The greedy developers

A common criticism of new developments is that developers will make an inordinate profit, and increased density is simply a cash grab. The real estate industry consistently receives amongst the lowest public trust ratings, and in fiction developers are often the villains that must be fought to save the neighbourhood. In that sense it’s understandable that people are apt to be suspicious of new projects or the pro-social arguments used to justify them.

It’s true of course that developers are out to make a profit, just like most anyone doing work. Profit is a great motivator but if there’s excess profits in the system, it’s usually a signal that the market is inefficient. There’s room for small builders in individual detached house builds, but with new custom build prices well over a million, those are luxury products to start with. For cheaper (and thus denser) housing, only those with deep pockets can afford to hold land for years while they wait for rezoning to be approved (or years more when it isn’t). That means that as land values escalate, developers are increasingly proposing more ambitious projects to make the numbers work, and those can only be done by national groups with deep pockets.

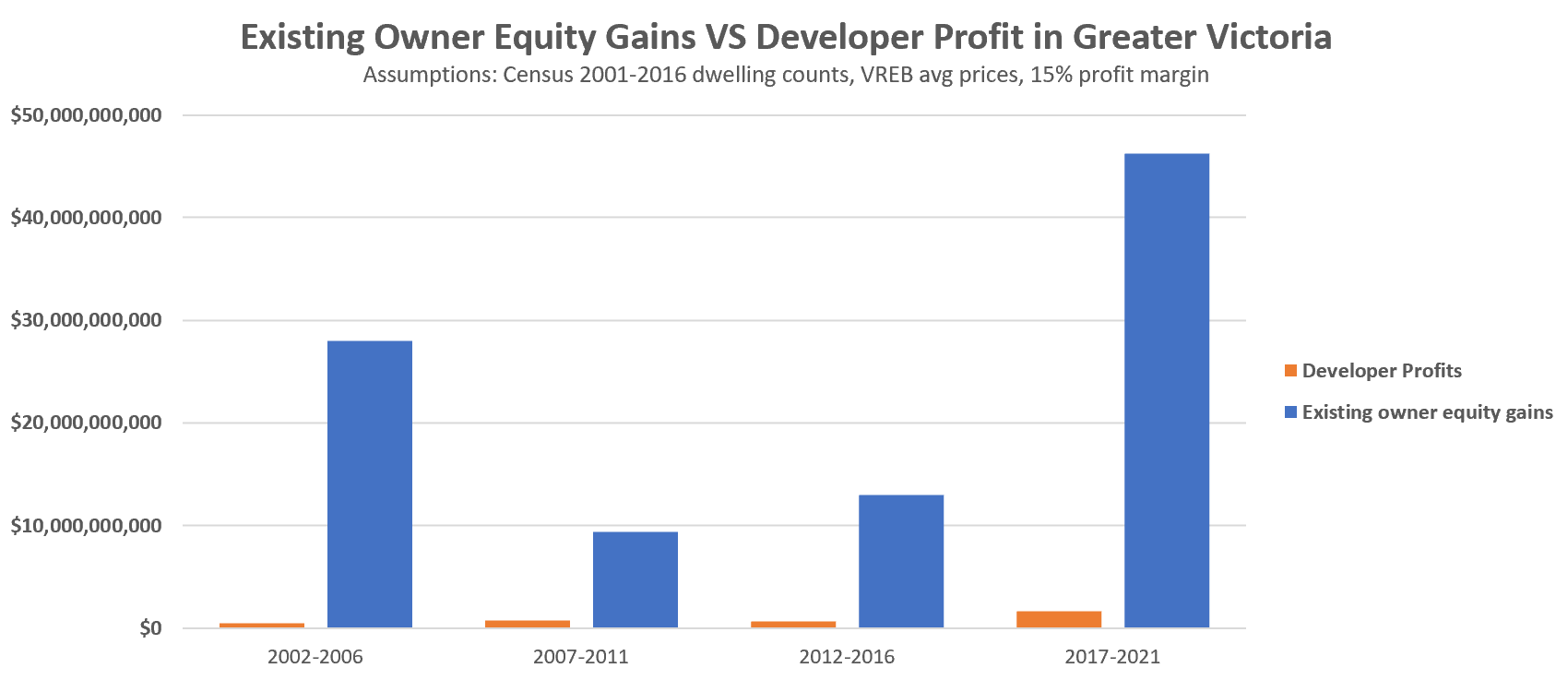

When a development works out, there’s clearly sizable profits involved. However with the bulk of opposition usually coming from incumbent home owners, it’s worth looking into who’s making the real money here. To compare the gains of developers to homeowners, I used census dwelling counts, average home price history, and CMHC housing completions to estimate the profit made by developers. For the last 20 years it looks like this.

Even in years with limited price appreciation, the equity gains of incumbent owners dwarfs any profits made by developers. On average, equity gains outpace developer profit by more than 25 times. We can quibble about assumptions and profit margins here, but it’s clear we’re in an entirely different ballgame with existing owners gaining an astonishing $46 billion in the last 5 years ($18B of which was just in the last 12 months).

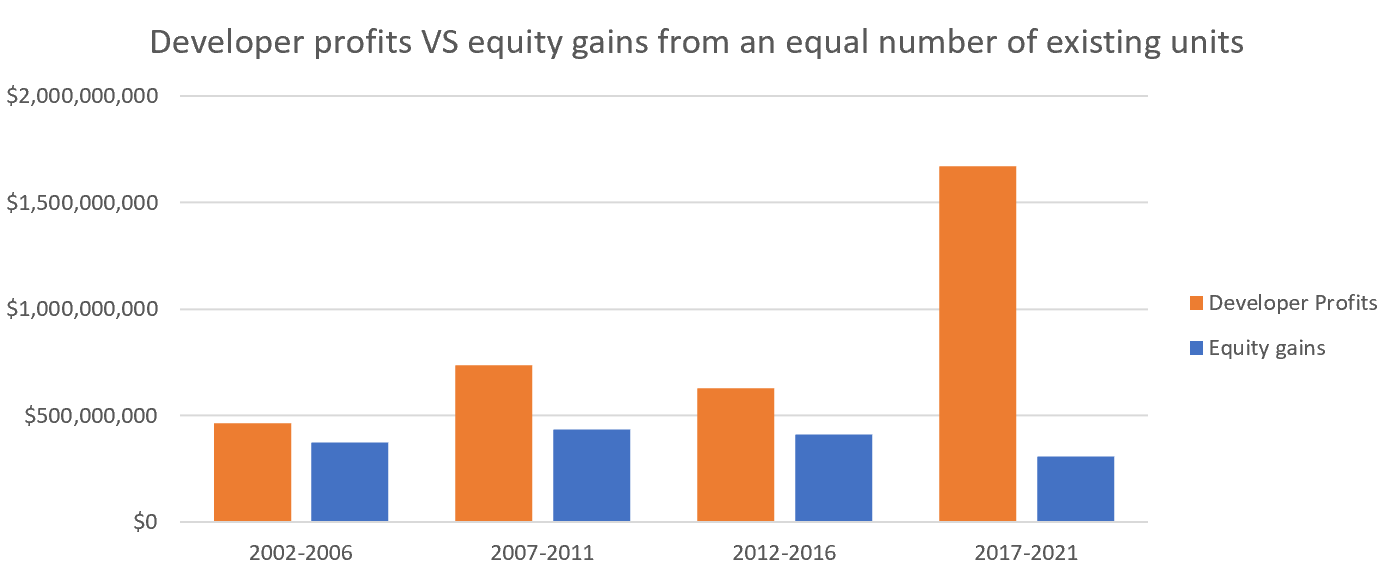

Now you may argue that it’s unfair to compare the gains of all owners to the profits from only new construction. If we just look at the equity gains from an equal number of single family, townhouses, and condos as was constructed in that year, it looks like this.

Note that the assumption behind developer profits is that units are sold, so the large profits in recent years are likely substantially overstated because much of the apartment construction was actually rentals rather than condos. In this case developers have the upper hand, but the numbers are still comparable in many years, and we should remember that the owners made those gains by doing nothing at all, while developers took the risk to build new housing.

If developer profits remain distasteful to you, we can also look at the reality of housing construction. Jill Atkey, CEO of the BC Non Profit Housing Association recently tweeted that at the peak of government social housing construction, only 10% of housing built was affordable (below market) housing. Since then social housing construction has dropped dramatically. However it means that even with a huge increase in affordable housing funding to return to those levels, 90% of housing needs will need to be addressed by developers building market housing (and making a profit doing so). Ironically the people opposing projects on the basis of excess developer profits likely live in houses built by developers themselves, simply because that’s the majority of our housing stock.

On a personal note, we live in a cookie cutter house that was slapped together by a greedy developer.

It’s been standing for 50 years, it’s lovely, and we are so grateful. I’m sure someone made a nice profit on it many decades ago, but I can’t imagine why that should matter to me.

Also the weekly numbers courtesy of the VREB:

| July 2021 |

July

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 253 | 435 | 979 | ||

| New Listings | 325 | 590 | 1480 | ||

| Active Listings | 1391 | 1417 | 2653 | ||

| Sales to New Listings | 65% | 74% | 66% | ||

| Sales YoY Change | -12% | -14% | |||

| Months of Inventory | 2.7 | ||||

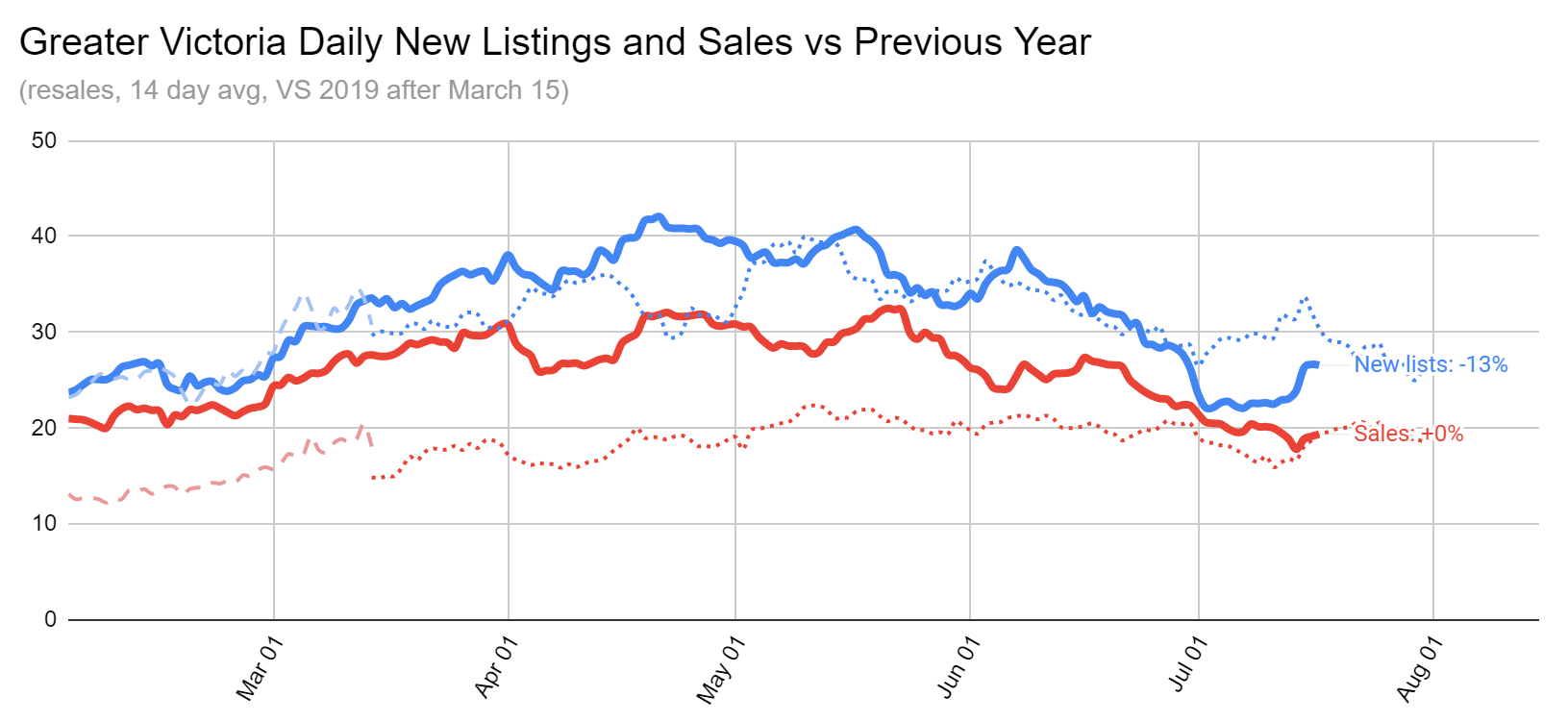

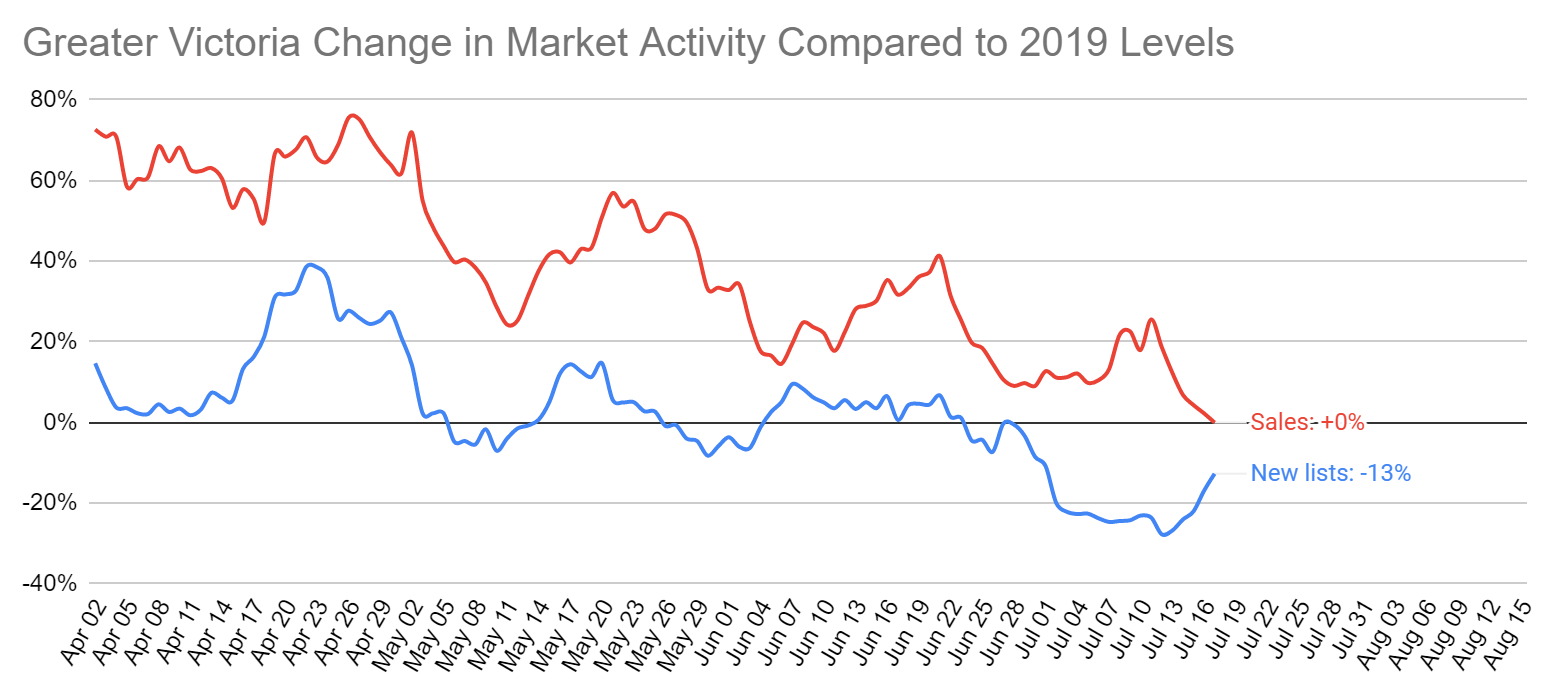

While there was a small rebound in new listings last week, we are still suffering from the disappearance of the usual start of month inventory. One potential reason other than economic reopening that’s giving people other things to do is that the start of month properties are often re-lists that didn’t sell previously. In this market there simply aren’t that many of those. Inventory remains 49% lower than this week last year.

Partially because of the inventory crunch, and partially because of continued market slowdown, sales for the first time are now roughly unchanged from 2019’s “normal” levels. Expect this to go up again as some of the new listings from last week get absorbed, but the slowing trend is unmistakable.

Roughly halfway through July, prices are roughly unchanged from June as measured by the median price to assessment ratio. Over asks seem to be slowing a bit, but best to wait for the full month’s data before trying to read too much into that.

New post: https://househuntvictoria.ca/2021/07/26/new-listings-drought-while-out-of-town-buyers-stay-high/

Sorry, the house at 2952 is at $649.900. Maybe expecting many bids? Or maybe price at 2956 Trestle was an error and was meant to be $624,900.

Court ordered sale at 2956 Trestle Place. 3 beds, 3 baths 1372 Sq. Ft. No garage. Built in 2013 Asking $824,900. Yard is a mess.

A couple houses away at 2952 Trestle Place. 3 beds, 3 baths. 1289 Sq. Ft. finished and 205 Sq ft unfinished. Single garage. Built 2014. House looks in great shape and yard tidy.

Weird.

This appears to be the case states side too.

[USA] Housing boom is over as new home sales fall to pandemic low

https://www.cnbc.com/2021/07/26/housing-boom-is-over-as-new-home-sales-fall-to-pandemic-low.html

Sales of new single family homes fell to an annualized rate of 676,000, 6.6% below May’s rate of 724,000 and 19.4% below the June 2020 level of 839,000.

The median price of a newly built home in June rose just 6% from June 2020

The inventory of new homes for sale jumped from a 5.5-month supply in May to a 6.3-month supply in June. Last fall, it sat at a low of just 3.5 months.

“In my view someone is deserving if they aren’t receiving a government subsidy to hold on to the property.”

In BC, does that include the people who get the Homeowner Grant?

Here is where I got those numbers:

https://calgaryherald.com/news/local-news/as-smoke-billows-back-over-calgary-for-next-week-b-c-asks-vacationers-to-prepare

Well sure you can pick a single year. Why not instead point out the good news of many (9) smoke free years Calgary had during the last 20 years, compared to no (0) smoke free years in the 1950s-80s? As shown in the chart https://twitter.com/YYC_Weather/status/1031736626249129986

Even the worst year (by far) in that period (1969) only had 268 smoke hours. Doesn’t really compare to 450.

Actually Calgary smoke was worse in the 1950s to 1970s.

7/10 of Calgary’s smokiest years were 1950s-70s, compared to 1980-2021. Perhaps your source misled you by cherry-picking 1981-2010 as the comparison range.

https://twitter.com/YYC_Weather/status/1031736626249129986

I think an investment property should be owned for 5 years to qualify as a capital gain. That would imply that the investor was serious about providing a viable long term rental for the public to access. It would also discourage flipping properties and encourage investors wanting to provide stable long term housing. Another way to enforce this would be to insist on fixed 5 year mortgages for investment properties with heavy penalties if it is paid out early. Just a thought. Almost every property I’ve invested in I’ve owned for at least 5 years, that was the only way I could realize a reasonable appreciation in price, unfortunately that doesn’t apply in this crazy market.

Summer air in Calgary isn’t quite what it used to be.

1981-2010

Average smoky hours per year: 12

2018: 450 hours

2021, so far: 115 hours

In my view someone is deserving if they aren’t receiving a government subsidy to hold on to the property.

Proceeds of property flipping are only taxable as business income if the CRA determines that the flipping is being done as an occupation. Otherwise, the sale of a non-principal residence is taxed as a capital gain. Whether or not the proceeds of most of this current speculative activity will actually get redefined by the CRA as business income remains to be seen. It is also a question as to how many of these current flippers: 1) are aware of the difference between capital gains tax and business income tax and the CRA’s definition of each as it applies to their real estate flips; and 2) believe that they will get away with the lower capital gains tax obligation and so, are going ahead anyway. It may also be that the market is increasing fast enough that paying the higher business income tax is worth it.

Proceeds of flipping are taxable as straight income at the marginal rate in the year that the property is sold. That’s a pretty good penalty in itself. There are also penalties for not reporting the income. CRA can and does go after short term flippers. Not to say they couldn’t be catching more.

With regard to the article below, note that a tax assessment and prosecution for tax evasion are two different things. The former is civil and the latter is criminal.

https://www.theglobeandmail.com/real-estate/article-cra-cracks-down-on-tax-cheating-by-real-estate-flippers/

Hi Frank — I think the assumption that government workers who own investment properties would translate into formal public policy to further their own interest overstates the influence that most bureaucrats have on policy decisions. Most government workers are small cogs in huge wheels. The layers of bureaucracy involved in making or implementing policy recommendations, along with the scrutiny involved in those layers (whether you believe it or not, there is scrutiny in all those layers), tends to reduce the influence of any single bureaucrat, or the likelihood of a broad “conspiracy” of many to further their own interests. Similarly, politicians are subject to enough public scrutiny that I think it is most likely that any confluence between their personal real estate interests and the public policy they implement is less likely to be designed and more likely to be coincidental. Having said that, nothing is impossible, so who knows what future auditors or media investigations might dig up?

MAG- I was trying to get information on what professions own investment properties to see if there is any impetus to either slow price escalation or bring prices down. If well paid politicians and government workers own investment properties, then it will never happen. If a high percentage of realtors own them, then it is in their best interest to keep prices higher. I would guess that realtors, on a percentage basis, are the profession owning the most. You’d be crazy not to. Doctors and lawyers are too tied up with their professions to want to be bothered, however, some of them do. I’m sure all professions are represented to some degree, it would be nice to know who owns the most and if that could influence the market. I didn’t try too hard, but couldn’t get much information, it might not exist.

Regarding the existential discussion about the “undeserving” existing (oldster) homeowners vs the “deserving” wannabe-but-can’t-be-homeowners (youngsters), my question is who decides who is deserving and who isn’t? Are lottery winners “deserving” of their millions because they bought the right ticket? Couldn’t that money be better spent helping more people? Yet we don’t characterize them as greedy and the source of all evil. Stereotyping an entire population cohort based on some personal sense of outrage or grievance isn’t a basis for developing functional public policy. Neither is solving one injustice by creating another. Throwing around gratuitous blame may make one feel quite righteous, but it usually doesn’t lead to policies and actions that actually solve problems. That requires hard slogging through mounds of objective data to sort out the complexities of the problems and develop solutions that actually address those problems without creating new ones. So far, I haven’t seen governments at any level doing much of that kind of work. Much easier and politically advantageous to stoke the personal grievance furnace.

https://www.thestar.com/business/2021/07/24/realtors-are-making-big-money-flipping-houses-but-should-they.html?li_source=LI&li_medium=star_web_ymbii

Further to earlier comments on the role of speculators and flippers. In most cases, a speculation tax wouldn’t apply to these homes, either because they can claim some short-term renovations being done, or merely a few months of actual ownership which negates most of the tax. Yet the impact of their actions on the market prices is much higher than, say, someone who owns a vacation property for decades but ends up having to pay the full spec tax. It appears that the capital gains tax isn’t high enough to discourage such flipping, especially when the market is accelerating as fast as it currently is.

I’d be interested to hear opinions on whether the realtors participating in this speculation practice are doing something inherently unethical, given their early access to inside information. Though legal, it seems to me to be a very fine line they are walking.

Usually happens when they tried to go for a bidding war, it didn’t work, so now they try to list what they think is market. Or it’s been some time since they listed and then they think the market moved up in the meantime.

Severe under listing is usually the secret to triggering bidding wars. In this case listing essentially at assessment when the median sale price is 30+% over.

I’m seeing a lot of homes not selling being relisted but at a higher price. This market keeps getting crazier. Also did anyone view 959 Lampson place? It was listed for 899k and went for 1.2million. Was it the lot size that got the bidding war going?

I’ll just keep saying this. We haven’t seen the drop in real estate demand from the drop in immigration yet. If and when there’s a rebound in immigration the impact on the market will be 2-3 years after that

Wait till Hong Kongers come and Canadian citizens living in Hong Kong return to Canada!

Vancouver, get ready for HAM 2.0!

Then, Victoria, get ready for more Vancouver cash-out buyers!

NaN- now you’re talking, but that doesn’t further Trudeau’s agenda to become a big player on the world stage. All the current immigrants want to bring more of their families into Canada and if you want their votes you have to give them what they want. I think everyone thinks the same way, enough is enough. Immigration has been low for two years and prices have gone crazy. Wait til the floodgates open up. At least we don’t have millions of desperate Central Americans walking across the border like down south. The Americans put them into controlled encampments but thousands sneak through and mix with people they have connections with. Only inhumane treatment would stop that influx and nobody wants that. Humanity is faced with some daunting problems these days and nobody has the answer.

I know. Which one is way easier and less expensive, greatly reducing immigration or building hundreds of thousands of units of affordable housing every year?

I didn’t really talk about that but Canada’s immigration policy is also generally inappropriate. Why do we need 400,000 extra people to fight over our residential re while an entire generation of Canadians are already struggling? I believe the costs far outweigh any benefits from this many people coming here at this time.

In the mean time our school system and the politicians are encourage young Canadians to pursuit useless liberal arts degrees. So that they can be forever renters.

So at the end of the day, you have to look the situation and see what your options are.

a. Join the rest of the winning millennials and out bid your peers.

b. Be forever renter.

c. Pack your bag and move to greener pasture.

Even if prices fall, the era of affordable houses in Canada seems to be done

https://www.theglobeandmail.com/investing/personal-finance/article-even-if-prices-fall-the-era-of-affordable-houses-in-canada-seems-to-be/?ref=premium

If the population is growing 500,000/year does it really matter if people are renting or owning? We still need enough housing units to house 500,000 and there is the problem in my opinion. If we were building enough housing for 550,000 people I doubt investors would be a problem.

It is not like investors are buying up properties and letting them sit vacant.

I have another Croatian tradesperson friendly here on a work visa. Doesn’t look like he will be able swing enough points for permanent residency. But we let in all the university degrees that speak good English, take up government jobs, and buy real estate. Makes sense.

I’ve spent about half my life living in rented homes, and appreciated the landlords that were providing the places for me, at a reasonable price, in cities, locations and times of my choosing. I wasn’t prepared or interested in buying a home at that time. But when I did decide to buy, I didn’t want all the landlords to evict their tenants and sell their homes so that I could buy a home cheaper, like your horrible suggestion above.

I’ve never been a landlord, and have no plans to become one. But as an ex-tenant, here’s a big thank you to all the landlords out there who provide quality rentals at a fair price to people that need them.

Deb- If all the rental properties were put on the market over a period of a couple years, the out of town demand would soak up a majority of it, prices probably wouldn’t decline appreciably and you’d be out on the street. Be careful what you wish for. Referring back to Ladysmith, where prices are lower, according to my property manager there is simply no places to rent. The absence of homeless encampments might be a big draw.

Not true because there are many Victoria renters who want to buy but because of property investors they are priced out of the market, I know I am one of them and so are my two sons.

You can spin this any way you want but the fact is that having the market out of the reach of local Victorians works too well for investors. What ever would they do if people could afford to buy home and didn’t have to rent. Well I suggest they would put their many investment properties on the market and find a more lucrative place to stash their cash.

Not true, because you have assumed that all buyers are current Victoria renters, which is obviously not the case. Not all buy-to-occupy buyers are current Victoria renters. For example, 5,000 Canadians (net) per year move to Victoria and many buy homes, and none of them are “moving out of Victoria rental accommodation”

If you don’t agree, let me explain…

For example, If an Albertan buys an owner occupied Victoria home, and moves here to own, the rental stock and supply is unchanged.

However, if the investor landlord outbids the Albertan on the Victoria home, the landlord now lists the house for rent, and the rental supply goes up by one, which you have said cannot happen.

If the Albertan is unable to buy here, he may rent here instead (and we end up with unchanged rental supply). But the outbid Albertan might stay put or move elsewhere, and in these cases the investor landlord who has out bid the Albertan has increased our rental supply.

The overall effect being that investor landlords will have a net positive effect on increasing rental supply.

Nobody is talking about discouraging investment in purpose built rentals, or condos for that matter. Investors buying the limited supply of SFH does nothing to increase net rental supply, as I have pointed out. The same amount of SFH will be built regardless of who buys them.

And, reduce the rental supply next to zero minus a few government sponsors low income housing.

Take investors out the equation and you have no new rental properties.

Couldn’t agree more, in my case I rent a place and I would love to buy but there is nothing in this area that comes close to what I can pay now. If I found a place to buy then someone else would have this rental to live in. Investors want it all their way, build more so we can buy more and rent out more to make more wealth for us. Take investors out of the equation and you just have two happy families!

I own lots of them. Guess how?

You’re missing the point that the new owner occupier will move out of their rental accommodation, making it available to someone else.

The purchase of an existing property by an investor does NOT increase net rental supply compared to a purchase by a new owner occupier.

Leo would likely have data on this , but I would assume that investor landlord rentals skew towards the lower rungs on the housing ladder, which is what you and I want to see. If you look at what’s available (kijiji , Craigslist), there aren’t many high end condos or nice SFH for rent.

NaN- When I bought my properties, there was no shortage of housing. The sellers didn’t care where the money came from, they just wanted to unload their property on anyone, it didn’t matter. Some of them needed thousands of dollars of renovations. I just put a $10,000 roof on the Ladysmith property, there goes any revenue this year. This isn’t an easy game, things can go south in a second. Talk to the owners of the condo that collapsed in Florida, I’m sure investors are losing a lot of sleep lately. Investors also prop up markets when they’re down, it’s called a market. I think the guilty parties today are flippers. They’re the ones putting multiple offers on several properties a month making it look like there is huge demand. An investor buys a house every few years, maybe sell one at the same time. It’s the flippers driving prices higher, ask a real estate agent how many they have on speed dial. They list a property, notify their flippers and like magic there are 4 or 5 lowball offers putting an artificial pressure on the buyers.

Agreed. There needs to be a location, confined and away from the city, where homeless people can live as long as they want inside a tent or shipping container or mini cabin or whatever, without fear of being uprooted. At this location, offer them all the service and support they need and/or want. It’s stable, predictable outdoor living for the segment of the homeless population that refuses to live indoors even when offered a space, and it’s much less drama and crime for the rest of us.

Of course, this will never happen for a bunch of reasons.

Who can afford to buy those? Very few.

Owning ten homes is very, very rare. How about the most common scenario based on the stats, which is owning one home and a second that is rented out. If we need rental stock and government is not providing it and it does not make economic sense for developers to build rental housing we are only left with private owners as a means to increase available stock. Government needs to step in to change this dynamic with an investment in affordable rentals and rent geared to income homes.

I don’t find anything immoral about owning a rental. I do find that there are problems with lack of rental housing stock and lack of affordable homes to buy that are creating hardship.

@ Patrick – I think you are half right – there is certainly room for investor involvement in residential RE but likely more at the level you point to it being most important – low end apartment blocks, etc. There is no “keeping people off the bottom” or other moral purpose in owning 7 high end condos and three single family houses all in the same city. These investors are increasing prices over all with money they didn’t earn and at the same time lowering the quality of life for families who work in the community and would otherwise own, seeking to extract the value created by others at the expense of the communities they live in.

It is a preferred outcome if an investor landlord outbids a prospective owner occupier. Rental housing is more important than owner occupied housing. We are at or near all time highs in home ownership.

Much of the housing demand is profit based as the FTB assume they will make money on their house.

As you state above the would -be owner occupier “wants” to be an owner. But they don’t “need” to. Whereas someone looking for a rental “needs” something or they’re out on the street or out of the city.

That’s why in a housing crisis it’s better for an investor landlord to outbid a prospective owner occupier on a home sale.

The lowest rung on the housing ladder (renting) is more important than the higher rungs, because it keeps people off rock bottom.

@ frank- that’s the point. Their loss your gain- you say that like you deserve the windfall you extracted from that family while they pay your mortgage because they were too poor to outbid the next investor in line?

If investors weren’t able to buy it, your “offer” would have been much more affordable to them because there would be NO demand from anyone other than people who actually need the house to live in.

Maybe I wasn’t clear on this before but patriotz said it too- every single investor in residential real estate is outbidding a potential owner occupier.

Given how important owning real estate is to wealth building in Canada, efficiently performing labour and general quality of life in both working years and retirement, I think allowing investors to multiply gains at the loss of would be owners when there is a massive shortage of supply affordable to owners who actually work in our communities is simply a wrong.

your rental in lady smith provides bare minimum subsistence to three generations but 100% of the wealth creation and all the downstream benefits to your net worth, family, stress level etc goes to you, at the expense of that three generations who will live their lives running on a treadmill because investors are allowed in the market to outbid them and prevent them from building equity of their own.

Aren’t there two problems? Lack of rentals and lack of homes for sale? I’m not sure one wins over the other.

My rental property in Ladysmith is currently providing for three generations of one family. I sell it, the elderly woman who is being cared for by her adult daughter would probably have to be put into a care home. The children of the adult daughter might end up on the street. There simply is no place for them to go. Although this is an opportune time to sell, I know it would cause them a great deal of grief. Who would buy the property? Probably a retired couple from another part of the country. Please think things through thoroughly before offering “solutions “ that do not solve anything. I offered to sell them the house 4 years ago and they didn’t take my offer. It has doubled in value since, their loss, my gain.

The problem you haven’t addressed is that an investor who buys a property is outbidding someone who wants to be an owner-occupier.

Raising property taxes would probably make things worse. Investors would liquidate rental properties and put people who cannot afford a house out on the street. Cities should be run more efficiently, they are experts at creating more bureaucracy thereby creating the need for more money. Taking more from tax payers takes money out of the general economy. I work hard for my money and don’t like it taken away to feed a hungry beast.

Funny, I keep reading on this forum how unaffordable SFH rentals are in Victoria. Do we have any data on where lower income working households actually live?

We have higher income taxes in large part due to government provided health care. You really have to bundle health care costs and taxes together to compare disposable incomes. And our record high and still increasing mortgage debt shows that the money for RE purchases is primarily coming from borrowing.

That depends very much on the state and sometimes the city. Some US states have no income tax or sales tax and consequently have high property taxes. Remember to look at the actual tax bill and not just the rate when comparing. I am an advocate of lower income taxes and higher property taxes.

My idea to “toss people out” is a complete misinterpretation of what I was trying to convey. Ousting the homeless from city encampments accomplishes nothing, it only kicks the can down the road. It’s the equivalent of chasing your tail. Giving them their own area might make them feel more secure, an important step in possibly improving their situation. Tear down one encampment and another one will appear somewhere else. Designate an permanent area for them, give them some support, and who knows, it might actually work. The current confrontational approach does not work, and only disrupts their already precarious lifestyle. Give them what they want, not what you want them to conform to. There is no housing solution, they can’t mentally handle the responsibility. They prefer their freedom outdoors, let them have what is a stable environment for themselves.

Yep. Me too. We just got back and it was bad depending on wind direction.

One of the biggest reasons we sold our place in the Okanagan. One too many summers in the smoke.

Thanks, that does clarify your position, which I did misunderstand.

Your idea to force investors to sell has a problem which you haven’t addressed though, because investors are landlords with tenants. It would force tenants out of all those homes sold by their landlords. These rental homes are a major source for affordable housing for the lower income households.

That plan is an attempt at redistribution of the existing stock. Which won’t help.

Because you can’t fight Leo’s first law of housing dynamics, namely …. “You can’t solve a housing crisis by redistribution.”

@ Patrick – Maybe I’m misunderstood – when I say restrict housing demand in a reasonable manner, I mean preventing investment generally in residential real estate, for everyone i.e. if you aren’t buying to to live in it yourself, you can’t buy it. This would require that all investors in residential real estate sell, generally, and new buyers would need to be qualified as Canadian citizens with taxable income earned in Canada for a minimum number of years before being granted access to the residential RE market. This would be an absolute boon for millennials (which I am not) as hundreds of thousands of houses would be made available to Canadians families that want to own housing almost over night.

I am aware that it would 100% piss off every single residential investor and cost many of them millions (including myself) and I don’t care. That is a fair price to pay in my mind as it is either that or the end of Canadian society and that is not hyperbole. Franks earlier idea about tossing homeless out to keep property values up isn’t the first time I have heard that stupid idea and with taxpayer funded cops starting to beat Canadians at the behest of investors many of which pay no taxes makes me sick. If prices keep rising, investors will have access to more credit & buy more, permanent housing will become increasingly scarce for people starting out and the line between haves and have nots will rise to the point where those disenfranchised will become increasingly educated, richer stronger and more violent as their labor is increasingly devalued to benefit asset owners. They will either leave or start a class war or both. Either way, we all lose.

I hope that is more clear. The world isn’t short of things to invest in, and if you need to invest in RE, buy commercial. Residential real estate is special because it’s a necessity to perform labor and as such, the prices where the labor is performed should be aligned to it. If you want to vacation in Victoria, rent a hotel.

On entitlement, I see none stronger than sellers to their unearned gains. I bought many years ago and own plenty of real estate – about half my net worth is in real estate. But perhaps I am more aware of what is in my and Canadian communities best interest is over the long term.

The fairly tale dream is believing you will want to live in Canada if we don’t solve this problem.

Probably a bit more than that.

Yes. Premiums went up 14% here as well (to just over $1300) but coverage doubled (from ~$1M to $2M) and earthquake deductible went from a percentage (~10%) to a fixed amount ($25k I think). So increase but substantially better coverage.

One reason I think Canadian real estate prices are higher than in the U.S. is the fact that they pay ridiculous health insurance premiums ( even if they have a plan where they work, they usually still have to contribute out of pocket). Unless,of course, you work for the government. Our “free” health care frees up a lot of cash for investment. I’ve also heard that property taxes in the U.S. are extremely high, that’ll keep prices down.

What a load of entitled crap.

The demand you want to restrict, is from young househunters just like you Nan, not the bogeymen you mention (old people, investors, “high paid” city employees).

Millennials are the biggest cohort ever, larger than the boomers. They have delayed home ownership just like they delayed everything else, in favour of more education and higher salaries. Now they’re older, and many have the high salaries and savings, and are buying homes in huge numbers (over 50% of NA home sales are going to millennials).

You should have realized that sooner and bought ahead of the wave of millennials, and there have been plenty of posts about it here for years. The good news for you and other HH’s is that this unprecedented wave of Millennial buyers is just getting started, and will last at least 10 years. On top of that, there are 5000 Canadians of all ages moving to Victoria every year who can afford our housing. Hold your nose, and buy what you can afford now, and forget your fairy tale dream about “housing demand being restricted in a meaningful way”.

Nan: Actually, I agree with much of what you believe more than I do not: Too much government intervention in the wrong places for sure.

For instance, health care premiums. I think everyone living in Canada under the age of 19 or say up until the age of 25 if still in some form of post secondary education, should not be required to pay monthly premiums. It should be free. This should include basic dental health as well. After than, according to income up to a certain level, every one should pay something.

I think if a senior is getting the supplement, paid by the taxpayers, he/she should not be able to have TFSA’s income excluded from their total income. Some of them have well over $100K in the plan, yet get all these perks where other do not.

Also, except in certain circumstances, no-one should be able to defer their property tax. If you can’t pay, you can’t own. Simple.

There were many in my age group who made much more than I did but squandered their money on frivolous items. Holidays, golf memberships, RV’s, boats, a new car every three years, upgrading their 6 year old kitchen, you name it. They now receive the supplement, SAFER , extra GST amounts, COVID payments etc. and more. I know, it just doesn’t seem fair.

No matter what happens in life, there are always going to be people who get a little more for doing much less. They play the game. What are you going to do? The users have always been there. Not just right now, but for many, many decades before. That will never change. They will figure it out long before we do.

And yes, seniors or anyone else that own more than their principle residence plus a vacation property or perhaps up to a certain amount of investment real estate should be required to have a substantial down payment.

More thought must be put into equalizing peoples circumstances. On the other hand, I don’t believe we are ready to be a totally socialized republic either.

But then, I could never vote, in all conscious for the NDP.

In Seattle’s hot housing market, nearly a quarter of sales are all cash

https://www.seattletimes.com/business/real-estate/in-seattles-hot-housing-market-nearly-a-quarter-of-sales-are-all-cash/

“A lot of people are coming from markets like the Bay Area, where prices are higher. They’re coming in here with no sticker shock,” said Nick Glant, a founding broker at Compass Seattle. Glant said his most recent all-cash deals were in the range of $2.5 million to $4 million.

… Seattle-area home prices are climbing at the third-fastest rate in the nation…

I don’t think age is of any particular consequence. Perhaps I should have used established real estate wealth versus labour or buyers versus sellers. Old and young are incidental.

Anyways, how on earth did we afford child care before the government came to help? Oh wait the government hadn’t pumped houses to a million dollars yet so there was plenty of money to go around. It’s all part of the same problem. Too much government in the wrong places (credit expansion) and not enough in the right places (residential real estate ownership controls)

Leo, is your house insured with TD through the UVic alumni program? My premiums with them went up 14% this year. Over the past five years, premiums have increased 41% (almost as much as TD’s dividend). There has been no change in coverage nor have there been any claims. I was considering shopping around but it seems premiums are going up at a large clip no matter the insurer. Entire towns being flooded out or burnt up has a financial cost I suppose.

From Facebook. Seems like the stress test is more or less irrelevant now if people who say they can’t pass the stress test for the place they want are being offered mortgages that don’t require the stress test

Young people predominantly vote left-wing. They’ve got what they voted for.

Thanks, Mr. Buddy. All good to know re: federal program and getting an efficiency assessment. We want the heat pump for the environmental considerations but also definitely for the A/C factor. It seems inevitable that that’ll come in handy a few times a year or more from here on out. (I’d also like a HEPA filter for the now seemingly annual wildfire smoke.)

Risky mortgages stoke fears Canada may see subprime-like disaster

https://www.pressreader.com/canada/calgary-herald/20210722/281956020807540

You are right on one level at least Nan. I intend to stay in my home for as long as possible. I do not wish the younger generation to in any manner subsidize my stay in an “old peoples home”. I can take care of myself.

Think of it this way. Those 25 year old’s you are talking about will also be subsidizing child care soon Ten dollars per day? I guess those 38 yr old parents will be getting that perk for their kids and the youth of today will be paying for it but will not be able afford a child of their own.

It is very difficult for young couples and especially single parents to realize their dream of home ownership. But you know, as many have mentioned, you can also move to the city of Edmonton a purchase a home there at a third of the cost of here.

This government needs to build institutions to properly care for the mentally ill. It needs to build more affordable and appropriate “rental” housing for the poor and for those on low income.

A way down on the totem poll is building three bedroom, 2 1/2 bath SFD’s for a couple with one child earning over $100K per year.

Could you answer that one question Nan? How old is old in your books?

Housing, alcohol and weed: Canadians’ pandemic spending habits are changing how inflation is measured

https://financialpost.com/news/economy/housing-alcohol-and-weed-canadians-pandemic-spending-habits-are-changing-how-inflation-is-measured

Heatpumps clearly need to get better at reducing maintenance costs- totally agree that there’s nothing like baseboards or natural gas appliances in terms of simplicity. Although I’d suspect that many of the NG furnaces that haven’t been tuned aren’t running very efficiently but people don’t seem to know or care.

It’s the same thing for cars though- with my EV, I see the impact on range when I put a bike rack or roof rack on it- it’s a dramatic difference. But the same thing happens to a typical car too (changes in aerodynamics = increased drag), but no one seems to care because it’s not obvious. I’m always amazed at the number of people who leave their boxes mounted on their roofs year round when they probably use them rarely- complete waste of gas.

I guess for me when we get close to cost parity on heat pumps vs NG fireplace (which is an inefficient way of heating a house BTW compared to a furnace or NG space heater), why wouldn’t you choose something that’s more ecological and has a better chance of leaving the planet more habitable for my kids? Some of us would pay a lot more, but when it’s close to parity, I suspect the average person would pick more ecological. Throw in AC and it becomes a no brainer.

@Alexandra I do not equate an aversion to the young having their youth extracted to fund the existences of the old as disrespectful or hateful, but I do see the entitlement of the old to the fruits of the labour of the young as exactly that.

This is not to say that I don’t support a reasonable transfers of wealth to maintain a functioning society but before you say “this is no different than any other generation buying houses with mortgages from the previous ones” I suggest you review your math. Down payments these days are literally the cost of an entire house 15 years ago and wages are flat.

This is financial vampirism, plain and simple.

@frank If you think houses are twice as expensive relative to incomes in Canada as they are in the US because of anything other than Canada’s government intervention in the re market, you aren’t paying attention.

This story about Danbrook One is wild. I had heard of some of the issues from engineers involved previously who estimated the repairs to the buildings core may not even be economic to complete.

https://www.capitaldaily.ca/news/should-not-have-happened-new-documents-outline-potentially-catastrophic-failures-in-danbrook-one-design

Sounded like a dirty thermocouple and/or thermostat, a quick look and clean the soot off the thermocouple or replace, and clean the thermostat (possibly dust or pet hair) should do the trick.

Does not sound like the blower connection, they could have done a continuity/resistant check to make sure that it is working properly, but more likely poor air flow from dirty filter (perhaps filter replacement every 3 months or less if one have pets), and one may want to check the return air duct to make sure that there are no obstruction/s.

Check and do a continuity test or test with known good the thermocouple and igniter.

Why replace the blower when you can do a continuity check on the wires, replace the broken wire or find the broken portion and splice it together with a crimp connector or twist wire nut?

This article is causing a stir:

https://www.wsj.com/articles/startup-claims-breakthrough-in-long-duration-batteries-11626946330

This is just my opinion but I think that no matter how affordable housing becomes ( which is not going to happen) there will still be homeless people struggling with their addictions. Dysfunctional people consumed by powerful addictive substances really are unable to maintain a reasonable standard of living no matter how much you give them. High housing prices do not create drug addicts and alcoholics. Until we remove these destructive substances from our society (which is not going to happen because the government gets too much revenue from them) people are going to fall victim and ruin their one and only life.

Yeah, and it shouldn’t be free.

This article gets into how sheisty FortisBC is, and how gutless the B.C. government is:

https://www.nationalobserver.com/2021/05/17/opinion/time-stop-playing-nice-fossil-fuel-companies-blocking-climate-action

It’s government policies, both on the demand and supply side, that created the housing problem.

NaN – You should run for political office, the government can solve all the problems that people create for themselves. I just don’t see any evidence.

2021: Canada is the the overall #1 Country.

Canada ranks #1 in QUALITY OF LIFE & social purpose. Also:

Good job market

Caring about human rights

Committed to social justice

#1 Non-corrupt and respecting property rights

Canada and Nordic countries are viewed as most committed to social justice — while the US is #18.

Racial equality ranks #69 behind China and Iraq.

I would be interested, when people talk about “old people”, what age group is that? Over 50 with maybe another 50 years to live?

Personally, with great emotional but NO financial support from my parents, I made it on my own as a single parent. I never once received child care benefits, unemployment insurance, workers compensation, maternity leave, education grant, seniors supplement and I have never applied for a deferment of property taxes, nor am I in receipt of a huge government pension.

I ensured a decent education for my daughter and I cared for my elderly mother until she passed. Most people of my age had nothing but the utmost respect for our parents, we appreciated how hard they worked just to make ends meet.

It sounds as though some on here actually “hate” and possess such lack of respect towards their parents/grandparents. How very, very sad.

Appropos of nothing, I was surprised with the insurance renewal this year. They changed some policies and though I ended up paying about $200 more, limits more than doubled, and earthquake coverage got substantially better with a much lower deductible so I don’t think rates went up at all.

Meanwhile I was in the interior at the insurance place and overheard someone saying they had bought a new house and wanted to get home insurance. They told her because of nearby fires it would be impossible to buy fire insurance for now. Wonder if many of the homes in the interior will become uninsurable to fire at some point.

I have a natural gas outlet on the deck and recently bought a new BBQ so I considered going natural gas but:

1. Natural gas versions of BBQs are generally $100-$200 more than the propane version.

2. My BBQ is portable, so I can take it to the beach or camping, not possible with nat gas version.

3. Fixed fees to have the natural gas connection at all is ~$150/year. Only makes sense if you’re using more gas than just BBQ.

The advantage is you never have to worry about propane refills or the tank, but didn’t end up making sense in the end.

Maybe it makes zero sense economically, right now, but I don’t see how you can go wrong running as to a brand new home. It’s free. Even if you just did the BBQ outlet and nothing else it makes sense econimically and environmentally. How is going to gas station to pick up propane more environmentally friendly than a natural gas BBQ.

If things change in the future and hydro skyrockets you just switch to gas.

No reason to feel guilty but I’m continually amazed that people that profess concern about climate change then go and put gas into their homes because they feel it’s slightly more convenient (nevermind it makes zero sense economically, environmentally, or comfort wise these days in most situations). Same vibe as people concerned about housing affordability voting against new housing.

Guess I’m just unlucky then. Both of the gas fireplaces in our place are broken. It’s not the igniters either, one of them just randomly shuts off. The gas furnace backup also has a problem electrically that I’ve had a guy look at a couple times ($) but they’ve never quite got to the bottom of. Sometimes it won’t ignite, they think it’s a bad connection to the fan motor so could try replacing that for a few hundred.

Let’s just throw all the “poor” people who can’t afford to house themselves in the trash hey Frank?

Housing is expensive in Canada first because old people (like you, most likely) weren’t financially responsible and voted for it, second because there is too much credit, third because there is too much speculative demand from people who shouldn’t own the housing (this includes investment demand from inside and outside a Canada) and fourth because everyone in the industry makes too much money now- city employees are at the top of that list piling on fees and boosting salaries etc. There is no way to curtail the sense of entitlement of the old and if we need credit to be abundant for macro reasons, the only way to lower prices is to restrict demand in a meaningful way. We need supply but without demand restriction and a change in nimbyism there is NO chance of that actually working by itself.

For the record, demand restriction is NOT RACIST. It is about allocating Canadian resources to Canadians in the same way we do with any other resource our country has to offer. Do we want to provide healthcare to the whole world as well? Of course not. Should you be able to monopolize a hospitals services even if you are entitled to use them as a Canadian? Also of course not. We are not reasonably allocating a finite resource to Canadians who need it right now and need to do better.

Forced sales for all units that violate reasonable ownership rules and prices get real affordable in a minute. (And if you feel poor all of a sudden because your real estate empire isn’t worth as much, or you are forced to sell, tough- thems the breaks. You probably didn’t earn it anyway and as they say easy come easy go). If you were responsible financially, your properties will yield over your costs and you’ll have some investment diversity beyond re and will be less rich but otherwise fine and young people won’t have to sell their souls for the bare necessities of life.

I would even suggest that politicians set targets of price to income for regions because no one and I mean NO ONE with appreciable equity in Canada today has actually earned it (including myself- I have earned as much from my house since I bought it as I have from my job and I am in the 1%) and I am tired of the financial body snatching we see as “necessary” to keep the whole thing afloat. If you are old and didn’t plan well enough, then it is YOU who deserve to struggle, not the young who have (made no mistakes) are being forced to transfer the value of their youth to sellers for a roof over their heads via the ludicrous system we have going right now.

And if you bought at these prices and get sucked under water with a mortgage you don’t want to pay, there is absolutely zero probability that you did your homework and bought because it made financial sense. Being financially stupid gets people punished too.

Saying we can’t house the poor (who are really quickly becoming just the young without pre existing parental wealth) because we are becoming like other shitty quasi third world countries is a complete fucking cop out for a country with 1/10th the population as the US, just as much land and likely more resources. There is enough to go around for every CANADIAN. We just can’t house the whole world successfully and it is greedy lazy people like you that are turning this once beautiful land of infinite opportunity for all who wanted to work hard into the corrupt, entitled, morally bereft cesspool it is becoming.

When I lived my house I had a Valour H4 and yea completely abused it running it around the clock (I preferred the heat over my heatpump) and never had a single issue. Heatpump one of my heads leaked, needed servicing, etc.

If it wasn’t for air exchange requirements my fav setup would be gas fireplace + baseboards in bedrooms.

92% of new cars sold in BC are still ICE so I am going to feel guilty about using gas in my house…..common. All the houses we are building right now we bring gas to the house as it is free, and we do a heat pump and gas fireplace (which can heat >50% of the home in most circumstances). Use whatever is cheaper. Then there are all the other conveniences such as not having to lug propane for your BBQ.

For the millionth time I’ll bring this up again…….if you really want change everyone should be living in towers and walking to work. Advocating for not using Natural Gas while we clear cut everything to make way for cookie cutter subdivisions where everyone has 2 cars is a complete joke in my opinion. People want change, as long as it doesn’t impact them.

And for those advocating Natural Gas as a heating source- I really hope we get to the point soon where heating with NG is viewed similarly to heating with coal: something to be embarrassed about because it impacts one’s neighbours/world substantially more than other heating sources.

The province is literally on fire- and natural gas contributes to it a lot more than BC Hydro electricity. (You can quibble about how green BC Hydro is, but it’s orders of magnitude cleaner than natural gas, under any credible analysis). Saving a few bucks a month with natural gas seems like a false savings if we continue to see heat waves and fires/smoke every summer.

I feel for those genuinely having a hard time paying for heating/electricity bills and have to make this choice solely on economics, but I’m guessing that’s not too many people who are reading this blog. My analysis is that with the government programs, over a 20 year period, the difference between a heat pump and NG for my house is basically a wash.

https://www.youtube.com/watch?v=XHK1OBSBpwc

Cynthia- the Federal Requirement to get an Energy Audit is very similar to what the BC programs required 3-5 years ago, and were in place when we upgraded our oil furnace to a heat pump.

While it’s certainly an extra step, they can be useful, as sometimes what they find isn’t intuitive to non-technical folks. I didn’t find it useful, but I’d already extensively retrofitted my place by that point.

But it was still worth it to get the grant- and with the current federal and provincial grants, it should be a no brainer to get the heatpump. Just over three years ago, I was quoted $6k for a high efficiency natural gas furnace vs $12k for a high efficiency heat pump. I’m sure prices have gone up, but with $5k from the federal program, $3k from the province (and $2k if you happen to live in Victoria), it is actually your cheapest option.

Plus it makes a significant dent in your GHG emissions, and for the couple of days/year we have a heat wave, the AC is really nice too.

Frank, this dystopian vision doesn’t work, they prefer Beacon Hill park or downtown hotels.

To be fair lets compare the profits of a single developer with the gains of any single family home. I know that you are just having fun with charts Leo but you just may be chipping away on your credibility this time. There are a few family developers whose profits each year are in the tens of millions and I dont know of anyone’s house that has gone up ten million in a year. I assume that you already know how disconnected your numbers are and that you are just having fun.

Total chaos in Toronto as an “army” of police cleared a large homeless encampment. It looked like something that only happens in other countries. Maybe we have to come to the conclusion that the only solution would be to create homeless encampments on designated areas outside of major cities. Supply the occupants tents, food and their drugs of choice and let them fend for themselves. I don’t think many of them are capable of integrating into society and should be left to pursue the life some of them have chosen, mainly due to substance abuse issues. Some form of medical assistance should also be provided. I think many of them would embrace this primitive lifestyle rather than be treated like a pest society wants eradicated. There are similar slums surrounding major cities around the world, I guess Canada, given its high housing costs, is “coming of age” and becoming one of those countries. Controversial, but practical?

lol well James, if one owned a couple of SFH rentals in the core then they can retire even with the reduced pension 😉

Narrator: “But it turns out, he knew exactly what he was talking about.”

I’m not joking, the solutions are too painful and would tank the world economy. The real people in power won’t let that happen. Going electric everything is never going to happen, we don’t have the generating capacity to meet the demand and construction of new sources takes forever. I feel sorry for the people with 50 years ahead of them, it’s going to be really rough. It already is for billions of our population.

I’ve looked into solar for my commercial building, it just wasn’t feasible and would have been a huge headache, the young people I was dealing with didn’t seem fully competent. So I’m sticking to my mid- efficiency furnaces that cost under $2000 a year to heat a 6500 sq. ft. brick building in Winnipeg. It would take 50 years to break even but I probably would have spent another 100 grand upgrading the system over time. At least I could say I was an environmentalist for a few months.

@Frank I hope you’re joking. If not, you must be EOL or not have kids.

Cynthia- Put in a high efficiency natural gas furnace, we can’t save the environment, it’s too far gone.

Kind of off topic but hopefully someone has some insight into this…

I’m interested in replacing my mid-90s furnace in my 1950s house with a heat pump. The furnace still works fine but is bound to go sometime soon just because of its age. Has anyone gone through the new federal program ($5000ish rebate) yet? It seems like a huge headache because you have to get a whole-house energy efficiency assessment done before you can even get a quote for a heat pump or some such thing. But I’m guessing there’s no way around that…

Gas still is cheaper at basic usage (I believe as of this Apr pricing), and gas is much cheaper by a large margin when you go over 1,350 kWh in electric consumption. Perhaps the taxes will eventually equalize the the costs or raise gas price above electric (highly doubtful because gas costs is a relatively small portion of the overall service fee).

Another factor that one might want to look at is maintenance/repair, and service lifespan.

You can abuse the fireplace to the cows come home that may need a thermocouple or igniter replacement for less than $20 very 10 years or more.

Abusing a heat pump would require replacement in 10-12 years and that not include expensive yearly maintenance, early contactor failure, gas recharge if you have a slow leak, or blower failure (compressor failure is an automatic heat pump replacement). And, due to stringents efficiency regulation manufacture have to squeeze every last bit of efficiencies out of a heat pump so the reliability is lowered and complexity of it making repair expensive so it is logical for users to replace the unit instead of repair.

https://www.fortisbc.com/services/natural-gas-services/why-choose-natural-gas/annual-fuel-cost-comparison#tab-1

Just saw this on Reddit Victoria in response to some NIMBY pushback on the Harris Green project:

That’s a taxable benefit, both in the US and Canada. The tax evasion charges against Trump Org are grounded in this.

https://slate.com/business/2021/07/trump-organization-allen-weisselberg-charges-tax-evasion-fringe-benefits.html

I don’t think this is true today and certainly won’t be as the carbon tax escalates over the next 10 years.

Most of these billionaires live off the company as an expense to the company. All his needs are a perk of being the owner, I don’t know how that is taxed, probably buried in the company financials.

Maybe they have issues with these billionaires legally paying lower taxes than a typical worker in some cases.

https://thehill.com/changing-america/respect/equality/558352-elon-musk-explains-his-extremely-low-tax-rate

“Musk reportedly paid less than $70,000 in federal income taxes between 2015 and 2017 and paid nothing in 2018 — despite having a net worth of $152 billion. He lives off loans made from his stock options, meaning he doesn’t take a salary from his company.“

https://www.businessinsider.com/jeff-bezos-did-not-pay-income-taxes-2-years-report-2021-6

“ Bezos can skip paying taxes on his accumulated wealth from the Amazon stock because stock gains aren’t taxed until they are realized by selling off the stock.”

This is what we did and it is very economical and esthetically pleasing. House is warm all over but we can turn off the baseboards upstairs if a room is not in use. We have baseboards downstairs but we don’t even use them in winter because the gas fireplace is enough.

I hear you, but the author was saying fireplace for the main floor at ground level, perhaps the living room, dining room, kitchen, and bathroom. And, gas is so cheap that you can just leave it on to over power everywhere and grossly over sized isn’t a problem with a fireplace. However, you can’t do that with heat pump because it become inefficient, uneconomical, and shorten the lifespan of the heat pump.

Thanks for all the help. I’ll do some more research on heat pumps vs gas fireplaces. We have no gas currently in the house, so we have to see the cost to add one. Through fortis bc, seems cheap as house very close to the road. Will do more homework.

Thanks Leo!

Try Barnes & Co https://www.inspectionsvictoria.com/

Yes! HEAT PUMPS!

Can anyone recommend a quality home inspector that can really dig down on possible flaws? Someone that is fully competent in the behind the walls and under the ground issues. I don’t mind paying a premium.

The alternative is a gas fireplace so it would be the same. But one heat source can heat the main living area of most homes.

I’m sorry you will have uncomfortable cold spots/rooms if you have only 1 or 2 heads, unless the house only have 1 or 2 rooms, fans need to be added, or something to move the air around.

I’m sorry to budge in your conversation with Leo.

Yes, heat pump will work.

You have 3 options for the top floor:

1. Package Unit in the atic (cheapest setup, but not most efficient).

2. Central AC/heatpump (require duct work, and is most expensive).

3. Mini Split/Ductless Split (most efficient, but ugly).

You can go with multi head mini split, or multiple single head mini split units (multiple single head mini split often are cheaper than a multi head unit).

Excellent idea, a single gas fireplace can heat up your entire house if need be pending the size (btu).

Yes, not a central one with ducts, just a mini split with one or two heads. Would heat/cool most of the house and then leave the baseboards as backup for the far away bedrooms

Same idea as the above. Get the cheaper heat source for the main living area, leave the baseboards above.

The economics also depend on whether you have gas already. The fixed costs drive up the per GJ cost substantially if you’re bringing it in just for the fireplace. If you have gas already it’s not as big of a deal. Anyway I would at least investigate it as an option.

“Actually it was way worse in the old times.”

Yep. We probably have aggressive wildfire suppression to thank for the smoke free summers of childhood. Too bad Trump had to open his mouth on the subject of forest management, because I suspect it has as much, if not more to do with the current situation than climate change.

I don’t understand the whole greedy developers and Bezos is a horrible person for going to space today. You have an issue with Bezos’ net wealth? Don’t buy from Amazon. Have an issue with Elon, but one of the many other EVs out there on the market not named Tesla. Have an issue with greedy developers…just get 20 people together in your office to raise some capital, buy some land, rezone it, hire a contractor to build it, etc., shouldn’t be too difficult.

If I am shopping for a pre-sale condo I am looking for the best possible deal. Why would I care how much the developer pockets. If you make the barrier to entry for smaller developers lower you have more competition and lower prices. The biggest barrier to entry is munciaplities and the re-zoning process. Big players can afford to spend hundreds of thousands and be voted down by city council. Smaller firms can’t afford that.

Thank you Leo.

We are on concrete ie no basement. Just main floor and 3 beds up. All setup with baseboard.

Would a heat pump still work in such a setup?

We were thinking just adding a small gas fireplace for downstairs and leave baseboard upstairs.

Thanks for any advice you can give.

Ended up with a couple of accepted offers on my listings with buyers being from Kelowna….could it be the smoke 🙂

Poor forestry management has much to do with the BC wildfires. Indigenous communities have managed the forests for thousands of years by “cultural burning”(prescribed burns of “ground fuel” like fallen branches, bushes, logs, stumps and fallen leaves, needles, branches, and cones https://www.fs.usda.gov/Internet/FSE_DOCUMENTS/stelprdb5042664.html), but are hampered now by government red tape, and too lengthy approval processes.

https://www.ctvnews.ca/canada/fire-experts-prescribe-indigenous-cultural-burns-to-reduce-wildfire-risk-in-b-c-1.5513720

“Wildfire experts say British Columbia must spark far more prescribed burns, akin to how Indigenous communities have managed forests, to mitigate the risk of huge blazes. Indigenous communities still express barriers to cultural burning, said Christianson, pointing to lengthy approval processes and a lack of sustained funding to support knowledge transmission between elders and a new generation of fire keepers.”

Actually it was way worse in the old times.

Just heard on the radio that one day breathing this smoke is equivalent to smoking a pack on cigarettes. This also facilitates transmission of the virus.

If the mainland becomes less appealing, then more people will go to the Island. Not sure I’d like to live in the interior, those fires are unbelievable.

Wonder if these terrible fire seasons will put a dent in demand for the interior.

Getting so bad, nearly every summer is smoky for weeks. Danger of being burned out of your home. Going to be impossible to buy insurance in many areas.

The scary reality of climate change. I grew up in the Okanagan and it was never even remotely like this.

Anything more than 15% you would probably have trouble with pre-sales which could potentially tank the Project. if a developer is really aggressive and has a view on the market then they can do the minimum presales to get financing then hold all the units until when the Project is complete. That obviously comes with big risks.

“…so the margin for error is so thin that it is often evaporate or huge loss if there are delays or mistakes.”

and unlike a dam, an underpass, a blue bridge, or really anything that government procurement touches, there is no one to eat the bill to if the thing goes off the rails.

How much do you expect to get a return of any kind of investment if your money is on the line?

Developer not only taking on huge risks with their money, they also have to do physical work.

During a downturn developers often bid below 10% profit margin. I have heard as low as 4-5% just to keep their employees working, so the margin for error is so thin that profit often evaporate or huge loss if there are delays or mistakes.

“We can quibble about assumptions and profit margins here”

I’ll bite, I love a good quibble. Why 15% profit margin for developers, Is that an industry rule of thumb for decision making?

@Ash ok i stand corrected (my bad James). It looks like under the new rules you either need to be 60 years old or have 35 years of service whichever comes first for the unreduced pension. So the previous example of someone starting at 25 and working until 55 doesn’t work anymore.

So for one to retire in their 50’s they would need to start working at government prior to age 25. If you start at 22 (standard age after university assuming no time off) then you can retire at 57 with an unreduced pension.

@KS re:provincial government pension plan. James is right, the rule of 85 is no longer, as of 2019. Rule of 85 still applies to service earned prior to 2019 so people retiring these days are largely unaffected but that’s going to change going forward.

Great post Leo.

Teranet Victoria up 3.6% for June and 18.6% YOY.

https://housepriceindex.ca/2021/07/june2021/

First!