Jan 29 Market Update

Weekly sales numbers courtesy of the VREB.

| Jan 2018 |

Jan

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 41 | 115 | 251 | 360 | 478 |

| New Listings | 124 | 276 | 469 | 671 | 753 |

| Active Listings | 1398 | 1417 | 1420 | 1469 | 1516 |

| Sales to New Listings | 33% | 42% | 53% | 54% | 63% |

| Sales Projection | — | 368 | 458 | 434 | |

| Months of Inventory | 3.2 | ||||

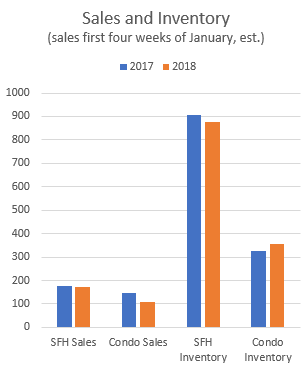

Based on the headline numbers as reported by the board, the message is simple. With inventory at the same level as a year ago, sales are down less than 10%. So much for the stress test right? Condo sales are off the hook with two out of every five going in a bidding war of some magnitude. Realtors are drowning in business cards and we’re already seeing the start of the yearly news stories warning that you’ll be priced out forever if you delay any further. Predictably, this has caused condo prices to spike with the price per square foot up some 10% since the fall.

Thing is, as we saw last week, the number of old sales being counted in those totals is distorting the picture a bit. Looking just at pending sales in the first 4 weeks of January, we get a closer picture to reality. Single family sales and inventory are more or less exactly where they were this time last year, while condo sales are down and inventory is up.

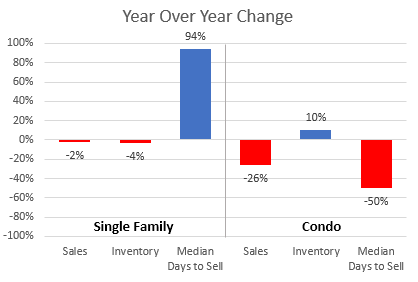

Or in changes since last year if you like.

A market of contradictions then. There are just as many single family homes selling now as last year, but they are taking nearly twice as long to sell (31 days). Meanwhile condo sales are down by a quarter, inventory is up, but they are selling twice as fast as last year (8 days). Perhaps I am wrong but the condo market seems more driven by panic of the few rather than solid demand. Can that last through the spring?

It’s almost every day now that we see stories of money laundering and fraud in real estate. There are measures coming in the February budget (three weeks away) to target those avoiding the PTT and foreign buyers tax through numbered corporations I’m sure of it. That is the the one politically safe way to attack the market. After all who can argue against cracking down on fraud? Don’t expect too much else, after all the politicos love to talk about how they want to protect peoples’ equity but it is another kick to a weakening market.

Am I the only one who thinks buying a condo is extremely risky? I have heard so many horror stories about fees going up ( especially after the first year or so). Problems hidden from reports…yes that can still happen. My sister is a top corporate lawyer..she is extremely careful and diligent….ridiculously so and yet a condo she bought had major water damage just a year into ownership. The small strata had kept it a secret…in fact they told her when water starting streaming in from the suite above just to patch over it. She finally had to threaten court action ( and she pointed out she could get the best legal representation for free…she hated saying that but these people had no clue what they were getting into) two stressful years later they paid up and when she sold she told the new owner the entire story..the strata encouraged her not to. This was an 800,00 condo in West Van. She vowed to never buy a condo,again and strongly advises people to be extremely careful.

Anyway I tell this story only because I feel if my sister can get snookered anyone can.

So many other reasons own an apartment does not appeal…at least when you rent you can move without paying huge realtor fees et. I also hate the idea of having to deal with my neighbours…lol. A few wingnuts could make life very difficult.

Anyway all these people rushing into that market doesn’t seem prudent. Are they all doing their homework? And even if they are fees, assesmennts can go up…can they all afford that scenario?

Marco: “It’s like how many people would be content to live in an all original 1950s house?”

I would. In fact that’s exactly what I would like. But good luck finding one that hasn’t been tarted up with a gawdawful horizontal glass tile backsplash and greyish-brown paint, among other charm eliminating updates. Double pane windows, on the other hand, would certainly be worthwhile.

LeoS, I know you are in Gordon Head but do you drive near UVic? The increase in Audi, BMW and Mercedes sedans (either black or white) is startling. Just the last 18 months. I won’t say that all of them are driven by 20-something asian males, but the proportion is large.

UVic has had a very active campaign targeting China for new students because they pay higher fees than Canadians. It is working.

Yikes, that is 4 posts in a row. Sorry to spam the thread, folks.

Jerry, I don’t agree with you, but you definitely made me laugh.

I do agree that some areas of the city need better planning for Car traffic, though. Choking car access is going to make serious problems, even if bike lanes are a great thing for multiple reasons.

I thought I should add, I agree with others that have said that, if we are serious about offshore money being a problem, we should just ban it like New Zealand. Even there it is just for existing homes (not new construction).

All this pissing around with tax rules is just skirting the problem, if it is a real one. For the GVRD and CRD, just limit existing homes to people with legal permanent residency.

For corporate ownership of residential property, make sure it is a Canadian controlled corporation. Done.

Of course, this does not address the immigration scams (Quebec, cough cough) but that is really a different issue.

Beancounter, thank-you for trying to address my question. However, I am going to say that you answered with philosophy and treated it as though it was truth. In Canada we tax income and we also tax property, with each examining “fairness” on its own terms. You are essentially saying that no-one can stay in the city unless they have full employment. I think that is insane.

I agree that speculation is a serious issue, but this “surtax” is going to have serious negative unintended consequences if it is rushed. I still think the new rule in China is good: if you want a mortgage on a second home, down payment minimum 40%. On a third home, minimum 60%. Preventing overleveraging would decrease speculation and also protect idiot house investors from themselves when the downturn comes.

While offshore money is a real issue as well, I think Canadian speculation and low interest rates are driving more of the recent rise.

Me too … don’t loose hope – I think eventually he will – but only on the foreign buyer issue! It will just continue until it reaches a breaking point which eventually it will. They aren’t ready for it yet… riots on the streets are what’s required and I don’t see that happening yet… do you? Canadians don’t riot like the Brits do 😉

I knew you would post it before you even did! 🙂 In my view one of the most desirable developments now approved for this area!

Victoria: Just like LA.

@LeoM – Yep I had a good time that summer. Few hours shoveling in the morning, nap, few hours shoveling in the afternoon on the other side of the house. Lots of time to think.

LeoS said: “Or do it like my dad. Hire your kid (me) to dig everything by hand with a shovel, lay pipe, and fill in drain rock over a summer. ”

Leo, I hope you dad is still around so you can go give him a firm handshake and thank him for everything you learned from him that summer, and I’m not referring to digging a ditch and laying pipe.

@introvert

So what happened in LA? Correction? Continued increases? Riots?

Different time. Different place. But the sentiment expressed is exactly the same:

No bike lanes in Langford? That’s the first credible reason we have been offered to move there.

Had a chance to view the idiocy in front of Sen Zushi today. One entire lane of a street in a congested city lost to use because a handful of the self-righteous can’t find any other excuse to wear inappropriate Spandex.

It’s like visiting your doctor and asking him to harden your arteries for you.

Interesting. So my prediction is probably on the money.

The first one cost $600 and a decade later the iPhone 8 costs about the same. The new iPhone is several hundred times faster and better than the first one. Does that mean the price went down because you’re getting more for your money? No, you’re still just getting one smartphone.

Yea, but you can still buy a $50 cellphone; however, you average Joe isn’t satisfied unless it is the iPhone 44. Same goes with cars….just no market for a $9,900 bare bones car with no A/C and crank windows.

It’s like how many people would be content to live in an all original 1950s house? Expectations have gone up. If the kitchen doesn’t have soft-close how does one survive.

Pretty sure to get approval in Langford you have to promise not to put a bikelane in.

I was in this subdivsion the other day and the developers had to put in a 1.5 m wide bike lane.

http://www.keycorp.ca/southpoint/site

Except it doesn’t matter that the quality improved because the lower quality item is no longer available. The definition of a basic car or a basic house or a basic TV will change, but it makes no sense to quality adjust when looking at the price.

Take an iPhone for example. The first one cost $600 and a decade later the iPhone 8 costs about the same. The new iPhone is several hundred times faster and better than the first one. Does that mean the price went down because you’re getting more for your money? No, you’re still just getting one smartphone.

Pretty sure to get approval in Langford you have to promise not to put a bikelane in.

I bet half the units will immediately be snapped up by wealthy Alberta retirees, who will be tickled to live across the street from the beach, with a grocery store, bank, pharmacy, coffee shop, and medical clinic on the ground floor of their building.

From what I’ve heard the pre-sale at Sayward Hill is currently mostly selling to CND out-of-towners.

Or do it like my dad. Hire your kid (me) to dig everything by hand with a shovel, lay pipe, and fill in drain rock over a summer. Can’t remember what I made that summer, but less than $5k for sure.

I bet half the units will immediately be snapped up by wealthy Alberta retirees, who will be tickled to live across the street from the beach, with a grocery store, bank, pharmacy, coffee shop, and medical clinic on the ground floor of their building.

Cordova Bay certainly has its charms.

One final thought is I’ve seen savvy people do $20,000 drain tile quotes for less than 5k. They rent their own mini-excavator plus some hand shovelling, go to home depot to buy the material and hire a plumber to glue to pipes together and install them with the right grade.

I’ve helped my dad install drain tiles on the houses he builds. It isn’t rocket science, we’ve passed inspection every time.

The problem is everyone waits until their basement suite floods and then they are in a panic versus taking your time in August to repair/replace the system.

I really hope Mr Weaver is listened to but I have my doubts: http://www.cbc.ca/news/canada/british-columbia/weaver-housing-reccomedations-1.4513085

Is this tongue-in-cheek or do you actually know that’s what the target price is?

I can’t see this location being less than $700 a foot average so there will be lots of units over a million (the larger ones and the ocean view ones).

A 13 year old condo on Sayward Hill just sold for $876 a foot.

Good to know. Thanks, Marko.

Many here feel the same about me!

Marko, scroll way down and answer my goddamn drain tile question, please!

Dammit I hoped it would just go away…..it is like asking me what kind of inspection results do I see on original 1980s BMWs. If the inspection is crap you’ll have electrical gremlins and if the inspection is great you’ll still face electrical gremlins.

We are talking pre-1980 drain tiles so even if working okay it is still clay tiles or even worse crap concrete tiles (literally piece of 1′ tile laid one next to the other, not solid pipe).

To answer your question I would say 1/3 of the time the entire system is crap, 1/3 of the time the corners are crap, and 1/3 of the time you can’t really get a camera or an auger cable far enough to figure out what kind of shape the tiles are in…..most likley bad at that point.

Capital region housing market unbalanced, overvalued: CMHC

According to CMHC, the demand is coming from increased migration from other parts of Canada and within the province [VREB will tally the majority of them as “local buyers,” of course]. It said with more retirees expected to come to the region every year that’s not about to slow down.

“The world and retiring Albertans have discovered this place,” he said. “We saw [the baby boomers] coming 15 years ago, and it took about 10 years for that to materialize, but now it’s happening.

“And as long as the economy remains strong and the millennial group keep getting their careers on track and then looking for homes, pressure will continue to be put on communities like Victoria, which are ideal places to live,” Edge said.

http://www.timescolonist.com/business/capital-region-housing-market-unbalanced-overvalued-cmhc-1.23159564

“Victoria has also been flagged for concern when it comes to home prices.

RBC’s most recent “Housing Trends and Affordability” report named Victoria as one of three cities that saw their worst affordability levels ever, in the third quarter of 2017.”

Yep, all these millennials flocking here to live a life of dreariness in Introvert’s basement.

“B.C. city named Canada’s No. 2 place for millennials, and it sure isn’t Vancouver”

Weak methodology – they just measured things that they think millenials might care about. They did not survey millenials as that would take actual work.

The fact that they are luxury condos is a bonus for the city.

Marko

Is this tongue-in-cheek or do you actually know that’s what the target price is?

The article says nothing about affordability or price. I assume they’d be more expensive than the Lyra, which I guess would put them in the million range. Probably no 3 bedroom units either.

Marko, scroll way down and answer my goddamn drain tile question, please!

Saanich council vote was 8-1

That’s awesome. I am surprised it wasn’t voted down on the basis of the condos would be over a million 🙂

Introvert

First time I’ve heard of Point2homes. Seems like a click-bait article (original here).

Saanich is #6 though, so maybe it is legit ;).

Poor Chilliwack always getting a bad rap. I’d choose Chilliwack over a lot of places in BC (assuming I didn’t have to commute). Cheap housing, beautiful area, the amenities of the lower mainland and it’s easy to get pretty much anywhere else in the province. Whistler would be a bit of a pain from Chilliwack, but Hemlock/Sasquatch and Manning are close and easy to get to.

Cordova Bay Plaza development approved by Saanich council

http://www.timescolonist.com/news/local/cordova-bay-plaza-development-approved-by-saanich-council-1.23158690

Saanich council vote was 8-1, with only Mr. “By the way, I worked with Steve Jobs” voting against.

B.C. city named Canada’s No. 2 place for millennials, and it sure isn’t Vancouver

https://globalnews.ca/news/3996888/canada-best-cities-millennials/

Interesting tweet via Ross Kay. The industry is desperate to keep herding the FOMO sheep with bullshit. Talk about despicable, no wonder most people despise these salesmen cons.

@CREBNow

Using “magnetic” headlines with dynamic language can help boost interest says Sandquist. Creating a fear of missing out (#FOMO) can help grab potential buyers #creb18

Leo and some others are really having a hard time adjusting to the reality that land in certain locations has become worth a lot.

Welcome, local buyer!

And my goal is to never see Victoria become as dense as those.

Oh my god. Not this debate again…

Barrister

That’s CRA wording and it’s purposeful. They make things ambiguous so they can decide on the interpretation as it suits them. Like the whole recent fiasco over interpreting employee discounts as taxable.

Current income tax interpretation bulletins

2785 Leigh Rd is residential?! I’ve driven past there quite a few times recently and assumed it was commercial. It looks like 626 Alpha street (the Wes-Tech plumbing building). Good location for the elderly (ambulance dispatch across the road!), ha.

301-2732 Matson Rd looks interesting. A condo my family could actually live in (well.. depending on their pet rules). 3 bed 3 bath nearly 2k sqft and a way better layout than my house. Balcony is around the same size as my deck too. Concrete building so I assume the noise levels are ok. Hmm.. one parking spot?! Bah.

LeoM:

With all due respect, this is about as clear as mud. There is an exception for rental use if “the rental portion of the property is small in relation to the whole property”. I was not able to find any definition of “small” (what idiot wrote this is beyond me). Smaller than a breadbox? Do they mean a closet or a single bedroom or is a basement suite small. How about a single room that is twenty by thirty. How about a 1000 square foot suite in a 8000 square foot home. What about a large bedroom but with joint

use of the kitchen, dining room, living room, library , pool room and basement theater?

Whoever wrote this needs to be fired. Did I miss a definition of “small” somewhere in here?

Everyday you hear the conversation.

“I’ve been cheating on my taxes for the last ten years and I just got caught”

Really people are going to tell you that they are cheats? Basically telling you that they are crap in order to get your confidence, trust, and respect.

I took a drive over to Olympic Pen. in Washington State last fall… Driving along the coast from Port Angeles towards Cape Flattery you can see the island in all it’s glory on the other side of Juan… The amount of empty tree farms from Sooke onwards to Port Renfrew, basking in southerly sunshine, gently sloping land up from the ocean – definitely would be a beautiful setting for some new cities I was thinking… But no, not in Canadistan, sorry Josh. Instead – we squish people in to smaller and smaller spaces in our existing cities in the second largest country on earth – quite perplexing.

Meanwhile, in my other country – the UK – they are creating new garden cities to alleviate crowding and provide much needed housing as despite Brexit the population continues to grow (they have managed to reduce immigration by 1/3 since Brexit – now down to approx. net migration 200,000/year). Outside London, most people with a bit of tenacity and hard work can afford a nice home w/ garden (albeit may be a row home or semi-detached) but it’s not outside the realm of thinking there, even though they invite globalized capital just like here. In such a crowded country – you don’t have to resort to living in a tiny condo.

http://www.telegraph.co.uk/news/2017/01/02/new-garden-towns-villages-provide-200000-homes-ease-housing/

http://www.bbc.com/news/uk-38486907

https://www.gov.uk/government/news/first-ever-garden-villages-named-with-government-support

But wait, the UK is only seven times larger than Vancouver Island, but w/ 65.6 million people much more crowded- unlike Canada however, most of it is livable and w/ a relatively pleasant climate. While most of Canada is inhospitable weather-wise and terrain-wise (with the exception of course, of the BC Coast where many would like to live). We are increasing immigration in our large country to 300,000/year! Why not? There’s much space from coast to coast to coast. Here on the BC coast we still have plenty of empty space…but we aren’t utilizing it. I think we could do a whole lot more here with all our empty space that we are not doing.

Our existing cities here are full – where we are building cookie cutter homes (Westhills, Royal Bay) – it’s possibly starting to go for over $1 million! This isn’t making for a nice quality of life for struggling families.

So I ask – what will it take? I think our Gov’t is expecting people to settle in the more unpleasant bits of Canada and so, they don’t give a damn about it. If people want to live here, do we just expect them to live in tiny condo’s as the supply of SFH shrinks and cost of it keeps growing? I guess so…

Yes, the Chinese are creating so many new cities they have gone too far and so now have ‘ghost cities’ all brand new but no one to fill them…

https://en.wikipedia.org/wiki/List_of_under-occupied_developments_in_China

http://www.businessinsider.com/these-chinese-cities-are-ghost-towns-2017-4/#it-was-the-uniform-newness-of-these-cities-that-originally-piqued-my-interest-caemmerer-said-4

Capital gains are payable on your basement suite. It doesn’t get any clearer than this document from CRA:

Would love to hear some real-life example in Victoria. You would think there would be a ton as every other home has a suite.

What does Monterey work out to then, a 6% increase, or about 4% YOY? A little better than inflation I guess….

Capital gains are payable on your basement suite. It doesn’t get any clearer than this document from CRA:

https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/formspubs/prioryear/t4036/t4036-16e.pdf

1050 Monterey Ave in South OB – bought for $1,401k in July 2016 – sold for $1,488k today. They barely broke even there…

My clients offered and were outbid on this property back in July. I thought $1,401k was a healthy number back then for this property. The fact is it still went up another 87k since that time. Transaction costs for the seller are a separate issue.

Marko Juras

This is so true it hurts. I tried to talk the wife into oceanfront property in Duncan (comox valley?). At the time it was a similar value to our house (I think that has since changed in Duncan’s favour). Resounding no.

Also brought it up with friends that telecommute. “Yeah, sweet place. Awesome price.. but no f-ing way I’m moving to Duncan.”

Of course most people I know in tech are dead set they have to be in Vancouver or Victoria in case they lose their telecommute position and have to get a desk job. Hasn’t happened to any yet, but the pragmatism is strong in the technical types.

And even then it can be sketchy. So you got a new vehicle as cheap as a slightly used one. That’s great and all, but one accident and the accelerated depreciation kills its value. You can just turn in a lease and they have to deal with the extra depreciation (as long as the damage was fixed there’s no penalty).

We “don’t do” accelerated depreciation in BC (if we did ICBC would be further in the hole). There is the odd court case, but it tends to be extreme circumstances and generally has to be a realised loss (can’t claim a loss if you don’t sell it). Again, exceptions to that rule but they are pretty rare.

If the lease rate is good, leasing can be the best financial option. You aren’t stuck with a depreciating asset you may not want. But people seem to think it’s “throwing money away” just like they think that with renting.

A couple sales Mr. Fancy pants here is watching 😉 …

1050 Monterey Ave in South OB – bought for $1,401k in July 2016 – sold for $1,488k today. They barely broke even there…

15 Marlborough St in Fairfield – the Albertan’s made some dough here…

Sold for $1,465k in Jan. 2016 – then the Albertans bought it for $1,517k in Feb. 2017… Now… drumroll…

They just sold it for $1,869k after listing it for $1,950k. So, that’s a healthy profit of about $300k in just one year! Go cowtown! Now – are they heading back to Calgary as per Hawk’s dreams? What can you get for that price in Cowtown?

They could do it largely through tax incentives. Reside and work in this town of 10k people, and until it’s 100k people, get a hefty tax break.

Why do people pay double for a home in South Oak Bay versus Langford?

Even people that work from home don’t want to buy in Duncan if they don’t have to.

CS

Don’t forget Jeff bezos and his late 90s Accord. Not sure if he has upgraded it yet but he was a billionaire when he drove it.

Steve Ballmer apparently drives a ford fusion hybrid.

Josh

Sure, plenty of land for housing but apparently not housing you are happy with type or location). Why do you think they are building squished together SFH on tiny lots all the way out Happy Valley road? Why are there 3 or more new condo buildings going up around Goldstream and Jacklin? Units built can keep up with demand, but a lot of those units are high densisty or out in the boonies.

There may be plenty of land for housing in general, but there isn’t plenty of land for SFH near town.

Yes, this is entirely wrong. We need people making minimum wage to be able to live here without scraping by.

Of course that’s a separate issue from affordable SFHs and affordable SFH is different from affordable housing.

Not too long ago you could buy a new SFH out in happy valley for under 400K (now the lots are selling for 200K up from 100K and building costs and profit margin are up.. so I’m assuming well over 500K now).

I’m willing to bet they’ll be cheap again soon, since they are tearing down trees at a tremendous pace out there.

Luke

Woah woah woah.. look at mr fancy pants over here. I see plenty of places I like between 900K-1.2 million. Of course the ones on the cheaper end of the scale need a bit of updating.

Barrister all the good land near water or the US is taken. Only way to create a real town outside current areas is by a large company or Government creating a town with jobs, Do not see it happening here.

Josh:

Stealing from Simon and Garfunkel, maybe we should call it the “Troubled Bridge over Water”.

“The story of that bridge is one of abject failure and abhorrent ineptitude. I hates it.”

If it works 2 years from now everyone will forget the last 8 years. If it doesn’t go up and down without issues. What fun that will be.

GWAC:

I dont disgree but that begs the question of whether we should have active government participation in creating new towns and cities following the model used in Switzerland with great success.

Whenever there’s a recession and people cry out for the government to do something, they generally react by throwing money at construction companies through infrastructure projects (and signage to make sure people know). The construction industry does well and every other industry sheds jobs like they’re going out of style. For the life of me, I don’t understand why the government has never focused on building entirely new cities, or at least growing medium size cities. They could do it largely through tax incentives. Reside and work in this town of 10k people, and until it’s 100k people, get a hefty tax break. Start a business in that city and get another tax break. It would cause construction to do very well, but it would also help every business that goes into those new buildings. We could really use another major costal city in BC. There’s plenty I don’t like about China, but there’s something admirable about their government saying “we’re making 3 new cities” then bam, 3 new cities exist within 10 years.

The story of that bridge is one of abject failure and abhorrent ineptitude. I hates it.

Canada will probable see no new towns/cities created. Its just population being pushed from the core and these areas being more populated and including further out towns. IE Hamilton/Guelph/Langford/colewood as part of the greater area.

Gwac: I am not sure that we totally disagree. But the expansion of Toronto into neighbouring municipalities is not really the creation of an additional city. Municipal borders aside, both Esquimalt and Oak Bay are clearly part of the GVA.

Barrister you can say that about every city. Probably 50 around Toronto.

Nearly impossible to start a city without a connection and infrastructure to/from another city or big business.

Only reason we have the vast majority of the towns on this island is the logging companies.

All about Jobs and being located near them.

Caveat:

With respect, Langford is simply an expansion of greater Victoria as is the growth in the Saanich peninsula.

Jack

I hope the pill works. Feb 4th we find out if it goes up.

Blue bridge looked unfinished and cheap. Big white is sharp looking. with some lights at night even better.

Barrister – arguably we HAVE created several new cities. Look at the population of Abbotsford in 1970 and now. Same for Kelowna. There are your two new medium cities. They just happened to replace existing towns. We have also created some new small cities from 1970 to 2018. Think Langford. There was not a city there in 1970.

Imagine the size of “the little blue pill” to get the “big white” to go up.

It could be worse. They could have painted it in flesh tones.

Number 6:

What corruption in BC, unheard of, totally shocking, never heard of it happening here. BC is known across Canada for its total integrity both in politics and business. Its reputation is as stellar as Chicago.

gwac: different strokes for different folks. Seems boring to me and certainly not worth the fortune we paid for it. But we can agree to disagree.

There was an attempt to create a new town on the Malahat at Bamerton. It failed due to environmental concerns. Which translates into the developer wasn’t paying off the right politicians.

For example Sun River Estates, the developer bribed the politician with $50,000 and the land was taken out of the ALR. Or the politician that had an new overpass built on the Pat Bay Highway near the airport that lead right to the residential development he was involved with developing.

Yes we could have new towns built and we should. You just need to know who to write the check to.

I really like the look of “big white”. Our new bridge. I think it will really adds something nice to the city.

Gwac: Absolutely agree that the top 10% of agents must have almost half the listings in some parts of town. In Oak Bay most listings are spread over a handful of agents. I just checked one agent who I know and he has 22 listings. Sort of suggests that there must be a lot of agents with no listings.

Barrister

To add the top 10 to 20% of the agents have a large % I would imagine leaving others in a difficult situation as sales drop

James: play nice lets not start up again with everybody name calling. But your point is excellent and stands on its own merits.

Nan:

I suspect that the real estate ad may have something to do with the fact that the number of real estate agents and the number of listings are almost the same.

Barrister

Not sure how much land is available up Island to Duncan. A lot is FN,forestry or ALC restricted. Sooke area I think has a lot available.

Shorter distance you putz. Commuting is commuting. You don’t have to wait in traffic if you don’t want to. It takes me 25 minutes to get to work by bike. Google maps says that in a car it normally takes 16-28 minutes if i leave at the same time. If you go from langford at 9 o’clock(or 6:40), it’s 16-30 minutes on average, but if you leave between 7:20 and 8:20 it can take up to 50 minutes.

By my calculation, it costs roughly 2.5x as much per kilometer to drive a new car as it does to drive a 3-5 year old one. Trying to figure out the optimal way to finance overpriced consumption of status has always seemed like a waste of effort. But I guess someone has to buy those cars new and eat the depreciation so I can buy that car for 60-70% off when it’s only 5% used up, so maybe I should keep my mouth shut!

Also, for the first time ever I heard a real estate agent ad on the radio this morning stating that if they sell your house in less than a month you’ll get at least $1,000 of the commission back because the commission should reflect the amount of work (or lack thereof) that goes into selling the house in this market. 100% of their listings had been sold in less than a month over the previous year.

Maybe Victorian’s are starting to wake up a bit to how monstrously overpriced RE commissions are!

Marko

I get it but I like owning my stuff and owning it for a long time so that plays into it. A vehicle is just something to get me and my family/stuff from one place to another. I only buy Japanese for the reliability.

Problem with leasing is you have nothing at the end of 3 or 4 years

If you buy with cash your car will have depreciated down to the lease residual +/- some so you are exactly in the same spot; however, without any options. The issue is leasing on average isn’t 5% where your cost of interest is high.

I understand the argument buying used versus new, which makes sense. When I had a regular job at the hospital I always hustled used cars (I would buy them via lease take-overs where the owner would pay me cash to take their lease, etc.). People don’t understand lease-takeoves so there was low demand so a couple of times I found super desperate sellers. Once the cash the owner gave me covered 13 months of lease payments 🙂

However, if we are talking brand new it rarely makes sense to pay cash unless there is some crazy cash incentive which as I’ve said is very rare currently.

A if we are talking what makes sense…..Honda Fit or Honda Insight like our friend on here has 🙂

Toronto has a lot of land if you are talking a 60 to 80 km radius. Using the same metrics so does Victoria (70km takes you past Duncan).

I spent all my working life commuting at least an hour to work each day and I only managed that by being in the office by 7:30 and almost never leaving before 8;00 thus avoiding rush hour. In spite of a really good income the commute was a trade off for getting a SFH. Looking back, I would have been much smarter to move to Waterloo or Kitchener.

below is 1k monthly payment nothing down

Problem with leasing is you have nothing at the end of 3 or 4 years.. At least a loan you have something after you pay. In Victoria there is no reason not to have a car 10 to 15 years. My basis on this is a car has a longer lifespan than the cool factor of owning the latest year model. If you use your car for work and/or put on a lot of mileage and can deduct it than that is another story.

My friend has a 80k suv that has 1000k nothing down lease payments. Puts on 15k a year in mileage renews every 3 years. So 72k paid in 6 years and 100k in mileage. That car has another 6 years and 100k left on it at least. Does not add up for me.

What angers people is the sense of going backwards. Making much more money than their parents but being able to afford less. Or making a decent living but being able to afford only a condo. It would be different if places had always been expensive.

Is there anything other than real estate that people can afford less of? Just look at cars for example…your base Honda Civic comes with power windows/locks and 42 airbags. Inflation adjusted it is also way cheaper than a 40hp Yugo which is pretty much a death trap on wheels.

Also, let’s not forget that a 1950s home had one electrical plug per room. Now it is like 10 plugs, cat5e wiring, hardwired smoke alarm, pot lights, all the circuits are grounded, AFCI breakers (recent new code), etc., etc. Not comparing apples to apples.

Not to mention developing Gordon Head a bit cheaper than blasting apart some hill in Langford or Sooke where you have to get 101 environmental reports and agree to a bike lane before you can put a shovel in the ground.

I have a relative in law enforcement, and in all his years of handing out speeding tickets to drivers of expensive cars in Vancouver, he said he never once encountered one that wasn’t a lease.

I am helping my dad buy a new Honda Ridgeline right now. He has had his current truck for 17 years and doesn’t want to let it go but I am forcing him to let it go.

He has cash for the Ridgeline but the lease is 24 months at 0.9% and there is no cash incentive. Why on earth wouldn’t you lease? Your cost of interest is like $700-$800 which you can re-coup via investments AND you have the option of just returning the truck if you don’t like it or the option of buying the truck and selling it (if worth more than residual) or the option of buying it out and keeping it for another 15 years.

Same situation last year, my mom got a new car also have 17 years and my parents wanted to pay cash and I was like…yea no, 60 month financing.

The issue is manufacturers just aren’t doing significant cash incentives, often none.

I lease my Tesla for various reasons like if the battery sucks I can just return it. I could pay cash using funds from my PREC but doesn’t make sense imo.

Barrister, back in the 1960s there was a lot of postulation about what would happen with an earth population that was perceived to go up linearly from that point on (rapid increase due to recent advances in medicine). To assess this, there were some longitudinal studies done on human migration patterns resulting from population growth. The hypothesis was what you were mentioning – that new cities would form on previously empty lands. What they found over time is that instead, people crowded more and more into existing urban regions. You find this tendency globally, for better or worse. So the answer might be, because humans tend to go to what’s known, rather than go to a new frontier.

Toronto has had a historically boom/bust market that is not really related to how much land there is (believe it or not, there has been and still is, tonnes of land there). Here’s an excerpt from the Toronto star, 1988 when RE prices had recently doubled:

“Mortgage rates are low. Ontario’s economy is superheated … and, to make matters worse, land is in short supply. Politicians and tenants’ groups have declared a housing affordability crisis—again—and have called for a tax on speculators’ profits to cool down the frenzy.”

Shortly thereafter, poof went the RE market – and somehow, the vernacular “no land available” disappeared until we saw it again near the peak of the next cycle, 27 years later.

Why? I have no idea. But it’s a great opportunity for the new Provincial government. My vote would be for a floating, earthquakeproof, town in Saanich Inlet connected by floating bridges to the Peninsula to the East and to the Island Highway, north of the Malahat, to the West. For home owners, there’d be no land to buy, just some floating dock space to lease from the city. Such a project would provide an incredible opportunity for innovation in urban design to minmize air and noise pollution (no cars), water pollution (separate gray water and sanitary sewers, the latter connected directly to a sterilization and dehydration plant for the production of fertilizer), and energy conservation.

@Barrister, the answer is simple. 120 million per bridge, 80 million per overpass, 2 Billion for a sewer system, 200 million in legal for FN claims. It’s simply too expensive to build new centres. We built this one on the back of Chinese slaves so you can’t even equate it to inflation….

Let me throw out a thought for the general wisdom of the group. In the last fifty years (1970 to today)

the population of BC has grown from about 2 million to 4 million. (yes, I know that it is closer to 4.4 and that it is 48 years we are talking about but lets stay with the big picture).

In spite of the population doubling there has been absolutely no effort to develop any new cities instead we have focused on cramming more and more people into Vancouver and Victoria. Unlike Kansas city both Vancouver and Victoria have obvious geographic constraints more so than even Toronto which sits on Lake Ontario. The experience of most cities in North America is that there is a threshold of increased density which when crossed leads to a rapid acceleration of housing prices. I experienced the same in Toronto.

My simple question (and I am sure someone will point out that it follows from my simple mind) is why when we have doubled the population we have made virtually no effort to create at least two new medium cities. Trying to cram more and more people every year into the same city envelop has predictable consequences and sometimes I feel that everyone is ignoring the elephant in the room.

@Trekker

Just fill out the form at the top right (under “Interested in monitoring sales”) or email me and I can set you up with the portal to get the more detailed listing info and monitor sales prices.

Welcome to the blog. It is mostly friendly.

You’ve made similar comparisons several times, and with respect, I don’t think it’s meaningful. You might as well argue that when 1 billion people in the world have no access to fresh clean water, we shouldn’t complain about a little excess chlorine in ours. Or, because we don’t have to pay usurious health care costs as in the USA, we shouldn’t mind waiting 4 to 8 hours in the ER waiting room, or a few years for a knee replacement. You can take it to any extreme you like – families in sub-Saharan Africa would look at your Croatian condos as literal palaces – for them it’s common and accepted practice to raise a family of 5 or more kids in a 1 room shack (and no access to sanitation or clean water).

Just because a country like Croatia or any other country in Europe may have a different market, these differences often go way back in time and are rooted in a different social structure as well as much less available land. Unlike Europe, we don’t have a history of feudalism in Canada and I don’t think what we’re seeing with housing atm means that that social system is starting to take hold.

People here who argue “we’re running out of land” honestly need to give their head a shake. We have more land here than almost anyone in the world, and one of the lowest national population densities. While metro Victoria’s density is much higher than our national average at about 530 meatbags/km2, it’s not particularly high compared many other urban regions.

People are simply viewing certain Canadian markets’ real estate as a perpetual money making machine, a view which waxes and wanes with our RE cycle.

I remember someone telling me in, I think it was in 1970, that in the financial community, a hundred thousand to invest was considered real money. But then in 1970, I recall a five bedroom home on the UBC Endowment lands being offered for, I think it was, $108 K. So the way things are going, if you’re planning to retire with “real money” in about 45 years time, you’ll need a billion dollars.

At about ten times median family income, a million dollars still represents real money doesn’t it.

That’s what makes the current RE market seem insane. A run down Oak Bay bung, now costs real money.

Hey, anyone knows where I can find the strata fee of the property posted in MLS? Why are the strata fees such as condo maintenance fee not included in the listing in BC? And on which website can I find the sold prices?

I am new to Victoria. Can’t afford SFH that are getting so expensive. Might settle for a townhouse or condo.

This website is helpful. The bloggers seem very friendly 🙂

LeoS

People may be earning more actual dollars than their parents but their actual purchasing power has gone down. There is a lot of factors involved in this calculation but one cannot ignore that the average Canadian is now working about five months of the year just to pay taxes. It was more like three months when I first started working. Maybe we are getting real value for those extra tax dollars but at the end of the day you are going to be able to buy less chocolate bars.

As I understand it, the property surtax is not designed to catch foreign buyers. It’s to ensure that everyone pays their fair share of taxes. The privilege of living in our society and all of it’s generous social services (healthcare, etc.) comes with a price. Our strongly progressive tax system, up to very recently, has been very effective at limiting inequality. Unfortunately the influx of global wealth has subverted this system, and now we are witnessing some pretty shocking growth in inequality. The cheap domestic capital part of the equation driving this RE run-up is nothing more than a Ponzi scheme. Trading houses at ever higher prices. Who’s paying the bulk of the tab for this inequality? Well, anyone foolish enough to take on massive debt to own a home to live in it. And renters of course.

The phenomenon of the “millionaire migrants” who apparently pay less income tax than refugees are an issue with the tax base. They are not foreign buyers, but they do hold a lot of wealth. The surtax would get them to pay their due, along with foreign buyers. In the two cases you mention below a “fair share” of taxes are most definitely not being paid. The 40-hour-a-week neighbours would not be happy that you paid for your house cash yet don’t have the money to fund the system you would be enjoying. Rightly so – they work almost half the year to support the system.

For most people these days, the bulk of their “net worth” is in their principle residence. Outside of it, the balance sheet looks somewhat poor for most. So the government is definitely walking on eggshells when tinkering with the market. It’s makes sense on some level, but on another it seems akin to adding my credit card limit to my net worth. Your home is usually where you eat, sleep, take a shower. There is only a net gain when you decrease your standard of living (downsizing, moving to Moosejaw, etc.). Investment RE on the other hand is of course what I’d consider a traditional asset in the net worth calculation.

FYI – on the topic of expensive cars and wealth: I have a relative in law enforcement, and in all his years of handing out speeding tickets to drivers of expensive cars in Vancouver, he said he never once encountered one that wasn’t a lease. Apparently cars are a horrible investment.

“There is a lot of talk about this property “surtax” idea, where an extra property tax can be offset by income taxes paid. The aim is to catch foreign buyers who own property but do not contribute to the tax base.

If anyone here has more info on how this is supposed to work, I would be grateful.

I have a mock scenario: BC resident, works at decent paying job until mid-40s, inherits decent amount, pays off house and retires. No substantial income taxes from that point onward. Wouldn’t this surtax end up punishing this local owner more than a rich foreign buyer who is just parking money abroad?

Scenario 2: BC born Canadian citizen, goes to Europe at age 35 to work, comes back at age 55 to retire. Is this person a “foreign buyer” we are trying to discourage with this tax?

The surtax seems reasonable on the surface, but to make it “fair” it is going to have so many exclusions as to require a 30 page form each year.”

Ento:

You are right it is simply a matter of purchasing power. I think of it in terms of chocolate bars.

When I was a kid a full sized chocolate bar was a nickel and it was also about twenty percent larger than today. You also where not paying tax on it. You do the math.

Leo:

Not all houses in the core are crap. There are some pretty nice properties although I would agree that there is a fair share of crap out there.

What angers people is the sense of going backwards. Making much more money than their parents but being able to afford less. Or making a decent living but being able to afford only a condo. It would be different if places had always been expensive.

And let’s face it, the people on this blog are more than likely in the higher ends of income brackets. Look at discussions on other forums and most have given up on ever owning anything.

I always thought 10 million was becoming the new 1 million. When I was as a kid growing up in the 80s, I asked my Mom if you could live for the rest of your life on 1 million. She said yes, a person could live comfortably on just the interest. Of course, rates were higher then, and a savings account generated 5% or so. So $50k a year. The BoC inflation calculator says 50k in 1985 is just over $100k in 2017, but interest rates are much lower. Still, 1% return today (100k a year in interest) seems very much comparable to that 4-5% savings account rate then.

Thus, for me 10 M is the new 1 M.

How our neighbours feel about wealth

https://www.cnbc.com/2017/06/21/how-much-money-americans-think-it-takes-to-be-considered-rich.html

$2.4 million USD in 2013 is the answer. With 5 years of RE appreciation, the number is likely closer to well over $3.0 million USD.

When we say “shelter” what are we talking about? SFH or a Condo?

As bad as the situation is it still isn’t dire.

If I had to replay things starting now and I went to respiratory therapy school (three years) I am out at 21 yrs old making 70-80k with a bit of overtime (available all the time). That income would allow me to buy this

https://www.realtor.ca/Residential/Single-Family/18882673/401-845-Johnson-St-Victoria-British-Columbia-V8W1M2

I wouldn’t have a car since the Jubilee is close by and I would throw a desperate friend into the den for $800 a month. Pre-pay cellphone and a bunch of other cost saving measures to maximize savings for a downpayment on a SFH down the road. I would hustle CPAP machines on my days off.

If you do an arts degree and then at 25 yrs old decide to pursue something a tad more employable and you finally land a half decent job in your late 20s with 50k of student debt then of course you are going to have issues getting into the housing market.

My cousin is an oncologist (plus a PHD he did in Toronto) in Zagreb, Croatia and he makes $3,000 CND per month. Him and his wife (a family doctor) live in a two bedroom condo with their four kids. They are hoping to upgrade to a larger condo….SFH not a chance. That is how life is in the majority of the world. Here on the other hand it would be some sort of crime to raise a family in a condo. It can’t possibly be done.

A million in net worth is no longer exceptionally rich in Canadian standards, so I agree the term “millionaire” is less useful as a term to describe the really rich.

Still it’s a better financial position than many/most Canadians, so if you have attained “millionaire” status whether by hard work, exceptional smarts, or just dumb luck take a moment to feel happy/lucky/proud.

Median household net worth in Canada – 295 K, BC – 430 K.

I’m thinking for Van and now Vic 3 million is the new 1 million! Noticing no decent homes under 1.5m in the core tells me that having a decent home in the core and another 1.5m in the bank is what it takes to be Set for life for most people. (Barrister not included). So it’s the same as what having one million was like in, say, year 2000. Loosely speaking of course!

Well said. We are nearing a situation here where society is becoming too polarized. I notice it if I dare tell people I’m a homeowner in OB. It shouldn’t be a big deal. Wouldn’t it be nice if it was a bit more like Oklahoma City here sometimes ( like where anyone can own a SFH).

It should be like what CS said there. However, here on the west coast – I think largely due to allowing commodification of RE – Our society is in serious danger of becoming broken, polarized, fragmented, hollowed out and full of despair among those who have no hope of ever getting ahead or even thinking of having a decent shelter they can be proud of – no matter how hard they work. If that’s what happens, in the end it may be what destroys this once beautiful place, even for me.

I’m not saying they’re the same. A millionaire has always been used as a term for someone that is wealthy. Of course it means having a million dollars in net worth but that was when that represented real money, not a run down 70s shack. Millionaires had a $100k home and $900k in actual investments. That is no longer the case because any SFH owner that has owned for a while is now a millionaire. It has lost its original meaning.

I wouldn’t put much stock in a fixed rule like that. Not saying rental returns make sense (they don’t) but waiting for the 1% rule means a rental in Victoria hasn’t made sense for decades and it just isn’t true.

Padmapper data is absolute garbage I have no idea how they can release it with a straight face. But yes rents are increasing quite quickly

Yes, completely inapplicable to our market now. There are two types of markets in NA as far as I can tell – cash flow markets based on the 1% rule (maybe somewhere in Nova Scotia and lots of the rust belt) and investment markets based on appreciation. We are in the latter, along with most highly desirable areas which have been like that for longer than we have – like Hawaii or San Francisco or Boston or New York or Toronto…

Investment-based markets have higher buy-ins and are riskier if there is a downturn or interest rate hike and you are highly leveraged. You need deeper pockets to have reasonable security. Cash flow markets are often a safer investment, but they don’t exist in our province as far as I can tell apart from a few resource-based towns in boom periods – which tend to be unstable.

Rents are not too low imo and this is just a false dichotomy – and house prices have been rising faster than inflation here for more than 70 years.

As far as being a millionaire or not, I always thought it was based on net worth? Net worth includes your home. And, hey, we don’t even have to debate it because a definition exists:

I don’t have a lot of sympathy for someone with a million dollar home collecting bottles, they have options to unlock equity and make life easier. A family saving for a down payment in this market has a much bigger hill to climb and much less of a cushion for hard times.

I still can’t get over that near 50% over ask that Michael posted

A subset of the truly rich realize that they are way beyond having to signal their wealth by driving expensive cars.

I have to agree with Introvert. A millionaire is someone with one million dollars in net worth. Nothing more, nothing less. Could be in cash, could be in stock, could be in ownership of a business, could be in real estate. An accredited investor is a different beast – http://venturelawcorp.com/accredited-investor-definition-canada/. Generally you have to be significantly richer than a mere millionaire to be an accredited investor

That sounds delicious. We actually have a guy regularly come to the office selling exactly that. Whole thing going on – the french beret, lame tasselled socks and the accent. Great guy. Sells all different kinds including my favourite triple cream brie. I didn’t buy this time, and now I regret it. FFS

Expensive cars are to impress. They are the biggest

depreciation waste of time/money. I know someone who has spent 80k in 6 years on a lease renewed once with a new car and has zero to show for it at the end of the second term. It was not a right off

Would like some cheese with that whine?

BC MLAs’ Public Disclosures Online Once Again for You

https://thetyee.ca/News/2018/01/29/MLA-Disclosures-Online-Again/

These are always interesting to poke through…

For example, I see that Premier John Horgan has an “Integrity Fossil Fuel Free” mutual fund portfolio. Right on!

But often the very rich really don’t care.

J.D. Rockefeller III was killed in a car crash. The car he was in at the time was an old Ford Mustang.

The late Barry Sherman, Canada’s 15th wealthiest by some accounts, drove to work in a Chrysler Sebring. Prince Charles, I believe, has a Mini.

They do count. No one was talking about accredited investors. We were talking about net worth.

That was from census 2016.

When you buy an executive home surely you deserve an executive car! If you buy a new house you can’t just park your shitty Corolla in front of it. That’s the advantage of the core. The houses are crap so no one notices when your car is too. 😉

Precisely the angle I was going to talk about in the next article. I mean they haven’t been published for very long, but are the measures actually useful for anything?

Those don’t count. There’s a reason that accredited investors are defined as having $1M outside the primary residence. Otherwise they’d have every tom dick and harry that bought a house 20 years ago thinking they’re investing geniuses getting into real investments.

That’s lovely, but we weren’t talking about bike commuting.

I sort of see your point. I often forget the fact that Langford has lately become expensive, too.

Political slants aren’t relevant unless you choose to inject that into the issue. Practically, shelter needs to be affordable to all segments of a community for that community to run. We need home care providers as well as doctors, laborers as well as engineers, scientists as well as teachers, retailers as well as managers .

I don’t think most people here would argue, “I think it’s wrong that someone making 70k per year cannot afford a home in Uplands”, but I do think it’s another matter when they cannot afford to buy anything anywhere. This is what is increasingly happening, and not just at that tier of society.

When people making 150k north qualify for housing subsidies, or cardiologists and neurosurgeons not in the market are struggling to get in – that is bad for a community and families, promotes economic polarization, and ultimately acts as a broadly impoverishing force and drag on the economy.

But it would be the view of the great majority of mankind that those who do an honest day’s work in a community, day in day out, deserve to live in that community in decent accommodation if such an outcome is attainable through good financial regulation, social policy and management of public resources.

That is, unless we have given up on the democratic ideal, to create a decent life for all.

“That’s the capitalist way of looking at it”

A substantial number of people would say that it is the only way of looking at it.

There’s plenty of ~300k populated cities in Canada where incomes are higher and yet they’re cheaper. Ottawa has over a million people and the incomes are the highest in the country, and yet their houses are cheaper. So ya, I find that surprising. Although my surprise has expired after looking into why. BC has been experiencing a speculative fever.

I think the numbers and analysis in that article point out that the idea that “there’s only so much land” is false.

Whenever I’m pointing out how bad affordability is, people seem to think I’m expressing entitlement. I’d love a SFH in the core, but entitlement doesn’t have anything to do with that desire. I’m pointing out how multi-decade eroding affordability is bad for everyone. If everyone was aware of just how bad a market jam packed with speculators is, we could collectively decide to do something about it. But I might as well scream into a paper bag and mail that to city hall.

That’s the capitalist way of looking at it. I’m not talking about Uplands though. Here’s a question – at what income level does someone “deserve” to be homeless? 2 people making minimum wage need to spend damn near 40% of their income on rent for a 1 bedroom. According to padmapper, rent jumped 17.6% for 1 bed places this month. Bad affordability isn’t just about complaining.

“Either rents are far too low or house prices are far too high. My opinion is a combination of both; house prices should decline substantially and rents should increase significantly.”

Rents are already maxed out for the average joe. If you want to see a mass exodus from Victoria to Calgary or other eastern locales, then cheer on. It’s the end of a bubble, rising rates, new layoffs by corporations, tightening credit, and rising gas prices. Political uprising in the US only compounds the situation with a lunatic threatening nuke wars every week.

“Shaw offers voluntary buyouts to 6,500 workers; job losses could top 650

News like this is great—a weaker Canadian economy might mean fewer interest rate hikes!”

Fricking brilliant ! No job to buy a house or pay the mortgage/rent. What a stable genius.

Lots of comments lately about monthly rental rates, investment properties, landlords’ profits, and the insanity of purchasing a rental property these days.

I’ve also noticed lots of younger people on this blog who have never experienced anything but rising house prices and declining interest rates during their adult life.

There is an age-old formula for determining whether or not the purchase of a rental property makes financial sense. It’s commonly called the “1% rule” and it’s defined as: “the One Percent Rule states that the gross monthly rent should be at least one percent of the property purchase price.”

In other words, if house/condo is rented for $3000 per month then the maximum purchase price should be $300,000.

Conversely, if you buy a house/condo for $900,000 then you should be receiving a gross monthly rent of $9,000.

To comprehend how far out of whack things are these days, consider this: the actual percentage these days for SFH rentals is about one-third of one percent!!

Either rents are far too low or house prices are far too high. My opinion is a combination of both; house prices should decline substantially and rents should increase significantly.

The days when escalating property values subsidized low rents seems over. The markets seems in transition now, but we won’t know for sure until the annual Spring ‘rush’ has past. September to December of this year will be interesting times in the real estate market.

I work with a bunch of people in Langford, and their bike commute is shorter than mine.

No, it was just the 70s.

Number 6

No one suggested Sooke is in Greater Victoria (currently).

It is strange they include it. That has got to skew numbers for Victoria down a bit (depending on how they weight Sooke numbers).

edit:

caveat emptor

Oops, and I stand corrected. The more you know.

It comes as no surprise that millionaires can be dumb.

I never qualified myself to be a member. Yet another thing you’ve made up, as is your wont.

News like this is great—a weaker Canadian economy might mean fewer interest rate hikes!

Good argument, Soper: the distance is similar!

Was his house on 300 acres?

Here’s what’s currently for sale in desirable Wynyard: https://www.point2homes.com/CA/Real-Estate-Listings/SK/Wynyard.html

Nobody “deserves” to own shelter in any location they choose. It would be like me complaining that the Uplands is out of reach.

Greater Victoria is most but not all of the CRD. The logical definition of “Greater Victoria” is the Victoria Census Metropolitan Area (CMA) as defined by Statistics Canada. Look up the CMA here –

http://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/index.cfm?Lang=E

And yes Sooke is part of it.

James Soper

Excellent point. I definitely should not have said always (damn risky universal quantifiers). How about from the 80s onwards?

Josh

Every country is going to have least affordable cities. Is it any surprise Victoria is near the top? Even if Victoria were affordable it would be one of the least affordable in Canada. Maybe not 2, but definitely top 5.

No I’m not currently affected, but I know the pain of Victoria being pricey. In 2007 all my older coworkers had houses, even ones that made less than me and they had all had them since they were my age or younger. We were in a condo.. in Esquimalt! I can relate to the frustration and yes, the current situation is worse.

Difference between shelter and a SFH. But again, we have post secondary education and decent jobs so we felt quite entitled to a SFH, preferably in core. We worked hard in school, got good jobs, surely we should be able to afford a SFH!

What we ended up with was definitely settling. No, we weren’t cornered into a condo/town, but we started in a condo saved and waiting for an opportunity to move up. It’s not like there are no housing options, it just the options don’t seem fair. I totally agree.

By the time I was 30 I was making more than my parents ever made. Add my wife’s income to that and we couldn’t afford the house I grew up in (which my parents bought when they were 30-31). Didn’t seem fair, but that was reality at the time.

Not sure of the point of posting this. Sure, we have plenty of housing stock but that’s by units as a whole. Raw supply and raw demand may match, but specific demand (in this case SFH in core) exceeds the supply. There have been a few subdivided lots in Saanich somewhat recently. They plunk a spec “modern” house on there then ask 1.3 million plus and they sell like hotcakes. I think one was on Majestic. Really not my taste at all.. but there is enough demand to sell at those prices.

Seen the listings on Mt Douglas X?! Those blow my mind. Who is buying those? > 2 million for Mt Doug cross?! Probably helps that the cattle farm is gone ;).

Anyhow, be patient. Things can’t go up forever. I think the condo market is on the cusp of collapsing. SFH has got to lose gas at some point. I thought it would have corrected by this past fall, but it seems my guesses are as bad as anyone else’s.

Number 6: What are non manualized structures? It is consistently one of the prominent search terms that people use to find this site. Don’t ask me why…

Teranet isn’t a source to determine if Sooke is or isn’t in Greater Victoria.

Google the Capital Regional District.

If I were earning that kind of dough, I wouldn’t own a car. Join a car club and book an exotic car for the times I want to drive.

https://youtu.be/0UOSIfEu5GE

Both those things will lead to the opposite of a crash. All explained by a word that starts with an I, and ends with an N 🙂

Hint: The Dow went nowhere from ’65-’81, while mtg rates tripled & RE went up 900%.

Victoria is the 2nd least affordable city in the nation and neighbours with the least affordable city. Is that just shrug-able information to you? Just because you’re not affected doesn’t mean it’s not bad.

Ya, screw average people who have double full-time incomes working skilled jobs. Why should they deserve shelter? Only people who earn their wealth through birthright are truly worthy of the noble Langford 2 bedroom home.

Sooke isn’t in Greater Victoria. I didn’t realize it was in our teranet, that seems like a mistake.

https://househuntvictoria.ca/2017/10/25/no-we-arent-underbuilding-in-victoria-and-other-census-bits/

This isn’t Tokyo or Hong Kong. Many SFHs in the core are already split into 4 to 6 apartments. I’d love to see a heat map of subdivided buildings that look like SFHs.

Trying to make some sense out of house prices in the core this month. The new OSFI regulations may be having an affect on middle income families but the uber riche crowd seem not to be affected.

The mode this January for middle income households decreased by $100,000 while the secondary mode for the uber crowd increased by about $200,000.

That puts middle income households at around $700,000 and the light my cigar with a $100 bill crowd at $1,250,000.

That’s a big spread for the two modes and they are going in opposite directions. What this means is both the average and the median are way up for this month from December but have market prices really increased?

Define always.

My neighbour moved from Wynyard Saskatchewan to Victoria(GH). He sold the house in Wynyard for more than he paid for the one here in Victoria. Similar houses.

The Pat bay has definitely gotten a lot worse during rush hour in the past few years.

Langford is what a couple of kilometers farther away from downtown than Gordon head?

It’s definitely not a 45 minute drive at best, maybe at worst.

@Andy7

You can use “markdown”.

Add > before any text you want to quote (greater than symbol).

Double asterisk surrounding is bold. Single is italic. Not sure what else is supported by wordpress comments. Anyone tried a chart/table?

@Hawk

Thanks for the link! Helps the lazy (i.e. me). One thing that stuck out from the summer report:

“.. to a seven-year high..”

Which we have since surpassed.

Isn’t the Victoria cycle usually around 7 years long? Could we have finally reached peak?

2022 is the new 2014. You heard it here first!

@ Leo S

“Like it or not cars are a reflection of wealth. Drive around Vancouver and see the difference. I doubt it’s because all those people are leveraged to the hilt and all the people here are the millionaire next door”

Leo — You’d be surprised at how many wealthy people drive regular cars (Ford trucks, Toyota etc). Flashy cars don’t always signal genuine wealth.

“61 percent of people who earn $250,000 or more aren’t buying luxury brands at all. They’re buying the same Toyotas, Hondas and Fords as the rest of us.”

On a side note, how do I get the quotation marks I see on this blog to show up when I want to quote someone?

And so it begins. Look for other corporations to start similar cutbacks. I just heard of several in Vic getting the axe or buyout offer.

Shaw offers voluntary buyouts to 6,500 workers; job losses could top 650

As more people cut the cable, Calgary-based Shaw Communications Inc. is offering voluntary buyouts to nearly half of its 14,000-strong workforce as it aims to transform into a leaner and more digitally-focused operation.

http://calgaryherald.com/business/local-business/shaw-offers-voluntary-buyouts-to-6500-workers-job-losses-could-top-650

“Bingo,

December 2017 RBC housing affordability report.”

That’s the one I was referring too. Thanks LF. It broke 60%.

” RBC’s aggregate affordability measure

rose for a 10th consecutive time last quarter, jumping by 2.7 percentage

points to a record-high of 61.5%. Victoria’s measure, in fact, recorded the

second-largest increase relative to a year ago (7.2 percentage points) among

the markets we track in Canada after Toronto. ”

http://www.rbc.com/newsroom/reports/rbc-housing-affordability.html

No income, no pension? Then it’s a reverse mortgage. And man, you don’t want to go there.

@LF Thanks!

Josh

I’m familiar with the term “bc housing crisis”, but we are talking about buying a SFH in Victoria. There are still “affordable” purchase options in greater Victoria.. just can’t be picky about where or what type of housing.

I’d agree Victoria has a rental crisis. Rent rates and availability (while not as obscene as Vancouver, home of the $1000 den rental) are bad and that needs to be addressed more seriously.

What about out on Happy Valley road? How about Metchosin? Sooke? Seems like it’s inevitable that Sooke will end up part of Greater Victoria. Teranet includes it as part of Victoria.

Also, why does a SFH have to be in reach of the average earner?

As the city grows that can’t stay true. We only have so much land. I think the patient will have an opportunity to buy a SFH in the next cycle, but who knows what will happen the cycle after that (if Victoria keeps growing).

Affordable housing is key, but affordable low density housing? Definitely not sustainable.

Some kind of settling has been the norm as Victoria grew. My parents couldn’t afford the truly desirable areas (despite decent income). They settled for a new build in Saanich West (which was probably similar to buying out in West hills back then). Affordable SFH have kept moving away from the core. It crept out to the peninsula and Colwood, then Langford, then out towards Metchosin and Sooke.

Maybe if we allowed land to come out of the ALR it would add some slack for a bit, but it seems the demand for SFH in the core outstrips the supply.

Number 6 – I agree that a portion of “millionaires” are house rich and cash poor. Not a huge portion but some portion.

Part of the issue is assets vs income. it is one thing to have a $1M in assets and near zero income, quite another to have $1M in assets along with a decent employment or pension income.

$1M in assets actually isn’t a huge amount if that is all you have to live on (no income , no pension)

You weren’t disqualified to be a member of the club – you were never invited.

Caveat and Introvert. You do understand what a paper millionaire is? They are unrealized gains and most investors understand that when we call someone a billionaire that includes unrealized gains.

But they are still unrealized gains. We live in a society where you can have a net worth of a million dollars but not be able to buy food this week.

I would find it difficult for anyone to think of a millionaire as a person having to collect bottles in order to afford a meal. But that’s what happens in Victoria. People are house rich and income poor. I see it more often than you probably do, as these people are re-financing to live in this city as their expenses are more than their income. They only have a couple hundred bucks in the bank but they have a million dollar house.

Google “BC housing crisis”. It’s not a term I invented to be melodramatic. As mentioned in this thread $150k/year is in the top 14% of earners here, and yet that number still qualifies for a BC housing subsidy at 845 Johnson St. http://www.timescolonist.com/business/downtown-condos-to-sell-below-market-rates-to-qualified-buyers-1.23051102

What would you call it? The BC housing affordability whoopsie daisy? There are no SFHs in the greater Victoria area which are remotely affordable to average earners, even at near rock bottom rates, even if they have no debt, even if they have 20% down. That’s not normal, don’t care what RBC or the big 5 have to say about it.

Bingo,

December 2017 RBC housing affordability report.

The people I know who bought luxury cars and live in homes squished up against a neighbour on a micro-lot used the house to buy the car. They couldn’t get a conventional car loan but could use a HELOC.

Hawk

Have a link? Was it an updated version of the one I’m referring to (i.e. the historical bands of income to housing in various cities)?

CS

So interest rates go up, nominal housing prices go down but mortgage payments aren’t any better due to increased rates. Great for people sitting on cash (Hawk) makes no difference for your average person that can barely scrape together a down payment.

If black swan event happens then maybe interest rates stay the same and nominal house prices drop further (or both!).. but in such an event people are likely losing jobs or job security (still no more affordable for your average family) and investments are sunk (so people sitting on investments have less purchasing power). Of course the guy with the 100s of thousands in the mattress is doing great, well assuming he didn’t put the cash in there a decade ago and inflation ate it up.

I’m not saying it will never get better. Affordability in Victoria sits in a band. We’re nearing the top end (a few more interest hikes and maybe we’ll test the top end). There will be sunnier days, but Victoria won’t be truly “affordable”, it’ll just move into the lower end of the band (which is still more expensive than most of Canada).

” The RBC report I posted, erm.. a year or so ago (maybe longer), showed we are within historical norms.”

That’s pretty funny. The last RBC report a few weeks ago says we just exceeded historical highs in affordability as we just passed 2006/2007 peaks which matched early 90’s when markets peaked. The Trump Tank looks imminent as he tries to destroy democracy. Markets never like that shit.

No you can’t. You have to have all your money in a bank account, withdrawable in a nanosecond.

And you’re disqualified from the millionaire club if you used debt to get there. Sorry, Jeff Bezos. You’re not a real billionaire because you borrowed a few hundred thousand from your parents to start Amazon.com.

Langford gets a worse rap than it deserves.

Sure the commute sucks but so might the commute if you lived in in Central Saanich, North Saanich, Sidney or Highlands. Those communities don’t get looked down on the same way that Langford does.

Negatives about Langford

– the commute if you have to do it

– terrible urban planning and mostly you’ll be driving decent distances to every amenity you need

Positives about Langford

-cheaper

-great access to parks and nature

-access to big box shopping

-faster to get out of town

#6 – you know that Scrooge McDuck isn’t a real character – right. You can be rich without having an actual money bin to jump in.

They’ll do it by waiting for the crash that rising interest rates and a falling stock market will bring. Right now, the DOW is off 332 points (1.26%, or about $1 trillion, equivalent to a drop of perhaps $100 billion on the Canadian market).

We call Bill Gates and Warren Buffet “billionaires” even though I am certain that neither of them ever has a billion in actual cash or cash equivalents lying around (that would be stupid). MSFT and BRK.A are not cash and must be sold if those guys want large sums of cash. Therefore it is still reasonable to call someone with a net worth greater than 1,000,000 a millionaire. Millionaires just aren’t as rare as they used to be in Canada and globally.

In some cases it is reasonable to distinguish people that have more than $1M in investable assets (discounting the principal residence) from the run of the mill millionaires (including the principal residence)

If stories like this help you get through these tough times, then I want you to hold on to them.

@introvert – haha, awesome.

I haven’t heard of that wine. Is it tasty?

– its a bit salty

All those dummies stuck daily in the Colwood Crawl—why don’t they just travel when it’s not rush hour?

– exactly. ‘boss, I’ve decided to work 11-7 to avoid the crawl’… boss: you can work 830 to 5 or work somewhere else.