CMHC: Victoria Overvalued

Last year the CMHC started releasing their quarterly housing assessments and I had some fun ridiculing their conclusions. Once again they’ve swapped out the analyst in charge of Victoria, which makes it the 4th analyst in just over year, and none of them are from here.

The new report for Spring 2017 is out, and by new report for Spring 2017 I mean released spring 2017 and actually only covering data up to Dec 2016. Again, how a measure is supposed to give an “early indication of potentially problematic housing market conditions” when the measure is at minimum 4 months out of date I have no idea.

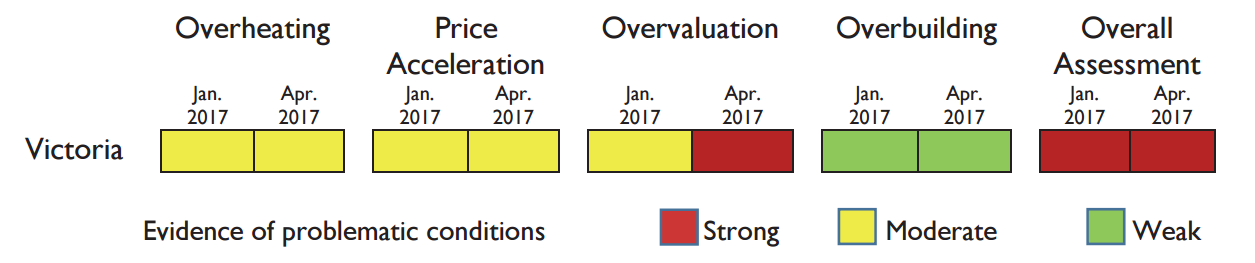

They analyze the housing market based on evidence of Overheating, Price Acceleration, Overvaluation, and Overbuilding. Let’s go through their analysis in detail.

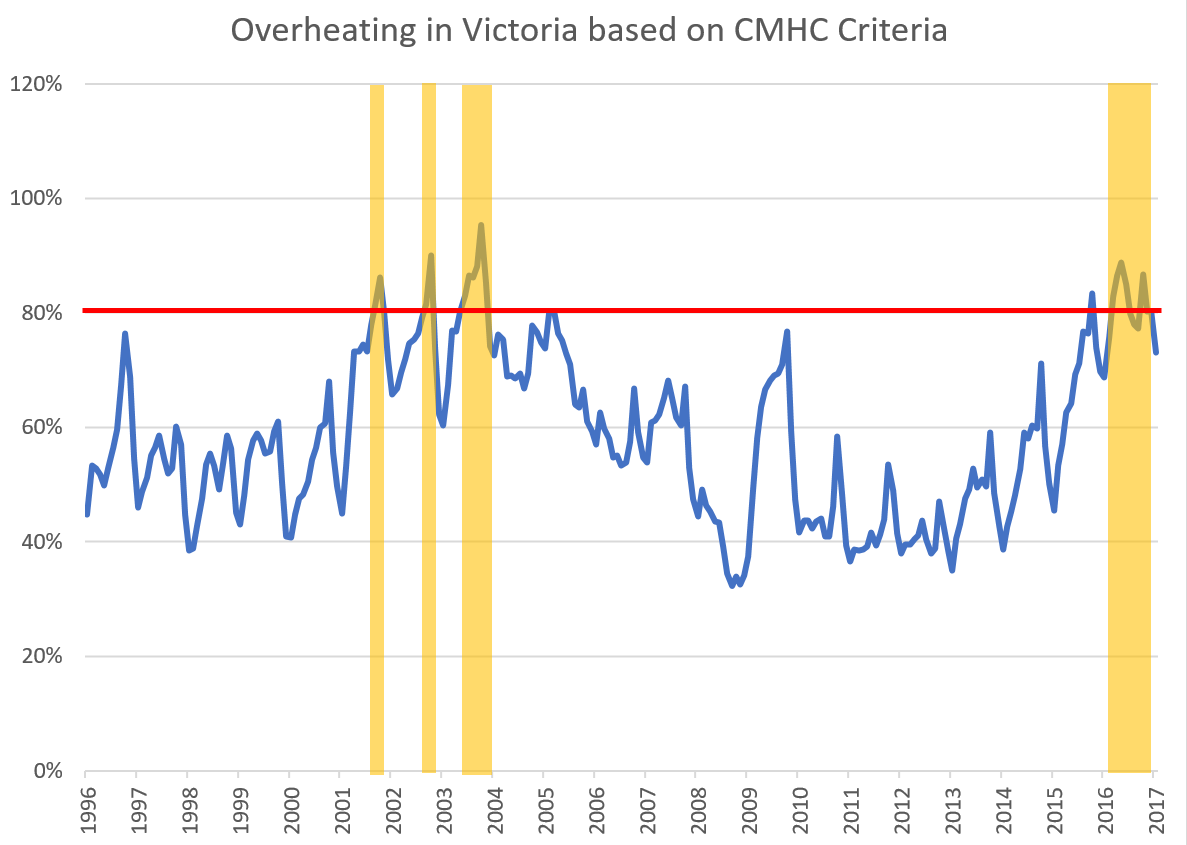

Overheating

Their definition of overheating is a sales to new listings ratio of 80% or higher for the quarter. This is relatively sensible, although the threshold is quite high. Looking back at recent history, the hot market recently and the mid 2000s would have been identified as overheating. Note that the overheating evidence does not go higher than “moderate evidence” because it is only based on one metric (sales/list ratio > 80%).

Price Acceleration

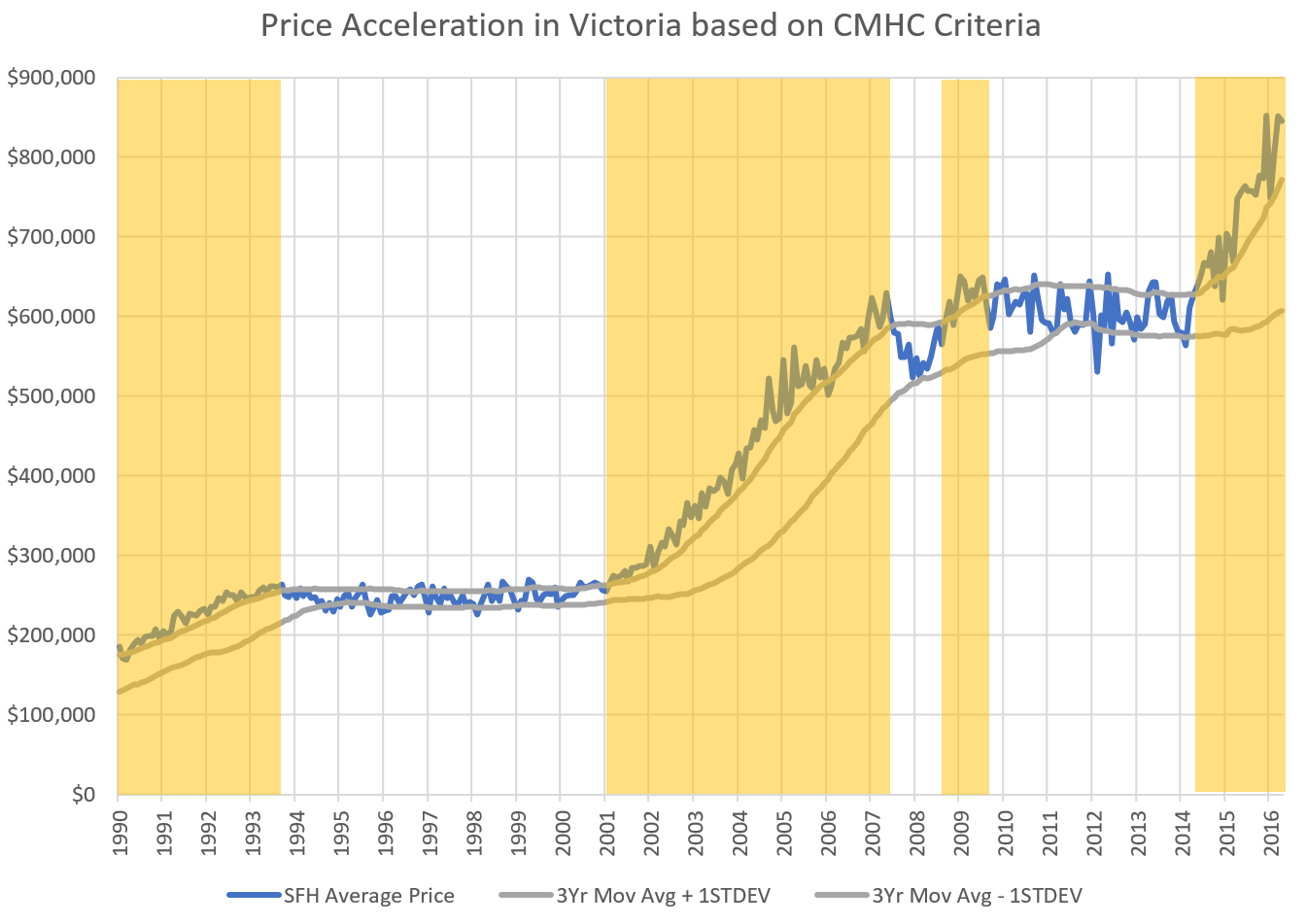

CMHC defines price acceleration as follows. They take the 3 year moving average MLS Price, then they create a band of plus or minus one standard deviation. If the current MLS price is within that band, everything is OK. If it is above that band, there is evidence of price acceleration.

Seems on the surface of it to be logical. After all we know that prices have accelerated and sure enough it indicates price acceleration recently. Problem is that it is actually nonsense, and this method doesn’t identify price acceleration at all, it merely identifies price increases. This is clear when we look at the complete history of Victoria and mark the areas where the CMHC method identifies price acceleration.

Seems on the surface of it to be logical. After all we know that prices have accelerated and sure enough it indicates price acceleration recently. Problem is that it is actually nonsense, and this method doesn’t identify price acceleration at all, it merely identifies price increases. This is clear when we look at the complete history of Victoria and mark the areas where the CMHC method identifies price acceleration.

Prices were not accelerating in most of the highlighted areas, they were simply increasing at a large enough rate to escape the 3 year average. So while the identification of price acceleration is useful, this method does not do it.

So when the CMHC says “evidence of price acceleration” what they are actually saying is “prices are increasing at above about 5% per year” which has nothing to do with acceleration. An example of acceleration would be if prices increase 5% in the first quarter, then 7% in the second, then 9% in the third.

Overbuilding

CMHC rightly concludes we don’t have an issue with overbuilding here. Unabsorbed new build housing inventory is at record lows. That said, construction is on a tear lately and the number of units hitting the market will definitely be increasing soon.

Overvaluation

This is where it gets interesting. First of all let’s remind ourselves that as recently as 6 months ago, the CMHC thought there was no evidence of overvaluation in Victoria. All was peachy and hunky dory. Then prices increased by some 5% and suddenly there is strong evidence of overvaluation? Clearly whatever method came up with that result is flawed.

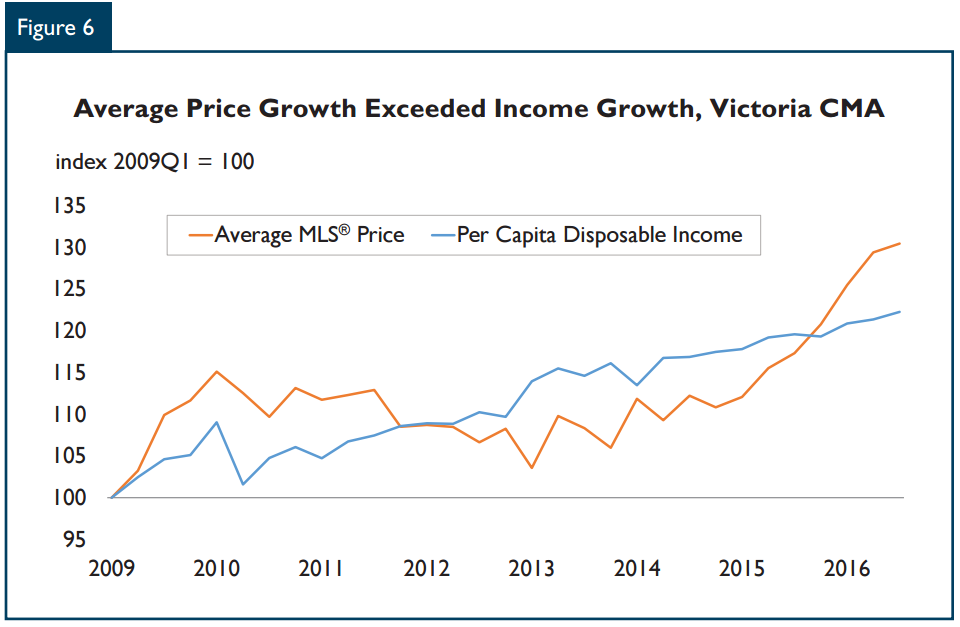

The CMHC says that recent gains have resulted in “average prices strongly exceeding those supported by local fundamentals”. How did they come to this conclusion? Well they give this figure as Exhibit A where they compare income growth since 2009 to the average price.

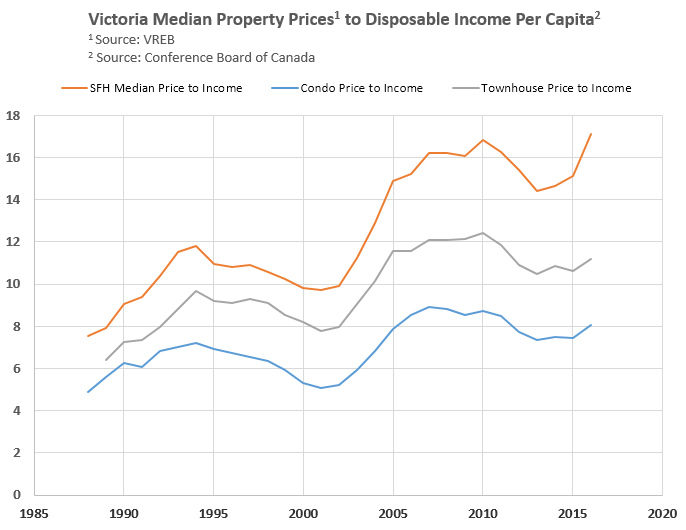

Since price growth has outpaced income growth, their conclusion is that the market is overvalued. There are so many things wrong with that I don’t know where to start, but let’s go back to the whole point of this housing market assessment. The thing is supposed to alert people of problematic conditions with the assumption that problematic conditions could lead to price declines and a destabilized market. So what does comparing price gains with income gains tell us about the market? Pretty much nothing. House prices have outpaced incomes for decades, this is not a recent thing. By this measure the Victoria market would have been overvalued for as far back as we have data, and that makes the measure kind of pointless.

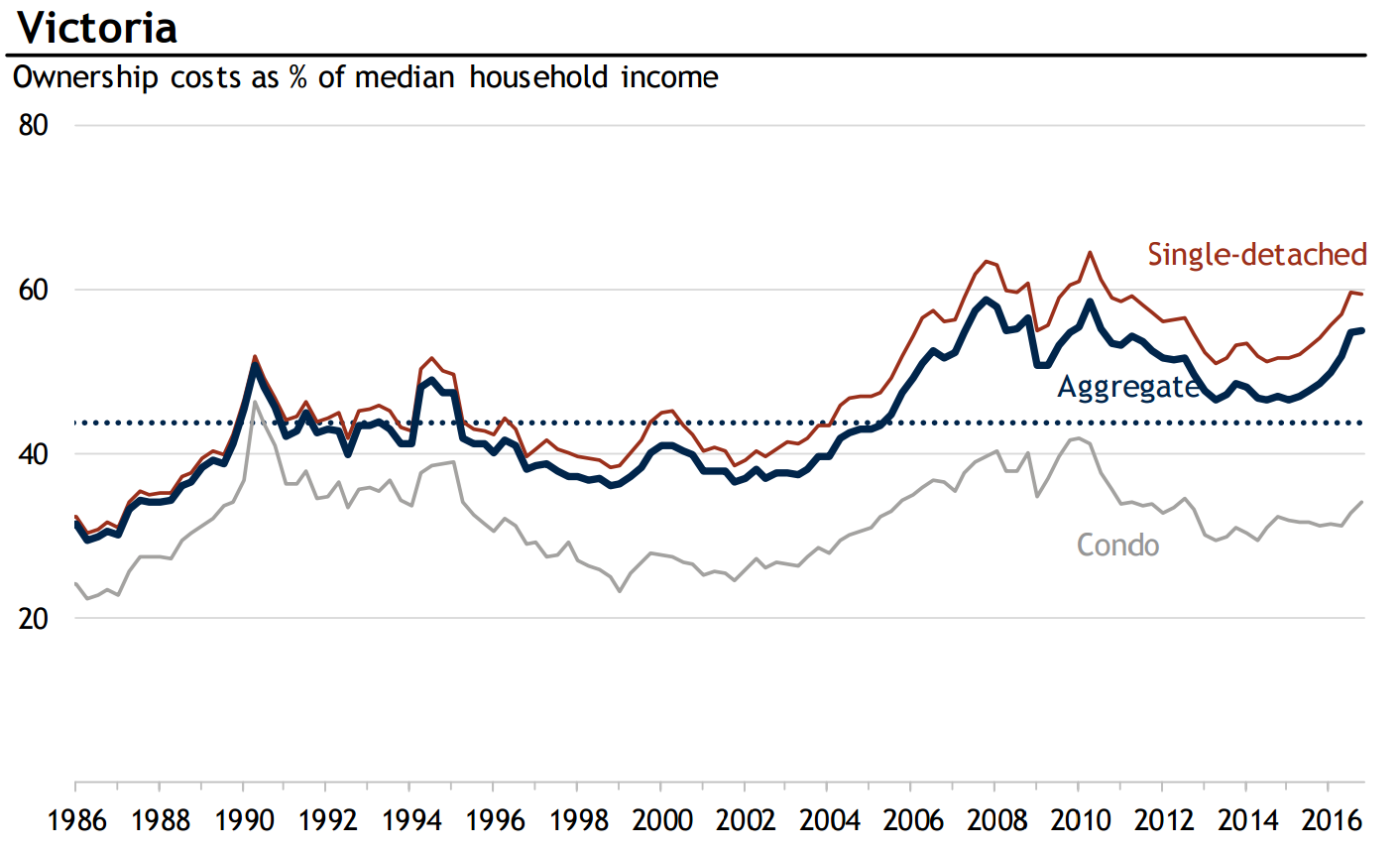

Of course, their method may be more complex than what they show – and likely is since they reference multiple metrics which they don’t talk about – but then why give such terrible examples to show that the market is overvalued? It’s not like there’s a shortage of affordability measures out there. RBC publishes a good measure of affordability regularly that shows Victoria detached houses at near record poor affordability levels and I’ve done the odd chart myself.

So is Victoria overvalued? I’d say in detached homes we are bumping into the limit of what locals can afford and that is good evidence of overvaluation. We’ve seen a massive drop in detached home sales last month and while part of that is due to low inventory, I believe part of it is also due to price exhaustion from local buyers.

Too early to tell if they’re right or not, but I don’t have any confidence in their method given what we’ve seen here in the last year. Firstly the data needs to be kept more up to date, and secondly we need to see some evidence that their method can identify problematic conditions when applied to the past. Would this method have identified previous peaks as problematic? Without some backtesting we have no idea if these housing market assessments are worth the bits they’re made of.

New post: https://househuntvictoria.ca/2017/05/08/may-8-market-update/

And how would that change any of my analysis? As I’m showing what is happening now – this month – at this time. The data for May might change as the month progresses. We will see in another week. But right now at this time we seem to be back to historical norms with Active and Months of Inventory on an upward trend.

But if you have data that shows something else? I’d like to see it.

Thanks for the analysis JD. Appreciate the time you take to put that together.

So you are comparing seven days in May to historical January to April averages?

Why not compare to January to April 2017? Then you’d at least be comparing something somewhat alike and you wouldn’t be using just seven days of data to compare to past 90 day periods.

Or did you mean you used January to April 2017 when you wrote May because it just seems completely illogical otherwise?

I looked over a decade of data for January to April of each year to find a baseline for a ratio of new listings to sales. Which is one of the more important metrics on determining what is happening in the marketplace. As it answers the question are new listings coming to the market more than, less than or at enough of a rate to keep pace with the homes being sold.

Ten year average

1.58:1 for Saanich East

1.57:1 for Victoria

1.67:1 for Oak Bay

And this is what the ratios are for May

Saanich East 1.6:1

Victoria 1.46:1

Oak Bay 1.59:1

May is turning out to be not much different than the historical average for the last decade.

Now last year was a tough year on buyers. And the new listings to sales ratio for January to April illustrated that very well.

New Listings to Sales Ratio January to April 2016

Saanich East 1.23:1

Victoria 1.25:1

Oak Bay 1.23:1

Does this mean the market is moving towards a balance between buyers and sellers as Active Listings and Months of Inventory begin to increase? It does seem so as both active listings and months of inventory are currently on an upward trend.

That’s good for buyers as that would mean more selection this May. You’ll still pay too much for crap but at least you will have more crap to choose from.

Our own homegrown Canadian auto loan bubble. 25% subprime sounds like the alt-mortgage bubble.

Canadians Are Buying A Record Number Of New Cars, With A Record Amount Of Financing

“The right to debt seems to be a topic all Canadians are embracing, and the auto sector is no different. The BoC has estimated that 25% of borrowers are non-prime, which incase you didn’t know is Canadian-English for “sub-prime.” These buyers generally have a FICO score below 670, and face predatory loans with up to 25% interest. This makes it difficult to build positive equity on car loans.”

https://betterdwelling.com/canadians-buying-record-number-new-cars/

I wonder if the better option is for the buyer to provide tax receipts – how much income did you report for the last 5 years? None? Buying a 1,000,000 house and you’re a “homemaker”? Perhaps it’s time for an investigation.

Buyer origin per se isn’t as important, IMO, as where the money was generated.

The problem with the income tax receipt idea is the potential overreach of government, though I really have no idea how that would work administratively.

Won’t have to worry about a foreign buyers tax as China is getting closer to imploding. Their funny money stacking of high risk lending is coming home to roost.

A credit crisis over there means extreme fire sales over here, then toss in Home Capital contagion. Yikes. Don’t sweat it pumpers, it’s only money. 😉

Kyle Bass Warns “All Hell Is About To Break Loose” In China

China’s credit system expanded “too recklessly and too quickly,” and “it’s beginning to unravel,” warns Hayman Capital’s Kyle Bass.

Crucially, Bass notes that ballooning assets in Chinese wealth management products are another sign of a looming credit crisis in the nation.

“think about this – in the US, our asset-liability mismatch at the peak of our subprime greatness was around 2%! … China’s mismatch is more than 10% of the system.”

http://www.zerohedge.com/news/2017-05-03/kyle-bass-warns-all-hell-about-break-loose-china

Richard, starts with a C and ends with a C.

Why do they care about the buyer’s origin? The only thing that matters is that they aren’t Canadian citizens, landed immigrants or permanent residents. That’s all they need to ask. Asking the origin of the buyer sets up an accusation of racism. On the form they fill in, do they actually have to put down where they are from or just that they are from away?

Yeah, there is a lot of misinformation, likely due to media coverage in Vancouver, but this is very different than a realtor misleading a client about the specific deal they are involved in. There is no intent to mislead in passing on general views that may be incorrect but are believed by the realtor, there is intent where a realtor is trying to solicit higher bids on a property they are the listing or selling agent for by lying about who the other parties making bids are.

Yes. Looks like it has been set down for October – I haven’t really been following that closely.

A judge could find differently and Joe Arvay is a good lawyer and he is arguing disproportional effect (not racist on its face but affect Asians more than others)- which seems weak to me given the section 1 strength.

The question is not whether this is discrimination, it is, it is whether it is permitted discrimination. Given the stats in Vancouver a foreign buyer’s tax seems a reasonable limit to me, not sure if it would stand up in Victoria though given the stats which may also be why the City backed down. The province may also be waiting for this case before adding any other areas.

Mr. Arvay is also saying that BC doesn’t have jurisdiction to do this as the regulation of foreign capital is an exclusive federal power. I haven’t considered that, and it is possible, but it is different from an unjustified discrimination argument.

My best guess, and I don’t have all the facts, is that the tax, if within provincial powers, will likely be upheld under section 1 for Vancouver except for those who had no warning and had deals in progress and had to pay the extra 15% or lose their deposit – that seemed completely unreasonable at the time and still does.

The plaintiff in this case was one of of those individuals and she did end up losing her deposit I believe as she was unable to come up with an additional 80k with a weeks’ notice. I have no idea why the government implemented the tax this way, they were setting themselves up for a lawsuit yet this was the response:

Ridiculous.

Lots of people and groups are currently being blamed too – not just Chinese nationals. It is the speculators, the investors, the landlords, the realtors, the banks, the government – all being scapegoated, that is unfairly blamed as a group without adequate evidence that they are causing prices to escalate. People who are frustrated are venting their feelings on these groups and unfairly labeling them as unethical or immoral as a result imo.

The facts I’ve seen don’t support the level of blame, some things need to be addressed and some have been, but there are multiple factors including a natural up cycle that creates excessive consumer confidence. In Victoria most houses are being bought by Canadian buyers and the majority of them are local. As far as I can tell this means most people are using retained equity or have family help.

Yeah lots of problems with discussing something like a foreign buyer’s tax.

I’ve actually heard the same from a friend of mine. His realtor told him asian investors were buying up anything. No idea why they would say that, but let’s consider that realtors aren’t any more immune to prejudice than anyone else, and probably aren’t considering the data any more than the average consumer.

Isn’t the case still before the courts?

It’s like getting the Tesla over the ’89 5.0 mustang. One uses way less gas (or no gas) than the other, and also happens to be better made. I’m going to leave Dasmo’s blog entry…notice where the top loss of heat comes from: https://blackturtleredphoenix.wordpress.com/2016/09/15/not-going-to-make-it/

PS – not Pella – a proper good window. I can’t quite put my finger on the proper automotive equivalent of a Pella…looks fast but isn’t.

It doesn’t make sense it all circumstances, but in some, it most definitely does.

How come Hawk never mentions the list prices in his price slashes?

And anyway, according to others list price is meaningless. I was wondering if it was Hawk who scooped up the ‘Oak Bay Classic’on Currie Rd. Recently sold for $1,050k

I agree that it is not just about that, the difficult bit is the willingness to engage in outrage and pass on unverified facts on a public blog that support a belief that your sister was treated unjustly and deprived of a home by foreign Asians who bought purely to invest. That is the type of thing that perpetuates prejudice.

Not to be too hard on you in particular, there are many looking for someone to blame for house appreciation and willing to believe unverified information if it agrees with their views. It is part of the psychology of scapegoating – make yourself into the aggrieved party and find someone to unfairly assign the feelings of anger and frustration to. Happens within some cohorts every single time there is economic hardship and has throughout recorded history.

Where are your facts on this? I’m not aware of buyers being misled as a common issue? And your sister had already made an offer and was outbid wasn’t she? She didn’t raise her bid and there is no evidence that the successful bidder was misled in any way?

It seems like what you are saying is that a realtor intentionally misled your sister. That seems possible, but unlikely. There are rules against this conduct by realtors:

Also, a foreign buyer tax is permitted discrimination and is not race-based (racism) because it applies to all foreign buyers no matter their race. Canada is allowed to give preference to citizens and permanent residents in this case – it is part of government’s job to protect and promote the well-being of citizens. The tax was a good thing in Vancouver and might be a good thing here too, but there are many reasons for price appreciation in Victoria – maybe not very dramatic reasons on their own and mostly part of the up cycle of RE imo, but some related to newer factors like internet information and globalization.

Possible, but there are probably other reasons given the stats even if this is what they told you. There are way more realtors in Ontario than the market can support right now. Effects of a hot market with low inventory – like here. There is currently one realtor for every 140 people in the Greater Toronto Area and active listings are down 51% from last year. Your neighbours are more likely to be feeling this rather than the preference for an Asian listing agent given that only 4.9% of buyers in TO are foreign, including all countries, and foreign buyers and their agents use MLS.

http://business.financialpost.com/personal-finance/mortgages-real-estate/canada-housing-bubble-agents

I think the cycle won’t be up forever and the factors at play will shift. It may take more government intervention, not sure, but the changes need to be incremental and well-thought out based on facts in order to ensure that the outcome is not more negative than positive overall for Canadians.

Man this looks UGLY. Imagine the next shoe to drop. Everyone was doing it. Everyone.

Coming soon ostriches. 😉

The Great Melt

“35 percent of the TSX is exposed to the real estate industry. Canadian household debt is at 167 percent of disposable income. We have an over-extended real estate market and an economy with a large amount of leverage. And now, we have our first piece of evidence of bad underwriting in the mortgage industry,” Thorne said.

“We know everyone is doing it,” a Toronto-based mortgage broker who refused to be named told VICE Money. “I had clients who were freelancers, and didn’t have a steady income, but I trusted they had the financial backing of their parents so we would use their parents’ income to qualify them for a mortgage.”

This particular broker worked in tandem with a real estate agent, who also chose not to be named. Their target market? Young Canadians, mostly downtown Toronto renters who were keen to get a foot into the real estate door, but had previously been rejected by the big banks for having not met the criteria to receive a mortgage. “That’s the role of a mortgage broker, though,” the broker told VICE Money.”

https://news.vice.com/story/the-spectacular-implosion-of-home-capital-group

You guys must miss my price slashings with your OCD thing. 4037 Providence Pl in prime Golden Head appears to be relisted again at the $60K slashed price from a week or so ago and still not sold. The market must be ready to really tank when these almost new digs can’t get a bite from the foreigners.

“Any idea if there are “bunkered” homes on the market? ”

I haven’t heard of any – except for the hidden bunkers related to BC’s hydroponics industry 🙂

Is HAWK the eternal optimist or the eternal pessimist, I can’t figure it out!

Dasmo you overpaid for it by at least $200 and Hawk is waiting until it is back to that price.

My First house was built for $3500 in 1933….

Perhaps not, and I’m not saying it’s enough. But assuming she isn’t lying, then wait times are down by 50% (from 12-18 months to 6-9 months). Still stupidly high, but it does appear they are aware of the issue and working on it. Keeping the pressure on will make them continue working on it.

These are numbers she is just randomly throwing out. Having been involved in a number of projects in the City of Victoria it has been getting worse and worse for the last 7-8 years. The crap the city makes you go through on a residential home is insane. I can’t imagine doing a commercial project, I guess it might be a tad easier as you would have an entire team of people working on it.

When we have a market correction which is just a matter of time instead of seeing newer homes drop in price you’ll simply see no construction and no new inventory. The fixed costs created by WCB, HPO, municipality, etc., are so high that there will simply be no building versus building cheaper and selling cheaper.

We already beat the window discussion to death 🙂 I have Milgard windows in my house. The reason you get Pella windows over Starlinem or other is the same reason you get a BMW over a Corolla.

Your basic brand new windows with current code/certifications are already efficient and with most people spending only around $2,000/year on utilities there just isn’t any room to save anything on super high-end windows. If utilities were $10,000 and top of the line windows could bring it down to $8,000 that would make more sense.

.” total permit fees about $9,000 not including the reports needed etc”.

There’s inflation for you, in the 50’s you could BUILD a house for $9,000.

What banking institution is that BITTERBEAR?

Wow sidekick that’s a long wait time! My building permit was turned around in weeks! But I already had two development permits approved so I’m sure that helped. Yes two development permits…. total permit fees about $9,000 not including the reports needed etc.

You are doing the advanced framing passive house right? As an owner build?

I see super cheap materials in “high end builds” all the time. Those Starline windows are in most….

Follow up on confidential banking document breach. My paid off LOC has been “frozen” as I am now part of a fraud investigation.

Any idea if there are “bunkered” homes on the market? Some are concerned about catastrophic climate change, nuclear war, zombie apocalypses, and the like. They’re probably out there but perhaps not advertised for obvious reasons; seems like an underground market.

Victoria has always been a safe-haven for families worldwide to escape from something.

Anecdotally, having grown up in OB when it wasn’t so snobbish or perceived snobbish, here is just my recollection:

1950’s lots of Europeans Germans/English etc..

1960’s lots of Greeks/Italians/lots of Americans where do you think we get our strong marijuana culture? LOL

1970’s lots of Americans

1980’s South Africans/English/UK/Indians/Japanese/Iranians and lots of richer people

1990’s Eastern Europe/UK/ Indians/Hong Kong/and lots of richer people

2000’s Asians/Americans/ and lots of richer people

Now: lots of rich people from everywhere

Canada has always been accommodating and moreover, we have had a good record of immigrants assimilating into our Canadian Fabric. For a whole host of reasons, RE has been unaffordable in our city. BUT this has happened the world over.

What Victorians can do and hopefully quickly before it gets ugly is implement policies to alleviate this. I have personally seen models that are quite effective, even moreso than a foreigner tax:

1/ cap foreign ownership as a % of properties in a certain area (e.g. Manila)

2/ restrict people who don’t have a local ID (such as a driver’s license) saying you have resided in Victoria for at least 5 years to purchase RE. Goes for Canadians and foreigners alike (e.g. Shanghai/Beijing)

3/ build great infrastructure when you can get to “A” to “B” faster financed by “tolls”, if you can get to the big landmass called WC in 15-20 mins, that would be a great place.

Again, it is not impossible, but it will take some leadership. You can even raise the “stamp tax” to 25% and have that refunded if it makes the masses happy! I’ve been throwing around the infrastructure on this blog before the run-up.

The bad news for buyers now, is the 2nd thing they teach you in economics and after supply and demand. And that is prices are “sticky”! World debt has gone from $40T to $100T USD in nearly a decade so there is lots of cheap money floating around looking for a home and a return on investment. Prices are going to be flatish with a 10-15% max downside IMO over the next black Swan event, but the opposite can be said about the upside.

numbers hack, you need to talk to Chinese Canadian Justin Fung of HALT in Vancouver for a download of that the real issues are. The only scapegoat is racism itself.

It’s not bulls vs bears on this blog anymore, it is essentially classic “class warfare”, pitting “haves” against “have nots”.

The GINI co-efficient that measure the wealth divide tells us the wealthy WORLDWIDE have more and the REST have less. If you want something more Canada-centric, this report from the Fraser Institute, the same guys that rank the schools was just issued a few weeks ago. Good read:

https://www.fraserinstitute.org/sites/default/files/understanding-wealth-inequality-in-canada.pdf

If you are a person of yellow skin tone, or specifically Asian, even though as foreigners you purchased less than 0.5% of Vic RE in the last quarter, you are the “scape goats”…prejudice is still alive and well…how sad…

Guess Switzerland and Australia are racist too ? If the BC government didn’t allow this province to be an offshore tax haven for money launderers this wouldn’t have to be implemented.

Victoria should have the tax too as a preventive measure, not until after the damage is done. Lets hope the NDP gets in Tuesday to begin to repair the damage of the corrupt Liberals.

7 Countries That Tax Foreign Property Investors, Should Canada?

https://betterdwelling.com/city/toronto/7-places-tax-foreign-property-investors/

“if you think foreigners should pay a speculation tax on houses/condos when they sell, then lobby the government to follow the Hawaii method.”

Agree LeoM, but I was wondering what is the best way we could lobby the gov’t? It seems that whenever people try, Tony Joe pops up crying wolf about racism. (because as most people understand, this has to do with limiting non-residents/non-citizens speculating in Canada real estate – just as all other countries in the world do)

I like Hawaii’s methods as well – they have designated “Hawaii resident” and vacation property zones – to curb both domestic & foreign speculation. (PEI has great rules too)

My rellies from the prairies often say that Victoria is the Hawaii of Canada – and it’s true related to weather and tourism – so it would be good to look at US jurisdictions like Hawaii for ideas.

“I had to do all the paperwork for a home in Fairfield last year and the between permit crap, during build crap, and occupancy crap it added approximately 6 months to the length of a RESIDENTIAL HOME.” Marko Juras

I FEEL FOR YOU BROTHER…..sad indeed. Oh, for the good old days… Maybe permitting etc. should be completely taken out of the hands of municipalities.

Perhaps not, and I’m not saying it’s enough. But assuming she isn’t lying, then wait times are down by 50% (from 12-18 months to 6-9 months). Still stupidly high, but it does appear they are aware of the issue and working on it. Keeping the pressure on will make them continue working on it.

“We don’t have a formal application yet, but the uptake has certainly started in terms of interest,” said Victoria Mayor Lisa Helps. – See more at: http://www.timescolonist.com/news/local/no-negative-feedback-after-victoria-relaxes-rules-on-garden-suites-1.18657085#sthash.NE520GQS.dpuf

Yea, no **** no applications, people find out about the HPO owner-builder exam from city staff.

Still waiting on my application submitted mid January.

If you submitted your exact same plans to build on a lot in Langford you would have had a permit in five business days, same BC Building Code.

I had to do all the paperwork for a home in Fairfield last year and the between permit crap, during build crap, and occupancy crap it added approximately 6 months to the length of a RESIDENTIAL HOME. When I look back at the 6 months lost nothing changed the quality of the home….literally 6 months of useless bureaucracy.

Lisa Helps is not in touch with what actually goes on in the building department.

Texas is 6th worst.

% of home value

Best to find a state with no income tax and low muni taxes. But somehow that is probably in the middle of nowhere interesting. You pay for what you get I guess

https://www.thebalance.com/best-and-worst-states-for-property-taxes-3193328

“That’s the reason my brother, sold his house in Houston where Municipal Taxes are 3% of assessed value or recent current purchase price and he moved his business to Knoxville, Tennessee.”

Texas has 4th lowest tax rates, Tennessee has the 6th. They have to make it up somewhere with zero income tax.

“4. Texas

Taxes paid by residents as pct. of income: 7.5%

Total state taxes collected: $48.6 billion (3rd highest)

Tax burden per capita: 3,088 (8th smallest)

Income per capita: $41,269 (23rd highest)

Texas is one of a handful of states with no income tax – individual or corporate. Texas also has among the lowest gas tax rates.

I’ve said it on this blog a couple times in the past, but if you think foreigners should pay a speculation tax on houses/condos when they sell, then lobby the government to follow the Hawaii method. Complaining on this blog will not effect legislative changes.

Foreigners who own property in Hawaii pay a hefty tax on the sale of property; and they can’t escape paying it. When a property is sold in Hawaii all the money goes into an escrow account with a major bank or a lawyer. If the property was sold by a foreigner then 15+% of the TOTAL sale price is paid to the government as a foreigner speculation tax. The seller can then apply to the government for a review to determine if they are eligible for a partial refund, but few are eligible.

Because most American jurisdictions use escrow, it’s impossible to avoid paying the foreigners tax in jurisdictions that impose a foreigners tax. It’s a simple system and it works to eliminate rampant foreign speculation.

Still waiting on my application submitted mid January. I’ve found it to be a mixed bag so far. I’ve enjoyed the building and engineering departments. Bylaw and parks less so. Part of the problem is I’m non-standard I suppose.

As for builders making $, I notice the new Amity build on Richmond is using Starline windows (https://www.realtor.ca/Residential/Single-Family/18045772/863-Richmond-Ave-Victoria-British-Columbia-V8S3Z3). Nothing like paying high-end restaurant prices and getting McDonalds.

I think it was unfortunate that he/she said ‘white’. However, it’s also true that much of the resentment is focused on people of Asian descent, even if they have been here for many generations.

Overall – people need to stop looking for a particular demographic to blame. Low global interest rates, zoning, and CMHC are are the underlying causes of this real estate boom. Foreign buying has a localized effect in some areas, but it’s not really an issue here.

I’m super sick of these entitled white people that think the market should bend to their poverty/income level, “just because they grew up here”.

Who said the person was white and what does it matter if she is? I’m sick of people who look down their noses at anyone having difficulty affording a home for their family and I’m pretty sure it was chinesecanadian who brought racism to the table here anyway. I’m sure there are just as many entitled Chinese kids out there that grew up here and are pissed off about the same thing- housing is 2-3x more expensive than is was 15 years ago. And that sucks no matter what you look like.

Victoria is changing. Change is hard.

One of the best lines I’ve ever read on the blog.

Good thing we have the Speculation Police here to protect us!

GWAC I was always amused by people who used to refer to the States and how much cheaper house prices were there. Well not when you add back in the municipal taxes. At the time my brother and I had comparable homes and his taxes were 10x what mine were. Not only that his water bill was unbelievably high. After the first month using his underground sprinklers and then receiving a $2,000 bill he never used them again!

On the subject of water you have a really great rate here in Victoria as you do with Hydro, way cheaper than Calgary, almost half.

Forgot about interest rates!

Richard the big one is interest rates.

VICBOT you are absolutely right that there are a multitude of factors contributing to rising house prices and all are to blame;

Construction Costs

New building code requirements

The falling Loonie, higher cost on materials

Longer construction times

Municipal cost increases for services and permits

Municipal bylaw requirements

Title transfer fees

Increased CMHC fees

Investors and Flippers

and on and on it goes……

Richard seems like there are some crazy taxes in some areas of the states. I think they pay a large part of the education costs

That house at the end of the show went for 375k somewhere around there. That is one way to lower house price raise municipal taxes really high.

“I bitch about my 4K tax bill. Watching house hunter in lake wood ny. 560k house tax bill is 21k usd. Wtf.”

That’s the reason my brother, sold his house in Houston where Municipal Taxes are 3% of assessed value or recent current purchase price and he moved his business to Knoxville, Tennessee.

Interesting info on the home building costs. However in the last 2 years, the energy efficiency codes & costs to builders haven’t gone up 50%, whereas house prices in Victoria have.

So there doesn’t seem to be a huge cause-and-effect there. Other arguments for high house prices include the fact that low interest rates make the monthly mortgage payments still within reach of your average buyer. Then you’ve got the double whammy of millennial families & baby boomers, plus speculators smelling profits.

In terms of housing construction, we have a labour shortage due to there being more retiring boomers than experienced tradespeople to fill their shoes. But it’s one factor of many.

I bitch about my 4K tax bill. Watching house hunter in lake wood ny. 560k house tax bill is 21k usd. Wtf.

I would be all for lower standards if it would create affordable housing but it won’t. It will only increase profits.

So houses in the 1940s were just as expensive as now since they took just as long to build right?

“If we accept this as true, or even a substantially contributing factor, we’d see aggressive price inflation in houses across the board, not just in the bubbly areas. The problem would exist everywhere” (Local Fool)

The problem does exist everywhere, the numbers just arn’t as extreme as in TO, VAN & VIC. I bought a SFD inner city Calgary 1998 for $140,000, it was completely average. In spite of the recession and almost 10% current unemployment in Calgary the average SFD price today is $590,000. That still is within reach of most double income earners even though quadrupling in 20 years. According to this blog Victoria SFD have basically doubled since 2007 making many parts of Victoria out of reach of double income earners. Saskatoon, Regina, Edmonton have experienced similiar situations to Calgary.

To put it in perspective the house I bought in 1998 would have been physically comparable to the new listing at 1849 Gonzales Ave. priced at $929,900

Houses are more expensive to build today because the profit margin is a lot larger. Contractors are busy and so they can charge more. Wouldn’t you do the same!

One of my sources in the building supply industry has told me that some builders are making a 50 percent profit on a house. Some even more on custom houses.

In contrast builders that outlay their own cash and build speculative housing to sell later take a much lower profit because they want to move the property quickly.

So expect the cost of building a house to come down when the marketplace slows down in the next recession as builders become competitive once more.

The cost to build a home including land has ranged as low as $242 to as much as $632 per finished square foot in the last month. This is a ridiculously wide range. And it is almost impossible to get a builder to tell you his hard costs. Builders and the trades are making astonishingly good incomes.

Sorry on the below it is paid to view.

http://www.theglobeandmail.com/news/investigations/investigation-x2-condo-toronto/article34906278/

This is huge part of the problem in Toronto

You’ve made similar assertions in the past, and I have trouble believing this on its face for a very simple reason.

If we accept this as true, or even a substantially contributing factor, we’d see aggressive price inflation in houses across the board, not just in the bubbly areas. The problem would exist everywhere – in fact, energy efficiency would be even more critical in prairie regions and other regions further north, and yet we don’t see this occurring. What am I missing here?

“1967, CMHC published Canadian Wood Frame House Construction which became an on-site resource for small builders and trades. The average house constructed in the 1940s takes seven months and 2,400 site person hours. By the mid-1960s, the average house takes eight weeks and 950 site person hours to build.” Quoted from the historical archives of CMHC.

This is the reason why house prices are so unaffordable today, imagine building a house today in 8 weeks and only 950 site person hours. Most builders today need a minimum of 6 months to build a house, yes there are a few real speedsters that can do it in four. Why does it take so much more? Because they have become so much more complicated mostly to do with energy efficiency. So maybe we need to do a total revisit of home construction as they did in 1967 and come up with way more cost effective and practical solutions substantially reducing time and cost.

To say the foreign buyer tax is racially motivated is also off. It’s motivated by anger over the Canadian dream being snuffed out for people. The racists come out at times like this sure but it’s not the motivation. Speculation in residential real estate isn’t good for the community bottom line…. case in point the divide it’s creating. The racism it’s inspiring.

3Richard Haysom: the person who made the comment was me. You perhaps did not notice that I informed my sister straightaway of who the actual buyer of the home was. She was misinformed. She was happy and thanked the person who clarified it. This is not discrimination against a certain race, it’s about the price of homes soaring at levels because buyers are being led to believe they are bidding against foreign investors. And foreign investment is a part of the problem.

I have a couple of neighbors who are real estate agents. They are not getting work because potential sellers in my neighborhood believe they will get top dollar with an Asian agent. Maybe this scenario is not happening in Victoria, but it’s happening in Ontario.

People are angry at Asian investors, not Asian people in general. Let’s not play with words here and turn it into a race issue.

” It seems backwards to me that someone can own Canadian land (i.e. a part of Canada) and not have citizenship.”

OK fine, then this is a federal issue not provincial or municipal. And what are the Feds doing? Nada, or at least I haven’t heard anything other than make Canadians declare all RE sales on their tax returns.

Slap a hug speculative tax. All proceeds earned if sold before move in or before 1 full year are tax 100% at 100%. How’s that. All money goes to the government. Let see what would happen.

Lisa Helps said they cut processing times for development permits in half. Not true?

Yes but you also cut out the speculators. You don’t just do one thing

This always backfires. All it does is drive up prices. The benefit is only temporary and then the public is subsidizing owners forever.

I’m in favor a ‘non-Canadian’ buyer’s tax (race isn’t part of the discussion at all). Personally I don’t even care if non-Canadians (not immigrants) are able to buy here at all. If one doesn’t live and/or work here they don’t need to own a SFH here. As Gwac said “not everyone was meant to own a SFH”. Buy a condo instead as a vacation property. And I would accept the same treatment as a Canadian abroad. It seems backwards to me that someone can own Canadian land (i.e. a part of Canada) and not have citizenship.

Let’s look at the new tax stats on who pays what in Vancouver. Do you want that to happen here?

Areas with the highest real estate prices have the lowest average income, and that’s a serious problem

“To start, Wozny says it’s hard to imagine that the disparity would be caused by demand.

Instead, he says there may be something slightly more nefarious going on.

“What it appears to be, by inference, is that there is a lot of money in Vancouver that is unknown to the government of Canada.”

And Gordon, who works in the School of Public Policy at SFU, agrees with that assertion.

He says the numbers suggest a large share of the real estate market in Metro Vancouver is foreign money.

Which, in turn, creates an issue when it comes to affordability, Gordon says.

“What that does is push people making reasonably high incomes in Vancouver out to the suburbs.”

And it makes for some skewed statistics, as Gordon says the price of an average detached home in Richmond is nearly 28 times the average income.

In fact, Wozny says Richmond’s average income was lower than some rural logging towns in the interior.”

http://www.cknw.com/2017/05/05/steele-drex-areas-with-the-highest-real-estate-prices-have-the-lowest-average-income-and-thats-a-serious-problem/

from Chinese Canadian Justin Fung: An open letter to those who play the race card

http://www.straight.com/news/734326/justin-fung-open-letter-those-who-play-race-card-vancouver-housing-affordability-debate

“As one of the resident Chinese-Canadians on the HALT team, I was particularly frustrated to see this misleading headline on the front page of the Vancouver Sun “Is Racism Part of the Issue? …

Let’s stop talking about racism … It’s distracting us from getting to solutions to making housing affordable for those of us who call this city home. It’s time we cut through the bullshit and hold our elected political leaders accountable for the mess they refuse to clean up.”

“Btw those comments yesterday about the GH house were typically anti foreigner. Funny how it ended up being a 4 th generation Canadian. Too funny.

I am white born here so let’s get that out.”

I’m with you GWAC those comments yesterday were sickening. I’m impressed the lady had the courage to comment on this blog but she should never have had to. It’s shameful that a fourth generation Canadian has to defend herself or relative. It is without doubt that the underlying motives of the “foreigners tax” is racially inspired and the politicians are just lapping it up, disgusting.

If the top agent in town puts out videos saying Victoria is dirt cheap compared to Beijing and they have oodles of cash and we have to keep buying ASAP, then what’s the problem with the tax ?

I was told by someone I know who sold high end stuff to rich foreigners and it’s because they are cheap mofos by nature, not because of the tax itself.

Foreigner brings jobs and help the economy and make our country better. Making them go elsewhere with their money does not make sense.They help pay for social programs and government jobs that people in Canada love. I like that ideology better.

Not all tough. Let’s say a foreigner in theory buys a $1,000,000 home in Fairfield and doesn’t move here and does not rent it out. What are their yearly contributions?

Property taxes, which barely cover the aging infrastructure of the muncipality.

Am I missing any other significant contributions? They have to buy home insurance and need to have the home maintained but so would a non-foreigner so I don’t see any sort of gain there.

If they are not paying income tax they are not contributing to things like the Mckenzie Interchange, for example.

The 15% tax has exemptions for those legit in terms of working and living in Canada.

That’s fine if they actually move/work/live here to participate in our society – I don’t care where anyone’s from, if their ambition is to do this then they contribute to Canada.

When we have ‘astronaut families’, where the main income earner is elsewhere earning large amounts that they could not possibly earn here, and then not paying virtually any Canadian income taxes, sending money to the family members here who are often living a lavish lifestyle in the best parts of cities in expensive homes, (and possibly even claiming free MSP or GST tax credits while they’re at it). Or, when we have foreign or domestic speculators buying homes to sit empty as if homes are commodities like Gold or potash. Or, when we have ‘students’ or ‘home-makers’ buying multi million dollar homes on poverty level incomes… then that’s where it isn’t working in Canadian residents favour.

In fact, Canadian citizens or Permanent residents living and working here and paying high income and sales taxes here (not matter what their ethnicity is) are the ones who support everything here.

And now, Canadians or PR living here are having to compete with these globalized income earners for the best housing in our own country. This is where things have gone wrong as this problem wasn’t addressed long ago when it should’ve been, and this is why many Cdn’s have had to take on too much debt. This is why even high income earners in Vancouver, TO, and now here in the core are struggling to buy a SFH if they don’t have equity already. This is one of the reasons house prices have gone so high.

Yes, our Gov’t is also making the problem worse by not allowing enough building, and I’ll add (again) not building enough diverse housing as we are out of land for more SFH in Van and Vic.

Finally, probably most importantly – our Gov’t’s are not doing enough to protect Canadian residents who play by the rules here, from the influences of the newly globalized world. One can see in other western countries – that voting for Trump, Brexit, and now possibly – ‘Frexit’ – are how people in those countries that have more of a core national identity than Canada are attempting to respond to this. Does Canada stand out as one of the few western countries that doesn’t respond to the new globalized world in the same way? Is this because unlike other western countries, we lack a core national identity?

No one is against honest foreign folks coming here and putting down roots. The facts remain that many don’t and they have billions of dollars behind them and our government does fuck all to stop it until some recent lip service.

This is the money that creates ghost tower condos/hoods as seen in Vancouver and beginning to be noticeable here. They don’t spend dollars here nor are part of the community, and if you put out a tax to say we’re at least watching then they will go elsewhere.

If you want to be here so bad then what’s another 15% ? They do it to us buying over there. This race card thing is total bullshit.

Government must crack down on dark money to create housing affordability in Vancouver

“Canada has had a reputation as an open, transparent, trustworthy society, which operates on the principles of “peace, order and good government.”

But when it comes to stopping billions of dollars of illicit money funnelling into Canadian real estate, our elected officials don’t deserve their status.

The governments of Canada and B.C. have consistently failed to protect Canadians from unsavoury, tax-evading speculators in real estate, who have made Metro Vancouver and Toronto housing unaffordable.

Even though most Canadians remain unaware of the complex world of dark money, Vancouver-based financial researcher Adam Ross makes clear Metro Vancouver and Toronto have become hot spots for shady global real-estate deals.

Because of lax rules in Canada and B.C. it is easy for rich investors in real estate to hire accountants and lawyers to hide their identities.

Offshore speculators can therefore avoid detection by their own governments, including the rising giant of China. And they can avoid or evade taxes in Canada.”

http://vancouversun.com/opinion/columnists/douglas-todd-vancouver-is-a-money-laundering-haven

Gwac my previous post has some of the rules and restrictions on foreign ownership in the different US states – not just capital gains taxes.

What US state has a foreigner buyers tax. Not a capital gains tax at the end which is perfectly fine. Canada does it just does not enforce it. Not a larger yearly tax on non residents which is fine. BC can do that to their hearts content. Does not impact people from buying and spending their money.

Funny how the racist card always gets played when people run out of other excuses. Let’s keep it to the topic – ie., the US has taxes & laws about foreign RE ownership – bottom line. We can too.

We are not talking about Mexicans or Syrians flooding the borders. We are talking about people with money buying housing, paying their real estate taxes and spending their money here. 2 different things lets not mix those up in defending our stupid racist tax on housing put in before an election to stop the whiny socialists.

Btw those comments yesterday about the GH house were typically anti foreigner. Funny how it ended up being a 4 th generation Canadian. Too funny.

I am white born here so let’s get that out.

gwac, the US has these taxes & restrictions exactly because foreign investment doesn’t automatically pay for jobs and social programs.

The US National Association of Realtors PDF linked below describes US state gov’t rules that say, “Foreign corporation ownership, without more, of real or personal property does not constitute transacting business in state.”

ie., The US states want to ensure that foreign ownership actually provides jobs & social programs.

For 99% of countries around the world including the US, that’s why it’s common sense to protect security & stability (eg., food security & taxes for social programs) through RE rules/taxes. True whether they’re Democrat or Republican.

Vicbot it is common sense for those that follow that ideology. Some of us don’t.

Foreigner brings jobs and help the economy and make our country better. Making them go elsewhere with their money does not make sense.They help pay for social programs and government jobs that people in Canada love. I like that ideology better.

Agree with Leo & Marko especially “You don’t really need a place in Flordia to survive and you can always rent as well or just pony up and pay the tax.”

The US actually has FIRPTA – a 15% withholding tax on the sale of RE by a foreign entities, and there are high estate taxes for non-US citizens. Many states have restrictions (eg., Hawaii has areas designated for Hawaii residents only) or don’t allow foreign ownership at all (eg., Wyoming, Kansas). Some have land restrictions or reporting reqs (eg., California). There might be a flat 30% tax on rentals and/or no allowances for expense deductions like mortgage interest.

More US state info here:

https://www.nar.realtor/NCommSrc.nsf/files/Alien%20Land%20Ownership%20Guide%20%28November%202006%29.pdf/$FILE/Alien%20Land%20Ownership%20Guide%20%28November%202006%29.pdf

PEI already has much stricter limits on out-of-province owners of RE than Vancouver does.

Hong Kong raised its stamp duty from 15% to 30% in Nov 2016 to tame prices.

In fact Canada is behind the times when you look at rest of world:

http://www.theglobeandmail.com/report-on-business/how-other-countries-have-tried-to-deter-foreign-real-estate-investors/article31128696/

It’s just common sense. As freedom said, “there is no need to bring race into it.”

Make building easier.

The muncipal and pronvical governments currently in power are doing exactly the opposite of this.

Arizona and Florida feel those people are helping their economy. Which is true. Somehow the reverse is not true when a Foreignor buys in BC. Politics and not sound economic analysis is what happening. All those foreigner who bought in Toronto or Seattle instead of BC what the future impact on jobs and tax dollars on money not spent. Did it really help anyone locally buy. Was there a slow down already happening. Prices are starting to go up now. In my opinion it is a failed program.

You want to help people find places. Make building easier. Change what you build to accept today’s economics. Go directly to those people with tax incentives and low interest rates that help them buy. Finally not everyone was meant to own a SFH.

Totoro, when you come up with a good response I will debate you but it’s a waste of time debating someone who is only putting forward a contrarion statement and an assortment of logical fallacies.

https://youtu.be/Oj8RIEQH7zA

If I had a crystal ball that is the question I would be asking. I don’t and neither do you. Today, imo, the only real questions to ask are:

a. What can I afford?

b. Do I believe the risk of a market downturn and costs of ownership outweighs the value of owning a home?

c. If I am buying with someone else are we in a stable relationship?

If you answer these questions affirmatively then the question that is left is what does it take to buy a home in this market because that is market value, not what you believe a house might be worth in three years. Ask people who thought like you did ten years ago and have been waiting for a better time to buy ever since how that has worked out for them. It didn’t and it might not for you either – or it might.

I say the risk in waiting if you are ready to buy is almost never worth it looking at the past stats – there is only ever the deal of the day today. And that Arbutus house might not have been a good deal, I don’t know really as that is not an area I follow closely, but the price was set by the free market.

What are you talking about? There is no evidence I am aware of that shows that our market is made up of “mostly speculators” and this is part of the ridiculous blame game that obscures facts and creates scapegoats. I too find it alarming to see witch hunt behaviour among people who should really know better. And blaming buyers for anything instead of looking for the facts underpinning the root causes and solutions to affordability is a waste of time as far as I can tell.

Where is your evidence of this? In this particular case you have someone stating:

First the buyer was scapegoated as an Asian investor and now you are labelling them a “speculator”?

Do we honestly believe we can impose foreign buyers tax on non Canadians and not expect reciprocal treatment?

I have to agree with Leo….who cares. So I might have to go down to Florida and pay a tax? You don’t really need a place in Flordia to survive and you can always rent as well or just pony up and pay the tax.

I guess the alternative theory would be if those from out East are turned off by a theoretically tax in Florida they would flood Victoria? and we are screwed yet again.

In a speculative market what a home is physically comprised of such as size, quality, busy road is of secondary importance to what is paid for it. A speculator is buying on the assumption that prices will be higher in a year or two rather than if the property provides accommodation for their long term future needs. Another reason why a market comprised mostly of speculators is distorted from a market of people buying homes to live or invest in for the long term.

I think the foreign (non-Canadian-resident) buyer tax or other similar measurements are right thing to do, to restrict foreign investment and speculation in our housing markets, regardless it is an issue or not right now.

But it is should be based on nationality and residency. Whether one is for it or against it, there is no need to bring race into it.

So what? If people in Florida or Arizona feel that Canadians are distorting their market to the detriment of locals then they should be allowed to levy extra taxes.

I support the foreign buyer tax. Victoria aside, it was definitely a big problem in Vancouver and the tax helped a bit in scaling back demand. Maybe it’s not enough or maybe there’s a loophole to be closed but the principle that offshore speculation in housing should be restricted is good.

“You do realize this is the assessed value at July 1, 2016 right? Since then my understanding is that there has been 24-30% appreciation in SFHs in that area. Assuming the assessed was accurate at July 1 it would be at 987k-1.o2 million now”

I think you missed my point. If you really believe this home is a great deal for over a million you must think every home in gordon head that has been selling for over a million in rough shape is a good deal. Current appreciation has little to do with the homes true value. The question you should be asking is what is it realistically worth in another year or two in a balanced market. The house hasn’t been updated since Michael Jackson was the rage and its on a busy road where it would be hard to even pull out of your driveway. A house that is updated and on a quiet road in this sort of area will always pull in a good price but this one doesn’t tick most of the check boxes.

Right from the get go I found the blaming of foreign buyers insidious along with the 15% foreign buyers tax. Canadians by the 100,000 buy real estate in warmer climes especially the US. Do we honestly believe we can impose foreign buyers tax on non Canadians and not expect reciprocal treatment? Personally I have no interest in buying US real estate especially with the implementation of the new FATCA regulations but for all those Canadians that have and dream of buying in the States expect a reciprocal response from the US government, because they are looking for every conceivable reason to raise tax money and our 15% foreign buyers tax just opens the door for them to do just that.

Ya. Chinese are a big part of our heritage here. It’s a shame there is a negative light being cast on them. People are feeling angry and frustrated. They want something to blame. It’s been a shocking jump in prices so I get it. But how does the saying go again? Oh ya…. don’t hate the player. Hate the game….

I read the link for 3 minutes, my head hurts. Just too much hate….

LeoS, please understand I am not dissing this blog. If those “childish” (nicest word I can think of) comments on Facebook, it is a norm. But on this blog too? One with all the fancy graphs / up to date numbers / smarter than average home owners and buyers, and yet, hatred blinds the mind.

Thanks Lurkess for the info. I’m still in shock at how fast prices have gone up around the university. I can see why it makes buyers frustrated – low inventory, and then the general sentiment that you have to bid over-ask to get it.

Our street usually holds a street party each summer. At last summer street party, after a few drinks, neighbours started talking about where they were from originally. It turned out that all Caucasian neighbours were from outside Victoria with most of them immigrated from Europe, the only Victoria-born person is a Chinese Canadian whose family has been living in Victoria for at least three generations.

An interesting fact: in spring of 1860, Vancouver Island had a Chinese population of 1,577, and a white population of 2,884. Of course the native people were here first, but we are all immigrants after them, regardless race or gender, or arrival time.

And this is the tamest online discussion board I’m a part of. Drop by http://vancouvercondo.info sometimes if you want to see where it goes when uncontrolled.

Reading this blog makes me see why Witch Hunt happened, and why it will continues to happen.

Listen to rumor, then pass on the rumor; demeaning others’ success, blame own incompetence on others.

The worst part is never admit their wrong doing. Try to save face and blame on society, demand more rules.

Strangertimes: “Where are you getting the info that this house is a good deal at under 1.1 million. If you’re talking about the other side of arbutus road you would be right because the homes are far away from the road and overlooking arbutus cove. 2291 is on the other side. You’re right by a really busy road with maybe a slight view of the ocean and the house looks really dated. The home is assessed at 788 for a reason. Its crazy if anyone would consider this a good deal.”

Very well put and couldn’t agree more. Sounds like the home was quite dated from reading other comments on here. A renovated home with suite in place, perhaps it would be worth it. There are homes already priced at a million and on a more desirable street.

Mary: yes, transparency should be implemented, not a foreign buyers tax. I did look up Australia’s real estate practices and its brilliant and fair.

Amazingly enough I agree with Bearkilla. Commute to the peninsula is faster now but could slow down.

I’ve been doing the peninsula commute for two years now and it is awesome; I time it so I always beat the 7:00 am departure from Vancouver onto the highway @ Mount Newton Cross and there isn’t any congestion until Uptown.

On Friday mornings, there literally isn’t any congestion, not even at Uptown. Not sure what the deal is, maybe everyone has flex Fridays?

I stare at the real time navigation on my screen and feel sorry for the Westshore people…sometimes I see red (traffic at a crawl) all the way to Thetis Lake.

Yes.

Also when I read the comments about realtors aren’t disclosing the nationality and other details about the people making offers that is absolute bulls**t

How would the listing agent know the details other than what is on the offer? There is no checkbox that says “family,” or “investor.”

That is why I don’t buy 90% of the comments on this blog. If you are outbid not only should the listing agent not be disclosing information about the successful buyer but he or she most likely wouldn’t know much about the successful buyer in the first place.

I would say the majority of listings I sell I have no idea what the intention of the buyer is on completion. Sellers look for the best possible contract, vetting people for what they plan to do with the property is of lesser importance.

Everyone also talks the talk but put $1 million family offer or $1.1 investor offer and see which one the seller chooses.

Well, as soon as the sale completes we’ll be able to verify the new owner information. It will become public. My bet is that any buyer of Asian descent, even a fourth generation Canadian one, gets pegged as a rich foreigner by people who are looking for someone to blame quite frequently.

There should be transparency in bids as is the way it is in Australia.

Full of problems as well such as fake bidders being planted to drive up the price….in a slow market barely anything meets the sellers’ reserve price, etc.

@ ChineseCanadian, thanks for clarifying, it puts these rumours to bed. i am sick of hearing them as well.

Also when I read the comments about realtors aren’t disclosing the nationality and other details about the people making offers that is absolute bulls**t. Clearly people that think that don’t have good relationships with your realtors. Anyone that actually does have a friend with a realtor knows that people talk and they will tell you the truth cause they talk. Well at least the realtors that like each other do. And do you really think that realtors are the most honest group a follow the privacy rules or whatever they are and don’t quietly tell people this?

vicbot – we are local, and we make decent (not high) income. i can confirm for you that we are pre-approved by our bank to make a purchase, such as that arbutus home, at that selling price. whether or not we’d actually make the offer though, is a different story.

Baseless speculation removed - adminI don’t know where people come up with all this crap so thank you ChineseCanadian for speaking up! As soon as the comment was posted I knew the odds that an non-CND Asian investor bought it were in the neighbourhood of 1 in 200. The odds that a CND Asian family bought it were much larger.

Every day I have to listen to crap like “non-CND Asians are buying up the neighbourhood” or “our friends got the house because they submitted a letter with their offer,” ummghhhh no your friends got the house because they submitted a letter and OUTBID the next best offer by 50k, or they got the home for 10k less than the best offer but the best offer was conditional and they went unconditional. The odds of a letter working are typically zero to none.

People are so naive…..if you over pay by 50k the listing realtor is not going to call back and say “congrats on being so smart, you overpaid by 50k,” he or she will play it as “the sellers loved the letter about the buyers’ family and picked your offer.”

Ha! They did not enjoy your facts.

Not only are you participating in scapegoating Asians in a public forum without checking facts first, you are also trying to set a market value based on your own beliefs and coming from a non-biased position.

You do realize this is the assessed value at July 1, 2016 right? Since then my understanding is that there has been 24-30% appreciation in SFHs in that area. Assuming the assessed was accurate at July 1 it would be at 987k-1.o2 million now.

Well that didn’t take long. Banned from the Victoria Realtors Facebook group after 3 days and only 2 very polite comments.

🙂

“Please note that the house on Arbutus Road 2291 Arbutus Rd is actually priced well at being sold at under 1.1 mil”

Where are you getting the info that this house is a good deal at under 1.1 million. If you’re talking about the other side of arbutus road you would be right because the homes are far away from the road and overlooking arbutus cove. 2291 is on the other side. You’re right by a really busy road with maybe a slight view of the ocean and the house looks really dated. The home is assessed at 788 for a reason. Its crazy if anyone would consider this a good deal.

Bear mountain would have been a decent place to pick up a place when they could hardly give them away.

Amazingly enough I agree with Bearkilla. Commute to the peninsula is faster now but could slow down. Colwood crawl can’t get much slower and may improve with infrastructure in the future (plus biking distance)

Vicbot, I only said that because I would’ve been accused of being a non-hardworking whiner considering what I was discussing at the time. Like I said there are lots of people who live below their means or don’t go all in on their homes. Good day to you sir.

Completely agree on the transparency thing.

Has anyone googled the selling agents name yet?

Might be an idea to read her C.V.

ChineseCanadian, just curious, was your cousin moving to Victoria from another city? Would be interested to know if out-of-town demand is still pushing prices up, because $1.028M is still high for local incomes – or maybe not, and I’m behind the times.

Then again, because you’re a new anonymous poster, I don’t know who to believe anymore 🙂

Wolf, when you said you “can afford a SFH in the core” it seemed like that’s the only place you were looking. If not, great!

…so uh, Canadian…

ChineseCanadian, my sister is happy the house was sold to a family. Thank you for clarifying who bought the home. It’s unfortunate it sold for so high because we think it wasn’t necessary to go that high to get the house. There should be transparency in bids as is the way it is in Australia.

@ ChineseCanadian

Well said.

I know that Vancouver has a major problem with overseas investors. But as far as I can tell they have very little direct influence on the market in Victoria.

She was informed it was a Chinese investor. I will let her know. Perhaps she will file a complaint

@ Mary

2291 Arbutus Rd was not sold to an “Asian investor”. It was sold to my cousin who grew up in Gordon Head and is a 4th generation Canadian, and is an equally important “family”, just like you!

I’m super sick of these entitled white people that think the market should bend to their poverty/income level, “just because they grew up here”.

As noted, an incredibly small portion of houses are bought by out of Canada buyers, and I would wager a bet, that most of them are buying ahead of moving here, or are dual USA/CAD citizens.

//quick edit: Please also note that that house on Arbutus Road 2291 Arbutus Rd is actually priced well by being sold at under 1.1m. The average selling price around that area is well above that. The buyer got a good deal. The 899 listing price obviously was under priced.

“you said you only want to buy in the core – not Langford. Then you insult people who’ve had to move out of Victoria and back later – and don’t want to do the same”

Now who’s posting alternative facts. You have no idea where I am or am not wanting or willing to buy. I actually look in many communities. I know many people in Langford and don’t recall insulting anyone who has moved there. Get your stories straight; my priorities aren’t what you think they are. I don’t care at all about Oak Bay, for example.

As posted by Leo recently, non-CND Asian buyers are well under 1% in Victoria.

This whole situation is kind of like scapegoating AirBnB….blame AirBnB for the rental crisis and completely ignore the actual numbers.

Everyone is trying to use non-CND Asian buyers as a scapegoat even thought in Victoria for every non-CND Asian buyer there are 4x-5x non-CND US buyers (around 2.5%).

Interesting Wolf, when you first started posting in March you said you only want to buy in the core – not Langford. Then you insult people who’ve had to move out of Victoria and back later – and don’t want to do the same – because you deserve to live in your dream house at 30.

We agree on some things though – it’s not good when houses turn into stocks, but hard to tell when it’s going to stop. As bank economists & Poloz have said, domestic & international investors have caused prices to soar in Van & TO. It’s probably happening here – to what degree I don’t know – the university areas around UBC & SFU were always prized and a similar thing is happening with a few kms of UVic. This is also going on in other parts of the world.

Mary, how do you know that the home was sold to a person who is not a landed immigrant or Canadian citizen and bought only for investment purposes?

I’m not saying this is not true, but usually the identity, nationality and purpose behind an offer are not disclosed to someone else making an offer. The purpose is usually not disclosed to the vendor at all as it is not a question on the contract documents.

I guess some would prefer a 80km/h 40 minute commute to Sidney or whatever but keep in mind that it will always be at least a 40 minute drive. During non rush hour times you can drive from the westshore to downtown in less than 15 minutes.

A decent number are. 2287 NICKLAUS DR sold for $1,420,000

2211 WOODHAMPTON RISE for $1,220,000

2039 HEDGESTONE LANE for 1,330,000

Most of that commuting time is spent trying to get out of the core. It took me an hour to get to Spectrum school the other day from downtown. After that it’s just minutes to Langford.

The new interchange will have a profound effect on real estate prices with some areas increasing in price and others declining.

“many people in Victoria who have survived war and immigrated to Canada – some as ex. engineers and not all as refugees, or were Canadians serving in war”

Thanks totoro, yes, I forgot to consider these people when I was trolling Vicbot earlier this morning.

2291 Arbutus Rd was just sold to an Asian investor for $1,028,000. It was listed at $899. I know this because my sister put in an offer. She has been desperately looking for a home for her family with the intention of using it as a family dwelling. The counter offer was stalled for three days because the sellers of the estate were waiting for a million dollar offer. The sellers were informed that a family was putting in an offer. The million dollar offer came along and another family loses a home.

I suppose you’re using ‘you’ in the argumentative sense Vicbot because I personally don’t mind a 40 min commute and never said that I did. I used to do more than that everyday (not here) but now I live in the core steps from the beach.

People I know who do the commute though would argue that it takes longer than that, especially to Sooke. For them being stuck in traffic and moving very slowly is probably part of the frustration. A 40 min commute going 80 km/h is a lot different than a 40 min commute going 5-10 km/h.

Is the percentage of out of town buyers increasing or decreasing?

Almost everyone on this blog has come from another part of the world. Victoria has always and will always have out of town buyers. So 25% maybe high or maybe low depending on historic norms.

And it also depends on where most of the out of towners are buying? 30 years ago it would have been mostly houses in the core. Today the probability is that most out of town buyers are buying condos and in the Western Communities.

Victorians that have owned real estate here for 20 or 30 years and paid off their mortgage are rich. They can use a large chunk of their equity to buy a rental property or a house for their children and that’s most likely what they are doing.

Unfortunately, they are putting all of their eggs in one basket. And if history teaches anything we know that the last ones in on a sure thing usually lose everything.

We have not heard from Hawk today. Spoke with a realtor that I know who said that he has seen a noticeable slowdown in the number of people viewing his listings.

By the way, I certainly agree that local incomes are the single biggest factor in the pricing of houses. On the other hand having a quarter of the houses sell to out of towners must have some impact as well but I have no idea how to measure that.

Does anyone know if the houses on Bear mountain are actually selling at those high prices?

Mowed the lawn and spent about three hours sanding this morning so time for lunch with my sweetie.

If housing is unaffordable then how can it sell? A Faberge Egg is unaffordable to most people on the planet yet they still sell. That’s because that definition of “affordable” matters on who is buying.

Today’s buyer is not the same as the buyer of a decade ago. Today’s detached house buyers have big down payments so defining affordable based on a 20 or 25% down payment is moot.

But that’s not to say that today’s buyers have unlimited access to larger and larger down payments. We just don’t know what that level is. So a little back engineering is necessary. If house prices have plateaued then we can assume we have reached the point where buyer’s affordability has peaked.

Yesterday’s buyers were constrained based primarily on income. Today’s buyers are constrained mostly on the size of the down payment.

In contrast to the detached house market, consider the condo market. Since condos are generally first time purchases for many people there is an affordability constraint due to income. And that’s one reason why condo prices do not appreciate at the same rate as detached houses.

“Vicbot you didn’t “survive a war”, you were just a casual observer and didn’t even pick up a weapon.”

Wolf your comments are quickly becoming “alternative facts.”

My words were that I: “worked with people from China, Lebanon, South Africa, etc. So yes, Wolf, you start to recognize First World Problems when you talk to fellow engineers who’ve survived wars.”

I worked every day with engineers from those countries (as well as Iran, India, Bangladesh, UAE, Bosnia, etc). (they weren’t refugees) They had what we would call “Perspective.” GEE, how great Canada is compared to the battles and/or bombs and/or conflicts they just experienced and are still traumatized by.

Seriously, you look like a huge whiner when you’re incensed by a 40 min commute to Langford or Sooke. One called us “Marshmallow Land” because a few people here don’t understand how lucky we all are.

Maybe you’re just trolling, but if I could leave Victoria & do a 40 minute commute to work when I was younger, you can too.

Does actually. In Victoria the 65 year average is 7% per year. That far exceeds the inflation rate for the past 65 years: http://www.tradingeconomics.com/canada/inflation-cpi

Yes, a part of the jump in net worth is house value, although there is also a jump in mortgage debt, but all other asset categories have also risen in constant dollars. Private pensions represent 30% of net worth, including RRSPS:

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil110-eng.htm

http://www.statcan.gc.ca/daily-quotidien/140225/dq140225b-eng.htm

Only because housing has exceeded inflation. Which doesn’t happened over the long term historically.

No, that is the average. There is no “affordable line”. Just a pattern of house prices not increasing when affordability is poor (with a general trend of decreasing affordability over time in SFH as the proportion of condos increases).

He did not say he did. He is right that there are many people in Victoria who have survived war and immigrated to Canada – some as ex. engineers and not all as refugees, or were Canadians serving in war.

Of course, but we are talking about net worth. Net worth is your assets minus all debts. Owning a two million dollar house with a 1.5 million dollar mortgage puts your net worth at 500k less the cost of selling if you have no other assets.

Vicbot you didn’t “survive a war”, you were just a casual observer and didn’t even pick up a weapon. To me that seems disrespectful to those who are actually refugees. You could’ve just stayed home.

The only people here who survived a war are the wrinkly folks in Oak Bay who fought in WW2.