Shadow Money

I talk about affordability a lot on this site, and I’ll say again I believe it is one of the most powerful factors influencing the price of real estate in most markets, including ours. In the end, people buy houses by taking out mortgages, and they pay for those mortgages with their incomes. Many care little about how much the house costs as long as they can swing the monthly payment, but if those numbers don’t work prices can’t keep rising. That’s been shown quite convincingly in the history of house prices in Victoria.

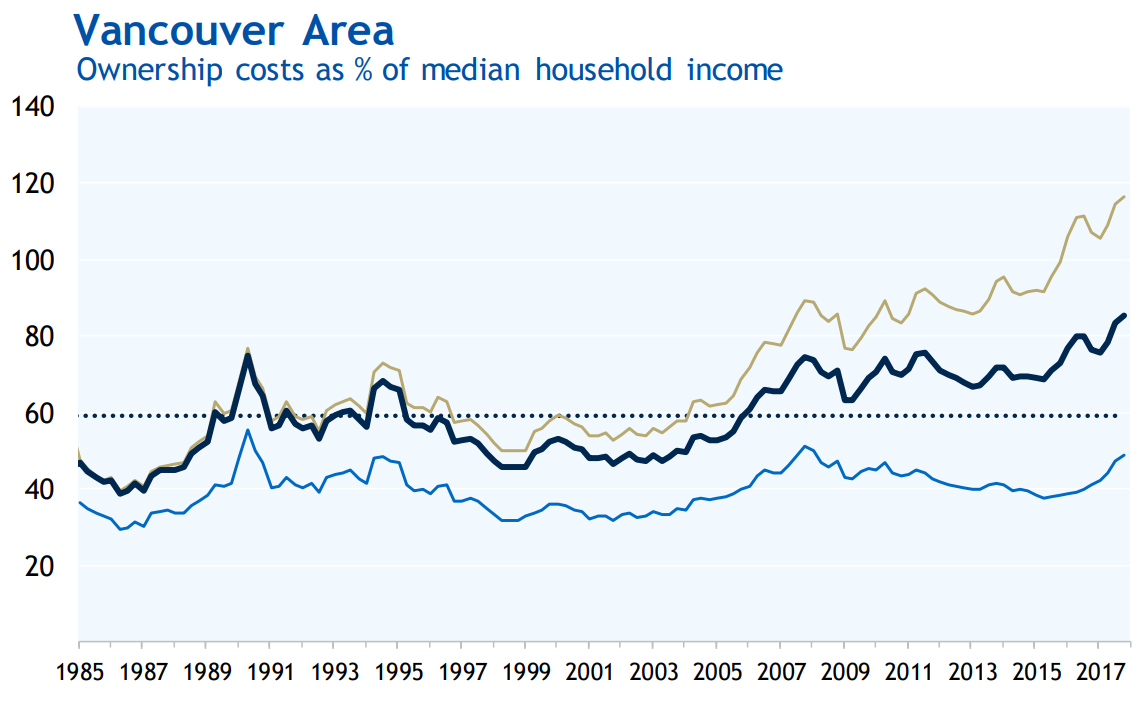

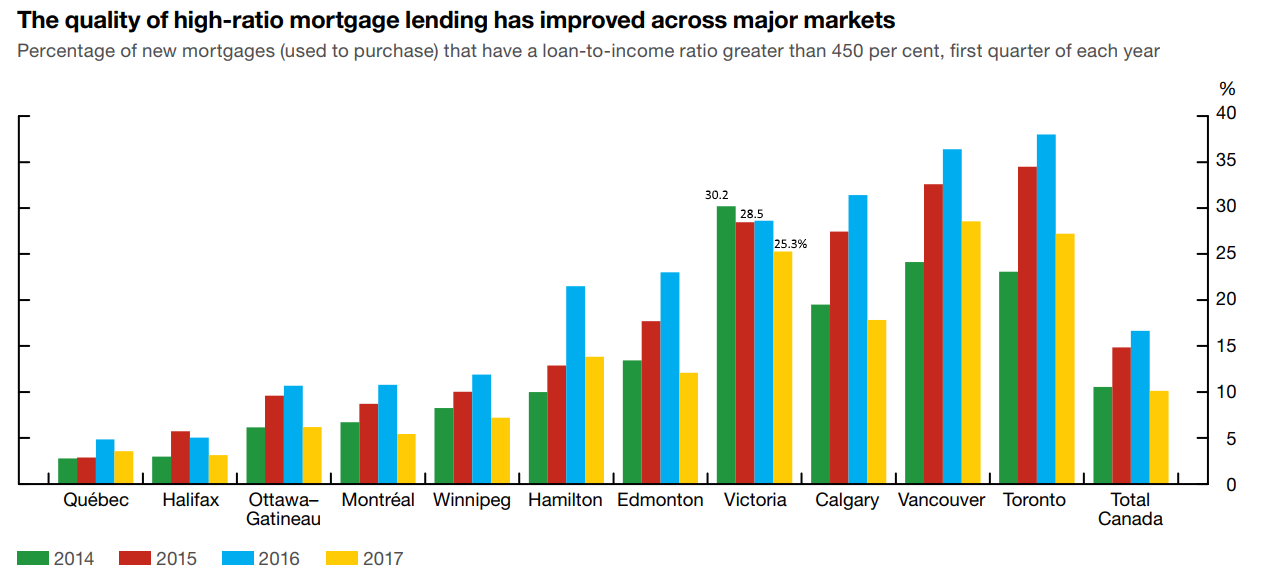

But there’s a snag. It only works when the majority of the money is coming from incomes and those buyers represent the dominant force in the market. If the money is being imported from outside the region or country, or coming from sources that aren’t captured in the income stats then affordability constraints become less important. We only have to look across the strait to see a market where single family house prices have broken out beyond any affordability constraints.

Source: RBC Affordability Report

Vancouver is an example where the flow of foreign or out of town money, speculation, proceeds of crime and other un-tracked funds have combined to drive the market out of the hands of most buyers earning local incomes. Although single family detached houses are expected to become less affordable over time in a growing city due to the rising cost of land, the takeoff in Vancouver has been outside of all reasonable trends.

Recently the government has been attacking this shadow money from several angles:

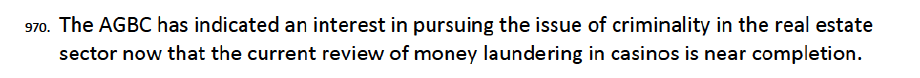

- The foreign buyers tax – 20% extra property transfer tax for sales to foreign buyers which, when introduced to Vancouver in 2016 reduced foreign buying activity (at least the obvious kind) by around two thirds. We are still waiting to see what the impact will be in Victoria since it came in effect in February. Data for May should be out soon and I expect a moderate decline in foreign buying activity. Some people said the tax just drove people to find workarounds by buying through numbered companies and blind trusts, so the province is introducing the

- Beneficial Ownership Registry – This registry is intended to show the beneficial owners of land purchased by companies and trusts. With increased transparency comes the potential to catch those trying to avoid the foreign buyers tax, or even just speculate on land without paying the regular property transfer tax. It should shine a light on who owns what, which given that no one knows who owns half of the most expensive houses in Vancouver, is desperately needed. Still in the consultation stage but if the NDP is still in power I assume this will be created soon. Today we also saw the results of the

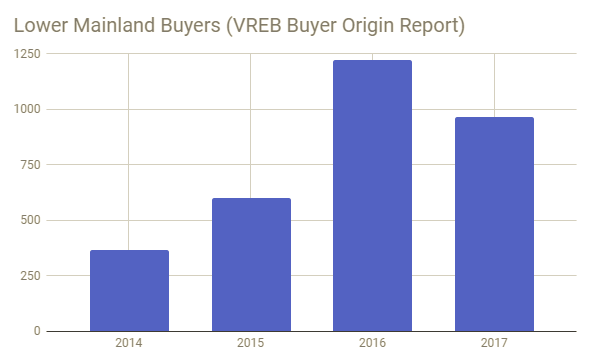

- Money Laundering Report – That 250 page tome showed how rampant money laundering has been going on through BC casinos, and how this money found its way into real estate. Victoria is not mentioned in this report, nor are our small casinos which isn’t surprising. The impact from this report is to blow open another part of the shady underworld of real estate financing and change the attitude of looking the other way. If you look deep in the report, you will find out what the attorney general is setting his sights on next:

Outside of regulation, a rarely mentioned blow to shadow money is coming up in the form of marijuana legalization on October 17th. As discussed in a Capital Economics report from last year, BC real estate is anticipated to be negatively impacted by the transfer of billions of dollars in revenue from the underground market (where it is often laundered through real estate) to the mainstream economy. Legalization should be a net positive to the economy, but it will shift much of the profits to where they can be tracked and taxed.

Will all these measures to reduce the flow of shadow money into real estate mean lower prices? I don’t know but I suspect the impact in Victoria will be minor. This is more about fairness and protecting us from future distortions in the market. Many people are angry about being priced out of their local real estate markets through no fault of their own. Even those with great jobs and incomes have found that house prices outpaced any possible savings and I believe that much of that anger comes from the realization that the system is unfair. How can anyone compete with the flood of shadow money routed through networks of legal constructs and fronts? The fairness in the system is a bigger problem than house prices themselves. A detached house in Vancouver will always be very expensive, but that would be easier to swallow if at least the playing field were level. I am hopeful that we are now moving in the right direction to get there. None of the individual changes will turn the market on its own, but the list of them together is getting pretty long.

June numbers https://househuntvictoria.ca/2018/07/02/june-market-summary/

They’re…. let’s say not so great. Can’t wait to see what the TC writes this month.

Greece is irrelevant, Italy, while a much bigger deal than Greece doesn’t do enough trade with us to do too much if they sank into the Mediterranean tomorrow (about $10 billion/year). Brexit is hot air and hyperbole. The foreign risk sources to Canadian housing markets are IMO, the US and China.

You have one that increasingly looks bent on completely redoing the trade landscape, and that won’t be to our advantage. Perhaps the worst of that will be in our manufacturing core, in Ontario. The bigger consideration may be its rising rates and us getting dragged along with it. Poloz can’t do a thing when all is said and done.

China…well that’s one’s interesting. Their stock market is once again imploding, its gargantuan property market is starting to show signs of serious weakness, their credit cycle is going from stale to downright putrid, their Yuan is eroding faster than Roseanne’s career with capital controls strangling its outflows, and they now face the spectre of a trade war with Uncle Sam.

Not using a “technique” on you Intro, that’s just what’s going on. And it ain’t pretty for anyone, or real estate.

Zero risk? Yeah, forgetting for a moment that you missed out on $300K of gains, you’ve got zero risk today. It’s gotta be a great feeling.

This is awesome because it reminds me of how, a few years ago, info and others were constantly citing Greece’s insolvency as a means of bolstering the argument that Victoria real estate would soon crash.

Good times.

Hahaha clever, not a just Fool after all! If only that one came from the mind of Grant Flanders.

Now everyone, imagine the above said in a Homer Simpson voice.

Grant, this comment is worse than one by Ned Flanders himself. I can’t imagine having you as my neighbor.

Trade wars will spark inflation not seen since 81. We’re talking trillions of tariffs versus trillions of global debt derivatives ready to blow. Keep wishing upon a star. I prefer to stick with reality.

BOE Warns of Growing Risks in Global Debt Markets

Bank of England sees threats to financial stability coming from unease over Italian debts and worries about borrowing in China

“The recent tightening in global financial conditions could be a precursor to a much more substantial snapback in world interest rates and more challenging bank, corporate and sovereign funding conditions,” BOE Governor Mark Carney

https://www.wsj.com/articles/boe-warns-of-growing-risks-to-global-debt-markets-1530094618

Hilarious reading the homeowners panicked posts trying slag those who hold zero risk as the bubble starts to leak its noxious fumes. Saw a lot of “new price” signs out there today.

All their wives will be screaming “why didn’t you get us out when they were lined up around the block and stuffing our mailbox pleading to sell?” “Because I’m a greedy bastard dear.” 🙂

CE,

Sting well delivered. Haha.

Bear evolution

2007 – This, that and the other thing – market’s going to crash!

2009 – Don’t buy, the market is crashing!

2010 – This, that and the other thing – markets going to crash!

2013 – Market is in a slow motion crash. Don’t buy!

2015 – Stick a fork in it!

2016 – Look out below pumpers!

2017 – This pig is done!

2018 – This, that, and the other thing – market’s going to crash!

Also do I need to mention that interest rates have been on the cusp of spiking upwards since 2007.

Looking forward to June’s numbers 🙂

Via Steve Saretsky: Vancouver condo sales fell 32% year over year in June. Fewest sales since June 2012.

That’s what bubble deniers say. If people were actually buying just to have a place to live, there would be no bubble. A bubble by definition is when buyers expect some additional return rather than value of shelter, which is rental value. If someone buys an investment property, it obviously isn’t based on needing a place to live. And a high proportion of sales are to investors, whether they be locals looking for capital gains or foreigners trying to shelter money, or outright money laundering.

You just know that Hawk’s wife rues the day he conjured the brilliant idea of selling because the crash was clearly “imminent.”

That was probably a $300,000 boo boo. Sure hope Hawk likes his job, because even though he’s in his sixties he’s probably gonna be at it for a while.

“Wait, I thought the demand in the Lower Mainland was driven by people needing a place to live. Why have people stopped needing a place to live?”

Think of the chicken and egg – which came first. In economics, no such confusion exists. Demand comes before supply.

They still need a place to live – they can’t pay [down payment, mortgage financing, all the taxes and fees] what the seller thinks they can get for the place – so it does not get sold and inventory rises [sure sign if disequilibrium]. In economics it is called “Say’s Law” – simply put, supply does not create its own demand. Very good chart, Local Fool: it underlines the factual theme based on the true data. You can’t ignore the data (tale of the tape) – the “tape” never lies. The “demand” from the organized crime / money launderer is drying up – so the price tags look pretty foolish.

“I usually skim the first two sentences then safely skip the rest” – YUP, many did that in class too – academic probation first year and then flunked out – good to know both sides, be well read and follow the data objectively – no agenda here.

U’R-A-GENIUS – I am mere mortal. For the record, I am not a pumper (bull) or a bear. I just follow the data and it is pointing one way and one way only. In time, the data will change and I will follow that path too. You don’t have to read my posts – hey, I am fairly new to this Board and just offering some input from someone who has seen a few things.

I just don’t see the drug-dealers saving this one by laundering and pouring the money in to real estate only to have it seized and sold. Once one or 2 are seized and sold, we will see a flood of these high-end listings as they try and flee – but then the taxman is alerted – won’t end well for them. You can be the inveterate cheerleader for them, but I say let them swing in the wind.

Oh look another bear came out of the woodwork today to join the other ultra successful bears. He has his own slogan too. cool.

Feels like 2009 all over again. They are all hyped up and full of themselves. The tears will follow and the angry spouses telling them why did I listen to you….

If I had a dollar for every time someone on the blog said something to the effect of: “The next few [insert time measurement] will be interesting/instructive.”

Let me spoil it for you: by the fall, we won’t have a clearer picture of what’s happening. There never is a clear picture.

I’m really hoping Trump blows up the markets; I want (yet another) super low interest rate when I renew my mortgage!

Whenever I hear about potential economic trouble on the news I say to myself in a Mr. Burns voice, “excellent.”

Bull Evolution

1) I bought a house years ago – Imma genius

2) House prices never going down – Imma genius

3) House prices MAY flatten for a while – Imma genius

4) Maybe prices drop 10%, who cares – Imma genius

5) If they crash, I’ll just buy another – Imma genius.

Bear, bull or halibut I think everyone can agree buying a house without an inspection is just asking to get a large diameter pipe up the hooha. I like Barrister’s idea of regulating it, but it’d need safeguards – e.g. if a traditional inspection isn’t part of the original offer then the buyer can only back out of the deal if the “regulated inspection” finds issues requiring remediation that cost more than x% of sale price. This way it’s only ever leveraged for houses with major problems. The subset of items for a regulated inspection could be scaled back to mold, structural integrity, roofing, main electrical and main plumbing.

I have been on here a long time—long enough to have seen the global financial crisis only reduce prices in Victoria by around 5%, before they increased 40%.

But the main point I wish to make is that it’s all well and good if prices fall in Vancouver, but if houses still cost $1M+ after the decline it’s not going to make much of a difference for most of humanity seeking home ownership in the Lower Mainland.

I usually skim the first two sentences then safely skip the rest.

Trump about to blow up the markets. EU $300 billion car tariffs alone. Keep pumping pumpers.

Renter

The value of the realtor was telling you the truth. Put in conditions and there was zero chance of getting the house. Stupid time but unfortunately playing the game made buyers do foolish things.

Total sales and inventory, all types, City of Vancouver. You can see the lift the attached segment is giving to the market, given the repression currently plaguing detached homes. However, as we’ve heard, the sales activity in condos has recently turned sharply negative – down 40 to 48%. But the real issue is the steadily rising inventory. Some of it’s seasonal, but you can see in the YOY that this year is not like the last. Is this a RE cycle at work, or statistical noise?

On residential real estate they really should change the law and allow everyone a three or four day business window to conduct inspections. It is outrageous that the government has not done this a long while ago. In my mind any inconvenience to the seller is outweighed by the need to protect the buyer.

Gwac, I’m not the best, I’m the most verbose (Though, VB is rapidly chipping at my throne). I actually bash foolish financial choices. I believe the market is where it is because of that foolishness.

It’s true, the trend has not gone on long enough to completely support the “it’s broken for sure” position. So we say, “follow the trend unless you have clear reason to think that trend has been broken”. What we’re seeing could be just a blip, and then onwards and upwards.

I don’t believe that will be the case moving forward, but all we have to do is watch for a few more months. By the fall we should have a much better picture. And if I’m wrong, think of all my juicy little quotes you can repeat back to me, and have a good chuckle while I ferment in the depths of my outhouse. The real scare is if I manage to climb out and say…I told you so.

Not in a price range. I was actively looking for a house these last 4 years and yeah made subject-to offers and most of the houses I looked at did not do a 4 day sale. That seemed to be the last year or two but certainly not in late 2014/2015.

Missing the point. What’s the value of the “expert REALTOR” when they keep telling you to not do subject to offers? When they tell you to “get in on it NOW”. The REALTOR associations love to say how bad a deal can be if you go without a licensed REALTOR. How bad can the deal be if you actually listen to a REALTOR’s advice? Pretty bad I’d say based on anecdotal evidence as in that article.

Local

Vancouver tells the story buy on any dip or pay few 100k more. Most housing markets have cycles all a bit different but have a tendency of repeating themselves.

Local you know as a basher you are the best. I actually would like a drop here just so you can get something. The rest I hope get greedy and miss again.

Renters

Most houses during this period did the 4 day sale. Thursday on the market. Sunday offers. Same process over and over maybe a bully offer here or there but usually followed the Thursday- Sunday.

RiP, that’s no excuse to abandon due diligence. No one is forced to bypass an inspection, it is the buyers themselves that are forcing themselves upon a lopsided and foolish transaction. When the market is behaving that way, that’s a pretty strong signal to back away. Most won’t though.

When houses were selling in mere hours from being offered for sale, there was no time for a pre-inspection.

Actually, the graph tells a story of sales volumes in Vancouver that continue to drop to levels not seen in decades. This has implications for our market as well – even Michael knows that. The market bashing is coming from the data, more than anything. If you disagree, attack that information. If you can’t, you can choose to attack the messenger. People will see right through the latter, though.

You’ve been on here long enough to know that declining sales are a leading indicator of falling prices, if the decline in sales is persistent enough. Hence if the moribund sales pace continues, prices will continue to drop – even the most ardent brand of BC exceptionalism isn’t immune to that inevitability.

Hawk: If there is mold on the premises that was knowingly not disclosed, I do wonder if they might have a legal route to pursue a remedy. Still a good point: Don’t ever skip the home inspection.

Anyone who did not get a home inspection that is on them. Smart people during this period did pre- inspections before the offer.

From Hawk’s linked article about home inspections:

Tempted? REALTORS pushed the no subject to contracts these last few years. McClintock’s membership who are supposed to be “the experts” were the ones telling homebuyers to skip what he is now saying they shouldn’t have. Ridiculous & irresponsible.

Australia is about to allow first time buyers the ability to raid their pensions to buy a home. IMO, this is worse than the 37.5k BC offered to folks in 2016. Australia has promoted their housing bubble at almost every level of government however, and is pretty determined to keep it going. Ultimately, this won’t work and I suspect will just damage some people’s finances further.

https://www.news.com.au/finance/real-estate/melbourne-vic/super-savings-ready-for-withdrawal/news-story/5b818b2ee5f479e10af864b80a3201cb

Another day and the bashers are in fine form. No holiday for you guys. lol

The graphs tells the story of both Florida and LV. Repeats itself over and over. Boom/bust.

Yes you heard it here first. Victoria is not LV but keep that dream alive folks.

Victoria core has how many buildable lots right now that are not ALR. 200 to 500 maybe if that. LV 500,000 or more. Desert goes on forever.

You know what repeats itself in Victoria. The lesson learned to bashers of real estate in Victoria… Over and over.

Are houses still selling for millions of dollars? Yes? OK.

It’s a mystery. The same bizarre phenomenon happened in the USA about a decade ago. Everyone needed a place to live, and then for some reason they didn’t.

In 2007, Las Vegas had one of the most inflated RE markets – did you know that one of the concerns was that they were running out of land? Yes, they actually used that line there, just like everywhere else. They must have found some soon after though, because prices fell over a third.

And a decade later, they’re back above those peaks – anyone want to guess what the explanation is? Hint…it’s trademarked on HHV. 😛

I wonder how many of these stories we aren’t hearing about because buyers the last couple of years are too embarrassed to go to the media to warn others that home inspections are a vital part of buying process ?

I recall some who touted that paying for disasters afterwards was just part of the expectation by passing on home inspections. I think it was an agent who said it too.

Passing on home inspection turns into nightmare for Nanaimo family

“The family’s investigator, James Craig, said he’s learned that over the years the house filled with water, which likely led to the mold evidenced in reports they’ve now paid for.

Mold that makes it impossible for Matthew Noel to live in the home now.

“The whole house is filled with penicillin and stachybotrys which are both toxic molds,” said Noel. “Life-threatening molds and I can’t breathe in there.”

https://www.cheknews.ca/passing-on-home-inspection-turns-into-nightmare-for-nanaimo-family-466110/

Wait, I thought the demand in the Lower Mainland was driven by people needing a place to live. Why have people stopped needing a place to live?

Via Steve Saretsky. Vancouver sales falling into the abyss. Worst since 91 is something worth noting.

Beautiful day out there today; hope everyone gets to enjoy.

I stand corrected and I will roundly beat the neighbor who told me this. My fault for not double checking.

“Barrister #45726

Patriotz:

The bulk of the retirees on the island are coming from Vancouver and we wont mention all the inter provincial transfers that BC has collected for years as a have not province shall we.”

Maybe you misheard? I’m surprised that anyone who even claimed to know anything about it would be so wrong.

All time receipts under equalization, rounded to the nearest $B. Followed by percentage of amount received, followed by percentage of canadian population in 2016

The have-nots

Quebec – $198B 50.5 of total ever paid out/ 23.2% of Canadian population

Man – $46B 11.7% / 3.6%

NS – $44B 11.1% / 2.6%

NB – $43B 10.9% / 2.1%

NF – $25B 6.4% / 1.5%

PEI – $9B 2.4% / 0.41%

The haves

Ont – $17B 4.2% / 38.3%

Sask – $8B 2.1% / 3.1%

BC – $3B 0.6% / 13.2%

Alta – 0 0% / 11.6%

if you want to see in details the last 10 years of most payouts to all provinces under most of these types of programs:

https://www.fin.gc.ca/fedprov/mtp-eng.asp#Alberta

Of interest, the 2018/19 payout

Per Capita across all Canadians $2031

NL, AB, BC, Sask – $1421/per capita – the current haves.

PEI – $4131/pc

NS – $3339/pc

NB – $3881/pc

PQ – $2809/pc

Ont – $1488/pc

Man – $2923/pc

Yukon – $25,836/pc

NWT – $29,666/pc

Nunavut – $42,204/pc

@ Patriotz

“About 45% apparently.”

Oh, OK.

But the largest destination for US auto exports is Canada, which since the formation of the US Canadian auto pact in 1965 has been essentially part of a single N. American (high wage) market. In any case, at $147 billion, or about one third of the US trade deficit, the US trade deficit in automobiles is massive, so it’s hard to see how a tariff on imports would damage the US auto industry as a whole. True, if GM had to build more small cars in the States, instead of importing them from Asia and selling them under a GM badge, they might not do very well in competition with Asian manufacturers such as Honda and Mazda operating in the US. Still US auto industry workers would benefit if a greater proportion of cars sold in the US were manufactured in the US.

Furthermore, the tariffs Trump is talking about are just that, tariffs he’s talking about. If China removes its 25% tariff on US cars, then the US position would presumably change. Likewise, the EU tariff of 10% versus a current US tariff of only 2.5%.

That’s “le Canada”. Sorry for being pedantic, but it goes with the language . 🙂

About 45% apparently. Keep in mind that’s just goods exports. That is, it doesn’t include the value of US technology used when a US firm builds cars outside the US.

https://en.wikipedia.org/wiki/Comparison_of_imports_vs_exports_of_the_United_States

Interesting YouTube talk. She definitely seems new to real estate although that doesn’t mean her thoughts aren’t valid.

I was turned off by her “white people from Toronto” description. I get she was trying to say non Asian but Canadians come in all colours….

( and TO is the most diverse city in the world so maybe some of those Torontoians aren’t t white?).

HAPPY CANADA DAY!

‘I am not soft on crime,’ Coleman insists after damning casino report

Rich Coleman admits the deposed Liberal government could have done a much better job stopping money-laundering in B.C. casinos.

But the former top cop for the province bristles at suggestions he “turned a blind eye” to casino crime. And he insists last week’s bombshell money-laundering report will not stop him running for mayor of Surrey, something he’s still considering.

“I am not soft on crime,” Coleman said in his first comments since the release of a damning report, entitled “Dirty Money,” by former RCMP deputy commissioner Peter German.

“I’ve never seen a perfect government and we weren’t perfect,” he said. “But it wasn’t a question of anyone being complicit or turning a blind eye to anything. Everything we did was in the best interests of the public.”

http://theprovince.com/news/bc-politics/mike-smyth-i-am-not-soft-on-crime-coleman-insists-after-damning-casino-report

That could be a fair point. Thanks. I had thought though, that a lot of what she said sounded familiar compared to some of Leo’s articles as well as a few other realtors I follow online (Saretzky, Bigland and sometimes a few others). She just seemed to have a “tell it like it is” vibe, whatever “is” actually is.

Grant, not sure why you’d call it out as conjecture – that fact is identified in the part where I wrote “IMO”. That’s 99% of this board’s content, including your own. 😀

I don’t expect that Vancouver’s economy is going to be ruined via the housing market or anywhere else in North America. Believe it or not, when housing prices run well in excess of what the economy can support, over the long run, prices tend to be self correcting. I’m not worried about that outcome, I’m more worried about the degree of nicety in getting to it.

The reporting by Sam Cooper and the Globe & Mail both had reported that some of the drug money and foreign money were ending up in the BC real estate market [it is not restricted to Vancouver]. Some here don’t accept that finding. It is linked to organized crime, opioid crisis and housing. The money organized crime can pay for real estate, the more they can launder – think about it (see second link below). See (videos):

https://globalnews.ca/video/4301449/money-laundering-at-b-c-casinos-linked-to-housing-opioid-crises

https://globalnews.ca/video/4292634/b-c-to-create-housing-registry-to-stop-money-laundering

https://globalnews.ca/video/4293564/money-123-is-canada-entering-an-era-of-flat-home-prices

As Local Fool pointed out, German moves on to his second report, namely to opine on whether there is a link between the money laundering and your inflated house price [great article]:

https://thestar.com/vancouver/2018/06/28/real-estate-investigation-is-next-for-author-of-bc-casino-money-laundering-report.html

Keep an open mind and you will be astonished, I suspect, at the link. Our opaque RE ownership system makes us a mark for organized crime money laundering. However you may have deluded yourself in to believing your home is worth millions, it is not – this is an artificial construct partly created by artificially low interest rates, flood of foreign money looking to hide in a safe regime and, yes, organized crime laundering money.

And finally – let’s support reuniting kids with their parents – shame on Trump, that morally bankrupt draft-dodger who Russian put in to the White House. He knows little to nothing about economics and surely even less about humanity.

Viva La Canada – Happy Canada Day !!!!

Listening to this realtor https://www.youtube.com/watch?v=epkkQNy4uKY

This does somewhat match what we saw at open houses in Fairfield and oak bay. So many of the couples we ran into were from out east moving here. I think that probably has to do with the area and costs of those areas with people cashing out there and coming over here. I just found it interesting at the time.

I didn’t see those types of people at a open house on the peninsula or even Cordova Bay. But that is also a small interpretation of what we saw so take that with a grain of salt.

This needs a citation showing a study, research or real world examples of how a RE market ruined a city’s economy and how Vancouver fits the model. Otherwise it’s really just conjecture.

Nice to see Marc Cahodes on the same page as me. This is just the tip of the iceberg as journalists dig deeper than they already have. Leaks will happen as insiders will want to expose the BC Liberals for what they really are. Corrupt crooks.

No probably not, and thankfully, I don’t think we’ll need to. He’s right though, IMO – the Vancouver market needs a very serious, large scale correction or else it will ultimately ruin the economy.

I hope everyone doesn’t mind the news links I’m posting but there is lots of interesting articles today:

“An ex-Wall Street short seller’s drastic advice for saving Vancouver’s economy — and itself”

https://globalnews.ca/news/4306119/marc-cohodes-money-laundering-vancouver/amp/

LOL – file that under “never going to happen”.

@ Grant

“Stop whitewashing the bloodstains from BC’s Dirty Money Laundromat”

And

“Lower Mainland real estate ‘refugees’ head to Vancouver Island for better home values, quality of life”

They could be wrong about the quality of life. The kid next door OD’d on opiates earlier this year.

In related news, I see Christy Clark has just been appointed a director of Shaw Cable. I use Shaw currently. Can folks suggest a more reputable service provider.

Yes, and both accounts will be on either side of the truth which is somewhere in the middle.

@ Patriotz

You think GM wouldn’t “itself” lie if that served its bottom line?

But, in fact, there is no contradiction between what I said:

and what GM said — that higher tariffs on imported cars would:

GM is whimpering about how higher import tariffs on automobiles might affect employment in America by GM. I am talking about how higher import tariffs on automobiles undoubtedly would affect employment in America by the auto industry as a whole, including the component makers, who accounted for the bulk of employment in Detroit, until the globalists decided to trash Detroit, and much of the rest of US manufacturing.

Yes, it might lead to a smaller GM and and fewer US jobs with GM. But if every car sold in America were 90% American made, including the components, as was the case prior to the 1994 GATT agreement, there’d be more US jobs in the auto industry, than would otherwise be the case, whether GM provided more of fewer of those jobs.

As for

Just how many US built cars, other than Teslas, does the US export as a fraction of the number of cars that the US imports? One percent, three percent? LOL

Why am I not surprised the guy who let the owner builder exam get instituted under his watch is the same guy looking the other way on money laundering? https://househuntvictoria.ca/2017/02/23/the-owner-builder-exam/

Maybe. I am not on one side or another, just looking at the issues as they come up. HST reversal was a big mistake, Site C good, pipeline necessary.

Too cynical for me. Both of them approached the issues that they believe are real problems in the province with the strategy they thought would work. Liberals were in power too long and that corrupted them but I don’t think they weren’t out to improve the province. Once the current government loses power some of the changes they have made (limiting money in politics, maybe prop. rep.) will have long standing positive effects.

“Lower Mainland real estate ‘refugees’ head to Vancouver Island for better home values, quality of life”

http://vancouversun.com/news/local-news/lower-mainlanders-moving-to-central-vancouver-island-en-masse/amp

“Stop whitewashing the bloodstains from BC’s Dirty Money Laundromat”

https://www.nationalobserver.com/2018/06/30/opinion/stop-whitewashing-bloodstains-bcs-dirty-money-laundromat

GM itself disagrees with you. “The largest US automaker said in comments filed on Friday with the US commerce department that overly broad tariffs could “lead to a smaller GM, a reduced presence at home and abroad for this iconic American company, and risk less – not more – US jobs”.”

You must keep in mind that other countries would retaliate against imports of US cars. That would leave the US auto industry, which has made huge investments based on NAFTA trade efficiencies, fractured and unable to compete globally.

https://www.theguardian.com/business/2018/jun/29/general-motors-trump-tariffs-gm-jobs

Also, I’d like to point out that saying migrants are people is not claiming moral high ground or “donning a clock of moral superiority”. It’s just common decency. Remember common decency?

@ Local Fool

Thanks for sharing the video, checked it out. She has an interesting perspective and here’s where I also see her logic is flawed. She’s a newbie realtor, sounds like she got her license in 2016. As a newbie, caucasian realtor, with less than 2 years working in the field, she doesn’t have a lot of experience and she’s not going to be attracting the big money Asian buyers. They’ll most likely go to more experienced, luxury market oriented realtors, often with an assistant who speaks Chinese (if they don’t themselves). So it’s not surprising that she doesn’t have any experience with them and thinks they’re not influencing the market. For that type of info, you really need to go to a guy like Alan Angell out of West Van who I believe said 70% of his buyers were/are Chinese. Talk to the Victoria equivalent of him, and I’m sure we’ll get the real picture.

Would love to see the convo on here stay somewhat connected to RE and not delve too deeply into US politics as it’s such a hot button topic for people. Just my 2 cents, thanks.

You know some weird folks.

The family separation policy was wildly more expensive than the previous method of keeping the family in one facility near where they made their claim. They were flying the parents to facilities in Seattle, while their infant was detained in California. Do you think that’s “dealing” with them? The Trump administration is testing their powers of dehumanization.

Josh:

The vast bulk of them are illegal immigrants in the United States and do not qualify under the United Nations definition of refugees. People who don a clock of moral superiority more often than not have very serious character flaws. But I would to hear your plan on how to deal with Trump flooding us with a million or more economic migrants. Transferring America problem to us will certainly put a smile on Trumps face but it would devastate Canada.

Sorry if this already linked:

BC’s Gaming and Policy Enforcement Branch fired workers exposing money laundering. But where’s the follow up. Why no one being prosecuted for protecting the criminals?

What we need is to start sending drug dealers, money launderers and their political enablers to jail for life. Or better still, shoot the scrum.

@ Barrister

“Nobody ever wins a trade war and I have no doubt that we can give the US a bloody nose but we will likely end up with our right arm cut off. ”

That’s a rather broad statement. If Canadian car plants are shuttered and production moved to the states then US auto industry workers, at least, will likely reap a benefit.

Here’s an interesting video from a (I think) Victoria realtor talking about foreign buying on the Island and beyond. I’ve never heard of her before. She seems refreshingly candid, talks about the price run up without pumping or dooming, what in her view caused it, and what factors played roles at different points in the last few years…see what you think. I really enjoyed her insight.

https://www.youtube.com/watch?v=epkkQNy4uKY

A lot of times Josh is the moral conscience on the blog. Respect.

The looney left again has shrewdly chosen cause, taking the unearned moral high ground to lend “support” to an issue with placards and marching and braying but without the chance that one would ever have to become actually involved. This, like the Nigerian school girls, is sufficiently distant to ensure that you appear to be sensitive without the need to get your hands dirty.

Refugees were and are more beneficial economically and tax-wise than those in the wealthy immigrant program. We’ve been talking for months about how the construction industry is in dire need of workers. So what’s your problem?

Calling them “illegals” is callous. That’s not their identity – they’re humans and they’re allowed to exist ffs.

Hawk:

BC has always been known for its corruption but relax I am confidant that it will continue to hold the title. If you take the money laundering out of the casinos you would be removing most if not all the profit. The duffel bags are embarrassing please bring the money in briefcases. The more it changes the more it remains the same.

Great opinion piece by Gary Mason.

Is British Columbia the corruption capital of Canada?

“Is British Columbia the most corrupt province in the country? If there was any doubt before, I think it’s been safely removed now.”

“Many, including myself, have asked: Where was the provincial government? Why wasn’t the solicitor-general at the time, Rich Coleman, all over this? Why wasn’t this issue an urgent priority for the Liberal cabinet of the day? People could see what was going on. These suspicious transactions were being captured on video. And yet, nothing was done.”

“Meantime, the corruption that was evident in the casinos was allowed to spread into other sectors of the B.C. economy, having a direct, deleterious impact on the lives of thousands and thousands of innocent people. Unbelievable.

What happened in B.C. is a scandal for the ages and has likely helped make the province the corruption capital of the country. What a well-deserved honour.”

https://www.theglobeandmail.com/opinion/article-is-british-columbia-the-corruption-capital-of-canada/

And this is why we need to investigate exactly who made what decisions and why. And we need to hold those responsible accountable for their actions. If we dont, then there is no deterrent and it will happen again.

To think we should just move on and not investigate thoroughly is asinine.

http://www.cbc.ca/news/canada/british-columbia/money-laundering-casino-bclc-1.4729146

I was going to comment on how I’ve noticed fewer homes selling at over-ask prices to then be put on the rental market. Found one today though – 5105 Lochside Drive. I believe that one sold for around $1 million and the rental is for $3300. I guess the new owner is looking for price appreciation? I can’t imagine that rent (if they can get it) would cover expenses unless they put down a very large downpayment.

On another note – MLS 394890, 1737 Applewood Place is listed for $889,000 which is exactly what it sold for in April 2017. Someone is taking a bit of a haircut there. It’s an interesting market to watch for sure.

Josh:

Removing Canada from the US safe third country rule; that would certainly thrill Trump to no end and solve a good part of the immigration issue for him. The US would ship illegals up here by the hundreds of thousands and just point them at the border. And if you think Trump would not do it you are really mistaken. And guess what the closet border point is:- BC. You think we have a housing crisis now just wait till Trump discouvers Canada as the great dumping ground. I am beginning to suspect that you are a secret Trump supporter.

Don’t upzone Seattle neighborhoods

Seattle must preserve single-family neighborhoods, one of its most precious assets. Mayor Jenny Durkan should suspend an ill-conceived proposal to triple density in neighborhoods, especially since a city study says that will have little effect on affordability.

https://www.seattletimes.com/opinion/editorials/dont-upzone-seattle-neighborhoods/

Put the hst back in Leo and used the extra money generated for mental illness in the province. 100% behind it.

That tax should never have been taken out. That mistake in caving is on the liberals. No leadership there. Liberals were a maintaince government and really did not show a lot of leadership on a lot of portfolios so no argument there.

The NDP has focused on two issues that are politically motivated. Casinos and housing. I doubt either 2 will have any impact on affordability or money laundering. They caved on the hydro project and really are just doing the bare minimum on the pipeline to keep the greens happy. All in all the minority NDP are doing what they have to do politically to stay in power. To sum it up NDP are just as bad as the liberals in that they are doing SFA To make things better in this province for the real problems that are here. Seems all government have one goal and that is staying In power by giving freebies to their base.

I have 100% respect for you Leo but we will probably disagree on most things.

Josh no one has been arrested or will be from the former government so stop with the BS.

Members of our elected government had a personal hand in money laundering for foreign criminals which had a direct detrimental effect on locals affording housing. That sounds like a conservatives capslock wet dream. But no, because it’s the liberals (conservatives), you’re out here defending by deflection. It really is pathetic.

Victoria march against family separation is today from 12-2pm. This is about stopping the practice of separating indigenous children from their parents (which still happens), and removing the US from the Safe Third Country Agreement, which is the least we can do given the circumstance.

Another gloomy day today

So what do you propose? Reassign every government worker to the mental health file and immediately stop work on everything else?

It is possible to do two things at once. Although I do wonder what your reaction would be if they rolled out a big new mental health support program tomorrow and said they are raising taxes to pay for it. I suspect you will no longer be quite as enthused about doing something about mental health.

You get further if you stop thinking of the issues as black and white. Of course they haven’t solved money laundering, I doubt you will find anyone that will make that claim. However they have made it more difficult and they have made it so the government sponsored casinos aren’t the enablers of it on a large scale while the government regulator looks the other way. I can’t really see how you can think that’s a bad idea.

Your argument here is like saying fake IDs will always be printed, so we shouldn’t care if ICBC gets into the fake ID printing business.

Leo

It’s about a Government who should focus on bigger more important issues. Instead of ones that give it political points to it base but have no real end impact.

They have fooled people into thinking they have solved the laundering issue. Casinos is a small fraction of the problem.

And to score more points and again create no real impact let’s continue on with a probe of real estate.

Consider the source… However if there is actual data behind that claim I’d like to see it. I talk to a lot of construction and civil engineering companies. No slowdown in sight for construction although they would love to have a break.

Talking tonight with a well connected lawyer in Toronto and there seems to be rumblings at both GM and Honda about possible closures of some or all of their Ontario plants. Early stages but serious considerations are underway. I suspect that we are a long way away from that but who knows with Trump.

Nobody ever wins a trade war and I have no doubt that we can give the US a bloody nose but we will likely end up with our right arm cut off. This things do have a way of working out but there is serious risk out there. I am just hoping that the politicians have not painted themselves into a corner. It will be interesting to see what if any impact this has over the summer on the Canadian dollar.

@tomato

The reason your comments keep getting stuck in moderation is that you signed up for an account but are posting as guest instead of logging in. The system gets confused that way. You can either log in to avoid this, or I can remove the account and you can keep posting as guest.

Great example of “whataboutism”. Yes we could make things better, but what about this other unrelated and untenable problem that has no answers? What about that? Shouldn’t we all just sit on our hands until that big problem is solved?

Langford is included in the spec tax

Most of the CRD excluding islands

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/understand/additional-property-transfer-tax/bc-areas

I am just quoting the mayor of Langford who spoke at a Townhall meeting in Oak Bay last night. Perhaps someone who is up to date on this can tell me whether I misunderstood what he was saying.

Doesn’t make sense as the spec tax won’t apply to the Juan de Fuca electoral district.

BC has been a net contributor to such transfers, i.e. a have province, for about as long as they’ve been around as far as I know.

As for the size of Victoria, I’m just commenting on the idea that it’s gotten so big that the government ought to be spending money to relocate things out of the city to elsewhere on the Island, or to attract retirees. About the surest way I can think of to make a government unpopular anywhere else in the province.

Patriotz:

The bulk of the retirees on the island are coming from Vancouver and we wont mention all the inter provincial transfers that BC has collected for years as a have not province shall we.

By the way many retirees from Ontario pay a lot more income tax in BC than your average employed person in the province and that does not include what they spend in the local economy.

But go ahead develop Golden BC as a retirement community for native BC taxpayers.

I am not a real estate booster and I think that a slow moderation of prices would be healthy but I am not sure that people appreciate what a real really estate crash would mean to BC’s economy.

Not sure what your point is about the relative size of the provincial capital, assuming there is one in the first place. Might as well compare the national capitals size to BC while we are at it.

Largest one month median drop in a very long time, plus slashes stacking up hourly, with highest rates in years at the hottest time of the year shows this market is about to begin to crater. Intorovert losing half his assessment rise must be causing some serious indigestion. Bummer 😉

BC is Canada’s 3rd largest province, yet it has the 6th largest capital city. It’s also the smallest capital city relative to the population of the province. To boot VI has less than 20% of the province’s population.

If the government is going to decentralize, it’s going to be to the Interior.

You mean for all those people who spent their working lives paying income and sales tax somewhere else?

Will have to correct you on that one. Inventory always increases in the spring, up to around June, then falls for the rest of the year:

I agree that the combination of decreased sales and increased inventory means that market conditions have slowed by over 50% from the same time last year.

Not doubting this happens, but not prepared to accept it as fact without evidence either.

Absolutely agree there. The shadow money distorting Vancouver also indirectly distorts our market (and that of up island). It is all connected.

After 10 years of analyzing the market I have just become a lot more cautious about my predictions. Thanks for the detailed post.

So that Van Sun article is definitely an RE pump piece. Thanks for posting it LeoS, it’s always interesting to see.

Quick check to the VIREB shows this…

Sales peaked in 2016. Prices didn’t though.

As of May 2018 – SFH Sales:

Campbell River: Sales down 24% from 2016 peak. Now back to 2014/2015 sales amounts.

Comox Valley: Sales down 28% from peak. Still 15% above 2014/2015 sales.

Cowichan Valley: May sales down 26% from peak. Still ~ 25% above 2014/2015 sales.

Nanaimo: Sales down 33% from peak. Back to 2014/2015 sales.

Parksville/Qualicum: Sales have fallen off a cliff. Down 53% from peak. Down 34%+ from 2014/2015 sales.

Now the timing of that article makes perfect sense. The market’s sales are falling significantly in certain areas and the RE industry is trying to pump them back up.

@Grace

Campbell River also has a new hospital as well 🙂

Qualicum Parksville ALMOST makes your criteria Barrister. A hospital is desperately needed IMHO. Comox has anew one . Had to go there once and it seems very good. We could not find a doctor here and after 8 years without one in Victoria I was determined to have one. Got a young doctor in Comox. Almost an hours drive to see your doctor…and I am grateful. He is no longer taking patients.

Completely agree that the government needs to start shifting things around on the island.

Vancouver Island is still a prime retirement spot for Canadians. House prices are not married to incomes when a large portion of the buyers are people with thirty years of savings and capital behind their purchases.

The good news for younger people is that a few years from now the baby boomers will be dying faster than the numbers retiring.

If the government is looking for a solution in the meantime build a good medical school and a first rate hospital up island and a nice planned small town with good theater and facilities aimed towards filling the needs of the retired. That would leave Victoria free to expand its tourist and hi-tech base. One does not have to be inventive just go take a look at how the Swiss have developed cluster communities and duplicate it. Unlike the Swiss we on the island dont even have to deal with building in the Alps.

I know that the developers would hate the idea of having an alternative to Victoria built on the island were 50,000 people might move out of the city but this would improve the quality of life both for the old and the young.

[Hawk puts all the stock in the last month]

Whoops, my bad, the article said the Comox Valley in 2017 saw 30% of buyers from the Lower Mainland. Yep, that definitely sounds about right.

Realtors in Qualicum and Parksville confirm lots of Lower Mainlanders buying here. Our house has gone up over 20% ( or more) since we bought a year and a half ago.tkaes abit of the sting out of selling in Victoria.

Many Albertans buying here too. We get more average wage earners who have been priced out of the city and or people looking for a quieter lifestyle but still with amenities.

Parksville is seeing a housing boom…kind of ugly uniform looking homes IMHO but they are popular. Eaglecrest and Chartwell neighbourhoods are selling very well. Not being a golfer etc. those places don’t appeal to me but hey….

We want to move back to the Lower island in four years….personally hoping the north island continues to grow and prosper!

@Leo S

I’d be curious to see what the % is in the Comox Valley and Campbell River. For the last 3 years, the CV has seen a huge increase in people from Van moving over. Average house has gone from about 300k to 600 k in that timeframe, give or take a bit and the traffic has become pretty bad at certain times of the day. Cumberland which used to be the cheapest place to buy (hence attracting the younger crowd, has become one of the more expensive places to buy). Not uncommon to see houses pushing up against 1 M now in parts of the CV. Personally, I think Van is starting to become a better deal in some ways than the island now, depending on where you are.

LeoS, I find that Vancouver Sun article a bit odd. It’s definitely on point, but why now? This has been going on for years. It sounds like a real estate ad in some regards. I believe sales have really dropped mid island (not really up island CV & CR wise) in the last few months so this article feels like a bit of an RE pumping article. I could be completely wrong of course 🙂

Numbers Hack,

I would add that many of the “poor” of which you speak are making six figures.

Josh

Just like Hibernia they will make a profit. Hibernia 2b. Its not about brainwashing/ its about understanding what is good for the economy and still make a buck… The owner of the pipeline make $$$ every time a drop of oil goes through it.

https://business.financialpost.com/commodities/energy/if-ottawa-sells-its-hibernia-oil-field-stake-it-must-fetch-top-dollar

gwac, how brainwashed can one person get? In your conservative brain, how do you justify adding $6.5 billion in unplanned spending on the 2018-2019 fiscal year? This single act raised our deficit by 36%. Kinder Morgan saw a return of over 600% for a pipeline they didn’t build, and which still doesn’t have all approval to reach the coast. But no, it’s all “this 0.5% tax is punishing success!” and “the tax man is taking my hard earned money and giving it to the lazy socialists!”. Open your gd eyes.

gwac, you are the typical BC liberal ostrich. Puts their head in the sand and says so what ? This is why the NDP will rule the next 7 years. They have more than enough ammo to show they have zero business being in control of the books ever again. ICBC , BC Hydro, casinos, real estate money laundering, etc etc. I can’t wait til Coleman, DeJong and Christy are investigated for selling us out. But you’re all fine with that.

Best you take the weekend off, the numbers next week look very bad for the pumpers. Praying for a few weekend sales when most go away is wishful thinking. The party is over and slashes building by the hour still.

There is a lot of variability month to month, so you shouldn’t put too much stock in any given month. Especially the average price can fluctuate by over 10% from one month to the next. Median is slightly less volatile but still the noise is bigger than most any signal.

The number announced by VREB will be somewhat different for a couple reasons:

Gahh. I really think we should wait for Dr. German’s upcoming report on RE. I have confidence in his work.

People seem to be making assumptions and conclusions on the RE market that aren’t really justified right now. All we know is that our gaming institutions are flashing fail, a lot of money has probably been laundered and RE is a vulnerable sector.

Hawk

That is an amazing math story you just made up with all the multiplication assumptions. Really hope accounting is not your profession.

“No huge movement so far on average and median although they are both down June to date.

Single family, greater victoria

Average: $892,000 (down $35k from May, up $10k from last year)

Median: $780,000 (down $45k from May, up $15k from last year”

Leo both of those numbers seem pretty substantial (almost 4 and 6%). Which numbers is more useful when talking about house prices? Also, assuming no changes, is this the number that the VREB will report on Tuesday? I’m seeing more slashes again today…

“Auditor MNP LLP explains the reasons for its report, noting that the enforcement branch “compiled a document which identified approximately $13.5 million in $20 bills being accepted in River Rock in July 2015.”

Multiply that by 12 times 14 years River Rock has been open, that’s $2.5 billion. Flipped into real estate and flipped over and over and you have tens of billions. $100 million is a drop in the bucket.

You assume that $100 million is the total ? Talk about naive and trying to spin a major story that will effect us for years to come.

As I said Sam Cooper showed one guy with a billion, and many many more with the same to flip over and over for over the last 16 years of a corrupt BC lib government. The more you spin the more pathetic you look. You must work for them, no one can defend corruption to this degree without a connection.

The cynical might argue that since drug money will get laundered one way or another (and it most definitely will) that the BC government would rather get its cut as opposed to having somewhere else get a cut of the action.

@GWAC

I am in agreement with you. Regardless of political affiliation, this Province has problems with RE values vs incomes and mental health/drug addiction.

1/ There is foreign money in our RE, it could be 3% or it could be 100%. As many other posters have brought up, a lot of this has to do with QE and once in a millennia interest rates.

2/ Every story needs a culprit/bogey man, in our story it is Chinese. Look at the polls, 3 major cities over 1/2 the population is thinks foreign money is the main culprit. We don’t want to say, but they look different, their culture is different then ours, and oh god…their English is atrocious… Makes me think about my great great grand parents that settled in Victoria…did they experience the same thing? But there is nothing illegal from my decades of working around the world that says buying RE in another country is illegal!

China has literally transformed itself a third world nation to one that is able to provide first rate services to their citizens. Yes, there are some growing pains, but be rest assured, their transformation was done via good old “elbow grease” and not corruption. Does corruption make you a better iPhone? China has lots of wealthy people…because they have lots of people 1/5 people on earth…but imagine working from rags to riches and having people have predisposed thoughts that your money was ill-gotten? I’ve been on this blog for years, and reading some recent comments, you can see their train of thought and disposition. This is wrong IMO.

3/ Desirable cities around the world, small or large, have seen their RE values skyrocket in the last decade by a factor of X. Many of these cities have little or no foreign influence. This is the problem with QE; people with hard assets (e.g. the rich and land owners) keep on getting richer and people without, keep getting priced out of the market. This is a classic example of rich getting richer and the poor getting poorer…however it has never happened on such a scale in G7 nations and developed countries. Social safety nets around the world are underfunded and the socialist rallying cry is for wealth distribution. As per all revolutions, wealth disparity or the semblance of it creates the greatest social chaos. This is about class warfare; and there are most than enough historic references of how this ends up.

4/ Mental Health is a culmination of broken safety nets, broken families and Drug addiction. Putting someone who has mental health problems into a Upland’s home – do you think they are going to get better?

People often only need two things to get them through life – something to fight for and someone to believe in them. It might be an over simplification, but if you can give them those too things, then they will start sorting out their own problems. GWAC is right, we need to catch them early and help them out, so they don’t end up on Vancouver’s East Side.

5/ Affordable Housing for locals is not as simple. Macro factors beyond our control is still flooding the world with cheap money and interest rates going north of 5% are as likely as winning the 6/49. Governments around the world are trying to put speed bumps in front of this bull with varying results. Local policies that favour more supply and local consumption are likely the best solutions if society can afford them.

Apologies for the rant, but just had to get that off my chest 🙂

Apparently the prospect of the new spec tax has already slowed building in Langford.

And of the people on HHV, Hawk would be last.

Caveat

BC liberal could have done more on

Casinos

mental health

homelessness

foreign buyers purchasing housing and not using it

kept the HST

limiting corp/union donations. (NDP helped themselves to this pile of money also)

GWAC being a “non-socialist” doesn’t forbid you from acknowledging that the last government allowed some very problematic corruption to flourish. Free your mind. Being right of centre doesn’t commit you to defending every action or inaction by the BC Liberals, the Conservatives, etc.

I’m left of centre but I certainly won’t defend everything that a left government does or criticize everything a right government does

examples of money laundering. Many more ways. Casino example is explained. Buy a lot of chips. Play a bit. Get a check for the rest.

Methods[edit]

Money laundering can take several forms, although most methods can be categorized into one of a few types. These include “bank methods, smurfing [also known as structuring], currency exchanges, and double-invoicing”.[10]

Structuring: Often known as smurfing, this is a method of placement whereby cash is broken into smaller deposits of money, used to defeat suspicion of money laundering and to avoid anti-money laundering reporting requirements. A sub-component of this is to use smaller amounts of cash to purchase bearer instruments, such as money orders, and then ultimately deposit those, again in small amounts.[11]

Bulk cash smuggling: This involves physically smuggling cash to another jurisdiction and depositing it in a financial institution, such as an offshore bank, with greater bank secrecy or less rigorous money laundering enforcement.[12]

Cash-intensive businesses: In this method, a business typically expected to receive a large proportion of its revenue as cash uses its accounts to deposit criminally derived cash. Such enterprises often operate openly and in doing so generate cash revenue from incidental legitimate business in addition to the illicit cash – in such cases the business will usually claim all cash received as legitimate earnings. Service businesses are best suited to this method, as such enterprises have little or no variable costs and/or a large ratio between revenue and variable costs, which makes it difficult to detect discrepancies between revenues and costs. Examples are parking structures, strip clubs, tanning salons, car washes, arcades, bars, restaurants, and casinos.

Trade-based laundering: This involves under- or over-valuing invoices to disguise the movement of money.[13] For example, the art market has been accused of being an ideal vehicle for money laundering due to several unique aspects of art such as the subjective value of artworks as well as the secrecy of auction houses about the identity of the buyer and seller.[14]

Shell companies and trusts: Trusts and shell companies disguise the true owners of money. Trusts and corporate vehicles, depending on the jurisdiction, need not disclose their true owner. Sometimes referred to by the slang term rathole, though that term usually refers to a person acting as the fictitious owner rather than the business entity.[15][16]

Round-tripping: Here, money is deposited in a controlled foreign corporation offshore, preferably in a tax haven where minimal records are kept, and then shipped back as a foreign direct investment, exempt from taxation. A variant on this is to transfer money to a law firm or similar organization as funds on account of fees, then to cancel the retainer and, when the money is remitted, represent the sums received from the lawyers as a legacy under a will or proceeds of litigation.[16]

Bank capture: In this case, money launderers or criminals buy a controlling interest in a bank, preferably in a jurisdiction with weak money laundering controls, and then move money through the bank without scrutiny.

Casinos: In this method, an individual walks into a casino and buys chips with illicit cash. The individual will then play for a relatively short time. When the person cashes in the chips, they will expect to take payment in a check, or at least get a receipt so they can claim the proceeds as gambling winnings.[12]

Other gambling: Money is spent on gambling, preferably on high odds games. One way to minimize risk with this method is to bet on every possible outcome of some event that has many possible outcomes, so no outcome(s) have short odds, and the bettor will lose only the vigorish and will have one or more winning bets that can be shown as the source of money. The losing bets will remain hidden.

Real estate: Someone purchases real estate with illegal proceeds and then sells the property.[16] To outsiders, the proceeds from the sale look like legitimate income. Alternatively, the price of the property is manipulated: the seller agrees to a contract that underrepresents the value of the property, and receives criminal proceeds to make up the difference.[15]

Black salaries: A company may have unregistered employees without written contracts and pay them cash salaries. Dirty money might be used to pay them.[17]

Tax amnesties: For example, those that legalize unreported assets and cash in tax havens.[18]

Life insurance business: Assignment of policies to unidentified third parties and for which no plausible reasons can be ascertained

I doubt very much that’s there’s much overlap between the two. Think about it – aren’t there enough local crooks to handle buying properties with laundered money? Why take the 15/20% hit? Plus keep in mind the withholding requirements when buying property from a foreign owner. This greatly reduces the liquidity of the property.

Please be clear I am talking about de jure foreign buying as referred to by LF a couple of posts down.

Victoria Born:

I totally understand the involvement of the casinos but the only link to housing is some of the “clean” money is being invested in real estate although it could just as easily be invested in the stock market or the bond market or buying businesses. For that matter it could just as easily be moved to the US or elsewhere.

Local

Point is the casinos are just one avenue. It closes, many more open up. A business/ buy an expensive car and than reselling. There is a thousand and one ways to launder money. NDP has not stopped it. It will move. Cash is the real problem We are getting there and one day cash will be gone.

This is all political smoke and mirrors to fool the base into thinking they have solved the issue. Not solved just moved to other avenues. Criminals are smarter than politicians.

If you honestly think this has stopped any criminal activity think again….

Interesting, I’m looking at the low end (under 750, saanich, shawnigan and duncan) and even I’m seeing price changes and sales under ask (one 110K haircut in maple bay). Haven’t seen that in years. almost afraid to post it in case I jinx myself.

I continue to think you’re missing the point. Moving money illegally in and of itself may not be that harmful (more optics than anything), it’s what that activity is connected to.

That’s what’s killing people, it’s probably a factor in promoting gang violence, it exacerbates the problems faced by our most vulnerable citizens, degrades the civic environment, burdens our justice system and generally creates a lesser quality place to live. Plus, we get a shitty and embarrassing reputation to boot. Would we have problems if there was no drug trade? Yes. So, should we adopt a streak of nihilism, and do nothing about it because we’d have issues anyways?

I don’t give two hoots what someone’s political stripe is; the above are not virtues to strive for in any society I’d want to live.

No, in every case I referred to, I was questioning whether money laundering was the dominant dynamic keeping the market where it is. Is all foreign money coming in laundered money? Perhaps if its movement is in contravention to the originating country’s laws. But Dr. German seems to make a distinction. He estimates 100 million dollars have been laundered in BC casinos – we also know that the FB reporting data showed nearly 900 million coming into BC RE over a period of only 5 weeks, shown after they started recording FB transactions (and shortly before the surprise implementation of the FB tax).

So I wonder if he’s not equating foreign buying with laundering. I don’t think I would, automatically. But, I think both are a problem for slightly different reasons. It’s not really a “believe it, or head in the sand” proposition; it’s understanding the nuance of the phenomenon. Perhaps it would be best to see his upcoming report specific to RE. Regardless, I don’t want drug money buying our houses, killing folks, clogging our courts and causing untold social strife.

On a side note, your comment on New Zealand: I recall recently reading something that said since the FB ban, prices haven’t yet moved. I don’t recall which source it was though or if it was reliable. I know people with Oz passports can still buy in NZ.

I would think so.

Hawk it was in the report. I think I will believe the report than Hawk from House Hunt Victoria.

Hawk all it takes a few sales end of the month and that median and average is right back up. Keep the dream alive Hawk, That is all that some people have.

I will reiterate some guy rolling around naked in the Mcdonalds parking lot last nite is a bigger issue than the Casinos. Mental health problems are on the rise and real solutions need to be found. NDP lets here the plan on that…..

What`s the plan on the Uptown camp ground NDP??? I am sure the people living around camp care a tad more about that than the bloody casinos.

$100 million gwac ? Boy you have your head up your ass. Try billions. Sam Cooper showed one guy alone had one billion to play with. Multiply it by many thousands of launderers.

How about all the tax avoiders from those billions that would have paid for medical and mental health/homeless problems. Oh right, no big deal, lets us pay for instead of the criminals milking us dry.

35k/45K is a very substantial one month move for average and median, and the largest in some time. Doesn’t look good for the pumpers. Can’t be all those slashes right ? 😉

Victoria Born I rally do not care about the Casino stuff. All fluff, all politics. Spend the time/ money effort dealing with real problems that do not get the political points. Addiction /mental health and homelessness. NDP has done zero on those except more band aid solutions. Those are bigger society problems than 100m being laundered through casinos.

Those people don’t vote so lets just keep going after those that vote with freebies and other stuff.

Barrister, look at your profession. Lawyers have had zero obligation to report anything shady up until lately and still don’t. They know who butters their bread.

Barrister – you asked about how RE is used to launder money. You put the cart before the horse. A fentanyl drug dealer can’t walk in to a bank with $500,000 in $20 bills and deposit the money in to a bank account. The drug dealer can’t take the money to a lawyer’s office to deposit to a pooled or segregated trust account – any cash deposit of $7500 or more must be reported by the LLB/JD. The drug money is taken in bags to a casino and used to buy chips. Play a few games and then cash out. The casino does not give you back cash – you get a cheque drawn on the casino’s account. Now, the dealer deposits the cheque in to his or bank account, then invests it in expensive RE. This is the simplest example and shows that most of casino payouts are return of capital:

http://vancouversun.com/news/local-news/massive-bclc-casino-cheque-payouts-were-mostly-returned-funds?video_autoplay=true

Sam Cooper goes through the actual mechanics of it:

http://vancouversun.com/author/samcooperprov

There are some really fascinating investigative reports in the last link.

Oh, and I love the real estate boards saying that laundered money is not to blame. The absolute height of BS – they knew and Realtors knew exactly what was going on – they market to foreigners, turn a blind eye, all to make a commission. It is a dirty business and their hands are dirty. They have a vested interest to deflect to save the goose that laid that golden egg. To them, a buck is a buck, dirty or clean. Think of the conflict of interest before you believe a word they say.

Victoria Born,

Now 1 in 4 Seattle condos sit empty with landlords throwing freebies and reduced rents to get them filled. Looks like the HAM was late to the game there and will be first to bail once they realize they made a mistake.

The BC Liberal housing critic Sam Sullivan still thinks it’s OK to take corporate donations from developers, who no doubt are connected to all the offshore money. Unreal. No ethics, nor shame, just like gwac.

Douglas Todd: B.C. Liberal housing critic sees no conflict over developers’ cash

http://vancouversun.com/news/politics/douglas-todd-b-c-liberal-housing-critic-sees-no-conflict-over-developers-cash

Sounds like a plan. I think that is what happens to most people who are FI and happy anyway. The work they do is done because they want to, not have to. The fact that an activity provides money can be an aside, rather than the motivation.

Local Fool [post 45649] – let me deal with a few of the regions you point to. Let’s start with Australia. You say it is the most unaffordable housing market based on all metrics and you appear to be saying that “foreign money” is not the cause. i am surprised as the foreign money was identified as the cause of the inflating RE market long before it showed up in Vancouver, but measures they implemented are changing that:

https://news.com.au/finance/economy/australian-economy/house-prices-set-to-tumble-after-buyers-flee/news-story/239b695952fd07ffd4b270fcfcdef637

Next, let’s look at New Zealand, another very expensive real estate nation. You guessed it: foreign money pouring in from China. It got so bad that the government made it illegal for foreigners to buy real estate:

https://news.com.au/finance/economy/australian-economy/house-prices-set-to-tumble-after-buyers-flee/news-story/239b695952fd07ffd4b270fcfcdef637

Next, Seattle. The truth is that Seattle was moving along at a normal pace, but when Vancouver enacted the foreign buyer’s tax, foreigners started to pump up Seattle’s market. take a read:

https://seattletimes.com/business/real-estate/foreign-buyers-drop-off-as-seattle-housing-market-hits-hottest-tempo-since-2006-bubble/

Still not convinced. Well, the buyer from China is very interested and has been for time time in Seattle. Take a read:

https://thestranger.com/slog/2017/11/10/25557400/only-china-can-save-seattles-housing-market-from-value-inflation

It is not limited to the areas you identified. It is clear that all western developed nations are the targets for international money [much from China]. here is an excellent analysis that discusses the “on the ground” expos in China that targets our RE markets as safe “investments” which crowds out our citizens:

https://mansionglobal.com/articles/western-cities-want-to-slow-flood-of-chinese-home-buying-nothing-works-99277

I splashed cold water on my face long ago in or around 2012 to see the problem and have read with fascination at the international flow of capital in to our real estate markets. According to the German report [Dirty Money] the BC Liberals were warned in early 2011 – they ignored it as these “investors” laundered their cash and donated some to their campaigns. I am not an NDP supporter, but finally a government is splashing cold water on their face as well. Wake up and smell the coffee. Or, you can hide in this:

“Lastly anyone who really believes money laundering had any impact in Victoria has lost any sense of reality on what is going on with house prices the last 9 years”.

Or this:

So again, and I can’t believe I read this, “Am I the only one who does not care about the casino situation?” Answer: YES.

“OMG all this casino stuff. It will all be forgotten in a month because the vast majority of people don’t give a crap. It will have zero impact on Victoria prices” – lost, just lost.

Patriotz – I understand that issue just fine. I distinguished between the leagl owner [one on title] and the equittable or beneficial owner. Both should be disclosed in a public [free] registry. At present, you have to pay for a land tittle office search to get the former and can’t get the latter. I know the issue just fine, but thanks.

There is a diagram in the report.

Traditionally money laundering has been described as a process which (sometimes) takes place in three distinct stages.

Placement, the stage at which criminally derived funds are introduced in the financial system. This is often done in amounts less than 10k which are not reportable transactions.

Layering, the substantive stage of the process in which the property is ‘washed’ and its ownership and source is disguised. Ie. through a casino or complex series of transfers through institutions.

Integration, the final stage at which the ‘laundered’ property is re-introduced into the legitimate economy. Invested or used to purchase in something, sometimes by a proxy.

My understanding is that RE investment happens at the integration stage. It happens because it offers a very profitable return in markets like Vancouver which far exceeds unleveraged bonds due to the use of financing which also removes the need to place or layer the full purchase price.

Exactly.

Paying a commission to visa does not deal with the regulation of gaming and make the problem go away and you will still need regulation. You will still have loan sharks laundering cash There are many workarounds. You will still have suspicious transactions that need to be reported and investigated.

I suggest your read the report “Dirty Money” – it answers your questions and is interesting. https://news.gov.bc.ca/files/German_Gaming_Final_Report.pdf