Cheap no longer: An up-island update

We know that the single family market here is crazy, with record high sales for the last three months, bidding wars commonplace, low inventory, and the inevitably associated rapid gains in prices. But what of further north? While we may be quite land-constrained down here which has lead to decades of densification, it’s easy to forget that we live on an island the size of Belgium, with only one twelfth of the population.

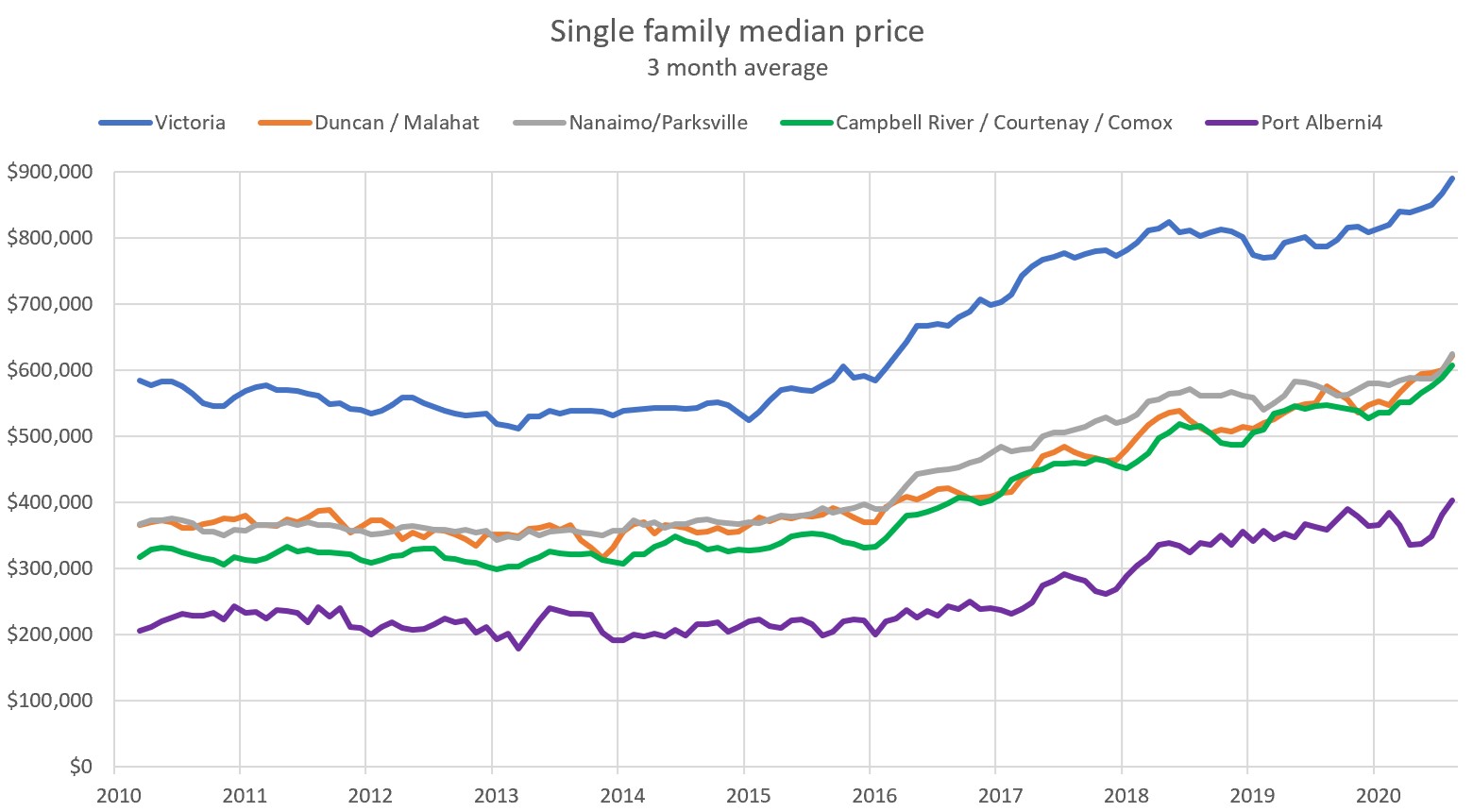

Despite that, most of the island is certainly no longer cheap. Just take a look at the last few years of prices on the island.

A few things to note from this chart:

- The regions are certainly connected in price, and after a couple year pause in appreciation, all the regions have seen price acceleration in recent months.

- Victoria prices escalated faster 2016 to 2018, but took a longer pause after the stress test than up-island communities.

- There is less difference in prices on the east coast of the island than you might expect. Even all the way up in Campbell River, the September median price was nearly $600,000, nearly identical to that in Nanaimo and Duncan. Only Port Alberni is substantially cheaper.

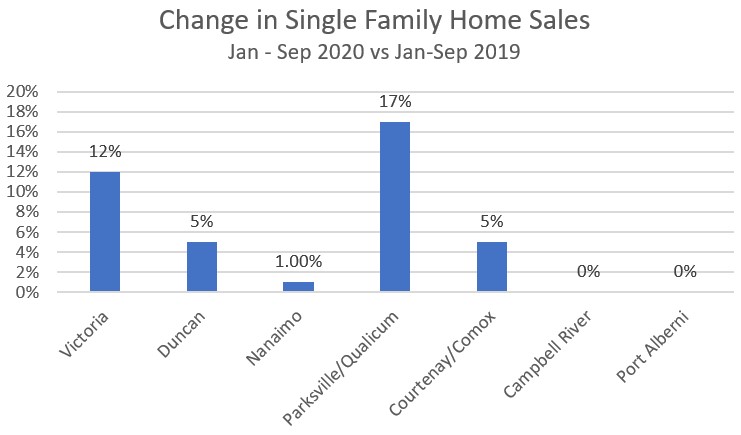

- Prices up the east coast of the island are now the same as they were in Victoria at the start of 2016.

Sales are up drastically year over year in recent months just like in Victoria, although up island has not seen the drastic jump in luxury sales that we have in Victoria. We know that in the last few months the statistics have been distorted by pent up demand so it makes little sense to compare those months to the same last year. When looking at year to date sales, it’s interesting to note that only Victoria and Parksville/Qualicum have seen really substantial jumps in sales volume. Is this all driven by people taking early retirement due to the pandemic? There’s certainly anecdotal information to back that up, but it’s interesting to see the strong differences between the cities.

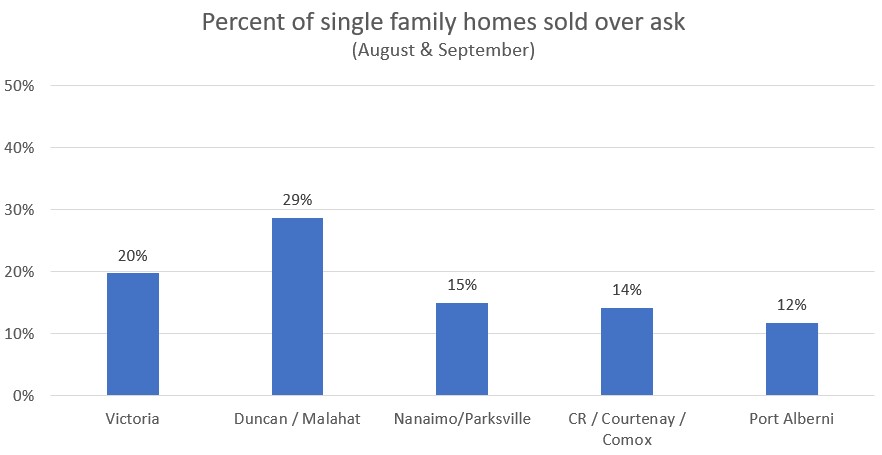

Bidding wars are elevated around the island though. In this case Duncan/Malahat may be pushed up due to quite a few of those cheaper homes on the Malahat being sold to Victoria commuters, so this is reflective more of the strength of the Victoria market than Duncan.

In any case with very low inventory and high demand around the island, home builders should be kept busy for the foreseeable future (which in COVID times is about a week from now).

Thoughts on the job report https://househuntvictoria.ca/2020/10/09/jobs-friday-and-the-state-of-the-deferral-cliff

As many of the regulars on this forum might know, I have always been positive about real estate during my lifetime.

I actually still am positive.

However, having said that, it might be valuable for everyone to take the time to re watch “The Big Short” and “99 Houses”.

Both movies are sobering.

Hope you find time to see them again, or for those who haven’t, it’s worth seeing them for the first time.

That’s on purpose. House prices are not up 25% from July 2019, so when a house sells for 25% or 30% higher than assessed value it is pretty good evidence for either an above market sale or a bad assessment. In this case I would bet on the latter because of the two suites and double garage that has potential. Would not be captured properly in the assessed value

I agree a slightly better approach would be to dynamically make the cutoff a couple standard deviations from the median but not practical without a lot of work

..

Sounds like you would have filtered out this property if it had sold for asking. The 25% threshold might be too conservative in a rapidly changing market, considering assessment price is now close to 1.5 years old

Very interesting given that everyone was expecting the government to resume their process to relax the mortgage stress test (to contract + 2% instead of using benchmark rates). Looks like a good chance that won’t happen anymore and maybe even go the other way. Previously it seemed Macklen was not acknowledging debt risks like Evan Siddall was.

I wonder if this is a possible start to signal some upcoming restrictions on borrowing. There seems that quite a few that confuse having the ability to take on debt with the accumulation wealth.

https://www.bnnbloomberg.ca/macklem-puts-dangerously-over-leveraged-canadians-on-notice-1.1505447

I find assessments individually not that useful, but assessments as a whole pretty good at measuring value. It’s definitely important to realize that the valuation date is last July when interpreting the percent change. I also filter out sales more than 25% above or below assessment to remove some outliers and new builds that have changed substantially since the assessment.

For example in Oct 2012 the median sale was 4% under assessment, which matches pretty closely to how prices were changing then.

“Median house sold for 10% over assessment in September. Median condo 6% over.”

What would that number usually be? Just curious. I feel like assessments are often below market value, but my perception might be skewed by the properties I’m seeing.

Although now that I think about your previous comment, by this time of year assessed values are already over one year out of date, so maybe not.

Median house sold for 10% over assessment in September. Median condo 6% over.

Assessments will be way off in 2021 because it’s value on July 1, when market was still relatively depressed and won’t really capture current craziness.

Is that right eh. Something like 24% over assessed value, I wonder if that’s a preview for assessment increases in that neighbourhood. Thanks

Pending at $931,500

I see 2706 Victor Street sold in Oaklands… it seemed overpriced to me at $970k, but I know nothing. Does anyone know what it sold for?

This couple collected $6M unlawfully, forged official documents, etc ” involving over 900 mortgage files “. But what about “the honest” applicants who allowed or even encouraged the broker to lie on documentation…very simple, Canada real estate is home of fraudsters!

https://www.cbc.ca/news/canada/british-columbia/shadow-broker-erfani-chaudhary-1.5752506

Good jobs report. Employment in terms of hours worked back to 73% of prepandemic levels.

But under appreciated risk is that the real unemployment picture is substantially different than indicated by the labour force survey due to skewing in who is no longer responding

But is it easier than opting out of the foreign buyers tax?

It’s so easy to vote by mail. I already did it.

Sounds awful w/r to containing Covid off the island.

I know. But some of those RVs are worth more than a house in Saskatchewan or New Brunswick!

Yeah, but it’s about people who live in their RV’s.

High income folks doing better than ever, taking advantage of rebound in stock market and leveraging low interest rates to acquire assets while low income folks don’t benefit and job losses increasingly becoming long term. Top half recovers, bottom half doesn’t, hence the roughly K shape

Leo: Exactly what is a K shaped recouvery. (Honest question).

Snowbirds unable to go south flock to Vancouver Island

https://www.timescolonist.com/snowbirds-unable-to-go-south-flock-to-vancouver-island-1.24217193

I’m having mixed feelings right now…

University Heights project on hold because of dispute between developer, Home Depot

https://www.timescolonist.com/real-estate/university-heights-project-on-hold-because-of-dispute-between-developer-home-depot-1.24217208

K shaped recovery in full steam.

Totally off the hook with the listings collapse.

Surprisingly enough it doesn’t seem to be happening here yet. After a listings boom at the start of September, last two weeks new condo lists were lower than the year ago. Sales also very brisk in the last 2 weeks.

Lots of crazy stuff happens. I listed a half duplex earlier this year and the neighbor (other half duplex) just had his agent write up an offer and bought it unexpectedly (my client and neighbor were unable to reach terms on their own but putting it on MLS really lite a fire under the neighbor to secure it).

Someone could go unconditional site unseen, etc.

Maybe a tenant bought it?

Too many scenarios to list.

I heard 2632 fernwood road sold for 1.23m….how does a house come on the market at 6pm….they have viewings next day at 1-5pm, and the house sells at 11am on the same day? Does anyone have any ideas how this works ? Thanks

Some movements in the Big Suck again with pressure on the condo side of things.

https://financialpost.com/real-estate/toronto-condo-prices-could-peak-on-rush-of-new-listings

It will be interesting to how much the condo listings continue to go up here and if there will be a fall off in sales. The rental rate trend is something worth noting and I have some stories of the declining rental prices in Vancouver as well.

Looks like 2632 Fernwood Rd sold. Anyone know for how much?

It was clear. When Weaver switched to being Independent, he and the two Greens all said they’d continue to support the government for the duration of the agreement, which is exactly what they did.

This “uncertainty” that the NDP said it was facing is total bullshit. The NDP’s $5B COVID spending plan passed unanimously in the legislature. And the Greens were in such disarray, having just selected a new leader, that there was precisely a zero percent chance they’d break the agreement and topple the government before the fixed election date.

With all those facts in mind, from a purely political perspective, was it smart for the NDP to break the agreement and call an election right now? Judging by the polls so far, yes.

Nobody is now holding the balance of power because the Legislature has been dissolved.

The polls are saying that the NDP will do better than last time (indeed that’s the reason for the election call) but as always it’s wait and see.

The line from the other parties should be that they welcome the chance at an election because they have better plans for BC. Whinging about the election will get them nowhere

Yeah, pretty sure that agreement was signed between Weaver and Horgan; with W gone, it’s not clear it would have worked. I don’t think anyone expected Green support to be unconditional going forward.

No, the Green-NDP agreement states that the Greens must support the NDP on all motions of confidence. And Furstenau repeatedly stated that she would continue to support the NDP because that was the deal they all signed.

The agreement also states that the Green-NDP partnership would last until the next fixed election date, so the NDP is breaking the deal and trying to blame it on the Greens. And that lie seems to have worked if it’s fooling people like DuranDuran.

I think the election call was self-serving, but not (just, mainly) for the obvious reasons – other parties in disarray, chance to get a majority, etc.

With Weaver gone, Furstenau is now holding the balance of power. So the NDP are stuck with a much more volatile and less predictable trigger ready to cause a failed confidence vote going forward. NDP could have just waited for the inevitable to happen, and risk the election call happening at a time when other parties were for some reason in a stronger position than they are now. (Now that would have been a power move, if done successfully – blame the election call on the Greens).

Instead they opted for the much cleaner option of letting the electorate decide now. There’s no way other parties would have acted differently, if in the same situation; and given the tenuous nature of the current government anyway, I don’t think they can even be blamed for an election call. It was just a matter of time.

I agree – I think any party would have done the same thing. The conservatives just did it in New Brunswick and it worked out for them. If you are thinking the Liberal party wouldn’t have done the same thing given the same scenario I think you are fooling yourself. The only thing I would like to see is any of the parties addressing the massive debit burden we are taking on. I get rates are low but when the Province loses its “AAA” rating and if rates go back up it is going to be an issue. They should start planning now.

Industrial developer snaps up 13 acres in Langford

https://www.timescolonist.com/real-estate/industrial-developer-snaps-up-13-acres-in-langford-1.24216425

“have” should be “having” in the last sentence below.

The timing of the election call was Machiavellian. That said, the left usually isn’t Machiavellian enough. So to the BC NDP I say, “well played.”

My riding is Oak Bay-Gordon Head. The Greens, whom I voted for last time, are (sadly) running an unknown candidate, while the NDP is offering up well-known thoroughbred Murray Rankin.

This riding is more unpredictable than most in Victoria, have gone NDP, Liberal, and Green (in that order) since 1989.

Update on the deferral cliff. Looking forward to that provincial data.

I just read that there is currently only 11 active covid cases on the Island with a total of 221 cases. Probably the lowest numbers in a moderately populated region. This is not going unnoticed, expect more people relocating to the Island.

Calling a snap election during a pandemic is self-serving and not in the best interests of BC imo. Def in the best interests of the NDP and I don’t appreciate it being sold as anything else. The rent freeze is of little real effect, but I guess it has some sort of promo power.

I voted Green last time, but now they are in a bit of disarray with no time to really recover before the election. The liberal platform has some things that don’t appeal to me either. It seems like their biggest selling point might be that the NDP is purportedly considering a home equity tax while they are not.

Anyway, not sure how I’ll vote but I did get my mail in ballot today.

Not sure if their platform is anti-landlord, but I agree that a rent freeze is bad in the long run. Hopefully it stays temporary.

Encouraging a shift away from the secondary rental market is fine in my book, since secondary rentals tend to be more tenuous than purpose built rentals, but it does require a matching increase in construction of purpose built rentals. I’d rather see them commit to keeping the supply of purpose built rentals coming than trying to keep rents flat by force.

Well there is this pandemic… Don’t think you can blame them for that.

It is, but I doubt they will suffer too much for it. A bit mystified that the opposition is going with “your government was so effective and stable, why threaten it” as their primary argument.

It’s too bad the NDP is likely going to win. Their rent freeze and anti-landlord platform, IMHO, is a recipe for long-term disaster. Evidence does not support rental caps and it’s very unfair to the landlords who take risks and have escalating maintenance costs/taxes.

Housing aside:

-Under their leadership, our homeless situation has gotten much worse and we are forced to pay taxes for parks we can’t even use.

-Their election call is purely opportunistic. They completely lose their moral standing on COVID for unnecessarily sending people to the polls.

-Their promise to increase surgical capacity is a fantasy. I have direct contact with many people in healthcare and they tell me that surgical capacity increase is a lie and only intended to win votes. Think about it: how can you increase surgical capacity when your workforce is gonna call in sick due to cold/flu/COVID on a daily basis and your hospital beds are already at capacity for non-covid surgical/medical cases.

-Though they take credit for their COVID situation, most of it is due to luck and randomness of the spread of the disease. In fact, lockdowns have no strong evidence and have cause massive collateral damage. They are calling this election early to ride the COVID-based popularity and ensure that they don’t pay the price for the soon-to-be-revealed damage done to our economy & social fabric

Having said all of this, I don’t think the Liberals are any better.

Thanks Leo for the info on Ladysmith. Any reason why it’s not as active as other localities.

NDP promises a rent freeze until 2022 and a renter’s rebate of $400 a year for households under $80,000 a year not already receiving rental support

Grouped under Duncan, here’s the price history just for Ladysmith. Sales are actually down 25% in 2020 to date. Lowest sales since 2013 even though inventory appears unchanged. New lists down 20% though, which has kept market balance from deteriorating.

Where would Ladysmith real estate be most closely related to. Nanaimo?

Boy, that new McKenzie interchange is something, isn’t it? No stops, no wait, on a quick dash to the West Shore at 5:45 p.m. today — unheard of!

2632 Fernwood Rd Victoria BC V8T 3A2 asking for 1.2M 5bed 3 bath…

Wonder what the cap rate is….

It’s actually part of the Port Alberni sub-market in the board’s classification. Perhaps that’s not how most would classify it, but last year there were only 13 MLS sales in Tofino so doesn’t matter much. Also lots of one of a kind places there that are very pricey.

I would have thought the same thing about Campbell River 10 years ago, but then it increased by 83%

Maybe. Great location for recreation. Hottest summers of any place on the Island, I think. But the place seems pretty run-down, from my recollection. So I have trouble seeing how it suddenly becomes appealing. But what do I know?

BTW, great post, Leo.

One market I wish you had included is Tofino. It’s pricey!

I think Vancouver will always be more expensive than Victoria, which will always be more expensive than Nanaimo, P/Q, Comox Valley, etc.

The price deltas between them fluctuate, which can make a strategic move extra profitable, at times.

Forecast for a price appreciation.

https://financialpost.com/executive/executive-summary/posthaste-canadas-home-prices-to-rise-12-by-the-end-of-2022-economists-predict

Will there be a wave of FOMO during a recession and massive job losses fueled by low interest rates that could push this madness even further. When does this start presenting a challenge in Canada as a separate home owner class viewed as a increasing social disparity in terms of wealth accumulation?

Must be because there’s no where to build in the core of comox/cumberland/courtenay hahaha.

Victoria’s 7 cheapest houses:

https://victoria.citified.ca/news/fall-2020-heres-what-499-998-wont-buy-in-victoria-as-we-count-down-capitals-7-cheapest-houses/?fbclid=IwAR1OuMFaW-5fMc1PvGkv3rXBs1ttinRWi8IAlw4JT-YK4HoysczIfOz6xxg

What a bargain!

Still lots in the 600k range for a sfh. Benchmarks are up over the last ten years but still 200-300k cheaper than Victoria.

Interesting data, thanks Leo! The differential between Victoria and up island seems to hold pretty steady at 250k-300k (excl Alberni).

Courtenay/Comox/CR seem to have gained ground on Duncan/Nanaimo over the last 5 years, to now be equal. At least 5 friends/colleagues I’ve told that we just bought in Courtenay relayed that their plan is to either retire there or move up to the Comox Valley if their work allows. Cashing out of the Victoria market and banking at least $250k-$300k is pretty attractive, even now with prices up island so crazy.

The average household income in the Comox Valley is lower than Victoria, and many locals are priced out of the market (same as everywhere else I guess).

One observation when buying was that inventory was almost non-existent up there. It doesn’t take a large swing in sales there to absorb all of the inventory.

Lol… Oh well, there goes the up island plan B for for my housing solution..

So from an appreciation standpoint, are you better off buying two houses in Port Alberni going forward compared to 1 house in Victoria?

In percentage terms yes. Change from 2010 to 2020 (Single Family Median)

Greater Victoria: +51%

Duncan: +65%

Nanaimo: +65%

Parksville/Qualicum: +67%

Comox Valley: +83%

Campbell River: +83%

Port Alberni: +79%

Thanks Leo! Appears there was higher appreciation in all areas vs. Victoria from 2010 to 2020?

Deryk, great to hear from you again.

Great article once again. I drove through downtown yesterday and was struck with the thought, or at least my wife was, that the City of Victoria is a lot less appealing than it was seven years ago while at the same time the West shore is actually developing more appeal.

100% agree. Difference between Langford/Colwood and Sooke has really shrunk imo in last 90 days when you compare comparable houses. Barely any discount.

Interesting. We certainly get that same feeling out here in Sooke. There is not as big a difference in prices as there used to be. You do get much more (larger lots and a newer house, but the difference is just not as huge as it was a few very short years ago. ) Things appear to sell very fast as well.

Very interesting. Thanks for looking at more of the island.