July 9 Market Update

It’s only been 4 business days in July which sometimes makes the numbers a bit wonky, but a brief update of market conditions nonetheless.

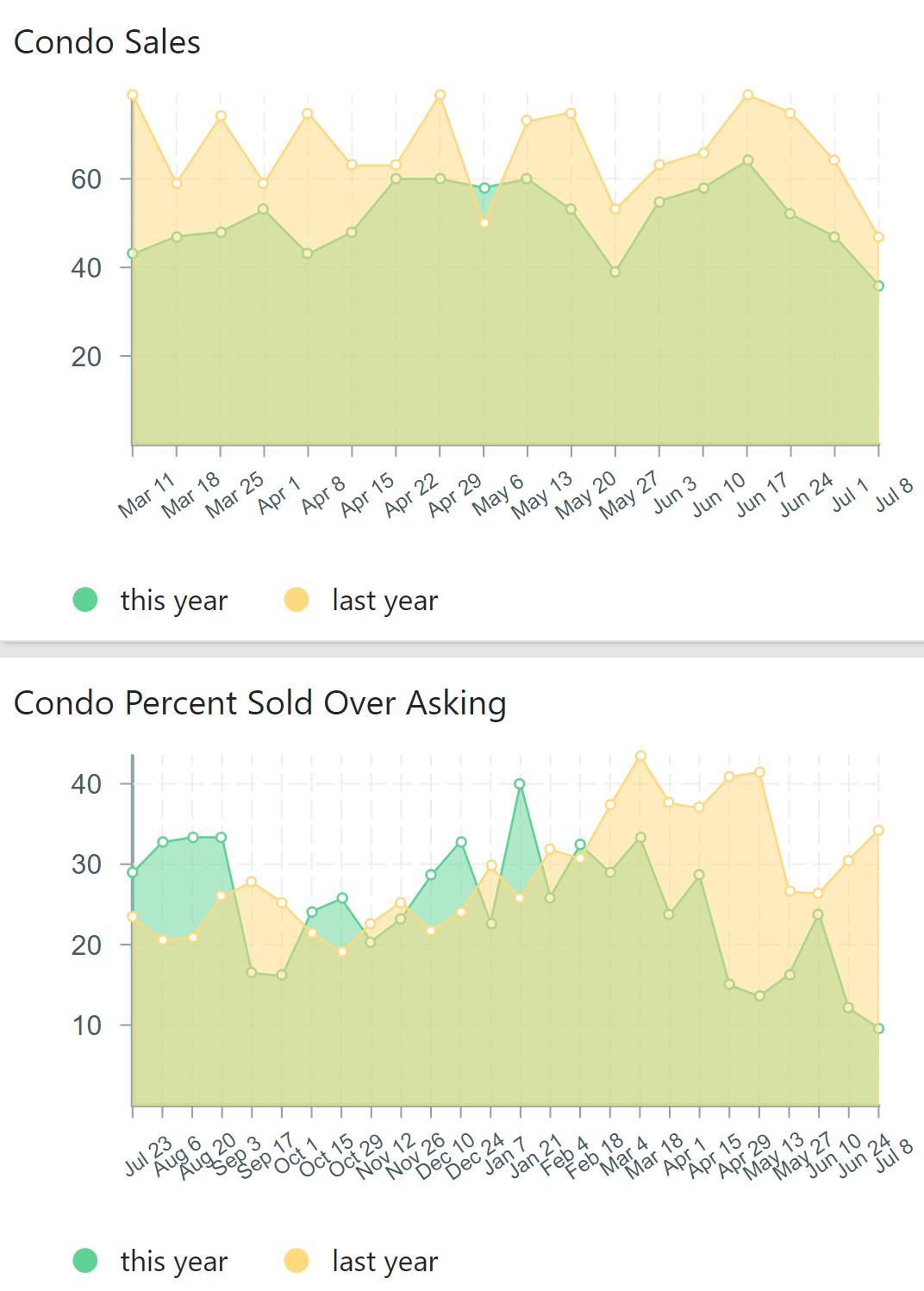

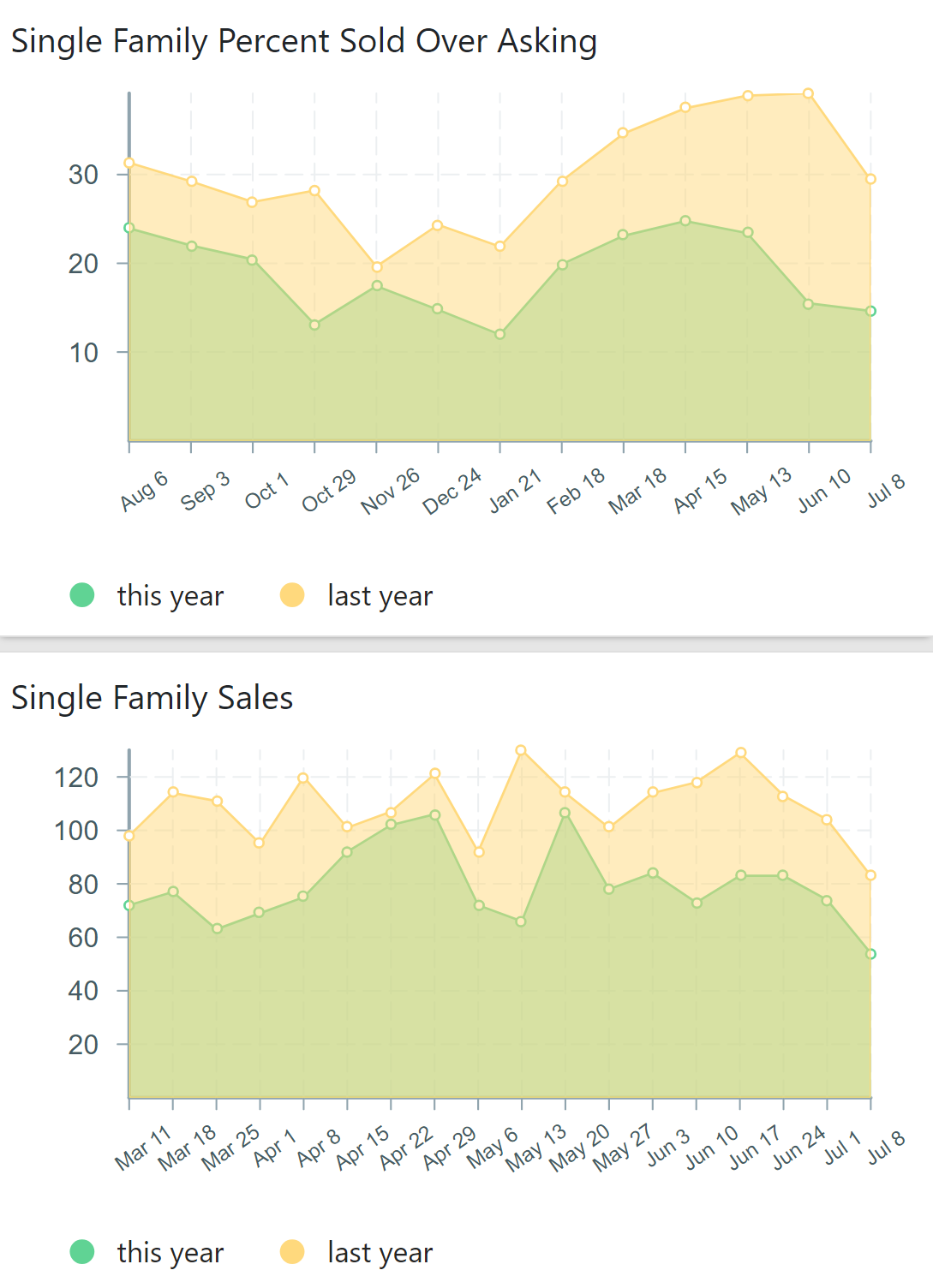

The spring selling season for single family is definitely over at this point, with July sales traditionally dropping substantially from May and June. Indeed sales are down to half of the peak level we saw in the spring and currently around 22% down from the level of last year. Over asks have settled in at around 15% of properties, which is still about double what we normally see in a very slow market, but half the rate of last year.

In condos, sales haven’t declined as much but bidding wars have likewise almost gone the way of the dodo. A huge difference to the market we were in a year ago.

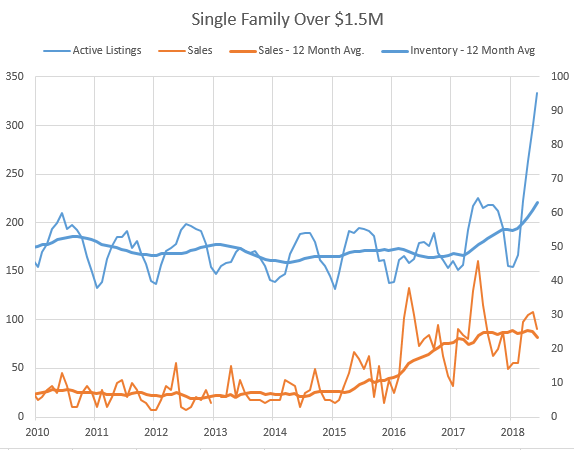

A few regular readers are interested in the high end of the market which we’ve seen is a big part of the sales drop in June. There has been a huge jump in active listings in the $1.5M+ segment this year, with inventory more than doubling since January. Now we would expect more listings in the high end just due to general price inflation, however the increase in inventory this year goes far beyond that (about double). At the same time sales have been weak this year, with some 45% fewer properties changing hands in June compared to a year ago. This will be an interesting segment to watch.

Here also are the weekly sales numbers courtesy of the VREB.

| July 2018 |

July

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 147 | 790 | |||

| New Listings | 280 | 1104 | |||

| Active Listings | 2622 | 1921 | |||

| Sales to New Listings | 53% | 72% | |||

| Sales Projection | 620 | ||||

| Months of Inventory | 2.4 | ||||

Ash, “2170 Neil just sold for 895k, under ask and under assessment. Haven’t been inside” We viewed it and I would consider it a tear down as the electrical was dangerous and there were really no redeeming features to make it worth investing in, and the basement suite was terrible.

Hello Beancounter;

You are only pointing to half of the story – the out of work rust belt worker formally employed in an industry [such as the coal industry] that cannot compete globally. To blame globalization for the ills you point out is akin to blaming the personal computer technological revolution, that increased worker productivity, for high unemployment. Give it some thought. Technological advancement continues to move forward, as will globalization, in one form or another. The benefits of trade are indisputable.

Yes, there are casualties but in the aggregate our GDP [and the GDP of the our trading partners] is higher. Please read Poloz’s latest thoughts on the current “trade war” – it will shave our GDP measurably. Canada is an exporter – we are a key beneficiary of globalization both from the current account and capital account.

The western developed world does not have a comparative advantage in all industries, so that arrogance needs to evaporate. By retraining the “rust belt” worker in the fields of our comparative advantages, that worker will earn more, live longer, pay more taxes, support his or her family and, along the way, consume more. There is a lag, but that displaced worker is better off over the long term. As is our trading partner with whom we trade the goods and products in which we have the comparative advantage. Time and time again empirical studies support this as being true. World growth rates are higher as is global GNP.

This reg seems to be on the way out – is it likely to result in higher (relative) prices for Oak Bay?

Beancounter,

I’ve mentioned this before, but I’ll say again, your posts are a real treasure to read. I wish I had your eloquence and depth of insight. I’m sure I’m not the only one that appreciates your contribution here, when you choose to offer it. Cheers.

Pardon if I wade into this discussion, but I am curious: What brought us to this current state of the developed world is no doubt complex, but while globalization has grown, hasn’t wealth inequality in developed countries increased? I read a mind blowing statistic: That the top .1% now own as much wealth as the bottom 90% in the USA. The masses here are hurting, yes? Is this something you are saying is not due to globalization and greedy multinational corporations pushing it for shareholder profits, or it is due to something else? Does free trade actually exist (has it ever?), or do you have faith that it could actually exist before WWIII? I am not being facetious. I don’t claim to be an expert on any of this, but there is academic theory and then there is reality.

My boots on the ground perspective about the woes of workers in developed countries seems very real when I think about it: Try telling the destroyed factory communities of the gutted Rust Belt that globalization has lifted an untold number of people out of poverty and see if that assuages their anger. To me Trump is a symptom, not a source. Directing anger at Trump, removing him, will absolutely not solve anything. There is a deep insidious rot in the system that has been festering for some time. That rot is what got him elected. Removing him would be like giving aspirin to a patient with brain cancer who is complaining of a headache.

With that said his tariff policy seems absurd on the surface because there is no way in Hades that the tariffs would fire up the domestic engines of industry of which said tariffs are targeting. Sadly I would love to see manufacturing be the main engine of our economy again, for both personal and environmental reasons (I am the type that always look to pay the premium for quality goods made domestically), and also that it is one the most economically fruitful of all sectors, but I know that is pipe dream without a global cataclysm. To be honest I am all for free trade in theory, but I can’t tell how much of the staggering rise of inequality we are seeing in this country and across the developed world is due to of globalization or horrifying monetary policy.

CS: Reread my post – there is a link to a well-written pro / con article that is so plainly written and understandable that even you could follow it. I cited it and reproduced the conclusion for you. My education is not the issue, but perhaps the opposite may be true for you. I don’t need to “work out from first principles”, as it is outlined in my written and well-defended dissertation. On trade (theory or policy), my friend, I take a back-seat to no one. You and Mr. Trump are isolationists – it is all about “me, me, me”. What you fail to observe is that the world is round and encapsulates more that just you and your neighbor. Economics is about the efficient allocation of resources, not the hoarding of money by the greedy few at the cost of the many. Globalization results in more for all in the aggregate, not more for you and less for the poor.

Thanks for the lecture – but no thanks. Once enlightened, one cannot go back. This is Plato’s Allegory of the Cave. You are plainly wrong about Ricardo and Jeff Rubin, a globalist, is entirely correct about the benefits of trade to all. Read his best selling book – you are sure to learn something.

James – you assume that Trump is of sound mind and knows of what he speaks. He has proven time and time again that he is and does not. The foundation for his anti-trade stance is what is flawed. Everything that flows after that is rubbish. For example – the USA benefited vastly from NAFTA, but he says they were taken advantage of – total nonsense.

Hawk – I am with you. But, let’s save ICBC. Go to http://www.roadbc.ca and sign the petition before it is too late.

Nice recap on the corrupt BC Libs. The next 16 years sounds good to me. Lots more skeletons to come I’m sure.

The deceit that was the BC Liberals’ case for power

“When the New Democrats took over, they discovered just what a financial basket case the Crown corporation was, and getting worse by the day. The Liberals siphoned more than $1-billion from ICBC’s financial reserves to help balance their budgets. No wonder they made it look easy. Then there was the Site C dam, whose costs were far greater than the Liberals let on. Add to that Metro Vancouver’s transit plan, stalled because of the petulant, ego-driven actions of the former government. Consequently, all sorts of work that could have begun years ago got put off. And let’s not forget the housing crisis, which the Liberals denied existed until prices were out of control.

We could go on. And on.

Suffice to say that it will be a long time before the Liberals can, with a straight face, attempt to use “fiscal stewardship” as the reason to vote for them. In fact, it may be the NDP that resorts to talking about the former government’s 16-year reign of error, and why the province doesn’t want to revisit those days any time soon.”

https://www.theglobeandmail.com/opinion/article-the-deceit-that-was-the-bc-liberals-case-for-power/

It doesn’t really matter in this context who they are, since they don’t want to be in a trade relationship, clearly they don’t expect to gain from it.

Well who is “they”? It goes without saying that political processes don’t always result in sensible economic policies, particularly when the voters are poorly informed on the issues and the consequences of policy decisions. In the case of both the US and UK, business interests have been strongly opposed to enacting trade barriers.

Re: Jeff rubin

“…his thesis on oil failed as the price fell from $150 a barrel to $30. He correctly predicted many years ago $100 oil, then said it would hit $200 – it went to $30. He says that the oil sands are not commercially viable at $70 a barrel.”

Sounds like wildly unreliable source of information. According to oil sands mag, sands oil produced by the SAGD process is viable at just over $40.00 per barrel. MEG Energy, which uses the SAGD process, has seen its share price double this year.

Rubin, incidentally is one of those globalist shills who falsely asserts, without reference to the issue of factor mobility, that Ricardo’s theory of comparative advantage proves the benefits of free trade to all concerned. That is false, as Ricardo noted, although in Ricardo’s day, factor mobility, specifically capital mobility, was only a theoretical issue since in that age of petty entrepreneurial industrialism, companies capable of operating internationally were few and far between.

Wouldn’t this mean that whenever a country starts to back out of trade agreements that they’re no longer expect to gain from the the trade relationship? And that it doesn’t benefit that country? Therefore, trade shouldn’t be promoted, but barriers enacted to eliminate free trade, which is exactly what the U.S is doing at this moment and clearly should be lauded by the economic community since it follows from this basic principle.

2170 Neil just sold for 895k, under ask and under assessment. Haven’t been inside but I’d say that’s well below what it would have sold for a year ago. Three beds on the main and two bed suite down, sun room off the back…this is the best value I’ve seen in some time, again with the caveat that I haven’t been in it. Possibly the suite restrictions in Oak Bay keep a lid on this type of home.

Jeff Rubin is a fantastic speaker, former Chief Economist at CIBC, but his thesis on oil failed as the price fell from $150 a barrel to $30. Still, he is a very knowledgeable economist and worth listening to. As oil prices rise, we will hear more from him.

He correctly predicted many years ago $100 oil, then said it would hit $200 – it went to $30. He says that the oil sands are not commercially viable at $70 a barrel.

https://thetyee.ca/News/2016/03/18/Jeff-Rubin-Carbon-Talks/

VB

No, VB, it was you who embarrassed yourself misstating facts without citations, as in:

Your trouble is your two degrees in economics, particularly the higher degree.

As that other excellent Canadian economist, Stephen Leacock, explained, Ph.D. stands for “Filled Up,” or impervious to evidence.

But as someone trained in economics, you should be able to work out from first principles what the consequences will be of free trade with factor mobility between developed and developing countries. You know the forces and the factors involved: supply, demand, land, labor, capital and technology.

The developed countries have lots of capital and technology so they have high labor productivity, and hence high wages. That is, until globalization kicks in. Then capital and technology is moved to where the labor is cheap and the cheap labor is moved to where labor is dear. Result: long-term real income stagnation or decline in the developed world, rapid increase in labor productivity and wages in the developing world.

You have evidently not read David Ricardo, who clearly states that free trade between rich and poor countries will be mutually beneficial only in the absence of factor mobility. The St. Louis Fed, has a paper on the subject confirming Ricardo’s proviso.

Globalization vs isolationism isn’t necessarily at the extremes. Bilateral trade with the USA was far more beneficial to Canada in some sectors than the NAFTA agreement. I tend to agree that companies have definitely taken advantage of the “cheaper labour” solution to the disadvantage of Canadian and USA workers.

This paper by Jeff Rubin is illuminating in regards to the Auto sector.

https://www.cigionline.org/sites/default/files/documents/Paper%20no.138web_1.pdf

“With near wage parity between the two countries, Canadian and US trade in vehicles and auto parts has been relatively balanced for decades compared to the huge bilateral trade deficits that both countries have recently incurred with Mexico in this sector.”

Alberta has the youngest population of any province. In particular, many more young families who are the group who are most in debt in any province. You’d need to normalize the numbers demographically to get a valid comparison, which I haven’t seen.

I wouldn’t say Alberta house prices are “relatively modest”, they look reasonable compared to BC and GTA but that’s about it, given that their cities sit in the middle of empty prairie.

Marko:

I am sure that I must be missing something but is it not the job of the building inspectors to make sure that everything is up to code? If an owner builder screws up wont they just make him redo it? I built in Toronto and we had multiple inspections at every stage. Maybe it is different in BC?

In the little corner of Alberta that I lived in, it’s not that much of a mystery. Folks had crazy incomes from the oil patch and loved their toys & vacations. I had several friends who loved to take the whole family (grandparents included) on all inclusive vacations every year so there is an easy $10k-$15k drop. How about new RV’s? That’s an easy $50k & up. New trucks. Vehicles for all the kids as they get their drivers license. Cellphone plans for everyone in the house – one friend couldn’t even tell me what her monthly payment was for 5 phones in the house. Came out of her checking account every month so as long as she kept money in there, it’s all good. Money management was a rare find.

Hello all,

Thank you for your advice. A lot of what you have said about waiting until winter 2019, more selection etc. aligns with what I have thought myself.

As someone who grew up in a small Ontario town (with starter homes selling for 200k) it has taken a while to wrap my head around Victoria prices. I sometimes wonder if I have adjusted to this new reality of looking at 750k homes that are quite frankly dumps and thinking ‘wow I think this one is a real contender!’ …or maybe I have just been brainwashed…. It is difficult for me to see the value in these properties.

On the other hand I feel very fortunate to be in a position to buy a home in Victoria…in my 30’s, no debt, +130k household income, 20% down etc. Unfortunately these are the circumstances you need to be in to barely afford the least expensive SFH. How is this sustainable?

Jaleek – your comment about the ‘mass of retirees coming here really doesn’t apply because no one in Windsor, St John’s or Montreal is retiring here’ …I don’t think is entirely true. My ‘boomer generation’ parents, and several others in the same boat, have mostly come from households with high rates of home ownership and are in the que for large inheritances….they are using these cash windfalls to move to more appealing parts of Canada. (Albeit my sample size is small and I don’t claim this to be a fact – just my personal experience).

Globalization: no change in thesis here – the evidence is so stacked against the protectionist camp that you embarrass yourself every time you misstate the facts. You don’t provide any citation for your conclusions, because they are just false. Your thesis is broken down to this: Me, me, me. However, what you have demonstrated, through the courage of your conviction, is that you have a price and can be bought. To quote your leader: “sad”.

We have discussed how [many reject this] incomes dictate housing values. Latest on BNN [folks, this also applied to Victoria, IMHO]:

Want to pay San Francisco housing prices on a Columbus, Ohio income? Move to Vancouver.

While policymakers from Seattle to Boston lament a growing urban affordability crisis, a new study of home prices and earnings across more than 100 major U.S. and Canadian metropolitan areas shows Vancouver in an ignominious class of its own.

The median cost of a Vancouver home, adjusted for purchasing power parity, is US$672,000 — costly but still 15 per cent to 26 per cent below that of San Jose and San Francisco, the two most expensive housing markets, according to Andy Yan, director of Simon Fraser University’s City Program, whose study accounted for the difference in buying power of a dollar across geographies and currencies.

What pushes Vancouver to the top of the unaffordability rankings is paltry wages. In Canada’s third-largest city, the median household earns the equivalent of US$61,036 a year — in line with Columbus and less than families in Omaha, Nebraska, Kansas City, Missouri and even Lancaster, Pennsylvania, a rural community of 59,000 known for cornfields.

The Pacific Coast city’s property market is entering a slowdown after policymakers intervened with a slew of measures to temper demand, including a foreign buyers tax and tighter mortgage rules, along with higher interest rates. Sales hit a five-year low last month, while the number of homes on the market swelled to the most in three years.

But the figures show just how difficult it will be to close the affordability gap after a run up that’s seen the price of a typical home triple since 2005.

“You need one of two things: either Vancouver real estate prices need to halve to attain a certain level of affordability, or you need to double incomes,” Yan said.

An outright correction would be potentially devastating — real estate development is the province’s largest industry and housing a key driver of the local economy. Doubling incomes is wildly ambitious — similar in scale to a 10-year goal that China has set for itself.

“That’s the Herculean task of what Vancouver is facing,” Yan says.

Same people running BC housing still. Unfortunately the NDP loves the idea of government oversight so unlikely the exam will change

Ask your realtor to set you up with the matrix/PCS portal, or send me an email leo.spalteholz@gmail.com and I’ll set you up with the portal to monitor price changes in the price range / housing type / area you are looking for. I’m not active in sales so I won’t bug you about anything else.

Just because a government program escapes the axe doesn’t mean it has merit. Bureaucratic programs live on for a number of reasons. Sometimes stupid programs are popular with the public (HOG). In the case of the exam it is overall small potatoes – probably hasn’t made it on government radar. While the exam does significant harm to those affected it only hurts a small not politically connected constituency.

Always mysterious to me how those with the highest income and relatively modest house prices have the highest debts.

Inventory decreases into the fall/winter.

He hasn’t and likely won’t. Sadly once these sort of programs start they usually don’t get killed unless they are extra extra stupid like the libs silly first time buyer program. That is why it is important not to start stupid programs in the first place.

An example of a stupid program that will probably never get killed – the Homeowner’s Grant.

1) Lets local government tax higher than they would otherwise as they know that the provincial government will pick up part of the tab.

2) Uses general revenue to pay a subsidy to a group of people (homeowners) who on average are not needing the subsidy. Deferment programs exist to cover most of the people that actually have trouble paying taxes.

3) Costs money to administer.

4) Ensures that other taxes – PST or income tax are higher than they would otherwise be.

The NDP has had over a year to get rid of the Liberal exam that was created to help their friends according to a bunch of you on here. Still there on the site, must be some merit to it if the greens and ndp left if there. Or is everyone in bed with the industry. 🙂

Bureaucracy for bureaucracy’s sake then. There is no problem with owner built houses in BC that needed solving!

If there is no problem, then no test, no matter how well designed, can solve that problem.

Just wondering

I am in the exact position as you for the most part. This forum is a bit of addiction.

I plan to wait it out at least for a few more months and see how this plays out. While I can see in the long run argument of RE going up – I really am not seeing any evidence in the short-term (for me that is at least 6 months if not a year) of anything to suggest prices going up – and stable at best isn’t looking that great either – I am not talking a crash but if a 1.4 mill house goes down to 1.2 – what happens to the $1.2 mill house? And while I would like to say – and so on and so forth I believe (and I am a nobody – so remember that) our price range will have less movement because that’s the price range that the majority can afford. (Just saying that sounds crazy given low housing costs elsewhere)

Having said that I think there will be better quality of house in that price range – maybe people will compete for those quality offerings so who knows

I would really like to be up on price slashes that Hawk refers to – because that reality price site just sucks when it comes to the island so is there another way to get that info?

I review real estate every day – I should take a break – and houses that are just out of my price range have been sitting on the market for months, or have relisted and still no buyers so that says something. Even making a great salary puts a million dollar house out of reach unless you have a significant bank roll to go with it for most people and this bunk about a mass of retirees coming here really doesn’t apply because no one in Windsor, St John’s or Montreal is retiring here, however if your selling a house from van , tor or some crazy market you have a shot at buying here.

Foreign buyers are disappearing to some extent

because of the measures put in place by the Province, interest rate increases, Fbt, speculation tax and for the Chinese the rmb has devalued. This works in our favour in the short run

If I have to spend 12,000 in rent to save $50k then I’m all for that.

If things make a turn for the worst – we’ll hear it hear it here first anyways- so that’s a plus

Anyways those are the thoughts of a random joe

that shows you know what you are doing when building a house.

An owner builder doesn’t mean you are physically building the house…you are just organizing all the professionals and tradespeople and you can’t teach that via an exam.

Do I know anything about building code? Nope. It’s all the small common sense things the add up in my opinion. When I went to Slegg Lumber to buy my roofing material I bought really good quality singles, I bought super upgraded ridge caps, I paid extra to have downspouts extended across the lower roof lines, etc., etc. Crap you know a builder certainly isn’t going to do because he or she can’t get there money back on it. Builder buys the cheapest roofing material with the crappiest ridge caps that crack, etc. When was the last time you saw a spec house with downspouts across lower roof line? No one does and then your roof wears out prematurely in those spots.

I’ve sent out the study guide I’ve developed to over 1,000 people and honestly there hasn’t been one individual that has ever emailed me back with any sort of remotely positive response. When I hear back from people it is typically along the lines of…..”thanks for the study guide…..I passed the exam and this nightmare is over….what a waste of time and delayed our build 3 months and now we’ve lost our framing contractor.”

Regarding the oil change I wasn’t referering to mechanics. I was refer to individuals that change their own oil at home. Do you think an exam should be required to do so?

Do you think sellers wanting to sell their own home privately should be required to write an exam to show that they know what they are doing?

Has Comrade Horgan eliminated the test? Just curious if not why?

Because politics is about optics, not actually dealing with the root cause. Why do you think the government(s) went after AirBnB? Big bad corporation making billions causing the housing crisis; the optics of it look good for politicians with the average Joe.

The average Joe doesn’t understand real problems like this bs exam or how the City of Victoria takes three months to turn around permits when it should be 5 to 7 business days. Too distracted with the pipeline and bike lanes.

Just wondering……

You say you are likely to be in Victoria for a long time/forever. The other question to ask yourself is whether you see yourself in this first home for quite a long time.

If you think you can comfortably afford a house that you’ll be happy in for quite some time – then don’t be afraid to buy now. But I don’t think it would be a great time to buy something that you are going to want to upgrade from in a few years. That whole property ladder thing doesn’t work so well if we get a few years of stagnant or worse declining prices. Also I’d say a bad time to stretch for something you can barely afford.

The general trend in Victoria has been rising prices. So on a very broad average – waiting to buy has meant paying more. However there are a whole lot of factors in play right now that would suggest this might not be an “AVERAGE” moment in Victoria RE history. Big recent runup in prices, prices at upper end of affordability levels, rising rates, government measures aimed at curbing house prices.

With all that stuff happening it is pretty hard to imagine the market running away from you in the next 6 months or a year and pretty easy to imagine that you might at least get better selection 6 months or a year from now.

At the very least I’d be pretty picky now. It seems like the time for FOMO is past.

+- 6 months is not much in the slow moving real estate market.

You should not obsess about +- 10% if you are holding for the long term, but on the other hand, you should think about what you will need for the long term (+ kids?) to ensure that the long term part actually pans out. The urgency is out of the market, so you can afford to be a little patient to find what will work best rather than just what you win an offer on.

Pretty much doesn’t exist and if it did there’d be a lot of competition. Make a list of the must haves, and be flexible about the rest, you will likely get a better deal.

A young woman on the mainland is looking to rent a condo in Vancouver. She’s got a decent income, and spotted a listing for a condo asking $5600 per month. She emailed the landlord offering $3000 per month for long term tenancy – below is the actual response to the inquiry.

I already think Vancouver condos are going to be in serious trouble, but this is simply horrifying.

JustWondering: I would be careful who you take advice from, myself included. An unbiased opinion on this blog is rare, and you already know as much about the market as everyone else here. Toss your chips in when you see an opportunity to win or are prepared to lose.

I agree! I really expected that house to sell at around $1,250,000 given location, neighborhood, size, & condition.

Marko

You are very passionate about the test. Some of your points are valid other ones comparing changing ones oil with building a house are a bit out there (a legal mechanic who wants to work on someone’s car needs to go through a testing apprenticeship process) I do not see why a more practical test of some kind cannot to administered that shows you know what you are doing when building a house. Regardless of whether you are building one or a 100. I agree a written test about memory is garbage.

Has Comrade Horgan eliminated the test? Just curious if not why?

Taken off the market for a bit and then back on at $1,198,000 and the accepted contract is $1,140,000 and under assessed value of $1,176,000.

Plus an insane roof to boot. Seems like decent bang for buck compared to what is still fetching high 800s/low 900s.

My advice: if the ideal house presents itself and you can afford it, try to buy it. Timing the market is a fool’s errand. If you buy and hold for 25 years, whether you could have saved 5% on the purchase price matters not.

+1

I don’t think now is a good time to buy an investment property but a principal residence with a suite if you can find the right house you can’t go too wrong long term.

Selection is increasing and there is definitively room to negotiate on some properties.

Just saw that a house nearby is under contract. I’ve casually watched this one more out of curiosity than anything else. It’s been on and off the market for well over a year. Current MLS #393835. Started around $1,498,000 then dropped to $1,350,000 and then I think it may have dropped again. Taken off the market for a bit and then back on at $1,198,000 and the accepted contract is $1,140,000 and under assessed value of $1,176,000. I was quite surprised to see that number as the home is in Sunnymead and decently sized with a basement suite of 2/3 bedrooms and separate entrance from the walk-out basement.

Definitely getting interesting out there…..

Marko, congrats to you and all Croatians for the win vs England, and I’m routing for the Croat team to take the cup vs France.

Small country, big dreams 🙂

Welcome, local buyer! (That is what you will be recorded as in the VREB statistics when you do buy.)

My advice: if the ideal house presents itself and you can afford it, try to buy it. Timing the market is a fool’s errand. If you buy and hold for 25 years, whether you could have saved 5% on the purchase price matters not.

Marko I usually agree with you but if teachers,FP, electrians,plummers and a thousand other groups need to write some sort of test. I am ok with someone building a house doing the same. The test definitely could be improved as you outlined. The concept I think is good

So how come licenced builders don’t have to write the exam? I have a couple of close builder friends and both have admitted there is no chance they would pass the exam.

I could use the same argument that there is no proof the test for any professional proves anything other than you can remember stuff.

Do you think individuals changing their own oil should have to pass an exam? After all, don’t you think the consumer needs to be protected from the risk of buying a car where the oil may not have been changed properly?

If you are an owner-builder you are building your own home, not homes for other people. Not to mention you have to hire the same professional engineers and go through the same city inspector a builder does.

If you ever built a home you would realize how idiotic the exam is….like I am going to argue with my structural engineer about nailing patterns, or even better the city inspector….that would go over really well. You can’t build a house in Greater Victoria without a structural engineer so what is the point of memorizing useless structural concepts? What is the point of memorizing gas meter clearances when Fortis Gas comes and installs the meter? You would hope Fortis would know how far from a window the gas meter needs to be.

The best has to be chimney questions. Some owner-builders get up to 5 questions out of 100 regarding chimney code. Problem being no one is building chimneys…..direct vent fireplaces 🙂

The owner-builder exam is asinine. Nobody is locking up that much capital only to engage in the home building process hapazardly. Buyers shouldn’t be coddled. Just silliness.

Make sure y’all get your flues cleaned before December. And no oatmeal raisin cookies…for the love of God please no oatmeal raisin cookies.

@ VB

Free global trade has lowered poverty from Bangladesh to China, while wiping out jobs and creating poverty in Pittsburg and Detroit, and reducing Ontario, once the powerhouse of the Canadian economy, to the status of a have-not province.

As for life-spans, they are actually falling in America among the blue-collar class, as real wages have fallen, with post 1994 off-shoring of jobs.

As for medical advances, globalization has resulted inpharmaceutical R & D being off-shored from Montreal to Shanghai, and Bangalore.

So do try to see through your own brainwashing and think things through on basic principles. You will then see that globalization has made Canadians, as a whole, poorer not richer. However, as a shareholder in various global corporations, I’m OK.

Wait until the winter of 2019 or 2020, minimum 20% depreciation is likely in your price range. The fixer upper you buy with suite potential today could be a fully renovated home with two bedroom suite in Victoria once market stabilization happens. Also, you will have a larger downpayment if waiting until then, giving you more lending options with lower monthly payments. Don’t look at renting now as paying your landlord’s mortgage but time to educate yourself on all aspects of homeownership.

Protectionists vs Globalists

Globalists: Free global trade has proven to lower poverty, lower prices, improve living standards, increase life-spans, expand employment, encourage medical advances and raise incomes FOR ALL by increasing the size of the pie. Trade is not a zero sum game, because it expands the size of the pie / markets / incomes / wealth.

Protectionists: Also called, “isolationists”. The size of the pie is finite; mine, mine, mine. Only the strong survive and the weak perish. Build a wall to keep “them” out, while keeping “us” in. It creates monopolies and oligopolies because there is less competition. This requires more government and regulation, such as in communism [planned economy]. Trade is a zero sum game.

What kind of world do you want to live in?

“When goods are not allowed to cross borders, soldiers will.” — Frederic Bastiat

Here is a critical examination, both pro and con, should you care:

http://www.economicsdiscussion.net/international-trade/policy/foreign-trade-policy-free-trade-versus-protection/10779

Conclusion:

We have critically examined the various arguments in favour of protection. Some of them are valid, other appears to be misplaced. Some people consider trade as a ‘zero sum game’, that is, in trading if one gains, the other loses. This has given rise to the doctrine of exploitation.

For example, it is believed by some that the developing countries like India are exploited by the developed countries such as the USA, Japan, Britain. That is, the developing countries are net losers in trading with the developed countries. However, in our view, this is wrong thinking. No trade can occur without expectations of gain.

India would not have entered into trade relations with USA if it did not expect to gain from it. Trade occurs between two countries if it benefits both the trading partners, the developed and the developing countries. Therefore, in our view world trade should be promoted by lifting barriers put up by various countries based on wrong notions about effects of free trade.

Some countries such as USA and Japan have resorted to protectionist measures as a retaliation against foreign countries who restrict imports into their countries. The retaliatory actions of imposing trade barriers have done great harm to the expansion of world trade. New international organisation WTO (World Trade Organisation) which has replaced earlier GATT has been set up.

WTO has framed rules which every country should observe so that barriers to trade be removed and world trade be promoted without doing any injustice to the member countries. It may be noted that retaliatory activities of restricting imports from foreign countries generally lead to the depression in the economies of the world as it happened during the worldwide depression of 1930s. The retaliatory activities may cause another global depression.

Then right now, Westshore might be the place to look. If you don’t care about prices up or down 10% over 6 months and you plan to stay here forever, you might consider waiting a few months. I suspect you’ll have more choice then, if for no other reason but seasonal increases in inventory. There’s just not a lot of homes that meet your criteria right now. If you’ve been following this blog for “a while” then you’re at least somewhat aware of the market changes we’re seeing at the moment, so the degree to which that influences your decision to buy or hold, will also be a personal choice.

I’ll have a go at this. Times Colonist:

Homeless. Weed. Activism. Tourism. Bicycles. Homeless. Homeless people on bicycles with backpacks. Sewage. Activism. Homeless. Weed. Bicycles. Boater missing. Two boaters missing. Bicycles. Taxes are great.

Hello all,

I have been following this blog for a while now and was wondering if anyone would care to give advice on my situation:

-Moved to Victoria 1 yr ago and have been renting

-Now in a position to buy (have been looking for the last 6 months)

-Will be in Victoria for the long term (all family is here, career, etc)

-Ideally want to find a SFH with suite/suite potential mortgage helper

-Looking for under $750k

I am really torn if I should ‘wait it out’ …keep renting for another 6 months and see what the market does…or If I am going to in Victoria for the next 25+ years I should bother with obsessing with +/- 10% fluctuations…

Thoughts? (first time home buyer here…)

Thank you in advance.

Quick summary of every edition of the Calgary Herald, for those less familiar:

Jobs. Jobs. Investment. Jobs. Stupid enviros. Investment. Jobs. Taxes are evil. Jobs. Investment. Jobs. Jobs.

Not in the 90s.

I’m reading the Calgary Herald these days…

Interest rate hike bad news for debt-burdened Calgarians, stressed housing market

“Albertans have always seemed to have higher levels of debt than other parts of Canada,” she said.

Albertans were the least likely among all the provinces in the survey at 22 per cent to say their debt situation has improved compared to five years ago.

https://calgaryherald.com/news/local-news/interest-rate-hike-bad-news-for-debt-burdened-calgarians-stressed-housing-market

@ BeanCounter

Thanks for the link to an excellent article by Andie Xie. It reveals what the Never Trumpers and globalist liberals want to conceal, namely, that globalization has many more losers than winners, the winners being not you or your neighbor, but the mega corporations and the people who own them.

That’s why, whenever you hear someone on the CBC talking about Trump’s trade wars, they always warn that tariffs mean higher prices. What they never point out is that higher prices are the whole point. Higher prices are what are needed to permit domestic production, which employs Canadians, Americans, etc., at wages they can live on.

In addition to protection of home industry, we need tough anti-monopoly laws to ensure vigorous competition within the domestic (i.e., North American + EU) economic space, such as produced the Japanese post-war economic miracle.

Rook, no.

Michael: Can you explain the repeat sales index for me. Start with basics. Thanks

Local Fool. I’m curious, do you work in finance?

Marko, congrats to you and all Croatians for the win vs England, and I’m routing for the Croat team to take the cup vs France.

Based on what metrics?

Repeat sales index is out. Victoria looks like it might be accelerating, up 1.3% in June.

This is when crashes happen. Sudden, fast, and painful.

Vancouver Condo Inventory Trending Upwards in a Big Way

While history doesn’t repeat, it certainly does rhyme. All real estate booms follow a very similar pattern. Higher prices tend to pull demand forward, at the same time drawing in a larger class of investors.

…just a few years ago there was a healthy number of condos for sale. However, in a very short time frame condo inventory plunged to record lows over the past few years. Rising prices and a perceived scarcity created a fear of missing out and buyers snatched up remaining units almost regardless of price or condition.

However, the good times don’t last forever. While Developers are making profits hand over fist, the extrapolation of current market conditions leads to an overshoot of expectations, and ultimately an oversupply of new housing. This generally comes at a time when demand begins to falter.

We are currently experiencing signals that the Greater Vancouver condo market is in the late stages of its real estate cycle. As of June 2018, sales have decreased by 35%, inventory has increased by 57%, and many developers have begun offering bonuses and decorating allowances on available pre sale units.

http://vancitycondoguide.com/vancouver-condo-inventory-trending-upwards/

Come on… that Toronto article states that the data is incomplete. And it relates to condo apartments w/ leases tracked through the MLS. Notice that according to their dataset, the number of leases fell 8% from previous year. Condo units registered are down so may be a cause but since it’s not a full picture of rental action in the area, kinda hard to tell.

Toronto rents sky rocketing

2300 for 732 sq ft

https://www.theglobeandmail.com/real-estate/toronto/article-gta-condo-rental-rates-up-another-112-per-cent/

@Beancounter

1000 HVV points for your post #46209! That’s one of the most eloquent explanations I’ve seen of the very valid conservative viewpoint about the issues with governments, taxes and spending. 99 times out of 100 those who are not entrepreneurs have views about wealth and success that are formed with a massive knowledge gap about what it really takes to be a successful entrepreneur – the massive risk, the incredibly hard work, and the luck that must come as well. Instead all they see is excess, greed and arrogance. The problem is many of those successful entrepreneurs, having fought and battled to get where they are, then feed that narrative because they become quite protective of their rewards and want to share as little of it as possible – “I earned it, keep your damn hands off it.” Unfortunately in my experience there are few altruistic entrepreneurs who are both successful and grateful. More often than not the very traits that allowed them to be successful often overtake their entire viewpoint – their money is being taken and wasted. What they fail to realize is that they would not have their success and wealth without society providing the framework in which for them to achieve it. It’s like a game of Monopoly played in the real world – there must be a balance or the entire thing will collapse. I think the US is getting dangerously close to this point..

Dear Chris:

Precisely what do you think my political beliefs are by the way? And what do you base that on. This instant labeling done by all sides seems like the Canadian version of Trump politics. Worse, it tends to interfere with crafting solutions to very real problems.

It might be more productive to see what we agree on rather than dance around issues.

For a start, we can both agree that the handling of cash in the casinos was outrageous.

I believe that names should definitely be named and appropriate charges laid and people should be fired where appropriate. It is an issue of both justice and deterrence. I believe, contrary to the reports suggestion, that cash be limited at the casino. Continuing to accept wads of cash just seems to invite laundering.

We can also agree that 100 million is just the tip of the iceberg for the amount of drug money being laundered in the province.Billions in marijuana money has been laundered over the past twenty years. More police resources need to be dedicated to this problem and there are number of changes that need to be made to our banking systems. But it is not a problem that is about to go away anytime soon.

Frankly, I think is time to accept that drug use is not a winnable war using the methods employed so far. I would support both the decriminalization of drug use but only if we provide drug addicts with free heroin. While this will not eliminate the drug trade it will certainly reduce it by the simple expedient of taking a lot of the profit out of it. The cost of medically pure heroin is substantial less than the policing costs as matters stand now. The harsh reality is that most addicts are life long and that treatment programs have an abysmally low success rate. Yes we should still offer treatment but we might as well recognize that most addicts are hooked for life. Continuing with policies that are both expensive and ineffective seems stupid to me. Does that make me left wing or right wing.

Most days I just wish both wings would just flap and fly off somewhere else.

There is a problem at universities. Part of it is the vast growth in administration/overhead. Here is an article from the States, but Canada has similar figures https://www.huffingtonpost.com/2014/02/06/higher-ed-administrators-growth_n_4738584.html

Well said. I don’t fully endorse either the NDP or the Liberals but I am glad we have two normal relatively sane non-extreme political parties in BC. That way we can “throw the bums out” from time to time without disastrous consequences.

“Seems to”. That is, you are setting up a straw man.

FYI, for those interested in bigger picture economics an entertaining read from my favourite economist:

https://www.scmp.com/comment/insight-opinion/united-states/article/2150329/three-reasons-not-blame-trump-when-global-free

I can see eye to eye with part of this angle. After being in business for so many years, and also formerly entrenched in academia, I can wholeheartedly say that inside the government/university-(mostly) taxpayer-funded bubbleverse there is a clear collective mindset that is completely detached from the reality of how hard it is to earn the dollars needed to fund these out of control bloated staff counts and budgets.

The amount of sweat and hard work most businesses must push to produce every dollar of real income is simply not realized inside the said bubble. To illustrate, take a certain university’s “Director of Diversity Engagement” (whatever that is) who makes 430k a year. In the real world the 430k needed for a business to create such a position with that kind of salary would need to be justified by producing far more that than what the salary commands. This simply does not happen inside the bubbleverse, and I believe that is why so many have a hatred of the government and university system. It’s almost as if the money is thought of as the result of magical pixie dust to be whipped out of thin air. Well, considering debt levels of most governments I guess that is not far off from the truth.

With that said, the former government was criminally corrupt and thank god there was a changing of the guard.

Marko I usually agree with you but if teachers,FP, electrians,plummers and a thousand other groups need to write some sort of test. I am ok with someone building a house doing the same. The test definitely could be improved as you outlined. The concept I think is good

I could use the same argument that there is no proof the test for any professional proves anything other than you can remember stuff.

Back to the god dame exam. Jesus no offense but someone who has no ducking clue should not be building a house than selling. You may not like the exam and it could have been better but you need to show some ability if they are going to have the government /private insure it.

The exam lead me to cast a vote (for the Greens) for the first time in my life. Who knows when or if I’ll ever vote again but in my opinion the exam was a blatant example of Liberal corruption and I can’t stand the NDP but corruption is worse and needed to go.

When the exam came out I was 90% confident it was BS based on my experiences (having just finished owner-building a home, attended inspections of owner-builder homes over the years, the questions on the exam, etc) and then when I put in the FOIs to BC Housing I became 100% confident it was BS. Then BC Housing tried to silence me, I had to hire a lawyer, spend $$$$, and paused me speaking out against the exam for 1.5 yrs. After the investigation I was found of not doing anything wrong, so I am going to ramp up my anti-exam message again.

If you can find ANYTHING that shows that owner-builder homes in BC are more problematic or of lower quality than builder homes, please feel free to share.

Reality is the vast majority of owner-builder homes I’ve been inside including mine are a cut above builder homes that are built for pure profit.

As far as selling an owner-builder home the exam didn’t change anything……you still have to wait if you want to sell. You can’t build and then sell right away.

The owner-builder exam is extremely anti-affordability. It is probably holding back 5 to 20 garden suites from being built in the City of Victoria every year. That is just a small fraction all the various places it impacts affordability. For what? Absolutely nothing.

Not to mention Ford turning back the clock to 1960’s sex education. Right wing stone-age thinkers blow my mind.

gwac you are to lunch. House demand has been pulled forward the last 2 years from FOMO and rising rates plus stress test. The emotional wannabe buyers have now woken up and have stepped back to thank their lucky stars they got shut out of this gong show as the slashes stack up like used car lots.

NDP are saving people from blowing their financial brains out while your corrupt BC Liberals were pilfering the cash registers for years. Wake up, you’re making a fool of yourself.

CE. They were sitting in the opposition for 17 years with plently of Governmnwt money to look and come up with a plan. Only plans they have come up with are on the fly to try to bring house prices down. That will back fire big time because you have not taken away demand you have delayed it so watch out what happens in a couple years in Victoria and Vancouver

NDP are as useless as the liberals except they will spend other people’s money building bigger empires.

Ontario just scrapped electric car rebates.

Back to the god dame exam. Jesus no offense but someone who has no ducking clue should not be building a house than selling. You may not like the exam and it could have been better but you need to show some ability if they are going to have the government /private insure it.

The first time incentive sorry I see nothing wrong in helping first timers.

Next!!!!

Really? These have gotten steadily worse for probably the last 30 years including the last 17 of Liberal government. But the NDP are incompetent because they haven’t solved it all in their first year?

Is Doug Ford a failure? I hear he hasn’t yet fixed every problem in Ontario and he has been in power MORE THAN ONE WEEK.

Good one gwac!

May I offer:

https://www.theglobeandmail.com/news/british-columbia/experts-weigh-in-on-british-columbias-first-time-homebuyers-initiative/article33419797/

and

https://www.bchousing.org/licensing-consumer-services/owner-builder/owner-builder-exam

Though I guess you could argue this wasn’t spending “for the sake of spending” but rather spending “for the sake of donors”.

Leif let’s see how the NDP solve all those issues you laid out. ICBC stop the lawsuits. Universities cut staff and benefits. Hydro cut staff and benefits. Your savior NDP will do none of that. Things costs money either people pay for it or taxes do. Unfortunately most people do not understand the economics of solving issues and just throw blame.

Barrister:

100 million over 10 years – The right (despite being new here you are obviously right leaning, based on your comments) loves to use this figure to discredit the investigation and never bother to iterate that this was mentioned as the minimum amount. People coming into casinos with hundreds of thousands of dollars at a time most likely represent the extremes and a small part of the overall issue.

Pot has been basically legal for decades in BC and the gross revenue (wholesale or direct from grower) is completely untaxed. How do you think this money (estimated to be in the billions in BC) is laundered? Ever hear of trades taking cash for work? Funding down payments for grow houses?

Chinese money is definitely a massive issue but it’s not the only issue. The Liberals threw everything they possibly could at our real estate market – massive, unfettered access to foreign capital, lax enforcement of anything to do with real estate, etc. etc.

There are many issues that have caused our real estate to become overvalued. Maybe try to be objective and not let your political beliefs skew your thinking (as so many do these days…).

Patriotz:

Your politics is distorting your judgement. The problem is that Eby seems to believe that the allegations about 100 million over 10 years distorting the real estate market has any real credibility. The allegation, without a lot more supporting evidence, on its face is a bit of a bridge too far. One could equally argue that my bringing in 1.6 million from California has helped to distort the real estate market. Certainly a lot more than a 100 million of American money over the last ten years has entered the BC market.

Money laundering, in the casinos and everywhere else, is a very real problem which needs to be addressed on its own merits. But you are right about facts and innuendo but you seem to overlook the lack of basic facts that support the allegation that the money laundering is a major or even a serious factor in the run up of housing costs in BC.

Frankly I was shocked that the report did not name the parties responsible but instead chose to hang a cloud of innuendo over a broad swath of people that might be innocent of any wrong doing.

Before you suggest that my comments are politically motivated let me remind you that I am a recent arrival to BC and not sympathetic to any political party. What I find objectionable is politicians that keep insisting on spinning the story for headlines. You are correct that a lot of Hoong’s letter is also spin. His central point that 100 million is trivial in terms of influencing the BC real estate market carries some weight in my mind. I was struck by this fact when I read the report as well.

What is overlooked by the politicians is the billions of dollars that have been brought into Canada from China and invested into Canadian real estate as a safe heaven. Much of this money has been shipped out of China in breach of China’s currency regulation laws often with the indirect assistance of our banks. I am not an expert in this area of law but as near as I can tell this activity is not against the laws of Canada. It would appear that the Chinese government does have civil remedies to claim against this money in Canada but the individuals transferring the money have not actually broken any Canadian laws. Nor has any Canadian government proposed laws to enforce China’s currency regulation laws. It seems to be a matter of ignoring the elephant in the room.

I am not sure who I dislike more, politicians or all the political groupies who support them.

@guest_46109

“Actually pretty tame for being in power 17 years.”

Are you living in BC?

Pretty tame to sell out BC Hydro and buy massive private contracts causing BC Hydro prices to balloon for no reason other than make some people rich.

Pretty tame to let ICBC go into the shit hole?

Pretty tame to allow laundering of money and a housing crisis?

Pretty tame to allow Universities to increase tuition 33% a year from what I paid in my first year of UVic $1200 to now $5000 a semester?

Yeah pretty tame stuff, just cost 99% of BC residents some very untame results to their pocket books and forever screwed over various public corporations that are supposed to work for the people.

When you are in power so long there is always stuff you can find. Actually pretty tame for being in power 17 years.

Some make this job easier than others.

The Casino is yesterdays news. All politics to try to shame the previous government.

We can not move on to waste more money on the housing report. More politics by this guy to seem like he is fighting for the little guy. All BS.

NDP done nothing so far of any impact….to help anyone. Where are they to deal with the homeless issue. Right there on the highway for them all to see. Where are they in dealing with the drug issue. Right there a little walk from the legislation building. All they have done is spend a big bunch of money on housing with nothing to show.

Liberals are not better at fixing stuff. They just do not spend for the sake of spending and pretending to fix things.

I doubt the $100M was the extent of it anyway. That’s just what they could definitively prove with footage in the period of writing the report.

This letter is long on the latter and short on the former. For example: “According to Mr. Eby, their criminal activities have simultaneously caused Vancouver’s housing bubble, fentanyl crisis, and gangland activities.”

What Eby actually said (Feb 16): “The nature of these allegations, that this money-laundering activity is actively influencing our real estate market and is connected to the sale of life-destroying fentanyl, underline the critical importance of addressing money laundering urgently and not ignoring it.”

There are plenty of other non-sequitors. “Why has Mr. Eby not made any reference to the numerous expert studies by housing economists at the Canada Mortgage and Housing Corporation.” The report wasn’t about causes of the housing bubble, it was about money laundering at casinos.

And so on.

Article from the Georgia Straight…Facts vs Innuendo

https://www.straight.com/news/1099146/open-letter-attorney-general-david-eby-and-investigator-peter-german-bcs-dirty-money

According to Mr. Eby, their criminal activities have simultaneously caused Vancouver’s housing bubble, fentanyl crisis, and gangland activities. Mr. German states that the “Vancouver Model” has laundered in excess of $100 million over a decade. This works out to an average of more than $10 million a year.

<

ol>

According to the B.C. Real Estate Association, the total value of homes sold in Metro Vancouver last year was $48.9 billion. In 2016, it was $53.3 billion. The $10 million in laundered money represents equal or less than 0.02 percent of both amounts. Mr. Eby has repeatedly claimed that laundered money has fuelled Vancouver’s “housing crisis”. Can he explain how $10 million is able to move a market 5,000 times as large?

Please do not post whole articles in comments, excerpts only - adminMillennial Home Ownership…different priorities compared to other generations, thoughtful insight

https://www.cnbc.com/2018/07/09/these-are-the-reasons-why-millions-of-millennials-cant-buy-houses.html

Ian: “To me, institutions buying long bonds are saying 1) don’t care where rates go – matching liabilities 2) don’t know where rates are going – matching benchmark weight 3) think rates are going down – cap gains. 4) reaching for yield – Japanese and Euro investors who are looking at at 0% and 0 3% at home.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Hey Ian, you are not entirely wrong, however, :

1) Institutions have to care about interest rates because they are buying long term bonds to try to duration match their liabilities. Unfortunately, those liabilities are usually sitting in 20 to 30 yr bonds. In a rising interest rate market those longer duration bonds will devastate the capital investment. As a general rule, for every 1% increase in interest rates, a bond's price will change approximately 1% in the opposite direction for every year of duration.

Interesting fact, pension plans use to have the same mandate/rules as life insurance companies before they introduced the Prudent Person Rule.

2) Most large institutional investors have extremely good financial advisors, investment committees and consultants that base their investments around the direction of interest rates.

3) Institutional investors that chase yield tend to overlook the liability side of the ledger. The yield between the 10 yr duration bond and longer duration bonds is minimal. It would make more sense for the Pension plans to invest in the 20 – 30 yr. duration bonds if yield was the only concern. Capital loss is the primary concern when they are deciding which duration to choose when interest rates are rising.

The fact that they are opting for the 10 yr duration bond tells us that they are very concerned about the impact of rising rates on their long bond portfolio.

So, these Institutional investors are telling us rates are going up and will continue.

Tesla Plots Bold China Factory Move, Stays Silent on Cost

https://www.bloomberg.com/news/articles/2018-07-10/tesla-is-said-to-plan-china-plant-with-500-000-vehicle-capacity

Didn’t think you meant today 🙁

I’m in NRGY.UN, and SHLE, an unloved stock trading at 3X next year’s cashflow, while renting a much loved house trading at 50X next year’s cashflow. Looking for that spread to narrow so I can buy said house..

Why do houses trade at such crazy multiples?

Oops,

I was following you until:

To me, institutions buying long bonds are saying 1) don’t care where rates go – matching liabilities 2) don’t know where rates are going – matching benchmark weight 3) think rates are going down – cap gains. 4) reaching for yield – Japanese and Euro investors who are looking at at 0% and 0 3% at home.

“Looks like it could hit low 60’s in coming months.”

Low 60’s of low two hundreds.

Iran has said if the US stops their oil being shipped through the Persian Gulf, no one else’s oil will get shipped that way either, and that means half the world’s exported oil.

happy to see lot of new listings in newer buildings @YYJ downtown. I am ready to pick up a deal.

Oil took a $4 hit. Looks like it could hit low 60’s in coming months.

44 more slashes the last 3 days. Remember when they went on TV with their kids to beg for a house in Fairfield like there will never be another one ever ? Now you can take your pick.

gwac, quit the spin job and spit it out. Your baseless daily griping is getting to be the angry old guy yelling at the cloud deal. Meanwhile your BC Libs chucked $43 million down the crapper on a basic land deal. So how do you define “nice” people ? Like Trump’s “fine people” I guess.

Vaughn Palmer: Incompetence left B.C. government millions short in land sale

https://vancouversun.com/opinion/columnists/vaughn-palmer-incompetence-left-b-c-government-millions-short-in-land-sale?video_autoplay=true

Ian: “To help us understand this analysis, what mortgage rate do you forecast in 3 years time?”

Hi Ian, I know that your question was for gwac, but I thought that I would add my own two cents worth.

Invariably some people look at the recent flattening of the yield curve, particularly between the 2yr and 10yr bond yields and suggest that the 10yr yield is telling us that the mortgage rates will be low for some time.

The problem with that assumption is that they are not looking at the Institutional investors (pension and insurance plans) and understanding what message they are relaying to the market.

The bond market is the largest market in the world and institutional investors are looking for long term security without much capital depreciation. When interest rates climb, long term bonds suffer capital losses in direct proportion to the bond term.

These investors want to be in 20 – 30 yr bonds but the loss would be incredibly magnified on the longest term bonds.

The flight to safety is the 10 yr. bond which offers a certain amount of stable returns for outgoing payments and lower capital depreciation. These investors are keeping the 10 yr. yield low and are telegraphing a very large message: “RATES ARE GOING HIGHER”.

It could very well be that we will see an inversion in the yield curve in the not too distant future.

Tread carefully and good luck.

Leif

Not biggest enough balls for that. 🙂

@guest_46109

If your so big on oil why not jump in with both feet and get into a leveraged ETF (USOU). Its up 351% in the past 1 year.

XEG is up 23.90% in the same time period.

Barrister – I agree with your take on realtors – the conflict of interest is glaringly obvious.

I do have to offer my two bits on this subject, as well. Over 35 years I have purchased 7 homes … never owning more than one at a time. Lol. In each one of those purchases, except for the last one where I utilized a friend, there have been other “sudden” bids on the homes.

Now, after the first two times, when I was still a young man, I became very skeptical of the “other bid”. My response on all of the other homes were exactly the same … “oh well, too bad, we’ll keep looking.”

The realtor’s response, invariably with few variations, “the other offer fell through, are you still interested?”.

Now, with all due respect to house salespeople, this could very well have worked in my favour during the sale of my homes BUT in all that time I never received more than one offer and never over asking.

and

And yet the CREA spends massive amounts of money crafting advertising to make one believe that a REALTOR is in your best interest. Check out this article:

http://www.remonline.com/creas-no-regrets-ad-campaign-includes-serving-tea-pop-events/

“More importantly, surveys have found that consumers are more likely to choose a Realtor after seeing the TV commercials than they were before, Sukkau says. “We’re moving the needle in the right direction. We just want to make sure that the Realtor is always front and centre, top-of-mind.” ……. Sukkau, who was at the pop-up all day, says people told her, “I can’t believe anybody would not use a Realtor.””

The advertising is crafted in a way to make one forget about the obvious (conflict of interest) and to go with the message. You must trust a realtor.

So why would anyone believe that a realtor has your best interests at heart? Because they’ve been told that over and over again by an Argument from Authority.

PS: CREA was reprimanded for misleading the public by Advertising Standards Canada over their biker ad.

RBC, BMO and TD just hiked their prime rates by a full quarter-point. You will note that on the way down, banks did not pass on the full BOC rate cuts, but on the way up, they hike fully. The net interest margins are rising and the spread is getting very healthy for the banks. The downside for them are the loan defaults, so important to watch that and their loan loss provisions.

The press is shifting focus now to the indebted consumer. BOC reports that only 25% of all mortgages are variable – they take a hit right off the bat today. Those with closed mortgages coming up for renewal will feel it. Next BOC rate decision will be interesting indeed.

Barrister – I agree with your take on realtors – the conflict of interest is glaringly obvious. The buyer’s realtor wants the buyer to pay the highest price possible – the commission is greater. Is anybody really subscribing to Royal Lepage’s view that the Toronto RE market will rebound and that the National Benchmark house price will rise 4.5% by end of the year? They are trying to influence sentiment but offer no “economic” bases as a foundation.

People need to understand that. The realtor’s overriding interest is that a transaction takes place. Otherwise they don’t get paid. A realtor’s advice on pricing, accepting offers, countering, making offers (for a buying agent realtor) should always be assumed to be coloured by that bias.

That said if you have an honest competent realtor there is some alignment of interest. They want to get good exposure for your selling property and they want to show you properties that match your interests. They have a shared interest in getting the paperwork at least somewhat correct. More generally they want to leave you with a positive impression so you recommend other clients to them.

I’d agree with Barrister – look for someone that seems to have the basic competence. Beyond that – choose someone that doesn’t grate on you.

The buying realtors I have worked with were decent. One in particular pointed out some neighbourhood and property factors that I might have overlooked.

It is amazing that we have such a well compensated industry to achieve the basic functions that realtors serve. I vaguely remember a quote from somewhere about how it is good to be a middleman when large sums of money are exchanged.

@ Leo S

"Annie argues that one effective counter-strategy (i.e., to overconfidence in ones own beliefs about the future) is to assign a confidence to your beliefs.”For investors, it might be more useful study chaos theory.

Why would anyone ever believe that the realtor has your best interests at heart? Your economic interests dont align at all. Mostly I look for a realtor that seems competent enough not to screw up the paperwork and whose office is competent enough to set up showings. No offence to all the realtors online here but your function is really pretty limited.

So true. RE industry likes to promote the idea that RE would be cheaper if the province scrapped the PTT.

Likely the RE industry also hates the PTT because it acts to suppress the level of transactions (albeit not very effectively).

The reason I asked and the reason I’m still pondering the question surrounds the fact that humans are basically lemmings – the term is “Argument from Authority”. We have cognitive biases towards a perceived authority. The realtor’s associations have done a spectacular job of telling us that buying/selling without a licensed realtor is fraught with peril. The commercials I’ve seen are really scare tactics but designed to convince someone that they can’t go it alone. So where am I headed with this? I believe that many people are not as savvy in purchasing a home as you imply. We tend to go with the authority in the situation because we’re told:

“the largest transaction of your life deserves the expertise of a realtor”

Now hoping that our buyer’s realtor has our best interests at heart is all well and good but what happens when that realtor hasn’t earned a commission in awhile? Would s/he still have that best interest in mind? Hopefully the buyer is also doing the homework and asking the right questions but it’s tough. On the flip side, how does a seller know how to pick a realtor? Would it be the one who says – look at me! I got over asking on my last X number of houses sold who never mentions that s/he played a game to get that over ask?

I’m not sure where I’m going with this but it falls along the line of falling markets and the games played to trick people into believing that the market isn’t really falling.

So yeah those couple of points lower could matter… maybe… I’m not the authority here just someone with a nagging thought on this so it’s all IMHO.

Hawk you are just one big amusement for me. No greivances at all. Thought of starting a gofundme account. If so you really should get nicer. People like to contribute to nice down on their luck people.

As the facts continue to come out, we are seeing the BC Liberal’s incompetence and neglect front and center. I read the article of the murder in China that revealed the $100+ million used to purchase BC real estate. I suspect that the figures we hear [foreign money purchasing BC RE, including right here in sleepy Victoria] are only a fraction of what is really taking place. Saw a news clip of a home in Richmond that has been vacant for 6 years – nice home. Locals can’t find rentals and these big homes sit idle. The only time someone saw anyone there, the owner said, “off to airport”.

What kind of community do you want? Does it make you feel wealthy when your home is assessed in the 7 figures due to drug-money laundering or capital fleeing China for “safe” land just to park? Eventually, the spin cycle stops and you have to dry the laundry – sometimes it is on the clothesline for all to see. I don’t like what I am seeing – homelessness, drug addiction, greed, tents, expensive cars (driver has no job), huge vacant homes, and a government that got away with letting it happen. The next report from Mr. German will be interesting, but it will be conservative on the numbers, just like his estimate of the volume of casino money laundering.

LeoS – the trade wars and NAFTA are significant – they affect jobs and incomes, which used to be what RE valued were based on. Sanity may return and tent city dwellers may some day have a real home to own or rent.

Gwac, what are these bad choices and who is exactly lazy ? Please itemize your grievances so we can better understand your daily anger at people getting help when they are down or unemployable etc.

You seem to think the people who are in rough shape or caught some bad breaks are living the high life off your wallet, so please show us for once and for all.

WCP/TOG/SPY and the little known YGR are mine Ian.

XEG is my biggest holding right now.

Warning playing oil can lose big $$$.

I have never suggest you cash anything to buy anything.

Only thing I have ever said over and over is a person is a complete and utter moron to spec on your house. iE sell hoping to buy cheaper.

Buying a house or property is a personal choice based on each persons wants and needs. House prices go up over time. Waiting if you want one can be expensive.

Interestingly gwac, we have similar outlooks, but come to different conclusions. Next couple years TSX up 30%, with a big lift from energy stocks (which I see up 50-100%), vs. Vic RE flat to down.

Why would you suggest I cash in my stocks to buy a house?

Loonie up to 76.6 this morning before falling back on oil down $2

Hawk I do not believe the government is there to bail people out for their bad choices in life or their laziness

Hawk where do you fall in the above?

Chinese investments in Aussie property dive 81% on capital controls

“If these restrictions continue, we expect Chinese investment into Australia to record its lowest year since 2012,” said Ben Martin-Henry, associate director of capital markets and forecasting. The capital controls are having a “meaningful impact” globally, he said.

https://www.businesstimes.com.sg/real-estate/chinese-investments-in-aussie-property-dive-81-on-capital-controls

You’re a BC Liberal praying for the NDP demise that are here now for the next 7 years at least due to being exposed as the corrupt criminals they are. Wee Wilkie is a joke and has no hope in hell. The only way they balance a book is if it’s from dirty money.

You’re also a heartless dick who doesn’t like people getting a leg up when they are knocked down or giving folks a break to make a better community. You’re in the wrong province, Doug Ford will welcome you back no prob.

When I looked yesterday morning it was at 76.202

This morning it’s at 76.187

Family of man murdered in China claims accused killer used victim’s funds to buy millions in B.C. real estate.

Just a little bit of cash… $113 million dollars.

https://biv.com/article/2018/07/family-man-murdered-china-claims-accused-killer-used-victims-funds-buy-millions-bc

I wonder how many more open aired laundry stories will pour into the Supreme Court of BC in the next few years. I really hope the CRA follows up with some audits to track this money flow and tax it.

Why can we no longer delete?

http://markets.businessinsider.com/news/stocks/canada-boc-interest-rate-decision-july-2018-2018-7-1027358859

Loonie climbing on interest rate increase.

Previous sale 03-Feb-2017 for $367,500 (prior to reno presumably). Owner is still looking for a big return IMHO. Assessed at $532K, unclear how much of reno is built into that.

As expected BOC raised a quarter point. Banks should follow quickly raising their prime rates and that impacts everyone’s variable mortgages and other Variable loans.

Some slashes for the under 800K club (with suite/suite potential) which I follow:

4150 Hawkes ave 34K slash from 749K to 715K

3137 Harriet – 739K to 709K to now 699K (needs some updating but has a suite)

Very nicely updated duplex on 828 ellery st – started at 699K and now is 675K

571 normandy in royal oak 749K to 725K

And my favorite of the bunch 1075 Gosper -50K slash; was 849K and now is 799K

I know prices slashes aren’t indicative of anything but somehow they still make me feel good! Curious to see how the interest rate plays out in a couple hours here.