How to build enough housing

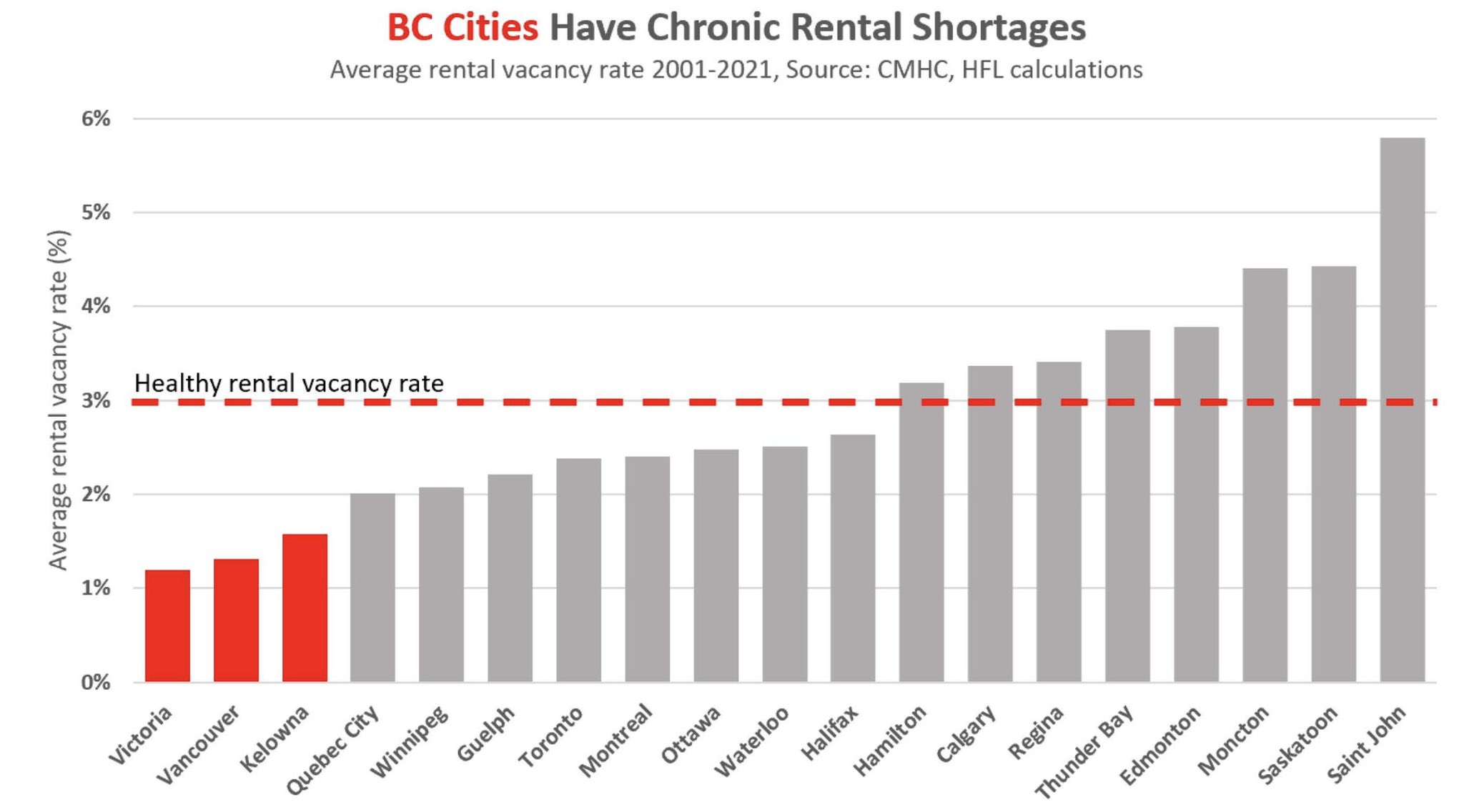

There’s no doubt that we have a severe housing shortage in Canada and BC is especially bad. We can see that in long term rental vacancy rates which are lowest in BC cities (Victoria being the worst in the country), and have predictably lead to an associated rapid increase in rents.

More and more reports are coming to the conclusion that we need to rapidly increase the rate of home building if we are to bring affordability back to the housing market, whether for rented or purchased accommodation.

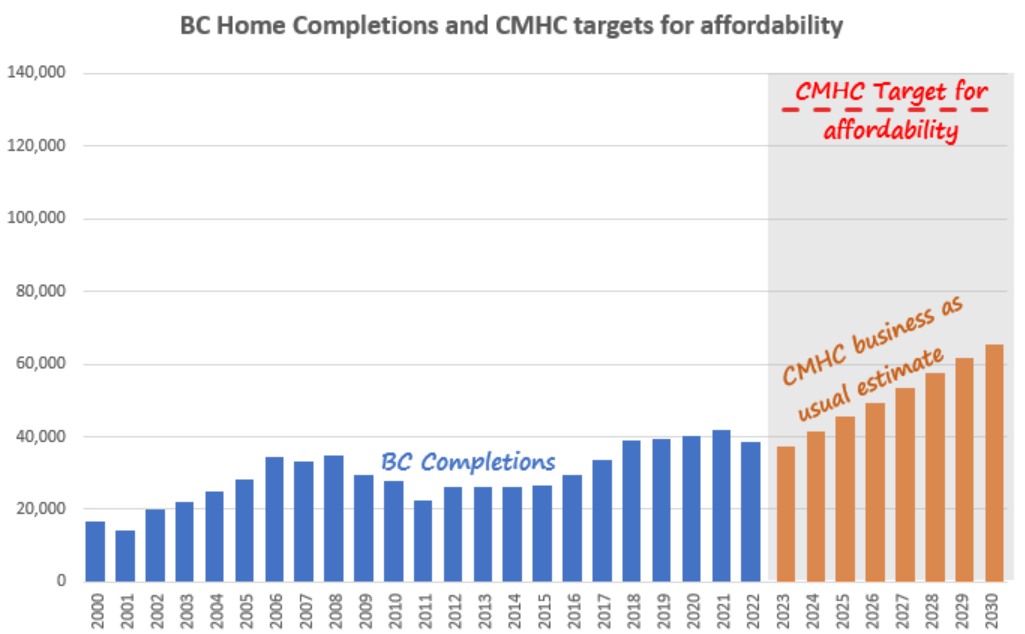

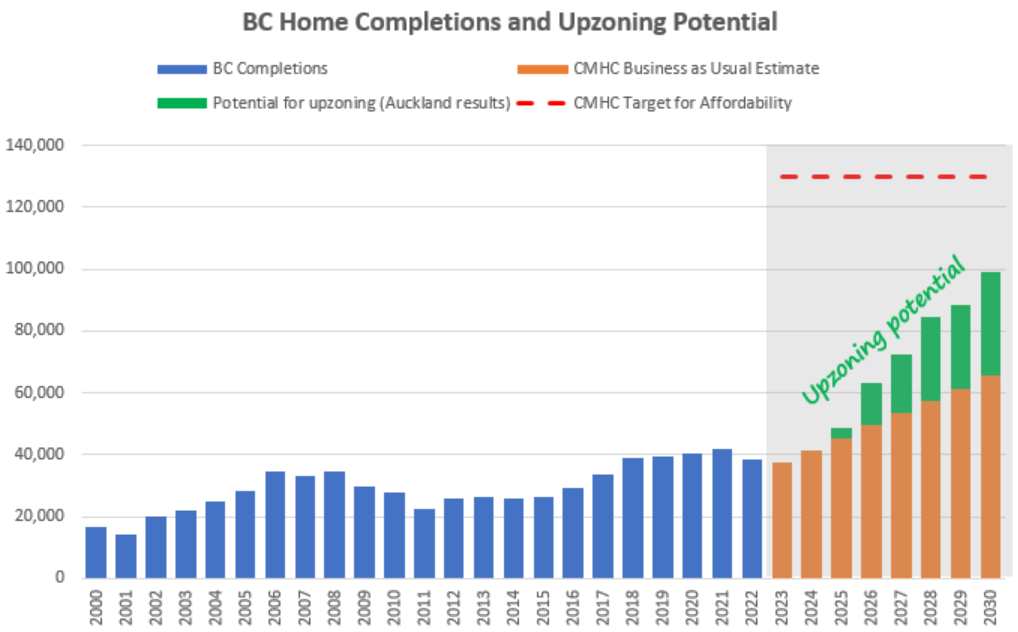

CMHC waded into that fray last year, with a report concluding that Canada needed to build an extra 3.5 million new homes than what would normally be expected under current policies. In BC without any reforms they expect a growth of 375,000 dwellings from 2022 to 2030, and estimate that we would need an additional 570,000 to bring affordability back to the province.

Using past patterns of how construction has led to dwelling growth (to get 100 new dwellings you need to build at least 110 new homes to account for demolitions), we can estimate that we would need to complete an average of about 130,000 homes every year from 2023 to 2030 to hit that target.

When put in context with our current completion rate, that looks entirely impossible, and it is. If CMHC is correct and we need that many new homes to restore affordability, then we’re certainly not getting there by 2030.

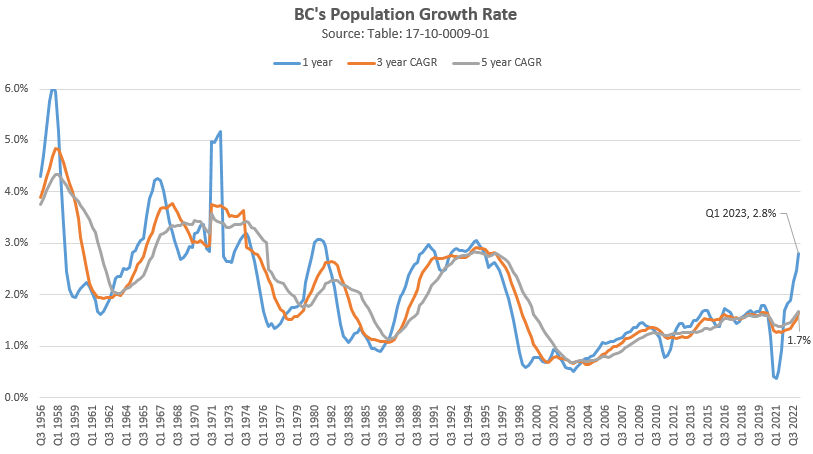

It’s unclear exactly what assumptions for population growth are underlying those numbers, but growth has certainly picked up recently in the country. Though it’s not that remarkable if we look at a longer time periods, if the short term growth rate is sustained we are heading back to rates we last saw in the mid 90s. That will put additional pressure on housing by adding demand.

It’s worth noting that outside of building more homes, we could also reduce immigration levels. In fact if we don’t solve the housing crisis we may end up with a backlash against immigration, a fear voiced by CIBC’s CEO Victor Dodig at a recent Canadian Club event. Many will ask why we don’t pre-emptively ramp down immigration to reduce pressure on housing rather than just looking to build more. That’s a possibility but I would note that this option is not even a topic conversation amongst any of our national parties at this point, with all of them seemingly in favour of the current growth plan. No matter what happens with immigration levels though, we’ll need to figure out the supply side. The housing crisis didn’t start 5 years ago with higher immigration rates, and it won’t be solved even if we cut immigration in half tomorrow.

But what can we do when there’s labour shortages and funding for social housing is still down from the levels of 50 years ago? Certainly there should be more spending on affordable and non-market housing, but with only about 5% of the population currently living in such housing, even a doubling in that housing stock would still leave 90% of the the population reliant on market housing to live in. The current government’s slogan of building housing for the middle class rings hollow when they can’t even come close to meeting the housing needs of low income British Columbians. In the end the reality is that we need to find a way to get the private housing market to work for most people. But how?

The parallel to New Zealand

BC and New Zealand share many similarities. Both have a population around 5 million people. Both have been growing at an average rate of about 1.5% per year in the last 10 years. Both have major cities that are hemmed in by the ocean. Both have a shortage of skilled trades and high construction costs. Both restricted foreign buyers and taxed empty homes in the hopes that this would reign in house prices. In both cases these measures had only a minor impact.

But New Zealand went a step further and boldly upzoned nearly their entire country. In effect they allowed 3 units and 3 stories on most every lot, and restricted municipalities to set height limits below 6 stories or impose parking minimums near transit. Modelling of those reforms estimated that they would produce an additional 75,000 homes in 5 years and reduce prices and rents relative to the base case. They concluded that the reforms were “likely to lead to more affordable and equitable urban living than would happen in their absence. The difference will be small at first, noticeable within a decade, and enormous for the next generation”.

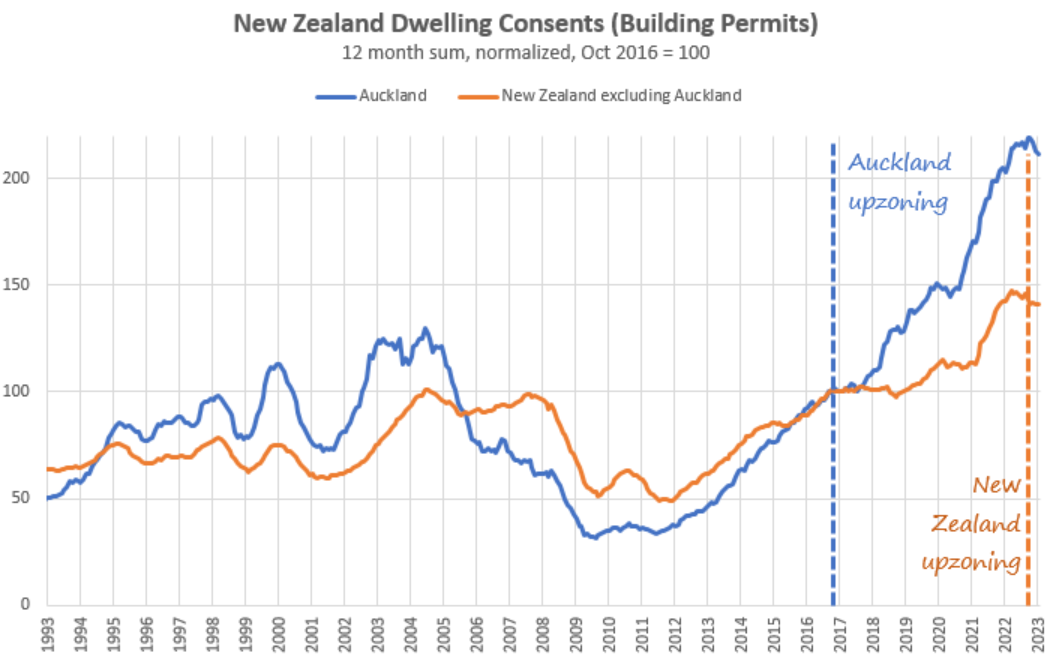

But modelling is not reality, and the nation-wide reforms have only recently taken effect (in August of 2022). It’s far too early to say whether they will achieve their goals and solve the housing shortage. However the city of Auckland did a similarly broad upzoning in 2016 called the Auckland Unitary Plan. It allowed multifamily housing from 3 to 6 stories in most of the city to be built by right. It’s been 6 years since that point, and the data are looking very promising.

As of January 2023, building permits in Auckland are up 110% since the upzoning, while they are up only 40% in the rest of the country. Of course you can’t live in a building permit, and generally there’s a delay of 1 to 2 years before those permits turn into homes. Nevertheless, a study from last year estimated that the change had grown the housing stock by 5%, and data show that this increase in supply was starting to put downward pressure on rents and prices.

If BC enacted a similar upzoning with similar success, we would still not hit CMHC’s 2030 target for dwellings, but we might dramatically close the gap. If we had a similar response in terms of building permits and applied a 2 year lag to turn those into completions, it would look like this.

BC wouldn’t be affordable, but we could be much better off than we are currently, and as the study on Auckland’s success implies, the full benefits of the change are likely yet to come. Data from New Zealand and other jurisdictions implementing broad zoning reforms will be helpful to assess the impact of such changes in the long run.

Of course this is all very speculative. We don’t know if New Zealand’s nationwide upzoning will be similarly successful to the Auckland one, and there are plenty of differences between BC and New Zealand that could lead to different results from similar reforms. However the evidence is coming in that broad zoning reform is one of the few things that will actually bring about change at the scale that is necessary to address the shortage without breaking the bank. It’s about as close to a silver bullet as we’re likely to find.

Reduce the paper work, increases the number of builds and affordability

Not rocket science. States with the least red tape (building permits) create more affordable housing of equal quality

Its a fallacy that building permits make for safer homes, the stats don’t support that assertion

similar arguments were made regarding owner builds, forcing home owners to pass an exam and still having to hire a project manager saying owner builds were unsafe. Again the stats never supported that assertion

Fantastic article Leo, truly appreciate the comparison to a working model with similar demographics. Worth sharing for sure!

I think it would have been prodent to note that BC, Manitoba, Ontario and PEI are the only provinces with rent control and are generally the provinces with the highest rents. Government, with no hands on experience in providing or managing market rental, create nothing but problems when they interfer with market economics. Does it make sense in BC to build rental where your income is controlled to 2% and your expenses are subject to market with property taxes, energy and insurance out of control?

The province needs to force municipalities to use their OCP as a definitive document and not a guideline. This would expedite the process. Another suggestion would be to grant rezoning and have the expensive process before DP is issued, making it much easier to finance. Large corporation and REITs can’t tie up fund for the 5 to 6 years from application to building completion. They have shareholders that require dividentds.

Auch, but 100% true 🙂

As I mentioned on HHV six months ago or so I’ve never seen so much misinformation being posted and it appears to be only getting worse. Unfortunately I am skipping and not reading comments by certain posters so who knows how much misinformation is in there as well.

I am down for lively debate and differing opinions but people posting completely false non-sense is getting annoying.

you wrote previously

No owner would apply such restrictions (unless an incredibly specific situation where the owner owns the adjust property and doesn’t want their views blocked). The restrictive covenant would be implemented by the municipality as part of the rezoning process.

You have to pull the title to write an offer (you need to know who owns the property for the purposes of drafting the offer); therefore, it is part of process. Everyone writing an offer would see the restrictive covenant in place.

It was 4 years ago, checked one on Windsor, pretty sure it was up around Roslyn or Brighton area though.

It was a height and squ footage restrictions on the title along with a design approval requirement. It was 4 years ago, we went down the road with checking bylaws for what we could build and etc… and we pulled the title as we were prepping the offer and there we saw the restrictions that differed from the bylaws (added to the title a year earlier). It ended up saving us because we didn’t carry through with offer because of it. If we did buy, we would have been stuck with the build during the pandemic that would have blown our budget and timelines to a level we would not have been able to recover from. Not to mention what it takes to get a sidewalk put in nowadays…..

I wonder why VREB hasn’t released the March data. Still cooking up the benchmark data perhaps

They are out as of 30 min ago.

…..But maybe a little too quick?

As of 1830hrs their ‘Press Release’ and ‘ Statistics Package for Media’ link to February’s data.

Don’t think the Dow Jones or S&P will be reacting to this transgression :~)

These types of restrictive covenants are legal unless overridden by provincial legislation. I wouldn’t be surprised if it became illegal to restrict secondary suites by way of existing and future covenants. After all, if strata’s can no longer restrict rentals and municipalities can no longer prohibit secondary suites I don’t see why it is fair to allow any SFH development to restrict secondary suites – got to be contrary to public policy in a housing crisis I’d think.

Quite smart for government to implement a renter’s credit that requires the renter to report the address and amount of rent paid. I’m in favour of this method of uncovering tax evasion.

Actually more common than you think; however, they are not restrictive covenants applied by the owners but put in place many decades ago.

I don’t think Oak Bay homes normally have restrictive covenants on title. Broadmead is the place where you see that on almost all properties i.e. no secondary suites etc.

Umm really was that the corner lot on Windsor that they built a little rancher on ? It had a height restriction on it

Okay give me an example of a restrictive title modification on a building lot that the owner applied under their own will? (It wasn’t forced upon them by the municipality).

I agree that government incentives are idiotic. It was even crazier when you had to wait one or more years for an EV, but they still had incentives.

As for the economical thing, of course it will take another 10 to 25 years for the conversion to happen but in my mind there is no question that it is coming. You would have to be living under a rock to think EVs are a trend that will fade. If my 8 year old EV is bulletproof at close to 250,000 km just imagine what the future holds for EVs in terms of range, reliability, charging speeds, battery life.

Why would I only be looking at EVs going forward if the product sucks?

That’s why I caveated “as some”, it was on building lots I was looking at that were being sold by adjacent property holder (no view corridor). They had title modifications put in place to ensure there was a measure of control. The statement was not an Oak Bay centric, it just happened to be Oak Bay. Overall, the point was, it was foolish that these happen, especially from your point, to devalue their own sale value. Also ran into the dated restrictive covenant from the 1980s up in Lands End that added headaches to building anything on top of the foolishness that comes from municipalities already. The point is anything that stalls getting things built is a negative impact.

I completely agree, but people don’t make sense. As you know, many rich and poor people have pets that advocates for the climate, but at the same time have no qualm with wasting resources on their pets.

For me, I see it as an economical thing. I already own my ICE cars that I purchased used and will continue to do my own maintenance and repairs on them for at least 10-20 more years.

I see it is absolutely wasteful for the government to spend money on incentives, as well as doling out money on various unneeded pet projects and hiring more of their friends to be on the public trough.

PS. Just got the record I often commute by bicycle instead of driving, I have no kids, and no pets, so my overall carbon footprint is likely much less than the average person that avocated for EVs.

lol….HHV is getting ridiculous with misinformation. Since you’ve noticed multiple properties how about just give me one example of an Oak Bay property where a restrictive covenant was applied prior to sale that wasn’t associated with a view corridor being blocked (sellers owns the view property as well). What seller is going to place a restrictive covenant on their property to lower their market value prior to sale. Where exactly is the logic there.

We are talking prior to sale here, not a restrictive covenant from 100 years ago.

Well, the FHSA landed with a big bed shit today. No financial institutions are ready for it, I spent my morning getting told by every institution I called that they are hoping to have it up and running in the next 3 or 4 months. I would hate to lose out on $16k in tax deductions by purchasing before I can get an account opened.

If they are living hand to mouth they probably can’t afford $200 lift tickets at Mount Washington; therefore, used Leaf will do in terms of range. Leo has posted experiences with his used 15k? Leaf many times.

That being said Toyota stopped offering the Yaris, Honda stopped offering the Fit, etc., etc. Best selling vehicle is the F150. I drive around all day and I am not surrounded by 4 cylinder compacts last time I checked.

In the majority of the markets around the world manufactures such as Toyota not only sell the Yaris (with a much smaller engine) but they also have cars in the lineup smaller than the Yaris.

Average new car in Canada is around 55k and you can buy a Mazda3 (really really nice car) for 23k. Mazda doesn’t even bother to offer the Mazda2 in Canada which would be around 17k as no one would buy it. Which is odd if everyone is hurting so much.

They are out as of 30 min ago.

My point is that many people that are living hand to mouth aren’t buying new cars, and are buying something that the outlay is as low as possible.

I don’t doubt that it won’t happen, but one have to factor in the economic of it to make sense. Thanks to the prolific cheap dense energy (oil) that was discovered in the late 1800, and since then the global poverty rate has dropped greatly.

Model Y is going to be 58k CND by the end of the year in my opinion. Model Y is simply starting to decimating the European market. RWD Model Y in Europe is 47k Euros which is undercutting the competition big time. A piece of crap Q5 with no equipment and a 150 hp engine is 52k Euros. Something comparable in terms of equipment for the Q5 is like 70k Euros. Higher level trim CX-5s are into the mid 40s in Europe.

I don’t really understand your point? The majority of EV drivers aren’t driving new cars either. My Model S is pushing 8 years old and worth 30k give or take? I think the average car parked infront of a Kettle Creek house is worth more than my car.

You have to compare apples to apples and the average cost of a brand new car in Canada is well over 50k. Model 3 is $54,990.

Let me know what I am missing with these numbers.

A comparable car to mine in terms of HP and size (Audi S7 for example) would be 15L per 100km. 250,000 km dividend by 100 km x 15 = 37,500 liters x 1.70 = $63,750 or approximately $60,000 in gas savings when you factor in electricity. Add another $20,000 in maintenance savings. and it drives like new versus if I had an Audi S7 it would be falling apart and not reliable enough for me to drive given the nature of my business where I need to reliably show up to showings.

Tesla has the margins to bring the Model 3 under 50k and Y under 55k, at that point the competition is really screwed imo.

I wonder why VREB hasn’t released the March data. Still cooking up the benchmark data perhaps 🙂

By the way, it is the 3rd today.

Not mention having to pay a subscription fee for already installed equipment that you paid for at purchase….. Oh, you want heated seats, pay the subscription fee to turn them on… Almost getting back to the pay toilet world. It’s amazing how people gripe about privacy, but they seem very comfortable with their car transmitting all the data it can about their lives 24/7 back to a company.

How many bottom halves of the population can afford a $60K or $100K?

And, would you buy a $100K model y if you couldn’t write the tax off as a business expenses?

Perhaps you haven’t noticed that the majority of the population aren’t driving new cars. And, many that live hand to mouth drives used cars that worth much less than $10K, because they do not have the outlay cash to purchase an expensive new car.

In have noticed that some properties in Oak Bay have coming with title modifications to limit what can be done in the future that are getting put on by owners before sale. I understand the restrictive covenants from initial development, but new restrictive covenants being allowed on properties before sale is getting nuts. “Oh, you own this property, but you need permission from the previous owner or their estate to do something with it”. All those title covenants should expire at point of sale.

That is quite the provincial housing plan! Impressive

“Not a record low for march but still quite sluggish. Too bad there’s still so few listings otherwise it would be a lot better for buyers”

The first three months of 2023 was characterized by Pent-Up Demand. I think the rest of the year will be characterized by Pent-Up Supply.

Below market rates is questionable too. How or who determines that the rent is below market rates? The only way that comes to my mind is to freeze rent increases for that specific property. The renters can change but the home owner could not raise their rates. In a couple of years then the suite will be below market rates. But not initially.

I’ve watched 15 years of governments barking up the wrong tree housing (for 10 of those years I didn’t know it was the wrong tree). Yes I’m happy they’ve finally found the right tree and that deserves some credit. Don’t worry we’ll hold them to account if they don’t get the squirrel.

Of course, since it’s the NDP, let’s give them another participation trophy for simply announcing more “plans”, with no immediate action.

Shhhh…No mention of their failed housing promises over the last 5 years.

“We also know that some people want to do their

part and help with the housing crisis but need

financial support to turn a portion of their home

or property into a suite for the long-term rental

market. To support this, the Province is introducing

a pilot, three-year financial incentive program.

Beginning in early 2024, homeowners will be able

to access a forgivable loan of 50% of the cost of

renovations, up to a maximum of $40,000 over five

years. Over time, the loan can be forgiven if the

homeowner meets all conditions laid out in the

program, including renting their unit out at below

market rates for a minimum of five years. “

The zoning will allow for legal suites. It will not make suites that were not built to code legal. There will still be a ton of illegal suites from those shabby fire traps to folks that don’t declare the revenue as income or want to pay the capital gains on a portion of their primary residence when they sell. The zoning just allows for those wanting to build legitimate suites to do so….and pay taxes.. insurance and etc…

Legalizing suites everywhere is going to be interesting. I looked at an illegal suite last week. Low 6.5 feet ceiling, the suite was mostly built below grade level with small bedroom windows that an adult could not get out of in a fire, and no smoke detectors . I suspect it would cost $40,000 to $60,000 to update that illegal suite to meet fire and safety standards. Potentially a death trap for renters if a fire broke out.

A few years back there was a triplex on Fort street that had an illegal suite and a fire broke out. They died. How the FuiK are you going to legalize those? Just because there is a rental shortage does not mean that unsafe housing is now acceptable.

Implementation will be a ways out. Eby says “Legislation in the fall”, but I like the direction.

Many neighborhoods have covenants that would prevent duplexes, triplexes etc. , as well as covenants preventing subdivisions.

I doubt the government would have the courage to pass laws that would pierce those covenants.

Finally! An actual spec tax, that affects BCers, and not mostly targeted at foreigners.

Oak Bay folks going to love this 🙂

Provincial announcement as far as I can tell from the speech

Right in the middle of your forecast range of 550-650 Leo, nice work.

Not a record low for march but still quite sluggish. Too bad there’s still so few listings otherwise it would be a lot better for buyers

Surprised we didn’t break 600 in sales seemed busier than that out there hmm

March

Total sales: 590 (down 29%)

New lists: 1118 (down 8%)

Inventory: 1970 (up 85%)

I agree with “HopefulHomebuyer”. I think many of us would agree.

The government should give tax benefits to anyone who creates new housing. It might be argued that they already do this. For example: Different levels of governments fund social housing projects etc. (Baptist housing comes to mind where they received funding, which I think is good. Just not enough of it being done!)

EV’s were funded by government around the world because they wanted to encourage new, emerging technology that showed that there could be significant benefits to our environment and health outcomes. (Everyone benefits from health benefits and a healthier planet.)

I don’t know that that’s necessarily true. As they say, there are more republicans in California than in Texas, and more Democrats in Texas than New York.

Provincial housing announcement at 11. Apparently significant.

I understand that there are quite a few people in this group that are very hopeful about the EV vehicle transition. I will withhold my enthusiasm until 10% of all new vehicles are electric and have zero government rebates. I think it will take a long time, but I could be wrong.

I just think there would be a big out cry if the government collected a lot of taxes from unwilling buyers and provided rebates to the few in the highest tax brackets to purchase a house or condo. Yet the argument is that it is for the greater good….

I also meant to mention that EV adoption is not about being forced by governments or trying to look cool.

I’ve said it before, I drive an electric car because I can’t afford to drive a gas car. I’m absolutely serious:)

For those who think that they will be driving their gas car until it runs into the ground, you might want to think about where you are going to get your gas. (I’ll get laughed at for saying that but I think it will be a real problem)

As more people shift over to electric, the gas stations will start to close or the gas stations that do decide to hang in there will charge an arm and a leg for the gas.

My point is that the government does not need to set any dates for the switchover. It’s going to happen quickly without them because it is so cheap to drive an EV. ( Cheaper than the bus, virtually no maintenance, virtually no brake pads needed, no mufflers, no tune ups, virtually no pollution with thoughtful recycling etc etc.)

Of course ….no issue is black and white. But I haven’t spoke to anyone who drives an electric car who would ever go back to gas.

My advice is don;t buy a used one. Technology is changing quickly and my understanding is you don’t get the government grants

for a used car.

These grants are not needed and will likely be discontinued. Might as well get in before they are gone.

(I appologise for talking about cars on a real estate forum – but someone did bring it up:)

Useful, though at this point there’s enough momentum to gradually phase out the subsidies and the transition will happen regardless. Very few will want to buy a gas car by 2030, almost none by 2035.

Reminds me of this chart of solar installs. Very few ecofascists in Texas but they simply make it easy to build lots of stuff, and solar is a no brainer of things to build. The same thing is happening and will happen with EVs.

It’s my ecofascist agenda.

I drive a chevrolet Bolt and love it. The insurance is about the same as any other car I’ve driven. I also get a discount because it has the emergency braking mode …which is an excellent feature. (Perhaps should be mandatory on all cars?) It warns me to brake if something is ahead of me and if I don’t react fast enough it will brake for me. You can set the advance warning to different ranges of sensitivity.

The idea behind ev subsidies is to hasten the transition. It took 50 years for US farms to switch from using horses to using tractors, for instance

link and transportation is indeed a major part of both greenhouse gases and pollution worldwide. In Canada it’s over 20% of our emissions, with passenger cars and road-based freight by far the biggest categories link. And sure, it will be harder to decarbonize planes and big trucks than small cars, but it’s already happening, and Canadian companies are active in these innovations. It might take hydrogen-based fuel cells technologies for jets to make the switch but it’ll happen. And it needs to happen.

Look what the ecofascists are doing tou our country QT! I hope you are as outraged as I am.

https://www.westernstandard.news/news/federal-budget-commits-funding-to-convert-one-lane-of-transcanada-highway-for-bicycles/article_fd569356-ce77-11ed-99ff-ffbfc5f0777e.html

Instead of banning April Fools Day, how about using some critical thinking skills and not latching onto random “evidence” that supports your beliefs.

I have to admit I missed the disclaimer in red print that the article was an April Fools satire. I fail to see why such an article was allowed to be put on line in the first place. It now puts into question every article one reads, as if that wasn’t already an issue. What I believe was an accurate article, which inspired the exaggeration, stated that New York council is banning low quality (non UL approved) or reconditioned batteries for ebikes and scooters. Apparently, owners are charging their ebikes in their apartments and some have caused serious fires. I’ve also heard that insurance for EVs in the U.S. is extremely high, I’m not sure what it is in Canada. I believe that Tesla offers insurance for its vehicles and other manufacturers are beginning to do the same. It’s not if but when an EV fire erupts on a ferry and lives are lost. They are simply too difficult to extinguish. I also would not want to be in any accident in an EV. To each their own.

I am not an environmentalist by any means but will only buy EVs going forward. It is simply a much much better product in my opinion. Sure, government incentives helped speed up absorption but things will go in that direction government incentives or not. Personally, I think the government incentives on EVs are idiotic. There is no need for them, EVs would still sell.

Here is my personal Tesla with 200,000 km on it – https://www.youtube.com/watch?v=q9bOvREYaME&t

250,000 km review coming this summer.

When someone makes an ICE that drives like brand new after 250,000 km with almost no maintenance and no gas, let me know.

Couldn’t agree more with this. I’ve had my own buyers mislead about their intentions in letters many times (i.e., note they will take care of beautiful gardens but they are buying the property as a tear down, etc.)

I actually find it a bit disgusting how fake people are in the letters and the appeal to emotion on a seven figure purchase. I would be a huge fan of letters being banned. I’ve seen enough photos of families with 2.2 kids and 1.4 dogs and “this is our dream home we can see our family growing in.” What about the family that can’t put food on the table.

You point re charity is spot on. Take the extra money and donate to people that are actually in need. All your doing by not taking the best offer is financing the SUVs and boat that will be in-front of the house shortly after purchase.

followed by

Not sure I follow. So your realtor was initially the listing agent and then you brought in your friend to be your realtor after?

I find it interesting how I’ve been involved in a 1000+ transactions and all things equal I haven’t seen letters work, but every other person has purchased their home by beating out a bunch of other buyers with a letter. Very interesting.

The seller almost always (other oddball situations like the one Peter described below which don’t have anything to do with a letter) goes with the best offer, not to be confused with the highest.

Common multiple offer scenario

$1,050,000 conditional

$1,040,000 conditional

$1,025,000 unconditional with letter

$1,000,000 conditional

Call back the unconditional buyers’ agent with congratulations my clients loved your clients’ letter and despite higher offers they went with yours, congrats!

Buyer thinks the letter worked while reality is they went with the what they perceived to be the best offer.

If the $1,050,000 was unconditional as well, which one do you think the seller is going with?

Not 100% in the time frame that the ecofascists are forcing upon the public by 2030/2035.

And, what’s wrong with giving people a choice to adapt within their own time and finances instead of dictating it?

And let me remind you Canadian Charter of Rights guarantee its citizens fundamental freedoms, and democratic rights.

PS. Has your mom ever say “if your friends jumped off a bridge, would you do it too”?

Just because your friends do a stupid thing and virtue signal, you don’t have to do it as well to be a cool kid.

You are really grasping at the straws here.

Where in my sentence that said government didn’t have incentives in oil and gas?

And, the purchased of the pipeline was thanks to their f_kup by catering to the activists instead of let the private company do its tasks.

And, please tell me that BC Hydro didn’t get any incentives from the government with infrastructure/dam construction. And, when was the last time PC or gas power cars minus hybrid got an incentive?

Fortis has been incentivizing hard for quite a while now. And to say government dollars don’t go into oil and gas is a bit ridiculous….anybody want to buy a pipeline?

15 years ago there weren’t (really) any EVs, and now Tesla is shipping 420K a quarter. It takes time, but we’re well on our way to electrification.

Not yet.

The idea that we just need a little more government money to convince people that a product is a great purchase is troublesome. Nobody buys tube tv’s anymore and that was accomplished without subsidies. The majority of the people in the world do not own a car, and until an electric car is as convenient as a liquid fuel car and costs are similar without subsidies, the first car that new car owners will buy will be powered by fossil fuels. I understand that some people are worried about the changing climate and rising global CO2 ppm, but even if globally every existing car was magically replaced with an electric one, global CO2 ppm would continue to rise. Transportation only makes up a fraction of the total energy use, and then only a portion of that is currently even possible. There are no electric jumbo jets, or transport ships or fleets of 10 hour day semi trucks.

If you are an intelligent country then look to the Dutch and learn to adapt. You don’t hear them say that living below sea level is impossible or that you can’t be a highly functioning society with a dense population (they are very similar to India)

PC was completely logical progress that was adopted by the free market to take over the tedious booking keeping process and then some. Eco is forced upon everyone by the fanatics. And, there were no wasteful incentives for PC purchase, unlike like EV, windows, heating, etc…, that money could be use in more important things, such as pay down the national debt, create a national wealth fund, improve infrastructures, housing, education/research and health care.

They are two different things. But the PC opened up new industries and I think eco jobs and products have the same potential. Private enterprise will get us there too but on the scale that is needed we also need the government to provide the business environment for them to succeed. Just as we needed the government to encourage more EV chargers so that the use of electric vehicles could develop more quickly.

2 completely different things.

The Personal Computer was a logical step that proved a simple computer can solve tedious math equations reliably in a relatively short time. A process that required hundred of people to crunch for months during the 40s.

The “eco” is being shovelling down our throat by ecofascists instead of letting the demand of the free market develop it like the PC. And, the wrong here is that virtue signalling is more important than the actual environment, helping others, and solve poverty.

Will ecofascism destroy the middle class? Or will it open up new industries as did personal PCs in the 1980’s. Some of the best paying jobs are now in IT. Jobs that didn’t exist prior to the 1980’s

Do we really need many human family doctors, when an appointment/visit is a phone call?

We can’t purchase many common medicines such as antibiotics for ourselves and love ones when needed without going through the rigmarole and if you are lucky you might get some on the 3rd or 4th doctor visits. While farm animals are constantly fed with antibiotics.

https://en.wikipedia.org/wiki/Antibiotic_use_in_livestock

The joke is on the people who voted and backed the idea that carbon tax and ban gas cars by 2030/2035, because climate change has always been around and will continue to change long after we are all gone.

And, noway in hell manufactures and supply chains would be able to come up with the resource in such a short time frame to satisfy demand.

IMHO, ecofascism will destroy the middle class, increase costs of living, and widen the fissure between the have and have not.

I’m trying to think of what industries Artificial Intelligence would make more productive than they are today. The example that keeps coming to my mind is Theranos. Elizabeth Holmes promised lower costs by eliminating people to do the testing as well as a faster turn around time. Higher volume of work at lower costs. So what other types of industries would AI benefit?

Could AI eliminate the need for family doctors?

Obviously an April fools joke. Especially given mayor Adams has made a big commitment to electrifying the city’s fleet

The Mayor of New York City is banning electric cars from entering 5 boroughs due to the hazard they pose to people’s safety in a crowded city. Finally someone woke up.

Noticing quite a few new listings popping up. Prices seem to be evening out as well.

Every technological revolution is filled with speculators and lots of companies that won’t survive long term. AI will be no different.

Beginning to think that AI is the next dot com.

Now home from six weeks in the sun. Back to 6 degrees C, feels like 2. Took my tablet so able to keep up with the conversation here. Like a soap opera, nothing really changes.

Perhaps car ownership is different than home ownership in terms of attachment. Years ago I owned a gorgeous little top of the line Toyota Celica. I’ve always been fairly frugal, so it was a few year old when I purchased it and I kept it for many years. I babied that little guy. It was jewel to me. Washed and vacuumed it every week. A few times a year polished it with turtle was. It was garage kept and I ensured regular oil changes etc. were always performed. People were forever complimenting me on it. I sold it when it was around 20 years old. Anyway, many times in the next few years, I saw the young lady I sold it to driving around town. It would appear she kept it just as I did…..I don’t know why, but it made my day when I saw her.

Off-topic: good recent episode of Kara Swisher’s podcast:

OpenAI CEO Sam Altman on GPT-4 & the A.I. Arms Race

https://podcasts.apple.com/us/podcast/openai-ceo-sam-altman-on-gpt-4-the-a-i-arms-race/id1643307527?i=1000605522804

It seems to be a nice steady number of sales with prices maybe increasing just a tad.

Buyers and sellers market are generally determined by both the sales to new listings ratio, and the sales to active listings ratio (Months of inventory). Months of inventory is in sellers market territory again after briefly touching the low end of balanced. The sales to new list ratio is weaker, about balanced market territory.

It hasn’t moved to a buyer’s market through the downturn.

Would those three charts indicate a sellers market?

Barrister, we did not have a realtor. So we worked with the selling agent to get things accomplished and then brought in our friend who is a realtor for the paper work at a substantial reduced commission. We did the same for both houses that we have bought.

Yep, in need of some listings….

Cover blown.

What happens when a special assessment comes in on a rental only property, I guess the owner is out of pocket. Sounds like the worst real estate investment in the world.

Being a robot I have zero interest in what happens to my house after I sell it. Torch the place for all I care

I’d hate to see my family home turned into a crack house.

Was news to me as well. Someone sent it to me.

Yes sorry tenants. The last sale in that complex went for $300k with the note “The current tenant is original occupant from 1994 and is paying $800 per month plus utilities”

A whole 1.3% cap rate!

I’ve never heard of a rental only condo. I guess the tenants are grandfathered in at their current rent. I would also suspect this keeps the prices down on this type of property.

Do you mean the tenants?

I saw this and thought:

a) is there a rent cap, and,

b) those tenants are never going to leave.

Not to sound too harsh, but I have zero openness to being swayed by a family being “good” as part of a home sale. Seems highly subjective, difficult to substantiate, and irrelevant. If you are swayed by this to the point of selling for less, you probably should be using a realtor to conduct business on your behalf. I’d rather get more for the house and donate the difference to a charity of my choice.

Here’s your chance to provide affordable housing by buying this condo and tenants can rent at about half the market rate. You get a cap rate of about 2% and can speculate on the tenants moving, at which point it jumps to over 6%

https://t.co/Pd9VkqvEYj

Friendly, please explain how your realtor actually even got to talk to the sellers? Offers are usually just sent to the vendors real estate agent. How often does direct contact with the actual sellers ever occur?

Ok, but it’s still a relatively free market and people are free to care about what they care about, and deal with their own asset in a sale as they see fit. Let’s hope that doesn’t change – but I wouldn’t be surprised if it does.

That’s insane. Once you sell something, it is no longer yours, and what is done with it is no longer your business, nor should you care. I see why practices such letters and personal side dealings are often banned in some US real estate markets because the term “good people” is relative and can be abused in an often discriminatory way. But hey, if a letter gets it done, more power to you, nothing in that letter is required to true and your realtor can only share what you authorize them to say. That way everyone can have a garden loving family with you and your children trying to find your forever home. I can just imagine the seller and their realtor looking at 11 offers: “hey, this one offer is already the highest by $40k, but it has a letter about how desperate they are and how much they love our house and will keep the garden. Okay, let’s god back to them, and tell them they are good people and we would love to sell them the house because they are just right for it, but they need to do a bit better on the price”…..

https://www.youtube.com/watch?v=Fcvlp8LRiZo

The wishing of housing crash following the banks just went out the window, because construction materials and labour costs went up $70K on a 2400 sqf house.

My realtor convinced the seller that we were a good family that will keep their garden going and all their beautiful work would not be wasted. We beat out over 10 buyers just for this reason.. people do care. That was 2015 though..

I’ll give you one that probably wouldn’t occur to most people: last house we sold, we took an offer about $10k below the higher offer because we simply couldn’t stand the interactions with the higher offer buyer/agent.

I don’t remember all the ins & outs, but I do remember my wife and I both had an overwhelming impression of that higher offer buyer/agent being super-aggressive whereas the lower offer people were just straightforward to deal with, and overall we felt the higher-offer person was just going to di** us around after the inspection or even with some come-backs after completion (the house was 1940s with add-ons and a bunch of issues). We just got a bad feeling, and went with our gut. Never thought about it since then until just now in this discussion.

Right. And what happened to all those European banks buying negative interest rate bonds? I have a feeling those are sitting on their books somewhere, without accounting for the paper losses. Awaiting some kind of government help of course.

From your law practice experience, did you find that those two went together? So that clients who were “frequent flyers” in divorce court were also big risk takers with their non-marital financial ventures?

For some, a mortgage payment rising $2,000/month would be no big deal. For others, it would be catastrophic and they might lose their house.

The point being, whether a financial risk is “rational” depends on how big the risk is relative to your total assets/income. Not like you described it – based on the “promising” payout you get if you’re right.

If someone offered you favorable odds 60/40 on a single coin flip, it would be rational to accept that for a $100 bet.

But irrational to accept that for betting your entire net worth on a single coin flip. I learned that from watching “Deal or no Deal” 🙂

I don’t see much difference between the couple that bet on interest rates staying low and the actions of large U.S. banks run by supposed financial experts. They invested their deposits in secure long term bonds, and when rates went up, the bonds value dropped, and to attract more deposits they had to pay higher rates on new deposits, a spread they couldn’t cover. Plus lending dried up due to the higher rates. I wouldn’t be surprised if most banks are in the same predicament. For those reasons, I believe interest rate increases are almost over and will be coming down to the 3% range in the near future. Rates should never have been pushed to near zero, that was a mistake that fuelled inflation.

People are prone to dance on the edge of a cliff when it comes to finances and marriages.

That spread was the market saying that there was a high risk of interest rates going up. Which is just what happened.

What’s really quite unfortunate about this couple is that they didn’t understand the possibilities of what could happen and the people they trusted to advise them (bankers, realtors and public statements by government officials) fed into their false sense of security. I don’t think they recognized that this choice was a gamble.

Truthfully, there was nothing irrational about takings a 2.5% variable over a 4% fixed rate: that’s a very promising spread.

But for a family taking on a mortgage at 7x gross family income is a variable rate mortgage an added risk? Absolutely.

The reality is that without sufficient regulation some people will always find ways to take on more financial risk than they realize. I actually wonder if they had bought 3 months later if they would have even qualified for that loan under the stronger mortgage stress test rules?

The job of the listing agent is to keep everyone informed as to how many offers they are competing with. An assumption that is made is if you as the buyer are competing and you know how many offers you are competing with is that you are putting your best foot forward. I always tell my buyers you most often have only one crack at it in a multiple offer situation.

I am not staying this is a great or fair system, but it is how it works in reality at this point and time.

You can’t counter multiple offers at one time. As the seller you typically take the best offer and you accept or counter that offer or ask them to make an adjustment. Therefore, if there are 5 offers you don’t go back to everyone, you go back to one person.

In practical terms in multiple offers trying to negotiate with everyone would just become a huge mess. Keep in mind there is usually only a few hours at hand to handle all of this.

Buyers always wonder why their offered wasn’t countered, well because once again if the seller is going to counter the one offer they can they counter the best one not the worst one, or the one they feel will most likely lead to the most advantageous outcome for the seller. For example, sometimes there is a lower offer in terms of price but you counter it because it is unconditional versus the higher offer is conditional.

Millenial, it hurts! Was it Wildwood? Just a wild guess. What I don’t understand is if you were both close or the same in price, and presenting in a multiple offer situation, why not go back to both potential buyers and say hey, there’s two very similar offers happening here do you want to re-write your offer at all? Maybe they just wanted a higher deposit or something? Or go back to you and say we want to work with you but if you could only change this little thing your offer would be golden? I never get the lack of negotiation that seems to go on. I’m sure your dream home is still out there.

Your guess is close but has a few incorrect assumptions. . I have a call in to you about another matter, and if you call back it will be easier to tell than write.

(For any curious onlookers, I never personally approached the seller or their agent, but engaged “professionals” expecting them to do their job. My offer was based on my available funds, which turned out to be 11% below the sellers planned spring ask , which was mid way between their two fall asking prices…..I had to go home and dig up some more money to close the deal…call me

You probably appreciate that an agent has to run a business and would be aware of the statistics as perfectly explained by Leo just last week – https://househuntvictoria.ca/2023/03/20/under-ask/

With comments from me regarding some real life scenarios.

I don’t remember a lot from my university days, but I do remember taking stats at Uvic and standard deviations. When it comes to my business I prefer to write offers within 1 or 2 standard deviations, not 3 and you get a good idea of what that looks like in Leos charts from last week.

If you want to write conditional low ball offers on properties that have been on market for less than two weeks unfortunately the time invested and potential reward is not going to be there for experienced agents. Once you get to a certain point in your career you have to turn down business and one is going to turn down business he or she feels is the least likely to be successful, along with other factors such as geography. I regularly turn down listings in Sooke as there are only so many hours in a week at my disposal.

You may be able to find a less experienced newer agent that will take a chance on something with a lower probability of working out such as writing offers below asking that are 3 standard deviations out.

I have to admit I did write a couple of low ball offers personally as in 10% off asking in November on tear downs that were on market 60+ days and I went in unconditional, 200k deposit upon acceptance, 10 business day close. I didn’t get either but I felt at least they had a chance.

In the previous thread you wrote

I am having a hard time understanding how this went down?

You cold-called a seller with a low-ball? They said no? Then you tried to hire a buyer’s agent who refused to write up a 11% below last falls asking price offer. After that you found someone who did write up a 11% below asking offer and that was negotiated down to 2% below asking price, which wasn’t really the current asking price but the asking price from a few months ago at which the sellers couldn’t sell the home for? Doesn’t sound like the 1st buyer’s agent was off in the assessment off the value of the home, but rather off on reading the situation at hand (that you would come up 9% + – ).

I have to admit I’ve been wrong many times in my career on reading the situation, particular on the listing end (seller wants what I consider to be an unrealistic price). 9 out of 10 times I am correct but every 10th one I screw up (seller gets lucky or aggressively drops the price and the property sells). That being said I am content with 9 out of 10 success rate on my assessment. The other 9 times either it doesn’t sell or I get fired and the seller re-lists with a different agent at a lower price.

This requires a 10 page reply, but I’ll try to keep it short.

First of all, the sellers went with an offer that was potential identical in net price to yours and that offer successfully removed conditions. In conclusion the sellers picked the correct offer as there is no guaranteed that you would have removed conditions. If you were a 100% guarantee you would have submitted an unconditional offer. A lot of the other comments are not relevant, who cares when they removed conditions? It could have been 11:59 pm, makes no difference. Conditions successfully removed is all that matters.

Second of all, the sellers accepted your back-up offer which means they were willing to work with your offer in absence of the other offer; however, they thought the other offer was better for whatever reason.

There is a million and one reasons why the sellers may have opted to work with the other offer assuming the purchase price was identical. I’ll list just a few as all of them would literally require a 10 page reply.

The net purchase price of the other offer could have actually been higher. For example, as a buyer’s agent in certain circumstances to avoid PTT or CMHC criteria I’ll separate out the appliances for my buyers and we’ll add a separate addendum. $999,990 + 10k for appliances beats out $1,005,000 appliances included; however, the sale would be reported as $999,900 and the $1,005,000 offer would be confused as to why they didn’t secure the home. The net purchase price can manifest itself in other ways as well. For example, the buyer’s agent can accept a reduced cooperating commission making the offer more attractive to the sellers.

The buyers had a non-refundable deposit after the 3 day rescission period and you didn’t. In 2016 I wrote a lot of conditional offers with a portion of the deposit being non-refundable. It worked in securing properties for my buyers but I went away from the practice due to practical reasons. One of those practical reasons was it was very difficult to re-negotiate the price post poor inspection as the seller has leverage over the buyer due to the non-refundable deposit. However, when you have multiple conditional offers going up against each other a non-refundable deposit helps. I usually wrote it up as $1,000 to $5,000 non-refundable.

Intangibles such as the sellers personally know the buyers. Many other factors here. For example, a savvy listing agent would due a research in the background and maybe the successful buyers sold a property with a completion date (visible in our system) that lined up with the completion date on the offer. The thought process here would be they’ve sold their home, they need a place to live, and they are more likely to remove conditions due to their circumstances. Another example, I once had a listing where the tenants made an offer through their agent and obviously they had a huge advantage as everyone wanted vacant possession and the tenants were willing to complete in 10 business days. The seller sold to them for less and then three higher offers were questions me as to why it was sold for less. Maybe the buyers’ family member lives next door, etc.

Etc., etc.

I could go on all day on this topic but you simply lost out, move on. Big picture, personally having grown up in Croatia (war similar to Ukraine from 1991 to 1995) and then having worked in ICU for 4 years and witnessing death on a daily basis I just have never been able to relate to disappointment and anger over losing out over a seven figure home. This isn’t taking food off the table for your kids.

Do you think something nefarious happened? It sounds to me like the sellers could have just preferred the other offer over yours for some reason. Maybe there were fewer conditions, or maybe the deposit was bigger. Or maybe the dreaded “letter” was the king-maker.

Hi Barrister…best to e mail me rather than tie up this forum.

I gave the e mail in my last comments.

Not this Monday but the next would be good for a coffee.

Noticing what seems to be a lot more listings and sold signs so maybe a market stabilizing

Deryk: Mondays work for me generally although I am tied up this coming Monday. Let me know if the Monday after works for you as we get closer to the date.

https://www.bcrea.bc.ca/legally-speaking/back-up-offers-theres-a-clause-for-that-519/

Did you have a contract or did they just ask you to amend your offer to keep it open to the end of the first offer’s subject removal period? If there was a written and signed contract, it would be tough to have a miscommunication.

Oblio

Arrow, who was your person?

Thanks!

Hi Barrister…for sure….. lets get together for a coffee sometime.

I come into Victoria every Monday and Friday for old man soccer. Perhaps we could meet one morning before the game.

derykhouston@shaw.ca

Awesome!

I had a buyer’s agent who did not present my 11% “lowball” so the next day I found a new buyer’s agent who gladly negotiated with the seller (unconditional offer followed by two counter offers).

I bought the place for 2% under ask. All involved did well on that sale (except one person).

Deryk, it has been a number of years since I have seen you. If you are in the city love to get together over lunch or a coffee. Alternatively, I can make it out to Sooke.

If a property has been on the market for months and looks like it needs work, a low ball offer is feasible. In a hot/tight market with limited supply, you’re dreaming and wasting everyone’s time.

That obligation is on the sellers side, not the buyers side. If the sellers agent receives a written offer they must present it to the seller no matter how bad it is (unless they’ve received instructions otherwise from the seller).

But a buyer’s agent only has to present offers to the sellers insofar as they want to continue working with that buyer. If the agent thinks you’re wasting their time with unrealistic offers they may just fire you instead. But, low sales means hungry realtors, and so you may find agents are more willing to try it

Maybe things have changed but it was my impression that a realtor was obliged to present any offer.

(I’m sure that that used to be the case at least.)

I used to insist that they present the offer.

If I had a realtor working for me in the sale of my house, that did not present all offers ….I’d fire him or her on the spot.

Curious, what is your low-ball criteria? 5%, 10%, 15%, 20% under or other? If they view time as money, they might look at their time and effort as the cost if they don’t honestly think the offer will succeed. A lower ball offer probably needs to have multiple factors in place for it to have a reasonable chance of success.

Can someone please recommend a real-estate agent that is willing to take some risks? I appreciate informed decision making, but I also know my own comfort and having a realtor that supports a buyers decision and is motivated seems harder to find than you would think. What does a realtor have to lose with a low ball offer, honestly it’s not their money? Thanks

Going variable is a little analogous to buy and hold investing in that you may only see a payoff if you maintain the approach for a while. Variable is almost certainly going to save you money over the life of the mortgage, but not necessarily every year or even every five year period. And it’s going to cost you money if you panic and lock in at the worst time when rates spike upward,

Much lower break penalty is another advantage of variable.

But if you can’t stand the potential volatility or if you legitimately can’t afford higher payments (despite somehow passing the stress test) then obviously fixed would be the better choice.

https://www.cmls.ca/brokers/download-resource?id=21

It is worth every penny for 5 more cops and 9 more firefighters. And, what does Saanich get for 6% increase?

Locked in a 4.5% 5 year fixed pre-approved last week that is good until August….

With what lenders?

And just like that the 5 year CAD bond is over 3.0% again.

Lol…. Ahh, the misuse and misrepresentation of stats is always fun. Especially on confusing correlation with causation. So, yes, there is a descrepency of net worth when comparing the vast cohorts of renters vs. owners overall because the rental cohort by it’s nature contains higher numbers of low income folks, but doesn’t mean renters are all low income and low net worth or that net worth was solely generated from the grace of home ownership. Yes, higher income people are more likely to own a home, however, they are likely to have a higher net worth anyways (could be, but not necessarily generated through home ownership). If you want to make an accurate comparison, you would need to compare equivalent incomes and ages with the renter v. home owner data (probably gives you a vastly different result). The same false narratives get generated about childrens school performance in rental v. owners, it’s not the ownership that the key variable, it’s the incomes, the ownership part just gets dragged along for the ride because higher incomes tend to be home owners……

For those Canadians who can afford the down payment and meet their monthly mortgage costs, homeownership is a tremendous wealth generator. For example, the median net worth of the two-thirds of Canadian households (66.5%) who owned their own home in 2021 was over 28 times larger compared with households that did not ($685,400 versus $24,000).

Approximately half of the condos built in Toronto and Vancouver from 2016 to 2020 were used as investment properties

In the Vancouver metropolitan area, over one-quarter (27.0%) of the condos built in 2000 or earlier were used as investment properties in 2020. The rate rises to over one-third (37.6%) for condos built from 2001 to 2015 and up to almost half (48.1%) for those built after 2015.

Source Statistics Canada March 20, 2023

On January 12, 2023 OSFI launched public consultation on guideline B-20: Residential Mortgage Underwriting Practices and Procedures.

Guideline B-20 including the following five principles:

Principle 1: Comprehensive Residential Mortgage Underwriting Policy (RMUP)

Principle 2: Due diligence regarding borrower identity, background and willingness to service debt obligations

Principle 3: Assessment of borrower capacity to service debt obligations on a timely basis

Principle 4: Sound collateral management and appraisal processes

Principle 5: Effective credit and counterparty risk management practices and procedures

Budget Highlights.

Through the Financial Consumer Agency of Canada, publishing a guideline to protect Canadians with mortgages who are facing exceptional circumstances. Specifically, ensure that federally regulated financial institutions provide Canadians with fair and equitable access to relief measures that are appropriate for the circumstances they are facing, including by extending amortizations, adjusting payment schedules, or authorizing lump-sum payments. Existing mortgage regulations may also allow lenders to provide a temporary mortgage amortization extension—even past 25 years.

Financial institutions will be able to start offering the Tax-Free First Home Savings Account to Canadians as of April 1, 2023.

Langford residents brace for potential 12% tax hike

https://www.timescolonist.com/local-news/langford-residents-brace-for-potential-12-tax-hike-6774242

Regarding the resignation, the old Monty Python “Mr Hilter” sketch seems in order:

https://youtu.be/JTLeBybJhSo

This is correct. Did the ccb calculator again and it was my error – it gives the annual total benefit, not the monthly benefit.

Strange story. Of note, it appears the councilor wasn’t forced or even asked to resign for the comment. It was just his own decision to resign, for reasons unexplained.

https://www.cheknews.ca/north-saanich-councillor-resigns-after-calling-mayor-mr-hitler-1146203/

https://www.theglobeandmail.com/canada/british-columbia/article-north-saanich-bc-councillor-resigns-after-referring-to-mayor-as-mr/

The CCB is being overestimated here. We have a combined income of $150k and 1 kid under 6. We get $99 a month.

If “winning” means “saving thousand in interest”, but losing means possibly losing your home (primary residence), then I don’t think it’s worth the risk, period. People in this situation shouldn’t be gambling on future interest rates. They should lock in for 5 years minimum, preferably ten.

I did the calculations on the CCB calculator assigning one income of 100k and the other of 50k based on an professions reported and province of Ontario. With two kids under 6 they would get just under 1000/month tax-free. This amount declines after age 6, but I did not redo for this factor and estimated it at 600/month.

Not sure where the difference for you was, or if there was an error for you or for me.

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/canada-child-benefit-overview/canada-child-benefit-we-calculate-your-ccb.html#family-net-income-definition

150K combined income, one kid under 6, one over, gets $331.38/month. CCB calculator.

You win some you lose some Patrick. People who bought in 2018 and went with a fixed rate mortgage of 3.5-75% would have saved thousands in interest payments if they had gone variable instead. But the future is unknown, so all you can do is make a decision based on your risk tolerance and the information available at the time. Information available at the time this couple purchased their home included forward guidance from the Bank of Canada, which, in hindsight, was a big whoopsy.

I’m also guessing the couple used a B lender – not sure who else would have been offering 4% fixed rate mortgages in April 2021.

I don’t know. A decent sized house in a decent neighbourhood in the Greater Toronto area is not a middle-class certainty or right.

The risks of a variable mortgage are something that can be planned for, and owning a primary residence is still a very good investment of capital and use of credit long term imo.

If they cannot afford the increased rate mortgage then they are very obviously living above their means – and they are responsible for this.

This doesn’t mean that I have no sympathy for the stress this creates or the motivation to go variable at the time. However, placing the blame outside of themselves is disempowering psychologically.

They have also coped pretty well so far. With 150k combined income and 40% going to housing they should still have about $3800/month after tax, not including the child tax credits for two children – about $600-1000/month non-taxable. Not sure how this leaves them short overall, maybe they have expensive car payments or something.

I wish there was a requirement to verify the math of things before articles are published.

The saddest part of the story is that they didn’t go for a fixed mortgage at 4% (5 year term, though 10-year term would have been better). If they had visited HHV comment section at that time (April 2021), they would have seen a lot of support for choosing a floating rate instead of a fixed. I’ve been one of those always reccomending a fixed rate, and still am. Preferably a 10 year term, which is now available for as low as 5.48% from BOM https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

Perhaps some of the RE experts here in the comment section who have been recommending floating rates could comment on whether they agree that ”choose floating rate” was bad advice for people like this couple in the article.

Pulling out all the stops to buy the most house you could, with a short term or floating mortgage, worked for 40 years. People got the impression that getting into ownership was the big hump, and from then on the house would deliver financial security. It apparently didn’t occur to recent buyers that this trend was just that, something that could end or reverse, rather than some immutable law of nature.

Yes, expectations being different is a factor. I don’t think it’s some great mystery how that happened, years of crazy-low rates fed some ridiculous notions of a new normal – remember all the stupid discussions in the financial press trying to rationalize negative rates as somehow being ok? Well, somehow it turns out one plus one still equals two. In Victoria and pretty much everywhere else, people usually buy the maximum house they can afford, with affordability being defined as monthly costs. And at a time of maximum financial distortions caused by artificially ridiculous rates, people still maxed out and then compounded it with going variable. So now the piper has to be paid. Sure you feel bad for families under pressure, but in the scheme of things, a 5% or so 5 year rate is historically low.

I don’t really see the housing market correcting another 20% or whatever to compensate, and so unfortunately I think a corollary of this giant financial detour in world markets is a generation being squeezed out of housing or squeezed further down the food-chain in terms of housing. And that’s just one distortion.

Obviously that couple has been stuck with a variable rate mortgage. What I fail to understand is why they would not have gone with a fixed rate and tightened their belts a bit to start with. I remember growing up that we rarely ate out and by rarely I mean two maybe three times a year. The vacation

was using Uncle Thomas’ cabin up in Gravenhurst and it was not even on the lake.

My point is that expectations seem wildly different. Frugal was not a word but virtually a religion growing up. I know that times have changed but sadly my world view has not changed. Let the old fart comments begin.

Any idea where New Zealand is getting its increase in population from? It’s a lot easier to pack a truck and drive from anywhere in Canada to B.C. New Zealand is in the middle of nowhere.

More to the point I think.

https://storeys.com/where-median-income-households-afford-house-canada/

Unfortunately, from what is being defined as affordable, that 7x income doesn’t look too far off what many folks have been doing. It’s surprising how close people were and are willing to push to edge of poor financial management to buy house and pinning things on the hope that costs don’t increase, no one loses a job, gets sick, and that the tax payer will sponsor their retirements.

This story is sad and I have sympathy for them. I can totally understand why they’d feel so frustrated.

However… and I’m not entirely blaming them for this because I think it’s probably an “Easy” trap to fall into…. they had a combined household income of 110k and they got a 790k mortgage. That seems like a huge mortgage for that income. Is that a common mortgage for people to have? More than 7 times their annual income?

You’re playing percentage games with tiny numbers. Yes. Auckland permits rose from 100 to 210 with the upcoming which is 110%. Whoopee – 110 more building permits per year! If it’s OK to talk % instead, why not point out in the previous 6 years building permits had risen 150% – more than that 110% rise, when they rose from 40 to 100? That would make a case that % growth in Auckland permits fell with the introduction of the up-zoning, which is counter to your narrative. The way I look at it, the NZ building numbers are all tiny, and they just aren’t building enough in Auckland and NZ, and this hasn’t improved much with upzoning.

If you’ve searched the world, and this feeble “Auckland NZ” data is the best example of an upzoning success, it sure doesn’t sound promising as a solution to the housing crisis.

From: https://macleans.ca/economy/realestateeconomy/my-mortgage-payments-rose-almost-2000-in-a-year/amp/

I guess someone needs to explain to them the benefits of the YOLO approach.

lol, maybe I will start calling them “undocumented suites”.

Yup, that’s the one Patriotz. My bad wrong St. John

Want to comment on the effect of real estate investment trusts?

Ummmm, could we please share this with Ministry of Housing, I hate to say it but I know that government is slow to look at cross-jurisdictional case studies!

You mean this article? That’s St. John’s Newfoundland, not Saint John New Brunswick which is shown in the graph.

https://www.cbc.ca/news/canada/newfoundland-labrador/stjohns-rental-market-1.6486715

I just read a CBC article about St. John posted on June 14, 2022. Despite their high vacancy rate their rents have increased during 2022 substantially. Are we missing something?

In the article Hope Jamieson who is a manger for the Community Housing Transformation Centre stated that 52 percent of the province’s rental units are owned by real estate investment trusts.

Things that make you go hmmmmm.

Super relevant and informative as always Leo. I noticed that Auckland’s upzoning was 3 to 6 stories. Did they do anything that sped up the rezoning process or simplified the approval process?

The current staff at City of Victoria are by and large good people doing the best they can but they are understaffed and over worked in a system that’s solutions over the last 50 years has been to add regulation on top of regulation. Even Missing middle doesn’t completely solve that. They either need more resources, or more authority delegated to them to have some leeway in what they approve or don’t. Say what you want about Langford, they knew how to get things approved and we could use a bit more of the same.