Is the fall a better time to buy?

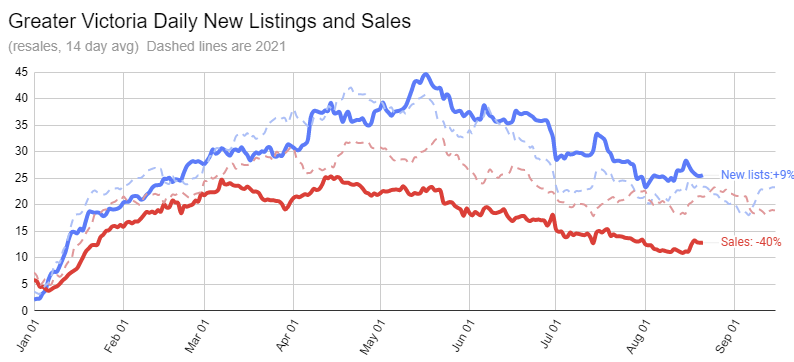

As the summer winds down (😭) we are approaching the second wind for the Victoria market which starts in September. That’s when we generally see a bump in new listings and stable sales as the new inventory sells in September and October. After October, unsuccessful sellers that can afford to wait generally take their listings off the market and wait for the spring market to try again. At that point new lists and inventory plummets until the new year.

But what of sellers that can’t afford to postpone their sale? Whether due to fortunate or unfortunate life events, there are always a certain number of sellers that need to sell. The timing of those events doesn’t correspond to yearly market cycles so we likely have about the same number of must-sellers year round. Because the discretionary sellers drop off sharply in the late fall, it stands to reason that a greater percentage of the active listings into November and December are motivated sellers, and by extension there should be a greater chance of getting a favourable deal as a buyer.

But is that actually true? Personally I’ve seen enough interesting sales in the fall that I think it is, but it’s unclear whether that is actually common or powerful enough of an effect to show up in the stats. Are you statistically more likely to get a lower price while the market is quiet? Let’s take a look.

Other than just watching individual sales, we can estimate “deals” for buyers using either the sales to assessed value ratio, or the sales to list price ratio. If sellers are more motivated they should be dropping their price more to sell, and that should drive prices down relative to assessed value at the end of the year.

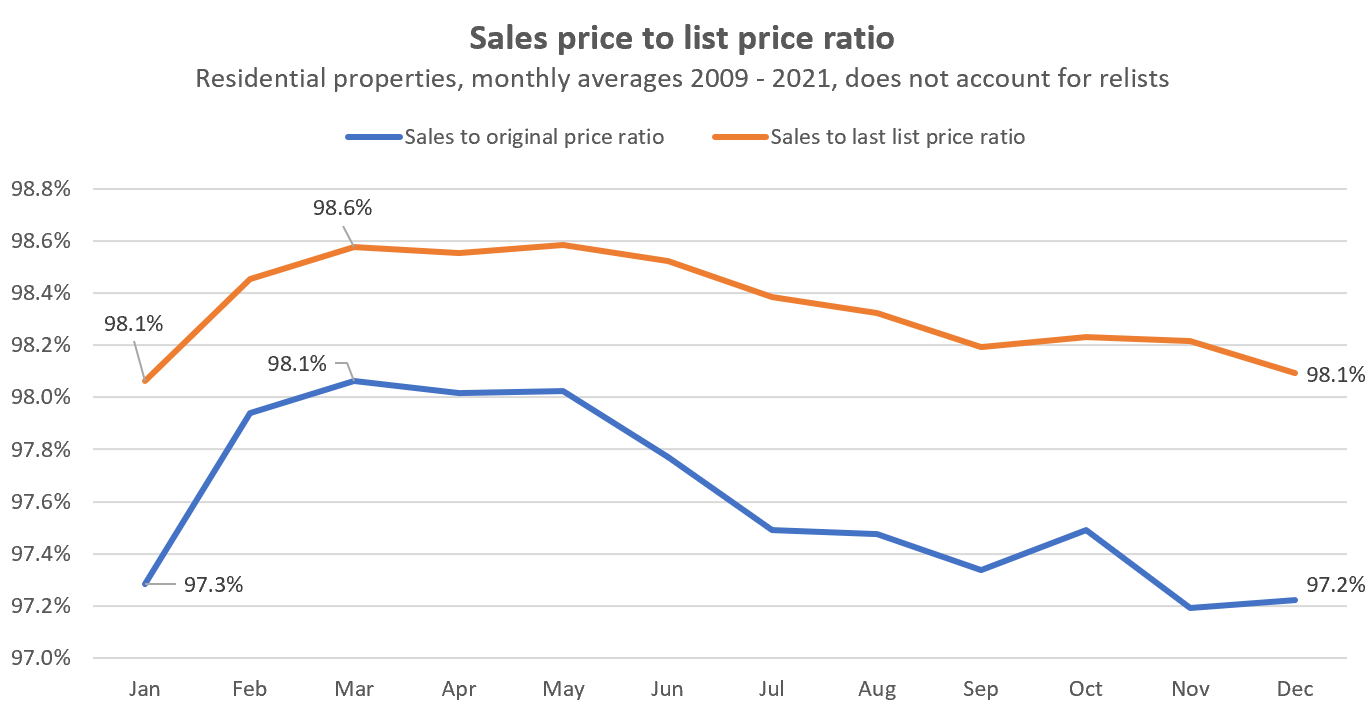

The problem of course is that the market is usually in the process of cooling off or heating up, which confounds attempts to look at years in isolation. However when we combine the average sales to list price ratio for the last dozen years we can see that sellers tend to compromise on price more during the fall and winter than during the spring. The difference isn’t huge, with just a 1% difference between the average sales price in the spring and the winter, but it is there. It also shows that most sellers are loathe to take lowball offers, with the average sale price even during the slowest periods just 2% less than asking. Instead sellers are more likely to slowly drop prices over time or relist if the original price was too high (note the chart does not take into account relists).

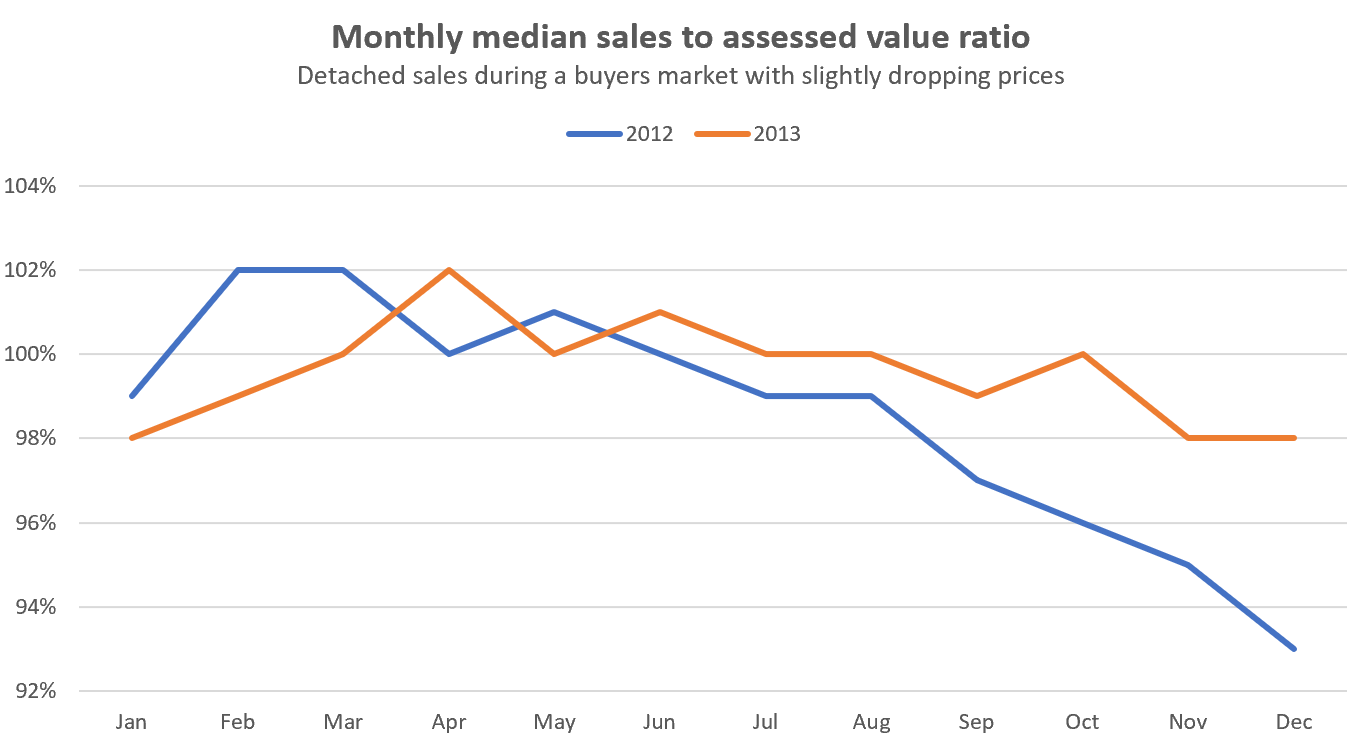

So we know that sellers tend to drop their prices after the spring market, but does that make those sales a better deal for buyers? What if those sellers still hanging on in July were just delusional about their asking price in the spring and are now just coming in line with market value? That’s where the sales to assessed value ratio may shed some light. For that answer I extracted median sales to assessed value ratios for 2012 and 2013. That was a buyers market with slowly declining prices, and the market continued to weaken until about mid 2013, when it slowly started strengthening.

Again the trend towards weaker sales in the fall and winter persists. 2013 is the flattest market and shows that late fall sales went for a few percent less relative to their valuations compared to sales in the spring. In a weakening market like 2012 the difference was more pronounced, though most of that was likely the entire market moving down, not seasonal factors.

So although most buyers call it quits in November and December, it’s probably still worth your time to keep looking and see if you can find some sellers eager to make a deal. Looking out for vacant units or properties that have been listed for a long time with steady price drops is often a good start.

Also the weekly numbers courtesy of the VREB.

| August 2022 |

August

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 189 | 304 | 831 | |

| New Listings | 236 | 468 | 686 | 894 | |

| Active Listings | 2157 | 2190 | 2178 | 1120 | |

| Sales to New Listings | 35% | 40% | 44% | 93% | |

| Sales YoY Change | -42% | -43% | -44% | ||

| Months of Inventory | 1.3 | ||||

Little change from the week before, with new lists more or less normal and sales relatively slow outside of last Wednesday when we had a bit of a bump.

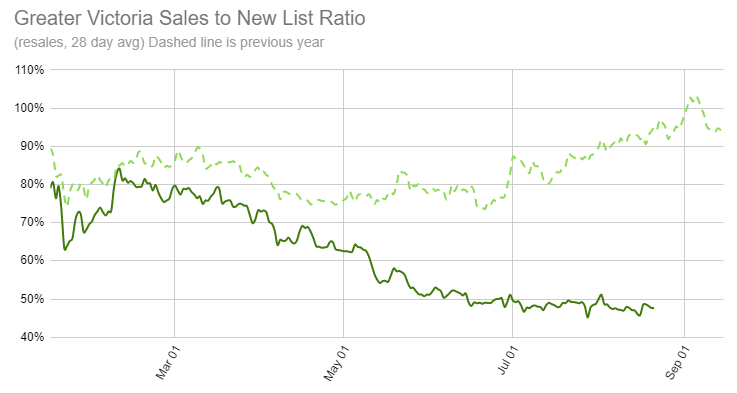

As fixed mortgage rates have stabilized, so too has the sales to list ratio, which has now been relatively stable for two months. Last year at this time it was rising steadily so relatively the gap is still growing, but in terms of absolute conditions little has changed.

We’ll get another overnight rate hike in 2 weeks, but with inflation starting to ease it seems we won’t be reaching interest rates that would truly be destabilizing for the market. That’s not to say we will quickly return to rising prices. Some 2% of fixed mortgages renew every month and at substantially higher rates than they were locked in at before. That will continually suck spending power out of the economy and sour appetites for larger debt loads. However it’s clear to me that wherever we finally land on prices this correction isn’t going to solve our housing crisis.

What’s still unclear is what happens if we can’t manage to solve the housing shortage and are chronically undersupplied in coming years. People need a place to live, but they also need to be able to pay for it which is a constraint on prices and rents. As those rise more people will simply be pushed out of the housing system into less expensive cities (if there’s work there) or outright homelessness. An inability to solve the housing shortage may support prices, but it’s also bullish for societal turmoil and instability. More on that in a future post.

New post: https://househuntvictoria.ca/2022/08/29/will-investors-set-a-floor-on-prices/

Since you’d be buying as an investor/landlord…..If you’re able to correctly predict that the prime rate is going to 8%, your talent is being wasted on waiting for 8% prime to happen and then buying a house to rent out. For example, you can 4X your money in the stock/bond market on a correct bet like that.

$2.21M

So that’s why commodities prices on the open market all sky rocketed?

Couldn’t have been trillions of dollars of money printing.

I think Inflation will be over very quickly once prime rate gets to inflation ~8%. People swill be begging for jobs.

Does anyone know what 683 Bradley Dyne Road sold for in North Saanich? Thanks in advance!

At least some of the inflationary pressure is a farce. Mrs. Fool employs a lot with consultants in various firms and is frequently doing contracts with many of them. Most of the proponents have increased their asking prices by at least 15- 25%, and in one case someone asked for a 55% lift.

Funny thing happens when you force them to open their books and itemize their actual costs. You’ll see the cause of the inflation is often, “inflation is being talked about everywhere so here’s my chance to be greedy and take advantage”.

Their underlying operating costs haven’t changed, or, have changed minimally. Retailers and their suppliers are doing this left right and center too. The next favorite excuse I’ve been seeing is, “Increase in costs due to climate change”. It’s like a riot – a few people are genuinely upset about a social issue, the rest are just using it as an excuse for lawlessness.

The one happy part is, the 55% guy was forced to either bring his increase down to earth or be removed as a qualified supplier, to which he chose the former.

Ya no end in site for inflation and Canada does have to keep up with the U.S for now with interest rates Cant have the loonie sliding too much

Nice one rush4life.

On rates I’m curious to see what happens if they can’t get inflation back to 2%. Honestly I’m having trouble believing we will return to that with massive supply chain disruptions seemingly becoming commonplace. The scale of the disruption and cost of flooding in Pakistan and drought in China is huge. If those types of events keep happening in manufacturing centres I could see higher inflation persisting that doesn’t respond well to rates.

Basically why I don’t believe in any housing forecast that predicts out more than a few months:

[img [/img]

[/img]

Also i was thinking that the next rate increase that might be it, but after hearing Jerome Powell speak about disinflation i think we are due for some more rate increases even after the one next week. “We must keep at it until the job is done….The successful Volcker disinflation of the early 1980’s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem high inflation and to start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now. These lessons are guiding us as we use our tools to bring inflation down….”

“Introvert

August 29, 2022 8:38 am

First Mersereau and now Taylor announce they are not running for re-election to Saanich Council.”

2 weeks in a row actually.

I can’t find numbers for the entire month when I look at past posts, but it generally seems like inventory always goes down in August to the point that in 2018 when inventory was going down, seasonally adjusted inventory was actually climbing. That being said, based on a graph from the 2021 post, it looks like this is the 3rd lowest august in the last 20 years in terms of sales.

Not looking to buy right now but wanted to help my partner experience the reality of different homes to understand some of their and my concerns are details and not determining factors. Some life circumstance time pressure to buy but after waiting so long with such a storm brewing it doesn’t make sense to hurry, waiting for market psychology to shift and inventory.

Inventory down from last week.

Month to date figures:

Sales: 420 (down 44% from last year)

New lists: 887 (up 10%)

Inventory: 2164 (up 93%)

New post tonight

We’re hoping to be FTB in the spring. In the meantime I’ve learned an enormous amount from all of you. 🙂

First Mersereau and now Taylor announce they are not running for re-election to Saanich Council.

https://www.cheknews.ca/rebecca-mersereau-announces-she-will-not-seek-re-election-for-saanich-council-1076453/

https://www.cheknews.ca/ned-taylor-to-not-seek-re-election-for-saanich-council-1082472/

I don’t agree that “ nearly everyone here owns “. i think there are plenty of renters here too.For example, look among recent posts and you’ll find some likely renters. Leo might know the renter:homeowner mix.

They’ve always done this. Helps realtors who are looking to find clients, and allows realtors who are established to not do the open houses.

Ya, I was out for a walk a week ago and saw an open house sign and decided to have a look. It was all quiet accept for the realtor. What seemed strange was the amount of details the realtor was sharing about the owners and their situation and etc… Then the realtor jumped right to asking to represent me for an offer on the house… Which I responded with “didn’t they change it so the one realtor can’t represent both the buyer and seller”? That’s when I discovered the realtor was showing another realtors’ listing, but they were both from the same office. I guess it’s a strategy to try to keep as much of the transaction money in house as possible. Though, it really didn’t seem to pass the smell test.

Good question who here is actively looking to buy?

Who exactly are you referring to? Nearly everyone here owns.

Anecdotally. Tried visiting several open houses today in Victoria and Westshore in the 1.5-2m range. Some places seemed late to open their open house and were passed by. Untenanted, higher price to assessed and less effort in presentation seemed to correlate. Felt like quite a range in value to price with odd premiums in places that don’t seem to justify it. Sellers holding on to price dreams, not feeling the pressure yet.

Ran into a number of aggressive realtors hunting new clients hard and pushing bs narrative about great time to buy. Definitely seems like some bills are going unpaid. Arrived to one listing as the showing time ended, realtors more than happy to see someone, home on the market several weeks, asking about representation, veggie trays half full and signup technology not working. Felt like we were one of the few or only to have visited.

I would love to see the statistic.

If everything is equal, then the economy/real estate is on a decline and perhaps will hit bottom in the next 18-24 months as it tend to lag behind the stock market by 1.5-2 years. Unless the recent market rebounce is merely a dead cat bounce.

2590 Wesley was all about the rental effectiveness. Already setup with 2 suites each with separate laundy, water tanks, etc. A 3 BR upper and 2BR lower. Fantastic house for a rental and looked to be a nice shape. Perhaps $5500/month rents. I thought it was very attractively priced at $950k. Not surprised at all to see it go $65k over ask in a day.

Final sale price is really all that matters. Bidding wars can be engineered no matter the market conditions.

Hard to say if the market has firmed up a bit in the last couple weeks. Sales up but that’s the same as what happened last August. Could just be normal seasonality, but given reports from Toronto and Vancouver of same thing it’s definitely worth keeping an eye on. Certainly there’s people that will pick up places at 10% less than they would have bought them in Feb. Most people’s buying window is measured in months, not the many years that real estate cycles operate on. Unless you are expecting a price crash the other pressures often make it not sensible to wait out even if it’s going to be another 10%.

2590 Wesley was listed at 7 am last Monday morning, sold Monday evening, six offers, winning offer unconditional. The only possible value add is that it sits on what appears to be a conforming R2 lot, so one could tear down and build a strata duplex @ $507k per unit land cost, but that’s just my observation–it wasn’t advertised on that basis. It’s very hard to understand this particular sale in view of current market conditions where other listings can be languishing for weeks. Final sale price is not unreasonable so that’s somewhat encouraging compared to a few months ago, but still…

3.5

Those are predictions for the future. Sure there are “potential discounts” in the future.

My comment was about the present, where we haven’t yet seen “demand destruction” in the economy (including housing). I don’t think buyers have disappeared, and they’re willing to stretch as hard as ever to buy.

It’s tough to have that one both ways. It’s either affordability has eroded to point to push buyers out or there is a pile of buyers with ability to buy making demand. Also, the simplistic view of affordability being just a metric of the monthly carrying cost doesn’t affect all buyers. There are circumstances where deteriorating affordability allows for certain cohorts to find increased value because it lessens demand in previously competitive sectors. If 35 of 39 unsuccessful bidders are no longer in a position to bid. Yes, prices and cost might still be up, but as inventory increases and cost pressures begin hitting harder the opportunities begin to present themselves for potential discounts where affordability can be added to equation for previously out of reach value properties (not all properties, but some and many no longer with multiple bids).

On the topic of rates being around 9% to tame inflation- question for you analysts out there…

What are markets pricing in right now over the next year and a half?

Im doubtful we’ll see those levels.

2950 Wesley – so an unremarkable house on a 5200 sqft lot in Oaklands is still about a mill.

Hmmm…alright then.

$1.015 mil

I dont believe that a nine percent interest is all that high considering the inflation rate.

QT: It is August, people are on holiday and you sort of expect less shoppers. But it would be interesting to know if there is an overall statistical slowdown occurring.

I don’t think that interest rates need to be that insanely high but it a possibility. Based upon my limited observation. The economy is starting to slowdown, because there are less shoppers at our local Home Depot and Costco in the recent couple of weeks compare to post pandemic lockdown to the middle of the summer.

For “demand destruction”, I’m referring to the economy in general.

But let’s apply it to the Victoria housing market.

Falling housing sales or prices doesn’t measure “demand destruction”.

Demand destruction means “a permanent or sustained decline in the demand for a certain good in response to persistent high prices or limited supply.”

I haven’t seen any signs of househunters “changing their mind” about buying a home here. Affordability is still at or near worst levels ever. ROCers are still moving here.

All the same “HHV usual suspects” are still here, hoping to snag their dream home. One look at Leo’s affordability chart shows people are willing to pay at/near record % of their monthly incomes to buy homes here.

Signs of demand destruction would be a HH’er giving up and deciding to rent long term, or deciding not to move here to buy in the first place. That would show up as a big improvement on Leo’s affordability chart.

While we don’t have bidding war with 40 bids like a few months ago, we do have the 39 unsuccessful bidders still house hunting. And more have moved here since – no demand destruction there.

I really do not think we will have a clear picture on the market until the spring. I have no handle on this at all and I can see things going a number of ways.Of coarse that is not helpful to anyone.

2590 Wesley seemed like a great investment house. Not surprised to see it go in just a few days, before the open house even. Did anyone see what it sold for?

CPI is a lagging indicator.

Last 2 months have been the lowest sales for those months in 20 years, but go on.

I suspect that by next year we will see a few more hikes.

Is this the new Frank?

We haven’t stopped the ascent yet. With 7% inflation, interest rates should be around 9% to cool things down. I don’t see any signs of demand destruction.from 2.5% rates.

100bps would be a good move, but as you said not likely.

A smarmy Ottawa lifer masquerading as the saviour of the working class. Buttons pushed.

One reason lower income people might be feeling poorer is the “welfare wall”. As they earn more money, their low-income benefits are clawed away. So that a single mother with 3 kids making $55,000 per year will face a marginal tax rate of 80% on the next $1 of income (because of taxes + clawed back benefits)

That’s an extreme example, but the globe and mail article charts the various “marginal tax+clawback” rates that affect low income workers, providing a disincentive for them to work. And they all show very high marginal tax+clawback rates for low income Canadians. Warning: this article mentions Pierre Poilievre , which seems to “push buttons” of some people here. If so, they should just skip that part and look at the Liberal/NDP government government Dept. of Finance charts that show the high “marginal tax+ clawback” rates that poor people face. Such as a marginal tax+clawback 41.3% rate on annual income of $24-33k per year. https://www.theglobeandmail.com/business/article-pierre-poilievre-tax-reform/

We can guess about the combinations of increases but by next year rates will be up substantially. If you are feeling poorer it is because you are.

The good news is that for most people the mortgage increases are manageable but only just. Combined with food and gas inflation that will leave very little income for other discretionary spending like restaurants or travel. We might look back and see this as the last golden summer.

I do hope I am wrong.

100bps would be well on the way to bury the levered markets like Toronto, Vancouver and Victoria.

Don’t forget step 3: plunging the economy into a recession, causing job losses to pile up. Or do we still believe in the elusive soft landing around here?

In 1981 Victoria had 57 zones.

Today we have 652.

Totally normal, totally healthy I’m sure.

From the way Tiff has been travelling around to business forums and advising government to try to curb wage inflation to stop a possible second wave of inflation, they just might need to go big again to help that out. It looks like they might want to add some flexibility back to the labour market by step 1: slowing the economy through a quicker interest rate rise and step 2: force some folks back into the labour market because of their increasing costs.. (want to afford those increased payments, time to pick up some weekend shifts at another job or add in some overtime). Also, to protect the dollar and Canada’s buying power to keep Canada from getting buried by the US dollar value.

Don’t see that happening, 75bps maybe but still think 50bps is the current likely scenario

From: https://www.cbc.ca/news/business/powell-fed-speech-interest-rate-hikes-1.6563183

BoC should get out Infront of the FED and go with another 100 points on their rate with the announcement on the 7th.

Pre-approved design templates have been used with success in the past to promote housing construction. For example the Vancouver special was a pre-approved template design that’s why there’s so many of them. Eventually they cancelled the program because there was a backlash against the monotony. More recently Kelowna upzoned 800 lots to quadplexes and offered a few pre-approved designs which really helped small builders get their projects off the ground quickly. Again it was cancelled eventually because of negative feedback about too many identical homes. No real reason why they couldn’t offer more options for infill designs though, which I believe they are doing for their second phase targetting some 6000 lots to upzone.

There are ugly builds of all shapes of houses. Anything can be designed right or wrong and the pitch of a roof does not automatically exclude a house from ridicule. We will see more and more houses that challenge our tastes as the step code gets up towards level 5. Essentially a square house with no windows is the ultimate form for energy efficiency and every added window and jog in the walls reduces that efficiency. When Im calculating the RSI values for different roof assemblies I can get much higher results for a flat roof than a pitched one for less cost and less materials. BC Building Code requires R28 continuous insulation in a flat roof vs R40 Batt insulation in a typical peak roof truss.

Good point. Lots of ugly, boxy SFH builds these days.

There’s a few houses made of stone around town (the one on the corner of quadra and beckwith comes to mind, apparently it’s a registered heritage home) and I always thought it would be so cool to live in a house like that… I mean if earthquakes weren’t a possibility of course.

“Personally, I think the worst style of house is the early 90s plaster special. Best is the mid century post and beam split. Wish they built more of them around here.”

I sold a post and beam and miss the vaulted ceilings but the insulation was horrible. I like the high ceiling Victorians or New York style brownstones.

I just don’t even know where to start

Some of those houses look pretty bad, but I guess the intent is to squeeze as much house as possible onto the smallest lot possible. Makes sense to build tall boxes with low pitched roof lines.

Personally, I think the worst style of house is the early 90s plaster special. Best is the mid century post and beam split. Wish they built more of them around here.

Yep, I did. It’s big draw backs are the heritage designation (for getting work done) and the corner lot (losing a lot of an already small yard to setbacks). As well, the pictures made it look to be in a lot better shape then what it is actually. It needs a fair bit a work that will be complicated by the heritage headache.

I’m curious too, as it is in the geographic area (and price range) in which we are looking. It does seem good value for the area.

My sister and her husband purchased an investment SFH in Nanaimo a few months ago at peak with 25% down, and the 5 year fixed interest is less than 2%. They are now laughing because the rent covered their mortgage, insurance, and property tax payments, and they are pocketing an additional $500 every month.

Afaik hardy board is more expensive than fir or cedar ?

Ha this made me laugh out loud

Cedar and fir is expensive so a lot of hardy board and synthetic materials are being used So kinda getting that look and finish on a lot of new builds probably age as well as a lot of 70s aluminum siding with ball dents

A lovely single detached house built by right.

Can I get this in a cornflower blue?

I do not understand the recent (within the last 10 years) predilection for building SFHs that look like chiropractor’s offices.

With the roofs that are shaped upside down (rising up from the center rather than down) and massively overshooting the side of the house, the sauna-style dark stained cedar siding with black trim and black windows joined with wavy silver aluminum accent siding, and ultra square/boxy design. It’s just hideous, IMO and will probably date very badly. There’s nothing about it that feels like “home” at all. Worse still are interiors that are absolutely parched white everything, and are one giant, cavernous room with nothing but a kitchen island in the middle of it.

I can’t stand “trendy” most of the time. It’s just like at some point, green shag carpet with brown veneer wall paneling was considered trendy, and yet now we wonder who could possibly have looked at that and thought, “This looks nice – lets build with this”.

Heh, I must be getting old…

Yes, they have to meet the design guidelines.

Most of which is crap though. I mean look at a lot of new single detached that are built. Hard to be uglier than that.

I don’t know enough about the slot homes and why they were built VS whether the alternatives are better. No problem with some design guidelines, but often they are abused to restrict housing with the review boards holding up projects due to ridiculous aesthetic complaints, like not liking a type of brick, or complaining that the blue used for accents is too bright.

There can be real ugly missing middle homes built. Does Victoria’s proposal have something to prevent “ugly”missing middle buildings?

For example, Denver has had a problem with “slot homes”. A developer tears down a single house and replaces it with a sideways set of 4-6 condos. Huge profits for the developer as each unit sells for as much as the old house did. No porch, few windows facing the street. Residents found these slot home designs to be so ugly they’ve banned them. And replaced them with more aesthetic designs.

https://denverite.com/2018/05/07/denver-slot-home-replacements/

Ash, I believe it was amended to six on every lot with a height of 34.4 feet. Do not recall the setbacks. If anyone knows for sure let us know. I am fairly sure about the height being amended for every lot.

Received in my mail a leaflet trying to get people to come to council on Sept 1 and speak out against missing middle. A gloomy image of 3 story apartment/townhouse blocks towering over small SFHs accompanied the message.

Quick question – does the current proposal allow up to 6 units on a non-corner lot, or 4?

Did anyone walk through 304 Robertson St? Just sold for 1.35M, which to me sounds like good value for that house in that location. But I didn’t check it out.

Today in Times Colonist – Sluggish August sees fewer buyers, price cuts for higher-end homes

https://www.timescolonist.com/business/sluggish-august-sees-fewer-buyers-price-cuts-for-higher-end-homes-5738831

“August is living up to its reputation as real estate’s slowest month.

Karen Dinnie-Smyth, president of the Victoria Real Estate Board, said with just one week left in the month, sales have dropped as high interest rates and soaring inflation push new buyers out of the market.

Listings have dropped substantially again, and most buyers right now are those who have sold one property with the intention of moving to another, she said.

“They’re not new entrants [to the market], so that’s the cycle that we’re seeing right now. We are going to have to see interest rates come down somewhat before we start seeing much new entry into the market.”

Dinnie-Smyth said the board is anticipating 350 to 400 sales this month, less than half last August’s 831 residential sales amid a red-hot market, and down from the 510 sales recorded in July of this year.”

You replied specifically to only “But I didn’t lose. ” with “But instead you sold it at a loss “.

Patrick a good take on the 80s and where we are today i think u summed it up well I myself differ from where we go from here but it’s the beauty of having differing options cheers

The Vancouver price bust (82-86) mostly happened AFTER the 1982 peak of interest rates, during a time when rates were FALLING

—The reason for this is UNEMPLOYMENT in BC. A series of recessions from 1981-86 hit BC, and unemployment exploded from 8% to 15%.

—When homeowners lose their job, they often are forced to sell the home.

If we see unemployment spike to 10% here (from current 5%), we’ll likely see forced selling from unemployed homeowners. (I don’t expect this to happen)

— Not only did they sell their BC home, but they moved out of BC to other provinces . A double whammy.

— As it is now, the economy is great, unemployment at lows, plentiful jobs. People here waiting for homeowners to be “smoked out” of their homes by a 2-3% rise in mortgage rates will be disappointed, as those gainfully employed homeowners will continue to pay their mortgages.

The point being, I don’t expect a “bust” in Victoria prices (>25% drop) unless the economy tanks and unemployment rises. Then we will see forced selling and vacant rentals. No signs of that now.

That wasn’t material to my post. I’ve reworded it anyway.

Here’s some statCan data from the Canadian Housing a Survey (2018). Since they don’t mention Victoria, I’m guessing that Victoria would fit in between Toronto and Montreal, with about 30% of FTB getting a SFH

https://www150.statcan.gc.ca/n1/daily-quotidien/200115/dq200115b-eng.htm

Canadian Housing Survey: A profile of first-time homebuyers, 2018

“Just over 1.3 million, or 9.0%, of Canadian households bought their first home within the previous five years according to new data from the 2018 Canadian Housing Survey.

However, the type of home these first-time homeowners bought depends on where they live. Rising home prices in certain markets over the last decade, changes in mortgage underwriting rules and shifts of the housing stock toward multifamily dwelling constructions are among the factors that can influence first-time buyers when they choose a home.

Nationally, just over half of first-time homebuyers (52.9%) bought a single-detached home within the previous five years. In Canada’s three largest census metropolitan areas (CMAs), however, this rate is lower, at 38.1% in Montréal, 26.4% in Toronto and 21.4% in Vancouver

What motivated first time homebuyers to enter the market? Two-thirds cited “to become a homeowner” as their top reason for entering the housing market, while one-quarter reported “to upgrade to a larger or better quality dwelling” or “to form own household.”

Families accounted for about three-quarters of first-time homebuyers nationally and in the CMAs of Toronto and Montréal, compared with just over two-thirds of first-time homebuyers in Vancouver.

About half of first-time homebuyers nationally and in the CMAs of Montréal and Vancouver were under the age of 35, compared with 41.2% of first-time homebuyers in Toronto.“

They didn’t sell at a loss.

Good questions, I don’t think there are any actual stats on this. Would be pretty easy for the land title registry to produce this data but of course they would rather sell access to their data to the real estate industry instead.

While we are asking strange questions, what percentage of condo sales are to FTB.

Do FTB usually buy a house or a condo (actually if anyone knows the ratio that would be super interesting).

Hopefully declining house prices will help put the brakes on some divorces.

That’s the right attitude. Sure you could’ve made a few million simply hanging onto the 1980s Vancouver house. But instead you sold it and moved away from BC.

No point being steamed about that. Life was harder back then. Yes, it may have been easy to buy a house. But it wasn’t as easy to stay employed to pay for it. High unemployment (12-15%) and multiple job-loss recessions in BC in the 1980s meant many people lost their homes.

We’re in good times right now – record low unemployment. People are happily paying off their houses, including those who bought in Feb 2022. Only 1/1200 mortgages in Victoria are delinquent – a record low. May the good times keep rolling!

“In the US, they’re seeing big price drops and house cancellations in “Pandemic boomtowns”. These were the lockdown getaways that people flocked to. I wonder if Ucluelet and Tofino saw that? And who knows….maybe Victoria too?”

I’m in an interesting job at the moment, working for a high net worth non-resident on a renovation in the Victoria area. I had no idea so many people with so much money – huge money – were purchasing in the area. This interest in Vancouver Island isn’t going away, it’s only increasing.

But I didn’t lose. The point was that I was able to buy a second house at the market bottom without selling the first one. Because interest rates had already gone down substantially.

Well no, because I got to enjoy a historic decline in interest rates and the person who bought in Feb 2022 won’t.

And this isn’t about me – or you – it’s about interest rates and RE cycles. You’re entitled to the view that 2022 is just like 1982, but I’m not buying it.

I just looked at my Feb/March/April buyer sales and the thing is most of my clients sold as well. For example, I have clients that hought a house in Gordon Head that has probably dropped 150k? But we also sold their townhome in Feb for 175k more than a recent comparable sale in the complex.

Some of the first time buyers secured much better interest rates than they would obtain currently.

I have an inventor that bought a condo I talked to the other day….doesn’t care rent comes in every month in it for the long haul. Kind of like buying Telus stock and it drops 10%. Yes would have been better to buy on drop but you know dividend isn’t going anywhere.

When I go through the list I don’t think too many people are losing sleep.

So how is that $40 in their pocket then? Sorry I don’t follow your logic.

Construction workers simply aren’t are a substantial amount of buyers in this day and age. I would say in my personal business government or government related (bc gov, military, uvic, etc.) buyers outnumber construction workers 20 to 1.

Problem with construction is the pay (as an employee) isn’t great. Banks don’t like construction workers either.

Finally the ones that can afford real estate and are self employed with successful businesses will adapt and do just fine. Most skillsful tradespeople can cross over between new construction and other avenues (existing inventory repairs/maintenance).

With oil continuing to hold at a level conducive with healthy profitability that could lead back to some investment in that sector, etc.

You have to remember an electrician, for example, can work residential, at the dock, go work on a potash facilities and a bunch of other things. They won’t be coming to wire your basement suite reno for $20/hr anytime soon.

It’s the trend line Marko. Those in construction are making less than the previous months but still living at their current expenses. That downward trend line indicates that things are going to get worse.

The purpose of raising interest rates is to slow down the economy and the first to feel the pinch are those in construction as demand for new homes softens.

How do sub contractors get mortgages? The same way as anyone else that is self employed. I’m sure you must know of agents that under contribute during the year and then pay a bundle at tax filing time using their lines of credit.

Condo inventory below historical averages. I’ve sold a couple of condos this month and 10x easier to sell than 2013 when depreciation reports came into effect + crap market. Hard to sell than 12 months ago? Yes.

Ok, so how are they then suppose to qualify for a mortgage?

No worries, purpose of this blog is for people to discuss and educate themselves on things they may not be aware of.

Ok I googled it and found my own answer, thanks for enjoying my pointless comments! https://www.easy123mortgage.ca/difference-between-a-lender-b-lender/

This is such a nOob question but what’s an alt lender? Our broker recommended first national because they are apparently easy to work with and have good rates, so that’s who we went with. They’re not a TD or a RBC but I always assumed they were basically the same thing. But is that an example of an alt lender?

Or are alt lenders the ones who charge extra high rates in exchange for riskier loans? What’s an example of one?

Leo I think the people in real trouble are the ones that couldn’t get a mortgage with the traditional banks and went with the alt lenders.

Marko, $40 dollars an hour may not seem much to someone on a pay roll as they have taxes and benefits deducted at the source. But we live in a world where house developers are using sub contractors to avoid CPP and EI. Those subs are suppose to remit their own taxes. But are they? There is a big difference between $40 an hour after deductions to $40 in your wallet without deductions.

On trigger rates

Wow, if you got “steamed” about losing $15k on a sale in 1982, do you also get “steamed” thinking about what that Vancouver house would be worth now, if only you’d held it?

I expect that your answer is “no, doesn’t bother me at all”.

And that’s likely the same position as the people who bought in Feb. 2022 ; they are happy their house hunt is over, and they spend their weekends with family, barbecues and HomeDepot projects.

Has new construction fallen off a cliff?

Seems like it to me. Have to wait for the August numbers but it seems to have slowed down a lot over the last three weeks.

Spoke with one agent about condos, in general, and she thinks that there are too many condominiums for sale in Victoria. Not that we have not had a lot more condominiums for sale in the past. Just that we have too many condominiums relative to demand. Of course this is anecdotal and it is just her feeling relative to the past performance of the market. She just hasn’t adapted to having a condo take more than two weeks to sell.

But, imagine that too many listings!

I bought my first house before the bottom of the early 80’s bust and I was pretty steamed when I found out that it would not sell for what I had paid for it. By about $15,000. But I did something about it – I bought another one. Doesn’t work when rates are going up though.

Exactly, and they took cash they had and turned it into a material loss because the value of that down payment they made has vanished off the value and they don’t have the cash on hand anymore.

That’s funny, affordability can be viewed in different ways. People focus way too much on the monthly in and out. The idea is what is being paid on interest over term. So what if mortgage rates are higher: the buyer just needs shorten the amortization period and increase the down payment and the monthly payment to equalize the interest cost on term to have the same affect as the lower rate. As well, if you don’t view housing as an investment, but a lifestyle choice instead, the selection and quality of the property matters more than just buy whatever you can, with all you can and hope it works out. I assume most people can flex a few grand a month either way and can adjust and move to the affordability formula that suits their personal situation the best….. Well, unless they always spend all they can, whenever they can, on anything they can and borrow on top of that… Maybe they are having some issues..

People aren’t going to want a do-over (buy in aug 2022 vs Feb 2022)…., because they’d need to:

– finish their 25 year mortgage 6 months later.

If that’s the case, then they most definitely went variable in February, and they’ve probably already hit their trigger amount.

bullshit, everyone I know who bought in Feb/March/April are looking at current prices thinking damn I f’d up and want a do over. Now that is not a very large sample size but I suspect almost everyone will have the same experience with the people they know. You only really stop looking/thinking about the market once you are in the black. It’s psychological, don’t try to fight it or deny it, its the same way with all large purchases unless you are truly wealthy.

Thanks for that, I forgot to mention this in my original response.

They may not qualify to borrow that much, and not be able buy the house now period.

Not sure about that, the graphs may depict this, but I think in reality any decent SFH in the core is likely down more than 120k. Maybe someone can pull up some examples of similar solds from Feb versus June. you are also assuming they made the smart choice of picking fixed versus variable mortgage.

Folks who want to play that game should have the cash to play the speculation game, if they don’t they should buy something they like that they can afford when available.

If they waited until now they’d be getting a mortgage for $880k, not $1M. So $350 more a month, $20k more in 5 years, they only have paid $111k off the loan, but their balance at the end of the term would actually be $74k less than if they bought in February. So they’re up 54k.

Many of the “I’m so smart that I’m waiting for higher mortgage payments ” HHVers we see here may end up buying with worse affordability, or even worse (like many HHV “lifers” here)… never buying at all

meh equity is meaningless unless you cash out or use it as collateral, but the couple hundred grand in extra mortgage balance is very real.

Yes, but today people haven’t lost that $150k or $200k in down payment that the February buyers have had disappear in a market equity loss. As well, the majority were doing variables…. So, they added to their Feb unaffordability by compounding it with their increased debt servicing cost on that higher price… Best of both worlds!

Patrick that won’t fit on a shirt

rigghht, somehow paying couple hundred grand more for the same asset is better…. please preach these technicalities to those who bough in Feb and are now regretting not waiting. maybe something like: “who cares if your mortgage balance is couple hundred k bigger at the end of your 5 year term, atleast you saved couple hundred bucks a month for those 5 years….”

Ahem…Victoria FTB affordability is worse now than February.

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-household-income-mortgage-stress-test/

Next msg

So how many should we order?

And there is the first t-shirt design slogan for HHV merchandise

Could be worse, you could have bought unconditional in Feb and found yourself with a defective home because you listened to all these bulls preaching the supply and immigration narrative and how desirable it is here with zero concept or understanding of macroeconomics and affordability……

No sense in looking back. You are going to be okay.

I would; however, consider listing now if you do want to move. Test the waters even if the timing is not ideal.

Patrick. Without a doubt we saw a pandemic horde move in. That going away has a big something to do with my predicament since everyone is now tapped out. We risk seeing an oversized downside in prices unless the fact that there is no inventory to speak of dampens that fall. We have to wait and see. I wish I sold in February

In the US, they’re seeing big price drops and house cancellations in “Pandemic boomtowns”. These were the lockdown getaways that people flocked to. I wonder if Ucluelet and Tofino saw that? And who knows….maybe Victoria too?

https://www.route-fifty.com/tech-data/2022/08/home-sales-pandemic-boomtowns-go-bust/376197/

Home Sale Prices Fall Swiftly in Pandemic Boomtowns

“ Boise, Denver, Tacoma, Sacramento, Phoenix, San Diego and Portland—were among the fastest cooling housing markets in the first half of this year “after attracting scores of eager homebuyers during the pandemic,” the report said. ”

bond yields and oil ripping, CAD teetering, BOC rate decision in a 2 weeks. Get those high rents locked in while you can folks!

I serve Ucluelet and Tofino which have been booming for the last 4 years. We saw the largest increases in assessments on the island. It’s mostly Vancouver and Alberta money that has been flooding in. It is a small niche market however it seems to have been in lock step with Victoria for growth from the same sources. Keep in mind the work I do is getting projects approved so a year ahead of developers even announcing projects. No one hears about it when projects that I am involved with are cancelled as they never get to public hearing. I used to be based in Vancouver and did work on projects all over the world from Abu Dhabi to Las Vegas. Different scale but the writing on the wall is the same this time as it was back in 2008-9. On the upside this is bullish for real estate since it further constrains supply of housing.

What area(s) are you referring to? Victoria? Ucluelet?

I agree. there are other articles out there regarding projects on hold but maybe a localized version of the story. It is a bit of a leading indicator as projects are usually a year or more away after project start up or in Victoria many years with all the red tape The effect this has on future affordability and supply constraints is on topic

Leo, that seems like a good HHV topic… “Did Development Just Fall Off a Cliff?”

Ahhh my bad I thought you were in Victoria. Here 3k gets you a teardown rental if you are lucky. I posted yesterday in previous post a friend of mine (government employed at over 100k, no pets, great references) sent out 90-95 inquiries for a rental and only three people got back to her. Was able to secure one of the three but based on the photos she sent me it sucks.

No. This is a risk and clearly a fear, but not a certainty. You can, imo, control for this to a large degree but the stress cost might be too high for you to manage this option given your response.

What is stopping you? It sounds to me like you have planned well even if pulling the trigger is early and scary and you are worried about work.

Math-wise, you should be able to pay off your condo with the proceeds of the house and have what, 600k left?

With your skill set you are employable, or self-employable. Even if your job market takes a turn for the worse, there will be people looking for, for example, carriage house designs in Victoria to increase their income long-term. And maybe you have some transferable skills and could start applying in Victoria if you are willing to work for someone else.

Spend the time to work out the math carefully and count your stress costs too. Take care of yourself 🙂

I feel lucky Im getting all this free good advice guys. Im frazzled and this helps

Here where I live yes for a brand new home of similar size to mine. Alternatively I would move to my own condo in Vic

totoro All of those things are under consideration. I had my home built small so there is no suite potential. I could do a Carriage house but that is cost prohibitive. I am not a fan of tenanting my house as it would be destroyed. Im ready to leave Ucluelet and that was the reason for buying the condo as I was afraid in 10 years it would eat up too much of the proceeds from the house sale. I thought I was being smart buying my retirement residence early and having a tenant contribute to the pay down. Now life is changing fast. I could live in it from a comfort standpoint for sure. Its a nice building B/W cook/fort street. I figure im 20 years out before im 6 feet under in a modest pine box.

+1, I recently received $6k/month for my personal condo while away and I think maybe could have got more as it rented within an hour of putting it up on AirBnB (I had a 30 day minimum setting). In the past I always use to leave it empty and even though I don’t need the $ at $6k/month won’t be leaving it empty again. Too much to pass up. Nothing crazy, 2 bed 2 bath 1,000 sq/ft.

Amazing how many people don’t understand this concept and bitch all day long on Facebook about developers building 1 bedroom condos. Guess what, if developers built 3 bedroom condos people wouldn’t buy because they would rather drive to Sooke for a 3 bedroom house so they have have a 12′ yard.

I design single family homes as well as multi family and mixed use condo developments and resort masterplanning and development consulting. I do a lot of rezoning and development permit applications as well. I was turning down work on a weekly basis because I couldn’t keep up with demand. Now I am sitting here starring at this blog. It was like the tap turned off 3 weeks ago. I have 8 projects under construction currently but nothing else in the pipeline. I haven’t seen it like this since 2009 when I last found myself out of work

Have you seen the SFHs renting for $3k/month? Not to mention lack of stability.

On the whole 100% agree with totoro difficult to beat principal residence in terms of investment. Tax free (only other thing that comes close is TSFA but that has a limit), leverage (what other investment you going to leverage 20/1), etc.

Appreciation going forward won’t be what it was the last 10, 20, 30, 40 years but still I think difficult to outperform principal residence. Just think of all the extra gains you have to make in any other vehicle to offset the taxes.

Stress cost is a real cost.

This route is one option, and not the worst thing in the world depending on other factors that I don’t have a handle on (personal preferences/long-term goals/family/your age and years left in the workforce etc..).

Other things to consider:

Can you put a suite in your primary residence – would you want to?

Can you rent out your furnished primary residence for a high amount over the summer and move to the condo only for this period of time, and then rent the condo out furnished for the remaining part of the year? Would you want to?

Can you just rent your house out and live in the condo and be cash flow positive?

What type of development and what parts of it have it fallen off a cliff?

Totoro Thank you for your input that was actually very helpful. I am trying to figure out what to do as I am in the development world and work has fallen off a cliff. I have a million + in equity on my primary (paid off) and a Condo I would move to with 2k/month mortgage. Trying to decide if selling and moving to the condo makes more sense than stressing out about work for the next decade only to die a few years later from a heart attack

The S&P 500 index acts as a benchmark of the performance of the U.S. stock market overall, dating back to the 1920s (in its current form, to the 1950s). The index has returned a historic annualized average return of around 11.88% since its 1957 inception through the end of 2021.

However, if your place is entirely paid off or you have a lot of retained equity your overall ROI declines along with your risk. Some people just stay put and are content with the appreciation/depreciation at low risk. Those who want to maximize returns will use a HELOC to invest in something that you can deduct the interest from.

I would say that you could take your million dollars of equity and invest it long-term and withdraw $40,000/year (mostly taxable) safely for your lifetime. $40,000/year may cover your shelter costs in 10 years, but probably not if you want to keep the same level of housing as you own. And you’d have to take on the instability and constraints of being a renter.

You could also just invest it and let it compound and live as a renter on your current income and in ten years your million in the S&P consistently reinvested might be about 1.7 million and your safe rate of withdrawal would be $68,000/year (taxable) out of which you’d have to pay $3000-$6000/month for shelter.

If you kept your house you could sell in 10 years and also probably have 1.7 million – but tax free – and you would have paid only your holding costs for your home instead of rent, so should have had additional income to invest if you were still working.

If you had a HELOC and invested in the market and kept your house you would likely have a higher return overall, but at higher risk.

In order to work this out entirely I recommend you do a simple spreadsheet for a ten year period for all your options. Compounding returns are the goal at the risk level you are comfortable with.

Hey Introvert:

Not saying anything on my own here. The basic mission of the central bank is to keep inflation within a window around 2%. The main way they do so is with interest rates. Whether rates do the job or not determines whether the interest rate is natural, high, or low. That sort of measure is easy to postdict, hard to understand in the present and future. Inflation has been high for some time now, so interest rates were too low. If BoC left interest rates alone and inflation returned to ~ 2%, then current rates would be natural, although that scenario seems unlikely.

So are interest rates artificially high right now?

And is there a “natural” level for interest rates?

Running some math here. If I sold my house today I would have conservatively 1 million cash to invest. Historical returns on the S&P are 10% giving me an annual income of 100k. Rent a place for $3k/month leaves me with 64k annual return. Essentially it is costing me 64k per year plus property taxes plus maintenance and insurance to hold onto this place in lost opportunity. Over 10 years I would see a gain of 640k and that’s if I didn’t reinvest the money just put it in my mattress. I wonder if my house will be worth 640k more than it is today in 10 years. I think that’s a very optimistic view of the market considering we are at peak affordability. Im not a mathematician so feel free to poke a hole in this.

I was responding to someone else’s comment regarding renting. More than one conversation happening at the same time.

Totally understandable. The interest rate change has a huge effect given how high prices are. I guess we will find out how it plays out over the next few years.

Totoro I appreciate what you are saying my own past experience has been exactly as you describe. I do not think it will continue to be the case given the price of homes today and normalizing interest rates. I have been a housing bull for 25 years I just feel a little less bullish for the first time over that period

Again, your comments were specific to a primary residence, as were mine in response – and not in respect of “investment condos”. I’ve never been a fan of condos as an investment, but it has worked well for Marko.

This is a Victoria based board and your statement was specific to primary residences. Objectively, and based on past performance, not recent past performance but 60 years of past performance in our market, you are absolutely incorrect.

While past performance is no guarantee of future performance, you have to live somewhere and it is the best predictor we have – although I agree we have had super high run ups and there may be some compensatory downturns. But rents in Victoria for a 2 bedroom rose 34% this past year. How about Ucluelet?

Run the real life numbers for a rent vs. buy. Calculate out your ROI. Do it for your place, or your parents, or people you know. Then come back to me with a better return for the risk and I will be grateful for the information and likely act on it if it checks out.

Not sure Kristan. There are a lot of variables in play with this. Are countries with lower cost of housing performing better in business, for example? I agree that a lot of money is being spent on housing in Canada. Just not sure that it is at the cost of other investments or if the proceeds are fueling other investments.

First I think you missed the point I was making entirely in that I was in defence of rising real estate prices as people generally don’t like to lose money and I was never comparing the value of owning over renting. I wouldn’t want to rent mostly because of the insecurity of it. I will say that once we hit 5% interest rates then the cost to rent a 500k condo will be cheaper than the interest only, condo fees insurance and income tax servicing costs thus making it a better deal to rent that condo and invest the 800/month difference in the S&P. The only hope of a return at those rates is asset appreciation which I don’t see being robust for a while. That is a risk I see with my own investment condo which I will gladly sell you if you think its such a great investment..

Hey Totoro,

Briefly

Oh, that’s not what I’m saying at all. I agree with the strategies you’re talking about, but I think this back-and-forth started with a macro claim. That decreasing affordability as a function of time (not just here in Greater Victoria but more broadly) leads to (taking into account all actors) a net drain for productive economy. Roughly, more and more money being dumped into the same basic need (housing) leads to less net investment elsewhere. Yes though, I agree that by getting in, we will be better off in the long run.

It is not plain incorrect. Many people have lost their shirts investing real estate. Recent history is not necessarily the future potential. I know what you are talking about and I have done well with real estate. I just don.t trust we will continue to see real estate perform the way it has.

And this in itself has been a constant in our market.

My grandparents bought a single family house in Oak Bay in the 1950s. I couldn’t afford to buy the same house when I started working even though our income was, even adjusted for inflation, higher than theirs and we had a down payment.

My point is that affordability worsens over time here for housing. This means it is appreciating at higher than inflation and has done consistently over time for a long period.

There are a number of strategies and the primary one is you as a first time buyer may choose ex. a townhouse over a house, for example, as a first home or you may choose a place with a suite or rent out a room to compensate. Or even… co-own a large house with another family.

This maintains affordability for you and you start to benefit from higher than inflation appreciation (over time) while your shelter cost is not subject to the inflation in the rental market. Once you have accumulated equity you will likely be able to buy a different home if you want.

Buying a house is not a “net sink”. You are a math guy. Use a spreadsheet and do the calculations over time. Lots of free ones on the internet.

Agreed. The black hole of government doesn’t always deliver.

Developers just give people what they ask for Its the people who are asking for things they cant afford but are unwilling to compromise that I cant figure out.

I agree with that statement. If you look at the older homes and apartments from say the 1940’s, 1950’s and 1960’s, you can see a much simpler way of life. Now, it’s standard and expected to have marble or granite countertops, for example, even in small condos. I compare that to the vinyl kitchen and bathroom floors and formica countertops of those vintage homes – even the high end unrenovated homes of the era in fancy older neighbourhoods.

My point is the affordability crisis is due in some part to consumer tastes.

Agreed. Great post Totoro!

Best deal is sleeping in beacon hill park.

This is just plain incorrect.

Your primary residence is likely going to be the absolute best investment vehicle for the risk you will ever have access to.

Think about it:

Yes, there are ownership costs and selling costs (which you can minimize). But still, I’d love to hear what works better than this for the same level of risk. And most Canadians are risk averse, even buying a house is scary for them.

Is renting a better deal?

Totally and that’s the biggest number I didn’t even mention. Even if you sell a house and recover exactly what you paid including interest commissions and taxes the house prices would continue to rise. I think a primary residence is more of a forced savings than an investment vehicle because the returns aren’t that great unless your timing is impeccable

And interest.

Hey Patrick:

Long term, yes, 100% agreed, and this is probably the most important point for policy in the region. Short term, there was clearly a lot of excess demand as a result of low rates, an effect visible throughout the Western world not just Victoria. Whether things plateau or return to a bit about pre-pandemic levels, I guess we’ll see.

Hey Totoro:

Yes and no. If affordability was ~ constant as a function of time, then I would completely agree. But affordability has just taken a huge hit the past few years, which I would contend makes housing a net sink, relative to what it was in the before-times.

Incidentally, completely agreed on a capital gains tax that was directed toward purpose-built rentals. If it was done intelligently, which is a big ask..

Very true. Also, lots of people want to take grandpa’s money

I design homes both single family and multifamily for individual clients and also developers for a living. I have a pretty good handle on things. Developers just give people what they ask for Its the people who are asking for things they cant afford but are unwilling to compromise that I cant figure out.

How not to fight inflation…

Saskatchewan is sending every resident over the age of 18 a cheque for $500.

https://regina.ctvnews.ca/500-tax-credit-cheques-coming-for-sask-residents-this-fall-1.6037809

We had the biggest increase in economic activity ever going through the 1930’s to WWII to the 1950’s, yet houses remained affordable to one income households.

And we have seen the biggest increase in house prices ever over the last 40 years, at a time when real wages have largely gone nowhere.

For sure if all other factors remain equal, house prices will correlate with nominal economic activity. But they haven’t.

Every property has a market price at which it will sell. Period. The reason developers don’t build dwellings with only one bathroom is that the lower cost is more than offset by the decrease in price which someone is willing to pay. Thus lower profit, And that goes for the other features you described.

These frills may well make the difference for those at the limits of affordability, but as long as there are enough buyers – particularly those who had bought earlier at lower prices and have plenty of buying power – they will sell.

I would think an incredibly small portion of construction workers in Victoria can afford to purchase. Sure the GC if he or she is component but a really good framer, for example, is making maybe $40ish per hour? That won’t get you far in terms of real estate in Victoria.

I’d disagree. We have a few factors that work in tandem to create excess demand on limited supply: good location, immigration (including retirees from other areas of Canada), retained equity, remote work, zoning restrictions, cost of redevelopment, economic conditions locally, and interest rates.

5 year CAD yield back to 3.2% now…, will we break 4% this year?? Maybe people shouldn’t call the peak in interest rate just yet!

Here is another thought, after BoC saw the impact of lowering rates has on inflation do people think they will just go right back to the same playbook in 2023 if the economy softens?? If they do that and inflation goes rampant again they will go down in history as the biggest idiots.

CAD/USD = 77 cents also….

The root cause of high home prices is increased economic activity which creates demand. New construction has brought a lot workers to Victoria from rural BC and Alberta for the high paying jobs. These workers need housing and they have the money to pay for it. This is also increases speculation in real estate.

When construction slows down then the economy will shrink and prices will decline.

Maybe we need to build a better small retirement city somewhere like Mill Bay or Cow Bay that would take the pressure off Victoria.

Investors can’t magically drive up prices. The root cause is demand and (lack of) supply. Investors paying high prices only works because there is enough demand to sustain correspondingly high rents. The more people that want to live here the higher prices go. If all these people didn’t want to live here investors would lose money.

At the end of the day need more supply…

Looks like Ucluelet is going to pass a bylaw allowing ADU on all single family lots and the public hearing had not one person opposed. This is a good step.

This sums it up.

https://youtu.be/f-oC-kNtPTs

If rates are 6% in 5 years then your house is up by 25%?? Should be comforting to the people who bought in Feb and March….

You should consider all other rising cost associated with ownership also

Kristan you’re basically describing us, double income 2 kids. We wanted 3! We bought a house with 3 in mind. But the financial implications (that the rising rates have made us think more seriously about) mean we’ll probably stop at 2. (Not just financial – also the lack of healthcare and the general awfulness of newborns and how I don’t really want to work full time with 3 kids, 2 is hard enough. If I could quit my job then sure but that brings us back to: money! Haha)

G. Hill – you’re not alone! We also have a hefty mortgage. I’ve started cost cutting to prepare myself early for a more austere lifestyle in 4 years when we renew. It gives me comfort, even if rates drop again, I like the feeling taking some proactive measures bring …assuming our income remains the same, I think we can “survive” (albeit unhappily) with 10% rates, anything more and we’ll be a … motivated seller . But all my “renewal scenario” calculations in my big nerdy spreadsheet cap out at 7% and I’m hopeful rates in four years will be closer to 4%.

I think my point is I wouldn’t be the only person doing this and thus the comparable would also be factoring increased costs of any taxes. I know people do this and I do it too. If they built more houses then this wouldn’t happen but until they do sellers are determining the market

Where prices are also set by supply and demand and based on comparables. Transaction costs are not part of the equation imo, although they affect your ROI.

https://newcanadianlife.com/why-are-houses-so-expensive-in-canada/#:~:text=Houses%20are%20so%20expensive%20in%20Canada%20because%20there%20is%20a,over%20the%20last%20several%20years.

I m not sure I have never sold into one of those. I only sell into a sellers market so I can set the price Of the 6 homes I have bought and sold since 2001 I have never sold below asking and only asked what I deemed was a good return. Then buy another beater and renovate or build new. I never really treated houses as investments but I was very aware of what my costs and fees were and used that information to set my price.

There won’t be a housing shortage once construction workers are let go and they return to rural BC and Alberta.

Odds are in 5 years, if rates are 6%, we’ve likely had about 25% in inflation over those 5 years. This means your salary is likely up 25% , and your house selling price is up 25% ( I predict more than that). That’ll soften the blow of increased mortgage payments. And you made a smart move locking in 5 year 1.9% term in 2021- so that’s a problem for the 2026 version of you to solve. Until then, congrats on the house and kids – enjoy!

I’d disagree. It is largely supply and demand, and listing prices are based on market comparables. How do you explain flat or declining markets?

As a seller I can absolutely ask whatever I want. Sure no-one has to bite but If the landscape changes as far as costs to carry an investment the prices will reflect that as the market adjusts to that new reality.No one sells without considering the net after fees. One of the reasons prices keep climbing is people sell and absolutely factor in the selling fees. If you sell for what you paid you have lost the amount equal to commissions and taxes

How high do we think 5 year fixed rates will go?

I have 1.6 mil in mortgage. But the current interest rate is 1.9%. Assuming we renew into a 6% environment in 2026, we’re looking at trying to find room for 36k worth of additional cost. We make good money, but with two kids and rising inflation I am genuinely unsure how to make that work.

And 6% is starting to feel conservative.

(Yes, I know we took a big mortgage, I don’t think anyone was calling for 5 year fixed rates to increase by 3 percent in <12 months).

Kristan,

Yes, I agree with your post. I would welcome a fall in house prices if it means better affordability. Raising rates doesn’t do that. Like many, I think the only way to get there is through building more homes. That’s derived from LeoS’ first law of Housing: “You can’t solve a housing crisis by redistribution”

The market is what it is. You can’t, as a seller, just add on costs.

You will become that guy if you buy. You just happen to (probably) be younger than him/her at the moment. They get to die earlier most likely as well.

It is a moving window and someone with more equity likely just has less life and health left so they are at a different stage. It’s like saying your grandpa has more money than you.

Yes, affordability is not as quite good as it was, but that was the same case for almost anyone buying over the past 40 years. You may not have more debt because people don’t start out the same way as they once did. You buy a smaller space first most likely.

Yes. Maybe if you keep your same pace and don’t have a side hustle or suite, etc. When we bought 20 years ago were were in the exact same position as that. And we needed a roommate to make it work. And it felt like a privilege not a sacrifice.

I also agree that skyrocketing housing prices are not a great thing for society. I would be in favour of taxing capital gains if the proceeds when to purpose built rentals.

All should be an interesting watch. People are going to be pretty shocked when BoC rate increases continue into the spring.

At some level, all I’m saying is that something has to give when the cost of shelter goes up and up and up relative to average salary. Yes, I agree that people are buying homes (hopefully we will too!) and many more will. But the who and the how are important. As you agree, the who around here are largely those with means, i.e. gentrification, and the how often involves at least one of and usually more than one of:

– both spouses working, often with a smaller number of kids than in times past,

– help from mum and dad

– already having a hold in the market

Those are notable changes from 50 years ago.

Two parents pulling in 6 figure salaries from the government leads to 1.6m sales in Royal Bay. One parent working and one at home with kids leads to long-term rent or a condo. I’d expect that the former are going to be closer to your representative buyer in the market these days than the latter. (Could be wrong though!)

As for investing, the raw numbers might be lower (point taken!), but that doesn’t mean that the effect on the market is smaller. Tech in the Bay Area is an extreme example. Tech comprises 9% of the employment market there, but is able to dominate the terms of the housing market, because so little new construction is allowed by zoning and so there is little supply at any given time. Supply and demand right? Inventory has been so low the past couple of years that I’d guess housing-as-investing (especially given low interest rates!) has had an outside effect on the market here.

Housing is becoming be more expensive, (less affordable) but that’s different than it becoming un-affordable . Because home ownership rate is at or near all-time high (68.55% in Canada), with record low mortgage delinquency, this means a near record number of Canadians have bought and are affording payments on their home. So home ownership is more attainable for the average Canadian than ever before. This also means that investment ownership is at or near all-time low. (That’s defining the term “investors” as any non-homeowner occupied home).

How do those facts square with your statement that more housing is directed at investment? If that were true, home ownership rate would be down.

You know who ends up paying those taxes? The buyer. Sellers add the costs of the transaction including taxes to the list price. I always have when I have sold property subject to capital gains.

It’s not a few though is it, it’s a large amount. That 61% of people that rent already have housing, they just can’t afford to buy it, in no small part because there are too many investors in the market driving up the price.

Makes sense too!

Yes, but this is looking at only one half of the equation, namely the guy who benefits from the rise in home equity. You have to also factor in what happens to the next buyer, who has to go further into the hole to purchase the home and therefore has less income to invest later, the next one after that, and so on, to determine whether this is a net source or sink to productive sectors of the economy.

Likely when we buy we will provide the seller with an enormous windfall of tax-free profit, which they might do all sorts of things with. Invest in the market; buy an RV; who knows? We however will be far more constrained. We’ve spent our adult lives living simply, saving a down payment, and when we do get to buy almost all of our income for the next 20 years will go into shelter, taxes, food, and higher education for our kids. There won’t be much left. That’s the inevitable consequence of unaffordability.

Personally, so be it, that’s still better than the vast majority of people have had it throughout human history. But I’m mentioning our example specifically with this question in mind of whether these enormous growths in housing values are productive or not.

I’m totally open to being proved wrong here, but I would expect that benefiting this way with returns that outpace the rest of the G7 by a large amount is ultimately smoke and mirrors. No such thing as a free lunch and all that. More simply, that this is more wealth transfer than productive economy.

Fair enough! Right, property taxes are definitely not high enough to do that, so in any case it’s out of reach.

Home equity is used to do all sorts of things. For example, start businesses. 34% of Heloc money is used for investment purposes. 26% is used for debt consolidation. And home owners use their homes as a retirement investment – more than half plan to or are doing this – what do you think funds long-term care and fuels retirement spending for many? Without this source of income taxpayers would be subsidizing long-term care to a greater degree. I agree that the rate of appreciation on homes in Victoria is beyond reasonable and not a social good, but the answer is probably to tax the gains.

Because we have a community charter that sets out municipal powers and responsibilities based on what they tax for. Affordable housing is not a municipal responsibility because they do not have the revenues for this and I’m pretty sure property owners will not vote for a Council that wants to take this on and this is who pays taxes. The federal and provincial governments have this power and responsibility, and the ability to tax for it Canada.

Why not both provincial and municipal? Fair point that provincial should get more responsibility for failures here, but it’s not clear to me that CoV doesn’t bear responsibility either. Major cities in the States offer (far too little, but still nonzero amounts of) affordable and purpose-built housing independent of what the State/Federal government does.

As for investments, yes, at some level I agree, but the main problem here is the tragedy of the commons we’re living through as a result of it being taken too far. There’s a macroeconomic problem: housing is generally a non-productive investment, new construction excepted. People trading the same properties back and forth doesn’t do anything, doesn’t build anything, it only sucks money out that could be used elsewhere. And the societal problem is that when so much of housing is directed toward investment that it becomes increasingly unaffordable for the average person.

It is not a municipal responsibility to build purpose-built rentals.

I do agree that zoning restrictions are part of the problem.

Housing is an investment. That is not going to change imo. Government could make it a less attractive investment by taxing capital gains and using the proceeds to build affordable housing. Increasing the affordable rental stock in general increases the vacancy rates and decreases the upward pressure on rents.

Not sure about the analysis on monetary policy. Seems like Bank of Canada has a whole matrix they use. I’d like to read a reasonable critique of this.