Affordable housing

Today the feds announced their new affordable housing strategy which bundles together previous announcements to build another 100,000 affordable housing units, repair 300,000 existing ones, and try to reduce housing need amongst other promises. It also commits $4 billion to rent subsidies to support some 300,000 low income earners starting in 2020 (so I guess those low income earners first have to vote the Liberals back in).

In general I see this positively. Housing is or should be a right and the lack of it costs society far more than we save by trying to skimp on it. I also think more focus needs to be on providing stable and affordable rental housing rather than focusing on trying to shovel everyone into home ownership by handing out free debt. Generally handing out free debt or subsidies to home buyers just results in higher prices and worse affordability for everyone.

On the rental side, I believe we need government supported rental construction so this is a welcome announcement on that front and will combine with the province’s modest commitments in that area. In the 60s we had a rental construction boom and those low rise buildings are still serving us well for affordable housing now, although they are aging and will need significant repairs soon. Relying on private owners to provide housing through suites is fundamentally inferior to properly managed rental units where people don’t have to fear getting kicked out on the owners’ whim.

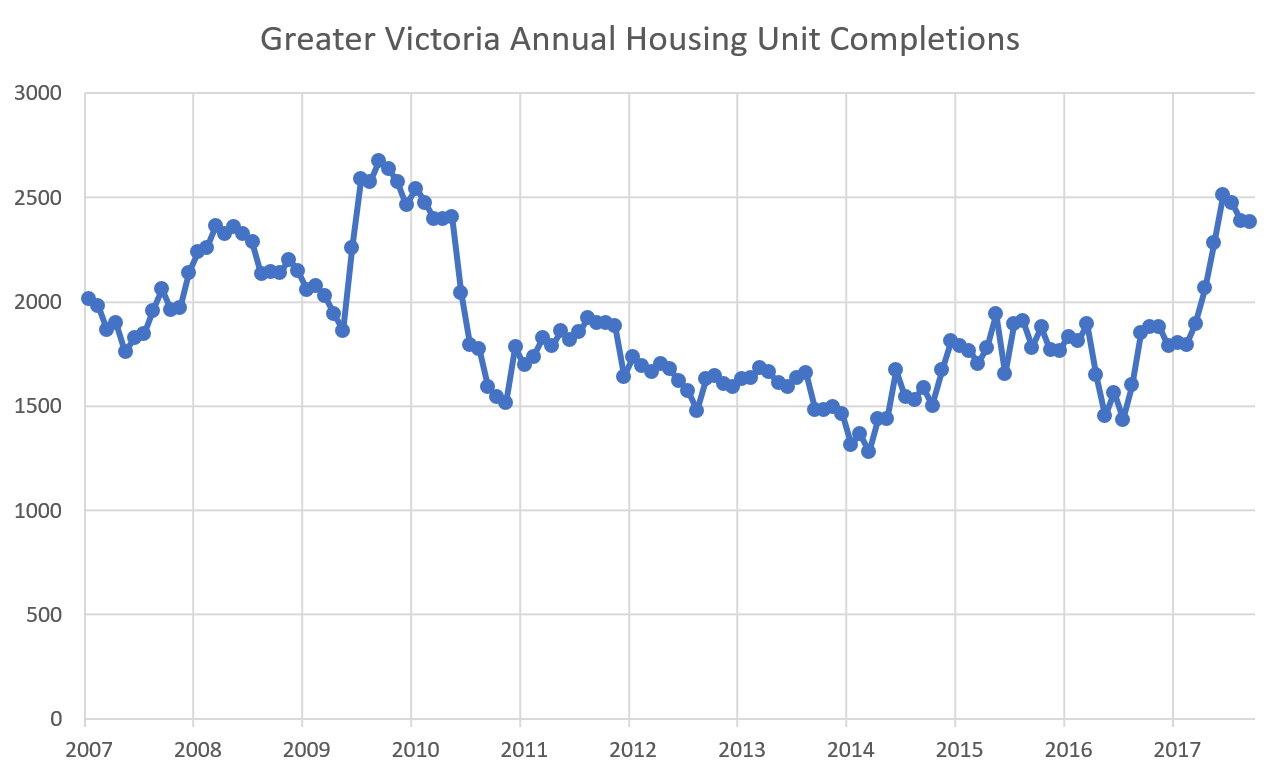

However, while 100,000 units seems like a lot, I wonder if it will really make a difference in Victoria. Firstly, that is over the next decade, so right off the bat we are down to 10,000 units annually. Assuming that construction is distributed on a per-capita basis, and about 1% of Canadians live in Victoria, we should expect an extra 100 affordable units to be built per year from this funding.

Not exactly going to make a huge dent in a market where we have about 2000 new units completed per year.

It’s a start, but we’re going to need a bigger collaboration between the feds, province, and our jungle of municipalities to really improve housing affordability. I also wonder what will count as an affordable unit. I hear endless radio ads for the new Vivid on Yates development which offers units at 8% below market value for people earning under $150,000 annually (that would be more than 85% of Victoria households). Can a condo going for 8% below market really count as affordable when the median condo increased 17% from last year?

What do you think? Should the government be involved in affordable housing? Is this the right approach? Or should we do something more radical like razing James Bay to stack container houses?

Monday numbers: https://househuntvictoria.ca/2017/11/27/nov-27-market-update

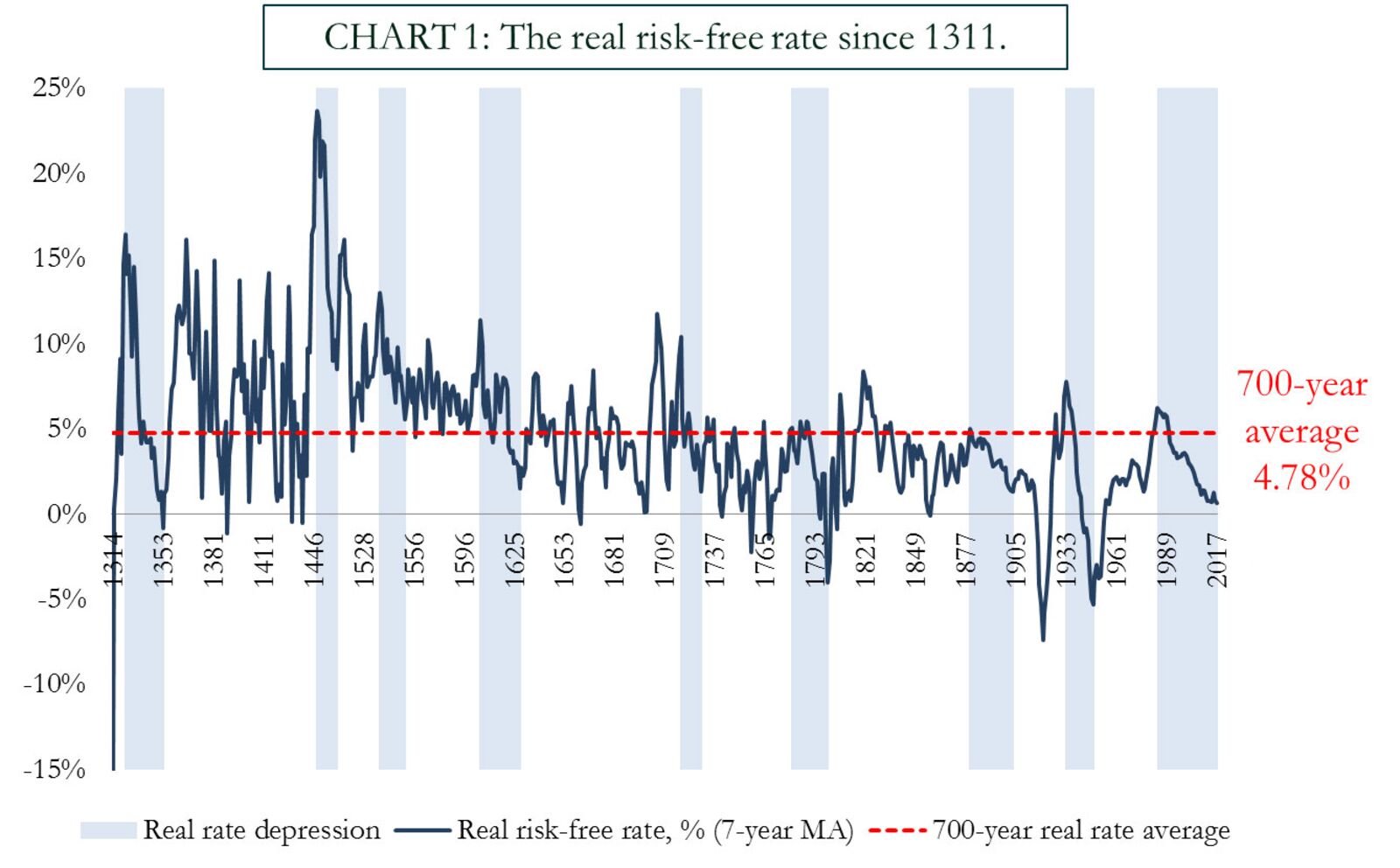

Off side, I kind of wonder what happened back then to cause such a huge rise in rates. The plague wasn’t at its peak anymore, though I don’t know if that was related. I wonder if there were other macro events. Really stands out.

Yeah I suspect the average interest rates in 1400 are probably less relevant than more recent ones.

As for posting a sticky, it would be cool if we had a way to post things more permanently to collect the knowledge that has been shared over time in a way that’s easier to find than searching comments. I don’t think I’m able to do it myself though. Maybe some sort of wiki? Not sure if it would get any traction though, but I wonder what a general structure would look like? Primer on the Victoria market, history, external factors, things to know when buying, selling, etc? Would be nice to have a mix of big picture and perhaps more actionable local info.

Awesome graph Leo! Can you post that here in a sticky fashion? Perhaps in the tools section. P.S. the 350 year average looks closer to 2.99% 😉

Right, I think on a very long time scale this is true. Eventually interest rates will go up and then our price/income will come down again. Problem is those timescales are just too long to take practical action on. Will we face several decades of rising rates or an explosion upwards? If so, now, or in 10 years?

Very interesting article though. Thanks for posting.

LF: Yes thanks for the correction. I was somewhat muddled. But in the comparison of US and Canadian debt,the comparison is in the same currency, surely? If so, the rise in the Canadian debt relative to the US debt since 2008 can be attributed entirely to the decline in the value of the C$ relative to the US$.

“When I started researching the market back in 2009 or so, a ton of the people saying there is a bubble had the argument that price/income ratio should be about 3 or 4 and anything above that was a bubble that will return to those ratios over time. I’m not sure where that idea came from, perhaps it was a rule of thumb 30 years ago when interest rates were higher.

Problem is, it just doesn’t hold up in practice on so many levels.”

Economists use tools like the P/I ratio as an indicator of fair value because long-term history provides good precedent for doing so. For example, the P/I ratio of 3-5x is often quoted because it has been shown any deviation from this range has proven unsustainable and ultimately resulted in a crash. The range of 3-5x in fact has proven true for at least the last 5 crashes (I believe – could be wrong here). In other words it something akin to a Newton’s gravitational constant, or as close as you can get to such a thing in the weird world of economics.

It may seem right to dismiss the P/I ratio in our current economic “cycle”, but then again the period you have quoted is:

The 3rd longest expansion in history

The second lowest rate cycle dating back to the 13th century.

https://www.bloomberg.com/news/articles/2017-11-07/centuries-of-data-forewarn-of-rapid-reversal-from-low-interest-rates

Economists don’t have a squat’s worth of predictive power. If they did they would be branded soothsayers. Nobody knows what’s going to happen or how what nobody knows will happen happen. Only after the dust settles can a small subset usually say “I told you so.”

I’ll say two that weren’t on your list – Hong Kong or Sweden, but not for a few more years.

If I understand you and the source article correctly, the graph depicts debts from households and businesses. It’s not sovereign debt. My trim-down of the article may have made it look like it was referring to the latter; it isn’t.

“China (red) and Canada (black) [are] up in their own universe, competing with each other to see whose debt will implode first. ”

LF, virtually all the increase in debt since 2008 (as shown in your chart) can be attributed to the fall in the C$ against the US$ from parity in 2008 to 77 cents today. So insofar as our public debt is mainly denominated in C$ we’re not much worse off than we were ten years, although we sure have a pile of debt. But household debt relative to income has almost doubled since 1990, is much higher than in the US, and looks very burdensome indeed.

http://static5.businessinsider.com/image/54aea0136da8118f2ae2093d-986-726/screen%20shot%202015-01-08%20at%2010.14.22%20am.png

Yes, Barrister, I like that idea, especially if these are well designed communities with rapid transit planned from the outset to connect the new centers with existing centers.

In particular, I really like the idea of a floating city in Saanich Inlet, with a floating bridge connecting Mill Bay and Brentwood Bay, and with rapid transit links to Victoria, the Airport, Sidney and Swartz Bay.

But if we have to build on dry land, then a compact engineered city in Saanich would be good. Every street to have a service tunnel, to handle water, power, etc., plus a door-to-door parcel delivery service — a sort of mini hyperloop, the kind powered by compressed air as used in department stores of old to send customers’s cash to the cashier in the basement, or wherever. Maybe Musk’s Boring Co. could drive the tunnels.

Looks like short term vacation rental restrictions are moving ahead, with possibly a reduced license fee for transient zoned properties.

http://www.vicnews.com/news/draft-short-term-rental-bylaw-considered-in-victoria/

Thanks for posting the article Leo S.

I always hear the argument from people renting out their suites short term that they wouldn’t rent out their suites long term. And yet, I’ve seen over and over again that when they can no longer rent out a unit short term, it more often than not, tends to go back into the long term rental pool. The people that don’t need the money, aren’t renting their suites out at all in the first place.

CS:

The better solution would be to create a second and even third city the size (or a bit smaller) of Victoria elsewhere on the island. That avoids both massive density and urban sprawl.

I think both has to happen. Need more supply for sure but we have to make sure that supply is going to owner-occupiers or dedicated rental stock.

I’m just full of doom and gloom for everyone…

Whose Private-Sector Debt Will Implode Next: US, Canada, China, Eurozone, Japan?

“The Financial Crisis in the US was a consequence of too much debt and too much risk, among numerous other factors, and the whole house of cards came down. Now, after eight years of experimental monetary policies and huge amounts of deficit spending by governments around the globe, public debt has ballooned.

China is now where Japan was before its credit bubble blew up in the early 1990s. China’s private-sector debt – the part that has been officially acknowledged – surged from 20% of GDP in 2008 to 211% of GDP in 2017. It also assumes that China’s GDP numbers are not inflated.

But…Private sector debt in Canada…as percent of GDP has soared to 217%, within a hair of where Japan was in Q3 1993, before the credit bubble imploded.

China (red) and Canada (black) [are] up in their own universe, competing with each other to see whose debt will implode first. By comparison, the US, the Eurozone, and Japan look practically tame. Note how in 2008 Canada was right in their neighborhood[.]

Within this group of economies, when it comes to the next private-sector-debt bubble implosion, there are really two places to look: Canada and China. In Canada households are on the hook, being among the most indebted in the world. In China, the debt binge has spread across businesses and households alike.”

https://wolfstreet.com/2017/11/22/private-sector-debt-implode-next-us-eurozone-japan-china-or-canada/

LF, thanks for the links. The FSR, page 6, shows a huge jump in mortgages over 450% in 2014 relative to other cities. I bet that’s statistically significant. What was Victoria doing that other cities weren’t?

A problem with the BCGEU proposals is that they place heavy reliance on taxing real estate development. I guess that’s on the principle that supply is irrelevant. However, if you think more homes not fewer would soften prices, then this socialist inspired proposal is a dud.

In the last 45 years, the cost of building a basic house has approximately doubled from $1oo per foot to $200. But in Oak Bay the cost of a lot has risen from $5-10 thousand to around a million plus. Thus whereas land accounted for generally less than 10% of the cost of modest new home on a small lot, today, it would account for about 70%.

The solution to the supply problem is thus either sprawl or increased density. Increasing density in the core seems a no brainer.

On the main page below the PDF link, there’s some data sets there. Don’t know if those are helpful or not. 😛

Thanks, I was hoping it would be a data series published somewhere, but I guess not.

As for wealth driving the market. Yes a lot of homeowners are able to cash in because their real estate has appreciated so much. For example anyone selling out of Vancouver can buy a place in a cheaper city and retire very comfortably.

But when that wealth that was created by real estate is extracted and plowed back into real estate then it loses its power. Yes the original asset appreciated, but then it was used to buy the same inflated asset, so you haven’t gained anything. So one set of parents take out $100,000 to help their kid buy a $400,000 house and another take out $500,000 to help their kid buy a 1.5M house. Maybe the latter parents feel wealthier, but the first kid is probably in a better position.

Yes, it’s published online via the BOC in their Financial System Review. Link below. In this most recent edition, it’s on page 7, chart 4. A pile of other meaty tidbits in there, too. Not much of it is encouraging, and it’s entirely to do with elevated consumer debt levels and housing sector imbalances.

The ratio of household debt to disposable income is nearing 170 per cent. Household credit growth has been strong, exceeding disposable income gains for the past several years (Chart 2). The bulk of this growth, about 90 per cent, comes from mortgage credit and HELOCs…Over the past two years, credit growth has exceeded the rate that would be expected based on income growth and interest rates by roughly one-third, or approximately $55 billion. Much of this amount is likely concentrated in the Toronto and Vancouver regions, where growth in house prices has been exceptionally strong.

Folks, the above is what I’m talking about when I rebut claims that “wealth” is going to be some new or greater force moving this market to ever higher prices in the future. Why are we “wealthy” at the moment? Because we’re borrowing our brains out. Don’t take my word for it; have a look at the PDF.

https://www.bankofcanada.ca/publications/fsr/

http://www.bankofcanada.ca/wp-content/uploads/2017/06/fsr-june2017.pdf

Just because wealth has always existed doesn’t mean that it will always affect Victoria in exactly the same way, or in the same proportion, as it has in the past.

And it could be a new factor in the market. We don’t really know.

“Don’t forget about inherited wealth, which will be a big feature in coming years.”

This is a massive misperception of reailty. All the people I know whose parents are dying off or have over the last years are not rushing out to buy a bigger house or planning to. They are stashing the cash away for retirement or paying off their HELOC’s/mortgages.

They didn’t win the lottery in most cases. They had to split the money between up to 4 siblings. Another bubble fantasy hype that’s not true.

Data from VREB

Combined numbers for Victoria, Oak Bay, Saanich East for OCTOBER

victoria/OB/SEyear 2013 2014 2015 2016 2017

sales 92 123 162 132 105

volume 60.4M 80.7M 130.7M 138.6M 109.6M

Hopefully, these numbers line up once posted.

Sure, but this has been going on since the beginning of time. Rich get richer. I don’t see it as a new phenomenon.

It wouldn’t surprise me if home ownership rates continued to drop though. In fact I bet ownership rates are lower in larger cities than smaller.

I never could find the source of that data. Do you know where it is?

When I started researching the market back in 2009 or so, a ton of the people saying there is a bubble had the argument that price/income ratio should be about 3 or 4 and anything above that was a bubble that will return to those ratios over time. I’m not sure where that idea came from, perhaps it was a rule of thumb 30 years ago when interest rates were higher.

Problem is, it just doesn’t hold up in practice on so many levels.

I would like to see that data. It would be very interesting. The only proxy I am aware of is that chart depicting on a city by city basis, the amount of people taking out mortgages in excess of 450% of income. Nationally, Victoria was very high. That would seem to imply there’s a lot of people here taking on large amounts of debt and with the pace of this market, that the acquisition of this debt has been fairly rapid.

LeoS, not sure if price to incomes are completely useless, unless you are strictly speaking of predictive power. I think it could demonstrate aberrant market conditions presuming there was a nominal cost of credit over time. If that ratio spikes as the cost of credit drops, then if the latter returns to nominal values, you might be able to suggest that trouble could ensue. I suspect the CB might use that metric in conjunction with some others, but that’s just a guess. Otherwise not sure what you mean. Where do you think it could be of use then, or why do people like to use it?

Wealth is def. a big part of what drives Victoria’s core market, imo. The debt stat’s LF posts are National Stat’s, so we don’t have an accurate picture of what goes on locally for debt.

Don’t forget about inherited wealth, which will be a big feature in coming years.

Some excellent ideas in the BCGEU proposal, Leo… I suspect the NDP may take up some of these, I like the idea of closing loopholes on PTT, taxing developers who leave land vacant, improving foreign buyers tax to add a property surcharge to capture anyone who doesn’t pay BC Income tax (not just Canadian)- which should also be over a certain amount to eliminate people who don’t have real jobs from claiming, adjust property class taxes to discourage speculation, and reform PTT (I think it should be much lower for purchases under $1m and for resident usage).

Some of the ideas under ‘Regulate Reform and Redesign’ are also good – except I disagree w/ elimination of homeowner grant which should actually be increased for places assessed under $1m. (maybe roll back the recent increase for HG from assessed under $1.6m?)

I like some of the ‘Invest and build’ ideas, as so far we def. aren’t seeing enough of a coordinated approach to social housing here yet. At the moment seeming to house them all in former motels around Burnside, and by concentrating all these people mostly in one ‘hood it just lends to increasing problems there. I caution this isn’t the best approach – we can see the crime that is omnipresent in the ‘new tent city’ Johnson Rd facility for ex., and the increasing crime in Burnside. However, spreading people out would encounter ‘NIMBY’ so I’m not sure what the solution is when many of these people are caught in an endless spiral of addiction, etc.? Perhaps – ensure they are willing to undergo treatment for addiction and enter into re-employment services before being ‘given’ housing? Implement ‘means testing’ to ensure that people are not given handouts unless they show they are trying to better themselves and in genuine need. Then continue to monitor.

I haven’t seen any credible evidence that price/income is some sort of ratio that has any predictive power. It ignores the cost of credit making the measure useless. In fact ignoring the homeownership rate as well makes it doubly useless.

Affordability measures correct the first, by taking into account interest rates. But they still don’t take into account the income of the actual buyers, so it’s not perfect.

Wealth has always existed. It is not some new factor in the market.

Sure, and Vancouver is larger, and Toronto is even larger, and Halifax is small, and Montreal is mid-size, and everyone in those cities is making those same arguments.

Don’t get me wrong, I’m relatively bullish on Victoria as a city and investing in land will work out in the long term, but the idea that because prices are increasing they must continue to increase doesn’t hold much water.

Introvert: “My contention is that wealth may play a very important, overlooked role in how those “out of town buyers” and those “local buyers moving up from a condo, or a rental,” as you say, are purchasing these detached houses in the core.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I think that the wealthy buyer aspect of price appreciation goes a long way to support the continued rising prices meme.

The challenge is more in determining the nature of that wealth. Quite possibly local speculators are/have been utilizing their heloc “wealth” to tap into the gold mine. If this is the real reason for “wealth”, every community is in a lot of trouble.

http://vancouversun.com/news/local-news/surrey-man-sentenced-fined-for-real-estate-income-tax-evasion

“B.C. title documents show that Dhudwal currently owns 10 properties in Surrey, valued at $8.8 million in total. In various mortgage documents for these homes, Dhudwal lists his occupation as “self-employed” and also “janitorial,” as well as “sawmill worker.”

You want the corrupt BC Liberals and federal Cons back in Bearkilla ? You’re one sick dude.

How did Russia rig the election comrade? I’d love to know how to do it here.

Intorovert , why must you continually post blatant lies about me in Trump like style ? Small hand syndrome? Obviously you know nothing about how real life works.

ICYMI, Trump won from a Russian rigged election just like real estate was rigged by politicians and central banks to save their asses. That rigging is now coming unglued. Look out below.

Great way for making sure that people cut things down. Weaver seems determined to piss a lot of people off.

That’s a very definitive statement from someone who is usually more careful.

I never said that incomes don’t matter; I implied that wealth matters more.

My contention is that wealth may play a very important, overlooked role in how those “out of town buyers” and those “local buyers moving up from a condo, or a rental,” as you say, are purchasing these detached houses in the core.

Victoria is small, so it takes a relatively small number of wealthy people who choose to move/invest/speculate here to make a huge difference in our market. I don’t think that’s magical thinking at all.

Housing values in the core of desirable cities do decline, but almost never to the point that “regular” folks can suddenly afford SFHs there. My point is that once these core areas are unaffordable to most, they tend to stay that way, even after any declines.

Hmmm, Weaver’s a smart guy. This smacks of an ulterior motive ie more surveillance of bodies of water?

Hmm. Come to think of it, there are a lot of waterfront properties in Gordon Head with nice little wild corners. Maybe I have a bunch of new ways to get to the ocean!

I am sure Oak Bay must have this, too. Time to hit google maps satellite view. I wonder if Andrew’s constituents will like this newfound sense of free access?

I am aghast at Andrew Weaver’s proposed “Right to Roam” act. It essentially turns any private land that has been left wild into public land:

Act:

https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/40th-parliament/6th-session/bills/first-reading/m223-1

Comments from farmers:

http://www.countrylifeinbc.com/ranchers-resist-expanding-public-roaming-rights.html

I generally support the greens, but this is horrendous. Every property owner who has left 0.01 acre of wild space is vulnerable to people walking across their lot, or even camping there if the wording of the bill doesn’t change.

People in the highlands will be overjoyed to have folks playing paintball in front of their house because they chose trees instead of a lawn.

We need to destroy property rights because some folks in Merritt can’t go fishing?

In fact, this is just going to make people rip up wild areas to prevent the public from using their private property. Talk about anti-Green policy.

Looks like short term vacation rental restrictions are moving ahead, with possibly a reduced license fee for transient zoned properties.

http://www.vicnews.com/news/draft-short-term-rental-bylaw-considered-in-victoria/

Sweden’s cooling housing market is a preview for others with low rates and property bubbles

What’s happening in Sweden is being watched by policymakers in places with low interest rates and property bubbles, like Canada and Australia.

In Sweden, a combination of low interest rates and rapidly rising house prices has been making the central bank nervous for years. House prices have increased by an average of 9% per year for the past three years, pushing up household indebtedness in lockstep.

But now it seems cracks are appearing in Sweden’s housing market, after property prices fell 1.5% in September from the month before and a further 3% in October, some of the steepest declines in years.

“High and rising household indebtedness poses the greatest risk to the Swedish economy,” the Riksbank said. Household debts are growing much faster than incomes in Sweden. The average debt-to-income ratio for households with mortgages was 338% in September, up from 326% a year earlier.

What’s happening there could serve as a preview for places where interest rates have also been low for years and experts fear that housing bubbles have inflated to dangerous levels.

Stockholm and Sydney don’t have that much in common, but as Australia’s housing market balloons to four times the size of GDP, policymakers there should be watching closely to see whether Sweden’s housing market cools in a way that gives over-indebted households time to adjust and the central bank room to raise rates without shocking the system.

https://qz.com/1137615/swedens-cooling-housing-market-is-a-preview-for-others-with-low-rates-and-property-bubbles/

BCGEU’s proposal for improving housing affordability.

https://d3n8a8pro7vhmx.cloudfront.net/bcgeu/pages/4846/attachments/original/1511208604/housing-plan-FINAL-nov20.pdf

Well that settles it then. Once any asset starts going up, it will go up forever. There is no way it can ever go down.

Price to income ratios are not at that level because interest rates are low.

People moving within the same market have no real effect on it.

Let’s take detached houses in the core. A certain percentage of the owners of those houses die or move out of town every year.

That means those houses need to be purchased by newcomers. Those people may be out of town buyers, or they may be local buyers moving up from a condo, or a rental.

So the only way prices can be supported is if there are enough newcomers buying up the properties that are vacated by existing owners.

Incomes are how those people are buying into that market, so I won’t buy for a second that incomes don’t matter. In the end the source of the wealth for most people is incomes (or debt of course, which is awarded based on incomes).

Even for out of town buyers, the wealth had to have come from somewhere. The idea there is some wealth source that will never dry up is a sort of magical thinking that doesn’t hold up. If that were the case we would have never seen housing values in the core of any city decline. And yet it happens all the time, even in cities that are doing well economically.

Unlikely, but I think the image of me shocked and exasperated is kind of funny. Throw a little red-faced anger with a sprinkling of perspiration in there too. The charts I post don’t have any predictive power anyways. Just a reason for folks to pause and think about where consumers are going financially and the choices we make.

If you’d rather not, you could just make fun of me. Wouldn’t be hard. As the ever-gracious Mr. Trump said to Senator Paul, “believe me, there’s plenty of subject matter right there”. Make fun of my grease stained hoodie (it’s even got holes), call me a raging renter, belittle my ill-refined tastes in alcohol, or make fun of my car. Actually, I like my car. It’s great. Fast too. Stay away from dissing from my car, Introvert.

“The market isn’t going to crash”

Oh, well, now we know. LOL.

What has happened is that all levels and agencies of government stood idly by as credit exploded to the point that Canadians became the most indebted people on the face of the planet, then they, the governing agents, panicked, with the BoC, the OSFI, the Feds, the Province of BC and the municipalities all trying to cram the lid on before house price inflation totally destabilizes the economy and the political class loses all credibility. The joint efforts create, it seems to me, the very real risk of a major market correction.

But while we are teetering at the tippy top, or just beyond, we will continue to get confident predictions of crash or boom that are worth less than a puff of hot air. No one has a realistic quantitative model of how the market is evolving. What is heard here is mere speculation: bulls and bears talking their own interest.

SPOILER ALERT

The market isn’t going to crash and bears will still be posting daily to this blog a decade from now claiming a crash is imminent. Put me in the screencap.

You do have something there introvert. I am building a house way above my pay grade. Only my wealth allows me to (knock on wood) I’ll be cashing in that lottery ticket in the new year…

When the SFH median in the core eventually hits $1M, Local Fool will be like, “But my charts!!!”

You got me! Anyone who was wrong about Mr Grab-’em-By-The-Pussy becoming president has to also know nothing about Victoria, British Columbia, real estate.

The dude who sold thinking prices would plummet only to see them skyrocket 40% is calling me a fool from his damp Gorge basement suite that he wants us to believe is the penthouse suite of the Oak Bay Beach Hotel.

“That’s why I don’t think prices in the core will ever drop significantly.”

This is why the market will tank hard. Markets never ever needed government intervention before like what we are seeing now. If the OSFI doesn’t kill it the NDP will along with higher rates coming.

Too many entitled fools like Intorovert who have never experienced real losing in a harsh bear market. Totally clueless and arrogant to what’s coming but when you live in an insulated bubble you lose touch with reality and denial of epic debt bombs.

@vanreport

“I’m seeing more and more millennials. It’s a substantial increase. Every time you see a millennial walk into your office – it’s disturbing. Many are homeowners seeking solutions to their debt woes.” – Rob Kilner, licensed insolvency trustee.

Canadian “private sector debt as percent of GDP has soared to 217%, within a hair of where Japan was in Q3 1993” (h/t @wolfofwolfst ) https://t.co/3CbeROJdZy

“Vancouver real estate is ominously overpriced and financed by too much debt. A crash is inevitable. The market is in trouble. A lot of trouble.” – Jack Miles, managing partner of $30 billion hedge fund

#vanre

Oh I don’t need to be right or wrong. If anyone knew for sure they wouldn’t be posting in here.

I just did a quick search. There’s probably better charts. By all means if you think you find something that blows a hole in my rebuttal, put it up.

Does that chart show net debt or total debt? I feel like holding a 500k mortgage is fine if you have >500k in equity in investments or home equity. That chart may or may not capture that. Numbers can be skewed to tell whatever story needs to be told.

When you look at it like this, yes, things might look more robust. Because wealth is distinct from incomes, the disparity of home prices versus incomes becomes less relevant. Right? Well, not quite, because that misses part of the picture.

It is true – as a whole, we may be wealthier than ever before, and that is certainly concentrating in some of our cities. Ours is one. The question I’d want to ask is where that wealth is coming from. Our wages are generally flat, and that’s not a particularly new issue. Yet our wealth has been growing rather steadily, especially in the metro regions (sorry too lazy to pull up a chart to show this).

So if wages are flat, and our wealth is rising, something other than our wages is causing this shift. Either there is wealth pouring into this country on a truly epic scale, or, we’re using something other than our wages to create this wealth.

Hence my assertion is, the enormous debt growth we’re amassing is from dumping red ink into housing, and is the primary driver of this growth in “wealth”:

http://i.huffpost.com/gen/4846234/original.jpg

Is a large and rapidly growing mountain of debt a firm underpinning for this wealth? I don’t know. Don’t have a degree in finance, but intuitively I’d say no.

“price-to-income ratios for SFHs in the core are never going back to 3:1 or even 4:1”

Intro, do you rate this more or less certain than your guarantee that Trump would not be elected US President?

To me, it makes a crash seem like a real possibility.

Agree completely introvert.

Precious things inevitably become commodified. Like it or not, real estate already has, and water will soon.

Many folks here need to face reality: price-to-income ratios for SFHs in the core are never going back to 3:1 or even 4:1. If you’re waiting for that to happen, you’re going to be sad.

If you bought your house in the core a long time ago, the appreciation has made you relatively wealthy. This group can now move laterally or slightly up without taking on any mortgage or just a modest one.

If you bought your house in the core more recently, you probably have some wealth combined with a good/great income, meaning you probably don’t have an $800k mortgage.

To my mind, it’s more about wealth than about incomes. For many years now, wealth has accumulated in the core, and this will continue. That’s why I don’t think prices in the core will ever drop significantly.

IMO, it’s pure fantasy to think that interest rates, mortgage rules, foreign ownership crackdowns, Airbnb crackdowns, unoccupied dwellings crackdowns, Chinese capital flight crackdowns, or anything else of the sort, will bring prices in core back down to levels the bears regard as “affordable.”

I think land mass has become a smaller part of the equation now. It more about proximity. We can’t deploy slave labour for infrastructure anymore so it’s getting more and expensive to build infrastructure to support sprawl. Economic proximity is another big one. Australia’s desert probably equates to our tundra….

I agree that in general the government has done a reasonable job to try to reign in prices. We went from 0 down 40 year mortgages in 2008 to 5+% down 25 years and a +2% stress test in 10 years.

Now the province is on board as well with foreign buyers tax and possibly more restrictions coming. The municipalities are starting to push more construction to help supply.

So everything could be better, but can you imagine how bad it would be if they never restricted credit?

It is comical how two countries with such a massive amount of land can have such similar problems with housing affordability.

In most ways, it is. It’s one of the reasons that makes me think, “yes, it can get worse here”. The difference between here and Oz though, is the degree to which the latter promotes housing growth at almost every level of society. The citizens, both levels of government, the banks – they all work in concert to enable price growth to continue. Things like “negative gearing” have become almost as sacred to them as the US second amendment is to Americans. Interest only loans are pervasive as well, which are often extremely dangerous instruments to use unless you can predict time a market perfectly. Most people can’t, save for luck.

At least our leadership knows there’s an issue and they know generally what’s coming – which is why you see them acting now to try to make the inevitable less damaging when it finally occurs. Ozzie leadership IMO, acts almost like many of the general public here – ho hum, nothing could possibly go wrong.

And people who declare “racist” in response to protesting foreign cash or excess immigration are intellectually and morally dishonest. Some of them actually do believe such a protest is racist. It’s a politically correct and absurd red herring designed to frighten or distract people from having the kinds of discussions that we need to have – that if we do have, could knock a few fat-cat’s apple carts over.

Residential real estate is a precious national resource, second only to food and water. We ought to be mindful of that.

Great post LF – also the article about Australia – yes, it appears to sound a lot like Canada but their situation looks worse than ours when you look at some of those graphs – Boom to Burden and Gung-ho-Banks.

Re. the Renters – good for you and Hawk, but many renters don’t have that kind of security. I would almost consider myself a socialist- however, I do recognize there are flaws with that system as with anything. Unlike some other sheltered homeowners in OB, my job puts me out there with everybody in society – so I get to directly see the consequences of inequality, and if it worsens it adversely effects me. I see things from their perspective as well.

I think we may finally be heading in the right direction with the new Gov’t – they may also, thankfully, be much more cautious than previous almost reckless NDP Gov’t’s.

Ok, if Van moves to do this then what does that mean for us? One irony is the person who perpetuated the whole study back in 2015, Andy Yan, was of Chinese descent – yet still almost called ‘racist’. The discussion couldn’t happen for a long time because of the ‘race’ card and probably has something to do with the history of ‘head tax’ and ‘ban on Chinese immigration’ for a long time here. Kind of like not wanting to address past injustices towards First Nations. Finally, they seem to be able to have this discussion that should have been had way back in the year 2000 when China was just on the cusp of starting to rise.

If, like Denmark for ex., we had taken steps to protect residents/citizens from foreign buyers here BEFORE all the prices rose to ridiculousness we probably would see a vastly different housing market than we do now. Denmark took steps to protect their citizens before there was any problem- and guess what – unlike Canada, NZ, Aust., UK, – they don’t have a problem! Now, the problem we have is prices rose well beyond income levels, so local people (not already in the market in the early 2000’s) either had to pay more for a home or had to borrow more to compete. Now, if the Gov’t goes too far to try to kill the housing market – they will damage equity for these people which could cause all those bankruptcies to rise. I predict they’ll be very cautious come Feb. budget time.

Of interest – here’s a list of what the European countries do (or don’t do) with regards to foreign buyers: https://tranio.com/traniopedia/tips/european_limitations_on_foreign_property_purchases/

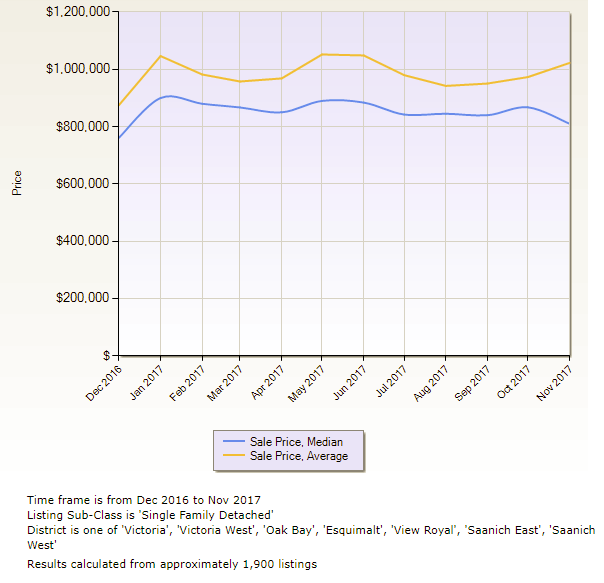

Right, I mean we almost got there this year, 3 years ahead of a prediction I thought was unlikely.

What do you mean by this, Leo? We still have two years to go.

Local Fool:

Interesting article on Australia. Felt could almost insert the word Canada instead. Good read. Thanks

Vancouver is investigating “tax and financial regulations to limit the commodification of housing and land for speculative investment” including restricting foreign ownership as part of their 10 year plan. Could get interesting.

http://vancouversun.com/news/local-news/sea-change-vancouver-considers-restricting-property-ownership-by-non-permanent-residents

A couple years ago Michael predicted a million dollar median SFH house price in the core by 2020. I was very doubtful. Gotta say we got pretty damn close.

https://househuntvictoria.ca/2015/10/28/market-update-oct-26th/#comment-2865

Question is if it is moving up anymore. So far no in the core.

I’ve been watching the market so long that I think it will be very surprising when it turns. Thing about most runups is they go on much longer than anyone thinks. Including the people that say that.

$12M sale of a 96 acre farm in Central Saanich. That will kick the average up several notches this month. Currently at $930,000 for SFH in greater victoria. Median unchanged from October.

The unfortunate irony Jerry, is the bulk of your writing on this site indicates you tend to draw your focus to Hawk’s postings, by repeatedly attempting to imply how no one reads them. Then you yourself, usually offer little content to the discussion. Not sure whether that’s lost on you or not, or you think your jabs are clever, or it’s just a passive aggressive protest to content you don’t like. Probably better to skip his posts silently, or perhaps add something meaningful to the thread. I’m sure you have something to offer and besides, there’s plenty of subject matter to go around.

Speaking of subject matter, some interesting housing news coming from our (arguable) sister country’s housing market…

The Party Is Over for Australia’s $5.6 Trillion Housing Frenzy

https://www.bloomberg.com/news/articles/2017-11-23/australia-faces-housing-hangover-twice-size-of-u-s-subprime-era

Every once and a while one of these threads takes a little segue and one realizes that there are people who come here frequently yet still read Hawk’s posts.

Dr. Johnson said that second marriages are the “triumph of hope over experience”. This behaviour is similar.

Intorotroll, you really need to get out of the house sometime. Dwelling all day on how to be a twerp isn’t good for your health. Did the trip to Langford do you in ?

Don, it’s all good. You were confusing where you were coming from. January or Feb ? Since I’m not an owner I wouldn’t recall precisely, other than it’s in the new year. I assume all the condos assessments will go up if their prices have popped $70K to $100K that will add to higher taxes.

If you own and can afford it, great ! Embrace it and don’t sweat it. If you’re an on the fence buyer I would be highly cautious after watching what happened in Vancouver a year ago where it dropped $300K average price in a short period of time and with even more government intervention coming. The Victoria NeverEverland crowd is in for a wake up call is just my perception from all the multiples of compounding economic evidence globally, as well as locally. Red alert as CMHC warns.

LF, I was harassed about my situation, not the rest of Victoria’s.

Dank basement suite in the Gorge, scanning for MLS price slashes all day. Has a calendar reminder to check public court records for bankruptcies and foreclosures. Google Alerts feeds him daily articles containing the phrase “real estate bubble.”

Yeah, I’d say Hawk pretty much has life by the balls.

A little haughty. For those of us who have fortunate rental circumstances, right now I think renting is a much better choice. But that’s not true for many others and their families. Constant evictions, renovictions, fixed term lease loopholes, usurious/unscrupulous landlords, and a, “if you don’t like something (something’s broken, insects, moldy etc) then you can get out, I ain’t helping you” dynamic. Those people live with a perpetual and pervasive sense of desperation, hopelessness and fear.

Imagine living under those conditions. It would be terrible and it’s the reality that many people are facing now. I really have no idea what people do if they’re a family with kids and making 40k. I recall some stats on renters overall being put up here recently, and it was very sad. I’m no socialist, but the level of inequality seems to be growing around these parts and that has real consequences for society.

@ Hawk, you said “If those assessments go up 20% in February will you feel better ?”

Property assessments are sent to us in January not February and at that time it is already old news. Why don’t you know about this? You sound really smart.

Personally, I will be happy if assessments stay where they are or even go down. I really only care about what the mortgage rate will be in 5 years.

All good and honestly, I have read your comments for the last two years and I like what you say. It has given me a sound perspective on what could be and is how ludicrous everything is in the last few years. You have taught me a lot.

If I can stay where I live, I have a patch of land you can grow your vegetables on in case you are correct. Full Respect although sideways or upside down at times.

Ha Ha Don, I thought that was a little harsh….

LF, they are still trying to flog 6 penthouses since they built the place a few years now. Overpriced ya think?

FYI, My penthouse has awesome ocean/city views thanks. Many renters like me have it good. Great neighbors,stress free, cash in the bank, no worries of leaking roofs to pay for, or building nightmares taking years off your life. Thanks for asking. 😉

The house humpers fear level is definitely maxing out with the $40K beat down last month as OFSI turns out the lights.

You can’t post an article about Canada having highest debt levels globally or sudden increase in bankruptcies and foreclosures without getting attacked like hyenas in heat. Bizarre. What will happen if it’s another $40K next month? Coal in the stockings ? 😉

Don,

If those assessments go up 20% in February will you feel better ?

Are you allowed to stay long term in that hotel? Serious question, as I don’t even know how that works. Would be about 10k a month if it’s calculated by day. A tad much for me and the lady.

I wouldn’t live on the Gorge if it was an exclusive 1000 s/f suite going for $250 per month no catch. I work around there and often walk on the GG at lunch time. Some of the things I’ve seen are not for this site, and that’s not even the worst of it.

Sorry, that was a typo when I said I was not a fan of Deb. I meant I was not a fan of Debt. Funny how one letter can make such a difference in the English language, or can it?

Before hawk was ‘info’ with her ascii charts and predictions of doom. After her prediction of “sales will tank” there were year over year increases in sales for multi years.

It hasn’t been nearly that long. It just feels that way.

There’s no way he’s living in a hotel. He’s in a dank basement suite in the Gorge.

Nah, Hawk’s only been around for a couple of years. Early 2015, I believe. He has definitely been posting ‘the end is nigh’ since that time, however.

That’s an interesting article LF – a trait of the Chinese is they also have perseverance.

No doubt there are still going to be ways they will try to get capital out, but if controls actually really start working, finally the tide may turn on their investment in RE around these parts.

Don Beach – Since you’re new here you may not know this… Apparently Hawk’s been posting numerous negative comments on here almost daily for something like ten years. I don’t know the full story, but some longer posters on here would – I think he sold his house a long time ago in the core – predicting a market crash – then house prices soared and continued to rise ever since. He still predicts a crash though it’s yet to happen, if ever. My prediction is his relentless negative posts from his perch at the suite he rents in the OB Hotel Penthouse, with awesome ocean view, continue for another ten years.

You have to admire him for one thing – which is perseverence.

China Reports Breaking Up Gang That Moved $3 Billion Abroad

Chinese police say they have broken up a gang that smuggled 20 billion yuan ($3 billion) out of the country, evading financial controls imposed by Beijing to stem an outflow of capital from the economy.

Seven suspects were detained in the case centered in the southern city Shaoguan near Hong Kong but as many as 10,000 people might have been involved, the official Xinhua News Agency reported.

Chinese authorities have steadily tightened foreign-exchange controls to stem a multibillion-dollar outflow of capital that they say hampers financial management in the world’s second-largest economy.

https://www.bloomberg.com/news/articles/2017-11-24/china-reports-breaking-up-gang-that-moved-3-billion-abroad

@ Deb,

Sorry for offending you. Obviously by definition everyone that uses a credit card is in debt. You missed my point completely.

Actually, I am a fan of Hawk but not Deb.

Barrister -1287 Rockland sold for $1,570k in March 2017. You can find that info on BC assessment. Interesting it was a year and one day after selling for $798,900 in March 2016. An increase of $2,113 each day – minus whatever the cost of the reno’s were, but no doubt still a huge profit. I looked at this house when it was for sale in early 2016 and it was in really rough shape plus there was an old swimming pool taking up the entire back yard. Looking at the pics now it looks transformed, but if they get $1.7 for it that’s not the hugest profit. Maybe the place is cursed or haunted so that’s why they must escape? (there was a fire in 1937 that destroyed the original old mansion called Gisburn that was once there – now only the gates remain).

Pic of the original mansion ‘Gisburn house’ here…

http://search-bcarchives.royalbcmuseum.bc.ca/robert-irving-home-gisburn-house-victoria

Another wannabe ‘flip’ that has caught my eye where if they sell it will make more than Rockland… https://www.realtor.ca/Residential/Single-Family/18823091/15-Marlborough-St-Victoria-British-Columbia-V8V4A6

This place was bought by Albertans in Feb. 2017 for $1,517k – previous owners paid $1,465k for it in Jan 2016. The Albertans are hoping to cash in as it’s now listed for $1,948k, if they get that they would’ve made over $400k or about $1600 per day, in just 9 months on this place that, while fixed up, doesn’t even have much of a backyard! My prediction is they are overpriced.

Here’s a crazy overpriced home without a yard: Apparently this place gets over $5k/mo. in rent, but you’d need to rent that for a really long time to surface after forking out those big bucks. https://www.realtor.ca/Residential/Single-Family/18888196/62-Cambridge-St-Victoria-British-Columbia-V8V4A9. Only $1.9m – hurry everyone!

Hawk’s having an ‘up’ day… much more cheerful than usual.

Hawk, you have a new fan! Sounds fiesty, too…

@Don Beach

Definition of debt:

An amount owed to a person or organization for funds borrowed. Debt can be represented by a loan note, bond, mortgage or other form stating repayment terms and, if applicable, interest requirements. These different forms all imply intent to pay back an amount owed by a specific date, which is set forth in the repayment terms.

Read more: http://www.investorwords.com/1313/debt.html#ixzz4zPEY3F7r

Firstly you are wrong and obviously only posting to attack Hawk. I suggest everyone ignore your comments and all move on.

RE: Bankruptcy and foreclosure.

Here is an article saying:

Why One in Six Canadians Will Eventually Go Bankrupt

http://www.huffingtonpost.ca/douglas-hoyes/personal-finances_b_4589688.html

If the population of Victoria ~ over 20 years old is around 250,000 and they live until 70 years old .

That is 50 years 41,000 of will go bankrupt in our life time. That is ~ 820 per year , or 15 per week is normal. Hello Hawk, thank you for sharing how good everything is here at this time. Please mention this again when we have 50-100 people going bankrupt each week. Otherwise you are wasting everyone’s time. Speaking of time , you are too busy to spend the 15 seconds to look up the assessed value of a property yet can spend hundreds of hours researching and posting negative comments?? Speaking of assessed value. Each year the Land Value has been increasing(this may change) and is a pertinent statistic. I agree the house value is not at all accurate and has not been changing as much. Hawk, you talk about what has happened in the past and you are correct. I think you are missing the point . QE changed everything and the past is gone forever. Another thought on debt, Say Hawk has 10 properties all with 90% paid off. Each worth ~$500 K , he will be 1/2 a million in debt while worth 4.5 million with his property alone. By definition he is in debt so is that a bad place to be?

Thanks Barrister. Confirms my decision to not go to Best Buy tonite.

Intorovert, you are the fertilizer.

Don, as the market turns the calls to the counselors will increase. That’s psych as well as credit counselors. Divorce lawyers win the lotto. Negative equity will hit hundreds of thousands in a heartbeat. Perspectives change fast and the tears will flow like rivers.

Thinking a mortgage is debt is a fallacy and is only pertinent if your mortgage is more than what you can sell your property for. This may happen and then it will be debt. Anyone who thinks mortgage is debt has never really been in debt. Maybe its just a word but anyone who has ever really been in debt thinks differently. I guarantee anyone who considers their mortgage a debt wile they maintain a positive equity position has never been in real trouble financially.

You just lead us to the fertilizer.

If we’re going on personal prediction track records, that means invest in Bitcoin, everyone.

Michael:

There were major renovations that had the house gutted and it sold after that again. The husband died and the wife could not bear being in the house. Rather sad, it was their dream retirement home.

I know it sold for $798k in Spring of 2016.

The best bang for your buck is still Langford at $290 a square foot.

Assuming of course that you are not chained to a cubicle in downtown Victoria where you have to drive in and out everyday.

HaHa, Barrister I did the same thing. Once every five years I go to Mallwart and it happened to be today! Anyway bought a cheap vacuum and left.

Does anyone know what 1287 Rockland sold for about a year ago? They are asking 1.7 million now and it sure feels like a fast flip.

I forgot it is black Friday and I went to Best Buy. Turned around and walked out. It made we wonder how many people are spending money that they cannot afford. That was an interesting article about the number of people that dont consider their mortgage a debt, thanks Hawk.

I was often amazed in my practice at how many people did not have a clue about basic finances. It was combination of what they did not know and the things that they did know, that were totally wrong, that was the problem.

As for the Sales to Assessment ratios for single family homes in Esquimalt for the last 6 months they ranged from a low of 112% to a high 137% depending on condition and updating. The median or typical house has been selling at 123% or its current government assessed value.

Or you might think that the typical home in Esquimalt has been selling at around $370 a finished square foot for the last six month.

In contrast Oak Bay’s median S/A is 116% but the typical house is selling for around $550 per finished square foot.

Victoria City comes in at around 118% and about $435 a square foot.

…………Your mileage will vary………….

“No, and for a simple reason. The locals can’t afford to keep up, and a city cannot afford to lose its locals. A human community like a city is an organic entity that requires numerous economic and civic participants for it to run.”

Bang on LF. Who does Mike think is going to pay $2000 a sq ft to own or even rent it on an average wage just to stay here? Talk about a mass exodus to the interior/prairies or back east. Every market has a limit and we’re here now. This is where Mike loses touch with the real world and why millionaires regularly blow themselves up.

When 30% of mortgage holders don’t think a mortgage is classed as debt, you know the end is nigh.

3 in 10 Canadians consider themselves debt-free while carrying a mortgage

http://news.buzzbuzzhome.com/2017/11/canadians-consider-debt-free-mortgage.html

You’re not talking about modest gains, you’re talking about enormous ones. $2,000 per square foot for a condo in Victoria is unreasonable in 2017 dollars, IMO. Before, you were saying $2,500. Impossible? No. I do agree with you that fiat money creation is the underlying cause for this situation, though.

Does QE support further rises? Yes, but that’s not the whole picture. I don’t know enough to draw it in its entirely, but I see at at least two problems.

QE putting investment yields to the floor and causing Chinese money to grow little legs has caused a misallocation of liquidity into unproductive, but perceivedly safe assets. But it is unproductive nonetheless, as land doesn’t produce wealth on its own. House building does have numerous spin off benefits to an economy, but that’s a closed end loop (a FIRE economy) which requires a continuous injection of perpetual and increasing amounts of money in an ultimately unproductive regime to sustain.

At this time, QE appears to be in its sunset stages, not ramping up. I couldn’t tell you whether the global unwinding of it is a coordinated effort, but it’s not isolated to Canada. Yes, rates are still low, and banks can still create money in cyberspace from nothing. So that’s an inflationary force on RE prices. But so far, it’s now beginning to travel in the “wrong” direction for inflation.

Secondly, let’s suppose the impossible – that QE never unwinds and hyperinflation never happens. Do house prices continue to go up in perpetuity, subject only to the highest global bidder?

No, and for a simple reason. The locals can’t afford to keep up, and a city cannot afford to lose its locals. A human community like a city is an organic entity that requires numerous economic and civic participants for it to run. If it’s only rich immigrants that can afford it, then what kind of economy does the city have left? No matter how much we are convinced otherwise, I don’t see how one can abrogate this very simple principle.

What happens when the flood of money enters our system is prices rise, and locals scramble desperately to keep up. And that’s in part, what we’re doing and we’ll collectively fail in doing it. But our attempt to do it anyways is being recorded in our consumer debt stats and its concurrent acceleration.

To presume that flows of foreign cash will perpetually sustain a housing market regardless of what locals can afford is in my opinion, magical thinking. We’re not getting out of the consequences, and nothing is going to the moon.

Speaking of bitcoin, another bubble ready to burst.

https://www.marketwatch.com/story/how-bitcoin-fever-is-like-the-dot-com-bubble-in-one-chart-2017-11-21

LF, agreed, Mike is just pumping for the purposes of dumping his properties he just scooped on his 2 week bear raid he proclaimed.

If he really believed “all indicators” then the mother of all indicators is money flow and it’s now heading back down with China clamping off the outflows.

Wait til the foreigners have to disclose who they really are and where they really live. The astronaut dads will be dumping their shacks faster than they are already.

Total Dollars Spent on Vancouver Real Estate Drops 15% This Year

“The expensive detached market has softened big time. Dollar volumes are in the gutter, dropping 28% this year after experiencing 25% growth in 2014 and 30% growth in 2015.”

http://vancitycondoguide.com/dollars-spent-vancouver-real-estate/

LF, don’t overlook that debt (or money) creation is what drives these cycles. I’m not trying to get you going, and you’re certainly not an idiot (sound smarter than me). It’s not such a bad idea to sit this one out, as long as you’re not wasting all your time & energy when there are so many other financial opportunities. Ie. If you had bought just $1000 worth of bitcoin 7 years ago, you would now have over $130 million worth!

I would love to be proven wrong, but I’m not seeing anything obvious that could derail a few more years of modest gains. If wrong, let’s get this crash started. I’m up for a good financial cleansing! 🙂

@JS

“When people say there’s not a supply problem, they just mean there are more than enough places to live for everyone in the city, they’re just not being used that way, or affordable for the people who want to live in them. ”

Yes, that is surely correct.

So we are to understand that the claim that there is no supply problem, does not mean that there is no supply problem, but that demand, for whatever reason, has rising faster than supply.

I guess my comment, which some may have found unduly abrasive, was intended to encourage some way of referring to an upsurge in demand, other than by declaring supply to be no factor in the determination of price.

@LF

“None of the huge amounts of new supply in Vancouver has helped – prices have only gone up.”

You cannot know that. All you can say is that (a) there are many factors affecting price, and (b) when demand rises the increase in supply may be insufficient to prevent prices increasing.

When you talk of new condo developments evoking expectations of unlimited riches, you are describing the psychology underlying a manic increase in demand — an increase that may overwhelm the ongoing increase in supply.

Michael, I honestly don’t think you believe much of what you come on here to say. It just doesn’t make any sense.

Declaring “all indicators indicate further gains” is just nonsense. That’s not to say gains literally cannot happen, but the indicators that matter – what people earn, how much debt they have, the type of debt they have, the rate of that debt increase, the cost to service that debt, the policies and regulations surroundings the conveyance of debt – none of these “indicate further gains”.

Some time ago you stated that you don’t ignore those types of metrics – and yet you never actually speak to them in a way which mitigates them. If you’re unable to do that – and explain why the above either doesn’t matter or is overridden by a larger, more compelling force – then you are either completely ignorant or just on here to get idiots like me going. And the latter is easy to do, so it’s kind of a lousy accomplishment.

When there is insatiable demand, it doesn’t matter how much supply you provide. When that demand dies, then things go pop with an over-abundance of supply. When people say there’s not a supply problem, they just mean there are more than enough places to live for everyone in the city, they’re just not being used that way, or affordable for the people who want to live in them. Just like there isn’t a food supply problem in the world, but countless people die from starvation every day. It’s a distribution problem.

80% of Vancouver listings slashing. Looks like a bloody mess.

http://www.myrealtycheck.ca/

7 more bankruptcies and 2 foreclosures this week in Victoria.

CS

I don’t think it’s that bizarre. In the long run, yes, S/D is a basic tenet of asset pricing. But in certain instances, for certain periods, adding new supply can fan the flames by feeding a great raging maw of seemingly limitless demand. None of the huge amounts of new supply in Vancouver has helped – prices have only gone up. Several years ago, many analysts were waiting for a precipitous drop in condo prices in Toronto, given what was perceived to be a large, pending over supply versus their rate of absorption.

Then relatively quickly after the CB dropped interest rates further, RE market psychology changed, or more precisely, its intensity and scope grew. Suddenly everyone wanted condos, a “supply” issue ensued, and euphoria was in full swing. Any new condo development is simply viewed as an effortless path to riches, something that is certain to increase aggressively in value year after year. Why buy one unit, when you can buy several? Some folks were even buying out whole floors.

In other words, market psychology can overwhelm normal market metrics. Just not forever. In this case, new supply doesn’t make any difference – until it does. It’s a function of psychology, as the same is true for markets. It’s all the rage, until it’s not.

“all indicators seem to be pointing to another ~5 years of real gains. ”

So Mike, can you tell us how the average buyer is supposed to keep buying as credit lending tightens,interest rates rise and government/OSFI intervention ramps up taking away 20% buying power ? NDP new spec/flipper rules haven’t been implemented yet either.

Please explain as the Vancouver professionals are on the outside looking in. Since your a double millionaire you should know the math in major detail.

But maybe you’re having a tough time flogging those condos ?

Vancouver’s Rental Reality: The professional couple that still can’t beat the rental trap

https://globalnews.ca/news/3875847/vancouvers-rental-reality-the-professional-couple-that-still-cant-beat-the-rental-trap/

CS:”But perhaps some sensitive soul can explain to me why I am wrong.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<

https://www.theglobeandmail.com/real-estate/vancouver/academic-takes-on-vancouvers-housing-supply-myth/article37015584/?campaign_id=A100

“CS, I’m not sure whether I’m alone in this, but I find your repeated sarcasm very amusing.”

Well how can I say this without upsetting anyone?

Economics is, in my view, mostly guff, but if there is one thing in economics that is correct, it is, surely, the idea that supply and demand dictate price. Therefore, repeated suggestions to the effect that increasing supply will do nothing to moderate house prices seem bizarre to me. But perhaps some sensitive soul can explain to me why I am wrong.

Agreed, and after 7 years of ‘real’ losses (’08-’15) especially for Vic, all indicators seem to be pointing to another ~5 years of real gains. As much as I’d like to see this recent lull turn into a crash or at least healthy correction, gov regulations only have temporary effects, ie. 2016’s foreigner tax.

Numbershack, aren’t we exporting condos? 😉

Too funny, now I do it. Thanks for the heads up.

😀

“Canadian households lead the world in terms of debt: OECD”

LF, I already posted ICYMI. 😉

Great post numbers. China interest rates edging up too can create some major problems if it continues. The insurance companies and pension plans are in major doo doo.

“The reason for this is that the insurance companies, just as the pension funds, re-insurers and other longer-term “mandated” investment vehicles have spent the last eight years loading up on highly risky assets, such as illiquid private equity, hedge funds and real estate. ”

“At the end of 2Q 2017, U.S. insurance companies’ holdings of private equity stood at the highest levels in history, and their exposures to direct real estate assets were almost at the levels comparable to 2007. Ditto for the pension funds.”

Hey Don, look them up yourself. I don’t have time to list it all. I just lead you to the water.

The $10K off Rockland was just to make a point that price slashes are happening after only 11 days in prime areas. Was not about the amount or assessment etc.

Assessment means nothing according to Marko, only to those who try to just say they are overpriced. Well they all are which is why 90% are going under ask now where a month or two ago they were all going over ask with bidding wars.

Most condos are 30% plus over assessment which I agree is ridiculous. With new builds hitting the market soon en mass the condo bubble is soon to blow up in the coming months and OSFI rules cutting out the first time buyer bigtime.

Vic RE doesn’t scare me at all.

But this should scare everyone.

http://www.zerohedge.com/news/2017-11-19/stage-has-been-set-next-financial-crisis

CBs created this mess…now who is going to pay for it? Uncharted waters…better buy some gold!

On a side note, in order for incomes to improve in Victoria, BC, and Canada and in general, we need productivity gains and innovation. Our economy is truly global now and in order to compete, we need to foster the above through policies and investment.

What good is a nice (social/subsidized) roof over your head if you can’t pay for the groceries?

Don

Hawk occasionally posts the list price with slashes, but seems to be rare. I agree that it makes a world of difference. $1,000 off of a used 2001 Honda Civic is a lot different than $1,000 off a new Tesla Roadster 😀

@Deb, I agree that speculation in housing is simply not beneficial to society. Shelter should not be sold off on the international stage as it is right now.

But… all that cheap money is enabling these purchases. It can be traced right back to the QE and resulting low interest rates.

There are many things they could do that they won’t like taxing non resident ownership at a higher rate, taxing flippers heavily, creating a one year tax holiday on non primary property sales, simply not bumping everyone’s assessments higher, restricting blind auctions in real estate sales, not creating a building code that will double the cost of building….

@ Hawk,

You are a bright guy. Please post assessed value and listed value for each of your price slashes!

303-1115 ROCKLAND AVE VICTORIA V8V 3H8

Total Value Assessed as of July 1st, 2016

$271,000

Listed Value with your $10 k slash is $335,000

23% over last years assessment.

Hello, they need to slash another $30 k to be real.

Hello?, please post assessed and listed value with your slashing!

FYI: Vancouver targets more density in single-family neighbourhoods

http://www.metronews.ca/news/vancouver/2017/11/23/vancouver-targets-more-density-in-single-family-neighbourhoods.html

Way to go!

+1 🙂

Victoria housing strategy sees results http://www.cbc.ca/beta/news/canada/british-columbia/victoria-housing-shortage-strategy-review-1.4414784

Victoria council gets crapped on a lot but they’re the only municipality outside of Langford that seems to be getting anything done on the supply side

CS, I’m not sure whether I’m alone in this, but I find your repeated sarcasm very amusing.

“And despite a surplus of housing stock, affordability has significantly worsened – a contradiction to the supply mantra”

Yeah, obviously we should start demolishing houses by the thousand, see what that does for prices.

@dasmo

You assume too much. I was not referring to my personal circumstances which very different from the young people with or without children trying to find a home.

As far as I can see what is happening in Canada is not because of the government “printing money” but because of so many greedy people jumping on the investor band wagon. That and the amount of foreign money entering the market.

This Realestate inflation problem is occurring world wide in any attractive market. Realestate is now just another market commodity like gold or wheat and to hell with the future of our young people.

Canadian households lead the world in terms of debt: OECD

Household debt levels in Canada are higher than those in any country included in a new OECD report, and the organization says it’s a major risk to the country’s economy.

A lot of the debt that Canadians have been accumulating is tied to real estate, which doesn’t tend to grow the economy as much as other forms of debt, such as businesses borrowing to expand.

That’s bad news because the OECD says there’s a correlation between higher-than-normal house prices, and which way the economy is headed. “Research points to a number of links between high indebtedness and the risks of severe recessions,” the OECD said.

High prices in some cities are often justified by a corresponding increase in rents, but the OECD says even by that metric, Canadians are borrowing more than they should to finance real estate, even if it’s an alleged income property.

Compared to long-term averages, Canadian house prices are almost 50 per cent higher than they should be, compared to what homeowners can charge in rent.

Housing debt isn’t the only form of debt that Canadians are taking more of, but the OECD says it’s clear that the main driver of debt loads is inflated house prices.

http://www.cbc.ca/news/business/oecd-debt-1.4415860

Good link Andy. The flippers and foreigners scamming are screwed as CRA now goes back 6 or 7 years for all their other flips they failed to pay up on. Jail is a major option as well as forfeiture.

“Your price slashes, nice or not, are always simply: overpriced properties for what the market is willing to pay for them. They may not be crap and I didn’t say they all were, but some are.”

Again you miss the boat completely of what I said Luke, they are nice places that are overpriced as is the whole market which is why there are 15 to 30 price slashes every day. Over a month that’s 450 to 1200 slashes which is how much percent of the listed properties ? Hmmm.

Since you are the master of crap I’m sure you’ll see that every place I posted today was in very nice condition but you failed to even look at them. I rarely post the junk, just the decent places that are under the gun and some having multiple slashes which you also ignore.

BTW, price slashes are indication of the agents being out of touch with a changing market and declining average and median prices. Typical of a maxed out market leaning to the downside.

Steele & Drex – worth a quick listen…

https://omny.fm/shows/steele-drex/drivetime-headline-more-information-than-ever-abou

Leo S. “Leo S

November 23, 2017 at 2:27 pm

I thought this analysis was quite good by Don Pittis:

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Then there is the interesting hypothesis by Dr. Rose.

https://www.theglobeandmail.com/real-estate/vancouver/academic-takes-on-vancouvers-housing-supply-myth/article37015584/?campaign_id=A100

“Put another way, for every 100 households that came along, Metro Vancouver added 119 net units of housing. According to census data, there are also 66,719 unoccupied dwellings in Metro Vancouver.

And despite a surplus of housing stock, affordability has significantly worsened – a contradiction to the supply mantra.”

Let’s add some historical context to Luke’s assertions. As I posted earlier this year, here it is again – an article that was printed in the Toronto Star – nearly 30 years ago.

HOT, HOT HOUSES: Forget all those conspiracy theories about what’s behind the crazy Toronto real estate market. Here are the real reasons why house prices are soaring – and why they’ll stay high

Friday, July 15, 1988

MICHAEL SALTER

Absolutely everyone from cab drivers to chief executives has a story about Toronto’s crazy housing market. Politicians and tenants’ groups have declared a housing ‘affordability crisis’ – again – and have called for a tax on speculators’ profits to cool down the frenzy. Dark words are muttered about how foreign money is to blame.

In fact, the price explosion has occurred for simpler reasons. Mortgage rates are low… Residents of this huge, rich, expensive urban conglomeration have taken somewhat hopefully to calling their city ‘world class.’ But the price of being world class is ‘Manhattanization.’ Torontonians are getting a taste of the housing problems of the world’s major cities.

Owning a house is now the investment of choice for most of the middle class. Because inflation has outpaced wage gains for most of the decade, salary earners feel they can gain ground only by possessing property. The equity in a house provides – tax free – a major portion of most people’s retirement nest egg. To cope with the high costs, it’s become standard practice for house-poor owners to build and rent out a self-contained apartment.

For many Torontonians, the North American dream of home ownership has already faded, and they’ve joined the ranks of renters, probably for good. Those intent on owning will find themselves forced to think small.

Soon after this piece appeared, the Toronto market experienced a devastating correction which took decades to recover from, adjusted for inflation. And that’s simply how it goes.

Folks, RE is a cycle. In every cycle, people are convinced at the top that this time is different. It isn’t. And we’ll do it again in the next cycle – someone like Michael or Luke will find a publication from authority, charts that may appear inarguable, and detailed reasons galore why house prices are no longer related to local incomes, will stay that way, and that we need to just “get used to it”. What we need to get used to is that markets ebb and flow in a fairly constant motion. This latest cycle has been skewed and extended by central banks, but this cycle – gravity – will always prevail in the end.

Barrister you are off on James Bay. (Or are you being sarcastic?) It is absolutely not the place for high rise density. For one, their should be a View scape behind the parliament buildings to retain its silhouette. Plus people will need to leave JB and it’s tough enough getting out without adding thousands more vehicles. The area from the Hudson to Uptown is the skyscraper zone….

This article almost makes it seem like nothing will solve the problems we are all constantly talking about on here. Maybe part of it is we just need to get used to new realities? It will be hard. I think there are partial solutions though, and steps to be taken and we can’t just give up. But the future is def. going to look very different from the past and present. Sorry Deb – but we will never go back to SFD being affordable for most like it was over 7/8 years ago.

This sums it up how many long time Victorians, and also other Canadians in cities across Canada, are getting caught off guard by how their cities and country is getting noticed. They are going to have a hard time getting used to the way things are heading… but it’s the way it is in much of the rest of the world.

“Canada is going through a difficult transition that others have gone through before. There is no longer room for every family to have its suburban picket fence.

Get used to higher density

Increased housing density is blocked by people living in single family dwellings they never could afford to buy. Like elsewhere in the world urban dwellers will eventually become accustomed to higher-density housing going up next door.”

I must admit I will have a hard time getting used to this as well. Life in tiny apartments in HK is not pretty. We are a long way from that, though they are closer to it in Van.

I’m not trying to troll, NAN, but I lose sight of what the problem actually is and I think by reminding ourselves of the cost of inaction, we might also remind the government.

Freedom, you are right, I don’t want to live in a society like that. Is that what it will take before the government does something? Maybe.