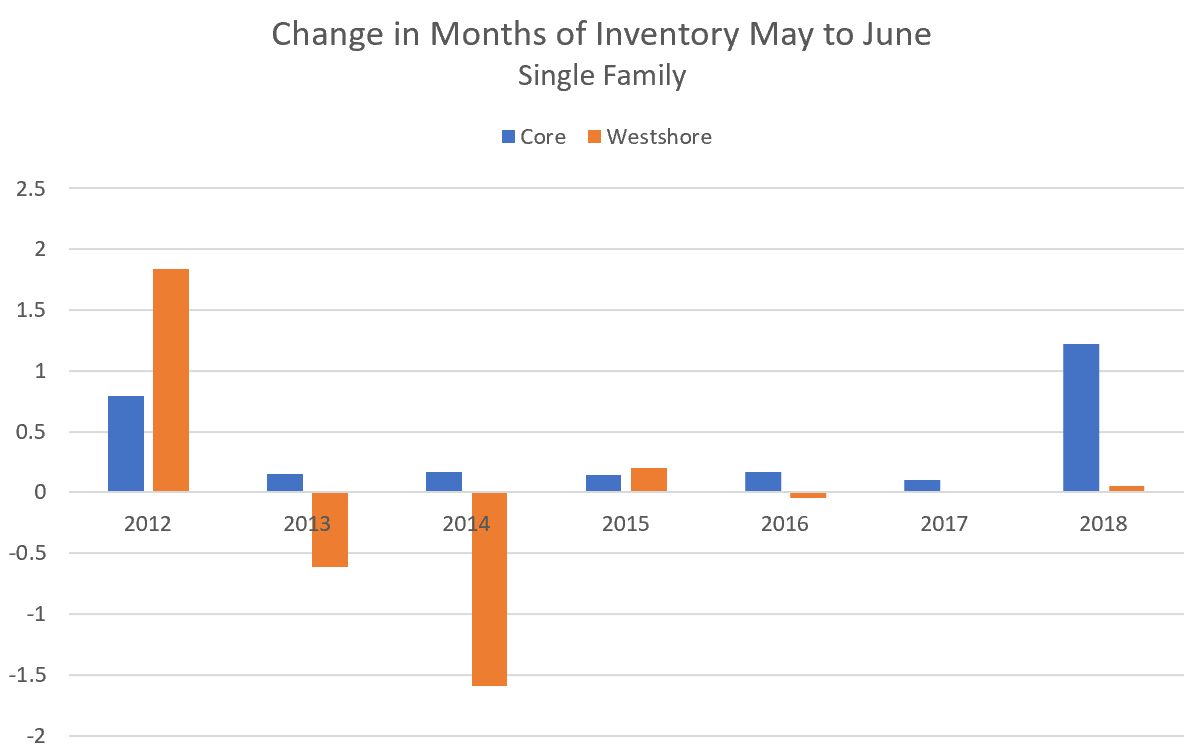

We can examine market conditions and where the drop in sales has hit the hardest by looking at the months of inventory. From that we can see that the market is more or less back to 2014/2015 conditions but this time in the cooling part of the cycle. Conditions are pretty similar in the core and out on the westshore for single family properties.

One difference between the core and westshore comes out when looking at what changed between May and June. This is a time when months of inventory normally stays relatively constant however this year it jumped in the core indicating a strong slowdown last month.

Long story short: While almost the entire market cooled off, the drop in sales was concentrated in the core, and there in the higher end of the market.

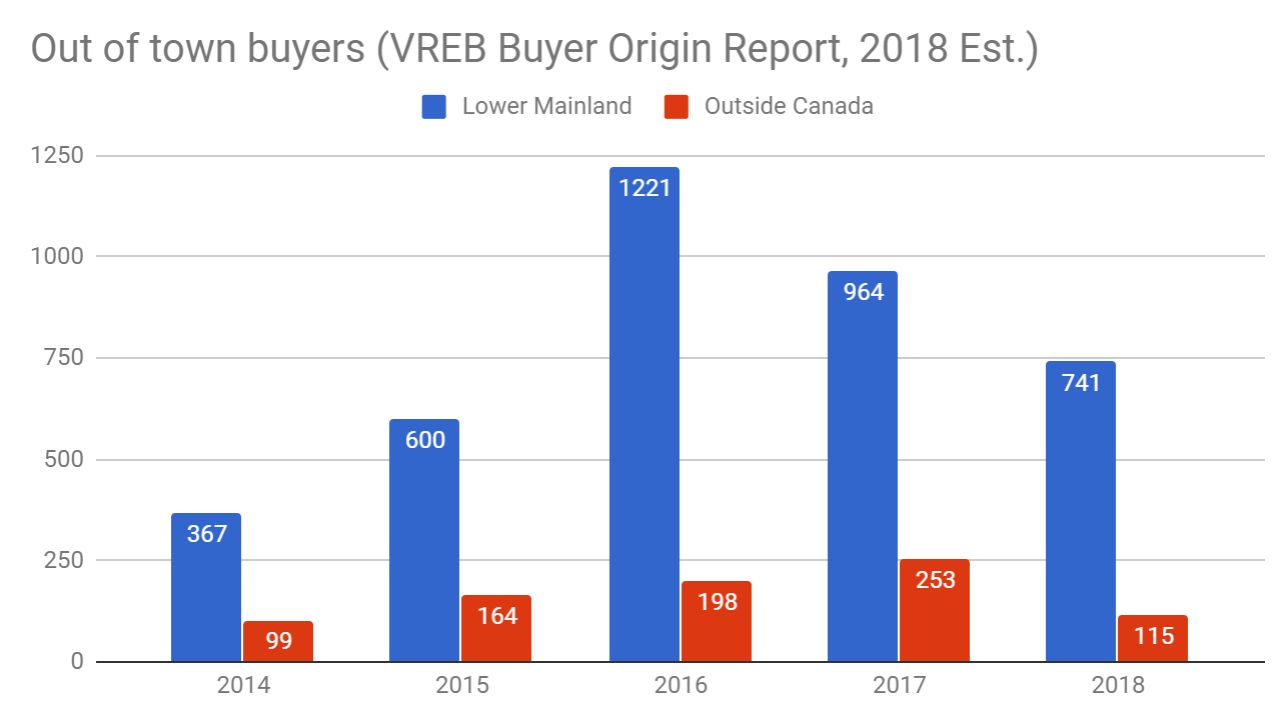

There are many reasons for the slowdown that we have covered here, including poor affordability, the stress test, and uncertainty due to incoming taxes. However one reason is also a reduction in out of town buyers. According to the VREB buyer origin report for the first half of the year, both buyers from the lower mainland and buyers from outside Canada have dropped substantially this year. It appears that despite the anecdotes, the wealth of those buyers is not limitless and higher prices have put a damper on their buying just like that of locals.

LF,

If CE opened his mind to the global world and did some DD he would find that China is going to be dropping a huge turd on the markets by fall/winter. The ponzi scheme is about to be blown open in the coming months. Every country that allowed them to walk in with their HAM and let them run wild, thinking they will be some saviour to their economies will be suffering some serious hurt. BC will be first in line as the official money laundering capital of North America.

Love that line

CE, slamming and generalizing the messengers as opposed to debating the data, isn’t strength of argument. Almost no one here specifically argues what you listed below either, which makes the assertion even sillier. Is a crash in BC RE (30%+) possible? Definitely. Is it “right around the corner”? I have no clue – but it’s abundantly obvious that the market is changing and by some accounts, rather quickly.

One thing I do know is there’s more data coming, and I’ll be presenting it to you regardless of whatever “narrative” it suits. Markets are always in a state of change. Having said that my guess for the near future is, you won’t like what I’ll be posting. 🙂

At least we can admire a few of the bears here for their consistent narrative.

1) The crash is always just around the corner.

2) It’s always time to “stick a fork in it”.

3) No matter what the new is, it supports the crash narrative.

i.e.

Poloz hikes – interest rates are rising, market is going to crash.

Poloz stands pat – the economy is tanking, market is going to crash

Full agreement with you on that one – media distortions aside (“if it bleeds it leads”) it is the most peaceful, prosperous time ever across the globe. Unfortunately it does come with the big asterisk that we’re quite likely in overshoot – at a minimum we know ecosystems are being destroyed at unprecedented rates and climate change is more or less not being addressed. Those are gigantic problems and the world in 50 years may not be as peaceful or prosperous as it is now. For my 2 daughters I certainly hope we pull one out of the hat… makes discussions about real estate seem rather trivial.

I wanted to share this chart below – it’ll look familiar to other cycle charts, but what I really like in this one is the added text:

Low emotional cost, and high financial cost,

Versus:

High emotional cost, low financial cost.

So simple, so true, and so universal. 🙂 However, the goal should never be to try to time the bottom, as you probably won’t be successful. But an awareness of these principles could make it less likely you will make a foolish choice.

The state of the world is really better today than in the 1950’s or 1960’s, when people had much larger families. But parents in those days were familiar with the 1930’s and 1940’s, when things were really really bad, so they correctly believed things were getting better. Also today every bad thing that happens on the planet gets media exposure. The present is really one of the most peaceful times in human history.

@guest_46071

And I know quite a few who decided not to have a child so I guess that would balance out. It is not just finance that stops my friends from having children it is the state of the world/environment. The number of times I have heard “why would I bring a child into this mess” is kind of scary.

Anecdotal evidence regarding the falling birth rate. We know 16 couples that have either had or are having a child in 2018 and most of them it is either there 2nd, 3rd, 4th ect. It feels like an echo echo boom the last few years.

I was wondering if anyone else noticed that quiet little shift in narrative.

GWAC:

I dont see anything wrong or surprising about Josh’s wife asking him to marry her. He obviously has a lot of desirable qualities that I suspect a number of women would prize.

A review of the thread below reveals a decidedly different tone to the current RE market and what one may expect 12 to 18 months out. Very interesting.

The “bulls” now use the oft-quoted “over the long term” to buttress their “RE is a great investment” thesis. But that is not where we are at. We are facing a very different set of market variables than 1 year ago. On Wednesday, the proverbial cat will be out of the bag. That will make it 4 hikes in less than 1 year [both sides of the border if you are keeping score].

As Josh points out, there is another demon lurking in the darkness – the full brunt of the spec tax, which I think will be more of a negative blow than local residents think. Josh makes a compelling argument that as inventory rises through the fall and winter, the “Spring” selling season of 2019 will be the true test. I subscribe to that view, as well, but I think the Fall / Winter of 2019 and early 2020 is where a buyer should dust off the cheque book.

LF – I also agree with your all of points below, but don’t let it go to your head. Real estate is a lagging indicator so you would expect there to be a lag of 6 to 12 months in a rising rate environment – particularly since we are a ling way from equilibrium.

Hawk has continued to point to the over-indebtedness of the consumer who just could not fight off the addiction to ultra low rates and now you have to pay the piper. The HELOC is your enemy now.

A recession is coming. Since 1929, we have had, what, 10 of them and all but 1 was caused by the Fed hiking rates. No one will ever convince me otherwise. The yield curve is flattening and the result is the same every time.

It is not different this time – it never is. Keep your powder dry and stay thirsty my friends. Eventually, “wealth returns to its rightful owners” {a borrowed quote, so don’t shoot the messenger}.

Josh:

You might have just asked to borrow her spreadsheet? But I might just be a tad cynical when it comes to marriage. I had a few clients rather shocked to discover that their savings were about to be depleted to pay their spouses student loans.Personally, I have always chosen to believe that the spike in divorces shortly after the completion of graduate or professional degrees is merely coincidental.

Your wife asked you to marry her? Did I get that right???

I don’t think it would have gone over well if I pulled out a bunch of spreadsheets when my wife asked me to marry her.

The fact that four in ten first marriages end in divorce these days in Canada also should give people some pause when considering having kids. It may not have a major impact but it should. I suspect that most people do not do a rational cost benefit analysis when it comes to marriage.

I think March 2019 has real potential to be a bloodbath. Fall and winter will have plenty of inventory, and then people are going to get the bill on the spec tax.

As a member of the procreating demographic, I can assure those discussing the matter that cost of living really did affect our decision to have just one.

The context was the decline in birth rates from 1960, and how they were already low by 2000. The baby boom is not coming back regardless of how much encouragement the government might offer. I also said:

The average days-on-market for houses in the core is now at 32. A balanced market with stable prices typically has between 30 to 90 days. New house listings for July are coming on at the pace of 4.5 new listings for every sale. That’s indicative of a buyer’s market with stable to decreasing prices.

In May the months-of-inventory for houses was 2.96. That rose to 4.18 in June and right now it appears that the MOI for July is rising quickly and we could hit 6 months of inventory of houses by the end of the month.

I think we are heading for a buyer’s market by the end of the summer with a noticeable decline in middle income houses priced between $800,000 to $1,000,000. I don’t think anyone that has bought in the last 18 months has lost on the sale price. But neither have they gained any value either. And I think that is going to lead to a change in the condominium market as people continue to hold off on buying another investment condo.

The number of sales of condos in the core has been trending lower. In 2016 there were 2,319 condo sales in the core. That declined to 2,132 last year. And half way through this year we are only at 903 (projected for the year at 1,800).

As in any other business faced with declining sales eventually it becomes necessary to cut prices. What we’ll start to see as sale volumes drop is that a small group of sellers that have to sell for financial and personal reasons becoming a larger percentile of the market. They don’t have the luxury of waiting for the best price.

There is also an opportunity for people to buy up the property ladder in this market as there will be more selection. However, you may want to re-think the idea of not selling your existing home and keeping it as a rental with the looming specter of declining house prices.

Did Mike miss the news again ? Seattle renters are getting free rent and many other freebies as the renters leave town and the new condos hit the market like it is here. Seattle listings are surging as well. This is how bubbles end with 4 more US hikes to come in the next year and most likely as many in Canada wether Poloz likes it or not.

Seattle renters score big as landlords dangle freebies to fill empty apartments

“For years, the Seattle rental market was so heated that renters would constantly monitor online listings and quickly show up to available apartments with checkbooks and references in hand. For many apartments, they’d have to fill out applications on the spot and cross their fingers.

Those days are over. A glut of new apartments washing over the city has quickly turned the tables as vacancy rates hit their highest levels since the recession, led by downtown Seattle, where one-fourth of all apartments are now sitting empty.

Landlords who are increasingly hard-pressed to fill their open apartments are offering deals like a free month’s rent, lucrative gift cards and even free electronics.

A review of online apartment ads last week found 157 different apartment buildings in the city of Seattle offering significant deals for anyone willing to sign a long-term lease — and that was just for public ads posted in one 24-hour span. There were dozens more specials on offer in the suburbs.”

https://www.seattletimes.com/business/real-estate/free-amazon-echo-2-months-free-rent-2500-gift-cards-seattle-apartment-glut-gives-renters-freebies/

With just two days to go before an anticipated interest rate hike by the Bank of Canada, one of country’s top bankruptcy firms is warning a “staggering” number of Canadians are on the brink of financial disaster.”

LF,

Don’t get the pumpers all worked up. Debt don’t matter and it’s the New Paradigm remember ?

@ patriotz

You’re telling me that if I have to drop over $3,000/month for 2 kids in daycare, that’s not going to deter me from having more kids? And if housing costs are sky high and my mortgage is also taking a big chunk out of my paycheck, that will not affect birth rates? C’mon, give me a break.

Talk to any young couple in Vancouver about this issue; I guarantee housing and daycare costs are having an effect on birth rate in pricey areas. Look at the amount of young couples for instance that had to move out of Whistler and Vancouver (sky high prices) to be able to afford to start a family.

I’m not usually much of a forecaster, Gwac, as I don’t know what will happen next. I just know what the data says, what history says, and what’s going on now. If there’s something specific you’re raising, raise it. If you’re just trying to tickle me, I ain’t tickled thus. 😛

Local I would have to say Michael had been a tad more accurate that you… 🙂

No. Part of responding on forums is in talking to the recipient directly, but more importantly it enables others who don’t post to see the exchange of ideas. Michael will keep posting his material; I already know that. If I was trying to bend other posters to my will, I’d say I have a success rate of about 0.0%. That’s not going to change, but that’s not the point for me.

Wasn’t implying anthing, simply posting FFrate vs price out of interest.

Hey Leo are we gonna see a weekly update today? I know you just made the last post on Friday but still wanted to check in….

you’re talking to a wall.

Wow some people love their soccer.

Or hate their job.

Nither really, I am certainly not a soccer fan but I try to go every Euro/World Cup Croatia qualifies for. Croats have been under rule of other empires for centuries so when you finally have your own country as of 1991 and a population of 4 million you have off the chart national pride. Our president is at every game and then after each game she is hugging all the players, etc. It’s a huge thing in terms of bringing the country together.

You also never know who you are going to sit next too at a game. I once sat close to the president at a qualifying match (she randomly showed up without security by herself) and last time I sat next to Dario Saric (Croat plays in the NBA).

When Goran Ivanisevic won Wimbeldon approximately 80% of my hometown (Split) came out to await him. That would be like 320,000 out of 400,000 people in Greater Victoria awaiting a athelete downtown. Probably not going to happen.

Thanks, yes I agree.

Can someone check for me, did 1999 Lansdowne Rd (MLS# 395171) not already sell about 2 months ago and now it is back up for sale?

LF, you failed to point out that it’s completely inappropriate to compare the Fed funds rate to house prices. You should compare mortgage rates. The 30 year fixed term rate has in fact been pretty flat since 2012, with a small uptick so far in 2018. The US economy has been recovering over the whole period, so one would expect house prices to rise.

http://www.freddiemac.com/pmms/pmms30.html

This implication you’re making here is completely unfounded. Higher rates don’t increase house prices, they restrain them. Higher prices are usually a indicator of broader growth, then the rates hike to control inflation. You can also see the reverse in effect – as home prices fall, interest rates are also falling due to the weakening economy. In either case, the interest rate movement typically proceeds the growth or decline of RE, not the reverse as you’re suggesting.

But the biggest part you’re missing here is that QE has distorted home prices as people seek yield in higher risk asset classes such as real estate. This is everywhere, but especially acute in Canada. Even the BoC has acknowledged this enormous imbalance, where inflation in home prices has been rampant but very low everywhere else. In fact, housing related industries in Canada as a portion of GDP are more than 2 standard deviations above its long term mean.

It’s resulted in the quandary that the BoC faces right now: hike and it will be bad now, or don’t hike now and it’ll be worse later. While they are hiking now, the amount of money flowing nationally into housing is dropping rapidly despite the paltry economic expansion, due to these imbalances. Another hike on Wednesday isn’t the magic elixir that’s going to abrogate the contraction cycle and make things magically take off again.

Interest rates are not about house prices. They’re about the rate of inflation, in which home prices are among several different indicators.

Or hate their job.

“I think that if housing and daycare costs came down to a more reasonable amount, we’d see birth rates go up”

This would appear to be a variation on the “rhythm method”.

If, at the moment of conception, your mind is totally focussed on SFH median prices I strongly advise against sharing this information with your wife.

Quitting a job to see a soccer game. Wow some people love their soccer.

Marko, are you heading back to Russia for the semi-final?

Not going back for semi-final but will try to go back for final. I kept my Fan ID (Visa for Russia) in the event they made it to the final but getting tickets will be difficult. My cousin in Croatia burned through all his vacation so he is giving notice to his boss if we make the final and can get tickets.

On my flight back there was great wifi…even managed to send off a few DocuSigns 🙂

how QE affects rates

http://ichef.bbci.co.uk/news/624/media/images/80420000/gif/_80420417_quantitative_easing_v4_624in.gif

Quick update on rates vs price, for anyone interested.

The rate low was Jan 2012 at 0.04%.

The price low was Feb 2012.

Marko, are you heading back to Russia for the semi-final?

28% of Canadians fear bankruptcy ahead of Bank of Canada decision

With just two days to go before an anticipated interest rate hike by the Bank of Canada, one of country’s top bankruptcy firms is warning a “staggering” number of Canadians are on the brink of financial disaster.

Twenty-eight per cent of respondents to a new survey, which was conducted on behalf of MNP from June 15 to June 19, said another rate increase will hurdle them toward bankruptcy, while 42 per cent say if rates rise much more they’d fear for their financial well-being. While both readings were down modestly from the previous quarterly survey, that’s not lessening the alarm.

“When you look at the staggering number of people who are teetering on the edge, it’s clear that we are going to start seeing a rise in delinquencies as rates rise,” said MNP President Grant Bazian in a release.

The Bank of Canada has raised interest rates three times since last summer, and investors overwhelmingly expect the bank will boost its target for the overnight rate to 1.5 per cent on Wednesday.

https://www.bnnbloomberg.ca/28-of-canadians-fear-bankruptcy-ahead-of-bank-of-canada-decision-1.1104704

Canadians Hold Onto Less Cash As The Great Deleveraging Begins

Canadians are holding onto less cash, according to the country’s central bank. Bank of Canada (BoC) numbers show M1+, a measurement of “cash,” is seeing growth plummet. The deceleration of growth is a sign that consumers are spending more to service debt.

Growth of M1+ is decelerating at the fastest pace in over a decade. The BoC estimates annual growth at 4% in May, down from 11.6% last year. This is a huge drop from just a month ago, when the 12 month rate of change was 5.5%. We’re now at the lowest pace of growth since October 2003. The decline is almost certainly a result of higher interest rates.

The most recent hike is still driving both the M1+ and consumer credit growth to multi-year lows. Hiking into this deceleration would likely drop it to levels Canada hasn’t seen in over twenty years.

https://betterdwelling.com/canadians-hold-onto-less-cash-as-the-great-deleveraging-begins/

Had little effect in Quebec. Nearly free daycare and among the most affordable housing in Canada. I do think that expensive daycare and housing are bad for the economy and social cohesion though and should be addressed.

There won’t be that many baby boomers left 20-25 years from now – at least not many fit to move across the country.

And in 2000, before the great RE bubble began, there were 336,910 births. The drop off had already happened. There were much bigger factors in play, namely effective birth control and working women becoming the norm. I do think that over the last few years RE prices in Toronto and Vancouver have had some downward effect, but that’s really a blip in the big trend.

https://www.statista.com/statistics/443051/number-of-births-in-canada/

What a difference a year makes!! Here are three popular phrases from last year that are now history:

1. Bully Bid

2. SOLD in one day

3. Unconditional offer

Andy7

I’m not sure if the Liberals agreed to build the Cowichan Hospital or not, but it is part of the BC health care infrastructure strategy that has been floating around as early as 2007 if I remember correctly.

A Victoria thread over on Reddit asked the following:

The top two replies according to up votes are:

And

@ CS

“Ridiculously high housing costs are surely one factor.”

Totally agree. I think that if housing and daycare costs came down to a more reasonable amount, we’d see birth rates go up and need to be less reliant on immigration. Apparently in Sweden it’s under $300/month for daycare versus $1,500+/month in BC.

Found this online:

“Daycare/preschool cost in Sweden: 3% of the guardian’s income but no more than $190.50USD (1260SEK) per month for ages 1-2 years old, that drops to 2% for the second kid and 1% for the third. Ages 3-5 is free. All children are guaranteed a spot (although there are occasionally place shortages that lead to a a few months of waiting time in some cities). Lunch and healthy snacks are provided for free by the school. So is breakfast if the child starts early in the morning. They daycares/preschools are generally small and placed in every neighboorhood (e.g. there are 5 within a 15 minute walk of our apartment).

As an ex-pat American living in Sweden, I cannot understand why American culture, which is supposedly so bent on “family values” doesn’t have a system like this. The “high tax” argument just doesn’t cut it. My family of 3 lives comfortably on my single PhD student salary + my partner’s sporadic artist’s income. So obviously we’re not being gouged by taxes. Granted we live in a 1 bedroom apartment and don’t own a car (don’t need one), but we are able to afford all the basics, plus a few extras and save a bit on my “highly taxed” income.”

https://www.reddit.com/r/beyondthebump/comments/26l8qi/daycare_cost_in_sweden_is/

What people need to remember is that real estate is a cycle – it’s always in that cycle, and the overall cycle doesn’t change. Understand this cycle, watch for the indicators, respect the data, pay attention to the wider context in which the market exists, don’t overextend, and don’t jump in emotionally.

That way when the day comes, you can feel confident that the time is right for you to buy, whatever “right for you” entails.

Thanks again, fellas and ladies, for clarifying certain matters. After reading through all the comments and pausing to reflect where necessary, I have come to the conclusion that now is no time to buy. I am a non-expert owning one investment property and another modest property that I bought in the core. I really like this blog!

Will BC get wise to this practice and stop it from happening?

https://m.huffingtonpost.ca/2018/07/07/recycled-listings-housing-data_a_23476792/?guccounter=1

Seems very common to do this nowadays, is it deceiving buyers enough to change the rules?

CS I would also say women are working more now than in 1960. Double income has also added to increased housing costs.

@ GWAC

“Number between 250 and 300K regardless of the party and will remain the same. We need those to keep the economy growing.”

Why do we need to keep the economy growing?

To provide food and lodging for the immigrants!

Actually, we need more people to retain control of the territory. The second largest country, the 38th largest population.

What’s sad is that whereas in the past Canadians themselves added to the population, they are now a dying breed.

In 1960, there were 478,561 births in Canada, last year despite a doubling of population since 1960, there were only 390,573 births, and a far below replacement fertility rate.

Why?

Ridiculously high housing costs are surely one factor.

Good example of inventory building up in the higher end of the market is Shoal Point 21 Dallas Rd. Has 15 listings in it last time I counted.

When you add close to 10% of the population every 10 to 14 years housing is impacted. They Mostly all go to Ontario/ BC and Que. Since most of the country no one wants to live in. The existing popular cities absorb the immigrats.

Signs of change… So far this week I’ve received an email from a mortgage broker offering a $500 gift card for a buyer, and today I saw a real estate group based in Vancouver advertising they need work, they’re almost out of listings. I haven’t seen these two advertise like this in the last few years, I see it as a definite sign the tide is changing.

@QT

Re: Cowichan Hospital

I didn’t realize the Libs had agreed to build a new hospital in Cowichan? I thought it was an NDP campaign promise that was given the go ahead the other day…

Haha, careful there you might weaken your narrative.

Fascinating. Thanks

We’re in Calgary for a while. Weather is pleasant. Car hasn’t been vandalized yet due to B.C. licence plate. Will keep you posted.

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016006-eng.htm

Graph at the bottom since 1900.

Not going to change.

https://www.statista.com/statistics/443063/number-of-immigrants-in-canada/#0

2000-2017

Number between 250 and 300K regardless of the party and will remain the same. We need those to keep the economy growing.

And political ones. Who knows what will happen after the next election.

Santa, you’re a bit of a lunatic. You’d make for a far more entertaining mall Santa than the bored retirees they hire year after year at Mayfair/Hillside.

I can see the kids now: “Santa, how’s Rudolph?”

Who? Oh. He was slaughtered by the Finns. But don’t worry. Bulls get slaughtered, bears get slaughtered, pigs get slaughtered, and only reindeer fly. But if you’re in Finland, even reindeer get slaughtered. What do you want, you little pigeon-goose?

Then at that moment…snap the picture. That’ll be $20.00, please.

Sarcasm aside, that’s not quite the whole picture.

Firstly, immigration as a source of population growth hasn’t been all that different compared to historically. One of the reasons they want to increase the levels of immigration is because our population growth alone is very low, and is now rapidly ageing. Both of these are headwinds for the housing market. So adding these immigrants isn’t quite the boon to RE it may seem, as they are new demand vis-à-vis disappearing demand. The net affect given large enough numbers would be greater demand, but that’s why we build supply as we always have. And where are these immigrants all going when they get here? Victoria? 😛

The other thing to consider is about half of those Canada is looking to admit are family reunification or refugee class. These aren’t people that are going to be coming in with large amounts of money. Investor class immigrants are much, much too small a proportion of in-traffic to keep our inflated housing markets up, especially after the program was killed (you’d need an absolute wall of cash to deluge the country year after year after year – the opposite is what is now happening). QIIP remains, but I don’t think the argument changes.

The final thing is, immigration to Canada is substantially affected by economic cycles. You can see it in the numbers – it fell dramatically in the early to mid 80s, early to mid 90s, and pretty symmetrically before that all the way back to the great depression. When we hit our next recession, I suspect you’ll see the same thing you’ve seen the last 100 years.

Taking an old dynamic (immigration), and casting it as something new and/or a paradigm shift at that, isn’t really supported in the data.

Crazy time on here I see.

Fine, Marko…I’ll capitulate. You want to know what I do? Here:

I’m the most prominent real estate developer in my part of the world. In fact I’m probably the only person that has ever dared to build where I have. I create mostly commercial properties. I have strict standards for my employees. For example, at my most recent build, a toy factory in Murmansk, I refused to hire anyone over 4 feet in height. Smaller hands are faster hands. Smaller people need less food. That’s good business sense. If you ever need anything built north of the Arctic circle I’m your man.

I’m morbidly obese and my wardrobe consists solely of oversized red velour tracksuits so I think you’ll know me when you see me.

Remember Marko…bulls get slaughtered, bears get slaughtered, pigs get slaughtered, and I nly reindeer fly. But if you’re in Finland, even reindeer get slaughtered. I learned that the hard way.

Take care you pigeon.

Love Santa

From the article Patriotz linked:

Imagine that. /s

And we’re accepting another 1Million over the next 3 years. (And to my knowledge this doesn’t include the multi-year visa entries.) Maybe they’ll all live in tents so the RE crash can take place forthwith. /s

From previous post:

Transformer – due to family interests, we’ve restricted our searches to certain areas so there is quite a bit of the Victoria area I’m not that familiar with.

There are a couple other family-oriented areas I would recommend one look at. The Lake Hill area bounded by Quadra & Lochside Trail (west & east) and Panorama Drive & about Nicholson Ave (north & south) is a nice cluster of homes centered around Beckwith Park. This is a very active park with tennis courts, fields & trails that cross through. Anytime I walk my dog through that area, I always see lots of activity at the park and certainly evidence of kids out and about. I’m not a big fan of being close to Quadra due to all of the traffic heading towards Pat Bay or down to McKenzie but this neighborhood is tucked off to the side with lots of trails to get you around should you prefer to bike. It does feel like the closer you get to McKenzie (south of McBriar/Nicholson-ish) the more broken up the houses are for rentals. I could be wrong but it just feels that way. Quadra is the main road for getting around especially if you’re closer to Beckwith Park. There are a few roads that can get you to McKenzie without going on Quadra but they are what I call “dinky-doo” streets and often not worth taking as it’s slow traveling.

Another area to consider is Royal Oak bounded by Greenlea Drive & Lodi Ave (north & south) and Wilkinson & West Saanich / Glanford (west & east). This is SD63 territory with Royal Oak Middle School at the north side. It’s fairly easy access to Pat Bay and back roads like Wilkinson. Brydon Park is located closer to the southeast side of this area and has lots of trails from the park. This is another area I like to walk my dog through. It’s super close to Royal Oak Shopping Center and most of the streets are quiet except for the cut-through ones of Mann & Greenlea. There is a tunnel under the Pat Bay by the shopping center that allows for pedestrian & bike traffic to cross over to Broadmead. I take this tunnel often when heading over for a quick trip to the shopping center or for some activity at the school. Royal Oak Middle School is the location for quite a few interesting break & summer camps – I know as my daughter has attended a few there and biking was a great option for us due to limited car access to the school.

If I think of others, I’ll post. Hope this helps.

BTW one day I’ll introduce myself to you in the real world and you’ll have no idea that it’s me. That’ll be weird.

I’ll be sure to lose sleep over who the mystery “experienced developer” is.

Well that’s another Einstein conclusion gwac. When we hit the inevitable recession and a credit crunch,(which is now happening in “slo-mo”), the 20,000 or so people who have moved here the last few years who are in construction/real estate related jobs declines hard (which are the first to be hit, and numbers showed last month and month previous BC wide this is the case), then population decline is a given.

Imagine just 5000 leaving all at once to the next building boom town, there would be some serious damage to all local markets.

Now we have stores that can’t find employees and have to shut early , like popular coffee shops like Moka House, which is in a prime tourist zone in a high end building. Signs the youth are leaving Vic due to high costs of living. Typical blow off top behavior, AKA the “denial phase”.

Pretty soon you’ll be flipping your own burgers at McRonny’s, gwac. 😉

Yes, thank you for the correction.

Great read – here is an unobstructed link:

https://outline.com/wa89E2

Holy mother of Batman, Jim… 😛

GWAC, thanks for simplifying. In the span of two posts, your expected return had gone from 18 months of 0% return to 3 years of 0% return.

Road to riches, really.

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-canadas-roaring-housing-market-is-a-global-anomaly/

“No developed country depended so much on residential investment as we did from 2008 to 2016. We’re the glaring exception to the general downward drift across advanced economies.”

Paywall. I am using PressReader but it doesn’t allow copy/paste, I typed in the above manually. I do recommend you read the article.

Andy7,

A new Duncan Hospital was in the plan for a while now, and the original plan was to start construction 2 years after North Island Hospitals completion. And, the plan also included a new Sidney Hospital 6 years after North Island Hospital completion.

patriotz,

IMHO, the RE price will continue to march on, unless there is a decline in population as Gwac stated which is highly unlikely.

An excerpt from a 2014 Time Colonist article:

“The West Shore is what’s left, where there’s opportunity for development — but that window won’t be open for very long,” he says. “Given a restoration of significant economic growth, I think we’ll find the carrying capacity of the West Shore is maybe 15 years… what you see in currently zoned Langford and Colwood is kind of it,” Baldwin says, noting the focus would then turn to redevelopment and replacement, like what is seen in the core municipalities.

http://www.timescolonist.com/magazines/much-of-capital-region-s-growth-will-happen-on-the-west-shore-1.915749

I don’t know if that’s a slip or not. Long term, I certainly expect nominal prices to go up. I don’t think today’s real prices are sustainable, because I think real household incomes have peaked, and interest rates will have to go up long term. A decline in real prices does not necessarily mean a rapid drop in nominal prices (i.e. a crash), but we may well get one if the economic factors line up the right way.

Ian

In simpler terms for ya. We are in a flat period for 2 to 3 years. That is the plus or minus 10% at the end of 3 years from today’s price. Than a 40% increase. The 3 years following. How’s that I hope the clarification works for you.

Hey, Horgan’s reading Barrister’s posts!

Leo,

$1MM is an important price point. I’m wondering if reduction in $1MM+ was due to houses that would have sold for 1MM+ in May, but sold below in June. This would match up with reduction in price/assessed. Same could be true at $700K level. If so, could indicate true price drop rather than just change in mix.

Your challenge for today: State something that has held true for 99% of all investments in history…

New hospital planned for the Cowichan Valley.

https://www.cheknews.ca/province-gives-the-go-ahead-for-a-new-cowichan-valley-hospital-467561/

Funny. For all the rhetoric that goes back and forth, the downside portion of your prediction isn’t laughably far off that of your opponent’s. You must come for the comradery. T-shirt?

1 to 2 years we are plus or minus 10%.

I see what you did there. 🙂 I don’t think anyone is talking about “long term” upward price. If that’s the measurement you could easily be right, especially in real dollars. However, I’m pretty sure most bears here are talking about between now and the next 1 to 2 years, not 5+.

Only thing that will stop Victoria RE prices from staying on their longterm upward price scale is a population decline. Opposite is going to happen. SE,OB and parts of Victoria are priced for the top 20 to 25%. Rest of the core the next 25%. This will only go down in the future. Not everyone is gauaranteed a sfh.

I have to correct you, Hawk.

Monetary tightening started a little over 1 year ago. The Fed started tightening even before that with the reduction and then elimination of Quantitative Easing {QE} and then started to tighten by raising interest rates. The UK broke with the EU on monetary policy. The EU central bank has given notice of reductions in their QE. In Canada, we have already had 3 rate hikes since January 1, 2017 and likely will see a hike on July 11 given the recent jobs numbers. Wage growth is always the last we see in a cycle, but with the the US and Canada at full-employment, wage pressures are building – example: restaurants can’t find servers to do the job. Interest rates in the bond market have been rising steadily, no need to just focus on the 10-year US treasury which goes above 3% and down, then up above, and repeat…. Mortgage rates are rising which tells us that all credit rates are rising.

Credit tightening is a foregone conclusion and it is the consequences of that which are now materializing. There will be excuses [yeah, but……….] along the way but we are there now and the next 12 to 18 months [may be even 24, as you suggest] will follow the retracing pattern.

I rustled Marko’s feathers…

He’s very defensive…

Final unsolicited note to you, Marko. Only because I’m getting responses and it tickles me that you are responding to someone with the handle ‘Santa’

Don’t let the things you believe become an extension of your ego. Specifically, don’t let your assessment of the market become an extension of your ego. You can change those two things at any time on a whim. Now that’s something only an experienced businessman would tell you. Or maybe I’m a sociopath. Either way, how do you feel about a pacifier this Xmas?

I kid of course.

BTW one day I’ll introduce myself to you in the real world and you’ll have no idea that it’s me. That’ll be weird.

Take care you goose.

If you’ve got prophetic skills Hawk, please tell everyone your prediction for RE here for 2019, 5, and 10 year windows. Also, please tell us your TSX & S&P levels for the same time period. I will worship you as my god if youre predictions come true.

You know it’s SHTF time when Ozzie Jurrock the biggest real estate pumper in BC finally agrees with me that a credit crisis is coming, and those who don’t prepare won’t be able to take advantage of the massive deals in a year or two from now.

“* The US is tightening the money supply and increasing interest rates.

* Major nations around the world are seeing a huge collapse in their

currencies (notably India at an all-time low).

* Interest rates are on the move in England, the USA and likely in Canada

this month.

We are seeing a continued tightening of credit worldwide and while it is

slow at this time we must take note! A credit crunch is brewing!”

‘Slo-Mo Credit Crunch’ Has Already Taken Hold, Bond Guru Says

https://www.bloomberg.com/news/articles/2018-07-04/-slo-mo-credit-crunch-has-already-taken-hold-bond-guru-says

I was hoping to see something just like this, Leo S – thank you. This analysis supports my thesis on the 2018 Victoria RE market. The market was running far too fast in 2017, then there was an overlap in to 2017 when “fear of missing out” took over, but at a slower pace. The Foreign [outside of BC] buyer was present to pick up the slack. And now, it is time to pay the piper as 2018 (all 6 months so far) is pressured by policy changes, with more on the way, and interest rates rising [with the jobs numbers, the July 11 BOC announcement should be a quarter-point hike, even with the trade wars]. We still need more supply, and the Westshore and condos is where that will continue. The next foot to drop is price (which has started) – there is no other path, frankly.

I would have liked to have seen similar data for $1.5 to $3.0 million [or even higher] which would encompass the luxury market. May be next time.

“They are hoarding their cash like most smart people should be thinking about doing over the next year, not buying over priced real estate when affordability indexes are exceeding 2007 to 2009 levels with many more rate hikes to come”.

It is not just doctors………….catching that falling knife will surely increase demand for doctors, but also bankruptcy trustees and foreclosure lawyers. The next 12 to 18 months will be fascinating to watch – and we have a front row seat.

Santa, you nailed it. Marko hasn’t worked through a real bear market. The coming one will be a massive learning lesson for many who are smug enough to think things only go up forever because some new doctor comes to Victoria every 20 years.

The more doctors I am seeing lately are renting and driving POS cars etc. They are hoarding their cash like most smart people should be thinking about doing over the next year, not buying over priced real estate when affordability indexes are exceeding 2007 to 2009 levels with many more rate hikes to come.

Definitely a chunk of the desirability of the single family home owership is because of price appreciation. That was clear in the US when prices were down and suddenly people weren’t nearly so interested in buying.

I think the tax breaks given to owner-occupiers have a lot to do with people wanting to buy, or wanting to stay in, more house than they really need. I think if they went away the desire for that yard would diminish.

Rather like how the “cultural” desire to own your own home falls when prices start falling. I mean the general public of course, not present company. 🙂

So the % of households that actually wants a SFH has dropped too. You would expect the % of housing stock that is SFH to decline independently of affordability issues.

I would argue that the number of households that need a SFH has dropped; however, the number that want likely stays similar in terms of % and increases in terms of absolute terms. Having a yard seems to be a big cultural thing here.

Great set of graphs and stats. One other factor, perhaps minor, is that there has been a actual reduction in the number of single family homes in the core when one takes into account the number of SFH that have converted into multi-rental units or into condos. Visually they still look like SFH but in reality they are multi-familly homes. A bit of a grey area but it could be argued that all the homes with basement suites have ceased to really be single family homes. Certainly the pricing of these houses has been affected by the existence of the “mortgage helper”.

Keep in mind that the % of households that are traditional families (i.e. 3 members or more) is a lot smaller than it used to be. So the % of households that actually wants a SFH has dropped too. You would expect the % of housing stock that is SFH to decline independently of affordability issues.

From previous:

Yup. Pretty simple really. That’s why we have a decades long trend of deterioration of affordability for single family houses. The pool of single family home buyers is concentrating more at the higher end of the income curve as the proportion of single family homes drops as a percentage of all homes available.

So while it seems like single family is getting less affordable (and it is, to the entire population), it is not actually getting less affordable to those buying them (outside of the normal cycles of up and down).