Playing with affordability

We know that there’s been no relief in affordability lately. After staying relatively steady for a year as prices fell in concert with rising rates, it deteriorated even more in recent months as rates pushed higher both in the bond market and from the central bank. Impossible to call a top, but in the past we have seen a cycle of affordability deteriorating for a number of years followed by improvement. In the condo market we’ve seen affordability generally stay within a fixed range over the decades. Affordability of single family homes also seems to cycle back and forth, with the additional trend of gradually getting less and less affordable over decades as single family homes make up a smaller and smaller proportion of the housing stock.

What will happen this time? Will affordability improve over the next few years as it has in the past, or are we in for permanently unaffordable real estate market? No one knows for sure, but I put together a simple tool to allow you to play with the data and see how it impacts affordability. In the chart below you can see affordability for houses, townhouses, and condos charted since 1987. Up until October 2023 it uses the actual median prices (3 month average), BC household income, and prevailing discounted mortgage rates to compute affordability. Then there’s a projection for 1 year into the future to October 2024, where you can change the parameters. Use the sliders below the chart to move prices, incomes, and mortgage rates and see the impact on affordability. By default it starts at the current values (with the caveat that it uses the October 2023 prices rather than the 3 month average, which is why the October 2023 and 2024 data points aren’t the same). You can adjust the parameters up and down by 50% (except income which only goes up).

Of course the market isn’t going to swing that wildly in one year, but the tool allows you to visualize how affordability would change, regardless of the timeframe. For example at today’s rates and prices, incomes would have to jump 50% to make homes as affordable as they were pre-pandemic. But if the average rate dropped back to 3.5%, it would only take a ~17% increase in incomes without moving prices at all. And if incomes only increased say 10% and rates stabilized at 5%, it would take a 15-20% drop in prices to get to the same point. Hundreds of options. Remember that the projection point one year out is arbitrary, you can imagine it anywhere in the future.

What do you think is the most likely outcome?

Also the weekly numbers

| November 2023 |

Nov

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 66 | 152 | 384 | ||

| New Listings | 192 | 429 | 785 | ||

| Active Listings | 2722 | 2743 | 2111 | ||

| Sales to New Listings | 34% | 35% | 49% | ||

| Sales YoY Change | -5% | -3% | -41% | ||

| New Lists YoY Change | +12% | +14% | +13% | ||

| Inventory YoY Change | +25% | +25% | +138% | ||

| Months of Inventory | 5.5 | ||||

No huge moves in the market in the first two weeks of the month. New listings from the grandfathered AirBnB units are still hitting the market in a noticeable way which has contributed to bringing the volume of new listings up by 14% over last year, but it’s not a huge flood. In the last three weeks there were 33 listings in those buildings, VS just 5 in the same period a year ago. Most sellers know it’s a tough time to sell at the best of times going into the traditionally quietest part of the year. With higher rates and an uncertain market, the buyer pool is shallow enough that even market-priced listings may linger a lot longer on the market than most people are used to. The ones that are braving it have generally not managed to turn the listings into sales, indicating that advertised prices are still too high given the new reality without short term rentals. That said it’s worth a try, and there have been a couple sales at prices I would say are little changed from their pre-regulation value. There aren’t many buyers biting, but it only takes one.

The increase in new listings is most noticeable from the short term rental regulations, but listings are also up for most other property types. These are small numbers, but something to watch as an indicator of owner stress that will show up long before any movement in mortgage arrears rates. The central bank has warned that rates may stay “higher for good”, as in not returning fully to the ultra-low levels we saw during and before the pandemic. I wouldn’t say they have a lot of credibility on rate predictions given their famous flub of rates staying low for a very long time, but borrowers should probably not be banking on seeing sub 3% rates before their next renewal, or perhaps even the following one. In the short term there is some rate relief coming though, with bond yields falling again to their lowest level since July after a low inflation print out of the US. Whether the inflation fight is done or not, bond investors believe the end is in sight.

New post: https://househuntvictoria.ca/2023/11/21/leaseholds

2,200-home development in south Nanaimo gets go-ahead

https://www.timescolonist.com/local-news/2200-home-development-in-south-nanaimo-gets-go-ahead-7860805

@Frank I’ll answer since I was one of the ones going on about how awesome they are to stay in when traveling with kids (hotels are fine for me without kids). I’m not too surprised that the government is coming down hard on them. Too many people were drinking from the well and it caused another well to dry up – the government waited as long as it could and then finally had to do something. I understand why the government did what it did and I support it. We are still staying in an Airbnb when we go to cultus lake next summer but I booked it already and made sure it was one in someone’s primary residence. So the big planners like me will still probably have some options since we do things way ahead. Although less options isn’t awesome but I understand why and generally support the legislation. People were just too damn greedy.

While I’m in the mood of sitting here and talking to myself at 3:45am, This Island Is a spectacular place to live, development is in its infancy. If you think the prices are high now…you had better think again.

It has been mentioned here many times, Its not timing the market…Its time In the market.

It has also been mentioned here many times, do whatever everyone else is doing.

patriotz…Look at Hawaii, all the locals live in the jungle except the ones who bought and held Real estate.

I seem to remember a few months ago when Airbnbs were being discussed here, several contributors commented on how fabulous they were and used them all the time when traveling. I understood their point of view. Now that they seem to soon become a thing of the past, at least in Canada, what do they think now?

Keeping people working in RE and supporting current price levels are two different things, and are largely in opposition to each other if you think about it. Bottom line is people have to afford the product to keep them working. That’s the very reason RE busts happen.

Eby and company aren’t dumb enough to bring in something that won’t work and will decrease rental supply – and they’ve said so repeatedly. That’s the polar opposite to the restrictions on STR, which do work and do increase rental supply.

The Feds are going to step up. The RE industry is Huge. Loan officers, bank managers, mortgage brokers, insurance brokers, real estate agents, lawyers, concrete suppliers, lumber suppliers, paint suppliers, excavation and trucking, surveyors, engineers, city hall, loggers, carpenters, plumbers, electricians, roofers, painters, land scapers, coffee shops, restaurants, That’s just off the top of my head…along with all the taxes the above generate.

Its just way too big to fail…And they know it.

3% 5 year fixed by early 2025.

These good deals are back in 1998. In today’s world… fair market value is the best deal your going to get, end of story.

OK, I’ll bite … where are these “good deals”?

I was considering doing an Airbnb in my back yard cottage of my primary residence. CRA is all over it. You need a business license, I’m guessing you lose your capital gains exemption on your primary residence now that you are using it as a business.

There’s no such thing as a free lunch…I knew it was too good to be true.

I bailed.

You really only have to look at the tone of comments like this to realize how charged/polarizing this has become. And I keep coming back to thinking that, in this type of environment, it would be better to consider the possibility of vacancy control also being on the table at some point, if the economy doesn’t roll over first.

I’m good, I have my forever house.

Then jump on it Max.

Its the best tangible asset to own…and the 40% drop in the 80s recovered…bigly.

You can live in it, touch it, feel it, smell it, you can even taste it if that’s your thing…but most important is its yours, and you can call it home.

Its forced savings which are 100% tax free. I don’t expect the same price accelerated run up we have experienced over the past couple of decades. When I bought my house in 1998 we were right in the middle of a recession…I got a good deal…I jumped on it.

I am seeing some pretty good deals out there right now.

Guess you don’t consider a 40% drop in the 80s to not be sizeable? Only took a decade to recover.

65k and 95k lower than the winning bids. The listings weren’t stale and had multiple offers on them.

Nope, but they can be sleazy and cut corners in a multitude of other way. Much more variability with “mom and pop” landlords. Some great, some terrible.

I was born and raised in Victoria. Through my 50 years I have never seen a sizable RE correction. This could be the bottom, this could be the time to buy.

Use these airbnb’s as your entry point.

When I bought my house in 1998 for $225k my wife thought I was nuts. I was young, over leveraged, working 7 days a week just to make the wheels turn.

You have to live somewhere, tax free gains, security…Its never going to crash.

CBC reporting that tomorrow Freeland will announce:

https://www.youtube.com/watch?v=lK309z7PH3M

You want punishment of landlords, take a look at New Zealand where mortgage interest isn’t deductible – at all – for any loan taken out since 2021.

Airbnb is a nest of pirates and any action against them at any level is well deserved. It appears to me from what I’ve read that the focus will be on encouraging more purpose built rentals, not bashing existing landlords whether large or small. But we’ll see.

The liberals have successfully navigated the past elections by making outlandish promises (affordable housing, etc.) before the elections to buy votes from one group (Millennials, etc.) and not keeping the promises to keep the votes from another group (boomers, etc.).

Now, they are worried that the past strategies won’t work in the next election. They are losing the younger voters, their main voting block. They have decided (or at least appear) to punish the investors in the housing market and capitalize on the resentment of renters and younger, first time buyers towards landlords and investors. They will closely monitor the polls to see what’s sticking and hammer on those that get the maximum support. Airbnb is an obvious target and their action on them is getting huge support. They need a big bump in polls so they will go big on announcements tomorrow.

Shouldn’t be, since ABC REIT can’t evict you because they’ve sold the unit or want to move in themselves.

Typically increasing taxes isn’t much of a hail Mary to save the day for unpopular governments. But if you can somehow demonize the mom and pop landlords, then perhaps the capital gains tweak could be popular. From where I sit, the big rental companies (REITs and others) are actually just as hated as the “mom and pop” landlords)

If this happens it will be interesting to see how it is applied. What about capital gains on other kinds of second or third properties that are not rented, such as vacation properties? It would be perverse if there was more favourable tax treatment on vacation properties left empty most of the time than on small time rentals.

how much lower were your unconditionals?

Made 2 unconditional offers so far this fall. Both sellers went with the higher conditionals, but they were in positions to wait for them to be lifted. Also going with a 10% deposit on offers to try to overcome the any rescission period apprehension by hopefully showing we are serious about getting it done. See what the 3rd try brings. Just not about to write any letters.

Keep your eye on the re-sales at dockside green.

They need to be careful (but they won’t be), chasing populist policies can backfire quickly because they are seldom thought out all the way (especially by dying governments at the end of their cycle trying to hang on). Investment builds these things called homes and with all artificial costs every level of government adds to build homes; to minus a lot of money that gets homes built will likely end in many fewer homes down the road. Nothing like shooting ourselves in the foot.

https://loanscanada.ca/taxes/avoid-capital-gains-tax-on-rental-property/

They talk about some strategies to “offset” the capital gains with capital losses elsewhere, not avoiding capital gains.

Would you prefer to pay 20% tax (assuming 40% bracket) now or 40% later when the house is sold for funding retirement (presumably in 15-25 years)? I think most investors who bought before Covid would prefer to pay 20% now (bird in hand) rather than 40% later. Investors who bought during the Covid FOMO may not have any capital gains so their main issue is negative cash flow with variable rate mortgages. How long can they handle negative cashflows?

Since capital gains with stocks would still have 50% inclusion rate, it makes sense to buy them right now and it will make even more sense with 100% inclusion on RE capital gains (if a grace period is given before implementation).

Banks are not ready to pass on the savings from the recent drop in yields. The credit spreads (mortgage rates minus GoC bond yields) generally expand in recessions anyway. Investors with negative cash flows better have deep pockets.

Investors are very important for the housing market as they have historically caused an over heated market to soften. When investors believe the market is over priced they sell, thereby increasing supply and bringing prices down.

That didn’t happen this time as the low interest rate and high rental rates encouraged investors to purchase.

The government is now incentivizing investors to do what they should have done pre-pandemic. Sell.

Basically if you investors can’t control yourselves then the government is going to bring the cane out of the cabinet and give you a thrashing.

Bingo

Yup, risk of bad moves is high when government panics. So far generally ok/good, but anything could happen when you’re down in the polls.

Problem is everyone freezes up when there is an opportunity. Lowball unconditional offer strategy would be a good one to employ in the current market but you just don’t see it. You see lowballs, but with conditions, which don’t have nearly the same pyschological impact on the seller.

You throw down something unconditional infront of a seller that has been trying to sell for a while all of a sudden their “bottom line” can change. Best part as a buyer is you can put wording into the contract “This is an unconditional offer” but legsilation still gives you three business days to change your mind for a small fee. My experience so far with the rescission period legislation (aka cooling off period) is sellers still view the “unconditional offer” as unconditional.

Like you give a seller

$1,025,000 8 days conditions

and $1,000,000 “unconditional”

The majority of sellers will go with unconditional even thought for $2,500 penalty the unconditional buyer can bail.

I don’t think there’d be a pre-announcement of a cap gains increase on rental properties. In the past, theyve made any changes in cap gains rates effective on the date of announcement, usually budget day. There’s a reason for that, which is that people don’t need to sell to trigger the gain. They can (and would) do various things, a simple example is to change use of the property from a rental to principle residence which crystallizes the gain, which they would pay at the lower rate thanks to the government giving them notice. So if they do it, it will likely be a surprise, and effective upon announcement.

Ahh I remember that year, it was wild!! I am honestly surprised there were 268 transactions though but I bet you could have gotten a steal if you put in a lowball all cash offer with no conditions.

Yes but realistically if someone has a bunch of rentals (which they have substantial unrealized gains in) and feds announce this, it should motivate them to sell at least part of their portfolio prior to it coming into effect. Those who are cashflow negative or barely neutral but have unrealized gains will be even more motivated.

The reason for that is probably due to the taxation of the retained earnings used to buy the real estate vs. your personal tax rate if the money was withdrawn Marko. Because you likely have high personal income this route may make sense. And because you have a mortgage and other costs of ownership for your corp your taxes won’t be that high most likely although your accounting and legal fees will add up. As the mortgage is paid down and rents rise you’ll be paying 50% on any net income and capital gains if you sell.

Property rights is concerning, but let’s see what happens to lending standards and liquidity available to finance mortgages if the feds ban mortgage penalties tomorrow for missed payments. The contracts become no longer worth the paper they are written on. I can imagine many lenders wanting a higher premium for rates from many borrowers if they can’t collect penalties for contract breaches. As well, it will probably drive down the amount of risk may lenders are willing accept and end up driving more borrowers to higher rate alternative lenders. The funny part is that they are bringing these rules to protect some borrowers, but it will likely result in those folks that are challenged to make their payments not being able to get financed or refinanced in the end.

Under the advice of my accountant I have my rental properties in my Holdco, from a tax perspective doesn’t seem too bad?

Mind you a lot of downsides…..almost impossible to finance and ultra complicated with personal guarantees and all sorts of crap, it’s like 100 pds files to get a 200k mortgage on a 500k condo and the interest rates are higher as “commercial.” Accounting and legal fees every year add up. More and more government non-sense like the benificial ownership registry and filing all of that.

Down 3% on what was the down from last year.. I would have to look back at Leo’s charts but I do recall a lot of months being down 30-40% last year. So, it might be tough to drive numbers even lower… It would be quite the signal if monthly drops continue happen off what were lows from the previous year.

Total jibber jabber. Corporations pay way more tax on passive income and pay capital gains taxes.

To qualify for the active business corporate tax rate you need to hire more than five full-time employees for a real estate business. If you don’t, you are taxed at the passive income rate. If you have five or more full-time employees you are a small business and paying wages and this active business can include rental income but you are still taxed on the capital gains. There is no free lunch.

My napkin month….unless we get an increase in sales now due to 5-year bonds sliding every day.

230 + 78 + 60 = 368 for the month

2020 – 795

2021 – 653

2022 – 384

2023 – 368ish?

Other notable slow Novembers

2012 – 366

2008 – 268

2000 – 387

and that is it! All other Novembers since 1990 have been over 400.

We’ve also never had two consecutive years with Novembers under 400 since 1990.

While at the same time very week we hit an all time record in terms of licenced agents with the VREB with 1653 this morning, another all time record.

50% has already held me back from selling any real estate (if it wasn’t for the taxes I would probably sell something and buy some dividend paying stocks). At 25% or 0% keeping the real estate investments forever at that point.

Same situation here, except it has affected me personally in a positive sense since I airbnb my personal residence and my competition is now removed. I recently received a 42 night stay @ $11,000 request in the New Year from a local couple renovating their condo but I won’t be away so I declined and I think I’ll up my nightly rate to $325 (30 day minimum) for 2024…..which will be more than I spend on a daily basis while I am away, plane tickets included. Last year I was getting $250/night during my two trips.

What bothers me is the attack on property rights and you just don’t know what is next.

I wasn’t referring to primary residences, but your accountant definitely knows more than I do about this. I did find this, but I know nothing of the reliability of the source:

https://loanscanada.ca/taxes/avoid-capital-gains-tax-on-rental-property/

A corporation is a legal entity within which to conduct business and is distinct from its owners. You can choose to incorporate your rental property business to reduce your tax obligations, since corporations pay less tax than individuals. Plus, you can save on tax rates by splitting dividend income amongst shareholders.

However, incorporating your rental property business involves ongoing administrative costs, which are usually much higher for a corporation than a sole proprietorship.

I already commented on a previous post of what my insider contacts out east have heard. They are going after small mom and pops with multiple units, not purpose built apartments etc. I can’t recall exactly now and don’t got time to search for old posts, but I think it was the same 50% cap gains exemption on first rental property, 25% on second and 0% on 3 or more and would only apply to certain RE products.

They want to be seen as doing something about the “commodification of housing”

Not that I know of.

Corporations are not eligible for the primary residence exemption and must pay capital gains on the sale of assets, including real estate. The government gets way more taxes from the sale of rental real estate, whether owned by individuals or corporations, than it does from primary residences. In addition the rents received by a corporation are considered passive income and taxed at 50%.

Our accountant told us it is usually far better to own real estate personally than through a corporation due to the tax burden.

Wouldn’t purpose-built rentals tend to be owned by corporations? And if so, wouldn’t the tax rules that apply to them be different? I’ve heard it’s easier for a corporation to dodge capital gains than for a lowly schmuck with a couple of investment properties.

Maybe someday Canada can have tax laws as convoluted as the United States. Perchance to dream.

Hopefully they don’t do this; however, they are looking to get votes at the moment. What seems dumb from a reasoned position might have knee-jerk voter appeal. Huge failure of government if this is where they go, but it seems possible.

Ever since the removal of legal str zoning, which did not affect me personally, I have little faith that any of level of government will act in a manner that considers those who have worked hard and did follow the rules in their all steam ahead housing crisis response that is decades late. Erosion of confidence in stable laws and rules and vilifying any sector of society unfairly is not a good thing for the economy imo.

I am in agreement with many of the changes that have been made, but feel like we are heading to overcorrect, which often happens with big social shifts.

Homeowners Refuse to Accept the Awkward Truth: They’re Rich

https://thewalrus.ca/homeowners-refuse-to-accept-the-awkward-truth-theyre-rich/

It would be pretty ironic if the feds pass rules to reduce costs on purpose built rentals (incentivizing them) and then increase costs for secondary market rentals (discincentivizing them).

I doubt they are dumb enough to do that. Doesn’t do anything for the housing shortage, except potentially make it worse.

Patriotz asked “What do you do with the difficult cases?

Well…first off ….most if not all of the participants had drug issues.

But you make a very good point. It’s why you have to look carefully when a group talks about the success rate.

So what do you do with the difficult cases?

You give them a choice of the program if they choose not to do drugs.

If they do not want to do that then you admit them into a program against their will.

That’s the part that takes courage if we ever want to change things.

The Red Fish in Vancouver offers such a choice and as I mentioned before, the ones that are admitted against their will and then a year later are asked if they want to be part of the program…. guess what? A large percentage of them decide to stay in the program voluntarily.

And they are grateful for getting their lives back.

People often make this choice when they are told…you stay in Jail or you enter this program. They often choose the program.

There are solutions. Ones that do work. But they take courage from the politicians.

I can see that such programs are now being looked at now. But it takes courage.

The cost of what we are doing now is enormous with so many layers of groups and governments.

Anyway. I am done responding on this issue for a while. This is a housing site.

Thanks for everyone’s patience.

It does effect all of us and relates to housing.

I’m thinking that poster might of been thinking of ideas like 100% capital gains inclusion rates on non primary residence properties. Also tightning up rules for what qualifies for the primary residence exception. Thats my best guess.

I’ve never been a landlord, so I know very little about this. Are you talking about the elimination of certain loopholes? I thought rental properties were subject to capital gains tax.

Of course, because you’ve picked the easiest cases before you’ve even started. How do we deal with the tough ones?

BC Housing is partnering with Kelowna to build a tiny home community with 50+ units. Scheduled to open early 2024. There will be government funded staff on site 24.7. This global article has three videos, with interviews from various stakeholders, including interviews with a homeless woman (who is in favour), and mayors of Duncan (that already has a tiny home community). And also the mayor of Kelowna, who is also optimistic.

I like that at least we are trying something, involving a heated home, and a short time line.

Anyway, here’s the November 2023 article describing the Kelowna tiny home plans and mayor of duncan talking about the existing tiny home community . There are three separate videos . All the people interviewed seem upbeat about the idea, with the exception of a business owner (in the industrial zone which is the site) https://globalnews.ca/news/10079545/tiny-homes-kelowna-proven-track-record-manufacturer/ I would hope they are building these close to transit.

Will a change in the Capital Gains be the straw that breaks the camel’s back?

Depends on how it is implemented.

My opinion is that never have so few people owned so much real estate. If legislation was passed that set a date in the future that the tax change would be applied, then you might expect a flurry of landlords selling off their surplus properties before the change is implemented.

@Deryk

I remember thinking about how promising it sounded. You think about how many people who would have made it through the program in the 15 years it would have been around, and it’s just such a shame, such a waste that they shut that down.

Yes James…the place you mentioned was Woodwynn Farms. (Now called Mawuec since it was given back to the first nations.)

There was much written about it in the papers at the time. (WIth a lot of errors I might say! And so a lot of misinformation was generated)

That’s where I volunteered and created a large peace garden filled full of crops. The photo shows the peace garden. The lavender alone had the ability to produce over forty thousand dollars of lavender soap, per season.

The participants helped with the production.

We had just established and proven the process and had good contacts to market the soap across Canada when the plug was pulled because of the pushback from the community.

I saw amazing changes in the participants when I was there. Their confidence and excitement in life changed dramatically over each year.

No drugs were allowed. One of the key ingredients to success.

After witnessing the changes in people, using that approach, It’s why I am not a fan of band aide solutions.

That’s for the people who makes the big bucks to predict. MY opinion is still the same, higher rate duration will be the biggest factor.

For anyone interested in alternative solutions to how BC is currently handling people with addictions and mental illness, you might wish to read this article.

https://goldenageofgaia.com/2021/10/16/port-alberni-vs-that-ogre-on-the-river-a-new-therapeutic-community-for-women/

It is much the same idea as to what Woodwyn Farms was all about.

The idea of community and people working to grow their own food does wonders for the healing process and helps them form new friends and a sense of pride.

A therapeutic community is a full rounded experience that creates a life that helps people gets to the root of their issues.

There are many such places using the label of “Therapeutic community” because it has become a popular buzz word.

For example, we visited such a place in NB and it was a total failure. Why? Because the participants were not allowed to do any work on the farm to grow their own food because it was viewed by the government as slave labor. Instead…the participants stood around smoking in small groups. The program totally missed the point of what a therapeutic community is all about.

Anyway. If you have time, the above article gives a good description of a place that is doing it right.

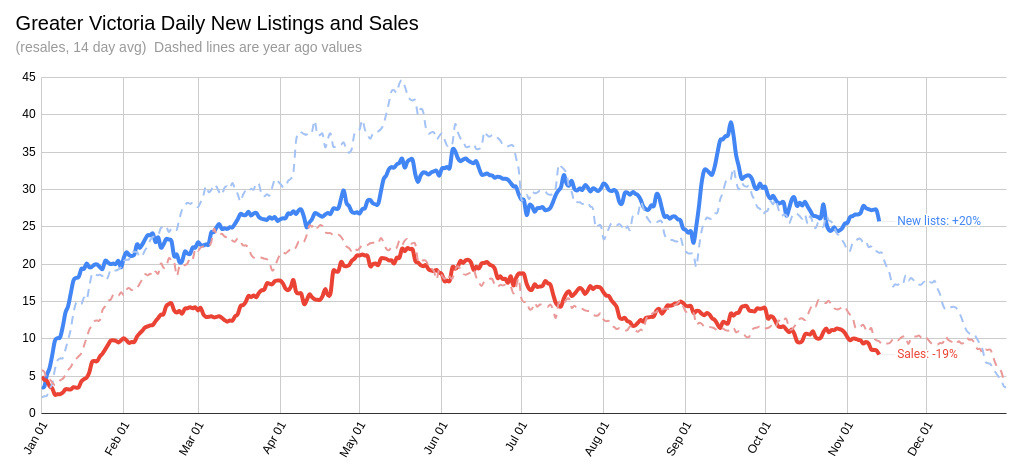

Month to date market activity:

Sales: 230 (down 3% from same time last year)

New lists: 612 (up 19%)

Inventory: 2744 (up 28%)

To add to this, I did a quick google search to see what their listing price were. I don’t have access to MLS so forgive me if this is incorrect!

1547 oak park (suited): 1.05 (listed at 1.15)

977 kentwood: 1.2 (listed at 1.339)

1554 ash rd: 850 (listed 1,069,999)

3840 cedar hill rd (suited) 975 (listed at 1.089)

Will that be the straw that breaks the RE market?

STR getting hammered on all sides. Not sure what areas in other provinces that are high priced don’t already have STR controls though.

There was someone on the island who wanted to house people on a farm, and have them help work the land while they recovered from addiction (if I remember correctly, it was because that’s what helped them). They already had a parcel of land in Central Saanich, but it was shut down by the NIMBY neighbours if I remember correctly.

Edit: Woodwynn farm, they tried for a decade.

https://www.timescolonist.com/islander/woodwynn-farm-dedicated-to-changing-lives-of-homeless-4637755

https://www.victoriabuzz.com/2020/12/traditional-lands-at-woodwynn-farm-returned-to-tsartlip-first-nation/

Where I am living they have converted some parking lots in outer rims of cities to something like a tent city except it’s people with camper vans and the like.

As for the tiny towns. To me it’s largely about density. My understanding is that tiny town by Royal athletic is considered successful (including by the people living there). There’s only 20 (or something low like that) units so they all know each other. Cameras (in outdoor shared spaces) also help. People create their own communities and to say nothing will work isn’t especially helpful. Though I do 100% agree that significant density for that population in particular would be very unwise.

Thanks, Deryk, obviously you make valid points. The problem seems pretty overwhelming, and of course it’s easier to sort of tune out, give some money to charity & mentally just move on. Hats off to those who actually get into the trenches.

couple of good prices in the recent sales.

1547 oak park (suited): 1.05

977 kentwood: 1.2

1554 ash rd: 850

3840 cedar hill rd (suited) 975

Surprised 983 Abbey road is still there at 1.15

LMAO, CRA coming in hot for short-term rentals now. I am telling you, next up are changes to capital gains tax for rental properties.

.

Yes, in the South Pacific (Tahiti) for sure. I met people who asked me where Canada was! But I said Vancouver in lots of places, and they knew it. Somehow, everyone knew Seattle and they knew what the weather was like etc. funny thing is Americans know Vancouver but then ask how bad the winters are. Then you say “it’s like Seattle” and they know all about it, and ask about the rain 🙂

Interesting. Is Seattle really more globally well-known than Vancouver? I mean, the latter hosted the Olympics semi-recently.

Seems like a good plan to me. Thanks for the discussion.

I didn’t make it to Paris. I’ll take your word about the Paris tent cities being “fashionable”, but this article from France isn’t as charitable and calls them “chaos”

https://www.thelocal.fr/20190329/out-of-sight-but-still-there-the-scandal-of-squalid-paris-migrant-camps

“Chaos at the gates of Paris

The ‘tent city’ huddles under Paris’ busy inner ring road, largely invisible to the many thousands of drivers who pass each day.

“It’s awful here, people are fighting all the time, over the food when there’s not enough, and then the drug people cause trouble sometimes,” said the 22-year-old who said he has been living under the noisy flyover for the past two months.

Thanks Peter for a thoughtful conversation on homelessness.( I could point to someone else who does not have the same thoughtfulness, but I won’t)

I have learned a lot about homelessness and mental illness and addictions and the revolving door court system and the collateral damage to the families as they try to cope with the mounting legal bills and lack of help from the government for adults with mental illness, especially for people who refuse treatment.

I honestly believe that the system will have to try the Tiny Home approach until they witness for themselves that it is not working.

I raised the question about safety in an earlier post.

Will there be someone to escort people to the washrooms in the middle of the night? (Those ideas have been tossed around at times)

What about drug use? Are they allowed?

What do you do with someone who doesn’t want to follow any rules?

Do they get evicted?

Where do they go?

Who is going to police these Tiny Home sites if they deteriorate in safety like Pandora has. (No company in Victoria will serve legal papers on a person on Pandora street because it is deemed unsafe. If you ask the police to help, they will accompany you, but not after dark because they say it is not safe to do so.) There are many legitimate reasons to be serving someone living on the street with court papers. (Travel permission needs, children’s visitation arrangements, civil assault charges, divorce papers etc etc)

What makes us think these Tiny home’s will not deteriorate like Pandora street?

The same basic issues will exist. No support for mental illness issues. Same drug issues.

Who will do the laundry? (I presume there will be a facility as part of the set up.)

Will the people in these tiny homes learn how to choose good food groups and take part in the preparation of the food in the communal kitchen? Or will they be fed clam shell meals of questionable nutrition? (It looks like the units have no kitchen in each unit and I believe I read somewhere that a they would all share a kitchen space or eating area.) Who organizes all that?

Who takes on the legal responsibility of legal claims against the site in the event of damage to property or persons?

I could go on and on.

I’m not expecting you to answer these questions Peter. I’m simply pointing out some of the logistics that need to be considered.

I’m also not talking about people who just can’t find housing while they go to school or work. I’m talking about the people who can’t cope because of mental illness and addictions.

I like the model of the Red Fish in Vancouver. (I think it is out on the Lougheed highway somewhere.)

I mentioned it in an earlier post.

Patrick I guess u weren’t in Paris, even there I found them to be fashionable.

First of all I believe the court ruling said that they had to have shelter spaces and not their own unit. We bought a lot of motels and if they are full ( I have heard that they are not) then just throw bunk beds into the rooms. Solves the housing problem if that is the goal.

If your goal is to help the drug addicted then most of them require extended institutionalization, most often on an involuntary basis since they are seriously brain damaged from the drugs. Give it a moments thought and ask yourself what do the drugs actually do that creates an addict?

I don’t think so. I did a lot of travelling this year, including Europe, South Pacific and Australia/NZ.

I didn’t see tent cities or even tents on the street anywhere.

Moreover, when chatting with a casual stranger, when they asked me where I was from, to save time I’d say Seattle as they always knew where that was. And I found that one thing they knew about Seattle and wanted to talk about was the Seattle homeless problem with people living in tents in the street, and they’d say “that’s crazy, why do they allow that, it would be illegal here”.

So “urban tenting” isn’t the new norm in other places, and should be stopped here too, as long as we have homes available for these unfortunate people.

You’ve got me mixed up with someone else. I think you’re looking for “Caveat”

Patrick, if you are going to quote me, at least be accurate as to context. I was not saying that all SFH will drop in value. I did say that SFH that are adjacent to a newly built four story MM will likely drop a significant amount in value. The identical home a few blocks away, all else being equal, is worth more than the same home besides a four story apartment block.

Moreover, I suspect that there will be little or no upward pressure from up zoning virtually the whole province. Basically, you have removed the element of scarcity by upzoning everything.

Pretty sure urban tenting is here to stay. It’s one of many crises in Canada. We should just work on the doctor shtick first so I don’t have to pay Telus every month .

It’s an interesting point. We live in North Saanich so about as far away from the direct issue as you can imagine. And yet, about a month ago, suddenly there was a person living in their car on the side of the road not far from us. So, I will admit, first thought was uncharitable – well, WTH and how do we get rid of this person? Followed very quickly by well, live & let live, they’re not harming me. But then by about day 3 I drive by, and guess what, now the guy has spread garbage all around the car – I mean, like, a field of garbage. Next day he’s gone, no action of mine, but I was glad to see it. Just because you’re living in your car shouldn’t mean suddenly no rules apply to you?

As per usual, I don’t have the answers, but Deryk I’m wondering what you see as answers or why the tiny homes idea couldn’t be at least part of a ‘solution’? Genuinely interested, as I know you have immersed yourself in these issues.

Obviously there can’t be one single panacea, as some of the homeless are homeless for vastly different reasons. I’ve had a family member in the throes of addiction and I was very glad they were able to get state-sponsored help – it worked, they’re clean, they’re working, and renting. And then nowadays, there are perhaps more and more people drifting near the edge of homelessness by economic reasons and they don’t want to be there and deserve help. Unfortunately, there also seem to be increasing numbers of aggressive people for whom anything goes – friend of mine had their car utterly vandalized recently downtown by one in a very confrontational event.

Having NO enforcement of laws, and buying them hotels in the downtown core seems crazy to me, and so when someone proposes something like tiny homes or whatever, I think it’s worth at least a real discussion of pros & cons.

Derek

Yes, but who is the NIMBY here? Maybe it’s you!

If you wake up tomorrow to find a pitched tent on your front lawn, with a homeless guy living in it. When deciding what to do next. Will you apply all these points you’ve made about homelessness being a complex problem, and how ‘time will tell’ what happens. Or do you phone the police immediately with the goal of removing the homeless guy and his tent ASAP? And if the cops come, and tell you “great news, we talked to the guy, and he’s agreed to move his tent a little off your property and onto the city boulevard in front of your house.

Are you cool with that homeless guy living on your property or the boulevard? Or would you instantly become a NIMBY (that you despise) and say I don’t want a “homeless guy in my yard!” And would you want to hear the points you’ve brought forward here on HHV, like the homeless guy telling you that your house is a great location for him, being near his drug dealer and a pawn shop to fence his stolen goods!

The point is, if you don’t want to be a NIMBY on tent cities , you’d need to be willing to tolerate a tent city on your street, not just “downtown” – where you don’t live! instead, ask yourself “as a caring, concerned advocate for homeless people, what would I tolerate for homeless people living on my own street?”, and you’ll have your answer as to what cities should do about homeless living on the streets.

Just order a new tiny home, they cost $21,500 CAD.

I didn’t hear anyone say that it is societies job to create housing for addicts closer to the drug dealers.

I believe that the mentally ill and those with addictions should be modestly housed and properly taken care of.

For those who do not want to get off drugs and want to live on the streets , then they should be taken into a care facility where they can be treated for their mental illness as well as addictions.

There is such a place in Vancouver. I believe it is called the Red Fish. Many are there on their own free will.

Some are in there against their will. What they are finding is that those who were taken in against their own will ….a large percentage of them agree to be in the program after a one year trial period and are excited to have the chance to have their lives back.

I would like to see more places like that.

Just looking at the repurposed hotels , I’m sure the tiny homes will quickly look like crap in no time flat . Like the temporary classrooms they probably be still there 30 years from now

The legal system we have inherited has had vagrancy laws in force for the last 680 years, the most recent iteration dates from 1824 and has the mellifluous and resonant title “An Act for the Punishment of Idle and Disorderly Persons, and Rogues and Vagabonds”.

Back to the future.

Ridiculous. It’s not society’s job to be an enabler for drug addicts by finding them housing close to their drug dealer.

Let them live on the outskirts of the city and take a bus downtown if they like to hangout there. It’s called “commuting.”

At least do we agree that tent cities like Pandora aren’t a ”workable solution”? And could you tell me what under what conditions you would say that we can remove the tent city ? Or is a tent city another problem that you just want everyone to sit back and take a take a “time will tell” approach.

I agree with VIc RE analyst. (“Most of them are downtown because that’s where the action is.”

They definitely prefer being close to the network they have. (The Drug dealers, pawn shops or those who pray on them and will give them money for any items they have “found”)

Some do not want to be in a place like “Our Place” because they have been raped there.

Some often reject any rules and get kicked out.

Mental illness and drug addiction is complicated. (The victims of drug addiction and mental illness learn all sorts of survival tools. They will say that they have a sore back and so sitting in a hot tub at the Y would benefit them. The system might arrange for them to be get taken there once or twice a week, but the real reason they are there is so that they can drink the hand sanitizer. That’s just one simple example to illustrate that it is complicated and how things can go sideways quickly.

But this is not the right place to get into this properly.

Setting up “Tiny Homes” is not the answer. It sounds good on the surface but it is not the answer.

A tent city is legal if no homes are available, so police can’t enforce laws and remove it.

Making tiny homes available makes it legal for tent cities to be dismantled.

Of course homeless/drug addicts like being downtown. They just won’t be able to live in a tent on the street. Either they come up with a different place to live on their own, or they live in the tiny home and bus themselves downtown mornings and return home at night.

Patrick…you would do better if you listened to people carefully. For one thing, I was not talking about you.

Anyway. Time will tell.

I stick with my opinion.

Tiny homes will prove to be an unworkable solution for so many reasons.

Let’s agree to have opposite viewpoints and that’s fine with me.

Let’s assume they interviewed a homeless person on Pandora, and they said “no. I won’t move to a tiny home. I want to keep living in a tent here on Pandora.”. Would this change your opinion? Should there be a right for anyone to permanently live in a tent on the street, even if free housing is available for them? I say “no”, what say you?

This is the point: If there are no homes available, under BC law police can’t dismantle the tent cities. If there are tiny homes available, the homeless might not want to go there, but they can’t live on the street legally, and the police can legally enforce the laws and dismantle the tent city – and “tent city problem solved”.

Luckily, if you wish to see what the “tiny homes” and their environs will look like after one year we have a living example right in our town. Take an (appropriately-paced) short walk on Spruce Ave between Nanaimo and Redbrick and you can see all the gratitude for our largesse.

Cynical? Perhaps. Please provide a contrary example.

What kind of idiot actually believes that homeless people/drug addicts only set up shop downtown because they can’t set up else where? Most of them are downtown because that’s where the action is.

What I didn’t see in the article is what the homeless think of living in re-purposed shipping container at the outer limits of the city.

-That would have been good reporting.

Why would you make an unfounded assumption that I don’t? “have a handle on what the [homelessness] problem are?” Your background is an artist yet I don’t make a rude assumption that you don’t know what you’re talking about.

You may be talking to somebody with 30+ years full-time working experience in medicine. And a person like that might have a handle on both homelessness and the underlying mental and addiction problems that go along with it.

Anyway, in this discussion I would hope that we both have an open mind, and you are not just here dishing out “lessons to learn”.

If you read my post, I am clearly identifying “tent cities”as the problem we are solving. Finding them a home solves a problem (ends “homelessness” ) but of course doesn’t end the underlying problems. And it ends tent cities- which is a good and humane thing .

I have never suggested that finding housing will solve the underlying mental health or drug problems, facing many homeless people, because it won’t. Finding them a home, whether it be a tiny home or one of your hoped-for Christchurch cathedral site homes that you are expecting to see will also not solve these mental/drug problems

Finding homeless people a tiny home will, however, mean that they are not homeless people. And there are no more disgraceful inhumane tent cities. And then we we have solved the homeless part of the problem and can focus on treating the underlying chronic mental and addiction problems in the population, regardless if they live in tiny, mobile, condos or houses.

https://househuntvictoria.ca/2023/11/14/playing-with-affordability/#comment-107673

They need to be incarcerated for a minimum of 2 years.

Sorry Patrick but we will likely never agree on this issue.

I’m not sure what your background is so it is difficult to know what to say.

I think the best lesson for anyone who does not have a handle on what the problems are will be to watch what happens in the coming years.

I see so many red flags.

I do think that we would both agree that it will take more than just housing to find solutions to this issue.

Currently there is practically no help either for the victims or the family.

One top BC official even suggested that the problem is with the families and that they just don’t love these people enough and that’s why they are on the street. (A great way to push the problem onto the families and absolve the government of responsibility.)

That’s just how out of touch the government is.

Time will reveal how these Tiny Homes will work or fail. I hope we have a lot of parking lots because the problem is huge.

I also hope they provide security and mental support for these people.

Federal government is announcing additional measures on housing Tuesday, including a prohibition on deducting any expenses from STR income if the unit is not legal. That will have a big impact in other provinces. https://torontostar.pressreader.com/article/281500755987512

Yes. #4 sounds right. Upzoning laws have started to appear in BC and I don’t think they had any measurable effect on SFH property prices. But we are losing SFH as a % of total dwellings, so this likely leads to higher SFH property values over time, assuming a “detached home with a yard and picket fence” is still the desired home for 70% + of Canadians.

Deryk,

I disagree with you describing the tiny homes as a “band-aid”, at least to the tent city on Pandora. The solution is to outlaw and dismantle the tent city, as long as there are homes to move the people to. That’s not just me saying it, this is BC court decisions according to laws, where judges say that people’s right to live in a tent in public spaces exists, but only when there is no alternative available to them. Tiny homes provides this alternative. So as long as we have a supply of tiny homes (or better) available, the cities can dismantle tent cities on an ongoing basis, which isn’t a “band-aid”

I describe the tiny homes as a temporary solution, but it is much better than nothing, which is all we are offering now. Of course is it aspirational that we should build every homeless person a better home than that. Be realistic, do you think we have the ability to build a beautiful home for every homeless person, when working Canadians can’t afford starter homes?

I hear you that you’re “not a fan of tiny homes”. But we shouldn’t let “perfect” become the enemy of “good enough”. In this case, your “think bigger” solution is “perfect”, but multi-year, complex, costly and opposed by some groups. “Good enough” is instant and affordable (one month) and means a heated, insulated tiny home. Don’t compare a tiny home with “perfect”, compare it a tent outdoors on Pandora. Much of your message describes the problems that occur when we “think bigger”, and this translates to any years of struggles with nothin achieved.

In the meantime, at $21,500 cad per housing unit, and a time of one month for installation, these modular tiny homes are an instant, legal solution. So instead of 50+ people living in tents on Pandora, they are living in these homes. And the tent city ends. This is what’s happening in Ontario, and I hope that it comes to Pandora as well.

“Patriotz true that, we are probaly entering a period of dead money in real estate , so many will start looking for returns elsewhere and probably still using leverage . But it sure was a fun ride and always hate to see it end”.

It was one hell of a bull run and its all tax free.

Gen x bought in 1998.

Sorry….but I’m not a big fan of “Tiny Homes”.

One can take away a parking lot and place a small number of these tiny homes or you can build several hundred homes. (As they will be doing at Christ Church in Victoria.)

If you talk to the people who are looking at this issue, and I’ve been given tours and lectures on this, you will hear them say, “Money is not the problem” They can get access to the money to build. What they can’t get is the land…because people will say….it’s a good idea, but it’s not a good idea in this neighborhood.

That’s one of the main problems.

The same thing happened with Woodwynn farms in central Saanich.

There were “private” , wealthy funders who wanted to do something for the street people, who were willing to fund multiple housing units (With the concept of Building into the slope of the land so that farming could even take place on the roof area as well)

Woodwynn had a policy of no drugs allowed or you were out of the program, immediately.

It was very much based on the same idea as one of the worlds most successful treatment centers, San Patrianos in Italy)

I volunteered there for a number of years and witnessed amazing changes in the people going through the program. It was not for everyone of course because drug addiction is a tough nut to crack but overall, we saw it was working. The participants worked on the farm fields all day farming and they could stay in the program as long as they needed. (They basically worked for their meals, growing their own food for the most part.

However, because of the continual pushback from the surrounding community, who did not want “these kinds of people” in their neighborhood, the funders pulled out because there was no point in continuing if the program could not be put into full gear and the government would not allow housing for the farmers/participants to be built on the land.

The BC government bought the 200 Acre site. (Zoned ALR).

The 200acre site was then given back to the first nations as part of reconciliation. (Treaties had not been signed etc)

It will likely be taken out of the ALR and pulled into the first nations reserve land which they have the right to apply for. The band will then do what they want with the 200 acres because it is their right to do so. I believe that the land is in good hands.

My point is that Nimbyism is a real thing and I would find it hard to believe that Tiny Homes will be the answer.

We need to think bigger in terms of a plan to solve the street issue. There is too much money being spent on Band aide solutions.

Do note that the article is talking about 30 year term, not 30 year amortization. Interesting bur irrelevant to Canada.

https://jaycoupar.royallepage.ca/details.php?mls=547&mlsid=R2832814

Not unusual. Not cherry picking. Small lot. Small house. East side of Vancouver.

$1.8 million

By the way… a great article in the NYT about 30 yr mortgage trap.

https://www.nytimes.com/2023/11/19/business/economy/30-year-mortgage.html

Just curious, do the new 36 ft height limit for MM in Victoria mean that you could build a single family home to that height?

So will the new provincial rules:

(1) Lop hundreds of thousands of dollars off SFH property values due to the awfulness of being nearby a fourplex? ( Barrister)

(2) increase SFH property values so much that the taxes will be insane? (WhateverIwanttocallmyself)

(3) Decrease SFH property values so much that people will be suing for “diminution of value”? (Also Whatever …..)

(4) Cause a small upward blip in detached SFH value superimposed on the long run trend of worsening SFH affordability? (My attempted paraphrase of Leo)

I pick #4.

This may be of assistance to you Patriotz.

HIGHEST AND BEST USE:

The reasonably probable use of Real Property, that is physically possible, legally permissible, financially feasible, and maximally productive, and that results in the highest value.

-If you have a single family zoned land but the neighborhood is being rezoned multi-family then the market value would be the higher of the two.

If you owned a piece of land that was zoned single family but the neighbors on both sides of you had their property rezoned to multi-family would you sell your land for the price of a single family lot or the price of a multi-family lot? I hope that you would choose the higher of the two.

The assessment authority estimates market value at its Highest and Best Use.

And before everyone and their dog goes off to google. Yes there are exceptions set by legislation such as land in the Agricultural Land Reserve.

Was waiting around for the overpriced lawyers to do another turn.

BC’s Assessment Act says market value. That may or may not be what you mean, but that’s what it says.

This seems like an actual good example of government solving homelessness crisis by building tiny homes with facilities. Here’s how some Canadian cities are solving their problem of tent cities, by removing them and providing affordable tiny homes to the homeless.

The process is to build this temp housing (within a month) and then remove the tent city by providing this housing . Cities like Peterborough are solving some of their homelessness problems by finding a vacant parking lot in outskirts of the city, and constructing 50 tiny homes and a community center with kitchen/tables/seats/washrooms. Tiny home is 107 sq. Feet and has electricity/heat/ A/C but no plumbing. All made from shipping containers. Cost is $21,000 CAD per tiny unit made in Waterloo Ontario. Seems like they can put these together from scratch in a month. Of course total costs will be higher than $21,000 per resident but this is an example about government actually solving a homeless problem by building shelters for people with facilities on-site. And if there’s a transit stop nearby, residents can travel to/from the city as needed.

https://www.thepeterboroughexaminer.com/news/peterborough-region/new-homes-for-peterborough-s-homeless-to-be-built-from-steel-shipping-containers/article_5b84f13e-b0fa-568b-b8d3-b2918e68faef.html

“The 50 modular cabins for homeless people that are about to be installed in the municipal Rehill parking lot off Wolfe Street are going to be made from steel shipping containers.

Each cabin will cost the city $21,150, said city spokesperson Brendan Wedley in an email on Wednesday.

For 50 cabins, that adds up to $1,057,500 (not including a security cabin, washroom cabin or other costs).

Site preparation began Monday at the parking lot when a general contractor began ripping up sections of asphalt.

Soon it’s expected that flatbed trucks will be delivering the cabins, fully built and ready to be placed on site by a crane.

The cabins are built in Cambridge, Ont. by a company called Now Housing.

Delivery is expected shortly, senior vice-president Brian Munro said in a phone interview Tuesday, though he didn’t have a date.

Although some buildings made from shipping containers are designed to be industrial-looking, Munro said the Peterborough cabins will appear more like conventional tiny homes.”

———- //////

Here’s how the Waterloo company builds, transports and installs the tiny homes and community center with facilities.

https://www.youtube.com/watch?v=yvatxus-6qg’’

Our governments seem willing to change zoning and regulations instantly to deal with the housing crisis, so I hope they are willing to make any regulatory changes needed to allow this solution to be used to remove our tent cities like Pandora in short order. And give the homeless a heated, secure tiny home with access to facilities and (hopefully) near transit).

OK, this 50 unit tiny home community isn’t “the Uplands,” but it sure beats a haphazard insecure tent city on Pandora!

Here’s the article Jimmy’s referencing:

https://www.timescolonist.com/local-news/affordable-housing-component-no-longer-required-for-foul-bay-townhouse-development-7850202

Someone mentioned that OAS is not means tested, which is true. The full amount is not available to everyone, however. The number of years (after the age of 18) that your pink posterior has been parked within the Dominion is tallied. To get the full amount that number has to be 40 or more and if it is less than 40 the amount you will receive is reduced pro-rata.

Tax and housing experts are concerned that sweeping housing reforms proposed by the B.C. NDP, which would force higher density in single-family neighborhoods and around transit hubs, could leave homeowners and small businesses on the hook for inflated property taxes that are based on the “highest and best use” of the land.

The government’s small-scale multi-unit housing bill, which if passed will force municipalities to approve up to six units on a single-family lot, could result in such lots being taxed at the rate of a multi-unit townhouse.

If we want to build affordable housing it is necessary to address rising land values from up zoning. If we don’t then rising land values will likely defeat the province’s reforms as the higher land costs would make building multi-plex properties economically unfeasible.

But it depends on what the province is considering a multi-plex. Is it residential with permits for the suites or is multi-family with individually strata titled suites? There is a huge difference between the two. The first is rental housing the later is condos/town homes. Same building, same building costs but they sell for vastly different prices.

If the intention is rentals then these will be appealing to investors that are buying on the buildings income. If these buildings are four units or less then they fall under residential lending policies. Over five units then they are commercial loans that are more difficult and expensive to finance. Four units or less will have a larger pool of investors than five or more as almost everyone on this blog would potentially be able to qualify for a bank loan at residential interest rates for a four suite rental. Not so much for five or more suites. In my opinion you can kiss the idea of building a six-plex good-bye as there are not enough investors for these buildings in Victoria.

What a residential four-plex with four permits will likely effect are those investors that currently have say four individual condominiums. These four suite rental buildings will have lower expenses and a better rate of return than owning four condos. And the four suiter will be a lot less to purchase than four separate condos. That will take the pressure off condo prices for home ownership. Furthermore, a rental four suiter will not substantially increase land values. Unlike a condo complex with four separately titled condos which will increase land values due to up zoning from residential to multi-family.

It would be less than ideal to increase the supply of individual condos when so many are being built today. An increase in the supply of condos has the potential to slow down hi rise condominium construction and put other projects on hold.

Peter tough to do an apples to apples comparison today to the 80s . There is whole bunch more at play than just the price of a house . Canada itself has changed a bunch since then and that too plays in to the real estate market in not a positive way

Enjoy your welfare cheque…ummm OAS

It’s mostly folks taking things they just don’t need that are meant for people in need. Like the scummy guys in their leather jackets and gold chains I saw loading their trunks on their BMWs with boxes from the foodbank they were taking turns in line at.

I don’t have a good handle on the purpose of OAS but it seems like you could live in a house worth 2 million tax free equity that was bought forty years ago and you could have low income. If someone lives in a house worth 500k but has 1.5k in other assets but low enough income to qualify for OAS are they more scummy than the person with all their assets in one house? Doesn’t really make sense to me.

Probably not to be repeated, even in Calgary.

Your story is interesting to me, because we bought in Calgary in 1985, and while the economic picture by that time was vastly different, the scale of income/house price wasn’t, at least not for us. It was my first career job and our first house purchase. I was making $23k a year, and the house (half duplex) we bought was I think $48k, so still only about a double. Calgary was in the middle of a savage recession and foreclosures were rampant, especially since their laws allowed you to walk away without being personally on the hook. When we were looking, we didn’t even use a realtor at first, we just went to our bank and they said ok what area are you interested in, we told them, then they gave us their foreclosure list for that neighbourhood & said just drive around and pick half a dozen homes you’d like to see and our bank person will take you to look at them.

Most of the places we looked at had significant damage done by a departing homeowner who had lost everything. Like holes punched into the drywall. One had removed the fireplace, and I don’t mean a franklin stove, I mean he had dismantled the rock surround of the fireplace and left this gaping hole (we didn’t buy that place, but it was only $28k).

The mortgage rate was still 11.75 but as you say, the monthly payment was very manageable even on our very modest income.

A few years back, we were lucky enough to be living in West Vancouver. The place next door was lived in by the postman who used to deliver the mail in the neighbourhood – imagine, a single-family house in West Vancouver owned by the local postie. Different world to today.

The picture today is so vastly different in terms of pricing compared to incomes to make stories like this just sort of an interesting footnote, but the reality is, the goalposts have moved so far that a whole generation or two or three have been/are being left further and further behind, plus the whole time they have to put up with the frustration of older folks always telling them how tough they had it. It really is different now, and it only took this little short time to get here. And that’s with the other major change including now having two working spouses to support a lifestyle not as good (in terms of housing) as what you previously had with just one.

I don’t have the answers.

Nope, didn’t say that at all. Just saying it’s not a pension. However, I would suggest that someone with millions in assets who doesn’t declare a large income in retirement is a bit scummy for taking it a benefit meant for the vulnerable in society.

Yes I do, but for the most part now, those benefits are flowing to people factoring the benefits into their retirement planning and ensuring lower declarable incomes in retirement to receive a welfare benefit they do not need (see scummy comment above).

Umm..Really, please consult any dictionary to learn the meaning of the word “pension”.

Real world example from the ’80’s: Purchased at the absolute peak of a Calgary bubble in ’83. Price was $92,000, borrowed 10k as personal loan to fund the downpayment. Mortgage rate was 11.75%. Don’t recall the exact payment but household income was around $50k before tax. Even with that mortgage rate this was no stress at all because the purchase price was less than two times our very-modest salaries. There is no equivalent scale of income/house price available anywhere in Canada in the present day.

I don’t think affordability presently is anything as high as the peak of the 80s, and there is a huge different between 5.7% unemployment rate and 12-22% unemployment rate.

No, however Canadian government is not known to run an efficient or balance budget.

Less tax leave more money in the economy so that the economy grow.

Some US states have no or little sale tax, and low income tax, but high property tax, therefore it encourages the economy to flow, instead of encourage people to lock their money in real estate.

Money need to be invested in the economy, not real estate or precious metals.

Not long ago, many people on this board scoffed at anything that less than a SFH in James Bay, Fairfield, or Gordon Head. The reality is that inflation and perpetual population growth is going to be around for the foreseeable future, so housing is going to continue to go up and perhaps much quicker than salary.

Are you suggesting that taxes should not support the disabled elderly who cannot otherwise support themselves?

You see no value in providing the elderly with a minimum income?

Yes, that was a big topic in the 2010s, and then again as house prices (first maybe in Vancouver and then in Victoria) really started to get divorced more from that income growth. I remember endless discussion on some forum (maybe ozzie jurock, or maybe that victoria-based forum that existed then, not sure now) about how this divorce from income growth meant that house prices inexorably had to come back down.

And while I’m sure there is in fact some of that & some mean reversion under way, I don’t see some huge price adjustment being in the cards – as others have said, after this huge run-up, a 10% or so adjustment followed maybe by a couple of sideways years would hardly be a “collapse”. I realize all bets are off if inflation stays sticky, but it looks increasingly like we just had to move the “meal through the python” in terms of all the covid stimulus and in that sense indeed a transitory inflation effect. I think…

And also, sorry to say, but looking back at what the discussions were in the 2010s, I think in retrospect there was indeed an element of Victoria locals being late to understanding that their housing was going to increasingly move beyond normal income ranges to the extent it was going to become more influenced by the wealth effect from other parts of Canada, plus being commodified to an extent, and what that would mean for those who thought that a single-family house in Fairfield, say, should always remain in reach for an average income-earner here.

Yes. We did a 3-month house swap with a professor from Zurich (ETH) . He told us he would have a good pension (and the survivor’s pension is even better), but had to contribute in a lot.

To clarify that last post, when I say “unprecedented” I’m talking about recent history.

The last time affordability was this low was the 1980s, which is the closest situation in living memory to what we have now.

And I point out in a previous comment, Gen X were not buying homes in that period.

I recall these discussions in Vancouver in the early 2010s. People were sure that prices had risen so much that the housing market was unsustainable. However, much of this sentiment was based solely on house price appreciation, and didn’t take into account the rise in local incomes seen during this period. I later read this report from IMF researchers in 2019, who modelled Canadian housing prices as only slightly above fundamental trend predictions until 2014-2015 (in Vancouver), and other markets were exactly on trend until 2015.

That modelling took into account both rises in local incomes, reduced interest rates, and rental market dynamics. (See: Figure 1: https://www.imf.org/-/media/Files/Publications/WP/2019/wpiea2019248-print-pdf.ashx).

Certainly there was a trend to lower affordability prior to 2015 in Canada, but I would argue, and I suspect most here would agree (including yourself, Leo) that the repeated doubling of home prices in 2015 and then again in 2021 produced an unprecedented situation quite different from what came before.

Yes, the 1st Canada Pension Plan enhancement was phased in between 2019 and 2023; with the 2nd part coming between 2024 and 2025. It will grow to replace one third (33.33%) of the average work earnings vs one quarter (25%) before the changes. Of course, CPP contribution rates have been increased as well.

See: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-enhancement.html

That’s an alternative fact. Folks like to call those pensions because they don’t like the view that they are merely leeching off the hard work of their fellow citizens. If OAS and GIS are pensions, what would you say the percentages employee and employer contributions are? Would you describe those as either defined benefit or defined contribution? OAS and GIS are simply old person welfare in place mostly to buy votes. If you are looking for a different term other than welfare, Guaranteed Basic Income for elderly fits better, but they are in no ways pensions. They are 100% taxpayer funded entitlements in place the support the feeble, sick, lame or lazy when when they reach their twilight years.

“VicREanalyst November 17, 2023 11:39 am

Flex Fridays LMAO”

You posted quite a bit yesterday. Took the day off work did you?

They are in fact pensions. They are funded differently than CPP, but they are pensions.

Switzerland has mandatory, and expensive, workplace-based pensions. There’s no free lunch.

https://www.pensionfundsonline.co.uk/content/country-profiles/switzerland

The Canadian pensions suck. My friend in Switzerland just retired, I’m not sure what he gets for a company pension, I’ll check with him, but his entire pension is 6000 Swiss Francs. That’s $9000 Canadian. Yes it is much more expensive in Switzerland (we’re catching up), but that’s pretty healthy. I have no idea what he has for savings.

The OAS clawback doesn’t even start until $81,761 individual income. That’s well above the median income for employed people, never mind retirees. OAS is an unearned benefit so you could call it welfare, but it’s not limited to people in genuine need. Which leads us to…

GIS not OAS. GIS really does have a low income threshold.

This seems to be the prevailing view, but I’m not sure why. House prices increased ~50% during the pandemic, not because of a sudden improvement in economic fundamentals, but due to low interest rates and a FOMO frenzy.

Now that we have higher interest rates and less FOMO, it seems perfectly reasonable that prices could adjust significantly. As we’ve seen over the last few years, sentiment can change rapidly.

I don’t necessarily believe it will be that damaging to existing home-owners either.

Recent purchasers with small down-payments who are suddenly underwater, maybe.

But most places I’m looking at are on the market for (and are assessed at) 50%-100% more than the last sale price. If the seller takes a 25% haircut on their asking price, they’re still ahead, and in a sane world they’d be happy.

I wouldn’t say OAS is a welfare benefit. Most seniors qualify for that one as you need to have taxable income over $80k+ in retirement. Combined with tax splitting measures on pensions (and RIF’s for people over 65), I think the overwhelming majority of seniors get the full amount.

Only GIC is intended for low income earners.

Not sure? Average is currently 722 not 717 for new recipients so I guess it went up a bit. https://www.canada.ca/en/services/benefits/publicpensions/cpp/payment-amounts.html

That might be true in small towns that used to be cheap but it’s not true in any of the expensive cities like Vancouver, Toronto, or Victoria.

Nothing about the current run-up is unusual compared to the last two. And prices in 2008 look cheap now but back then we were having all the same conversations because prices had just doubled in just a few years

Didn’t it get beefed up a ton though? I think working people today will be able to expect a lot more

The average CPP payment is $717 a month in Canada. I was referring to employer pensions that ex teachers, police, or other unionized or public service employees may have and which are intended to replace incomes and may or may not be indexed to ex. 70% of the best 5 years. About 50% of Canadians have no employer pension plan.

If you have no employer pension then you’ll need to save more or work longer. For many Canadians their primary source of savings is their home. For seniors without employer pensions who did not work in higher paying jobs or who ex. got divorced or became ill and could not work at some point, it is likely that they will need to access home equity in retirement.

“categorizing people by a single measure, whether by generation, investment, gender, or race, and pitting them against each other is going to solve anything”

Well, it is intended to solve something. Out at the far end of the spectrum of the left, where the needle hovers over “approaching pure evil” this is THE strategy for our days. Having failed to gain power by the ballot box, revolution, and the murder of millions this, for them, is going to solve everything….