What about those downsizers?

Migration and downsizing has been a recent topic in the housing discourse both here and on Facebook. With an aging population, some think that there will be a large increase in house listings from seniors living in too-large homes while others (including yours truly) believe that most people won’t downsize until forced to for health reasons.

Downsizing is a topic that I’ve found to be difficult to get solid information on. You will find various surveys out there that say that either a large number of people end up downsizing or that most will stay put. A good article in the Financial Post making the latter case cited two surveys that indicated around 9 in 10 seniors intend to stay in their current home as long as they were able to. Note that many articles include a move from a single family detached house to a smaller single family detached house in the downsizing category. While technically true that the living space may be smaller, it’s not really an interesting form of downsizing from the house hunting perspective, since it is just trading one house for another and won’t increase the inventory of houses. In fact this kind of downsizing may add competition for first time buyers for those entry level ranchers that are popular for both types of buyers. However in this article I’m only interested in downsizing from a detached house to a townhouse or condo.

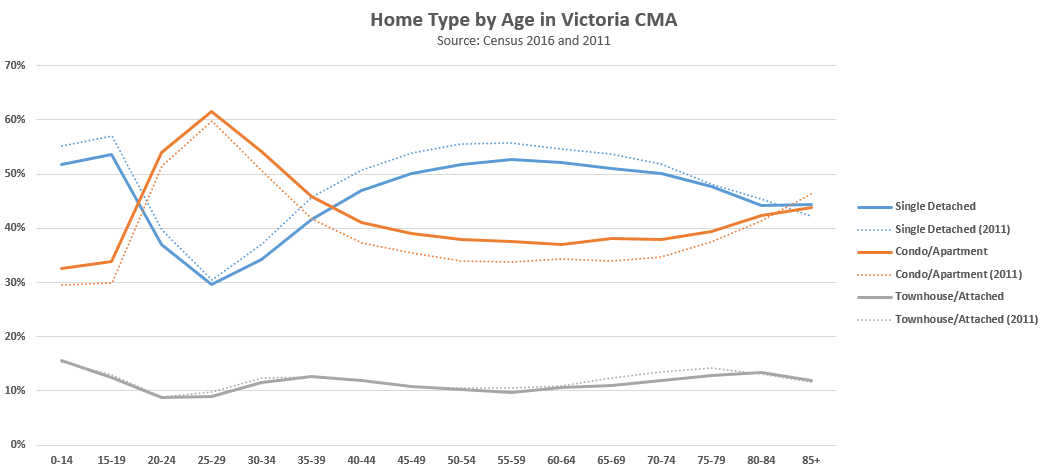

For that, I pulled some data on the type of home that people occupy by age in Victoria. It looks like this.

Some things to note on this chart:

- A high percentage of children live in single detached homes while they’re with their parents.

- As children move out of the home, the percentage living in apartments skyrockets while the single detached category drops.

- As ownership rate increases in their late 20s to mid 40s, the percentage living in houses climbs quickly.

- Single detached house ownership peaks at age 55-59, and starts to drop slightly until age 70-74, after which it drops more quickly.

- From 2011 to 2016, the percentage of people living in single detached homes dropped substantially, with a corresponding increase in the rate of condo or apartment living.

Of course there are multiple factors at work here so we can’t isolate people downsizing from people upgrading from condos to detached homes at older ages, or migration to Victoria into either houses or condos. Let’s take a look at just owners though to narrow it down a bit. Unfortunately I can’t find a table with tenure and age, the closest is tenure and age of primary household maintainer, which is slightly different.

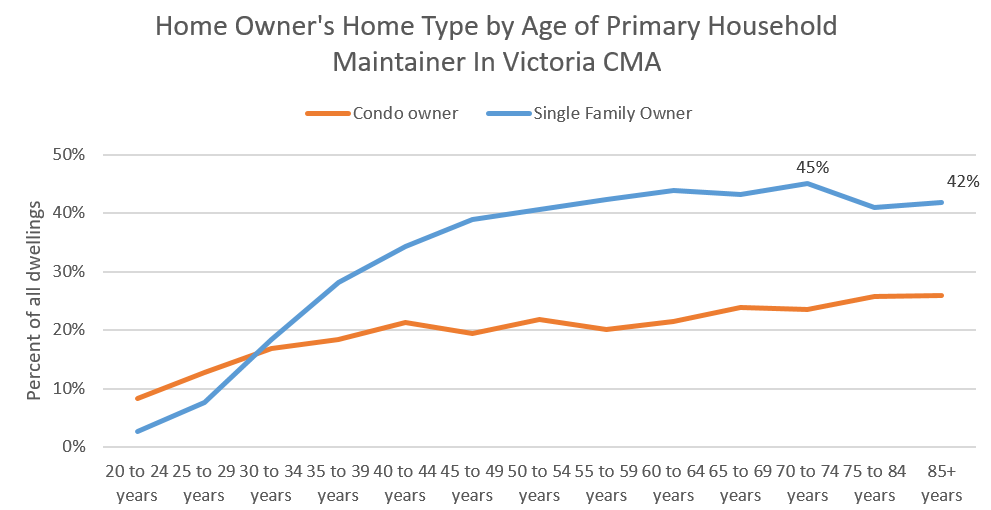

In these data, the peak ownership rate for single family homes is between 70 and 74 years, and then drops only a bit to 42% for those over 85 years old. This is not a fixed sample that follows owners of single detached homes over time so it’s only a proxy for downsizing. We can’t use it to determine what exact percentage of house owners downsize to condos as they age. However given that house ownership stays stubbornly high to the end, and the small drops happen only when the chance of dying (and hence the adverse health events that force a move out of the house) starts to increase substantially, I think we can safely conclude that voluntary downsizing from houses to condos remains relatively rare.

With strong home price appreciation, low rates that make it easier to access that equity, and the ability to defer property tax, there’s also less economic pressure than ever to downsize which may keep more people in their homes for longer. While the rate of home selling should slowly increase as the population ages, there likely won’t be a big downsizing wave.

.

Also the weekly numbers courtesy of the VREB:

| July 2021 |

July

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 253 | 979 | |||

| New Listings | 325 | 1480 | |||

| Active Listings | 1391 | 2653 | |||

| Sales to New Listings | 65% | 66% | |||

| Sales YoY Change | -12% | ||||

| Months of Inventory | 2.7 | ||||

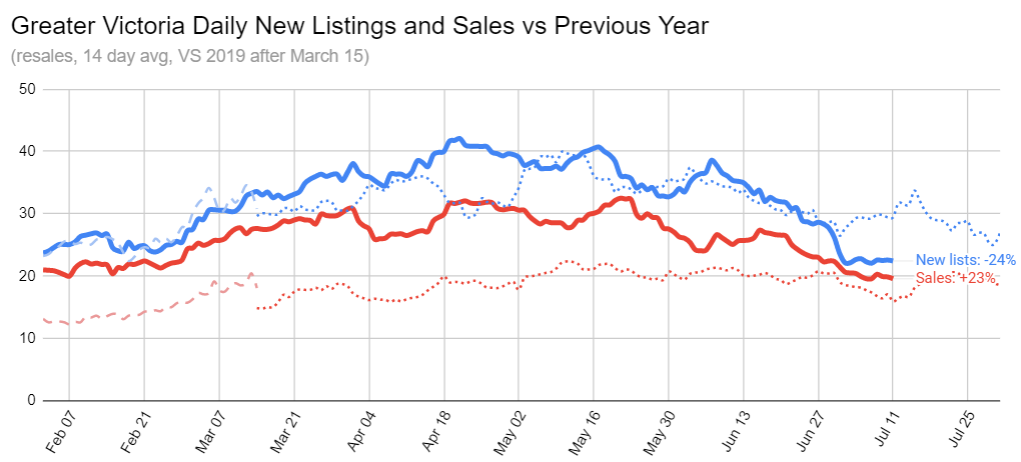

Sales are running slower than last June, but we know that comparison (just like when we were up by triple digits) is meaningless since last June was anything but a usual month. Compared to 2019 levels, we are still at noticeably higher sales levels.

The big story to start the month was the lack of the new listings bump that we usually see as unsold listing are refreshed or new listings come on board. Instead of a bump in new listings, they really dropped off. Summer vacation is on, and everyone is desperate to get out and vacation instead of listing their homes. If you’ve been out on the roads or out at any of our parks you will notice that they are exceptionally busy with people enjoying the relaxed restrictions and summer weather. That unfortunately leaves the remaining house hunters competing for scarce inventory, down 49% from this time last year. We already know that it will take many months if not years to build inventory to average levels, and if this re-opening hiatus on new listings lasts it certainly won’t help.

Thank you Leo.

We are on concrete ie no basement. Just main floor and 3 beds up. All setup with baseboard.

Would a heat pump still work in such a setup?

We were thinking just adding a small gas fireplace for downstairs and leave baseboard upstairs.

Thanks for any advice you can give.

New post: https://househuntvictoria.ca/2021/07/19/the-greedy-developers/

I’d go with a heat pump myself. Big rebates now ($5000 federal + $3000 provincial), cleaner, you get AC, and similar cost as gas for heat (can go for a single head mini split for essentially free after the rebates).

For gas I’ve heard lots of good things about Valor fireplaces.

Slight change of subject. Have baseboard heat throughout the house and am looking for some suggestions to add natural gas fireplace on the main floor, hoping to save some costs.

Any reputable ones in the city that can help with gas installations?

Thank you.

Listing expired.

Thanks for understanding ks. I used to be able to keep all my thoughts in order and pound everything out on a keyboard quicker than a wink. Not so much now. I frequently make errors.

As I understand it, in Canada, one can only contribute to a maximum of 35 years to a government defined pension plan. So if you were in the military, RCMP, any form of government and moved to another, the total pensionable service can only add up to a total of 35 years.

If you took your contributions out at the time of leaving, then you would be able to buy back that time at your new current salary. Usually you will only have one year to have that option from the start of your new employment. If you are only 30 years old or so, and planning to work another 30 years, then it would be prudent to buy it back because you would always be paying at that rate. Many, I think purchase the time back over several years. Also, of course you can buy back time at the same place of employment if you were a casual employee and not paying into a plan and then went on permanent where contributions are mandatory. For example as a nurse working at Victoria General.

Does anyone know what 8-1019 Pemberton sold for? Thanks.

no worries, I don’t think James knew what he was talking about. As long as they don’t change the 85 rule (move it higher) then there is nothing preventing people from retiring in their mid to late 50’s without penalty.

If one was 57 and had 35 years of service in a in-demand job and still wants to work, that person should retire immediately and then get another job whether it be consulting or something else. I wonder if you can move from provincial to municipal and do another 8 years and also collect the municipal DB also since they are different plans. If you can do that then you would have ~70% of your highest 5 year salary from the provincial DB and then another ~16% of the highest 5 year from the municipal DB at 65.

Should have been more clear…rental applications. You’ll get like 30 on a teardown SFH.

lol, sorry again. I was on the phone as I was typing all that up quickly. So I meant you can retire with an immediate annuity without penalty as early as age 55 with 30 yrs service = the “85” you were talking about. But at age 65 you can also retire without penalty (or reduction) with only 15 years pensionable service. So in other words an “unreduced” pension would come into affect if you reached the “85” magic factor, or at age 65 what ever comes first. If you continued to work after age 55 with the 50 years of pensionable service, you could only be a contributor for another 5 yrs, totaling up to the 35 yr max.

This was all in response to James Soper’s comments on retiring. If one was 57 years old right now, and they had their 30-35 yrs of service in they might consider retiring now instead of waiting. Depending on what you want in life.

Sorry if I was confusing ks112, (I often am). Your pension is 2% of your average salary over the best 5 consecutive years multiplied by the number of years service to a maximum of 35 years. So, once you get your 35 years in as a contributor at say 55 years of age (you started @ age 20 X 35 = 85) and you still continue to work until you are 60; your pension is still calculated by the 35yrs but your average salary would probably be greater and so the pension would have increased. At one time if you quit working before the age of 50 and wanted to receive a pension you would have to wait until the age of 55 and then you could receive an “annual allowance” having a substantial “penalty”. However if one had waited until they were 50 to quit they would not be penalized at age 55 when they received their annual allowance.

Anyway, I believe in around 2016 some of the pension rules and calculations changed.

Alexandracdn. The maximum pensionable service and unreduced pension are different things. If you don’t hit the “85” number then you would get a reduced pension compared to someone who did hit “85” even if you both have the exact same pension service years. I don’t think that “85” mark has changed recently.

….sorry, I missed out 10 years with Municipal and then worked 25 years with the feds, it would add up to the full 35 yrs.

I just did a calculation of a pension for someone now 57 yrs of age with 34 years of service ….. maximum years of service for pensionable calculation is 35 yrs.

So they were born in 1964. Over the past 5 years of pensionable service they earned an average of $65K per annum.

If they retired right now they would receive approximately $32K per year for a lifetime (plus COLA each year), as well as a bridge benefit of $12K per yr. for a total of $44K per year if they opted to not take their CPP until they were 65.

If she worked until she was 60 yrs of age instead of 57, she would receive just slightly more, as the calculation would be times 35 years of service instead of 34. But the bridge benefit of $12K per year would now be paid only for 5 more years instead of 8 years.

If she were to retire at age 65, she would get pretty well the same pension i.e. the $32K per year but now her CPP would kick in and she would no longer get the bridge benefit of a little over $12K per year.

Of course, we are calculating at the same rate of pay i.e. $65K per year and over the next 8 years her salary would no doubt go up.

ks112,, one can only pay into a DPP to a maximum of 35 years. That includes any pensionable service.

So if you worked for the municipal gov’t for 10 yrs and left that money in their pension plan and then worked for the Federal government and were a contributor to their pension plan, that would add up to a total of 35 years. After that you no longer are able to contribute to any pension plan. However, when doing the pension calculation, your average salary over usually your last 5 years of service would still factor in. One is not penalized because they only have 25 yrs of service at age 60 say, but your pension is only multiplied by that number of years.

How did the pensions change? I am pretty sure as long as you hit the “85” number it is all good. so if you started at 25, by the time you are 55 you would have hit the “85” and you can get the unreduced pension.

What do you mean number of applications? Like applications to rezone to the city?

That’s another issue with the current system. Saanich has 12 public hearings a year usually. Say 4 projects a night. So 48 projects at best to be approved and some of those are just to build a duplex which is totally inconsequential. Approve all of them and it’s not enough to meet demand.

Not so much any more. They’ve changed the pensions.

Going forward it will be extremely rare to retire at 55, especially without a reduction.

I have had a couple of clients buy SFH teardowns recently that they are renting until re-zoning approval and the number of applications is off the chart.

Rental situation back to horrible with returning students. These projects should be fasttracked any time the vacancy rate is under 4%

Pretty hard to beat CMHC financing thought if you can quaify for it -> https://assets.cmhc-schl.gc.ca/sites/cmhc/nhs/rental-construction-financing/nhs-rcfi-highlight-sheet-en.pdf?rev=120a2f86-ec9d-4508-8e74-be508d014a04

Kenny- There are fine facilities of course, but what do they cost? Most average care homes that people can afford are what I’m referring to. Also, the condition of the occupants is the depressing part in the homes caring for advanced cases. Best to stay clear of them unless you’re very well off.

‘

‘

Public nursing homes monthly cost is tied to your income with max cost of about $3,300 per month, including Mt St Mary’s and the new Summit building on Hillside with all private rooms.

Marko, was involved in large rental project with financing just below 2.5 over 30 years last year with a major bank. Pretty much free money. There biggest problem with Harris green is that no local contractor can handle a project this size.

Kenny- There are fine facilities of course, but what do they cost? Most average care homes that people can afford are what I’m referring to. Also, the condition of the occupants is the depressing part in the homes caring for advanced cases. Best to stay clear of them unless you’re very well off.

Ran into a fellow from Alberta who is unemployed and is here to sell one of his 7 houses in Victoria. I know it is super anecdotal, but it makes me think speculation may have gotten out of hand. A separate one on the anecdotal side of things, on my bike ride today I decided to ride past some of the places I considered buying in the last 6 months and 4 of the 5 were sitting vacant. It just seems weird out there on the real estate side of things.

‘

‘

Your suspicions are correct, speculation is completely out of hand and this will not end well, but of course people will tell you it’s different this time and it never is.

https://twitter.com/i/status/1416417427856973827

Introvert- Have you ever been to a seniors care home? Probably the most depressing place on Earth.

”

‘

‘

Really, have you spent much time in many of them, I have been to many fine nursing homes including Mount St Mary’s in downtown, beautiful grounds, chapel, wonderful programs, private rooms etc.. Now of course with covid it’s made it harder and maybe that’s what you’re referring.

I guess that could be interpreted different ways, maybe they don’t mean that 33% of units need to be affordable in phase one.

Instead maybe it means that 33% of total affordable units need to occur during phase one. If so, that’s close to 15% across the board.

The Harris Green developers likely expected the 15% and they likely won’t stop because of it. But how about other developers that will pass on Victoria and build elsewhere? Some developers have previously made it known that a 15% affordable home requirement could “derail the supply of new homes” and might make some of them “pull the plug”. https://victoria.citified.ca/news/victoria-councils-affordable-housing-agenda-could-derail-the-supply-of-new-homes/

Isn’t the simplest and best way to get affordable homes to build lots of homes? If supply is more than demand, then they have to lower prices to sell/rent the rest and those are the “affordable” ones. That will likely make all homes more affordable, not just 15% of small, new units. If there is still a housing shortage, these baby steps by city council are not going to make typical homes more affordable.

Except the TC reports that council is asking for 33% affordable units during the first phase , which is totally outrageous.

Phase one (1045 Yates) is two towers, 20 stories each. Phase two (900 Yates) adds three more towers, 28-32 stories). The whole thing needs to average 15%.

I’d expect that if they expect 33% affordable units for phase one, that could be a big deal, and possibly a deal breaker. Who knows if phase two ever gets done if the economy or housing turns down. Then they’re stuck 33% affordable housing, why choose this over other options in other cities?

https://www.pressreader.com/canada/times-colonist/20210716/281547998903170

“Councillors voted 5-4 Thursday to move forward with the project if the developer meets several conditions, including increasing affordable units to at least 15 per cent (with at least 33 per cent during the first phase of development), increasing the number of two- and three-bedroom units, ensuring the public plaza is mostly “park-like green space,” providing five per cent accessible units and securing at least 450 square metres for child-care space.

Some of these rental projects are being financed at 1% +/- (through CMHC programs) so asking for 15% affordable units is not totally outrageous.

Either way too much government involvement/manipulation creates a lot of inefficiency.

When we rented our entire house in 2013 we paid 1800/month. Now seems like it would be north of $3000 based on what I’m hearing. That plus price jumps probably incentivized a few investors even though the cash flow is not any better

Umm- Probably out of towers getting things in order back home to make the big move. It takes time.

Introvert- Have you ever been to a seniors care home? Probably the most depressing place on Earth.

Ran into a fellow from Alberta who is unemployed and is here to sell one of his 7 houses in Victoria. I know it is super anecdotal, but it makes me think speculation may have gotten out of hand. A separate one on the anecdotal side of things, on my bike ride today I decided to ride past some of the places I considered buying in the last 6 months and 4 of the 5 were sitting vacant. It just seems weird out there on the real estate side of things.

Depends, but yes, someone will have to pay.

The subsidies that are available are government and density. I don’t think they are giving bonus density for the affordability so if it’s not government then it’s up to the developer to value engineer to get it to work. Smaller units, less expensive finishing, fewer amenities, etc. Many ways to do that without taking a lower profit margin.. Not an issue for council to ask for things, but then the process should be somehow streamlined to compensate. I doubt that will happen.

I don’t know how people can compare a “senior” at age 55 to that of one who is 95. Many public servants retire between the ages of 55-60 with unpenalized pensions. A few years ago the median age of a Fed. Gov’t employee at retirement was 61.7. When you are young just starting out as a public servant, you view 25 years of employment as a “lifetime.”

There are a myriad of stats out there. We can all choose one to defend our opinion or our argument at any particular time.

Back in 2011, 38.6 percent of families were comprised of single child homes. Each year that stat is climbing. So, do we say those three people “need” a 2800 sq.ft home and a “senior” couple at age 56 with their child now living on her own should move to a 800 sq ft condo? On a cul-de-sac where I used to live, out of the 6 homes there, only one is retired couple and the other five households comprise couples in their late 40’s to late 50’s both working and the children (1) gone. Are they seniors? Or do they have more of a right to live in a large SFD than a person of 60 yrs of age? And what about couples that are unable to have children. But he loves to do woodworking in his shop and she likes to fiddle in the garden. Should they not be able to have the same dream of homeownership as the couple with one or two kids?

When a couple work five days per week and their one or two children is in school the same amount, your home is enjoyed or lived in only a few hours per day. In other words it is totally vacant for over 1/3rd of the time. On the other hand, the retired couple are using and enjoying their home and garden for much of that time. Some of you (again mostly public servants), have been able to work from home during COVID. There are many reasons why so many of you now want to move from that apartment/condo. YOU ARE TOGETHER LOOKING AT AND HEARING EACH OTHER ALL DAY. There is no place for the two of you to sit down at a table and enjoy a meal, there is no place to have some peaceful space alone, there is no place to sit in the sun, there is no real space for you both to be sitting at your computer/laptop etc and have some privacy to correspond, play games or do your banking. If the TV is on, both of you are subjected to the noise…..you can’t get away from it. There is no place to entertain as there is only room for one sofa with that silly chaise lounge attached.

I love having a nice home. I love gardening. I love to watch the birds, the squirrels, the deer and all the wild life around me. I love entertaining all our couple friends in the separate dining room in the winter and on the patio in the summer. I love having our families from Vancouver, and SASK. stay here with us and having room for them. Much of this is what makes us still vibrant, physically fit and happy. There are others whom travel ALOT and love the freedom of their condo. It is nice to have the choice ….. at least for now.

My partner’s 95-year-old great aunt lives in a SFH in Surrey. Recently suffered a fall, is recuperating in hospital. Refuses to go to an assisted-care facility. Plans are in the works to move heaven and earth for her to continue living at home.

The developer could have built under the zoning that existed when they bought the property. They asked for a zoning change to increase their profits. Nothing wrong with that. Nor is there anything wrong with council asking for something in return for those increased profits.

Having said that, my view is that it’s better to establish zoning and guidelines for densification city wide rather than deal with it piecemeal.

Mike Moffat comes to the same conclusions for Ontario. https://mikepmoffatt.medium.com/ontarians-on-the-move-2021-edition-17-waiting-for-seniors-to-age-out-of-their-homes-is-not-a-c16019130a6c

I wonder who gets these units and basically wins tens of thousands of dollars?

15% affordable units….. what does that mean?

A unit will have a market price. To make it “affordable” the developer will have to accept a lower profit margin than he expected. To make this a condition for approval is simple extortion so that the council can play out its’ fantasies. It’s nice we have counsellors with a messiah complex but the market is what the market is.

Great to see that the Harris Green ( https://harrisgreen.ca) proposal to build 1500 purpose built rentals (fort/Quadra) got past the first stage (barely, by a 5 to 4 council vote). The development company (starlight) has been engaging the community for input for over two years now, that shows what a lengthy process this type of development is. Now it goes to full scale community hearings, so the whole thing is many years away from completion.

As usual, council have thrown up a bunch of conditions. 15% affordable units, more 2 and 3 bdr units, and more

https://twitter.com/JoePerkinsCHEK/status/1415834405281566725

For the talk about adding costs to homes, here’s one on something as simple as blinds.

From: https://nationalpost.com/news/canada/health-canadas-confusing-and-unworkable-regulations-spur-bitter-fight-with-window-blind-industry

mine was approved a couple of weeks after applying as well (after some back & forth about not uploading proper ownership information in the form of utility bill). The energuide people I had picked also have not responded, and i HATE chasing people…so Leo (or others), is Method someone you’ve worked with? I just don’t know any of them. And, is it clear you can just change who you picked to begin with (as the initial one you picked was sort of part of the application)?

Yes mine got approved about a week ago. I went with Method for the energuide though since City Green never replied

Not me, and I applied early as well.

Lol, so functionally banned until next spring. Cruise ship season winds down in September and the last few stragglers out in early October and then start up is in April and May…. Government is artful in trying to make policy look like one thing when it is actually doing something else.

Hmm, back to back days of double digit SFD listings coming on..

The only reason people don’t want to move to Alberta is there are few 6 figure grunt jobs like in the past. Open up the oil sands and they’ll all flood back. In droves, lots of people love Alberta, not my cup of tea.

Cruise ships allowed back sailing through our waters November 1 – earlier than planned, but useless as few if any cruise ships pass our way after Nov 1. It remains to be seen if this is “too little too late” to stop the push in Congress to allow US ships to skip Canadian ports like Victoria permanently.

https://www.ctvnews.ca/politics/cruise-ships-allowed-to-sail-in-canadian-waters-starting-nov-1-1.5510713

“ Ian Robertson, CEO of the Greater Victoria Harbour Authority said the ban lifting earlier than planned was welcome news.

“This is what we’ve been advocating for,” he said in an interview. “For government to send a positive signal that cruise would be welcome back in 2022. It’s a good day.”

Has anyone here heard back from the Canada Greener Homes Grant program? I applied right when it opened up but still haven’t heard anything. Just checked my application and it’s still only at “Registration Completed” and apparently has not yet been reviewed by them.

” My friend just sold their very modest small house in Fairfield for a 106k over asking.”

”

‘

That means nothing as it was most likely underpriced, modest home in Fairfield 1.2MM

“Those are Vancouver prices AND it is definitely NOT Oak Bay”

‘

‘

LOL, it’s one block away from Oak Bay border

Canadians don’t want to move to Alberta

June 2021 marked the fourth consecutive quarter of net negative inter-provincial migration.

3,384 more people moved out of Alberta heading to other provinces than arrived here from them.

B.C. was the big winner in the migration sweepstakes, with over 9,000 more Canadians moving there to live.

https://calgary.ctvnews.ca/canadians-don-t-want-to-move-to-alberta-1.5508102

Barrister: Sadly that is the position I’m in. There is so little to choose from. Lots of people selling less than desirable properties right now it being a sellers market and all.

Anything half decent goes in a frenzy.

Those are Vancouver prices AND it is definitely NOT Oak Bay.

Karise: My friend just sold their very modest small house in Fairfield for a 106k over asking. I look around and even if you sell then the problem is what is out there to buy?

But it’s not

It’s Victoria. And 1.2 million for a 2 bedroom condo is expensive in any area of Victoria.

Geez you guys – it’s Oak Bay, of course it’s expensive. Call me when Rock Bay crack shacks are going for $1.5M, that would be gentrification.

Interesting how areas change over time. This is now a “premium area” according to developers and the new condos going in at the garden works site start at 1.2 million for a 2 bed.. we are full on gentrification in an area that used to have an A&W with a parking lot.

https://victoria.citified.ca/news/oak-bay-avenues-up-market-redfern-condominium-nears-30-percent-sold-status-construction-launching-this-fall/?fbclid=IwAR1TXnvEPyfzLvrwlfSjgmyGgcIS4g1E4E-Ls7m4Q1I5krKsK-0tkzeA0cI

Barrister: I agree. I’m still house shopping and for awhile things seemed to calm a bit. Now it seems the train has come off the rails again. Unconditional offers and way over asking bids.

I am rather amazed at the actual selling prices of a lot of the houses. It feels like something is spinning out of control.

Just heard this on BNN: “There is a wall of money wanting to buy something .” That might explain 1980’s era hockey cards and video games selling for $1,000,000+. It’s insanity.

I put part of the blame on all this money creation on the high tech industry. Valuations are insane. Microsoft and Apple reached a one trillion market cap a couple years ago. They have both more than doubled in 2 years. Anyone owning these equities has made a pile of money on them in the last five years. My paltry 250 shares of Microsoft has increased $40,000 in two years . Wish I would have bought more. In 2008, it was trading around $15, today, over $280. Looks like the sky’s the limit, and maybe for housing prices as well.

“ Births definitely have an upsizing effect. Talk to any realtor or person expecting. They want another bedroom.”

And arrival of the first child seems to necessitate an upgrade to some giant SUV. Baby on board! I have always had small cars. must have been a bad parent.

Wow, first time in a long time, a fair amount of SFD listings came on the system today. Hope it’s not an anomaly (but it probably is)…

Inflation is only positive for housing prices if wages keep up AND interest rates don’t go up. It’s mostly wage inflation that the central banks are worried about today, so getting those two conditions together isn’t a sure thing.

Births definitely have an upsizing effect. Talk to any realtor or person expecting. They want another bedroom.

That is a heck of a lot more than the housing that is being built, and the core aim is mostly condos and apartments. It is an unattractive trend for young families so the housing “crisis” will continue on for decades to come.

In the mean time ten of thousands, and perhaps more will be looking to house their pets. Plus the energy demand for the extra 100,000 cars commuting to Victoria from Sooke and the West Shore in 20 years.

Does bribing people with popsicles not violate some bylaw?

This is a good read: https://www.fernwoodforward.com/post/finding-support-and-help-how-your-community-can-make-a-difference

I think there’s going to be big and much needed changes to CALUCs and neighbourhood associations soon. Either by changing their official role or grassroots take-overs.

It look like the price of housing is not going to slow down for another year or two.

Bank of Canada willing to let inflation run hot on road to ‘complete’ recovery

https://financialpost.com/news/economy/bank-of-canada-keeps-interest-rate-at-0-25

People with pets having a hard time finding a place to rent. A dog and only 3 cats, might as well get a couple goats to eat the lawn. What are people thinking?

Nothing we don’t already know about…

Market tight for tenants seeking houses or suites to rent

https://www.timescolonist.com/news/local/market-tight-for-tenants-seeking-houses-or-suites-to-rent-1.24341920

Frank,

An equal number of births and deaths per year wouldn’t lower demand for housing or nursing homes. Yes, a death removes an older person who is likely a homeowner and a birth adds a non-homeowner baby. However, since a year has passed, it has made every age group one year older. So on average, the number of people at every age stays similar to what it was the prior year. The 86 year old who died is replaced in the population numbers by an 85 year old that’s turned 86, so the nursing homes are just as full. The newborn baby is age 0, but the previous year 0 year old has turned 1, so those numbers haven’t increased.

So in the aggregate, (and ignoring other factors like changes in life expectancy) the average age and therefore housing demand in the population stays about the same from an equal number of births and deaths.

Patrick- Your statistics and calculations cannot be disputed, however, the impact on housing demand is not accurately represented. Every death should free up some aspect of housing: personal care home resident makes room for someone on the waiting list, a condo or apartment; only those leaving a spouse behind in their residence do not add housing to the market. Whereas births have zero impact on housing demand, for at least 20 years. Therefore the net demand for actual housing is not 6000 individuals but more like 3000. Does that make sense?

https://www.savenorthsaanich.ca/

The 5,000 migration figure (actually 5,200) is separate from deaths. We lose 500 from births (3000) minus deaths (3500).

The G. Victoria population is actually rising by 6,000 per year,

All the components of Victoria population changes (averaged over the last 5 years) are below…

In a typical year (ie average over the last 5 years), Victoria population rises by 6,000.

Total 6,000 population growth per year (5200+2000+3000-3500-700=6000)

All data from statscan https://www150.statcan.gc.ca/t1/tbl1/en/cv!recreate.action?pid=1710013601&selectedNodeIds=1D70,1D142,1D144,4D1&checkedLevels=1D1,2D1&refPeriods=20150101,20190101&dimensionLayouts=layout3,layout2,layout2,layout2,layout2&vectorDisplay=false

Does that figure of 5000 net migration per year take into consideration the number of deaths that occur each year. Is the entire population increasing every year or not dropping as much. Statistics can sometimes hide the truth. I guess the number of births would exceed or balance the number of deaths. Damn procreation. I wonder what the birth/death ratio is?

Yes, good point. It would be tricky to use snapshots of census data and then attempt to separate the various factors to get at the numbers and motivation for downsizing.

For example, Victoria seems a much friendlier climate for seniors than the prairies where I grew up. It’s hard for seniors there to deal with the cold and snow, with risks of falling etc. If that’s the case, it would mean less need for downsizing for seniors here than elsewhere in Canada, and that’s an issue unrelated to health. And that might also help explain the 5,000 people (of all ages) that migrate here per year (net of those who leave ) from elsewhere in Canada.

Careful, this does not show progression of the same people over time, but is a snapshot of ownership rates by age today. Condo and SFH ownership may increase with current age largely because RE used to be more affordable, thus the older someone is the more likely they are to be an owner. The difference being that once people get to around 70 there are factors motivating some to get out of SFH ownership.

I think the fact that SFH ownership peaks at 73 and only drops from 45% to 43% at 85 speaks for itself. There is no doubt that many people just don’t downsize until they are forced to by ill health or die. Rent is irrelevant to the finding really as we have the numbers for ownership and they don’t change much.

The fact that the rate of condo ownership continues to rise until death, apparently, many mean that some of the SFH owners become condo owners or that renters convert to owners.

Seniors downsizing often rent instead of buying. This is the norm in many seniors apartments, with healthy active seniors living in rented units.

You’ve ignored that in only looking at people downsizing to an owned condo.

That would be the same type of mistake as “safely concluding” that very few teenagers move out of their parents home by looking at teenager homeownership rates, as you aren’t counting the teenagers that move out to rent.

Seniors condo ownership does rise on your chart from 20% (age 57) to 26% (age 80). That’s already more than “relatively rare”, and if you also added in rented units it would show a bigger rise.

Moreover, CMHC data from the 2016 census provides additional data showing changes in where seniors live, pointing to big moves to apartments and seniors residences.

In comparing 55-64 year olds to 75+ year olds, CMHC has SFH dwelling falling 15% from 66% to 56%, and apartment living rising 50%, from 22% to 33%. And people residing in “collective dwellings” (seniors residences and nursing homes) rising 15X from 1% to 15%. Those changes don’t look “relatively rare” to me.

Page 19 and 20 https://assets.cmhc-schl.gc.ca/sites/cmhc/data-research/publications-reports/housing-for-older-canadians/housing-for-older-canadians-understanding-the-market.pdf?rev=7b7a784b-2d3f-45bf-9df1-89856f704d75

If it’s next to impossible to find a place to downsize to, I guess you’re only option is to stay where you are.

Thank you Leo for an interesting article. Just to complicate things a bit I suspect that survey questions on downsizing tend not to be predictive of actual actions. Most people like to avoid thinking about having to downsize since it underscores the inevitability of aging. If there was a survey of people in their seventies that asked when they bought their first condo then these might produce a more accurate picture.