Nov 20 Market Update

Weekly sales numbers courtesy of the VREB.

| Nov 2017 |

Nov

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 83 | 241 | 408 | 599 | |

| New Listings | 157 | 387 | 553 | 786 | |

| Active Listings | 1909 | 1916 | 1855 | 1815 | |

| Sales to New Listings | 53% | 62% | 74% | 76% | |

| Sales Projection | — | 610 | 664 | ||

| Months of Inventory | 3.0 | ||||

The case of the misleading sales statistics continues from last week. Not quite as bad this week, but still of the 167 sales reported for the week, 8 actually happened in the spring, and another 11 happened between the summer and 2 weeks ago. So while sales appear to be up 11% from last year, they are actually going at about the same pace. Still a quite active market though. We will likely pass 600 sales which is significantly higher than the 10 year average of 484. In a slow year we would see only about 380 sales in November.

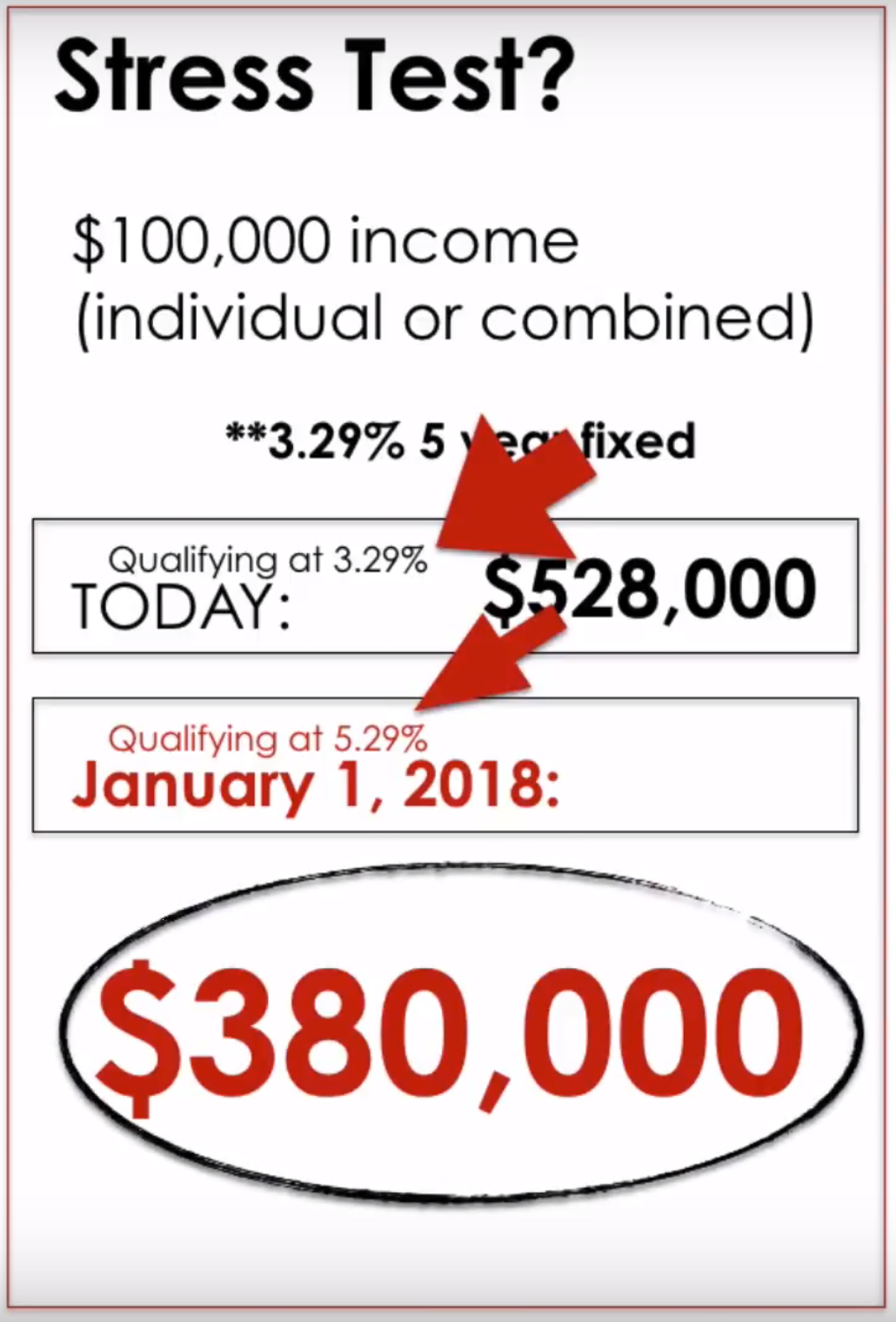

I think we are seeing some sales pulled ahead due to the upcoming OSFI stress test which has been called the mother of all mortgage rule changes. I bet quite a few buyers that were thinking about jumping in the spring are looking for ways to move that up a few months. Unfortunately for them, selection still sucks so it will be slim pickings until at least February.

Deal of the week goes to the sale of Secretary Island for $4M. Just think for the price of a couple Oak Bay shacks you could have owned 66 acres of secret lair potential!

Luke and LF,

You can check out this story about buyer’s tax responsibility:

http://vancouversun.com/news/local-news/house-buyer-beware-landmark-b-c-court-ruling-will-shake-real-estate-industry

It is same in US as well. Since CRA and IRS can’t go after foreign sellers after they sold and left, so it is buyers, their agent and lawyer who must make sure that the proper tax is withheld and only the remainder money amount given to the foreign seller.

Also in US, if a rental property foreign owner doesn’t file US income tax return for the rental income, the rental agent must withhold 30% of gross rent to IRS. The IRS requires that a withholding agent (such as a real property manager who collects the rent on behalf of the non-US resident) be personally and primarily liable for any tax that must be withheld from the rental income. Canada also has very similar tax rules.

Thoughts on the new housing strategy? https://househuntvictoria.ca/2017/11/22/affordable-housing/

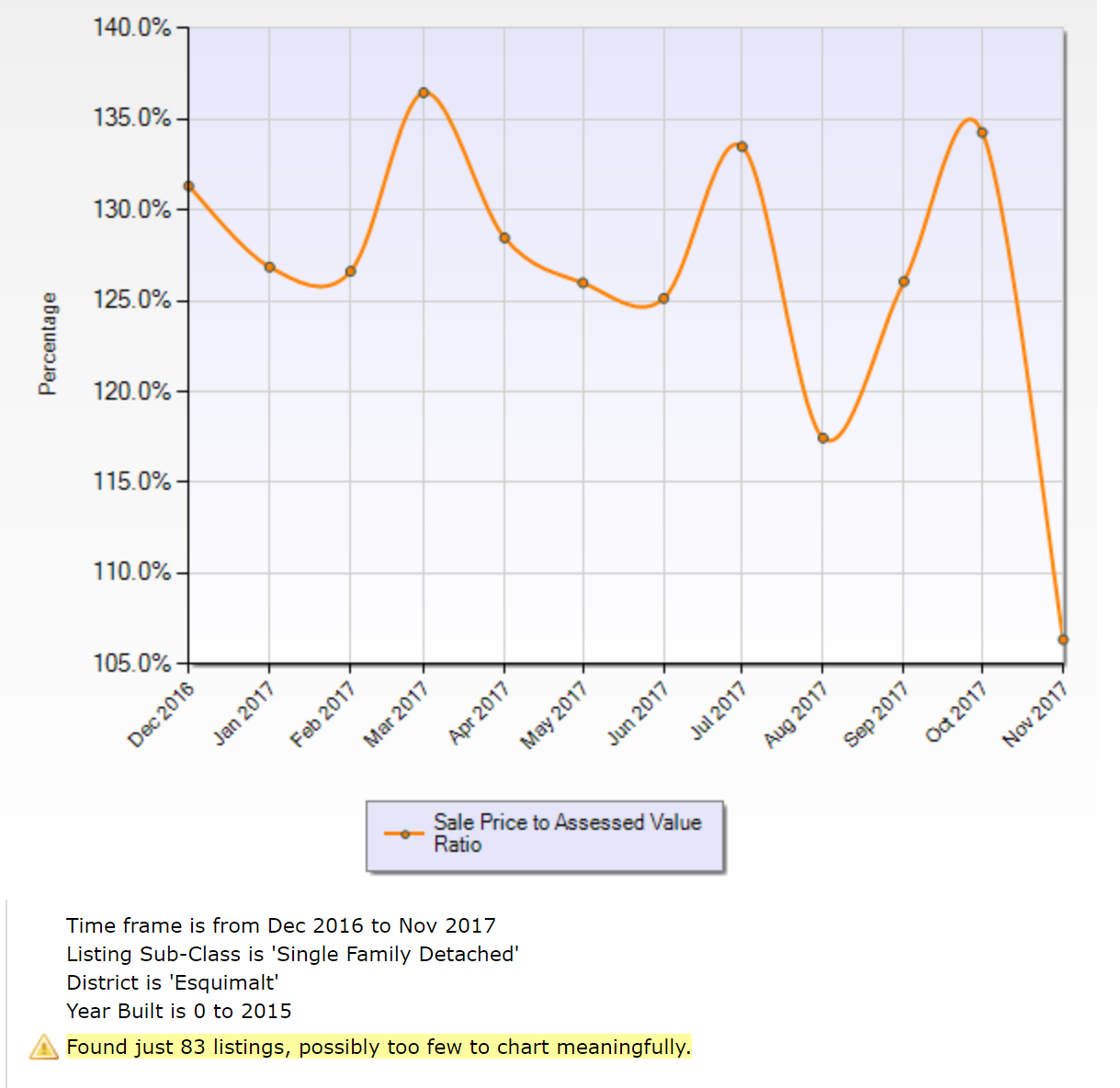

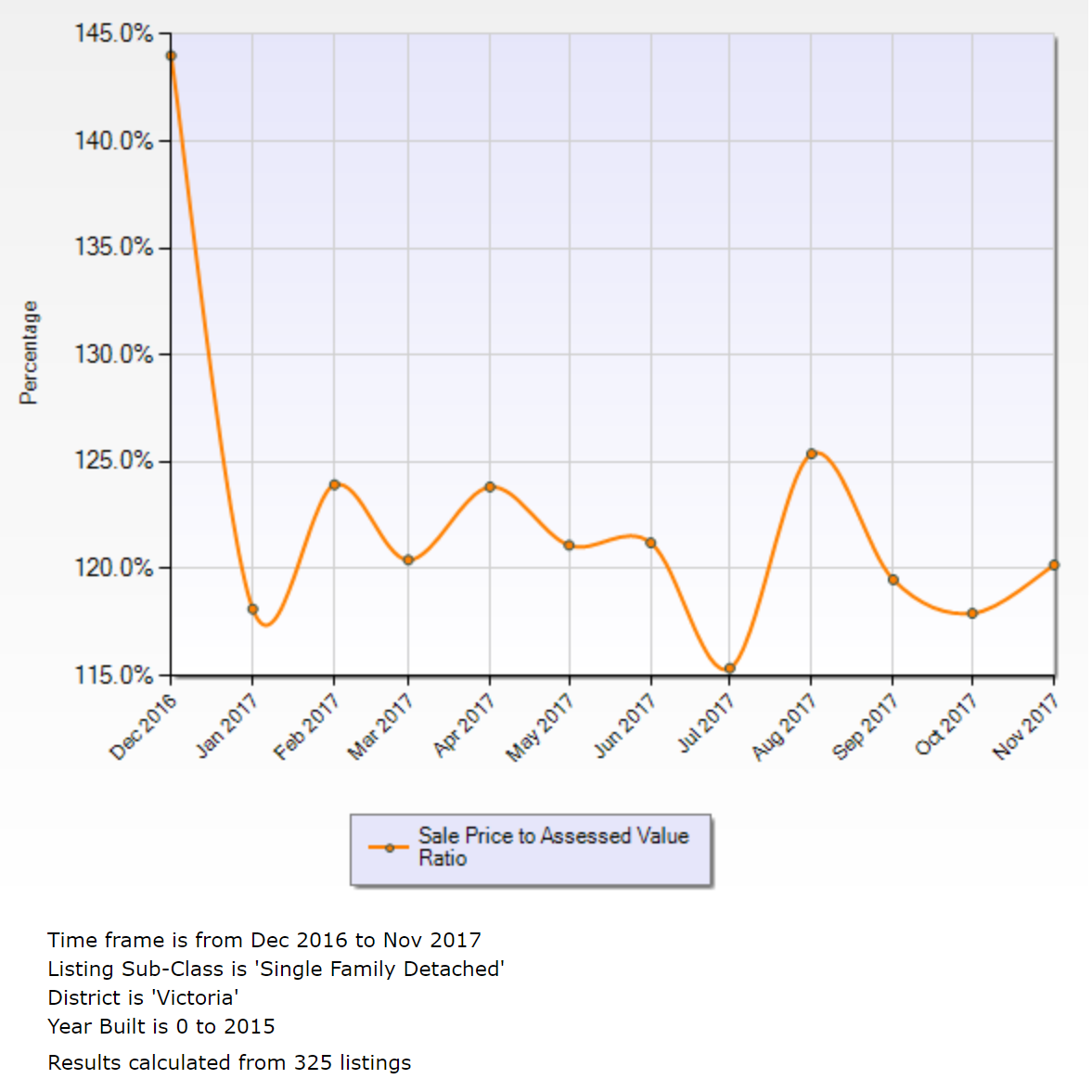

The problem with sale price/ assessed value ratio is that the statistics that the VREB system generates on this are not reliable. Once in a while a new build will be put in as $1 assessed value which pulls the average completely out of whack for that month. Only by removing the outliers does it really work. The statistic seems to be the average and no option for median.

However here it is for SFH in Esquimalt, excluding new builds to try to settle down the data a bit.

And Victoria

You can safely ignore the Dec 2016 data point, as it is affected by those outliers.

Thanks Hawk. I know I ramble on at times but it’s fun because it often generates discussion or controversy. Well I guess a bit like Robert Plant I just gotta keep on rambling …

Oh I see your landlord has posted your digs in the OB Hotel on Beach Drive. Where will ol Hawk move to now? Prices aren’t going back to 1997 levels…

Here’s another hot buy on Beach Drive that just came up… it’ll be over $2000 per foot before you know it.

411-1175 BEACH DR, 1679ft, $2,399,900.

“Already posted, Hawk”

Hard to see it LF, was planted in the middle of another one of Luke’s long winded ramblings.

Anyone else see the condo at Beach Drive and Windsor intersection ? Looks like another leaker. Paying top price with an extra $100K surprise must hurt.

John Dollar, can you please remind us/update is on the sale price to assessed value ratios in the core these days? Interested in SFH in Victoria and Esquimalt particularly if possible. I saw a listing in Esquimalt today that’s at 1.66x assessed value, wondering if that’s normal or if sellers are taking a flyer.

Thanks all for good discussion as usual!

The new changes to the property transfer tax form must be due to money laundering techniques that involve both seller and buyer working together to launder money. That’s the only common sense conclusion I can reach based on the limited information available today. This new requirement will probably be a simple act of both buyer and seller presenting their passports to their lawyer during the property transfer process.

I would suggest that part of the purchase price should be held back, in trust, until the seller satisfies the government as to their status. In most cases a government issued certificate of status could be obtained prior to the sale. The onus should be on the seller. Naturally, the government can charge a unreasonable fee for the certificate.

Already posted, Hawk.

The more I think about Luke’s comments, the more I wonder what this policy is about. If the seller is unable to hide their residency, fine. I get it.

But if I’m a buyer, my responsibility to ensure everything’s kosher on the seller sure as heck is going to dissuade me from wanting to buy a house – especially in Vancouver. Could this be a quiet way of suppressing demand?

I don’t doubt the NDP want to help”solve” the affordability issue, but the fact is most folks own and politicians aren’t going to want to wear a market cave-in. This could introduce a lot of apprehension and caution in a market where there was none previously.

Could this be a little like Morneau’s upcoming tax policies where he touts “fairness” as his reasons? Ie, framing it in a way that garners public support behind what would be otherwise politically difficult to do (tax increase).

So it could be like, “who would oppose making it dangerous to buy or sell when the transaction basis is shady or done by flippers, off shore investors and tax evaders”?

Don’t know if what I’m saying makes sense, just a thought.

Attention money launderers,scamsters, flippers and tax evaders. Your hiding places are depleting.

B.C. property-transfer tax forms to indicate seller’s residency

“The B.C. government will soon require sellers to disclose their residency during a real-estate transaction so that information can be shared with the Canada Revenue Agency (CRA).

Observers say it’s a much-needed change that replaces an honour system that was open to abuse by speculators seeking to avoid paying capital-gains tax on properties they don’t live in. But some worry that because the province is placing the onus for confirming that information on the buyer, it exposes them to potential fines or even jail time if they get it wrong. A buyer who doesn’t properly certify a seller’s residency status could also be on the hook for unpaid capital-gains tax.”

https://www.theglobeandmail.com/news/british-columbia/bc-property-transfer-tax-forms-to-indicate-sellers-residency/article37047238/

” Every sold unit that came thru my condoPCS today went over ask bidding war, and many seem to be closer to Uptown.”

90% have been selling under for the last few weeks. Keep cherry picking tho Mike. 😉

$1000 over ask on Washington is a bidding war ? lol.

The previous Short St went for under asking by$10K.

Your implication being, that those urban south Saanich sales represent seniors participating in over-ask bidding wars.

Possible. Not very likely. More likely, priced out families and desperate FTBs.

Maybe some are downsizing to the outskirts of downtown near amenities?? Every sold unit that came thru my condoPCS today went over ask bidding war, and many seem to be closer to Uptown.

102-940 INVERNESS RD

203-3008 WASHINGTON AVE

203-940 BOULDERWOOD RISE

103-490 MARSETT PL

403-820 SHORT ST

It makes absolutely no sense and my prediction is they will have to tweak it so onus is placed on Sellers not buyers to pay capital gains.

How on earth can you expect Buyers to verify someone else is properly paying their taxes! This makes it very scary to be a buyer now unless you can somehow verify someone is completely Canadian and resident full time in their home and I wonder if the part comes in where there is a suite they didn’t declare partial capital gains for??! WTF!

People could be bankrupted by this if forced to pay extraordinary capital gains bills for others who may have flown the coop so to speak (i.e. left the country). Am I missing something about how ridiculous this seems??!

Exactly – Grandma and Grandpa don’t want to live downtown when they’d like to stay in their homes as long as possible, esp. given downtown is less desirable for them now and more ok w/ yuppie types. And, with people living longer and healthier than ever before…

We’ve hashed this out until the cows come home – but, the population is rising here faster than National Average – Canada is now taking on increased immigration (some of them will come here) – Young people still house horny though they often can’t afford the core so they go to the Westshore – Density is increasing in the core (perhaps more density outside of downtown for Grandma and Grandpa would be great then?). Grandma and Grandpa often don’t leave their homes until they depart for the pie in the sky. Gov’t is still failing to act and likely will fail on foreign buyers. OSFI only likely to hurt the most leveraged or bottom of barrel buyers. I just don’t see your dream of – what?- $500k houses in the core? happening ever again Hawk, sorry. What price do you think or dream the average house price in the core will crash to anyway, I’m curious.

Re. the homeless people – I spend a lot of time downtown in the evenings – has anyone noticed increased people sleeping right on the sidewalks right beside busy streets in the wet and cold? Seems crazy that’s happening in this city and country.

Ya I don’t know how they’d implement it. What is a level of effort that is acceptable? At what level of deficiency of that effort renders it punishable by a fine? Or jail time? How do you measure?

I’d need to see the wording of the underpinning legislation. As a country, we generally don’t like to have a lot of omission-based criminal offences, so it may be you’d have to knowingly do business with a shady character.

I certainly think that more light needs to be shone on the transaction and title registration side of things. Would discourage abuse. Is this the best way? Dunno…

https://www.theglobeandmail.com/news/british-columbia/bc-property-transfer-tax-forms-to-indicate-sellers-residency/article37047238/

Great article LF – however, did you notice the part about the BUYERS having to verify the Resident status of the Seller for Capital Gains purposes or face jail time/severe fines, etc. This strikes me as being very wrong! WTF?

“But some worry that because the province is placing the onus for confirming that information on the buyer, it exposes them to potential fines or even jail time if they get it wrong. A buyer who doesn’t properly certify a seller’s residency status could also be on the hook for unpaid capital-gains tax.”

So now when buying a property people have to make sure the person they’re buying from isn’t liable for capital gains??! Wow – you’d think that the onus on that would be placed on the seller. I can’t believe how ridiculous this is!

I wonder if this applies to the new ‘partial capital gains’ where if you are buying a house w/ a suite you may have to pay the Sellers portion of Capital gains if you don’t verify that the seller paid it?! Am I the only one who thinks this is ridiculous?

@Leif

/18/april-18-market-update/#comment-7846

If West Saanich is included in the core

Here’s a comment with the long story, near the bottom is the house bit… In-between that comment and now the bank gave us a reduced rate of 2.29% for 2 years, <-wow right!

So this October we had to be careful not to be as aggressive on paying it down before the due date and just cash out at the renewal (ha ha bye) date.

I would get a mortgage for half, invest the other half since damn sure I will make more than 2.5% a year. But I also don’t like debt or the banks thus the split. Can always liquidate as rates start to rise to cut the mortgage down. Or just make lump sum payments at the end of your terms from your investment gains.

As for investing in Facebook, it has nothing to do with practicality. It’s simply that it’s growing that counts at this to investors. At least they are making profits. Look at Amazon of which has maybe turned a small profit a couple of quarters in its entire existence yet it continues to march forward with a significantly negative P/E! Our entire financial system is faith based anyway so it’s best not to think to hard about it.

Nan: Since you seem to be familiar with the stock market can you explain why Facebook common shares are worth anything more than the paper they are printed on? Near as I can tell even if Facebook increases its profits by 10 times or a hundred times why would these shares ever be worth a penny?

Bingo:

I would buy cash for the house. It is the only investment that you can sell without paying tax.

@ Barrister Stock market =/= Facebook. Most companies do make profits and are valued appropriately on a risk adjusted basis.

At a high level, investing in one company is risky (especially one like facebook that as you pointed out has no profits or control component to common shareholders) but investing in profitable business on the stock market is a simile for investing in billions of people all working to make things other people want to buy to make their lives better.

Dollar for dollar and on a risk adjusted basis, stock market investing simply has a better long term return than lending money and hoping you get paid back because by definition, the people you lend to need to have something left after interest payments to you or they wouldn’t have borrowed in the first place, or acquiring hard assets like houses, land or metals, because typically, the money to bid up the prices of hard assets comes from profitable business as well. (although QE has helped a lot here lately).

All things being equal, an investment in business will generally beat out the other two, because they have to, by definition. Now, QE and migration have made a mess of things over the last 20 years as banks printed untold sums of money and 3 billion people got TV’s and realized they didn’t need to live in a relatively terrible part of the world, but I would expect this to slow down as inflation ramps up and credit is pulled from the system and affected populations get tired of the impacts on their towns and put up barriers to entry, as you are now seeing.

Absent QE and rampant migration, the investing hierarchy will be reinstated (not that stocks have been that bad the last 10 years anyway) with investing in business coming out on top over all periods as it has for the last 200 years simply because the value of everything is derived from the value created by businesses.

On the risk end of things, take a look at some of the charts here: http://www.getrichslowly.org/2008/12/16/how-much-does-the-stock-market-actually-return/

Over almost every holding period, while the values of individual stocks do all sorts of things, the value of an investment in the stock market is very low risk, even over periods as short as 3 years. An unleveraged return of 10% per year roughly including inflation is standard.

Oh – and one last thing for those of you who didn’t like current valuations:

it is impossible to time the market.

Valuations can come down when profits go up, not only when prices come down. Given the massive amounts of QE in the system, this if far more likely.

Hypothetical scenario (more on debt vs investments):

Let’s say you were to sell your place in Victoria and move somewhere else (up island, interior, another Province.. whatever). Numbers aren’t really necessary, as a number let’s say you have 400K equity, or rather will clear 400K after the sale of your home (nice round number and would represent having about 50% equity in a median sfh here).

In the community you are moving to you can buy a house outright for 400K including all closing costs (i.e. you have the option to be mortgage free).

Would you:

a. Buy the house cash

b. Get a mortgage

If you select b, how much would you put down and what would you do with the remaining cash?

I am one of those people that really dont understand the stock market. I have yet to have anyone tell why Facebook common shares are worth anything at all. Ultimately a share of a company is only worth something because it sooner or later gets a share of the profits. The common shares dont have any voting control at all. Even if the company becomes super profitable it is more likely than not that the common shareholders will never see a penny. Yes, you can make a profit if you can find a bigger fool to buy it. But near as I can tell all you are getting and all you will ever get is a piece of paper.

Since a lot of you guys are very savvy when it comes to stocks maybe you can explain it to me.

BTW Mike, nice chart. With the first timers getting squeezed qualifying 20% plus just shows this market is set up to tank when you remove the first level of the food chain.

Anyone want their grandma living downtown in a high rise with all the crackheads and crazy homeless people please put your hands up. The ponzi scheme is about to be exposed, warts and all.

Professor calls Metro Vancouver’s housing shortage a ‘myth’

“Instead, Rose contends that “speculative investment” has resulted in tens of thousands of empty homes and led to the region’s sky-high prices.

He says as of 2016, the Metro Vancouver region had more than 60,000 vacant units.”

http://bc.ctvnews.ca/professor-calls-metro-vancouver-s-housing-shortage-a-myth-1.3686691

introvert:

Thanks for the response. I can understand and respect that. There are ETFs based around “ethical” companies, but I haven’t done the research and am always skeptical of claims like that.

In response to leo you said:

Totally. If it’s an ETF built around such companies are you going to research every one of the companies covered by the ETF? Individual stocks are pretty risky, so while it would be less breadth you’d need to do more depth.

Leo S

You and me both. If that were to happen I’d reduce my mortgage payments and put that money into my investments more aggressively.

AS for the current market evaluations.. I’ve heard everything from “we’re in a bubble” to we’re begging of cycle or mid cycle. Personally I think there’s more growth to go in this cycle (economy is just warming up) but I’m hesitant to drop more money into the TSX as a whole until NAFTA is figured out.

Caveat Emptor

Yeah, we are similar though I’d generalize that to all debt. We don’t like owing anyone anything. Of course not enough to move and be mortgage free….

“Hence, why all the househumpers on here are missing the moneytrain.

Here are the 6 S’s that are starting to push 10M boomers to sell their houses:”

They will just move to new smaller communities or in their kids basement suites which creates nothing for Victoria. I see it all the time. Victoria screwed up decades ago not planning for the inevitable onslaught. They may move to Langford or even the Okanogan.

So many slashes stacking up but too cheap to drop it more than $20K or so. Having to do such tiny slashes in hot hoods like Oak Bay in a forward sales market is not a good sign.

Hence, why all the househumpers on here are missing the moneytrain.

Here are the 6 S’s that are starting to push 10M boomers to sell their houses:

^Stairless (no basements to flood 🙂 )

^Security (safety & ease of travel)

^Simple (low maintenance)

^Seaview (some view)

^Something to do/walk to (near amenities)

^$$$$$$ from the sale

http://i.imgur.com/l7tU73P.png

Also, note the declining housebuyers over the next 20yrs – average housebuyer is age 34.

Can’t really say paying down debt is a bad thing. As has been said, investing is not guaranteed. That said, investing has been a way better choice over the last decade. That that said, it doesn’t mean it will be over the next decade. The longer we sit at these low rates the greater the odds of them going up….

And it’s a bit better still if you’re renting out a suite, as you can claim a tax deduction on a portion of your mortgage interest (as well as on your property tax, home insurance, home repairs, and accounting/bookkeeping expenses—to name a few).

“There is plenty of room for more practical things in school” – thank you – that is my point. Lets get back to housing talk.

There is plenty of room for more practical things in school. The first ten years should be art, music, cooking, experimental science mechanics, physed, carpentry and language. There is math in music, chemistry in cooking, history in art…. but…. discounting the exploration of higher level concepts and understanding the underlying mechanisms of things because there is an app for it would be a social mistake.

Entomologist – thank you for proving my point. How many people in reality use that calculation on an even semi-regular basis compared to how many people use budgeting and would be better suited learning how credit cards can screw you over? In reality when we learn that calculation in school (which I did and already forgot) it is followed up with “here is how to do it on the calculator” – press 4 buttons and solve for “n”. I have been in that scenario with clients hundreds of times working in a bank and do you think I ever drew it out long form and solved using a logarithm? No. not once. If you are saying you think there is no room to add in some more practical finance courses in high school and that all current courses are much too useful then i don’t know what to tell you. I have real world experience dealing with thousands of people who could have used some basic finance knowledge rather than using logarithms but you can believe what you want.

Has anyone noticed the new street lights that Victoria is putting up? The lights are actually almost blindingly bright and actually when up your night vision when you are driving on side streets. Why is it that the City of Victoria cannot get even basic things right.

Oops, I hope Hogue is right but I doubt that it will have much effect in Victoria where there are flocks of vultures, both exotic and our local brown variety, hovering over the nearly dead.

I would say 75% of the homes we have seen in Victoria over the past 3 months are from sales by elderly peoples their children after they pass away or elderly which are moving into either a old folks home or downsizing. This may be due to the type of homes we are looking at (800k-1M) but I do find it to be the majority of the homes we have seen. Today we went to one where the couple had to entirely leave the province and will not be returning due to medical issues.

I find it interesting to see how many “workshops” are in these homes. I would say that these workshops judging by the materials and style they are put together are for an elderly generation, 70+.

Wonder how many people actually downsize to condos. I bet not many. Most stay in their houses until they can’t, and then they go to assisted living / residential care / the graveyard.

I actually wonder the same thing, are they actually moving to condos. Judging by the way their houses are left it looks like exactly what you wrote.

House Mortgage paid off. Took 5.5 years.

We were/are not financially literate enough to get into stocks. And rates for GICs, or Mutual funds, etc.. were were nothing special to off balance the rate of the mortgage and factoring in inflation.

So we decided to hammer all our extra money at the Mortgage. We start with a 25 year mortgage on track to pay it down in 10 years. But with all the double payments and lump sums at the end of those years, it turned out to be 5.5 years.

Now we can get our RRSP and TFSA maxed. And a security liquid saving lasting for 6 month (for if the terrible happens and we loose our jobs). And now get financially literate enough to understand stocks, business, and maybe more real-estate (rental/s).

What was your mortgage amount for?

A SFH in the core is what 850k now, lets say 20% down its still so 680k (I know this is relative to now and now 5.5 years ago) but that is $10,326 a month based on 6 years @3%. $123,912 a year. That would require $190k in income just to pay that mortgage.

Very interesting to hear people talk about paying their mortgages quickly but I assume its not on a large amount. I could have paid off my previous condo in 5 years as well but did a mix of paying it off an investments. I don’t think many people in Victoria are paying a SFH off in 6 years seeing the median household income is $77,820 (https://en.wikipedia.org/wiki/List_of_Median_household_income_of_cities_in_Canada)

Why pay down the mortgage above the minimum.

For me much the same reasons as Leo

1) Guaranteed return

2) Don’t like current stock market valuations

3) Somewhat irrational desire to be rid of the mortgage and have one less interaction with the banks.

Yes #2 is market timing to an extent and I may end up behind. I am not avoiding the stock market totally just currently putting less into equity investments and more into the mortgage.

Since the “return” you get on paying your mortgage isn’t taxable it’s actually a bit better than it appears too.

Paying down aggressively is obviously also a hedge against mortgage rates massively increasing. I don’t believe that is likely to happen at all, but if it did you’d benefit (especially since the markets could be tanking at that point)

Numeracy is the prerequisite to so many things I’d really hate to dumb down our math curriculum.

I don’t need your fancy pants logarithms when I can just do trial and error with the x^y button on my calculator.

B.C. property-transfer tax forms to indicate seller’s residency

The B.C. government will soon require sellers to disclose their residency during a real-estate transaction so that information can be shared with the Canada Revenue Agency (CRA).

Observers say it’s a much-needed change that replaces an honour system that was open to abuse by speculators seeking to avoid paying capital-gains tax on properties they don’t live in.

“What was missing [before the changes] was the ability to simply check off a box, yes or no, that says, ‘I am a tax resident of Canada’ – that was the real battle,” Mr. Kurland said.

There is such a box on some other private-sector standard real estate forms, but that information was not typically shared with the CRA and amounted to an honour system that was vulnerable to abuse, Mr. Kurland maintains.

The changes affect B.C.’s Property Transfer Tax Return (PTTR) and take effect Nov. 27.

https://www.theglobeandmail.com/news/british-columbia/bc-property-transfer-tax-forms-to-indicate-sellers-residency/article37047238/

Wonder how many people actually downsize to condos. I bet not many. Most stay in their houses until they can’t, and then they go to assisted living / residential care / the graveyard.

I keep investing, just biasing more towards the guaranteed investments with stock valuations high, and more towards equities when valuations are lower. No significant amount in cash.

Putting extra payments on a mortgage or otherwise reducing expenses is a guaranteed return. Investments aren’t. Long-term broad-market investments are very likely to beat paying down one’s mortgage more quickly, but it’s not guaranteed.

Ah yes, market timing 🙂 You’ll likely miss growth by waiting to buy the dip. Best to keep regularly investing and holding.

http://awealthofcommonsense.com/2014/02/worlds-worst-market-timer/

Oak Bay councillors reject luxury condo development as wrong fit

Oak Bay councillors have given a unanimous thumbs down to a 14-unit condo development on Oak Bay Avenue aimed at the “high-end” market. The four-storey building, named The Quest, was proposed for 2326 Oak Bay Ave. The site is now occupied by single-family house sandwiched between two multi-storey buildings.

[Oak Bay Mayor Nils] Jensen said Oak Bay needs dwellings to allow older people to sell a family home, move into something smaller and retain a little money to augment a pension. He said luxury condominiums don’t serve community needs right now.

“A lot of our residents who want to down-size cannot find appropriate housing in Oak Bay,” he said. “They have to leave the community and that’s unfortunate because all their social networks and personal histories are here.”

http://www.timescolonist.com/business/oak-bay-councillors-reject-luxury-condo-development-as-wrong-fit-1.23101321

Ah the oxymoronal political line on housing: “We will improve affordability!! Oh and we will protect homeowners’ equity!”

Completely impossible.

I think you need to have a talk with the ladies in the house….

Yeah as much as I understand that it is sub-optimal, I still prefer investments that reduce expenses rather than those that increase income. No idea why. The other side of it is that at current valuations the stock market makes me somewhat nervous so we do a bit of both (investing + pay down mortgage). If there was a big crash in the market I would switch to putting every spare penny into the market until it recovered.

Good. We need more of that. Housing prices are insane and if prefab brings it down then great.

I live in one of the basically two layouts that were built in Gordon head. Hundreds of very similar homes that I’m sure many people snubbed their nose at at the time they were put up.

Does it make a damn bit of difference to day to day life? Nope. The places are all standing 50 years later and I don’t see any major problems with them.

THis is your chance folks. Sign up now

Hehe…. I think Entomologist just schooled rush4life. I agree school was a colossal waste of time but putting “mortgage law and finance” on the curriculum would definitely have made me a drop out!

Rush4life –

How many years does it take to make money, say $50,000 at 7% compounding interest rate? Let’s say we have $10,000 to start with.

Well, let’s start by calculating the compounding rate of return over several years.

F= final amount

i=interest rate

C=initial capital

y=number of years

F=C*(1+i/100)^y

e.g., for eight years

F = 10000*(1+.07)^8

= 17,181.86

So to answer our original question, we need the inverse of this equation.

y=log_[1+i/100] (F/C), where log_[1+i/100] is the logarithm, with a base of (1+i/100)

=log_1.07 (50,000/10,000)

=log_1.07(5)

=23.78762

It’ll take a bit more than 23 3/4 years to make 50k out of 10k at a 7% interest rate.

Logarithms do have their uses.

Yes, and that’s unquestionably a good thing. But I’m still not eager to spend my time researching prospective investments when I’d much rather pay off my mortgage—which happens also to be an endeavour requiring comparatively little thought.

A long time ago, I played fantasy sports. I excelled at it, but at the cost of all my free time. I fear investing would be similar.

Possibly. Although lots of potential in renewable energy these days. Huge disruption happening right now in that space.

“This one always gets me, same with people who want to learn how to do their taxes instead of Math.

What do you think accounting and basic finance use?”

I didn’t say “math”. I specifically said complex math and used an example of a logarithm – when was the last time you used a logarithm in “basic finance” or “accounting”? All I was saying is there are a lot of things taught in high school that have no practical use in the real world and yet things like buying houses (mortgages), saving money, or real budgeting get left out.

I’m sort of philosophically opposed to the stock market. I wouldn’t want to encourage companies that hurt people and/or the environment by investing my money in them. And, in many cases, the best returns come from companies that do the most damage.

Bitterbear:

You receive two bills one for the municipality and one from the province. Both would be using the dame assessment figure for the house.

The object is not just to discourage new foreign buyers but to encourage present foreign owners to sell out and return the housing stock back to Canadians..

introvert

Care to elaborate? Don’t like it? There are plenty of things I don’t like but do. Brushing teeth, working, paying my bills…

Something like the 3 ETF solution proposed by CCP is pretty damn low risk even in the short term (plus it’s bond market exposure as well as stock market) and super easy to maintain. Keep some cash on the side for emergencies (so you don’t have to cash in investments during a low period) and it’s basically worry free. My SO’s investments are the CCP model portfolio.

Anyhow, not criticizing (tone is difficult to convey online), I’m genuinely curious.

Can’t disagree with that. Definitely a good reason.

I like knowing that the market can plummet and I won’t be underwater. I don’t like being tied to debt I can’t easily get out of. If I need to ditch the house, I know I can, same with the vehicles etc.

Speaking of vehicles, I don’t understand people who do stuff like the 7+ year car payment. Come year 6 you have a vehicle out of warranty that isn’t paid off that is quite possibly worth less than the outstanding loan. Lose your job or the transmission blows up and you’re short on funds.. then what?

I don’t know enough about the tax system, so you can help me out here but if you quadruple property taxes, doesn’t that stay at the municipal level? What about contributing to healthcare, education, social safety net, infrastructure? Would you need a tax beyond property tax for that?

Otherwise, you have taxes benefitting the local level but not beyond. Does that make sense?

This one always gets me, same with people who want to learn how to do their taxes instead of Math.

What do you think accounting and basic finance use?

Bitterbear:

It would be simpler to just add an additional property tax bill on top of the regular bill. Make the total new tax three or four times the regular property tax and then up it again the year after.

What about taking the assessed value of a foreign purchased property, calculate the income required to own it with a 20% downpayment (arbitrary) then calculate the income tax that a person with that income would be required to pay and charge that to the foreign owned property every year. If people want property here they should pay like they live here.

Maybe, but actually they were barely voted in and only got in by the skin of their teeth by teaming up w/ Greens. They will be very careful about whatever they do because they will want to win popular vote come the next election.

My best guess is whatever they announce in Feb. will be a balance to try to appease people’s concerns about the ludicrous housing market in Van and now here, and how that’s effecting the livability of these places for the future. All while trying to not overly damage existing homeowner’s equity. How do they accomplish this because things are already so expensive? Horgan even said so last week in Van that he didn’t want to damage home equity. They are definitely in a difficult position and can’t please everybody – like the upcoming decision on Site C.

Keep in mind that just 1% of China that’s now coming into enormous wealth is 14 or 15 million people – almost half of Canada’s population! Yes, they are not all focused on Canada but we in BC are a target market that’s high on their list, and they have just been shut out of New Zealand.

There have been some really good ideas presented on this blog from people on how to deal with the foreign influence (i.e. tie things to Canadian earned income tax, etc). IMO, this is one of the biggest reasons our housing market is so out of whack from reality – or it’s a big part of the puzzle that if taken out would be revealed. Making sure that these foreign buyers pay tax through the nose which is what pays for why Canada is such a great society that attracted them in the first place should come first and foremost in the Feb. budget. Also, let’s not just go after future foreign buyers – make existing foreign owners pay! Make sure all loopholes are closed! They shouldn’t expect to have all the benefits of our great country, yet not pay for it.

It’s a tall order though, and I suspect there will be failings on the Gov’t’s part come Feb. though. Def. going to be interesting to see what happens come Feb.

Well thanks Cavaet – I’ve just realized something else besides having ski hills nearby about Vancouver that’s better than Vic – there’s very few sump pumps in Metro Van. (at least from my experience there). Driving through South OB yesterday after another sump pump experience I noticed practically every house in the flat area down there has basements below grade, and I’d bet practically every house has a sump pump. South OB was not looking so great – what’s the big deal about it? I guess b/c it’s quiet and near the ocean… while also near downtown, but far enough away.

averse

Yup. I personally don’t like the stock market, so paying off the mortgage ASAP is an easy choice. Plus, as the mortgage principal diminishes, so too does risk.

@Garden Suitor

Bit presumptuous there, who says I don’t also do frivolous consumer spending and the extra money is after that? 😉 Thanks for the words of encouragement. I still think prioritizing debt over investments when the numbers say investments is irrational. It may be responsible, but it’s still irrational.

Halibut, introvert, Leo s and others that do the same.. do you know why you do that?

In our case it’s not a fear of investments (well diversified portfolio and we keep sufficient cash in case of a lost job or emergency). Seems we just really don’t like debt. I know my parents were really diligent on paying down their mortgage quickly, but that didn’t influence my sibling (never never plan mortgage and 2 luxury cars).

@rush4life

Thanks for the inside info. That’s interesting to hear.

“RBC economist Robert Hogue said that, although the changes are not a surprise, they will have a real impact on the market.”

Wait til the NDP bring in the anti-speculators tax plus other market cooling laws in the new year. I believe Eby is sincere in getting a grip on the money laundering scum that rape our system daily and will do it right. They were voted in to do something big and it’s coming like a tsunami.

Oops, I hope Hogue is right but I doubt that it will have much effect in Victoria where there are flocks of vultures, both exotic and our local brown variety, hovering over the nearly dead.

Bitterbear: “Barrister, I agree. I don’t think the OSFI rules will have an impact on the overall market unless foreign investment, househoarding and speculation are also curbed. The rules will only hurt marginal buyers which could drop prices at the low end but bargains will be scooped up by the land barons.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

An interesting opinion, Bitterbear. Let’s hear from the vested interests on the possible repercussions.

https://www.canadianrealestatemagazine.ca/market-update/industry-reacts-to-osfi-b20-update-232610.aspx

“RBC economist Robert Hogue said that, although the changes are not a surprise, they will have a real impact on the market.

“We expect that, following a brief run-up in activity fueled by buyers rushing to lock-in existing qualifying criteria, the change will have a dampening impact on the housing market shortly after it comes into effect in January. It has the potential initially to rock the market because non-insured mortgages represent a large share of the mortgage market,” Hogue wrote.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Interestingly, this was from October and he has been correct so far. Mind you, I think most people had the same observation.

In terms of people purchasing near max I would say, in my experience working at a bank for 5 out of the last 6 years, that it is quite common. It was common for people to come in, get preapproved for an amount and use close to every last penny of their approval. I would always tell people just because you qualify for something doesn’t mean it’s necessarily affordable but then they would buy the house and come in with a new truck loan a couple months after and ask how to reduce payments as things have become unaffordable. *side note: We should be teaching basic finance in high school and stop worrying about Logarithms or complex Math that isn’t used outside of high school class for most people… but I digress.

If I had to guess i’d say about 50% of the uninsured new home buys i did would have been impacted by these rules – that is why I believe it will have SOME impact – though to what extent it is hard to say. I will be waiting until Spring to see what happens to buy and with any luck NDP will compound this and maybe I can find something affordable in Victoria – otherwise I will be left working downtown and living out in Westshore if I want to own a home. That’s just my two cents – i’d love to hear from some brokers who would have more insight as the last two years where I was doing mortgages I probably only did about 40 of them – so its not a lot to go on.

House Mortgage paid off. Took 5.5 years.

We were/are not financially literate enough to get into stocks. And rates for GICs, or Mutual funds, etc.. were were nothing special to off balance the rate of the mortgage and factoring in inflation.

So we decided to hammer all our extra money at the Mortgage. We start with a 25 year mortgage on track to pay it down in 10 years. But with all the double payments and lump sums at the end of those years, it turned out to be 5.5 years.

Now we can get our RRSP and TFSA maxed. And a security liquid saving lasting for 6 month (for if the terrible happens and we loose our jobs). And now get financially literate enough to understand stocks, business, and maybe more real-estate (rental/s).

I personally don’t think sump pumps are a big deal. It’s maybe 4-5K for a redundant duplex pump system which should last a long time (assuming you have power). Sewer pumps on the other hand suck. People put all kinds of things down the sewer lines which will eventually kill even the fanciest pumps – and fixing them isn’t particularly pleasant. Ask me how I know 😉 I just put in a new 2HP one (very large, very heavy, 240V, $2.5K) and it will still eventually get clogged by tampons or wet-wipes. Those things aren’t sewer safe no matter what the box says.

Count me in that group too, Bingo.

We upped our monthly payments to the maximum allowed under our mortgage which I think was 20%. Amazing to think that that shaved six years off our amortization.

1) zoning bylaws that force you to build a basement way underground or not at all

2) Old sewer lines that aren’t buried very deep

That’s my guess anyhow

Bingo – investing vs paying mortgage depends on a lot of things, but yes by the math (and at current rates) you’re better off paying the minimum on mortgage and sinking the rest into long-term broad-market investments. That is our choice (still have some room in our registered accounts, but getting closer to maxed). Either one is good compared to frivolous consumer spending though, so you’re good either way though IMO 🙂

introvert

And so is Leo S and I guess me. I prefer debt adverse to weird, to each their own though.

We put too much towards the mortgage and should be putting more of that towards investments. Our TFSA and RRSP aren’t maxed, so that’s where extra money should be going rather than paying down a debt with an interest rate under 3%.

We’ll see what new tax rules stick, I might have to make a big RRSP contribution next year.

This is weird b/c I thought OB didn’t allow suites, though we all know perhaps up to half the houses there have them. Maybe I need to educate myself on what OB allows, but since that one is a new build you’d think they’d have to follow all the rules.

I had a poke around the Oliver house yesterday that’s getting so much discussion on this thread, given it’s vacant – they fit a lot of house on a small-ish lot. Not sure how the white stucco will hold up. Great location of course, but $2.6m and then you have to add GST+PTT which is huge. The house fit into the ‘hood ok but for that price I’d expect a mansion, maybe I’m also out of touch.

The thing that struck me about it – and maybe this comes from not being originally from Victoria… There was an interesting sound of a water feature mixed with electrical hum in the backyard, after turning the corner I was struck by a sewage like smell – in the deep basement right by the entrance to the lower level there was an open sewer drain grate and – yep you guessed it – Sump Pump! I looked for the big red light and alarm in case the sump pump ever breaks down but maybe that’s inside. I hate sump pump’s, so glad I found a house that uses gravity, I don’t understand why so many homes in Victoria/OB have sump pumps! They can have it for almost $3m – ridiculous!

josh

So many possible scenarios and everyone has their own opinion. I have a hard time believing prices won’t drop in Victoria as a result of the changes. But even if prices were guaranteed to drop there are hypothetical scenarios where it still makes sense to buy.

E.g. If you can afford a SFH before the changes but are top of your range (you can afford a fixer upper, and that’s it), then after the changes housing prices have to drop 20% so you have the same buying power. If SFH prices only drop 10%, you could be SOL on buying a SFH. Also if that pushes more people into condos and towns that could increase prices of that housing stock, meaning not only are you pushed into an inferior housing choice, you can’t get as nice a place. (I don’t think they are inferior, but that seems to be the common mentality, a SFH of your own is the pinnacle of housing)

I’d wait until the dust settles if I was in the market to buy and I think anyone with at least 20% down is crazy to not wait, but I can sympathize with people who think it’s now or never.

That being said, if you can’t afford to buy after the changes, can you really afford to buy now? The new rules seem pretty sane. 0 down 30+ year mortgages should not have existed and the current rules are still too loose.

Ento:

I know the house on St. Charles bu, sorry, that is not mine. We have not made a final decision as to whether to move since I still have more surgery to look forward to ahead of me.

The house in Oak Bay has a basement suite but I wonder how many people that can afford 2.6 million for a house really want to have tenants (some might want that for family members). It will be interesting to see if it sells fast.

What is the cut of a general contractor, around 20%? If a builder doesn’t normally make more money (plus sale agent commission) than a general contractor, why bother to be a builder?

I’m in my mid-thirties, and the only thing I max out on with respect to my mortgage is extra payments to principal.

But I’m weird.

Think new Langford developments, only with wider streets.

It’s not a bad question to ask, though Leo. My impression from being an active consumer in the ‘new home builder’ market lately is that it’s a pretty well-functioning market. As in, there’s lots of competition and many choices. There’s surely something to reducing red tape, as Marko has discussed a number of times – HPO exam, permitting, way more municipalities for 350k people than makes sense, etc. But that’s only assuming we want more redevelopment happening.

Places with higher unemployment, lower min. wages and cheaper land will undoubtedly result in cheaper housing.

A 3-minute search on Zillow in NE Houston found me a couple of 8,000 ft^2 lots for US$17k each (Touchstone & Springdale streets). Of course there’s going to be cheaper housing there.

The big question is, of those 50% that could be affected, how many people were buying within the top 25% of their qualified amounts? Those are the ones that will be sidelined for a while

I guess the mortgage lenders are the only ones that would have the facts. I’m sure realtors would be able to have a sense of the numbers.

From what I have seen from my friends and coworkers either buying their first home or upgrading they have all maxed out there allowable mortgage limit. These are people in their mid to late 30s.

Leo – illegal labour working unsafely for under-the-table untaxed wages. That, or vast assemblages of cookie cutter low-qual developments to make economies of scale with cheap designs of identical structures. A la Calgary suburbs – a sea of brown vinyl siding.

Folks – that Oliver st. house isn’t really that big by modern custom home standards. 3700 ft^2 isn’t breaking any records. Do a search for places over 1.5 M and the majority around the peninsula are much larger. A quick look at current listings reveal that it’s no effort at all to find 5000 ft^2 homes: 1123 Highview in North Saanich (5840 ft^2), a couple in Cordova Bay, three inland places currently in North Saanich south of the airport in the 4500-5200 ft^2 (a bargain, at 1.8M-2.1M), etc. There are currently two listings on Ardmore rd over 8000 ft^2; a historic Rockland mansion for 3.1M with 10 bathrooms and 7800 ft^2 of space. (Is that Barrister’s place? Wink.). Excessive, yes, most of these.

And another quirk of building new – you have to pay for unfinished space (garage, etc.), but don’t get ‘credit’ in the RE listing. The house in question on Oliver has an expansive garage. That’s probably an extra 550 ft^2 of space that needs a foundation, framing, drywall, roofing, and expensive garage doors. No, it doesn’t need custom tile and won’t cost $300/ft^2, but might cost $200/ft^2 on top of the finished living space (our builder told us unfinished space was roughly 60% the cost of finished space, on average).

And as for whether or not this represents good value – well, perusing the latest drama in BC’s softwood lumber politicking, as well as Victoria’s current unemployment rate, suggest just why both labour and materials might cost something here. Or do we think our luxury housing should be built by undocumented immigrants working unsafely for $40/day? And I’m all for repurposed materials, but they’re not cheaper than the new stuff. Shit’s expensive.

(The bigger question is – why are wages not keeping up?)

What I’ve never gotten an answer to is how anyone builds a new house in a cheaper market. Every time we hear stories about how given the cost of building even at these crazy prices the builders aren’t making that much money.

And yet… houses get built in markets where the average price is way less than here. The building costs aren’t cheaper there, and yet somehow magically those builders still find it profitable to build.

It’s funny, there’s opinions ranging from “market killer” to “no effect at all”.

I would wonder if the things you listed, especially the last two, are symptoms rather than causes. “Land barons” tend to show up in force in a rising market, and if it’s rising long enough you get a “buy the dip” mentality (a slowdown is simply viewed as a brief sale until aggressive increases begin again). This is a tale as old as time. Nothing we’re really seeing is terribly new, though its length and intensity is unusual.

When the market really turns, those “land barons” will look elsewhere. As for foreign investors, if they’re looking to snap up homes in the BC south coast right now for profit, I’d suspect their advisor is getting tips from REIN Canada or some other like fitting. Don’t think there’s a lot of opportunity for them left now. If it’s for actual immigration and QUIIP stuff, who knows. But I doubt it’ll be enough to hold the market up on its own.

So if the truth lies somewhere in between the house cost $1,750,000 to build 😉

Barrister, I agree. I don’t think the OSFI rules will have an impact on the overall market unless foreign investment, househoarding and speculation are also curbed. The rules will only hurt marginal buyers which could drop prices at the low end but bargains will be scooped up by the land barons. The only impact it has is making the rich richer and the poor poorer. The so-called “middle-class” (people who think they are rich but are blithely unaware of the precariousness of those riches) will not be affected until they get hit with normal interest rates.

I am not sure that the new mortgage rules will have as much effect as some people think. The effect will not be seen evenly through the city and will have a lot more impact on the West Shore than the core.

The impact of this change could be significant if the NDP government actually takes effective steps to drastically reduce foreign money in the BC real estate market. As if 2018 sees another point of interest rate increases than this might also have a greater impact on the market. Considering how much of the BC economy relies on endless construction I would be concerned about were things might be heading.

Marko:

I suspect that you are right about the builder being into it for at least 2 mil. but I still question the value that is there to the buyer. At the end of the day you have to compare it to other properties on the market. If you happen to notice can you let us know what this house sells for?

I suspect at that price it more likely cost them about 1.5 million all in

Given the builder paid $1,050,000 for the tear down highly unlikely. Also, looking at the fit/finish highly doubt this was around $200 per square foot builder cost; would have definitively been more than that. This is a north of $2 million all in for the builder. How much north tough to say.

Everyone was cashing it in when you bought a lot for $600,000 and it was worth $900,000 by the time the home was finished and sold 12-18 months later. You basically made $300,000 on the land and maybe $150,000 to $200,000 on the improvements.

Take away the land appreciation and you are back to regular margin which are not as large as people think.

$350 / sq is what the builders would charge not their cost. They will have their own carpenters, will purchase everything at their discount etc. So, take that $350 and make it $200. Maybe less since the larger sqft can reduce the per sqft cost.

I suspect at that price it more likely cost them about 1.5 million all in. I picked up some wood from a usedvic ad that was in a large extravagant house in the uplands. In chatting with the fellow who was maybe 40 something, it turns out he was a builder of custom homes. Obviously making good money over the last little while and it wasn’t even a boom. No matter what the industry people want you to believe, margins are not tight right now….

Seems kind of a lot for such a large house. I doubt they are paying that much.

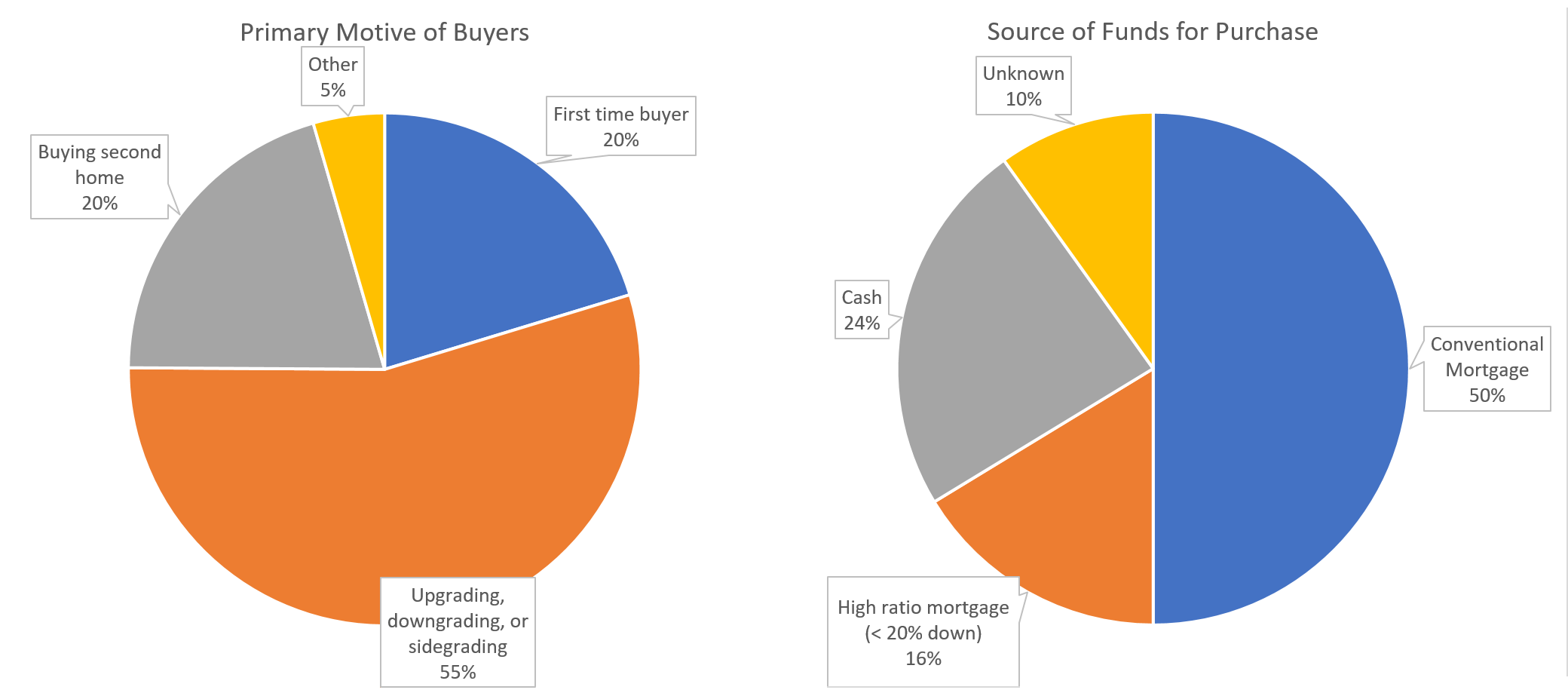

As for the stress test, it will reduce the purchasing power of about 50% of buyers in Victoria. Those who are currently using a conventional mortgage to buy their house.

The stress test last fall affected up to 16% and to be honest I couldn’t really see the impact on the resale market specifically.

The big question is, of those 50% that could be affected, how many people were buying within the top 25% of their qualified amounts? Those are the ones that will be sidelined for a while.

Bitterbear, yes it’s definitely still alive and well at CIBC. Low down payment, zero credit history under international students section.

“When you are ready to purchase a home, we offer you a simplified mortgage application process, with no Canadian credit history required.”

“In Canada, most people need to get a loan from their bank if they want to buy a home. A loan for buying a home is called a mortgage.

CIBC offers a Newcomer Mortgage that you may qualify for even if you do not have a Canadian credit history. The approval process is simple and you do not require a large down payment. If you do not have Canadian income, we also have a special Foreign Income Program that may allow you to”

https://www.cibc.com/en/special-offers/international-student-offers.html

“BMO’s guidelines also require clients, including “foreign students with a valid study permit,” to have the equivalent of one year’s mortgage payments on hand at the time the loan is issued.

The exemptions appear to be designed to attract citizens of foreign countries and newcomers to Canada as clients by making it less onerous for them to obtain and build credit here. Canadian applicants must still prove their sources of income. Critics say that puts locals at an unfair disadvantage and inadvertently encourages real estate speculation by foreigners who have easier access to credit.”

https://www.theglobeandmail.com/real-estate/vancouver/canadian-banks-mortgage-guidelines-favour-foreign-home-buyers/article31869946/

(From the previous thread:)

When patronizing small businesses (especially ones I really like) I always pay with Interac, because the retailer only gets dinged with a flat fee of $0.06 per transaction.

When I buy from Amazon, Walmart, and other giants I always pay with Visa to collect a few rewards points.

Ento:

I dont doubt your calculations on Oliver are correct but, nevertheless, that strikes me as a lot of money for what it is. Obviously, I have lost touch with costs these days.

Josh, I stand corrected.

Bitterbear, it’s charmander :). Pokemon is always a thing.

If you believe that the prices are not going to drop despite the changes, or that they will continue to increase, then you might be inclined to make a move now.

Other than that, I totally get your bewilderment. I’d definitely take a wait-and-see. It may take a few months after implementation before we can really get a sense of the market effects.

Hawk, that’s an old photo from a number of years ago when Charizard was still a thing.

I get your point though. In the CIBC at Royal Oak, there’s a sign in Mandarin only. One person told me it says that you can bank in the language of your choice and another said it was offering a 2.49% interest rate on something. If anyone can translate, I’d be curious to know….

What is the mentality and reasoning of someone who is rushing to buy now before what they can afford gets slashed? Theoretically these must be people who are actually making use of the difference between now and then. Does the thought that property prices might decline just not occur to them at all?

“Oo a big scary cut in buying power is coming. I’d better pour everything I have into a risky market and it’s riskiest time so that…”

.. so that what? What on earth is the benefit to that?

“A very plain box for CIBC branch office”

Since CIBC is the one bank up to it’s ass in alligators with the highest risk mortgage debt, might as well go as cheap as possible while trying to suck in the last of the sheep… I mean “students” with big daddy’s “unverified” income.

http://images.huffingtonpost.com/2016-09-19-1474281563-8677988-CIBCBranchMortgagesForInternationalStudents.jpg

Barrister –

RE 609 Oliver street. EvalueBC has the lot valued at 908k. The new house is 3700 ft^2, and looks pretty swanky. Estimating $350/ft^2, that gives a build cost of about 1.3M. So if I’m anywhere close, the cost of the property to the builder is roughly 2.2 M or so. If they sell for something like 2.5M, that gives a bit of profit to the builder, but not particularly excessive, really; mind you, I could be off by 100-200k either way here.