January – Condos jump, sales drop

Quick preview of the month’s numbers before the official news release by the board. The median for both condos and single family homes jumped about $30,000 from December to January. However year over year, condos are up about 14% while single family is only up 5%.

As discussed before, it’s interesting to see the condo market go so insane when market conditions are actually on a cooling trend, and significantly less in favour of sellers than this time last year.

You won’t really find many single family houses under $600,000 anymore in the core (4 to be exact). That amount gets you only the smallest rancher. Even heading west there won’t be anything under half a million until you get to Sooke. Meanwhile condos built in the last two decades bigger than a matchbox start at $350,000.

The CMHC has taken notice (or rather, continues to take notice), rating Victoria as having strong evidence of overvaluation, and moderate evidence of price acceleration and overheating.

Now I’ve criticized the CMHC’s housing market assessments quite a lot in the past. They’ve been late to the game, and not particularly consistent. However it seems to have settled down now, with the past few assessments coming to more or less the same conclusion. Victoria has a high level of vulnerability. But what exactly does that mean?

CMHC says that the Housing Market Assessment (HMA) “can help Canadians make more informed decisions”. So what should we do in response to the several quarters of red alerts? I’ve pointed out before that we have had extended periods in the past where CMHC’s indicators would have called out similar problematic conditions (mid 2000s) and yet nothing happened. So far the only indicator I’ve seen that has any particular pattern to it is affordability. In that area, we are at record highs (i.e. record poor affordability) in Victoria and getting to a point where we normally see a pullback.

RBC Affordability Report – Dec 2017

The good news is that with a low unemployment rate, we should see wages increase which will improve affordability. On the other hand, in past corrections our affordability improved mostly because of dropping interest rates and price stagnation. Right now, rates are going the opposite way, and could very well hurt affordability more quickly than even continued price increases. More on this in a future article.

Monday numbers: https://househuntvictoria.ca/latest

Interesting article:

https://www.google.ca/amp/www.cbc.ca/amp/1.4519972

Looks like vancity is implementing it’s own stress test and Desjardin is using OFSI stress test. The article says mortgage brokers seeing 20% more rejections but I think that is anecdotal.

Marko that was 2009. that video

As it should be relatively loose – it’s not designed to target Canadians who have paid into the system. Do you honestly believe that the international student that bought the home in Point Grey for $31 million would be able to exempt themselves out of the 600k exemption under any circumstance? That’s who it would be designed to catch.

A headache? Well, if people have turned their primary residence into their primary investment asset, then filling out some forms are a minor price to pay to exert some pushback on the state of affairs that has essentially become the wild west and is strangling the working class. I pay 5k every year to file taxes for my corporation that generates far more economic output that my home ever could.

Um, no. I think RE windfalls should be taxed after a certain threshold simply because a home produces so little economically given its ridiculously large appetite for money and credit that could be going to drive the economy. It has such a poor economic contribution in comparison to other investments, yet all other investments are taxed, as they should be. Even on the sale of my corporation I am exempt only on the first 850k. And that’s only on the sale of shares. Assets? Capital gain right off the bat. Even in the “taxes=socialism=communism” USA only the first 500k of your primary residence is exempt, capital gain thereafter.

With that said, I am open to hearing why these massive windfalls should not be taxed whatsoever. Perhaps I am missing something obvious.

We’re talking going forward. Stress test at 6% is not a stretch when it’s currently above 5.

@Marko

Well written post. One thing I learned over many years and cycles in my business career is “going with the flow” and the “trend is your friend”. You can complain all you want or just ride the tide. We’ve done much better riding the tide over the last 35 years than fighting it and not even talking real estate.

You can slice/dice/analyze all you want, but the trend lines prevail almost all the time.

#RE Speculation

It is prevalent everywhere in the world. See the Economist Global Price Index since 1980

See where Canada ranks versus comparable countries.

http://www.propertyclub.co.nz/wp-content/uploads/2017/03/NZ-global-house-price-index.jpg

Also you wonder why Forestry companies, traditionally the biggest driver in the BC economy are dwindling in importance. Wood products are getting less money than they were in 1996. But finished products have gone up crazy. The Ikea bentwood chair and stool was 99$ when it was introduced in the late 90s…now? $299…?

http://forisk.com/wordpress/wp-content/assets/SLA-figure-20161026.jpg

No one is complaining about the chair?

The bulls have taken advantage of such conditions to make immense profits.

I kind of clued into this when I worked with my father doing stone masonry. Society doesn’t reward hard work, it rewards flipping paper. Hence, I am flipping paper for a living not framing houses or building stone walls.

Same with student loans; I took 10 years to pay mine to take advantage of conditions (tax deductible, government randomly reduced balance owing on two occasions in the mid 2000s, easier to get scholarships/bursaries for subsequent education if you check off “yes” to student loans on the application). If conditions were unfavorable I had enough money after 3 months of working to pay them off.

Same extends to the low interest environment. Either you complain about how savers are not rewarded in society or you take advantage of the situation.

Do I think it is complete BS that someone who was irresponsible and maxed out on credit to buy the biggest possible house with 5% down has down way better than someone who prudently wanted to avoid CMHC fees, but the market ran away on them during their quest fora 20% downpayment? Yes, but that is the situation. Either your read it and adapt or you just complain how the situation isn’t what you want it to be.

I’m no fan of Garth on accuracy but he’s on the money with rates.

What? https://www.youtube.com/watch?v=1S7OumrfatY – foward to 5:45

“The world is full of cheap money & lots of it has found its way into BC RE. ”

Vicinvestor,

You’re assuming the cheap money is here forever. Major bull mistake. Like when bond/stock markets freeze up, so does credit and margin. Two things that make the financial world turn. Squeeze either of them and a major money flow situation happens like every other crisis the last 40 years.

Credit markets are not some never ending freebie and with a 10 year run on stock and housing markets is peaking waiting for the catalyst(s) to send them south. It’s now a global market place of intertwined economies. With trade wars brewing and higher rates on the way it will impact house markets way more powerful than in the mid 2000’s rate hikes when household debt levels were nothing like today. Markets101.

This is known as shadow inventory. Homes that are vacant and can be put on the market immediately if the investor/speculator feels the market is in a downturn. It could swamp the number of house listings over night or I should say as fast as the agents can type up a listing.

It’s a risk that few people are talking about.

It’s Monday morning in Asia and all the stock markets are down. Should be an interesting Monday morning in North America when our markets open. Maybe we’ll see those new stock exchange AI computer algorithms automatically kick in to prevent a stock market ‘flash crash’.

Not the ones on this blog. They make think they are bulls but they haven’t bought anything in the last few years. They are steers.

VicInvestor1983

Everything in Vancouver is overpriced. In what world is it normal for a house to be 2+M dollars? It’s a total shit show and at some point the party will end, likely similar to musical chairs.

I do know that SFH’s did the run up first, followed by condos and THs. Now SFHs have flattened while condos/THs are still on a tear; I think it’s only a matter of time before condos/THs follow SFHs. As for that timeline, no idea.

One thing you have to remember is for the longest time we’ve had declining interest rates. Now we have increasing interest rates. That will affect the market to some degree.

As you know, the foreign buyers are a huge influence in Vancouver. When you walk down a street and 60%+ of the street is foreign owned and empty on the majority of the streets, that’s a huge problem, and something that needs to be addressed and not allowed to happen.

I truly don’t believe Vancouver has a supply issue. I don’t buy into the whole “we are surrounded by mountains/ ocean etc” argument — yes it’s true on one hand, but we don’t have the population base yet for it to be the major problem; when I see the amount of empty homes, it’s laughable. We have an occupancy problem. We have a huge money laundering/ foreign funds/speculation (foreign and local) problem that is the number 1 priority to address in my opinion. Settle that, and let’s see where the market goes.

Exactly. While there is a domestic component, a major cause has been foreign capital. Vancouver is now N. America’s capital of luxury cars. The bears can keep blaming this or that (if only CHMC hadn’t, If only foreign $& was controlled, blah blah). But conditions are what they are. The bulls have taken advantage of such conditions to make immense profits.

I agree to a point, but certain issues need regulation. This is one of them. Governments around the world have outmoded or no policies in place to deal with the global capital phenomenon. I can guarantee you without the foreign capital tsunami, house prices in BC (and TO) would be nowhere near what they have risen to. 27x times earnings in Vancouver for a SFH? Under what interest rate environment, without involving an historic Ponzi scheme, could it reach such a level? Don’t look domestic – wage trends over the last three decades barely outpace inflation.

Once and future, thanks for the > tip.

@Andy7: how do you define ‘over-priced’? And what % correction are you expecting to see ‘affordability’? I have family who told me today their $650k condos pre-bought 2 years ago are now $1 million. Thus, we’d need a 35% correction just to get to 2016 prices. Do you predict such a large correction?

Fascinating how complimentary markets such as Vancouver and Victoria sometimes work in unison as home prices in Vancouver stagnate and condominium prices increase like we are having here.

The underlying cause is likely qualifying for a mortgage by local buyers. Those that are not affected by the regulations are home owners using their equity to buy a condo.

And by local buyers I mean local buyers not Introvert’s made up definition to suit his agenda to cause needless difficulties or distress for others just to get some giggles.

VicInvestor1983

Might not seem like much, but when you put that on a 2 M dollar house, that’s a 100-200 k drop. Granted, those houses are still WAY overpriced, but SFH always leads the way and the condos and THs follow at a later date.

No, and the beauty of the thing is, no one needs to be these days. It’s never been easier to find information, to look up and see what lessons we can learn from history. Folks – we’ve been here before, and made all the same arguments before. All you have to do is go look. The only difference is, we’ve never been so indebted before.

No there isn’t, but you may have heard the expression that it “tends to rhyme”. Expansions and contractions in our housing market are inevitable, and despite what some people repeatedly insist, its material underpinnings haven’t changed. Yes, our market has been getting broader investor interest because of how it’s behaving, but the former is completely contingent on the latter. They won’t be as interested when the market moves to contract. Housing must track incomes over the long term, with acknowledgement to interest rates and the ease of credit. Our housing market is very, very imbalanced right now, so we can expect to see more of the decelerating trend we have been. It’s not some farcical concept confined to the purview of a raging renter – this is the immutable laws of market dynamics at work. This will all end, only to eventually begin again.

Truth. CMHC should be scrapped and the banks be made to carry 100% of the risk, IMO.

@ Hawk: i’m not a housing bull. Kinda ambivalent & have been humbled with many previous failed outlooks. But, you’re too negative about the market. Even SFH in Van had dropped a modest 5-10%. But condos have been on a tear, some increasing by 50% in the last 2-3 years. The world is full of cheap money & lots of it has found its way into BC RE. We’ll see where this massive debt bubble goes. At this point, the real estate speceulators have really won out.

Busting up the long term casino/real estate fraud game is scaring the Asians off of BC. Detached sales in Van are flat just as house prices here are flat. The easy money has been made which is clearly another bubble top sign.

Douglas Todd: Why illicit foreign casino cash often goes straight into Vancouver housing

“It’s almost hard to believe the dismaying stories that Postmedia investigative reporter Sam Cooper has been producing about the laundering of hundreds of millions of dollars of East Asian cash through Metro Vancouver casinos and the funnelling of much of it into the city’s pricey real estate.

Yet Cooper continues to clearly map out, using impeccable high-level sources, the trans-national connections between Chinese drug traffickers, B.C. casinos and the city’s housing market. He has been so effective that NDP Attorney General David Eby ended years of B.C. Liberal inaction on casino fraud to launch an investigation by money-laundering specialist Peter German.”

http://vancouversun.com/opinion/columnists/douglas-todd-why-illicit-foreign-casino-cash-often-goes-straight-into-vancouver-housing

I welcome all foreigners to dump their Golden Head ghost houses. 1 out of 5 houses of any hood is a serious detriment to the community. Anyone wanting more of it is a disgrace to their neighbors.

Everything must go: Chinese investors sell off their foreign RE holdings

As HNA Group’s debt troubles seem to go from from bad to worse, the company is now planning on selling of about $16 billion in assets in the first six months of 2018, Bloomberg reports.

But HNA is not the only company with a global portfolio whose wings are being clipped by the Chinese government’s efforts to stymie capital outflows: Dalian Wanda Group and Anbang Insurance Group are also putting properties on the market — or being asked to, in the latter’s case, according to Bloomberg.

https://therealdeal.com/2018/02/03/everything-must-go-chinese-investors-sell-off-their-foreign-re-holdings/

“Someone takes a blog with all anonymous contributors too seriously!”

Says the paranoid narcissist who had the evidence a lock because of dates times etc. of being a child killer. You need a shrink ASAP.

No, I’m not, but luckily there’s no immutable law that history must repeat itself.

Asian investors, I welcome you! I particularly recommend Gordon Head! 🙂

Are you old enough to remember 1981?

This was a very common news article way back in 1981/82…

Someone posted another similar news article a week ago, but we should expect to see these stories weekly in 2018/19.

In 1981 the news started off with these stories, then as the weeks passed we had weekly news of people selling because the new mortgage rate was unaffordable, then came the weekly foreclosure lists… The news articles were always written as emotional pieces… “this unfortunate person…” and then people blamed the government for everything. Then as the situation worsened the news reporters quoted the government who started blaming the speculators. I wonder if it will be any different this time.

…déjà vu or just a temporary anomaly…

https://www.thestar.com/business/real_estate/2018/01/29/how-a-softer-housing-market-has-crushed-pre-construction-home-buyers-dreams.html

I’m with you. Defer your property taxes. Scavenge more bottles. Sell your million-dollar house and buy a $500K condo.

The only thing destitute about these people is their imagination.

A reminder to everyone who wants to quote something: Use a > symbol in front of the text (like in old-school emails).

It makes it a little easier to see who is saying what…

Dasmo, I agree.

Beancounter, you were talking about the source of funds used to buy the house. CRA only asks to keep tax records for a finite time. What proportion of the BC housing stock will have those records?

Yes, I was speaking in hypotheticals. However, as I said before:

Home owners are perceived as being the last of the wealthy.

Is it any wonder that the government is coming after them.

This is a group of people that can be bled with taxes and more taxes and more taxes.

Some wisdom for those that talk about their cars and their homes and their investments and how rich they are. Other people are listening.

If you want to keep your wealth – learn to keep your mouth shut.

has anyone heard about this? Juwai partnering up with an Asian investment group to make it easier to sell real estate to ultra rich Asian investors.

https://betterdwelling.com/juwai-partners-sell-us-canadian-real-estate-ultra-rich-asian-investors/

I second that question as well. Does anyone know or have a theory?

In so many ways it’s government that helped create the housing mess via CMHC, cheap money, allowing banks to take zero risk etc. Why would you think that more heavy handed intervention in a punitive way will end well?

Well, that is certainly a position you can take. It is one where no-one can accumulate value in their home. You are essentially saying that, when you retire, you need to sell your home and become a renter.

Also, why not make income tax over 150k at 100%? After all, those people who make more money have an advantage over everyone else? I am not going to take a position on either of those things, but you are proposing a complete rewriting of the social contract.

Some day you may no longer be young and, sitting where the boomers are now, you may find the law is not so much to your liking. Personally, I don’t find “socialism” to be a bad word, like many in the USA do now, but this may be going a little too far for many people’s tastes.”

Come on now. You seem to be taking a nonsensically extreme position on this. You mean to tell me that a house bought in 1942 for 25k now worth let’s say $6 million and sold, that the windfall gain shouldn’t be taxed at all? What other “investments” do you know of in this country can you make such a profit and not be taxed? You do realize that real estate, for the locals who live and work here plus the retirees, this is largely a zero-sum game, yes? To protect that equity there is a cost. That cost is the increased debt burden for everyone that works and pays rent or a mortgage.

“So every SFH in Greater Vancouver is going to have an extra 20k tax? Wow.”

Yes. I am not wowed. You own a home assessed over $1 million and you pay income taxes then you will not pay the surtax. I don’t get the issue with this. Skip the actual amounts, they would be graded to make sense. Again, don’t quote me on the ACTUAL tax rate, that’s ridiculous to assume a number I’ve thrown out before morning coffee should be the number written into law. I’m confused. Your argument seems to be based on a premise that hardly anyone works and pays taxes. On a side note – you can get NOAs dating back to 2004, 14 years. For most homeowners who aren’t retired, they are employed. Usually you need a job to pay the mortgage. The cases you mention are decidedly in the minority – see below.

For seniors or the “early” retiree, defer the tax or use a paid-in CPP threshold and exempt them completely. They won’t ever have to see it. Not sure what the issue is with this.

“What about someone that loses their job? What about someone that goes back to school? What about someone who is a new Canadian, moving to Canada for a brand new job? Do they have to make enough to pay 20k in income tax just to have the right to a house? Not every foreign immigrant is a rich speculator.”

The cases you mention above are:

1. Loses their job? Well, that implies they had a job. Unemployed? You still file taxes each year. Unemployment exemption. I don’t get what the issue is? Student loans carry the exact same exemption program.

2. Goes back to school? Again, you will have to more clearly state the situation in which you bought a house, now assessed at more than $1 million, and have no records of employment or any taxes paid back 14 years, and are able to afford the home. Could have an exemption program as above.

3. You just arrived here and bought a house for more than $1 million, and don’t pay at least 20k in taxes to the government? Hmmm. Yeah, I would say you should pay the tax for at least the first year.

The problem is not retirees or immigrants. The problem is speculators. They should have a much higher tax on non-primary residences. Maybe 2-3% of the value of the unit per year. That ought to get the market going again.

The concept of housing needs to change. Right now it’s regarded as a casino. The situation needs to change, so that it is viewed as a place to live first.

I suspect that a lot of people in Canada are going to get burned once the market turns. Most of the younger generation do not know what hard times are like, and they’re going to be in for a shock.

Continuing on this thought. It is worrying to me that:

1) We have a problem with housing.

2) It needs to be fixed.

3) Some people are lashing out at random targets, like retirees.

Surely we should try to address the actual problems. I don’t think retirees are the problem, do you? I am neither a boomer or retiree, but I do hope to retire before I die.

Addendum: I agree with Chris that the politics of boomers have been part of the problem, but punishing individual home owners for the sins of their age-group seems draconian to me. Your retiree neighbour may have voted against every “idiot” who got elected.

“devalue our currency to remain competitive”

I understand Trump is very receptive to foreign countries devaluing to gain market share over American Companies so this should be no problem for Canada…

“Some day you may no longer be young and, sitting where the boomers are now, you may find the law is not so much to your liking”

Considering the boomers created the current situation (a complete lack of any foresight in housing), ran up insurmountable public debt by electing idiot after idiot which of course ensured they paid less tax than what the country required, I don’t really blame the millenniums for being somewhat pissed off!

swch25

I think there might be a lot of potential homeowners coming to this site for information regarding the housing market in Victoria. For first time buyers in particular, the timing of making the huge decision to buy or not to buy is significant. To only have real estate bulls (one extreme) posting anecdotes that all is rosy in Victoria is potentially misleading. ” I’ve never heard anyone I know mention having a HELOC.” HELOCs are out of there, IMHO the stats are alarming. And of course, every person that owns a HELOC would openly share such information with all their friends. But name calling…in kindergarden are we?

Hawk:. “Between 42% and 47% of outstanding mortgages (depending whose numbers you believe) come up for renewal in 2018.”

I have seen this before and I have a question. Does anyone know why so many mortgages would be up for renewal this year? Was 2013 a great time to refinance + huge sales that year?

Well, that is certainly a position you can take. It is one where no-one can accumulate value in their home. You are essentially saying that, when you retire, you need to sell your home and become a renter.

Also, why not make income tax over 150k at 100%? After all, those people who make more money have an advantage over everyone else? I am not going to take a position on either of those things, but you are proposing a complete rewriting of the social contract.

Some day you may no longer be young and, sitting where the boomers are now, you may find the law is not so much to your liking. Personally, I don’t find “socialism” to be a bad word, like many in the USA do now, but this may be going a little too far for many people’s tastes.

Someone takes a blog with all anonymous contributors too seriously!

The question is: why didn’t you?

I never understand why we have sympathy for house rich retirees. It’s behind ludicrous. They have had a huge unfair advantage over millenials. Let them take our a loan against their house and pay their taxes.

So every SFH in Greater Vancouver is going to have an extra 20k tax? Wow.

Beancounter, I can tell you are trying. However, you have obviously never been involved in writing laws or enforcing taxes. This is insane. Not everyone bought their house in the last 3 years and keeps tax records.

(Barrister, I inserted a space into taxis.) I think Beancounter and others are trying to come up with a way that retired people would be exempt. However, I only see hand-waving. What about someone that loses their job? What about someone that goes back to school? What about someone who is a new Canadian, moving to Canada for a brand new job? Do they have to make enough to pay 20k in income tax just to have the right to a house? Not every foreign immigrant is a rich speculator.

There are way too many exemptions that the thing will be riddled with holes, difficult to enforce, and resented by every home owner who has to fill out invasive tax forms every year.

If you make property tax enforcement like the gestapo and treat regular home-owners like criminals, it will not end well. A change in government will happen pretty promptly, I predict. That is too bad, because I tend to agree with the Greens and NDP on a lot of other issues.

“As Garth explains

Nothing like a guy who is always wrong citing another guy who is always wrong.”

You bulls can’t even handle having facts explained to you. Almost 50% of mortgages up for renewal is massive in a new world of stress tests and higher credit qualifying. Sad.

“In case you were wondering, this is a potential disaster for Canadian real estate.

Between 42% and 47% of outstanding mortgages (depending whose numbers you believe) come up for renewal in 2018. Almost all of them will be refinancing at a higher rate, putting pressure on owners in a land where household debt is off the charts. You can bet that many will try to bail out and take their profits at the same time the pool of available buyers is shrunk by rates and regs.”

“Introvert, the level of narcissism that you possess is mind-boggling.”

You got that right. Anyone who can accuse someone on here of being a child killer because they take a holiday from posting, gets proven wrong, then not even have a shred of decency to apologize but spin BS excuses is a level of narcissist reserved for the Trumpians. Extremely disturbing.

@CharlieDontSurf you’re a a little bitter over something. Wow. No reason to be an asshole; we’re all here to learn and try to decipher what’s going on out there. No ones discounting your point of view. Show the same courtesy to others.

I’m not saying the stats are false. There’s a lot of extreme views here to one side or another. The truth probably lies somewhere in the middle.

“Dude, it is assessed as of July 1st, 2017 $369,200 ( 2016 – $290,700)

The seller is shooting for the moon.”

Hey “Dude”, most condos are selling 25 to 30% over assessment. What planet have you been on lately? Southgate condo sold for $725 listed for $400’s. You bull(shitters) are so desperate to save the bubble it’s getting pathetic.

I suspect that a crash in Vancouver would have a major impact on the market in Victoria. What is obvious is that the Victoria market is not supported by the domestic income levels.

I lived in Toronto, Ontario. HELOC is common here as well as owning multiple homes. Many of colleagues and friends I know have mortgages on both residential and investment properties. Those that bought pre-construction houses in the past two years might be difficult to get the conversational mortgages under the stress test. Those that bought the investment properties a few years ago are doing very well financially.

When the asset price rising 20%/year, it created a lot of speculations and anxiety. It looks like the same story repeats in Victoria, maybe in a smaller scale. Vancouver has a different story.

“More unscientific anecdotal data for you: most people I know in vic do own a house (30-something professionals are who i hang out with). I’ve never heard anyone I know mention having a HELOC.”

So the stats on Canadian HELOCs are false. OK thank-you.

If the Toronto housing market crashes and Vancouver experiences a major correction, what will the impact be on Victoria? None? Some? A lot?

The biggest problem with the taxis that it would unfairly hit retired people who have little income but often houses that have risen in value far beyond what they bought them for. This is particularly true in both Vancouver and Victoria. You are talking about levying a tax that is greater than most peoples incomes when they are retired. Probably it would lower house prices but it would also crash whole sectors of the BC economy.

I really believe that it would be much wiser to simply tax non Canadian owned residential property at a high rate. This would discourage foreign ownership, encourage foreign owners to sell and also provide taxable income that would benefit all residents of BC. The impact would not be so great that it would crash both the real estate market and the construction industry.

Personally I really enjoy introverts posts.

He’s right. Anyone who bought before the spike and aggressively paid down principal is sitting pretty. I don’t see how introvert talking about his situation is narcissistic. It’s anecdotal evidence that some people aren’t worried about a crash. I happen to be in a similar situation; as are most people I know.

More unscientific anecdotal data for you: most people I know in vic do own a house (30-something professionals are who i hang out with). I’ve never heard anyone I know mention having a HELOC.

Introverts posts are kind of the reciprocal of hawks posts with some personality. Keep them coming.

Introvert, the level of narcissism that you possess is mind-boggling. I was clearly referring to the current condition of the Canadian housing market, not the housing market at your house.

Congratulations on taking advantage of the low interest rate period we have been experiencing over the last decade and paying down your mortgage. But, I think you are in the minority. I think the majority have been taking out HELOCs for various non-productive or equity diminishing reasons. They were right to buy when they did, but wrong to play HELOC roulette believing that interest rates will never go up and that housing prices will never come down.

Once and Future:

“OK, lets say I believe you that this is the case. Please tell me the details of how this tax will be applied and its exemptions. Really, that was my original question. I want to know how it will stop speculators, but not harm other people, who I would call “regular Canadians”, who only own one home and live in it.

I am certainly prepared to be convinced, but everything I have read (like the Green party paper that Leo S linked to) is just filled with platitudes.”

Set a threshold, say $1 million assessed value for the tax to trigger.

Say tax is 2%.

My home is assessed at $ 1million – I’m assessed 20K in surtax.

My NOA provides the rebate for the 20K, since I pay more than 20k to the government in income tax. Therefore I don’t pay the surtax. If your house is $6 million, your tax would be $120k. Let’s say you claim a poverty level income in Canada, paid only 1k in income tax, then your surtax is $119k.

Exemptions: Provide NOA history and other supporting evidence (date and purchase price of home, etc.) that clearly shows that whatever money was used to help fund the house was earned in Canada one way or another. Let’s say I bought my house when the assessed value was 400k, not 1 million, and I have an NOA history of working in Canada. That could be enough to trigger a complete exemption. We could go on ad nauseam about how to qualify for an exemption, but it is not that difficult an exercise in my opinion, especially with a team of people, and the amount of evidence one could easily provide to the government. Bottom line is that one way or another you will be forced to reveal the source of your funding, which is the root of the problem, and the source of the funding will be used to determine whether or not you pay the tax.

Dude, it is assessed as of July 1st, 2017 $369,200 ( 2016 – $290,700)

The seller is shooting for the moon.

The boxes are just too hot and crazy now, I won’t touch it with a 10-foot pole.

It is funny that Bears are the one timing the market, gamble their heyday trying to beat the market.

The market went up, they lost the bet. Many bears cry foul, want the whole system revoked to suit their ideology.

Really? I’d prefer to be right three out of four times rather than the reverse.

So far, “right, right, right” has meant my house has gone up dramatically in value since 2009 (as I’ve also aggressively paid down the principal). So if a “wrong” happens, and the market crashes, it will have to be one hell of a crash for me to wish I had done things differently.

What were we arguing about? I don’t remember. All I remember is being worried rates might rise, going for the 10 year term at 3.79 which seemed pretty good – and was, and then being offered a deal to switch lenders without penalty. We ended up with 2.49% for the remainder of the term which we are happy with.

Statistics seem to favour variable rates over the longer term though.

Regarding Gate’s thought:

3 rate hikes by the Bank of Canada in less than one year (which also coincides with the time Trump has been in office) certainly provides room for interest rates decrease if needed.

Introvert,

I have been following Garth Turner’s blog for almost two years now. He has correctly predicted the actions of many organizations related to the real estate market in Canada that entire time. I am actually amazed at how accurate his predictions on interest rates have been.

Ross Kay has also been correctly forecasting the Canadian housing market during the last two years. For those with a strong background in research and statistics his podcasts present information that cannot be found anywhere else.

Heard this somewhere…

“I would rather be wrong, wrong, wrong, right, than right, right, right, wrong.”

I’m no fan of Garth on accuracy but he’s on the money with rates. Stress test at 6% is pretty likely

Mostly by aging in place

I have a scenario where rates drop in the short term. If the US pulls out of NAFTA, Canada will be in a position where we have to devalue our currency to remain competitive. One way to do this is to reduce our rates. Political risk is fairly high right now. Trudeau has stated that Canada is ready if the US pulls from NAFTA. Other than a plan to make our product cheaper, how else could he be ready?

Just a thought…

I think though, if you cut through the dramatic presentation that Garth puts on and just look at the numbers he presents, it does merit at least some discussion. The qualifying benchmark is suddenly very much higher than before, in tandem with real rates continuing to rise. Anyone watching the bond market as well? It’s not a pile of nothing going on, things are at least for now, changing. We haven’t even gotten to budget day on February 20th, so we’ll see what that brings.

I had a thought earlier, and I wouldn’t mind a rebuttal or at least another perspective. If you look at about 40 years ago, we had a period of very strong inflation, which seemed to get almost out of control – the BoC responded by jacking up rates all the way to ~21%, which of course ate our RE market at the time.

I’m wondering if, given some of the commentary from the Fed and the BoC, if they’re “anticipating” in advance and trying to proactively prevent excess inflation and a need to have the huge hikes of the early 80’s. Now labour is more global, and I can accept that as a different dynamic from before. But is that very relevant to Canada specifically to a degree that wage gains are a thing of the past? Does anyone here think they’re trying to avoid a repeat of what happened then and perhaps stave off stagflation?

Introvert: Do two wrongs make a right?

They don’t call Garth’s blog greater fool for nothing. I think he’s referring to himself… and talk about tripe in the comments.

If anyone disagrees with Garth’s ignorance around foreign buyers on the west coast it should be Hawk…

I see Hawks feeling better though… or is that worse?

not housing but not sure who else to ask.

Can anyone recommend a good car mechanic in East Saanich? Ours retired.

Agreed – adding that as an introduction is not a credibility enhancer.

Nothing like a guy who is always wrong citing another guy who is always wrong.

837 Selkirk Ave , #103 just reduced $10K to $459K. How can 20 to 25 buyers not want to buy this place ? Nice shape, popular location. Picky buyers is more like it.

2526 Blackwood St in prime Haultain /Cook St area slashed $40K to $649K.

Prime Golden Head slashed $50K to $1.24 million at 4536 Vantreight Drive.

Quite a few in Westshore under the knife as well.

Never a good sign when those syndicated mortgage big shots get busted and given the boot. Never just one cockroach in the kitchen. What’s a billion dollars right ? They have some deals in this town ? 😉

Ontario watchdog revokes licence of Fortress’ lead mortgage broker BDMC

“FSCO said BDMC and three mortgage brokers that marketed Fortress products were fined a total of $1.1 million

BDMC confirmed that it had agreed a settlement with the Financial Services Commission of Ontario (FSCO) and would stop all mortgage brokerage activities. BDMC said it had raised $920 million for real estate projects from over 14,000 investors.”

http://business.financialpost.com/real-estate/mortgages/update-1-ontario-regulator-revokes-mortgage-broker-bdmc-license-after-probe

As Garth explains, the bubble is about to explode as stress tests will hit 6% by year end,the buyers dry up, and all those mortgages up for renewal better have a good job to re-qualify, especially if you’ve maxed out your lottery win on a HELOC. Seniors and millennials will not save you.

“Five-year Canada bonds help determine five-year fixed mortgage rates, which now sit above 3.3% at the chartered banks. It’s no stretch to think they could be 4% by the end of the year (or sooner). Add in the stress test premium dictated by the federal B20 rules, and borrowers (plus renewers who switch lenders) must qualify at the 6% level. Yes, that’s three times the cost of a mortgage back in the halcyon, bubblicious, FOMO, houses-always-go-up days of your youth – 10 months ago.

In case you were wondering, this is a potential disaster for Canadian real estate.

Between 42% and 47% of outstanding mortgages (depending whose numbers you believe) come up for renewal in 2018. Almost all of them will be refinancing at a higher rate, putting pressure on owners in a land where household debt is off the charts. You can bet that many will try to bail out and take their profits at the same time the pool of available buyers is shrunk by rates and regs.”

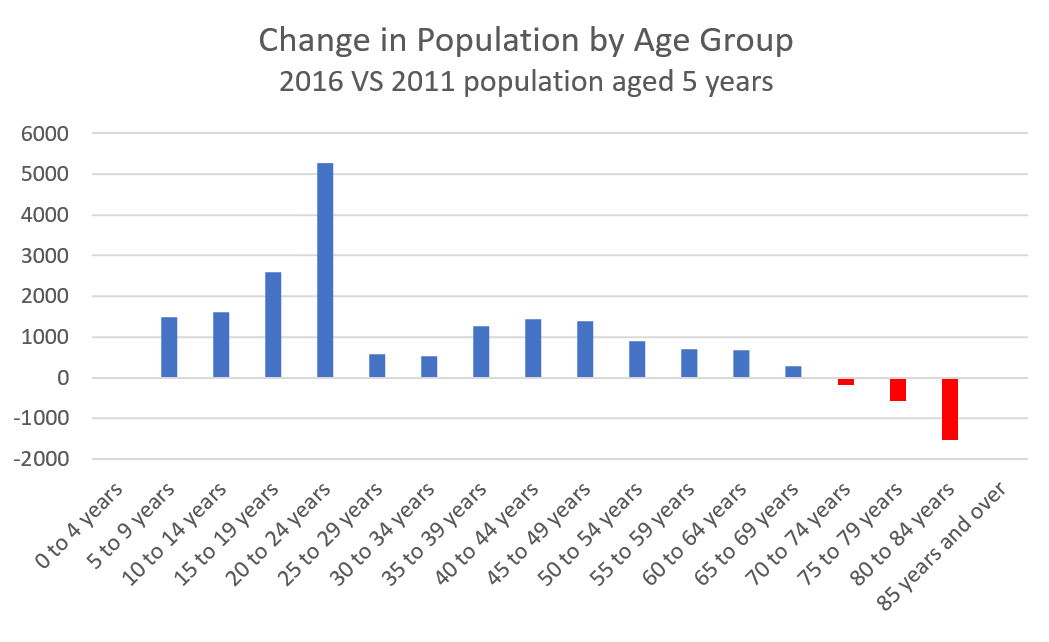

It said with more retirees expected to come to the region every year that’s not about to slow down.

I think they’re looking forward, not at 2016 vs 2011 (as per your barchart).

It wouldn’t really surprise me if the number of seniors doubled here by 2030,

as well as car insurance…lol.

I said:

Bingo said:

What god-given right do people have to borrow money just to make investments? If the bank or government thinks that leverage is dangerous, they can very much step in to reduce it.

There are lots of things that are limited to the rich. There are lots of things that people buy with borrowed money, while trying to act rich, that they really shouldn’t. See the previous conversation about expensive cars.

Everyone has a right to affordable housing, yes. People do not have a right to unlimited borrowing.

No 6:

What is keeping the buyers from offering another 100k might be a lack of money. Or that rents simply will not justify another 100k.

About that woman who bought and then had the prices drop by another 90k, I wonder how mortgages work with a pre sale. I assume that you have to qualify a short while before closing and the question arises of whether she will have enough equity or cash to get a mortgage?

“My feeling exactly regarding 845 Johnson. Or any pre-construction for that matter.”

Meet your new neighbors after that awesome bidding war.

“So what’s stopping them from adding another 50K or 100K to their offers?”

I assume they are maxed out on Ma and Pa if they can’t pony up. When nothing worth looking at comes up anymore then this is when fads like real estate run their course and the buyers move on and forget about the fleeting thought of owning something they probably can’t afford in the first place.

Thus the bubble pops like we are seeing in Toronto where they buyers gave up, the listings have increased and owners are left wondering what the hell happened.

Pour que? Story time.

My feeling exactly regarding 845 Johnson. Or any pre-construction for that matter.

Yep. I can confirm that Ottawa looks better and better with each visit of realtor.ca. It’s where family, friends, my current employer and a very desirable future employer already are.

Your buyers just have to suck it up and pay the higher price. That’s what has happened in past markets. There is more to choose from if they increase their offer.

So what’s stopping them from adding another 50K or 100K to their offers?

“Not sure where they got that idea. The CMHC report actually says that migration is up amongst young people that are more likely to support home buying. And this is true. Population growth is driven by those under 65, not over.”

The millennials are also the most mobile in history and fastest to pull up stakes, load up the SUV/catch a flight and hit the road for new adventures. If they came here from somewhere else they don’t have the family roots to keep them here. Huge misrepresentation of reality.

“You haven’t even taken possession and that $90,000 you put down as a deposit is gone.

I repeat. This would suck.”

The “can’t happen here” crowd are in for a very rude awakening.

Sounds like the VREB is shitting bricks about the coming new NDP spec/FB rules. The party may soon be over. No profits in 6 months and then more rules killing buyers is a thing of beauty.

“We can also see the effects of headwinds influencing our market in 2018,

including attempts to curb demand at all levels of government. “

Well prices have increased. So yes there is less inventory at lower price brackets. But if the demand for condos has actually increased then there would be more sales even at the new prices. Maybe people haven’t adjusted to the prices so they aren’t willing to spend what they now see as an exorbitant amount.

I certainly accept that there is demand for sub $400k properties and those are getting snapped up, but perhaps people can’t afford to move up to where the condos are now being listed. Just like I’m sure there is huge demand for a $600,000 house in the core but that just doesn’t exist anymore.

It is interesting though that of the 140 condos that have been on the market for more than 2 weeks, 55 of them are pre-construction. In January, there were 300 active condo listings that were not pre-construction and last January there were 302. So it is true that there is not more inventory of actually built units out there, it’s just the same as last year.

Last year we had less inventory than now. And yet we had a third more sales. That theory makes no sense.

What are the price brackets for the inventory? That is great that we have more inventory but if the inventory is expensive, non-rentable, non in-suite laundry it leaves people scrambling and going crazy for limited sub $500,000 inventory.

This week I listed a couple of condos. We thought we were going market value on price so no offer delay. One condo had three unconditional offers and the other had two unconditional offers within 24 hours of listing.

The pending condo sales that came through today are just mind boggling.

210 – 898 Vernon for $450,000 – purchased two years ago for 276,500. Highest sale in the complex by 60k. More per square foot than what I paid at my Lyra pre-sale purchased this past summer.

The condo market is nuts, and it can’t possibly last, I am just curious if it flatlines or pulls back.

Leo – I hear that same low inventory suppressing sales line spouted by a realtor almost every time I go to an open house. I’m guessing it’s what the brokerages are telling the realtors? Marko, feel free to correct me.

The brokerage never tells me anything. For me personally the inventory theory stems from my personal business more than anything. I have more buyers than ever before on my roster that would buy if they could find something in their search parameter and not be outbid. I use to have 5-6 buyers max. Now I have upward of 20-25 but I am not busy with showings as rarely does anything worth looking at come up.

@Marko

@Leo S

Leo – I hear that same low inventory suppressing sales line spouted by a realtor almost every time I go to an open house. I’m guessing it’s what the brokerages are telling the realtors? Marko, feel free to correct me.

She bought for $955,000 in phase 1 of the development. It’s not finished yet. Same type of house on similar sized lot as part of phase 2 is selling for $96,000 less.

You haven’t even taken possession and that $90,000 you put down as a deposit is gone.

I repeat. This would suck.

This is 100% a non-story. There are units selling at the Janion in excess of $300,000 that individuals paid $110,000 – $140,000 on the pre-sale. I don’t see the developer running some sort of sob story how he undertook a huge amount of stress and risk to make maybe $20k per unit and people are making >$150,000 just flipping the paper.

I can’t comprehend how much common sense you would have to lack to assume that a pre-sale can only go up in value? How could you be that naive? Obviously if prices only went up the developer would hold out and sell everything on completion. You buy a pre-sale you take on risk of the price dropping and the developer takes on the risk of the price going up (and his or her construction costs going up during the build).

I’ve lucked out with some massive gains on pre-sales, but I realize it is only a matter of time before I get badly burned. However, the only difference is I won’t be complaining like someone screwed me over.

I beg to differ.

Interesting. Same rate as when totoro and I were arguing about the virtue of using a 10 year fixed about 5 years ago.

Not sure where they got that idea. The CMHC report actually says that migration is up amongst young people that are more likely to support home buying. And this is true. Population growth is driven by those under 65, not over.

Last year we had less inventory than now. And yet we had a third more sales. That theory makes no sense.

Active condo listings:

Jan 2017: 327

Jan 2018: 365

New condo listings:

Jan 2017: 211

Jan 2018: 211

Condo sales:

Jan 2017: 173

Jan 2018: 128

@Grace

I’d bet most people aren’t simply because they don’t know about it, which is a shame. It can save someone a lot of money both with the structure itself and their health. It’s definitely something to be done along with the building inspection.

Very interesting Andy.

But are people rushing to buy condos or houses right now doing something like that? I highly doubt it.

But that is good to know.

“Hey, nothing says fairness like colonial courts deciding cases between the colony and Indigenous peoples…”

The world is not ruled by fairness. It is ruled by the balance of political or judicial power, or when that breaks down, the balance of force. It’s therefore unwise to rouse passions on the side that cannot possibly win the struggle by raising the irrelevant and endlessly debatable issue of fairness.

All Canadians, well the vast majority, want the first nations to get a reasonable deal. But the first nations account for 2.5% of Canada’s population, so it’s not likely that Canada will hand over $100 billion plus in oil sands investment to Alberta’s 220,000 first nations just because of some piece of paper signed by a foreign monarch more than 100 years ago.

Fun fact: the tar sands probably violate Treaty 8 (signed in 1899 by Queen Victoria):

http://www.yesmagazine.org/planet/alberta-tar-sands-illegal-treaty-8-first-nations-shell-oil

I assume the Athabasca Chipewyan First Nation lost the case because, well, the oil sands continue.

Hey, nothing says fairness like colonial courts deciding cases between the colony and Indigenous peoples…

Worth a read…

Why illicit foreign casino cash often goes straight into Vancouver housing

http://vancouversun.com/opinion/columnists/douglas-todd-why-illicit-foreign-casino-cash-often-goes-straight-into-vancouver-housing

This would suck.

https://www.thestar.com/business/real_estate/2018/01/29/how-a-softer-housing-market-has-crushed-pre-construction-home-buyers-dreams.html

She bought for $955,000 in phase 1 of the development. It’s not finished yet. Same type of house on similar sized lot as part of phase 2 is selling for $96,000 less.

You haven’t even taken possession and that $90,000 you put down as a deposit is gone.

I repeat. This would suck.

@Grace

One important thing to do when you buy any piece of property is to get a mold test done, and not the air type, rather you swipe the dust from various parts of the house onto a cloth and mail it into a lab — it will tell you if the place has mold, which signals water damage.

If you’re checking a SFH, it’s a wise idea to use two cloths, one for the main house and one for the basement/crawlspace — that way it’s easier to see where the problem is (if there is one).

Costs a couple hundred bucks and is definitely worth it. Can pay a little extra for a quick turn around time.

This is the lab recommended by one of the top mold experts in the USA, Dr. Ritchie Shoemaker.

https://www.mycometrics.com/

The test to order is:

HERTSMI – AccuCloth Kit

https://www.mycometrics.com/products.html

I have NO affiliation with this company, but have successfully used it in properties to get a reading on the mold levels (if any). This particular test identifies the molds that are harmful to human health.

Fair points Marko.

But yes houses are money pits too. Which is why in our old age I am okay with renting.

I will be looking to y,all to,find us the perfect place.

Of course lawyers, doctors, engineers are just people.

I know my sister and she is one of the toughest, smartest people out there. She never turns off being a litigator…..lol.

We always did 90% of home maintenance …rarely hired anyone except for the roof……that is expensive!

As far as home maintenance costs, it’s way cheaper to do stuff yourself. You don’t have that option in a condo. The only labour I’ve paid for is a chimney sweep and tree falling. Not including yard work I’ve done drywall, electrical, trim work, painting, framing, plumbing, siding, stairs, window and door installations. Other than electrical I had never done any of this before. Just watch some youtube videos and read some forums. Lots of help out there and the satisfaction of DIY is greater than writing a cheque. Granted we have a rancher which makes repairs and maintenance easier, but that was part of our purchase decision.

They can claim anything, but it must be proven. There are several things a court will test in determining unceded Title for a non-treaty First Nation, of which there are plenty in BC. Tsawout and a few other FNs on the Peninsula are signatories of the Douglas Treaty, which changes those calculations.

In matters relating to Douglas Treaty, it can be more challenging because the descriptions of the lands ceded “entirely and for ever” are more vague compared to modern treaties. Met their Chief several times a few years ago. Kindest and gentlest man you’d ever meet.

Here’s the text to those treaties if you’re interested.

https://www.aadnc-aandc.gc.ca/eng/1100100029052/1100100029053#saanichSouth

https://www.theglobeandmail.com/news/british-columbia/bc-first-nation-claims-title-to-victoria-area-island-owned-by-billionaire/article37804058/

https://globalnews.ca/news/3999335/canadas-most-valuable-private-island-at-centre-of-b-c-first-nations-land-claim/

Did anyone see this story? This is the island you can see from Island View Beach. Can FN just claim anything they want to in Canada if it wasn’t ‘surrendered’? I’m not well versed in FN rights but I guess the European settlers did just basically invade and walk over/ take over their land.

Interesting to see how cautious the VREB press release is.

https://www.vreb.org/current-statistics

“We expected January to be a bit slower after the increase in activity we saw in November and December, which was likely due in part to buyers entering the market early to avoid the new mortgage stress test, We have yet to see the full effect of the stress test, as many people attained a 90 -120 day pre-approval before the test became required January 1.”

“”We can also see the effects of headwinds influencing our market in 2018, including attempts to curb demand at all levels of government. The mortgage stress test is the latest to be introduced, and we may learn of further measures later this month when the provincial budget is released.”

The VREB is striking out against Andrew Weaver as well for his positions on real estate. All the boards are also lobbying the province extremely hard to delay the implementation of the new real estate regulations (banning limited dual agency) by a year. Chance of that being successful is exactly zero, but it shows how concerned they are.

My sister is a top corporate lawyer

I’ve represented a lot of lawyers and doctors over the years and can’t say they make better real estate decisions versus average Joe or Suzy. Engineers are probably the worst though in terms of real estate decision making.

Also, having been on strata councils in various functions even lawyers that specialize in strata law often lack common sense. I know a few times we’ve had lawyers draft proposed bylaw amendments and it was well worded, but poorly thought out. It is like they had no real life experience of how things actually work.

As far as condo vs house. I live in a house and I own multiple condos and have lived in condos. Today I had my garderner at the house. In the last month I’ve had a gas fireplace service, heat pump service, garage door service. In the fall I had the gutters cleaned, sprinklers blown out, and I am probably forgetting a few things. This is 2.5 year old house.

Condo on the other hand….the minute someone says special assessment everyone has a meltdown even if it is $500 to replace carpets in the hallway or similar.

My only thought on condos is I personally would only ever buy concrete. Concrete doesn’t carry as big of a premium as it should, imo; therefore, it is worth the extra differential cost. Big difference in having a solid 10” concrete balcony versus wood frame which you know at some point will need replacement.

Exactly Bingo. It’s what makes this place both useful and entertaining….

We just miss Hawk and since he hasn’t posted since yesterday. A little poking often brings him out to the party.

This blog wouldn’t be the same without Hawk. He’s a fixture and he’d be missed if he disappeared. I honestly think he plays an important role with his position and opinions. Last thing we need is a echo chamber.

I see Bingo and Introvert are working hard at lowering the tone of this blog……..again!

Grand Poobah, First Lord of the Oak Bay Beach Hotel.

Actually I like that, might have to take it for myself (the grand poobah bit).

Going with the bird theme here are The Funniest Bird Names to Say Out Loud

I’m kinda split between hoary puffleg and great tit.

Let’s start calling Michael “the Oracle.”

And while we’re at it, let’s give Hawk a nickname. What’s the opposite of an oracle?

This makes me wonder how hard it would be to make EBay for houses. Cut out realtors, standardize the legal work, maybe even standardize inspection and put that right on the page before the listing goes live, and have a 100% transparent bidding process. Interesting thought…

6th largest point decline for the Dow in history and it went do 666 points! The end is nigh!

I hope everyone bought something in the market today! Best sale in 2 years!

I expect Monday to be back to normal which with building inflation, record employment and job creation, lower US corporate taxes, and record earnings across the board is up, up UP!

No need to thank me 🙂

@ Bingo

I don’t know all the details but yes the seller knew. It was Avery small building…under 20 suites. According to my sister they all knew.

They tried to get her to be part of their scheme but no way would she do that. They dragged their feet forever but when they saw she meant business they had the work done. They had to move out for weeks.

We thought about buying a townhouse when we sold,our house and my sister went over all the things that can go wrong with a strata.

We don’t want to ever be that involved with our neighbours….so we will end up renting when we come back to the city. Unless house prices plunge…..fingers crossed! Hahaha.

Hmmmmm.

It might reduce land values by a tiny fraction, and the reduction would be only temporary.

“I own a plot of land that can have something worth 2 million if improved or 60 million. What should I expect for that piece of land?”

I’ll answer my own question:

700k vs 2 million….

Luke

I dunno, guy with the junk is pretty quiet in this ‘hood. It’s the realtor that’s the noisy one and he probably has the best kept yard.

Funny thing is in a condo you wouldn’t want kids as neighbours, but in a SFH they are likely to be quiet neighbours (can’t hear them bouncing a basketball on the floor at 5am from outside the house). Of course kids become teens and teens are awful.

There’s always time to chat up the neighbours. I’ve had a few prospective neighbours come ask me about the neighbourhood. I’m always glad to answer any questions they have.

This is a great idea, and what was already done years ago in the UK – some of my relatives there lived in a social semi-detached home. In 1999 after the Gov’t there started to allow people who were long term in social housing to buy their own homes- they were able to buy it for £6000! Well under market value at that time but the scheme was based on how many years they’d already been there. It was in a small town called King’s Lynn 120 miles north of London. Anyway, they sold it just ten years later after not many reno’s for £170,000 around 2010. This is just one example of what lifted many people out of poverty over there – and these people are now solidly middle class, and no longer dependant on the Gov’t subsidies. Yes it did irk some people who were not in social housing and probably had to work hard to buy private housing before the scheme was launched – but it made it a much less polarized society over there than it was during and before the Thatcher era. Mind you, they already had much more social housing than Canada’s ever had.

It’s a great idea to reduce the polarized gap we now see increasing esp. here in BC. It is also a great plan to give poorer people some hope b/c right now they have no way to get out of the vortex of extreme poverty. Somehow, I don’t see it happening here though, but w/ the NDP you never know.

Yes, OB def. has a noise bylaw. My neighbours tell me, the OB police dept. was well familiar w/ the people who lived here before me. Their teenage sons used to create a huge amount of noise and should’ve lived in the country. They will attend to noise complaints.

In an SFH you are much less likely to be disturbed by noise than in a condo. That’s why I say top floor, corner unit is desirable. But you may still end up w/ noisy people just below or beside. It’s true that you are dependant on quality of neighbours in an SFH and so it’s ‘luck of the draw’ as to who your neighbours are… but most people are fairly good I would say you can scope it out before you buy (if there’s a bunch of junk in the yard that may not be a good sign). Maybe watch the ‘hood for a bit before you buy. However, one couldn’t have done that for too long in our most recent market…

Anybody ever seen or heard of a destitute politician other than foremer Alberta Premier Ralph Klein wandering in drunk to a homeless shelter?

Also would be interesting to know how many former and current MLA’s hold condo’s in downtown Victoria subsidized by their living allowance. Wonder if there is an upward tick in sales every election…

Funny, the same thing was said by Poloz several months ago, ie, BoC was raising in anticipation of future inflation data. So it far it looks as though he may have been right.

Markets aren’t looking good today, and Bitcoin is even worse. I suspect eventually the latter will readjust to its fundamental value, which is roughly zero point zero.

Here you Barrister, the median price dropped from $739,950 to $676,000 for houses in Langford and Colwood.

Sep 2017 $645,000

Oct 2017 $677,500

Nov 2017 $686,000

Dec 2017 $739,950

Jan 2018 $676,000

That’s a fact. The median dropped by 8.6%. But that doesn’t mean prices fell by 8.6%.

The sample size is too small. What you need is more sales or higher quality of data using narrower physical and locational parameters.

Markets tanking, people feeling less rich, 5 year interest rates primed for 3 or more hikes this year. Not looking good for bloated housing markets as bankers tighten the leash.

Fed agrees.

*KAPLAN: IF WE WAIT TO SEE ACTUAL INFLATION, WE’LL BE TOO LATE

*KAPLAN: BASE CASE IS FOR 3 RATE HIKES IN 2018, COULD BE MORE

@Grace

That sounds awful. Mine wasn’t a big deal, just a pita. No one hated me for insisting the roofing problem got fixed and they were probably glad I (reluctantly) took it on. Helps that we had enough contingency to cover the repairs no problem. We also had to replace a bunch of deck railings as a separate project (in the 2 years I was there). I remember being upset about all the time off work I wasn’t being compensated for. Seems laughable now that I know how much work an older house is.

Hiding stuff from the minutes sounds pretty damning. Did the seller know and not disclose it? Or could they claim they didn’t know because it wasn’t in the minutes and they weren’t on council?Horrible. I can somewhat understand a shady home owner trying to hide defects, but a strata council colluding to hide issues? Not one stood up against it?

10 year 3.79% fixed. That is some pretty crazy cheap money still being offered. Good deal if you really believe interest rates are going to spike.

Don’t know how to highlight a name.

Bingo

In my sisters case the strata conspired to keep all the leakage problems out of the minutes. My sister tried every thing she could to avoid threatening legal action. Of course after all was said and done she wanted out and the whole place hated her. She sold to another lawyer and disclosed everything. It was a total mess and she and her husband did not get to enjoy a single day there.

She always says if she could get snookered anyone could. She is one of those lawyers..suspicious of everything and does meticulous homework and yet she was conned.

Sorry it happened to you.

Hey Leo, if you are still considering a forum in addition to the comment section, it looks like there’s a plugin to use WP users in PHPBB. Siteground has a one click install for phpbb3 in cpanel.

I believe in math. I own a plot of land that can have something worth 2 million if improved or 60 million. What should I expect for that piece of land?

@ Dasmo

“However increasing allowable density will NOT reduce land values….”

You reject all of economics, or just the law of supply and demand?

@ Bman

“In an SFD, you are at the mercy of the dickhead living next door who blasts AC/DC until 3 am most nights,”

Where do you live? Does your municipality not have an anti-noise bylaw? Oak Bay, and Saanich do for sure, and they enforce it when requested (by way of the police department) to do so.

I think a blanket rezoning is necessary. The spot zoning of everything is plain BS. However increasing allowable density will NOT reduce land values….

Grace

Been there. Had the exact same reaction from the then president on strata, “Oh just put some caulk there to stop it.” On the inside of my ceiling?! To stop a roof leak?! He also thought it was my problem, to which I had to inform him that, “No, the building envelope is the strata’s problem.”

Luckily the rest of strata was a bit more sane. Someone else ended up president, I ended up on council and I was assigned the roofing project (which I really didn’t have the time for then). Definitely not fond memories.

Luke

Interesting that they mention capital gains (and how many time the primary residence exclusion can be used), but don’t talk about increasing the inclusion rate. I thought the feds already brought that up as an option.

If you increased the inclusion rate to 100% on second properties that would curb a lot of speculation. It doesn’t prevent the middle class from buying second properties (or 3rd, 4th etc) but it puts a damper on people hoarding properties hoping their value goes sky high. People would still buy rental properties, but it would tip the favour in only doing so when the rental is cashflow positive. You can buy a cashflow positive rental in Quesnel for 20% down, but you can’t do that in Victoria, Vancouver or Toronto.

You can still buy a vacation property, you just have to swallow the fact the tax man is going to want a nice big chunk of any gain. Which I think is fine. If the purpose is recreation you shouldn’t care about getting the most out of it possible from an investment standpoint.

Announce it’ll take effect next tax year and watch the market get flooded with “investment” properties to avoid paying twice the tax.

Introvert

Yeah, so good luck getting anyone in gov’t behind raising the inclusion rate. Minimally they’d want a grandfather clause.

In Ontario:

OREA seeking input on improving transparency of real estate industry

In a white paper released Thursday, OREA said the current sales system creates “suspicion and mistrust” by forcing prospective buyers to “blind bid” because realtors cannot disclose the contents of an offer to anyone other than the seller.

“The unsuccessful buyers often feel they didn’t have a fair chance and could have bid higher if they had known what they were up against,” said OREA, in its white paper. “The winning buyer may feel they ‘overpaid’ because they were the successful offer.”

http://theprovince.com/pmn/business-pmn/orea-seeking-input-on-improving-transparency-of-real-estate-industry/wcm/d5147299-b877-44dd-a33a-7828f1ebc1f6

“At least with a house you get to decide when you have work done and how it is done.”

Yes and no. When the basement fills up with sewage, there ain’t much choice. For other stuff, seems like most people don’t do their own work and hire a $20,000 tradesman anyway.

“With a condo you are at the mercy of a strata council …and who wants to fight with their neighbours? I have heard about all out wars in some buildings.”

In an SFD, you are at the mercy of the dickhead living next door who blasts AC/DC until 3 am most nights, and your asshole neighbour who rented their house to that guy.

@ Bman

” I was thinking in terms of maintenance/repair costs, special assessments.”

Yes, you have a point.

Although the thing about owning a house and therefore having control over the cost of maintenance versus owning a condo. and having to pay whatever the strata corporation decides to spend, is that the the control enjoyed by the home owner is mostly real, not illusory.

It is truly amazing how long maintenance can be deferred. In fact, with a bit of fill here or there, a lick of paint, even a bucket to catch the drips from a leaking roof, costly maintenance can be deferred almost indefinitely.

Indeed with increasing age, what is the point? One is not going to be around long enough to justify the expense of fixing leaky gutters or a sagging fence.

Numbers Hack,

The weakness of your proposal is Point 2: “investors can purchase these bonds and write them off their taxes”

Sounds OK for investors, but it is simply a transfer of cost to goverment, primarily the Federal Government. The Feds are not likely to buy that. And in any case, the taxes foregone have to be made up for by other taxes. So one might as well simply opt for a scheme directly funded by government, i.e., the taxpayer, and specifically the BC taxpayer, which would mean, for the scheme you propose, an extra thousand dollars per person per year for ten years.

A better scheme would be to compel municipalities to undertake rezoning to create higher densities for all types of housing. That would achieve an increased supply at reduced cost, the reduction in cost being borne by current land owners, many of them speculators, who would see land values fall.

CS,

I get that. I was thinking in terms of maintenance/repair costs, special assessments, monthly fees and all that.

@ Bman

“Is it riskier than buying a 60 year old home on oil heat, with all original cloth-bound wiring, and a cracked foundation?”

No one invests a substantial amount in a 60-year-old home with a cracked foundation. What they invest in is a piece of land with a more or less worthless pile of junk located on it.

In Oak Bay, a 50 foot lot is now assessed at around $887,000, so the risk entailed in an investment in an old house inOak Bay is not in the shack but in the land it stands on.

Number 6: Do you know how much median prices dropped in Langford? I assume it was only a sliver at this point.

You mean the 30% drop in condo sales?

Actually I get a higher average price for single family homes in the core, western communities and Saanich Peninsular at $951,506 based on 182 sales.

The problem though is the geographical distribution of sales and the use of the average. Too few sales over too wide of an area.

Instead if you narrowed the geographical area to Oak Bay, Victoria and Saanich East and used the median instead then you get $1,013,500 over 62 sales . That still is a record high.

But look what happens when you get out of those premium districts into the middle income area. The median price in Victoria West, Esquimalt, View Royal and Saanich West declined from December to $700,450 based on 32 sales.

And what about Langford and Colwood? Areas that most of suspect where buyers make use of extensive financing. Again the median price dropped from December to $676,000 based on 36 sales.

This is starting out to be a very interesting year.

At least with a house you get to decide when you have work done and how it is done. With a condo you are at the mercy of a strata council …and who wants to fight with their neighbours? I have heard about all out wars in some buildings.

But with house prices so high I get the appeal to own something. I just hope people are doing the research needed before buying into an entire building.

Governments have never been efficient in allocation of capital. My previous post is that you can build a decent 800-1000 sq ft apartment with land for $300,000 per unit. Then realized that the majority of the housing crisis is in the South Island/Lower Mainland/Okanagan. Not really cheap places to build! If the cost of those units is close to $35 billion, then the cost to each and every 4MM residents of BC is close to $9000 over 10 years.

Why not do this?

1/ create a Co., not a crown one, and issue 4,000,000 bonds worth $9000 each (over tranches in 10 years)

2/ investors, yes investors can purchase these bonds and write them off their taxes (tax benefit)

3/ UBCM municipalities can give a property tax holiday for like 5 years on the built properties

4/ funds raised are used to make social housing (price set by government)

5/ they can be rented and investors may or may not get a dividend payment

6/ FINALLY, allow the social housing to be freehold, that the people living there AFTER a 3 or 5 year term have a chance to purchase them (e.g. at a set rate, if it cost $300K, then sell at $350K), which gives a small but decent return to the people fronting the money.

I think the above is much better than adding an annual 3600$/yr more taxes for 10 years to the avg family of 4 to pay for this. Also from ease of implementation, if you are buying an investment property, then it is mandatory you buy 10% of the value of your 2nd property in these bonds. If you are a non-resident, then raise it to 20% of the purchase price in these bonds plus your 15% tax.

Lots of ways to skin the cat, but something that has to sensible and implementable without destroying the golden goose IMHO.

UBCM Report Favourite Lines:

ensuring a soft landing for investors that have a substantial portion of their savings tied up in

real estate

aka the 70% of the population that owns real estate, we are going to drive down prices but are going to do it slowly.

1.10 Funding rental housing- We do not recommend a specific funding source, but highlight that property transfer tax revenues are significant – over $2 billion in 2016

aka, want to build 114,000 rental units over 10 years. Cost @ $300K/unit is going to be $35 billion, but we don’t where the funding is coming from.

So if they take all the PTT and make housing out of it, you are still out $1.5 billion/ year over 10 years. The tricky part is PTT revenue to the government is directly correlated with house values. If house values go down/transactions go down, guess what? PTT income decreases.

That’s why the NDP is in between a rock and a hard place. It is a balancing act that no one envies and IMHO a policy where “polarization” will inevitable as there is no easy solutions.

Hawk – Today’s buyers are tomorrows losers when the new spec/FB laws kick in.

I personally don’t believe there will be any sort of foreign buyer tax in the new budget.

‘Am I the only one who thinks buying a condo is extremely risky?’

Certainly not. Is it riskier than buying a 60 year old home on oil heat, with all original cloth-bound wiring, and a cracked foundation?

I guess it would be helpful to know how the maintenance costs of an SFD vs. condo compare over the long run.

Is a special assessment all that different from spending $20,000 on a new roof, another $20,000 on electrical service upgrade and a rewire, and $10,000 to do the drain tile on an SFD?

Seems like an irrational aversion (like my fear of flying). I would rather drive because I like the illusion of being in control, in spite of the facts.

I wonder if the increase in condo sales might be related to a combination of factors

– the 15% foreign buyers tax

– recognizing that Victoria is sought after market and still offers more bang for the buck compared to Vancouver.

– easier for a condo unit to fly under the radar if unoccupied

– cheaper for speculators to purchase who feel that this segment of the market will be increase in demand due to increased interest rates and tightening mortgage rules

I am curious to know

-What percentage of condo purchases are made by non-residents and any relationship between this increase and when Van implemented their 15% tax in August?

-How many of the condos are left vacant and if this is increasing over the years?

Great post, thanks for putting up.

Nope – I concur. Not just risky but also every time I look at a condo I can’t personally picture living in one. Just having someone on the other side of walls, floors, ceilings is enough to put one off. But I also hate Strata’s! It’s not something I find easy to think about contending with… however, maybe if a top floor or corner unit? If it had a special view. That’s why I find that new Cordova Bay development really interesting. That’s a pretty special area too.

This blog will be buzzing after the strategy from the Gov’t is finally released on Feb. 20th…