April 9th Market Update

Weekly sales numbers courtesy of the VREB.

| Apr 2018 |

Apr

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 158 | 885 | |||

| New Listings | 331 | 1270 | |||

| Active Listings | 1842 | 1690 | |||

| Sales to New Listings | 48% | 70% | |||

| Sales Projection | — | ||||

| Months of Inventory | 1.9 | ||||

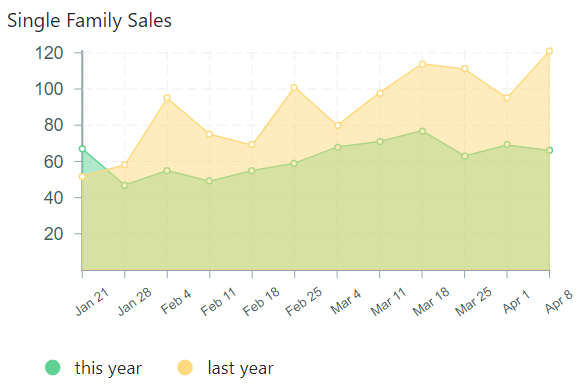

As we progress into the spring the declines are getting more pronounced in the single family market. The dip we saw a couple weeks ago has continued and I’m tired of saying it, but this is not the time of the year for sales to be flat. Overall sales are down 30% but in single family its north of 40%. Meanwhile inventory is up 10%.

Those sluggish sales are starting to show up in the days on market which rose from 13 to 19 in the past week. These are small increases but coming far ahead of the usual seasonal slowdown. On pricing, the median single family house is selling for 15% over assessment (estimated value at July 1, 2017) while the median condo is at 19% over.

The condo market, while not weakening as much as the single family market is still down some 30%. Inventory is still desperately low there though and new listings are not coming on quickly enough to change that yet. On that front, we will have to wait on any units to be driven onto the market from the spec tax (no real sign of that yet) or some of the very high level of new construction to be completed. Although much of what is currently under construction is already sold, many of those units are bought by investors/speculators and will hit the market after completion anyway to try to take advantage of the runup in condo prices.

Classy, people say this when they lack maturity and have no valid argument to contribute.

New post: https://househuntvictoria.ca/latest

RE Lost Soul:

Time to put Lost Soul on the ignore list.

Your copy/paste job doesn’t help me much, holmes. Give me a link directly connecting their growth to crap oil transport or I call BS!!!!

My family sold their house in Regina for approx. $120K in 2000 (bought in 1979 for $76K). It would now be around $300K.

When I moved here in 2001, a similar house would have been around $300K and would now be around $900K. You could also say $400K to $1.2M if you compare location (i.e. near the university). It’s hard to compare directly because the neighbourhoods aren’t exactly the same, and Victoria has a large price premium for certain neighbourhoods.

Since government salaries are public, I recently did some comparison, and the jobs I looked at had similar salaries. Imagine if you make $100K here or there, but an average house costs $500K less there. If only I could tolerate the cold. Apparently other people also see advantages worth paying for to be in Victoria. And they are able to pay, however that has been enabled.

“You understand that it’s coming to market regardless right?”

I don’t think he does. That generation’s engagement with problems is limited to tub-thumping and solipsism. It would be optimistic to try and introduce rationality into the discussion.

You need to learn how to use the World Wide Web:

Meanwhile, CN is focused on clearing the backlog, Finn said. CN Rail has ordered 200 new locomotives and expects to get 60 this year and leased 130 locomotives in the interim.

The company is also hiring more than 1,000 new employees

From Alberta.

It’s still coming from somewhere or you wouldn’t be driving around, or getting your garbage from China, or wearing Goretex rain gear or drinking out of plastic water bottles, or going on trips on airplanes or enjoying fruits and vegetables in the middle of winter.

Oh wait, it’s not the oil that’s the problem. It’s the people in this province who demand oil, and things that come from it.

While I don’t love flooding river valleys this does actually make sense. Massive backup hydroelectric storage enables more reliance on intermittent renewables like wind and solar. We are going to need a whole lot of that to wean the North American power grid off of burning coal for electricity.

De-carbonizing the economy is not going to be easy or cheap, but getting rid of coal fired electricity is a good first step. Metallurgical coal (most of what BC exports) can come later.

Assuming basic economics works, denying the oil cheap transport via pipeline will mean that less of it will come to market. If transport by train was a perfect substitute for pipelines, Alberta and the oil companies wouldn’t be in such a tizzy about needing a pipeline.

Show me proof of this, cite a source or something? Or I will deem you just another fear mongering politically driven crackpot like Don Pittis.

Hi Grant:

How about these (all allow pets):

http://www.usedvictoria.com/classified-ad/4-Bedroom-Full-House-on-Oak-Bay-Border-no-suites_31556916

http://www.usedvictoria.com/classified-ad/House-for-Rent-in-Gordon-Head—4-Bed-2-Bath-Fully-Renovated-Avail-Sept-1st_22251286

Actually there are quite a few (some have suite though) in usedVictoria with 3 to 4 bedrooms, allow pets and rent under $4k/m, and in good or okay locations

@Michael you are misinterpreting that population graph. Boomers are a spike, millennials are a block and the block is bigger than the boomers. Why do you think we are building bike lanes?

I so agree Deb.

I have had incredible luck with putting my needs out there. If you write a detailed, honest, well thought out ad people will respond.

Victorians will help out. It really is an amazing community.

@Grant

Have you tried advertising for a place in the area you want to stay in. That is how we have found our last 3 places. Granted we don’t have a dog but it is worth a try. Used Victoria always works for us and add a family photo. Be honest about your situation if you do get a reply.

Good luck.

You understand that it’s coming to market regardless right?

It’s just going to be coming in a railcar instead of a pipeline. CN is already upping capacity.

@Grant

If I were in your shoes, I’d call up Remax and see if they have any rentals. I think they tend to have a sales and property management division. If not them, then one of the other brokerages. A lot of realtors post available rentals, so they’re another source to inquire with.

I have seen some lovely Oak Bay houses for rent. They are out there. Join some Facebook groups like Victoria rentals and the Oak Bay locals group. People are amazingly helpful and have connections.

I can’t believe there aren’t

some really nice places for rent if you can afford them.

Where it is really tough is for people in the middle and lower end of the spectrum. Then all you have you have is crap.

Any who are opposed to transmountain please feel free to post comments on this CBC news article….

http://www.cbc.ca/news/canada/british-columbia/b-c-business-leaders-announce-campaign-in-support-of-trans-mountain-pipeline-1.4616388

Band together and stop this insanity!!!

“You must be desperate, dude. You’re reaching so hard!”

Desperate? Where the hell have you been? Scouring international publications for tourist brochures is “desperate”.

Victoria is front page international headline news for last 2 weeks from our local whistleblower . You’re looking at the back page where no one reads.

Horgan seems to be the only west coast premiere in the last few terms that hasn’t acted like some posturing gangster. I didn’t like his approval of Site C but on the whole, he’s doing well IMO.

The world is a complicated place, but given how dire the climate situation is, I don’t think that matters. Does generating a fatal blow to Canadian nationalism matter when we’re talking about Earth’s 6th mass extinction? I say no. The TL;DR of climate change and the Paris agreement is that we need to pivot hard and pivot now, and things are still going to get bad. Not only do we need to stop new exploitation, we need to scale back existing exploitation to zero and consider ways to extract CO2 out of the atmosphere.

Picking the middle of two extremes isn’t automatically correct. I honestly don’t give a damn about Alberta’s oil industry. They have other industries. They’ll adapt, as we all will. Or we won’t adapt and we’re doomed. I don’t think it’s that complicated.

@Introvert

It’s important to ask oneself why average home prices in Regina, Halifax, and Calgary aren’t $800k like ours, when we all had the same access to easy credit.

Also, keep in mind that foreign buyers have never played a substantial role in Victoria’s market.

How is 1 in 10 foreign buyers not a substantial role in Saanich? We actually don’t even know to what degree they play since numbered corporations and the various other loop holes allowed them to dump money here.

The price was driven up because non local buyers had more money than local buyers and they didn’t mind spending an extra $50,100 or 200k to buy a home they wanted. What do you think happened to the street where one lady moved from Van to be with her daughter and paid $200k over asking so she could be on that street. Her comment was something like “I sold my place in Vancouver for 2 million. What is another $200k over asking to live beside my daughter we still have a million in the bank. (I’m paraphrasing)

Now pump a bunch more of those through the system and eventually it will continually rise the prices up.

So rent for 2 years…

?

She doesn’t have to change schools once she’s in anyway.

If it works for our situation I will but it’s looking increasingly unlikely. We’ve been looking and not only is the rental market still pretty tight, but for our requirements we’re not finding anything, and that’s even with a (begrudging) willingness to pay close to $4K a month. Seriously I see more wanted ads seeking large Executive style homes for rent than ads for them. And we’ve got a dog. And I’ve got a daughter going into Gr 11 and we’re not going to disrupt her yet again once she’s into a particular school.

@Grant

Like so many have said on here, I think your best bet would be to rent to start with.

Rent for a year or so, figure out what areas you like/don’t like, look at a bunch of homes for sale and let the market work itself out as to which way it’s headed. One month in you might find a house you love, or maybe you’ll figure out the neighborhood you thought you wanted to live in, you don’t actually want to.

If you don’t want to rent, then another other option is to stay at different AirBNBs in different neighborhoods to get a feel for those areas. And then buy.

When I want to get a feel for a neighborhood I walk my dog through it and talk to the neighbors about the area; they’ll tell you all sorts of things.

“Sometimes” being when house prices are at a cyclical low and mortgage rates stay at all time lows for a decade. I’m certainly not going to argue with that.

What are the 3 Universities in town? Uvic, Royal Roads and…. SMU?

You must be desperate, dude. You’re reaching so hard!

Nice pic Intorvert. That’s the same pic CNN used yesterday talking about Victoria’s new notoriety as THE tech connection to the Trump election /Cambridge Analytica/Facebook/Russian fraud right out of Market Square. Such a great tourist attraction now. Come see where the dirty work really went down!

Canadian firm tied to Facebook data scandal got $100K from feds in 2017

Facebook has suspended AggregateIQ amid allegations data was improperly used

http://www.cbc.ca/news/politics/aggregateiq-facebook-liberal-data-1.4609167

“When credit tightens prices fall. When it loosens, they rise. Central banks are raising rates, and banks are now tightening credit both due to regulation and their own assessments of the market’s potential from here.”

Exactly LF. As usual Mike doesn’t get the big point that credit begins to tighten at the end of the credit cycle not the beginning. The US didn’t tighten even with rising rates til it was too late. Canada is doing it now because they know they are up shit creek and lent out too much money the past 10 years.

If we’re going to post fancy charts then pick a spot where you think Toronto is on the roller coaster then put Victoria in the last cart coming over the peak.

http://vancitycondoguide.com/wp-content/uploads/2016/10/Screen-Shot-2016-10-24-at-8.01.34-PM.png

It seems you and Leo are in agreement.

I think most people here get it, Michael. Higher rates imply a hotter economy, implying more wages, begetting higher home prices. Fortunately, it’s actually simpler than that. At essence, home prices are set by how much banks are willing to lend. That moves in cycles. When credit tightens prices fall. When it loosens, they rise. Central banks are raising rates, and banks are now tightening credit both due to regulation and their own assessments of the market’s potential from here.

Interest rates affect how much of that debt we can afford to carry, which is also subject to other variables such as income growth and inflation. Incomes are rising slowly, but consumer debt has been rising much, much faster and for a long time. Now we’re at extreme levels of consumer debt, and sitting on a precipice. Inflation could reduce the burden in nominal terms, but interest rates would spike even higher. This is the rock & hard place that has the BoC pooping bricks.

The only thing “mind boggling” here is if someone honestly believes that rising rates against our current consumer financial backdrop are going to somehow reignite the real estate gravy train at this stage of the cycle. Rising rates are actually one of the largest systemic financial risks this country faces.

I believe that is because gains in employment and income were stronger upward pressures than the downward pressure from rising rates. Both are pushing on the same lever of affordability

Oh, cool. Today the New York Times wrote a glowing piece about Victoria in its Travel section:

It begins:

https://www.nytimes.com/2018/04/12/travel/36-hours-in-victoria-british-columbia.html

“I think irrationality is the problem. For instance, it’s mind-boggling how everyone still holds onto the belief that if rates rise, prices must fall.”

Yeah that’s hilarious James. Mike doesn’t get that’s just why the US crash happened. Wait til we see BC tank as the debt bombs that didn’t exist in mid 2000’s explodes.

18%? Ouch. Condos next.

Ooops posted earlier but worth a second read.

What It Was Like to Get Caught in Toronto’s Housing Slump

“Some 866 homeowners had clinched a sale but were not able to close, eventually selling to another buyer later in the year for C$140,200 less on average. Some buyers had to walk away as they weren’t able to sell their own homes or the banks appraised the house for less than what they agreed to. Another 122 sellers sold their houses for an average $107,325 lower than what they bought it for earlier. By the time the dust had settled in July, the median price had dropped to C$626,000 from C$765,000 in March.

To put that 18 percent four-month decline in perspective, it took major U.S. cities 20 months on average for prices to fall 18 percent from their peaks between 2005 and 2006, with Miami the shortest at 12 months, according to the report.”

https://www.bloomberg.com/news/articles/2018-04-12/what-it-was-like-to-get-caught-in-toronto-s-record-housing-slump

I think renting can def. be more affordable. Here is an example of why it is more expensive to rent than buy sometimes and might be going forward.

Ex. SFH homes purchased for $589k in 2009. Mortgage is $2500/month plus about $500/month in additional ownership costs including repairs and maintenance. House has a suite that is renting for $1200/month. Means actual cost to live there for the owners was $1300/month plus LOC on the down payment of about $300/month. So $1600 a month total. In 2009 it would have rented for $2000/month for the upstairs and $2400/month today. And say the house sold for 800k last year – a profit of about $200k via mere listing and sold privately. So the owners gained $200k plus approx. 30k in lower COL.

So now the new owners have a house worth $800k and a mortgage of $3500/month. They would have paid $2400/month to rent the same space so lets say they are behind $1600/month. Less the suite income and they are behind $400/month and any income tax on the rental income plus the LOC on the down payment. Over time rents will rise and the home will appreciate. Likely they will be in a better position owning that they would have been renting as well if they don’t have to sell in a downturn and interest rates don’t sky rocket – which are risks that some people might feel better not having in their lives.

If you have extremely cheap rent and no suite the numbers will shift too. Extremely cheap rent and secure tenure (ie. parents’ suite? work in exchange for rent?) and I’d be tempted not to buy.

However demand certainly won’t outpace like it has over the past two decades. House-buying 30+ yr-olds are now in decline for the next ~20 years (especially in BC – see below). Also, the decades-long boomer upsizing trend has now started to shift to downsizing. That said, I don’t think SFH will see much in the way of nominal declines thanks to inflation & immigration, but in real terms they will underperform. Single-level houses with security & walking distance to amenities will fair better.

James my intelligent friend, I never once said correlation implies causation. I merely said “holds onto the belief that if rates rise, prices must fall.” Clearly that’s not always the case.

Thanks again Michael for proving you’re an idiot that still believes that Correlation implies causation.

As Leo S said, the Sooke Lake Reservoir supplies the core municipalities. It is a good question and we are lucky to have an excellent water system. If you are an infrastructure nerd, the history is well covered here:

https://en.wikipedia.org/wiki/Timeline_of_the_Greater_Victoria_Water_System

There are a few places in greater Victoria that have smaller local water systems, but many of those are also managed by the CRD.

https://www.crd.bc.ca/service/drinking-water/systems

While the CRD are good stewards, not all of these systems are as robust as the main supply system.

It’s not just rising rates by themselves. In 2012 Seattle house prices were at a cyclical low. I don’t know about Seattle in particular, but US household debt was under 100% of disposable income, another cyclical low. Also Seattle was heading into a tech boom that boosted incomes.

Also your graph is US Treasury yields. Take at look at mortgage rates and you will see that the rise, proportionally, was far lower.

http://www.freddiemac.com/pmms/pmms30.html

Try house prices and household debt at cyclical highs, and see what higher mortgage rates do.

I think irrationality is the problem. For instance, it’s mind-boggling how everyone still holds onto the belief that if rates rise, prices must fall.

(example)

What?? My picture of helicopters deicing wind turbines was over the top?

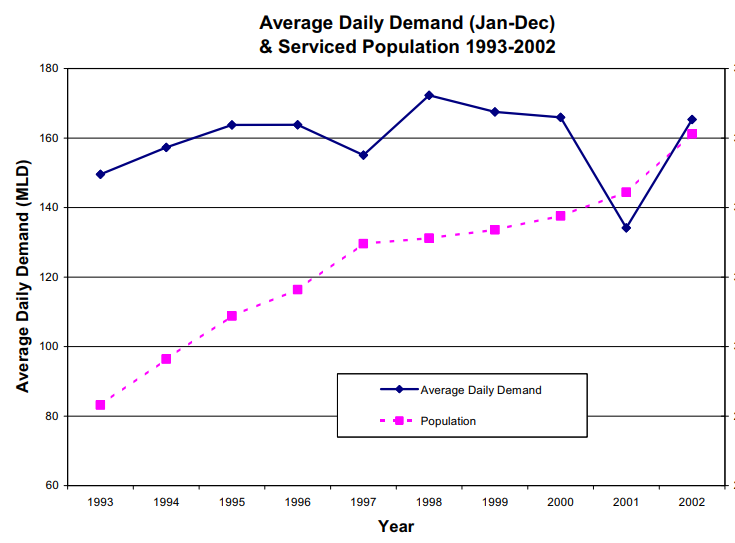

It’s true, and we’re paying more for water because we’re collectively using less of it.

Wanting the perfect option isn’t foolish as much as it is human. Thinking you can get it deliberately and through analysis perhaps is. That doesn’t stop people like us from trying though. It’s part of why my screen name is what it is. 🙂

You’re sensing risk on both ends, because there is. But it’s as I say. Regardless of market, don’t overextend, presume higher rates, and buy to live in for an extended time. But I don’t think you’re going to get burned waiting a bit, if you can.

Let’s be honest, Notley’s probably a goner irrespective of the pipeline outcome. The only difference will be whether she loses by a landslide or by a slightly smaller landslide.

I know.

Grant, I’ve got the solution.

If you can swing it, buy a home that you can afford that meets 90% of your needs for the next 20 years. Stay in the home for 20 years. In the end, you will do very well—there’s no need to worry.

“outdoor water use accounts for almost 50% of water used around the average home in the CRD”

I would hope people are being more responsible and that had lead to drop per capita.

Sooke lake reservoir: https://www.crd.bc.ca/service/drinking-water/watershed-protection/sooke-water-supply-area-(primary-water-supply)

What’s interesting is that water use flatlined after 1995 despite large increase in population.

Sick double burn.

@LocalFool

I vacillate between being confident and then not. I always want the perfect option, or at least to know with certainty which way things are going to go. It’s foolish for sure, especially on stuff like real estate where there are so many factors at play.

On another topic, what’s the drinking water situation like in general on the island? In my research on Mill Bay I’ve discovered they’ve stopped new development until next year due to water issues with the wells they rely on. That got me thinking, where does most of Victoria’s fresh water come from?

I think the numbers support your argument, however the political optics do not. Right now in Alberta you have a major percentage of the populace that are mad as hell Notley and the NDP are in power and worse, that they’ve introduced a carbon tax. For many it’s like Satan incarnate is at the controls. If this pipeline isn’t built, it’ll be one more nail in Notley’s re-election bid. And if the pipeline doesn’t get built, and Notley gets turfed and you have the atrocity of a Jason Kenney led government, oh boy, Canadians everywhere will ruefully wish for the days of the Notley administration. I kid you not – Kenney is off the tracks whacko, a little Republican wannabe.

Oh well, I guess I’ll pop some more popcorn and grab a seat to watch the fireworks.

Removed. I’m not allowing this blog to be used to spread complete nonsense. Take it over to vibrantvictoria - adminGrant, there are currently a lot of tankers passing through the Salish Sea and I don’t hear many people talking about ridding them. What’s at issue is whether we want a lot more.

Also, Alberta has been a “have” province its whole life without the Kinder Morgan expansion, so I don’t accept the argument that this project is crucial to Alberta or to Canada. Canada and Alberta will survive just fine if it fails to proceed.

I agree, Grant, that carbon taxes are good. But the feds have also allowed Alberta to increase its emissions by 47%, which is kind of nuts given what we know about climate change.

I am perfectly happy with BC coal business. BC has no moral right to criticize Alberta and its oil.

Both are being shipped out of the same area. Both are bad for the environment. Both are the old economy. Both are being sold to foreign countries. Difference is Alberta has to use BC`s port which the federal gov has approved.

Do you mean in homebuying? I had thought you were feeling confident, or were you just weighing that side of the argument?

They are comparing a “median house price” (which seems to include condos, since C$765,000 sounds too low for houses at peak) with the Case-Shiller US index which is a repeat sale index. Teranet which is also a repeat sale index doesn’t show nearly as big a decline, less than 10% off peak as of March.

Yeahright

The parking lot is huge and probably developed first until the leases run out.

True. Thankfully, if it’s not First Nations stopping it legally via court decision then it will be First Nations—and concerned citizens—stopping it via continued mass civil disobedience.

I’m guessing Trudeau won’t call in the Army to force this pipeline through. But, then again, I was wrong about Trump becoming president.

…. and one more for the “bears”.

https://www.bloomberg.com/news/articles/2018-04-12/what-it-was-like-to-get-caught-in-toronto-s-record-housing-slump

The 18% dive in four months was faster than in U.S. crash

A speculative mood hit Toronto,’ Realosophy president says

“To put that 18 percent four-month decline in perspective, it took major U.S. cities 20 months on average for prices to fall 18 percent from their peaks between 2005 and 2006, with Miami the shortest at 12 months, according to the report.”

@gwac > BC dirty little secret

Another piece of that article is that when you burn all the coal that’s coming out of BC, the CO2 produced is actually nearly the equivalent of what the oil sands is producing. Clap clap BC.

Iron building is included in the deal but not the business, it stays.

https://vancouverisland.ctvnews.ca/seven-acre-parcel-of-land-in-victoria-s-old-town-up-for-sale-1.3881521

RE: Josh’s post

Come on, are things in life EVER that black and white, or that simple?

Uhm, it actually isn’t stupid, it’s pragmatic. More on this in a bit…

So in isolation I totally agree with your comment – it’s ridiculous that with what we know about carbon and our environment, that sources like the oil sands are considered for future exploitation. It just doesn’t make sense. But we don’t live in an isolated or simple world!

Let’s see how quickly we can put out a spectrum of possible actions.

First let’s set the stage. Let’s all assume for the moment that global warming is real and needs immediate attention. Let’s also acknowledge that Alberta and Saskatchewan are, dumbly or smartly, incredibly reliant on O&G for public revenues, and in fact the economy in general. Let’s also acknowledge the massive amounts of dollars that have flowed out of Alberta as part of redistribution to the rest of Canada, so it’s not like only Alberta has profited here, everyone in Canada has. So, there’s absolutely nothing controversial in anything I’ve listed here.

So our options range from on one end:

1) “All hands on decks, we’ll ignore what the rest of the world does we’re going to be a shining beacon of light and we’re going to mothball those industries in Canada which are dependent on the carbon economy.”

To the other end:

2) “Screw the rest of the world, we’re going to double down on the carbon energy industry” (Which BTW is what Weaver argues Harper did, and I tend to agree with him)

And then we have our options in between.

Josh’s idealist approach is essentially #1. Now, let’s say we’re going to do that. The only way you wouldn’t implement that scenario and not generate a fatal blow to nationalism is to have all the other provinces start to massively directly financial support to Alberta. I can’t even get my head around how it would happen. But we all know that wouldn’t realistically happen. And if that financial compensation didn’t happen, you’d have provinces getting Balkanized so quickly our collective HHV heads would spin. Civil wars start over stuff like this.

So, can we agree we need a 3) something inbetween? And that’s where I think you make some lemonade out of all these lemons. The best scholars and smartest minds are coalescing around the idea that best, most realistic and serious approach to global warming is accomplished via the implementation of carbon taxes. That’s what Trudeau and the Feds want, that’s what the NDP has done in Alberta. But if you’re going to hit the industry, if you’re going to spur economies to transition away from carbon energy, it has to be done in a way that you don’t kill the patient in the process. Thus the federal approval of things like pipelines and in the meantime you hope like hell there is a massive push to diversify those provinces that are so reliant on carbon economy. As an added wrinkle, I really think the best solution is more refining within Canada, but it’s also the more expensive option and no one wants to pony the $ to do it! So again, we’re left to shipping the oil out.

This quandary we’ve globally got ourselves in is a real fucking mess. It’s going to take an intelligent and pragmatic approach to even try to solve it.

Just another take on interest rates and Central Banks.

http://www.cityam.com/283649/interest-rates-should-set-market-not-central-banks

“The US housing bubble was largely generated by the Federal Reserve’s one per cent interest rate policy of 2003-4, which resulted in more houses being built than were justified by the amount of resources and saving in the economy. In a free market, the sudden rise in demand for borrowing would have caused higher interest rates. The current protracted low interest rates have resulted in a global debt bubble which dwarfs the debt bubbles of the last decade.”

BC dirty little secret

https://dogwoodbc.ca/wp-content/uploads/2016/08/Coal-BCs-Dirty-Secret-web.pdf

a quote from the article

“coal is the single greatest threat to civilization and all life on our planet”

Where is Andrew on this???

How do countries with no fossil fuels buried in the ground pay for their social programs?

And Alberta is making sure of it.

I agree with you there. That the NDP is pursuing LNG is hypocritical and wrong. I don’t support it.

Electricity such a fine destruction of land has been done in BC and Canada to produce it. That’s ok…

They do. And so do you.

And BC should do the same with their coal.

If Alberta loves their dirty oil so much they should use it themselves.

To hell with shipping their dirty crap around the world, Alberta should stop being hypocrites and immediately start construction on a mega plant to process and burn their own dirty oil/bitumen and use it to generate electricity.

Alberta can then be a leader in supplying North America with electricity. Alberta can also deal with all the infrastructure required under the Paris Accord and Canadian environmental laws and disposal of the toxic waste.

North America needs energy, but it could be electricity instead of dirty oil.

Just like BC has no legal right to stop a federally approved pipeline crossing it’s land.

Blah blah blah.

Wouldn’t they just not send anything that could be used in Burnaby? They currently switch what they’re sending in the pipeline, from Gas, to jet fuel to Dilbit. Pretty easy to just send dilbit.

Considering something like 80% of the gasoline you currently use comes from this source, you should probably be looking for that cliff. Also the Vancouver Airport is 100% powered by jet fuel from Alberta.

Alberta isn’t going to cut off the oil because they have no legal right to do so, and even if they did it would create havoc with the petroleum industry, Trans Mountain, and TM’s customers in Washington State where most of the oil goes. Notley is just trying to sound tough which I understand since she has an election next year.

While we’re talking about coal, let’s note it’s Alberta that mines thermal coal and uses it to generate power, not BC. It also exports thermal coal via Prince Rupert. You might remember Christy Clark’s grandstanding last year that threatened to impose a tax on thermal coal moving through BC (no legal power to do so, but never mind).

Coal is much worse for the environment, and for individual health on account of mercury emissions.

So instead of getting it from Alberta because of risk of spills into the ocean by tankers, you’re going to get it from other places via tankers.

Well done… well done.

Pat

Read the article. Thermal coal and lots of it goes through the port.

“If there was a big slow down in RE do you think most people would keep their jobs?”

“Sure most people would keep their jobs. 85% of people kept their jobs in the early 1980’s in BC. 90% in the US a decade ago. It only takes a small % of the population to get into trouble to tank the RE market when prices are at historic highs, because sustaining such highs requires the best of all scenarios.”

Good reminder patriotz. In 1981 there was no soup kitchen lineups, no families in the streets. They just carried on, found a second job, found a better job, or just rode it out and cut back on wasteful spending. There’s more support systems in place now then there ever was back then, which was about nil.

10% can tank the market is all you need to remember, and by the looks of the debt bomb it will be more than that this time around.

Amen to that. I now have a very severe case of paralysis by analysis.

“The BC coal exported from Westshore is metallurgical, i.e. it’s used to make steel, not burned as a fuel.”

Lets not let the facts get in the way of gwac’s muddled hypocrisy, patriotz. He thinks Christy wouldn’t be doing the same but she did with the Northern Gateway that also went belly up.

Alberta wants it all, it’s their way or the highway after they blew the bank the last 20 years.

“On Tuesday, Premier Christy Clark said the pipeline will die if Alberta doesn’t negotiate with British Columbia over the sharing of economic benefits.”

““We will not share royalties, and I see nothing else proposed and would not be prepared to consider anything else,” Redford said Tuesday morning.”

““I think it’s a little unreasonable to suggest that I’m trying to destroy Confederation. I’m only trying to get B.C.’s fair share out of this project and make sure we’re protecting our environment. It’s as simple as that,” said Clark”

Sounds very similar to Horgan’s words.

http://www.theprovince.com/news/politics/alison+redford+turns+heat+northern+gateway+royalty+words/6982233/story.html

Where is the outrage????

No outrage because its coming from BC mines..

Gwac,

Thank you for bringing this to the forefront of the debate. Boiled down this issue is no different than transmountain, an environmental and health hazard exist.

In terms of outrage I think coal export has gone under the radar because the level of risk of environmental or health hazard exposure is lower being it is solid not a fluid like diluted bitumen. However, mixture with salt water due to shipping accident, storm surge or tsunami then outrage would fly through the roof.

Still I’m not pleased re: coal exports and will lobby to stop this before disaster strikes.

Yep its the good kind of fossil fuel that causes no harm to extract or use. Got it…..

BC good fossil fuel. Alberta bad fossil fuel. I think I understand.

The BC coal exported from Westshore is metallurgical, i.e. it’s used to make steel, not burned as a fuel.

Also the terminal isn’t in Vancouver, it’s in Delta. In any case the local government has no power to shut it down.

City of Vancouver now defines $3,702 rent as “affordable” housing

It’s 2018, and the City of Vancouver has changed the definition of “for-profit affordable rental housing”. For this year, a new three-bedroom rental on the West Side of the city with a starting rate of $3,702 per month is considered affordable.

A new rental in East Vancouver with three bedrooms with a starting rate of $3,365 is deemed affordable by the city. Also for the same part of the city, the following rates will be considered affordable: $2,505 for a two-bedroom rental; $1,730, one bedroom; and $1,496, studio.

https://www.straight.com/news/1039161/city-vancouver-now-defines-3702-rent-affordable-housing

They’re saying it won’t be long before cars don’t run on gas anymore? No, I guess they’re saying they can cut BC off from petroleum supplies. Aside from their having no legal right to discriminate against other provinces in supply, they seem to be talking at though it’s the 1970’s where oil was in short supply, rather than a sunset commodity that producers are racing to get rid of before the music stops playing. Actually they know the latter quite well, which is why they want that pipeline built.

http://nationalpost.com/news/politics/yes-anti-pipeline-vancouver-really-is-north-americas-largest-exporter-of-coal

Vancouver BC likes other kinds of fossil fuel. Hypocrisy is amazing.

Where is the outrage????

No outrage because its coming from BC mines..

Sorry Patriotz, I didn’t word that quite right but in my opinion and in reference to Leo’s last post there could be many thousands of good jobs lost in the construction and FIRE industry if there was a slowdown. That is not insignificant and I suspect there would be many more jobs lost than that if this turned into a catastrophic event. What happens when everyone stops rolling in money? Expensive tastes don’t go away.

Also something I’ve been thinking about in regards to moving up the RE ladder. I am thinking if you live in a fancy condo or townhouse you are probably not going to want to live in a crappy SFH which may be all the move uppers can now afford. Go from new everything to having to renovate and spend money you don’t have to get fancy cupboards. I know every time I have rented somewhere new I “move up”. Now that I rent a house I would never want to go back to basement dwelling. Luckily my place is not fancy and I’m ok with buying a house equally unfancy.

I was thinking the cheapest houses would get more expensive with the stress test because everyone could afford less but now I’m thinking the opposite. The people moving up now can’t afford anything as nice as what they have so they are waiting. Did anyone paying attention in 2007/8 see the results of this? Any predictions?

Solid rant, Josh. Respect.

We are using more and more oil every day. They’re not trying to help a private corp build a pipeline, they’re trying to get BC to back off screwing over a private company who’s building an already approved pipeline.

Alberta’s counter is: that won’t continue.

Its reckless and stupid to think our social programs pay for themselves.

There is no new economy as some would like people to believe that is generating massive tax dollars. . Its the old economy that pays for all those wonderful social programs people love.

Yep all is going to shit. Bla Bla bla. Endless rhetoric of doom and gloom.

LNG is NDP good but oil is bad. How much energy is used for LNG.

Socialist talk out of both sides of their mouth when it benefits them.

Just because people want it doesn’t mean we should sell it to them. Jobs-above-all-other-considerations is stupid and reckless, and is what is going to eventually destroy everything.

Decades from now our planet will be in shambles, half of all animals will be extinct, there will be heat waves and endless forest fires, and we’ll be saying, “Gee, at least most of us had awesome jobs back in 2018.”

Regina and Halifax have always been cheaper than Victoria, i.e. they started from a much lower base at the beginning of the runup. The fact is that the runup in prices has been Canada wide. Winnipeg has seen a higher % rise since 2000 than Victoria. Calgary and Halifax not far behind. Regina isn’t on Teranet, but I do know it’s a lot more expensive than in 2000.

Into

Its about selling or product to people who want it. This is good for our economy and good for jobs. Too much me in this province.

Josh’s essay is completely right.

It’s astounding that two levels of government are trying to help a private corporation build a pipeline to transport shit we know is hurting the planet and that we don’t need more of.

The argument that I use gas in my car is countered by saying, “Yes, I do. And it got into my fuel tank just fine without the Kinder Morgan pipeline expansion.”

Balls of Steel. Got it….

Steal is what the NDP is doing to taxpayers

Sorry for the confusion.

Sure most people would keep their jobs. 85% of people kept their jobs in the early 1980’s in BC. 90% in the US a decade ago. It only takes a small % of the population to get into trouble to tank the RE market when prices are at historic highs, because sustaining such highs requires the best of all scenarios.

It’s steel, geniuses. Had to chime in after seeing the mistake repeated ~6 times.

It’s not that demand can’t collapse, that prices can’t take a sizable plunge; it’s that prices probably won’t plunge to anywhere near the level that many hope/think. That goes for Toronto, Vancouver, and Victoria, IMO.

It can’t be totally understood; it’s too complex and we always have incomplete data.

And this is coming from Leo, you guys. I love what I’m hearing.

It’s important to ask oneself why average home prices in Regina, Halifax, and Calgary aren’t $800k like ours, when we all had the same access to easy credit.

Also, keep in mind that foreign buyers have never played a substantial role in Victoria’s market.

Interesting & worrisome article about Vancouver.

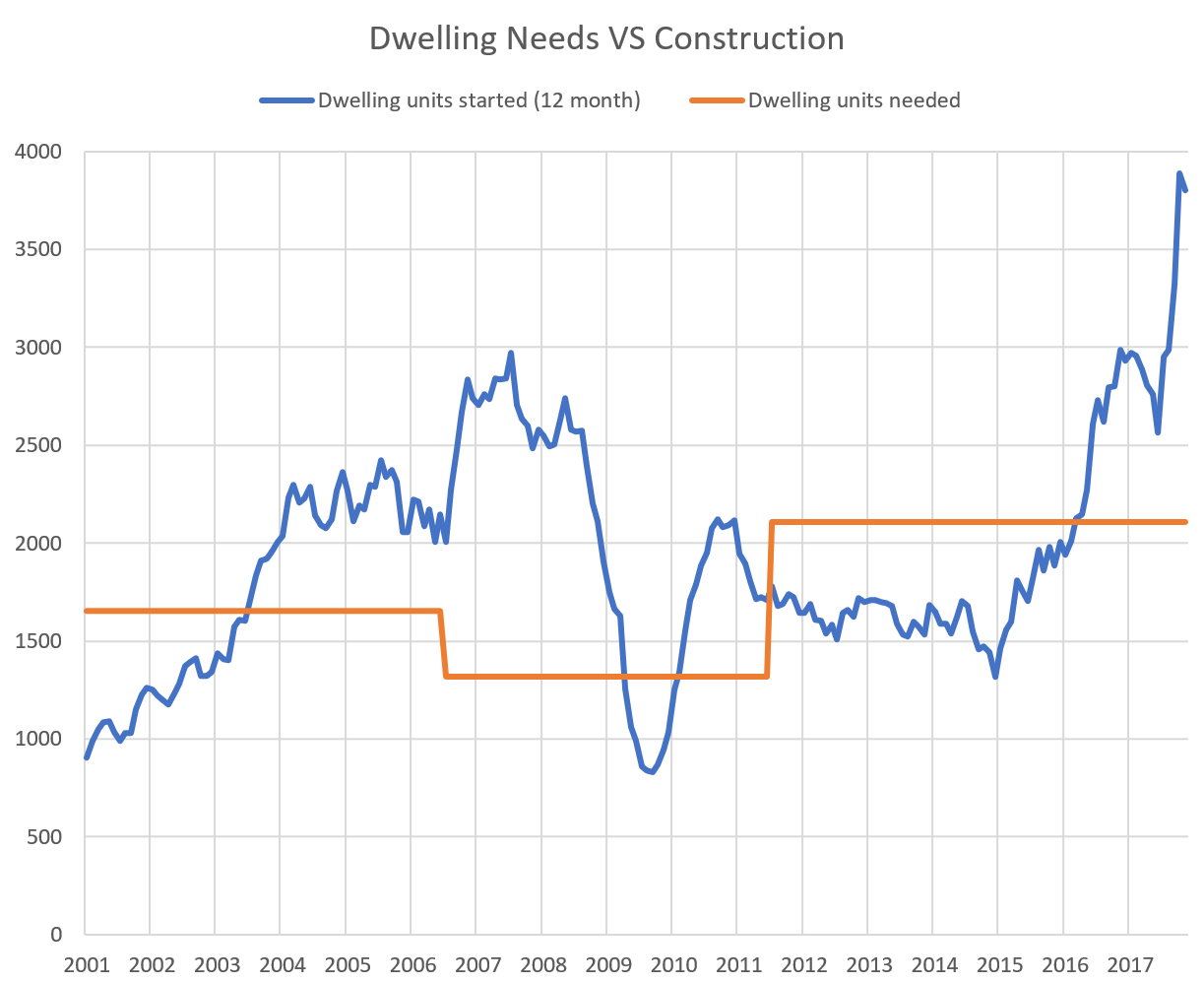

Housing starts roar as sales go quiet

https://biv.com/article/2018/04/housing-starts-roar-sales-go-quiet

Because they think the government will take care of them. I have heard many people I know saying the government won’t raise rates because too many people would be in trouble. I’m not sure what their threshold of “high” is but I guess that is what we are all questioning. What is the interest point that sends everything crumbling?

Totoro, I agree with some of your points but others I cannot understand. In what way is renting not affordable? If I were to buy the house I currently rent my monthly costs would triple (maybe quadruple). And if I were to buy an affordable house it would be in a less desirable location than where I live. Just curious about what you are trying to get at.

It is easy to say prices will go up in the long term so it isn’t risky to buy a house (for first time buyer) and that a job loss or illness isn’t likely. So if you happen to find an 800k house with a suite, it sure as heck won’t be in a desirable neighborhood. And an emergency fund and down payment? 2-300k isn’t easy for most people to save up. Seriously put yourself in someone else’s shoes before you give advice. Lay it out for us. Seriously. Give me real life examples.

This is why I can’t take your advice/predictions seriously. If you cannot imagine other people’s situations how can you make RE predictions? If there was a big slow down in RE do you think most people would keep their jobs? How big of an emergency fund do you think most people have?

Dasmo, perhaps. We’re just arguing intuition, though. But, I did point out earlier – similar reasoning was applied to Toronto and boy-howdy, did sentiment ever change. It would appear then, that that reasoning is not helping them much atm. Does that translate to here? I dunno.

But if people are convinced housing will quickly make them rich, you’ll never build enough. Conversely, if people suddenly are convinced they’re going to get Mattamy’ed and be financially FUBARed, you bet a significant portion of demand will evaporate even if much less was being built than there is.

I wonder why they would be interested in publishing that on the Vancouver Sun.

What about that whole global warming thing? You can’t support the accelerated exploitation of fossil fuels without being a climate denier. I suppose you could if you were a nihilist, but I’m assuming you don’t actually want to cause the sea to swallow cities, mass extinctions and the worst migrate crisis in human history.

Trudeau’s line of “let’s use the profits from oil to invest in clean energy” is amazing levels of stupidity. Or perhaps assumes amazing levels of stupidity in the public. Wind is already cheaper than coal and solar continues to plummet.

Ponder for a moment the total lunacy of taking chunks of tar-laden sand, diluting them with a mixture of salt water and hydraulic fluid, putting them in a pipe to ship across 1/3rd of the most mountainous regions of the world’s second-largest country, shipping them across the largest ocean, and refining it on the literal other side of the world. Do you seriously think that’s going to lower gas prices around the corner from your house? Do you seriously think we should be exploiting the world’s dirtiest source of oil after the Paris agreement? If so, it would be vastly more efficient to locate your nearest cliff and leap from it.

“Plus he probably owns a stack of oil stocks”

He is a she. She is very smart and good at her job. To discuss intelligently trying watching it.

No LF, we need overbuilding in a big way to drop prices – in a big way. We need to overshoot present demand AND have demand drop. Then you will be in full on buyers territory. Otherwise it will be as before. Opportunity for those bold to seek it but no obvious fire sale.

gwac,

ICYMI, that’s the interviewer’s job. BNN is pro oil, they pump stocks for a business. Plus he probably owns a stack of oil stocks.

Spec tax working on Van rentals. Victoria next. Good work Horgan !

New empty-homes tax beginning to ease the rental picture

http://vancouversun.com/sponsored/business-sponsored/new-empty-homes-tax-beginning-to-ease-the-rental-picture

Agree Leo, but that’s a different issue and something that’s been going on for a long time. I don’t really even think that’s a problem and it happens anywhere a city grows. However and IMO, compositional changes in inventory and resultant price growth in SFHs due to simple population growth is inadequate in explaining what this market, and many other markets in Canada, have seen over the last ~2 years. I know, you’re not saying it is.

I agree with Gwac who thinks that’s not as much as a factor here than in Van or Tor. Victoria has seen itself deal with increased speculation, be a pressure relief valve from other markets, FOMO, population growth, dropping rates etc. It’d be foolish to pin it to one cause. But I bet speculation and FOMO have made a substantive contribution within the last 2 years.

Another way to say this is, “we need supply to meet demand”. Yes, true. But as Gwac pointed out, it goes both ways: Either an increase in supply, drop in demand or both. Usually both. Lots of the former is coming on-line, if I’m not mistaken.

Hawk

The interviewer did a good job dealing with his BS and circle talk.

“Watch the whole thing. This guy is controlling the NDP and the province.”

Common sense always gets the righties tighties in a knot. 😉

“While we are on the oil subject…”

I like how Leif always repeats my posts. Keep up the good work lad. 😉

Back to the debt bomb and coming housing correction. If you wait for Stats Can to prove it then you’ve already lost bigtime.

Canadians warned to climb out of debt before it’s too late, as threat of cooling housing markets looms

“Hannah, president of the Credit Counselling Society, is seeing an influx of clients as higher financing costs begin to bite and people find it harder to manage. Phone calls were up 5.3 per cent in the first quarter from a year earlier, while online chats increased 40 per cent.”

http://business.financialpost.com/news/economy/dr-debt-warns-canadians-to-get-financial-houses-in-order

https://www.bnn.ca/the-one-way-b-c-will-back-down-from-trans-mountain-fight-1.1054793

Watch the whole thing. This guy is controlling the NDP and the province.

@gwac prices won’t budge in the stats until a lot more pressure happens. There is a huge perceptual crutch for sellers to list high and stay there. It’s that official letter they have telling them there house is worth one million dollars. This is why it’s only sales that are sliding. The other crutch is low vacancy rates so some that don’t sell can choose to rent if it works. It’s like post financial crisis. The stats didn’t show it but deals were out there.

@Leo, the immense complexity, cost and time it takes to build condos are the constraints. Land is as well but in relation to infrastructure. So condos can’t simply fill demand. They are built in a speculative way by nature due to the time it takes to complete. In reference to the infrastructure constraints I will say again, if the NDP was truly motivated to help the housing crisis they would have committed a tram link from west hills to downtown on the E&N ASAP. Then provided loans/grants for private industry to build affordable rental and owned high density dwellings along the corridor. We actually need overbuilding in a big way to have an impact on prices. Otherwise all that will happen is a handful of people will get deals on a handful of properties from sellers who find themselves in a bind.

Local Fool:

I am not really convinced that speculation alone was the major cause of the run up in prices here in Victoria. Obviously there are a number of factors but the two outstanding ones are a combination of low mortgage rates and a flood of retires from Vancouver and Alberta who had deep pockets.

https://www.bnn.ca/trudeau-to-meet-with-notley-horgan-about-trans-mountain-on-sunday-1.1054973

Horgan is going to lose the fight. This is more than just about a pipeline its about how confederation works. Do we want 10 countries or 1. Now how do we make Horgan look like he did not lose and face the wrath of the Prof.

I would love to be in that meeting. Alberta has nothing to lose in this fight and will go all out. Trudeau and Horgan have a lot to lose.

Alberta has paid way more into this country than it has gotten back and its time to get something back.

Does anyone have any idea what the average mortgage in Victoria is at the moment?

I am not sure why some people seem to be surprised that mortgage rates are moving back to about 5% or 6%. That is a pretty average rate and certainly, historically speaking, would not be considered high.

For a good period of time normal rates ran between 10 and 12% and thus was definitely not peak rates back then. A rise in interest rates was pretty well predictable and actually was a lot longer in coming than most people thought. Yet, some people are acting like it is a shocking development. On the other hand, at my age, I guess I should not be really be surprised.

As the city grows demand for SFH will outpace supply for sure, and has been for decades. Doesn’t mean prices can’t and won’t come down but SFH will get more unaffordable to the average family over time. There is no way around that. Condos is more the speculative mania I would say since there are no fundamental constraints to supply there. There might be temporary shortages but those will always be corrected by increased construction (like we see now). Just a matter of time. If you’re gonna invest in condos, it better make sense from a rental yield perspective.

No argument there. Haha!

Arrived back in Calgary to -4° heavy fog and snowing. North backyards have 3′ of snow while south front yard are barren really quite weird. HAWK I hope you are out enjoying Victoria’s fine weather, if only on my behalf, enjoy a cool one on some great little outdoor patio, cheers Bud!

LF

Something has to happen to either supply or demand for a correction here. Will that correction stagnate prices or send them down no idea. I stopped trying to understand this market along time ago. Everything is against this market/ rates/ regulation/ prices and prices have not budged.

Too much knowledge/being rational has been a bad thing in this market the past 4 years.

I read both articles and much to my surprise they contain nearly identical information. My guess is that the CIBC article duplicating previous information is to justify the horrendous monthly mortgage payment increases they are about to inflict on many hard working Canadians.

How opportunistic, I hope that come renewal time homeowners speak to their accountant or crunch the numbers from the bank to see if everything jives. This will be the next big bank scam some employee blows the whistle on…high mortgage payments that are not in line with promised interest rates. Then the bank will add it to fine print in mortgage agreement and make it all ok. Criminals.

Side note: CIBC would not even look at my mortgage refinance application to try and save my home before I was forced to sell. Is there a regulator I can report them to for this?

Not sure if population growth is above or below any long term trend. Regardless, the same argument was (and is actually still being) made by Torontonians. Centre of the universe, everyone wants to be here, choice destination from immigrants. So far, it’s not helping them as aggregate demand continues to collapse.

I can’t statistically debate your point on spec here vs in bigger cities, but you can make inferences from the suddenness and scale of the demand increase here – to say nothing of the hundreds of thousands of dollars that prices have suddenly increased. IMO, these are signs of speculative activity. Housing markets don’t just shoot up like that from organic growth.

Totoro

I agree with your post. The problem is most have neither of the two.

Rising rates just add to the issue. People can do whatever they want all I said was you have to have balls of steal to take on that much debt and more. I am sure there is credit card debt with a lot of these people with those size mortgages.

Local its all totally insanity. The problem is we have a huge supply/demand issue that is not going away with the expected population growth here in the core and on the island. Spec is not as prevalent here as Van and Toronto.

Losing a job – make sure you have an emergency fund.

Health issues – make sure you have disability insurance.

There is risk in everything. Don’t buy and you run the risk of lost affordability and equity as many here have discovered. I’m not saying that you should buy what you cannot afford to pay for, I am saying that not buying has its own set of concerns that I personally find way more risky than job loss or ill health.

If you are worried, having a suite provides some peace of mind and you can always rent out a room or the whole place and move into the suite if times are really difficult and you’ve just bought and don’t have enough equity to sell.

And renting is not that affordable in Victoria as an alternative unless you are willing to live in less desirable places than you would as an owner.

Thanks Leo and Patriotz.

Gwac, 2240 Woodhouse Rd is one such a case. Who knows how much they borrowed, but if it’s a fair bit, I suspect they’re going to regret it over the next few years. Balls of steel is one way to put it. Monumental foolishness could be another.

The degree to which people have a way of rationalizing and normalizing complete and utter insanity is quite interesting to me. People who don’t really ever leave this region have no idea how unhinged and frighteningly hilarious our market currently is.

If you feel some of the posts here are rooted in fear, nothing compares to the writings of fear mongering, politically driven crackpot Don Pittis….

http://www.cbc.ca/news/business/canada-real-estate-home-prices-1.4613215

Leif

My words were you have to have balls of steal to borrow that kind of money. Losing a jobs or health issues make that size unmanageable in bad times.

“http://www.rbc.com/economics/economic-reports/pdf/financial-markets/rates.pdf

RBC forecast rates from Monday”

Looks like a a bump up in rates for each quarter of 2018. That would put us 1% higher at the end of 2018 around 4.5% for a fixed 5 year and 6.5% for the stress test.

That is an extra $450 a month for a $600k mortgage.

Btw going back to whoever said a 600k mortgage is crazy I’m pretty sure that is where entry is on a 800k home these day’s. That is 25% down and then all the other closing costs, moving, furniture etc on top.

I look back and think how easy it would have been to buy a house in the nicer neighborhoods from 2013 to 2015 in terms of affordability in this city. That is not the case anymore which is why at least 6 or 7 of us posters who all make significant wages are on the sidelines.

My understanding matches patriotz however I thought when Teranet reduced the delay in their indexes they may have mixed in some current sale data as well. Don’t quote me on that but the Teranet used to be 6 weeks delayed, now down to 2 weeks.

Note that Teranet gets its data from Land Titles, so the index reflects the prices of properties that closed in a given month. As well it uses a 3 month moving average. This means the March index represents closings in Jan, Feb and March 2018, most of which would likely be “sales” (in real estate board parlance) that took place in 2017.

From that globe article

“For Vicki Clayton, the cost of her failed deal was even higher. After a buyer agreed to pay $1.9-million for her North York tear-down bungalow in late April, 2017, the transaction fell through as the market plunged and the two parties couldn’t agree on a lower price. She relisted her house and it recently sold for $1.27-million, a loss of $630,000”

The buyer could be on the hook for the 630k plus legal fees. ouch

Leo, in your opinion is it reasonable to surmise that that increase was from the pre-B20 rush?

We’re winning!

The Teranet–National Bank National Composite House Price IndexTM was unchanged in March – the first time outside a recession when the March composite index was not up at least 0.2 percentage points from February and the first time outside a recession when March indexes were up for only four of the 11 metropolitan markets of the composite index – Victoria (1.0%), Vancouver (0.5%), Winnipeg (0.5%) and Quebec City (0.1%)

http://www.rbc.com/economics/economic-reports/pdf/financial-markets/rates.pdf

RBC forecast rates from Monday…

Holy shite did I lose a lot of sleep over potential closing default on my recent home sale here. I guess it remains to be seen if prices decline as quickly as in Toronto?

Nice silver bullet Leif! I bet Trudeau or one of his team read this article and it took the wind out of their sails. I have a couple things to contribute from having my boots on the ground in the oilsands.

Believe it or not, many oilsands producers are already selling byproducts from heavy oil upgrading to overseas buyers. Getting the same byproduct along with bitumen and some other heavy metals, including and aside from ones mentioned in article may be seen as a good buy overseas(F****** nuts, I know). The reason is with the twinning of transmountain in place, transport costs would be lower. Buyers already in the producers rolodex may jump at the opportunity to pay a fraction for partially refined product. It will be very cheap but after final refining and shipping costs I don’t know where it will be compared to refined light crude.

The sad part in all of this for me is that technology has been implemented in the oilsands to minimize environmental impact (I believe much more can still be done) but in some places overseas lack of regulation and moral conscience would jeopardize an already fragile planet even more.

This pipeline must be stopped at all costs!!!

“Hundreds of homeowners whose real estate transactions collapsed in the aftermath of Toronto’s market plunge last spring lost an average of $140,000 in property value when they eventually managed to sell their houses, according to a new report.

The study is the first to measure the loss of market value associated with so-called closing defaults, an unwelcome reality of real estate that lawyers say surged in the last half of 2017.

The report also identifies high demand from real estate investors as a key factor that fuelled the region’s white-hot market in early 2017. Investors bought 16.5 per cent of all low-rise houses in the Greater Toronto Area in the first quarter last year, a 65-per-cent increase compared to 12 months earlier.”

https://www.theglobeandmail.com/real-estate/toronto/article-closing-defaults-hit-toronto-sellers-hard-in-housing-plunge-report/

While we are on the oil subject…

Here is an interesting view into why the pipeline and shipping from Vancouver is already inferior. I had not read about LOOP or the VLLC’S.

https://www.nationalobserver.com/2018/03/07/opinion/fatal-flaw-albertas-oil-expansion

“These are the reasons—hiding in plain sight—why Western Canada bitumen fetches the infamous “discount” price per barrel compared to oil supplies shipped from Texas and the North Sea. The LOOP terminal for VLCCs will magnify that spread, and no mythical Asian refiner, trader, or nation is likely to purchase for long a dirtier product that costs more and arrives on slower, smaller boats.”

“917k omfg. How much was a place like this 2012. 500k”

What was 5 year interest rates like in 2012 ? 5.37% . I’m sure it will revisit the old price as rates move back to that level over the next year or so, along with the stress test at 7.37% What’s a couple more grand a month on the mortgage these days eh ? Chicken scratch. 😉

So you’re saying we aren’t currently building thousands of rentals?

Well you pay for the privilege of the open. So it all depends on whether you think you will need to break it or not. Another strategy is to go variable, penalties are usually lower (commonly 3 months interest instead of the interest rate differential).

@Leif: I wish! Rockland area. We’ve found the city somewhat resistant to subdivision in our area. So much for densification!

@VicInvestor1983 and @gwac

2240 Woodhouse Rd is pretty much all land value

Total Value Assessed as of July 1st, 2017 $880,900

Land $818,000

Buildings $62,900

Previous Year Value $803,300

Land $736,000

Buildings $67,300

https://www.bcassessment.ca/Property/Info/QTAwMDBIUTk5Ng==

@VicInvestor1983 is your 1/2 acre in Oak Bay?

@Gwac: I guess that’s the land value now in that area! Boy am I glad I’m sitting on a 1/2 acre lot!

Thanks Leif, FWIW the new article was published by CIBC, haven’t had time to read BoC one yet.

Glad there is some forward thinking politicians versus the stone age oil based righties.

“Weaver said that while it’s clear the Canadian oil sector is hurting, the country’s focus on pipelines won’t help the economy.

“[Stephen] Harper and the Conservatives went all-in on an oil economy at a time when the rest of the world was diversifying its economy, and moving toward renewables, moving toward clean tech and bringing technology together with our resource sector,” Weaver said.

“Dragging us, kicking and screaming back to the early 21st century is precisely what’s going to leave us behind.”

917k omfg. How much was a place like this 2012. 500k

The flattening of the yield curve http://www.worldgovernmentbonds.com/country/united-states/ suggest to me that rates might not being going up very fast or very far lest they trigger the dreaded Trump-cession.

What was the sell price for 2240 Woodhouse?

$917,500 is what it shows on my list.

What was the sell price for 2240 Woodhouse?

@Lost Soul

https://betterdwelling.com/bank-of-canada-half-of-canadian-real-estate-mortgages-will-renew-by-next-year/

Looks like November 2017. On google you can click “Tools” -> “Time” and select a custom range. I find it very useful when trying to read past news and or recent news within the past few days etc.

https://www.bnn.ca/b-c-green-party-s-weaver-slams-alberta-feds-panicked-trans-mountain-response-1.1053989

Wow the beaver is ripping it up! I too think Energy East was the way to go or at least refine it somewhere on the west (BC or AB) not shipping bitumen to China or SEA.

It is great to see the her yaking away and Weaver laying it down.

As far as I can tell Leif this is a new report on many major media websites. Can you please post a link with date of original article from last summer? People are already getting caught with their pants down (like myself) and are forced to sell or default if they can’t pay outrageously high monthly payments. This is just the beginning IMO.

~buy gold 2018

Interest rates are rising as we type – the Fed’s moves are raising rates in the bond market which is where mortgage rates are set. I commented about this previously. Cheap money has be sloshing around the world for far too long – we are now seeing some inflation and labour market constraints – rates must rise and I expect the BOC to move April 18 or May 30 – let’s get on with it.

As far as the pipleline goes – one view is the BC [NDP and Greens] are forward looking. Let’s stop being the Trudeau Sr. and Jr. lap-dogs for the USA. Alberta always wants to strut about their bitumen wealth. Come on – Canada would be far, far better off if we stopped being a branch-plant for the USA. Canada needs to develop refining capacity and refine our own bitumen in to oil and gas that we can sell to the world and become energy independent ourselves. Why is eastern Canada importing oil from Venesuala to refine. Energy East was a better plan that Trans-Mountain. A Texas company looking to profit and reward its own shareholders – they must be laughing.

I am not a fan of the Green Party, but spend 12 minutes watching this exchange:

https://www.bnn.ca/b-c-green-party-s-weaver-slams-alberta-feds-panicked-trans-mountain-response-1.1053989

Or, do you favour this bullying:

https://www.bnn.ca/alberta-prepared-to-stare-down-b-c-over-trans-mountain-notley-1.1054069

Developing a refining platform in Canada [do it in Alberta or in BC or both] will create great wealth for Canada.

Yup. The court will force BC to accept its fate. Horgan will be deeply disappointed, but we have to respect the court decision. Notley will be the new hero in Alberta, she will save the environment by intro more taxes. Selfie-boy is a happy boy, $$$ to the East and RCMP will do his dirty work.

@Lost Soul that was originally posted about sometime last summer or fall regarding 50% of all mortgages coming up for renewal in 2018. The question will be before or after rates go up again and again.

I’m curious if Poloz will raise rates in the next meeting or May as has been suggested in another recent post.

Lost Soul, the worst news seems to have been missed today. Rates are heading up bigtime in the US, which means 5 year rates here going up in tandem effecting the stress tests even more.

The Federal Reserve plans to hike interest rates even faster

“Buoyed by a strengthening economy and increased confidence that the Federal Reserve will reach its inflation target in the near future, central bank policymakers suggested the path of future rate hikes could be “slightly steeper” over the next few years than previously thought, according to minutes of their March meeting released on Wednesday.”

http://money.cnn.com/2018/04/11/news/economy/fed-rate-hike/index.html?sr=twCNN041118economy0628PMStory

Gas=liquidity

Will the market reach the gas station? Will it run out? Will the hike to the gas station be long or short?

@Barrister

11 year old yoddler in Walmart:

https://www.youtube.com/watch?v=jlmNwjdYVnk

@Grant

Yes, the BC liberals are incredibly corrupt.

@Dasmo

Good analogy. Curious to see how many months this phase lasts.

This is why I say the market is sputtering. It’s like when you run out of gas. You don’t just slow down or stop…. you surge and slow surge and slow (and pray you make the gas station). Cream that has all the check boxes for someone ready to buy pops up and Bam. While other places sit…. wirrrrr. This is also why you won’t see price reductions in the stats. The houses that aren’t selling are just sitting with small incremental price reductions as the sellers aren’t desperate enough especially when they see the place a few doors down get listed and it sells instantly, overnight. So everyone is confused.

Oh boy…look at this…half of all mortgages up for renewal in 2018?

https://www.bnn.ca/nearly-half-of-canada-s-mortgages-up-for-renewal-in-2018-cibc-1.1053959

http://www.news1130.com/2018/04/10/home-construction-surges-metro-vancouver-led-condos/

Construction is at record highs all across the country. This means we will have a record number of units coming on to the market for the next few years no matter what happens to prices. Construction will eventually drop with falling prices, but historically this has not been accompanied by rising rents. One big reason is that when RE amounts to an all time high % of the economy, there is a significant dropoff in average household income during RE downturns.

Marko this what confuses me too. Houses seem to be listed higher than I think it should and then sell quickly and at or over asking. Other houses sit there. It is messing with me a bit because I’m waiting to find something and so surprised at the prices this year in what seems to be a less heated market than last year. The only thing I can think of is that the sentiment hasn’t quite changed yet. These buyers don’t read the news? The people paying these prices have no doubt that prices will be higher 3 months from now because they have already seen the increases over the past few years and their dreams of home ownership slipping from them. It is a last ditch effort before the next big increases. Or maybe people finally able to move up with big gains on their condos?

Marko, any pattern via market segment, or is it everything?

Everything from crappy old condos to house in Sun Rivers (Sooke) you see going over asking.

Kudos Grant, it partially opened in December 2017. What’s missing in the ability to refine dil. bit. into gasoline or even diesel here. This refinery is only refining light oil to produce diesel now. They are a long ways from producing gasoline from heavy oil in Alberta. It’s not economically or environmentally feasible like your post mentioned.

Spoken like a true Albertan supporter but hey I admire anyone who does not contribute to fear. They just have to be honest with themselves in the process.

Thanks for the support Introvert and for teaching me how to quote a comment. +1

Yeah, I think what gets lost in the news sound-bites, is that the issue is deep and complex. Alberta has painted itself into a corner and now is holding BC hostage to solve its mismanagement. Low royalties followed by a drop in prices led to a glut of capacity. In Canada we have a long tradition of exporting jobs.

Sadly David Black’s Kitimat refinery seems like a long-shot (thanks for the link, Introvert).

Personally, I think they should rebuild the refinery in Kamloops. It is in the perfect spot for the existing pipeline and could supply all of Southern BC. This would ease our reliance on Washinton state refineries.

Anyway, behind all the smoke and noise from Notley, in fact Horgan has actually done very little to stop the pipeline beyond asking for a court ruling on jurisdiction.

Link from patriotz below:

Marko, any pattern via market segment, or is it everything?

What an odd market I am seeing….sales slowing for sure, lots of price drops, new listings very low by historically comparisons and an abnormal number of properties going over asking price.

2016/2017 made a lot more sense….a ton of over asking but very few price drops with high sales.

It’s like the pattern right now is it gets listed and sells over asking or it doesn’t sell.

Source: Canadian Centre for Policy Alternatives

I’m pretty sure we have always had it backwards: corporations should be begging the government to operate in our abundant province, as opposed to the government begging corporations to crap on our environment for measly royalties and ephemeral jobs.

Apparently, when bitumen mixes with sediment (e.g., from the Fraser River delta, hello!) it tends to sink. Also, the studies on bitumen that they’re doing are in a lab in Saskatchewan, if I’m not mistaken. So, real-world studies! No worries there…

Alberta has always been shortsighted and seemingly can’t break the habit.

It bites them at every oil downturn, and yet they never learn.

GTA House Prices Falling Furthest Where Investors Once Dominated

…Realosophy Realty published a report titled Freeholds on Fire: How Investor Demand for Houses is Driving Up Prices in the Greater Toronto Area that looked at how investors in the GTA were impacting the market for single family homes.

Looking at the areas that have had the steepest decline in prices during the first quarter of 2018 versus the first quarter of 2017, it’s no surprise that the areas that were once dominated by investors are showing the steepest price declines.

We published our report to caution buyers about the impacts this type of speculative buying might have on the market in these areas. One of the key signs of a housing bubble is when more and more people start to buy real estate strictly as an investment rather than as a place to live.

This means that as a home buyer you want to be more cautious about buying in a neighbourhood that has a high number of investors.

https://www.movesmartly.com/articles/gta-house-prices-falling-furthest-where-investors-once-dominated

I’m sure I’ll get jumped all over for this comment, but with new tanker designs the chance of a spill is actually very, very low. I totally get the desire to not increase the chances from what they are, but if there truly was a iron clad principle that “beaches aren’t a science experiment”, then all existing oil tanker traffic should also be banned immediately. A bitumen spill would likely be worse, but let’s not kid ourselves because any oil spill would be a disaster.

Some of the references from that national observer link on the changing dynamics of shipping oil bear vetting out. However I can’t imagine the oil execs in Alberta are ignorant of them – they aren’t going to build a pipeline if there won’t be tankers to pick it up.

Anyways – that’s enough from me on this off topic item.

“As most of us are aware, the GreeNDP recently instituted campaign finance reform”

Yep more theft from the taxpayers

“The national observer Hawk . Not oil friendly.”

Because they post actual facts and numbers that doesn’t conform to the influential massive money the oil & gas corps swing ? Bummer you don’t want to hear about facts.

If was going to spend billions on a pipeline, I think I would want to know if the ships are able to maximize my investment and aren’t going to competitors in the US instead or insist on major price cuts to the bitumen junk oil after the fact. I think it’s called being a smart businessman.

I’m all for oil and gas bizz too Lost Soul but lets step back and look at the emergency oil spill response teams ? Where are they ? Not a peep out of JT and Notley.

That was Horgan’s first reason for not wanting the pipeline and they have yet to produce a game plan. Sorry, but my west coast beaches aren’t a science experiment.

On that note, the new North West Refinery is now (2017) in operation in Alberta, and its the first refinery built in Canada in 30 YEARS. (kind of astounding isn’t it?) The Alberta government and industry would love to not have to ship oil out because oil producers are losing gobs of money on the price differentials between WCS and WTI. But here’s the rub – nobody wants to take on the risk of building the refineries and even NWR has been derided as a boondoggle. The refinery is currently doing 20,000bpd (adding a value of $23/barrel margin to producers) and will scale to 80,000 by summer 2018, but it’s pretty small in relation to production capacities. Proposals to bump up NWR capacity are not being warmly received in Alberta because existing costs for NWR have soared to $9.5 billion (a doubling from $5.7B estimates). The Alberta government contributed a lot of dollars to the project and is considered to have been an unwise investment.

So the appetite for new refineries isn’t there which means the alternative is to ship oil out. Pipeline, rail tanker, whatever, because the economics are so much better to get the refining done in Asia or the US. And in the bigger picture everyone wants to fill their car up with gas for cheap (and keep all sorts of transportation related costs down), keep refineries out of their backyard, restrict oil movement through sensitive ecosystems, keep jobs and reduce carbon output. See any problems with that wish-list? But I digress..

Personally I don’t feel too sorry for Alberta’s plight. They’ve made their bed for the last 50 years and the lack of economic diversification is now really starting to bite. But I’m actually proud of the current NDP government because they recognize the situation and had the balls to implement a carbon tax. In return they bargained with the feds to get this pipeline built because the economic conditions in Alberta pretty much require it. And BC is (rightly or wrongly, the distinction is irrelevant) boxing Alberta into a corner. It’s a wounded cat and the fight could get ugly.

Yes.

David Black first proposed such an idea six years ago, but it seems to be going nowhere.

http://www.cbc.ca/news/canada/british-columbia/media-mogul-david-black-makes-another-pitch-for-his-northern-refinery-1.3922739

Some aren’t. Some are. Some really are.

As most of us are aware, the GreeNDP recently instituted campaign finance reform:

http://www.cbc.ca/news/canada/british-columbia/b-c-government-to-ban-union-and-corporate-political-donations-1.4295482

That is sobering as hell, thanks Hawk. Wake up Alberta before it’s too late.

I think politicians care about seats. Those 2 represent what the population felt about the NDP and their great 90s success.

I appreciate your kindness, all of this info on diluted bitumen makes it very difficult to support twinning trans mountain pipeline, even for someone such as myself who is in support of Oil and Gas economic growth.

Crap oil shipping out of BC puts our ecosystem at great risk. If this pipeline goes through I will devote my life to preventing a spill and training to be qualified if one does (optimistic new found purpose ha)!

The false instant economic gratification from this pipeline creates a huge illusion for Alberta, it’s painfully short sighted. Please join me in stopping this.

The national observer Hawk . Not oil friendly.

https://en.m.wikipedia.org/wiki/National_Observer_(Canada)

Who cares about seats gwac. The numbers prove you’re full of it.

Governments change every ten years which is good for everyone. The facts are the books are cooked but the voters don’t see it til now.

Money laundering is rampant and the economy is built upon the next fool buying your four walled shack. Usually referred to as a house of sand economy.