A sellers market?

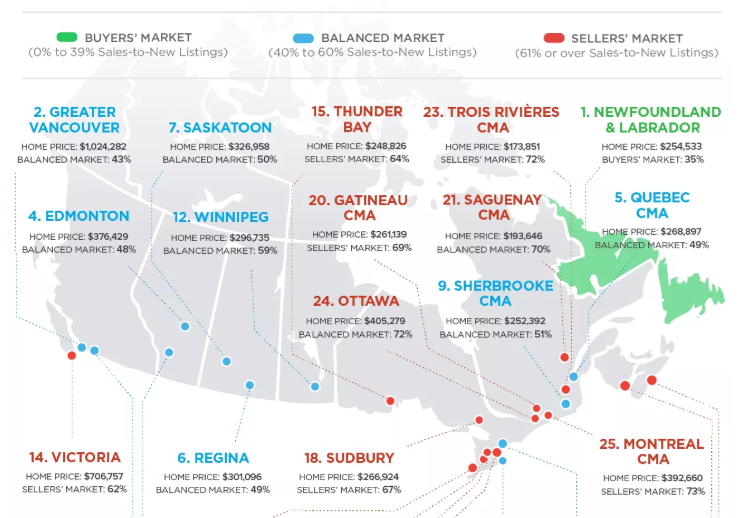

This week in the news: Zoocasa says Victoria is in a sellers market, and even more notably, the only hot spot in the west.

National markets by Sales to New List Ratio. Source: Zoocasa

Given they are comparing measuring the markets using the same metric and time period, we can be fairly certain that the relative comparison between the markets is accurate. Victoria is more active than Vancouver or Edmonton for example, but is it really in a sellers market? A lot of housing data in the news is misleading so let’s dig a little deeper before we believe those numbers.

First of all, sales to new listings ratio is not the best measure of whether we are in a sellers or buyers market. It is one of the indicators, but the overall balance of the market is best measured by months of inventory (or sales to active listings ratio which is the same thing in reverse). However if Zoocasa wants to examine the sales to new listings ratio, then let’s use that.

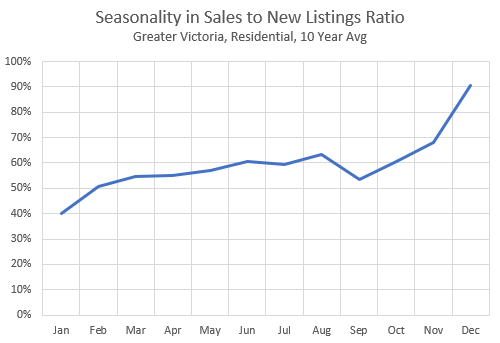

They are working from July data and correctly state that for Victoria that ratio was 62%. The CREA defines a sellers market as 61% or higher so by that definition we are in a mild sellers market. But let’s look closer. I assume we aren’t interested in the market conditions for gas stations and office space, so we narrow it down to only residential properties in Greater Victoria. That gives a sales to new listings ratio of, wait for it… 61%. So we’re still barely in a sellers market. But the problem is that sales to new listings ratio is highly seasonal as you can see below. If you were to look at that and apply the “rules” for how to interpret the sales to listings ratio, you would be forced to conclude that every January is a buyer’s market, and every December is an extreme sellers market. Of course that is nonsense so sales to new listings ratio on its own is not very useful.

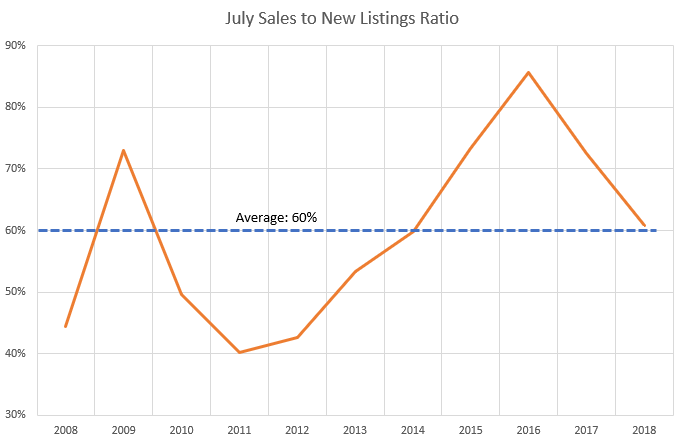

One could adjust the sales to new listings ratio to take out the seasonal component, but I know a lot of people get a little suspicious of this kind data manipulation, so let’s just look at how the sales to new listings ratio usually behaves in July.

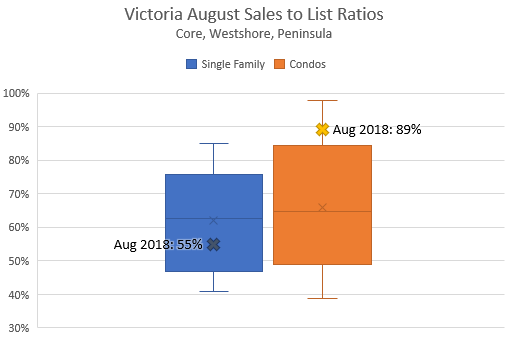

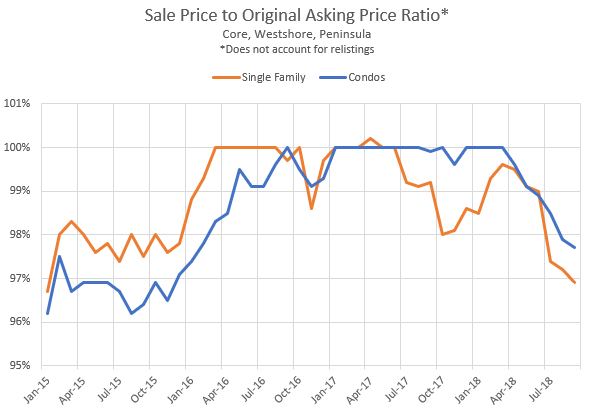

Now we get closer to the truth. Our sales to list ratio this July in Victoria was almost identical to the average. Certainly not a sellers market, which would be north of 70%, and not a buyers market either (40-50% range). Just a boring balanced market. As I pointed out last month though, it is a tale of two markets out there. Single family is dragging while condos are still pretty active.

Therefore, based on the sales to new listings ratio, we can safely reject the hypothesis that Victoria as a whole is in a sellers market.

The overall market is balanced, however we are experiencing quite a disconnect between the single family segment which is on the low end of balanced or in a mild buyers market and condos which are in a sellers market.

Ah, Local Fool, ever the optimist.

LeoS, perhaps they were talking about after the occupation permit is granted. Then you are on the hook unless you can unload all your finished units pronto.

Personally, I think development charges are fine and municipalities receive plenty of pushback (justified or not) to keep them in line with reality. What kills things is endless delays and hearings and redesigns and resubmissions. Charge what needs to be charged, refuse what needs to be refused, but give people an answer before the heat death of the universe.

Oh, and I still think the “spec” second home tax is an abomination.

September stats: https://househuntvictoria.ca/2018/09/30/september-numbers-2

In theory, but we’ll see. With Trump cutting US corporate taxes like he’s doing, I think Canada will struggle to attract investment and remain competitive.

Trifecta this weekend : NAFTA, Shell LNG – biggest infrastructure project in Canadian history – and Husky hostile takeover bid for MEG Energy. Oil stocks are gonna rip tomorrow. Canada is open for business again, and interest rates are heading up.

Sure, all future zoning should be row house style. Doesn’t mean you should tear up all that is here. That’s just vengeful….

One could argue single family zoning is NIMBYism enshrined in law. Developers not sharing my vision may be because my vision is technically illegal. Yes they ask for variances but wouldn’t more projects get built faster and cheaper if gentle density was permitted by right? And then we wouldn’t get to this point where land costs are so high because development has been artificially restrained.

I wasn’t around for the Westshore rail debate so I can’t speak to that, but I get the impression it was considered primarily as a commuter line.

KW’s LRT is 19km long, and will serve two downtowns, two universities, two malls, a business park, and many neighbourhoods in between. This corridor is now seeing unprecedented redevelopment. With a budget of 19km, you could build a network of light rail lines in Victoria, e.g. Downtown to UVic (8km), Downtown to Oak Bay (5km), etc. My dream is for the region decide where to focus density and spur development in these areas by building transit and upzoning around stations.

with Bovine Somatotropin growth hormones in it? I’d pass…

I guess the SEC wanted to fund their Xmas party….

Trump must have been more desperate than Trudeau. If the biggest concession we made was dairy then we essentially gave up nothing. Looking forward to cheaper cheese.

First Musk cuts a deal, now Trudeau! What a weekend.

That’s potentially a really big deal RE NAFTA.

I’m actually surprised, I figured it was likely that it wouldn’t be solved in time, but eventually we’d do something. Hopefully those families in Ontario will be able to keep those car manufacturing jobs.

Depending on the nature of the deal (and the presumed removal of the auto tariff threat) it potentially removes a significant barrier to Poloz following the Fed and jacking the rates.

Heh. Wow, I don’t think I’ve ever put so many weasel words into a sentence before.

wo, I agree with everything you say there except where you place blame. I can’t think of a single project as you described that was blocked by NIMBYs. In fact I can’t think of a development like that even being proposed. Blame those that block a Tram link from Langford to town. Blame developers for not sharing your vision. Colwood Corners for instance was a perfect spot for what you described. Instead they milked the location for a criminal scam. Blame them. Someone complaining at a meeting about a building being one story too tall is not to blame for the housing crisis.

Nice. Seems like smaller concessions than I expected for NAFTA. Dairy was inevitable, but nice to see Chapter 19 survived. They would not have been able to defend signing without that recourse I imagine.

https://globalnews.ca/news/4500068/nafta-2018-agreement-finalized/?utm_source=notification/

Nafta a done deal. Interest rate increase in October seems almost certain now – wonder when the next one comes after that….

Would be nice if that was ever the topic under discussion. Unfortunately it’s usually something much more dangerous like replacing a couple war shacks with a few townhouses that gets people out protesting at public hearings

I’m not sure what your point was here. I don’t want your mansion.

Here’s what I do want: To live in a vibrant, self-contained, walkable neighbourhood, with generous green spaces (and blue spaces :)), with transportation choices to the core.

I don’t want to live in a claustrophobic high-density condo tower district or in soulless low-density sprawl.

I want tree-lined streets where I can walk my dog three times a day. I want a grocery store, pharmacy, cafés, and restaurants within a comfortable 10 minute walk (“comfortable” discounts walks along busy arterial roads and strip mall parking lots). I want to get lost in a large park or go for a run unimpeded by traffic. If I’m not within 20 minutes walk of the core, then there should be frequent, rapid transit options as well as safe bike routes.

I can afford to buy in James Bay or Fairfield. But I don’t want James Bay to turn into the high-rise district. And I don’t want Fairfield to turn into a low-rise enclave of super-rich people.

If Greater Victoria planned ahead and built light rail with urban nodes then I’d be open to living elsewhere in the region. Kitchener-Waterloo (similar population) hasn’t even opened their LRT yet and it’s already seen $2B+ of development around the stations. But until there’s an alternative to driving to the core, the options for urban living are limited and getting worse thanks to NIMBYs.

Sure but why does it always have to polarize. It’s not so simple…. Can you agree that replacing Beacon Hill Park with a huge residential development might not be prudent?

I think gental denisty is a great way of adding housing stock to Victoria. I for one want to live in a city where people can live close to where they work and don’t have to spend endless hours stuck in traffic. I want there to be the option to stay here and raise your kids close to there grandparents. I don’t like the idea of saying, sorry we are full, you don’t have enough money, go live somewhere else. I also don’t like elitist attitude that our neighborhood is too nice to have denisty added to it and it should go somewhere else(that kind of sentiment really wrecks the “character” of our city).

There has been lots of talk of the causes of high house prices, but something that gets over looked is the small but very vocal NIMBY opposition that stops supply from getting added to the city. Our population has been growing much faster then housing has been added and it doesn’t take an economist to see what will happen. From purely an environmental perspective I want as much denisty added to the core as possible so there are less cars sitting in traffic burning fosssil fuels. Also how much better would our society be if parents were home 40 minutes later each morning to tend to kids as they go to school and got home earlier so they could spend more quality time with there family.

I agree Marko. I’m not saying nothing. CSV and surrounding the park can have a bunch more. But… I lived there 15 years ago and the CSV was busy still.

Areas like Fairfield are eyed because a developer can make more profit in these areas not because they want to help society.

True, but I do like density for vibrancy. Cook Street Village imo is way better now than it was 15 years ago. I rather go for a walk and there be other people out and about versus it be dead quiet.

Built them further….

“Oh and no high-rises behind the parliament buildings!”

Just stand closer.

Barrister, there is a 650-home retirement community just north of Mill Bay:

https://www.arbutusridge.ca

I’m also skeptical about the blame for the housing crisis being placed on keeping the character and protecting what is precious…. Areas like Fairfield are eyed because a developer can make more profit in these areas not because they want to help society. It’s too expensive to build new nice neighbourhoods when you can just capitalize on established ones.

Oh and no high-rises behind the parliament buildings!

James Soper: I am learning to sound like a very polite tourist in the hope that they all just shift to English. Strangely, most Swiss seem to speak English with better grammar than here.

WO Yes, and I lived in a 1930, 1800 square foot house in Toronto, an hours commute to work downtown for thirty five years while averaging a 65 hour work week. Move to Sooke and then work your ass off for thirty years and then get back to me.

Better still move to Toronto, then you can commute in winter but at least you can experience all the joys of high density living.

Barrister, you live in an 8000 sqft mansion on half an acre less than 2km from the downtown core in one of the densest cities in the country. You may be a tad out of touch on this one.

Something to be said for reducing fees for housing for sure, but this article is pretty misleading. https://www.cbc.ca/news/canada/british-columbia/layers-of-b-c-taxes-and-fees-add-up-to-26-tariff-on-new-home-costs-1.4842045

“These add up to approximately $220,000, so a condo that could sell for $620,000 now sells for $840,000.”

Is basically nonsense. A condo always sells for market value, not for what it costs to build.

“It takes at least three years to get all the necessary city permits and approvals — all the while, the land that they bought and intend to develop is subject to the vacant home tax. ”

An outright lie there. Land that is being redeveloped or is in the planning process to be is specifically exempt: https://vancouver.ca/home-property-development/will-your-home-be-taxed.aspx#pdSection46591

Thanks for the chuckle Barrister, reminded me of my favourite quotes from Mark Twain:

“Never argue with stupid people, they will drag you down to their level and then beat you with experience.”

“It’s easier to fool people than to convince them that they’ve been fooled.”

And this too:

“Proverbs: “Answer not a fool according to his folly, lest thou also be like unto him” (26:4).”

Fladdermusli

You learning das Schweizerdeutsch? ou francais?

Alarmist, much? Sounds like what you are describing as “mega-density” is a smaller, shorter version of something like 1015 Rockland: (https://abstractdevelopments.com/developments/the-emerson/). I’d say that’s gentle, and it’s not like entire streets would be razed overnight to make room for these multi-unit buildings.

The missus just checked out an apartment in Fairfield around Richardson & Cook. A 2.5-storey “house” divided into 6 apartments. My brother lived in a similar apartment in the area a couple years back. Decent alternative to living in a high-rise. I guess the world would implode though if a modern version were built south of Fairfield, east of Cook — in place of a SFH that would be torn down anyway for a multi-million dollar SFH.

First of all who said that it should just be B.C. dollars (last I looked we are still one country and maybe it is time to start acting like one). As long as we have a national immigration policy of adding about 300,000 people a year we will have to increase both the medical and housing situation. Simple math at work.

The real issue is whether just endlessly increasing density of the existing cities is either economically efficient or desirable from a quality of life.

I have to give great credit to the spin doctors for the developers they have done an incredible job in indoctrinating people into believing their story line. Like my dad said idiots who never question get what they deserve.

Back to my language tapes, progress is getting made.

As a matter of fact every city and town in Canada, possibly excepting Ft. McMurray and the like, is already an alternative retirement destination, since most people retire where they already live. I don’t see the point in spending BC taxpayers’ dollars to attract more retired people who will cost more BC taxpayers’ dollars.

WO: I agree that providing an alternative to Victoria as a retirement destination is a worth while goal.Off the top of my head if they built a first rate hospital along with a nursing school in Mill Bay along with a great planned community a lot of people would leap on the prospect. Reproduce a better Oak Bay but for a large portion of the older population easy access to a hospital is at the top of the list. I know that the Swiss have done a good job of building new smaller town usually clustered around a good hospital so we dont have to invent the concept from the ground up,

In terms of what might be proposed for James Bay it might be best to wait for when it is actually put to the city.

On a separate note, the free trade talks seem to be reaching a crescendo. Lets hope that we can strike a deal because it could get really bad.

WO said: “Perhaps the old grumpy NIMBYs in Fairfield/Gonzales/Rockland/etc. would be happier making a similar move, and then we can get on with gentle density in the rest of Victoria.”

Bullshit!!! “Gentle Density” is a misleading new term created by Gene Miller (semi-retired developer) and embraced by Lisa Helps. The term actually means “Mega-density” in traditional SFH neighbourhoods. Lisa Helps wrote an article in the Victoria News about ‘gentle density’ and it means building 6000 square foot buildings on 6000 square foot lots in quiet residential neighbourhoods; with each building containing 12 living units of 500 sq ft each, with 12 separate doors, one for each unit.

“Gentle Density” is a misleading term meant to fool the foolish who blindly follow Lisa Helps.

https://www.vicnews.com/opinion/mayors-message-neighbourhoods-are-for-everyone/

Barrister, how many storeys? Sounds like many but I ask for clarity because some people throw the term “high-rise” around for anything larger than say 6 storeys. Frustrating that the mid-rise areas get rebuilt as high-rise when there’s plenty of low-rise hoods that could take some of the density brunt.

On a related note: My parents had visitors from the UK recently and I met up with them. They retired in their 50s and moved from bustling London to a small village in Dorset of a couple hundred people. Lovely, happy people; they have no regrets of their lifestyle change as they approach their 70s. Perhaps the old grumpy NIMBYs in Fairfield/Gonzales/Rockland/etc. would be happier making a similar move, and then we can get on with gentle density in the rest of Victoria.

Quite the story. Denmark’s largest lender and bank in northern Europe with over 5 million customers. To think the Canadian banks are clean as a whistle is some major denial.

When the tide soon pulls out there’s going to be some major ass covering. Back in 2014 they were warned… sounds like the BC casino story.

Meet The Whistleblower Who Exposed A Record-Breaking $200BN Money Laundering Scheme

According to comments from Wilkinson published in the FT, Wilkinson first raised the issue of suspicious UK LLPs transacting through Danske’s Estonian branch back in 2014. While the bank’s audit division initially corroborated Wilkinson’s findings, the bank didn’t do anything to follow up until years later, after reporters tipped off by Wilkinson had come calling.

https://www.zerohedge.com/news/2018-09-26/whistleblower-who-exposed-record-breaking-200bn-money-laundering-scheme

VicHunter: My house is designated historic so the land value is questionable. Victoria has had a few unscrupulous house fires were historic homes vanished. I worry that some developer will grab this property.

My friend who is a developer was chatting with me last night and a very interesting conversation. (every time he comes over my wife just gets more determined to move) He is really hoping Lisa and the gang get in since he is planning on get approvals for two high rises in James Bay. Had to wait for the election since they are going to rise some stink but he is confident with the same council he will get the go ahead.

James Bay is not my favourite area and I understand that it is walking distance to downtown but I would hate to have it lose its charecter.

Perhaps. I could see a pushback there forcing them to back off like the CRA has on a few issues this year. If they could point to enough dedicated rental availability it would be easier.

Thanks Barrister, it sounds like your lot would be a good holding property. I am half keeping my eye out for things in your area but I have a large boat as well so need about 8000sq lot and 3000sq house so with my budget usually limits the areas I can make work. The Garden Suite I have in mind is for family and/or my home office, possibly with a little vacation rental during long weekends/holidays when there is peak earning power. I give my employees the flexibility to work from home and to hot-swap desks at the office, it makes sense to me to make use of a big lot and reduce my spend with my landlord. The home office use/write off will have capital gain consequences as well but given the overvaluation of houses right now I don’t think it will be an issue for a long time. I don’t view my house as an investment just a badly designed forced savings plan.

Going to view anouther 30+ Days on Market House, that had a 2% price drop and taking a good look at a friends house who might make a move up Island to realize some capital gains.

Wish my crystal ball could tell how far the 1M+ SFH market will fall, but my greatest fear is getting stuck with two houses. Anyone AirBnB their house while trying to sell, maybe a good alternative to renting?

How about increased revenue without having to change tax rates. With the proliferation of suites and RE price gains the federal and provincial governments (remember both levy income tax) are sitting on a gold mine of revenue and they’re not going to leave it untouched.

Have written on this a couple times and there has been rather extensive discussion about it on here.

https://househuntvictoria.ca/2016/10/07/do-you-have-to-pay-capital-gains-tax-on-your-suite/

https://househuntvictoria.ca/2017/09/28/capital-suite/

My conclusion from this is that most typical suites would jeopardize your principle residence exemption, however we don’t hear about this much in practice, so it is not something the CRA has made a point to enforce much in the past. However with increased reporting requirements for sale of principle residences that might still change .

Can’t tell if this is a selling feature or stigmatized property

https://www.sookenewsmirror.com/news/fairfield-home-for-sale-features-erotic-dungeon/

I assume you mean the rental suite was there when you bought it. The suite is a taxable property from day 1 and its cost base is a % of what you paid for the property. If you then rent out the other unit its cost base is a % of the market value of the property at the time you started the rental (deemed acquisition). If you sell the property the capital gain is based on the sell price minus the two cost bases.

It is possible to split this gain over different years by moving back into one of the units as your personal residence. This results in a capital gain on that unit (deemed disposition) based on a % of the market value of the property minus the cost base of the unit. But this has to be for real because CRA will go after you if it looks like you’re just gaming it.

All of it in the year the property is sold. As with any capital gain, 50% of it is added to income. No different from a capital gain on anything else.

Viola,

But is it such a disincentive to pay capital gains?

Perhaps someone can clear the air. Probably a good post on its own for Leo..

A curious example:

A couple in the top tax bracket buys a rental property 20 years ago sells today and retires the following year.

How are the capital gains assessed? On a yearly basis? Towards the current years income on a pension?

Mmmm, bubblicious.

Toronto, Vancouver Have World’s 3rd And 4th Largest Housing Bubbles: UBS

House prices are now falling in half of the cities that have the highest risk of a bubble burst, Swiss bank says.

https://www.huffingtonpost.ca/2018/09/29/toronto-vancouver-have-world-s-3rd-and-4th-largest-housing-bubbles-ubs_a_23544956/?utm_hp_ref=ca-business

30 years eh. I thought it was different this time. Once over 60% you are on your way to major correction time like the early 80’s.

Housing Affordability In Canada At Worst Levels In Almost 30 Years: RBC Economics

“High interest rates have a big impact in the higher-priced markets of Vancouver and Toronto, where households with an average income would need to use about 88.4 per cent and 75.9 per cent of their earnings to cover ownership costs, respectively. Victoria is also not far behind, with a household needing to use 65 per cent.”

https://www.huffingtonpost.ca/2018/09/28/housing-affordability-canada-rbc_a_23545103/?utm_hp_ref=ca-business

@guest_49569

That’s interesting and I will look into it and ask my accountant.

Makes me wonder if I have a property that went from being a primary residence with a rented suite to being fully rented (as in both units) and I hold it for a long time, will the capital gains apply to the original situation or just the last one since I would just say before it’s a business it was (truly and factually) my primary residence.

These rules are at odds with creating rentals either way. Just another disincentive.

Viola P – you should read this Tax Interpretstion from the Income Tax Rulings Directorate of the Canada Revenue Agency.

It’s clear that the Income Tax Rulings Directorate considers that self-contained basement suites will create a capital gains situation when a house is sold that contained a suite. Capital gains will be assessed based on the percentage of the space that was used as a self-contained rental suite and being less than 50% is irrelevant. Installation of a separate entry or kitchen for the suite guarantees that you will be subject to a capital gains assessment when the property is sold.

Our annual income tax forms now ask specific questions related to real estate transactions including your specific usage while you owned the property; i.e. was the property, or a portion thereof, rented.

https://taxinterpretations.com/node/452886

https://www.canada.ca/en/revenue-agency/services/tax/tax-professionals/income-tax-rulings-interpretations.html

@Barrister

Re: taxes

Are you referring to potential capital gains? I thought that if it’s the primary residence then it doesn’t apply. I’ve heard it might apply if you rent out more than 50% but I’ve never heard that as a potential issue for renting out less than half. It’s like when you’re self employed and write off a portion of the housing cost as a business expense because a room is used to do business from. It’s just a room in the house, not the whole house, right? Kinda similar, I’d think.

I’m no tax expert though.

VicHunter, actually Rockland has a pretty broad price range within its boundaries. My house is on the upper end because it sits on a 26,00 sq. ft lot and the house is about 8,000 sq ft with a carriage house in addition. I have seen some pretty good deals go out on smaller houses around the 1.1 mark in Rockland. They come up occasionally.

The one concern with a garden suite is the impact that it has on your principle residence exemption. Maybe one of the tax gurus can give a handle on it. If you have a 1,800 sq. foot house and a 600 sq foot rental garden suite what is the tax treatment when you sell the house?

@Victhunter

“It will be interesting to us if Saanich passes the Garden suite bylaw after the election. We can buy a 4br/3bt and then add a garden suite and fortunately I have a couple brothers who are carpenters!”

When we bought our first house in 2012 we were on a tight budget and bought a house that had a kind of half suite situation. We put in a lot of work with family help and 2 months after possession started renting out the suite. Buying a detached house with a suite was the best decision for us. It took the pressure off the housing cost obligation and increased the value of the home substantially. If you treat it like a business and strictly never rent to people based on emotions (i.e. because you feel sorry for them) then it is a worthwhile risk imo to take on a tenant.

Good luck!

https://www.cheknews.ca/famous-l-a-real-estate-firm-wants-to-draw-big-money-to-vancouver-island-493582/

Victoria housing starts continue to surge

Starts surged in the Victoria and Kelowna census metropolitan areas (CMAs), while Vancouver CMA starts were virtually unchanged from July.

Looking past monthly volatility and August’s jump, the trend has eased following a 2017 surge but remains robust. Abbotsford-Mission has experienced a sharp downtrend in new construction and is back to its pre-2015 trend. While recent trends in both Vancouver CMA and Kelowna starts have declined significantly, levels remain elevated. Victoria continues on an upswing.

Year to date, Victoria CMA starts rose 32% through August, and Vancouver starts were virtually unchanged, while Abbotsford-Mission (down 57%) and Kelowna (down 29%) were both substantially low

https://biv.com/article/2018/09/housing-construction-increased-bc-august

@Barrister Yeah, sounds like a 1 bedroom no bath in your neighborhood is in my budget! I’ll have to pass. All good, like Leo’s post says it’s now a buyers market (if I read his graphs correctly) for SFH’s so given our widening search area we’ll find something. Drove by half a dozen houses for sale in a two block radius in Gordon Head today. It will be interesting to us if Saanich passes the Garden suite bylaw after the election. We can buy a 4br/3bt and then add a garden suite and fortunately I have a couple brothers who are carpenters!

In addition to knowing the size of the market (months of inventory) and how fast new listings are coming to the market (sales to new listing) you should consider how fast properties are leaving the market (days-on-market)

What constitutes a balanced, buyers or sellers market also depends on the type of property . Vacant land, residential, commercial, industrial all have different ratios that make them balanced or not. The key to understanding what those levels are is by looking at market prices. A balanced market will have stable prices, a sellers market will have rising and a buyers market will have declining.

The direction of movement in those ratios will indicate if the market for that type of property is heading towards rising or declining future prices.

Another item to consider is the velocity of the change in prices to see if the rate of increase itself is either increasing or decreasing.

There is no hard rule that 5 to 6 months of inventory or a 61% sales to new listings ratio is balanced. That’s just a convention. If prices have not increased or decreased in the last 18 months and these ratios have remained stable then we are in a balanced market despite them being lower or higher than the conventional wisdom.

Vichunter, actually I am in Rockland but from the sound of it I am probably out of your budget at somewhere around 3,2. If you are still interested we can meet.

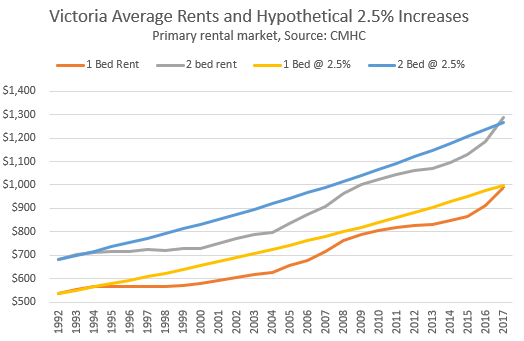

Victoria rents have been appreciating at about that 2.5%. So even with zero turnover, an apartment building should be able to track market rents with that kind of yearly increase.

It’s these older buildings that offer tenants reasonable rents in general. You can still find a 1 bedroom apartment in downtown Van for around $1,300- $1,400/unit in some of these older buildings, in good condition.

If I understand correctly I think your argument is if these older buildings are capped at 2.5% they are more likely to be torn down to become luxury towers?

If you start at $1,300 and go 4.5% for 10 years straight you are over $2,000/month. It wouldn’t take long for the reasonable rents to catch up. It isn’t just 4.5%, it is 4.5% with compounding every year.

@Barrister I think you are close to the Penny Farthing? Happy to meet there Sunday afternoon for a pint with my boy and then wander over. Me thinks the neighbourhood can only afford us 3 bedrooms but happy to look!

Yeah I didn’t mean to imply our old landlord was, he was super nice and not raising rents on purpose.

The point is it’s the landlords choice. They can raise rents to meet market, or not raise rents. Either way I would have little sympathy for landlords complaining about the rent increase cap when they haven’t been raising rates and are now behind market and realizing it’s not enough.

@Leo S

I don’t think it’s about being stupid. Perhaps not the best business model, but I think it’s about some of these landlords having a lot of compassion and appreciation for their tenants, and a lot of them having lived through tight times themselves. I remember reading about a woman in San Fran who owned an apartment building that only allowed pet owners to live there — that was her soft spot. I worry more about the people and businesses that are out to gauge and take whatever they can get, with no regard or empathy for anyone else.

Can’t fix stupid.

Our old landlord owned two low rise apartment buildings, one on Quadra and one in Sidney. His policy was never to raise rents for existing tenants. Told us about a lady he had up in Sidney that was still paying her rent from the 70s. That was bad business but I guess he valued the low turnover more than the money.

I think it was from BC Hydros site. Collected that data when I wrote that article on solar power

Looks like Binab has a new project. https://www.cheknews.ca/famous-l-a-real-estate-firm-wants-to-draw-big-money-to-vancouver-island-493582/

I guess those LA buyers won’t mind paying the 20% foreign buyers tax?

@Marko

It’s these older buildings that offer tenants reasonable rents in general. You can still find a 1 bedroom apartment in downtown Van for around $1,300- $1,400/unit in some of these older buildings, in good condition.

Yes, and that building your friend’s parents owned then gets sold, tends to be torn down, turned into luxury condos or high priced rentals and those affordable rentals are lost. So really, we should care about older apartment buildings if we are talking about affordability in rental stock.

VicHunter, we are thinking of selling our six bedroom, six full bath house if you are in the market.

It will be terrible for all the people that have not been doing rent increases or not charging market rent after a turn over.

How do you screw up so bad that you can’t adjust the rent on turn over? My strategy is rent to tenants staying 1 to 2 years, no rent increases, and then adjust at turnover. I have no issues adjusting at turnover, but something in me would just feel bad about issuing a rent increase to an existing tenant especially if they are solid.

Marko Juras and Leo S are housing schemes valid 20 years after they are put in place? I’m seeing corporations as the decision makers that are likely dissolved by now as they incorporated in the 1970’s. How does the Broadmead Home Owners Association police the place, do they have legal recourse for violations?

Good question. I have no idea what they do in Broadmead. People are definitively following some parts of the covenant like all the real estate signs have to be the same etc., but they have completely turned a blind eye to other parts like cedar shake roof replacements.

I know North Saanich and Deak Park have been at odds over covenants with lawyer review ->

https://www.peninsulanewsreview.com/local-news/north-saanichs-suite-plan-at-odds-with-community-association/

From what I understand, you rent out newer properties. Deal with older rentals and older buildings/properties in general and you’re going to have some difficulties with your above rational. The costs aren’t covered by 2.5% per year and what I see happening is the costs will still get transferred onto the tenants, it’s just going to require more work to do so.

The only argument I buy is this could potentially decrease new apartment building construction.

Older rental buildings have seen massive appreciation who really cares about them? My friend’s parents sold an older rental building in Vancouver last year for $6.x million. They purchased it in the early 1980s for something like $350,000.

If you apply the 2.5% increase year after year with compounding you are looking at 30% in 10 years. Given low inflation I think the landlord should be able to survive.

If you want to monitor electricity usage for a tenant but don’t have separate meters, you can purchase a device that fits inside your panel (http://www.theenergydetective.com/ is one example). This assumes your tenant has (mostly) dedicated circuits.

@Wolf “Anyone else notice the flurry of homes listed for sale the last several days over $1.25 million?” Must be in the 3-4 bedroom range? my search is for at least 5br 3bth so haven’t seen too many. I’m surprised there is not more of a rush to the 999,999 price for motivated sellers who can take a profit from pre-2016 purchases. Couple unfinished houses listed today in the 999 and 1.15 range, some scared developers? With the difficulties most will have getting a 200k down payment together that 1 Million and up segment also a portion of the Chinese cash flo is stopping in September due to a new tax treaty. Outside of Gordon Head/Oak Bay/Victoria Core, seems set for the biggest crash. French Beach spec house for 1.15M+ etc….

http://vancitycondoguide.com/canada-china-to-share-tax-information-starting-in-september/

“ #49685

A good strategy for SFH landlords is to ask a higher rent but then offer to pay the tenants for yard upkeep. In other words, charge $250 premium per month but then pay them $250 if all the yard work is done according to a written agreement. If rent controls are imposed then tell the tenant that you (the landlord) will be doing yard upkeep henceforth. Voilà a $250 per month rent increase. This technique also works well if you want to get rid of a bad tenant.

Also, landlords should always make the tenants responsible for their own utilities, they respect it more if they are paying their own bills.“

That my friend is definitely a sleezeball way of getting around the rent control, not to mention then you would be doing the yard work or paying someone else to do it, so how much further would you be ahead ?

You are correct with utilities, that is HUGE so many people make the mistake of including them and then there is no coming back.

One of the best things we have done is all our units have separate hydro meteres, so they all have to set up and pay their own accounts, we are not chasing people down for bills split between units. Time is money. Not only that how is it fair to tennants when one unit has 4 baths a day and does 6 loads of laundry well the other has a shower and does laundry once a week ?

We will never again let tenants handle garden/lawn care, it will never be done to the standard you want and it’s awesome having a 3rd party check on your properties every week or two.

Marko is correct with the new allowable rent increase, as long as you have market rents now you should be fine !

It will be terrible for all the people that have not been doing rent increases or not charging market rent after a turn over.

This was helpful. Where did you find these numbers?

Anyone else notice the flurry of homes listed for sale the last several days over $1.25 million?

As the US goes, Canada goes. Charts rolling over for new sales, pending sales and US housing stocks.

Pending Home Sales Plunge In August Led By Collapse In West

Pending home sales plunged in August, dropping 1.8% MoM (almost four times worse than expected) to its lowest since Oct 2014 (and fell 2.5% YoY) – the fourth month of annual declines in a row…

As Bloomberg notes, the decline, which was broad-based across all four regions, shows that higher mortgage rates, rising prices and a shortage of affordable homes continue to squeeze buyers. Existing-home sales in August matched the lowest in more than two years, while revisions to new-home sales showed a slower market than thought, according to previously released figures.

https://www.zerohedge.com/news/2018-09-27/pending-home-sales-plunge-august-led-collapse-west

Yes, because of politically influenced policies that kept rates frozen for the majority of the previous 10 years

Here is the rate increase history

1993 3.90%

1994 0%

1995 0%

1996 0%

1997 0%

1998 0%

1999 0%

2000 0%

2001 0%

2002 0%

2003 0%

2004 4.85%

2005 0%

2006 1.54%

2007 0%

2008 2.34%

2009 8.74%

2010 6.11%

2011 8%

2012 3.91%

2013 1.44%

2014 0%

2015 9%

2016 6%

2017 4%

2018 3.50%

2019 3%

Average 2.46%

Over 25 years we get an average 2.5% increase annually. Basically an exact match for inflation. Agreed that if the province wasn’t regularly raiding BC Hydro’s profits it would be a even better.

The casino story that will never die. Coleman said smarten up over there, and they said shove it, fatso.

Now we have Elon the fraudster fleecing the flock. White collar crime will bring this house of cards down once again. Just a matter of when.

Report warned Liberals of money laundering in B.C. casinos in 2012

A report obtained by CTV News through the Freedom of Information Act shows the now well-documented problem of money laundering in B.C. casinos had been on the former Liberal government’s radar for years.

The document, which was prepared by the province’s gambling watchdog in November 2012, makes reference to “suspicious cash increasing at an alarming rate,” despite new measures introduced in 2011 to combat dirty money in the gaming industry.

https://bc.ctvnews.ca/report-warned-liberals-of-money-laundering-in-b-c-casinos-in-2012-1.4112829

Depends on how it was discussed. If you are telling the renter that rent is $2500 but to sweeten the deal you are paying them $250 for yard work then that could be considered to be part of the contract even if it isn’t written. You are setting an expectation. And practically if you are using that as a way to entice renters to pay a high rent, then you are going to need to discuss that deal up front.

Just seems precarious because outside of the legalities of it, you are trying to circumvent rent controls so whether this is a loophole or not is somewhat beside the point. If costs are rising you just increase rent by 2.5% every year. A rental where costs are driven up so suddenly that that won’t be enough is likely a bad rental to start with. Either it’s too expensive and the only reason it works is low interest rates, or it had serious deferred maintenance that you didn’t plan for. And a rental where a $40 increase in utilities breaks the bank is a horrible rental to start with.

Well that’s the Step 1 rate.

In fiscal 2012:

“79% of B.C. Hydro customers on Vancouver Island paid the Step 2 rate at least once.”

“About 35 per cent of customers on the Island always paid the Step 2 rate.”

https://www.timescolonist.com/opinion/why-b-c-hydro-bills-sting-more-on-vancouver-island-1.2179990

For now…

“Hydro has almost $6 billion in deferral and regulatory accounts — loans that electricity users have to pay back one day in the form of higher rates.” (June 11, 2018)

https://vancouversun.com/news/local-news/government-launches-reviews-into-bc-hydro-over-costs-future-of-energy-sector

@guest_49698 My guess is downward pressure only come from seeing similar properties sell for less. I haven’t started low balling anyone but I think it is best to try with people who are already lowering their prices as they are showing motivation to sell, even 2-3%.

Has anyone looked at 2314 Greenlands? Looks like a rich UVIC student cashing out after buying at a good price before the runup.

@guest_49614 and @Leo S are housing schemes valid 20 years after they are put in place? I’m seeing corporations as the decision makers that are likely dissolved by now as they incorporated in the 1970’s. How does the Broadmead Home Owners Association police the place, do they have legal recourse for violations?

Hydro is still the primary heat source for many homes we see, can’t imagine what it costs to heat a 3,500 – 2,500sq foot and up home with just electricity. (Before you eco’s chime in a family of 6 with a home office is comfy in that size)

Manitoba and Quebec are cheaper than BC, but we are pretty cheap relative to most locations in North America

8.8 cents/kWh is what.. the lowest in the country? Also cheaper than every U.S State even without accounting for difference in currency values.

BC Hydro “raised residential rates 73% between 2007 and 2017, while inflation was 17%.”

https://in-sights.ca/2018/02/13/site-c-a-kodak-moment/

And there are many more rate increases to come:

“Hydro has almost $6 billion in deferral and regulatory accounts — loans that electricity users have to pay back one day in the form of higher rates.” (June 11, 2018)

https://vancouversun.com/news/local-news/government-launches-reviews-into-bc-hydro-over-costs-future-of-energy-sector

If you think there’s nothing to complain about/be very concerned about, you’re not paying enough attention.

@ Marko

From what I understand, you rent out newer properties. Deal with older rentals and older buildings/properties in general and you’re going to have some difficulties with your above rational. The costs aren’t covered by 2.5% per year and what I see happening is the costs will still get transferred onto the tenants, it’s just going to require more work to do so.

Crazy hydro increases? I paid less this summer than last. Step 1 still 8.8 cents/kWh. Way too much complaining about hydro.

Housing starts in Vancouver are beginning to falter as the cycle matures…

“A slowdown in housing starts suggests homebuilders perceive risks ahead or simply can’t make new projects feasible due to elevated land prices and construction costs, which is typical at this stage of the cycle.”

https://vancitycondoguide.com/vancouver-housing-starts-roll-over/

The issue is that yard upkeep is a usual tenant duty. Thus I think the RTB would consider such an arrangement to be a contrivance to get around rent controls. Barring an actual case we are only dealing with differing opinions of course. If you’re a landlord try it out and see what happens.

How is the 2.5% max rental increase even news. I’ve never issued a rent increase to a tenant.

This 2.5% max rental increase is only a factor if you are sloppy and mismanage the rental. For example, you rent it too low or you don’t apply the increase every year for 10 years and then you fall behind…..tough luck. Your problem as the landlord (I have one unit like this that is now way below market but superb tenant).

Plenty of strategies to avoid long term tenants too like rent fully furnished. Rent to miltiary or contract postings, or medical residents, etc.

If you do a 2.5% rate increase every year not sure how you run into trouble. Your biggest expense is the mortgage and the principal drops every year. Even if strata fees go up 7%, for example, they are a small expense so the 2.5% absolute on the rent more than offsets the 7% on strata fees.

Sorry to inform you Patriots, but you’re wrong.

If I sign a standard residential tenancy agreement with you to rent my SFH rental property for $2500 per month, then that is your rent obligation. If I offer to pay you $250/mo for yard upkeep and you do the agreed to work, then I’ll pay you $250/mo. If you don’t do the work I won’t pay you. This does not contravene the RTA, your rent is established with our RTA contract. Our side agreement for yard work is completely separate from our RTA contract.

This does not invoke section 5 of the RTA because our agreement for yard upkeep isn’t part of our RTA contract.

2 Michigan St townhouses dropped their price on the same day. One by 1.7% and the other by 3%. I’m glad it’s going in the right direction but what a joke.

I had no idea he was talking about RE. Who knew? Didn’t mind Gangsta’s paradise. The subsequent Amish Paradise, was way better IMO. Still find it funny.

Nope. As described, it’s a scheme to subvert rent controls.

Patriots, you misunderstand. When you accept a new tenant you agree to pay them for yard upkeep. It’s a way for them to help cover the monthly rent. Lawns in summer, snow in winter, leaf raking in autumn, salted sidewalk when icy. If they don’t do the work, they don’t get paid. When I was a landlord I always paid the tenants for maintaining the yard. There is nothing in the Residential Tenancy Act to prohibit paying tenants for work done. But, if they don’t do the work I wouldn’t pay them, in reality though they always did the work without issues.

Maybe It’s different with this millennial generation but in the days when I was a landlord, people who rented houses enjoyed doing the yardwork, if they didn’t they should’ve rented an apartment.

In the immortal lyrics of Coolio:

Ain’t no party like a west coast party

cuz a west coast party don’t stop

So like all five of them?

That Victoria has a disproportionate number of union jobs (and well-paying ones) for its size surely also makes some difference in terms of how desperate (or not) our RE market can ever become.

FWIW, from personal observation going back many years now, I can tell readers that Marko has been right far more than he has been wrong.

So, so glad that our tenant pays a percentage of Hydro as per our tenancy agreement, which we signed seven-ish years ago. This has added up to thousands of dollars.

And with the crazy Hydro rate increases that have already come and will continue to come as the Site C debacle unfolds, we won’t be eating those increases entirely on our own.

Peckford actually lives in Qualicum Beach. The Nanaimo address is probably for his office. He’s lived in BC since the early 1990’s.

Not sure any tenants would agree to that. I certainly wouldn’t. Sounds like a nightmare and good way to start arguing about whether the grass at 2.1 inches high constitutes successful completion of yard work

Simple. Pay less for the property.

A landlord cannot disguise a rent increase by changing tenant duties or offloading services previously paid for (e.g. hydro) to the tenant.

Clearly in an effort to better fulfill Introvert’s orders,

Amazon to open 450,000 square-foot warehouse in Tsawwassen

https://theprovince.com/business/commercial-real-estate/amazon-to-open-450000-square-foot-warehouse-in-tsawwassen/wcm/b92fabf3-19b1-41cc-a3f9-586678c4a358

You’re the first person on here that would say that Nanaimo is a shithole.

https://www.bloomberg.com/news/articles/2018-09-28/cost-of-carrying-a-home-in-toronto-vancouver-off-the-charts

Victoria’s the third least affordable in Canada after Vancouver and Toronto, and it’s only gonna get worse.

That’s quite a distance to relocate! But it’s a smart move.

A good strategy for SFH landlords is to ask a higher rent but then offer to pay the tenants for yard upkeep. In other words, charge $250 premium per month but then pay them $250 if all the yard work is done according to a written agreement. If rent controls are imposed then tell the tenant that you (the landlord) will be doing yard upkeep henceforth. Voilà a $250 per month rent increase. This technique also works well if you want to get rid of a bad tenant.

Also, landlords should always make the tenants responsible for their own utilities, they respect it more if they are paying their own bills.

))) LeoS: This will force some to think ahead a bit.

====vvvv

Does that group that you are forcing to “think ahead” also include politicians who think up these short-sighted laws?

Restricting rent increases and future options for landlords and developers will lead to reduced growth of numbers of new rental units. And likely higher rents in non controlled units.

If interest rates rise dramatically, this would drive up costs for landlords well above inflation. How are landlords supposed to “think ahead” for that?

Same thing 🙂

Patriots said: “My guess is that the NDP is actually holding most of their rental initiatives in reserve until the rate of private sector construction starts declining.”

More likely scenario is the NDP is holding back on their rental initiatives until 18 months before the next election, then they’ll go at it like gangbusters so the activity and results are on everyone’s mind at election time.

“I have just sent one of our longer tenants a notice of a rent increase for the full 4.5 per cent. We’ve only raised his rent once in the last seven years. The suite is below market in terms of pricing.”

Reminds me of one of my favourite quotes: “Your lack of planning does not constitute an emergency on my part”

Landlords run their rental badly by leaving money on the table, then panic when they realize they can’t just arbitrarily catch up in one year. This will force some to think ahead a bit. Another approach is to unbundle as much as possible. Don’t include utilities or internet or anything else that would could increase at a rate greater than inflation. That minimizes your risk as a landlord to being exposed to rising costs that exceed your ability to increase rent.

Actually all that matters is that the total number of units being built doesn’t decline. Reasoning is a corollary of my post below.

My guess is that the NDP is actually holding most of their rental initiatives in reserve until the rate of private sector construction starts declining.

They can’t move the dwellings to another province. They can sell, but that makes no difference to the rental supply, since the new owner is going to be another landlord or a new owner-occupier who moves out of their own rental.

Also an increasing number of landlords are homeowners who are renting out suites to make the mortgage payments, and they will have to give up their own homes if they want to get out of the business.

In any case I think the high rate of rental turnover make the issue moot for most landlords.

And inventory is still low enough that market priced quality places don’t get lost in a sea of listings. And things are still moving out there. It can certainly get slower than it is now.

Maybe that’s OK. As long as the government keeps pushing hard on building rental accommodation of all varieties (not just apartments), then we don’t need those private landlords. Lots of advantages to dedicated rental units over those of private investors.

“The offer that was actually countered stalled out at $100,000 (5%) apart. Can’t really blame my buyer as I don’t think it was worth the additional $100,000.

You will still see the occasional crazy sale as there are emotional buyers floating around….like I’ll suggest “let’s wait two weeks before resubmitting” and the buyer is like “no, send in a revised offer tomorrow.”

I think most sellers can hang on for a while and most will blame the lack of sale on seasonality and will take the attitude of “we will sell it in the spring.”

I am not a bear personally, but I would take the cash right now versus rolling the dice with spring 2019. My take is the odds of prices going up are slim to none, the odds of prices staying flat are high (80%+), and odds of substantial decrease is low (but not slim to none). If you average out the three makes sense to sell now versus risking it spring 2019, imo.”

Solid advice Marko! I think people will only truly start to panic and be willing to lower their prices substantially when they see 3 comparable homes in their neighborhood sell for consecutively lower prices.

As pointed out, RE declines often precede an economy downturn. AFIAC, the downturn in the U.S. started in mid-2005. Unfortunately with a large portion of the economy tied to the FIRE industry, once housing slowed down then the FIRE industry contracted.

Here’s an interesting view on the housing bubble/bust from 1985-1997 through newspaper headlines.

http://www.rntl.net/history_of_a_housing_bubble.htm

CAD $0.65

Marko Juras any counter to the 2% drop? Good on you for trying, do you think they may come back at you when Septembers numbers come out and October, November goes cold lots of inventory in that price range.

The offer that was actually countered stalled out at $100,000 (5%) apart. Can’t really blame my buyer as I don’t think it was worth the additional $100,000.

You will still see the occasional crazy sale as there are emotional buyers floating around….like I’ll suggest “let’s wait two weeks before resubmitting” and the buyer is like “no, send in a revised offer tomorrow.”

I think most sellers can hang on for a while and most will blame the lack of sale on seasonality and will take the attitude of “we will sell it in the spring.”

I am not a bear personally, but I would take the cash right now versus rolling the dice with spring 2019. My take is the odds of prices going up are slim to none, the odds of prices staying flat are high (80%+), and odds of substantial decrease is low (but not slim to none). If you average out the three makes sense to sell now versus risking it spring 2019, imo.

Landlords will revolt if the NDP expect them to subsidize rental accommodations. Annual Property Tax increases are almost double the inflation rate during the past several years, plumbers and electrians and other trades are charging 50% more than just 5 years ago. Bottom line these days is that a landlord’s expenses, especially in a SFH, increase significantly faster than the ‘official’ rate of inflation (the official rate is bogus).

This is just one more reason why landlords will be dumping rental properties, especially newbie landlords.

https://www.cbc.ca/news/canada/british-columbia/landlords-fear-financial-fallout-from-new-cap-on-rent-hikes-1.4841420?cmp=rss

I wonder where Victoria would fit: Bad news for tenants and landlords

Based on current prices, it would take 34 years worth of rent in Vancouver to cover the price of an investment property. In Toronto, it would take 25 years.

https://www.cbc.ca/news/business/toronto-vancouver-housing-bubble-1.4842272

Makes sense. I think the tricky part this time is that Canada is in a weaker position than the US. Will be interesting to see what happens if the US keeps raising rates and Canada tries to hold back

I think that’s fair.

@guest_49614 any counter to the 2% drop? Good on you for trying, do you think they may come back at you when Septembers numbers come out and October, November goes cold lots of inventory in that price range. The other thing I’m seeing is realtor/seller lack of motivation, 5 days to get building scheme and asbestos removal information and they came back just with the test results with no explanation if the asbestos removed or not. Another showing family members not informed and no heads up that they couldn’t show the suite. It’s not like we are looking at buying small assets there should be some major motivation as Vancouver horror show continues into Halloween!

Indeed, and a sign to look for of a weakening economy is when rates stop rising (ie. 2007).

Meantime, trillions in bond funds will continue migrating to tangible assets.

This continues to be said and it continues to be false. Once again, RE crashes usually tend to occur when things are looking at their best. If the reverse were true, people wouldn’t get burned when these things happened. Typically, a RE slowdown feeds a corresponding slowdown in the economy, which then becomes circular and self sustaining – it’s generally the inverse from the way up. This is especially true when the GDP is almost hopelessly tied to RE price inflation.

The kind of phraseology you can expect to hear will be something like,

“No one could have seen this coming.”

It’s not that a crash can’t start while the economy is strong, it’s that eventually the economy has to go south for a decline to continue. You don’t get a crash with a strong economy the whole time. So for truly significant declines we should watch for signs of the economy weakening.

Not true. In 81 Victoria construction was booming and interest rates started rising. Debt levels were only 100% of household income versus current 169%. HELOCS didn’t exist, few had credit cards (or multiple) with large limits.

Another point or so will have same effect as 3 to 5 points rise back then. Current sellers will all want out at once and it will be ugly.

In fact that’s when most crashes start. But people don’t notice until the economy, which had been disproportionately dependent on housing, is clearly in trouble. Remember the US housing crash started in early 2006, but to this day many people think it started in 2008, and believe the financial crisis caused the crash, when the reverse is true.

Well that didn’t take long. A brokerage out of Sechelt has launched a site to view sold prices in Vancouver.

The website is a trainwreck, but it does work when you sign up for an account (no sold prices for Victoria though)

https://www.zealty.ca/map.html

That was after 6 months of truly apocalyptic news reports.

We are going to need to see the economy turn down before we see significant declines in my opinion. You can’t have a crash while the economy is firing on all cylinders. It is definitely slowing, so perhaps that is starting to happen.

I can’t wrap my head around some of the trends in the condo market right now…..we’ve gone from pre-sales historically sold at a discount to pre-sales going at a substantial premium to re-sale. Complete headscratcher.

Also, I don’t think reality of the cooling market has set in for many sellers. I’ve written a $1.9 and $2.0 million offer for different clients this week, both with 10% of asking price and both have gone no where. One seller came down 2%, deal didn’t come together and the other seller didn’t even reply. Not sensing early 2009 style motivation to sell.

And another head scratcher.

Quite different market conditions for single family vs condos, and yet, quite similar behaviour as far as how much sellers need to cut prices to make a sale.

Take any measure you like and they have pointed to condos being in a sellers market all year. And yet, prices are not cooperating.

James Soper

And here’s a rebuttal for this article, nicely written too.

https://blogs.scientificamerican.com/guest-blog/myths-busted-clearing-up-the-misunderstandings-about-organic-farming/

This website compiles pesticide residue data from FDA testing. If you look at apples as an example, you can see that a lot of common pesticides found on apples are proven or possible human toxins.

http://whatsonmyfood.org/food.jsp?food=AP

Some of these are occasionally found on organic produce too, but the amounts are magnitudes less then conventional. Nicotine or tobacco isn’t in any of the lists.

Anyway, how did we end up discussing organic produce on a RE forum?

My inclination to say, even that’s not going to hold for much longer, is getting stronger and stronger with each passing week. I’d see if I can find a nice Debbie Downer article for ya’ll, but then again I’m not sure I even need to anymore…

Party’s over, BC.

Core, Westshore, Peninsula

SFH: Median sale price MtD is $800,000, down a bit from $810,000 in August and up $5k from last September

Condo: Median of $408,000, essentially unchanged from $410,000 in Aug. Up $18k from last Sept.

It’s interesting that despite the sales/list ratio indicating a strong sellers market in condos, prices have gone exactly nowhere this entire year.

The only interesting thing that is happening this September is inventory rising when it should be flat or dropping. The end of month expirations could still bring that down though so I’ll reserve judgement on that one.

Whoops! I can’t read (or write) today, apparently. Had a bad sleep last night.

BTW, not much must be happening in RE if we’re discussing organic food!

Isn’t this a case of the dog that didn’t bark? – you don’t come across them as they are neither sellers nor buyers?

Fair point.

@guest_49583 thanks for calling me out. Significant investment in drainage and landscaping 🙂

@Victhunter,

I appreciate your educational tidbits on here; could you break down the 100k into more detail? especially, how much is drainage?

Isn’t this a case of the dog that didn’t bark? – you don’t come across them as they are neither sellers nor buyers?

I am curious if there are other investment property owners in that strata will they be hitting the panic button and list their properties? Or will they wait and see?

11 out of the 12 units are owner occupied. The first sale was a job move. My clients upgraded to a SFH and not sure about the sale yesterday but it didn’t say it was a rental.

People sell for various reasons not just the “panic button.”

New regulatory structure likely coming to real estate based on report recommendations. https://news.gov.bc.ca/files/Real_Estate_Regulatory_Structure_Review_Report_2018.pdf

Uh oh.

By the time government really digs into the money laundering issue, some may be begging for it to return…

So far, I don’t think they’re really saying anything. What they said they intend to do, is what I thought they were actively doing and perhaps near completing. And maybe they are, but this all sounds more like a project initiation phase.

I mean, how hard can it be to ensure that transactional information is tracked and verified? “Here, I have 300k in 20 dollar bills I’d like to cash in for chips. Um, I work in…um real estate.”

My simple brain doth not comprehend…

https://blogs.scientificamerican.com/science-sushi/httpblogsscientificamericancomscience-sushi20110718mythbusting-101-organic-farming-conventional-agriculture/

Can you read? Did you actually mean to say that Organic Means that it IS GMO?

hard to find something that doesn’t exist. It’s your point, if you can’t corroborate it then please just don’t.

Seconding Saanich Organics. Awesome food.

Nice that Sam Cooper gets a question in about the failure of the oversight panel on gambling. Too bad they hadn’t heard of that issue yet.

Stream kept cutting out, but was there something new here? Seems like they are announcing the second phase review into real estate money laundering which they already said they would do.

Dramatic announcement on money laundering in the housing market!!! Afet almost a year in office they have decided to strike a committee of experts who will report in March. My dad managed to fight his way across Europe in less time.

Live Stream: Province announces action on money laundering in real estate

https://www.cbc.ca/news/canada/british-columbia/province-to-announce-action-on-money-laundering-in-real-estate-1.4841085

Thanks for that tip.

It reminded me of another outfit called Little Mountain Farm, which I see when driving the Mt Doug Parkway: https://www.littlemountainveggies.ca/

I’m definitely gonna look into these veggie box programs; there’s a lot to like about them.

There are local organic farms which will sell to you. For example, Saanich Organics has a box delivery. It ain’t cheap but hard to beat the quality.

Not sure what you’re referring to.

Then go get yourself one.

I’ll take my chances with what (some) organic farmers are using versus the alternative. That’s an easy call.

And unless I buy a farm and grow 30+ varieties of produce myself, I don’t have much choice beyond the supermarket’s organic and conventional offerings, now do I?

James Soper

Do you have citations for these two points?

I think you have a mistake there. I wouldn’t normally point it out, but since you’re such a stickler…

I think I’d need a citation there. I believe you only need to be using organic pesticides to be considered organic, which often means using more of the pesticide because it’s less effective. Some organic pesticides used include tobacco and nicotine, likely not as bad as round up – still not exactly what you thought you were buying.

Re: Marko Juras #49633

I am curious if there are other investment property owners in that strata will they be hitting the panic button and list their properties? Or will they wait and see?

I don’t think it’s the main reason, as others have pointed out, but you’re absolutely correct about the difference in regulations re: hormones and antibiotics.

Reminds me of another thing I read: a recent study shows (very small) amounts of glyphosate (a.k.a. Roundup) present in many cereal products:

https://www.ewg.org/childrenshealth/glyphosateincereal/

And, of course, there was this:

Monsanto Ordered to Pay $289 Million in Roundup Cancer Trial

https://www.nytimes.com/2018/08/10/business/monsanto-roundup-cancer-trial.html

The vast majority of the food our family eats is organic. No, organic food isn’t more nutritious. Yes, it costs more. Yes, some organic foods still contain pesticides, but it’s far less than is found in conventional food.

And organic means it’s GMO. Since genetically modified food is/was largely developed to withstand increased exposure to pesticides (like Roundup), I think avoiding GMOs is a safe bet, and a bet that we choose to take.

Noticing price weakness in certain segments…..good example from today.

8 – 2638 Shelbourne sold Jan 24th, 2018 for $799,999 (Listed by Sutton)

7 – 2638 Shelbourne sold March 20th, 2018 for $824,000 (Listed by Fair Realty)

9 – 2638 Shelbourne sold today for $775,000 after several price drops and a re-list. (Listed by Sotheby’s International Realty Canada)

8,7,9 all have the same orientation.

On a side note, I was the listing agent on #7 with my lower commission business model……just more proof that irrelevant of how much commission you pay to sell the market sets the price.

Sorry I could be wrong with the heritage house thing, I should have looked more closely at the details.

@guest_49619

This is a heritage house so I expect the buyers are going to live in the house or rent it out. Selling price $5,000 below ask and $46,000 above assessment. I think I am right with that but if not I am sure I will be corrected.

https://www.victoriacharacterhomes.com/listings/mls/399761/vi-downtown/1016-mcclure-st

Problem with that theory is new listings were similarly low in 2014 and those factors didn’t apply.

Who knows then but it does seem to be a clear trend especially when you adjust for how much housing supply has grown over the years.

I used to know a guy who used the term “hairy hand” in negotiating. The idea being you throw in something so glaring & obvious to distract from what’s really inside the contract. You “sweep away” the hand and accept the rest. I believe dairy in NAFTA is the hairy hand. There are several areas to be concerned about but one that would hit many pockets deeply is pharma. The US is pushing to extend the length of patent on biologics.

https://www.cbc.ca/news/health/nafta-pharmaceuticals-1.4805601

Interesting opinion piece on Politico website which advocates for Canada to hold out.

https://www.politico.com/agenda/story/2018/09/25/canada-trump-nafta-deal-000706

NAFTA doesn’t just go away. Yes tariffs are hard but take a look down south and you’ll see the beginnings of the fall-out from the tariffs placed on China and the resulting backlash. US farmers have lost foreign markets to other countries (Brazil, Argentina) and may never regain many of those. Ford announced that steel tariffs have hit it’s profits by $1B. Major retailers are asking that tariffs be lifted otherwise the impact to the US consumer will be felt in a negative manner.

I believe it is reasonable for Canada to reject dairy for a multitude of reasons. US dairy farming is heavily subsidized by varying levels of government. Level the playing field. Require that any imports must follow Canadian law relating to growth hormones, antibiotics, etc. And accept that supply management benefits big and small farms.

“LeoM are you sure? Isn’t it to protect the dairy farmers and the supply management system they have in place? Do you know if they have proposed allowing dairy products if the producer can prove they are not using the growth hormones?”

One of the big reasons is that in BC and other provinces, dairy farms are operated on a large scale. They have purchased quota over the years and have big scale operations(1000’s of cows). In Quebec there are many small farms(40 cows). The large operators would be able to compete on a global scale but the small farms in Quebec wouldn’t. If the Liberals get rid of supply management it would cost them many seats in Quebec and possibly the majority. That is why they won’t get rid of the supply management system.

https://www.theglobeandmail.com/news/politics/canadas-dairy-industry-is-a-rich-closed-club/article25124114/

Meanwhile, we just make the standard, almost timeless excuses as to why it simply won’t happen here.

LeoS: Not free this Friday but any day next week works.

@guest_49569 are you sure? Isn’t it to protect the dairy farmers and the supply management system they have in place? Do you know if they have proposed allowing dairy products if the producer can prove they are not using the growth hormones?

$1,145,000

The main reason that Canada is rejecting dairy from the USA in current NAFTA talks is because American dairy products are loaded with Monsanto developed Bovine Somatotropin growth hormones and these growth hormones are banned in Canada. These growth hormones in dairy have been linked to many medical issues, for example extremely early sexual maturation of very young girls (early menses onset, abnormally early breast development), breast cancer, rapid tumour metastasis, and many other medical issues, especially for females.

If we accept the Americans terms in the new NAFTA regarding dairy products, then we are also forced to accept the American view that these hormones are safe for human consumption. NAFTA has forced Canada to accept many unsafe synthetic chemical products from the USA.

https://en.m.wikipedia.org/wiki/Bovine_somatotropin

U.S. central bank chief issues warning on Canadian housing without even realizing it: Don Pittis

“Really, what hurts is if consumers are borrowing heavily and doing so … against an asset that can fall in value,” he said. “That’s a really serious matter, when you have a housing bubble and highly leveraged consumers and housing values fall.

“We know that’s a really bad situation.”

Not legally. Duplex means 2 legal dwellings.

In Vancouver you can sell a laneway house through a strata. You also need a strata to sell 1/2 a duplex if you don’t or can’t split the lot. There are a lot of strata duplexes in Vancouver on lots that were previously zoned duplex.

What did 1016 McClure St sell for? Was shocked sold so fast. Wonder what plans someone has for a tiny lot

We used IKAN and are happy with the results. IKEA has good storage and design and IKAN took the pain out of measuring, ordering and installing.

I’m using IKAN to do the kitchen, demo starts today actually. It’s more expensive than doing it yourself (obviously) but in only 1 week I will have a 100% brand new kitchen. In ONE week. No way I could accomplish that on a DIY!

A few of my clients have used IKAN with good success.

Could it be adult kids stuck in the basement slowing down listings?

I’ve thought about this is as well but I just don’t see it too often in my day to day real estate travels.

The big difference is that you can sell half of a duplex whereas you can’t sell a suite or a laneway house

+1

Has anyone else noticed the ever increasing number of SFH for sale that are empty? No furniture, no major kitchen upgrades, just stark and empty. Were these rental properties, or has the owner upgraded or downsized, or has the owner left Victoria?

I’ve definitively noticed this for sure in the last few months of showing properties, but I haven’t identified a clear trend. Mixed bag of reason why vacant.

)) Yeah seems clear now that Canada will be forced to accept some kind of deal that is worse than what we currently have with NAFTA.

=====vvvvv

The only holdup seems to be dairy. That’s a very small percent of total trade, well under 1% of total trade. Even if tariffs are lowered, would remain under 2%. A US think tank agrees https://www.brookings.edu/blog/up-front/2018/06/13/a-trumped-up-charge-against-canadian-dairy-tariffs/ .

I think it will be settled with a little reduction in the dairy tariffs, that were planned anyway under the proposed TPP.

It would have a deleterious effect on housing to raise them, but housing is not the mandate of the BoC. And, Canada is not a hermetically sealed container. It’ll be very hard to hold them in the face of a hawkish US Fed, not to mention rising bond yields. If they don’t, it’ll hit our currency, possibly significantly. Given the amount of non-durable goods we bring in from the states and gasoline being priced in USD, it would not be a good scene at all, real prices would rise, inflation would spike, and it would happen at a time when Canadians are least able to deal with it. Some exports might get a boost, except for that little tariff thingy.

That was IMO, always inevitable. I really think our leadership acted too big for its britches. They may be taking a calculated risk that by refusing to sign on to anything now, they may be able to get a better deal with a subsequent administration. We must understand, we need them way, way more than they need us.

Yeah seems clear now that Canada will be forced to accept some kind of deal that is worse than what we currently have with NAFTA. The idea of a win win outcome is fantasy. The only reason Trump wanted to renegotiate was to make it more favourable to the US.

Question is only how much worse will Canada accept

Gonna be hard to keep raising interest rates in Canada if our economy gets screwed up!

Not looking good for Canada…Here’s the video of uncle Donald today rejecting trade talks with Canada, and getting closer and closer to implementing major tarrifs on cars built in this country.

https://www.youtube.com/watch?v=yYmgmBU4Fq4

Yeah basically they have gone from max three dwellings to max 4.

The big difference is that you can sell half of a duplex whereas you can’t sell a suite or a laneway house

@guest_49569

ya ,, have noticed too on a few houses and condos,,, maybe the flippers realize the liquid market has dried up and need to sell quick .. a few houses that i seen around my area use to have an Albertan licensed car park in front of the house