No, our ownership rate is not 39%

When the piece from real estate marketers Point2Homes hit the comments section a couple weeks ago I didn’t think much of it. They were making the interesting point that home ownership in Canada declined for the first time in decades, and they included a comparison of home ownership rates by city.

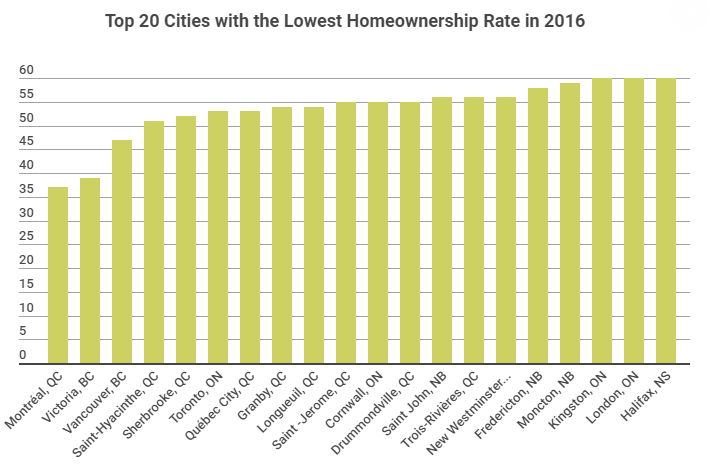

Ownership rates by city – Source: Point2Homes

The chart immediately set off my BS detector. There is no way that ownership rates in Victoria are that different from other cities. Reader patriotz quickly pointed out that they were pulling data from the City of Victoria, rather than the Greater Victoria area. That makes it technically correct, but essentially meaningless since we are comparing only the downtown core of our city to cities that are not part of a larger area.

However it seems other people discovered the chart as well, and this week the piece ran in VictoriaBuzz and the Times Colonist. Both marveled at how low our ownership rates were, but didn’t mention the obvious problem with the comparison. The real estate board did point out that ownership rates in Langford are much higher, but didn’t miss the chance to blame government policy for the drop in ownership rates (which happened before government intervention).

The real issue is that if you want to compare ownership rates, then you better compare apples to apples, which in this case are census metropolitan areas.

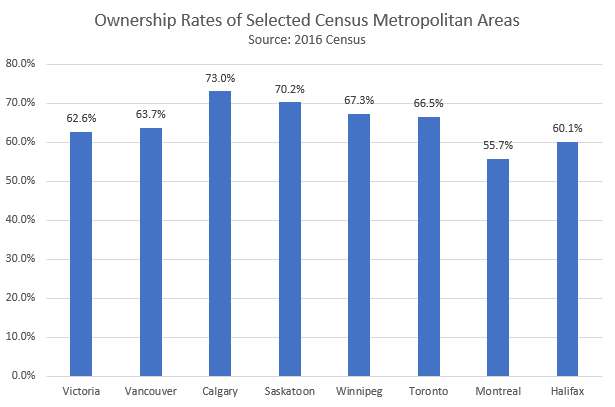

Victoria still has a lower than average ownership rate but it’s not nearly as dramatic as the above coverage would have you believe. Strained affordability might be part of the reason for the lower rate, but the much more affordable Halifax has an even lower rate of home ownership so there are clearly many other factors at play. One of those may be that we have a pretty large university population dragging down the ownership rate.

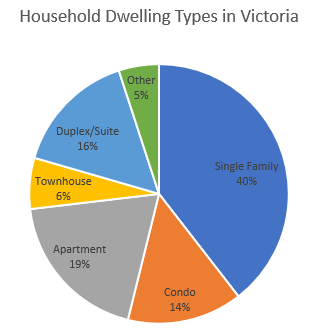

Not surprisingly, the ownership rate in single family is much higher than that for attached dwellings. In Victoria about 40% of the housing is single family, with the rest some mix of attached or other housing types. Note that what they call “duplexes” are mostly suites in single family houses.

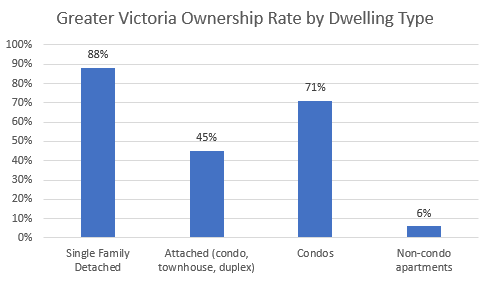

Splitting dwellings by type gives us a better idea of ownership rates in the region. In order to separate out condos that are rented from dedicated rentals, we can split apartments by whether they are part of a condominium corporation or not.

So there you have it. Our ownership rate is 63% not 39%. About 12% of single family housing is rented, and about 29% of condos are rented in Victoria. The rest of the rentals are mostly dedicated ones, and there are currently thousands more of those under construction so watch for the overall ownership rate to continue to decline.

In other news this week, Vancouver councilors just voted to upzone almost all single family neighbourhoods to allow duplexes, and Saanich approved the 800 unit Nigel Valley project. It’s good to see that governments are finally getting on board with building housing that will serve everyone, not just those with a spare few million.

Victoria Born only in one gold stock (was actually a nickel company , up 5 times in two weeks since I posted on here for Michael to have a look at ( up 15 times is a month). No one should really take anyone`s advice. This place proves it.

Enjoy your day.

Monday numbers: https://househuntvictoria.ca/2018/09/24/sept-24-market-update

Wasn’t aware of either definition or the differentiation. But in this case, I was talking about the effects of devaluation in the more inflated markets in Canada, based on the degree and speed of the price ascent and the recent reliance on housing as a significant GDP growth driver. Categorically unsustainable, IMO, and always was.

Local fool – are you speaking in the original sense of the word – reduce by 1/10th? or the more recent meaning – to destroy a large part of?

Gold? Free advice is usually worth what you pay for it.

Good to see the rental rate increase is under review. 4.5% increase is ridiculous.

More price slashes today, many below the inflated BC assessment figures. Sanity is slowly returning to this bubbly market.

US Fed will hike a quarter point. Canadian borrowing interest rates will rise as a result, particularly mortgage rates which are set in the bond market. 88% chance the BOC hikes in October – it has to do so. Get used to it.

I have just started to sell equities and moving to cash [2 year GICs are paying close to 3%] to take advantage of the falling RE prices. Yup, it is happening and 18 months to 24 months from now, we will be in a different world where mortgage rates will be much higher.

https://www.cbc.ca/news/canada/british-columbia/b-c-rental-housing-task-force-to-announce-recommendations-1.4836048

Hawk

Is it not lawn bowing season yet? Maybe that will be more successful than real-estate predictions.

Buy Gold stocks Hawk, some free advice.

Western governments aren’t “essentially bankrupt.”

Western governments would 100% do QE again, and bail out the banks, and bail out any other major institution it deems too-big-to-fail.

Very sad gwac you can’t read a chart. Maybe go check with the doc.

Landlords are finally getting the screws from their years of gouging.

Task force recommends change to how rent hikes are calculated

The BC Rental Housing Task Force is recommending the province only allow a maximum rent hike equal to the rate of inflation. The current formula is inflation plus two per cent. The task force proposes landlords be required to apply for additional increases to cover costs like maintenance.

Canadian borrowers will feel this week’s U.S. interest rate hike: Don Pittis

Markets are so certain that U.S. Federal Reserve chair Jerome Powell will raise rates this week that a failure to hike would likely have worse consequences for American markets than the impact of higher borrowing costs.

But the near certainty so cherished by market traders — who hate rude surprises — will provide little reassurance for the millions of people around the world, including over-borrowed Canadians, who will inevitably feel the effects of higher rates.

And not only are market indicators showing a 100 per cent expectation of a rate hike on Wednesday, most analysts expect another increase in December, with predictions of as many as four more quarter-point increases in 2019.

Canadians struggling with mortgage payments and other debt must take that into account, because the actions of the world’s most powerful central bank don’t stop at the border.

https://www.cbc.ca/news/business/fed-rates-housing-1.4831333

Hawk

Very sad. There`s help out there if you need it….

Interesting how the US housing is about to cave at lower debt levels but Canadian debt bomb is nothing to worry about because of CMHC. Fuzzy logic.

:large

:large

Debt is debt, and massive debt of 169% record of historical levels with a major amount of HELOC debt being in the past 2 years is indicative of a bubble about to blow. Charts don’t lie, but debt deniers that figure out multiple ways to distort the truth do.

Great definition of technology patriotz!

Technology is the way you use inputs to produce outputs. Without technology there is no economic activity.

are you sure ? .. in a place where profit is king,… and employees cost more money than automation .. lots of people will get laid off to cut cost

@Leo S Any thoughts of doing a blog on the high end of the market, how high inventory and price drops, could reduce the price of all housing? If the top end starts seeing some major reductions both in %off from list like your one graph showed but also through reductions and reasonable pricing? Right now my house would be listed in the sub 800k range but the 800-1.2 market seems pretty hot due to a lack of good inventory. It looks like there are close to 200 SFH at the 1.5M and up range with about 50 over 90 days? That is my guestimate using Realtor.ca. If these dropped in price, it might free up lower-priced inventory like mine driving down prices and get the market moving a little bit?….I know some 1.5M houses are willing to throw in sheep and all the 60’s fake wood paneling anyone could ever dream of but it might take a little more to get sales made at the high end.

Leo,

Government could reimplement QE.

Bankrupt? US would just print more money, increasing the supply of money, reducing the value of their debt. Could China and every other country dump their USD treasuries? Of course, but it would crash the value of their treasuries and they would take a serious loss to their investments. The damage to the USD would make US products more desirable and cheaper for other countries to purchase.

However the real fear that keeps me reading at night is if this trade war blossoms into a real war because China believes ______( insert any number of reasons here). While government can devalue their debt and print more money, a serious stop to global trade would do so much damage to the demand side for all goods and services, creating crushing unemployment.

Technology is only useful if you need it, and lets face it, it’s only a luxury. It doesn’t produce anything, it just makes production more efficient. They’re the first jobs that will disappear in a serious recession.

I don’t know, but in terms of RE, the argument that the “tech industry” is going to save ______________ (insert city) seems to be growing in popularity…

Toronto’s Tech Boom Will Keep Real Estate Frenzy Going: Forecast

It’s now in a class of cities with booming tech industries and rapidly rising house prices, a new forecast says.

https://www.huffingtonpost.ca/2018/09/22/tech-boom-toronto-real-estate_a_23538014/

(giggling)

You mean everyone having a share not just one guy who owns a rental building living in one of the units?

There’s the issue of co-ops. There are two kinds – the for-profit kind that used to be in vogue before condos were introduced in the 1970’s, and the not-for-profit kind which we are familiar with today. I don’t know how Stats Can classifies these.

Just curious about something…

Lots of talk on this blog recently about high personal debt, and international bubbles in RE & stocks, and potential crash, and international locations where a significant RE correct is underway, and drops in other assets, and Trump-onomics with tariffs, and trade wars with China, and NAFTA re-write to favour Americans, and $3 of government debt for every $1 of GDP, and $22 TRILLION debt in USA, and issues ad nauseam…

If another major financial catastrophe occurs, would the governments of the western world be able to bail-out the banks and corporations with another round of massive Quantative Easing? QE worked last time from 2008 to 2015, but since most western governments are now essentially bankrupt, would QE work again?

If not, what other options would governments’ have for rescuing the economy?

Serious questions, I can’t think of a single option other than QE-2.

Last Time I checked: Under the US Tax code most Americans can deduct the “interest” portion of their mortgages but only that portion that relates to the first $1,000,000 of principle [or $500,000 each for a couple]. Property taxes paid are also deductible. However, on sale of the principal residence, only $250,000 [or $500,000 for a couple] is exempt from income tax – the balance of the capital gain is taxable – welcome to the land of the brave and home of the free. Based on the Taxpayer Relief Act of 1997, if you are single, you will pay no capital gains tax on the first $250,000 you make when you sell your home. Married couples enjoy a $500,000 exemption. So, weight the tax deductibility of interest payments vs income tax on disposition. There really is no free lunch. Unlike in Canada, the first 50% of the balance of the capital gains are not tax exempt – the entire amount [after the exempt portion] becomes taxable even if you buy another home.

I believe, on balance, our system is better in Canada with the principal residence exemption even though the interest payments are not tax deductible. For rental property, the capital gains rules apply, but most will amortize the building’s value so there is possible sizable recapture on disposition – tax man has his or her hand out.

QT: “However, one have to take into account that American can write off their mortgage interests via income tax that would easily pay for the average Canadian HELOC owing amount in less than a year.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Lipstick meet pig.

http://www.cnbc.com/2017/04/17/heres-the-average-tax-refund-people-get-in-every-us-state.html

"According to the IRS, in Fiscal Year 2016, the average individual income tax refund was about $3,050. Note that this does not include refunds in categories such as business income taxes, estate and trust income tax, gift tax and employment tax."

http://www.cbc.ca/news/business/interest-rates-helocs-canada-debt-1.4192847

"They're not a tiny slice of the market, either. There are about three million active HELOCs across Canada, with an average balance of about $70,000, the Financial Consumer Agency of Canada warned last month."

At least he didn’t say “the help”

CBC’s Justin McElroy (hilariously) live-tweeted last night’s Oak Bay all-candidates meeting. Here’s one of those tweets:

Here’s the tweet thread: https://twitter.com/j_mcelroy/status/1043595865242316801

Hawk

It is true that US tariff was one of the cause for the great depression market crash, however the US/Canadian populous are not leverage anywhere near 1928~1929 level. And, the current stock market didn’t have a run up anywhere near the run up of the 20s (more than 10 folds in a decade).

Canadian HELOC debt may look risky compare to our southern neighbor. However, one have to take into account that American can write off their mortgage interests via income tax that would easily pay for the average Canadian HELOC owing amount in less than a year. Hence our true debt at the end of the day is not anywhere as risky as the American, and we also have CMHC that cover the more risky mortgages making it even less risk than what the average chicken little believe.

…talking about consuming .. boomers had it easy .. i know back when some of my old neighbours bought a place under a low salary job .. now millennial can’t even afford one with dual income .. boomers has accumulated wealth over future debts driving up the cost of living for others.. dont blame problems on a generation people .. greatest threat to housing market is caused by the past and developed into this over leveraged bubble

))) One of the greatest threats to the housing market is the consumer habits of young people (Millenials)

Yes, that’s possible. But the boomer generation were like that in the 60s and 70s (non materialistic, free love etc) and then conformed big time after age 40.

For the Millenials, time will tell.

Charlie,

The newbies don’t get that history does repeat itself eventually. With tarriffs being thrown at China on a weekly basis and now talks are cut off by the Chinese, they plan to let the US blow up and weather the storm. Guess whose going to get the stench and smoke from the bonfire on top of tarriffs ? Look out below.

From your Zerohedge article:

“And unfortunately, things are likely to only go downhill from here.

The trade war is really starting to take a toll on the global economy, and it continues to escalate. Back during the Great Depression we faced a similar scenario, and we would be wise to learn from history. ”

“[T]here came another folly of government intervention in 1930 transcending all the rest in significance. In a world staggering under a load of international debt which could be carried only if countries under pressure could produce goods and export them to their creditors, we, the great creditor nation of the world, with tariffs already far too high, raised our tariffs again. “

Yes it’s disgusting how Canada is the worst in the world and BC is the king of North America for money laundering/ fraud. We’re so nice and pleasant about it cause you don’t want to be PC offend anyone or your called a racist or discriminatory.

Meanwhile they laugh at the weak assed system we have due to Conservative/BC Libs. Good to see Eby being the only politician in Canada with some balls to try and do something about it.

Soon to be ex-millionaires Patrick, losing hundreds of thousands by the month. Meanwhile down in the US the millennials are getting turned off massive ball and chain debt bomb around their neck and have stopped buying houses.

Few are “millionaires”, they are just a “millionaire” on paper, which is no big deal when most is still mortgage debt plus HELOC.

This is why Americans are losing confidence in the housing market

Generational trends

One of the greatest threats to the housing market is the consumer habits of young people. Millennials have already been blamed for ruining, for example, Applebees and golf, and some experts predict the housing market could be the next victim of emerging consumer trends.

According to Business Insider, millennials are buying homes at a slower-than-usual rate. In the past, 25 to 34 was the typical age to start shopping for houses, but it seems millennials are lagging. Data show a major deterrent for young people is saving enough money for a down payment.

https://www.marketwatch.com/story/this-is-why-americans-are-losing-confidence-in-the-housing-market-2018-09-17?link=sfmw_tw

))) Hawk: Being proud and happy of major debt is called max denial/ insanity.

OK, but many “max denial/insane” people like that in Vancouver and Victoria are also now millionaires.

And…

NYC Home Sellers Are Cutting Prices Like It’s 2009—And Then Some

By Oshrat Carmiel

September 21, 2018, 2:00 AM PDT

https://www.bloomberg.com/news/articles/2018-09-21/nyc-home-sellers-cutting-prices-like-it-s-2009-and-then-some?utm_campaign=socialflow-organic&utm_content=business&utm_source=twitter&utm_medium=social&cmpid=socialflow-twitter-business

Some interesting numbers pertaining to the real estate market down south, from Zerohedge.

Evidence The Housing Bubble Is Bursting?: “Home Sellers Slashing Prices At Fastest Rate In Over Eight Years”

“It is quite interesting that prices are being cut fastest in the markets that were once the hottest, because that is exactly what happened during the subprime mortgage meltdown in 2008 too. In a previous article, I documented the fact that experts were warning that “the U.S. housing market looks headed for its worst slowdown in years”, but even I was stunned by how bad these new numbers are. According to Redfin, more than one out of every four homes for sale in America had a price drop within the most recent four week period…”

“That is absolutely crazy. I have never even heard of a number anywhere close to that in a 30 day period.”

https://www.zerohedge.com/news/2018-09-22/evidence-housing-bubble-bursting-home-sellers-slashing-prices-fastest-rate-over

Patrick:

“But don’t expect most Canadians to be like some here who are “sad and scared” about that possibility, to the point that they are refusing to buy.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<

You're right Patrick, most Canadians in other provinces may not be "sad and scared" of a 30% drop in house prices, but Albertans, British Columbians and Ontarians … not so much so.

http://www.rbc.com/economics/economic-reports/pdf/other-reports/householddebt_apr2018.pdf

Conclusion

The fact that Albertans—along with British Columbians and Ontarians—carry the heaviest debt loads on a per household basis in Canada inherently makes them more sensitive to interest rate increases. Their debt-service bills will get bigger, and possibly sooner than elsewhere in the country, when interest rates rise. It’s bound to cause many households to spend more cautiously on other goods and services. That could potentially restrain economic growth more in Alberta—and in BC and Ontario—than in other provinces.

How much more? That’s hard to say because the net economic impact of higher rates will also reflect the benefits received by saverhouseholds on the asset side of the balance sheet.

)) LocalFool: a slide in real estate in this country would decimate wealth.

Well sure, but you can be more precise than “decimate”. Since 46% of Canadian assets are in real estate of some kind, a 30% drop in real estate would drop total assets by 30%x46% = 14%. That would put them about where they were 3 years ago, and just be paper losses for most. But don’t expect most Canadians to be like some here who are “sad and scared” about that possibility, to the point that they are refusing to buy.

Moreover, that statement “a slide in real estate would decimate wealth” is true now, and was true in 1999, and true well before that too. It just isn’t more true now than it was in 1999, and 1999 would have been a great time to buy,

Speaking of homeownership and lack thereof:

https://www.cbc.ca/news/canada/quebec-immigrant-investor-consultants-hidden-camera-1.4832245

https://www.cbc.ca/news/canada/quebec-immigrant-investor-program-civil-servants-1.4830231

Isn’t it sad how little repercussion there is for fraud and white collar crime in Canada. I often think, “My yearly income taxes buys one of these douchebags a new Mercedes every couple of years.”

Here, I’ll repost the previous claim and rebuttal. I’m not going to respond again on this.

From:

https://househuntvictoria.ca/2018/04/09/april-9th-market-update/#comment-41845

Slick, and misleading. You’re probably quoting Statcan’s SFS survey from 2016, so let’s have a look at your analysis, using that.

Canadians have roughly 12 trillion CAD in assets as of 2016. The single largest source of it was primary real estate, at 33%. What you fail to mention, is that another 10% on top of that comes from the 1/5 of Canadians that own secondary real estate including cottages, timeshares, rental properties and other commercial properties. So the distribution of wealth tied into real estate is about 43%. That friends, is a big number. Indeed, Statscan remarked that “housing is both the largest asset and the largest debt for Canadians”.

And that level of consumer debt tied to RE and HELOC growth has gotten worse, rather quickly, if you’d like to read the latest BoC Financial system review at the link below. It appears you don’t share the BoC’s concern, though they’re not likely to sound the alarm for nothing.

The next largest source of wealth (and the largest gain) in wealth is EPP’s, at just under 30%. And so what? That’s not a liquid asset you can really do anything with until you retire, and I’m not aware of any large scale use of pension raiding to fund consumer spending. And…guess what a lot of pension funds in Canada have been buying these last few years? You guessed it – Canadian real estate!

The position of pension funds, who own such Canadian real estate landmarks as the Yorkdale Shopping Centre and the TD Centre in Toronto, continues to grow and the top 24 Canadian pension funds now own $188 billion of real estate, according to RBC analysts Neil Downey and Michael Smith. Allocation of real estate now amounts to 13 per cent of the total investments of $1.5 trillion at those funds.

Totoro, a slide in real estate in this country would decimate wealth. It always does – and with Canadians so involved in real estate directly and indirectly, I don’t find your rebuttal, “oh, we’re wealthy” terribly convincing or really even addressing the points he was talking about.

I don’t care if you use stats to prove a point – they’re a great tool. But don’t throw numbers up there, and orphan data at your discretion to support a slant.

http://www.statcan.gc.ca/daily-quotidien/171207/dq171207b-eng.htm

https://www.bankofcanada.ca/wp-content/uploads/2017/11/fsr-november2017.pdf

http://business.financialpost.com/real-estate/canadian-pension-funds-have-amassed-188b-in-real-estate-assets-and-they-are-hungry-for-more

Local fool: It’s been debunked repeatedly, but a few people still keep at it. Meh.

====v=v==bb

“A few people keep at it” also includes Stats Canada….

The family house is still only 36% of family assets (it was 32% in 1999)

The family mortgages are still only 9.3% of family net worth. They were 8.6% in 1999. Those are not big increases, and don’t justify the “swamped in debts”, “scary and sad” comments.

You should study the statscan chart here. https://www150.statcan.gc.ca/n1/daily-quotidien/171207/t002b-eng.htm

They present all the numbers you want, showing the state of Canadian family finances, from 1999 and 2016

It is illuminating comparing 1999 to 2016, which I shall now do.

Executive summary, from the table we see that comparing 1999 to 2016

– Family residence rose slightly from 32% of family assets to 36%

– Other real estate (cottages, commercial) rose slightly from 8 to 10% of family assets

– Mortgage payments on family residence rose very slightly from 8.6% of family assets to 9.3%

– debts as a % of assets rose slightly from 13% to 14%

– these are all small increases and don’t support statements of a huge rise in real estate as a % of Canadian family assets

– net worth (assets-debts) rose dramatically from $4.7 trillion to $12 trillion, and increase of 150% !

– most (54%) of Canadian net worth is not in any kind of real estate, which was a similar number in 1999 (60%).

If you want to argue against that, point at some numbers on that big stats can table, and show me anything that supports a claim that houses have risen dramatically as a percent of Canadian assets, or that mortgage payments have risen dramatically as a percent of Canadian net worth

He’s not kidding. He’s parroted that reasoning once before; Totoro used to post that argument regularly a while ago. It’s been debunked repeatedly, but a few people still keep at it. Meh.

Canadian household debt is not a problem? – not quite what is set out below. Here is a teaser:

https://www.youtube.com/watch?v=NrVoPGgZCKk

Steve is entirely correct – the Canadian population is swamped in debt. Using a debt / asset acid test is fool hearty in the face a housing slowdown, which is where we are. So, as asset valuation drops, surely the ratio goes against your theory. Unless, like some here, you think home valuations will continue up, up and up.

Patrick:

“the debt ratio of Canadian households was not significantly higher in 2015 than in 1990 (16.9% in 2015, compared with 16.7% in 1990). The same observation can be made if we measure the household debt ratio relative to net worth.

<<<<<<<<<<<<<<<<<<<<<<<<

….. and the previous paragraph

"Asset values have increased more than total debt between 2010 and 2015 (6.9% per annum, on average, compared with 4.8%), which explains the drop in the ratio over this period (2nd line of Table 1)."

I don't think everyone gets the satire in your post, Patrick, but that was fun. Thank you.

For those other people, Patrick is saying that the housing bubble created huge assets for net worth calculation and that increase masked the true debt picture very well.

Let's see what would happen if housing took a downturn.

http://www.washingtonpost.com/business/economy/fed-americans-wealth-dropped-40-percent/2012/06/11/gJQAlIsCVV_story.html?noredirect=on&utm_term=.7d732b0a9064

"The Federal Reserve said the median net worth of families plunged by 39 percent in just three years, from $126,400 in 2007 to $77,300 in 2010. That puts Americans roughly on par with where they were in 1992."

I’d be very worried , that was when gwac got his condo at 50% off. Rates were already coming down back then too, we have 4 to 6 more hikes to go.

Being proud and happy of major debt is called max denial/ insanity.

)j) Local Fool: “Canadians on a per-capita basis now owe $6,250”. There’s something very scary and sad about that fact. How could we do this to ourselves…

=====vvvv

Don’t be scared. Don’t be sad.

Feel proud and happy because net worth of Canadian families is at a record high ($12 trillion assets) vs total debts ($2 trillion). And only 1/3 of the assets ($4 trillion) is the family home.

Stats Canada data (via CBC) https://www.cbc.ca/news/business/statistics-canada-family-income-survey-1.4437137

“All in all, Canadians held $12 trillion in assets at the end of 2016, with family homes making up a third of that value. Canadian families owed $1.76 trillion at the end of last year (2016)”

And our ratio of debt to assets has not changed in the last 30 years. Stuck at 17%.

https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/pages/is-the-canadian-household-debt-ratio-too-high.aspx

“the debt ratio of Canadian households was not significantly higher in 2015 than in 1990 (16.9% in 2015, compared with 16.7% in 1990). The same observation can be made if we measure the household debt ratio relative to net worth.L

Great article, Charlie. Under all of this hoopla, there is real trouble. A few rate hikes and it starts to come to the surface. I will reiterate: Canadian incomes do not support the prices people are paying for homes and, as a direct consequence, people are taking on more and more debt. HELOCs are just one of the ticking time-bombs. You also have credit cards, lines of credit, retailers selling everything for “pay no interest for 24 months”, etc. Eventually, it all comes due.

There’s something very scary and sad about that fact. How could we do this to ourselves…

Bizznitch,

Sounds like just before the financial crash when Alberta “companies” turned into fly by nights leaving owners in a pile of crap. Heard several stories from the local ones the past year that are horrendous costing $100K plus to bring in new guys and clean up the disaster.

Alberta puts contractors in the cross hairs

Fraud Prevention Month attack is bad publicity for the contracting industry

“In Alberta, home renovation fraud remains one of the most common complaints received by Service Alberta,” McLean said in a media release. “Recently, there has been an increase in unlicensed, pre-paid contractors using online advertising to deceive Albertans about qualified and licensed services that don’t necessarily exist.”

https://www.canadiancontractor.ca/canadian-contractor/alberta-puts-contractors-cross-hairs/1003282780/

Charlie,

Good article, Canadians are in fantasy land thinking they will ever pay back that debt at multiples of US crash peak levels.

It’s in your price range, Soper. What’s holding you back?

High price = high desirability.

And before anyone equates population growth with desirability, not everyone can afford what they desire.

Good article from Wolf Richter.

HELOCs in the US & Canada: As “Scarred” Americans Learned Bitter Lesson, Canadians Went Nuts

by Wolf Richter • Sep 20, 2018

“In US dollar terms, to make it apples and apples, Canadians owe $225 billion in home equity loans. Americans owe $357 billion. But here is the thing: the US population (326 million) is about nine times larger than the Canadian population (36 million). On a per-capita basis, American owe $1,095. During the peak, they owed $1,868. Canadians on a per-capita basis now owe $6,250 — or 3.3 times as much as Americans did during the peak.”

I know someone here doing a renovation and they’re bringing in a whole crew from Alberta to do the work. Claim it’s 20% cheaper to do.

Sorry should have specified that the $659k sale was in Oct 2016. No idea why it’s not on BC assessment though.

So crazy. Hope this blows up politically

https://www.cbc.ca/news/canada/quebec-immigrant-investor-consultants-hidden-camera-1.4832245

Cost per square foot to build depends on everything from the cost of materials, design, but permitting, labourers, trades and general contractors cost more in BC than the East Coast because of supply and demand. I talk to trade contractors in ON and they are marking up way less then BC but I can tell you few contractors in either province are getting rich. It is tough comparing used homes but likely a closer comparison can be done on new builds in NB vs BC. Marko has done some videos on the cost per square foot but a lot comes down to builder and market choice. I have a 1400sq foot three bath home that is going to cost more per square foot than a 2000sq foot two bath home.

@guest_49400 and @guest_49387

“Ignoring the price of land why would a house like this cost so much more to build in Victoria?”

This is what I have really wondered as well. 200/300 now 400 $ a sqft seems crazy when houses are built in other areas of the country for a fraction of the price. Also in the US. Probably because they can here and do. They babe such a boom they can charge more and more each bid/year etc. Once this busts it will be interesting to see what it costs to build. I also don’t think the municipalities are helping with additional code changes and $$$ to build a new home.

Followed by Leo S saying:

Just piqued my curiosity because BC Assessment has the higher number. Is their value wrong?

The article point out that damn if you do and damn if you don’t.

I could be wrong here, but I feels that our system tend to lead politicians to cave into the demand of the loud minority groups to avoid conflicts and to keep their job. As the result, many politicians become apathetic as demonstrated by Barrister.

isnt this article about owner ship? .. not how many dweling is a primary home?

Why is the system broken based on that article?

Partially rented houses: Statscan considers a house with a suite to be a duplex. That duplex contains two households: one owner, one renter.

Person living with 3 roommates: Statscan defines household as: “Private household refers to a person or group of persons who occupy the same dwelling and do not have a usual place of residence elsewhere in Canada or abroad.”. So 4 roommates in one place is one household (occupied by a non-census-family).

James Soper: that is actually a pretty nice house for a reasonable price. Ignoring the price of land why would a house like this cost so much more to build in Victoria?

Barrister

Hear, hear. The system is broken.

http://www.victoriabuzz.com/2017/07/christie-point-development-approved/

“View Royal Council voted 3-2 to approve the rezoning of Christie Point, paving the way for the largest housing project in the town’s history… replacing 161 two-storey, 1960s-era apartments with 473 new ones…

But numerous members of the community remain staunchly opposed. In fact, tempers threatened to boil over at the council chambers on Tuesday. The Times Colonist reported that a middle-aged many confronted the Mayor after the vote, loudly calling him “a loser,” and saying “See you at the polls next time, buddy.””

what about partially rented houses .. what about people who lives with room mates… I, myself, have 3 room mates living under landlord who has 2 adult kids who cant own their own property .. .. simple math .. number of dwellings is significantly less than Families + working adults

Leo S

Ensuring that its oriented towards residents is the hard part.

Example:

Metrotown area in Burnaby had many old rental buildings, now all the people there are being demovicted to make space for ridiculously expensive condos. There will be more units alright, but most of the residents won’t be able to afford them.

https://gmrgm.mlsmatrix.com/matrix/shared/4d4rf5GJCd/750ChBasCapPeleBasCapPeleNewBrunswick

What half a million dollars should buy you.

No, it means that of all the households that live in non-strata apartments, 6% own their place and 94% rent it.

I puzzled about this for a while too and can’t completely figure it out. Patriotz’ theory sounds good though. Only other explanation I could think of was if there are any non-strata apartment buildings where people can own. Ever seen that?

63%. It is lower than most centres.

They’re not wrong, just that 98% of people when you say Victoria think you are talking about Greater Victoria, not the city of so they will be misled by the story. Just kinda sad that several different news organizations didn’t catch this before running the story.

Your realtor is correct.

“When the market took off in the second half of 2014 the TSX was at 15k….pretty sure it isn’t 30k now”.

The TSX is weighed way down by resource stocks. Marko – it is a “market” not a “captive compound”. The “market” includes the USA market and we have done just fine [and then some] on big cap technology and may others. Plus the foreign currency gains over the last 10 years as the C$ fell big time. Lastly, real estate in Victoria did NOT double between 2014 and the present [make sure you deduct your property taxes, water, sewer, garbage, maintenance and mortgage interest, before you start counting your gains, not to mention that juicy real estate fee owing on disposition], so let’s compare apples to apples. Oh, yes, deduct the $9.95 commission for the stock purchase from the gains too – to be fair.

In addressing affordability, with the foreign buyer now in Montreal or wherever, the elephant in the room that no one is looking at is incomes. Look at the median and average household incomes in Victoria. I would be very surprised if it exceeds $100,000. Canadian Census reports it at $86,640. See:

https://globalnews.ca/news/4143426/vancouver-victoria-income-growth-home-prices/

How can that support a bench mark home price of, what, $850,000 to $1,000,000? It can’t, plain and simple. Building more homes priced at the bench mark price is a waste of time. Added supply, in theory, should bring that bench mark price down but sellers want an outsized profit. There is the rub, isn’t it. The buyer, even with a 20% down payment, can’t afford that. You may say they can, but look at all of their debt [we have the most indebted household ever in history] – they won’t qualify for a mortgage using the stress test. It is NOT AFFORDABLE for the median or average income family.

Gotta love that bedroom that they barely squeezed the bed into. Wonder if the bed comes with the purchase?

Looks like a good deal, thanks for posting VTH. Only word of caution would be presence of asbestos with this style of roof which is difficult to inspect, check the attic (if any) or void above ceiling for vermiculite. Also sample and analyze roofing materials like shingles, roofing paper, tar and mastic before work begins. Shiplap (wood) ceiling would not be of any concern. Get your home inspector on the same page so there are no future surprises. Or just leave it the hell alone, undisturbed and rest easy.

PS for anyone looking for a house with a suite and also to keep Victoria’s rental ratios balanced, we went and viewed 860 Beckwith today, that was listed last night. A lot of house and property, in a good location, compared to others we have seen in Saanich but a little dark. You’ll want to be handy with lighting and punching skylights into torch-on roofing. Well priced and presented in my opinion by the realtor and sellers. It should go quickly unless the end is near and Hawk is right! https://www.realtor.ca/Residential/Single-Family/19935957/860-Beckwith-Ave-Victoria-British-Columbia-V8X3S3-Lake-Hill

Sure he does, as do I and others. It’s just the other side of the speculative coin.

Hawk doesn’t speculate on housing, just pot and gold stocks.

Goodness, Royal LePage is really pushing hard in the media. Have a look at their latest attempt to pump the market via the National Post…

“Canada’s housing market has achieved the ’magical soft landing’: Royal LePage”

https://business.financialpost.com/real-estate/canadas-housing-market-has-achieved-the-magical-soft-landing-royal-lepage

Hint: Canada hasn’t “passed through” the correction at all. The correction probably isn’t even at a midpoint yet, especially in British Columbia. Try again in a few years…

I am not crazy about a few of the incumbents. On the other hand a lot of the challengers are not ready for prime time either.

I see a lot of earnest well meaning people that don’t seem to realize that local government involves a whole lot of reviewing development applications and only small incremental chances to change the world for the better

Marg Gardiner is well ahead of the other challengers in terms of knowledge and readiness to be a councillor. That said she has some pretty NIMBY-ish background with the JBNA. I am not crazy about her, but I do think she’d overall be an asset to council.

The “New Council” group isn’t that impressive IMO. That said I’d be perfectly happy if one or two of them got onto council to shake things up a bit.

More than likely the six incumbent councillors get re-elected in which case there are really only two council seats up for grabs.

And of course Rob Duncan aka Changes the Clown for mayor! What could go wrong?

James you have to include all of the other 12 municipalities in this equation. Lots of people in Saanich, Sidney, Brentwood bay and dont forget little Esquimalt.

Just when I thought you were an international kind of guy. The S&P is up 100% the last 6 years ICYMI.

Toss in a couple of pot stocks and we’re talking multi baggers. 😉

Considering that Langford + Colwood population is only 50,000. 70 thousand more residences in downtown victoria would likely crater the market.

Most people when you say “affordable housing” think it refers to low income housing. That is not the case. Everyone needs affordable housing. A $2M SFH is affordable to some small percentage of locals, and a $1M duplex is affordable to a somewhat larger percentage of locals.

Everyone needs affordable housing, not just those with low incomes. So we need affordable housing for those earning $35,000 per year, as well as those earning $70,000, $100,000, $150,000, etc. Adding supply at any level that is geared towards local residents will help.

Both. I believe I can pull the data on mortgage vs no mortgage… Will take a look

Dasmo: “However, the reality of converting Vancouver SFHs to duplexes is a slow piecemeal process. Meanwhile you just goosed the value immediately for 90% of every SFH.”

<<<<<<<<<<<<<<<<<<<<<<<<<<

Steve Saretsky disagrees … well until the market bottoms, anyhow and then it becomes cost effective.

http://vancitycondoguide.com/city-of-vancouver-rezoning-single-family-homes/

"While typically up-zoning increases the value of the land, it’s unlikely to spark a speculative fever in the city’s detached housing market, where home sales have tumbled to record lows through the first eight months of the year."

We don’t want to live downtown. We will stay 28min bike ride/ 21min car ride away for many years to come.

I have a sort of math question that came up in conversation. Assuming that the goal is to make the city of Victoria affordable to the average working person that means that the people who live outside the City of Victoria but who live in Langford and throwout the CRD should be able to move to the city. So how many more units would we need to build to accommodate everybody who would prefer to live downtown. Put another way are we talking ten thousand more people or 70 thousand more?

Also if renting a condo coast half of what it does now would we have to build more units for people moving here from Vancouver for the cheap rent?

The politicians keep talking about how more density will make things cheaper but I can never get even a guessimate as do how many units we are talking about to have any real impact on dropping rent in the City of Victoria.

Does anyone know if anyone has modelled this?

Clarification…

I didn’t intend to insult any specific person when I used the word ‘dumb’. I have nothing against Marko… I just really enjoy pestering him. Also, I feel like he should adopt the slogan “Call me and I will save JUR-AS(S) some money!”. Major missed opportunity honestly.

Hawk is right about Seattle…it’s overbuilt. That said, when the pigs get slaughtered properties get picked up by stronger hands. Pessimists would decry that as an unfortunate and systemic wealth consolidation but it is what it is…

Meanwhile the stock market is up 100%. You don’t make zip until you sell and no owners on here have admitted to cashing out. 40% move down can happen faster than the rise.

When the market took off in the second half of 2014 the TSX was at 15k….pretty sure it isn’t 30k now.

Probably the owner is living in 1 unit of a building with 3+ units. which would appear to fall under “apartment” according to the classification above.

I am surprised that even 12% of SFHs are rented. That is pretty much every 10th house is rented.

6% non-condo apartments…does that mean the individual is renting an apartment, but they own property they themselves rent out or keep vacant?

Patriotz : Couple needs to slash spending, downsize to escape retirement debt disaster https://business.financialpost.com/personal-finance/couple-needs-to-slash-spending-downsize-to-escape-retirement-debt-disaster

===vvvv

I disagree with the recommendations in this article.

This article determines that this couple is not saving enough, and recommends that they sell their home and buy a downsized home, to reduce debt and prevent a debt disaster.

The analysis in that article fails to mention that couple is saving, by adding $16K equity per year via principal payments in their mortgage. (Payments of $3150 x 12 – interest of $860,000 x 2.54% = $16k per year principle payments ).

IMO, They have a solvable* cash flow problem ($1k per month) , but overall are saving money (via equity build). Hardly a “debt disaster”

*solvable by cutting expenses like cheaper life insurance, stop RSP and RESP, refinance credit card debt – to get into cash flow balance )

This fiftyish couple were in a position to buy in the 1990’s, yet the amount owing on their mortgage today greatly exceeds the purchase price of a house back then.

Enough said. Unless health related no sympathy for this. You live beyond your means time to pay the piper now.

How many more like them? The statistics say a lot.

Personally, I see it a lot. Then I again I see a lot of people that have multiple paid off properties as well. Tough to figure out how it all balances out.

The builders don’t determine the price. The buyers do. Now suppose that high end unit didn’t get built. The person who would have bought it would then have outbid someone else. And that person would have outbid someone else, etc. all the way down until you get to the marginal buyer, who can’t outbid anyone else and gets shut out of the market. So building the high end unit makes it possible for someone at the low end to buy.

This is such a simple concept no one on the city council seems to understand.

It is a similar concept to the rental towers going up downtown. Expensive yes, but certainl individuals move out of an overpriced $1,400/month basement suite into a $1,550/month condo which opens up the basement suite and if enough people move out of basements suites the price has to drop.

Found this on Kijiji:

https://www.kijiji.ca/v-1-bedroom-apartments-condos/victoria-bc/why-rent-when-its-cheaper-to-buy/1359343361?enableSearchNavigationFlag=true

Ugh, sign of a dire rental market. Median condo price is $400k and there’s just a handful of units that fit this criteria. I hope no one takes this advice seriously.

Doesn’t matter so much, more supply is more supply, so long as it’s not empty it’s a good thing.

Sorry, can’t feel for these type of situations.

Sell the place and rent. Put the extra cash in a diversified ETF balanced portfolio. Live within your means. Pay off debt. Save. Never get into debt again.

And why pay for the children’s education. Your job as a parent is to prepare your kids. Have them get good grades. Get them financially literate and get them to pay for their own schooling!

I would expect the % of residents who rent (in any market) to be smaller than the % of rental households, because the average rental household is smaller than the average owner household. I think they just don’t know what they are talking about.

Couple needs to slash spending, downsize to escape retirement debt disaster

This fiftyish couple were in a position to buy in the 1990’s, yet the amount owing on their mortgage today greatly exceeds the purchase price of a house back then. They will be vulnerable to interest rate increases well into their senior years. How many more like them? The statistics say a lot.

The builders don’t determine the price. The buyers do. Now suppose that high end unit didn’t get built. The person who would have bought it would then have outbid someone else. And that person would have outbid someone else, etc. all the way down until you get to the marginal buyer, who can’t outbid anyone else and gets shut out of the market. So building the high end unit makes it possible for someone at the low end to buy.

The proviso being, as Leo S pointed out, that we are dealing with residential demand.

It was on CHEK NEWS last night as well, saying that home ownership in “Victoria” is the second lowest in the country – reporting that two-thirds of all residents of Victoria rent, not own. It did not say that two-thirds of all homes are rentals – there is a difference. It raised an eye-brow and, as you pointed out, they used the word “Victoria” not “Greater Victoria”. Thanks for the clarification. CHEK NEWS = Fake News.

69% ownership still seems very low to me.

The realtor is telling me that their client bought in 2016 for $659,900 and that the sale happened off MLS. Is their client having trouble recalling?

Sure my non-sceptical side says sweeping up-zoning needs to happen in general in these areas. Like VICTORIA. There is barely a single-family home in Fairfield anyway for example. They almost all at least have a suite or two. Spot zoning is tedious and arduous. I’ve said that a million times before. However, the reality of converting Vancouver SFHs to duplexes is a slow piecemeal process. Meanwhile you just goosed the value immediately for 90% of every SFH.

Home ownership.

Is that with or without a mortgage. I wonder what that number would look like.

I don’t think that fairly frames the issue at all.

Few people actually say they want housing to become “cheap” which in Vancouver, will probably never happen anyways. Most people want it to be affordable, ie, that it reflects the economy around it. So, say I reframe your statement to say,

“The idea that if new housing is not affordable it doesn’t help affordability is probably the most persistent and most persistently wrong out there that is hurting affordability.”

Now you see the problem, which is what Dasmo (I think) is arguing. Unaffordable to locals is unaffordable period, regardless of whether it would cost them 80% of their income or 8000% of their income: they simply don’t make enough money to service the cost. In both cases, the same social and economic impoverishment occurs, GDP biases towards RE to a ridiculous degree, and the RE market itself becomes inherently dangerous and unstable.

The closest I could meet your statement in the middle would be to say that even if the new supply is unaffordable, it does increase the likelihood, by virtue of there being more of it, that the prices could eventually fall to something affordable – which means that the local homebuyer in that market segment, could make the payments comfortably at a given price and interest rate.

$4M is objectively more affordable than $6M. Don’t tell me it doesn’t help.

And the duplexes will not cost $4M.

The idea that if new housing is not cheap it doesn’t help affordability is probably the most persistent and most persistently wrong out there that is hurting affordability. All new supply helps, as long as it is oriented towards residents.

To hold up my skeptic representation here my thoughts are Van up-zoned to prop up the market not for altruistic reasons. It was a low hanging fruit considering the political mask that it can wear…. It does nothing for affordable housing now that it’s easier to build two 4 million dollar houses instead of one 6 million dollar one.

Totally agree Barrister. 100% uninspired by the concrete plans of anyone running at the moment mostly because they don’t exist.

I’ll be putting up a piece summarizing the housing platforms (such as they exist) for Victoria and Saanich council candidates before election.

I listened to a couple of candidate for city council tonight not sure if I am more angry or

just depressed. Asked both of them to name three concrete specific things that they would like to see done to improve the city or changes they would like to make. Neither one of them could come up with a single thing that was specific. I thought I was giving them a nice polite easy question. Ask them both to be more specific after getting none answers (saying that we need to do something about the homeless downtown is not an answer to the question when they dont give you a single specific thing that they plan to do about it). I honestly dont think that they where dancing around the question they simply had no policy or vision as to what needs to be done. It was not a matter of me disagreeing with them but rather they did not have a single specific plan that they were running on. I dont mean a detailed plan but there was absolutely nothing; not a single thing they want to accomplish. My neighbour commented that the city is filled with idiots that thrive on magical thinking and I am beginning to wonder if he is right.

God help you all. Unfortunately democracy has a bad habit of producing the type of government that people deserve.

Big sista across the water showing some pain. Can’t happen here cause we’re an island right ? $70K here and gwac and Intorovert would have a cardiac. 😉

Seattle home prices drop by $70,000 in three months as market continues to cool

The number of homes for sale across King County surged up 66 percent in the past year — and 86 percent just in the city of Seattle — the biggest rise in more than a decade.

Meanwhile the stock market is up 100%. You don’t make zip until you sell and no owners on here have admitted to cashing out. 40% move down can happen faster than the rise.

Thank you for clearing up the confusion Leo, greatly appreciated!!