June Market – Slowdown gains steam

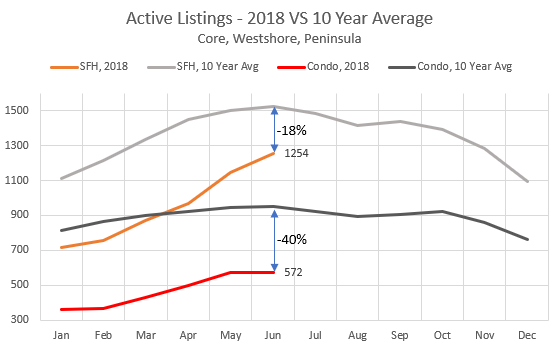

A preview of what’s been going on in the market before the official numbers come out tomorrow. On the listings front, the number of single family properties available for sale continued to climb in June. There were 109 more properties for sale in June than May, a time period where listings are usually relatively flat. You can see from the comparison to the 10 year average that single family listings are increasing, going from 35% below the 10 year average in January to down only 18% 6 months later. Condo inventory levels were unchanged from May and still extremely constrained, sitting at 40% below the 10 year average level.

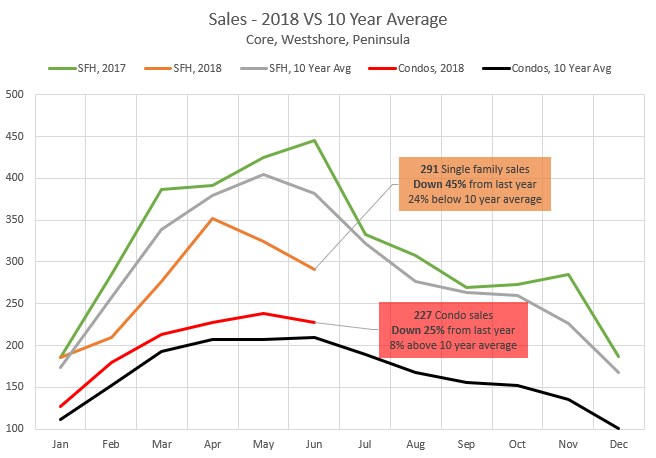

In sales, the picture is quite similar with single family very weak and underperforming substantially to what we would expect this time of year while condos are following pretty normal seasonal patterns. The dramatic dropoff in single family sales since April is quite astonishing especially compared to last year where sales increased in that period. Single family sales are down 45% compared to a year ago and a quarter below the 10 year average. July is usually where we see a steep drop in sales so it will be interesting to see if things really grind to a halt this month.

Foreign buyer data is also out for May, however it seems most of the 30 residential sales to foreign buyers in May managed to close before the May 18th deadline, because the additional property transfer tax was only paid on $1.6M in sales out of the total of $22M in sales volume. May 2017 there were 53 sales to foreign buyers, so sales are down 45% and sales volume slightly more due to a drop in the average sales price. These aren’t big numbers either way and not nearly enough to explain the large sales declines in the overall market but I expect another drop once the June numbers are out. I doubt we will see much more than 20 sales to foreign buyers per month in the future.

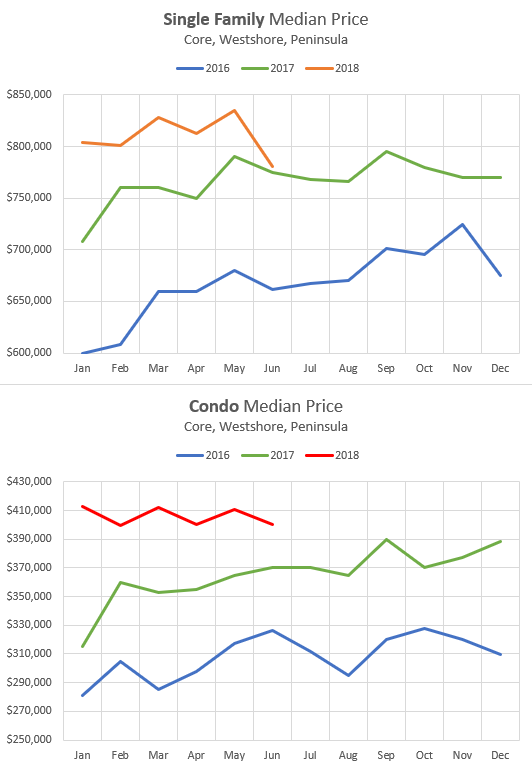

Prices are also down this month, with the median single family house dropping to $781,000 and the median condo coming in at $400,000. It’s a big drop for detached houses but remember that monthly prices fluctuate quite a bit month to month so do not be surprised if the single family median jumps back up a bit in July.

It seems clear that prices are at best flat and potentially starting to see some declines on the detached side which isn’t overly surprising given the weakness in sales in the last two months. What is surprising to me is that condo prices have been flat as well all year even though sales have not dropped as much and inventory is still extremely tight. It seems that either condo buyers are cautious about what they’re buying and focusing more on the lower end, or the stress test has forced them there.

How will the numbers be spun this month?

I love Marko. He’s very confused.

Closer look at prices in June: https://househuntvictoria.ca/2018/07/06/whats-going-on-with-prices

Santa’s anonymous unsolicited advice to Marko is STFU. LOL

Do you believe in Santa….. ??

The market is soften, imo $1.5M+ is slowly becoming a buyer market.

What happened to 1377 Hampshire Rd (MLS 394736) Price List$1,190,000 / Price Sold$1,426,000 / DoM 6? Bidding war??? Is it because the Lot Size SqFt 10,317 can be subdivided in OB?

Thinking that home ownership in Canada will soon be for the 1%, 5%, or 25%, and further, that it will stay that way henceforth, is IMO, just not realistic.

There is a big difference between home ownership and SFHs in the core of one of the most attractive places in Canada (one of the best countries in the world imo). Long term SFHs in the core of Victoria become a smaller and smaller percentage of overall housing inventory.

My theory as I’ve discussed before is as the population grows the absolute number of top 5% income households grows; however, the SFH in the core inventory does not. If the population of Sooke goes up and you need to hire an additional general surgeon at Vic General the odds are she or he is leaning towards the core in terms of a home purchase, not Sooke.

I think condos and property values on the Westshore will be far more elastic long term.

BTW I’m not a fool…I know better than to give out any personal details on the internet.

I asked the question because right off the bat based on your post I knew you wouldn’t give out any details….aka you aren’t an experienced developer.

If that’s the case you should be concerned about how poor predictions can undermine your credibility as a realtor

Fortunately, my clients have enough common sense to know that I can’t predict the market; however, I will continue to predict along with everyone else on the blog even if it means having poor predictions on record. Does not bother me one bit.

If my realtor tells me that single family homes in a city with under 500k inhabitants and an average family income of 90k CAD will forever be reserved for the top 5% even in the face of massive social, political, and economic policy changes you bet your behind I’m laughing on the inside and finding another realtor as soon as reasonably possible

You do realize REALTORS® merely care out transactions and have zero influence on the market? The fact that a REALTOR® has an opinion as to whether the market will go up or down is not correlated to his or her ability to carry out a transaction. An experienced developer would have a grasp of this simple concept.

As far as my long term opinion….feel free to call me out when an average family can afford an average SFH in the core.

Is there enough money in posting Tesla videos on YouTube?

I picked up a listing yesterday where the seller didn’t interview any other REALTORS®…..”Feel like I know you, I’ve been watching your videos for at least 5 years.”

So apparently there is money low budget YouTube videos.

As for the Tesla….100,000km…gas 1.54 a liter…haven’t serviced it once…battery at 99%. Don’t regret it one bit.

Part of his job to an extent, is to paint the good picture. The general public would probably believe that “5”%” claim right now. So, whatever. The problem more comes when someone has spent a lot of time in a different social system with very different RE market histories, then repeatedly supplants those market observations onto a RE market like Canada – “Because I see it there, it’s reasonable or likely for it to occur here too”.

The history of feudalism in European RE markets goes back for a millennia; it has no real presence in Canada. Thinking that home ownership in Canada will soon be for the 1%, 5%, or 25%, and further, that it will stay that way henceforth, is IMO, just not realistic.

Just to be clear Marko, you’re allowed to do whatever you want. I was just offering my unsolicited opinion. You responded, so I’m assuming you care what others think? If that’s the case you should be concerned about how poor predictions can undermine your credibility as a realtor…that it’s not really the realtor’s job to offer financial advice is irrelevant really. You should be obsessed with perception. If my realtor tells me that single family homes in a city with under 500k inhabitants and an average family income of 90k CAD will forever be reserved for the top 5% even in the face of massive social, political, and economic policy changes you bet your behind I’m laughing on the inside and finding another realtor as soon as reasonably possible. If you want to pull a Bernanke and announce publicly that you don’t buy the premise you go ahead and take that occupational risk. Is there enough money in posting Tesla videos on YouTube? Again, my unsolicited opinion so you need not respond.

I just want to make it clear that I have nothing against you personally. You seem like a swell fella.

BTW I’m not a fool…I know better than to give out any personal details on the internet.

It’s freaking Europe. The few SFH in the core areas of the big cities have always been for the wealthy. Here’s what you can get out of town in Germany, and remember no place is far from the big cities:

https://www.rightmove.co.uk/overseas-property/property-73231271.html

Hawk I had the stuff in Ontario. it is shit. No where near real ice.

Great video.

LOL… get in the 21st century there bud !

https://www.hockeyshot.ca/pp-hs-synthetic-ice-a/632.htm

You can get your own zamboni too gwac. It’ll give you something to do in old age. 😉

https://www.youtube.com/watch?v=EIivDD7UaUw

Hawk

Whether its fake or not no idea. if real you just need a hose and shovel. That’s what we used on our outdoor rink.

Enjoy the weekend Hawk.

0.7%. Up a tiny bit from 0.5% but still stupidly low.

Also there was the stress test for insured mortgages introduced start of 2017. That took a bite out of demand

RenterInParadise,

Great info! What about areas other than Cordova Bay? Any great, family-friendly neighborhoods else where? We are new-ish to Victoria and looking to buy, but haven’t narrowed the search to any specific region.

Did you just fall off the turnip truck gwac ? It’s called “fake ice”. Did you not stop and think “where’s the zamboni parked ? ” . 😉

Does anyone know if there been any change in the vacancy rate? I would think that prices would have a strong floor until we start having some change in the ability of rentals.

Also don’t be naive…never publicly announce your RE predictions…especially if you’re a realtor. Take care.

So, because I am a REALTOR® I am not allowed to participate in the prediction challenge we have on the blog every year? I’ve been very wrong the last few years and I don’t see people chewing me out as most people have enough common sense to know that no individual can predict the market with any sort of accuracy.

I’m generally a housing bull, but as a very experienced developer I can assure you that prices can fall anywhere and for myriad reasons.

Are you going to disclose who you are and the developments you’ve been behind? If not, all I can be assured of is that you are possibly neighbours with Hawk at the Oak Bay Beach Hotel.

And your anecdotes about Europe reflect a decade of aggressive QE and very loose regulation and not anything fundamental about the population’s attitude about housing.

SFHs in the core of large desirable Euro cities have been unaffordable for decades, not a decade.

Are foreign buyers dominating the Canadian RE market? Are foreign buyers going to prop up the real estate market from here on in? While we don’t know for sure, this chart might be a bit suggestive…

Marko…

I’m generally a housing bull, but as a very experienced developer I can assure you that prices can fall anywhere and for myriad reasons. And your anecdotes about Europe reflect a decade of aggressive QE and very loose regulation and not anything fundamental about the population’s attitude about housing. When the cost of money decreases the rich get richer. When lending practices get looser, the rich get richer. The central bankers of the World have encouraged a form of modern day feudalism to take root and I’m worried about the consequences. I hope I’ve accumulated enough money to stave off the pitchforks. Also don’t be naive…never publicly announce your RE predictions…especially if you’re a realtor. Take care.

I don’t take anything for granted these days. I suppose the next question would be whether or not EU items which travel through the USA will be subject to US tariff on their way here.

Via Steve Saretsky: “There are 2 bedroom condos now offering cash back to buyers. Crazy how quick things have changed.”

What hotel in Oakbay sold for 25m.

The only one I know is the one on the Ocean and it is own by debtors from the bankruptcy. 50 to 100m value.

Me thinks someone spreading BS.

I don’t think that demonstrates much, other than house price inflation is currently a global issue. As long as there’s a huge pile of desperate fiat looking for somewhere, anywhere, to hide and get yield, some of it will end up in RE. My concern with that is it helps promote more violent boom and bust cycles in housing, which is not good for any economy. However by the same token, that type of remnant/holdover feudalism you see in some areas of Europe isn’t coming to Canada, the United States or Australia.

That depends what you mean. If we’re talking about constant dollars over time, I don’t think that’s likely with interest rates being where they are. But as a portion of income devoted to housing, I suspect we’re going to be seeing a downward trend for a few years, before it inevitably starts going back up…save some calamity. I suspect that growing affordability will be seen via lower prices, but there are other ways it can happen.

I can’t believe this is still being raised as a reason for the current prices, or as the reason that prices will not ever reflect local incomes. It’s certainly a relevant force, but to say that’s the dynamic is just a bad argument, IMO. Retirees moving here is nothing new, but extraordinary prices on an Island away from your friends and family isn’t a selling point for everyone. If they’re cashing out from a bubble city, their ability to do that is forever dependent on a buyer giving them that exorbitant price. I don’t see any evidence of some newfound silver wave coming over us, especially not with sales volumes in the entire region plummeting so rapidly.

Yes. And places like Oak Bay, Ten mile point – these aren’t those areas and I don’t see that ever changing. Every city should have these areas, IMO. But not every area in a city can be like that over the long term.

This is a point that I personally have been making for some time: household incomes in Victoria do NOT support the housing prices in Victoria. This is evidence of a bubble and the government policies, as drastic as they may seem, are designed to deflate this. If they don’t work, other measures will be brought in. Eventually, prices will fall significantly to bring us back to the historical average – reversion to the mean.

I’ve been travelling quite a bit in the last few years and it is a common trend I’ve seen. If it is a desirable place local incomes do not support local housing prices.

The market will go up and down but the long-term trend of SFHs in the core in my opinion will be top 5% of household incomes or generational wealth.

Eventually will have to accept a townhome on the Westshore as the new upper middle class as I don’t even know if the true middle can afford a new townhome out there.

I am not say this is good but as the population grows the absolute number of the 5%ers increase but the inventory of the core stays essentially fixed. Despite the trend to work from home, etc., the desire to live in the core remains a constant it would appear.

Doesn’t matter how they get here. Tariffs depend on where product is made. Reason should be obvious.

As long as some locals are buying, some prices have to reflect local incomes. I haven’t seen any evidence that those buying with other means are anywhere near a majority.

just heard a story. a foreigner who does not live her brought a hotel in oak bay for 25M…. both agents and mortgage agent made a killing on commission etc.

tons $$ got laundried here via real estate in YYJ , people started to noticing them now…

Victoria Born:

You are absolutely right that household incomes in Victoria dont support the average price. But a significant part of the housing market is composed of people from outside Victoria. As long as there is a steady stream of retirees who seem to be buying for cash

(and I vaguely remember from one of Leo’s charts that about 25% of purchases are cash)

then one would not expect the Victoria market to reflect local incomes. In some areas, such as Oak Bay, I would hinder a guess that half the purchases are out of town.

Victoria Born

If only things were that simple. They are not. Core SFH in the future will be reserved for those with large incomes or large savings. Condos /renting and commuting for lower income people. Hey keep the fantasy alive believing we are in for a huge correction. The boat on Oakbay affordable homes left the port.

What the government is doing is not changing demand but delaying it. You may not like what happens in the near future when the delayed demand gets back in.

RBC Reports [re; Victoria]:

“The share of household income required to cover the costs of ownership of a typical home ballooned from 48 per cent in mid-2015 to 62.7 per cent in the first quarter” of 2018, said the Housing Trends and Affordability Report from RBC Economic Research, released Wednesday”.

This is a point that I personally have been making for some time: household incomes in Victoria do NOT support the housing prices in Victoria. This is evidence of a bubble and the government policies, as drastic as they may seem, are designed to deflate this. If they don’t work, other measures will be brought in. Eventually, prices will fall significantly to bring us back to the historical average – reversion to the mean. One need simply look at the luxury high end market to see what is happening there which will eventually erode the upper middle, middle, lower middle and starter homes.

The TC article suggests that listings [sellers] are dropping rapidly when the opposite is true. They also don’t even touch on the fact that the 2018 “hot” spring selling season was a dud in Victoria.

This is actually a really reputable seller. National Energy Equipment (a different vendor) put this on a quote: “*** Prices may be subject to change at any time if impacted by tariffs and surcharges beyond the control of NEEI. ***”

Yes, but the stuff we get here very often comes through the USA. If it’s not manufactured in the US then is it tariff-free? For example, Zehnder USA is the only way to get units here in Canada, even though they’re made in the EU.

You want the government to buy housing at today’s ridiculous prices, and then sell it back to a few lucky members of the public at lower prices, subsidized by all the other taxpayers who aren’t in on the deal?

I have a better idea. Why doesn’t the government just try to bring prices down instead of trying to push them up?

Received an email from a mortgage broker offering a $500 gift card if I send a client that purchases, their way.

Why don’t we have the NDP buy up a bunch of the housing inventory, then resell the property at an affordable price to taxpaying locals, while carrying the mortgage for a 25 year or 30 year term to help recoup some of the cost ?

QE for the housing market…

Marko what’s really going on out there

A wonder how much a hockey rink devalues a place. Electrical bill must be nice

On the market for $2.55 mill or rent for $4,000/month -> http://www.thepropertymanagers.ca/view-rentals/excecutive-furnished-home-on-bear-mountain-w-indoor-hockey-rink

There is this website: myrealtycheck.ca which shows prices adjustments. Through a realtor also.

The investor immigrant program was canceled under the Conservatives and has not come back. Also note that China ranks 3rd in source countries. 1st is Philippines which means that it’s far, far ahead per capita and also that being a millionaire doesn’t get you in.

And yes I know the Quebec IIP is still around but the numbers above include Quebec.

@ Ian

““More than a third of Chinese millionaires want to leave China, here’s where they want to go””

And Canada’s their third choice as a place of settlement. Justin surely thinks it better to have Chinese millionaires than deadbeat Canadians who cannot afford a house, so welcome millionaires all to Canada, a state but not a nation.

“I just hope that moron in Ottawa was smart enough to chose goods that we have other countries to get those items from.”

Here are some of the items:

Cups for use in the manufacture of candles;

Ferrules for use in the manufacture of pencils;

Fish egg incubators and parts thereof;

For climbing or mountaineering;

Identification bands for migratory birds;

Pigeon countermark leg bands;

LOL. Looks like leg-banding pigeons could get more expensive.

Great statement. Implies that tariffs are coming without actually saying they are, implies tariffs were supposed to already take effect but perhaps somehow didn’t, and urges people to buy now by giving the true yet meaningless statement that heat pumps in stock are tariff free.

A+ for effort.

Don’t see anything drastically wrong with it. I think the reliance on the benchmark as the correct measure of prices is misleading and they don’t emphasize how drastically the market has slowed down, but there is nothing blatantly incorrect in there like last month.

CS I know what is going on with the Tarrifs. I just hope that moron in Ottawa was smart enough to chose goods that we have other countries to get those items from.

Tariffs?

Windows, heat pumps, cars …

There is a window factory on Vancouver Island:

http://www.thermoproof.ca/about-thermoproof-windows

Heat pumps made in USA are mostly lower quality, inefficient, and noisy. All the good heat pumps are Japanese brands.

American made cars will cost more soon than the better quality Japanese models, so Canadians will buy more Toyotas, Nissan’s, Hondas. Guaranteed these manufacturers will start a serious marketing campaign to capture more market share when the auto tariffs start.

Canadian made autos:

https://www.ic.gc.ca/eic/site/auto-auto.nsf/eng/am00767.html

The point is, it’s a globalists marketplace these days; tariffs will just isolate the Made in USA products. In the 1950’s we had to buy American, they were the only manufacturer of many products, but those days are long gone.

@ GWAC

That can be the purpose of a tariff: to raise the price, thereby increasing the incentive for domestic production.

However, since we are imposing tariffs on the US only, the effect will likely be to divert demand to another foreign supplier, so the price increase won’t necessarily be commensurate with the tariff.

Canada had to chose: either to go along with the US, and join in a trade policy designed to restrain unfair trade practices, or go it alone, while continuing to insult Trump on a daily, if not hourly basis, via the state broadcaster, the CBC.

The Trudeau administration has chosen the latter course, believing perhaps that its best chance of reelection is to run against Trump, not Andrew Scheer.

What Canada’s policy means in economic terms is that we will be outside of the tariff ring-fence that the Trump administration is constructing, the purpose of which is not only to respond to unequal tariffs, e.g., the 25% tariff that China imposes on US automobiles, or the 10% tariff that the EU imposes on US automobiles, but to stem the tide of imports from the sweatshop economies, thereby to boost domestic production (and hence job creation) and wages.

The net result could be further devaluation of the C$ versus the US$, as the US trade deficit shrinks, which will offset in some measure the effect of US tariffs on Canadian exports, while raising the cost of imports, i.e., most manufactured goods that we buy. On the plus side, further dollar devaluation will raise the profits of our resource exporters.

“More than a third of Chinese millionaires want to leave China, here’s where they want to go”

https://www.cnbc.com/2018/07/05/more-than-a-third-of-chinese-millionaires-want-to-leave-china.html

Could this article get it any less correct?

http://www.timescolonist.com/real-estate/house-prices-taking-bigger-bite-of-household-incomes-in-region-1.23358293

AK –

One more consideration – schools. SD61 (Victoria) has just changed the priority order for enrolment at their schools. The change has affected a number of students who were on a pathway at a school not in their catchment. SD63 (Saanich) has not changed the order of priority for enrolment so it varies quite a bit from SD61. While the curriculum is the same at the schools, each has a different “flavor” or specialty. If you have school-age children or plan to have children, it helps to understand not only which school catchment a home is in but if you choose to go out of catchment, what does that mean for movements from elementary to middle and middle to high school.

Local

I will make sure there always a place for you at Tent city. 🙂

Vanlife is popular also

There is talk! I wonder who’s talking besides the sales person. They don’t seem to be on this list. Oh and of course heat pumps come from places beside the US in any case.

https://www.fin.gc.ca/access/tt-it/cacsap-cmpcaa-1-eng.asp

Your optimism against the odds is intoxicating, Gwac. I’ll let you know if I need the number to that self-help group for losered-out bears, but I just don’t think I’m going to need it. Stupid bears, they all think that don’t they. 🙂

I suspect the 11,000k might be an attempt to sell to a land assembler, but yes, I don’t see any other justification for that number. It’s a little over $1,750 per square foot, which indeed some attached units have sold for…and more. That pre-sale market is just a time bomb, IMO.

Local

That will be Victoria in a few years. 🙂

They find oil of the property?? no justification I can see.

Total value

Assessed as of July 1st, 2017

$2,993,400

Land

Buildings

$2,968,000

$25,400

Previous year value

Land

Buildings

$3,107,400

$3,082,000

$25,400

We are punishing American with tariffs???? Just another tax if we do not have non American suppliers for these goods. End result we pay more.

Old dingy Van West home – 2156 square feet house on a 6270 square foot lot…

$11,000,000

https://www.rew.ca/properties/R2283202/407-w-43rd-avenue-vancouver-bc

Also got this from a heat pump supplier:

“I don’t know if you are aware that there is talk of heat pumps being brought into Canada having a 25% tariff placed on them? We do have quite a few in stock that have not been subject to the tariff that was supposed to take place on July 1st”

AK

> Cordova Bay is gorgeous. … How are the demographics in your area? Are there more young families moving in?

The Cordova Bay / Sunnymead / Broadmead area is an interesting one. There are areas where younger families are moving in and the demographics seem to be changing. Sunnymead around Sunnymead Way / Maplegrove St is definitely a family magnet. Saanich recently overhauled McMinn Park and it’s gorgeous. Lots of areas in the park for people of all ages. Now Firbank Lane on the edge of Sunnymead has a different vibe – lots of suite rentals and I very rarely see any kids out.

Broadmead south of Royal Oak Drive has some large pockets of younger families. North of Royal Oak Drive on say Amblewood & Boulderwood has a different vibe and feels like older families / couples. Amblewood seems to be the speedway from off the ridge and down to Royal Oak Drive.

Cordova Bay is split based on whether you are up on “The Ridge” or not. Similar to Broadmead, there are pockets where you’ll find families. On the ridge, I find there is still a large number of older families/couples. With the new in-fills coming, the demographic should change. I find when I’m up on the ridge, I rarely see young kids out. There are several neighborhoods which appear to be ghost towns. There are 2 big developments coming that will likely change the “face” of Cordova Bay. One is a 4 building mixed-use (retail / condo) on the site of the old strip mall. That one is in progress now. The second big development is at the old Trio gravel pit site. There is a planned community of 385 homes (mix of SFH, townhouses, condos) where ground has been broken. I don’t know what the timeline is on that one but that’s a serious increase in the number of homes in this area.

I rate family friendly neighborhoods based on how receptive the families are to Halloween. My favorite neighborhood in this area is extremely family friendly. While not as close to the water, it is in an area that is easy for transportation. The neighborhood is bounded by Braefoot Rd & Cedar Hill Rd (west & east) and from Mt Doug Cross Rd to Arrow Rd (north & south). The people there know their neighbors & love their neighborhood. Lots of accessible pathways & roadways but tucked in so there is no real cut-through traffic.

Hope this helps.

@VictInvestor 1983

Re: Tariffs

“Are prices really rising immediately?

New Canadian tariffs on American goods came into effect July 1.

@guest_45921

They seem to be correct on the windows issue. Consulting the official list: https://www.fin.gc.ca/access/tt-it/cacsap-cmpcaa-1-eng.asp we find “Doors, windows and their frames and thresholds for doors”

So unless there is some easily obtainable non-US source of door and window frames it seems prices will rise.

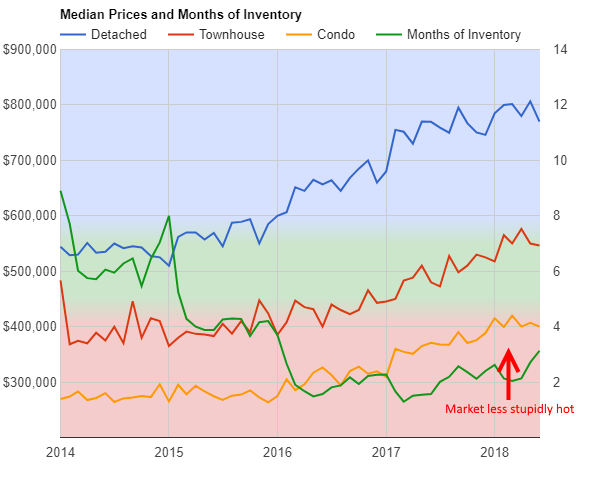

The Months of Inventory (MOI) last month for houses in the premium hoods of Victoria, Saanich East, and Oak Bay increased by 60 percent from May. It has been a long time since we’ve seen 5.3 MOI for premium neighbourhoods. That means more selection but at a median price of just under a million dollars you might think that there isn’t much value to be had at today’s prices.

But what about the remaining areas of Saanich West, Vic West, Esquimalt, and View Royal. The less that premium areas of the Core districts. The MOI for these hoods is still solidly a sellers market with little increase in the MOI from May to June at 2.4.

A median price of $750,000 is keeping this market in sellers’ territory.

Question re: tariffs

Was called by window company yesterday pushing me to commit to our estimate and buy the windows or “tariffs will increase the price by tomorrow”. Pressuring me to buy or are prices really rising immediately?

The phenomenon of sharply slowing sales isn’t limited to Victoria and Vancouver. Updated June stats from the various population centers on Vancouver Island:

Here’s that realtor I posted earlier, with a new update for June. Seems to reflect Leo’s article:

Sales Down ~ 30%

Inventory rising, but still tight

Increasing amounts of price cuts, but the cuts to date are generally small

Homes sitting on the market longer

A lot of recycled listings to mitigate appearance of “staleness”

Sellers are not used to “waiting to sell”

https://www.youtube.com/watch?v=jc7-iiCvTEc

Barrister – I appreciate your responses. Our agent did warn us about what types of listings to expect in that price range, but I think we were in denial about it 🙂 I’m from Victoria but its been a very long time since I’ve called it home. You’ve made some excellent points re: the flavors of the different areas, and being able to rent in the area would be a great option to learn about potential pitfalls (your Songhees comment is very interesting!) TBH I’ve looked into rentals for homes in James Bay and Fairfield but have not had much luck finding SFH’s for rent.

I’m curious to know more about the potential plan for condos in James Bay. Is the land assembly site you speak of close to James Bay Plaza? I can see the domino’s falling pretty quickly once one high-rise is approved. I’m not saying its a bad thing, would just give the area a different feel.

RenterInParadise – Cordova Bay is gorgeous. Years ago my wife’s family friends lived in the area and had a beautiful view. We nixed this area due to commute times, but after our experience this past weekend, we are re-visiting this as an option! How are the demographics in your area? Are there more young families moving in?

Wolf – Great point about quality. We only started looking at listing this past January (obviously we are very late to the Victoria Real Estate Party), but even in the past 6 months I’m starting to notice that listings in our range seem more appealing than when we first started. As an example, MLS 394979 (1932 Quamichan) was just listed yesterday at $950K, but 6 months ago it would have been listed over the million mark. My wifie didn’t quite believe me, but I will make her read your post!

Patriot – The numbers have lost all meaning. Its madness. For perspective, this is what recently sold “over asking” not far from us in Burnaby:

https://parveensandhu.com/featured/111-6878-southpoint-drive-burnaby-bc/

Very simple:

Market cooling off, but still in sellers market territory. More cooling will bring it to balanced (green area), then to buyers (blue area) market.

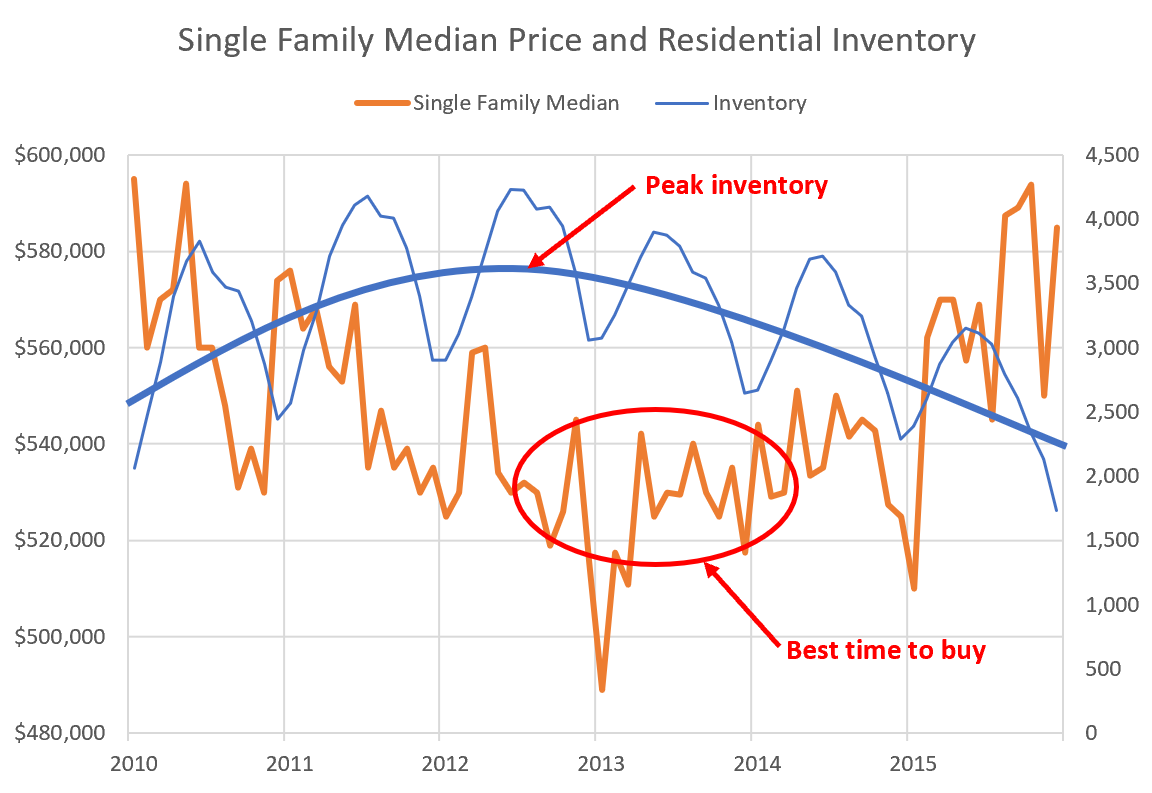

Not a bad strategy. The optimal time to buy in the last cycle was just past the peak inventory. That was the signal that the cycle had bottomed out.

Note that individual neighbourhoods started this inventory drawdown a little earlier than the broader market, and thus the optimal time to buy depended a little on what you were buying (a little earlier than indicated for SFH in core neighbourhoods, and a little later for condos).

Is it just me, or is that a little weasel-wordy?

Aside from the HPI being a poor measurement of price movement, here’s another explanation:

https://househuntvictoria.ca/2018/05/04/musings-on-future-affordability/#comment-43223

Actually it is possible, in the short run at least, for prices to go up with decreasing demand

at the new price level. Bad analogy warning. Last year ten chocolate bars were sold for a dollar each. This year all the chocolate bar sellers pump up their price to $1.20. But at that price there are only six chocolate bars sold. But the six sales convince the remaining chocolate bar sellers that their bars are indeed worth $1.20 if they only wait for the next buyers to come along. Meanwhile new people show up trying to sell the chocolate bars that they have. Then it becomes a question of the classical need to sell as opposed to need to buy. Initially, the mindset is that if Jimmy sold his chocolate bar for a $1.20 then mine is worth the same (or maybe more). The change occurs when the sale of bars grinds down to very few and a few sellers really have to sell (the estate or divorce chocolate bar flavors are high on the list). Then Jimmy sold for $1.20 three months ago, Billy sold for a $1.15 last month and Suzy sold just last week for a $1.05. Suddenly, when a pattern is perceived the remaining bar owners drop prices to get a sale today before the next guy.

And that is why a melting market is sticky on the way down. My wife just made me a milkshake.

Keep clicking your ruby slippers together bearthrilla and your fantasy will never burst. Facts are there are only 3 sales in the new Polo Park development and prices slashed $100K with North Saanich prices down. Reality sucks.

@ Leo M:

“My non-technical definition of a buyers market is when SFH prices have declined each month for a minimum of 12 consecutive months AND after the monthly declines have bottomed-out (+/- 5%) for at least 12 months.”

Yes.

The notion that a buyer’s market is indicated by rising inventory, seems like an invitation to buy on a falling market. In fact falling inventory is surely a better indication of when to buy, since declining supply will, all other things being equal, lead to increased prices.

I’m curious how house prices continue to rise despite cooling demand…

The Vancouver Island Real Estate Board posted this today:

Our June 2018 stats show that home prices in the VIREB area continue to rise despite cooling demand.

Last month, 444 single-family homes sold on the MLS® System compared to 518 in May and 617 one year ago. The number of apartments changing hands last month dropped by 21 per cent, but in the townhouse category, sales increased by 26 per cent.

The benchmark price of a single-family home reached $510,300 in June, a 15 per cent increase from one year ago.

For a look at our comprehensive stats, visit http://ow.ly/fm8j30kNYV9. Prefer a visual snapshot? You’ll find our June infographic at http://ow.ly/isb530kNYU8. #RealEstate #VancouverIsland #ProudREALTORS #HowREALTORSHelp

How to tell when you’re entering a buyers market:

1- You no longer hear the “buy a house as an investment” rhetoric day after day.

2- You no longer hear the “buy a house” rhetoric every day.

3- When your real estate agent calls you see how your house search is going, but was always so busy and never did in 2016.

4- When the mortgage specialist at your big 5 bank calls you to see how your house search is going, but you couldn’t get the time of day from them in 2016.

5- When the mortgage specialist at your big 5 bank proactively schedules mortgage pre-approval appointments for you and then when you’re there and ask how the mortgage business is going, they reply “business is down considerably”.

6- When prolific bulls that frequented HHV in 2016/17 are no longer posting here regularly and/or have since sold their investment properties (you know who you are). People find it interesting to watch an investment go up but lose interest when it’s flat or in a decline.

7- When the VREB uses disparaging terms such as “aggressive”, “dragging”, or “hobbled” to describe anything other than it’s goal of year over year house appreciation. We know they’re always optimistic so these terms probably indicate much worse.

8- When LeoS says so.

Anyone can twist the numbers but you can’t distort human behavior. People will follow the herd and rush out of the market while it’s dropping just as they rushed in while it was spiking.

The funniest part In all of this is the delusion of bears. They always pretend that when the big crash happens they’ll swoop in. We all know they’d never buy because the bottom might not be in yet. A wise man said that when picking bottoms you only get a stinky finger.

The reality here is there’s no crash coming bears. Even if there was you’ll never stop being a forenter.

The foreign buyers tax had an initial impact on “mom and pop” buyers, but most Chinese will just purchase through a corporation to bypass the penalty, Donia added.

http://www.cbc.ca/news/canada/british-columbia/foreign-real-estate-hotspots-1.4734117

Just another reason we need that beneficial ownership registry.

Ontario attracted the most interest with inquiries for $500 million US worth of properties. The top four cities were Toronto, Ottawa, Waterloo and London. That was followed by British Columbia at $328 million US with Vancouver leading, followed by Victoria, Richmond and Kelowna.

I don’t put much stock in these studies though. Much of it seems to be based on views. “Viewing” $328 million in properties in BC is essentially viewing 328 properties which is nothing.

HPI is a farce number made up by agents to keep the pump alive. Prices are flat in Oak Bay, & Langford, down in Esquimalt and North Saanich.

A few higher core sales doesn’t tell the tale with sales falling off the cliff. Damn near all of Golden Head is slashed the past month. That’s not a rising market.

Whatever keeps gwac from bike raging someone is safer for the public tho. 😉

The big drop in the median was driven mostly by sales mix. Of course the market did not drop that much in one month (more on this later). However I equally do not believe that single family house prices are increasing at $10k/month as indicated by the HPI numbers. Flies in the face of all other evidence.

Single family house prices were increasing at that rate in 2016. Market completely different now.

Nope. 🙂 Cycles don’t work over one year. Or two. Or five.

I’ve never liked it, regardless of market position. If the market descended, you won’t ever find me quoting that index to you. Only in BC, as they say.

Cry havoc; the battle rages on. I still have a free t-shirt and cookies for you if you’re interested in turning. I’ll charge Intro 5 dollars for the shirt, but he can join too. Or “she”, as Mr. Soper likes to say. Or “hir”, as the social engineers might put it.

That’s very common right now. If I look at my PCS they’re all over the place, with asking sometimes more than 60% over.

You sound like Mrs. Fool.

Just in fun, guys. Really, it’s okay, LOL

pretty sure she was agreeing that it was just a meaningless downward blip.

Give yourselves a slap, you two. Intro obviously referring to first line: ” …could be a meaningless blip..”

936 Wilmer in East Fairfield, oldtimer/tear down sold for $736K. This one backed into Bank St teardown which sold for $720K (?) recently.

Hey Bears chew on this for a while. lol You guys hand pumping each other. You will be hugging each other at your self help group for home owner wannabes in a couple years. Missing another cycle

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in

June 2017 was $829,600, while the benchmark value for the same home in June 2018 increased by 7.2 per cent

to $889,600, higher than May’s value of $878,100.

Let all hear about how HPI sucks. lol

Can assessed value be this out to lunch? Or is it the seller? MLS 394989 Assessed 768K, listed at 1.2MM. No mention of reno’s.

Nicely put, Local Fool. I too had to do a double-take.

Hawk – take your victory lap. However, I suspect you will be doing many of them before all is said and done, so get your carbs in.

Oh, look – CBC is catching on:

https://cbc.ca/news/canada/british-columbia/july-bc-real-estate-numbers-1.4733389

And the TC [this is a good one]:

http://timescolonist.com/real-estate/greater-victoria-real-estate-market-sees-fewer-sales-1.23357257

June is not a blip – June was the 7th month in a row of falling sales. Inventory is rising. RE may be “sticky” [what economists call downwardly rigid]. Call it what you want – seller psychology is the issue.

And, well you get the point. The data can only be interpreted one way – call it the median price, the mean or the mode – the “song remains the same”.

James Bay thrifties would be a good spot for a highrise, but that grocery store is critical to the neighbourhood. Downtown is a desert when it comes to sensible grocery stores. Everyone would have to drive or bus to Uptown and that corridor is bad enough at 5-6pm.

um Intro…did you just…say that? Rub my eyes, squint a little, look for other possible interpretations…Next thing you know we’ll have Gwac join in, and it’ll be a giant echo chamber of those creatures you posted. The horror. Certainly would be more boring.

When virtually no one thinks it’s a good time to be a bear, it usually is. When no one thinks it’s a good time to be a bull, it usually is. I suspect if you walked down Douglas street today doing a random poll, almost no one would have an awareness of the market changes happening, and even fewer would say they expect prices to ever fall meaningfully. Most everyone here is ahead of them in market knowledge.

All RE is sticky going down, depending somewhat on what drove it up in the first place. No one wants less than what their neighbor got. No New Paradigm™, no Armageddon™ – it’s the market at work. Like I’ve said from the beginning, years from now all the old arguments will resurface, be adjusted for present context, and made new again:

The daft, affordability is now forever gone, or the plaintive, the market will never recover. Both of those arguments are as “bankrupt” as the other…pardon the pun.

Definitely could be. Historically, Victoria’s prices have been quite sticky going down. I’m sure we’ll have a good sense of what’s happening at this very moment five years from now 🙂

Leo… I was wondering what the homes in Calgary are selling for compared to assessment …thanks

AK:

Since it seems you are buying your first house and it also sounds like you are from out of town I would strongly suggest that you rent for six months or a year before buying in Victoria. It is important to get a feel for the different areas. James Bay for example is really different in the summer when you have thousands of tourists each day flooding in from the cruise ships, along with tons of traffic, than it is in winter. Other areas have their own peculiar factors. I rented a condo in the Songhees for a year with a beautiful balcony

overlooking the harbour. As the days got longer in the summer I became really aware that I was living adjacent to an airport. Seaplanes look picturesque but when you get one taking off every few minutes in the summer I found it a bit more than just annoying.

Not saying it bothers everyone but it is good to get a better idea of what you are getting into. Also there are some streets that are hidden gems. You might find it worthwhile to wait for a house to show up on the market in one of these enclaves. A house is usually the single biggest purchase for most people and doing your research really pays off.

https://www.cnbc.com/2018/07/04/oecd-employment-outlook-blames-big-tech-for-poor-wage-growth.html

Tell your grandchildren and children to study STEM and Asian Languages.

They’ll be ahead of the game…

I doubt that pretending a property is a new listing in this market works. In this market buyers are likely to be looking for discounts not falling over each other to offer over the odds at open days (especially as they are mostly also sellers). Still it is misleading as you both say.

”What will it take for this website to say there is a buyers market????”

My non-technical definition of a buyers market is when SFH prices have declined each month for a minimum of 12 consecutive months AND after the monthly declines have bottomed-out (+/- 5%) for at least 12 months. Anytime after the 25th month is the beginning of a buyers market; especially during this cycle after the massive price increases during the past three years. Late Springtime 2020 will be a defining moment for Victoria real estate. SFH prices are sticky in a declining market, it starts slowly then accelerates (exponential), so it takes many months to change from a seller’s market to a buyer’s market.

Kershac:

Days on market stats from the VREB have always been less than reliable. As the market slows this measure will be increasingly bogus. The public’s low esteem of real estate agents is well deserved. Obviously there are individuals who are an exception but overall and collectively public mistrust is not just justified but has been earned.

@Kershac

Doesn’t make a big difference to anything except days on market which is always a bit lower than reality due to this practice.

Thing to remember is that properties sell for market value. All the lame listing tricks that people try are rounding errors at best in the big picture.

So this guy is betting a pint that prices here will be 20% higher next year. I doubt he’d honor it, and his reasoning is pretty worn out too. Credit cycles don’t generally peak and magically expand from there.

For some reason it reminds me of the more macabre bet that John McAfee made:

“I…predict Bitcoin at $1 mln by the end of 2020. I will…eat my [censored] if wrong.”

One thing I will say, I hope both gentlemen find a really good beer to go with that…

Noticing properties being relisted as ‘new listings’ that have been around since April. Not sure how that influences the stats.

The government web page says only that those confirmed under the BC Provincial Nominee Program are exempt from the FBT. That’s far more limited than work visas in general. No mention of students at all.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/understand/additional-property-transfer-tax

This quote should be on the masthead of the forum. The insanity summed up in one sentence.

How do you find out which property slashed its price on MLS?

Anyone want to win a free beer this time next year? https://www.reddit.com/r/VictoriaBC/comments/8vxigy/single_family_house_prices_drop_significantly_in/e1r8p7d/

One months median doesn’t prove a whole lot on its own. The numbers do jump around.

BUT I would not totally discount a fall of 5.5% (45,000) either. It has been quite a while since we have had a monthly drop of that magnitude. In the recent strongly rising market, occasionally monthly medians would fall by a percent or two but not 5+ percent.

So this could easily be a meaningless downward blip in a market that has flattened, but if I look at other evidence (rising inventory, rising DoM, provincial measures to cool the market, local crackdown on STVRs, national mortgage rules) I’d say this is quite possibly the start of a downward leg in prices. It won’t be a rapid fall unless inventory gets a lot higher though.

Would like to know this as well. They made a change allowing people on work visas to avoid the tax, but what about student work visas (every co-op student)?

Here’s a little bit of analysis on Vancouver detached homes, for anyone interested. Have a look at the chart below, specifically the dark blue line representing detached homes. The run up is obvious, but have a look at the yo-yo-ing over the last few months.

If you look at the green line at each of the peak points I drew, that is called the level of resistance. It is the point where the market is unable to move higher, despite the efforts of all willing market participants to drive it further. As this occurs, gravity gains the upper hand – and participants thinking it’s a “sale” jump back in. This begins to establish the level of support, denoted by the red line. This “support” has nothing to do with income support, or other economic fundamentals. This refers to the point in which market participants are willing to begin retesting the level of resistance. They jump in, and it climbs – but gets struck down by resistance again.

This process can go back and forth as many as several times, but it never continues indefinitely as less and less people are willing to jump in to retest the resistance. The true bearish signal is when and if you see a breech of the level of support, or, where prices drop markedly below the support level. It’s depicted by the light blue line I drew, just as an example, not a prediction. Once the prices descend below that barrier, that generally removes the resistance to further declines.

You can see the resistance and support dynamic occurring very clearly here, and you can also see the level of resistance growing stronger with each retest, denoted by the slight incline in the green bar.

The exponential decrease in SFH prices together with the exponential increase in listings was predictable, as many people predicted. 😉

I pride myself on my arbitrary and capricious decision making.

Correct, and that’s why I’m always blathering on about how unreliable monthly averages are, but prices don’t tend to drop this much in a rising market. In general, median prices will move along with the index. Sales mix does not change all that much in the long run.

Sort of. It is definitely more stable month to month and on par with the quality of the Teranet house price index (which I like slightly better because it is not designed by the realtor association). What I don’t like about it is that it is too complicated for anyone to understand how it is computed, and they will compute values for market segments without a single sale in that market segment for months. Not saying it isn’t a decent guess at prices, but it’s all a little too black box for me.

In Calgary or here? Here detached houses are selling on average 11% above assessment (in the last two weeks) and condos are selling 16% above assessment.

Generally the definition of a buyers market is over 6 months of inventory. We are still quite far from that, with current residential months of inventory at 3.1

However, months of inventory is a lagging indicator. It takes a while for inventory to build out, so it’s not great at determining whether it is a buyer’s market right now or not. For that, the sales to new listings ratio is better. At 54% for June, that is pretty weak. Not the weakest we’ve seen (42% in 2010-2012) but one could classify that as buyers market territory.

I bet the VREB will spin this as a blip pointing out short term factors ie waiting on regs, weather, holidays etc rather than long-term factors that will send the market into a longer-term decline ie rates, capital controls, crack down on laundering.

CHEK news at their finest tonight with a story about a couple from Vancouver who moved to Ladysmith the implication being that hoards of people are coming from the mainland so values will only go up. No mention of decreasing sales numbers, increasing rates. Shameless.

“No it does not. It is just the make up of sales that month. Maybe the distribution changed to sales of lower priced homes that month from the previous month.”

This will be a rarity for you but you are likely correct. The distribution probably shifted to lower priced homes because the higher priced homes are asking too much and the market does not support the asking price. So yes, those higher priced homes will likely sit on the market until they decide to lower their price which, when they do sell, will factor into the new, lower median. But the median is lower.

@AK: Just my opinion (as good or bad as anyone else’s) but wait 6 months and I think, for whatever price you are willing to pay, you will obtain a nicer home then than now. People always talk about prices going up or down but they forget about quality. Prices have been relatively flat or increasing slowly the last couple of months but look at the quality available at a certain price point in 2018 vs. 2017 or 2016. Huge improvement year over year. Although prices are not dropping like a rock you’re getting more for your buck and that is a hidden price decline.

Does foreign sales data include international students and temporary work visas? Its such a gaping loophole.

Entirely depends on what they do, and where they are in their life. Ie: If you have kids, retired, where do they work? etc.

If you worked in the Westshore or at Vic General, I’d give an entirely different answer than if you worked downtown. Same goes with if you had kids (or were planning on having some soon) vs. liking the restaurant scene and drinking. Either way, try to find a place close enough to bike to work and then you’ll at least have that option when Alberta cuts off the oil haha. Seriously though, you can bike to work all year, and it’s a wonderful way to get around if don’t need to drive a vehicle for a living.

Renter in Paradise:

I agree with you that being downtown may be of questionable value. James Bay in particular is targeted for a lot more condo development. Dont vouch for the truth of it, but a generally reliable source says that the owners of the Thrifty plaza are setting the groundwork for a high rise development on that large lot. There is at least one other land assembly that could hold another high rise. Both are waiting until after the municipal elections which I guess is smart.

Hey Leo (or anyone) – are the HPI numbers that the VREB doesn’t have yet a better indicator of the actual house price compared to the Median? Also did anyone see the Single family all other areas Median house price? It went from 704K in May to 599K in June – over 100K drop. There were only 60 sales so I know we need to wait a few more months but wow that’s a big change. Even crazier is its still up 18% YoY haha.

Local Fool:

Over did it a bit on Canada Day?

gwac,

The question is what will you say when it keeps tanking another $45K ? Your panic posts show some serious worry.

There are lots of great areas – just a matter of what his priorities are. For me, I like the Cordova Bay/Sunnymead area but that’s because it’s relatively cheap to be close to the water. Easy to get downtown ( < 15 min.), easy to get to airport ( < 15 min), lots of access roads & ways to get places. 1171 Sunnygrove Terrace MLS 392627. 4739 Carloss Pl MLS 394765 has peek-a-boo views. Lots of easy beach access points and long stretches of walkable beach. Quick & easy access to Lochside Trail to bike up the peninsula or down & onto Galloping Goose. These won't have the same vibe as being downtown but also won't have the same "vibe" as being downtown 🙂

Anyone want to know what you call a housing bear with no ears?

A housing b. 😛

Wow, what a massive fricking spin job ! No HPI or other numbers ? WTF is going on here ? Panic with the VREB price machine cause the numbers don’t look good ?

I’ve read the press release, and I actually thought it wasn’t too bad. I’ve seen worse. IMO, there was a bit of spin here:

Even demand side measures that are not yet live, like the Vancouver/Kelowna/Nanaimo/Victoria-specific Speculation Tax, are dragging the market down as many consumers stand aside to watch what happens.”

I don’t agree with that statement on the whole. Certainly there are folks holding out, but the bigger reason for the broad deterioration, IMO, is that access to credit is drying up, and no one can afford the prices anymore. Mania is dying and people are actually starting to think. This is pretty elementary stuff.

I’m sure they’re hoping for “pent up demand”, but I suspect we’re more likely to see “pent up supply”.

VREB June 2018:

https://vreb.org/current-statistics

Conflict of interest spin intact. LOL.

AK:

Your experience in Fairfield and James Bay is not surprising since you are looking at the bottom of the price range for those two areas. There is still demand for anything that is remotely affordable for local incomes in good areas. 800k is pretty well just the value of the lot these days. I am surprised that your realtor did not explain that anything under a million is basically bulldozer bait in those areas.

You might want to consider some different parts of Victoria that are further out from downtown. Prices are starting to move downwards but mostly in the more expensive areas like Uplands (no dont look there either, vacant lots are about 2 million) and so far not by much.

This last weekend was not a waste of time but rather a good introduction to the Victoria market. If you set out some of your basic criteria for a house, along with your price range, I think you will find a lot of people here will give you some great ideas both as where to look, where not to buy and why, and great insights into Victoria itself.

I bought here five years ago in a much easier market and it still took me eleven months to find the right place.

Okay folks, assume that he has a budget of 1.1 million and he is looking for a modest SFH, what are the suggestions? Lets take a minute out from beating each other up and see if we can help him out.

VREB stats and spin are both out. Basically the sales slowdown is because of the government but not to worry because there is this large herd of buyers who are waiting to see about the new regulations all of whom will flood back into the market soon.

I was in Victoria this past weekend to look at some homes for sale. Last Monday my wife and I picked out 6 listings we wanted to see in Fairfield and James Bay in the 800K – $1.2mil range. On Wednesday our agent sent us a tentative order with times for our chosen six. By Thursday, 2 of the 6 listings had conditional deals in place. On Friday, another one of the units accepted a conditional offer. And on Saturday, during an open house, another unit accepted an offer. Of our original 6, four houses were tentatively bought up before we were able to view them. The days on market for these units ranged from a few days to a few weeks. The units we did get to see were over-priced and under-whelming. No wonder they haven’t sold. I’m not doubting the trends Leo has presented, but from my very brief experience this past weekend, there is still demand out there for decent homes in desirable areas.

Question for those who are more experienced with house hunting than I am (we are first time buyers): We walked by a home which was for sale that had a key box attached to porch. My agent called the listing agent about showing the unit on short notice but the listing agent declined, saying they needed more notice. But from viewing the listing online, it appears the home was vacant and being staged. Is this normal?

@ Local Fool – I am flattered but I respectfully decline the crown, as it belongs to you – the rightful heir to the thrown. I enjoy reading your posts because I find them balanced and objective. You tend to see it for what it is; unlike 2 on this Board [no disrespect intended]. This is not a contest – the data is what interests me and this Board is a good way to discover local sentiment along with Leo S’s insight in to the data. So, LF, please keep up the good work and write until your heart is content.

Yes, when I read some posts here it takes me back to Plato’s Allegory of the Cave. A few here are inexorably chained in front of the wall watching the shadows cast by the flicker of a flame and appear to either be unable or unwilling to see what is in front of them [or behind them, for that matter].

I don’t have anything to grind or a horse in the race. I am objective. When the market turns back up, 2 years or so from now, I will be hopefully ahead of the curve and will tout it. I am confident that is where I sit today. The inherent flaw or crack in the BC RE market [particularly Victoria] appeared 18 months ago. 2016 was unsustainable. FOMO took over in January 2017. There is no gas in the tank now – it is just fumes. The headwinds include massive government policy, BOC mortgage stress test rate hikes, US Fed tightening, rising yields in the bond market [leading to rising mortgage rates], foreign money departing (or pausing to see if the gig is truly up – it will be) for greener more lax pastures, and organized crime (money laundering the opiate drug money) seeing the writing on the wall.

The next nail should come July 11, 2018. Or, I could be wrong – there is a first time for everything. LOL. I love this City – I was born here, but it is not immune to the laws of economics.

So I was fascinated by the recent Comox Valley stats, as I’ve been waiting to see that area turn as it was lagging behind; just like on the way up.

June 2018 had the lowest SFH sales over the last 15 YEARS. 2013 came in a very close 2nd. It’s not until 2002 and 2000 that we see lower sales.

That’s significant, especially considering the influx of people that have moved to the CV in the last few years. Granted, inventory is still in the toilet (just like last year), so don’t see prices heading south yet. Next few months should be an interesting watch.

Any word on what 255 Government sold for, if it sold?

I’ll be cheering falling prices very loudly, but they’re not falling yet. Median prices are volatile.

Whenever I’m projecting my financials out 25 years, I can see it mostly working but I’m not including kids. I want the first within 4 years or so, but it honestly might come down to making a decision between Victoria or kids. And Victoria wouldn’t win.

What’s taking the VREB so long to post stats?? Working too hard on the spin?? Lol

@What The Heck

I have a couple friends that live in Calgary and they come out to BC on vaca from time to time, but when asked, say they would never live on the Wet Coast due to the lack of sun. In the winters, they vacation somewhere warm, and they ski during the winters. Each to their own, but they enjoy it.

Grant.. thank you for your input.. I do value it.. I am an RN and my spouse is a Red Sesl trade., we would not go without jobs first.. I do worry about our kids mostly.., I truly fear for their future here.. it seems dismal.. how to afford housing?? A decent lifestyle.. both my spouse and I were raised in NW Ontario so the weather is not too huge of am issue., we have been here for 10 years .. the Ferry, the insane levels of red tape at every level. The lack of progress… the always having to take the ferry so my kids can compete with their sports.. etc etc.. the grey skies in winter..

those are my reasons.. not everyday.. not too sure what to do.,

Maybe just suck it up and enjoy the view

VB, you have overtaken my verbosity. I hereby pass the crown to you.

Use it wisely. Report the data. And thank you for bringing my attention to “Plato’s allegory of the cave”, because I had no %$#%$* idea what that was when you said it. And now, I do. 😀

https://en.wikipedia.org/wiki/Allegory_of_the_Cave

Hawk

So if next month median rebounds will you come on here and state prices have increased or will you just come on here stating something else???/ Just curious.

Median and average are garbage month over month because of the limited sales happening in Victoria. That is up and down.

Interesting comment from the “Recycled Listings” article. A Vancouver realtor who’s been 15 years in the business says about the current conditions there: “People are having to sharpen the pencil and dive into the sales data to find out where the market is. And it will take you a lot longer to sell. I just sold a house in south Burnaby that took 49 days that I would easily have sold in a week a year ago. It took us three offers before we got it sold. It’s a lot more work and a lot more open houses.”

I’ll be intrigued to see how open houses go here in Victoria. I have noticed what seems like more open houses than a year ago.

And boom, up island has now started to follow the rest of the island’s sales trend. Exception being CV townhomes which I’m sure will fall in line in due time.

Comox Valley:

SFH down 31% from June 2017.

Inventory still emaciated (slightly less than last year and less than 1/2 of where it was a few years ago). If sales are kept down in the next few months, should be interesting to see how long it takes inventory to build up.

Condo sales: – 31%

Townhome sales: + 114%

CV Condos (inventory up 15%) and townhomes (inventory up 100%) have accumulated inventory, in large part due to builders finally building more supply which I hope they continue to do as they are selling at a reasonable price point.

Campbell River got hit hard this month.

SFH sales down 21%. Inventory still emaciated.

Condos: – 31%

Townhomes: -57%

CR inventory seems low but I don’t know that market at all.

Only in gwac’s and Intorovert’s warped world is when median prices are down $50K it doesn’t mean it’s down at all, but when it’s up $50K it’s the mother of all bulls. Hilarious.

STATISTICS

Just in case you don’t know.

“Median” does not mean “average” (or mean). The median is the value separating the higher half of a data sample, a population, or a probability distribution, from the lower half. For a data set, it may be thought of as the “middle” value.

The mean means average. To find it, add together all of your values and divide by the number of addends. The median is the middle number of your data set when in order from least to greatest. The mode is the number that occurred the most often – and is an interesting statistic.

How to visualize the median:

-Put all the numbers in numerical order.

-If there is an odd number of results, the median is the middle number.

-If there is an even number of results, the median will be the mean of the two central numbers.

How to calculate the median:

{(n + 1) ÷ 2}th value, where n is the number of values in a set of data. In order to calculate the median, the data must first be ranked (sorted in ascending order). The median is the number in the middle. Median = the middle value of a set of ordered data.

Based on the data sample, as limited as it may be, we see a drop of $50,000 in the median, as defined above.

RBC HOUSING AFFORDABILITY

Today, RBC released their affordability report – rising mortgage rates are hurting affordability, they say, and they predict 4 quarter point hikes over the next 12 months by BOC. OUCH. Vancouver’s affordability ranking is at “crisis” levels. Victoria is close behind – imagine what full 100 basis point hike in mortgages will cause. RBC writes:

“Our view is that the Bank of Canada will proceed with a series of rate hikes that will raise its overnight rate from 1.25 per cent currently to 2.25 per cent in the first half of 2019. This would have the potential to stress housing affordability significantly.”

“Homeownership costs reached their highest levels on record in the first quarter of 2018 — considered by many as crisis levels,” the report’s authors wrote. “While the situation isn’t as extreme as it is in Vancouver, Victoria continued to experience marked deterioration in affordability in the first quarter.”

Do you really see this as the time to be buying a home in Victoria?

MONEY LAUNDERING & BC REAL ESTATE MARKET [Yes, Victoria too]

VICTORIA — British Columbia Attorney General David Eby says terms of reference are being discussed as the province moves ahead with the second phase of its battle against money laundering.

The first phase was unveiled last week with a report from former RCMP deputy commissioner Peter German, detailing money laundering in the gaming industry.

Part two will focus on monetary transactions linked to the housing market and Eby says he is working with Finance Minister Carole James to identify issues.

Bank of Canada Governor Stephen Poloz spoke to BNN Bloomberg’s Amanda Lang in Whistler, B.C. at the G7 Summit about trade uncertainty risks, rising debt levels and Canada’s housing market.

German says an examination of money laundering within the real estate industry must tackle problems linked to development and mortgages, as well as the sale of commercial and residential properties.

He predicts the second phase will be a “larger beast to tackle,” because he says real estate drives the economy in B.C., while gaming has had less of an overall impact.

German will also author the second report but says his investigation has just begun and there’s no word on a timeline for completion.

Phase one of German’s work, a 247-page report that identified blatant examples of money laundering in Metro Vancouver casinos, makes 48 recommendations and seeks sweeping reforms.

Those include appointment of an independent regulator overseeing the casino industry and creation of a specialized, around-the-clock police force to battle money laundering.

German found at least $100 million has been laundered through casinos but admits the total could be much higher, although without a forensic audit, he can’t provide an estimate.

Eby said last week that casino money laundering was linked to the opioid crisis and could also be connected to real estate.

Thank you for helping me make sense of a very complicated market Leo.

Yes, that’s possible. Sales mix shifts can obscure trends or create false ones. A lot of that was going on in Vancouver. Here, I don’t have any sales mix data from June to challenge that point though.

Leo (or someone), do you know what the mix was? Does it matter? I would think if you’re using median values, a drop would indicate the amount of capital in the market diminished for at least the period measured.

As someone making the move from Calgary to the island I can offer my $0.02 on this. If you have a good job in hand for Calgary, something better than you have now and job/pay is high on your priority list, then it sounds like a good option for you. Taxes are also lower in Alberta. Real estate in Calgary is definitely not doing well – CREB’s numbers show it for the city and anecdotally it took far too long for me to sell my place (a relatively new place and according to visiting realtors showed exceptionally well) We had it listed well below appraisal and sold for even less. The condo market is abysmal because of the flood of new condos that came to the market in the last few years – if you want a condo you’ll be able to get one for a very good price. Culturally and socially Calgary is exceptionally conservative – so if that is your cup of tea then even better. However if you’re more liberally inclined, it can be very challenging, even if your prime social circle is like-minded. The climate change denial here in Calgary is really something to behold. Weather – well, good luck with that. There was more snow and cold this last winter then I’ve seen in many years. November through April was awful, May we still had huge snow piles in front of the house. My family, our neighbors, social circle etc. we were all very worn out by the shoveling, cold, backed up traffic etc. it’s what took up the majority of the conversation. And now we have mosquito and hail season. So, if you enjoy trying to make lemonade from your lemons and like skiing, skating etc., the weather can be embraced instead of fought against. My family has run out of tolerance for the weather and we want out of this damn freezer.

In the valley of the blind, the one-eyed man is king.

Local

No it does not. It is just the make up of sales that month. Maybe the distribution changed to sales of lower priced homes that month from the previous month. . It does not mean that a SFH of the same characteristics in a neighbourhood fell 50k from month to month.

In a meta view of the market, yes it does. What one month’s drop doesn’t make, is a trend. Having said that, we can see that Vancouver detached has had the same trend now for 2 years, which is why I doubt we’re seeing a “blip” over here.

Leo’s update does seem to sound very similar to the data coming out of Vancouver, keeping in mind the typical lag.

Leo, that graphic was pretty tame, and you permitted it to stand when it was originally posted—but today you won’t?

Are you worried it’ll scare off advertisers?

At any rate, your arbitrary and capricious standards have been noted.

It’ll probably take a buyer’s market.

Victoria

This comment just goes to show you have no idea what you are talking about. Median does not mean prices have fallen especially with so little data points. Hey whatever makes you bears happy. Enjoy…

“According to your analysis, median SFH “price” has fallen $50,000 to approx $780,000 – that puts us at or very near the 2017 median price. In other words, 12 months of price gains have been eliminated.”

Fascinating. Thank you for the pre-June-2018 release data. As stated previously, the tape never lies. According to your analysis, median SFH “price” has fallen $50,000 to approx $780,000 – that puts us at or very near the 2017 median price. In other words, 12 months of price gains have been eliminated. The largest gains, as a %, were in 2016. I expect this retracement to continue, but at an accelerated pace due to the policy changes that are clearly having an impact and the expected mortgage rate increases.

However, Leo S, I think your analysis is more telling that you have noted. I appreciate that you are trying to be conservative, but the reality is that 2018 has not provided base support to the “Victoria housing prices stay flat or just keep rising” camp. The detached side of the market [even with price declines] looks out of equilibrium: prices must adjust downward to bring demand back in line with supply.

Supply is a mere 18% away from the 10 year average. The domestic buyer, with the local incomes, can’t afford to buy a SFH – so they look to condos which is why those boxes in the sky are seeing a floor below their prices. I bet you that foreign buying played a much, much bigger role to bring us to this point in the SFH market.

Regardless, the data supports the conclusion that the peak of the cycle is in the rear view mirror. This is not a “told you so moment”, it is just the data. There will be pain when mortgages come up for renewals. Property assessment values must drop.

As Barrister questions, I too am very interested in what is taking place in the $2 million-plus luxury market. I know you are busy, Leo S, so keep up the good work.

Hi everyone… long time reader.. first time commenting… lol.. so spouse and I are seriously thinking about jumping ship and moving to Calgary. Better jobs… more $$$ cheaper housing… etc… minus the comments “ why it’s so much better here.. blah blah” can someone tell me what the average price is above assessment? Ie “ houses are selling approx 10% above assessed.

Thanks

Kershac

More listings would tip it to a buyers market. Still a bit low on inventory but it is starting to move towards a buyers market slowly in my opinion. But frankly I would not rely any on my opinion.

Since the government is committed to making housing more affordable do you think that they are considering removing the land transfer tax?

Dont call it an outhouse, it has been renamed by the city to “Garden Suite” or Garden suite with basement suite potential.

What will it take for this website to say there is a buyers market????

Recycled listings around Vancouver obscure a major market correction

A detached house in Metro Vancouver took an average of 38 days to sell, according to the official statistics. It may appear that homes are selling in a reasonable span of time – but what the numbers don’t tell us is that many of the properties had been listed previously and returned to the market at a lower price.

These “recycled listings,” says David Stroud, chief executive of Mortgage Sandbox, are misleading the public and skewing Multiple Listing Service stats, on which the industry bases its market updates. It puts buyers at a disadvantage because they don’t know how long the property has sat on the market and the degree to which the seller may be motivated to sell.

Skewed data are also failing to give the consumer at large a proper understanding of the housing market, particularly the market for detached houses – which has been undergoing a severe correction since 2016.

“The sellers were in the driver’s seat for a lot of years. Buyers were having to way overextend themselves and took too many risks. Now, the pendulum is starting to swing back.”

https://outline.com/8e8pw9

Gotta say, your toleration of bad spell has increased significantly over the years.

Congrats on being a better people.

Here’s some good gloves to wear:

https://www.indiamart.com/proddetail/stainless-steel-mesh-gloves-14005060073.html