Checking in on forecasts

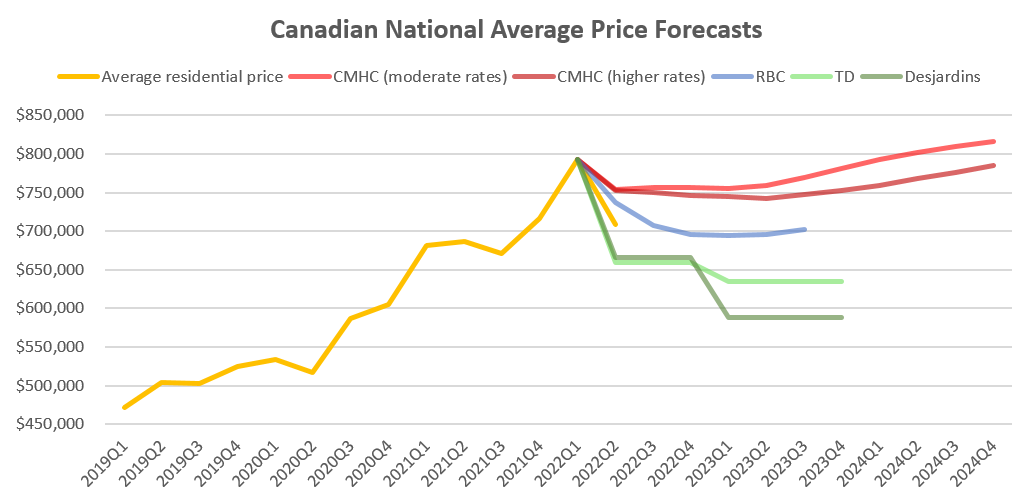

With the speed of the rate increases and associated price declines nationwide, forecasters have been scrambling to update their projections for the housing market in the country, mostly downward from what they were expecting before.

No one ever revisits the (in)accuracy of their previous forecasts, but it’s worth looking at what the big pundits are saying, if only to judge the sentiment. With second quarter price data out for the country it’s also worth seeing how those forecasts are shaping up so far. Forecasts below are from CMHC, RBC, TD, and Desjardins. Note that TD and Desjardins only posted the data for their annual estimates, hence the choppier chart.

Just like the last time, CMHC’s estimate is off to a flying start. They predicted a flat landing for prices with only a minor decrease from the first quarter of this year. While we’re only one quarter in to a two year forecast, the decline is already much higher than that and it would take a major rally to get back into their range of possible outcomes. Honestly I expect better from our national housing agency. At this point they should know not to make specific forecasts, or at the very least publish open data and models so everyone can examine their thinking and calculations when they issue something.

The big financial institutions have tended significantly more negative, but of course they’re not necessarily any better at seeing the future. Second quarter prices have nearly already reached the bottom of RBC’s forecast, while TD and Desjardins are more negative, seeing further declines in 2023. Where they agree is that prices will not give up all the pandemic gains, and that the correction will be over by sometime next year. I would tend to agree with that, given that prices were set to rise pre-pandemic anyway, and in previous corrections the acute price declines happened relatively quickly.

Why care about national prices? Two reasons:

- Though there are unique local attributes to every market, Victoria housing prices are affected by the same factors as national prices. No surprise then that Victoria has also turned down with rising rates.

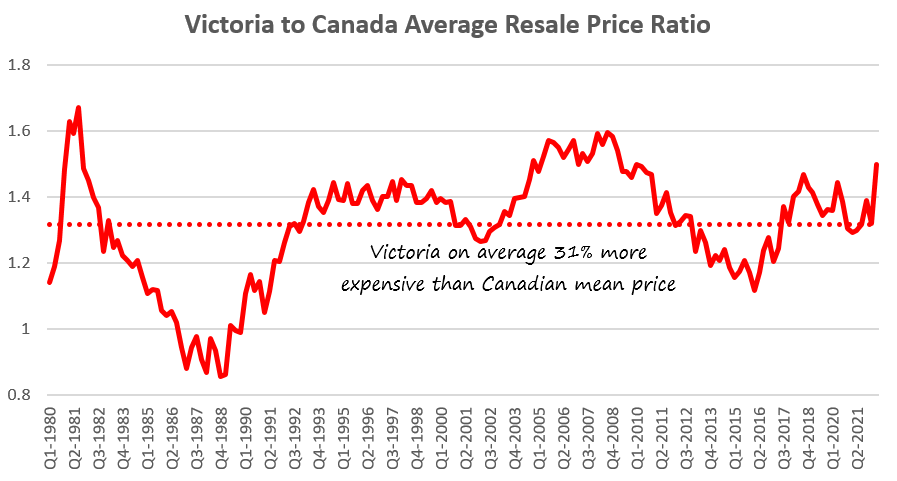

- Substitutability. Victoria is a premium market and likely always will be, but that premium is not infinite. On average over the last 40 years, prices in Victoria have been 31% higher than the national mean. In the second quarter they were 50% higher. As prices drop nationally that premium increases, attracting more people to other areas and decreasing demand in Victoria. It’s worth remembering though that the “natural” Victoria premium is not necessarily fixed over time and could be sustainable at a higher or lower level now than in the past.

Also the weekly numbers courtesy of the VREB.

| August 2022 |

August

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 189 | 831 | ||

| New Listings | 236 | 468 | 894 | ||

| Active Listings | 2157 | 2190 | 1120 | ||

| Sales to New Listings | 35% | 40% | 93% | ||

| Sales YoY Change | -42% | -43% | |||

| Months of Inventory | 1.3 | ||||

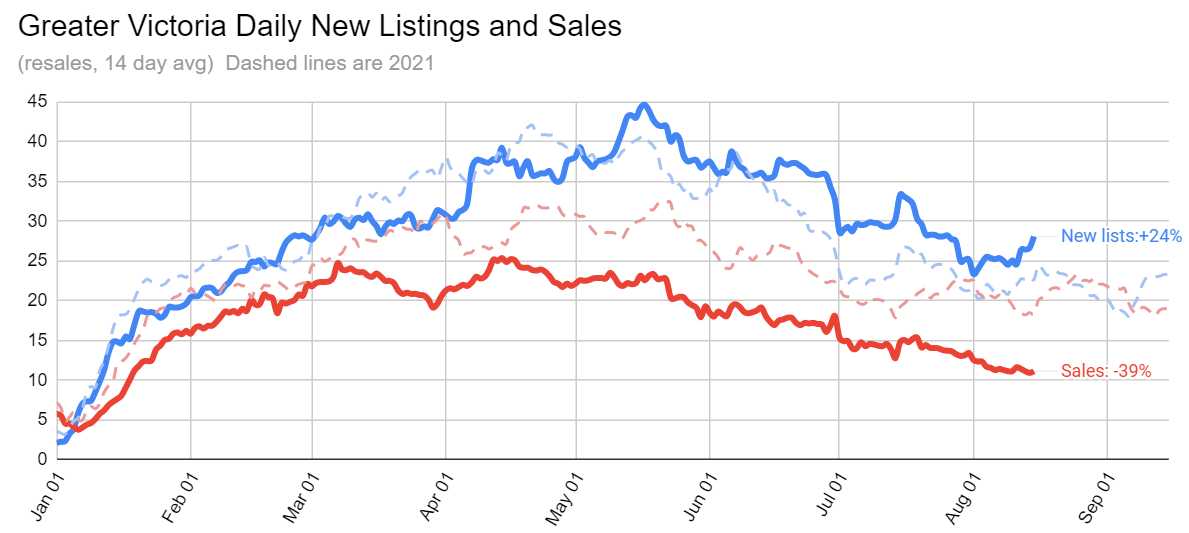

Sales continued their slide last week while listings stayed at a roughly normal level for the time of year. The recent uptick in listings on the chart below is mostly due to the long weekend moving out of the 14 day window, but it’s worth watching new listings closely. I believe a substantial increase there remains the biggest risk to market stability.

It’s been a surprisingly steady decline in sales since the spring, as you could draw a straight line from mid April to now with remarkably good fit. Normally there’s a bump in new listings in September and we should see an associated increase in sales as more inventory comes onboard then. The slow sales caused inventory to rise again after some weeks of stability, with 1070 more listings than this time last year. Only 4% of sales went for over the asking price in the last 14 days.

New post: https://househuntvictoria.ca/2022/08/22/is-the-fall-a-better-time-to-buy

It would be odd to have the market roar back without affordability returning (unless we get very strong wage gains + interest rate drops), but I’m not ruling it out.

Well new listings pick up in the spring as well, but yes I agree that with low inventory we are very vulnerable to a picking up in demand since that will quickly drive down the months of inventory into sellers market territory again.

Nope, very stable and steady slowdown so far. Too early to tell if we are stabilizing here for a bit or still slowing but seasonal patterns countering it.

What if you had an opportunity and means to buy your dream home at 500k less than it was earlier in the year, would you still refuse to sell your existing property at a loss? Too many variables to conclude what is going on. I sold a condo I owned on Rainbow Hill when Covid hit at a loss after transaction fees and at the lowest price ever in the development so I could purchase a development property in Colwood, also at an incredibly low price.

I wasn’t desperate, I just had a better opportunity.

Yeah by confusing I guess I just meant: they must be forced to sell, because if I had sunk that much money in I wouldn’t want to sell at that price.

For this particular home owner I am guessing close to three years start to finish. By the time he gets the engineering work done, tsunami analysis risk, writes the owner builder exam (and hopefully passes it), etc., that will take 6 to 9 months or so. Then the municipality will screw around with the permit 6 to 12 months. Then probably another 8 to 12 months or so to build.

I don’t really see anything confusing. The market doesn’t care about cost of renovation+realtor fees etc.

As for the second part often life circumstance can change whether it be work related, family dynamics, health, etc.

I renovated a house in Sunnymead with my father in 2012-2013 and we lost a substantial amount of money on it. It happens. Real estate markets don’t always go up, which some people have been lead to believe.

Here’s an odd listing.

This house sold in late 2021 for $1,095,000 and it looked quite nice at the time:

(Old listing with photos below)

http://www.sylviatherrien.ca/property-details/882761

Now it’s on the market again for $1,450,000 and looks like it’s had a major cosmetic overhaul

(New listing)

https://www.realtor.ca/real-estate/24797192/3981-blenkinsop-rd-saanich-blenkinsop

Confusing because: the new listing price must barely, if at all, cover the renovation cost + realtor fees etc? Also, the house pre-reno was really quite nice, doesn’t seem like a great candidate for a house flipper.

Still haven’t received my boulevard lawn deposit from City of Victoria. Sold the new build house back in April. There is so much beucracy that staff often don’t know what is going on themselves.

I sent in a request to have the lawn inspected…aka drive by step out of car for 10 seconds and got a reply 5 weeks later that they were understaffed.

With city of victoria and saanich I get this impression they manufacture bureaucracy and then they end up “under staffed” as a result of their own manufacured non-sense.

He was upset about a lot of things one of them being the existing house sewer lateral even thought functioning perfectly has to be replaced and munciaplity is forcing him to connect at a point that will require a sump (not enough grade) even though there is a point he could connect to that doesn’t require pump. Not sure if corner lot or similar.

Then obviously when he finishes this garden suite 3 years after starting the process and 350k later people will have a meltdown on facebook as to how much he wants for rent.

What is this garden suite going to cost. How many years before seeing a return>?

I wonder if step code and no natural gas apply, electrical/water/sewer/drainage services has to be upgrade, or sidewalk, trees, parking, and lawn need to be address?

Rental market…..friend with a 6 figure government job, great references, no pets, just texted me pictures of a crappy rental she secured.

Inventory is a better meausre/metric for sure but if we are hitting a 17 yr low for new listings for the year you can imagine what will happen to inventory when demand comes back and it will at some point.

All this slowdown will do is mask all the fundamental housing issues and we are going to be in a crisis with a few years again.

A person from Victoria called me today to get the owner builder study guide off me for a garden suite he is applying for….won’t mention municipality but he lives on an established street, not waterfront, municipality wants a tsunami analysis report on his house (100 yrs old) as part of the garden suite application, amongst a ton of other nonsense. There goes a few thousand dollars for no reason other than meeting some beurocratic checklist.

Says he had to tear down a small single falling apart garage to make room for garden suite…cost over 30k after dealing with hazmat, etc.

Still receive horror stories pertaining to owner builder exam every day. What has the government done? Nothing. Completely useless government department that will keep chugging along with zero accountability increasing housing costs. The executive that brought in the exam has left and is now working in Ontario.

Crystal Ball tells me sales and prices slide through the fall and winter before long term rally beginning second quarter of 2023.

Last two week resales in Greater Victoria:

Single family: 81 (down 36% from 126 same period last year)

Condos: 68 (down 43% from 119 last year)

Townhouse: 23 (down 40% from 38 last year)

I don’t expect prices will fall in the rest of Canada and not Victoria.

Imo I don’t think low inventory is holding back sales but it helps to slow the slide in prices But having said that I guess prices are sliding elsewhere in the country on low inventory

Leo do you have the comparison numbers on what % and how many of these sales are SFHs? (I believe many of these sales are not SFHs)

I think for sellers there is a psychological aspect too, probably more likely to cut prices if every third house on the street has a for sale sign on it.

Let’s see if I’ve learned from listening to y’all.

Inventory is 7 months at current sales rate, which sounds great but is still historically very low. Sales historically pick up in spring/summer, so if that indeed happens, then inventory will not be enough to keep prices from climbing yet again.

Is that basically the concern?

2012 – 462 sales @ 5,000 listings

2018 – 592 sales @ 2,600 listings

Agree with this.

The strong rental market currently is keeping sellers at bay as you eluded to previously. Looks like the 5 year CAD yield is above 3% again today, I think we need to 5%+ mortgages on both fixed and variable for an extended duration to induce some serious cracks.

Wouldn’t inventory be a better measure? Or are you saying new listings drive inventory so that is more important?

Sales: 304 (down 44%) – sales starting to stabilize a bit. We will hit around 460ish?

New lists: 686 (up 9%) – interest rates don’t appear to be flushing out sellers. If my numbers are correct there is a reasonable probability we end the year at a 17 year low for new listings. This is worrisome for when the demand comes back.

Inventory: 2178 (up 74%) – this is going to look ridiculous the next 10 months due to all time record low inventory being the comparison.

We are looking at 460 sales this month on 2,200 listings. It isn’t a complete disaster.

2012 – 462 sales @ 5,000 listings

2018 – 592 sales @ 2,600 listings

Last week it was +12%. The chart above is a little different than the figures posted by VREB. VREB is all listings for all property types (including commercial) in the entire VREB system including a couple out of area listings.

The chart above is just new listings of resale residential properties in Greater Victoria (13 munis, no gulf islands), and it’s a 14 day running average instead of month to date.

9% seems like a large drop off from the graph just above?

On twitter https://twitter.com/martin_bauman/status/1561725121760358400?s=21&t=v7EU_Dovj2FAJf7Wh5HvAQ

Month to date numbers:

Sales: 304 (down 44%)

New lists: 686 (up 9%)

Inventory: 2178 (up 74%)

Decent sales numbers on Wednesday but otherwise little change from last week. New post tonight.

House prices in Victoria have not really adjusted downwards in Victoria which is not totally surprising to me. I expect that there will be some moment downwards in the coming year but so many of the buyers are retirees that the downward pressure might be less than other cities.

Patrick, first time buyers with cash immigrating here seem to be doing fine.

House prices are slow to adjust to rising interest rates. Victoria also has a very high rate of cash buyers who are not interest rate sensitive.

Home affordability for FTB in Canada has worsened since March 2022, with Victoria worsening the most of 10 Canadian cities measured, with 23% higher income needed to pass the stress test to buy a home.

A globe and mail article (july 21, 2022), based on ratehub.ca data, says that affordability has worsened across Canada in June 2022 (compared to March 2022).

The income needed to buy an average home has increased. Of all cities measured, Victoria was the “worst” – 23% higher income needed to buy a home, so $187,000 household income needed. The point is that affordability has worsened across Canada, despite the fall in house prices, as the higher rates are making homes less affordable. This likely means a higher % of sales will go to new arrivals that have cash/incomes to buy the homes (gentrification).

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-household-income-mortgage-stress-test/

Most Royal Bay houses don’t have income suites. Maybe 10% of houses do. And plenty of people want smaller lots … less to take care of and bigger yards aren’t necessary when you have parks and trails right nearby. But it really doesn’t matter what the haters on here think. People who live there love it.

Why would anyone with lots of money want a house on a cramped 4000 sqft lot? On top of that most of those have income suites and most of the finishes aren’t high-end either.

“Evidence, or is this just your estimation?”

From one of the realtors I know selling homes there. Plus my many neighbours there. The demographic has changed a lot in the last 2 years compared to 5 years ago. Also most of the people on my street aren’t from Victoria. They moved from places like Van and Toronto having made money on real estate there.

Evidence, or is this just your estimation? I would guess most buyers in Royal Bay are families with 80% LTV

“ What’s the monthly mortgage and taxes on one those Royal Bay Places that sold for $1.5 mil?”

Most buyers in Royal Bay have a lot of money. Lots of cash buyers and people buying expensive homes with pretty low mortgages.

As far as I can tell, rental inflation is a big part of the reason inflation is up as much as it is, so until it comes down, interest rates will keep going up. Which as we’ve seen increases the “rent” that home owners pay in the inflation metrics.

I’ve noticed rental prices dropping as well…. I think the tend will continue. Most of those Royal bay houses have suites in them rented for close to 2k. If they’re fixed mortgage they will be fine . Each time I bought a house I’ve bought at the peak and it recovered and I was stressed out. In 25-30 years it’ll be paid off and there will be breathing room.

It sucks to potentially be underwater for a decade but it’s hard to feel sorry for anyone who has the income and assets to buy a detached house in Victoria

https://www.technologyreview.com/2021/04/28/1023236/how-megacities-fight-climate-change/

Been watching those new build Royal Bay SFD rental listings go from asking near $5k a month in rent not too long ago drop down to $3850 now. Some of the madness might be wearing off that so called insane rental market. What’s the monthly mortgage and taxes on one those Royal Bay Places that sold for $1.5 mil?

I find it preposterous that people want to hold back a capital city from growing. I understand a quaint village or small community like saltspring island but it’s arrogant to think that the growth of a city should be limited to suit some selfishly idealistic vision

Living in at least some sort of town or larger collection of people brings some modern conveniences many don’t want to live without. Living in a rural community typically means you are also responsible for a well, septic field, snow removal, garbage collection, fire protection, long police response time, power and phone outages, wildlife control, fence maintenance, etc, etc. Many people would rather go to a coffee shop or restaurant instead of worrying about why the water is tasting funny today. While rapidly improving, there is also the issue of internet speed.

Personally I much preferred Victoria when it was about 300,000 people. Far better than the 5000 person town near the rural area I grew up in and infinitely better than Vancouver or Toronto but obviously there are many different opinions. Each to their own but I would lean towards an attitude of “If you don’t like it here, go somewhere that has what you want. Don’t move to a place and try and change it into something different.

Good Sunday morning!

I see that 1381 craigdarroch road is no longer showing as an active listing. Does anyone know how much it ended up going for?

https://www.bbc.co.uk/ideas/videos/are-15-minute-cities-the-future/p0cqty38

People are social beings for sure.

Deryk just look to New York City for your answer : young people like being around other young people in vibrant cities and eschew the rural life for the most part, paying exorbitant rents for run down apartments in seedy areas. The question is which cities will provide them with the incomes to do this. We already see this with the most talented Canadians moving to Silicon Valley. Young people live on the outskirts and justify their decisions when it’s mostly about affordability.

People clearly prefer to live in cities at the moment. One only has to look at the price that people are willing to pay for a house.

But will the next generation? They walk around the city right now with their faces jammed into their phone anyway:)

I find it interesting to ask the question.

Depends on the country and economy. A megalopolis with good economy then perhaps what you said is true, but smaller cities similar to Victoria then the price spread isn’t so obscene.

Land price on a popular street less than 3 km from my old family house in core Saigon (HCMC) now command more than $100,000 CAD per square meter, however 1.5 hour away to the south (cheapest area near Saigon) city lot can be had for as little as $1000 per square meter. Vietnam GDP per capita is $2785 USD, and average wage in Saigon is $1082 CAD a month.

I think what is happening is inevitable. Society is changing/evolving on so many levels. The pandemic necessitated the need for so many to work from home and it sped up what was already gradually happening.

Because of how seemingly quickly this is all happening, all levels of governments are going to have to change direction in terms of rapid transit systems taking workers into town,

The “green” people around the world should be delighted. In the big cities, because of the deminished polution, we’ll be able to see the stars at night and the blue sky during the day.

Shoot, I was on the phone while gayly banging this out and pressed the wrong button before I was finished…………….lucky you!!!

I can’t see it happening in North America let alone around the rest of the world. In other parts of the world people place a much higher value on living close to the core of a majority city than we do in Canada. In Croatia, the equivalent of a Sooke SFH would be 1/2 or less of the price of a condo in Vic West, in an equivalent city. That being said the city centers in Europe are much nicer on average with century old streets, car free zones, etc.

My condo in Zagreb is worth approx. 300k euros. We sold my grandparent’s 10 acre farm, small lake/pond, house, amazing natural beauty close to Plitvicka Lakes National Park (google it) 1:45 drive away from Zagreb for 35k euros and lucky we got. Groceries, hospital, schools, and everything else with a 15 min drive of the farm. On average, people simply don’t want to live in the countryside/smaller places even if they have the basic amenities there and can work online.

Change happens. But when all of a sudden 25 percent of the pie goes missing, there won’t be enough dessert to go around.

This is me living in fantasy land most likely but I love the idea of all office workers switching to remote and the existing downtown office space converted to either housing or green space.

Many global companies have been doing this for years. Reduced office costs are a big saving.

Pre-Covid my wife’s employer had a Victoria office but only about 60% of the Victoria area employees ever showed up there. Post Covid they decided that remote work was going well enough that they gave up their Victoria office lease and everyone is now remote.

The demise of cities has been imminent for a long time.

https://www.nytimes.com/2021/07/12/upshot/covid-cities-predictions-wrong.html

If you grow up in a small rural community like I did, the allure of cities is much easier to understand.

I’m really not sure which side of the fence I’m on when it comes to what the effects will be as more people start to work from home and what effect that will have on cities.

It is somewhat discouraging, to hear city leaders complain as they try to get everyone back into the office …just so that business such as coffee shope, Restaurants and overpriced clothing stores stay viable. They seem oblivious that more and more people are refusing to own a second car with all those expenses such as gas, repairs etc. instead choosing to spend more time with their kids and family.

For our city leaders, it’s all about getting people back into the downtown to buy all the crap.

My daughter is young and refuses to ever go back into the office. Her employer supports that idea because they don’t need to expand their office and they get an employee who is super happy, alert and loves her job. She gives them more than their money’s worth.

It’s always hard to predict what it all means for cities and real estate.

My gut feeling tells me that long term, cities will shrink and slowly rot further.

As an artist, over the past several years, most of my work is sold online from enquiries around the world. That’s a huge shift from the days when one absolutely needed a gallery to represent one’s work.

Things do not stay the same.

We love Sooke by the way. Taxes are less. Housing costs are much less. People are friendly. Beaches are absolutely gorgeous and accessable. And our Victoria friends are close enough to zip into town and meet up with when we want to and visa versa.

Good point. And in the case of two equal performing employees, the one who shows up to do a little schmoozing may gain an advantage in a competition.

Patrick, language does change. It changed from IT sector to just tech. When did you least hear a newscaster talking about “IT stocks” and not “tech stocks”?

Clarity should be a primary aim of almost all non-artistic writing (poetry, etc). Saying “IT job” is ambiguous in a way that “tech job” isn’t. Feel free to keep introducing ambiguity, it’s your life.

You’re mostly right but there’s something to be said for building social connections, and in hybrid offices: If people get an unfair advantage by socializing and building in-real-life relationships they could also get a competitive edge for a promotion. There’s also the risk of people talking shop offline and the remote workers missing out on important conversations as a result. Might depend on how good the remote culture is at any given company. Some companies it’s not a concern at all, other companies it might be.

I don’t really understand this take. I manage a small team that is 100% remote. I know who the top performers are and that’s what matters to me. In a hybrid environment, I would assign zero points for showing up and keeping a seat warm. Having said that, some employees might perform better in an office environment…but all things being equal, I don’t care if I ever see your face in person as long as you get things done.

A couple of comments on recent posts: Having lived through the early 80’s (I bought in August 1981 at $20,000 off the original asking price). Prices didn’t really start to drop dramatically for several years. Sales were slow but anybody that didn’t have to sell hung on hopping to get a better price. It took a long time to get used to the idea you were going to have to accept a lot less than you might have once received. In some industries they call it the capitulation point.

Re working from home: Several people have mentioned the reduced promotion potential of not being at least somewhat visible in the office. For most traditional offices (ie ones where most staff have some office time and it isn’t a 100% virtual company) I think that is a very real issue. I would strongly expect that the most likely candidates are senior employees within 10 years of retirement who are valuable for their history with the company. They are more likely to be able to demand to be allowed to work remotely, less worried about promotions and worst case, if it doesn’t work out they can retire.

I agree, although it does seem like most sales are going under ask. Some marginally like say $15k but others significant like $50-100k

While sales are slow I am not seeing much in the way of price drops. I wonder how many days on market before people start thinking it may be time to adjust the price?

Agree with Garden Suitor. IT does not mean tech like you are thinking Patrick

That seems too complicated for me to understand or follow. Usage of terms in the English language change over time, usually to simplify them. And for me that means it’s OK to use the terms “IT”, and “IT sector” synonymously.

Thanks for the discussion.

“Information technology sector” has been shortened to “tech sector” or just “tech”. If you want to speak to the sector with just “IT” then you really need to make it “IT sector”. Otherwise it’s an anachronism. Heck, even saying “IT sector” instead of “tech” is quite dated to me.

But really it’s “an IT job” that is the ambiguous part. “A job in the IT sector” would include engineering.

IT departments are alive and well even in tech companies, I’ve had to deal with a few of them in my previous roles. Engineers (or developers/programmers/etc) generally know how to operate their machines. The IT dpmt is there to support other functions like marketing, sales, support, etc, for ensuring security policies are followed across the board, and device procurement and provisioning.

And I wouldn’t put any weight on listicles like that indeed link you posted. They typically are low value, put out for SEO blog spam purposes.

That was an interesting report Deryk.

It raised the issue of increased immigration of highly skilled workers who can keep their jobs in their home country – largely from the US. I would not be surprised if this starts to be a trend for people in the tech sector.

As an aside, one of our sons works for a big tech firm in Toronto – he was hired remotely and works from Victoria with a trip out to TO once or twice a year. No requirement to work from their offices but he needs to work on their time zone and he is limited to working abroad for more than two months a year. Hiring was based on demonstrated skill set and not location.

My other takeaway was don’t start a business downtown that services office workers – which is most of the businesses.

These are 3 remote worker “bogeymen” that have arrived onto my street in the last two years:

– guy from Manitoba with an auto business in Edmonton that he now runs remotely

– lawyer from Toronto that works remotely here

– pension fund manager from Vancouver working here remotely

Sorry GardenSuitor. For general use of the terms, “Programmers” like you are included within the broad use of the term “IT sector” (Information Technology)

And that doesn’t change if a programmer is called a software “engineer”, software “architect, or software “designer” , software “developer” etc.

I get the idea that in the old days a company would have an “IT” dept in the basement, with guys to fix hardware (ie mostly tell people to “restart the computer”). And maybe some still do, and some people like you still use the “IT” term narrowly to describe that..

But for common usage, acceptable use of the term “IT” has been broadened, and is synonymous with “tech”, and it includes software.

For example, here;s a list of the 23 job titles that are included in “IT” . You’re listed at # 5 “Computer Programmer” (and yes, I know that you’re so much more than that)

https://ca.indeed.com/career-advice/finding-a-job/careers-in-it

https://vancouvereconomic.com/wp-content/uploads/2021/02/Research-Brief-Remote-Work-Downtown-Vancouver-and-Property-Taxes-Final.pdf

Personally the ‘remote worker ‘ bombarding Victoria sounds like a lot of the other boogie men that make their way into this forum; – ie the Hong Kong people who were all going to flee here we when things got rough with China, or the Americans who were all googling how to move to Canada when Trump got into power. I doubt it makes any noticable impact.

Patrick, by “IT job” do you mean anyone in a tech company (Google, Shopify, etc) including software engineers? If so, it’s best to use “tech job”. As a software engineer I would never have described what I do as an “IT job” because it’s not accurate.

IT is a service role within a company managing employee computers and related infrastructure. Most knowledge based companies have IT roles, whether explicit in job title or carried by an office admin, etc. Big enough companies have entire IT departments headed up by a CISO.

Victoria and Kelowna are the only two CMAs in Canada that have more deaths than births. Have to make up that shortfall somehow.

Hm good question and I really don’t know, but I’m guessing there could be more coming? Like the first year of the pandemic you’re not sure whether it’s permanent and don’t want to make major life changes… then you settle in to the new reality… then you start thinking about “hey some of my friends moved, maybe I should too” – to be one of the people who moved in the first 2 years is pretty quick/aggressive, I imagine other people are a bit slower to adjust and make major life changes?

But I don’t know what percent of the population that even is, maybe it’s not enough people to make a difference.

Only the (near) 100% remote workers are relevant though. Most remote workers are hybrid and they can’t live in Victoria and keep working in Toronto. Even Vancouver to Victoria is unlikely for someone doing hybrid

Would be interesting to look at the employment numbers by industry and see where the growth has been in Victoria.

I think Victoria is just getting started. We will be getting the affluent work-at-homers, whose employers let them work wherever they want. These will be “ROC stars” – Toronto/ Vancouver/ Calgary lawyers, accountants, engineers etc. They will move to Vic., buy nice core SFH homes and work remotely for their companies back east

The total work-at-home numbers are huge. There’s 20 million employed in the Canada workforce. According to StatsCan, 24% work from home now, compared to about 4% in 2019.

That’s 4 million new work-at-homers in the last 3 years in Canada. Victoria gets about 5,000 Canadians moving here per year, the highest per capita (along with Ottawa) of a major city. So we know that ROCers love to move here. Now they don’t need a Victoria job waiting for them to move here – they’re bringing their job with them!

I know 5 people who moved from Toronto and 2 from Vancouver working remotely. All of them are earning Toronto wages and living in the core. Same job in Vic would pay a fraction of what they are making.

Wow, looks like open houses are making a comeback now.. Quite a few this weekend compared to the last while. Hopefully Marko’s clients haven’t pulled him into hosting any.

But – assuming remote boosts Victoria demand – is that already baked in (I.e those remote workers that were going to move to Victoria already have in the past 2 years) or is it still upcoming?

I’d say remote is bullish. Sure you can find cheaper AND similarly beautiful parts of pnw BC to work remote, but Victoria offers a lot more amenities. Good mix of amenities/beauty/“affordable” at least compared to Vancouver. Ignoring the healthcare problem of course, but I don’t know if people really research/think about/realize this when considering a move.

The government was already slow and bloated enough.

With more people working from home there is good reason to can 25% of the workforce. If these people are really a skilled as they are, they won’t have a problem getting a job somewhere else. Typically people are getting around a 10% raise, just switching positions.

Working from home has its place. I have some staff who are very highly productive at home. However, they also like to come in the office once a week. This nice thing about having billable time when you’re charging clients by the hour, you can quickly see things go sideways with an unproductive individual.

In April, across Canada, 19% of workers worked exclusively from home. Yet in Ottawa, same month, nearly 50% of Ottawa Residents were working from home. And guess what, they don’t want to go back.

PSAC employees will be pushing for this “right to work remotely” to be included in their union contracts.

What is going to happen to all those office buildings? The older ones will probably rot in place. And who needs a condo to own or rent downtown when no one is working in the area any longer? What about the taxi drivers, the bus drivers, the little dress boutiques, the cafe’s, restaurants and coffee houses, the child care workers, the office maintenance workers and cleaners, and so on? Where are they going to work from? Do you think unemployment may go up?

Will the Canadian economy boom?

Really hard to say if more remote is bullish for Victoria housing demand or not. I’d generally lean to somewhat bullish, though I’d say even more bullish for other island or say kootenay communities that are just as nice in many ways but cheaper.

It is getting hard to recruit for government positions in Victoria – competitions are failing as a result. Multiple ministries are now allowing positions that used to be restricted to Victoria to be located in ministry regional office if space is available (if the candidate is already located there in most cases). Often locations are listed as Kamloops, Nanaimo, Kelowna, Cranbrook, etc.

The medium term challenge will be for the PSA to secure more office space in these locations.

As long as Victoria isn’t “the” most expensive city and still one of the most desirable cities then I think remote work will be a net positive. I believe the stats for the last couple years have shown buyers from Vancouver being significant. You could still sell in Vancouver and retire in Victoria without downgrading your housing. Personally Im trying to get there for lifestyle and I would be going from fairly inexpensive to Victoria expensive. Happiness trumps all for me.

I see very little evidence of this. Most paper pusher jobs with the provincial government continue to be located in Victoria. You’d have a really hard time recruiting if you started restricting positions to geographical locations like Prince Rupert.

For homeowners in the expensive cities with supposed high cost of housing , the net “cost” of housing has been less than Zero for most people. By that I mean their equity in the house they bought exceeds all of the house payments they’ve made.

People may be happy coming to Victoria and paying a lot to buy a home. Because they expect to make back what they pay and more. And enjoy a nice home in a great city along the way. May sound too good to be true, but that’s exactly what’s happened for most homeowners in Victoria.

If you have a high paying remote job and want to stay in Canada, then you might choose Victoria. If you have a less high paying job and work remote you might choose a less expensive location. Victoria is pretty built up and we already have greater immigration than emigration so not sure how big of a factor this is overall.

Yes, but a lot more people do have to worry about the price of the city they want to live in. Given that, do you think remote work is going to be net positive or net negative for one of Canada’s most expensive cities?

https://knowledge.wharton.upenn.edu/article/whats-going-to-happen-to-all-those-empty-office-buildings/

Some people make a lot of money and don’t really have to worry too much about the price of the city they want to live in. A lot of people seem to think money is the only thing that matters to other people when in fact many of us chose to live where we are happy and don’t care if we could be living somewhere cheaper.

The point is that an employer in Calgary or Edmonton only has to offer enough pay for a reasonable standard of living in those cities. On top of that someone working in BC for an Alberta employer has to pay BC taxes, both income and sales. So you’d have to like Victoria an awful lot to take that kind of economic hit.

Not to mention the legal issues with an Alberta employer having an employee working in BC.

Remote work is about more than saving money. If you don’t like where your job is you can move to a city you like. For some people Victoria is more attractive than Vancouver Calgary, Edmonton or somewhere else.

That would be my take. If you could work anywhere, wouldn’t it make more sense to move to a less expensive market? Or for Victoria prices, you could move to San Diego and enjoy year round summer like weather.

It’s not that harsh, doing workplace health and safety evaluation and maintaining it for a remote workforce of declared employees is a massive incumbrance. We did when we sent our employees home and accepted a huge liability in locations that there is no control on by an employer. The way that liability is removed is by return to office or they become contractors. The first step, is any new worker looking for work from home is offered as a contractor, the steps after that are the ones already employees looking to stay home.

Isn’t the point of remote working is to get away from the cities where most of your pay goes towards a mortgage? A better lifestyle comes with more disposable income. It’s not what you earn, it’s what you keep. Trading Vancouver for Victoria is just a zero sum game.

Trade Vancouver for Mudge Island and you’ll be retired in 10 years.

I wouldn’t be that harsh but people need to think whether or not its realistic that companies will allow you have the freedom and benefit to work from where ever you want while maintaining your previous compensation and job security.

That would likely be true of anyone working in conventional employment in an institutional setting.

He is trying to say that not many will be working remotely in Prince George because everyone who is able to do remote work will move to Victoria or another desirable city, hence it is bullish for RE prices.

Job markets change and can change quickly, of course talent can always demand a bit more accomodation, but those refusing to return and go looking for other work are likely to run into a few things, such as lower compensation or becoming a contractor (losing benefits and security). Employers don’t want to accept the liability of the off-site office workplace being expanded indefinitely, especially on the health and safety aspect and making those folks contractors solves a lot of that. Not to mention, saving on benefits and future pension liabilities. Work from home folks, be careful, you are likely to get what you’re wishing for (in the remote part), but the rest of the terms are changing.

Lol good luck to those workers.

True, but given that, why wouldn’t the employer just hire someone who lives in Prince George, which is much more affordable. That’s assuming that there are software companies in Prince George.

And that leads to a broader issue – why would a software company look for remote workers in a city that’s more expensive than their home base? Isn’t it supposed to work the other way around? So Victoria versus Vancouver OK, but that’s just about it.

I can see that for government workers. Because they have a “job for life”, but need to work how/where the government wants them to.

Other remote workers aren’t tied to employers as much. If a programmer in Victoria is working remotely for a Prince George software company, he’s not going to be worried that they’ll ask him to move to Prince George. If they do, he’ll quit and find a different remote job, still working from Victoria. Statistics back this up, about 40% of remote workers say they’d try to find a different job if their employer insisted on them going back to the office. In the current “worker shortage” job market, they’d likely have little trouble doing so.

Regarding government workers. Governments are often trying to move govt jobs to rural areas with higher unemployment and low growth rates. Maybe they’ll advertise the remote jobs with a condition that the remote worker works from a rural area. And they don’t need to build anything new there. If so, Victoria might lose government jobs…. To places like Prince Rupert! And BC government jobs get spread equally across the province.

I work remotely 100%, but without an agreement that is set in stone. Thus, while I save time by not commuting, and money by not having to buy polyester clothing, I am not in a position to be able to move out of the City. How many other full time remote employees are in that predicament?

The stats are statCan data from Canadian businesses, not employees. And they reflect the expectations of the businesses (employers) over the next 3 months (May-July 2022)

Canadian Survey on Business Conditions, second quarter 2022

https://www150.statcan.gc.ca/n1/daily-quotidien/220530/dq220530b-eng.htm

the July Labour Force survey measured 24% of remote workers working 50% or more remotely in July 2022.

This lines up very well with the estimate in the business survey for 23% of employees working 50% or more remotely.

36% of remote workers in BC are 100% remote. It sure is “feasible” for them.

As you can see from BC stats on the chart in previous message, 23% of BC workers are remote (ie 50% or more remote).

And 36% of those 23% remote workers (36% x 23%=8.3%) are 100% remote. =/23=36%).

that 8.3% is too high of an estimate in my opinion.

Here ya go..

https://www.statista.com/statistics/1313447/work-arrangements-canadians-telework-province/

“ Work arrangements anticipated by Canadians for the next three months regarding telework in May 2022, by province or territory”

True. I wonder what the numbers are for 100% remote?

That’s something a nice recession will be able to address real quickly.

Your original point was that people are moving to Victoria because they can remote work full time. I don’t think that is the case because most remote work is a hybrid structure so unless you want to do the commute from say Edmonton couple times a week it just isn’t feasible.

1197 Lynn Rd Tofino. Listed 2.59 million Sold 3 DOM for 2.8 million. Someone didn’t get the memo

Ya, brevity is lost on some people. Email is frustrating, I try to explain to folks since I am reading 300+ emails in day, if what you’re asking isn’t clear between the subject line and the first two lines of the email content, it doesn’t get read. As for reports, always have to hit people over the head with main/critical points in the exec sum (most only read the one page) and have the complicated stuff to find well and simply indexed so they can feel dumb for asking when it’s pointed out to them.

Offshoring to India has been going on for decades. The relevant metric is our unemployment rate, which is at/near record low in BC and Canada.

A portion of remote work can be farmed to offshore centers. They are cheaper. The IT workers in Victoria are cheaper than in Silicon Valley because of the exchange rate. Most will be sub contractors so when the Canadian dollar rises relative to the US they are not given as much work.

It actually worked great, It kept team meetings on schedule. No meeting needs to be the entire day, tasks and production were figured out and when you get to the office you get to see the production from the night before. Review it, add notes and any other work and it was good to go.

Unemployment in April 2020 was 13% (up from 5% two months previous). https://www150.statcan.gc.ca/n1/daily-quotidien/200508/dq200508a-eng.htm

So that leaves 87% employed, and 40% home workers x 87% = 35% of the total work force working from home.

And then add back the 13% unemployed and you have 48% of the total workforce “ at home”. And close to the same number (52%) working outside the home.

Now (July 2022) there’s 24% at home, and 5% unemployment.

So that’s .24x.95= 23% of the employed working from home. And another 5% unemployed “at home”

Since it looks like the working remote numbers (24%) are holding up post Covid, this would seem to be a huge transformation affecting office real estate (negatively) and residential real estate (positively). And just like office workers like to work in “nice offices”, I think many remote workers who are able to will move to Victoria, buying bigger homes (SFH) with rooms for nice home office(s)

What I hate about working remotely is emails! People are just too damn lazy to read your work, so they email you. Then you end up cutting and pasting sections of your reports to them that already had the answers. And while you try not to be snarky in your emails, it’s hard not to imply “if you just read the damn report”.

Just saw 1611 Kisber Ave come up in my PCS.

Good Lord, if that atrocity doesn’t sell below-assessed, I’ll hang up my Bearish spurs for good.

someone in India is going to be working when you are asleep and asleep when you are working. Remote collaborative work really needs to happen in at least a decent overlapping time zone. I worked in an office that had two location. One hour time difference and they changed the Vancouver office hours so people would be at work at the same time.

Thanks Leo. Reading helps! 🙂

The trouble with work from home and work from anywhere, you need to make sure that your talent is unique and that you can demand the pay. If I don’t need to see you in the office, fine, but if I can find someone in India, it’s no different than someone living Lakeside in the BC interior doing the work, except for then pay level. 2/3rds of the last programming team I used was in India and worked great and it saved a lot.

In this case it’s “most of their hours at home”, so they would be counted as remote.

Out of curiosity, do those numbers apply to those who are partially working from home, or entirely?

We just went down south a few weeks ago to visit friends/family, and from talking with a few of our Silicon Valley friends, seems like a lot of folks in that field are working from home 3-4 days a week, but in the office 1-2. Not sure how folks like that get counted.

Also, Patrick, thanks for the comment about Renaissance earlier! I’m generally very skeptical of machine learning too, but the proof is in the pudding I suppose. (And, to Simons’ credit, the man has an enormous philanthropic effort. He singlehandedly funds about a third of pure mathematics research in the States these days, along with serious efforts in theoretical physics, biology, etc.) Regarding the closed fund, yeah, it’s definitely a lot better than the open one. Probably the single best non-salary benefit of working there is the option to invest in the closed fund.. :p

Thanks. Huge numbers given there aren’t any meaningful COVID restrictions left.

That’s 40% of the people who were working. But a lot of people whose jobs could not be done at home had simply lost their jobs. Unemployment was 13%.

I can add that at my own place of employment we can work at home (except those tied to hardware on site) but we are required to be available on site when requested.

From the earlier StatCan link I posted, statCan told us “ Roughly 40% of Canadian jobs can be done from home”

… and the labour force survey tells us that 24% are currently being done from home.

That means 24/40= 60% of all jobs that can be done from home ARE being done from home. At that transformation has happened in 2 years.

Labour force survey for July 2022, released aug 5. Work at home % is 24%, which is up YOY from 21% in July 2021.

https://www150.statcan.gc.ca/n1/daily-quotidien/220805/dq220805a-eng.htm

“ the proportion who worked most of their hours at home [in Canada, July 2022] edged up 0.4 percentage points to 24.2% (population aged 15 to 69; not seasonally adjusted)”

Thanks Patrick. For some reason I can’t find up to date info from the labour force survey. Curious to see what it is now

The labour force survey has been collecting data on % remote workers since the start of Covid (April 2020, when it found an incredible 40% working from home). It has tapered off to be about 20%. An interesting thing on the chart of percentage people working from home is a single data entry from 2016 showing 3.6% working at home.

If you look at the chart you might miss that 2016 data point.

https://www150.statcan.gc.ca/n1/pub/36-28-0001/2021010/article/00001-eng.htm

I think statscan started collecting data on this (remote workers), do you recall where this is?

I think you’re out of touch there. For example, most IT remote jobs aren’t restricted to city limits.

For remote jobs in general, browse through the “remote” listings, and less than half of them mention a city. https://ca.indeed.com/jobs?q=Remote&start=10&vjk=0c4c0eb89db499ed

You’ll find plenty of remote jobs that allow you to work in a different city and don’t require you to be a “true rock star”

In some cases being seen and known in the office might put you at the front of the line for layoffs. I have no doubt that I probably annoyed more than one person at my office.

Thanks Leo, those are my thoughts as well.

I don’t have any data on this, but my thinking is yes because:

1. Sellers with discretion on when to sell tend to time it for the spring or fall markets. If you have to sell then you have little control over when to list and might have to put it up in November so the chance of a winter listings being a motivated seller should be higher.

2. Many sellers try to list in the spring or fall and if it doesn’t sell they cancel the listing and try again next year. If listings are still there in the winter there’s probably a reason (again, higher percentage of active listings likely motivated)

Also, when layoffs happen you can bet someone who no one has ever seen in person will have a target on their back.

Very few jobs will allow for someone to live in a different city and work remotely full time, you need to be a true rockstar to have that kind of sway. So I don’t anticipate many people moving to Victoria because they can work their big city jobs fully remote. What I do see is people moving to the golf islands because they have a hybrid work structure from their Vancouver/Victoria job. The Victoria to Vancouver commute is a little too tedious via ferry and cost prohibitive via harbour air/helijet.

Hey guys, just wondering if anybody knows how much 2697 Otter Point road sold for? Thanks in advance!

Interesting reddit discussion on news of “Oak Bay plan to diversify housing types”. Note participants’s ages there are mostly between mid/late 20s to early/mid 40s.

https://www.reddit.com/r/VictoriaBC/comments/wrsboh/oak_bay_seeking_feedback_on_plan_to_diversify/

I started working from home in 2005. It worked well for me, but did not work for all my employees, some of whom needed the structure, oversight, and social life a workplace offered. Being a manager is a paid position for a reason.

Before COVID the tech company I work (10,000+ employees) for was very supportive of remote with about one third of the North American work force remote. I have been grandfathered in, bit all new hires now need to be tied to an office and they are “encouraging” everyone to come in 3 days a week in their new hybrid work approach.

Some companies will decide to go fully remote, but from what I see most mainstream companies prefer to have their employees in the office.

Already happening. It’s a supply and demand thing basically – remote work increases the available labour pool. For example, and this article is a year old.

https://www.reuters.com/world/the-great-reboot/pay-cut-google-employees-who-work-home-could-lose-money-2021-08-10/

I would expect unions representing office workers – and that essentially means in government – to resist two tier pay. But the flip side of that is if the employer has to pay the remote workers the same, there’s no incentive to let people work remotely.

I wonder if remote workers will be paid less? Then there is advancement in companies. I would guess that owners would have a bias to promote workers in the office over remote workers.

I would say its more open concept than cubicle lol, but yes expectations are that working from home will be more stringent as we move forward. If you move to a different city thinking that WFH will last forever then you should consider getting something in writing and have your lawyer read it over.

RBC apparently is also thinking the same thing and that may set a trend for other employers: https://www.reuters.com/business/finance/canadian-lender-rbc-looks-bring-more-employees-office-2022-08-16/

You mentioned that you work in an office “cubicle”. Do you really see the trend going to more people working in cubicles?

Ok, i will stick by my original assumption that Victoria people are slow to realize changes in the current market.

Seems like similar trends in desirable cities. At least for detached SFH.

https://blog.remax.ca/hottest-areas-in-greater-vancouver-greater-toronto-housing-market/

Also bucking the downward trend in the Greater Vancouver housing market in terms of preliminary estimates of Q2 median values are the core regions of Vancouver West (+2.4 per cent) and West Vancouver/Howe Sound (+8.2%).

Active Inventory Down in GTA & GVA

Despite the softening in housing markets overall, active detached housing listings in June were running almost 19 per cent below the 10-year average in the GTA, approximately 12 per cent below the 10-year average in the GVA and close to nine per cent below the 10-year average in Fraser Valley. This, at a time when builders are pulling up stakes and shelving proposed developments due to softer demand. While the impact of those decisions will not be felt immediately, the decision to withdraw will have major repercussions on housing markets in these major centres down the road.

“Inventory remains a puzzle that policy can’t solve in the foreseeable short or long term,” says Alexander. “It’s a real challenge, as supply of detached homes remains low from a historical perspective and also in the context of population growth and future needs. This will remain a crucial factor impacting Toronto and Vancouver, which are now seen as world-class markets. Tougher market conditions and a possible recession will be major market hurdles, but history reminds us that recessions often bring strong rebounds. There’s always a reason buyers say, ‘I wish I’d bought back then.’ Real estate has traditionally stood the test of time. Looking ahead, urbanization alone will be a significant boon to future housing demand, as Canada’s urban population is projected to grow by 10 million by 2050

Normally no but given Toronto slowed down a couple months ahead of Victoria it’s something I’m keeping a close eye on. Too early to say if it’s real or not

Lol, check back in a year with this assumption. I have a feeling it will be less than what it is currently.

Are we using the big cities as a leading indicator now?

I don’t think demand ever went away.

This points to higher prices coming.

They are both benchmarks.

benchmark definition: a standard or point of reference against which things may be compared or assessed

“ May 18, 2022 — The Teranet–National Bank National Composite House Price Index™ was developed to be a benchmark for financial professionals” https://housepriceindex.ca/2022/05/april2022/

Hmmm…. Toronto

No, it’s a repeat sales index. A different methodology.

Averages and medians are affected by sales mix. Analysts like Benny Tal have pointed this out as factor exaggerating the drop in Canada wide house prices.

Moreover, teranet is a Benchmark index. The Victoria MLS HPI benchmark for greater Victoria SFH rose 3.4% MOM in April compared to March. So that doesn’t indicate that Victoria SFH were “well beyond the peak”.

Anyway, if your point is that teranet lags 4 months instead of 3, that’s “small potatoes”, and hardly worthy of calling it “suspect”.

Could be but half of the cities on there are still showing at peak pricing (including many in Ontario) – many more are very near peak in fact all but two are within 2% from the peak. Most averages, medians, realtor experiences were saying we were well beyond peak by April so to me that timing seems a bit suspect.

Marko, it is the trend line for the last six months for gross revenue sales that I’m watching. Lower sales revenue during the last few months is a trending lower and that means less money circulating in the local economy. Less money circulating means fewer and/or under employment in jobs associated with real estate. So I’m guessing that there will be a softening in demand for labor and materials.

Properties currently under construction or renovation are not effected, but looking forward there may be further weakening with contractors having more control over the wages they offer to pay as the pool of workers increase.

Lay-offs or under employment in new construction should result in an increase in workers in the home renovation business as workers try to augment their incomes. So it should get easier, relative to the prior months, for home owners to find a contractor or contractors to take on work that they would have passed on before.

Let’s see what happens over the next six month.

Teranet House index out for “July” (rolling average of the last 3 months, and completions not sale date).

So it likely reflects sales 3 months ago – April 2022.

https://housepriceindex.ca/2022/08/july2022/

Canada down -0.2%,

Victoria up 0.51% to all-time-high

Victoria Teranet YOY up 19% YOY (the 19% YOY rise is less than the April 2022 vreb 25%+ YOY seen by average 25%/ median 24%/ benchmark prices 31% YOY to April 2022 https://www.vreb.org/media/attachments/view/doc/stats_release_2022_04/pdf/stats_release_2022_04.pdf )

As the name states plainly, that’s a preferred share fund. Preferred shares are a form of fixed income and their returns aren’t comparable to common stock indexes such as the S&P/TSX 60.

What’s the difference? Down payment = investment.

I’m being a little cheeky. I do see your point.

With much search and drill down, DCP.TO holding is mostly Canadian equity at 88.88%, and if they are so clever then perhaps their ETF witb MER rate at 0.54% would at least match or out perform the S&P/TSX 60, and not 28.09% lower than the S&P (dividend and MER are factored in).

Top Holdings

Holding Name Market Percent

CAD Currency 2.21%

Royal Bank of Canada – Pfd Sr BD 1.51%

Enbridge Inc – Pfd Sr 19 1.40%

Fortis Inc – Pfd Sr M 1.33%

Toronto-Dominion Bank – Pfd Sr 24 1.30%

Bank of Montreal – Pfd Sr 27 1.27%

Royal Bank of Canada – Pfd Sr BB 1.25%

Canadian Imperial Bank Commerce – Pfd Cl A Sr 47 1.24%

Toronto-Dominion Bank – Pfd Cl A Sr 5 1.24%

Royal Bank of Canada – Pfd Sr AZ 1.24%

Google search show it as a member coop. They do not have stock but do sell debentures and securities.

Caisses populaires don’t have stock, as far as I am aware. They are non profit cooperatives.

Perhaps you can find a less bogus comparison for Desjardins because I can’t find it, and the quoted Desjardins ETF is sold and manage by Desjardins itself.

That’s a bogus comparison. You are comparing the stocks of the banks themselves with an ETF (which one? who knows) managed by another institution. Not even apples and oranges, more like apples and mushrooms.

https://www.fondsdesjardins.com/etf/prices-performance/

To me it would be more credible with their predictions, if they run a solid company that their stock/EFT and beta would at least track closely with their peers.

5 years share price return and yearly dividend.

RBC stock up 39.91%, 3.97% dividend.

TD stock up 38.52%, 4.03% dividend.

Desjardins ETF down 7.97%, 4.24% dividend.

Cancelled, bought from a biding war earlier this year.

Quant funds don’t do better than the market overall. Yes, the renaissance medallion fund that you mentioned has done great. But it’s not open to the public. The same company does have a quant fund that is open to the public, but according to this article, it has underperformed the S&P over the time they measured https://www.institutionalinvestor.com/article/b1q3fndg77d0tg/Renaissance-s-Medallion-Fund-Surged-76-in-2020-But-Funds-Open-to-Outsiders-Tanked

One difference between a law of physics and an apparently discovered “law of the stock market” – the law of the stock market can make you money, but if others discover the same law, it will likely lose you money! Famed investor Ray Dalio describes that here ….

——-

“Another advantage of quant funds comes from their ability to draw insights by analyzing large amounts of data in real time. This might not necessarily be an advantage for future events, as noted by renowned fund manager Ray Dalio:

“If somebody discovers what you’ve discovered, not only is it worthless, but it becomes over-discounted, and it will produce losses. There is no guarantee that strategies that worked before will work again,” he says. A machine learning strategy that does not employ human logic is “bound to blow up eventually if it’s not accompanied by deep understanding“

——-

There are great quant firms like Renaissance. But there are also others, that instead use high frequency trading techniques that don’t require PhD’s modelling anything . Anyone interested should read this book… Flash Boys: Former RBC trader hero of Michael Lewis’s new book on how U.S. stock markets are rigged “ Everyone who owns equities is victimized by the practices, in which the fastest traders figure out which stocks investors plan to buy, purchase them first and then sell them back at a higher price‘ https://financialpost.com/news/fp-street/flash-boys-former-rbc-trader-hero-of-michael-lewiss-new-book-on-how-u-s-stock-markets-are-rigged

Did the house on Clifford (around 2.5m) sell or was it taken off the market? Thanks in advance.

From: https://www.reuters.com/markets/us/fed-minutes-may-hint-rationale-size-coming-rate-hikes-2022-08-17/

Agreed, Marko. (Although to take advantage one got to have enough financial stability to put monies into investments instead of say having those funds tied up in a future down payment..)

Perhaps I’m being too roundabout, but what I’m hinting at is that the best people I know in the quant-fi industry are almost completely abandoning efforts like the forecasts Leo was citing. They don’t take them seriously at all, and instead are going all-in on modeling these things the way one models a gas of particles. Yes, absolutely, that’s common sense (to not take these predictions too seriously), but as the old quote goes “common sense isn’t so common”..

Can confirm, Leo’s reports/graphs are on par or better than institutional sell side reports from the big banks.

I don’t, government agency. If you are making 6 figures vacation, flex days, pension writing non-sense reports with tax payer money why would you care at all. At TD at least there is a small chance they can you if are consistently way off.

They probably spend millions on reports Leo could do a better job on as a side hobby.

Thing is gross sales revenue from real estate for 2022 will be the second highest on record only behind 2021. Who knows what 2023 brings but this has been a stellar year riding the huge revenue seen in the first four months of the year.

Good luck with that! While there will be some industries competing for a smaller pie (i.e. realtors) I just can’t see skillful contractors being short of work. As I said, we had issues finding trades on a brand new build on Shakespeare Street in 2011 and that was 500 sales on 5000 inventory type environment. That is about the time I started blogging on HHV about the absolute shortage of tradespeople.

Not a physicist. In fact I dropped out of highschool calculus and then out of organic chem at university so I am not that intelligent. However, I do have common sense and I didn’t fail out of grade 6 math.

If the S&P returns 10% average/year and you can get it right more often than not than it wouldn’t take long to become EXTREMELY wealthy.

If you can’t grasp the concept that markets cannot be predicted with any sort of certainty you are bound to fail in life imo. It leads to bad financial decisions such as paying high MERs (you falsely conclude the money manager can outperform and fall for the 2% MER), falling for get quick rich type business models, and everything else.

Regarding accuracy of predictions from large financial outfits, FWIW, here’s a physicist anecdote for you. Some years ago Jim Simons (mathematician at Stony Brook) decided to stop doing research and founded a quantitative finance company (Renaissance), and then hired a bunch of top-tier talent in mathematics and physics. Think people that either were tenured researchers at large research institutions, or were good enough to go down that road. Anyway since starting they have, well, roughly speaking, taken every body else’s lunch money in that field. Among other things they’re responsible for the push in high-frequency trading, 2008 was one of their best years, etc etc.

Anyway their methods are not at all open-sourced, but the main thing I’ve learned from talking with friends there is that those methods are mostly stochastic in nature. Meaning, they are able to model the market reasonably well as a random process. Many times they get it wrong, but more times they get it right, and when you have a high volume of trading all that matters is that you win more than you lose.

Long story short, I find it fascinating that some of the best people in quantitative finance have given up on deterministic predictive accounts of the market and instead gone all in on a statistical interpretation. And they’ve done very, very well with that approach.

Gross sales revenue from real estate is continuing to decline which means less money floating around in the local economy. Couple that with rising inflation, I would expect people to hold back on non essential purchases of goods and services.

I suspect that won’t hit everyone equally. As typical, in a recession, it will be the lower income households and those in the fire industries (finance, insurance, real estate) that will see the greater impact in their net worth.

If my crystal ball gazing is correct then we should find it is easier to hire contractors and get competitive bids over the next several months, as these industries will experience higher employment and under employment than other industries.

broadmead for 1.3M now on a 14,000 sqft lot. Curious to see how much this goes for.

https://www.realtor.ca/real-estate/24771417/4526-emily-carr-dr-saanich-broadmead

I think the “second” or “first rate” designation is almost meaningless. As we’ve seen over and over again, the richest, most financially literate people in the world can’t consistently make predictions with any accuracy, regardless of what company they run or work for.

The predictions that they make, especially ones made for broad public consumption, are often skewed to enhance the business interests of the predictor. Even when they’re not, I don’t think it’s much more reliable than chance.

I agree with Leo where he says, “at the very least publish open data and models so everyone can examine their thinking and calculations when they issue something.” Transparency is, IMO, always a good thing with something like this.

Desjardins does have 7 million clients and $400 billion in assets under management. Are they second rate because they originated in Quebec? Their business has primarily grown in eastern Canada? Or is there another reason they are second rate?

Very interesting take on the premium factor for victoria!

Another interesting article, thank you Leo.

Are people who list in the winter time more likely to be in the category of “have to sell” compared to those who list in the traditional busier spring season?

CMHC maybe out to lunch in their projection, but I wouldn’t group second rates banks like Desjardins in the same group as CMHC, RBC, and TD, or put any weight on their prediction.