Feds panic on housing, will it help?

We’re 2 years into the current term of the federal government, and back when they were campaigning for the election, none of the parties had a particularly compelling housing policy. Many of the promised policies were about adding demand but also ended up as broken promises, with the Liberals neither raising the CMHC insurance limit from $1M, nor reducing CMHC premiums by 25%, nor increasing the home buyers tax credit. They did launch their First Home Savings Account which helps those with enough money to buy push up prices further.

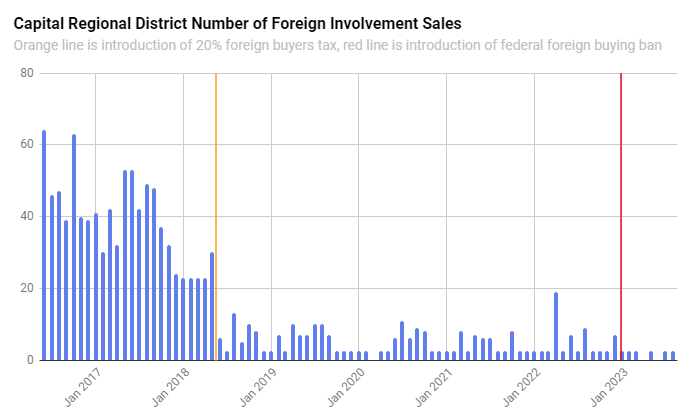

The Liberals also promised and delivered the ban on foreign buyers, which did little because foreign buyers were already very low due to BC’s and Ontario’s foreign buyers tax, and some of the remaining few buyers were exempt from the ban anyway. This year there’s been about 2 foreign buyers a month in Victoria, compared to an average of 5 a month in the years since the foreign buyers tax took effect.

The promised Housing Accelerator Fund was an excellent idea that took applications from cities this summer on how they would reform zoning and other processes to increase housing production, but it’s a long term reform that will take years to produce results.

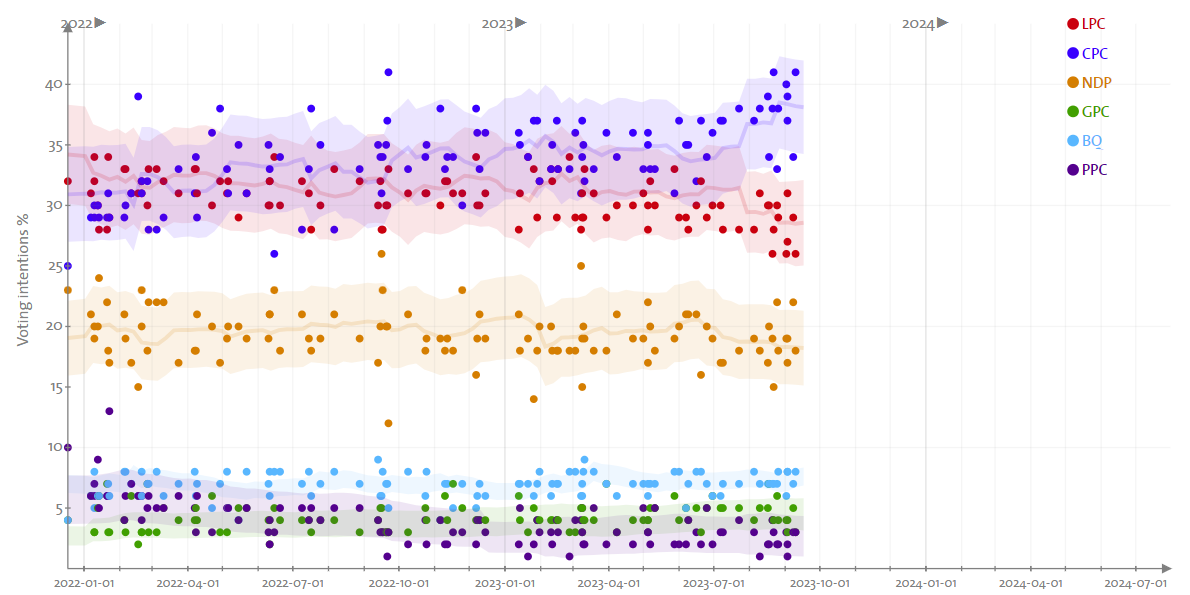

So we’re halfway through the term, and the Liberals have made essentially no progress on housing. Yes prices briefly cratered last year when rates increased, but some of that has bounced back, and on the ground affordability has only deteriorated. Buyers and renters are paying more than ever, and that’s likely a key factor behind why support for the Liberals has cratered recently, with the lost support all going to the Conservative party.

Those poll numbers have seemingly put the Liberals into panic mode, frantically trying to right the housing ship. It doesn’t help that the Conservatives have been crushing it on the communication front, with Poilievre pointing out in plain language how ridiculous the housing situation is, while the Liberals lamely announce a few dozen funded units here and there.

Last week they finally seemed to wake up, announcing both that London, ON was the first city to have their Housing Accelerator Fund approved and that GST would be removed from new purpose built rental housing construction. The London announcement was in some ways little more than the first award under the program they had announced earlier, with the city getting $74M for a slate of reforms including legalizing 4 units per lot and legalizing higher density developments near transit without rezoning. However it also seems like the criteria for the program have been sharpened, with multiple government communications referencing that cities needed to “end exclusionary zoning” in order to get the money. Most recently the new housing minister wrote a letter to Calgary threatening that their HAF funding would not be approved if they didn’t approve a plan to legalize diverse forms of infill housing in broad areas of the city (they did). An interesting bipartisan agreement, given the Conservatives’ Scott Aitchison had written a similar letter in support just a week earlier. Look out for dozens more of these announcements as cities across the country get awarded similar dollars for density.

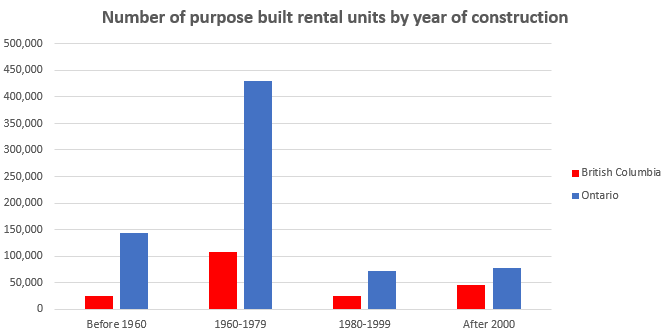

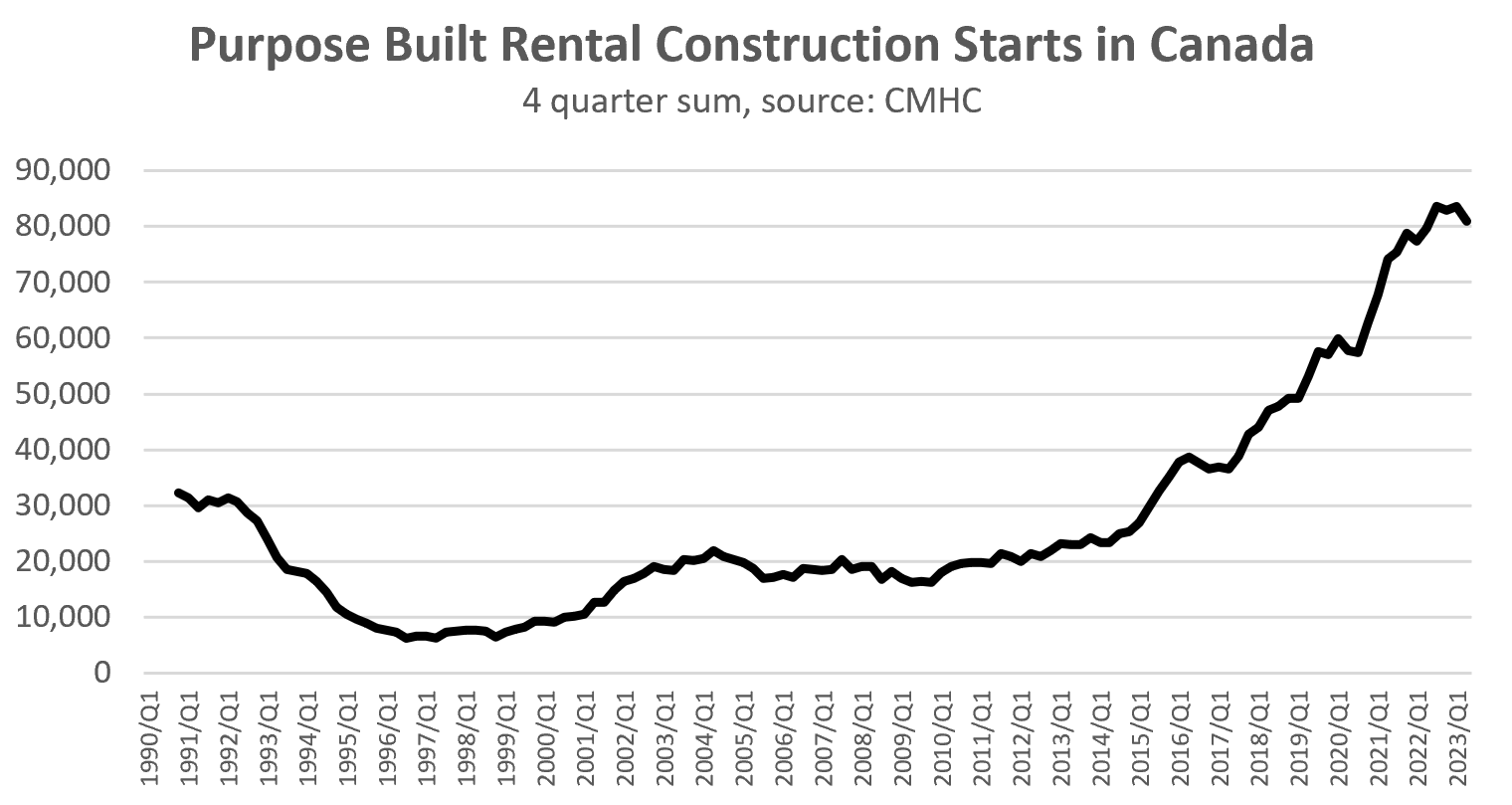

Meanwhile the GST reform has been broadly hailed by researchers and builders as being a big step towards keeping rental construction going in the face of higher rates and construction costs. For context, we used to build a lot of rentals, but that ended after favourable tax policies were scrapped, the condo was invented, and cities were broadly downzoned all in the 60s and 70s. In the last 30 years, BC added a net of only 20,000 purpose built rentals while population grew by 1.8 million people.

Low rates and CMHC funding programs have revived purpose built rental construction in recent years, but that was set to collapse with a lot of projects being shelved recently as financing conditions deteriorated. The GST exemption will bring a lot of these projects back on the table and hopefully keep the rental construction boom going.

Why do we want purpose built rentals? Primarily it’s a security of tenure story. Most of our evictions are due to methods only available to secondary market rentals (i.e owners use of property), so rented out condos are substantially less secure than purpose built rentals that will remain that way for decades. Purpose built rentals can also be bought up by non-profits and kept more affordable, as with the recently announced $500M rental acquisition fund from the province.

Will all those housing moves save the Liberal’s political bacon? I doubt it, but at least they’re swimming in the right direction. The problem with housing policy is that the reforms that are needed are boring, not always popular, and take years to really show results. After chasing quick fixes for the last 15 years, all parties finally agree that we need a lot more housing, but the mechanisms to get there aren’t obvious to those not immersed in it.

If you don’t understand the history of rental housing in Canada, the GST exemption sounds like a benefit for developers instead of an important incentive to bring more rental housing onboard. And almost no one blames their municipal government for the housing shortage, despite local government routinely spending hundreds of staff and council hours to actively slow down or block housing construction. The feds could move the needle faster by emphasizing quick build solutions like an epic rollout of student or military housing to take the pressure off local rental markets, but that seems to be still on the back burner. Very likely at this point people are so fed up at the cost of living that we’ll have a new federal party in power two years from now.

However in the meantime it seems the fear of losing is the best housing policy motivator of all time. We’ll probably see a lot more action on housing going forward.

Also the weekly numbers.

| September 2023 |

Sep

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 141 | 260 | 410 | ||

| New Listings | 414 | 743 | 1155 | ||

| Active Listings | 2543 | 2618 | 2300 | ||

| Sales to New Listings | 34% | 35% | 35% | ||

| Sales YoY Change | +18% | +15% | -46% | ||

| New Lists YoY Change | +19% | +12% | +18% | ||

| Inventory YoY Change | +18% | +17% | +104% | ||

| Months of Inventory | 5.6 | ||||

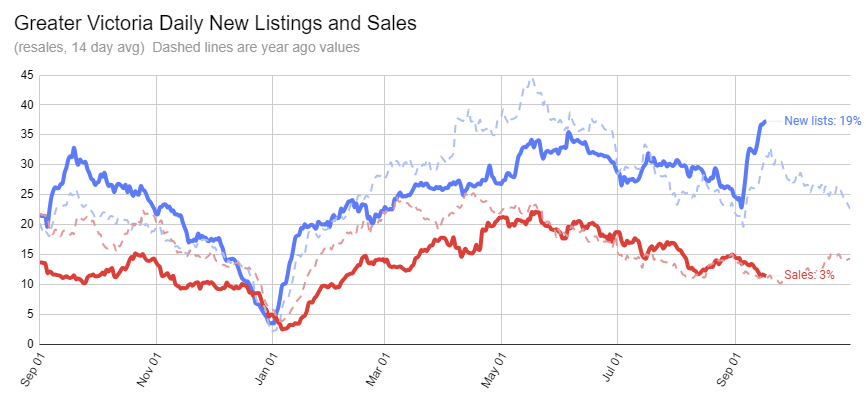

The weekly numbers say we’re up 15% on sales for the month, but that seems mostly to be an artifact of the weekly reports. They count up reported sales minus collapsed sales from previous periods, but are sensitive to how many sales happened to be reported to the board any given week by the agents. If we just compare pending sales, we are basically tracking the same as last September. In the two weeks since labour day we’ve had 186 residential resales in Greater Victoria VS 184 the same weeks last year. I would be surprised if all those additional listings didn’t turn into some more sales later in the month though. The rate of new lists stayed healthy last week. Normally around now is the peak for the fall market and we should see it gradually decline going forward, but it’s welcome news for buyers heading into the fall season.

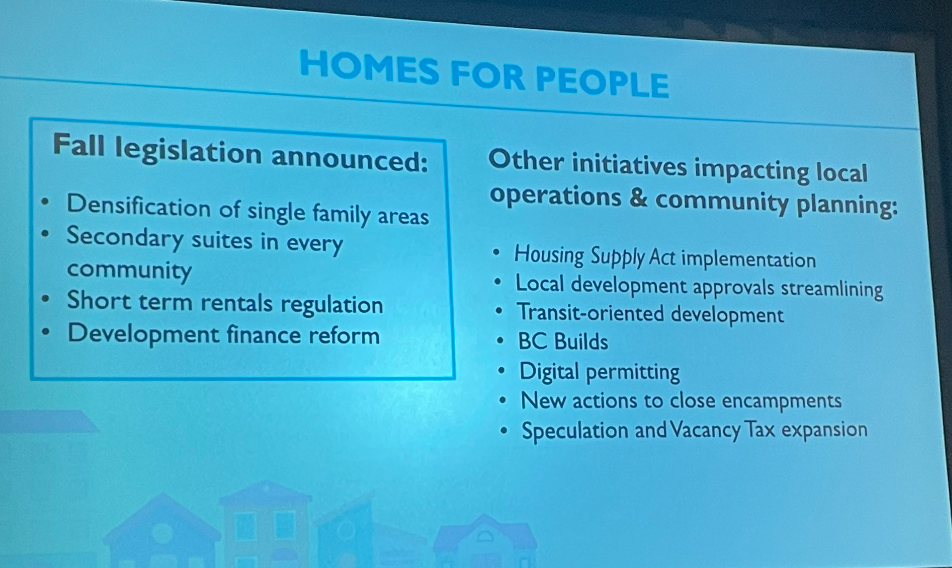

Meanwhile the provincial government has been focusing on housing as well, with an announcement this morning of a one-stop shop for provincial permits (good, but most permitting delays are at the local level), and a new program to provide up to $40,000 in grants to cover up to 50% of the costs of putting in a secondary rental suite. The catch? The owner needs to commit to renting that suite out at below market rates for 5 years. In Victoria that below market rate is $1300 for a 1 bed unit, while market rents are around $2000/month. So even if you got the full $40k grant, you would lose $700 * 12 * 5 = $42,000 over 5 years in lost rent, and then be stuck with a tenant that is locked in at below market rent that you can’t raise beyond the couple yearly percent. Don’t get me wrong, I’m all for affordable housing, but this is not the way to get it and I predict this program will be a flop.

Here’s what else is coming up this fall. Legalizing suites everywhere (they basically already are), legalizing 4 units on every lot (at least in urban areas), restricting short term rentals, and development finance reform (likely killing the toxic Community Amenity Contributions that slow housing and raise prices). Oh and those housing targets for Saanich, Oak Bay, and Victoria should be announced soon. A little birdie tells me they are going to be high. Stay tuned.

New post: https://househuntvictoria.ca/2023/09/25/what-happened-to-those-rental-restricted-condos/

That is an interesting question that we have to wait for it to play out.

However, there is a possibility of cost of shipping will increase if El Nino affect rain fall in Panama since it is a fresh water canal.

Just pressed the thumbs up Totoro but that doesn’t do enough justice: good job by you!

Been a difficult couple of months trying to help folks I know with median incomes find an affordable rental. There is a lot of competition for anything ok and it is all expensive. Throw in a kid or a pet and it gets much harder.

My week was capped off by a neighbour asking me to write a letter opposing another retired neighbour’s application for a variance to legally build a suite for their extended family… on a 10,000 foot lot. I wrote a letter of support. Not sure how you change homeowner attitudes, I guess part of it is by changing laws.

I can’t imagine trying to buy based on income, or rent if you are a family and earn the median or less right now. It is overwhelming.

Just wondering about the effect of China’s housing implosion will have on the future demand for worldwide commodities. China a nation of 1.4 billion people has a glut of unsold housing.

When the cost of materials are rising, all developers are hit equally with rising costs which they pass on to the consumer and house prices rise.

But when the cost of materials decline, then each developer will have different costs depending on their anticipated completion date. From copper wire to toilet seats supplied by Chinese imports each developer will have different costs. That destabilizes the real estate market as consumers face spiraling downward costs and likely prices.

And since I know that most of the readers on this blog only read what they want to hear. Let me underscore that this is not happening at the moment. I’m just wondering what would happen if the Chinese real estate implosion spread to the demand for commodities, cost of exported goods, and the financial markets.

Oh well, enough about this. Let’s get back to farting cows.

Random fact: This year, 1.5% of buyers were unrepresented

The point you seem to be missing is that this methane cycle happens naturally and does not in itself increase greenhouse gas. What does increase it is releasing fossil methane.

Obviously, we should kill every farting, burping, and shitting animals on the planet because they all produce methane.

We should also dry out all lake beds, swamps, forest floors, tundras, rivers, and oceans, because they off-gas the most methane into the atmosphere.

Heck, water and oxygen breakdown organic material and off-gas methane, hence we should eliminate all H2O and oxygen on this planet all together.

Claim is (https://www.iea.org/reports/global-methane-tracker-2023/strategies-to-reduce-emissions-from-oil-and-gas-operations) that most leakage can be recaptured at little to no net cost. Interesting!

Actually essentially none of them can under the foreign buyers ban. And if they have an exemption (must have filed income tax returns for 5 years and buying a house under $500k) they are subject to the 20% foreign buyers tax.

No doubt population growth is housing demand. But 99% of international students are renting, not buying.

Month to date activity

Sales: 390 (+28% increase over same time last September)

New lists: 1044 (+15%)

Inventory: 2659 (+16%)

It’s pretending that gas leaks didn’t occur with coal mining when they would just off gas all of this previously.

I can’t open this, so it is with some trepidation that, without reading it, I’ll suggest….instead of just writing it off, then try to develop this industry with as many safeguards against leaks as possible? I’m only being a little bit facetious – Canada is surely one of the more responsible nations when it comes to safety and ethical standards for our resource industry?

Of course the views on this will often be diametrically opposed. I’m of the view that Canada is pretty myopic and simple-minded in viewing anything resource-related as “bad for the environment” instead of looking at the health of the planet as a whole & seeing LNG as a useful transitional fuel to replace coal being burned in China etc. Yes we are doing some of that, but it seems to me that’s been a grudging uphill fight with isolated successes rather than the low-hanging fruit for reducing global emissions and as something we’ve really embraced in the past when it could have made more of a difference. And I agree with the posters below who think that’s been for ideological reasons as much as anything.

Yes, we should all do what we can, and so even Canada’s relatively inconsequential emissions must be curbed and we should be part of the vanguard of that, but providing LNG is one thing we could have realistically done more of that could have had an overall positive worldwide effect punching beyond our weight-class. We pretty much didn’t, only a fraction of what we could have done. The window is now probably closing somewhat, I mean who would want to invest in mega-infrastructure of this type with risk of it all becoming a stranded asset. So now as a planet, we are more dependent on countries like China just seeing the light & doing the transition on their own, than we needed to be. In the meantime we get sanctimoniousness from Trudeau and Guillbeault.

If every country not named China, United States, India, or Russia decided that it shouldn’t do anything to address climate change because its individual slice of the global emissions pie was so small, the world would be giving up on 40% of the pie.

Leaks Can Make Natural Gas as Bad for the Climate as Coal, a Study Says

https://www.nytimes.com/2023/07/13/climate/natural-gas-leaks-coal-climate-change.html

and

Methane emissions from the energy sector are 70% higher than official figures

https://www.iea.org/news/methane-emissions-from-the-energy-sector-are-70-higher-than-official-figures

No, the Canada wide house price story is that only two provinces (Ontario $832k and BC $954k) have high prices. The rest have reasonable prices, ranging from $304k to $476k). Average household income in those 8 provinces is about $90k, making the average home about 4.5x income – close to the lowest price:income in the world.

https://wowa.ca/reports/canada-housing-market

That claim is what’s ludicrous. Go watch the W5 documentary “Cash Cows” on the CTV website.

As for foreign money being responsible for high prices, how come we saw such a big runup in mortgage debt in tandem with price rises during those super low interest rate years?

I am starting to wonder if we might be looking at 5% inflation by the end of the year. I grabbed a millshake at a local place and the price is up 25% in one year. Not scientific but a sign of the times.

They (the government) are finally starting to realize that the massive student visa numbers are a major contributing factor to the housing crisis. See chart below. Many are registered in bogus diploma mills that are popping up in shopping malls (especially in Ontario). And every one of them can purchase a house, ludicrous. I believe foreign money is responsible for high housing prices across the country. It’s a loophole that should be closed.

Edmonton is an exception but Victoria hasn’t changed relative to the rest of the country. We’re up about the same percentage as other markets are up in the last 5 years, in fact some are up a lot more dramatically compared to their normal pattern. Tons of random Ontario cities that have doubled when they used to be quite affordable, Atlantic Canada made a huge jump after being cheap for decades. I would expect if we’re going to see declines they would happen there more severely.

I think we’re just in for a very long stagnation though as affordability grinds against growth and prices 5 years from now aren’t much different than today

Absolute numbers are quite a bit higher in Victoria than the average across Canada. Where is a 100k Edmonton condo suppose to crash to?

One plant (LNG BC) under construction , that hopes to begin exporting in 2025. Hardly a “boom”.

Slow LNG development is analogous to the same problems as housing development (government inaction/regulation).

Canada’s LNG Projects Need to Get Going

https://smith.queensu.ca/insight/content/Canadas-LNG-Projects-Need-to-Get-Going.php

“Meanwhile, further north, only three of 15 Canadian LNG projects that have been proposed in recent years have made it out of regulatory limbo. Of those, only one project — LNG Canada’s terminal in British Columbia — is under construction.

As of last year, phase one of the British Columbia terminal was reported to be 70 per cent complete, with shipments expected to begin by 2025. For context, between 2014 and 2020 the U.S. approved 20 LNG export facilities and built seven. All this despite Canada’s prospective export platforms being closer to Asia and our gas cheaper to liquefy with Canada’s colder weather.”

It’s not either or. Both infrastructure and personal consumption will need to change. Carbon taxes incentivize both types of transitions in economically efficient ways.

I think we may be taking past each other a bit. My complaint is precisely that the measures taken here (and in the States as well) have been less effectual than they could have been on account of ideology. And I find that quite frustrating, a sign of not taking the problem seriously. We end up with carbon taxes as a way of punitively changing individual behavior instead of undertaking collective efforts in infrastructure that have even higher reductions.

Which one? I remember everyone freaking out about Trudeau saying there needs to be a business case and as far as I know that’s correct. I don’t think there’s any proposals to ship LNG to Europe that were killed. It just doesn’t make any sense when we can export directly to Asia from Prince Rupert

I agree, but what you’re saying is we’re not working hard enough to reduce emissions because we’re not building nuclear. Your original assertion was we were doing too much to reduce emissions, now you’re saying we’re doing too little.

Correct, but that doesn’t make it any less important. As I said, why did we bother to reduce our emissions of ozone depleting substances? Nothing that Canada emits makes a difference to the ozone layer. Same exact argument.

The whole “we’re a small country” doesn’t make a lick of sense to start with. Let’s say China was divided into 100 little Canada sized countries tomorrow. By your logic they would then no longer matter in terms of emissions and they could stop trying to cut GHG emissions because their contribution is insignificant.

Hey Leo,

Yes there’s been an LNG boom but there’s also been exporting proposals overseas largely to Europe that have been nixed. That’s what I’m referring to. Now admittedly I’m pretty decoupled from the news so maybe I got it wrong, but I recall this being a big thing over the past 1.5 years especially with increased European reliance on coal after the war with Ukraine.

Agreed. But far too little effort here. Sorry for being a bit hyperbolic, alas, but the more precise complaint is far too little has been done.

I think we have different things in mind. I’m not comparing carbon tax with say cap and trade, which may be the sort of discussion you have in mind, but rather comparing decreases in everyday consumption with changes to power infrastructure here but more importantly in the developing world. Imagine if China and India were largely relying on nuclear for their power generation. Everything we do here pales by comparison with the impact that would achieve.

Where do people get these crazy ideas?

There’s an LNG boom up north. LNG Canada project is almost done, Cedar LNG was just approved a couple months back

?? Ontario just made a big announcement on nuclear. Building out nuclear is good for emissions reductions.

Economists agree carbon taxes are the most efficient way to reduce emissions. Every other method will have more economic downsides than what we’re doing

Not exporting LNG (which would largely replace coal overseas); not building nuclear power plants; focusing on carbon taxes; all taken together is absolutely shooting yourself in the foot for ideological reasons.

Recently, China turned inward for domestic consumption that hasn’t sparked the economic growth that they hope for, hence export manufacture economic at all cost will continue at the demise of the environment.

China’s Abandoned, Obsolete Electric Cars Are Piling Up in Cities

https://www.bloomberg.com/features/2023-china-ev-graveyards/

Thanks, I don’t frequent HHV as often or read every article as I have in the past.

It’s literally the exact same problem. Big enough that no single country can solve it alone, and it requires collective action.

Good thing we’re not doing that

The scale of of building for uninhabited homes and the impact that has on the energy and environmental impact that occurs by accident dwarfs any actual effort to make it up on small scales elsewhere.

Those two points just fall into the false analogly, red herring and with a bit of strawman all rolled together.

Probably should be if the goal is to have an actual impact on climate change.

Is it? Mostly, there’s just not a need to hysterically or zealously shoot ourselves in our feet with policies that are really just overly symbolic without any substantive impact other than giving some folks a false sense of achievement when any actual achievement didn’t occur.

What does this have to do with vacant homes in china?

As for Canadas impact on climate, I’m always puzzled by that argument.

What impact did Canadas emissions of ozone depleting substances have on the ozone layer? Essentially zero. Now would the Montreal Protocol have been possible if every small country decided to ignore it and just keep emitting? No.

We could dump all our trash into the ocean and it wouldn’t make a massive difference to how much plastic is in there. So why don’t we?

I’m not overly concerned about China and climate. They will reduce emissions for the same reason everyone else will. Because they will suffer increasing humanitarian and economic consequences from climate change so they will want to mitigate those. That’s much easier when everyone else is pulling their weight too

Chins’s different kind of housing problem…

From: https://www.reuters.com/world/china/even-chinas-14-bln-population-cant-fill-all-its-vacant-homes-former-official-2023-09-23/

And folks think somehow Canada can make a difference on climate change by stopping pipelines, banning natural gas hookups, driving electric cars and having step code. Our scale on what we do here is irrelevant in comparison to where the big impacts exist.

I agree there are several reasons Victoria is resilient, but in this case the resiliency is Canada wide. I don’t see any markets crashing, though more murmurs of slowdowns in various markets

Did you read this article?

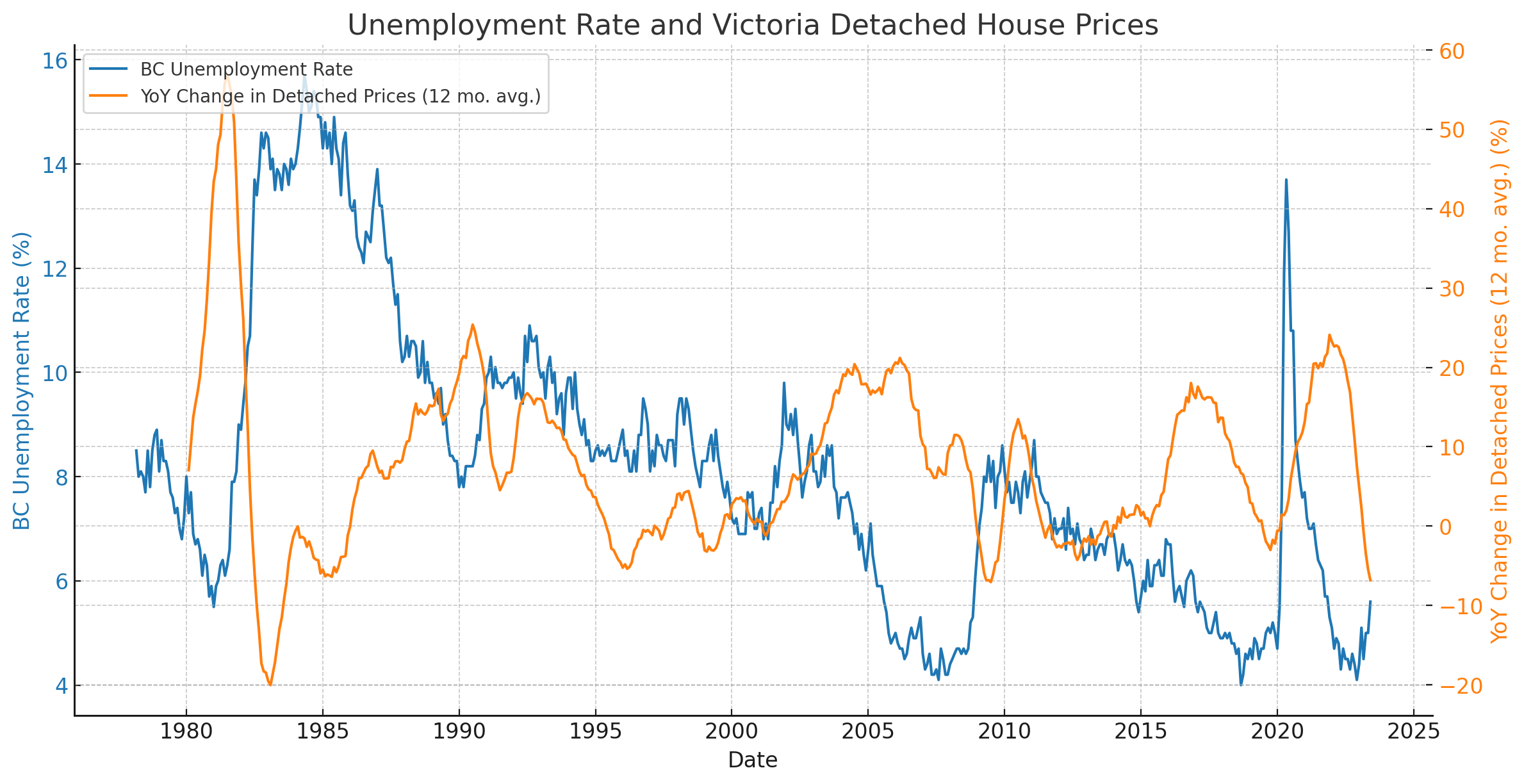

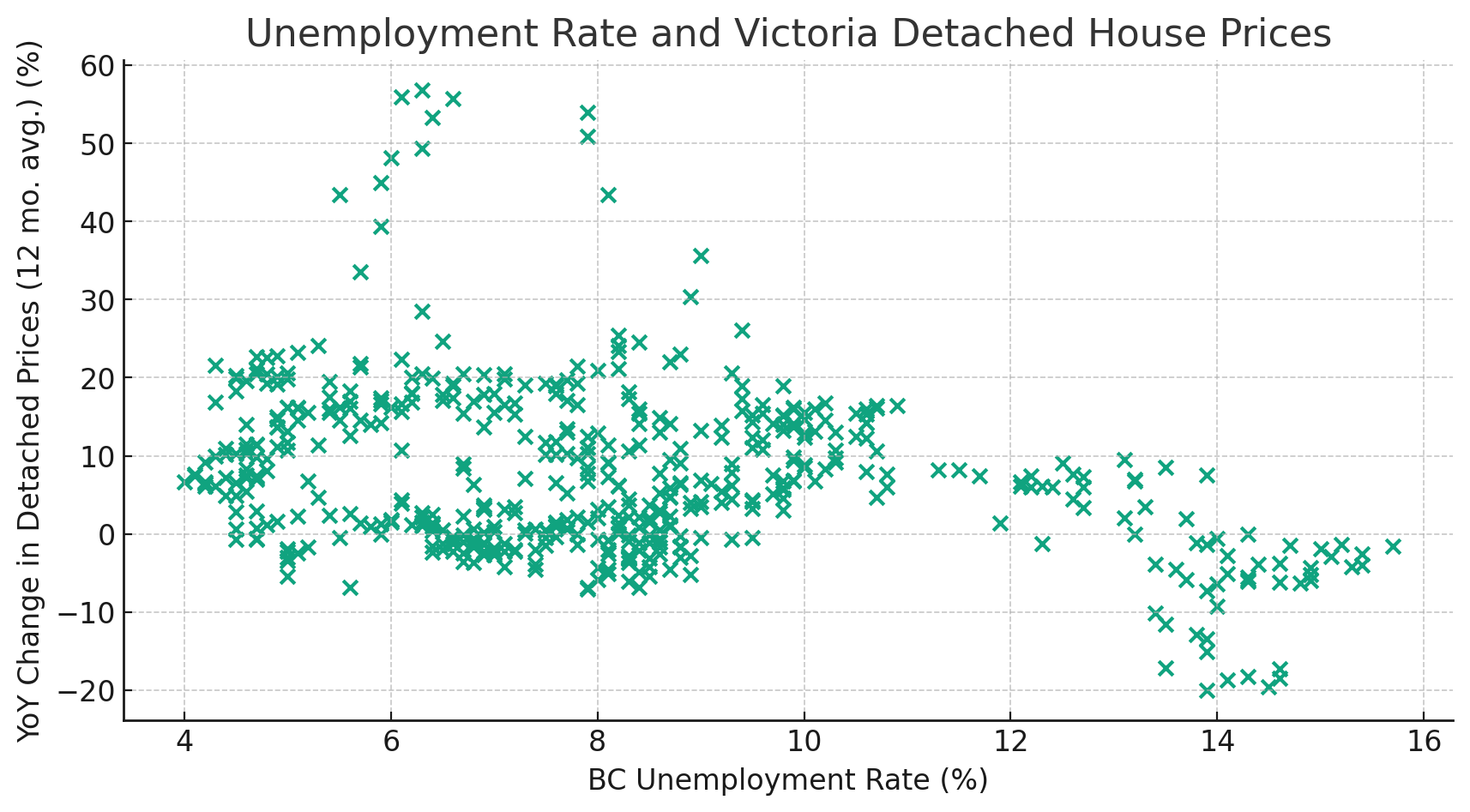

https://househuntvictoria.ca/2023/07/19/unemployment-is-likely-about-to-increase-will-it-drag-on-housing/

No doubt higher unemployment is negative for demand, but prices and unemployment rates have less correlation than you might expect.

One day Leos may entertain us and do an overlay graph of yearly housing price vs unemployment rate.

Historically low unemployment rate may have something to do with it.

IMHO, we will not see much of a crash when the unemployment rate is well below 6%, and we may see some softening, perhaps greater than 5-10% drop in price if we see a sustain unemployment rate above 8%.

https://tradingeconomics.com/canada/unemployment-rate

Yes, who will get the last laugh? 🙂

Interest rates trending up. Listings down, sales up a tad and holding in there. The market often seems to be tittering on the edge of substantial downward price pressure but the resiliency in Victoria is kind of insane imo. I think a substantial amount of equity/cash (some from other parts of Canada) keeps this market propped up.

Superadequacy is an improvement that costs more than its contributory value. Superadequacy is never curable.

Adding significantly more living areas than the surrounding properties is considered an over-improvement. While the property may have a larger gross livable area, it may not necessarily command a higher price in the market. When making improvements, it’s important to consider what is typical in the surrounding area.

Thanks for your thoughts, Whatever, on land value assessments. Intuitively, it just seems to me that the last two criteria you state for building (financial feasibility and maximum profitability) would improve for large single-family lots when that single-family zoning is removed e.g. perhaps an option to build a 3 plex instead of one home on the same site. So, I continue to ponder – will those old houses on large lots start to assess relatively higher moving forward? Perhaps not much, and maybe it would just be in cases where you had a tear down, but I think it will be interesting to watch over the next few years, not just in Victoria but in other areas of the province as well.

2273 Sage Lane- Now that was a house. Excellent value, would easily cost over $3 mil to replace including land.

Last week, and sharply.

$2.09M

sold price of 2273 Sage Ln? Thanks!

It is the thousands of unlicensed and likely illegal uses in residential zones that are impacting rental prices and availability if the studies on this matter are accurate.

I agree with this. Sure, every unit has an impact, but in terms of bang for the buck, true enforcement of the thousands of unlicenced and likely illegal units would seem more like the low-hanging fruit here. However, announcing enhanced enforcement is never going to be as sexy PR as announcing some sweeping new (marginally enforced) rule change “banning all AirBnBs”, so if I owned one of these even licenced and legal units, I’d be concerned.

I still think chances are, they’ll leave the licenced grandfathered ones alone, but it’s becoming more of a crapshoot given what a lightning rod these units have become. And I’d be somewhat more worried specifically if I owned one in the Janion. Because those units are so small, they’re really best suited for the AirBnB crowd, and would be I think quite a bit less desirable for a fall-back long-term rental than, say, a unit at the Union or Mermaid Wharf. I wouldn’t buy in the Janion for that reason to begin with (plus frankly, the Janion units seem especially expensive on a sq. ft. basis, and even just accessing the building for drop-off and pickup in a car is difficult).

Anyways, I also think the legal AirBnBs in downtown Victoria, within the transit zoning, serve a real need. Seems to me there really aren’t that many hotels in Victoria for the amount of tourist traffic.

It is possible to do a multi-building multiplex under the Victoria rules. But they’re so restrictive it’s unlikely (12m lot width per building)

As for parking, here are the current requirements in Victoria, and no indication they will change with the update

Right now only the city of Victoria has “missing middle” and their rules are different from Vancouver and parking is a consideration. Not sure what the provincial changes will be this fall.

Dee-Why?

@ arbutus – I’m wondering the same thing. We have a pretty large rectangular lot with the house on the front so a huge empty backyard. So does our neighbour. If parking is no longer a consideration can we just build like a fourplex back there?

We will still need cars. Maybe not personally owned cars. Otherwise we may need to build multi-storey car parks.

California regulators gave approval to two rival robotaxi companies, Cruise and Waymo, to operate their driverless cars 24/7 across all of San Francisco and charge passengers for their services.

https://youtu.be/AjQTcdvTG-U

Changes coming to missing middle. Vote on Sep 28

I doubt that City Hall has spoken with lenders about multiplexes. Five units and more are considered commercial loans not residential loans. Commercial real estate loans are more expensive and most home owners will likely not qualify for lower residential rates. The terms and collateral required are different too.

Then Arbutus, it would be necessary to determine the value of the site using a residual calculation. Since we don’t have any details of the size or quality of the improvements it isn’t possible to determine the value of the site.

At the moment single family lots are trading at high prices at around $125 per square foot in the lower priced neighborhoods. The property that sold along Shelbourne will likely be assembled with an adjoining lot or two for a condominium complex and it sold at about $131 a square foot. Not much difference. That’s the problem developers are facing today. They are having a difficult time finding low cost properties to assemble for a project. Victoria is more difficult as most properties have houses on them and the builder has to compete against those looking for a home to live in.

So while it is taking a long time to rezone and get approvals, this has been working in the developers favor as the properties that they bought five years ago have had an increase in the value of the condos when completed. A 30 percent increase in condo prices while they held the land, now makes the project economically feasible.

Even if the rezoning and approvals were done in six months, a developer has to look at their costs to acquire the land and construct the building relative to the selling prices and their anticipated profit. If it doesn’t pencil out then they will just hold the land until condo or town house prices increase and the development makes economic sense to build.

If single family zoned land were less expensive to purchase and assemble or strata home prices were increasing at 15% a year then we would be having a lot more new developments underway. But since condo prices have not changed significantly since January, most developers are holding back on starting new complexes unless they bought the land say five or more years ago. We are not like Calgary or Edmonton that can just open up another 640 acres of vacant land which keeps land values low and the project becomes viable sooner.

It comes down to the concept of Highest and Best Use.

“Highest and best use of a property is an economic concept that measures the interaction of four criteria: legal permissibility, physical possibility, financial feasibility, and maximum profitability

You can change the zoning, change the building envelope, and size of the project which JT, PP and Eby want. But they have not put much thought into the last two criteria which are the more important. If the project doesn’t pencil out – it doesn’t get built. That’s where the emphasis has to be for Victoria. And that’s probably going to be some form of public/private partnership with the city and/or province. Maybe along the lines of the False Creek leasehold development in Vancouver.

Interesting assessment on parking.

I don’t know the answer but maybe it will be like Vancouver’s new rules that state you can build a 4-6plex (depending on lot size) as of right in RS zones, provided that the lot:

• Is located in an RS zone;

• Has a rear lane (or is double-fronting);

• Has a frontage of 10 m (32.8 ft.) or more;

• Is not within a designated floodplain; and

• Is not a legally designated heritage site.

Too bad for people who don’t have double-frontage, a lane in back or have a heritage designation… But lot size will matter.

https://www.cbc.ca/news/canada/british-columbia/multiplex-housing-vancouver-1.6967977

Seems that new listings stayed pretty strong through the end of the week… It will be interesting to see when the seasonal drop off starts to happen.

I guess but that is like saying every residential unit is one less unit that could be a hotel. We have a housing crisis for sure but take away too many hotel units and we will have a crisis in the tourism sector creating hardship.

I don’t know the full history of the Janion but it markets itself as a hotel and was initially built in 1841 as a hotel with hotel zoning.

I think the more critical factor to it all is that for residentially zoned homes the priority use should be rentals beyond 30 days given the shortage and the fact they are not zoned for short-term. Leave the properly zoned .1% or less alone or you’ll get litigation and unfairness and potentially a shortage of tourist accommodation.

Whateveriwanttocallmyself, I guess that’s what I’m pondering, the law of diminishing marginal utility and whether this “law” will apply in the same way. In other words, with single family zoning both lots can hold one house but, if single family zoning is eliminated, will the larger lot have increased utility and therefore increased value per square foot? The larger lot may be able to hold, say, 2-3 townhouses and the smaller lot may still be only able to hold one dwelling due to required set backs, etc. I wouldn’t expect the larger lot to triple in value, but I wonder if the value per square foot will be greater than it is today, on a comparative basis, since the utility has increased. (?)

I mean this is basically true, even though I obviously don’t think we should be pursuing that. But the province has literally bought up hotels to use for housing.

I’m not saying it’s a good idea, just stating the fact that whether they are legal and licensed or illegal and unlicensed does not matter in terms of impact. Either way it’s one less unit for the long term market, and even though those buildings allow short term rentals as a permitted use, they were not built for short term use at the beginning so that’s quite different than hotels.

Totally agree that we need short term accommodation too. If we had housing abundance there would be no reason to go after short term accommodations

That’s like saying that legally zoned hotel units with kitchens are to blame for the housing crisis equally because they could be used for long term accommodation so they should have their zoning taken away. And I’m not talking about licensing but rather about zoning.

BC still needs transient accommodation if we have a tourism industry and people are entitled to rely on municipal zoning when they buy and use it for this purpose a. This is why we have laws on grandfathering zoning aka nonconforming uses. This is what applies when you have a legal use that changes to an illegal use:

In terms of contributory effect, there are competing considerations here and cumulatively the 99% or more units that are operating in residential zones without licences or proper zoning have no legitimate expectation that they should be able to operate or continue to operate short-term rentals going forward.

Not being shut down so far with an illegal use is a lack of enforcement and creates no rights.

So you find yourself now one of the one percenters that are making gobs of money and paying gobs of personal taxes.

Have you ever thought about buying a “leaky condo”?

They’re back!

https://www.youtube.com/watch?v=B1ULWx0eflM&pp=ygUYaSdsbCBiZSBiYWNrIHRlcm1pbmF0b3Ig

Your assumption is incorrect, due to the law of diminishing marginal utility. As the size of the lot increases, the price per square foot rate decreases.

For example a 6,000 square foot lot in the Mayfair area may have a value of $750,000 or $125 per square foot. But an 8,000 square feet lot in the same area would only have a value of $825,000 or about $100 per square foot.

The larger lot will be worth more, but not double or triple the amount of the small lot.

Assuming that single family zoning will soon be a thing of the past in B.C., I’ve been pondering the possible effect on land values per square foot for an older home sitting on a large lot vs a newer home on a small lot. e.g. say we have two homes side by side, one a newer home on a very small lot, the other an older home on a large lot, i.e. double, often triple, in lot size. If we assume the value of each lot is presently based on the same cost/square foot calculation, will value per square foot of land for the larger lot be assessed higher moving forward?

Great time to own a hotel .

There is another type of ownership that we have not discussed on this blog and that’s a Life Lease. This type of ownership would be orientated more to non-profit organizations considering building affordable housing for those that are 55 and over.

The project is legally structured so that residents have legal entitlement to reside in their units for life or until they wish to leave or become unable to live independently. This is done through leases. In practice, they operate much like a strata condominium in that residents pay operating costs towards the upkeep of the common building. The difference is that residents purchase the lease—the right to occupy the unit which is detailed in the Sublease—while legal title to the land remains with the housing corporation. This arrangement means that residents cannot leave the unit to their heirs in their wills. The Housing Corporation re‐purchases the lease from residents at 85% fair market value at the end of the lease, including on the death of a resident. The legal structure of the project benefits residents who seek a comfortable, long‐term home but who wish to avoid the inconvenience for themselves or their heirs of having to sell property in the future.

Another problem is that bank’s don’t lend on Life Leases. But if you’re looking for a home for your elderly parents or grand parents then this may be an affordable option as these Life Leases sell at a substantial discount to a strata development of about 50%. The monthly fees are about the same but property taxes are included.

$910k

Would it though? If you’re going to ban them, ban them everywhere. I’d say it’s counter to fairness and silly to have one specific building where it’s allowed.

The impact is identical whether they are licensed or not. But it’s not worth the trouble of pursuing the grandfathered units.

It would be counter to fairness and silly to change the zoning on the Janion imo. The short term rental impacts are not caused by a properly licensed and regulated and zoned building that is providing a service like this in the downtown core.

It is the thousands of unlicensed and likely illegal uses in residential zones that are impacting rental prices and availability if the studies on this matter are accurate.

Why single out the Janion? There are dozens of other hotels that could be banned.

/s

Same thing as what Quebec did, and I bet that’s what they’re rolling out this fall.

Yes, right now the grandfathering has been interpreted as applying to the whole building. Apparently city staff believe that as long as one unit is doing STR in the building, the whole building will remain grandfathered. One presumably could imagine different ways of interpreting grandfathering but I have no idea what the case law here is

Wouldn’t the idea be to change the zoning on the Janion and at the same time stipulate that current owners can maintain benefits of their current zoning until they die or sell? Seems like two things happening at once.

I think there is some confusion on licensing and zoning.

The Janion is zoned for transient use (hotel) and the Province is unlikely to interfere with this legal commercial zoning which is already regulated and people did rely on when buying.

However, a lot of Airbnbs are operating without a licence within residential zones which do not permit Airbnb at all. Others, like those in Victoria, may be licensed but they can only list their primary residence or a room in their home – whole house permanent secondary residences are not permitted already. Despite this, many listings are still not licensed.

What the Province could do is restrict short-term rentals in all residentially zoned areas or require all short term rental platforms to ensure that all listings are licensed before posting – like New York did. Requiring proof of licence and putting the onus to vet this onto the listing platform is cheaper and easier to enforce and it seems sensible to me. Then each municipality can permit – or not – and put conditions on the licence.

https://www.theguardian.com/us-news/2023/sep/06/airbnb-new-rental-regulation-nyc-housing

$2-3k

I dont see that the province has to grandfather the AirBandB’s regardless of previous use. If someone has some case law on this that is directly on point and specifically deals with provincial powers please share it with us (city or municipal powers are completely different).

Ultimately this is first and foremost a political decision and one that is likely to be met favorably by many people.

Doubt it, the short term license if it exists is issued to a particular owner and grandfathering, if it happens, would most likely be limited to that owner. I think the province would be on firm legal ground if they did so.

There will be airbnb owners that will not comply creating the need for some sort of policing and legal proceedings tying up the courts. That could take years. When the federal government banned trusts there were no grandfathered exceptions. Also, age restrictions on condos were not grandfathered.

How much to maintain a realtor license per year just to get access to MLS ? Thx

Likely anything with an existing license or permit to operate as a short term rental will be grandfathered. The government will not want to face the litigation and payouts for rolling back the clock on investment decisions that were in accordance with the existing laws and regulations. So, if they ban, existing ones will skyrocket in value because those units become a limited commodity. The solution, funny enough, is actually to drive up investment in short term rentals to point where they are market saturated and it drives the prices down and forces stock back into the long term rental market when investors desire stability from consistent tenancy. Anything that limits real estate investment now is a bad thing for the housing crisis because you need money and investment to do this thing called building places to live. Trying to regulate it and government attempting to stifle investment in one part on the false belief it will somehow force another part to appear will most likely end in more time consuming approval processes that will limit any potential affordability gains.

I suspect units in the Janion and similar buildings would lose substantial value. However I don’t think they would reverse the grandfathering that allows those buildings to be rented short term. Too many knock-on effects and could open them up to legal action.

Otherwise a couple hundred new condo listings perhaps. Negative impact, though wouldn’t be disastrous.

That McGill Airbnb report

How it was covered in the media: “ across the province, rents increased up to 16.6 per cent last year as a result.”

“ the rapid surge of short-term rentals in 2022 contributed to a 28 per cent rise in rent costs.”

The actual study: over 5 years Airbnb increased rents by 2.1% or $6/month on the island.

https://upgo.lab.mcgill.ca/publication/strs-housing-bc-2023-summer/Wachsmuth_BC_2023_08_10.pdf

Ban Airbnb already so we can move on to important things

Probably not much, the airbnb owners would just have to convert to a conventional rental model and wait for eventual appreciation while paying down the principal. Just like the good old days.

If the NDP bans all AirBandB (except limited to your principle residence) what impact, if any, on condo prices?

The legislation hasn’t been drafted yet. The NDP can still say that the legislation doesn’t go far enough and vote against it. None of the parties have spoken about what will happen to the input tax credits.

They give with one hand and take away with the other.

More of the do nothing people that only find their achievement with interfering with those that try to do something.

Real question then is will the Conservatives find some reason to vote against it.

The Conservatives and the NDP will find some reason to vote against it.

I mean it gets some projects off the shelf. So in that sense they will be built faster because otherwise they may have not been built at all, or not until rates dropped or rents rose

Three years from now, rents will be higher and developers richer.

Since the cost to the builder is lower, it increases the rental yield and makes them a more attractive investment.

Freeland on tv announced that removing the GST on apartment construction will get them built faster. How does that work?

They can let you have the rental income, but both CRA and IRS will hold them taxable based on their equity in the property. That goes for capital gains too.

No issue if they take a genuine (per Patrick) debt rather than equity position. That goes for the previous point too, except watch out for deemed interest income even if they’re not getting any.

I would consider it. That said there are a number of risks.

In general I’m in favour of mortgage lending within the family. Why pay 6% to the bank when older family members with assets are earning 5% from a GIC? Borrow the money at 5.5% and keep the money in the family. Obviously this requires good familial relations

does anyone insider know the sales on 3594 Shelbourne, seems ridiculous low.

I had a friend’s name on the title of a property we were going to flip in 2005. When I decided to keep it and buy him out, I had to pay the land transfer tax again.

Bad advice. Re-read the bolded section of the legal opinion from the article posted. They refer to the foreigner ban applying to any “legal or equitable” interest. Owing equity is an equitable interest, and your other “clever off-title ideas” above are a legal interest.

They don’t have to be on title. Essentially you are talking about a loan agreement with the equity return being a share of the eventual appreciation once sold. This could be registered against title btw, but not necessary to be enforceable.

Tillicum,

Since your relatives are US based, it would be a big mistake and two thumbs down on the idea from me.

For starters, there is a ban on foreigners “buying” RE on any city/town larger than 10,000 people. I put buying in quotes, because the law is much more broad than that an includes acquiring any kind of interest. Based on this, as soon as your relatives bought the equity from you, they might be violating the act and a forced sale of the home is a possible remedy.

Here’s a legal site where they do discuss this.

https://www.mcinnescooper.com/publications/prohibition-on-the-purchase-of-residential-property-by-non-canadians-act-5-faqs/#:~:text=The%20Act%20limits%20non%2DCanadians,Canadians%20citizens%20and%20permanent%20residents.

“3. What purchases does the Act apply to?

The Act applies to all acquisitions of either a legal or an equitable interest in residential property after January 1, 2023 until January 1, 2025 – not just “buying a house”. While no Canadian court has yet considered the breadth of this definition, it’s likely it captures any non-Canadian acquiring any interest in a residential property, including through a mortgage, option to purchase, easement, or lease.…”

Tillicum it would be no dice for me . Family rarely goes well in business

Interesting observation. It’s unfortunately difficult to tell from the listings because agents don’t consistently mark them as vacant if they are, but here’s what the data look like.

Yes to all that. And, if the investors are indeed expected to share in paying property taxes, insurance or major repairs, then wouldn’t it also be fair that they should be receiving a “rent” type of return on the $500k equity piece they’re providing (I mean, you’re partly “living in their $500k portion” of the house)? Or is the deal that they don’t receive “rent” but also don’t have to share expenses?

And just to note a pretty abstract point, but if CRA were really drilling down on this, they might say that as between relatives the investors should indeed be receiving a “rent” type of yield on their investment (or might view the trade-off for no sharing of expenses as being functionally similar), and then you as Canadians could have some Canadian withholding tax liability as the investors are non-residents. Sure, that is a very theoretical type of exercise that might never come to pass, but I’m just saying this is not all cut & dried and completely without such issues.

I agree with Barrister that whatever you do, if you do decide to go down this road, itemize all the points you think you’d need agreement on, and work all those points out with the investors, and do up a sort of layman’s-type of point-form pro forma agreement everyone is onside with BEFORE ever going to the lawyer. If trying to reduce legal fees, the last thing you want to do in this situation is ask the lawyer to think about all this fresh and “negotiate via lawyers”.

Just my 2 cents.

Existing shed = undocumented accessory dwelling unit!

Put everything in writing. Make sure you plan for estate considerations, bankruptcy and divorce even if it is super unlikely. In all of these circumstances you should not be compelled to sell and return the capital. I see Barrister’s post now and agree those are other nb. considerations.

Tillicum, are you expecting this to be a long term house for yourself. Need a lawyer to really look at this carefully since they are equity partners rather than a loan. What if they die does their estate have to wait until you decide to sell? What about major repairs. Are they sharing in paying property taxes or insurance? (Make a detailed list of all business issues before going to the lawyer, they charge by the minute). What is the impact on your principal residence status if you have equity partners in the property.

On a different note, are these relatives that you only see once every six months or just at Christmas.

@Tilicum – ask them for the contract if you’re interested and take it to lawyer ?

5 year bond yield above 4.3% which is kind of insane. New listings down substantially this week over the previous two weeks. Sales holding in there. Super difficult market to read.

Hey folks,

Been a long time reader of this blog since I sold my property in Victoria years ago, and appreciate the perspective of the different members. I would appreciate opinions on the following:

I’m located in Vancouver, and my wife and I are in the market for a detached home. My wife’s aunt and uncle are quite well off and have offered to provide funds to help us bump up the upper range of our budget. They could provide up to $500K and would take the corresponding amount of equity in the home with no expectation of return of capital until we sold the home. They also stated they would not expect any claim on any rental income generated from a suite. They are US based and view this as a win-win since my wife and I can get into the market, and they can get some exposure to real estate here in Vancouver. They are both successful business people, and seem to approach this with an investment mindset. Everything would be papered.

They just made the offer last night, and I’m still letting it simmer. My gut is leaning towards declining due to the obvious potential for conflict and strained relations (but also because it’s a huge hit to my ego), but my wife seems very keen to jump at the opportunity.

Any thoughts or considerations?

Many thanks in advance.

My feelings exactly. The time, effort and energy could be better utilized to earn money doing what you’re good at. Not to mention the stress involved, like dealing with contractors.

I personally wouldn’t undertake building anything, even a garden suite, in Greater Victoria. Too many variables, too much that could go sideways, too much of my time required, too much money, too much wear and tear on the chicken.

Better to buy things that someone else already built.

All that I can tell you, is that the majority of houses that I inspect today are vacant. The owners have moved on and those that are trying to re-finance or purchase are not qualifying as they can’t use the unauthorized suite to boost their income. Sales are starting to collapse.

The market is changing.

Ok but we are so far from that it’s not even funny.

Victoria has the worst chronic rental vacancy rate in the country. 20 year average of 1.2% vs healthy rate of around 3%

Economic viability of the project is the problem that JT, PP and Eby can’t grasp when it comes to affordable housing.

One can build lots of expensive rental housing and if enough of them get built and not rented, then someone can buy them as foreclosures at 75 cents on the dollar. That seems to be their plan to build, build, build until the market is saturated at the top end. Then the only places that would be selling would be foreclosures. That could halve the value of everyone’s homes.

But they have little choice but to sustain the vacuous rhetoric while doing very little. All they have to do is wait it out until the next recession hits. The market will take care of itself. Because it always has.

Sure, including the land you’d be into it for 2.75 million and it would only have a market value of 2 million tops.

Or you could just buy a fully renovated 4,165 square feet side by side duplex with two lower floor suites on a 12,000 square feet lot today at 776/778 Royal Oak for 2 million. It generates $9,000 a month in rent ($2,250 per suite) and has been listed off and on since January of this year.

The math does not work to build rental housing unless one can get a large subsidy from the government in the hundreds of thousands.

You would net more money by selling your property as is today than to build a rental.

I do the labour portion myself, so that helps a lot. Still, there are some items (like blasting) that I’ll just have to hold my nose for.

Guessing to build say 4 units right now excluding land would be around 2 mil . Couldn’t get that money back from renting and the bank would like you to sell them

Sidekick you are not going to be happy when you get the cost estimates for construction.

Existing shed + sewer right of way makes it impossible to fit.

Ravi Kahlon was asked about that at UBCM and categorically said vacancy control is not on the table.

Patrick- I was not aware of the 5 month notice rule in Manitoba. We’ve got the housing crisis beat here, look at the innovation people are resorting to below. Almost 3 feet wide, maybe 50 feet deep, the lap of luxury. Not sure how many it accommodates, there are no limits. A roof is optional, they even put up their own mail box , includes parking. No need for regulations here.

Victoria City does have surplus land such as the Smith’s Hill Reservoir that was built in 1909. That’s about 7 or 8 acres that could be redeveloped as low to mid rise rental housing. That land could be made available to developers with the city retaining ownership of the land. As the city would be setting the ground rental rate the City would be able adjust the ground rent to make the rentals affordable. By doing so the rents could be $500 to $1,000 per month under market rents.

Going from 2 months to 5 wouldn’t really bother me if I were still a landlord – I think that’s fair enough in an environment where mom & pop landlords do indeed provide most of the rentals, and by nature they are somewhat insecure from the tenant perspective.

The form of rent control/landlord tenant laws that would stop me from being a landlord (if I were still in that ‘business’) is if they ever do change the rules so that you can’t even set the rate to market between tenants. The drumbeat for that seems to be growing louder, and it’s described as a “loophole”. On your own property, with no tenants, in a “free market”!

I took it to the community consultation stage when the bylaw was first released. One neighbour was adamantly against it. Strangely enough, they lived on a small panhandle lot, which was pretty much the same as what I was proposing.

I’m probably going to build a multi-family once the province pushes zoning reform in oak bay. My neighbours there are not going to be happy.

You literally need a larger lot to get the permit, or just that it would be a squeeze?

Edit: Seems like the minimum lot size for a garden suite in Saanich is 400 square meters (4300 square feet). Your lot is larger than this.

The BC Liberals didn’t “fold as a party”; they simply changed their name.

The pig changed lipstick colour.

We are thinking about it to give at least one of the kids a separate space come university age but would need a bigger lot.

I briefly considered building an accessory dwelling unit, but chose not to due to the questionable economics and difficult regulatory environment.

I’m sure I’m not the only one.

It’s not like they’d be kept empty. Someone would be living in them. Less demand from mom & pop landlords = more affordable housing.

They didn’t win the last one.

I think that the goal at this moment needs to be creating more rental housing and ensuring continuity for the rental housing that exists. Once there the vacancy rate is higher and there are more secure rentals available, then we as a society can introduce new laws such as increasing the notice period for landlords use. The rental stock – reliant as it is already in too many mom and pop rentals with suites in their homes – needs to be protected first and foremost at this moment.

The liberals and the conservatives are pretty much the same, I wouldn’t expect much in a change of government

it doesn’t sound like you would take your unit off the market because of a change from 2 to 5 months notice to vacate. Just like you don’t stop being a landlord because of rent controls or other landlord tenant laws. I don’t think the government should become so afraid of landlords that the government won’t pass laws that make tenant rentals more secure.

But Patrick I think there is a real concern that this law would reduce even further the number of rental units. Because, there are mom and pop landlords (such as myself) who are renting out a unit (even below market) where sure the money is nice but no it really isn’t needed. Assuming the government works up to such a change publicly (could they do it all in secret?) wouldn’t a bunch of mom and pop landlords – maybe for other reasons as well – take these already precarious rentals off the market in anticipation of the change? Maybe not … I guess? I think it’s not a good comparison with Manitoba because I’m from there and I can tell you mom and pop landlords are rare there. Many of my cousins etc… own homes and not a single one rents out a part of it. So those tightening regulations that keep targeting the mom and pop landlords – seems risky until we move to more reliance on purpose built rentals. Really not the same hère and Manitoba.

You’re being far to charitable. I say let them win another election and there’s a high chance Liberals start to devour themselves. We could be blessed with a the Federal Liberals being so toxic that they need to fold as a party, a la the BC Liberals. It’s actually in the best interests of the country to have a fresh centrist party take their place.

I’m cheering for more government stimulus and handouts tbh. We’re circling the drain pretty slowly. Lets just blow the top off and get this over with.

Small but noticeable impact from the foreign buyers ban in BC as a whole.

Slightly lower rate post ban and some bunching of sales prior to the change indicating a few buyers frontran the ban. Not market moving stats by any means

Suites in peoples homes are not subsidized or public housing and no-one should expect this to be the case. We very clearly need publicly subsidized affordable rentals on a large scale.

In the current situation there needs to be a balance between landlord and tenant that encourages rentals while discouraging excessive price increases. The biggest part of this is the vacancy rate. A very low vacancy rate like now needs to be addressed through more supply.

If you want to discourage private landlords further you certainly could do so pretty easily, although I’d question the public policy logic. Many people who don’t really need the suite income would just put a friend or family member in a suite or leave it vacant if it became too restrictive or annoying to deal with.

We’ll see what the province rolls out on this pretty soon I guess. My bet is that they try to increase all types of longer term housing, including suites in homes, while restricting short-term rentals further.

All are good and valid points. But let’s not forget that BC had 3.1% growth in population YOY to April 1, 2023, the largest growth since 1974.

https://www2.gov.bc.ca/assets/gov/data/statistics/people-population-community/population/quarterly_population_highlights.pdf

“ From April 1, 2022, the population of B.C. has experienced a growth rate of 3.1%, marking the highest annual increase since 1974.”

Here’s the +38,600 BC population growth in the last 3 months measured (2023 q1). That was all from immigration (+40,000), with interprovincial migration being flat (-723 people). So the exodus from BC to Alberta isn’t that big a factor to date.

It’s a Catch-22. We need investors so that more housing is built. But we also need investors to divest themselves of properties to increase the number of listings.

And this is what has always happened in past boom/bust cycles. As investors leave the housing market that causes housing to come back onto the market driving prices down. However, the lower interest rates and high rental rates in the past kept investor’s demand for properties strong. Some estimates were that 30 percent and more of new units were being bought by investors. And the REITs along with small investor groups combining their resources were buying apartments and condos too. Never have so few people owned so much real estate.

But as the terms come up for renewal at the higher interest rates, more investors will choose to liquidate but that won’t be noticeable until 2024, 2025 and 2026.

Unless investors panic, which could happen if prices started to steadily decline or if the 24 to 35 year old renters choose to leave the city for better jobs and cheaper housing which happened in the BC recession in the 1980’s. Then investors will all want out at the same time.

What unfolds will depend on what happens to the BC economy, employment and vacancy rates. What’s different this time is that the 24 to 35 year old’s have a choice today and I believe they are starting to leave BC and Ontario as they can not get ahead in life here. If they want a house with a yard, a good paying job, and a bank account then Alberta is the place to go.

You don’t need to ”guess where this goes”, because they have that 5-month eviction notice law in Manitoba since 2013. And so are you expecting all your dire predictions above to have occurred in Manitoba housing, and something has broken? All of this because of changing notice for eviction from two months to five months? You’ve told us many times that your crystal ball is broken, and it seems to be on-the-fritz again.

Patrick, just as likely they would buy and simply not rent out part of the home in the first place. Let me guess where this goes. First get rid of the mom and pop rentals, scream that there is a rental shortage and then scream that we have to build thousands of government rentals and then bump up taxes until something breaks.

Once the law was in place, with 5 month notice for landlord use, there would be other would-be landlords like you that would think twice before buying a home for the purposes of an insecure rental that they plan to end by moving in. And so maybe they wouldn’t buy, and the home would sell instead to an occupier or a long term landlord that isn’t put off by five months notice.

I think this would be a good thing, as I don’t think our rental market needs mom-n-pop landlords providing insecure rentals that require only two months notice to evict. Anyway, they have this 5 month law in Manitoba, and maybe Frank (in Winnipeg) can tell us if the world is falling apart because of that.

I agree whateveriwant…..that the only way out of this world wide inflation which is producing this economic mess is a deep recession.

They are two different things. It is not an eviction if a landlord is giving notice of termination of tenancy for a reason permitted under the act. It goes to an eviction process if the tenant then refuses to leave.

Sure, it’s not an eviction if it’s the tenant who decides to move. 🙂

Indeed, the current leader of the BC Conservatives was a former BC Liberal (or United) who was booted out of the caucus for opposing the carbon tax. Interestingly, when Gordon Campbell introduced the BC carbon tax the NDP opposed it, favouring cap and trade instead. Campbell was right.

Sad but all too predictable that so many people aren’t even aware that BC like other provinces with their own carbon pricing is not subject to the federal tax. Even on this forum.

Make no mistake, the attack on carbon pricing is led by climate change deniers, or at best trivializers. Enjoy the next heat dome.

Me? Yes, I’d prefer more notice but I consider two months notice and one months’ rent reasonable. Making a landlord wait five months to get access to their own house has to be considered as well.

For example, if something happens to one of my parents I will be bringing the other parent to live with us in an accessible separate suite which does not have stairs. Waiting five months in these circumstances seems unreasonable to me, as does making a new purchaser of a rented home wait five months to take possession. A five-month delay on possession date means that some purchasers who need earlier possession will not make offers on rented homes.

Terminating a tenancy is not the same thing as an eviction. Most provinces are 60 days’ notice for landlord use and there is a huge penalty of 12 months’ rent if the landlord doesn’t actually move in in BC. NB is only 30 days’ notice for landlord use…

Paul Krugman informed us 3 years ago when they dropped interest rates that inflation was the last thing we had to worry about. El-Erian doesn’t believe that they’ll actually change their targets until the current inflation is dealt with, since it’ll be a real black mark on the reliability of the fed.

As the twitter thread says,this doesn’t apply to any projects (already a shovel in the ground). It’s impact won’t be felt for at least 2 years – likely after the election. Libs should fix that so it applies to existing developments too..

It’s not just “stress”, there are the practical benefits of having more notice. Arranging new schools, day care etc. Most of which have waiting lists.

Think about your personal circumstances. If for some reason you had to move to a new house, wouldn’t you prefer five months notice, or are you just fine with two months?

BC, the eviction capital of Canada, doesn’t also need the shortest period of notice for eviction in Canada.

CEO of the BC Non Profit Housing Association illustrates how much of a difference the GST waiver makes to affordable housing. Doesn’t apply to under construction projects, but it will lower rents in any new ones.

Probably a good thing. I like it better than fixed term limits like the US. Let the people decide when a leader is past their best before date

Not by much imo and possibly it will extend the period of stress.

If you are looking for a home for ex. Oct 1 then about 95% of the ads are going to appear on Aug 31 or Sept 1 when tenants give their one month’s notice that they are leaving. Anecdotally, we gave our tenants one year’s notice that we were moving in and they didn’t find anything until a month before the end of their tenancy.

Even if a landlord knows about an upcoming vacancy more than one month in advance, my experience with advertising units this far ahead of time is that you don’t get a great response.

I agrée totoro except massive subsidized buildings can create additional problems. It is better to diversify the kind of housing (subsidized, supportive) throughout a larger area to avoid some of the mistakes of the past. For example the new supportive housing building in Vic West on Catherine street – quite small and will work.

Or just have a recession.

Reminds me of the missing middle housing program in Victoria. Not a single taker so far despite all the hours of public meetings, controversy and cost to roll out.

I wonder how much money has been spent developing programs that don’t have practical utility and will not have any uptake – or minimal.

If you really want to encourage below market housing then build subsidized purpose-built rentals in vast quantities over the next ten years and, at the same time, roll out tax incentives for homeowners to add 1-3 suites to their homes without the need to reduce rents below market. This should stabilize rents eventually. And if you are going to give a grant for a suite then immediate family members should be eligible to live there at below market rates as this would then make a lot of sense for families and they’d be willing to take a loss or break even.

Maybe, but if inflation gets stuck at around 3%, and it seems like it might, I wouldn’t be surprised if the narrative starts to shift over time. Who knows.

Nothing is set in stone, and I’m talking about prominent economists like Paul Krugman and Mohamed El-Erian.

That’s unlikely. It’s a cat and mouse game between central bankers and the commodities. For reference, short term yields (US 2Y) in the US peaked in 2006-2007 but oil kept going up until 2008 and then collapsed. If the central bankers don’t sound serious about inflation, commodities will keep going up and when the high commodity prices stalls the economy, it will be a crash in every market: stocks, real estate, etc.

There are many other things happening in the macro environment including the bond market. For example, China, Japan, and other Asian countries were buying trillions in US debt for decades. Now they are reducing the exposure these bonds. This will keep the long term interest rates (2 to 30 year yield) higher relative to the last 40 years. Canadian rates are closely tied to the US rates. The central bankers won’t try QE until the inflation is too low (< 1%). At that point, we would be looking at a serious deflation including asset deflation.

A “kick in the groin”? I felt it more like someone pulling my leg 🙂

They’ve had a 2% target for over 30 years now. Only people who think it’s too low are in trouble debt wise. I bet all the retirees think 2% is a bit too high.

So true. And we get tired of all of them, and throw them out after 5-10 years.

Trudeau Sr., Mulroney, Chrétien, Harper and up-next … J. Trudeau…

Very true. We give way too much credit or blame to the party or leader in power.

To be fair, everything was Harper’s fault during the Harper years. It’s just the way it goes. The Libs will have been in power for a decade when the next election happens. They are a tired government.

Please work a ribeye steak into your anecdote, but include a trigger warning for Patrick 🙂

+1. The “pause” should have been another rate increase. We’re not done with inflation.

.

And last time I checked both major BC provincial parties supported continuation of the carbon tax.

Maybe we can be like The Globe and Mail comment forums where it always come backs to Trudeau.

Typhoon in the Phillipines? Train crash in Belgium? Crime spree in Denmark?

Blame Trudeau and his woke policies!

If that happens, I wouldn’t be surprised if a new consensus (eventually) emerges on a different inflation target. There is already chatter out there about 2 per cent being too low.

The Liberals are history and hopefully won’t be back for a long time. Instead of focusing on housing and healthcare which are the biggest threats to the Canadian economic future, they wasted time on divisive woke policies while allowing criminal money to be laundered through Canadian real estate. Crooks from all around the world now own mansions and penthouses in Canada while the average Canadian can’t even afford an apartment. Good Bye Liberals and don’t come back until you do some serious soul searching and get rid of your disconnected leadership which only cares about themselves instead of Canadians they are supposed to serve.

From: For the second consecutive month, Canada’s inflation rate has risen, and one economist is warning a spike inflation could mean more rate hikes are ahead.

https://www.ctvnews.ca/business/inflation-going-the-wrong-way-and-more-interest-rate-hikes-are-possible-economist-1.6568030

Not by all, please feel comfortable to share whatever you like…Some are always interested in what perspectives may be out there.

Oil is back over $90 (92.50 this morning). Can’t see it getting below 2.

Some of us actually enjoyed it, even if it’s just idle speculation.

Yes, great idea. Analogous to labour laws, where severance payable and notice periods depend on length of employment.

Sounds good to me. Germany also has a number of policies similar to this that are tied to length of tenancy

OK. But while we patiently wait for purpose built rentals to be actually built….

Here’s a no-cost, immediate way for the province to help the eviction crisis, and we just need to copy Manitoba’s law to do it.

An obvious way to help BC tenants with our high eviction rate is to make it harder for landlords to evict, such as increasing the notice period for “landlord use of property” from two months to something longer like five months in cities with low vacancy rates.

BC should learn from Manitoba, and copy Manitoba’s law regarding notice for eviction.

The Manitoba notice period for landlord use is 5 months notice in cities with low vacancy rates (<2.0%) and 3-4 months in other areas of Manitoba. They had this law since 2013, and it was introduced by a NDP government in Manitoba

Ideally increasing this period of notice would lower our eviction rate, but even if it doesn’t it would provide a longer notice period to tenants, reducing the stress and worry associated with evictions. “Fear of evictions” is a real and rational reason that renters want to become homeowners. So making rentals more secure like this will also help the housing crisis in general. And to be clear, of course we still need to build lots of purpose built rentals, this is just something immediate to help while we wait for that to happen.

Victoria’s vacancy rate is 1.5%. So based on Manitoba’s law, Victoria tenants would get FIVE months notice of eviction for landlord use instead of TWO months.

https://www.gov.mb.ca/cca/rtb/resource_list/noticetomove.pdf

And that’s why the conservatives will win in 2025.

The central bank says the carbon tax accounts for 0.15 percentage points of inflation but when was the last time Tiff came to paint your house?

Oh and we have a provincial carbon tax so it actually doesn’t matter what feds are in power

I also think there will be more hike(s). Just today there was an article on cbc that inflation is back up to 4%.

I just finished talking with some of my Bay Street friends in Toronto and since I was hung out to dry the last time I reported on their opinions on interest rate hikes I will avoid passing on their opinions.

On a completely separate and unrelated note, my painter was at my house yesterday and he believes that there is a real possibility of another half point increase before the end of the year. My painter says that the carbon tax is definitely having an impact on prices of just about everything but since it will double by 2030 we are only starting to feel the pinch. He described it more as a kick in the groin.

Global problem

G7

UK: 6.4%

Italy: 6.3%

Germany: 6.1%

France: 5.1%

Canada: 4.0%

US: 3.7%

Japan: 3.2%

I think it’s weird that they’re willing to put money in this form – again pinning hopes on the idea of mom and pop landlords being a significant part of the solution. What is needed is purpose built rental buildings. Put all the money towards that!

Kicking people out of an independent rental unit is not that easy in the first place. A lot of people simply dont think that dealing with tenants in the first place is worth all the hassle.

I imagine they increase those affordable rates every year so likely you’ll get $1300 + the allowable provincial rent increase, but still doesn’t make a lot of sense to me. Biggest challenge is that after 5 years you have a tenant renting for 35% under market value possibly forever. So either you’re an asshole that kicks them out at that point by moving family in or something, or you just keep losing money perpetually. Doesn’t feel like a great thing to sign up for

BOC needs to go another 50 BP to combat inflation created by the liberal government. The failed carbon tax is just making all aspects of life harder for Canadians. In increased prices that have any energy component. On top of that, their reckless spending just adds to inflation.