No rapid rate relief

That rapid hike in central bank rates after low variables lured more borrowers to those products has put a lot of stress on owners. Instead of facing higher payments, many variable borrowers have taken longer or even negative amortization periods instead, hoping that rates will soon drop. That’s evident in countless online discussions where borrowers are debating whether to lock their variable rates in to fixed rates now (and accept several years of high rates), or hang on and hope that variable rates drop.

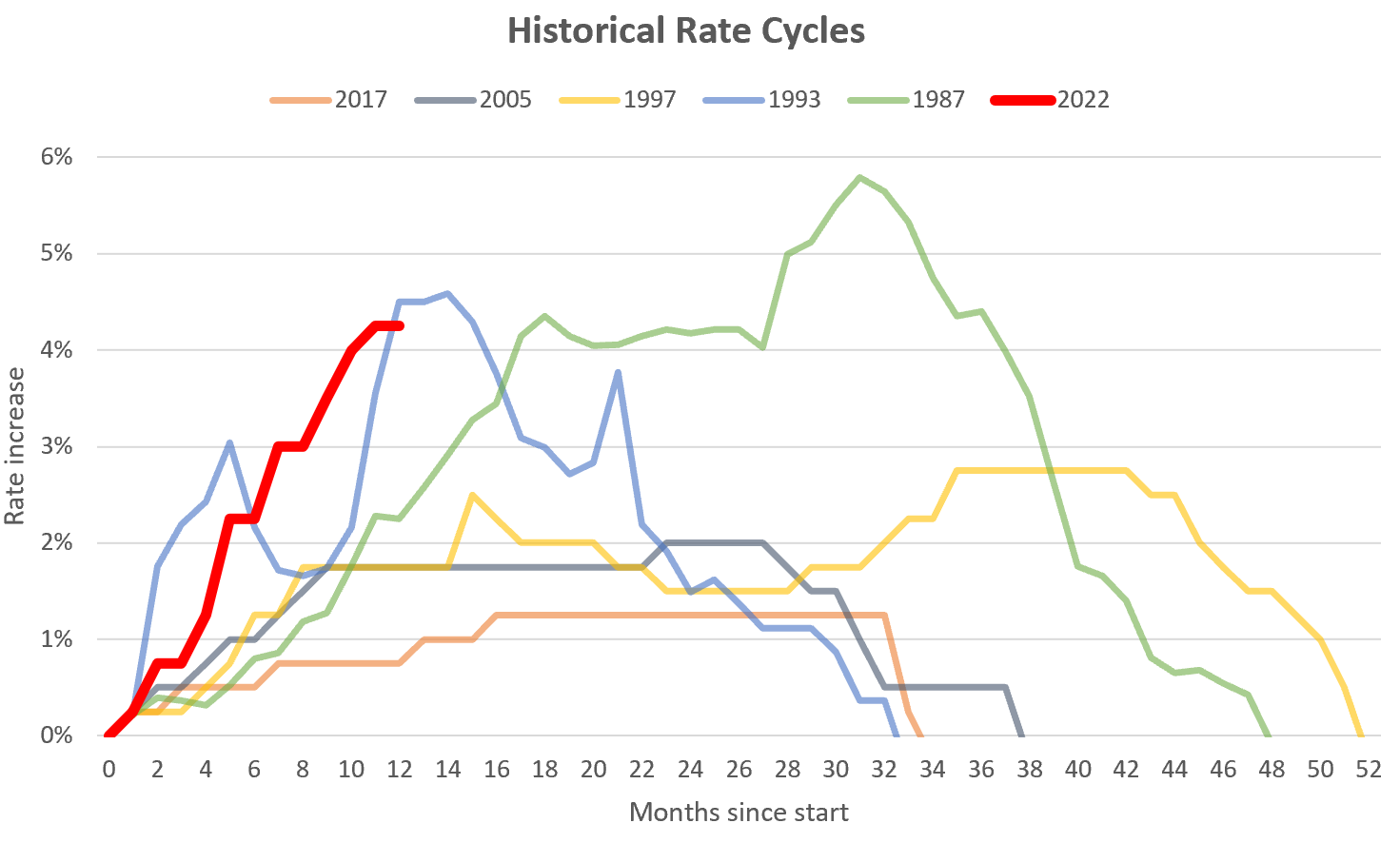

No one knows when or if they will drop, but it’s worth looking at past rate cycles to see how long it took both for rates to peak, and for rates to return to the previous low.

The good news for those under pressure is that we’re close to where past rate cycles have peaked, both in terms of time and in terms of time and magnitude of increase. The bad news if you’re banking on a rapid return to low rates is that in the past that has taken longer. In past cycles it took an additional 2 to nearly 4 more years for rates to drop down to the starting point, and that’s assuming we get back to rock bottom rates at some point at all. Decreases in central bank rates were also often led drops in bond market yields, and that hasn’t happened yet.

That’s not stopping people from still betting on variable rates though. Even with rates substantially higher than fixed products, we still had quite a few borrowers going for variable rates, pushing up the average rate of funds borrowed above the average cost of fixed products. Data is somewhat delayed with the last point from November 2022, but at that point 21% of mortgage volume was still going into variable rate products. Let’s see if that pays off. Either way the banks will benefit from the flow between variable and fixed rates, collecting penalties every time.

Also the weekly numbers.

| March 2023 |

Mar

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 66 | 833 | |||

| New Listings | 181 | 1217 | |||

| Active Listings | 1854 | 1063 | |||

| Sales to New Listings | 36% | 68% | |||

| Sales YoY Change | -45% | ||||

| Months of Inventory | 1.5 | ||||

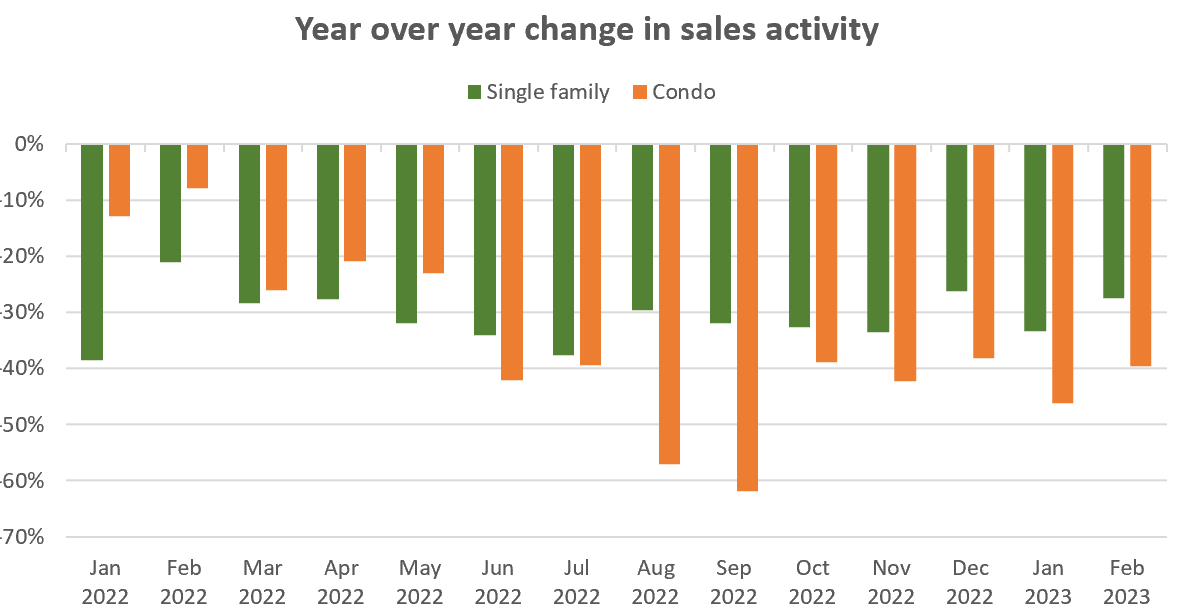

March 2022 was the last really strong month in Victoria, with the market starting to turn midway through the month. That means this month will be another of strong strong year over year declines in activity, but the magnitude of the declines will start to drop going forward. Around mid 2023 we should see stable or increasing activity year over year.

Sales seemed to have suffered somewhat with the drop in new listings, with both falling off when they should still be increasing. Despite a doubling of inventory from last year, we still have limited selection and without the frenzy of low rates the market needs the flowthrough from new listings to keep going.

When the market was hot, it was tough for people to upgrade because if you sold your house you ran the risk of the market getting away from you. Now prices have calmed down but people sitting on low fixed rate mortgages aren’t exactly keen to take on more debt at twice the interest, and risk renewing a larger loan into the same rates down the road. Two years ago I estimated that we wouldn’t return to normal inventory levels until 2024 to 2026. Despite some pretty severe market swings in the meantime that estimate is still looking pretty good, but we’re sitting on the slow end of it with an average of just under 1500 properties on the market in the last 12 months.

It’s going to be a grind.

New post: https://househuntvictoria.ca/2023/03/13/the-not-so-runaway-strata-fees/

No worries about the bank failures… will never happen Bernanke made that clear… just print more money,,. = no depression. QE goes up forever, Interest rates collapse , asset prices skyrocket, we have seen it twice recently and many many times BC. (Before Christ)

What a difference a day makes!

“ Traders in [Canadian] overnight interest swaps are now pricing in rate cuts from the Bank of Canada by June. Last week, traders were expecting the next move to be a hike.” https://www.bloomberg.com/news/articles/2023-03-13/canada-2-year-yield-plummets-most-since-1990s-as-rate-bets-pivot

There already is going to be a new hospital built: 6775 Bell McKinnon Road in North Cowichan. My niece is going to work there as a surgical/critical care nurse.

Yo Mt… have you heard of Las Vegas? Now more than ever Cities can go everywhere. We are all out of water and soon will be out of air .. the world becomes your oyster ( if you can get salt water)

Milton Keynes

Returning the money to the depositors will not require the government to print any money. They probably would have gotten most of their money back eventually as the bank was wound down and their assets were sold off. They just couldn’t liquidate their assets quick enough to meet the $42 billion in withdrawals in one day.

Yes, they may have had a slight shortfall at the end of the day due to their unrealized losses on bonds, but I am sure the depositors would have got more than 95c on the dollar in the end.

With the threat of additional bankruns it probably made sense to take this action.

Long-term, regulators will probably want to look at how they treat unrealized losses on bonds held to maturity. The current regulations actually encourage banks to hold on to these bonds (even if they know interest rates will keep going up) since they can keep the losses off their books. However, the government probably encourages this on purpose to keep the bond market strong.

No worries about the bank failures… It will never happen Bernanke changed that in 2008… just print more money,,.. QE triples up, Interest rates collapse asset prices skyrocket, we have seen it twice recently and many many times BC( Before Crist). Buy property in Victoria, yesterday or in November 2022. I am trying to Rent,.. anything in the $2500 range 3-4 bedroom?

I’ve found the central banker on the forum!

Pretty sure he lives in Winnipeg.

So based on the bond market freak out what are people’s bets on mortgage rates and the spring market?

Neither is living on an Island Frank. But you got no problem doing that.

Whatever- Remote communities are not more affordable. Food prices are 2-3x’s higher, selection sucks, good luck getting your car fixed, weeks to get a part, it’s no picnic. The cost of construction is probably double and you would probably get a very mediocre house. My friend’s daughter was a nurse in Thompson, until she got punched in the face. The job is hard enough without dealing with belligerent people. The residents would probably expect you to be on call 24/7. No fun.

That is exactly what I was saying myself.

As you yourself identified a few posts back most places that are good places to live already have people living there. Therefore most new cities will come from the growth of villages and towns. That growth may or may not come with a legal change like Mission made. There is no requirement in BC to update the municipal designation. That’s why we have a city of 700, towns of 15000 and villages of 4000 in BC.

The days of founding new towns to support a mine or other development seem to be past. These days people just fly in and out of work camps instead of moving their families to new settlements in the wilderness.

Maybe climate change will lead to formerly undesirable locations becoming more desirable settlement locations, but that’s a little more long term than we are talking here.

I am shocked that hiking rates 450 bps at record speed could break stuff.

lol 2nd & 3rd largest bank failures in US history. This soft landing is coming in hot.

No. I’m against the bailout of these SVB depositors, because there was a limit in coverage in place, which should be followed. What I want is the limit to be removed, so that this doesn’t happen to future depositors. Like any insurance, there are premiums that they will pay for this coverage, and so it’s not a “bailout”, it’s insurance coverage.

I’m in favour of future problems being prevented by extending FDIC/CDIC insurance to all depositors. I was (and still am) saying that the FDIC insurance (equivalent to CDIC in Canada ) should not have a limit ($250,000 in USA, $100,000 in Canada). Then there would have been premiums paid by large depositors, funds available to pay the claims. That WASN’T in place ahead of time, and so these large depositors weren’t insured.

If the FDIC insurance was in place, this SVB bank wouldn’t have collapsed in the first place, because it’s large non-insured depositors wouldn’t have panicked and withdrew money.

As it stands, the next time a bank looks to be in trouble, the same thing will happen and large depositors will suddenly flee, and the bank will collapse. But if they extend fdic insurance to all depositors, this won’t happen. If your small bank is in trouble, and you have $5 million deposited, without FDIC/CDIC insurance you will panic-transfer to a different bank, and the bank will collapse. If you are insured, so what, you’re insured, and no need to move your money. That’s why I want the insurance extended.

Now, because if this limit on fdic insurance, people are moving their money to big banks, that are “too big to fail”, so they’d be bailed out anyway. The SVB depositor bailout doesn’t help this problem, since the same thing (collapse) will happen to the next small bank in trouble.

Most of Switzerland’s trade is with the Euro zone. The Swiss Franc is traditionally seen as a safe haven currency and it rises in times of uncertainty. A higher Swiss Franc compensates for higher Euro prices, thus low inflation in CHF terms.

Canada is a resource currency not a safe haven currency and tends to fall in times of uncertainty. To make it rise against the USD would require much higher interest rates than the US.

Apparently, the Swiss also managed to avoid high inflation:

https://www.youtube.com/watch?v=mEBU0QkhYNI

That’s just a change in legal status, not a whole new population centre which is what we were discussing.

BC has seen a lot of instant cites appear and disappear over the years. Kitimat is still with us and is booming for the time being as a result of the LNG project, but before that it spent quite a few years as the Detroit of the North.

Most Swiss towns and cities have been population centres since the middle ages, or in many cases since Roman times. It is good how the Swiss have lots of interesing manufacturing, education and research stuff located all over the country including in some quite small centres. Helps to have a state of the art transportation system and that everything is relatively close together.

it’s happening constantly as villages and towns grow up and become cities. For example Mission, BC became a city in 2021.

New cities are going to happen where villages and towns already exist, because people already live in most of the best spots.

Well Frank, I don’t think that’s true. As it is now, new doctors can no longer afford to own a home in Victoria. A chance to be in a new hospital in a new affordable community would appeal to a lot of health providers. Their income would go a lot further towards an early retirement.

Good luck getting doctors and nurses in a remote community, not gonna happen.

The Island definitely needs another medical center. Increasing access to medical to those up island rather than air lifting down to Victoria wouldn’t be political suicide. It would be seen as the government being proactive to the needs of people.

Other U.S. banks being crucified today. First Republic down 63%, others even more. TD bank has exposure to U.S. banks, it’s only down 3% today, 13% for the last month. Looks like the steepest interest rate hikes in history might be followed by a corresponding decline.

Isn’t the bailout exactly what you were indicating support for here?:

I am going to predict 550 sales for the month.

Month to date activity

Sales: 175 (down 47% compared to same day last year)

New lists: 408 (down 13%)

Inventory: 1885 (up 102%)

New post tonight.

Government. More like this, I think they’re doing one currently in Nigeria.

Every place in BC that merits people living in it has a town of sorts already. Just let people work remotely and let personal choice and the markets do the rest.

You think that any BC government is going to furnish any small community with superior medical care in an attempt to lure retirees? Political suicide, as well as making no economic sense.

Up Island is already doing a good job of attracting retirees regardless.

The swiss seem to manage making small towns regularly. Build a medical and nursing school (which we desperately need) somewhere like Cowichen Bay and with the proper infrastructure it can be turned into a retirement community that competes with Oak Bay. People will move simply to be assured good medical care.

Of course. As previously discussed. https://househuntvictoria.ca/2023/03/06/no-rapid-rate-relief/#comment-99618

Brasilia.

No “prediction alert”?

Seems like an irrational reaction in the bond market but…

https://twitter.com/RobMcLister/status/1635281078008311811

5 year fixed plummeting down to under 3% this AM.

Legally they are temporary foreign workers, not refugees. Fact is there are a lot of vacancies in the low paid service sector and if these people weren’t brought in someone else likely would be.

Anyone granted permanent resident status gets included in the immigration target in the year that it is granted. So I see them mostly displacing other TFW’s short term and immigrants longer term.

900,000 applications have been received from Ukrainian refugees, 600,000 have been approved, in one year. How are we going to accommodate millions of people in the next few years? BTW, the ones I’ve spoken to are not planning on returning after the war, whenever that might be. This could be disastrous for our housing crisis, health care crisis.etc…I’m not against helping them, my grandparents escaped WWI from Eastern Europe. They never returned to even visit the relatives they left behind.

It definitely is a bailout, and the moral of the story here is that the Fed and the BoC going chicken out on holding or rising rates.

I could be wrong, but the bailout likely will keep inflation at the current level or a steady ascent thanks to more money printing.

You can’t just plunk a city in the middle of nowhere. There has to be employment for the residents, such as mining, forestry, etc.. We can’t all have government jobs. China built cities that are still uninhabited, you don’t hear much about them today.

Sprawl, that is the de-densification of cities, actually started with the innovations in mass transit at the beginning of the 20th century. Oak Bay was the sprawl of its day. It just doesn’t look sprawl-ish to us because we compare it to the post-WWII auto-oriented sprawl we are familiar with.

That’s a bailout of the depositors, not the bank. Two opposite parties – creditors versus debtor, respectively. The owners of the bank, i.e. the shareholders, are going to end up with nothing.

… in North America… and if you only consider the last 70 years of history.

You have a problem.

Frank: Exactly what happens if we do nothing?

We have two choices: 1) Rapidly increase supply and necessary infrastructure. Or: 2) Decrease demand. Take your pick.

Fed also opens a “Bank Term Funding Facility”. So if a bank bought $100 billion in long-term bonds, that have fallen to $90 billion with rising rates, they can borrow the full $100 billion from the fed using these bonds as collateral. Kick the can down the road – business as usual.

Historically, urban sprawl has been the way most cities grow. I’m not sure if I’m for urban sprawl or against it. There are pros and cons on both sides of the argument.

I think it would be better to spend the money in developing a city far enough away from Victoria and Nanaimo that commuting to either one is not a viable option. You would need schools, shopping, offices and all the services necessary to make this new city a viable option for people to move to. That would draw demand away from both Victoria and Nanaimo.

When was the last time Canada got a new city? All we’ve done is keep making the same cities bigger and bigger. Surely we have room for one more city in the second largest country in the world. Decades ago there was a plan to develop Bamberton into a city. There is a lot of open space up there. Almost enough space to fit half of all the homes that are in the core districts of Victoria. Potentially a city of 100,000 homes. May be even build a new Government House there.

Vancouver Island is frigging huge.

WSJ calls it a bailout, as do I.

Yes, of course we know that it’s a depositor bailout, not SVB equity or bond holders. And will be paid for by USA banks, not taxpayers.

“ The Silicon Valley Bank Bailout”

https://www.wsj.com/articles/the-silicon-valley-bank-bailout-chorus-yellen-treasury-fed-fdic-deposit-limit-dodd-frank-run-cc80761e

Once again, the YOLO risk management strategy prevails, and so SVB depositors get bailed out.

We are shielded from reality because most of Canada is too cold to live outdoor, and we are a very wealthy nation. However, we are on a trajectory of having homeless worker by putting the cart (eco) before the horse (people). Even a wealthy nation like the US have homeless people who hold regular jobs and are living outdoor in places like California, Hawaii, etc…

IMHO, we need to fix our system/mindset and build adequate housing/growth immediately to avoid an absolute broken society in the future.

Doesn’t sound like an actual bailout, the bank will still fail with equity holders and creditors wiped out. Only depositors will be made whole.

The bailout of depositors is actually positive compared to doing nothing, futures are green atm.

QT, if they are actively looking to buy or rent then they would be considered as part of the demand for housing. But somehow I don’t think they are. They are mostly the homeless, suffering from mental and addiction problems or transient workers that have little or no intention of renting or purchasing a home. When we speak of demand for housing we speak of “prospective” purchasers. A prospective buyer is a person who there are reasonable grounds to believe is a potential or likely buyer. Not everyone is a prospective purchaser.

Looking at those living on the streets and under bridges doesn’t equate to demand for housing. Instead you are seeing a broken system that is unable to adequately take care of the less fortunate in society.

From: https://apnews.com/article/silicon-valley-bank-bailout-yellen-deposits-failure-94f2185742981daf337c4691bbb9ec1e

Tomorrow and the rest of this week will not be a good time to look at your investment portfolio.

Not always. Many large cities are experiencing the phenomenon where the service people are staying under bridges, parks, graveyards, and vehicles while working in the city.

All the eco-hypocrites want other people to live in townhomes and condos, and not have cars or even parking spots.

And of course they must not disturb any trees, or even think about clear cutting anything.

Meanwhile, they:

– live in a SFH detached house, with cars/parking spots.

– clear cut (mow) their lawns regularly to prevent a forest from growing back.

Well how badly do you really want affordable housing in Victoria?

Because I know of 180 acres of undeveloped land in Fairfield that could be developed and solve the problems. (sarcasm alert)

-It’s called Beacon Hill Park. Or just take 25 acres of it, that would build a lot of 30 storey hi-rises. Who would notice if the park was 25 acres smaller?

Heck we could tear down Government House that’s 33 acres just by itself. Why do we need Government House anyway? It’s not like Charles and Camilla come here every year.

Population density per km2

United Kingdom 281

Germany 240

France 119

Switzerland 219

Italy 206

Croatia 73

Turkey 110

Ukraine 75

Vancouver island 27.64

Democratic process is dead, because it is no longer a simple eco-agenda, but more akeen to an eco-dictatorship. Where extremists are dictating how the majority of the population should live.

I personally believe that we have to remove much of the politicians, activists, and red tapes so that the free market provide what the populace want and need.

We’ll see sprawl irrespective of how successful we are at building infill high-density housing, as the desire for SFHs is too strong.

This is one of the biggest YIMBY fantasies: that building density in the core will slow down or even prevent sprawl.

I think town houses would be a good way to go. They can be very efficient as you don’t need side yard set backs that reduce the building envelope. But if you build them on single family lots then they will have to be crowded together.

In Victoria our side yards are ten on one side and five on the other. That makes the division between each home 15 feet. I always wondered why we had these side yards requirements. It seems to have come from the Fire Department, they need 15 combined feet to get the fire trucks between the houses to save lives.

In Vancouver they have 30 feet wide lots, but they also have rear lanes. That allows fire trucks to get access to the back yards to put out fires. It’s a safety issue. The picture Patriotz provided is an older home, if a fire started in the back room of that house, the homes on either side would be engulfed before the fire department could suppress it. One could have an entire block of houses on fire.

That didn’t take long. Emergency bailout of the SVB bank

https://www.cnn.com/2023/03/12/investing/svb-customer-bailout/index.html

And a second bailout (signature bank). Many more bailouts to come…

Yes, obviously. Anything to add?

Whatever your nailing it I’m a fan of townhouses as a alternative to sfd but they are not going to be cheap in the core But they will sell just not to someone who can’t pony up and that’s just fine

Patriotz, that’s a side by side duplex. A door is about 6.5 feet high. So that half duplex is a little over two house doors wide.

Bigger units cost bigger bucks. The families will not likely be able to afford them.

You simply can’t build affordable housing for middle income families that have only a 10 or 20 percent down payment. You can build it today but it won’t become affordable for ten or 20 years from now. The economics are just not there.

If we wanted affordable housing today we should have started 20 years ago. Because anything we build today won’t be affordable until 20 years from now.

Would you believe a 13.5 foot wide lot?

https://www.realtor.ca/real-estate/25301329/487-scarborough-rd-toronto-east-end-danforth

Looking forward to hearing you speaking in support at the next public hearing for family suitable housing

Price theory suggests that if rents and home prices get too expensive then demand will decrease. People will just stop coming to Victoria in the numbers that they have done in the past. That’s why higher interest rates are having an effect on the volume of sales.

Those that want to move here for work and find a place to rent, first time home owners and now middle income households are priced out of the market. Victoria will not be an option for them. They will find another place to find work and move to.

My thought is that the only ones that are keeping our market afloat are the out of town buyers that have sold their homes in other cities and have massively large down payments. But, in my opinion, there isn’t enough of them to keep the market stable for an extended period. Without price appreciation there is little chance of someone moving up the property ladder to their next home and the market will stagnate.

(sarcasm/ hyperbole alert!)-The average price of a house in Victoria might reach 5 million but only a half dozen homes a year will sell.

Right, but a 1 bedroom apartment is hardly suitable for a family. I think the homes for living group should embrace (not move away from) the criteria of 3+ bed, 1200+ square feet, as that is the suitable size for a family (w/ 2+ kids anyway). Especially now that 1-2 adults in family may need home offices as well.

Someone needs to speak up for families with children to advocate for bigger units, as these 2 bed, 800 sq ft overpriced, limited parking, missing middle units in 4-plexes we are seeing are too small for families.

It all seems more like a missing “muddle” 🙂

Townhomes that exist today would fit the missing middle for livable floor area because they have the square footage. But to build and sell them today at missing middle prices then the livable floor area is going to have to be reduced. We will end up with three-bedroom or two bedroom and den town homes at 850 square feet with three and more people living in them. And they are going to be weird looking as you have to go vertical to fit them onto a lot. Tall and skinny units with say two rooms on each floor. A four storey town house having about 200 square feet on each floor with three levels of stairs.

It’s just the physical constraint problems of trying to fit so many units on one single family lot.

Or we could just throw the zoning bylaws and community plans out the window and build zero lot line three and four storey condo buildings with no dedicated parking or yards. I doubt that is what most Victorians want to see happen to their neighborhoods. Or you could change the bylaws to allow 50 feet wide lots to be severed into two 25 foot wide lots. Imagine what those houses would look like? Crowded together homes that are 20 feet wide and and 80 feet long.

You just can’t fit a square peg into a round hole.

The workable solution in the past has been to assemble lots together. Maybe we should try to make that easier and far less expensive. But somethings have to give. And it’s likely all of the costly environmental concerns and city charges to tear down and assemble the lots. One would have to fire up the bulldozer and start at one end of the street and knock down all the older homes until you reached the end of the block. Then we would get the housing that we need but we would fill the land fills and have to build more land of them or export all of that crushed and toxic materials to somewhere else in the world.

You just can’t enjoy the good parts of something without having or dealing with the bad parts.

We also quote the rent of a 1 bed apartment as one of the indicators of the problem. Shortage is everywhere

Patrick- I disagree that there is plenty of land on VI or anywhere in Canada. The west coast of the Island is practically uninhabited. Is the weather that bad? Only 7% of Canada’s land mass is farmland, compared to 40% in the U.S. I was surprised to learn that the two countries have almost the same land mass, I always thought Canada was a lot larger, apparently not. If only 7% of the country is farmland, how much room is there to expand? Any expansion on the Prairies consumes farmland, a dwindling resource.

For the record, I got those criteria from the welcome graphic on homesforliving.ca

That’s where they declare a Victoria housing crisis, and graph the sales numbers of “family suitable units”.

fwiw, those criteria for suitable family units look fine to me for size (3+ bed, 1200+ sq ft).

“Family suitable units: 3+ beds, 1200+ sq ft,<30% average family income”

Well now we’re on the same page.

YIMBYS and NIMBYS having a productive alliance here? I’ll believe that when I see it…in the meantime I’d like to see some new sprawl as possibly the only solution to get more detached houses.

I personally don’t have a super strong position on sprawl. It’s a good thing that Langford built a lot of housing. I live in yesteryear’s sprawl and it would be the height of hypocrisy to oppose todays sprawl. We wrote a joint letter to the province with some other orgs and I pushed back at including a specific point opposing sprawl. Others have a stronger opinion here.

That said after what happened in Ontario and partially opening up the green belt I think it’s politically a dead end to push for sprawl. It will simply unite the environmentalists against housing reform. If Californias YIMBY movement taught us anything it’s that YIMBYs don’t win until they make alliances with progressives instead of fighting them.

Huh? One post ago you were worried that we were going to cut down forests to build houses. Now it seems you think we don’t have any land left and would need to go into the ocean? There’s plenty of land on VI to build houses on.

Yes.

Missing middle is a built form not a unit type. That said forms like townhouses are typically family suitable. In Addition Victoria’s missing middle policy specifically mandates that a proportion of the homes built (at least 2 or 30%) are family suitable

Not our criteria, never has been. Just one example of the shortage.

That said townhouses fit on every single lot and are exactly that size.

I’m sure if we just advocate hard enough we can sprawl into the ocean. Perhaps it’s no coincidence your name is Patrick

Well, none of those (above) have many units that meet the homesforliving.ca criteria (3 bed, 1300+ sq ft) for suitable family homes.

That makes no sense to me. You’re not pushing for the one type of home that 79% of young families want (detached house – see pic) , and is the only one that would actually meet your criteria (3 beds, 1300+sq ft) for suitable family housing (detached SFH). And your stated reasons against are “preserve wilderness” and reduce “car dependence”.

It’s fine to be advocating for preserving wilderness and reducing cars. But that’s an Eco-agenda. Don’t pretend that these 1-2 bed multi-units w/limited parking are the “homes for families” that families actually want, because as you can see in the attached pic, the homes that young families want are overwhelmingly detached SFH. And that means a detached house, yard and (gasp!) a garage with car(s). I expect that 79%+ of HHVers here are looking for exactly that too.

https://eyeonhousing.org/2019/10/millennials-want-spacious-new-single-family-homes/

Leo S, just wanting to understand if the vision is to create more rental housing or just more one and two bedroom condos? I suppose what “triggers’ me is the phrase “missing middle” to me that sounds as though the initiative is to create the type of housing we are not building ie family housing. One and two bedroom condos are good, but they would not be filling the gap between condo ownership and single family ownership.

It appears the U.S might have more problems with they’re banking and not just Silicon

I’ve been following MM potential property listings and sales closely and from what I can determine so far zero impact on market value as a result of the policy. I had anticipated 800k homes to be selling at 830 to 840k as a result of MM but haven’t even seen that come to fruition. I figured there would be very little uplift but I did not predict essentially zero uplift.

I like how people were freaking out the homeowners would benefit from the increase in land value, ha ha. Those with tear-downs aren’t even seeing a lift let alone those with livable homes.

I’ll bring this up for the millionth time in the last 12 months….it will be many many years before you see two MM projects on your block. For those concerned with MM by the time you see parking issues on your street Europeans would laugh at you’ll be either 6 feet under or in a nursing home so maybe best to spend energy on other things such as lack of healthcare. City of Victoria is already quoting more than 12 moths for a permit which really means 18 to 24 months plus time to build it. The 1st one built won’t be ready for people to move in for like 4 years.

I’m not sure I understand what you mean. There is no specific vision other than creating more housing options in traditionally single-family areas and matching zoning to what the community has already agreed they want as expressed in the official community plan.

Mixed use development, such as what you are talking about would not fall under the missing middle policy

Yes. The reason is it’s illegal to build.

Not sure what is complicated about our goal.

More rentals like Harris Green.

More condos like Hudson Place

More affordable housing like Nigel Valley

More townhouses like Rainbow St

More multiplexes like Pembroke

I think the only type of housing we’re not pushing for is greenfield sprawl. Though that also helps housing prices, reality is we have geographical constraints and most people involved don’t think it’s a great plan to flatten the wilderness for car dependent low density housing. That said if we don’t figure out how to build infill housing I suspect we will see a lot of sprawl happening and a lot of forests cut down for housing.

Exactly Patrick, unfortunately I think 10+ storey apartments are considered taboo (too much congestion, too many shadows) and will take forever to get approval. Putting six and twelve plexus in residential neighbourhoods is ill conceived. The problem is the Island simply does not have the available space to accommodate the demand. (Sad face emoji).

I say just build brownstones they are large enough and usually nice enough with just the right density for the inner core They are not going to be cheap but that’s just life

Missing middle takes effect today.

https://engage.victoria.ca/missing-middle-housing

If you want housing for everyone, you have to think big numbers. Maybe the “middle” is missing for a reason. – inefficient and costly to build small numbers of multi-units vs large buildings.

Forcing multi-units to “fit-in” to a tiny residential neighbourhood is inefficient and costly. Because they are limited by height and lot size. Better to build up to the sky.

– More efficient to build 10 Harris Greens, adding 15,000 units total.

– Instead of 2,500 x 6-plex units. Requiring demolition of 2,500 existing family suitable SFH. Ending up with overpriced townhomes, with accessibility and parking issues.

The stated goal is more housing for everyone. Too many housing policies are “more of this type of housing but less of this”. The result is the mess we are in.

It’s funny at the public hearing for the townhouses on Rainbow street one of the objections is there were too many 3 bedroom units and what about the people that want smaller spaces?

It’s all bad faith. Wake me up when we have an abundance of any type of units

6 plex with the first units at grade means 2 accessible units where previously there was none.

Unfortunately limiting the height of MM buildings last minute makes these harder to build. We’ll see what comes out of it.

Smaller apartment blocks are usually located on higher traffic streets, usually with a bus route. In a lot of cases, there is a bus stop outside the front door. This makes sense as parking would be limited. To build a six or twelve plex in the middle of a subdivision, blocks away from public transit would be extremely inconvenient. Introvert’s example has a very steep 12 step front staircase. Do the buildings have wheelchair access? Doesn’t look like it. Lots of people have hip, knee, and back problems and would have a hard time climbing those stairs, let alone the stairs in the building. I doubt there is an elevator. These buildings are fine if you are young and physically fit, but take a look at our aging population, half of them need a cane to get around. The other half would have a heart attack climbing stairs. I’m fit and I wouldn’t want to live in a place like that and I don’t think it’s practical for a lot of people. Properly designed apartment buildings have ramps and elevators to allow universal access.

It seems now we judge these by number of units, instead of suitability for families.

Any of those 12-plex units meet the stated goals of Homes for Living?

http://www.homesforliving.ca

family-suitable units: “3+ beds, 1,200+sq.ft,<30% of average family income”

“Current purpose built rental stock is 97% studio, 1, or 2 bed apartments not suitable for families”

————

The only family-suitable home size would have been the house they tore down to build this 12-plex.

If it were up to me this kind of 12plex would also be legal everywhere it fits

Flat roofs are more expensive.

Leo S, do you happen to have anything that explains the missing middle’s vision or mission statement. I’m wanting to re-develop a commercial/residential site with 10 to 12 units and would like to incorporate the missing middle into the design of the complex.

As the property is in the urban core, my thought is to redevelop the site with work/live units within a four storey complex. Each floor would be separately strata titled. And each strata would contain 3 to 4 rental suites that could be sold off to different investors. These would be revenue stratas. Because, in my opinion, the more competition there is among individual investors for renters the less chances there is for rent gouging by a single owner. Being revenue stratas of 3 or 4 units also opens up the market place to anyone wanting a revenue property as the revenue stratas now fall under residential mortgage lending guidelines and not commerical lending which is necessary for 5 units and more.

It’s two sixplexes next to each other. The one I posted is the one on the left, the one you posted from the architect is the one on the right. By the way this was not built under missing middle so not necessarily reflective of what can be built under it. I’ll have to take a look at the heights to see how it differs though. I know Caradonna cut the heights at the public hearing in exchange for basements.

But the picture is not what is mostly going to be built moving ahead. It will be the cheapest flat roof box going. Developers used to at least trade off better appearance in return for zoning approval. With the passage of the missing middle those days are gone.

Both LeoS and Marko are really aware of this so I am a little surprised that there is a least an implication that this type of architecture is what is mostly going to be built. MMI is passed so why is there still a need to spin the issue?

Lets give it a year and lets see what is actually getting built.

Moving the provincial capital back to new Westminster would certainly free up a lot of housing here. Much more logical location on so many levels. Turn the legislative buildings into the new museum.

I would definitely not want a six-plex built next to my house. 20+ neighbors instead of 2-4, several more vehicles that clutter the street, possibility of an Air BnB, the list goes on. No wonder residents but up resistance to these monstrosities. 95% of home owners don’t give a rat’s ass about the lack of housing. Maybe 100%. It’s called human nature.

Ditto. We’ve lived next to a triplex of similar size. Not sure what the problem is exactly, but it seems like a good idea to build this type of housing when there is a housing shortage. Having equity means there is always the option to move if you don’t like your neighbours, which is a good position to be in.

Not sure if you are being sarcastic or not? Looks perfectly fine imo. Actually I think it is attractive, would have no issues with this next door.

The building in a sixplex. The strata is a 12-plex (two sixplexes).

Introvert….its the future….learn it, live it, love it.

It’s already been happening, but tying himself to the yuan introduces other problems for Vlad. The reason nobody’s talking about it might be because it’s not a huge deal yet in the grand scheme of things.

https://www.atlanticcouncil.org/blogs/new-atlanticist/russia-and-china-have-been-teaming-up-to-reduce-reliance-on-the-dollar-heres-how-its-going/

What might be a big deal is what will happen if the Republicans extort the U.S. into defaulting on its debt. Hard to know what the ripple effects of that would be, but I’m guessing it won’t be fun.

Is the one in my picture a 12-plex?

Yeah, that SFH you cherrypicked there, Leo, is pretty ugly and bad.

Looks rather quaint, clean and can almost fit into any neighborhood. The 1940s 900 sqft bungalow seems more the eyesore next to it.

https://twitter.com/archimomtoo/status/1634378501137768448

Look at the height of this thing! I definitely wouldn’t want to be in the house beside it. Had a SF mansion been built instead, pretty sure it wouldn’t be this tall and blocky.

If this is typical of missing middle construction, hard pass.

Well there’s a real things tech sector and there’s a meta tech sector. It’s the latter that’s shedding jobs.

The HHV version…

“For every action, there is an equal and opposite criticism.” ~ Steven Wright.

What? . No reason for you to think that, because I said “I wish that [no bailouts] would be the case’.

These bailouts and money printing may destroy our currency, and turn our economy into something usually seen in central America.

I hope that they do what they say they’ll do, namely raise rates until inflation goes to 2%, even if this means a recession.

Unfortunately, I’m cynical enough to expect an emergency bailout, as I can’t see them actually letting these beloved SV unicorns lose any of their cash.

As an aside, there should be no limit on CDIC insurance, because the insurance doesn’t prevent bank runs from the big customers. We may see a bank run on all kind of small US regional banks on Monday, from customers with large deposits over the insured limit. If I had big money in a small US regional bank, I’d transfer it on Monday to a”too big to fail” bank like BOA.

For every action, there is an equal and opposite reaction — Newton’s third law

I’m wondering when the main stream media is going to talk about BRIC ( Brazil , Russia , India and China and South Africa….. and likely Iran, and Saudi Arabia shortly)

I have heard that on August 1st they will begin their new mechanism for trade….. using their own currencies in trade in much of their trade between each other, squeezing out a good chunk of using American dollar in trade. One has to wonder if their will be some kind of run on the American dollar as it is dumped. How much will that force America to increase rates to try and keep investors onside.

I can’t say I understand all this but I am surprised that this is not discussed more and can’t help but feel that it could change everything and cause a major drop in real estate in the USA as it faces this possible disaster. If real estate does drop in the USA then this will effect Canada as well in a very bad way.

Something significant is taking place internationally and yet I see few countries talking about it.

Anyone have some solid background on this change in August?

Sounds like that’s what your hoping for.

I’m guessing banks are helping to stop inventory from increasing Recessions and business cycles help to get rid of the dead weight

I wish that would be the case. But given the perceived (‘sugar rush”) successes of the 2008 and 2020 bailouts, I expect we’d see more and faster bailouts.

I think they’re looking for any reason to cut rates and print money again.

Or you could be buried under 10 feet (literally) of snow in the California mountains. By the time they could reach one community, they found 12 people dead. Now it’s time for an atmospheric river and flash floods coupled with mud slides. Is there really such a thing as paradise?

I’m a fan of geographic arbitrage if you can do it, whether for economic or health reasons, or both.

If you own in the Okanagan, you could think about renting your home out at a higher rate in July and August and live somewhere else with good air quality and lower temperatures – like Victoria.

FWIW, a natural, somewhat sunny and dryish climate of 23-26 degrees seems to have some health benefits and supports outdoor physical activity. Of course, only one factor and your diet, exercise/fitness level, sleep quality, and stress levels are a lot more significant no matter where you are.

“frequency of poor air quality in summer” is one of the reasons I’m trying to move to this more moderate climate (I’m not from the Okanagan though)

Part of downtown Kelowna, last summer when I was there, reminded me of Pandora. It struck me as a shame since it was rather picturesque otherwise. Wont be back.

Mountainside homes = easy to burn down in a wildfire.

Moreover, I wouldn’t buy in Kelowna at any price due to increasing frequency of poor air quality in summer.

Portion of a full-page ad in today’s Calgary Herald:

Very few people saw 2008 coming. This may be more like the tech crash of 2000, even Amazon is closing some of its distribution centers. The tech sector is shedding more jobs than anyone expected. We need more people to do real things.

It look like a bad batch of crystal dissatisfaction hit these streets.

The biggest difference between then and now is the peaking demographic bulge; regardless of any economic slowdown, unemployment will not have the same effect due to the growing number of people retiring.

Far worse than 2008???? What are you people on? Don’t see anything plausible that will yield anything approximating that result.

My guess is it’s far worse than 2008, no bailouts this time around either.

Silicon Valley Bank is the second largest bank failure in U.S. history.

We should thanks the government that cater to eco-extreamists to wasted decades of time and money to prop up international companies instead of putting our tax dollar to work locally.

Our healthcare system is failing the populous, our poor people aren’t getting proper housing, and we wasting billions on EV incentives and the alike. We drive investment out of Canada in the mining and energy sector, and discourage manufacturing because we are so snobbish with eco extremism, thinking that we are better than the rest of the manufacturing dirty world. So here we are paying for it.

To add to that: SVB had way more deposits than loans, due to having tonnes of deposits from startups that raised a ton of money from investors in the boom years. They invested all that excess cash in securities and bonds that lost value when prices go up. Also the startups have not been able to raise money as easily anymore so we’re drawing down their accounts.

This is not a typical bank that would have enough of a loan portfolio that would earn enough extra profit to offset losses from their bond holdings.

SVB bought a bunch of mortgage backed securities ($80 billion), they paid out less than 2% for 10 years. They had to sell them at a loss because they had no liquidity and people started withdrawing funds.

Might be 2008 all over again.

Inflation will probably be under 5% at next reading and will decrease to 2% or less by August. There will be no more interest rate hikes in Canada and there may be cuts by the end of the year. The $CAD will be a casualty though. 0.65 perhaps?

This has been a visible consequence of Canadian debt loads relative to the USD for at least 10 years. It was just a matter of time given that 100% of mortgage debt and 70% of food is denominated in $CAD that government would have to eventually choose household solvency over the CAD, which is actually great if you’re an exporter.

Rates will stay elevated though so housing will keep dropping as time wears on overleveraged borrowers and with the $CAD dropping maybe another 20%, you can expect to lose another 15-20% in RE this year relative to USD denominated assets.

my $0.02.

Higher rates are not necessarily good if you have lent a lot of money to companies that are very rate sensitive. Confidence and trust are absolutely necessary for the survival of any bank.

U.S. banks getting hit today, Silicon Bank insolvent. I thought higher interest rates were positive for banks.

Unlikely because the American wage inflation is not climbing as much as expected, and job lost are starting to show up in the stat.

Way too early to make a call, and there is no meeting in May. February and March CPI will come in before the next meeting in April.

I can’t see a new apartment having only one elevator, always need a second to reserve for tenants moving and emergencies. I’m sure code today would be minimum 2 elevators.

I agree to 50bps hike in April (thanks Dad, edited the month).

Congrats Marko on getting married. Very progressive of you to take your wife’s last name 🙂

Silicon bank is toast wondering if liquidity is starting to dry up here at our banks You would think construction loans are getting expensive

Below 50 units I typically see just one elevator and it isn’t super expensive sub 200k for one.

Just curious, at what level are elevators mandatory in an apartment/condo complex? Did a quick search and it looks like 5 storeys or more. I sure wouldn’t want to walk up 4 storeys to get to my place. What do a set of elevators add to the cost? Could be one reason why no one is rushing to build a larger (taller) apartment. Elevator maintenance s also a pain. To justify the added cost, I would think that a developer would only be interested in building a much taller building than 6 storeys. I would hate living in an apartment.

Hard and soft costs ad up to very different PPSQF depending on who and what you use. Be clear about what your asking for and you will get a better estimate

Whatever, sounds like you have already figured out your price point. Have fun with it, keep a reserve for cost overruns.

Friendly

Please better describe your thesis of vic being higher priced than van in even 10 yrs (giving it double the time you suggest).

I was born there, moved to vic, then moved back for 15 years and returned to vic 5 yrs ago.

It has been more or less double the price of victoria during most of that time for obvious reasons.

What exactly is “all over” for you? Interested in your perspective.

Introvert – settle down in your hopes – its unlikely to happen.

April is a long long long way… into the future in this market!

That’s not a very gutsy call, since you can say you were “right” if the increase is zero, 25, or 50.

I’m calling for a big goose egg in April

There is a difference between replacement costs for insurance and building new on a vacant lot. If the house is fire, smoke and water damaged, then some of your furnishings are going to have to be cleaned, the house is going to have to be torn down, and you will have to rent another home while all of this is being done. That’s why your replacement costs will be about 1.5 to 2 times the cost of building a new home.

I’m looking around to get costs of building a four storey, 10 or 11 suite, wood frame complex of around 11,000 square feet and a few have come in at around $300 to $350 a square foot.

I grew up in Vancouver and had a house on the Westside for almost 20 years after moving from Caulfield Cove at Lighthouse Park. I spent 30 years in two of the most impressive and expensive places on Earth… I was a landlord in both areas.

It is all over there … you could not pay me to live there. Victoria will be higher priced soon.. maybe not 5 years… wait for it!!

My neighbour, but with good quality windows and doors as well as good quality kitchen and bathroom told me that she ended up running 575 per sq. Doubt if thus is really helpful since it can really vary.

The lady who came from my insurance company nearly give me a heart attack when she walked me through her estimate of replacement cost.

Just had a colleague complete a build beginning of this year and it was $300/sf in Saanich and was with above average furnishings. I know some trades have softened since so that’s where my $275 came from.

LMAO, have you been to Vancouver?

There are lots of asset classes, and not all would get crushed. For example, commodities aren’t that rate sensitive, whereas long bonds are rate sensitive.

It’s hard to say how rate sensitive housing prices are. Rising rates typically are seen with inflation, rising income and high rising nominal GDP. Sure, existing mortgage payments rise with higher rates, but they don’t rise with inflation. And inflation raises rents and helps nominal house prices.

If I was betting, it would be that during “40 years of rising rates” nominal house prices would rise, not fall, and definitely not “be crushed”.

2 wheels if it’s just a 4 inch slab won’t take any weight if there’s some post for a deck over a carport that too won’t take much weight

Hard and soft cost around 400 bucks give or take a bit

Single storey is more expensive per sq.ft with foundation and roofing costs doubling their proportion relative to living area. It matters where you build as well. $275 /sq.ft won’t get you a house in Ucluelet/Tofino. Like not even close.

Anyone have a sense if slab foundations (65 box) can support an additional story above the bi level? Thanks

275

What do people think current average building costs are for a SFH per square foot? A single story as I know it makes a difference.

A 40 year decline in rates was a pretty good reason to buy a leveraged asset at the maximum affordable price. Worked for a lot of us on this board. When and how the new reality will sink in to the market, is the question.

I’m loving Friendly’s optimism here!

I can’t see Victoria being more expensive than Vancouver. I prefer Victoria, but more than half the people in BC live in greater Vancouver for a reason.

With the increase in interest rates and prices vs salaries it would be difficult for someone like me just starting out with kids who did not have family help and was buying with savings and wage-based borrowings to buy in Victoria.

I can see some of the less expensive but lifestyle-desirable markets appreciating faster than before with the expansion of work from home – places in the Kootenays, up Island, and the Interior.

That is where I would be looking to work from remotely if I was just starting out. Or I would look to buy a rental place in these markets so that equity could build, and try to get in a coop here, or to co-own a dividable home here as a start.

I’m not sure how relevant rates before explicit inflation targeting are.

If we do get 40 years of rising rates asset prices will of course be crushed. But underlying problems will all remain the same. There’s no good reason why homes should be priced on max purchasing power.

Rezone the entire city for 4-6 floors and we never need to build another high rise. Until that time, it’s the grand bargain for us.

Because, except for brief blips, they had been falling for 40 years. Most buyers didn’t remember anything else, and thought that this trend was permanent.

I am also mystified about why some many people thought that mortgage rates would stay at unprecedented low rates. Exactly what is the dividing line between optimistic and stupid?

If you love tall buildings that cast a shadow then move to Vancouver. For many people the lack of high density was the draw for Victoria.

While sales are slow I am not noticing any major drop in prices. The stats masters here would have a better idea of the precise situation on sales prices. I would not be totally surprised if parts of the island become more pricy than Vancouver in five years. Not saying it will happen but it would not shock me.

My variable rate has gone up just shy of 415% in the last year. Fixed rates from when I got my variable compared to now are 250% higher.

Not everyone is enamoured with Victoria, living on an island turns some people off. I have 2 friends (both retired couples) who chose Kelowna. I can’t see many people from that region wanting to relocate to the Island (with the exception of escaping frequent forest fires and deteriorating air quality). Victoria’s main problem is that it is small with little room to expand, and little desire for a building that casts a shadow.

Please remember… We are not only in BC. We are in Victoria .. life is way different.. I am hearing of huge price drops all over . Except .. prices are increasing here.. the time to buy was November 2022 or now. My ( non professional ) opinion is we will be higher priced than Vancouver in 5 years.

Yes, I was referring to the BoC rate, thought most would figure that out. Rates dropped to .25% in March 2020 thanks to the pandemic and remained there for 2 years resulting in historically low mortgage rates. That caused the massive price increases. Why anyone did not secure a fixed mortgage during that time is beyond me. Who was advising them? Did they think that would last forever? It also caused people to buy a property the really couldn’t afford, even with a stress test in place.

I don’t see rates going up much, if any further (governments owe too much money and will start reporting lower inflation rates), but we won’t return to the historic lows. We’ll see how a $3.35 million property sells and who buys it. Keep us posted Marko.

That’s the increase in the BoC rate, not mortgage rates. Proportional increase in mortgage rates is much lower because you’re looking at a higher base.

Here’s what’s happening in Canada’s biggest RE market. Will BC be immune? We’ll see.

https://www.thestar.com/news/gta/2023/02/03/gta-average-home-prices-plunge-a-record-164-per-cent-in-january.html

The January CPI and Q4 GDP data basically guaranteed that the bank wouldn’t walk back the pause it announced in January.

You do know that Ellie May is dead? Pronto might not be that fast.

Didn’t realize variable mortgage rates increased 18x over the past year. Thanks for the update.

Hey squad just found out about this group from a buddy at work that said there lots of chatter and andvice here and have a question. Is there a day of the week that’s better to write an offer on with the new rules?

I’d be looking to hire Jethro as a private detective.

The Clampetts? My 9 year old self would say get Ellie Mae here PRONTO…

Interest rates going from .25% last March to 4.5% in one year is only an 1800% increase, the most rapid increase in history. And prices haven’t plummeted? With today’s high employment, and demand for highly trained professionals (to replace retiring boomers), prices will remain strong. Only high unemployment would cause any noticeable decrease. Look at 2218 Kinross, a new build in what is essentially a middle class neighbourhood, asking $3.35 million. That’s the average price for a home in Beverly Hills. Maybe the Clampetts are going to relocate to Victoria. That’s a boomer joke.

I agree and demand will be poor throughout this entire year so it is up to supply to increase to deteriorate market conditions and that doesn’t seem to be happening. We had 200%+ more active inventory in 2011-2014 with similar sales figures and the market barely budged, especially SFHs. Condos did drop 10-14% 2008 to 2014.

Current sales figures and 1,800 listings is not going to put substantial downward pressure on the market in my opinion especially now that interest rates will see limited increases (compared to last year).

Yes Leo, I put that badly, was trying to deal with something else at the same time as typing. Average of last five years of March sales versus this years sales.

In my business, a lot. Just in the last two weeks I listed and sold a higher end condo to Alberta retirees in Vic West and then had different Alberta retirees buy a higher end condo in Vic West. Spec tax not an issue, they are selling in Alberta and moving here. Surprised the lack of GPs isn’t deterring anyone???

Couple of offers right now with Vancouverites. Leo would be able to comment smarter on this but it would appear to me that out of town buyers don’t fluctuate as much as one would think with fluctuations in the strenght or weakness of the market, price of oil, and a bunch of other factors. The only clear trend I ever saw was when Vancouver prices exploded before ours uptick from Vancouver but other than that stream of out of towers seems very steady.

As far as everyone commenting on Reddit about leaving Victoria my impression is most people leaving for Alberta are renting in Victoria? Not selling then buying in Alberta.

The other odd thing about buyers emailing me re purchasing is not unusual to get an email from a young professional couple looking up to 2 million, even at these interest rates. Kind of head scratching the qualifying capability of some people even with these rates.

Doesn’t say much really. What actually says something is how many buyers are willing to pay how much and how many sellers are willing to take so much. Otherwise known as supply and demand.

“I get way more emails from potential buyers versus sellers right now.” That says it all from someone directly engaged in the market. One question: How many are out of town buyers?

I would place a bet that towards the end of the year we see % wise increase in sales YOY. Last year was a large shock to the market and I don’t think we will see such a shock repeat this year.

The market balance could deteriorate on higher sales numbers over last year with a lot more new listings; therefore, higher inventory but that simply isn’t happening so far. If you look at my predictions in December I predicted 3,000+ active listing by May and we are not going to get there whatsoever. Being on the ground I have a good look a few weeks out and there just isn’t this flood of inventory around the corner. I get way more emails from potential buyers versus sellers right now.

My prediction is maybe we see a 2011 to 2014 type market…slow sales, slow and barely noticeable price declines but so far we haven’t even seen that after the initial shock. Prices bottomed out in November and have bounced back a bit especially for SFHs.

It would be something to see if new lists stay low and monthly sales comparisons to last year continue to drop % wise in the upcoming months (since they won’t be compared to peak sales months anymore). Yes, that monthly % of sales is likely to increase because of the comparison to declining months last year. But a greater fall off is possible especially if BoC needs to up it’s rate in April. Could it possibly end in a market stall? Where listings are limited and the volume of sales continues to fall at a significant rate that results in inventory growth without an uptick in new lists hitting the market.

Exactly, no one is saying it will be a good second half but probability wise having back to back near record lows years likely won’t happen even with a crap market.

Wanna make a list of things the boc said that didn’t come true?

Sorry you mean comparing sales against the long term average for the same month? Like comparing Feb 2023 sales against average for the last 5 or 10 Februaries?

I am working on a new automated chart that will show current activity vs historical range. I think that will be pretty neat.

Inventory was half what it is now last year and yet there were record level of sales. I don’t think that inventory has as much of an effect on sales as the real estate industry believes.

My guess – Over night Policy Rates are unlikely to go up or down the rest of the year. Longer term GoC bond yields will start to go down but banks may not pass the savings to mortgages.

Pretty soon we will start to see deterioration in jobs numbers and GDP numbers, but maybe no improvement in inflation numbers. BoC doesn’t want to kill the economy. The only reason they will hike the rates is when they see inflation going up from the current numbers.

Wondering if it would also be valuable o compare sales against the five month average for that month.

Sales were so low it’s going to be hard not to see some increase with more inventory on the market.

The bank told everyone that at the last meeting.

The key, friends, is to Windex your crystal ball.

Already told you that yesterday.

Bank of Canada holds interest rate steady

https://www.cbc.ca/news/business/bank-of-canada-decision-1.6771702

A few days ago, someone asked about Saanich’s property tax increase. Here ya go:

Saanich homeowners face 6.8 per cent tax hike

https://www.timescolonist.com/local-news/saanich-homeowners-face-68-per-cent-tax-hike-6664799

Nice that you’re catching up to my call..

rate dependent. If the cheapest mortgage rate starts with a 6 then I don’t think you can bank on that increase in sales.

I am calling no hike tomorrow but could be up to 50bps in April.

You mean post-1982 history. Didn’t work that way prior to that. Now when was the last time we had a big problem with inflation?

The spread between 5 years fixed and variables rate is a mere 1%, and if histories repeat itself as indicated by the graphs in this article. Then, variable rates will likely match fixed within 6 to 24 months, and after that it will be lower.

So the takeaway here is that it is highly that variable will be cheaper overall on a 5 year term basis between fixed and variable.

Brokerage account money gets 4.05% daily interest, daily liquidity, (TD money market fund – webbroker). Hard to imagine that it was close to 0% a year ago.

For the entire year yes as almost everyone on HHV predicted but as Leo notes second half will most likely be a YOY increase in sales.

So basically from Jan to mid Feb there was a uptick in buying activity and some corresponding upward movement in price because 5 year mortgage rates dropped (low 4’s for insured). Now that the rates ticked back up the buyers have also disappeared and all eyes are on what happens to prices.

Thurston, pretty sure the US does not give a crap about what we need. Come to think of it why should they.

“Leo isn’t say it won’t be a depressed market. He is saying we might see level or slight increase in YOY sales later this year and I would be willing to bet money on this not because it will be a brisk market but because the baseline will be near record low sales.”

I got that part. I am saying 2023 activity will be LOWER than 2022.

That was the joke.

Leo isn’t say it won’t be a depressed market. He is saying we might see level or slight increase in YOY sales later this year and I would be willing to bet money on this not because it will be a brisk market but because the baseline will be near record low sales.

“And the American 2-10 year yield inversion just breached 100bp. Clear indication of an incoming soft landing.”

More like a hard landing. Once the long end (10Y) starts to move lower, we are looking at a recession.

“Around mid 2023 we should see stable or increasing activity year over year.”

I doubt that. I think activity will be depressed until 2024-2025. Inventory will be low (and slowly rising due to lack of sales) for a while because most owners will be stuck in their current places without any upward mobility. Sales will be low because of difficulty in getting mortgages and lack of savings for down payment.

And the American 2-10 year yield inversion just breached 100bp. Clear indication of an incoming soft landing.

May need to go higher.

If the chart is supposed to be BoC bank rate, thanks for the clarification. It’s certainly not 5 year mortgage rates.

Barrister Canada needs the U.S to cut that out We don’t need to get into a currency shoot out not good for inflation

Leo’s chart is correct and “makes sense” for 1987, showing a 5.8% rise in the 1987-90 period . BOC bank rate rose from 7.05% (March 1987) to 14.05% (May 1990). Leo’s chart has a slightly different number than that, and likely has slightly different start and end points.

Here’s a BOC rate history ..

Powell just indicated that interest rates need to go higher in bigger increases.

That’s a great chart Leo. I haven’t actually seen this data presented the same way before.

It’s interesting to think that even if the current cycle followed a pattern more like 1993, we’re still 1.5-2 years from reaching a new settling (low) rate. It also makes clear that we’ve already completely eclipsed the trend of short-lived rate hiking cycles that occurred in the last 2 decades.

It’s also interesting to reflect on the fact that variable rate mortgages usually (I think it’s like 80% or the time?) outperform fixed rate mortgages. It’s crazy to see how wide the spread was in 2022 (almost a 1.5% premium for fixed), but now that looks like a steal. (Still no one can predict the future: over a 5 year mortgage cycle theoretically the variable could drop down and lead the area under the curve to be similar to those 3% fixed rates in early 2022. Who knows.)

Either way here we have a visceral example of exactly when the historical odds can flip and the fixed rate mortgages win out over variable (Ie just before a historically rapid and steep rise in interest rates).

For those few who bought a home on a fixed rate in 2022, it sounds like your bet paid off!

(Meanwhile everyone else basically just got the middle finger from the BOC.)

I think this is where Leo’s affordability graph comes in. Who cares if rates are 12% if a SFH costs 100k, and the relative price of housing (as a fraction of take home pay) is reasonable.

The story here (IMHO) is that affordability is probably near or at historical lows. How are we going to get back to historical affordability? Rates dropping, prices dropping, wage inflation, ???

My guess is that if most folks had floating payment variables instead of fixed (payment variables), we’d be in a recession already. Fixed payment variables are probably significantly muting the economic shock of rate increases. If 27% of variable holders (or whatever the percentage of variables with >30 year amorts was) aren’t increasing payments, I’d wager a good chunk of them can’t afford the real rate.

Will there be a fallout, and what might it look like?

Thanks, I suspected as much.

The vertical axis is the increase in the interest rate since the base year, not the interest rate itself.

Having said that, the graph for the base year 1987 doesn’t make sense to me. Maybe it’s supposed to be 1978?

I’m having trouble with the Historical Rate Cycle graph. I don’t remember near zero interest rates in 1987, 1993, or 1997. Even 2005. Please enlighten me. Were figures for each cycle adjusted?

That was a 40 year insured , though.. likely I do not know what it will be tomorrow. You may be correct.

Toronto … you are talking about today , which is all old news.. Please look forward, old news is old news. The Amortization from 40 years to 25 in the last 15 years.. WTF … I got a 40 year mortgage in 2008.. I can show you the paperwork .. and your info is ? The last 15 years .. not the next 15 years, everyone I have ever met can predicts the past.

Insured mortgages have a maximum amortization period of 25 years, while uninsured mortgages can be paid over a longer term. Not sure who offers longer than 25 currently.

If I were a bank, I’d listen to the OSFI rules on mortgage term lengths…

Barrister, they will be offering longer mortgage rates. What would you do if you were a bank? Unfortunately, for the house hunters this is not good news. A lot of things need to change.. 2% inflation target was picked out of thin air. I changed it just now.. we have a 4% inflation target to reflect the continual QE ( money printing ) Done ..,. it is literally that easy… we will see what Powell will do tomorrow but he has already started he will be increasing the inflation rate target after this round of hawks.. He is prepared for the change … just does not want his hand forced..

Friendly, I was not referring to any type of solution to real estate costs. I was simply stating that I dont believe that any of the big six banks are generally offering anything other than 25 year amortizations but I could be wrong about that.

@ Barrister , I think your thinking is solid.. it maybe I need to change my thinking .

http://www.theglobeandmail.com/business/article-banks-growing-mortgage-amortizations-higher-interest-rates/

All I am hearing is that the the solution is.., longer amortizations.

Maybe look at some national data? I could be totally wrong here but I have heard this from most of the top Macro Canadians who study it. Please repost your comment in 2 weeks and see how you think then.

The one thing that strikes me about rate hike discussions is that the present interest rates are still on the historic low side of things.

On a separate note, the store were I bought a lot of my fitness equipment seems to have closed. Totally meaningless but there seems to have been a few closures this past month,

Sunnybank seems to have sold at a very slight loss if one deducts the usual expenses. But still higher than purchased just a few months earlier.

Friendly, I dont understand why you are saying that 35 and fifty year amortizations are here to stay? The banks are allowing some mortgages on fixed payment variables to amortize over a longer period but that will only last until the mortgages are renewed in a few years. To the best of my knowledge none of the big six are offering anything more than 25 year amortizations generally but perhaps someone that is more familiar with this can chime in.

Leo.. you rock, am I highly gracious for your correct analysis. Predicting the future.. is not something that statistics can help with. anymore unless you include M2 Money supply and fractional reserve bank requirements in all analysis. As I mentioned, sentiment trumps all statistics.

From: https://www.ctvnews.ca/business/preparing-for-recession-canada-s-biggest-banks-put-aside-2-5-billion-for-loan-defaults-1.6301766

The banks seem to be prepping for something more than just a grind.

Also 35 year anatomizations are here to stay along with 50 year anatomizations in the future.. I find it rare that anyone understands what is happening. I do like your thoughts Leo, the first thing you told me 5 years ago is you were biased toward the market correcting. You forget to look at M2 money Supply. I do thank you and want to pay you one day for your work. You are biased for certain.

It will be fine … no grind … You are missing sentiment in this analysis.

1198 Sunnybank.

Sold $1.685M November 15, 2022

Sold $1.716M Feb 24, 2023