Does it make sense to buy a townhouse?

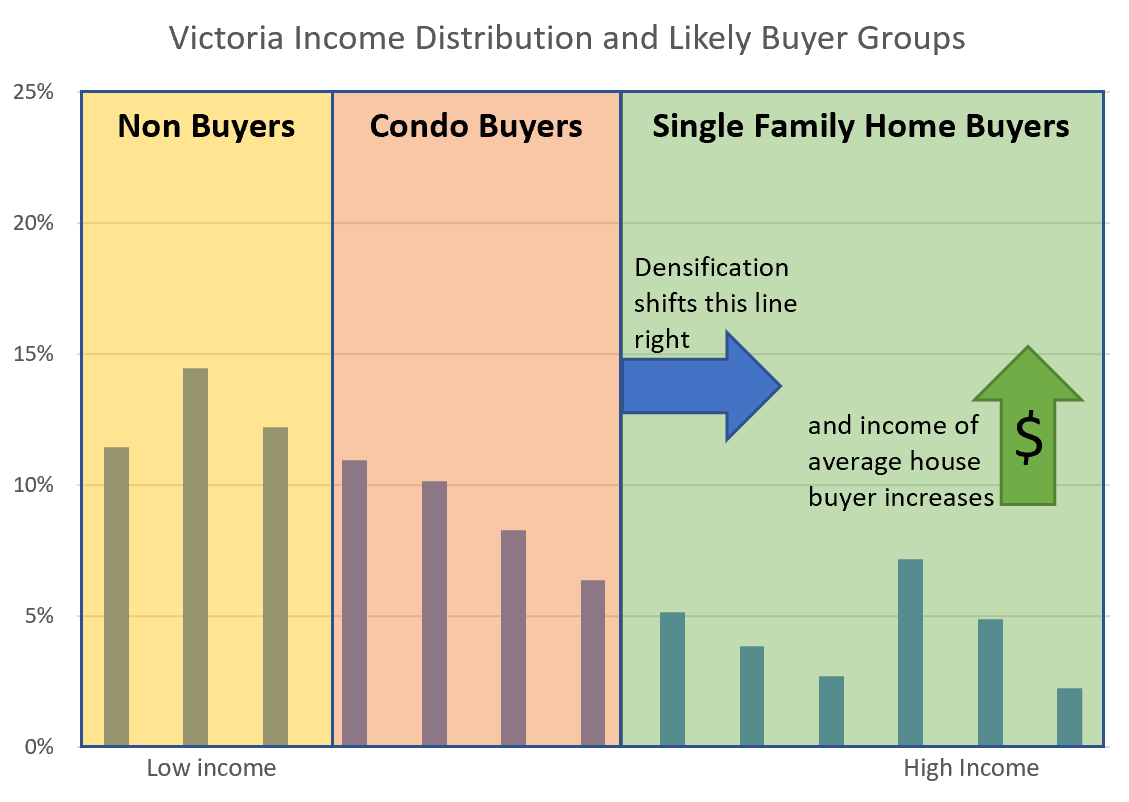

Let’s be honest, the average detached house is well out of reach of the average family. Price correction in the future or not, that’s not likely to change. For reasons I’ve discussed before, over the long run as the city densifies single family detached housing will get less and less affordable. Densification is happening already, but with easily developable land potentially exhausted this decade, it will only accelerate in the future.

Not pictured in this republishing of an older chart: Townhouses and other semi-detached properties that may eventually be the mainstay of middle class family housing

At the same time the reality is that condos, at least the ones we’re building, don’t work for most families. Not to mention the strata insurance issues and COVID-concerns that have made buyers wary of large complexes and shifted interest towards those with separate outside entries.

With detached prices spiking, it’s natural to wonder whether townhouses may be a reasonable alternative. Market conditions in townhouses are more active than for condos, but not nearly as hot as the fully detached market. In the last 18 months, single family homes median prices have increased around 10% while townhouse prices have hardly budged.

Of course in a townhouse you have strata fees, which for the typical resale townhouse at around $550k adds about $5000/year in costs for which you would typically get landscaping, private road and all exterior maintenace as well as the upkeep of common property like rec areas. Many of these costs are fixed, which is why for cheaper places you spend about 1% of the value in strata every year, while for higher end developments it drops to about 0.7%.

Assuming the strata is well run, you should be spending less on strata in a townhouse development than in maintenance for a detached house over the long run. For example you’re going to get a better deal on lawn care if it’s spread over a dozen units instead of one. However it doesn’t feel like that for two reasons:

- Maintenance expenses in a house are very lumpy. I usually spend well under $1000/year on my place, but eventually I’ll have to drop $10k on a roof, the same on redoing the perimeter drains or some other big ticket item. Most people are very bad at taking into account these one time big purchases so maintaining a detached house can feel much cheaper for long periods when nothing breaks.

- In a townhouse everything is outsourced, while most detached home owners do at least some of their own work. Whether that is mowing the lawn, cleaning the gutters, or painting, it’s relatively uncommon to outsource every little thing in a house but nearly impossible to do anything yourself on a townhouse. Whether that is a good or bad thing is debatable, but it does lead to higher upkeep expenses on townhouses.

If you weren’t in a townhouse, that typical $400/month strata fee at today’s ultra-low rates let’s you carry $100,000 in additional debt. That townhouse costing around $550,000 would have about 1500sqft and 3 beds, 2 baths. However a detached house of similar size is currently $750 – $800k so even if you could somehow reduce your maintenance expenses to near zero in a house for some period, you would still be spending an extra $400 to $600/month to get the same amount of interior space.

There’s a bias out there against stratas, but it’s inevitable that more and more Victorians will be living in one over time, either by choice or by necessity. With detached prices what they are, a post-pandemic shift in living preferences, and a government housing focus on the missing middle, I think there’s a big boost in townhouse demand coming. If I were a developer I’d be paying attention.

Also weekly numbers courtesy of the VREB (estimates prior to release)

| August 2020 |

Aug

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 207 | 449 | 692 | 661 | |

| New Listings | 339 | 655 | 1016 | 1006 | |

| Active Listings | 2713 | 2695 | 2713 | 2838 | |

| Sales to New Listings | 61% | 69% | 68% | 66% | |

| Sales YoY Change | +41% | +44% | +48% | ||

| Months of Inventory | 4.3 | ||||

Both new listings and sales remain strong throughout the week, with the current pace of activity now well over 50% higher than last August. Normally August is slow when everyone is on vacation, but with people stuck at home it’s clear Victorians have moved to their second favourite activity: buying and selling houses.

In a typical September we see a little surge of new listings at the beginning of the school year. This year with the uncertainty of return to school it may actually hurt new listing activity rather than help, but we’ll have to wait and see. Certainly all the regular seasonal patterns are out the window.

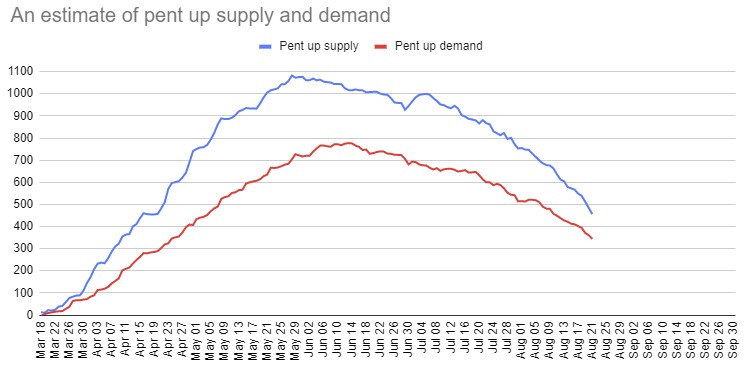

Pent up supply and demand is being burned up quickly now. What remains to be seen is how accurate my estimate of both was back in June. Will there be more pent up demand because the market was more active pre-pandemic? Or will there be more supply from owners in financial difficulty? At this rate of depletion we’ll find out about mid October. What I’m most interested in is whether the activity in the single family market is mostly buyers who were previously looking at condos and are stretching to houses (and thus merely shifting demand), or if that is new demand that will continue after we work through the missed spring market.

Last week was notable in that it was the first week that condo sales significantly outpaced the same period a year ago. One week does not make a trend, but after two months of detached sales well above last year’s levels, perhaps we’re finally starting to see some of the pent up demand show up in condos.

I will only have intermittent Internet access the next little while but should be back in time to look at a preview of the month’s numbers near the end of the month.

https://thewalrus.ca/how-universal-basic-income-will-save-the-economy/

And the next step will be currency debasement and full monetization of the debt. Hard asset prices will likely rise further, inequality will grow and more social unrest will occur.

My nice little sunny forecast for the end of the week…

We’ve essentially already done that.

If things continue to get worse and further restrictions are brought back the next step will be helicopter money. I wonder what that would do to the housing market. What’s the future of commercial real estate? What’s the future of our banks?

It’s beginning to look like most University’s in the U. S. will be going online. Infection rates are through the roof. I don’t think schools here will stay open long either.

I clearly remember living through the HIV-AIDS epidemic in the 1980’s and that scared the hell out of me even though I was not a part of the group most affected by it. I was working in close contact with thousands of people as a Chiropractor with no PPE or anything. I also was not required to a inquire about anyone’s recent sexual activities. I know transmission of the virus is different than covid, but not a lot was known at the time. AIDS was almost a certain death sentence and a long miserable death. The government did not close down establishments that contributed to the transmission of the disease or ban certain activities that spread it, that was too politically contentious. It still kills millions of people in underdeveloped countries that cannot afford the medication that is available. On the other hand, I am completely confident in the ability of my immune system to protect myself from imminent exposure to the covid19 virus or any mutation that may occur. My greatest fear is the fallout from the path we are being led down.

Covid

Yes, was briefly pending sale, then back on market, cancelled, and relisted just now.

Did 2666 Dalhousie get sold and go back on the market? I remember being surprised with the sale price a month or two ago but it seems back on the market. Wonder if/why the deal fell through…

And all over the globe people earning a living from the restaurant industry are buying software…….. So the circle goes.

I didn’t say “businesses (including restaurants)”, I just said “bars, restaurants and the like”, in response to someone who appeared to be saying that restrictions on restaurants would bring down the Island economy.

While we’re talking money, how much does the average hospitalized Covid case cost the government do you think?

Leaving Alberta~~~

~~ from GM.

When he was offered a job in British Columbia, Todd Kemper figured a potential loss on the sale of his house might be the price he had to pay to leave the Alberta market.

“I looked into my crystal ball and thought Alberta’s a one-trick pony – it always has been – and I do not see it performing well in the near- to mid-term,” Mr. Kemper said. “I thought if you can get out of this market now, do it.

There is and always has been a streak of anti-intellectualism in Alberta. It’s inevitable that intelligent people can read the tea leaves and decide to get out.”

Owing to more than a decade of volatility in Edmonton’s real estate market, which started in 2009 with a housing-price correction and has continued with long periods of oil price fluctuations, Mr. Kemper’s house had not gained value over his seven years of ownership. He didn’t see that changing.

Instead, Mr. Kemper, who works as a scientist with the federal government, saw growing rancour between Alberta’s provincial government and its doctors and teachers, and few signs of economic hope in future.

He left Alberta in January, after he sold his Edmonton bungalow for the same price he bought it for in 2013. He considers himself lucky.

Analysts are divided on whether the growing anecdotes of professionals leaving Alberta is a bona fide trend that will affect its real estate market. Data on migration flows lag at least a year, and those now available predate both the COVID-19 pandemic and the results of public sector cuts by the ruling United Conservative Party, which have mostly rolled out in 2020. But as the province’s economy staggers through a prolonged downturn, magnified by the COVID-19 pandemic, some homeowners in Alberta’s professional class are choosing to exit the province and have accepted a loss, or will try to rent out their properties, to do so.

The factors many point to include not only the housing market itself, which is an outlier in Canada for its weakness, but also tough job prospects, a lack of faith that the oil and gas industry will recover and the tone of provincial discourse.

In April, 2019, Alberta’s UCP government was elected to replace the New Democratic Party government on a mandate to rein in public spending. The resulting cuts have been severe. The University of Alberta, for example, is now restructuring amid a reduction in provincial funding totalling $110.3-million for the years 2019-21. More than 1,000 people there have already been let go.

As the cuts have rolled out, drama has often followed. In March, Health Minister Tyler Shandro walked to Calgary doctor Mukarram Zaidi’s driveway and, allegedly, yelled at Mr. Zaidi over critical Facebook comments he had made about UCP cuts.

In July, a survey by the Alberta Medical Association found that 42 per cent of the province’s doctors are searching for work elsewhere.

In a release, titled Looming physician exodus from Alberta, Christine Molnar, president of the association, said many have hit a breaking point.

“There are a host of opportunities for physicians across the globe. Alberta’s doctors aren’t practicing here because they have to, they practice here because they want to,” Dr. Molnar said in the release.

Position cuts led Carol Fenton, a medical health officer raised and educated with three degrees in Calgary, to look elsewhere for work. In late March, she accepted a job in B.C.

Dr. Fenton said she first attempted to rent her Calgary duplex, purchased in 2018, but could not find tenants at a rent that covered her costs. Dr. Fenton then listed the property for $5,000 less than she bought it for.

“We had, like, nothing – like, no action,” she said.

Dr. Fenton has now dropped the price by $30,000 but has yet to sell. “I’ve had two showings.”

She’s currently carrying both places and said she can drop the price further or rent for less than she pays on the mortgage. “Either way, I’m losing. But do I want an ongoing loss, or a one-time loss?” Corinne Lyall, a broker with Royal LePage Benchmark in Calgary, said the city’s market has experienced a downturn as a result of COVID-19 but now, as parts of the provincial economy are reopened, it’s showing signs of recovery. Year-to-date sales are at just 7 per cent lower than they were in 2019, Ms. Lyall said, and some buyers are taking advantage of deals.

She said pent-up demand has boosted July sales. “In July, we’ve out-performed July of last year, and that’s because we had a delayed spring market because of COVID,” Ms. Lyall said.

Indeed, the Canadian Real Estate Association’s July report notes that sales are still rebounding from the effect of COVID-19. In Alberta, CREA numbers show sales are up in Calgary by nearly 16 per cent, month over month, and by nearly 10 per cent in Edmonton.

Still, some watching the market are less certain a recovery is coming. One is Barton Goth, an insolvency trustee with Edmonton’s Goth & Co. Ltd.

Mr. Goth pointed out that Alberta homeowners with mortgages not secured with the Canadian Mortgage and Housing Corporation have the option to strategically default – similar to rules in the United States that led in 2008 to the phenomenon known as “jingle mail” or the sound of house keys mailed to banks.

Mr. Goth said he has helped many use this option during housing downturns in the past but also said his business often lags market difficulties.

“My phone’s been pretty quiet now as people are focused on survival first,” he said.

He expects that to change. “I fear that all our talk of the anticipated recovery is simply masking the Canadian reality. We are sitting atop a house of cards.”

Mr. Goth also said he sees a brain drain taking place in Alberta.

One person who left is Joyce Byrne, a magazine professional who recently moved back to Toronto.

But although Ms. Byrne has left Alberta, she’s still tied to its housing market. She arrived in Alberta in 2005, bought her one-bedroom Edmonton condo in 2007, near the height of the 2006-07 housing bubble. She has rented out the property since 2014 when she took a job in Calgary.

Ms. Byrne bought her condominium for $250,000. Thirteen years later, units in her building are currently listed for $170,000, and not selling, she said. Compounding things, Ms. Byrne is currently between jobs.

Ms. Byrne said she struggled with the decision but she has now relocated to Toronto.

“I spent quite a bit of time thinking about whether I could stay in Alberta,” Ms. Byrne said.

“The rent [I collect] is lower than I pay for it every month. My tenant is like everybody else – ‘Am I going to have a job?’ I just decided, I have to do something, and I can’t be tied there any longer because of that condo.

“I have my fingers crossed I can continue to carry it.”

~~

everybody is looking for somewhere warm, nice and we all complain who is right or what is right….

the end of of story to me is that: the market does not give a shit how people complain…. and what they complain… how people feel does determine their actions( buy or sell, nothing to do with facts… It’s more about If I like the place, if I like the agent, if I like the building, if I like the city if I like the neighborhood etc)

I am overly optimistic about Victoria as I do own.

Do you know how much businesses (including restaurants) provide in taxes to all levels of government each year? Those taxes pay the salaries for all levels of government employee, nurses, doctors, other health care workers, police officers, firefighters, etc. Software employees, especially in this region, do not provide the bulk of support to the overall economy here. Just a guess. Likely that is tourism, government/education, and the above professions. The people in these employment sectors then use these services so it is all quite interconnected.

Let’s say your average White Spot’s revenue is 1-5 million per year, then the payroll taxes alone would be well into six figures. Not to mention the GST/PST receipts (another 5-12% of total revenue), property taxes (which for commercial are about quadruple residential), and then business income tax. Add in licensing fees, Worksafe fees, and you are looking at several hundred thousand in government revenue from just one White Spot! Add up all the thousands of little shops and businesses around, then axe off 50-60% of them and you will see a massive impact on the “real” economy. Their importance to the overall health of the economy cannot be understated.

I too am wondering if we will see a covid-impacted economy affecting everything including the housing market by next spring. I guess it depends in part on the degree of continuing government support provided until this comes to some sort of end, which is predicted to be at least a year away.

I like the Portland model for high demand areas. I’m okay with higher density in these spots when we have prices that are so high that people with median family incomes can only buy a condo without a yard. Of course, this is pretty tough for elected officials to pass when existing homeowners get up in arms about increasing density. Oak Bay can’t even get legalized suites passed.

People work at a software company that sells products globally and eat at a local restaurant. Which business supports which?

The obvious problem is that we are not regulating and controlling all those diabetics.

Kenny G: I specifically stated that for a segment of the population the downtown condo experience is not their idea of wonderful. Different strokes for different folks but I suspect that there is a shift in perception as to the desirability of living in the core.

Couldn’t you make the same argument for any business?

That’s a stretch. If people spend less money on restaurants it’s not like they’re going out to buy some machine parts to help the local manufacturing industries. They may well spend money on other things, but it’s extremely likely those other things are not produced in the local economy and profits will go overseas.

Local services like restaurants don’t support the economy, rather the economy supports them. If people spend less of their discretionary income on restaurants they will spend more on something else.

The case can be made that continuing restrictions on bars, restaurants and the like help to protect the industries that really matter from lockdowns.

Yup that’s top on my list. When 80% of the land in Saanich only allows housing for the wealthiest 20% that’s an obvious problem. Guesstimated stats there but I’ll try to pull the actual figures from GIS.

Steady stream of letters to the TC regarding the GVPL’s slowest and crappiest reopening plan in the world.

Meanwhile, in Calgary, all library locations have been open since July 20, and all locations have returned to their regular service hours.

GVPL’s CEO is Maureen Sawa. $165K salary. (w) 250-940-1193.

https://www.timescolonist.com/opinion/letters/letters-aug-29-not-a-mural-when-on-the-ground-closed-libraries-quarantining-children-1.24194438

Barrister: I am not a fan of high density myself. I am actually thinking of “gentle” density as preferable to only having the option of large houses or high density condo towers since not everyone can afford a large house.

“Covid may have underscored that the downtown “condo” lifestyle is mostly illusionary. Other than hanging out at overpriced coffee shops or mediocre bars there is not much in the inner core of a city. For a increasing segment of the population they might simply be wanting to get away from people like Fern”

‘

‘

I think you’re making the mistake of projecting your feeling onto everyone else. There is a segment of the population that doesn’t want to own a car or be stuck in traffic for an hour a day commuting and enjoys the convenience of downtown, many people also work in the downtown core. I live within a 15 min walk from the core and love being close to the core. It sounds like you may be a senior and prefer to enjoy a large house in a quiet neighbourhood, so of course many of the things the downtown core offer may not appeal to you or be designed to appeal to you but don’t assume that everyone is like you.

Need safe supply.

Check for needles before playing. Charming.

https://www.timescolonist.com/news/local/signs-warning-of-hazards-installed-near-playgrounds-at-victoria-parks-1.24194376

I believe the 60% figure. Unless your restaurant is geared around takeout food it’s big trouble. Patios may make the summer survivable, but no one is sitting outside in the winter on a patio, and I very much doubt people will be either allowed or keen to pack into restaurants by then.

People still need a place to live. Maybe you collect less rent for a period but unless you are so on the edge that that is a deal breaker I don’t think it makes a lot of sense to sell. I don’t think we’ll be heading back to no evictions for failure to pay rent, but of course it’s something to be prepared for. But what would you invest in otherwise?

Frank: I dont have a crystal ball but if I owned investment properties that were SFh I would definitely be putting them on the market now. At best recouvery will be a slow and painful process,

Fern: As shocking as it may be to some people, the fact of the matter is that higher levels of density are not appealing to a lot of people. For one segment getting away from the loony left who prefer living in downtown cores is another major factor.

Covid may have underscored that the downtown “condo” lifestyle is mostly illusionary. Other than hanging out at overpriced coffee shops or mediocre bars there is not much in the inner core of a city. For a increasing segment of the population they might simply be wanting to get away from people like Fern,

I’m giving serious consideration to selling my investments properties on the Island before the looming economic collapse occurs. The lockdown and restrictions placed on businesses like restaurants has made their viability impossible. A recent report (heard on the radio) forecasts 60% of all restaurants will be closing permanently in the near future. There will be no one rushing in to replace these businesses either. Hundreds of thousands of jobs will vanish. I think it’s time to get our heads out of the sand.

It is a decision I do not take lightly as I hate displacing my tenants. One property currently provides 3 generations of one family housing for under $1500 a month. Putting the elderly mother into a personal care home would cost the government $200 a day.

Make sure that folks shovel their sidewalks in the winter. Can’t be too careful.

“I’m on the Saanich Housing task force as the housing advocate representative. Anything I should tell them to do, just let me know”

The Portland model! And more sidewalks : )

“32 per cent of Canadians no longer want to live in urban centres and instead would like to relocate to the suburbs or small towns”

Interesting. I wonder if this number would change if there were more small home options other than condos?

Perhaps it is best to look at weekly averages rather than single day results. But the trend has been very slowly up. Hospitalizations at 26 are still low and the deaths are few,

We have to expect that the numbers will increase as things start to open up a bit. Kids back at school will be a real bump up in likelihood. More people downtown, more in the pubs and more from off island. it helps with the economy but there is a price to pay. On the whole we have been lucky so far.

On the other hand we can definitely blame LeoS for any increases.

124 cases?? Sheesh I go on vacation for a few days and the whole province goes to shit.

I’m on the Saanich Housing task force as the housing advocate representative. Anything I should tell them to do, just let me know!

32percent of Canadians no longer want to live in urban centres because they are deteriorating or they can’t afford to live in the urban are they like. So being a realistic bunch they respond to any surveys or realtor questions by saying they want to live in other areas. You can only hold onto a dream for so long!

“32 per cent of Canadians no longer want to live in urban centres and instead would like to relocate to the suburbs or small towns,”

That doesn’t make much sense to me. You don’t have 32% of Canadians living in urban centres (as opposed to suburbs, etc.) in the first place. City of Vancouver is only 25% of the metro population for example.

There are also gems like this.:

“A real estate survey by Remax Reality predicts that Canadian housing prices will rise 4.6 per cent this year. In Ontario, it’s expected to increase by 5 per cent.”

I completely agree, however there must be a change in culture that accepts smaller living quarter, and shared community & development.

For now, “32 per cent of Canadians no longer want to live in urban centres and instead would like to relocate to the suburbs or small towns, 48 per cent want to live closer to green spaces, and 33 per cent want more square footage and more space while 44 per cent want more outdoor space”.

One third of Canadians no longer want to live in urban centres, survey finds – CTV Toronto — https://canadanewsmedia.ca/one-third-of-canadians-no-longer-want-to-live-in-urban-centres-survey-finds-ctv-toronto/

I remember in Ottawa in the late 60’s & early 70’s, contractors would build streets of attached townhomes ; each one a different style. Maybe a Cape Cod next to it a Dutch Colonial then a Craftsman style etc. It looked very attractive, so each family had an individual home with a different floor plan etc. I have always wondered why they didn’t do that here. Probably cost a bit more, but I think people would pay the difference for something unique.

It would be nice if there were more townhouses as well as row houses and smaller bungalow type houses too. The Portland approach posted here recently looked like a great housing mix. The cottages, especially, looked great. I wish we could adopt a similar approach here.

Options trading is guaranteed to produce entertainment though: https://www.reddit.com/r/wallstreetbets/

Glad I stimulated some discussion. Put and call options are a very sophisticated form of investing, I doubt most brokers understand them enough to provide insightful advice to novice investors. They are also not guaranteed to produce a profit, you can incur losses playing that game.

Last winter, some dudes tried to make it fun…

https://www.saanichnews.com/news/three-people-arrested-after-stolen-suv-gets-stuck-in-the-mud-in-saanich-field/

Sounds like a product opportunity

” Unlike stock, homes can be insured for complete loss. ”

I can get insurance against the price of my house going down? Where do I get that?

Re James Houlihan Park

An old rumour said that people live on Moonlight Ln didn’t want any planting in that park – so the ocean view from their house wouldn’t never be impacted, and they have connections way-up …

“Unlike stock, homes can be insured for complete loss. Phone your insurance broker and ask for stock insurance, he’ll die laughing.”

‘

‘

‘

Actually insurance on stocks is called buying put options. Let’s see you buy an option on your house that will guarantee a future value.

Unlike stock, homes can be insured for complete loss. Phone your insurance broker and ask for stock insurance, he’ll die laughing.

Question for Saanich folks: What’s with James Houlihan Park? Are they trying to win a prize for most boring park in Greater Victoria?

Can’t we all just agree that renting AND buying are for losers? We should all have been camping in Beacon Hill and putting our savings into Shopify stock

What Garden Suitor said. A house is not a stock because you can live in it or rent it out. Can’t analyze value without accounting for shelter value received unless you leave it empty – which they didn’t.

Housing is productive. You need to spend money to live somewhere, and owning is imputed rent.

Sure, the $120k downpayment is tied up in a single asset instead of a broad market index fund, and that’s an opportunity cost, and that should be factored in (and not enough people do). But everything after that is nuanced and we don’t have enough info to make a call on whether it was “wasted” compared to renting. If carrying cost is the same as rental (which it was pretty close in Victoria for a median SFH when we were looking in 2016), then owning puts you way ahead on the monthly payments as only 50% is wasted on interest vs 100% wasted going to your landlord.

And yes, you do need to account for transaction costs if you wanted to sell your house (and not enough people do). But imputed rent still makes it a productive asset even if you fully own it and live in it. I’m not sure what median SFH rent is nowadays, but back when we were looking it seemed to be around $2700. And at that time, imputed rent (minus property taxes + maintenance budgeting) compared to house value worked out to a 3-4% return on owning a house.

Too many people don’t talk about all of these variables, whether through innocent ignorance or willful malice to suit a narrative/position.

I didn’t assume that once. I said they were likely better off renting. I don’t know where it was ever said that they owned a 4 bedroom.

Main thing is they wouldn’t have tied up $120k-270k in a non productive asset for a decade (a very good decade for anyone invested in the US stock market at that.)

good day, just heard one undergrad classmate of mine recently brought a 1960ish house in Gordon Head at 900k….. 4 bed 3 bath. He regretted he was so busy getting promoted at work and did not buy when he was able in around 2010 when gordon head was OK ….. so now he and his family finally could be approved to buy something at a nice location with land in it.( the wife works a major IT firm, decent income, but also has three little monkeys, too) Apparently, they decided not to buy TH because they could afford to buy it does not mean they should buy TH.

The guy also graduated from a PHD program same as his wife, and they figured out somehow, Victoria is their choice after working in Vancouver 7 years…. they moved back during the pandemic as both of them working remotely. I guess Victoria is a nice location after all.

You are assuming that they would have free rent or rent less than the interest cost for 10 years? Seems improbable and a poor comparison given the reality of shelter costs. You need to account for the rent you would have paid if you did not have a mortgage.

A four-bedroom house averages $2500/month in Calgary currently. I’m not sure exactly what it would have been over the term, but appears likely to be significantly more than the interest cost over ten years even if rent was cheaper early on – like 100k more I’d estimate – which could cover repairs/maintenance transaction/insurance costs of owning for ten years.

Lots of rent vs. buy calculators out there if you want to run estimates. I’m not saying 0 appreciation for 10 years is great, just depends on the alternatives you might have had.

They put in 150k, plus paid 100-150k in interest that they don’t keep.

So they turned 370k-420k into 270k, and you’re not even taking inflation into account in your calculation. Take in Realtor costs,yearly taxes, insurance and maintenance and I really don’t think they made it out ahead of renting, even if they didn’t do any home improvements.

Unfortunately, housing is a commodity and is subject to market influences. The cost of materials fluctuate due to a variety of circumstances, look at the prices today. Availability of serviceable land supply ,we all know, is a problem. Housing in a stable market is probably the only reliable commodity that will keep up with real inflation, not the fake numbers they feed us.

Yeah, at the end of the day there are no guarantees. The TSX also was completely useless for a full decade (2006-2016), and negative if your timing was wrong.

My point was that the objectives of affordable housing and housing as investment vehicles are complete opposites. Would you rather buy an affordable place and possibly make nothing on your capital, or buy a much more expensive place with a higher chance (but no certainty) of making higher return? We have examples of both. No one knows the future, but Victoria’s identity seems solid as a place where housing generates a return, and consequently is expensive.

Assuming they would have to pay for shelter otherwise, they put this much into equity instead of rent, and in the case of one of them it was 8/10 years rented out so paid down with opm. Their mortgage would have likely have been about 2300/month only slightly more than half of which was interest.

This is unlikely to have been more expensive than rent counting other home ownership costs – not sure what Calgary prices were like but the average 4 bed currently rents for 2500/month there while the interest amount per month on this mortgage today would about $1250/month – less if refinanced at today’s rates.

But they didn’t. They started with 120K of their own money and added another 150K of their own money.

How is that? They didn’t pay cash and their purchasing power is based on down payment and income. They’ve paid down “loads of equity” and one had the house rented out for over 8 years of that time – the other would have had the benefit of shelter for their mortgage payment which has a market value in rental equivalent.

20% down on a 600k house over 10 years means they would have paid down 150k on the 480k mortgage – when sold they get back 270k less transaction costs on their original 120k less any unusual maintenance or improvement. Turning 120k into even 270k in 10 years beats inflation (that would have resulted in the 120k becoming 140k) and the interest cost for this period would have been less than rent and who knows what the rental of the home made overall.

I’m not saying this is the situation to aim for but you are making more than inflation.

The recent discussions about property values in cities like Calgary bring to light the precarious nature of investing in real estate. Add to that the collapse of air bnb rentals and it doesn’t take much for things to go south in a hurry. Escalating interest rates would be the death knell for investors, and prices would fall dramatically, which wouldn’t help anyone. Like stated earlier, Victoria is in a sweet spot being in a rich Province , in what I perceive to be a mediocre country, and the result is high real estate prices. I wouldn’t hold my breath waiting for things to change.

Article ends with the quote:

Def an odd choice for a public official to take part of a quote and use it to defame an individual.

https://vancouversun.com/news/head-of-federal-mortgage-insurer-lambasts-vancouver-realtor-on-twitter

Head of federal mortgage insurer lambastes Vancouver realtor on Twitter

Join the conversation with Siddell….

Inflation wise, a $525000 2010 house should be worth $623000 just to break even. In other words, their $525000 in 2020 is actually worth only $441000 in 2010 dollars. So they lost ~15% in terms of purchasing power, along with interest payments, and upkeep costs. Might have been cheaper to rent.

What is so bad about flat home prices? Whenever I purchase investment condos I never factor in appreciation into any calculation(s). If it happens, bonus, if not you just plug along. I take same approach to stocks. Buy solid companies that pay 4-5% dividend and if share price goes up, great, if not I am still collecting 4-5%.

Teranet for Calgary has hardly come down at all since the previous peak of October 2014. I think condos have gone down more though. I’m a bit mystified as to why given the hit oil has taken and the wide open spaces for growth.

https://housepriceindex.ca/#chart_compare=ab_calgary

Some Albertan homeowners, fearing a long downturn, eye the exits

We’re visiting family in Calgary right now. We were discussing RE the other day, and someone here said that it wouldn’t surprise them if the value of their house halves at some point, with the province continuing to bet the farm on the tar sands.

Just one Calgarian’s opinion, but there you have it.

https://twitter.com/lisaabramowicz1/status/1298377263176589317

U.S. banks are tightening business lending standards at the fastest pace since the last crisis, even though the Fed has taken unprecedented actions to make money cheap to borrow.

A lot of information provided by CMHC this week. The highest average mortgages in Canada:

1) Vancouver

2) Toronto

3) Victoria

https://www.cmhc-schl.gc.ca/en/data-and-research/data-tables/mortgage-debt

Total Outstanding Debt, Schedule Payment and Financial Obligation ($)

Average Value of New Mortgage Loans: Canada, Provinces and CMAs

Further data on the progress of deferrals in Q3.

https://twitter.com/SteveSaretsky/status/1298369772841652224

Equitable group; things that make you go hmmm

It’s a funny business. I have two friends who just sold 450-600k houses in Calgary this past year. Both owned for approx. 10 years and basically broke even on original purchase price (+/- 5%). Neither were too bitter – they both paid down lots of equity during that time on their mortgages; one had the house rented out for over 8 years of that time. As investments, these were obviously failures in terms of opportunity cost. That logic is partly why Albertans are livid with the federal government (something something didn’t support oil & gas despite buying old overpriced pipeline…? Causing Calgary to slump?). Slumping local economy = affordable housing. The grass is always greener.

For those so inclined, Calgary may offer excellent value. Housing is pretty affordable, having stagnated for the past 5 years or so along with oil industry fortunes. Or maybe it isn’t good value as it will continue to slump, along with the fossil fuel industry as a whole for decades to come. Is Calgary housing a good value bet? Or is the upward trend of Victoria prices a better bet, as it’s going to continue? Do you fancy yourself a value investor or a trend investor? Or are you just looking for a house for your family? You can’t have it all ways.

Human nature.

We live one of the best countries in the world. One of the best cities in that country and then people complain about not being able to afford a detached home (huge luxury in rest of the world) in one of the best neighborhoods in that city.

Me too. It’s hard not to be.

Though higher lately, the Island’s COVID rates are still (for now) the envy of most North American jurisdictions. Interest rates are now back to almost subterranean levels (which has exploded the minds of a few bears). And when immigration returns to pre-pandemic levels or higher, that’ll keep applying upward price pressure on RE, as well.

Also, with health officials emphasizing the relative safety of outdoor activities, it’s sure nice not to live in a bleak place where winter lasts for eight months of the year, as it does in much of Canada.

Thanks “Barrister”.

I’ve been hiding somewhat, from social media because I find it difficult to process negative responses to anything one says. If someone says black is black… there is always someone sitting in the wings to jump in and claim that black is actually white:)

I’m enjoying life despite this pandemic. We sold our 100 year old house in Victoria. It was time for a change and so we bought a brand new house in Sooke. We sold for a number of reasons. We are semi retired and we wanted something that only needed gardening work to be done. It was always our plan to move to Sooke. We still mainly live on a farm in central Saanich where we look after things on a month to month basis. I’m totally bullish on Victoria real estate and the island in general. Our family also enjoys opportunities on the other end of Canada…such as NB.

If I were younger I would definitely do my best to purchase rather than rent. Everyone has a different story and different needs and abilities and there is certainly no shame in renting.

Ones expectations of “reasonable” quality tend to rise with income. Is yours the median SFH, or something in the $1.0-1.3MM range? I’ve talked to a number of people in the family income range of $160-250k about housing (tech industry) and a lot of the time their definition of reasonable quality is a Fairfield character house. Many find the price tag unreasonable though.

We’re in an average Oaklands bungalow with a family income in that range above, and we rent our suite. That’s our definition of what’s reasonable given our other financial goals. It’s all a balance.

Deryk: Good to see you back on the blog, You have been missed. Hope you are staying safe these days. How about an update on where you are living now.

I also hate to be the bearer of good news but even Mill Bay is only an hours drive from downtown, I spent all my working life commuting more than that. Not sure why you need a condo downtown in order to avoid all of an hours commute especially since you think you are in the office only a couple of days a week.

I hate to be the bearer of good news, but there’s a more than decent chance that interest rates will remain quite low for another decade.

I believe that Victoria is still reasonably priced. I should point out that when I made that comment a few years back…. when Victoria area houses were around four hundred thousand, I took a lot of heat for that. It was still hard for first time buyers….. as it almost always is and my heart goes out to those trying to do so. If all you can afford is a townhouse then so be it.

Don’t hold back. Take the leap and nine times out of ten you will never regret it.

Best advice I was given years ago:

1. Think in terms of having the ability to hang on through the worst case scenario. (Lost job or health issues…. could you rent it out to cover the mortgage for example until you could get back on your feet)

2. Never place your home at risk: Don’t over leverage for example.

There is no doubt in my mind that Victoria will only get more pricier in the years ahead.

Perhaps some people might want to consider Moncton NB. where you can still buy a “complete” and lovely Duplex there ( with two thousand dollars of rental income) for less than two hundred thousand dollars. It’s a mind bender looking at their prices!!!

It’s all about making choices. For example: My mom and dad left Scotland because there was a better life offered in Canada.

BCREA forecast:

Multiple Listing Service® (MLS®) residential sales in the province are forecast to rise 6.5 per cent to 82,380 units this year, after recording 77,351 residential sales in 2019. MLS® residential sales are forecast to increase 17.6 per cent to 96,860 units in 2021.

“The outlook for the BC housing market is much brighter following a surprisingly strong recovery,” said Brendon Ogmundson, BCREA Chief Economist. “We expect home sales will sustain this momentum into 2021, aided by record-low mortgage rates and a recovering economy.”

With home sales more than fully recovered and now above pre-COVID-19 levels, combined with a decline in the supply of re-sale listings driven by the pandemic, many markets are now seeing sharply rising average prices despite a weak provincial economy. We are forecasting the provincial MLS® average price to finish the year up 7.7 per cent and to increase a further 3.7 per cent in 2021.

I agree it is not easy. If I was starting out today I’d probably be looking up Island too if it worked, or I would be buying something with a suite or co-owning here.

200k down and 180k a year, is that 180k combined income or are you the sole earner? Big difference in after tax income?

Umm Really: To stay on topic have you considered a townhouse. I do understand your problem, pretty well the same situation when I bought my first house. Gave up on vacations, dinners out and most everything else until I managed to knock back the mortgage until I was more comfortable with the amount. Being house poor sucks, ending up almost as poor at 60 but without a house sucks even more.

I’m in the same boat, make about 180k/a, or 175-200K, and can afford a one million dollar house in Victoria, which is nothing special as everyone knows. 800k debt for 30 years is not too appealing. What you need is a second property with a couple units rented out with some positive cash flow to cover itself. In about 8 years you sell the second property and go mortgage free on the first. It sucks, but it works.

Victoria is not worth the hassle. I wouldn’t recommend moving here unless you already have family, job, or some special connection to it. Up Island has many nice and somewhat cheaper places.

Any thoughts about 2129 Sandowne, quality of renovations? Price? Thanks

Sure. I guess it depends on your next best alternative. If you can move to a cheaper market and buy might be better. Renting is risky for various reasons including housing insecurity, inflation over time and lack of benefit from any tax free appreciation or mortgage pay down. Generally, it is probably better to buy a lower priced house than rent. Right now putting 160k down on an 800k home will give you a five year fixed mortgage of $2,630/month which is likely cheaper or than renting a SFH.

I also don’t see how buying a condo in town and a house out of town is going to be any less than the 800k a local SFH house would cost, and you’ll be paying time and money to commute and live apart 2–3 days a week and will pay capital gains on the condo when sold.

This is built into the debt service ratios applied by lenders. Higher mortgage rates are also used for qualification purposes. Not to say rates can’t rise past that over the term. We went with longer term fixed mortgages in the beginning as we were concerned about this but it turned out variable would have been better.

If you’ve done the short and long-term math then you have the numbers to work with. If you have inexpensive rent this could be better for you but a family income of 180k/year (assuming good job security) you are making more than double the median family income. I don’t know your circumstances, but this after tax income is objectively enough to pay reasonable expenses for an average family including disability insurance, buying a house, and investing for education/retirement – barring other debt/unusual spending.

People who have the discipline to save up 180k for a down payment don’t normally end up taking out HELOCs and living on them and there are equity-based limits. Data shows older homeowners have less debt, including HELOC debt, not more, as they age.

Umm.. Not really: You make sure valid points about buying a house and impacting your lifestyle. So dont buy a house. noting wrong with renting. Or move to a cheaper city or get a government job with a great pension.

Is Victoria overpriced. Definitely. The problem is that it is unlikely to get any better soon.

Just because you can doesn’t mean you should……

The funny thing is, there is a need to pay tax on that 180k (taxes are only going in one direction for the rest of our lifetimes) and 800k mortgage is a massive amount of debt (interest rates will go up eventually). The cost remains extremely prohibitive since it commits so much financial capacity just to one asset class and takes away from a well balanced life. I really don’t want to be working just to have a reasonable house. The idea is, I should be able to work less and degrade my earning capacity as I age. Being committed to such a large amount debt has enormous risks, especially if there is a health failure or an earnings downgrade that occurs unexpectedly. Purchasing in the current market does not allow any flexibility for my position, it makes me pot committed on real estate and negatively impacts lifestyle, the ability to save, retirement planning and fully funding education for my children. The current debt approach is going to catch a lot people by surprise across the board, to pay for the current debt splurge future pension earnings are going to be negatively impacted and likely delayed to an older age while facing increased taxes. Not having an independent ability to fund retirement with something other than selling a house will be extremely important (which takes some of the earning capacity from a home purchase). The people that have convinced themselves that putting living costs on a HELOC is pulling out equity gained instead of it being added debt will be in for a bit of a shock when on the sale of their property there isn’t a windfall to fully subsidize a retirement. Especially, if the wealth tax parade keeps gaining steam, all those future profits from one asset class keep getting smaller no matter how great the growth.

Dawson Mullin Law

MR

You are correct Perry did retire 🙁

We use Sitka law for all of our stuff now and they are great to deal with !

Can anyone recommend a reasonable price real estate lawyer? I use Perry Fainstein in the past but I heard he retired.

With 200k down and 180k income there is quite a bit that should be affordable? Seems like up to $1,000,000? With that you can get a nice house in many areas of Victoria.

https://www.ratehub.ca/mortgage-affordability-calculator

Oh well, I am getting to the point of tapping out on the possibility of home ownership in Victoria anyways. I have started looking at what my housing needs will likely be in 20 years from now and possibly purchase out of area. The future of my work will likely be only partial in office even after Covid-19 because we have discovered there is no real point to keeping all the space just warehouse workers. At most, I might need to be physically in office 2-3 days per week at the most. Maybe just pick up a condo in town for the occasional office use and park the family a few hours away in something meant for a family and I just live the Don Draper lifestyle commuting in when needed. The wife should go for that? Maybe leave out the Don Draper lifestyle part…. I am still surprised that with nearly 200k available for a down payment and almost 180k in income, that finding something reasonable to purchase for my family is not achievable in this city while still maintaining savings, education funds, some fun money and a retirement plan.

With August 31st being a Monday good chance we clear the previous August record of 883 sales.

Interesting article, 56 cases of covid in Korea linked to non-masked customers (hard to drink coffee with a mask) at Starbucks with the infected person sitting near the AC. None of the masked employees tested positive. https://ca.yahoo.com/news/56-people-got-coronavirus-starbucks-160600585.html

Cases this weekend were about 90 a day and hospitalizations are up again. It is far from disastrous but it is a bit worrisome. We will continue to see the numbers go up with the opening of schools and as things generally start to open up more.

It is easy to forget when we get buried in stats that Covid is more of a zero sum game. If you die from it the fact that there is a low incident of Covid in the Province is rather cold comfort.Stay safe, stay sensible and stay happy.

Phew! Glad you cleared that up for us.

It’s not about density. The non-strata townhouses in Ontario are just as dense as the strata townhouses in BC. Regarding cost, GTA is a lot more expensive than Victoria, Ottawa is a lot cheaper, yet both have plenty of non-strata. It appears to be simple unwillingness on the part of local governments to allow non-strata.

An identical column appeared in the print edition of this morning’s Globe and Mail under a different headline:

U.S. crosses the line debt hawks feared — but ‘nobody is very worried’

https://www.nytimes.com/2020/08/21/business/economy/national-debt-coronavirus-stimulus.html

cc: Local Fool, and the other debt worriers

@Patriotz, there does not seem to be any reason other than BC municipal politics makes development so risky and expensive that most developers go for the highest density possible to be viable.

One thing that puzzles me about BC is the unavailability of non-strata townhouses. They are very common in Ontario. I don’t think there’s anything in provincial law preventing them, so I guess it comes down to local governments not allowing them. But why?