Under ask

Though the market has tightened up in recent months, we’re still in a period where buyers are either in no big rush to buy, or are but remain constrained by high rates. That means sellers have had to list lower to sell quickly, or be prepared to be flexible on their asking price to move their properties. Tracking the percent of properties going for over the asking price is one way to track market activity (that measure usually explodes whenever we’re under 2 months of inventory), but another is looking at sales relative to asking prices.

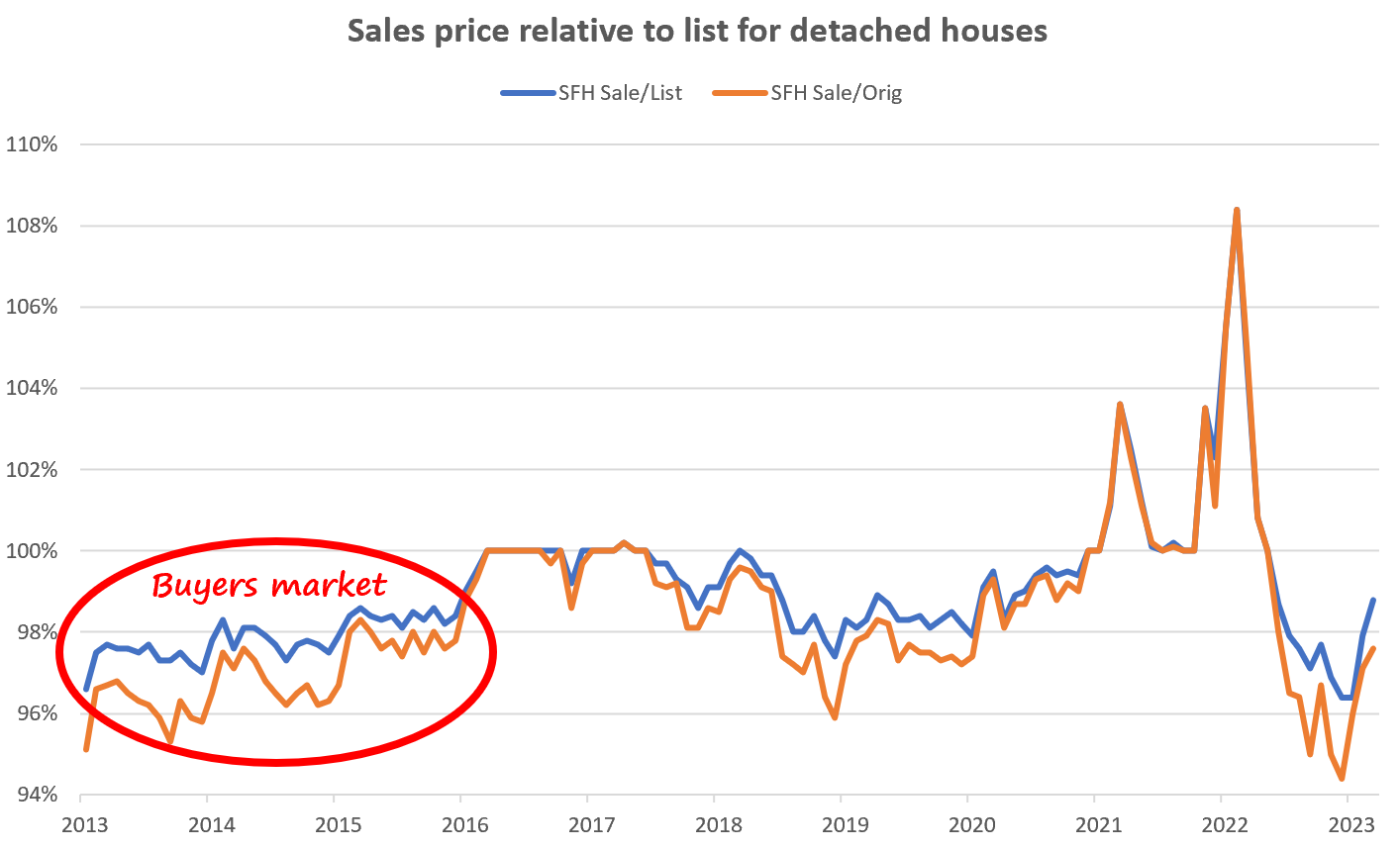

Sales price relative to last asking price usually falls within a narrow range, from sellers giving up about 2% of the list price in a slow buyers market like in 2013 with around 8-10 months of inventory, to the average place going for full asking price in a hot sellers markets like 2016 with 2 months of inventory. The post-pandemic market is a notable exception, where months of inventory dropped below 1 and over asks were routinely in the tens or hundreds of thousands of dollars. It’s worth noting that in slow markets sellers generally tend to prefer slowly dropping the price rather than taking very low offers. The chart below doesn’t capture the full extent of this, since the original asking price charted is for the listing that sold and doesn’t include the relatively common strategy of cancelling and relisting properties at a lower price.

With the rate shock of 2022, the average sale price of detached properties went from a peak of 8% above ask to a low of 3.6% under ask in December, while condos were bottomed at 2.5% under ask.

Both have since recovered somewhat, with detached properties selling for an average of 1.2% under ask in March to date and condos at 1.6% under. It’s worth noting that there is a little bit of seasonality in this measure, with the sales to list ratio usually rising about 0.5% between January and March and the fall usually being the best time for price flexibility.

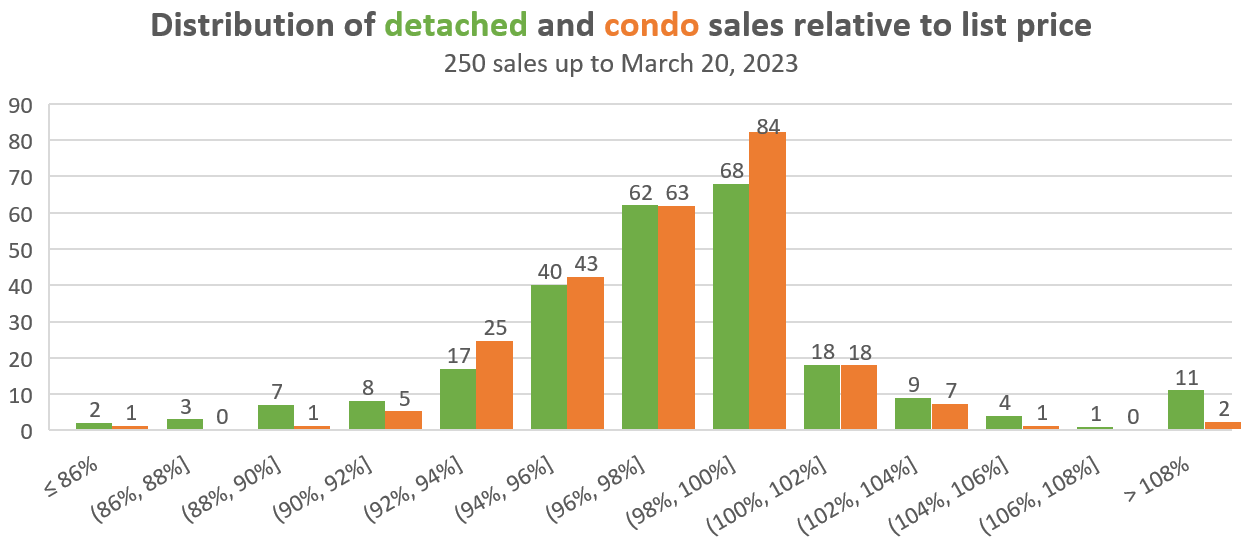

When you’re making offers, it depends on the specific property whether you will be able to go below asking price, have to go in at full ask, or even over. However if you’re considering properties that have been sitting on the market, it’s worth looking at the distribution of sales to see what sellers are likely to accept. There’s little point in offering 20% under ask if no one is going to be willing to sell that low (unless you know they are in a desperate situation and willing to negotiate). For the last 500 sales (250 condos and 250 houses), the sales distribution looks like this.

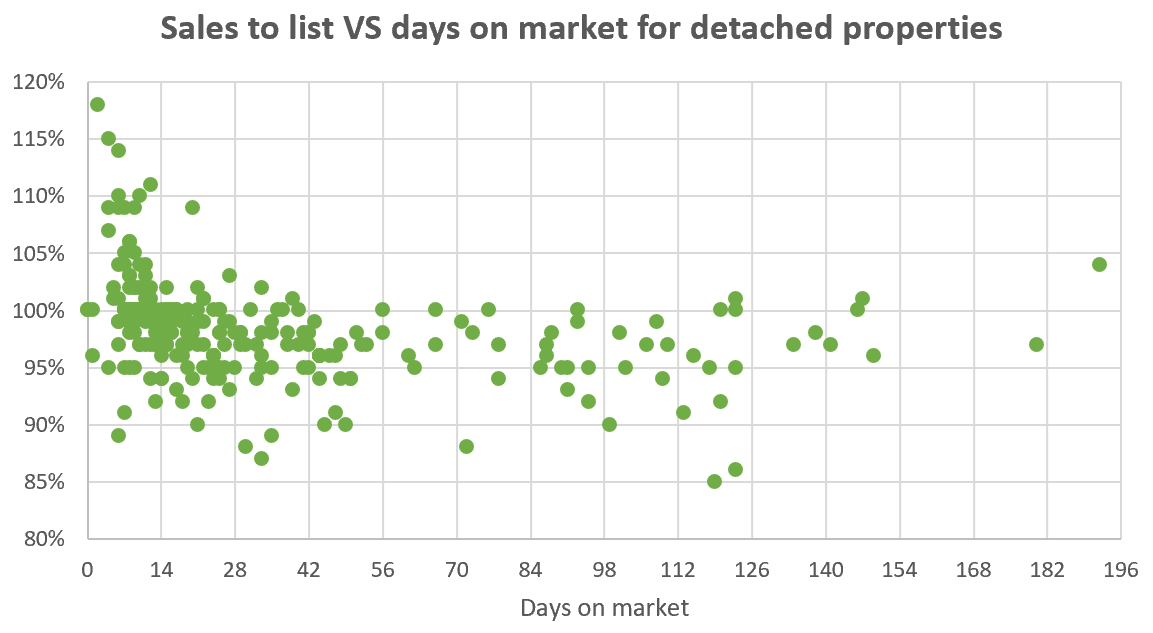

And while it’s clear that the vast majority of over-ask sales happen in the first week or two of a property being listed, beyond that the relationship between days on market and accepted price is not obvious. There are sellers willing to accept 5% off shortly after listing, and long listing times don’t necessarily lead to bigger discounts. The only surefire way to tell is to put out an offer and see if sellers respond.

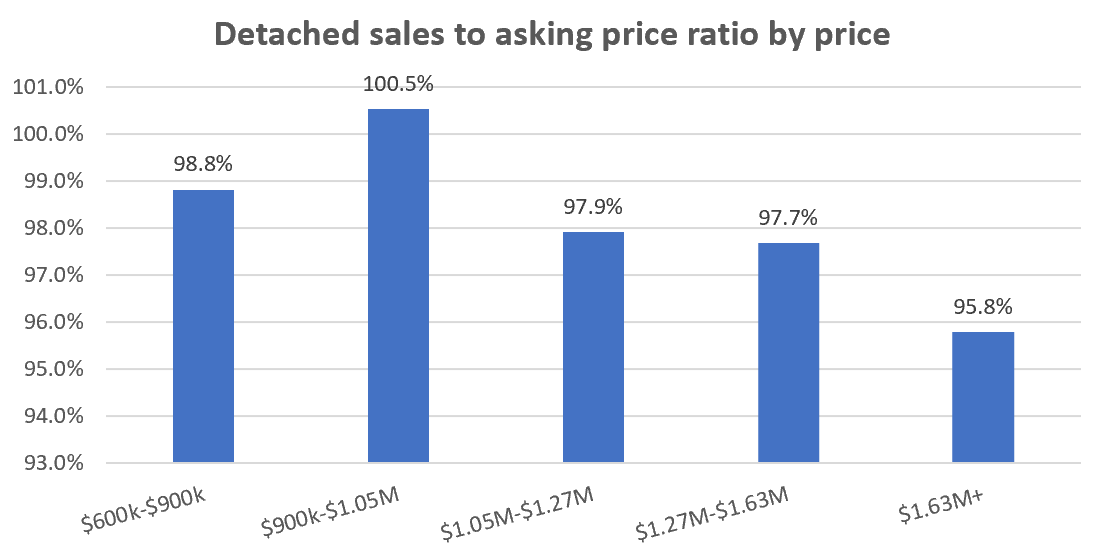

There was a question in the comments whether sellers of higher priced properties are more likely to compromise on price. The answer is yes, though the hottest segment of the market is not the cheapest properties but the second quintile with prices just under a million (a partial reason may be the bunching around the CMHC limit). The highest end properties are more likely to sell for a discount relative to the asking price.

How to use these data in the house hunt when it quickly becomes out of date as the market changes? You don’t need the full statistics to get a sense of the market in your price segment. Just ask any realtor to set up a portal so you can watch sales prices for the properties you are interested in and you’ll quickly get a sense for where sales prices are landing and which types of properties linger. Good luck.

Also the weekly numbers.

| March 2023 |

Mar

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 66 | 175 | 319 | 833 | |

| New Listings | 181 | 408 | 648 | 1217 | |

| Active Listings | 1854 | 1885 | 1913 | 1063 | |

| Sales to New Listings | 36% | 43% | 49% | 68% | |

| Sales YoY Change | -45% | -47% | -36% | ||

| Months of Inventory | 1.5 | ||||

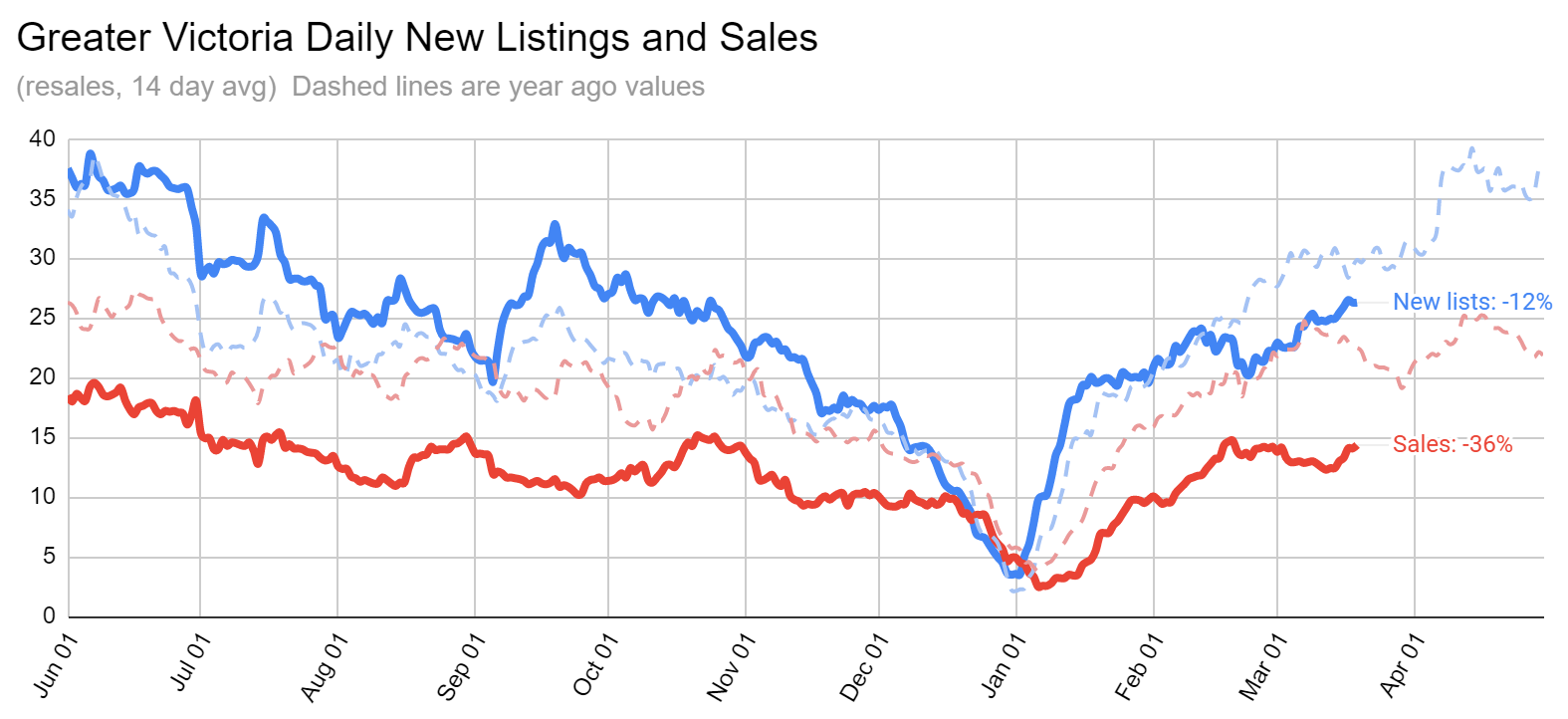

New listings have been recovering somewhat and with them sales have turned up as well. New listings are now lagging the year ago pace by 8% for the month to date, while sales are down by 36%. The big new listings month are still ahead of us, with April, May, and June usually forming the peak for new inventory.

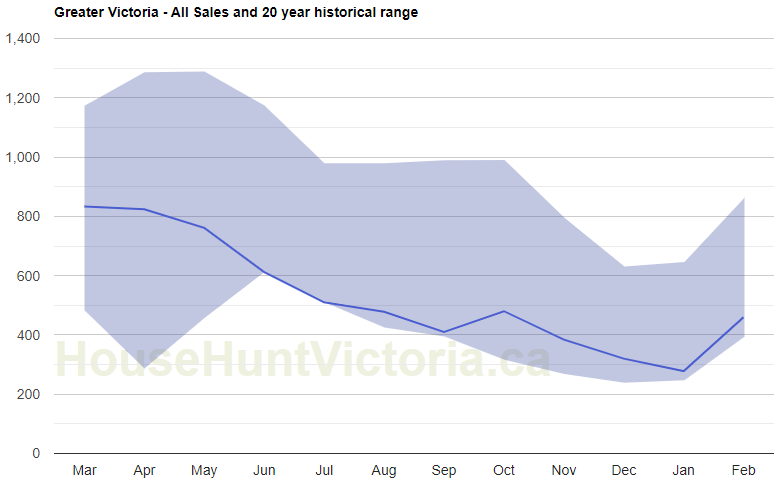

It’s difficult to predict the total for the month’s sales as they often swing from week to week, but we’ll likely land in the 550 to 650 sales range. We may get a little lull during spring break (now to end of the month) if buyers and sellers go travelling instead. I’ve been playing around with some new charts that allow us to see any segment of the market in the context of their historical range. While technically the seasonally adjusted charts that I put out every month are superior in terms of taking seasonal trends out of the data, there are still a lot of people that prefer the unprocessed numbers. This allows you to do something of a seasonal adjustment yourself by seeing how market activity has changed over the last 12 months relative to how it usually behaves. Check it out for total sales.

Thoughts? Interactive versions for all the different stats are coming soon.

My guy works for himself as the local handyperson. The guys I use to trim my trees charge a lot more.

Barrister is the person doing your landscaping getting paid $40 an hour or is the company he works for charging $40 an hour? Companies charge more because of overhead costs and the company owner is in business to make a profit. The landscaper doing the work might be only paid 60 percent of that $40 an hour charge. The rest goes to overhead costs and profit.

Mt. Tolmie what you are doing is making a claim that illegal suites are implied. You have not provided any evidence to support that claim. You would have to support that claim by contacting the municipality and ask them if they received a written complaint on an illegal suite would they take action? If the answer is yes, then your assumption would not be reasonable.

I’m off on vacation this week but new post scheduled for 10AM. I’ll try to post some market update charts in the comments perhaps later tonight.

Totoro: When you say that the average medium income is 80k is that for single income earners or couples. Is that for what age segment? Are you excluding seniors and students.

I am curious in that the BandB next door is paying even its cleaners 25 an hour or about 50k a year. The guy that does my garden cleaning is charging 40 an hour. These are basically jobs at the bottom of the pay pyramid. Not sure if that many people are working for minimum wage by the time they are 30 years old.

Maybe it was just Toronto but the old rule of thumb for a couple was that one salary paid for housing and the other salary paid for everything else.

I’m not sure about the 30% of income metric for housing affordability. It seems reasonable to apply this to the low end of household incomes where there is no room to adjust other expenses, but not to median and above incomes.

The median pre-tax income in Victoria is somewhere around 80k. 30% is $2000.

Hard to imagine a $2000 mortgage & ownership expenses for a new purchaser. They’ll be paying $2400/month on a $500,000 mortgage alone. Plus there is no accounting for equity paydown or the long-term appreciation that may result in the 30% metric.

The financial hurdle to get into the market is real though, and becoming increasingly difficult. I agree we need more types of family-friendly townhouses and multiplex housing options for buyers.

I haven’t seen any family-friendly market rentals for $2000. An average two bedroom condo is currently about $2400/month. And the vacancy rate for purpose built apartments is 1.5% and .2% for condos.

To call it a crisis for a large swath of renters who earn under the median is not hyperbole imo.

That municipal governments will continue their tacit approval of “illegal” suites is a reasonable assumption.

No. I have no interest in getting a mortgage from an unauthorized suite. I just dislike jibber jabber.

IMHO, those that have the need for housing should buy if they have the budget for it, because waiting often lead to disappointment due to forever increase in housing price.

The signs of a recession are not here, because the economy still humming along while supply hasn’t increased to meet demand.

Older people are not downsize, population increase, people still have jobs, and NIMBYs are putting up roadblocks on development.

Totoro, I understand your cognitive dissonance when it comes to Market Rental Reports. You don’t want it to be true and you have searched through the B-20 guidelines to find a specific reference to illegal rents. You’re expecting their regulations to be a book of instructions on how to verify income. OSFI does not write manuals on how to verify income, they leave that up to other organizations that provide the services.

In its first Annual Risk Outlook, OSFI identified several potential issues in the housing market and outlined planned and potential regulatory responses.

The report from the Office of the Superintendent of Financial Institutions (OSFI) covers risks related to everything from cyber-attacks and climate change to housing and corporate debt funding.

On housing, OSFI singled out risks associated with income verification for specific mortgage types, including self-employed and rentals.

The Appraisal Institute Executive then entered into discussions with OSFI to clarify what income verification from a third party (the appraiser) entails. Those discussions were then communicated by the Executive to their members under Best Practices. Income verification on a suite by an appraiser requires a site visit, and an investigation into the zoning and permitted uses of the Property.

If you have a house with an unauthorized suite it will still be valued in the same manner as before. Your property will be compared with other properties that have unauthorized suites to determine the market value. What has changed is the Market Rental Report is a stand alone report and that report has to comply with the regulations governing Highest and Best Use which means the rent has to be legally permissible. If the rent is “illegal” then that report can not be performed on that suite as it is not legally permissible. Instead the Market Rent Report will be on the entire property as a House with an “in-law suite” which is a phrase that most agents use to distinguish a home with an unauthorized suite for the use of family members. Homes with “in-law suites” are legally permissible under most zoning regulations.

The conflict that happens is that on the same page of a Market Rental Report that defines Highest and Best Use as those uses that are legally permitted is a report analysis that estimates a rental income on an illegal use. That Market Rental Report is now misleading and contravenes both CNAREA and AIC regulations. The AIC owns its own insurance company so the insurance provider has notified their appraisers that their insurance coverage will be voided for presenting a misleading report. CNAREA has its insurance through private insurers which can change at any time. So CNAREA appraisers will not know if they are insured or not until a claim is made against them and then their private insurer could deny them coverage. It’s difficult to argue for insurance coverage when the appraiser has contradicted themselves on the same page of the same report.

Some appraisers have suggested that they can get around this regulation by invoking an Extraordinary Condition or by providing a Consulting Report. That’s a really bad idea. Any hypothetical condition invoked by the appraiser must result in a credible analysis. They can’t just pull a hypothetical condition out of their arse, the appraiser has to explain why they are invoking this assumption. The condition must be a reasonable assumption. Invoking a condition for the purpose of circumventing a regulation or that the lender told them to, is not a legitimate reason. If that Consulting Report is attached to the mortgage appraisal report or is sent with the appraisal report in an email then they would be willfully disregarding the regulations. That’s worse than making an error. The appraiser has provided the evidence to hang themselves in the same email. Lenders do not make use of Consulting Reports for mortgage lending. Consulting Reports are written to a different standard and for a different intended use and in most cases will not reference a specific property. If the appraiser identifies a specific property and that it would rent for X amount, that is no longer a Consulting Report it is now a Market Rent Report and we are back to legally permissible uses again under a different reporting standard.

I think an issue that the general public is not aware of is how regulated appraisals have become over the last 30 years. The misconception is that an Appraisal Report is the same as a real estate agent’s opinion of value. They are not the same. An Appraisal report is a legal document that has to comply with Ethics Standards and Real Property Reporting Standards where that opinion has been developed through continuing education, experience, and court decisions. It isn’t just an opinion of value. It is a supported opinion of value that has to comply with Ethics Standards and Real Property Reporting Standards. And that should make sense to people when one realizes that an Appraisal releases millions of dollars in financing or is used to settle an Estate or a legal action, while a real estate agent’s opinion or your neighbors or your brother’s opinion does not.

Totoro, I understand why you want to find some creative way to get around these stress tests. You feel that the rug has been pulled out from under your feet and you don’t feel it is fair.

Canada has more doctors than ever, however the pay model and the amount of paperwork (red tapes) in family medicine is the root cause of the shortage.

Canada has more doctors than ever, so why can’t you get a family physician?

https://www.youtube.com/watch?v=MoO12F9eU9U

Canada has more family doctors than ever. Why is it so hard to see them?

https://www.theglobeandmail.com/canada/article-family-doctors-canada-shortages/

Since when is spending less than thirty percent of family income for a first time purchase the measure of affordability?

30% does not work even for Duncan. If that was the measure or goal then you would have to make housing cheaper here than in Duncan.

Inertia is on your side. And the target they state is just what it would take for the situation not to get substantially worse. Actual need is at least double that.

Saanich decades away from digging out of housing hole: report

https://www.timescolonist.com/local-news/saanich-decades-away-from-digging-out-of-housing-hole-report-6759185

“North Saanich council is so NIMBY that the planning consultant working on their new OCP fired them”

Leo, you mentioned a senior planner from North Saanich moved to Oak Bay. That was actually the head of the department. Although the senior planner left as well. They were the two staff with the most experience in the department. I do wish the remaining staff well and hope the new staff (yet to be hired) are treated better.

I would like to think that most homeless people have some identification, some are completely dysfunctional and would not have any ID. I’ll ask my friends that work in the hospitals how prevalent that is. There are also transient homeless people from other provinces that would lack coverage. The homeless also require a disproportionate amount of health care mostly due to substance abuse, poor diet, and exposure. Meanwhile, the Biden’s were lavishly wined and dined with our dignitaries and politicians. I’d hate to see that bill. I wonder if they’re good tippers?

If Canada had a surplus (like Norway’s $1.5 trillion sovereign wealth fund) and everyone’s health care needs were met, I would support treating anyone in need. But we don’t and wait times are causing suffering and death. At least we don’t have long food lines, yet.

Also saw on the news last night that in the Abbotsford area, people, with full time work, are parking trailers in highway rest areas and living out of them. Things are getting dire, the government has to get their head out of the sand. At least they’re raising alcohol taxes, something I fully support. I can’t believe the public outcry, what a bunch of losers.

https://toronto.ctvnews.ca/ontario-to-end-program-providing-health-care-to-uninsured-residents-1.6328932

The article also notes that some uninsured people are Canadians who are homeless and lack proper documentation. And note it’s not a given that a particular uninsured person is receiving medical services and not paying for them.

Of course they pay taxes. Everyone does. And keep in mind it’s the obligation of employers to withhold and submit income taxes regardless of immigration status. And a low income person, particularly one with children, is usually better off filing an income tax return than not filing.

Half a million sounds like a lot but note that there are almost 15 million people in Ontario. And the temporary residents from Ukraine are not part of that half million, as the Ontario government made them eligible for provincial health insurance. Nor are refugee claimants anywhere in Canada.

I bet it does, and it probably should.

That could be. However, an e-mail isn’t entirely futile; during meetings, councillors will often ask staff how many written submissions in support or in opposition were received, and that information helps inform decision-making.

In all honesty, though, I haven’t given feedback on a project for a long time now.

Can confirm.

Given that applications for it will start to be accepted in June, and the program has absolutely nothing to do with approving individual projects, I guess this is true.

They’ll never admit it, but speaking at the meeting gets weighted more heavily. I suspect most emails don’t get read by all councilors.

I like Introvert’s honestly.

For what it’s worth, I don’t support fixing the healthcare crisis because I stand to benefit from privatized healthcare.

On CBC News- Ontario has been covering treatment for people without health coverage since the pandemic. They are suspending that service. One doctor estimated 500,000 people in Ontario alone have no coverage. No wonder our health care system is overwhelmed. I wonder where these people came from and if they pay any taxes.

I do disagree with you because it appears you were incorrect. None of these “changes” are from the OSFI B-20.

The information you reference is different from the CNREA notice to appraisers stating that appraisers should not appraise market rental value for unauthorized suites where they are not permitted by zoning. A link to the announcement is here:

https://cnarea.ca/market-rent-request-secondary-suite-announcement-illegal-suites-clarification-demande-de-loyer-marchand-clarification-concernant-les-logements-secondaires-illegaux/#:~:text=We%20believe%20it%20to%20be%20self-evident%20that%20a,an%20opinion%20of%20Market%20Rent%20%28other%20than%20%240.%29

and this CNREA post clarifies the hypothetical exceptions and workarounds further: https://cnarea.ca/market-rent-request-secondary-suite/

It appears that CNREA appraisers who do residential real estate appraisals can still provide market rent assessments where the suite has not been authorized legally, but zoning permits it. If the zoning prohibits it they cannot provide market rent assessments, but it seems they can provide a consulting report?

However, I do see that this webinar from the AIC may also be what you are referencing: https://www.aicanada.ca/wp-content/uploads/Market-Rent-Webinar-Feb-14.pdf

Mr. Adlaw has posted this: https://www.adlawappraisals.com/19227-2/

True, though land use is fundamentally a provincial responsibility only delegated to the local government. Province can simply override the municipalities if they like. However I don’t think it would be necessary, it seems like there is widespread support for student housing on campus even amongst people that would not support any housing elsewhere

Universities are not Crown agencies and are subject to local government approval for development. An exception is UBC, which is its own local government.

https://www.uvic.ca/campusplanning/about/regulations/index.php

Totoro. What you quoted says it all. But, you can give your children a private mortgage and not have to follow OSFI rules because you are not a federally regulated financial institution.

What are OSFI guidelines?

OSFI publishes guidelines, which are essentially best or prudent practices, that it expects financial institutions to follow. Guidelines are used to set standards to govern industry activities and behavior.

“Lenders should also exercise rigorous due diligence in underwriting loans that are materially dependent on income derived from the property to repay the loan (e.g., rental income derived from an investment property).”

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Materially dependent on income is permitted uses. To include income from non permitted uses of the property would jeopardize the security of the loan as it effects the ability to repay the loan. Illegal suites do not meet the legal permissibility test. Any lender disregarding the legality of the suite would not be doing their rigorous due diligence.

OSFI increased the mortgage “stress tests” for lenders in 2018 and rental income is included in the test. There have been several updates since.

OSFI expects FRFIs (regulated lenders) to exercise due diligence and “rigorous’ efforts to verify income by an independent source (including Appraisers) especially for investment properties. OSFI regulated lenders at a senior level say they do not want “illegal rents”

source Appraisal Institute of Canada

The loan officer at the branch office may not have been aware of this before, but they are now.

In Appraisal terminology an illegal suite does not meet the definition of Highest and Best Use (legal)

“The reasonably probable use of Real Property, that is physically possible, legally permissible, financially feasible, and maximally productive, and that results in the highest value.”

To include the illegal use would put the appraiser in contravention of Real Property Appraisal Standard Rules

8.26 3.32 and 9.95

“AIC Members CANNOT provide market rents if the existing rental unit:

• is not allowed by the zoning bylaw and does not have the appropriate

permits required to meet safety, health and housing standards

(occupancy, fire, electrical, etc.) required by the Province (Territory)

or municipality.”

source Appraisal Institute of Canada

“AIC Members are not insured to provide market rent for unauthorized or illegal suite as this is contrary

to CUSPAP and AIC Professional Standards.”

source Appraisal Institute of Canada

You can disagree with me as much as you want. Because it doesn’t matter what you think. This is now the way it is through out Canada. Any appraiser that willfully disregards this will have their insurance voided and face further disciplinary action from the AIC.

So why the change? I can only give an opinion that the root cause is that some home owners have capitalized on using this as qualifying income in the past by adding multiple illegal suites to their homes. I recall one owner of an apartment building in Esquimalt that rented individual rooms in their apartment building to students rather than single tenancy suites so that they could boost the reported income to the bank. Well that door has been closed. The qualifying rents now have to be legal rents.

For most people that have illegal basement suites this will be more on an inconvenience than a deal breaker. For example if you rented the main floor of a house for $3,000 and the illegal basement suite at $2,500 that would be $5,500 per month. But now the rent would be calculated as a single tenancy for the entire house which would most likely be lower at say $4,500 a month.

The rationality of why the income from the suites has to be legal does make sense. Not just that the suite may be shut down and the applicant no longer meet their financial obligation to the bank, but one of health and safety.

From: https://www.ctvnews.ca/business/risk-of-a-hard-landing-for-canadian-economy-is-up-former-bank-of-canada-governor-says-1.6329136

There’s this thing called e-mail; introverts love it.

I guess Trudeau’s incentive program isn’t having much affect at the municipal level.

I have no specific opinion about this particular development and whether it’s a good spot or not, and in general have already commented on it earlier.

https://househuntvictoria.ca/2023/03/20/under-ask/#comment-99993

What I think should concern every taxpayer is how fundamentally broken this system is. A development application doesn’t get to the public hearing stage without hundreds and hundreds of hours of staff time funded by taxpayers. Developers ask staff if a project is compliant with the bylaws and work with them extensively to come up with one that is supportable. Voting it down (nearly unanimously as well) shows a total disconnect between how the non-political municipal staff interpret the town’s bylaws vs the political council and wastes huge amount of money without actually getting any more housing.

There was a similar situation in Colwood where a development was recommended by staff and in fact because it was compliant with the OCP they even recommended to approve it without public hearing. Instead the council killed it entirely, saying it was too big for the location and too far out. Nevermind that what the developer really wanted to build was townhouses, but that project was killed due to a mid-application restriction by council to allowable blasting.

Fine if they want development that’s in more walkable locations, but then it’s on council to directly ensure that their bylaws allow it to happen. Otherwise they are failing their communities, who again and again express that housing affordability is one of their top priorities

I like Introvert. An honest nimby that simply doesn’t like housing but is also too introverted to show up at a public hearing to oppose it

I don’t support more housing.

I don’t support fixing the housing crisis.

Did anyone catch that the new North Saanich council is so NIMBY that the planning consultant working on their new OCP fired them because they were impossible to work with and wouldn’t accept the result of their consultation with the community? And a senior planner quit and moved to Oak Bay because that was an improvement. Good stuff

https://www.timescolonist.com/local-news/consultant-for-north-saanich-quits-over-rift-about-how-council-deals-with-community-plan-6757340

Unless you have a link to a reliable source I have missed, you appear to be incorrect.

My understanding is that banks and lenders set their own policies on this and B-20 has not changed. They may discount rental income from unauthorized suites, or count it for mortgage qualification purposes, and they will assess any additional risk this poses.

The standard insured lenders need to meet is:

“Lenders should also exercise rigorous due diligence in underwriting loans that are materially dependent on income derived from the property to repay the loan (e.g., rental income derived from an investment property).”

https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20_dft.aspx

What you may be thinking of is the rules for CMHC insured mortgages. CMHC will only count 100% of legal suite income.

https://www.cmhc-schl.gc.ca/en/professionals/project-funding-and-mortgage-financing/mortgage-loan-insurance/mortgage-loan-insurance-homeownership-programs/rental-income

The Karens are saving green space for their children to camp out, because there will not be enough housing for their offspring in 20 years.

That doesn’t mean they were locals. One of the big opposers to the development was one of the Fairy Creek organizers who lives in Nanoose that was using his network to oppose the Parksville development. He really doesn’t need to address housing since he owns 4 up there….

–

It’s ALWAYS the wrong location. It’s not that I don’t support more housing. Just not here, or there, or over there either. Also not there. But I totally support fixing the housing crisis.

That’s one of the best NIMBY modifications I have seen. Extending it to places that you have visited. A tourist proxy NIMBY. Lol..

Didn’t mean to imply that you made that claim: mostly that some do on the topic.

Well, they also own a pipeline they can’t seem to build or have a budget set for it. Just imagine if they tried to build houses that needed to recoup the cost over a lifespan of a property. After consultation, DICAT, preferred bidders, some form of community benefits and union requirements; they will probably do just about as well as the province is doing building a hospital in Duncan. In the end we put them there and we get the government and policies we deserve.

Glad for this decision. I had the chance to explore this part of Parksville when I was on vacation there last summer. The natural characteristics of this site should make it off-limits for any development.

BTW, the city received 2,999 submissions about the proposal. Of those, 2,986 were opposed.

https://www.timescolonist.com/business/vote-on-monday-for-controversial-parksville-development-plan-6723612

Regarding RESPs, we just contribute the max amount to receive the full government kick-in, and we invest it in GICs. No fees.

Probably not doing as well as if we invested in the stock market, but we don’t invest in the stock market.

It does appear that there is an uptick in activity. Local home owners are once again returning to the banks to refinance their homes to purchase a rental property or a condo for their children/grand children. An issue that comes up more today is the Office of the Superintendent of Financial Institutions OSFI (B-20) regulations relating to illegal suites which I believe came into effect May of 2022.

When a home owner no longer has the income to service the debt, lenders will order an appraisal on the property along with a market rent report. The rent from their suite would be part of their income to qualify. That’s fine as long as the suite in their home is on permit from the city. If the suite is not on permit, then a market rent report can no longer be performed. Instead a market rent report can only be performed for the entire house and not separated into owner occupied and renter occupied. This is causing some home owners to have problems qualifying for a mortgage.

As with any changes to tighten up lending policies there is always a question of how to implement any change. In the past it was left up to the lenders themselves but this led to an ad hoc implementation. Some lenders followed the change and some did not. In order to implement this change consistently from coast to coast the regulators looked to the appraisers that provided these market rent reports, the appraiser’s reporting standards, and the appraiser’s insurance coverage.

At his point you might be asking yourself “what has this to do with the appraiser?” If that suite is shut down by the city or for any other reason can no longer be rented, then the mortgagee may no longer be able to make their payments and the property falls into foreclosure. The law suit that occurs generally goes along this line by the bank. “If the bank had known that the suite’s income was illegal then the bank would have never approved the loan and would not have suffered a loss” This type of court action usually follows after market prices have fallen and the lender can not sell the property for the amount of the outstanding mortgage. Whether this is a truthful statement by the lender or not has to be proven in court.

What is different today is that any appraiser that provides a market rental report on an illegal suite will have their insurance coverage voided without exception. If a court action occurs in the next seven years after the report is completed then the appraiser will have to defend that case at their personal costs and pay any damages which can be tens of thousands to defend not including damages. Without insurance coverage, this has a potential of wiping out an appraiser’s personal wealth. No appraiser is willing to take on this liability, so now there is a consistency in Canada on how rents from illegal suites can be used as income to qualify for a mortgage.

Appraisers, in general, have not welcomed this change. To the best of my knowledge this is the first time OSFI has looked at the appraisers to implement their regulations regarding lending practices. Appraisers don’t want to “police” lenders instead they preferred to state that the suite was not an authorized use and let the lender do their own due diligence. However, it seems to have worked. There is now consistency through out Canada on reporting income from suites. An appraiser that willfully disregards this regulation is now putting their own home up as collateral for any potential law suit and damages.

In March? 64 pending sales on March 26, 2021

In the last few years? 92 on September 4 2020.

Might not be precise, also when Marko says 42 he likely means sales reported, not sales pending, which is slightly different. Sometimes we get a bunch of sales reported on one day that are actually older sales (a few days to a few months old though the latter is rare)

In Calgary visiting family over Spring Break. There are so few EVs in this city! Marked difference from the West Coast. People here would be forgiven for not realizing an energy transition is fast afoot.

The other mentionable is potholes. Never seen a pothole, until now, that an adult could take a bath in — and it’s on a major arterial!

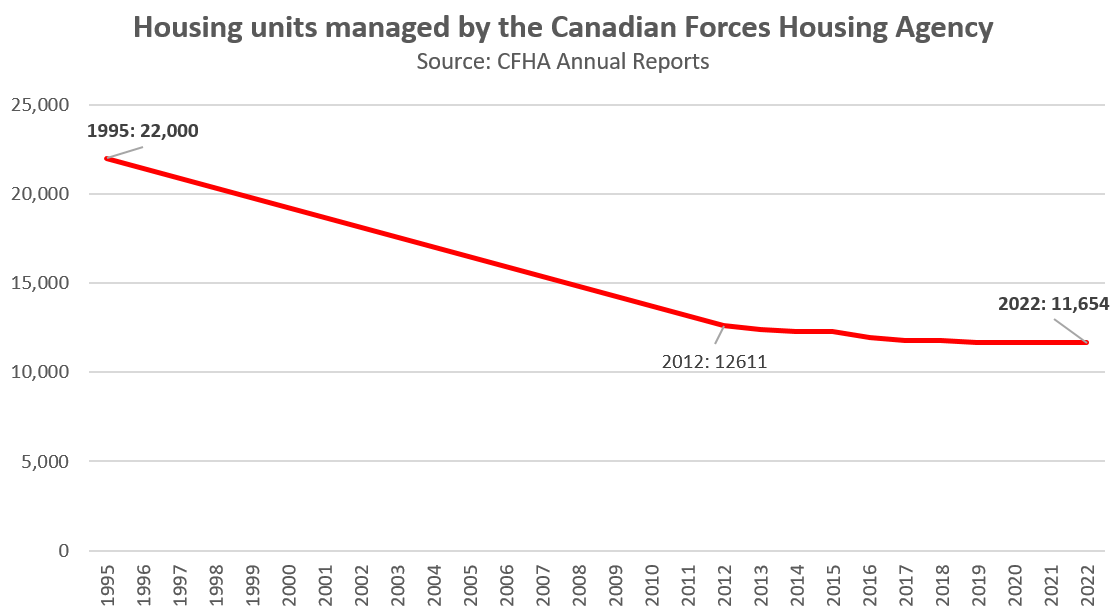

That’s fine, but the reality is today we have a massive wait list from CAF members waiting for housing. Since 2012 despite repeated promises to build more housing the number of housing units keeps declining every year.

Don’t get me wrong, 90% of the blame is on the federal government for chronically underfunding the housing agency (most of their money goes into maintenance trying to keep their 50s housing stock from falling down). But reading these annual reports I am struck by the fact that it’s all self congratulatory fluff about minor initiatives and not a single word about the horrible housing shortage for their members.

Strawman, I never made that claim.

The point is it’s an example of how badly the federal government does on housing. We can’t even solve the most trivial problems like building sufficient housing for service members, where we own the land, have absolute control over what can get built, and can recover all or most of the costs through rents over time.

It’s the same situation with students, and there’s a lot more of those. Provincial and federal government could simply decide to build enough student on campus housing to meet demand. Again they own the land, they are allowed to build on it, and they can structure it to make it cost neutral over the life of the building.

But they simply don’t.

Not to defend CFHA and their regular incompetentance, the graph itself is a bit deceptive when you’re just looking at the amount of housing they provide to members. The post cold war downsizing of the CAF from the 90s saw it go from around 130,000 personnel to around 68,000 with about a third of military facilities being closed (not sure those PMQs shut down in Bonn, Barrington Passage, Souix Lookout and Chetwynd impact the available housing provided to CAF members in Victoria). A better data point would be the percentage of available CFHA housing available to members over time. As well, the CAF also incentived members to purchase homes in communities that led to a low demand for PMQs for a couple of decades where they sat vacant. They great irony in this is that communities once lobbied against CAF provided housing because they viewed it as keeping money away from being spent on real estate purchases and rentals in local economies. Also, remember the CAF needs to set policy nationally and not locally for housing, so the policy will match what is in Winnipeg and Edmonton to what is in Victoria. Overall, claiming that there is a significant impact from military personnel on the housing market is as much or even more of a red herring as that of foreign buyers that keeps the focus away from addressing actual problems of red tape, bureaucratic and political incompetence that stops housing from being built.

I suspect that the market is finding its feet and simply adjusting for the new interest rates. Bottom line is that people still have to sell and people want to buy. Nevertheless we still have a bit of a ways to go,.

Marko-What’s the highest sales day you’re aware of? Approximately.

Largest sales day of the year, 42 pending sales so far today.

Man brandis and Swedish have been there since the eighties The crazy stuff people do these days I guess is the new normal

https://montrealgazette.com/news/local-news/airbnb-adds-criteria-for-quebec-hosts-following-old-montreal-fire

“Airbnb has announced three steps it will take to regulate listings in Quebec following last week’s fire in Old Montreal that killed at least four people and left another three presumed dead…. In a letter to Quebec Tourism Minister Caroline Proulx on Friday, Airbnb promised to remove listings that do not have a Corporation de l’industrie touristique du Québec permit number, require permit numbers for new listings and provide the Quebec government with a tool to support host compliance….

Quebecers operating short-term rentals were already required by the province to have a CITQ number — which depends on authorization from the municipality — but until now, Airbnb did not require proof of permits. As a result, thousands of properties were being rented out illegally across the province.”

Crazy news – brutal for the families. I wonder if they will be proactive and start applying those rules nationally instead of waiting for people to die to do it.

Damn those progressives with their strip clubs and massage parlours.

Perfect example of a progressive inner city to raise children that have strip clubs, massage parlour a block from Vancouver West End, while dogging needles and wade through human feces.

Perhaps we are saving the planet with one pile of sh_t at a time instead of focusing on economy and affordable housing.

https://bc.ctvnews.ca/it-was-disgusting-downtown-vancouver-building-smeared-with-human-feces-twice-this-month-1.6326972

lol been fooled by that enough times over the past 6 months.

Re: mortgage rates

BMO is listed as having a 10 year @ a low 5.58%. https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

That could be an explained by the inverted yield curve, since 10 year bond rates (2.72%) are actually lower than 5 year rates.(2.76%)

ok, right, my apologies

My mistake for being unclear. See relationship between bonds and mortgage rates below.

He’s referring to the 5 year bond yield (which mtg rates generally takes their cues from) – found here – https://ca.investing.com/rates-bonds/canada-5-year-bond-yield.

Generally when 5 year yields move up and down (they just dropped hard in the last week) you will see 5 year fixed rates follow. There is normally (maybe always?) a premium which is why mtg rates are higher than the bond yield – some details here – https://www.truenorthmortgage.ca/blog/how-government-bond-yields-relate-to-mortgage-rates.

There are other considerations on what the bank actually offers (perceived risks, appetite etc) and in a world where banks are collapsing its a bit hard to predict exactly what they will do for rates. But if the bond yield stays this low for a few more weeks mtg rates are likely to come down.

sorry, where do you see this, I’m just looking at ratehub and it’s giving me about 4.4 for fixed 5 year?

Who knew raising interest rates and banks would be the first to wobble Lots of dire stories on the wire this morning im hopeful this doesn’t spin out of control

Why I have zero confidence in the federal government to fix housing.

Exhibit 752

The Canadian Forces Housing Agency is literally mandated to “meet the future residential needs of members of the CAF”

They have 4500 people on their waitlist, they own the land, and they can recoup most of the costs via rents over the life of the building.

And yet they have cut their housing in half since they were founded

They never even mention that they have endless waitlists in their annual reports. They just pat themselves on the back about how good they are doing on various minor initiatives like providing good customer service or “greening” their housing.

They talk about demolitions like NIMBYs at a public hearing: “Demolitions contribute to the consolidation of housing sites and improve privacy, parking, landscaping, security and access issues”

Or worse, demolitions as climate action: “Demolitions contribute to the reduction of greenhouse gas emissions”

Wild.

Yeah if traders are right about their bets on rapid rate cuts later this year that would mean pretty severe recession.

Don’t know how that’ll help if the lending is tightening up, since we’ve had 3 regional american banks fail, and a major European bank, and there’s rumblings of a second major European bank (Deutsch).

What are 5 yr. mortgages?

For those feeling like a complete change….this “full duplex” caught my eye.

I swear I do not have any financial interest in this but I feel it is important that people who feel frustrated or at wits end with the prices in Victoria to know about other parts of the country and what your money can buy.

The asking price is under $200,000.00 which is astonishing. (In Sackville NB….steps to the university)

https://www.kijiji.ca/v-house-for-sale/moncton/30-lansdowne-st-sackville-new-brunswick/1654178793

(I know, I know, it’s cold out there and “no one” lives on the east coast because it is too cold:)

5 year bonds down to 2.7%.

The popcorn looks unpainted to me. We also have textured ceilings in some rooms which have been painted. All techniques welcome @gardener. Thanks

2wheels it’s a different process if it’s painted, as noted here. I’ve done a lot of removal of unpainted stipple so can pass along all my technique tips, if you are in an unpainted situation.

Thanks for the comments re popcorn remediation. It’s also great to know there are a couple true believers out there!

Shag style carpeting came back in style. Why not popcorn ceilings? How about living room conversation pits and sheet panelling too.

Sounds like a lot of work, I’ll just wait for our popcorn ceilings to come back into style.

Re the OCP and zoning:

As a confirmed NINBY I would not support automatically approving anything that fit the OCP but I would approve automatically changing the zoning to match the OCP when it’s term was up and the next OCP replaced it. That would give everybody fair warning of the changes coming and give those that don’t like it time to move. Developers would know what and when stuff was in the pipe and could buy ahead if they wanted to. I believe that was the original plan for OCP’s.

Re. popcorn ceilings, I know someone who covered theirs DIY with ceiling tiles and likes the result. YMMV

https://www.armstrongceilings.com/residential/en-us/project-ideas-and-installation/cover-popcorn-ceiling.html

I’ve done it to my own house, and it wasn’t painted. The removal process wasn’t bad, all it took was a water spray bottle and a drywall knife. However, skimming and sanding was a chore.

Sand/knock the loose and high point down by sanding if the ceiling is painted. Tape and repair holes/cracks before applying drywall compound, then quickly knock down high points by sanding, and skim on a second coat of drywall compound (perhaps this is the finishing coat).

If the ceiling is really rough, then it could be easier and cheap to cover it with fresh sheets of drywall.

I think it’s possible to come up with lots of different, entirely plausible scenarios, of which this is one. But overall, I think cautionary notes on this include (i) look at what the market is actually doing on the ground, and it seems like some of the realtors on this blog are telling us things aren’t as bad as one might think, nothing too dramatic going on, (ii) in the scheme of things, historically, mortgage rates are still cheap, and (iii) meanwhile, prices are indeed off, and (iv) finally, I can’t help but think there’s a lot of building pent-up demand.

Throwing it all into the hopper, I think if I were looking and lucky to find something I could afford that I liked and that fit my family needs, I’d go right ahead and buy it.

Good luck

I’ve tried to time markets before. One time I guessed right, and the other time I guessed wrong. Emphasis on guessed.

If I had to guess again, it feels like the cracks are starting to form. Central bankers are suddenly very nervous. The recession seems a lot closer than it did two weeks ago. So maybe in the fall or sometime next year, there will be a better buying opportunity than now. But it is just guessing – and in the 08/09 recession, house prices in Victoria peaked in 2010. So there really is no sense in trying to time it.

House prices are off peak by something like 15 to 20%, and the interest rate risk is minimal. Inventory sucks, but if I was in a position to buy, I’d be looking now. I wouldn’t wait for some magical market collapse.

If the popcorn ceiling has not been painted, I have been told that using Fabreeze on the ceiling will let you scrape it off easier. Otherwise it’s a lot of sanding.

If it’s painted, which it probably is, you can try skim coating it with drywall mud. If it’s unpainted, you may be able to just soak it with water and scrape it off.

I’ve done the skim coat thing before. It works well as long as the texture isn’t too rough, and dry wall mud is cheap.

If the texture is rough, I’d consider using something that sets up firmer. Like maybe do the first coat with a setting type compound and the finish with regular joint compound.

2 wheels u can get it tested if results are fine it can be scraped off and then re mud I have done it with a power scraper and muscle

2 wheels ….I’d simply gyproc over a popcorn ceiling.

Otherwise it’s a F3%^# horrible and likely a costly job:)

According to a news story in BBC……By Madeline Halpert & James FitzGerald

BBC News

Canada’s population grew by over a million people for the first time ever last year, the government has said.

The country’s population increased from 38,516,138 to 39,566,248 people, Statistics Canada said.

It also marked Canada’s highest annual population growth rate – 2.7% – since 1957.

The increase was in part fuelled by government efforts to recruit migrants to the country to ease labour shortages, Statistics Canada said.

The country also depends on migration to support an ageing population.

But Statistics Canada said the surge in the number of permanent and temporary immigrants could “also represent additional challenges for some regions of the country related to housing, infrastructure and transportation, and service delivery to the population”.

International migration accounted for nearly 96% of the population growth, according to the news release.

Renovation q for all you popcorn ceiling owners. Has anyone gone through the process of eradicating their popcorn ceilings and textured walls either through removal/replacement or covering them up and can share their story? Does anyone have a recommendation for lower cost solutions or tradespeople to go with? Thanks

No one on this blog knows the future. Remember all those posts in early 2020 saying “Wow, this pandemic thing is going to send real estate to the moon”

——- Oh, right. There weren’t any.

Usually real estate moves a bit slowly so I’d put my money on conditions being somewhat similar now and next fall.

It’s certainly plausible that prices could grind down a bit and be a few percent cheaper in the fall. Absent a shock don’t see them dramatically lower.

The immigration numbers count anyone given permanent resident status. During the pandemic most new permanent residents were already living in Canada under some other status. Thus the disconnect between immigration count and actual population change.

Good Morning,

Ok, follow all the time (love & respect Leo’s work so much). But, I want to know if people think I’m out to lunch. Originally, I believe even Leon said the full weight of interest hikes wouldn’t be felt for at least one year. It’s barely been a year since the first rate hike last March https://altrua.ca/canada-interest-rate-forecast/.

On that note, there are thoughts that housing will ramp up again (e.g., price), as people are now use to the shock of the rate hikes, US banking in the short term might release rates a bit, and we are going into the selling season.

But, I have some additional thoughts and would love feedback on: if rates do go up another .25 points likely this summer (look at the US), the ability of all banks (yes, Canada too) have less to lend (I.e., need to tighten the boot straps), and some people even the 20% of those who signed at the peak are forced to sell in the next couple of months, would indicate maybe a short term spike, but then also more housing availability and less people able to buy… am I way off – or given all of what’s happening – this fall, could actually be a very good time to buy, and now a very good time to sell?

Cheers

Up another quarter point, but a marked shift in rhetoric. That may be it for this cycle.

Bank of Canada won’t hike in May either.

Fed up another quarter point.

Developers proposing non-OCP compliant projects is a direct consequence of our current zoning system where everything must go through the same rezoning system no matter the project details.

Lot split? Years or rezoning

Duplex? Years of rezoning

Townhouses? Years of rezoning

Small apartment? Years of rezoning

Rentals? Years of rezoning

OCP compliant project? Years of rezoning

Non-OCP compliant? Years of rezoning

Non-profit housing? Years of rezoning

Luxury condo megatower? years of rezoning

When everything is equally painful, developers will ask for the max they think they can get away with. Zero incentive for sticking to the OCP

If we want devs to respect the OCP, if we want more affordable housing, we need to provide an easier path for those projects. Keep the OCP current with todays housing needs, then allow anything that’s OCP compliant to be built by right. Then by all means vote down non-OCP projects if you like

Everyone and everybody does have a right to protest and be heard

Are we at the point where voting against non OCP compliant developments is automatically considered NIMBYism?

Perhaps, developers should have included a plan for waterless toilet and grey water recycling, bicycle path with charging stations, and pot dispenser Starbucks would get the nod from the ecoactivists.

https://www.pqbnews.com/news/parksville-council-turns-down-800-unit-development/

Apparently, according to the chart below, immigration did not experience that much of a slowdown during the pandemic. In 2020, the immigration rate decrease to 1/2 normal, still allowing 184,000 new immigrants. 2021, over 400,000 new immigrants arrived. Not much of a pandemic induced fall off in immigration. Recently announced immigration measures to allow Turks and Syrians who were displaced by the earthquake into Canada with no mention of actual numbers.

Correct, but it seems as if the economy still is humming along, so people who can afford perhaps are willing to test the water.

One has to wonder how long a phd student and engineer can hold out in a 2 bed 1 bath house with 2 kids before they make the leap of faith to homeownership.

https://globalnews.ca/news/9569580/housing-market-canada-spring-outlook/

But demand isn’t just how many people. It’s how many people can pay how much.

It just means that there is a potential for jump in demand of homeownership than previous years.

Will be very interesting to see if this growth rate holds up in the 3 year annualized rate. As far as I know we’ve never seen this kind of growth when affordability was this poor nationwide. One presumes something will crack.

Yes, with the huge immigration processing backlog, now being processed it makes sense to average out the last few years.

Similar to Leo’s graph for BC, it’s making up for the very low numbers during the pandemic. Very large fluctuation in non-permanent residents.

Re funeral homes:

Look into Memorial societies. For a nominal fee they take down all your wishes and file them. On the sad day the family phones the memorial society and they give you the name of whichever funeral home they have the contract with (I think usually Royal Oak here but I am not sure). They provide the last wishes on file to the family. (typically type of service, hymns, flowers, place of internment etc.) There is a steep discount off the regular fees (something like 30% when I dealt with it). Worked very well with both my parents but that was 20+ years ago. That would typically mean the family is dealing with the funeral director so you would not be doing it directly but I am not sure.

On BNN- Canada’s population grew by over one million for the first time in 2022. I expect a higher number for 2023.

Population growth. 1 year growth highest since 1995, but 3 and 5 year growth rates nothing out of the ordinary

I also think McCalls may use Royal Oak Burial Park.

I’ll second Fern, McCall’s is great.

Thank you Leo and Fern, I will check them out today.

We had a good experience with Royal Oak Burial Park

Barrister, I highly recommend McCall Gardens.

Parksville council just nixed a potential 800 unit development on the river…old NIMBY’s win again.

I am off topic here but I am hoping for some advise. My neighbour was just diagnosed with stage four lung cancer. His wife has asked me to find a reasonably priced but caring funeral home. I have no idea how to go about this so I am hoping that someone might have a referral. He wants to actually handle the details himself so a funeral director who is sensitive is very important. Some days life sucks and this has been one of them.

Why not open an RESP a bank or discount brokerage, that’s what they are for.

Good idea.

English hard. And my editor was not useful either.

Why not open an RESP at a bank or discount brokerage, that’s what they are for. The feds match your contribution at 20%. Free money.

From: https://financialpost.com/executive/executive-summary/housing-market-would-be-hit-by-credit-crunch

TFSAs can only be opened at age 18. You could make your child your successor on your TFSA and have them assume your TFSA contributions and gains when you die.

There’s no need to be on a fixed payment plan, just lump sum the payment to get the bursary $5000 gets you a thousand for two kids annually (recover those tax dollars you paid and nothing like a 20% return just by contributing) Like anything else, check the fees and don’t deal with the people that have excessive fees or have ever sold Amway…It’s just a waste to leave that bursary money in the hands of the federal government. Keep in mind that anything that heavily weighs in mutual funds will have larger fees. As well, you will do better with fee for service financial advisors over commission based advisors. Somehow people get irked at spending $150 on a meeting and go to the person where the time is free but don’t realize it cost them thousands in commissions in the long run.

I’m not Leo, but I would suggest open a TFSA for your child and buys index ETFs that track the Dow, Nasdaq, and perhaps the TSX. Or, ETFs that track the top index performers, such as Nasdaq 100 and S&P 500.

If you contribute $2500 per year to your child TFSA in a Dow index ETF, using current market condition calculation would give you roughly $100K starting 18 years ago, and the Nasdaq is roughly $116K.

Your bank certainly can work with you to open a TSFA account, and buys index ETFs for you , such as ZQQ, QQQ, DIA, etc…

@Leo Re:

“The grossest are these savings funds for kids where salespeople guilt parents into signing up for fixed monthly payments into their kid’s RESP which is then invested (after thousands of dollars of sales charges). Part of the reason the returns aren’t awful though is because you are fixed to paying those monthly payments until the kid is an adult and if you fall on hard times and can’t keep paying they can take all or most of the fund. So richer parents benefit from poor parents that couldn’t afford to keep up the payments for 18 years.”

What would you recommend as an alternative? Something hands off and easy for non-financial people (that don’t want to become financial people).

First sentence reads a little funny to me Leo. As always, thanks for all the hard work.

Edit: After reading it 5 times I think I get it.

Inflation looking good. Combined with a range bound 5 year bond doesn’t look like we’ll see any more rate shocks.

Nothing great. Here’s the realtor survey results on retiree buyers.

Yeah once you get into luxury market you often see sellers with absolutely no clue about what the properties are worth and slowly marching down the asking price by the high 6 or low 7 figures over years. Only takes one buyer so may be a sensible strategy, but I wouldn’t personally want people traipsing through my house for years.

Are there any stats on age distribution of sellers and buyers? Could be interesting. One would expect sellers to be older and buyers younger, but is that the reality in Victoria?

Engaged before 1st offer, delivered report before final (more accurate & effective) offer.

I wonder if this is partly because high end properties are harder to value – fewer comparables. If you were unsure on market value and not under duress perhaps makes sense to start high and come down in increments to meet the market.

Probably not, just covering my bases in case everyone goes travelling during reading break haha

I can’t see 550. That would be a sales pace of 115 per week. This week we will see a 150 followed by a 130 as the week after is missing the Saturday-Sunday and will end the month at 600 on the low end. I am predicting 630 sales on 2,000 inventory.

All in all not too bad. The first 5 years of my real estate career featured Marchs like this and the world did not end.

March 2013 – 483 sales, 4333 active listings.

Wow, excellent post!! Incredibly well put together. This will be a permanent link for myself to send to clients when they want to write unrealistic low ball offers. Too bad you can’t collect royalties. Of course, everyone will come back with “you don’t know unless you try.” 🙂

As I said in the previous post, the discount off CURRENT asking price is shockingly low in a variety of markets (hot and cold). Conclusion is sellers prefer to drop the price versus take a substantial amount off CURRENT asking. Once again, not to be confused with ORIGINAL asking.

I think if you dug a bit further into it the few places selling at 10% off asking are typically homes needing a lot of work and updating or have other challenging characteristics.

The grossest are these savings funds for kids where salespeople guilt parents into signing up for fixed monthly payments into their kid’s RESP which is then invested (after thousands of dollars of sales charges). Part of the reason the returns aren’t awful though is because you are fixed to paying those monthly payments until the kid is an adult and if you fall on hard times and can’t keep paying they can take all or most of the fund. So richer parents benefit from poor parents that couldn’t afford to keep up the payments for 18 years.

Not for me, I just YOLO the kids’ RESP into bitcoin and meme stocks.