2024 Predictions

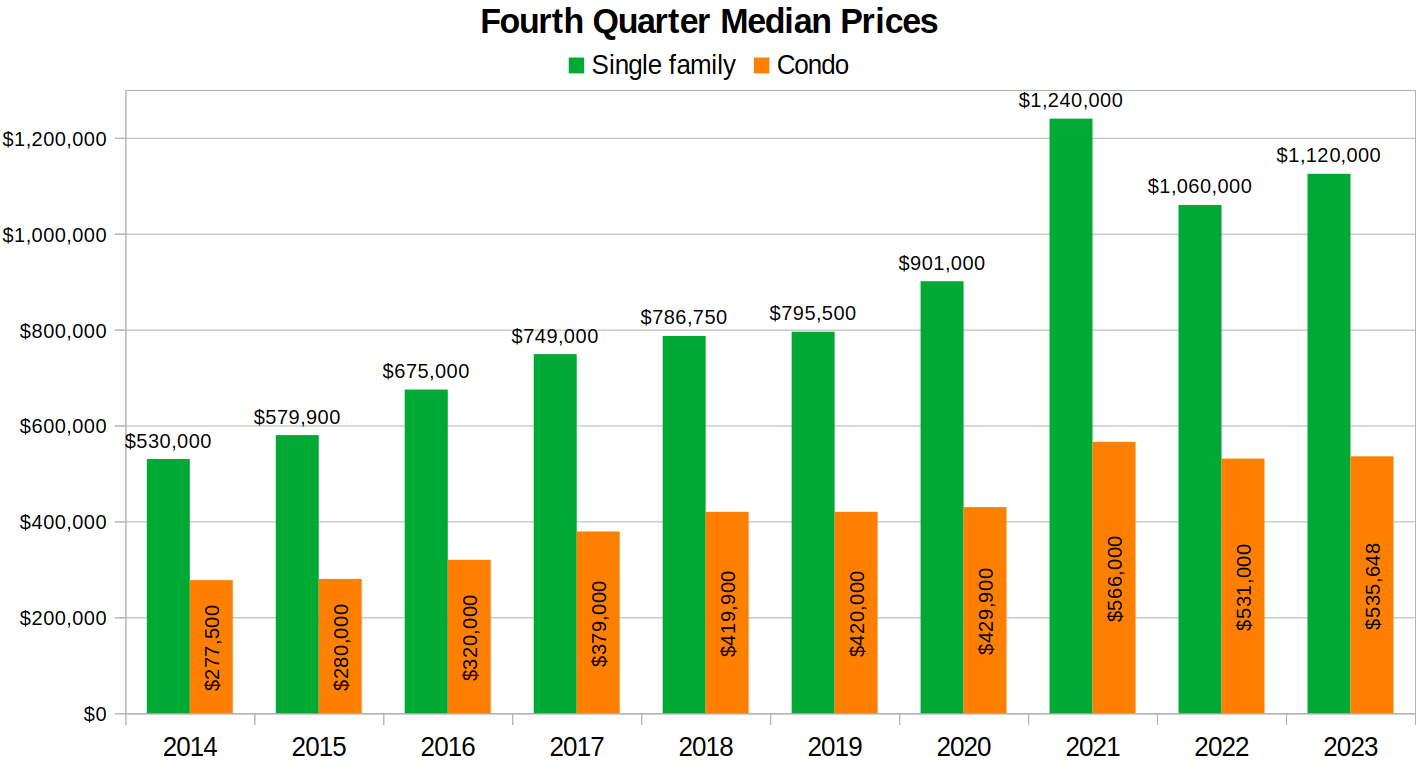

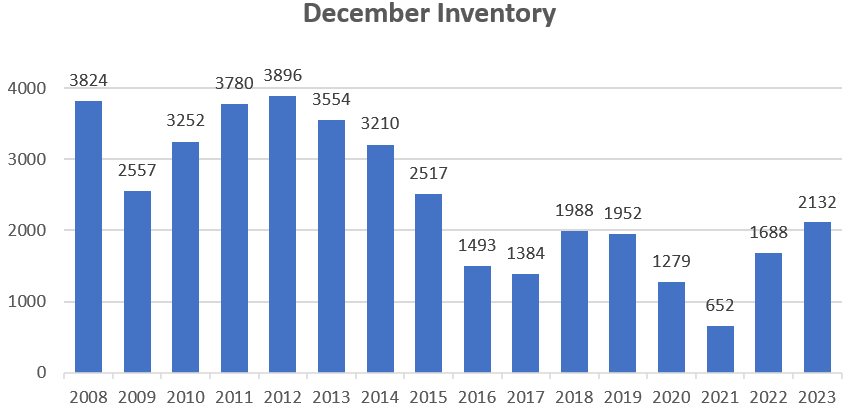

We’re finished another year, and while there were momentous changes on the policy front, the market did very little, ending not too far off from where it started in terms of prices, with about 25% more inventory on the market. Stable rates and spring optimism brought up activity and prices to start 2023, but that was partially reversed in the fall with higher rates and lower sales. Detached fourth quarter median prices were up 5.7% from a year ago, though by the end of December that narrowed to +4%.

As regular readers know, every year we make predictions on this blog for what will happen in the real estate market. Unlike the talking heads on TV, we actually review those predictions a year later to see just how close or far off they were. Other than being entertaining, the point of this retrospective is to remind people that though there are some metrics that correlate with future market prices, that doesn’t make the market predictable in any meaningful way on a short time scale. Nearly every year forecasters are surprised by something that no one predicted.

Here are all the predictions made a year ago.

| Name | Sales | Q4 Single Family Median | Q4 Condo Median | December Inventory | BoC Rate |

|---|---|---|---|---|---|

| Aaron Vaillancourt | 7299 | $884,500 | $595,000 | 2860 | 3.25% |

| alexandracdn | 6500 | $985,000 | $540,000 | 1900 | 4.75% |

| Alma Mater | 8000 | $1,100,000 | $749,000 | ||

| Animal Spirit | 5600 | $890,000 | $470,000 | 3200 | 4.25% |

| Arlin Baillie | 6800 | $985,000 | $500,000 | 4200 | 5.75% |

| Ashley B | 6900 | $990,000 | $515,000 | 2200 | 4.25% |

| Azra1964 | 6200 | $977,777 | $488,888 | 2223 | 4.50% |

| Bluebird | 5700 | $960,000 | $510,000 | 1999 | 4.75% |

| Bob Loblaw | 7250 | $855,000 | $510,000 | 2011 | 3.50% |

| Bonhomme | 5000 | $950,000 | $450,000 | 2500 | 4.00% |

| Boris | 6500 | $1,100,000 | $520,000 | 1900 | 3.25% |

| Brandon | 5500 | $800,000 | $420,000 | 2600 | 4.25% |

| Bromptonymous | 6500 | $843,000 | $433,000 | 1700 | 4.75% |

| Cadborosaurus | 9200 | $1,190,000 | $560,000 | 1400 | 3.00% |

| Cam B | 6050 | $965,000 | $475,000 | 2575 | 4.00% |

| Carl | 6777 | $977,000 | $467,000 | 1555 | 4.75% |

| caveat emptor | 6000 | $950,000 | $475,000 | 2650 | 4.25% |

| Chris L. | 7800 | $980,000 | $545,000 | 1950 | 4.75% |

| CM | 6020 | $965,000 | $450,000 | 2600 | 5.00% |

| Dale D | 5500 | $950,000 | $500,000 | 2300 | 4.25% |

| Darci Hayward | 7900 | $999,000 | $499,000 | 899 | 4.00% |

| Deb | 5780 | $925,000 | $465,000 | 2600 | 6.50% |

| Dinesh | 4700 | $750,000 | $410,000 | 2200 | 5.25% |

| Dude250 | 7500 | $1,150,000 | $550,000 | 2250 | 1.50% |

| Eric Loeper | 6000 | $975,000 | $515,000 | 1500 | 5.00% |

| Erich Schmitt | 5600 | $980,000 | $500,000 | 2000 | 4.00% |

| FatiguedBuyer | 7000 | $850,000 | $450,000 | 1850 | 5.00% |

| fern | 7890 | $900,000 | $460,000 | 1800 | 4.50% |

| Frank "Gooch" Murphy | 7200 | $1,030,000 | $510,000 | 1730 | 4.75% |

| freedom_2008 | 6000 | $1,000,000 | $500,000 | 2200 | 4.50% |

| FSC | 5500 | $850,000 | $450,000 | 4000 | 4.00% |

| G$ | 9345 | $1,150,000 | $615,000 | 2115 | 5.00% |

| GH SFH | 5760 | $920,000 | $450,000 | 3140 | 4.75% |

| Glenalder | 5,800 | $1,105,000 | $555,000 | 1,750 | 3.75% |

| Gonzo Guy | 5000 | $1,100,000 | $525,000 | 2400 | 4.75% |

| GregO | 5500 | $850,000 | $475,000 | 3200 | 5.00% |

| Gwac | 6500 | $1,100,000 | $550,000 | 1200 | 4.25% |

| hopefulBuyer | 6500 | $850,000 | $410,000 | 2500 | 4.50% |

| Inspector | 5,800 | $890,000 | $480,000 | 2500 | 5.25% |

| ITz Nordic | 6000 | $900,000 | $430,000 | 2400 | 5.00% |

| James P | 8340 | $1,050,000 | $525,000 | 2800 | 5.00% |

| Jane Marple | 8000 | $1,000,000 | $540,000 | 1500 | 3.50% |

| JayRock | 7800 | $1,150,000 | $540,000 | 1500 | 3.75% |

| Jaysteve | 6100 | $980,000 | $520,000 | 1950 | 4.50% |

| Jen | 3000 | $800,000 | $410,000 | 4500 | 4.75% |

| Jeremy | 7100 | $930,000 | $495,000 | 2200 | 4.50% |

| JuiceMan | 7500 | $875,000 | $415,000 | 1500 | 4.75% |

| Kenneth | 8200 | $1,100,000 | $540,000 | 1950 | 2.75% |

| Lanemim | 8500 | $800,000 | $430,000 | 3900 | 6.00% |

| Langford Land Assembly | 6237 | $980,000 | $467,000 | 1692 | 3.75% |

| Laurie | 6550 | $795,000 | $425,000 | 1500 | 4.00% |

| Lee Chambers | 5200 | $920,000 | $478,000 | 2650 | 3.75% |

| Lee M | 7325 | $958,000 | $508,000 | 2375 | 5.25% |

| Leo | 5800 | $999,999 | $495,000 | 2400 | 4.50% |

| Lims | 9300 | $895,000 | $497,000 | 1690 | 6.25% |

| LLI2023 | 5000 | $950,000 | $460,000 | 2000 | 5.00% |

| Looky Loo | 5200 | $875,000 | $450,000 | 2750 | 4.50% |

| Marko Juras | 6400 | $960,000 | $525,000 | 2500 | 4.50% |

| Megan G | 6200 | $895,000 | $425,000 | 2100 | 3.75% |

| Melissa | 8000 | $1,100,000 | $500,000 | 1300 | 3.75% |

| Mike In Mexico | 5800 | $875,000 | $515,000 | 4200 | 5.50% |

| Mike s | 6700 | $1,075,000 | $507,000 | 1900 | 3.75% |

| Misha S. | 7250 | $990,000 | $520,000 | 2000 | 3.50% |

| Mrs. LeoS | 6150 | $1,010,000 | $510,000 | 2000 | 4.50% |

| Mt. Tolmie Foothills | 7300 | $990,000 | $530,000 | 1800 | 3.80% |

| NE14T | 7223 | $987,654 | $484,000 | 2790 | 5.50% |

| newhomeowner | 6200 | $950,000 | $465,000 | 2042 | 4.00% |

| Nomadic | 6600 | $1,000,000 | $510,000 | 2000 | 4.00% |

| None | 4009 | $800,000 | $400,009 | 3000 | 5.00% |

| oracle | 5500 | $850,000 | $450,000 | 2000 | 5.90% |

| Patrick | 6500 | $1,100,000 | $525,000 | 1,900 | 4.00% |

| Pmac | 5675 | $922,500 | $441,500 | 2650 | 5.25% |

| Rafferty Fellows | 5900 | $960,000 | $480,000 | 2600 | 4.75% |

| Real Love | 5940 | $1,010,000 | $610,000 | 2200 | 4.25% |

| renter | 4500 | $580,000 | $270,000 | 4500 | 5.25% |

| RG | 6100 | $895,000 | $435,000 | 2950 | 5.00% |

| Rodger | 5000 | $850,000 | $450,000 | 3000 | 4.50% |

| rush4life | 5350 | $825,000 | $430,000 | 3300 | 6.00% |

| Ryan Matthews | 7000 | $900,000 | $480,000 | 1900 | 5.25% |

| SaanichAdam | 7000 | $975,000 | $500,000 | 2000 | 4.25% |

| Seattle Mariners 2023 WS Champions | 5500 | $890,000 | $500,000 | 2800 | 5.00% |

| Sikmuse | 5969 | $869,000 | 2569 | 4.00% | |

| Silky | 7000 | $900,000 | $500,000 | 3000 | 3.50% |

| Slade | 8200 | $1,025,000 | $505,000 | 2350 | 4.25% |

| slick | 5500 | $950,000 | 2500 | 4.25% | |

| Stan Evans | 5300 | $950,000 | $480,000 | 2800 | 4.75% |

| Stefan | 6200 | $950,000 | $500,000 | 1900 | 3.75% |

| Steve H | 5500 | $900,000 | $450,000 | 3000 | 4.25% |

| Steven C | 7300 | $960,000 | $460,000 | 1300 | 5.50% |

| Sunny | 9000 | $1,100,000 | $550,000 | 1500 | 3.50% |

| Tabitha A | 7100 | $850,000 | $500,000 | 1300 | 2.75% |

| Talk2mejasonv | 5000 | $923,000 | 2800 | 4.50% | |

| The Underwriter | 4500 | $900,000 | $465,000 | 3600 | 4.00% |

| Tomie Thomas | $1,100,000 | $560,000 | 1850 | 4.50% | |

| Toothurty | 7350 | $950,000 | $480,000 | 2500 | 5.00% |

| Tox Dioxin | 5785 | $1,078,000 | $542,000 | 2015 | 4.50% |

| Umm..really | 5200 | $850,000 | $475,000 | 3600 | 6.00% |

| Underachiever | 6600 | $800,000 | $400,000 | 3300 | 6.75% |

| Vanessa Roman | 7261 | $1,362,900 | $572,000 | 3114 | 4.75% |

| VicDude250 | 8500 | $1,150,000 | $550,000 | 1500 | 2.00% |

Out of a record 100 submissions, The median predictions were:

Sales: 6200

Single Family Median (Q4): $950,000

Condo Median (Q4): $498,000

December Inventory: 2200

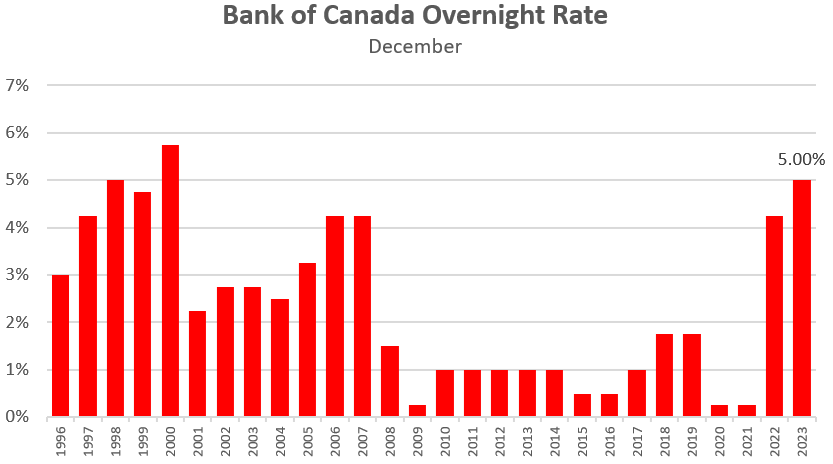

Bank of Canada Rate: 4.5%

And the actual values for this year:

Sales: 6207

Single Family Median (Q4): $1,120,000

Condo Median (Q4): $535,648

December Inventory: 2132

Bank of Canada Rate: 5.0%

The median guesses for sales and inventory were quite close to the actual, but the estimate on prices were substantially lower than where the market ended up. Most people also thought that the Bank of Canada would only raise a quarter point in 2023, but they increased by three quarters to hit 5%.

Winners

In the category of sales, there was a four way tie for the win, with Azra1964, newhomeowner, Megan G, and Stefan all guessing 6200 which was very close to the real total.

In house prices, the winner is Glenalder with a guess of $1,105,000.

In condos, we have another four way tie, with alexandracdn, Jane Marple, Kenneth, and JayRock all with guesses of $540,000.

For inventory, the winner is G$ with a guess of 2115.

Overall winner: To calculate the overall winner, I averaged the percentage errors on each estimate (only those who made predictions in every category qualified) to determine the forecaster with the minimum error across all 5 categories.

The winner, with an average error of only 5%, was Tox Dioxin. Congratulations!

The runner up with an average error of 6% was Mrs. Leo S. Just think of how much better this site would be if she was writing it instead of me (avg error of 10%).

2024 Predictions

My medium term forecast has not changed for a few years now. With affordability strained, the market will probably trade roughly sideways for a number of years while affordability returns via some combination of dropping rates, increasing incomes, and relatively minor price changes. Provincial housing reforms came much faster this year than I anticipated, and that puts some support under land (and therefore house) prices in the medium term while pushing multifamily prices down via better supply. Wherever the bottom was going to be for the price of a house (and perhaps we’re past it), it’s now likely to be somewhat higher, at least in the core. Long term the gap between multifamily and single family will increase as the supply of single family lots can’t expand, while supply of multifamily housing becomes more elastic. Last year I said that the boring was in for the market, and I’m sticking with it this year.

In 2024 I believe the stimulative effect from lower fixed rates will be roughly counteracted by the weakening economy, though not at the same time. Lower rates will bring buyers in the spring and I think we’ll see an improvement in market conditions in the coming months, though market conditions will not be as strong as they were last spring. I don’t believe the Bank of Canada will cut before late in the year, and the ongoing stress from mortgage renewals (which bite hardest in 2024 and 2025 if rates stay high) will keep a lid on the market and keep inventory growing. Any gains from the spring market will fall back by the end of the year.

Meanwhile government will continue to take action on housing, but I don’t expect anything groundbreaking. Premier Eby has said he’s “nowhere near satisfied” on housing, but I think the focus for new policies will be on investments in non-market housing which will take years to get moving. Nevertheless it’s going to be a momentous year for policy because all the reforms announced in 2023 will actually start getting implemented this year by local governments. Provincial standards are nice, but there’s still a hundred ways they can be hobbled (intentionally or not) during implementation. Federally I’ve heard that the focus of the budget will be housing, but again I don’t expect that to move the market in the short term. Remember the foreign buyer ban that took effect a year ago? At best it shaved a couple tenths of a percent off buyer numbers in BC.

The bigger development in 2024 will be the government tackling non-permanent resident growth in Canada. Like zoning, it’s a policy issue where public sentiment has swung hard in a very short time, and now the government is panicking. From not even acknowledging it some months ago to saying there’s “obviously a correlation” between temporary residents and housing costs, the immigration minister is saying there will be reforms to tackle the issue in early 2024. While there is certainly a problem with exploitative degree mills in Ontario, that’s less of an issue in BC, where universities have been cutting budgets due to dropping enrollment. At the same time a decent chunk of the increase in non-permanent residents are one-time humanitarian programs to support people fleeing conflict in Ukraine, Israel, Hong Kong, Syria, and others. There’s going to be some hard conversations about priorities at the national level, and how to balance the immigration program between economic and humanitarian goals. Prepare for unintended consequences as this gets unwound just like we experienced on the way up.

Here are my predictions for 2024, along with the historical values to help you make similar predictions:

- Sales: 6900. Rates dropping in 2024 will bring back some activity, though we will remain at the slow end of the historical range. The bond market has already brought down fixed rates to start the year, and there’s a chance for a Bank of Canada rate cut near the end of 2024. I also predict some churn from the regulatory changes coming into effect which will add some sales, but we’ll remain at the quiet end of activity.

- Single family Q4 2024 median: $1,100,000. I don’t expect a lot of movement in single family prices this year in either direction. Some supply will come on the market through mortgage stress, while there will be some churn and speculation on the low end related to the new land use rules. A wildcard is always the flows from Vancouver which seem to land mostly in the detached market, but I think we’ll end the year close to where we started after a spring boost.

- Condo Q4 2023 median: $513,000. I have a habit of predicting that condos will be weaker than detached, and I’m almost never right. But I never learn so again I’m predicting condos to drop around 4% this year. A rental market with more vacancy will make the jump to buying less attractive, while affordability on the buy side remains poor and keeps many buyers on the sidelines.

- Inventory: 2600. I expect inventory to keep growing, albeit fairly slowly this year.

- Bank of Canada rate: 4.75% Everyone expects rate cuts in 2024 and I’m no exception, but I think after the central banks were slammed for being too slow to raise rates, they will be very cautious when cutting to make sure that inflation doesn’t come roaring back. I expect only one rate cut late in 2024.

As usual we’re doing the same predictions in the Vancouver Island Housing Market Facebook group, so to facilitate collecting responses, I’ve set up a survey.

Click here to submit your predictions for 2024

If you want to keep track of the forecasts, they will show up in this spreadsheet of the results.

What do you think will happen in our housing market this year? Leave your prediction for sales, single family price, condo price, inventory, and interest rates using the form above, then drop them in the comments below to discuss.

What else do you expect to happen this year?

New (brief) post: https://househuntvictoria.ca/2024/01/08/december-signs-of-life-to-end-the-year/

How do people on this blog have the ability to recall what a poster wrote more a few weeks ago????

You don’t get to make up quotes, and ascribe them to me. You have Google, and you can easily find real quotes. I was quite clear, and here is an example of a typical post. Clearly I never said that homes are affordable to everyone, we have never had more this 61% home ownership in Victoria. But I do believe that we are still in the “golden age of affordability”, and by that as I have said many times “ This is still the golden age of affordability for homes in Victoria. Because It will only get worse with time, and in 10 years for affordability this current time will be considered “the good old days”

https://househuntvictoria.ca/2022/07/11/high-frequency-unaffordability/#comment-90911

“ Right now we have SFH as unaffordable (63%) to the average income, and condos quite affordable (30% of income). So we have a situation where some homes are unaffordable (SFH) and some are affordable (condos). Anyone saying “homes are unaffordable” seems to be not considering condos, and seems to be only referring to detached houses.

The correct way to describe this would be “detached houses are unaffordable to average incomes”. But I’ve never heard anyone describe it like that, because that isn’t a headline describing a crisis, it’s just stating the obvious. . Instead they say “homes are unaffordable” which does imply a crisis.

This is still the golden age of affordability for homes in Victoria. Because It will only get worse with time, and in 10 years for affordability this current time will be considered “the good old days”.

But rush4Life. let’s’ hear how your take on affordability differs from mine… A simple question for you . You’ve been a house hunter for many years, but haven’t bought. Is this because you can’t afford a home that would considered suitable for your family, or is that you are fussy and are holding out for something better than is available at current prices? I’m assuming that it’s because you’re fussy, so feel free to correct me on that point, and describe what home you could afford today, and describe why it is not suitable.

I’m not going to go through old posts, but I don’t believe that’s what you said at all. Besides the very ambiguous statement that houses are affordable to ‘many’ (there are ‘many’ millionaires across the globe so a lot of things are affordable to ‘many’ – but that doesn’t make them affordable) – what you actually said is that houses are affordable, in fact my recollection is that you took the home ownership rate and said that homes are more affordable then they have ever been despite just jumping up in price, because the homeownership was at or near peak in Canada. That’s where you took ‘heat’ because they aren’t more affordable than ever. Anyone looking at median incomes and prices (or Leos affordability graph) could have told you that. Or the fact that many people living in the homes they own couldn’t afford to purchase their homes at todays prices if they had to (could you, or introvert, or Leo buy today with the same income and inflation adjusted payments?) – i think thats a pretty good indicator that things are less affordable then they once were. That doesn’t mean that many people can’t purchase here – Vancouver and Toronto are still more expensive so people can sell their and move here and bank some cash – but I don’t believe thats what you said as no one would argue that.

Call me “Sir” on HouseHuntVictoria.ca

Beyond parody.

I’ve taken a lot of “heat” over the last 6 years on HHV by suggesting the heresy that, despite the housing crisis, that Victoria houses were still affordable to many. Because savings are not “unaffordable” if you can make them. For example, here in August 2021, when I pointed out that due to low interest rates that an incredible 79% of all mortgage payments were “forced savings”. Although I didn’t have many people on HHV back me up, apparently lots of buyers agreed with me, which was one reason prices rose during that time.

https://househuntvictoria.ca/2021/08/09/understanding-inflation-measurement-and-housing/#comment-81675

https://househuntvictoria.ca/2021/08/09/understanding-inflation-measurement-and-housing/#comment-81684

Here’s the typical case I was making to support my claim that houses were affordable back then (2021 and earlier). And I still think it’s true, even with higher rates, because appreciation is going to be higher with higher inflation, and if that happens that’s an indirect type of “forced savings” too.

Just the other day someone (Warren) was claiming Canada has almost zero class-gradient…

For most people it is not just a house or an asset but a home.The fact that it will eventually pay for a nice retirement home is a bonus.

Totoro, totally fun clip which I enjoyed (definitely not like Ike). These days I often cringe when young folks call me Sir (as in Sir, do you need help crossing the street).

Absolutely and especially for those without employer pensions. It is the buffer between comfort and hardship for so many elderly people.

The older I get the more I see the value of the forced savings part of a mortgage. At the risk of sounding elitist, it is absolutely shocking how many full grown adults don’t have even the most basic financial literacy, and carry large credit card balances their whole lives, or jump after get rich quick investments like weed stocks, shopify, crypto, etc. Even if a house doesn’t appreciate like it has in the past, being forced to pay it off has an innate value. Also why I’m in favour of the expanded CPP.

If VicREanalyst is so fucking important, what’s he doing on an anonymous internet blog?

LOLOLOLOLOL

If you do sell, it allows you to re-buy in almost any other city in Canada and be in equally good or even better financial shape.

Totoro. what does Dwight like mean? Sorry, it makes me think of Ike (yes, I am old).

Witnessed? My guess is most view the “you would call me sir” stance as a bit Dwight-like… but each to their own.

Lichtenstein has many plaque-on-the door corporate headquarters, which boost its nominal GDP. Also a small population. Only about 40K. That’s how it gets such a high GDP/capita without producing much of anything. And of course what matters to households is their share of the GDP, not the total.

I am not posturing, I am making a conclusion based on what I have witnessed. And exactly, you don’t who anonymous people are online, they could even be your co-workers or direct reports whom you are unknowingly engaging with 🙂

Meanwhile, here’s the kind of returns you can expect if you fancy yourself a clever contrarian. This refers to the Spartan Fund Management’s Libertas Real Asset Opportunities Fund, a hedge bet against Canadian housing. It’s down 14% this year alone.

“Launched in 2014, the Libertas fund’s investment thesis is straightforward: “Canada is in the midst of a credit bubble, with one of the most overvalued housing markets in the world and an economy that is over-reliant on debt and housing,” it says on its website.

So far, that bet hasn’t paid off.

Last year marked the fifth time the fund posted a double-digit annual loss, and overall it’s down about 80 per cent since its inception”

Cut and paste from the Financial Post today.

You don’t know who anonymous people are online. No point in posturing and probably quite a few here outrank you by your own measures.

Agreed in toto!

Agreed, which is why I advocated for more NP in my post (as well as user fees), leading to less physician visits per patient. There should be public walk-in clinics staffed by nurse practitioners and one Physician, that could handle large volumes of routine care (like acute ear infections). The vast majority of Physician visits are minor problems.

Just to be clear, you refer to me as sir because that is what you will do in real life. My family and I own several properties, both principal and investment and we really enjoy the tax advantages of those :). I think you need to concentrate on finding a house for your so called kids like you indicated, I don’t know how long you have been on this forum but you are doing a pretty lousy job at it so far given that you and your supposed kids have missed the biggest rally in recent history.

I suggest you take some of your own advice and spend some more time securing a principal residence for them before they get priced out and have to move in with you (aka less time on a internet forum posting crap with zero value). Maybe you can even use Marko to find something 😉

Hmm, the World Bank puts the number at 3.6/10^3 rather than the source you linked (OECD), which pegged it at 2.6/10^3. WHO gives numbers basically the same as World Bank (eg 3.55/10^3 for the US).

One should also be aware that in the States there are a large number of nurse practitioners and physician assistants, roughly 40% the number of practicing physicians, which makes primary care much easier to access. As a result estimates for number of physicians understate care there. If say you travel with a little one that has an ear infection to a populated area, you can go to a walk-in clinic, see a PA or NP (just as good as a family doctor for most needs), and be done within an hour for ~200 USD.

To compare and contrast, our smallest just went through nearly two weeks of a double ear infection before receiving care here.

From a practical point of view, having been on both sides of the border, I had access to health care in the States but not here. I’ve been sitting on an email list (thanks Introvert!) for the past year waiting to get matched up with a family doctor. Someday.

From a wider point of view, both systems have their advantages/disadvantages. The main problems in the States are that health care is tied to employment and for many reasons has a spiraling growth in cost far exceeding inflation. The main problem here is access along with having enough trained personnel. (There’s a secondary problem too; oversight in the States comes from agencies external to health care providers. But not here.) But this isn’t really a US vs. Canada issue anyway. One need only look to Europe, even countries on the wrong side of the Iron Curtain (Croatia has ~4/10^3 physicians), to see how it can be done.

But I’ll stop here, so as to not derail the conversation…

To be clear, your alter ego KS112 told us years ago that you don’t own your primary residence, as you are a tenant renting downtown, and own a GH rental (investment) property. Despite the obvious tax disadvantages, do you still see any value in a (peculiar) “get rich” scheme like that?

I’d strongly disagree.

Owning a primary residence has way higher ROI than any other investment a person can make on average and is the way most people become well off over time. In Victoria is the quintessential lower risk, tax exempt, lowest cost leverage, get rich move. It is just not a fast transition to rich or without any risk (divorce/illness/job loss) – but then most investments are not.

The net worth differences between homeowners and renters in BC is astounding. Of course exceptions can be found for high return stocks, but they are exceptions. A successful business can outstrip a primary residence, but at much higher risk and very few people are suited to running a business.

As I’ve been posting here for – what – 15 years? This is the move to make, your home is likely going to be your biggest and best investment, and it meets every criteria to be deemed an investment. Foolish to discount or minimize this. I think even Leo would agree at this point as I recall we had this same debate back before he purchased a home when he was still holding on to affordability as an upper limit on appreciation.

And, finally, you have to live somewhere and given the cost of housing how many people have extra money for speculative investments and investment properties – especially earlier on in their careers?

Seems to be some value deals to be had in Broadmead right now; however, not the most family friendly area and those Broadmead covenant headaches. But some value deals all the same…

Oh I am not advocating on people renting instead of buying. My position has always been that if you find a house you like and want to live there long term and can afford then you should buy it, who cares what prices do in 5/10 years. But owning your primary residence should not be seen as a get rich scheme, investment properties and other investments are for that purpose.

Maybe nothing. We disagree about whether or not you have assessed the relevant variables accurately. Time will tell about this if we are around in 20 years to compare. What we do know is that homeowners have come out massively ahead of renters in quality of life and net worth for the past 20 years. We’ll see what happens next.

The math with your assumptions indicates 20k a year more cashflow over 10 years, so not sure what more there is to say.

So now we are comparing quality of life during retirement and not in the 10 year time frame you had previously focused on?

As you can see with your own statement, outside of selling or HELOC there are no other way you can effectively monetize your primary residence and extract the paper wealth. With selling or HELOC you either have to find another place to live or take on more debt.

Yes, the importance of “detached houses”, when we have just removed the exclusivity of detached house zoning across the province.

I should have been clearer. The Comox Valley worked together to recruit doctors and collectively only 3% of residents are currently without a family doctor. The area that is covered includes Cumberland, Comox and Courtenay. Comox is 5km from Courtenay and 15km from Cumberland.

I would go so far as to include Royston and areas in the surrounding regional district as up for consideration for affordability and doctor access.

There’s a reason you put valley in brackets.

Better than the US, when you measure practicing Physicians or Physician visits per patient.

And Canada has higher patient visits per capita (6.6 visits per year) than average developed country.

If we could reduce the visits per patient per year from 6.6 to the US level (4.0 visits per patient per year) (by adding user fees and nurse practitioners), doctors could see 6.6 : 4.0= 65% more patients and we’d solve the family doctor shortage.

OECD data

https://www.commonwealthfund.org/publications/issue-briefs/2023/jan/us-health-care-global-perspective-2022

If you think Comox (Valley) is mostly a military base, you haven’t taken a very good look in awhile.

Tumbler Ridge area is beautiful. Lots of mountains, and waterfalls. Don’t know what that comment is about. Comox is mostly a military base.

Perhaps. But Canada still clocks in at ~2.5 physicians/10^3 residents. This is about 2/3 the average in the rest of the developed world..

https://data.worldbank.org/indicator/SH.MED.PHYS.ZS

Yup. Professionals are not at risk of housing insecurity but they also expect to be able to buy a detached house. And Comox is beautiful. It’s not like moving to Tumbler Ridge.

James to finance your child through a basic hockey season your probably looking at $3,000 to $5,000 including registration, equipment, out of town hockey tournaments, summer hockey camps, gas, etc… By 12 or 13 if your child plays at a higher level it is more like $20,000 to $30,000 per year and there are thousands of kids playing at that level in BC between the ages of 10 and 20. Children’s sports have now become a big business, the level of play has risen dramatically but im not sure of the enjoyment of it has.

Totally agree.

I should have been more careful with my wording.

I would not be surprised to see uptake on missing middle properties by developers.

I would be surprised if HELOC-driven second home purchases did not decline given rates and appreciation stagnation. In addition, STR purchases may essentially disappear and there were obviously many people purchasing places that were for STR or partial STR use.

Yes, good article. The Comox family Doc interviewed in the TC article is saying exactly the same thing I said a couple of years ago on HHV (see quote below). Many docs “quitting” family practice are really just switching to walk-in’s or tele-medicine. And so the new BC funding model for office based family docs is a good move in this direction to encourage them to stick with office based family practice. Here’s what the doc says in the article.…

https://www.timescolonist.com/local-news/community-recruitment-team-draws-44-family-doctors-to-comox-valley-8060234

“ We actually don’t have a family doctor shortage in Canada — we have a shortage of family doctors practicing family medicine,” he said. “If you took every family doctor in the country that was doing a walk-in clinic medicine, and put them into longitudinal practices, we wouldn’t have any patients in Canada without a family doctor.”

You mean like family doctors? I see that with the change in the funding model Comox has recently been very successful in addressing the doctor shortage by drawing 44 new doctors in due to lower cost of housing and other lifestyle factors. Comox currently has only 3% of the population without a family doctor. I would definitely move there if I was just starting out. You can buy a house for under 700k.

https://www.timescolonist.com/local-news/community-recruitment-team-draws-44-family-doctors-to-comox-valley-8060234

Do they? I don’t personally know of any renters with a higher quality of life than homeowners because they choose to rent but I know loads of people who have a huge uplift in quality of life because they bought – especially over time.

My parents, despite being low income, have had a comfortable retirement because they’ve owned a paid-off house for more than thirty years. Now that they are downsizing they will have a large amount of equity to increase their quality of life.

Nonsense. Minor hockey is like 2 grand a season if you’re not sticking your kid in an academy.

Lol. Talks about how prices haven’t dropped at current rates, then goes back to when rates were lower… “Gaslighting”.

Totoro, clearly the current rate increases haven’t dampened any enthusiasm for house purchases because we’re not back to 1843 prices in Victoria.

They can sell or HELOC it and it is worth a million. They can rent it out and travel. They can suite it and move into the suite and provide a home for a child or rent it out. It is how many Canadians fund their needs in later years. Meanwhile, someone who has rented instead doesn’t have this option.

Yes and leverage goes both ways, just ask the sellers on the MLS with list prices lower than their original purchase price. Main benefit of buying a house is stability and enjoyment, it is not a get rich/wealthy scheme. Yes someone’s POS house in say Sannich is worth $1 million, what good does that do for that person outside of selling it or doing a HELOC?

20k doesn’t get a couple kids through one hockey season.

Right, so the renter experiences a fairly significant lifestyle upgrade compared to the owner for 10 years. What is that worth? Don’t know but it is a question where the answer would differ from person to person.

But do you think idiotic bureaucracy like requiring an arborist report to build a garden suite in Saanich will ever go away? (then you wait more than a year for a permit while someone at Saanich “reviews” the arborist report aka files it away). It is a completely useless report that adds thousands of dollars to building housing when the common sense thing (especially given we are in a “housing crisis”) would be if your garden suite is within the footprint of the bylaws any tree is fair game, end of story. This is just a small example of many. You should see the non-sense in multi-family and the associated expenses.

Being involved in a rezoning/build has really opened my eyes as to how screwed we are on housing.

This is why the approvals system needs to be depoliticized as much as possible. As long as we have a discretionary process it remains broken and guarantees shortages.

Of course Victoria will never be cheap, but without a bunch of change we are on the Vancouver / San Francisco path for sure.

Yeah the housing market is a titanic. We know supply side reforms work, but at best they work by making things not get worse (i.e. rents stop increasing, multifamily prices stop increasing) while incomes catch up. They don’t work by crashing rents and prices. Supply doesn’t move that fast.

Someone who is struggling today may be better off moving to a cheaper locale than to hope things will radically improve in the short term.

And the other thing in a rent vs. buy analysis is leverage – I mean, many people take on say 500k or much more as debt to buy a house, but only a very small percentage of renters would ever take on that much debt to buy investments, or even be allowed to take on that much debt, or have the discipline to ride out blips and wait for the payoff over years as they do with RE.

Legislative reforms are a positive, unfortunately the bureaucracy doesn’t go away. Housing situation on the whole will just continue to get worse and worse. The only thing the legislative reforms will do is make the trend of worsening a bit slower in 5-10 years, but things will worse.

The reality is the average person doesn’t grasps Leo’s ultra simple hot dog example and given the average person can’t grasp that they will never understand concepts that would bring more inventory to housing; therefore, they will continue to elect politicians that will lead us down the path of worsening housing situation.

All the average person knows is to complain on Facebook about why a 1-bedroom in a new apartment building in Langford is $1,800/month or two bed $2,800/month, then that same person complains about too much density in Langford and how too many trees are being cut in Langford, ohhh and the greedy developers.

Multiple vacations abroad, eating out every day, partying on the weekends, ski trips to Whistler, buying garbage from Amazon, monthly payments on an $85,000 Tesla, a cat, a dog, having kids, putting your kids into hockey, owning a horse, buying a boat, buying an RV etc. etc.

It’s not hard to think of ways to blow an extra $20k.

You would be surprised! Just one angle I’ve seen is non-builders/non-developers picking up missing middle/BC legislation potential SFHs. I do agree that the majority of demand is from primary residence buyers but inventors have not completely disappeared.

If interest rates come down 2% which is totally within the realm of possibility it quickly changes the cash flow numbers. With immigration where it is and lack of supply there is a reasonable probability rents continue to increase.

I would not be shocked if a cash flow negative property today was cash flow positive within 5 years, let alone 10.

The COV missing middle has yet to produce a building permit, let alone a development and the provincial legislation will be many years behind. Questionable if we see a completed development under the BC legislation before 2028/2029.

Affordability is what matters, not rates directly. If affordability is good and rates increase, that worsens affordability but not enough for people to stop buying. If affordability is terrible and rates rise, then prices fall (see 2022).

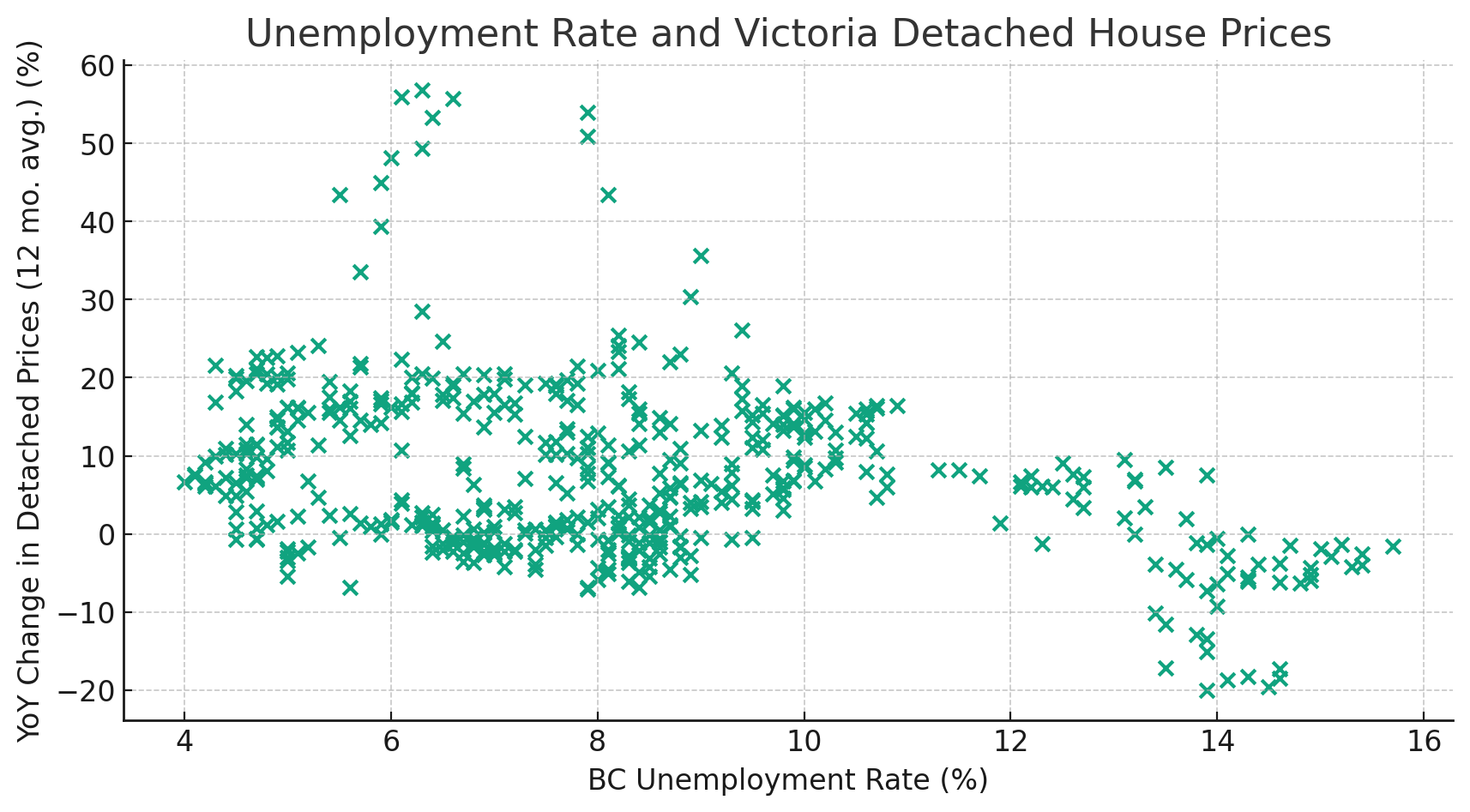

No doubt a poor economy isn’t great for real estate, but there’s less of a correlation between unemployment and house price growth than you might expect

Your assumption is that rising rates should result in lower house prices. But that isn’t what has occurred during other periods of rising rates (1970’s and 1980-81). Inflation correlates with higher house prices, not lower. While rising rates increase mortgage payments and have a negative effect on prices, that effect isn’t as strong as the upward effect on prices from expanding economy, wage growth. And in the current situation, you can add population growth. Periods of falling house prices have occurred as rates have fallen, because the cause of both of these is a failing economy.

I’ve been saying the same thing on HHV for years – that we should expect prices to rise as rates rise (because of the expanding inflating economy), and should expect prices to fall if/when the economy falters and the gov’t lowers rates.

That’s why house prices rose 5% in 2023 despite rate rises and we are close to peak prices in Victoria (within 5.6% of May 2022 peak according to Teranet ) https://housepriceindex.ca/2023/12/november2023/

All of my business calculations are in USD, so just for fun if you look at the rise in home prices in chart 2 between 2014 and 2023 the rise in home prices is a lot less dramatic in USD. That may tell us something about the actual purchasing power for the average Canadian.

This is what we call gaslighting.

Take a look at Figure 2 above. From Q4 2019 to Q4 2021 the relative gain in prices for SFH was 55%, whereas between peak prices in Victoria in Q4 2021, and and current prices in Victoria Q4 2023 the price drop was a whopping 9%.

Prices are still up 40% from the pre-pandemic baseline in this city. Same trend for condo prices.

So while there has been a slight slide in prices, overall the trend over the past few years is for prices to have risen dramatically.

Well if you are not assuming investing the difference then it’s a pointless argument to make because vs rent vs buy analysis is predicated on the difference in monthly cashflows to make it work. If the renter is not investing the difference then what is he/she doing with that 20k a year?

I see them proclaiming that they want to do the opposite, but thus far have done nothing to increase supply above what the market has already provided.

Municipalities have passed legislation that has led to zero new supply in the past 2 years.

The federal government has brought in over 1 million people in the past year, a majority of those people going to large urban centres, driving up population demand for housing.

The only action that plausibly might increase supply is the recent BC provincial legislation, which has yet to produce a single development.

Considering we have had 30 years of low supply, demand-oriented policies from government, and just now an inkling of action on supply (but zero action on reducing demand), I think my statement stands.

Totoro: I suspect the comment about governments stoking demand is the half million plus immigration policy of the Fed. Whether you agree with the policy or not ( a separate discussion), it is defiantly increasing housing demand.

Since we operate our business out of Lichtenstein, I saw an interesting stat comparing GDP per capita between Canada and Lichtenstein (calculated in USD). We are about a third of Lichtenstein . Just maybe if you are feeling poor it is simply because we are less wealthy than we think.

. ,

How so? I see them doing the opposite.

The math does not currently support buying investment property any more unless you are willing to be a landlord for 10 plus years and are ok with negative cash flow.

At current rates and market conditions using a heloc is to buy is not wise. So not sure who all these ‘speculators’ are you are referring to but the demand side is far more likely to be coming from primary residence buyers now imo.

Those that own rental properties will not be looking to sell en masse I’d think unless they are str operators. Str sales will bring more inventory to market this year imo.

Except they haven’t. Prices have dropped in most areas.

You know this is all anybody’s guess at this point.

On the one hand, with current rates it seemingly makes zero sense that prices have stayed stable. Even with record high immigration, downward price pressure should have been much higher.

The bullish case for RE seems to come down entirely to pent up demand. Basically, everyone holding real estate knows we have a supply shortage, and governments are trying to stoke demand instead of building supply, so they’re not willing to budge on prices and waiting for the next run up.

Frankly, I’m part of that pent up demand, and I would be happy to wait longer for a more sane market except it’s quite possible that speculators and investors may push prices higher and I might get priced out again.

So, unfortunately, in 2024 this is where we are again. As soon as rates start to slide, FOMO is just around corner. Unless something happens to break the speculator fervour, anything could happy in the coming year and it may not be what you’d expect.

If renting was a secure, affordable, option longer term owning would not be so desirable. It’s not except in extremely rare cases in BC.

Most people who rent are not diligently investing the difference between renting and owning. And even if they do, longterm the home owner has almost always been better off financially and stress cost wise re Patrick’s example even if appreciation slows and interest rates are higher.

Honestly, I’m kind of exhausted by how much time and life energy it takes to house a family in Victoria. Legislative reforms are helpful, but I currently don’t see how housing insecurity doesn’t continue to grow with all sorts of negative consequences.

Compare: buy $1.2m house with $200k down vs rent a house for $4k/month and invest $200k

Buying Houses (owner occupier) become better than rent over time. 10 years is too short to see that. Let’s look at 25 years.

buy $1.2m house with $200k down vs rent for $4k and invest $200k

—— for the buyer: After 25 years, the $1.2m house is paid off and likely worth $3.2m (assuming 4% nominal growth / year).

——- for the renter:

—- The renter (starting with $4k rent) has over the 25 years poured likely an average of $6k rent per month so 25x12x$6k=$1.8 million rent (!gasp!) poured down the drain, unwittingly paying off his landlord’s mortgage.

— And his $200k TFSA/brokerage account might be $1m (5% return and top ups in the early years until rent goes up) That $1m is enough for a 30% down payment on an equivalent but now $3.2m house if he finally fixes his mistake and decides to buy it, assuming he finds a bank to give him a $2.2m mortgage.

—- and the renter may have been evicted a few times, fun and games for his family moving around the city.

Summary: after 25 years … The buyer has $3.2m and has enjoyed secure/stable ownership for his family for 25 years, and pays no mortgage or rent.. The renter has much less equity…$1m, and has been jerked around on various rentals for 25 years, and still faces high rents. Like most homeowners, I’m sure glad I chose the “buyer” option many years ago.

lol the never-ending rent versus own calculation, here is a rough alternative:

Put 200k in whatever index fund and assume a conservative 5% return because real investment gurus don’t need to do this. Considering your mortgage assumption is 6%, then one should be able to get a 5% GIC or pretty close to it.

Rent the 1.2M house for I don’t know 5k/month? Positive cash-flow compared to mortgage/property tax/maintenance on the 1.2M house is somewhere around 2k a month or 25k a year at the start but factoring rent inflation call it 20k a year to take the midpoint for simplicity. Add that 20k to whatever fund every year.

10 years later you are at 577k or 377k total cash gain pre-tax. Assume 100k was from TFSA that leaves roughly 310k of capital gains of which ~150k is taxed at say 50%, so that is 75k in taxes or around 300K of after tax gains. All in all, 85k or a higher end Tesla better compared to buying the house but you trade stability for liquidity.

I don’t think the <600 sqft one bedroom and <900 sqft 2 bedroom units will fair well. large one and two bedroom units with big patios will be ok provided the 2 bedrooms don't cost as much as a decent house/townhouse.

The downtown condo market has me scratching my head. The average months of inventory for the last quarter was 12.6

Yet the median price over the same period hasn’t changed much.

There are about 166 condos for sale downtown which is about 40% of all the condos for sale in all of the Victoria Core districts. The number of vacant condos for sale is running about 30% which isn’t that bad.

If you’re looking to buy a downtown condo – you have the pick of the litter.

If prices do start to come down, I think we’ll see it in downtown condos first. But at this time sellers are holding hard on prices.

-Lots of downtown condos for sale. And lots of downtown condos for rent. I think most investors wait until their property goes vacant before they put it up for sale, so a lot of rental listings could be a sign of more condos coming to market soon.

It is just a math equation and what you are calling a “free boost” is really just another way of saving that the borrowing costs you less over time. It is also quite possible interest rates will drop – who knows.

Equally or more important is the rate of appreciation/depreciation.

At any interest rate you need some level of appreciation beyond the overall cost of borrowing to have a positive return. The lower the interest rate the greater the ROI because the cost of borrowing is lower. However, as long as there is some appreciation that over time exceed the costs of borrowing you are going to have the compound gains that leverage brings on the entire asset price.

You can see the math here in a really simple way ignoring factors like costs of ownership vs shelter value or other stuff like suiting your home and having rental income or adjusting for inflation:

Borrow 1 million for a 1.2 million home and 2% interest rate and use our actual rate of appreciation in Victoria for the past 10 years of approx. 6%:

Initial investment: 200k

2034 value is: 2.2 million

Equity paydown: 270k

Interest paid:173k

Total gain: 1.097 million

Total ROI: 448.5% or 18.5% per year tax exempt

Borrow 1 million for a 1.2 million home at 6% interest over 10 years and 4% average appreciation over 10 years (probably more likely going forward?)

Initial investment: 200k

2034 Value is: 1.8 million

Equity paydown: 165k

Gain: 765k

Interest paid: 550k

Total gain: 215k

Total ROI: 107.50% or 7.57% per year tax exempt

Scenario one is what has happened. Scenario two is just a guess, but a mortgage still seems to be worth it given the alternatives with 200k and the fact you need to live somewhere and presumably pay rent otherwise.

US CPI Inflation has risen prices 10X since 1960. Yet Fed rates were 2.5% in 1960 and are higher today (5.25%)

Inflation is a much bigger source of gains, and it is ongoing.

Poster “Airbnb4me” where you at???

RRSP gives you tax free or even tax negative returns, but too many people don’t understand why.

The point is that declining interest rates create gains in asset prices in and of themselves, and we’ve just seen the end of the largest decline in interest rates in history.

Sure if other factors lead to asset price gains with flat interest rates, more leverage will increase those gains. But you’re not getting that free boost any more.

From Reddit – 18,000 people live in this single building in Russia.

“The building has seven grocery stores, three beauty salons, one nalivayka [draft beer store], a florist, a construction material store, a private kindergarten, three cafes, a post office, an online pick-up point, a pharmacy, an out-patient hospital, a children’s sports center, a pet store, children’s store, a stationary store and a computer game club.

In Vancouver and Victoria prospective purchasers consider real estate such a low risk purchase that they are willing to accept a low rate of return at and sometimes less than the rate of inflation. And that is understandable as the marketplace has been resilient to a significant correction and real estate has been a highly liquid investment for a very, very long time.

It’s a rarity to see a court ordered sale as those that do get into financial trouble may easily sell their property without suffering a significant loss. So I would put people’s current assessment of risk in owning real estate at zero.

Primary residence long term is such a no brainer. The government basically gives you two tax free things, primary residence and TSFA; not using both and maxing out TSFA is financial suicide imo.

Interesting to see current rental yields for condos in major cities around the world. Vancouver has some of the lowest rental yields worldwide (3.1%), except for Asia and Sydney Australia. Yet, just “down the road” , Edmonton (5.8%) and Calgary (7.0%) have some of the highest yields worldwide.

5 cities from Canada included, with rental yields from high to low…

Calgary 7.0% rental yield

Edmonton 5.8%

Ottawa 4.0%

Toronto 3.7%

Vancouver 3.1%

(Victoria not big enough to be included)

Ignoring capital appreciation potential, obviously Calgary/Edmonton have more than double the rental yield of Vancouver.

Notables Topping the worldwide list with highest rental yields are

Miami 10%

cork, Ireland 8%

Chicago 7%

And at the bottom …

China/Hong Kong/Korea/Taiwan 1-2% !

Sydney, Australia 2.8%

Tokyo 3.1%

https://www.numbeo.com/property-investment/rankings_current.jsp?displayColumn=1

Yes, buying any condos or sfh in move in conditions won’t make cash flow neutral in short-term. From the Vancouver buyers’ trend on probate sales and development land, RE may be the game only for flippers or small developers in the next few years.

Interest rates up or down , leverage to get ahead is pretty much the only way to grow wealth . It is a long game and it more so comes down to the deal of day

A higher mortgage rate does not negate the power of leverage to magnify RE losses/gains. The basic value of shelter has to be accounted for as well as the appreciation rate over time. It is very likely leverage will work in your favour over time even at higher mortgage rates and your return will exceed the stock market – especially for a primary residence with a capital gains tax exemption.

Well that’s the point really. If you have a declining interest rate trend over 40 years, the more leverage you can get from an asset, the higher the returns are likely to be. We are looking at a new era going forward and that’s not going to to apply any more. Not saying you can’t still make money from RE, but it’s not going to be from that factor.

I am super bullish on real estate long term reason being is I don’t see the “housing crisis” being solved in my lifetime. High interest rates are masking the problem right now plus a small amount of sudden inventory from the previous STR units.

I have one cash flow negative condo right now but the sole reason it is cash flow negative is I financed it short term at close to 6%. If I am able to refinance it in 12 to 24 months closer to 4% I am cash flow neutral. Then, I’ve never had a situation in my life where I’ve rented any of my properties for less than exiting tenant. It’s been either the same, or the majority of the time more so eventually tenant will move out and I’ll rent it out for a couple of $200 more and all good. I am not saying rents will never fall, but in my opinion not super probable once the STR inventory clears out.

Real estate is a long term game and when I look at my real estate investments versus stocks both of which have done really well, I’ve done much much better in real estate on the whole as I was highly leveraged before interest rates started going up. I can’t/couldn’t leverage Embridge/TD/CN/etc. shares 4 to 1.

The returns on some of the pre-sales I bought in 2009/2011/2015/2017 and still own are really solid but it takes 10+ years to see the results (rents going up, mortgage principal going down, etc.)

I think five years of flat would be good for everyone.

Warren, I did not forget I just did not want to restart a debate on that here.

Upzoning has recently been done by the Ontario provincial government, with similarities to BC, and is “flopping”They haven’t upzoned the entire province, but have focused on certain areas, like close to transit hubs. ontario’s approach is different than BC in that they are given to developers for specific projects and not just general upzoning. Anyway, they have discovered that there have been very little results – so much so that they are considering cancelling much of the upzoning granted to developers.

I predict similar “lack of results” in BC, as measured by shovels-in-the-ground. All this confident talk about “increased supply” resulting from upzoning because it happened in Auckland may face the reality of the whole idea flopping like it has in Ontario.

At least I credit the Ontario government for acknowledging that it has been a flop, and considering cancelling the upzoning as a “use it or lose it” threat. I wouldn’t expect our BC government to ever admit that their ideas flopped. Just like when the our local missing middle upzoning flopped last year with few takers, the blame was on the regulations that needed to be “tweaked”, rather than the realization that economic factors outweigh these zoning changes. It’s nice to hear the Ontario government to say “we expect to see results” and take action (including cancellation) when it doesn’t happen.

https://www.cp24.com/news/ford-government-puts-its-own-zoning-tool-under-microscope-for-possible-cancellation-1.6686164

“ Ford government puts its own zoning tool under microscope for possible cancellation

As a result of the review, eight orders unrelated to housing are being consulted for proposed amendment or cancellation.

Another 14 housing-related MZOs are “under enhanced monitoring because they are showing a lack of progress.”

“I have always been clear that if we do not see the results we expect from a zoning order, our government will not hesitate to amend or revoke it,” Calandra said.

“This approach sends a clear message that when our government issues a minister’s zoning order to support priorities such as housing or long-term care, we expect to see results.”

A MZO is a provincial mechanism that allows the government to re-zone a piece of land and override municipal development bylaws or regulations.

Whatever, I think a lot of people would be happy with a flat to falling real estate market for a the next few years in order to bring some sanity back to the market and perhaps break the cult as real estate as an investment rather then a place to live.

I think in the last decade there has been an increase in the number of amateur investors that got caught up in the continuous and unrelenting hype of real estate. Positive cash flow, and a return on investment where the things that old fogeys talked about. The new paradigm was to buy for appreciation. Now after a couple of years of flat condo prices, rising property taxes, mortgage payments, and strata fees buying a condo as an investment isn’t as attractive anymore.

In my opinion, people are still paying too much for a condo. They are paying about 18.5 times gross rent for a downtown condo. Personally, I think that is too high. What multiple should someone be paying? That’s going to vary from person to person depending on their tolerance for risk and their personal rate of return relative to other investments that could be purchased instead.

I just don’t think we have seen the effects of the higher interest rates on a significant number of people renewing yet. That’s not likely to happen until the spring.

“Beware the Ides of March”

– Billy S.

There is no such thing as a single-unit sensible investment whether condo or detached. Should you wish to make a leveraged speculative play against future prices whilst subsidizing some stranger’s rent, please jump in, but if you’re looking for return on capital fugeddaboudit.

You forgot to include the capital cost of your downpayment. Common.

Wonder what the price needs to be at the Janion to make it be a sensible investment?

$1,395 a month does seem low. The suite might be in a one of the less desirable locations in the building. There is another listing at $1,595 a month in the Janion, but that would still be a negative cash flow with 20 percent down.

The investors that are left will be the optimistic ones that are betting on lower interest rates and higher rents in the future.

I think we are going to have a shake up in the rental market come this spring with a lot of rentals coming on to the market, There about 115 rentals on Craigslist available downtown at the moment. We may see that hit 200 by the spring. That could mean that some of the condos could remain vacant for two months before finding a tenant.

That’s a major downside of being a landlord of losing two months of rental income and still having to pay the bills. Some people might say to lower the rent to get a tenant, but that might not be possible for those that have jumbo mortgages on these properties. They need so much a month to pay their bills, accepting a lower rent just locks in their loss for a year and more.

Whatever, thank you but I am not looking for an appraiser. Someone on here was worried about whether TD knew what it was insuring and I was suggesting that they ask TD to send their appraiser to make sure that everyone knows what is being insured.

Looks like it’s dragging down the metropolitan too.

The rents are interesting. Not sure if that supports the investment price. My quick calculation, deducting insurance, strata fees, and property tax with twenty per cent down would leave you seriously in the hole every month at 1400 rent. Maybe my math is wrong but it looks like you are a thousand a month in the red.

Barrister then I would suggest Amanda Mills of Mills Appraisals. She is a very likable person, knowledgeable, and respected appraiser among lenders and her peers. She should be able to help you. Don’t have her phone number.

Barrister, there is a 315 square feet micro unit listed in the Janion at $1,395 per month.

The big surprise that has come from the changes to vacation rentals is the number of bedrooms in homes that have come on to Craigslist. Home owners renting out a bedroom with a bath for $900 a month. I’m guessing home owners were renting them as vacation rentals before the change.

Lots of rentals available in the $1,100 a month range along the Gorge that are now available to house those that could not afford to live in Victoria such pensioners.

Whatever, I guess I was not clear, I am insured with TD but I was mentioning that they actually sent an appraiser out to look at my house a couple of years ago. No idea if the appraiser worked for a third party and this was at no charge to me.

Barrister are you looking for an insurance appraiser or a market appraiser? Most residential appraisers don’t do insurance appraisals as the cost for the software (Marshal & Swift) and regular updates are excessive relative to the number of insurance assignments that are ordered. With today’s online programs it is no longer a profitable business to offer house insurance estimates.

Having said this, some Commercial Appraisers still make use of the Marshal & Swift software as they need to calculate replacement costs for multi-family housing so they might be able to help you with an insurance appraisal on a house.

I also should explain that the cost to build a new house on a vacant lot is not the same as its insurance cost. There are other costs associated with insurance such as demolition, partial damages, repairs, cleaning of furniture and fixtures, renting other accommodation while the repairs are being performed, etc. For example to build a new home on a vacant lot might be $350 a square foot. But the insurance cost would be substantially higher at say $500 a square foot and more for the above reasons. It will also depend on the coverage that you want. And lastly, the insurance is for replacement cost and not reproduction costs new. Replacement Costs are the costs to build a new home using today’s building materials and not the quality of materials when the home was built say in the 1930’s as many of those tradesman that did lathe and plaster work no longer exist.

And lastly, TD does not have appraisers on staff. Lenders use one of three national management companies such as NAS, SOLIDFI, and Real Property Solutions (RPS). These management companies and lenders set the fees charged. You will not have a choice of which appraiser to use or receive a copy of the appraisal. And those fees will be higher than if you hired your own appraiser directly as the management company charges an additional fee that bloats the cost that you end up paying sometimes doubling the cost to you.

Personally, I consider this to be collusion between the lenders and management companies to set fees. You should be able to chose who appraises your property, negotiate the best price for the service, and you should get a copy of the appraisal report. You should also be able to speak with the appraiser about any concerns that you have with the property description or how the analysis was performed.

For the most part, brokers, loans officers and appraisers dislike the management companies. However 85% of all mortgage appraisals originate from these three management companies in Canada.

I had a TD appraiser come and look at the house about a year ago. Can you request one?

Marko, what sort of rent can you get for a typical small Janion unit?

I’ve had TD home insurance since 2010 and they have never inspired my confidence — in fact, a couple of times I’ve been shocked by basic errors that I caught only thanks to conscientiousness. I don’t know why TD can’t tell its head from its ass, but I suspect it has a lot to do with its crappy method of scraping property information from databases combined with the fact that many (all?) of its insurance agents are WFH employees based in places like Nova Scotia.

All that being said, I’m reluctantly sticking with TD because their premium is always the lowest by far.

Gawd help me if I actually have to make a claim.

I’m just looking at different providers now, as my insurer just jumped our premium almost 25% for basically no reason (earthquake yes, but that’s only one part of it).

My hesitation with TD had always been that while the process of getting the insurance is dead-simple online, and the premium is relatively cheap, I’ve never been confident they’ve got it properly covered, in part because I think you can’t correspond with them by email on the record – is that still the case?

Just went through the process online, and their quote (which is quite a bit lower) takes into account the information on the house off public records or otherwise, presumably BC Assessment – but I already know that info is outdated, as is probably the case quite often.

In the process of finalizing TD insurance, is there a point where they send you all the “assumed” details on your house before you sign up, or are you effectively signing up to something that isn’t perhaps based on reality and so you only have sort of “maybe” insurance, which is not the point?

Downward price pressure in the previous STR buildings starting to show.

ERA unit down to $399k and a Janion unit down to $375k.

Just watched Frontline documentary “The Age of Easy Money” on PBS, it’s coming up at 12 noon PST today (Saturday Jan 6) on KCTS World, I recommend it. It appears to be blocked for streaming on the PBS website.

https://www.kcts9.org/schedule/world/20240106

It has been suggested that North Park would be an ideal area for major public housing and supportive housing developments. Not sure I agree but it seems to be a further continuation of the condos so I guess it makes sense.

Yikes – I think a few of you need to get out more. Canada is probably one of the least racist places on earth and additionally has almost zero class-gradient. If you find this difficult to comprehend, travel. Start with the UK.

Patriotz ya at 60 I guess I’m too young to remember lol

Plenty worse within my own lifetime, and worse than that before it.

Add classism to that list. “The house is not designated heritage but lies within the Prospect Heritage Conservation Area…”

With so many sticks available in OB to stick into the spokes of growth, I suspect that there will be none there.

I would not characterize the issue as “going after heritage buildings”. In the article linked a big objection was that the public’s view of the heritage building would be obscured…. No heritage buildings are projected to be removed.

I think a far bigger issue is the confusion and delay that is caused by going through a heritage conservation area (HCA) designation like this one: https://www.oakbay.ca/municipal-services/planning/heritage-conservation-area This has already in debate for eight years (HCA initiated by request from neighbours when a proposal for a development in the area came forward) which means every attempt to remediate or renovate a home or even a rock wall has been stymied.

Personally, I’m not opposed to an HCA in this area – it is historic, but the confusion and uncertainty this creates and endless delay means that the Province should probably mandate the process and timelines more carefully. It is a case study as to why rezoning and development approvals can be a black hole at the municipal level.

When it comes to trees, they are very clearly being used to stymie the type of development which would create way more environmental benefit overall than retaining a 1930s home with huge trees would. Have you ever seen an energy efficiency report for a 1930s home? And the environment is not defined by a municipal boundary. Retaining one huge tree in Oak Bay does not offset cutting down five in another area to build a new house.

Marko, true that , but it can’t be understated how much hatred and racism exists today in society . It’s the new normal and housing fuels that fire

I saw that….lol. How sad must this individual’s life be? Do they ever even turn on the news to see what is going on in the rest of the world. Why not focus on eating healthy and exercising….I can’t imagine what would bring me to the point in my life where I would give a 2 cent care about how a multi-million dollar home looks like in terms of architecture.

Easiest place to build on without having to tear down a lot of stuff would be the uplands, or the golf courses.

Totoro The upzoning in single family has been a big step forward , I don’t think going after trees and heritage buildings would be in the provinces best interest socially

The amount of flack the OB Council gets from neighbors is unbelievable. I don’t blame them from sending things back for more “reports”. In order to make changes stick the Province is going to have to clear away Council control of heritage “issues” and trees imo. It is a no win situation if you are on this Council even if you want to encourage development.

Case in point, this lovely card a neighbour received when they recently built a new home in Oak Bay:

https://www.facebook.com/photo/?fbid=10160396880582961&set=pcb.10160396976157961

lol….this would require some common sense and logic which guaranteed will never happen.

Half the University campus itself is in OB, perhaps they could get away with just upzoning that. 🙂

If I was Oak Bay, I would very publicly announce major rezoning around the University with a view to hitting targets, and helping with housing the student population and along the outer corridor with some ten story buildings. View the present downtown as historical. This should hit targets and hopeful satisfy the Province. We have only so many construction crews and the university development would consume many of our resources for the next decade.

If I were them and wanted to hit the housing targets without touching single family residential areas I’d upzone some areas in the centres and corridors to build mid rise of the type that already exists in Oak Bay, then make the fourplex regulations unworkable with various other regulations to limit development. I bet the province would look the other way if they were hitting the targets overall even if they were not really following all the new standards.

But what I suspect will happen is they’ll say no to both density in the centres and density in the neighbourhoods and there will be a showdown with the province. Going to be interesting

There’s likely a persistent negative bias over the years, will have to take a look. Would be interesting to compare it with the BCREA predictions over the years, but they do their best to erase their old predictions as soon as the new ones come out

Umm really , There is going to be a lot of trees in the way when it comes to the new zoning changes . A lot of protest to come

Those of you equipped to defeat paywalls may find this worth your while – not suggesting there are parallels, just as an interesting oblique to current discussions here.

https://www.telegraph.co.uk/money/property/australia-immigration-house-prices-renting/

My predictions also got missed due to using the comments rather than the form. No matter, I had followed the masses by being overly pessimistic.

Prediction for 2024: a slow fizzle at first, followed by a slightly exciting reversal when rates start coming down.

Ya, the province should probably include limits on the protected tree bylaws and heritage designations in the housing bill as well.

Well, not much has changed in Oak Bay except the ‘stop overdevelopment’ signs have disappeared. Now it is ‘stop insensitive design’. https://www.vicnews.com/local-news/insensitive-aesthetic-oak-bay-dislikes-new-homes-blocking-heritage-house-view-7292532

As expected, my insurance with TD jumped a lot at renewal, but strangely I’m still paying less ($1692) than you, Leo, for pretty much exactly the same house 🙂

You can try pushing up your deductibles. Not sure who your provider is, but TD lets you set them quite high and it can lower your cost by quite a bit.

I don’t intend to use the insurance unless something catastrophic happened, so it seemed pointless to have a low deductible.

Your best bet is to use google.

Example search:

house insurance site:househuntvictoria.ca

We paid ~$2k last year for a ~2000sqft 1970s house.

The problem with a national rental analysis is that the rental data is too broad and it can become outdated fast.

What I have to do is match a rental listing with the real estate board’s data to obtain important information such as address, age, and floor area. As I use a rent per square foot analysis which is very accurate. But, half the information provided by landlord’s is just wrong and needs to be checked for accuracy as landlord’s over state the floor area and the type of rental. Is the rent for the entire house, the main floor, basement, etc? Is it a new suite or one that has never seen paint. Is the rental downtown or in Gordon Head. Stats Can would need someone that knows the areas. As these factors make a big difference.

The problem is this takes time, which stats Canada will not spend on obtaining reliable data across the country. Stats Can would be better off speaking with the appraisal companies in the cities across Canada, as they already collect rental data and then just hire one of the appraisers to do the collection and analysis for Greater Victoria. Greater Victoria isn’t very big so it would only take one appraiser one day a week. By the way, this is where the lenders get their up to date rental income information – from their appraisers. But if Stats Can wants to pay me $90,000 a year to do it, I’ll go work for them. I can do it from a laptop on a beach in Hawaii.

I was actually thinking about building a rental data system for Greater Victoria, over the holidays, and how to present the analysis. It would have been a kick arse analysis too. But I’m not going to compete with Stats Can. I won’t lower my standards.

From: https://www.ctvnews.ca/business/statcan-rentals-ca-announce-new-tool-to-track-the-rental-market-in-canada-1.6711815

Okay, but I guess the question is: has anyone used rentals.ca in the 15 years? So, was padmapper (facetious) not available? Lol…I think rentals.ca was useful long ago because it sourced classifieds from newspapers nationally, just not really sure where it’s drawing data from today other than people posting on it directly.

Hi all, is there a way to search the comments for past posts? The reason I ask is that there was a good discussion regarding house insurance providers a while ago and I would like to see previous recommendations…..ours just came in approx 2k for bare bones, 1800 sq ft 1960’s home….are we getting hosed?

Whatever,

How’s your quick scan of the rental market now? can you summarize the trend on supply over the last year?

Median predictions so far:

Sales: 6503 (up 4.8%)

Single family prices: $1,129,000 (up .8%)

Condo prices: $525,000 (down 2%)

Inventory: 2403 (up 13%)

Bank of Canada rate: 4.5% (down 0.5 percentage points)

You will need to see immigration step back big time or a recession for the “bubble to burst”. cashflow neutral with rental income will always be the floor outside of a black swan event. Cashflow neutral entry points were there in 2014/15, early 2019 and for a couple months in 2020.

China’s 5Y Bond Yield is at 2.4%. The drop in bond yield won’t help their real estate market. We will be there next year. When the bubble bursts, it takes a decade to go back to a sustainable market. You can’t push on a string.

We should be so lucky:

China is facing the prospect of a long-drawn correction in its property sector, with the overhang in the housing inventory likely to take more than 10 years to clear, according to Hao Hong, chief economist and partner at GROW Investment Group.

“If you look at the inventory overhang situation — at this sales rate — it will take about two years to clear all the inventory that is outstanding in the market,” Hong told CNBC Street Signs Asia on Thursday.

“And then if you look at the property under construction, we have 6 million square meters under construction. At this rate, it will take probably more than 10 years to clear all those housing under construction. So, all in all, we’re talking about multi years in terms of correction,” he added.

Frank, I am too old to be a boomer, and I feel like I have lost too many friends already. But enjoy the day.