Nov 26 Market Update

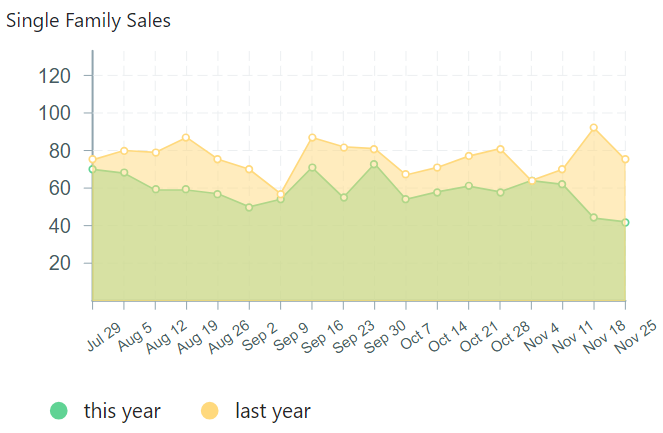

Weekly sales numbers courtesy of the VREB.

| November 2018 |

Nov

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 62 | 179 | 276 | 395 | 671 |

| New Listings | 123 | 313 | 477 | 659 | 843 |

| Active Listings | 2405 | 2377 | 2370 | 2353 | 1764 |

| Sales to New Listings | 50% | 57% | 58% | 60% | 80% |

| Sales Projection | — | 570 | 495 | 500 | |

| Months of Inventory | 2.6 | ||||

Looks like that ~27% decline from this time last year is where we’ll end up for the month. That larger drop than we’ve seen in the past few months is partially due to a drop in sales this year (which is normal for the season) and an increase in sales last year (stress test). We might get a few more sales this week than last as agents report sales before the end of the month so we might still hit 500 which would be a pretty average November.

Price wise, not a lot is happening this month. After a little jog upwards in October, the median single family house in the core, westshore, and peninsula is back down to $800,000, where it has been hanging out all year. With current market conditions, we shouldn’t be expecting price declines since single family started the year in a sellers market and has transitioned to a balanced market in recent months. Neither of those are associated with price declines, and in fact even balanced markets generally mean price increases in line with inflation. Later in the week I’ll dig deeper into what level of seasonally adjusted months of inventory leads to price declines in Victoria.

In other news, there’s a great report out from Global News on money laundering from the drug trade and how billions of it has gone into lower mainland real estate. The brilliant Sam Cooper who also blew open the casino story and forced the government to act is behind this one as well. When the casino investigation was released, some people scoffed at the paltry $100 million dollars that was estimated to have been laundered as far too small to affect the real estate market. But as expected, this was merely the tip of the iceberg and those showing up with duffel bags of twenties to a place with video surveillance were only the most brazen ones. With the next provincial investigation focused on the real estate sector, I think they are going to find some real doozies.

New post: https://househuntvictoria.ca/2018/12/02/november-numbers

.

WB isn’t invested in ETFs himself. His problem or rather THE problem with actively managed money is… well…. just see the Wolf Of Wall Street….

I don’t quite recall the exact dates or details of the challenge, but I think it’s close to the end of Warren Buffett’s 10 year challenge for hedge funds to beat a low cost S&P 500 tracking index (Vanguard).

On a personal note, this same “challenge” turned out to be good for my late father’s non RRSP portfolio….we learned after the fact from the liquidation of his estate….the bond funds either lost money, or were flat in terms of returns. However, his financial advisor had his “equity” exposure in this portfolio at 50% and was completely in the SPY ETF. Needless to say, that position saved the day in terms of total return.

I’m not saying luck doesn’t play a part but it simply does in life anyway. It’s probably luck that I was forced to sell a good chunk of AAPL before it sunk to its present lows (in order to prevent financial ruin). I wouldn’t have sold it otherwise that’s for sure. Can’t get lucky with an ETF though. 🙂

My gut says it’s gonna triple or quadruple. Any day now.

You’re the only stock picker I know with credibility as you have posted your total return. I’ll withhold judgement on the effectiveness of your strategy until we see it through the next bear market. I believe a good chunk of your returns have been due to picking a couple outperforming winners like Apple, but when those stop performing it may be harder to beat the market, and will you pick the next ones?

I’m ok with just betting on human ingenuity and investing in everything.

Good idea, but I don’t think 25 years is useful. I have yet to meet anyone who wants to rent forever. This blog is called househuntvictoria.ca after all. I think everyone here is looking to buy at some point in the future. So perhaps 3-5 year periods would be the most realistic.

Looks like some people are still optomistic about the market picking up in the spring.

I don’t know if any of my buyers are optimistic on prices going forward. Most people just need a place to live and they can afford it so they buy. The majority of my buyers also unsubscribe to the auto emails with new listings/pending sales and stop following the market.

Why not use the wait or buy calculator bottom of this page?

https://househuntvictoria.ca/resources-2/

Then you can run some scenarios to see what combination of price movement and interest rate changes will result in positive outcomes

No it isn’t. In the food market there’s an almost limitless array of substitutions. Housing, not so much. Further, each tier of housing is connected and interdependent to the others. A fall at the top narrows the gap to the lower tier, putting pressure on pricing there and so on. That’s exactly what occurred on the way up; it’s a tad disingenuous to think that the reverse doesn’t apply.

I have to agree with Patrick that it is difficult to navigate the rise and fall of real estate base from the rise and fall of interest rates. IMHO the likely hood of a housing price drop is low if any in the near future, because current mortgage rate is relatively cheap compare to historical average, and Victoria currently is not in a mass unemployment down fall.

How would high end condos have anything to do with the the average first time buyer?

It is like saying that filet mignon are stacking up at the market therefore the price of regular ground beef must drop soon.

Bloodbath.

247 Government St and a high end town house on Dalas both have sold signs on them today. Looks like some people are still optomistic about the market picking up in the spring.

Patrick, you have to remember the late 70’s rate rise was extremely fast and few got sucked in at the top because most couldn’t qualify. This boom has had many years of passengers and they had time to bloat up a HELOC on top of a large mortgage. Wasn’t possible for most in 81 when HELOC’s were not the norm. Unemployment rates were higher thru the late 70’s boom too. Average 6% or more.

Patrick,

CHEK news tonite says higher end new condo rentals are stacking up according to CMHC guy. Once they are soon forced to drop their prices then the chain reaction kicks in. Few could afford to have new presale rentals sit there empty month after month.

Interesting post Hawk. It also brings up a question for all here.

Are landlords with vacant units (vacant 6 months or more) liable for spec tax?

From what I’ve read, the answer is yes. There is no exclusion for “trying to find a tenant, but couldn’t”.

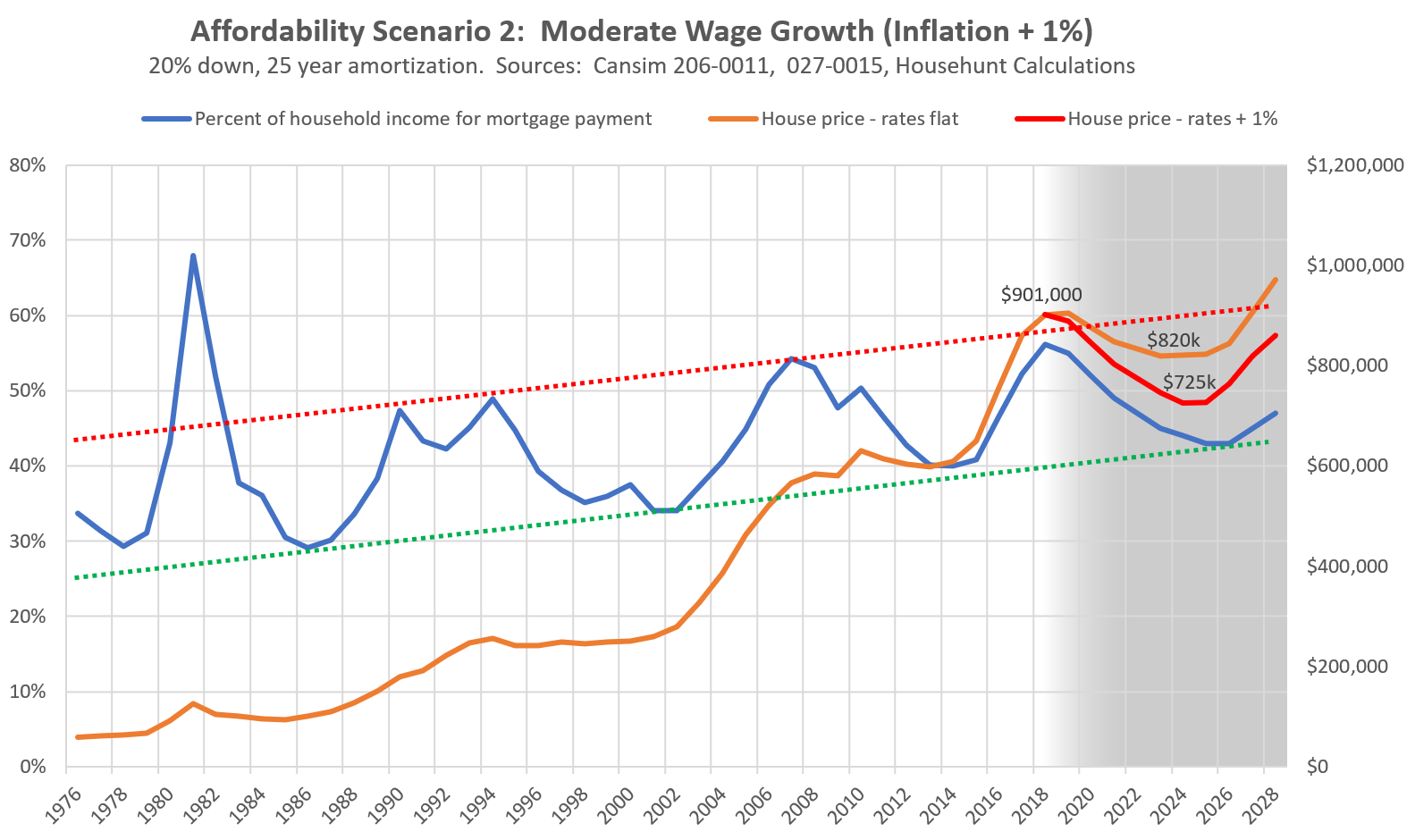

Josh, are you prepared to wait 7 years for prices to finish falling as a result of rate hikes? And 4 years to wait for prices to START to fall from Rate hikes. That’s what history (1978-1985) tells you are the waiting periods.

If you’re planning to “wait”, both history and the squiggled red-line predictions at the end of that graph you posted tell us that you’re going to need to wait 7 years to see the effects of rising rates on making prices fall. And waiting shorter than that will have you losing money. The best thing you could have done in 1978 when rates started a massive rise was to BUY. Worst thing you could have done was to buy in 1981 when rates had peaked and started to FALL.

The strategy of waiting out an interest rate rise, and then buying when rates started to fall would have been the only possible LOSING strategy someone could have had in Victoria since 1973. It would have you buying in 1981 with peak prices when rates peaked, and then losing money 3 years AFTER the peak.

There was a huge rise in interest rates in the 70s. From 9% rate in 1978 to 22% in 1981. During that incredible 13% rise in interest rates, what would you think Victoria prices did? Dropped? Nope… they doubled… Victoria Prices went UP, in fact doubled from $63K in 1978 to 1981 $126k.

Then rates fell massively, from 82-85 , from 22% to 10% and what do you think happened to Victoria house prices? Went up? No, dropped Victoria prices fell 25% along with the falling rates. From $126k to $93k.

The drop in house prices in the 80s occurred AFTER the rise in rates, and during a massive fall in rates. So for a guy like you that plans to wait it out, if you want history to be your guide, you can’t wait until rates start to fall, you gotta wait about 4 years after that, while they fall. Total waiting time was 7 years. Your posted graph predictions has 7 years of waiting as well. And the net result of all this waiting? You could have bought at $63K when rates started to rise in 1978, and been up 50% when all was done and prices troughed in 1985.

Interest rates in Canada, 1971 to present

https://www.ratehub.ca/csv/boc.csv

Victoria house prices, 1973 to present

https://www.vreb.org/media/attachments/view/doc/ye782017/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

p.s. I hope LeoS can create a graph from 1973 to present, based on these two indices, Victoria house prices, and mortgage rates in Canada, as represented in those two links above. That will tell the tale of the waiting game outlined above.

Anymore bullshit posts pumpers ? Time stamp June 2013 stating previous two years were major renters market. History will repeat itself, always does.

Greater Victoria rental rates still favour tenants

“Hunter of Devon Properties, which manages about 3,800 units in Greater Victoria, said the local vacancy rate is actually closer to six or seven per cent. “The market in the last two years is the softest we’ve seen it in 20 years,” he said.

Many owners and managers surveyed by CMHC are embarrassed to give out their actual vacancy rate, Hunter said.”

Was in my cash account but that had to be liquidated along with my TFSA to keep the building going. Thus the rebuilding. I still have AAPL in my RRSP though…

Wow https://twitter.com/IIF/status/1068492390921572352

Not only record household debt in Canada, corporate debt is another one we hold. Double that of US! I guess we will have a special place in history books, same as the Dutch with their tulip bubble.

LF,

Latest consumer numbers are down, house sales down,debt levels are up. The new year will bring much pain. It’s the business cycle doing its natural thing. Deniers will be severely roasted and many will quit posting as they will be so shook at what they let slip away.

More fake pumper posts. Our landlord was offering $100 for referrals of friends or family in 2012 range give or take.

So you haven’t jacked your rent in 10 years Intorovert? Must be scary place to live in but then again you would be one psycho landlord and couldn’t find anyone normal who would rent the dump.

Funny how the salesmen and landlords are the most belligerent on here lately trying to defend the inevitable recession /market cleansing.

Well, I do. Prices are flat in the first year of barely higher rates and they’ve only just started to go up. Furthermore:

Ah yes, the wailing cry of the heavily leveraged bull. “Well if you could have just bought in 20xx, my god you’d be rich!”. Spare me.

Patrick, all the HHV renters on the sideline have “bags of money”, they don’t care for the rate. They are waiting for the RE price cut, like the HDTV on Boxing Day…..

Greater Vancouver has just recorded a whopping 46% drop in home sales for November, YOY.

I keep warning, unless this reverts in a big way and fast, the market would appear to be in serious trouble. Like always, people covet that which is rapidly rising in value; conversely, they don’t covet that which is stagnant – and certainly not if it’s declining in value.

All the apparent wage growth, immigration, and touted “desirability” somehow doesn’t seem to be helping. I wonder if these things were symptoms rather than causes? Perhaps it was excess lending both foreign and domestic? Haha, what a concept.

“Ya well eff off, bear boy. Sellers in Vancouver aren’t, and won’t sell at lower prices”.

Actually they are, most especially in the higher segments. But that’s also spreading downwards, and outwards. On the whole, there has been a mild decrease in valuations. But like every other RE market, sales are a leading indicator of price movements. If there aren’t enough buyers willing to pay the price, and for long enough, the prices must fall. And yes, it actually is that simple. 🙂

When the excitement and enigma is gone, you’ll see this mess for what it is – exorbitantly overpriced shelter bid up by those who were convinced beyond any reason, that it was different this time™.

Oopsie daisy…

Weren’t you heavy in APPL?

Yes, that is so “difficult (for me) to understand”, because a rate rise of 1% would need to make house prices fall more than 9% for that “I’m waiting” plan to pay off.

This is because I don’t think prices will fall more than 9% if rates rise 1%. First of all, lets make sure I have the premise understood. You are waiting for mortgage rates to rise, so you can then buy a house and sign up for a big mortgage. Your hope is that the price has fallen on the house because of the rising rates.

Let’s have a look at the numbers on that. Home-gamers can follow along at this mortgage calculator https://www.scotiabank.com/mortgage/payment/en/payment.html with rates taken from here http://www.mortgagearchitects.ca/

Assume you’re buying a $800K house with $100K down.

Today, you’d borrow $700K . The payment would be $3,500 per month (25 year period, 3.49% 5-year rate).

But you wait, and your dream comes true. Rates rise 1% in the next year. If you still expect to pay $3,500 per month, you can only borrow $630K ( at 4.49% rate) and so with your $100k down payment you could buy a $730K house. That would be a 9% fall in house prices that ($800 to $730k) you’d need to see to break even.

If you’d bought a year ago, you could have bought a $860K house for $3,500 per month mortgage, because rates were 0.75% lower. So you’re already behind in this “waiting game” (as you can only buy a $800k house for $3,500/month), and your next hope is that you can buy a house for $730k if rates rise 1% for that $3,500 per month.

Yes, that is difficult for me to understand.

That specialty of discussion boards, the gratuitous insult couched as an open-ended prediction which the poster hopes nobody will remember.

Now, now. You’re contradicting FHawk’s News’ predetermined narrative.

Spot on.

@guest_52489

This would actually be really easy. Make the capital gains 100% of the gain on residential prop vs the 50% it is right now. LL clearly aren’t in it for the rent but rather the prop appreciation. Take away the appreciation benefit and the $ will seek yield somewhere else.

Check these IG ads from the developer of Topaz “20% off for a limited time only.

I’ll give you 30% off one of my condos, but I’ll set the price.

Terrible idea. BC actually had this in the late 1970’s and it resulted in zero vacancy rate and all sorts of under the table offers to get a place to rent.

The main purpose of the present tenant-in-place controls is to prevent bait-and-switch, eviction by rent increase and other abuses of tenants. Tenants move around enough so that no landlord is going to be stuck with significant under-market rentals except in exceptional cases.

Check these IG ads from the developer of Topaz “20% off for a limited time only”.

https://imgur.com/a/GiCBgv8

Same developer redoing the Pandora Medical Arts Building.

In 2012 they were begging for renters and giving deals all over the place. Incomes here only support so much rent is the bottom line then they stop moving here.

I rented my downtown 530 sq/ft unit with no parking in 2012 for $1,175/month. Had 11 applications. I don’t remember begging anyone.

Since the construction bizz may be turning a corner with developers cutting back 50% on projects I suspect the amount of people moving here to find work will fall off drastically like every other boom/bust, and the landlords will be soon dropping their rents 7% or more.

In 2012 they were begging for renters and giving deals all over the place. Incomes here only support so much rent is the bottom line then they stop moving here.

Why should renters pay for landlords dumb decision to pay too much for their rental ? The day of reckoning is happening now for gouging landlords IMHO.

re: vacancy control. Just wondering whether there would be a way to cut the pear in half so to speak. Perhaps, when a tenant leaves, the new tenant could be charged more than the allowed annual increase of an occupied unit but with a ‘reasonable’ cap such as 6% or so… The 6% figure is semi-arbitrary. Basically a number that ensures landlords can raise the rent more or less substantially but not astronomically. I believe that building a system with in-built incentives to push tenants out that is unhealthy. I do have sympathy for landlords who are limited to very small rental increases but if the cap between occupancies were relatively ‘reasonable’ (eye of the beholder I know), then perhaps we could provide reassurance to tenants while not impeding LLs ability to make their payments etc. Something that could reach some sort of balance between competing interests. I have been both a landlord and a tenant and thus empathize with both positions. Can’t help thinking there is a creative middle ground position possible.

“When you have a good tenant in, a lot of non-commercial LL’s don’t do annual increases in the rent. They simply correct to market when that tenant leaves. If vacancy control is applied, then those same LL’s would be nuts not to do annual increases..”

As a tenant, I vastly prefer the idea of having yearly rent increases which I can more or less plan for than to live in constant fear of having to leave my home.

As I said a while back, too much meddling by the government is a bad idea. Vacancy control will only create slums and super expensive new rentals. Stupid stuff… this only benefits those that need cheap rent and don’t mind renovating their rentals themselves…. or don’t mind bashed up walls, stained carpets and peeling paint.

Which bear on this blog has been poo-pooing rising rates? Not me. We want the wind to be taken out of the sails of rising prices and rising rates are a direct way to do that.

… yes. Is that so difficult to understand? It would be hypocritical otherwise. Why do you think I’m waiting? I’m not going to put myself in a paycheck-to-paycheck situation to become an owner and anyone that does is plainly stupid. There’s just no other word for it.

Hey Dad. For the record, of course I am aware that rent controls don’t currently apply to times of vacancy. You can refer to my post about the recent 7.5% YOY rent increases.

It seems you and I finally agree on one thing … (proposed) “vacancy control is a terrible idea”. I expect the GreeNDP and their one-sided rental task force to introduce it anyway. If/when that happens, will you still laugh when I call it Soviet-era price control?

Re: vacancy decontrol

I was responding to Patrick’s hysterical post about removing the automatic 2% rent increase and the end of rental housing. It seems that he is not aware that upon turnover, a landlord can charge whatever the market rent is.

That is why vacancy control is a terrible idea and Patrick’s characterization of the recently tweaked rent increase formula as “soviet-era price controls” is hilarious.

Think of the existing rent controls, but broader. This is a proposal that makes it so the rental rate is tied to the unit itself rather than the tenant. That means when the tenant leaves, the LL can only raise the rent by the specified amount allowed (CPI I guess), rather than to whatever the current market rate is.

The idea here I think, is to discourage renovictions. The problem is, renovictions on the scale they’ve been occurring are one symptom of (IMO) a housing bubble; these discussions tend to resurface in some jurisdictions whenever there is a bubbly market. As this bubble deflates, people won’t be renovicting very much as housing is no longer turning into blocks of gold overnight.

Rent control carries its own issues, but vacancy control is IMO, kind of nuts. There’s the usual “rental units wont be built, LL’s won’t rent out their suites” arguments, but the more immediate problem is how existing LL’s would respond.

When you have a good tenant in, a lot of non-commercial LL’s don’t do annual increases in the rent. They simply correct to market when that tenant leaves. If vacancy control is applied, then those same LL’s would be nuts not to do annual increases – not to mention the pre-existing issues I mentioned above.

This is all hypothetical of course, but the concerns do make intuitive sense. Of course if prices were to fall, then the consideration changes, as it’s kind of predicated on a continually rising market.

The rental task force that John horgan put together was supposed to release their recommendations yesterday, it looks like they did not and have now delayed it.

We went to one on the community meetings here in Victoria and some of the recommendations that were being suggested by tenants were ridiculous.

I have a feeling the recommendations that come out of this report will be presented as being advantageous to tenants. The reality is it will have an extremely negitive effect on them as most good landlords will bail and stop building or renovating rental housing.

Not common here for residential. More common for vacation properties.

I presume with % owned as tenants in common and separate rights agreement. Lots of precedents out there.

You may not be able to get a mortgage as easily and it will likely be .5% to 1%+ above the best available market rates. Co-ownership agreements address mortgage default and generally include a ‘right of first refusal.’ This means one owner wants to sell their interest in the property and the other owner(s) has the opportunity to purchase that interest at an agreed upon price (generally market value). The bank can still foreclose.

https://www.vancity.com/Mortgages/TypesOfMortgages/MixerMortgage/

On Friday I went with a neighbour to look at granite slabs for their kitchen. I was actually shocked at the ridiculous price.

< Patrick, heard of vacancy decontrol?<

I had not heard of it but it sounds like it could work

Patrick, heard of vacancy decontrol?

taxing can be good by reducing wealthy land owners from holding too many properties and monopolising this small city .. Unfortunately, the ones writing the laws are the wealthy land owners. Taxes ends up as cost for commoners and the less fortunate ones.. to fix the problem .. they should increase tax base on the number of properties owned. But then again .. this stifles growth and we will become a crumbling city with no one to build … history repeats itself . .. houses seems to build in different eras .. only during times when economic booms happens

the debate about taxing more to ensure affordability for less fortunate ones or allow trickle down effect with no regulations.

One is having reduced growth and the city can’t provide enough housing for the growing demands of rights to shelter… which cause more public outcries to solve housing crisis ,… result .. the bottom citizens suffers

The other one is allow uncontrolled growth… growth is good…,initially, some people gets a boost of wealth.. the less fortunate gets forced out .. public outcries for solutions .. but uncontrolled growth in a confined space with limited resource is like cancer — the host will eventually die. Result.. the bottom citizens suffers

Fortunately.. if you live long enough .. like another 50 years.. you will see populations growth reversal .. first world countries will have more old people dying off and the current generations wont be able produce enough offsprings due to affordability .. work force will be replaced with robots . transportation will be automated and people will start to migrate out of cities due to increase of automated transport speed .. housing crisis solved.. too bad many dies in the progress of progress

i dont have solutions … i just here to make pointless statements

Exactly my point! The way you (as a pro rental developer) “don’t put yourself in a position like that” – ie to face losses as a landlord when interest rates rise (raising your mortgage) but the GreeNDP govt has Soviet-era price controls that prevent you from raising rental prices above inflation is………

(dramatic pause to let you think about it for 5 seconds think about it as I’ll give you a chance to answer your own question before your read it )

….. is to NOT become a landlord in the first place! For a developer of rental houses it means to stop developing rental houses in BC, or just develop for sale. For existing landlords that means getting out of rental housing by selling.

You bears crack me up. You spend half your posts telling us that interest rates are going to rise, raising buyer mortgage costs to the moon, preventing people like Josh from buying a house. And then when I point out that this will affect prospective landlords too you say “oh well the landlord developers are professionals and won’t “put themselves in that position”.

Well now I have “Josh approved” advice for any potential buyer here worried about buying a house and facing rising interest rates raising mortgage costs. I’ll tell them what you told me … be a professional and don’t put yourself in a razor-thin position like that”

Oh my.., harsh. So if Josh buys a house , and rates rise so high he can’t pay his mortgage, would someone “like Josh” have no sympathy for him because he “should have known”? Or are your feelings different for landlord owners vs owner-occupiers?

No professional rental unit developer would put themselves in a razor-thin situation like that. Any amateur that does that should have known the risks and has none of my sympathy. Does your heart seriously bleed for landlords that relied so heavily upon that extra 2% increase?

Less wannabe RE tycoons snapping up properties to rent them out at ridiculous rates is a good thing. Purpose-built rental apartment buildings still make sense.

I’m not sure what the poster was referring to about the new taxes on the rental units.

But I am sure about the huge disincentive to build a new rental units created by the GreeNDP . And so are you Josh. It’s the one you just dismissed in your previous post. The one about capping rent increases to inflation regardless of the cost increases the landlord faces.

I would assume the banks lending money to developers of rental units will ask how the landlords will pay back the bank if interest rates increase and the mortgage payments go up. Before this new Cap on rent increases, the landlord would answer that he would increase the rent to cover his increased costs. Now with the NDP cap, he would have to answer “I may have a shortfall if rates rise and my mortgage payments rise, and can only raise my rent up to the cost of inflation” In which case the banker may say you don’t qualify for a loan to build rental units. So the developer may reply “OK how about if I build them to sell instead of rent because there’s no Cap on what I can sell it for that’s just market forces without the government putting a limit on it”

I would expect fewer rental units to be built, because who wants to build a product that has a built-in cap on revenue, and no cap on expenses?

I am curious (but not very) as to how they are going to register the basement suite’s title?

This could make an interesting day with the bank trying to place mortgages without joint liability. My practice was not in real estate but this smells like the sort of mine field that a lot of lawyers would simply refuse to handle. Nobody needs this sort of potential E.& O, problems.Most people dont really appreciate that with joint ventures liability to third parties attaches to all the members of the joint venture. You can limit liability to the asset by putting title in a corporation but then you lose the principle residence exemption.

I am going to stop writing because i am already up to about a half dozen problems with this. Makes for a nice law school exam question.

Hahahaha LOL

That made my afternoon…

Yes, I view it as a family investment. I also don’t view paying for higher education as a gift either, but as an investment made in the best interests of my child which requires them to apply themselves and not waste it.

I had to check out their website (http://sharedhomeownershipvictoria.com/shared-home-buyers/). The justifications look like the typical ‘fear-mongering’ of FOMO. I particularly enjoyed:

Good luck with that. Sounds like a terrible idea. Just buy a duplex.

Ya, what is it with those hippy-dippy NDP? What are we, a province that wants homes to be lived in!? Next they’ll be implementing policies to lower homelessness rates. PFF.

The area around Beacon Hill Park has had a number of basement suites for sale. I don’t understand it. Buying someone’s basement is super unattractive to me and I’m sure it’s no fun for the seller either.

What the hell are you talking about? Are you getting mad about an imaginary tax? Unsurprising if you are, that seems to be half of conservative arguments.

Actually in our case it’s not really applicable as my daughter is very impatient but has her head screwed on right and would probably do a cohab agreement on her own volition. But aside from that, I wouldn’t agree with the classification of this as a gift, as gifts should be given without strings attached. Rather this is part of an incentive program to put herself in the best possible long term position. She can make whatever choices she wants and always get my love but I’m only going to incentivize those options that I think are best for her.

Increasing what taxes?

The best way to encourage the building of purpose built rentals is to bring RE prices down. This increases the rental yield making rental properties a more attractive investment.

Which is usually the best time to buy. People thought the same in 2015.

Speaking of bankruptcies, they seem to be stacking up again past few weeks, plus 2 new foreclosures this week. Never seen so many civil forfeitures this past year. Is this a city of deadbeats who don’t pay their bills or just criminals ?

Most criminals/gangs screw up again within hours. In this case the odds of new charges are extremely high.

Yeah, I can’t wait to get back to some good ole money laundering, no checks on shady agents, 30% over ask bidding wars, and so ICBC and BC Hydro can go bankrupt for good. Wait a minute, the Liberals already bankrupted them. Some people are so fricking clueless.

@guest_52700

Market timing generally fails. Diversify and invest for the long term.

Local Fool – In the meantime, save, invest, and be liquid.

Invest where? Nothing seems safe at the moment.

Only within one year of being stayed. Very rare and usually only if new charges are brought against the accused.

“it is going to be hard (impossible?) to fix the many factors that have lead up to the affordable housing crisis”

It is creating a housing affordability crisis, not its elimination, that is the object of government policy.

Rising housing costs mean:

Rising house prices mean expansion of the construction industry, one of the few “manufacturing” sectors of the economy that cannot be off-shored to Asian sweatshops.

Expansion of the construction industry compensates for the effect that the loss of industrial capacity has had on jobs and tax revenues.

Falling house prices would mean, high unemployment, huge budget deficits, disappointed and in many cases bankrupt home owners, and goodbye Justin.

@LF: “Sometimes governments get it right – marginalizing cigarette smoking is one example”

In fact, governments generally did nothing to discourage cigarette smoking, raising the tobacco tax cautiously to avoid depressing revenue. But now everyone knows that tobacco kills, the government promotes the smoking of hashish instead, despite the known role or marijuana as a cause of both motor vehicle accidents and, in adolescents, schizophrenia.

Interesting listing – MLS 402146 & 402147 – in Langford. 2648 Crystalview Dr. is being sold as a shared home ownership. The main portion of the house is listed at $690,000 and the 1 bedroom suite is being sold separately at $175,000. So how does this work? What if you don’t get along with the person who purchased the basement suite (or vice versa). I haven’t seen a listing like this before – is this common at all? Just curious.

@guest_52484

“So, that’s in a class that most people can’t afford”

1/2 acre and a $1 million build for a total of 2 milllion!!! Of course most people can’t and shouldn’t be able to afford that. That’s luxury. People need to get used to duplexes and condos. That’s the new reality. No one has a god given right to a Vancouver downtown condo or a detached Victoria core house.

It is astonishing to believe that governments thinks that increasing taxes on people who are trying to build rental units, will encourage them to build more rental units.

The best way to create new rental units is to offer people incentives to bring new suites onto the market.

Imagine how many basement suites would come back onto the market if the government allowed the owner to pocket the rental income tax free?

Imagine if the government said to developers….. build a new building and we will allow you to have 10% of the income….. tax free. These are called incentives.

Now imagine the benefits. More units. Lower rents because there would be so much more product on the market. Less taxes for everyone because the governments would not have to spend as much money on creating the new units.

Instead….. we do the opposite.

Politically hard. The problem is the commodification of housing, abetted by tax policies and subsidies that encourage people (mostly local, but also foreign) to put their money into RE, rather than productive investments. If RE were treated the same as any other investment the problem would disappear. What’s stopping this is that so many Canadians have bet their financial well-being on their RE holdings. We have some excellent examples here in this forum.

This is over 1/2 acre lot in Arbutus/Queenswood area. I didn’t see pictures of the house, but assume it will get torn down. That seems like a good price for a large lot in that location, but it still means an over $2M property when done. So, that’s in a class that most people can’t afford.

There also needs to be some redistribution of wealth so we can all share in the prosperity. The gap between top and bottom income earners is too high, and much higher than it has been historically. No one is that indispensable and no one’s life energy is worth that much more than another’s. We are all human.

However, I think government interventions can go too far and make it unappealing to be a landlord. It is still essentially a private business and the landlord takes the risks associated with running it.

Unfortunately, it is going to be hard (impossible?) to fix the many factors that have lead up to the affordable housing crisis. I think a big issue is failure to build rental housing for 30 years (although much of those were leaky-condo years, so not entirely a bad thing). This is also like the failure to train physicians and set up collaborative care teams, leading to a family physician shortage now. An ounce of prevention is worth a pound of cure, but that’s not how governments usually work.

@Leo S

I think giving the control of hundreds of thousands in assets to someone under 25 whose brain has not fully matured and who has little life experience is generally risky. That being said, each kid is different. If I think back to myself at that age, I would have totally been asking for the cohabitation agreement myself if I were made aware of the risk. Maybe that’s why I stayed single for so long.

That don’t impress me much. I’ll wait until you buy your house, and you tell us that you’re still writing letters to Carole James telling her to keep at it, more taxes to keep lowering property values more. Until then, its just your self-serving money issue, and kudos to Carole James and John Horgan for not bothering to reply to you.

And away we go with another fact-free, off-the-cuff conspiracy theory. No longer about money-laundering, but now we move to the “cover-up”, complete with bribes, and high-level people…. just more speculative nonsense.

Can’t we get back to slashes?

I agree completely. I would also agree with the notion that the route to prosperity is through innovation and production, not selling pieces of land back and forth to each other at ever higher prices. The latter eventually impoverishes an economy, makes it noncompetitive, reduces its ability to weather recessions, and contributes to excessive social polarization.

Regardless of whether people believe taxes are inherently good or bad, I don’t think most people would agree you can “tax your way to prosperity”. I suspect the line of thinking is taxation and other policy tools are ways to encourage or discourage certain types of social and/or market behaviour. Sometimes governments get it right – marginalizing cigarette smoking is one example. Other times of course, they don’t, which is what people tend to remember.

@Robin

The government is not your friend. You think all these new taxes are a great idea? You can’t tax your way into prosperity. How about the outrageous rental increase cap the NDP are proposing? What are we, the Soviet Union?! I can’t wait to have the NDP kicked out so we can get rid of all this non sense government regulations.

Stayed charges can be brought back to court at any time. Wouldn’t be surprised they found out some high level people were on the take and they are covering it up until they get all of them. Those currently charged may be getting future plea deals. Eby will dig deep.

You don’t need a buyers strike, and it wouldn’t do anything anyways. You have to leave it to Mr. Market, as all people throughout history have done. Give him time to do his work; it seems he’s already starting to pull his sleeves up to do just that. In the meantime, save, invest, and be liquid.

Sounds like a Maoist rebellion. Also sounds like it has zero chance of working precisely because of what you said up there ^

Maoist leadership: “No buying property for 2 YEARS! No exceptions! We will tank the market and show those owners what’s what! BE STRONG COMRADES!”

Maoist rebels to themselves: “Ok so I guess I’m buying in 1 year and 11 months.”

The composition of my portfolio is largely irrelevant; the DJIA is up ~56% and the TSX is up ~25% since the beginning of 2016. People who bought stocks wisely at that time have experienced a run-up just like those that bought into the real estate market (in my opinion they’re correlated, but that’s another topic). I don’t think it’s skill, luck, or insider trading, although those are easy explanations to rationalize a missed opportunity. Anyone who simply bought and held Netflix, Nvidia, Amazon, and/or Apple (as examples) over those 2 years would have trounced my investments and the return of someone who instead bought the median SFH in 2016 (without also incurring the extra costs associated with real estate). I don’t think anyone would consider investing in those companies to be “wildly reckless” and I’m not necessarily trying to suggest that the trend will continue. Personally I have never owned any of those particular stocks (or bitcoin and cannabis stocks) and I know others who have done similarly well on the stock market over the last couple of years while also owning none of the aforementioned or wildly risky stocks (don’t worry, they don’t want to buy here). I don’t think it’s as rare as some people believe.

Big difference between being dropped and stayed.

Patrick re “Hate to spoil a great conspiracy theory….”

Yes, you caught me on that money laundering conspiracy theory……good thing I didn’t mention the lunar landings!

Charges being stayed hardly means a lack of guilt, and if you actually think money is not being laundered in the lower mainland housing market, then you must also believe that walking around with shopping bags full of cash is normal too!

Best of luck to you with the buyers strike…..just let me know when the strike is ending so I can jump in at that time.

“an organized buyers strike”

Finally a really great idea to resist this non-sense real estate market. Hard-working professionals are ridiculed in this city by real estate speculators and realtors. This is a call to reason.

“Hmmmmm….cool idea, can we also do the same for iPhones, Teslas, and a bunch of other things I feel are overpriced?”

I don’t see why not, but there’s millions of folks buying iPhones so your chances of making an impact are slightly lower. The fact that a realtor would take time to minimize my idea only gives it more legitimacy I suppose, nothing makes a realtor sweat more than a phone that isn’t ringing…

And I say that with all due respect as I’ve run across many really great realtors in Victoria to be honest. But sellers can’t cash out on their investment without us buyers, and the pressure to do so will only rise if they see prices start to go down. At the very least, an organized buyers strike would be fun to witness, unless your salary depends on it.

“>” “Text you want to quote” (all without quotation marks)

Apologies, I still don’t know how to reply to a specific part of a post the way you all do, still new here.

Introvert, I do appreciate this blog and I enjoy commenting here so far but what I really meant was something much wider spread than this. I’m sure it sounds like a pipe dream but I actually don’t think it’s that far fetched in this day an age. If the homeless can camp out around town and get publicity for expensive rental housing why can’t the middle class 20 and 30 something’s do the same for the detached family house market? I’ve already written Carole James and John Horgan several times to show support for their multitude of new taxes because I’m sure all they hear is the backlash from enraged property owners.

Maybe I’ll just start a Facebook group and go from there…

I think the main problem is buyers are not organized together to share information and strategy because we’re supposed to be competing against one another. I’m beginning to strongly feel we should start our own support group and petition other prospective buyers to wait out the sellers as long as possible. Spread the word on social media, meet and discuss properties or market trends, spend our untethered money on beer and ignore the realities of renting in a safe place while we watch prices plummet.

Hmmmmm….cool idea, can we also do the same for iPhones, Teslas, and a bunch of other things I feel are overpriced?

Maybe in theory, but has this ever happened lately?

What you’re describing is essentially HHV.

Yes, I will vote for Hawk as our great leader!

I’m sure many kids will do whatever to get the condo, but it makes it obvious that you don’t trust your adult kids to make their own choices. If you cant bring yourself to give a gift without controlling it, don’t give it at all.

Big backlash on that stay of charges. Province is looking into it. https://vancouversun.com/business/local-business/attorney-general-incredibly-disappointed-by-charges-stayed-in-b-c-s-largest-money-laundering-case

The stayed charges absolutely do not mean there was not a case here.

I think individual first time buyers tend to forget how much power they really have in these situations. I know it becomes frustrating to watch prices climb from the sidelines and to be told constantly that if you don’t take a huge risk and jump in now you’re missing out. Sometimes that’s true, I know I certainly missed out in 2015, but you have to understand the underlying mechanisms at work in the market from an unbiased point of view and where the real trends are headed (which is one of the reasons I appreciate this blog so much Leo and why I continue to spread the word about it).

All of the real estate owners eventually need us prospective buyers. Just as with everything the consumer has a lot of power and in real estate especially, a single buyer deciding not to buy has a much larger effect than deciding to buy a different brand of cereal, there’s just less of us buyers out there than the realtors/sellers want you to believe. All the news from the VREB focuses on new buyers from here or there to pressure local buyers into the market but in reality many properties are sitting now, most folks already jumped in during the 2016 rush. And rents going up? completely overblown. Rent is high here but still lower than the interest on a typical detached mortgage and they can build a lot more rental housing a lot faster than they can build houses.

I think the main problem is buyers are not organized together to share information and strategy because we’re supposed to be competing against one another. I’m beginning to strongly feel we should start our own support group and petition other prospective buyers to wait out the sellers as long as possible. Spread the word on social media, meet and discuss properties or market trends, spend our untethered money on beer and ignore the realities of renting in a safe place while we watch prices plummet.

It sounds ridiculous but a property-buying strike would make great headlines these days….Local Group Begins Lengthy Property-Buying Strike – Realtors Flock to China to Find New Buyers

I would say whether a parent would propose such a thing in the first place depends a great deal on the relationship.

The kid’s reaction depends a great deal on the relationship one has with him/her.

Would suck to be a kid relying on parents for help….I would definitively go the route of no help versus help + cohabitation agreement. Way too many scenarios under which I would not want to bust out a cohabitation agreement.

So you will try to evict your kid from their condo? Like I said, crappy life. Also completely controlling! If you want to support them in their life don’t give them a condo. Let them start living their life on their own. Experience some self sufficiency. If they can’t work because the study is too intense then give them a rental budget that makes financial sense. I lived with (at one point) seven people in a three bedroom apartment in Ottawa and survived just fine. I appreciated the extra cash for going out and spent most of my time at the campus anyway. I found Max, who lived in the back stair case landing a very interesting fellow!

The problem is how do you handle such a situation in advance. You cannot register an agreement not to have a partner move in against the title of the property. The best you can do is advance the money through a mortgage callable on demand. But that’s a game of chicken really – who’s really going to lose money if it comes to blows?

Now that’s a creative solution! 🙂

Me to my daughter if she gave me any grief about such an agreement:

“I get it, you love him, but life is about choices. You can live here, I’ll help support you, and you’ll get him to sign this agreement. If he doesn’t want to sign, well that’s a bit odd, but hey no problem, the two of you can figure out where you would like to live without my help.”

Signed for another year in the rental and nary a price increase in all the time I’ve been here. Also noticed a couple rentals come up here (Broadmead/Cordova Bay) that tried increases from previous that sat vacant for awhile. Don’t think they got their price increase. Guess it all depends. And yeah – still happy to be on the sidelines at this time.

Can’t stop. Won’t stop.

I always advised parents to fully mortgage a money advanced to a child for a property including a number of the terms and conditions referred to hereunder by others.

How would this help with the current common law structure in BC? The common law partner would still be entitled to the appreciation in the condo which seems to be the idea behind buying a kid a condo versus having them rent.

You need a co-habitation agreement and I am sure your kid will love……….”here is a condo, but you need sign a co-habitation agreement with any romantic interest that moves in.” Kid might accept it but it will cause strain for sure.

As a retired matrimonial barrister from Ontario. I always advised parents to fully mortgage a money advanced to a child for a property including a number of the terms and conditions referred to hereunder by others.

The objective was not to control the adult child but rather to protect them from claims either by a spouse or common law partner. There are some more rare situations were one has to protect the child from themselves (drug or alcohol addiction) but these are more commonly best handled by a trust.

I can only recall one situation where the grown child deeply and very vocally resented the idea of his ‘controlling parents” not giving them a outright gift of a condo.Following a totally outrageous display of screaming entitlement in my board room I meet with the parents and we managed to work out a more satisfactory arrangement for my clients. The kid received postcards from every city that the parents visited on their year long sabbatical tour of the world. The kid received a long overdue education in reality.

I haven’t looked into this specific case, but money laundering by nature is a pretty slippery activity. In so many cases it’s not easy to prove one way or another, as the “hockey duffel bag” example is probably an outlier in terms of how this activity manifests.

I don’t think we’ll ever know to what extent money laundering has effected BC RE. Probably some, but that’s nothing more than intuition. What isn’t intuition is the sudden and dramatic rise in fentanyl deaths in the province, which clearly does have links to the Chinese drug trade. Would an unmonitored RE market be an ideal place to move and clean that money (for the money that stays here)? Sure it would.

To me the issue isn’t arguing “yes it’s caused a bubble” or “no it hasn’t”, it’s more that I don’t want people to live in a place with that kind of activity goes on unchecked. It’s shameful, embarrassing, and the real human cost is absolutely appalling.

Im not going to sue a child but a former cl partner or spouse could sue your child and they could lose the money you put into this investment as a result, which you intended the child to have. And this happens fairly frequently despite other types of gifts and inheritances being exempt from division. Remove the risk of this and you are protecting your child from conflict, not controlling them. It also makes it not personal between the cohabiting couple.

fwiw I just discussed it with my son. His view is that it seems like a good idea to set it up like this.

Hate to spoil a great conspiracy theory, but you do realize that the money-laundering charges have been dropped? Or will you keep it going by theories as to why the charges may have been dropped?

https://www.cbc.ca/news/canada/british-columbia/money-laundering-charges-stayed-1.4923861

“In a written statement, Public Prosecution Service of Canada spokeswoman Nathalie Houle said the charges did not meet its prosecution test, which stipulate there be a reasonable prospect of conviction on evidence likely to be available at trial and it would best serve the public interest.”

I found most of that “great” Global article to be speculation, short on hard facts.

@ tdm2121 Exactly, why is there such an indifference? It is very clear that these homeowners are happy to sacrifice there kids ( with all this fentanyl crisis and expensive houses)…so that they can brag about home ownership. So sad.

Interesting sale: 2620 MacDonald Dr E

Original List: 1.1M

Assessed: 1.3M

Sold: 0.95M

150k less than land value and the house isn’t great but I’ve seen much worse.

” great report out from Global News on money laundering”

Just finished reading last half of the posts re Leo’s last Market Update, no one concerned that the pricey BC real estate market is supported by criminal activity???

Our last few years in Ontario we read about all the reasons why the Vancouver area housing prices kept increasing……………the mild winter, the mountains, the west coast life style……………what we didn’t know was, those reasons were in the backseat…………..the main driver of the expensive housing market………..MONEY LAUNDERING!!!

Big shaker in Anchorage this morning ICYMI. Someone was shooting down the odds of the big one here awhile back. A 6.6 did some fair damage by the looks of some of the buildings and threats of gas leaks etc. Scary stuff.

@totoro, I think you are in a bit of a fantasy / legal world there. Are you going to sue your kid? Either you gift the kid the condo and that’s it, it’s theirs to manage ( and pay the mortgage) or you don’t and you own it and they pay you rent. Otherwise you are simply risking a crappy life. It’s very true that they could take on a male roommate without thinking a relationship is there and thus no cohabitation agreement (who does that anyway, talk about a buzz kill). Over the course of a year some sexy things happen and then the relationship goes south and the roommate claims common law….

One of the reasons I prefer equity investing vs property is property is also a liability. It require money and attention to hold it and can gift you very expensive booby-traps. Like those old folks with the leaking oil tank taking all their retirement nest egg to clean up….

@Barrister

“but the most common new build is not 6000 sq feet but somewhere around 2500. (you need to stop driving in the Uplands).”

There seems to be some kind of rule that you don’t build a new house that costs less than the lot it’s built on. With lots in Oak Bay averaging, I would guess, a million dollars, that would mean 2500 square feet is likely on the lower end of the range for most new builds.

That certainly is the case in the Estevan area, e.g., the 11 new builds and major rebuilds on Lincoln Road during the last five years. At least three are six thousand feet or more, and the rest are pretty certainly over 2500.

.

Are you the “Wolf” of Wall Street?

I would definitely like to know the investment profile that produced that in a year!

I mean I get some picks that do rather well in the short term but that is usually dragged down by the ones that don’t. My Tesla and Etsy shares are up 25% in only a few months but my ETFs (which are a larger share of my TSFA) are all down. Though I am no Mustachian but rather a reckless stock picker, going all in on WEED I would not advise….

No, a shared appreciation mortgage is a legal mortgage in which the lender agrees as part of the loan to accept some or all payment in the form of a share of the increase in value (the appreciation) of the property. Typically seen only in private mortgages/loans.

You are substituting your opinion on how things should be vs. what you can do legally and how you can consider managing risk, which was the question posed by Marko. If you have a mortgage you legally own a property, but it is subject to mortgage terms and conditions including things like not renting it out without the mortgagor’s permission.

The adult child can legally own a property and you can legally contract with them on conditions, including occupancy, in exchange for providing financing/equity. It would be fool-hardy not to imo given the Family Relations Act issues that can arise and the plan being to assist your child and not create conflict for them in future. You can always forgive a condition, you can’t impose them without agreement afterwards.

CS: You have a point about the most common new build in Oak bay being larger and more expensive than in the 1950’s but the most common new build is not 6000 sq feet but somewhere around 2500. (you need to stop driving in the Uplands). But a valid point of comparing apples to mangoes.

Betting your nest egg on stocks with returns that high seems wildly reckless. But congrats, I guess.

It’s called applying yourself and doing your DD, talking to companies, studying financials, new trends etc. Being jealous/envious of someone’s hard work is just plain moronic.

3 new SE listings this morning, 2 in Golden Head and one in Caddy Bay all below assessment, one is $190K below and all below $1 million. All decent places in need of updating but 6 to 9 months ago even they wouldn’t be listed below assessment and would be sold well above. Funny, this is is how Westside Van started tanking but Victoria is always late to the game.

Yeah another argument for the heat pump. Not strictly necessary in Victoria but there’s a couple weeks in the summer when the AC is super nice to have. Going to get more of that as we get warmer summers

@ Robert

What is your current electric consumption for the year or every 2 months?

How many Litre of oil or how much does it cost to heat your home currently for the year?

@ Robert

Not factoring in basic charge, rate rider charge, delivery, rental, service fees, and taxes into the pricing.

Currently residential end users are charge anywhere from $3.89 to $6.39 per Gigajoule (GJ) from local gas distributors.

26 Litre of diesel is equivalent to 1 GJ. Equivalent to at the very least $26.

278 kWh of electricity is equivalent to 1 GJ. Equivalent to $24.58 (BC Hydro Step 1 pricing) to $36.86 (BC Hydro Step 2 pricing).

Air source heat pump would cut electric costs roughly 50% to 45%, however most home owner would run AC in the summer. Hence, most if not all power consumption saving from winter heating would be expense in the summer for cooling.

https://www.fortisbc.com/naturalgas/homes/customerchoice/pricecomparison/Pages/default.aspx

A share of appreciation is an equity position. You can’t have it both ways. If the child really owns the property they can do what they want with it. That also goes for an “agreement” not to have a partner move in.

If you want to control the property, own it yourself.

Doesn’t appear to be an option in this commenting platform. For now I’ve added a “Flag” feature on the right. When I’m not paying attention (like recently because my folks are in town) I will get an email if a comment is flagged as abusive / inappropriate and if it gets too many flags it gets put into moderation automatically.

Up for the vast majority.

A month ’til New year, I wonder what the assessment value will be – up / down / flat. If it goes up another 15%+, it doesn’t matter the asking price is under assessment for most.

We should hold a count down party here on HHV.

@Wolf

“we invested our down payment and ended up with a 76% and 47% year-over-year return on our stocks in 2016 and 2017 ”

Those returns are insane. Luck, insider trading, or phenomenal skill?

They’re waiting though. Blah blah blah no body wants to catch a falling knife, people will only jump back in on the way up blah blah blah.

I don’t know exactly the cost of putting in the gas, but based on the oil heating bills from our old place (1960s, 1700sqft split level) I think it would be well worth to replace the heating with something other than oil. Firstly for the savings, and secondly for resale. No one likes an oil tank on the property anymore.

We have an electric heat pump with gas furnace backup, two gas fireplaces, and gas hot water.

It’s kind of nice to have both gas and electricity on hand, which allows you to shift to one or the other depending on the price, but I wouldn’t bother if the gas wasn’t already there.

The problem with having gas is that you always pay the basic fee. That is $160/year just for the privilege of having the gas hooked up. That would pay for about 1500kWh of electricity, or 1.5 months of hydro usage in our house for absolutely nothing.

At today’s low prices for gas, we pay about $500/year for mostly the hot water + some fireplace use for a household of 3 adults and 2 kids.

Then you factor in the incentives that you can get right now which is $2350 towards a heat pump. https://efficiencybc.ca/incentives/mini-split-air-source-heat-pump/

So if I had oil, I would replace it with a mini split heat pump system.

Having more electrically powered equipment also means more potential to offset it in the future via solar panels. https://househuntvictoria.ca/2017/10/28/solar-power-does-it-make-sense-in-victoria/

“It goes down sometimes. But Victoria house appreciation over the long run is over 3.8% inflation-adjusted.”

Which probably doesn’t mean much. In the 1950’s the most common type of new home in Oak Bay seems to have been a 1200 square foot bung with one bathroom. Today, the most common type of new home in Oak Bay seems to be about 6000 square feet with four bedrooms and six or eight bathrooms. In addition, changes in mechanical and other specs, e.g., granite for arborite kitchen counters, will have had an effect on price.

It is open to question, therefore, whether the rise in the constant- dollar price is due to house price inflation or a change in housing type.

AZ,

If Leo can devise an ignore button then there wouldn’t be a need. Only defending my reality posts versus the bubble deniers who speak out of both sides of their mouths.

Hi all, just a question to get some feedback/real life insight?..

We recently got natural gas brought into our neighbourhood and was thinking of switching from oil (current fuel source for heating) to a natural gas furnace and possibly a natural gas fireplace insert.

We only bought last year and haven’t had a full winter of oil heating expenses under our belt so I don’t have a ton of data to work with for cost scenarios.

Has anyone don’t this recently, and if so what is a typical payback period? Our house is 1970’s and about 1700 sq ft.

Any other suggestions? Heat pump?

Thanks in advance

Introvert ‘That suggests to me that any price decline wont’t be too severe.’

Seriously, the more you comment on this blog, the more ignorant you sound. You should stop.

Seems like quite a few people with good money are waiting in the wings. That suggests to me that any price decline won’t be too severe.

Ouch!

Victoria rents up 7.5% YOY.

https://www.timescolonist.com/real-estate/greater-victoria-vacancy-rate-rises-slightly-as-rents-jump-7-5-per-cent-1.23512403

On a $2,000 rental that’s $150 extra per month, $1,800 extra per year.

Is this why the bears here are so gnarly?

From the article..

“Greater Victoria’s average rent climbed by 7.5 per cent. The turnover in Metro Victoria was 18.1 per cent in 2018, exposing roughly one in five units to current market-rental prices. Most new households are choosing to rent rather than buy, CMHC said.”

@ Robin. We’re in a similar position. We almost bought a home in 2016, having submitted a few offers, but were outbid. We weren’t willing to bid as high as others and I wasn’t willing to give a 20% down payment at the time (which therefore limited our maximum bid). I look back on these homes now and I’m glad we didn’t have the winning bid. They’re decent homes of course but, in our opinion, there’s much more available on the market today that we’d prefer to live in, and we find that is increasing considerably as time goes on. We didn’t get to jump into the market at the height of the frenzy and make some quick cash but the silver lining was that (in addition to saving) we invested our down payment and ended up with a 76% and 47% year-over-year return on our stocks in 2016 and 2017 – which has made us feel fortunate to have kept pace. Everyone else we know who was looking has either purchased a home (and is stretched to the limit doing major renovations) or has given up looking for a home altogether. So we’re on the sidelines too (by choice) but I’m keeping an eye out, watching for a nice looking sheep to straggle back from the herd that, as a wolf (i.e. not a bear or bull), I can opportunistically pounce on. I guess my point is, not buying a home isn’t the end of the world. Enjoy your life and it’ll work out in the end.

Use documentation from parents setting out assistance as a callable, repayable loan, promissory note or private mortgage to the child with compounding interest and a share of appreciation, which can be forgiven at a later point if the parents wish. Agree in writing with your child that any future partner needs to sign a cohabitation agreement prior to moving in.

I don’t understand the math, or maybe I have something wrong. A couple needs about 180k to qualify for a mortgage of $4000 a month. If this is the case, even after they have paid 6k in mortgage and daycare fees (which are deductible) they have at least 6k after tax to pay the other bills using their dependent deductions. Not really a hardship situation median family in Victoria lives on.

Robin,

I understand everything in your posts, except when you say “it takes “all” of our disposable income to pay a mortgage…etc” and then you use $4,000 per month as the example of your mortgage payment.

Because that $4k mortgage payment gets you a $1m house with your $200k down payment (25 year, 5 year term, 3.49%, See links below) .

Instead why not buy a $800k house with a $3,000 mortgage payment (see same links below) . That reduces your monthly expenses by $1,000 per month, and and then you’d be able to revise your statement above to now say “all we have left after paying everything I previously listed as consuming all our income” is $1,000 per month.

That’s not bad for someone starting out is it? Especially when $1,200 (40% of your mortgage payment ) is principal in the first year, increasing each year. So adding that to the the $1,000 means your “socking away” $2,200 per month in savings, and owning a $800k house.

So what price range are you looking at?

Here are links to verify those mortgage rates and calculations…

mortgage calculator … https://www.scotiabank.com/mortgage/payment/en/payment.html

and use the posted current mortgage rate for 5 years (3.49%) http://www.mortgagearchitects.ca/

It goes down sometimes. But Victoria house appreciation over the long run is over 3.8% inflation-adjusted.

Also, the concept of “paying a price to win” is a valuable one, IMO.

All good AZ I will give you a break till the new year. 🙂

Have a good Christmas and happy New year all.

Leo great work on the site.

Mill Springs sounded familiar. Turns out, we drove up there one morning in early spring last year, just to waste some time and get out of the city. Kids played at Deloume Park. The area was quite nice!

Glad you’re liking Island life, Grant.

I don’t understand the reliance on average or benchmark. You cannot buy a piece of an average home. You buy a home, and it’s either above average or below average. Knowing what’s going on with individual properties, segments of the market, etc. seems more important to me as averages are unduly influenced by homes at the high or low end when the market is not a normal distribution.

Looks like it’s time to update your sale price vs. assessment graph Leo! 🙂

Nothing to worry about right ? Keep on buying, someone needs to be a bagholder.

Three month USD Libor has climbed to 2.7%, the highest level in more than 10 years, with the key benchmark rate climbing 61% this year alone

What Easing: Libor Surges Most In 8 Months, Squeezing $200 Trillion In Credit

https://www.zerohedge.com/news/2018-11-29/what-easing-libor-surges-most-8-months-squeezing-199-trillion-credit

Rising Rates Are Killing The Housing Market

https://www.zerohedge.com/news/2018-11-29/rising-rates-are-killing-housing-market

Finally, China contracting is not a good sign either.

China PMI Plunges To 29-Month Lows, Nears Economic Contraction

https://www.zerohedge.com/news/2018-11-29/china-pmi-plunges-29-month-lows-nears-economic-contraction

Curious these days about the going price of vacant land. For those of us dumb enough to consider building a home, it seems that the asking price for building lots has not or will not budge, or at least not from my cursory look. This of course is a different animal than your normal house hunt, as the holding potential is greater for the seller.

The divide between paying for a lot with a demo house versus paying for just a vacant lot seems pretty slim. But the demo fees spoil the deal.

I would say time will tell, but my better judgement says…not really.

On other news, I just bought tickets for the HAWK and GWAC first annual pickleball tournament, Bulls vs. Bears, slash till you bleed! Venue to be determined. Steep ticket price.

Scouring the sales for Kraft dinner is coming back into vogue.

Doesn’t look good when the Feds have to try and juice the mortgage lending market when it’s tanking. Another ponzi scheme bound to go south like the US did.

Canada’s Central Bank Is Getting Ready To Provide Mortgage Liquidity

“To reiterate, Canada’s central bank is buying assets from federally owned companies, guaranteed by the federal government, with money they’re authorized to print by the federal government, secured with assets by the federal government… and it won’t have an impact on monetary policy. ”

Right, like when increased slashes below assessment don’t drop prices.

“On the other hand, it’s a sign of market weakness. The central bank only provides liquidity ahead of liquidity concerns. Mortgage credit growth fell to multi-year lows, and is likely to drop further as they hike to “neutral” policy rate. Any time we see a government institution step in to address liquidity concerns, it’s a bad sign.”

https://betterdwelling.com/canadas-central-bank-is-getting-ready-to-provide-mortgage-liquidity/

One of the more creative variations on “real estate is always goes up”.

For 30 year olds with two middle or upper middle class incomes these days that’s not putting some of your money into a house, it’s putting all of it. And I mean sacrificing a lot of things to do so as well beyond simply the down payment.

You have to make some sacrifices to put yourself in a position to get ahead.

but they are part of the reasons i come back to this forum.. popcorn is always ready for a nice fecal matter flinging session

buying an adult child a condo

Just curious what the plan is when his or her girlfriend or boyfriend moves in for 24 months? The 2013 makeover of the Family Law Act pertaining to common law is interesting.

Can we get gwac & Hawk their own forum so they can keep it to themselves?

lol Hawk. Must be a fun place in your head. Too bad you cannot charge to enter,

Sorry to interrupt your price slashes or below assessment work. Please get back to it.

Sure gwac, it wasn’t at the price you wanted 4 years ago but it’s a good BS line to use 4 years later at higher prices. Median drops one month and you lose your shit denying it. Seek help.

BC casino Money laundering charges stayed. No info on why and will not be coming forward because of operational privacy. NDP not happy. Political blow for them I guess.

https://www.bnnbloomberg.ca/one-of-canada-s-biggest-money-laundering-probes-has-collapsed-1.1175340

Hawk ya I have been looking for years. Have not seen what I want at the price I want. So if we see a correction I will be happy to step up. Not sure how its BS. I like land but its not needed so I wait. If it happens great if not so be it.

BTW, it’s been 4 years of you saying you’re buying some “acreage” but waiting for a deal. In other words, all bullshit.

Meanwhile back in the real world, 4691 Scottswood Place in Broadmead sold for $799K, $48K below assessment. Once again it’s a decent place in a prime hood.

Assessments sure seemed to matter when I was first posting the slashes. If it was above assessment it was no big deal, now they are below assessment and it’s still no big deal. Bulls are petrified.

Hawk

LOL. Enjoy your day Hawk.

More memory problems there gwac, best check with the doc as you’ve posted nothing of the sort. Every bear post is met by some slag, those are there daily to see. Every sign of a price drops results in increased temper tantrums. You have zero cred.

Hawk

Go back to my posts its all there. The difference between you and me is I post reality of what is actually happening you have posted 4 or 5 years of crash and BS on crashes coming.

I like to keep your crap in check with actual reality.

If I am wrong about the size of the correction. Happy to step up with acreage purchase.

My real-estate is not speculative and as I have stated will be going to my kids. Interest rates have no impact on me,

@Barrister

Positives:

1) The natural beauty, which is obvious for all to see. I’ve got hiking trails 50m from my door and the bay and marina are less than 1k away. Simply can’t beat that.

2) A much greater sense of community out here as opposed to Calgary. At the local Thrifty it’s common for people to take 2X as long to shop since they are running into others they know and talking. It’s even starting to happen to us already.

3) The weather. It really does seem like there is a conspiracy to tell people “oh don’t go to the island, it does nothing but rain out there.” (I got this a lot when I told people in Calgary I was moving here.) Yes, there have been some days of hard rain. Most days it’s a drizzle with gaps of sun here and there. Other days the sky is grey all day. But you know what? It’s GREEN. And it’s not freezing cold with regular dumps of feet upon feet of snow. And if you want to see grey, go to Calgary during the winter where, save some evergreens here and there, everything is dead/hibernating. Now THAT is grey.

4) Try a new winery Fridays! (or at least that’s what my wife and I have taken to calling it)

Negatives:

1) Taxes, oh my the taxes. I’ve mentioned this here before, collecting taxes on something that has already had a tax levied on it is incredibly oppressive. (Used cars in particular but PTT too.) Between this and the sales tax I’ve just taken to calling it all my special “weather tax”.

2) Finding qualified and honest contractors here on the island has been a real challenge.

3) Our strata council here in Mill Springs seems to be drunk on power. There’s quite the battle going on between one of the owners and the council, and the council is being incredibly belligerent about trying to enforce rules, that aren’t part of the bylaw, on an issue that isn’t the crisis they make it out to be.

Surprises:

1) Being out here in relatively close proximity to the farms we occasionally get this incredibly pungent smell which can only be described as a “bouquet of WTF!” I’ve been asking around and apparently it seems some of the farmers simply spray manure on their fields, and when they do if you are downwind, oh wow.

2) That there seems to be an issue with dumping. This is such a beautiful island and I can’t wrap my head around those who dump their trash in the wilderness.

3) The previous owners of my house were slobs who didn’t clean or do the maintenance they should have. So we’ve been spending more time and money giving the house the TLC it deserves. Considering I paid a premium for the house, I’ve been pretty grumpy about that.

Overall we feel very grateful to be here. My wife regularly tells me how happy she is with the house and area.

BB’s Share price dropped to about 1/3 it’s peak value after the iphone started being adopted. There were all the old folks and anti Apple people who simply loved their chicklets yes but old people don’t drive markets unless its the death market…

No one is touching Tesla yet. You don’t simply need an electric car, you need one that people want, you need advanced AI, you need a car OS and you need a charging network. The competition is way behind and is only now catching up. I’ll be worried when another manufacturer gets half a million pre-orders for their offering. But yes, I am aware Tesla is a risky play and am not all in on one stock. I also have shares in VW since I like their plans and also have shares in GM but I am dumping those cause I’m pissed off at them….

Oh bullshit, every time I post more price slashes and below assessment sales you whine like a baby “it’s not happening and never will !! ” over and over. Your act is getting so lame.

Thanks AZ Just trying to keep the posts honest. Assessments are released in Jan so we have been between 10 and 15 above on the average. As I have stated individual is useless but average seems to flush out the individual problems both positive and negative.

Charlie I have said for months the high-end stuff will and is coming down as well as all other stuff away from the core . I also said the benchmark core will come down between 5 to 10%. We are around 2% so far.

In the summer I posted that builders on high end stuff are suffering and having to cut prices.

I think core benchmark will be limited to 5% though. I expected by now to see more but the NDP spending and job creation in Victoria is keeping core benchmark stuff stable,

I also stated I would be happy to see some bigger cuts if they happen. I want to pick up acreage.

@ Dasmo

“…if you were into B.B. and didn’t sell It when the iPhone came out you were not aware…. ”

So you didn’t read.

Just saying. There are new Electric Cars coming to market right now (Even GM is getting on bored). So you are really gambling at this time on TESLA. According to your rebuttal.

Good Luck…

So gwac, are you saying asking/selling prices are beginning to come down ?