Changing rates and the market

The central bank is likely getting ready to hike again on Wednesday, with consensus expectations of a 0.25% increase in the overnight rate. However unlike previous rate hikes that directly increased both the lowest available rates and the stress test hurdle, I don’t believe this will affect the real estate market directly. The biggest impact will likely be accelerating a tsunami of refinancing as borrowers find fixed rates available for a full percentage point lower than what they are paying on variable. Get ready to wait on hold at your bank due to the always “unprecedented” call volume.

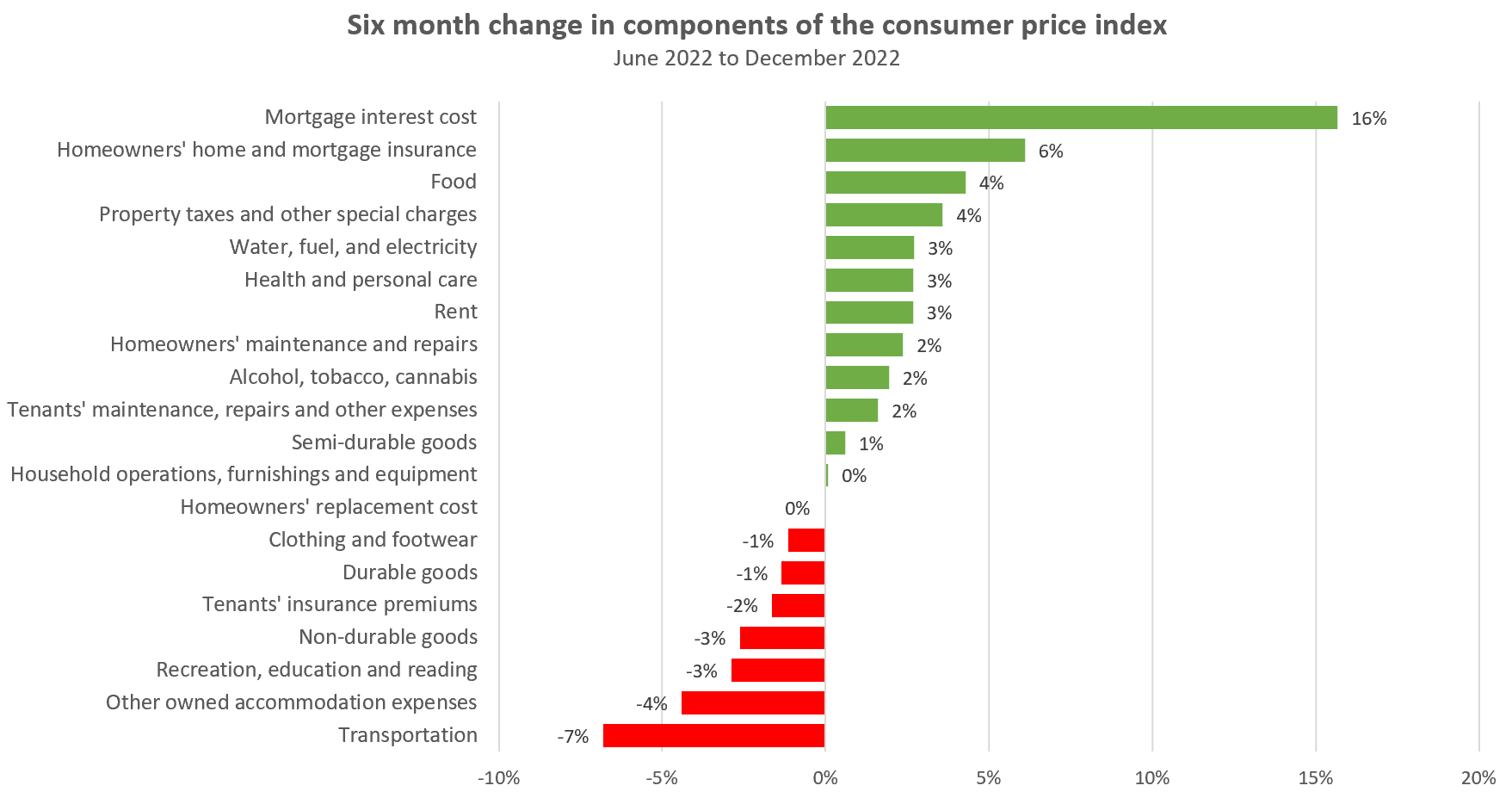

Of course the central bank is looking closely at inflation data, and will stop at nothing to drive it back to the target range of 1 to 3%. And if we break down where inflation is coming from, it’s pretty broad based with large increases in many categories.

However we know that everything is more expensive than a year ago. What’s more interesting is if prices are still going up, or if rate hikes and supply chain normalization have already done the job. While there are still things that rose in price in the last 6 months – most notably big ticket food and rent categories – the increases are a lot less, and there are a number where prices have pulled back as well. The massive exception is the category driven (partially) by rate hikes themselves: mortgage interest. Though we can argue about the definition of that category (it certainly lags), it’s clear that there have been real and large increases in the actual dollars households are paying on interest and it’s a significant force pushing up the CPI.

That raises the question: as the central bank prepares to hike again on Wednesday, are they considering the inherent feedback loop? And how low do other categories have to go to counter the impact of rates while returning us to the target range? I wouldn’t want to be in Tiff’s shoes.

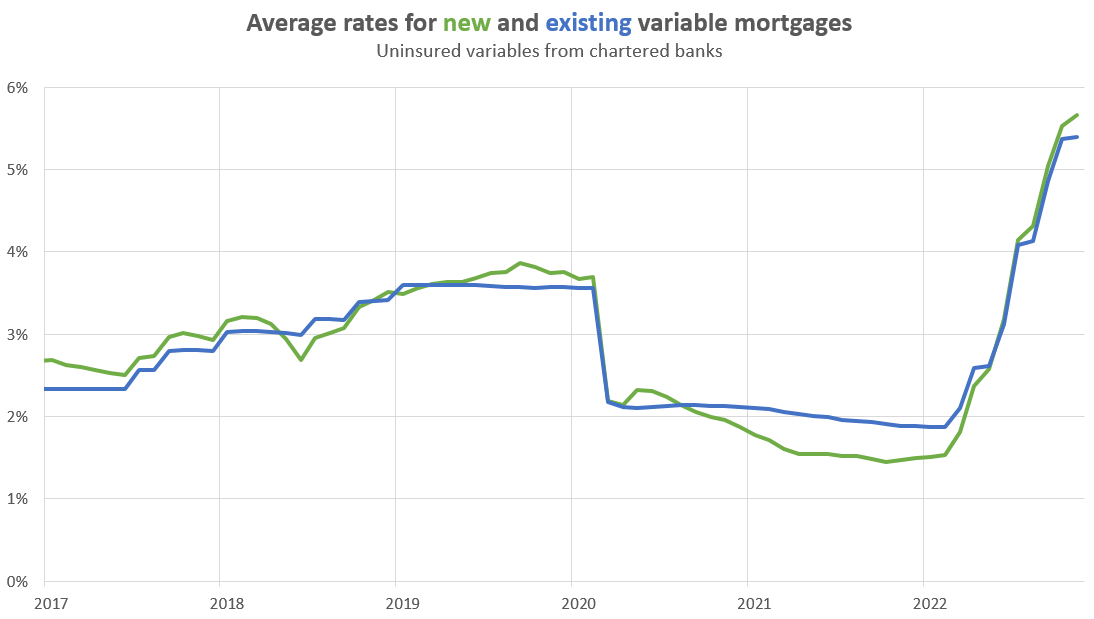

We know that the big impact from rising rates has been on variable rate borrowers, where every rate hike is immediately passed on to borrowers. Whether those borrowers end up with actually higher monthly rates when hitting their trigger points, or just ludicrously long amortizations instead is not really material, as the interest costs need to be paid one way or another.

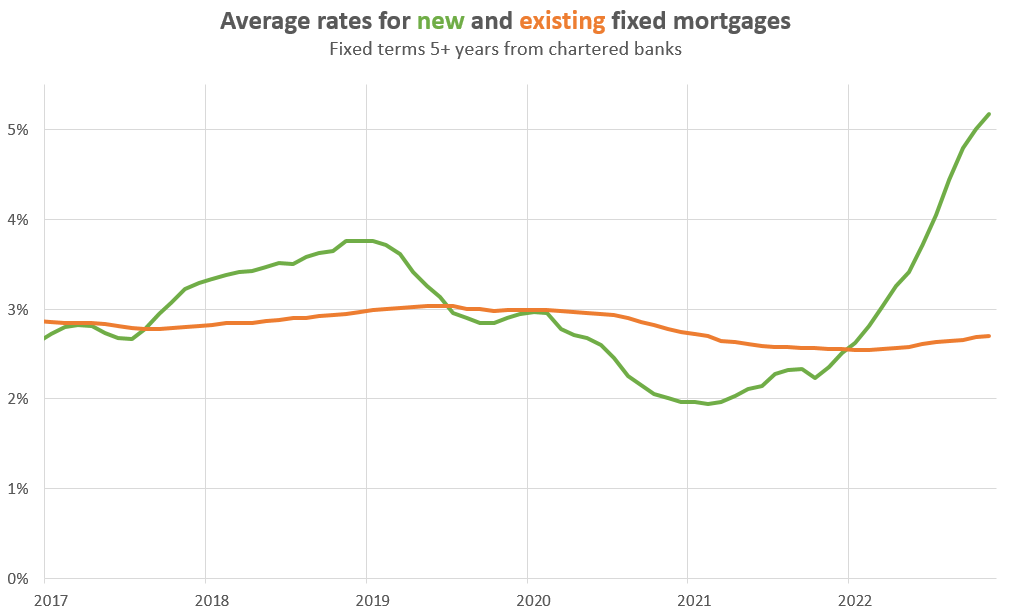

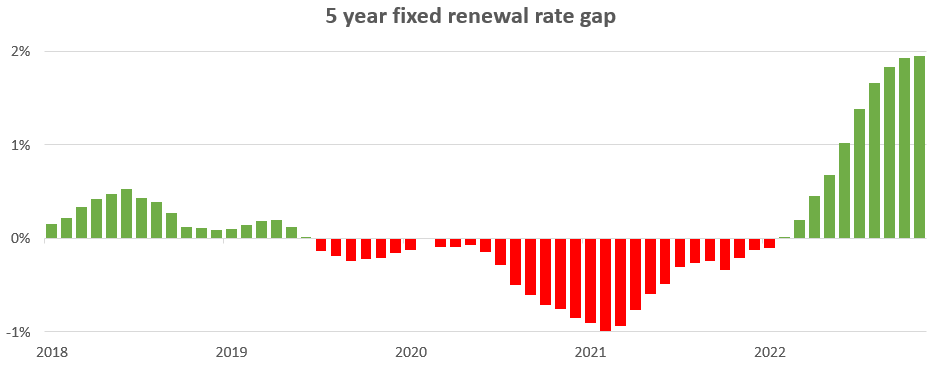

However for fixed rates which are two thirds of the outstanding mortgage book, it’s worth remembering that mortgage holders are still enjoying extremely low rates below 3%.

For the approximately 2% of borrowers that renew every month, the increased rate is a shocker, but as with variable borrowers stressed by trigger rates, fixed rate borrowers can also generally extend amortizations to spread the pain across a longer period.

For those wanting to stay on schedule, the renewal gap of nearly 2% combined with the average mortgage taken out in Victoria 5 years ago ($377,208) means a monthly payment increase of $332 or 18%. That’s sizeable, but given we haven’t seen the much more rapid rise in variable rates trigger a wave of distressed sellers, it seems that a much slower drip of higher rates to the fixed mortgage pool is unlikely to lead to a lot of distressed sellers either. Think of it more as a sucking of income out of the economy putting a drag on things. That drag is likely to continue, but with 5 year bonds dipping back below 3% which signal fixed rates in the mid 4s, it seems the time of continued rate hike shock is over.

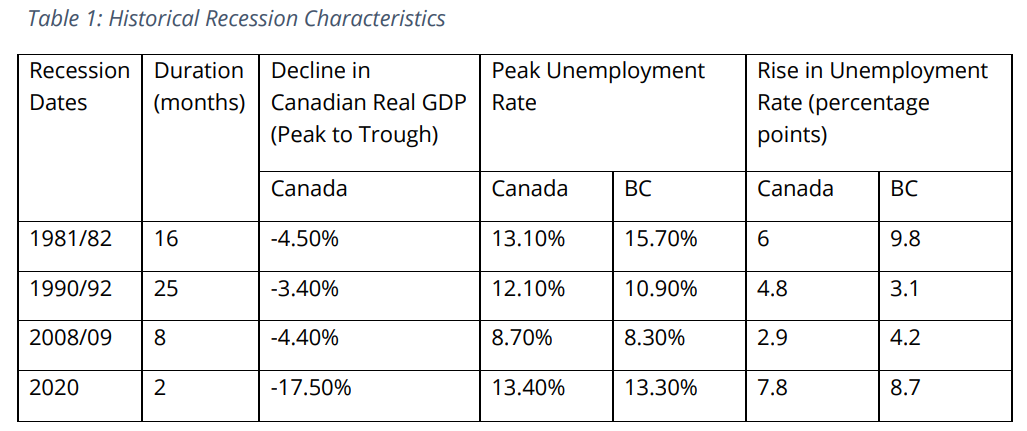

Without more rate shocks, I suspect we will see more price stability than last year as long as unemployment holds up. The much anticipated recession and associated drop in employment hasn’t arrived yet, though if it does arrive it normally comes with a significant deterioration in the labour market. The BCREA wrote an interesting paper looking at the real estate market during recessions, and though there isn’t enough consistency in real estate impact to make any predictions, past recessions have come with increases in the unemployment rate from +3.1% to +9.8%. That would bring us from an ultra-low 3.4% to moderate or high rates of unemployment. So far – though provinces with high priced real estate may be more vulnerable – predictions seem to be for a relatively mild recession, but we know how successful those predictions have been in the past.

Also the weekly numbers.

| January 2023 |

Jan

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 26 | 74 | 155 | 474 | |

| New Listings | 190 | 379 | 575 | 692 | |

| Active Listings | 1617 | 1670 | 1707 | 744 | |

| Sales to New Listings | 14% | 20% | 27% | 68% | |

| Sales YoY Change | -51% | -47% | -48% | ||

| Months of Inventory | 1.6 | ||||

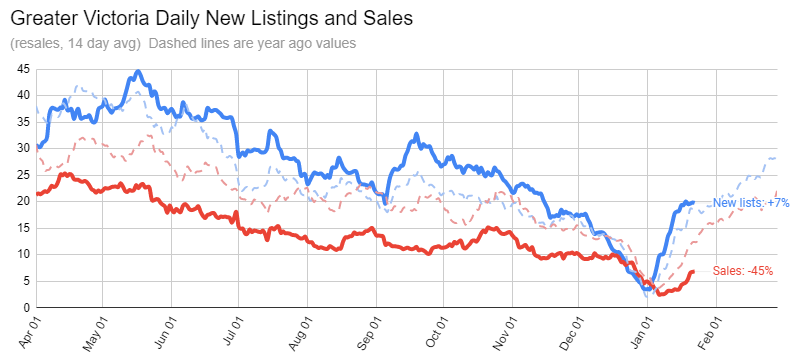

Finally sales have started the upward path that we expect in January, though still lagging substantially from the frenzied pace of a year ago. There’s one additional business day this January, but if we end the month down around 40% from the year ago pace, that would put us at the slowest January since 2009 when there were only 247 sales (still a decent chance we also exceed the 294 sales in January 2013).

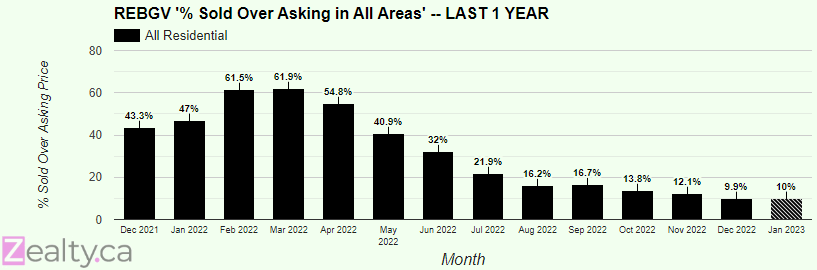

There’s lots of chatter online about the market picking up this year, for example here’s a thread of anecdotes from Realtors around the province. I’m not one to downplay anecdotes as they often signal market changes before they are visible in the data, but I don’t see a lot of reason to believe this is a significant change. In Vancouver the percentage of properties selling over ask in January is unchanged.

There’s a small uptick in Victoria, but given there have been so few sales I wouldn’t read much into that yet.

It’s certainly possible that we see some return of activity from previously very low levels. As I’ve pointed out repeatedly, with continued low inventory it won’t take much to stabilize the market, but I believe that still-poor affordability will put a lid on how much of a bump we’ll be able to see. I’d be pretty shocked if we saw an actual recovery with payments still this elevated. I suspect most of the excitement online is just people being fooled by the normal seasonal jump in the market that we see every year after the holidays, however the full month’s numbers will give us a better sense of whether there’s any substance to the murmurs.

Brief update on rental market before we get January’s numbers https://househuntvictoria.ca/2023/01/30/rental-market-remains-extremely-tight/

Coming shortly.

Gotta pump those tires: it’s getting really busy, buy now or miss out, take the discount while you can because the market is going to launch further out of reach! (sales is the game) Apparently, with just a signal of a possible pause on rates (not a decrease) magically changes those affordability numbers that were keeping some of the big buyer cohorts (FTBs-investors ) out, somehow now have found a way to buy. However, entering spring as inventory and selection grows, there will probably be a short lived burst of activity as those that have been watching (with the ability to buy) jump on improved selection that hasn’t been seen for a while. That will likely be short lived unless the affordability numbers improve.

They’re not, they’re a landlord with a very specific agenda to push so that the prices on their houses go up. Everything they say is just a smoke show for that.

Hey Marko, many thanks. Helpful and informative as always.

Just the ones that hired a ton of people. Looking at ones that didn’t (like Apple), and you won’t see any layoffs.

I can tell that expenses are being scrutinized at every tech firm currently and salary/payroll is definitely one of the first things looked at.

Not every major tech company. Just the ones that bet the farm on meta this and that. The nuts and bolts companies avoided this mentality to a large extent.

Also a lot of the outfits that the press describes as “tech” I wouldn’t give the label to in the first place, such as so-called fintech and last but by no means least, crypto.

Every major tech company fell into the same trap of thinking that pandemic economics was a new paradigm instead of temporary blip and went on a hiring spree. And no, boom and bust economic don’t please me.

If you are asking where to learn you probably aren’t in the 2% of savvy buyers that should be unrepresented.

As I noted best option for 98% of buyers, in my opinion, is secure a buyer’s agent that will offer you a kickback. There are quite a few platforms with lots of agents lurking such as Vancouver Island Housing Market FB page. We are also in a market where over 1,000 agents will not do one single transaction this month. Law firms are already slashing their prices for conveyancing so I would think there would be some motivated agents out there as well.

You can throw up a post along the lines of

Looking fo a buyer’s agent. Pre-approved for X amount with mortgage broker/bank [conveys you are serious]. Looking in X price range [commission varies based on price point substantially] in these areas for X product [some agent may not be excited about driving to Sooke, for example]. If you are willing to offer cash back on the cooperating commission please email me what you can offer at xxxxx@xxxxxx.com

Until later this year when we will be up every update. Context matters with these YOY numbers.

I think part of the reason behind this is lack of quality inventory so as a buyer’s agent every other offer you end up competiting in multiples. Also, when you go book showings a lot of places already have accepted offers secondary to the low inventory (if there were 4,000 listings most places would not have an accepted offer). It might make things seems busier than they actually are.

Translation: “Democracy. Pathetic.”

January 2023: Tech sector employment continuing to rise, with tech unemployment falling to only 1.8% in USA. And ManpowerGroup surveys show that tech will lead new hiring in 2023, with Canada leading the way, expecting to increase tech hiring by 34%. Biggest problem is a shortage of workers, not jobs.

https://www.computerworld.com/article/3542681/how-many-jobs-are-available-in-technology.html

“in the first quarter of 2023, the IT industry will lead all others in hirings, according to a new report from global staffing firm ManpowerGroup.

Geographically, North American organizations expect to increase tech hiring by 31%; US organizations expect a 29% increase in hiring and Canadian organizations expect at 34% increase. Large organizations with more than 250 are more than twice as optimistic as small businesses (with less than 10 employees) to hire in the coming quarter with outlooks of 29% and 13%, respectively.

Wanting to hire is one thing and actually being able to find tech talent is another. Currently, there is a dearth of tech talent available.

Despite strong optimism to hire, the industry faces a talent shortage where 76% of IT industry employers report difficulty finding the hard and soft skills needed, according to ManpowerGroup’s survey.

That’s what I figured when the tech people supposedly earning these high USD salaries stopped posting on here. Anyways, these companies are accountable to their shareholders hence the layoffs, Elon fired the first shot when he did what he did at Twitter so every other company is now on the hot seat.

None the less, it will be felt through the tech sector as far as employment and salaries go. BTW, insider contacts have told me that this is just the first salvo, much more planned this year.

Does it also please you “to no end” to have seen all the hiring that Microsoft has done since pre-Covid? The 10,000 cuts may seem like a lot but they’re still up 70,000 from pre-Covid, to 211,000.

The microsoft layoffs are already having an effect on my industry. It bothers me to no end that large tech companies will lay off thousands just because their profits are lower than their recent record highs.

Patrick,

Early in my email conversation with LTSA, I was given a link to a page about shutting the barn door after the horses have run. It states:

That’s a problem with monopolies like the land titles. If there were competing groups, they’d jump at the chance to introduce new features to improve the system, and have better features than the competition. Instead, they’re happy to pass the buck to another monopoly (the law society), that will probably also do-nothing.

Looks like what’s needed is government action to change the “mandate scope of the LTSA” so land titles can’t pass the buck. Seems like land titles is happy with their old methods, and needs a push to modernize to current technology and methods.

Having a suite providing monthly income is beneficial but could become problematic in the future. The income is taxable, monthly utilities would be greater as few suites would have separate meters, and the hundreds of thousands in taxes that might be incurred when your house is sold without the entire principal residence exemption. Something to think about.

A house payment of $5,500 a month can be affordable when you are getting $1,800 a month for a one-bedroom suite or 2,300 a month for a two-bedroom.

2000 will be a 2 bed suite so really you are looking at houses for 1.175 or less with a 2 bed suite. And also the monthly payments are increased since its now a $940k mortgage being carried assuming 20% down.

When it comes to house sales over the last three months, it’s about a 2:1 ratio for houses without a suite (median at $1,030,000) to houses that have a suite (median at $1,175,000). A house payment of $5,000 per month can be affordable when you get $2,000 a month rent for a suite.

It may become more affordable for those that own the home, if in the future they can have two suites instead of one. Not so much for the one buying the home as the price should go up.

Par for the course in terms of price discovery IMO. Everyone thinks they have a view on where interest rates are going and people’s behaviors are a reflection of that.

Bottom line is that for an 800k mortgage (assuming $1M house, 20% down, 30 year amort and 4.5% mortgage), you would likely need to pay ~$5k a month in housing related costs. That is not an insignificant amount in terms of after tax dollars given the typical HH income in Victoria and probably why sales are so low.

I’ve never seen such a disparity in anecdotes (positive across multiple markets) vs data (continued poor activity). Puzzling.

base effects will take over in the latter part of the year.

I submitted that idea to the LTSA suggesting that some REagents/lawyers had dropped the ball, and asked if the LTSA might change its ways. The reply was:

It would appear that sales being down north of 40 percent every month is becoming the norm

One factor that affects the rescission/unemployment situation vis-à-vis housing downturn is that the population demographics are different this time;. with so many boomers retiring and a relative shortage of working age people, a recession might not result in so much unemployment.

Hey Patrick, thanks!

Marko, any suggestions as to where to start learning how to be an unrepresented FTB?

I don’t know if we’ve ever (in modern times) had a sustained housing downturn without a recession+unemployment. If this time we somehow escape the recession with a “soft landing”, the housing downturn might be transitory. But if we get the expected recession/unemployment the housing downturn could drag on for years, fueled by rising unemployment.

My opinion is that the rate hikes take many months to percolated through the economy as only a small percentage of mortgages are renewed each month. The demand for conventional mortgages is way down and I suspect that most homes being purchased today have very large down payments that could have been from the sales of their homes in different cities. Out of town purchasers and high rents may be the reasons why prices in Victoria seem to be stable.

Mortgage renewals are not that much of a concern to me. Higher vacancy rates and lower rents however could cause a much faster decline. The 20 to 40 age group consist mostly of renters. If the trend continues for them to leave Victoria then that will have an immediate effect on a much larger group of home owners that rely on tenants to pay their mortgages. I’m not seeing any significant drop in rents at the moment and I won’t until I see vacancy signs start to appear in front of apartment blocks. The older apartment buildings are generally the least expensive units in a city to rent. Sometimes it is just a matter of looking for an increase in vacancy signs.

Kristan,

Marko posted some good advice as follows:

—-===

98% of buyers; try to secure an agent that will give you some sort of kickback

2% of savvy buyers; unrepresented

5-20% of sellers; mere posting

80-95% of sellers; lower commission full service

It doesn’t. My perspective remains that most people on variables didn’t notice much until the July hike and didn’t really get stretched until the Sep hike. So really its been 3ish months of trying to make the cashflows work which isn’t that long.

Duration matters more than the speed of the hikes IMO.

Hope you all had a nice weekend.

I was out of town traveling for work last week and caught bits and pieces of the discussion regarding realtor fees. What’s the conclusion when it comes to FTBs (yeah I have us in mind)? I’m happy to do some extra work and learning if it saves us several thousand dollars in fees and if I was pointed in the right direction..

As for absorbing rate hikes, I feel obliged to keep pointing to Leo’s affordability metrics for SFD. Going further up would be basically into uncharted territory no? Even the 80s boom here was relatively short-lived, and we’ve been stuck since ~ March.

How does that line up with conventional wisdom saying that the full effect of rate hikes takes a year or more to percolate through the economy?

https://www.cbc.ca/news/gopublic/hyundai-fire-servicing-sonata-1.6723164

Hyundai bursts into flames after routine servicing

If they had investigated this properly I am sure they would have discovered that this fire was ignited by a nearby Tesla.

Are you saying the effect of all the rate increases from march to Sep 2022 have now been fully absorbed in the Victoria RE market and the current pricing reflects that?

I believe most trigger rates were only hit at the Oct and Dec hikes.

More than that though. We’ve had a lack of inventory all of last year and didn’t stop prices from dropping. I think the difference is there’s no new shock and the last one (basically September’s rate hike) has been digested.

Lack of inventory was supressing sales last year. This year lack of inventory is supressing downward pressure on prices despite the massive increase in interest rates.

I am sure if an Oak Bay SFH family owner occupied home, for example, title transfered via fraud and the owners went to the media the BC Land Title would bring this in within a month or two. Most likely BC Land Title has a stance of why try to fix a problem that doesn’t really exist.

In Croatia where this is actually a small concern and my places have no mortgage/often vacant I placed private mortgages for 100 euros on my two properties with my cousin so it can’t clear title without him being involved in the discharge. Pretty sure you could do something here to safeguard if this is keeping you awake at night.

The way I am reading the below is two attempts on 3 million +/- transactions

I would have guessed that sales would have been more nut last year things were flying off the shelf. Next month (Feb) should be interesting/

If you spent $500 and pulled 30 titles in Oak Bay you could find 10+ without a mortgage.

Or you could just pretend to be a buyer and have your agent send you titles on listed properties and not spend the $500. The minute you list your property 1595 agents can see the title free of charge.

Can’t argue with that

I’m always surprised by how people freely give up information about not having a mortgage or how close they are to being mortgage free. Oak Bay properties being so expensive would be the hunting grounds for most fraudsters. A title search often shows when the last time a mortgage was registered. It’s simple math then to guestimate the size of any mortgage left on the property.

People should be a lot more guarded when talking to strangers about their wealth.

Month to date numbers:

Sales: 249 (down 43% compared to last January)

New lists: 741 (up 16%)

Inventory: 1740 (up 134%)

New post tonight.

5 year yields above 3% again. Doesn’t look like the bond market believes in any sustained duration below that point unless a recession actually happens.

Sometimes not even that is on the mortgage charge. I’ve seen them pretty much blank.

https://www.bloomberg.com/news/articles/2023-01-30/ford-cuts-price-of-electric-mustang-mach-e-in-response-to-tesla

Yup, price wars happening as predicted.

They can’t. They can however see the original mortgage balance and the date the mortgage was registered. Not hard to estimate current balance and equity from that.

@Patrick or anyone else,

.. as described in the CBC article…

“ So how does this actually happen? King says an organized crime group starts by looking through publicly available property records for a home without a mortgage — or a small one where there’s still a lot of equity left in the property — as a target.

How would someone legally be able to find out what’s left on a mortgage from publicly available records?

Well if that’s the best line of defense, that the “neighbours would be suspicious”, that sounds pretty bad to me. So if my neighbor’s weren’t suspicious, yah maybe they would get away with selling my house?

Well sure. But you can do that, and also secure the title to your home properly. And you should also make sure your smoke alarms work, even though chances of a fire are much less than getting a heart attack.

The point being, in the modern era, where I get three emails from subway after I order a sub sandwich to pickup, why can’t the land title office figure out how to email me when they’re about to transfer title of my property to someone else?

What about ownership fraud claims were title is actually transferred?

Is there an example of ownership fraud on an owner occupied home? How are agents going to show a home you live in? Even if you are on vacation and someone breaks into your home wouldn’t the neighbours be a little suspicious?

There is always a chance a plane crashes but I continue to take more than 10 flights every year and I don’t waste my energy on what ifs that are in the millions.

Odds of having heart attack very high so I focus energy on exercising every day and trying to eat half decent.

When someone posts on reddit/fb that their Oak Bay home was sold underneath them I’ll start paying attention. For the timing being I’ll follow the bulletins from BC Land Title.

CBC article…

“ Chicago Title Insurance Company has received more than 80 mortgage fraud claims since late 2019 — largely from the GTA and Greater Vancouver Area.”

Anyway, even it was one in a million, I wouldn’t be OK accepting a chance my owned house could be sold to someone else, and I might have to move out (and may or may not get compensated).

—-=——-====

For example, what safeguards are in place in Victoria to prevent this in 2023 ?

– homeowner with a fully paid off home goes overseas for 4 months. Rents his home out on air bnb (or Craigslist).to a single tenant.

– tenant is a scammer, and assume identity (ID fraud) of the homeowner, and sells the property. And vanishes with the cash. Homeowner returns to find the new homeowner living in his home, and all his possessions gone.

That was the first story that broke that made some sense. Still not the end of the world, seller will be compensated and hopefully they arrest the criminals.

Following that story a bunch of stories that don’t really add up followed….

https://www.cbc.ca/news/canada/toronto/title-fraud-toronto-condo-1.6720439

Current info – https://www.timescolonist.com/local-news/title-fraud-a-one-in-a-million-threat-in-bc-officials-say-6450867

They legally rented the property, posing as legit tenants. So would have got the keys from the owners or a management company.

.. as described in the CBC article…

“ So how does this actually happen? King says an organized crime group starts by looking through publicly available property records for a home without a mortgage — or a small one where there’s still a lot of equity left in the property — as a target.

From there, the groups who ultimately receive the fraudulent funds use stolen IDs and hire “stand-ins” to pose as tenants to gain access to the home, and other “stand-ins” impersonate homeowners to mortgage or sell it.

“A lot of times they’re petty criminals that are paid anywhere from $5,000 to $10,000 to stand-in and pose as the homeowners,” said King. “The people behind the frauds do not want to be front-facing.”

You’d need a current statement from them, not something from 2008. Maybe there was not much fraud then, but there is recently. I’m just going by the CBC article, quoting the land title insurance people, that say it has “skyrocketed” so much that he doesn’t know if they’ll be able to continue to offer this insurance. He mentioned most of it is in Toronto and Vancouver. So yes, probably low in Victoria. Is that a reason to forget about it and conclude that it can’t happen here?

I was shocked to see that no one including media contemplated this scenario when the stories started coming out of Ontario a couple of weeks ago.

As I mentioned previously too many details missing. Owner abroad for years, fraudsters obtain keys but not explained how they obtained the keys.

For example, if the fraudsters obtain a fob to the building and then had a locksmith change out the locks on an identified vacant unit you would think this would be in the the story “lobby cameras show fraudsters letting locksmith into the building” or something like that.

Lack or these details makes me suspicious in terms of did the seller somehow know the fraudsters; therefore, they had the keys?

I am interested to see the reports from the actual investigation as to how this actually went down.

sorry that wasn’t meant to be in quotes…

I receive weekly bulletins from BC Land Title, I can’t find an email received in the last two years where they quoted something like two in 10 million transactions but this is from 2008…

“The LTSA reports that over the past 18 years, the land title system processed 15 million transactions. During this time, two claims related to land ownership fraud were successfully resolved and only 14 claims related to mortgage fraud had been filed.”

I don’t see why BC Land Title would by lying. Can’t see how they could be lying, they would have to cook their accounting books re paying out the claims.

You also have to account for that land ownership fraud is likely higher in larger cities. In small places like Victoria everyone knows everyone. I know most real estate lawyer, most real estate lawyers know me. I know all realtors which wouldn’t be the case in Toronto. If a lawyer, for example, is dealing with a seller abroad he or she can phone me if any redflags to verify. I just rented a place to an individual that works at the same place another existing tenant works at. I texted that tenant to see if he knew the applicant and he did. Victoria is too small to manuever if everyone is doing their job properly.

Fans of Canadian economist David Rosenberg won’t want to miss his 1+ hour “breakfast with Dave” talk (Jan 2023).

He’s convinced that we are done with inflation, sure to get a recession with rising unemployment, and it will be worse in Canada for house prices and the CAD.

He’s a very likable, intelligent guy and presents his case very well.

https://youtu.be/QuNpDhgJJvA

Not sure how you came up with one in a million.

https://www.cbc.ca/news/canada/toronto/organized-crime-groups-behind-gta-home-sales-mortgages-without-owners-knowledge-1.6719978

“ There’s four title companies in the business in Canada and we estimate that industry wide, it’s easily $200 million, probably more, in fraud claims in the last two-and-a-half years.”

“ But with title transfer and mortgage fraud claims skyrocketing, title insurer John Rider worries about the sustainability of providing this coverage in the long-term.”

OK. Thanks a lot, Marko.

It doesn’t matter but if you want a copy you can pull it from BC Land Title (any memeber of the public can pull it). I have a professional account and it costs me $11 to pull any title, might cost a member of the public a bit more.

Don’t waste time with your lawyer, he or she will send you the title from when you purchased if they happen to have it on record. That is even of less use than the current title.

Thanks, Arrow.

I dusted off my file folder containing lawyer documents. One doc mentions that they will order a State of Title Certificate and forward it to me. However, I don’t see it here.

How important is this certificate for me to have for my records? Should I bother checking with my lawyer whether, according to their records, they sent it to me (14 years ago)? Or should I order one myself through ltsa.ca? Or should I not care because it doesn’t matter?

I hope that you represent the seller I end up buying from.

(Is that a BC duplicate title you have hidden somewhere?)

I like how people spend all this energy on a one in million scenario and then go eat chips or something else that increases their chances of a heart attack which is a much higher than one in a million scenario. Secondly, what are the outcomes if you end up in this one in a million scenario? Give or take, buyer gets to keep your house. You as the seller get compensated for your rental property. The authorities track down and arrest the criminals.

Yes, I’ve represented lots of sellers living abroad but there have never been any red flags on my end. Either I helped the sellers buy the property in person or if it is tenanted, I am picking up the keys at the property management company and meeting the tenants, etc.

The minute that Oak Bay home hit the market you could see something was off. It was 500k below market, no interior photos, etc.

A lot of these stories coming out don’t explain the details in full. Seller is out of country for years, unit/home is vacant (why is the place vacant for so long?), someone gains access (who gave them the keys/fob?), how does the listing agent obtain the keys/fobs? If obtaining in person, he or she should be IDing the sellers in person. If not obtaining the keys in person from sellers directly or property management company that is a huge red flag I would investigate. What is going on with the fintrac? (you have to ask the sellers for their nature of business or occupation). I always politely probe this a bit to make sure everything adds up. If they say anesthesiologist, for example, they better know what intubation is.

Like 100x things to lose sleep before this, at least in Canada. In my other countries with strong mafia influence yea you do need to worry about it, have a duplicate title hidden somewhere, etc. It happened to my uncle in Croatia. He had an extremely desirable piece of land with a teardown in the heart of Zagreb. In the family for 50+ years and he refused to sell it for the last 20 years, had huge offers (in the millions) for embassys including the US embassy but unfortunatey due to mental health issues kept turning down the offers. After 20 years eventually mafia broke into his house while he was working. Found title/duplicate title and transfered ownership. He was compensated but the lawyers also had ties to mafia and took 50-70% of the compensation.

Whateveriwant,

Yes indeed, a neighbour is who stopped the Oak Bay fraud attempt a few years ago.

It appears this tempest in a tea pot is all about the true owner’s name being fraudulently used on one piece of fake ID. Somewhere along the line someone is going to check a duplicate form of sellers identification before I lay my money down. I may be a country hick, but even a realtor or lawyer seeing a seller also in possession of a utility bill with the correct name would be better than money transfer based on a single piece of ID.

Arrow, I think Marko is the one to ask how that might not always be possible. As the seller may not be living in Victoria or is on vacation somewhere else at the time of closing the deal.

An imposter is not going to want to have a face to face meeting with your lawyer to verify their identity. Chances are the imposter is not using a lawyer. Those are more chances of being caught as your lawyer may be suspicious and have the police waiting for them when they show up.

Might just be easier to ask the neighbor(s) if they know the owner and for how long.

Your agent will pay for a State of Title search to show any charges against the property and the names of owners or the Numbered company that owns it. That is at a precise moment. Ten minutes later someone could register a charge against the Title. The Title Search is only good for that moment in time it is issued.

If you have taken out a Duplicate of Title then a charge can’t be registered until you bring the Duplicate back to the land’s office.

Whatever, You’ve been very helpful, thank you.

From what I’ve learned today, I will have my closing lawyer confirm dual verification of seller being the legitimate owner before proceeding.

https://ltsa.ca/property-owners/how-can-i/order-a-state-of-title-certificate/#

I use to work in the Land Registry in Vancouver for a filing company. It can be EXTREMELY busy. The documents being filed are huge and time sensitive and time dated. The legal assistants that are filing documents can get nasty if they have to wait to get their documents filed and paid. In the old days, it was necessary to purchase strata plans from the registry, you could feel the daggers in your back when you lined up to have them copied and then to pay for them as you were slowing things down. They detested new lawyers learning to do title searches as they were so slow. Add another layer of verification and the system that would require a response from an email, and it will grind to a snail’s pace and that will mean closing dates won’t be met.

And it isn’t there job. It’s the lawyers job to do before it gets to the registry. The lawyers are the ones getting paid the big bucks.

I doubt the fraudsters are going through the typical filing process, as too many people would need to be involved as well as large sums of money that has to be paid to register documents.

And we tend to think it’s the home owner that is getting scammed. It’s possible the home owner is in on it to scam the insurance company.

Nothing is going to wait until absolutely everyone has an e-mail or a phone. I assume it would work as an optional feature, where if you didn’t provide an email or a phone, you wouldn’t get that protection.

So it sounds like the land registry holds the title to my property, and that’s it.

Now what is a “State of Title Certificate”?

The LTSA seems to be the weak link in this track. If the Federal Gov’t & banks can implement dual verification requirements, maybe that Provincial office will, too.

Patrick the problem with the email is that some people don’t have an email address and others have changed their email addresses over the years.

Maybe one day everyone will be implanted with a micro chip at birth then we wouldn’t need cash or credit cards either. But I don’t think that’s likely to happen.

…..OR WILL IT????

Condensing a three hour lecture down to basic points. Canada had two predominate land title systems. Each province had one or the other system. Some still might still have the old English system

The old English system required a lawyer to search all of the past transfers on a property back to the original land grant from the Crown to establish if there were any charges against the Title still existing. That took a long, long time. Parts of the US still have that system and escrow can take months rather than a day.

And the Torrens system where the Registrar guarantees the Title at the Registry, unless a duplicate has been issued, and the lawyers no longer have to sift through dozens and dozens of past documents over a couple of hundred years in some provinces.

The land registry holds the Title to your property. A duplicate of Title is not a photocopy. Your lender can access your Title online to review so they don’t need a copy of it. You can remove your Duplicate Title from the registry but you will be strongly advised not to do so. If that document is lost then you will have an extremely difficult time to prove you are the owner. Anyone that has possession of that duplicate is now the owner. You need to put it in a safety deposit box immediately not in your desk at home. It’s kind of like a Bearer Bond who ever has possession of it – owns it.

You can transfer ownership without a lawyer at the land registry. With the Torrens system, vendor and purchaser can go to the registry and at the front desk transfer ownership in a half hour if there are no encumbrances. This is more common when a spouse passes away and the survivor with the proper documentation removes that person’s name from the Title.

Right, but worth it.

… an email from land titles “OK to transfer the title of your house to ______”? [yes] [no]

It could be done ahead of time (by lawyers) if timing was an issue. But the email is an extra layer of protection, as most identify thefts don’t also hack the email/phone.

Arrow an imposter would have to pay your deferred taxes so that the Title is unencumbered. The Title has to be free and clear of all encumbrances before it can be transferred to another person.

That adds one more level of complexity to their scheme which may make them choose an easier victim.

I would also be interested in more info on the most practical way to deal with this. I did look into putting the HELOC in place, which seemed like a great idea until I found out it would invalidate a mortgage-free discount on house insurance (worth about $300 a year in our case), even if nothing is drawn on the HELOC. Presumably the same result if I register some personal charge.

Can someone explain titles to me like I’m a 9-year-old? Does the Victoria Land Title Office hold my title? Does my credit union also hold a copy of title because I have a mortgage? Should I have a copy of title? If so, how do I get a copy?

That is a good point – so might not be worth the registration unless there was also an electronic consent to the change which might complicate conveyances.

Whateveriwanttocallmyself, you mentioned registering a charge against your own property and that sounds like the best solution. Do you think that BC’s deferred property tax arrangements against the title would be as effective?

Yes, and also an email or phone SMS that require pre-approved verification prior to any changes to title. Same thing that happens on many websites when profile changes are attempted.

This seems like a fixable problem.

Totoro, with our Torrens Title system a transfer of title can be done in less than a day. The home owner would have to act lighting speed quick to any electronic notification.

I would think an electronic finger print system that would be part of the Title would be a better option. They do this at Disney Land so that no one else can use your ride pass.

That would also reduce other types of crimes such as money laundering and straw buyers.

What this does not mention is that homeowners do not have direct access to this system – only professionals with a LTSA Enterprise account can do this – so a lawyer or notary – who will charge you.

I don’t know why every homeowner could not be given given opt-in electronic notification for a nominal charge when they buy a home which is registered as part of the conveyance. This would send them an email notification automatically when a notation is added to their property on the LTSA. It seems like a reasonable thing and does not require a professional to charge this service each time. Even though a fraudulent conveyance may be one in a million, the consequences are severe on the parties involved. Seems like a reasonable anti-fraud measure.

The cost to register a HELoC, is likely similar to a lawyer’s fee for what sounds like a more secure lock.

Do you think that BC’s deferred property tax arrangements against the title would provide an unwanted complication to would-be fraudsters?

Title insurance will protect you from loss, but not against someone from impersonating you and selling your property. You still will have to get the title to the property back and deal with the emotional trauma.

A HELOC will work as it is a charge against the property, then the lawyers have to clear the title from all charges before it can be transferred. Hopefully the lender would notify you promptly then. There is nothing stopping anyone to go to a bank and pay off someone else’s mortgage.

Or you can register a charge against your own property then your lawyer has to contact you to remove the charge. Those that are looking to commit this type of fraud are searching for properties that have a clear title or a small mortgage as these have to be paid out, by the fraudster, before the title can be transferred. Another way is to get a duplicate of the Title. This is an extremely important document. Immediately take it to your bank and put in a safety deposit bank. If you lose it, then you are in a world of hurt.

With a HELOC, the lender is going to charge you several hundred bucks to register a HELOC on the Title.

Very good idea, for 1. preventing house fraud and 2. emergency funds. Best to get the HLOC when one is still working, as it is harder to get for retired people without a good pension.

On the surface that would appear to be one, given there are about a million properties in BC. However like many other threats, it’s not random. Not likely to hit, say, the Empress. On the other hard:

As someone who’s done business with real estate agencies, I don’t really see it. Dealing with CREA for instance was pulling teeth. Months of back and forth just so that I can pay them money. Took over a year.

So what’s that 5 per year then?

Title fraud a one-in-a-million threat in B.C., officials say

https://www.timescolonist.com/local-news/title-fraud-a-one-in-a-million-threat-in-bc-officials-say-6450867

I have not really seen much of a decrease in prices (ignoring those three or four months of peak surge last year). I am sure that the Gods of The Stats have better answers than me but things seem to be either flat or maybe even notching up a bit.

Which is why they are called “laneway houses” over there. From what I’ve seen in Vancouver “garden suite” appears to be a euphemism for basement suite.

I’m definitely not discounting the importance of anecdotes and there’s a lot of chatter around the market heating up in other cities. I think it’s a bit early to tell in the data whether it’s real, but my prediction for the year was no more price drops for detached and I think that’s still the most likely.

Pretty much the situation we’ve been in for 6 months now. Buyers market sales but not buyers market inventory. The only reason we saw such a price drop is the epic rate hike shock. Without a further rate hike shock we don’t get another repeat of that. The wildcard is unemployment, but so far so good on that front.

Q. are buyer agent’s commissions paid by the home seller under serious threat in the USA?

There’s a big class action lawsuit in the US against various parts of the RE industry and agents. It is based on Sherman antitrust law and various state laws. Plaintiffs are seeking damages requiring repayment of 3X of any commissions received by buyer’s agents since 2015 for 100,000s of clients, which would be in the $billions, and wipe out many agencies.

Note: US competition/anti-trust law is different than Canadian law. And Canadian RE groups have different rules concerning buyer agents commissions and more permissive policies regarding rebates etc. So I’m not suggesting this is the same situation as Canada. But a ruling (or a settlement) in the USA would shake up buyer’s commissions in the USA, and may lead to pressure to do the same in Canada.

The basic allegation is that “forcing” a seller to pay a buyer agent commission is un-competitive and illegal under US antitrust law. And I put “forcing” in quotes, because it may also include anti-competitive behaviors that don’t strictly force, but do include things like agents not showing a home, or pressuring the seller to add a buyer commission.

The case got a big boost in Dec 2022 when it got set for trial which is expected to start in Feb 2023.

There’s an entertaining, well made video describing the entire situation here

“The Second Bombshell Lawsuit that Could End Buyer Agent Commissions”

https://www.youtube.com/watch?v=CL_7mw8ZGBI&t=123s

Pay me $40,000 per plan and I will stamp as many plans as you want.

It’s possible that we could see a market rally in the Spring that could bump prices up. Re-listing the property at a later date may work in the vendor’s favor.

I suspect that prospective purchasers look at the days on market and wonder why the property has not sold. Resetting the day count makes it a fresh listing and may draw more attention to property.

Quesnel is a hick-town, but their city council knows how to get housing on the ground quickly. Last summer they began offering 5 pre-drawn plans and permits within 3 days, all for free for the first few months.

https://www.quesnel.ca/our-community/news-notices/news-releases/save-money-and-time-quesnel%E2%80%99s-new-pre-reviewed-carriage

A private organization would turn around a permit in 8 business days with just as much due diligence, not that there is much in terms of due diligence as the engineer needs to stamp the plans so not like city takes any liability where it matters (the structure). It’s a small 2”x6” stick frame box using the same construction methods used for the last 100 years.

I would consider pulled a cancellation. It wasn’t cancelled. Listing expired and did they not extend and thus far they have not re-listed.

You will see a ton of cancellation and expired listings going forward compared to the last few years. I might have a few cancellations coming up shortly. For example, one scenario is sellers have a subject to the sale offer on a home and if their place can’t sell, or they are bumped via time clause by another offer, they just stay put in their place and cancel/expire their listing.

It’s the same in Victoria, close to 12 months to get a permit for a garden suite and around $40,000 in city fees before you can build. And that’s the rub, the costs to build make it uneconomical to rent on a month to month basis. You can double or triple the rent received if you could use them as short term rentals in order to paydown the mortgage faster. Then after a few years of mortgage paydown it would be economical to rent the suite on a long term basis.

Thanks Marko – so that just means it was pulled from the market?

The listing expired.

I don’t know about a rally but I’ve been following the sub 1 million core SFH inventory for last 6 months and it has dropped in less than half and not moving upwards to start the year. I know Leo will say it is still only January but I am just not seeing inventory in this segment trending in the right direction which is really surprising given how high interest rates.

We will end the month with sales similar to 2013 – 294 sales, but in 2013 we had 3,900 active listings and we won’t even be half of that this time around.

Hi everyone,

How can i get up to date information on what happened to a property? It was just pulled from mls but I’m just wondering why. I’m looking for 303 – 1015 rockland.

Thank you

I went onto a couple of web sites that build modular homes in factory. The designs and floor plans that they have are not in the allowable 400 or 600 square foot permitted garden suite. As these tend to be steel stud construction, I’m surprised that the don’t offer a two level design that could be delivered, stacked and bolted to each other on site.

Personally I would prefer a garden suite with a loft or a second floor. I see these in Vancouver as they tend to have much narrower lots than here. But Vancouver also have rear lanes in most parts of the city.

Re garden suites I’ve seen a really nice modular in Fernwood by West Coast Container Homes.

Leo is correct, muncipalities make everything a complete nightmare. Last I heard from clients doing garden suites in Gordon Head it was 9 to 12 months to get a building permit. City of Victoria is probably around there as well.

Not really too difficult to imagine. People read HHV for years, but they just don’t absorb anything.

I haven’t checked but the design guidelines in Victoria at least are extremely strict so likely wouldn’t be approved. There’s a reason that so few have been built. I do think there is an opportunity in someone creating a prefab unit that meets the guidelines, but I’ve talked to a couple builders about this and they think it’s essentially impossible under the current rules which vary based on neighbourhood and specific lot. One said they could get a garden suite landed here for $50k each but would need an order of at least 150, and the rules make this basically impossible

Garden suites need to be bigger couldn’t c myself living in a 1000 sq ft and I guess oak bay still not allowing them

Indeed. The term motivated reasoning comes to mind. It’s difficult to imagine being around HHV this long and not know what the point of MM is, and to then misrepresent it so baldly.

I wonder why home owners spend the time to build a garden suite on their property when they could simply buy a modular home and have it delivered. You would still need to provide a foundation and services for the modular home and the costs are about the same but you don’t have six months of construction. It would be done and rented in a month.

Or people who downsize from their core SFHs (both houseplexes and corner townhomes are required to have at least one adaptable dwelling).

Probably moved and vacated something from the westshore….

It is easy to criticize public figures/groups, but destructive criticism is only meant to silence others.

Wrt Lisa helps, I’d rather read the TC article below to get a better picture than listening to personal attacks. Thank you.

https://www.timescolonist.com/local-news/after-8-years-as-mayor-lisa-helps-looks-forward-to-quiet-time-6028481

In terms of B.C./Alberta intermigration, in the past number of years, is it correct to assume that, on average, higher net-worth individuals/households are moving from Alberta to B.C. and, on average, lower net-worth individuals/households are moving from B.C. to Alberta?

Simple numbers = bullshit. Ok. Not sure who you think is convinced by your attempt to explain that up is down.

Doesn’t matter, MM is passed, and clearly the province agrees with the direction. Neighbouring municipalities will adopt similar infill policies, and those that don’t will be overridden by the province at some point when they can’t hit their housing needs.

That means that MMH townhome owner or renter has vacated something else, likely cheaper, to move into the MMH townhome. This means that a cheaper housing unit is now available to someone. Or a downsizer who doesn’t want to live in a downtown condo can now buy a ground level condo in their neighborhood and sell their SFH.

Also, MMH inventory will age over the course of 10-20-30 years and become lower pricepoint inventory in the future just like 1990s townhomes sell for a lot less today than brand new product. Just like 1970s condos rent for 40% less than new product.

Finally, if we are going to talk about the environment to nauseam how can you possibly be against MMH. You can’t have it both ways.

I am a huge supporter of MMH but once again, I don’t know why the anti-crowd is upset/annoyed/etc. The anti-crowd for the most part will be 6 feet under by the time these MMH buildings are noticeable. Instead of stressing over MMH go play pickelball and walk your dog along Dallas.

Did the world end when garden suites were approved? Nope and very very few are being built.

I think people will be surprised how few MMH projects are built. The numbers are very tight at current teardown prices.

Missed this one lol. Oh yeah, I mean she had 8 years to get the MMH done and had to pass it off to her endorsement proxy council to pass. pathetic really.

Her track record as mayor includes tent cities, asking citizens to let homeless people come live in their spare bedrooms and standing by a police chief who was a total pervert, what a legacy to hitch your wagon to! Good luck with all that.

Lol duh. If it were rocket science there’s no way Homes For Living could get a bunch of simple minded parrots that read from written statements provided to them by their housing advocate friends elected to council.

It’s all lazy sound bites to get developers disguised as housing advocates into to getting what they want. UVic students even hopped onboard thinking this was about affordability. I’d hate to be the one that has to explain why the new MMH townhome they want to live in is ACTUALLY still owned by someone with more money than them (as explained earlier in this thread) and they now have the option to pay $4000 a month in rent or $6000+ on their mortgage.

Also, your distracting argument about the threshold of a +/- $1 million property being the difference between a 5% and 20% down payment is just more noise that fits your narrative based on current financial rules. When the financial goal posts move, so will the narrative. I feel bad for anyone that falls for any of this bullshit.

The latest term I’ve seen used is “equity-denied groups”.

Jesus, this isn’t rocket science

Median new construction single detached sale price last 6 months: $1.3M requiring down payment of $260,000

Median new construction townhouse last 6 months: $750,000, requiring down payment of $50,000

Both are suitable homes for families

Which one is more affordable?

Get stuffed lol, nice one. Because I’m not triggered by this conversation I won’t respond to that part, but…

Since my last post there’s now a different Vic city councillor that voted for MMH that is saying it will provide more affordable housing and Homes For Living endorsed them during the election. So now we have two housing advocates who are also two cogs in the fuck up factory that is Vic city council saying completely different things about MMH. I can spot their stupid from a mile out. These housing advocates really need to get their stories straight, it’s getting embarrassing!

Yes, Q3 2022 in BC was quite something, demographically. We had a migration out to Alberta, with a small overall net migration loss of 5,000 and still pulled off the largest net BC population increase for a quarter in history. About 53K people added to BC population in three months. Through immigration (+58k), with flat natural (birth/death) increase. Q3 is usually the biggest quarter for BC pop. Growth so we can’t annualize that. (If we did it would be something absurd like 4% growth).

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2019036-eng.htm

Totally agree.

I like the way that developers in the US tend to specify it, which is by % of Area Median Income.

So they’ll say something like:

10 units affordable for households at 100% of AMI

10 units affordable for households at 70% of AMI

5 units affordable for households at 30% of AMI

No room for misunderstanding there, people can easily convert that back to real monthly housing costs

OK. I guess I’m just used to the “old fashioned” use of the term, where “affordable housing” meant low-income, subsidized or public housing.

I can accept what you say, in that the definition has changed, and it means more affordable housing.

I think it would be beneficial if people make it clear what they mean by “affordable housing” though. Because when city council insists that 10% of the units be affordable housing, we should know what that means.

I guess we need a new term for housing that low-income people can afford.

https://vancouverisland.ctvnews.ca/number-of-people-leaving-b-c-for-alberta-reaches-20-year-high-1.6249825

The article interviews some folks that moved.

Only one of many definitions. Every level of government defines it differently. As a term it is useless.

Why do they get confused? Homes for Living doesn’t exist to push MM. MMHI is one key part to make housing more affordable but obviously not the only one. We also pushed hard for the rapid deployment of affordable housing policy as well which is allowing non-profits to develop low income housing by bypassing public hearing. Next up, showing up to important public hearings like 1500 rentals at Harris Green, reforming parking minimums, getting rid of dumb discretionary design guidelines, more student housing, etc

It’s fun to touch a hot stove over and over again. Plus, you can complain how hot the stove is!

Thing is I don’t have three million to buy Telus stock and I am not going to borrow $1.5 million to buy Telus stock. I feel comfortable with a 1.5 mill mortgage on a sixplex so you can use a bit of leverage. But yes, at the end of the day the numbers have to make sense. 5% return on stable dividend paying stocks is literally zero work. Even a GIC is now 4.5%, or you spend that $ and 4 years trying to build a MM sixplex.

This is why I find it hilarious that people think COV owners will be selling their homes for $1.5 mill for the purposes of MM.

I think there will be a market for these, but I do feel like they are inferior to a larger condo building. Surface parking, unless on ground floor you have stairs/no elevator/probably much smaller windows/wood-framed, etc. They won’t have the “character” of the character conversions.

I am going to guess $800 a foot for the ground floor units with a patio and $700 a foot for the non-ground floor units (stairs, no elevator not ideal), with parking included. Rough ballpark. Obviously location will be huge. Sixplex units on Howe in Fairfield will sell for a lot more than a sixplex on a random street behind Hillside Mall.

I wouldn’t be surprised if the premium locations like Fairfield went with underground parking so everyone has parking. This is very common in Europe but the driveway into the parkade is usually very steep (you don’t have enough run on a small lot). In Croatia we call multiplexes “urban villas.” They are extremely popular. I am not a huge fan as you have to be involved in the strata with so few people and being self-managed. Personally, for myself, I prefer the bigger buildings where I don’t have to deal with the strata or talk to anyone. I cast a vote at the AGM from time to time and that is all.

Right, if you get about 150K/yr rent for this sixplex rental (say 2-3bed, 2-2bed, 2-1bed) after expenses, that would be about 5% return, lower than the dividend yields of BCE/BNS/RSI/TRP/GWO/… and with different income tax treatment.

But it is investment diversification for some, if you want a certain % of real estate (including your principal residence) in your total portfolio.

Yes, it is a good cross mix. What would the 1,000 square foot units sell for (I know you’ll be renting, but what could you sell them for)?

Here’s Wikipedia’s definition of affordable housing… “ Affordable housing is housing which is deemed affordable to those with a household income at or below the median”

OK. But people get confused when they see the term “affordable housing”

https://www.homesforliving.ca/

Each MM building will have two 3-bedroom units. Depending on the size of the lot this will most likely play out in the form of two 3-bedrooms and two 2-bedrooms and two 1-bedrooms or four 1-bedrooms. More than two 3-bedrooms and studios would also work but I don’t think builders/developers will want to do more than two 3-bedrooms.

If you ask me that is a good cross-mix. 500 sq.ft. can work for young single professionals, young couple professionals, single seniors (especially if ground floor), etc.

Sidewalk to nowhere a bit easier to accept on 6 units versus a small SFH home.

I wan’t something very specific so would rather build than buy otherwise I’ll just contine buying condos. There is a long list of things beyond what I already mentioned below. For example, absolutely no pumps (storm or sewer). I want everything gravity fed and this requires the right lot grade/service depth/design (no basement), etc.

Not interested in being back in Croatia fishing getting a text from property manager that a pump failed and something flooded. Just not a fan of mechanical devices even with battery and every single other back-up.

500 square foot units without parking aren’t the family homes that the homes for living have been advocating for.

Get stuffed with this bullshit. Townhouses and multiplexes are cheaper than detached homes which is the only thing that can be built on these lots currently. That means they are more affordable. No one (and certainly not me or homes for living) ever said they were going to be affordable to low income folks. This policy is about creating homes for families who can’t afford a single detached house. You gotta be living under a rock not to realize there’s also a huge shortage of homes for middle income families. Other housing reforms like the rapid affordable initiative are aimed at housing for low income folks.

Great move by Eby. Lisa knows exactly what needs to be done on zoning reform at the provincial level.

To making these MM buildings work on the average size lot there will need to be a few units under 500k. You need to throw in two 3-bed units which will likely have a min sq.m. requirement of something like 90 sq.m. which means you’ll need small units to offset to come in under max buildable area. Also, on a 50′ wide lot (majority of Victoria) it will be difficult to stuff 6 parking spots in the back. Realistically the 2 to 3 spots you have in the back you will give to the 3 bed units. Therefore, you’ll be left with some 500 sq/ft units without parking slightly under 500k which isn’t cheap but might be a good alternative to someone who doesn’t want to live in a downtown condo on Pandora, but rather in a residential neighbourhood.

This is assuming they are strata. So far everyone I’ve talked to wants to do rentals.

Given what the city put you through with the delays, consultants and the sidewalk to nowhere etc., I’m surprised that you’d go back for more. Instead of buying turn key. Is the developer profit worth it at the end of the day?

Exactly. And of course one less SFH after the hand deconstructed tear down.

You could probably do a 5,000 sq/ft SFH under $300/sqft but not a sixplex. COV will drive up costs with consultants not required for SFH, additional fees for services, civil work, etc., etc.

Problem is when you get consultants involved on a small project you can’t spread the cost over 100 units and a consultant isn’t charging 6/100th for a sixplex vs 100-unit building.

As I’ve explained before you aren’t going to be seeing multiple sixplexes on your street anytime soon. This will be a 10-20-30 year thing.

This is a very smart plan imo. I wish I had the skill and patience to pull it off. It sounds like an ideal solution for tenants and you.

It’s hard to say why NB does not keep it’s immigrants. (The government is trying to do studies to find out.)

I believe it is because of the French/ English language issue, but then I haven’t done such a study:)

I have heard a lot about the language barrier as being a problem for people. If you want to do many jobs you must be bilingual. (Even paramedics….which does makes sense actually.)

The main movement of people seem to be from places like Toronto who are just fed up with paying huge mortgages. and can move to NB and save hundreds of thousands of dollars in costs.

Our duplex in Moncton has been very kind to us as an investment. It’s run by a property management company and so it is stress free. Easy to rent out and excellent income. Taxes were never too bad and even the governments has made some changes recently. Heating is terrible… but again… nothing outrageous or different from anywhere else on the east coast. (tenants pay their own heat anyway.)

I would never move out there myself but that is because I can afford to live in this part of the world comfortably, with no worries.

Moncton is not what it used to be. The governments there are spending money to attract people back and that has been working in recent years. A lot of new exciting projects that will provide high paying jobs. (Such as the marine research facility I mentioned before.)

I post this only to let people know about some of the exciting opportunities in the Maritimes.

Can you not get under $300/sqft now. not saying it provides a different outcome to the analysis but construction costs are coming down. On the commercial side, some subs are much more negotiable now than 6 months ago.

Rumor alert: No idea if it is true, but again I am hearing from some people who have been rather accurate in the past that their is a push to tie rent control to the unit rather than the tenant. Personally I am taking that one with a bit of a grain of salt myself. (Ebby in the past said henwas not considering it at the time, but with politicians…)

My actually question is what would that do, if anything, to the price of condos? What that cause any hesitancy in the building of purpose built apartments.

Ya except current/market rents already account for that rise noted so its pointless. Thanks for the discussion

Regarding MM and uplift in land value….complete non-sense imo.

Personally, I am looking for a MM property as I would like to build a rental sixplex over buying 6 more investment condos. Reasons being is I can design a MM sixplex with no elevator, surface parking, no common areas (each unit has their own exterior door), I can probably engage a rental property management company for 7-8% management fee versus 10-11% on individual condos, I can design a near maintenance free exterior facade with larger roof overhands, etc. Essentially, the advantage is I can get 6 units without the strata fees and those his units would be simple to manage and the building would be almost maintenance free for the next 20-30 years.

However, the numbers have to work. I can’t go out and drop $1 million on a MM teardown, 5,000 sq/ft x $350 to $400 a foot is another $2 million. That is $3 million for 6 units. For $3 million I can go out right now and buy a mix of older townhomes and newer condos as everything is now rentable. For example, this townhome is under 500k -> https://www.realtor.ca/real-estate/25226065/6-3341-mary-anne-cres-colwood-triangle

Sixplex is realistically going to take four years….two years of paperwork, four months notice to tenants, 18 months to build.

To make the numbers work I realistically need to find a teardown between 700 and 850k tops. The absolute shittiest houses will see a bit of an uplift. The livable million dollar house on an average sized lot will remain at a million dollars.

People throwing out numbers like $1.5 million on Reddit and FB…..yea. Developer is going to pay almost the equivalent of three units for the just the land, on a six unit project. Not sure what people are smoking.

Closer to a 2 million dollar townhouse at this point.

If by “affordable housing” you mean non-market correct it’s not. But more housing makes market housing more affordable.

What? No it isn’t, there’s a Vic councilor that voted for MM on Twitter right now explicitly stating that the MMHI is not about affordable housing. This is what the housing advocates like Homes For Living lied and sold people on when in reality if any of this MMH gets built you’ll have to wait in a long lineup with lots of other people for your chance to own a $1 million townhome next to Barrister’s house.

Couple that circus with Lisa Helps and her fake housing PhD being hired as an advisor by Eby and it’s been quite the dog and pony show for housing this week.

it’s the quality of the data

As did you.

Rising rents are relevant to your formula for buying. “ Its a combination of price, rents and mortgage rates.”

If it isn’t relevant to you, just ignore it. The comment was intended for everyone, and Leo’s chart is on the same topic.

How Lisa @ Co will approach the missing middle problem has yet to determined. My guess is they will buy down the interest rates for home owners to develop large family sized suites along with a cap on the rents that can be charged for a decade. How that will effect prices if the home owner sells before the term is anyone’s guess.

Along the same line as MURBs done in the past when investors built subsidized multi-family housing that could not be owner occupied for the first ten years.

?? what does that have to do anything.

On the chart..

What’s with the quality codes on the units in the different cities?

Every city is “excellent”, except Sidney (good/poor)

Does CMHC have something against Sidney?

Occupied and vacant rents

That CMHC rent report showed rents up 20% on turnover.

Sticking with that?

Maplewood you mean? I said cashflow neutrality or better on 3 bed up and 2 bed down rental then I will be getting one and I was expecting it in Feb 2023. Its a combination of price, rents and mortgage rates.

You’ve been calling for things to cool down in Feb. 2023, allowing you to scoop up something.

Sticking with that?

He did call the massive downturn in 2018 though. :o|

To see if SFH owners have won the lottery, I think we will have to see what the missing middle is. I don’t see any benefit for adding suites to a single family house unless it will provide a minimum of three-bedrooms and 1,000 square feet. The missing middle is affordable family size units that will allow low equity families to live in Victoria.

Otherwise the home owners are just directly competing with developers that are already building small one and two-room units. The idea that you might have four or six suites in your home may be just a pipe dream.

The cost of adding a 1,000 square foot addition or raising the home by one storey is monstrous. You will most likely have to rent that three-bedroom suite at a premium to recover these costs. Ten years from now when the home owners have paid down their mortgage then these suites may have an impact on affordability.

(sarcasm alert)

Otherwise start tearing down the schools in Victoria and putting up hi-rises, because without families we are not going to need them.

LMAO, that’s the same guy who called 25bps rate hike and done in 2022.

Martin is implying the land lift is large and single detached lots will gain value.

Truth is we simply don’t know what the impact on land value will be, but now we have test and control groups we can track this and hopefully answer that question.

However:

1. Under the current system single detached owners are already winning the lottery and we don’t get any new housing out of it.

2. The City’s contracted economic analysis report concluded that the economic case for missing middle units was marginal. In other words the land lift was negative or low.

3. Land lift is how we get units built, and that is after all the whole point. If there’s no profit in it then people will just keep tearing down old places and replacing them with mansions.

Vancouver YouTuber Steve Saretsky is seeing a housing market rally, expected to “coincide with higher prices”

Have SFH owners in Victoria won the lottery with the new rezoning?? Long term will this drive up SFH prices? Interested to hear everyone’s thoughts.

Twitter comment from Michael Pelletier (regular finance commentator on BNN Bloomberg):

https://mobile.twitter.com/MPelletierCIO/status/1619063629877489665

Fair enough, I have zero idea what kind of jobs there are in Moncton. Anyone got some recent sales in Roya Bay? My realtor insider contacts are both on vacation currently.

That’s Leo’s version of “Thanks for the discussion” 🙂

This is offtopic and not going to lead anywhere productive further comments will be deleted

Right. And BC Health Paxlovid eligibility specifically includes people that “self-identify as indigenous”. That includes racially white people with no indigenous ancestry, that simply self-identify as indigenous. There are white supremacist groups (“white settlers”) in Quebec that self-identify as indigenous, and so they’ll be eligible for Paxlovid from BC Health. https://nbmediacoop.org/2019/11/22/race-shifters-white-people-who-identify-as-indigenous/

Mind you, many white supremacists are also unvaccinated, and anyone completely unvaccinated over 50 is automatically eligible for Paxlovid, even in perfect health. But no Paxlovid for a 95 year old BC vaccinated woman with heart failure and asthma (because that’s only two chronic conditions and you need three). Maybe it’s time for her to self-identify as indigenous?

If anyone is looking for a plumber for work around their house, I met someone at coffee this morning that is looking for work. Robb Bouchard 250-883-7590

Not not the same house. Rather a $200K house, which doesn’t exist in Victoria. 🙂

The East Coast has had much lower-cost housing all along, but has not attracted many immigrants. Immigrants looking for lower-cost housing have typically chosen places like Winnipeg. There would need to be a huge uptick in secure jobs suitable for immigrants in Moncton to see this change imo.

It is science-based. Indigenous people as a group, like seniors, are at 3.5-5 times the risk of serious illness should they get Covid than the non-Indigenous population. They also have, in general, overcrowded multi-gen housing in which transmission risk is elevated for all ages. https://www.cmaj.ca/content/cmaj/192/48/E1620.full.pdf

I recommend google. You’ll find a bunch of information on this.

If you believe the immigration hype then you have to assume that atleast a portion of the immigrants will be attracted to lower cost housing and would want to move there despite the harsh winters. So on a % basis it could very well outperform Victoria given how low the prices are to begin with (see westshore over the past couple years as an example)

A few things to keep in mind about Moncton.

Your 200k house will have a $4,218/year property tax bill. $200,000 in RE would cost you under $900 in property taxes here. This bill continues on after you’ve paid down your mortgage.

Your utility bills will be much higher. This also continues after your mortgage has been paid down.

Winter is long and storms are severe.

The average long-run appreciation rate in Moncton has been very low – which is why you can buy a house for 200k. This changed during the pandemic, but there is no guarantee this trend will continue. The average long-run appreciation rate in Victoria and a number of areas of BC (unadjusted) is over 7% I believe – might be lower going forward but I’ll be it exceeds Moncton’s.

If you have a pension and are fine with moving, the East Coast might be a good place to be able to buy a house and have more disposable income. If, like 1/4 of Canadians, you plan on using your home equity in retirement it might not be a great plan.

I never really understood the part about giving priority to the indigenous population simply based on indigenous status. Why isn’t it just based on need, say indigenous folks living in underserved remote community? If I live next to indigenous folks and we both have otherwise equal health status and equal access to healthcare, what’s the priority all about? making up for past wrongs wouldn’t seem like “healthcare” policy. Not sure why, but I don’t think I’ve seen much if any public discussion about this.

For anyone unable to get into the real estate market here in Victoria, or is tired of paying huge rents, there are alternatives in other parts of Canada.

New Brunswick for example.

https://www.royallepage.ca/en/property/new-brunswick/moncton/143-north-st/19067387/?utm_source=allclassifieds.ca

A simple, modest little house for $199,000.00 asking price in Moncton NB. There are lots of them available.

(I have no financial interest in this house. I simply give it as an example for others to consider what is out there.)

There are few places like Victoria. But there are astonishingly good deals out there for family’s if a person is interested in experiencing a new adventure. (Millions of people live in eastern Canada and the united States.) Moncton is a growing city with some very exciting new developments going on. For example: The major new Marine science center addition … which will add something like over 300 new employees “after” it is built.

@Introvert your favourite inflation indicator (lumber) is up to $525 per 1000 board feet today.

Whats the lowest sales of those royal bay houses recently?

Impersonators posing as homeowners linked to 32 fraud cases in Ontario and B.C.

https://www.ctvnews.ca/canada/impersonators-posing-as-homeowners-linked-to-32-fraud-cases-in-ontario-and-b-c-1.6246976

Victoria council adopts divisive missing middle housing program

https://www.timescolonist.com/local-news/victoria-council-adopts-divisive-missing-middle-housing-program-6443676

https://www.theglobeandmail.com/canada/article-private-lenders-rein-in-real-estate-borrowers/