February: Market tightens up due to low new listings

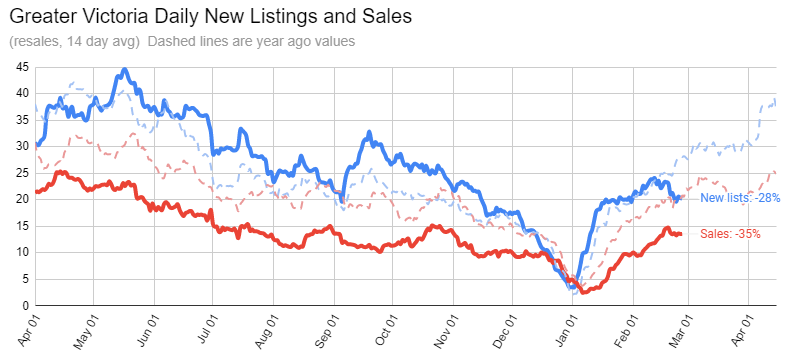

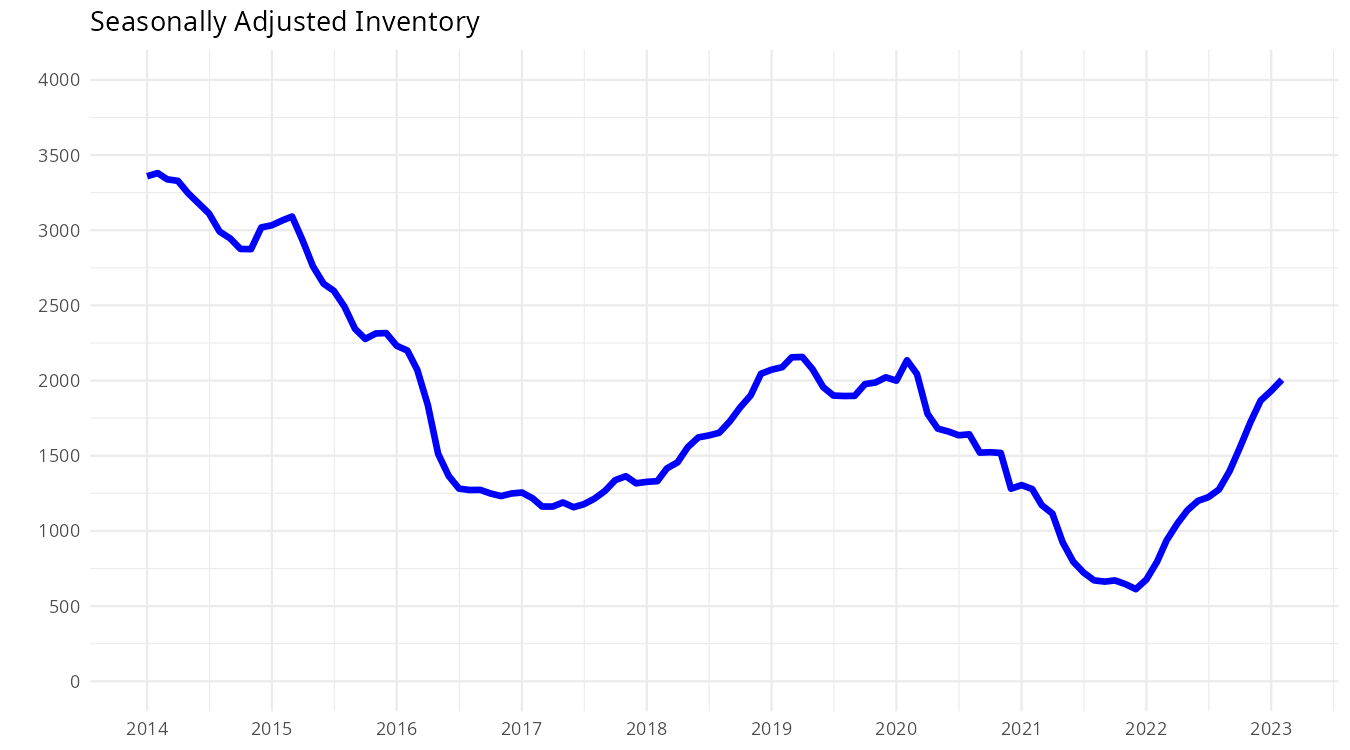

February numbers are in, and though sales were nothing to write home about, the market nevertheless tightened up substantially due to a mid-month dropoff in new listings. After tracking the year ago numbers quite closely in 2023, new listings started dropping midway through February and ended the month down 13% from the year ago.

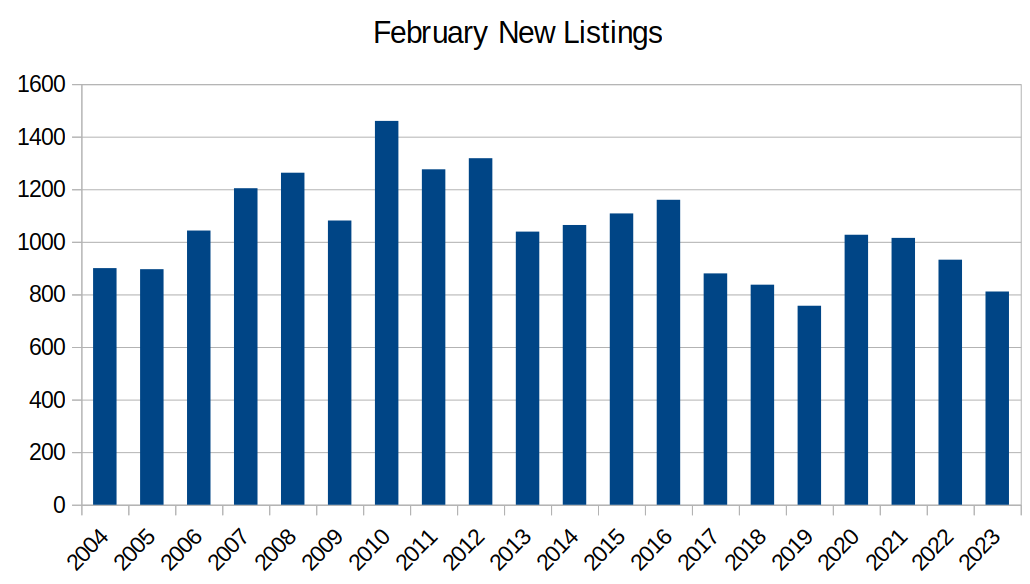

And it’s not that last February was anything to write home about in terms of new listings either. It was already on the low side, which brought this February to the second lowest rate of new listings in 20 years.

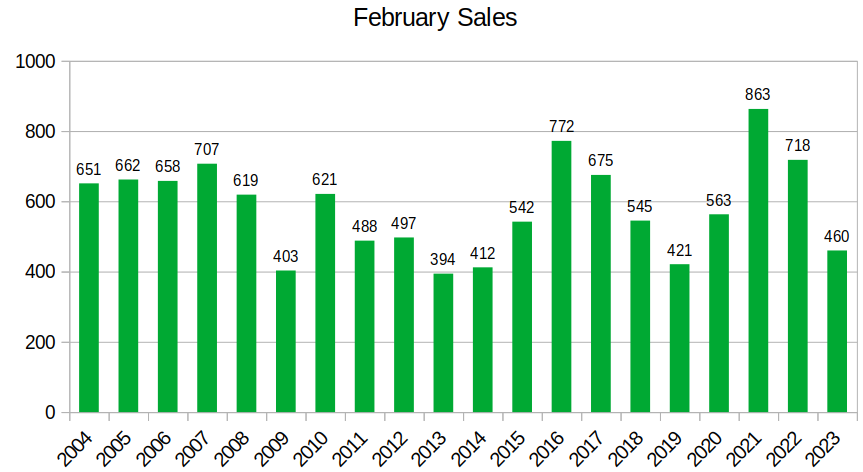

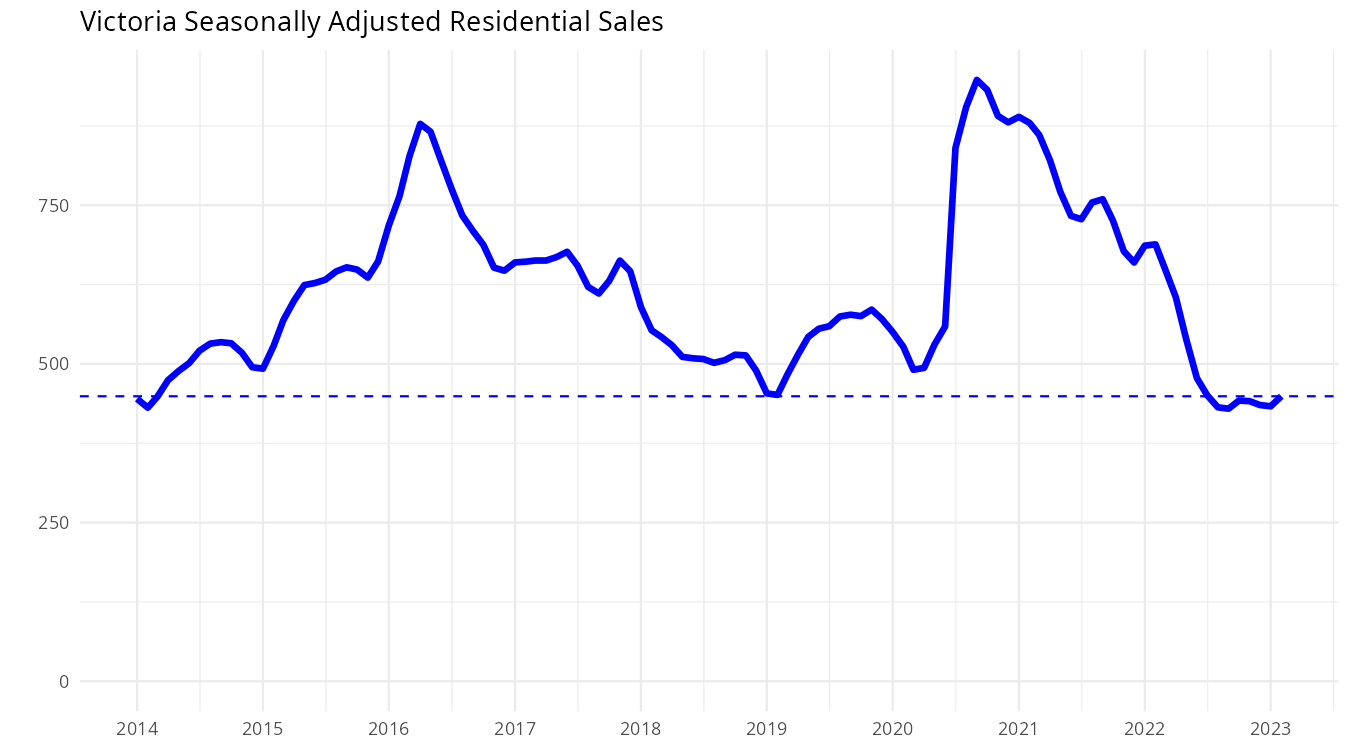

Sales were down even more of course at 36% less than last February. However it’s worth pointing out that it was still a more active month than February of 2013 and 2014 when we had twice the inventory on the market (and lower interest rates).

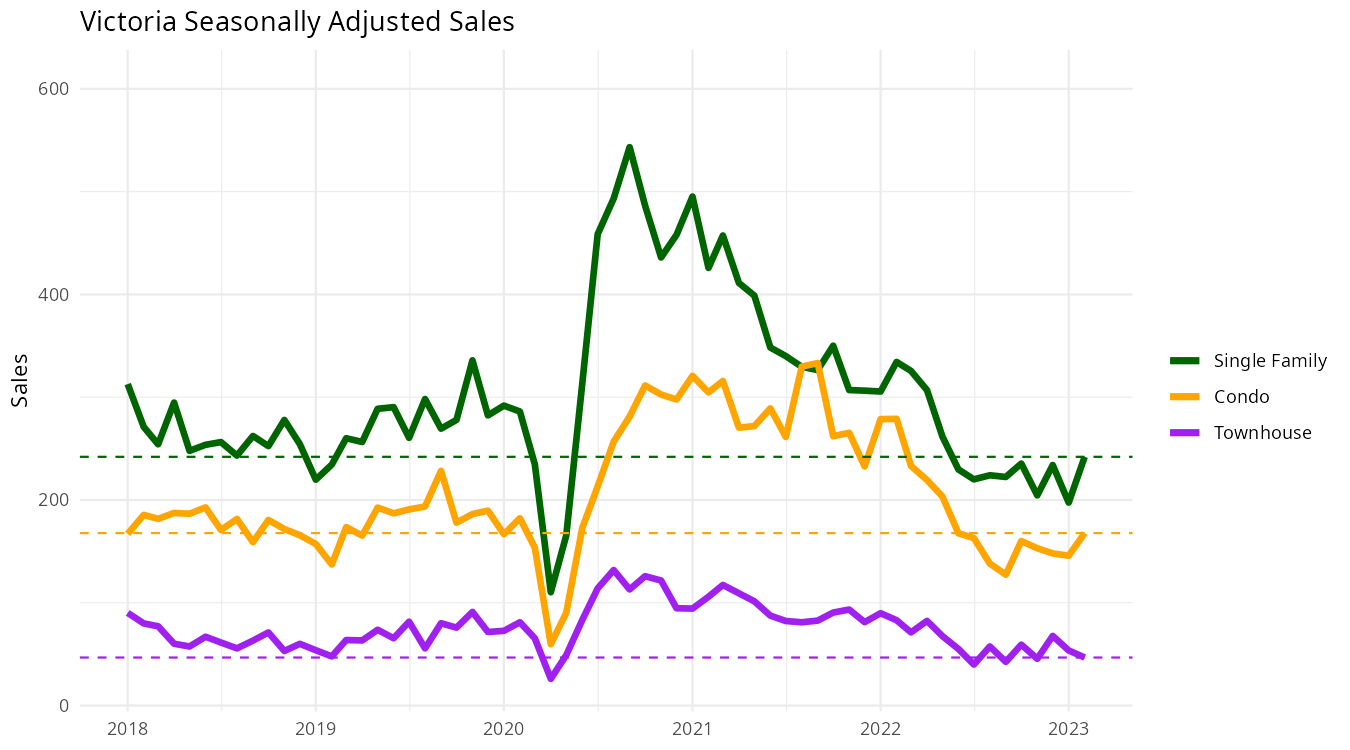

Digging into sales by property type, there’s no great change from what we’ve seen for the last 8 months beyond the usual noise. A small uptick in detached sales, but overall sales have been basically flat since mid 2022.

Inventory is still growing, but if low listings continue in March that could end.

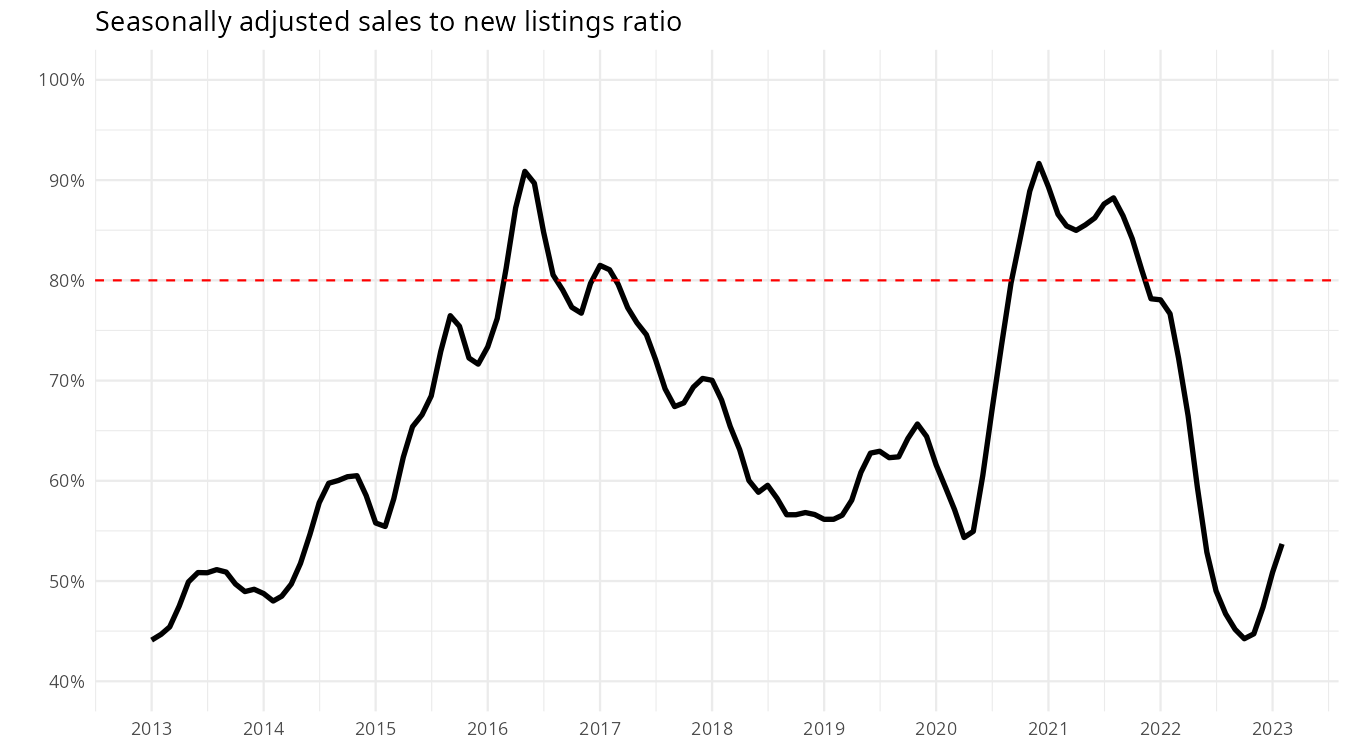

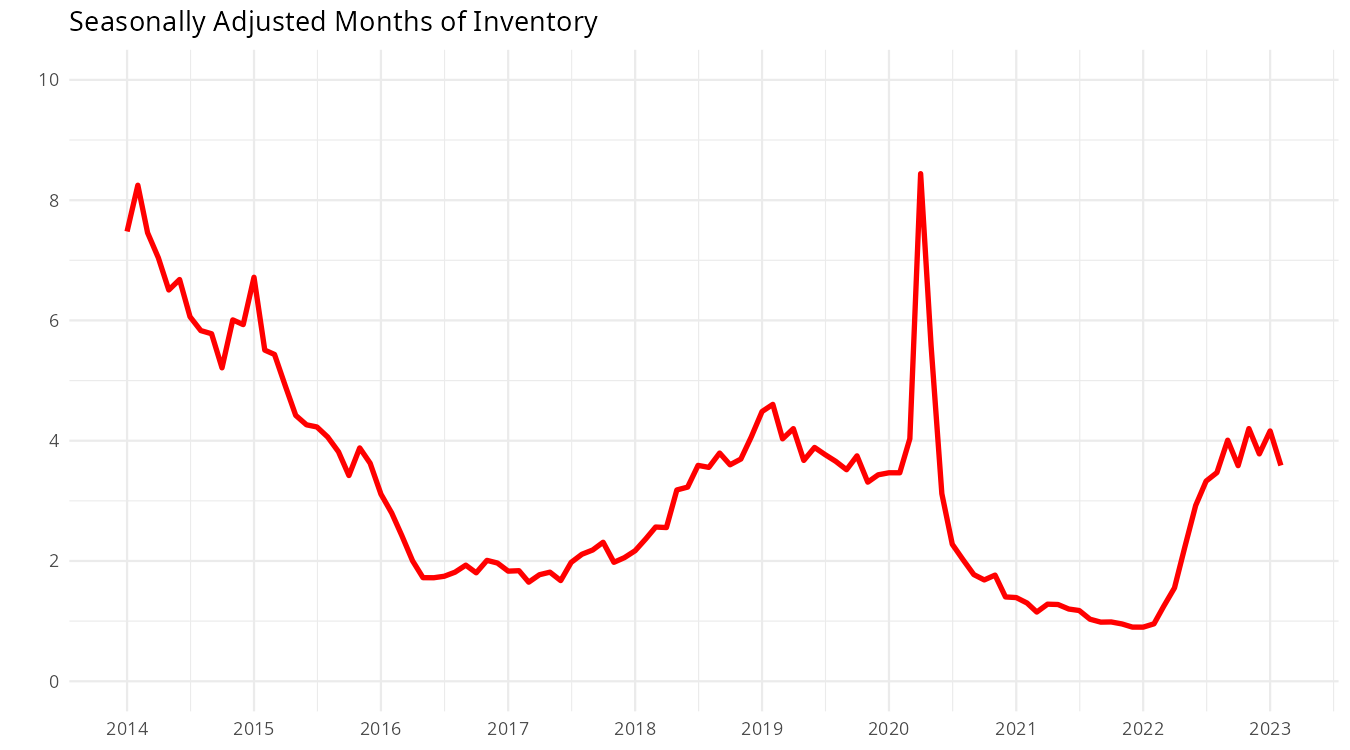

The drop in new listings tightened up market conditions, with months of inventory dropping from January and the sales to new list ratio rising.

Prices have stabilized in response, and the three month average of detached medians even ticked up recently as the very weak November reading of under a million moved out of the window.

More reliable than average and median prices is the median sales to assessed value ratio. The problem is that early in the year it’s always tough to get a reliable read on it, as many sales still have their old 2022 assessment listed, and there is no automatic way to retrieve the updated assessments. Sometimes it takes months for the board to bring in the new assessment data, but this year seems to be better. Of the sales in February, 60% were listed relative to the new 2023 assessments. The median detached property went for 3% under its assessed value, while the median condo went for 1% under. Both were roughly unchanged from the January numbers (based on few sales). For following months I’ll resurrect the chart once the data gets more reliable.

Kicking the can down the road

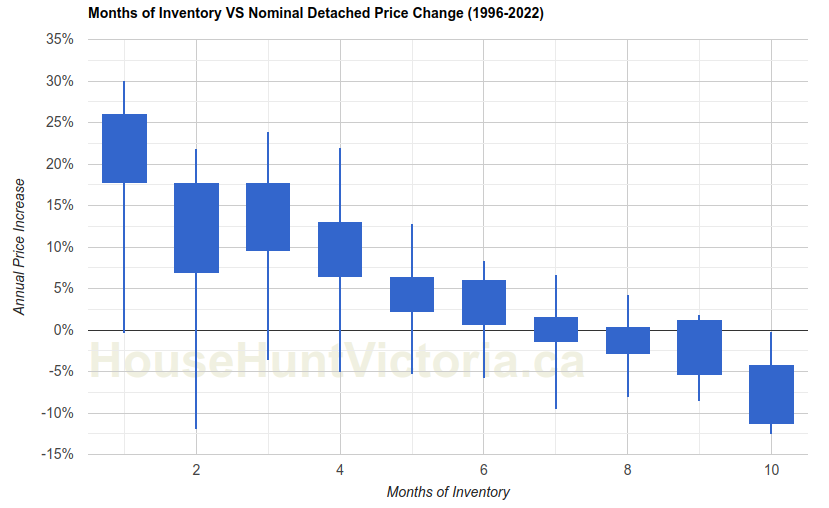

Last month I discussed that with the acute shock of rising rates passing, we need to look at current market conditions more closely. Well with those market conditions stuck in high sellers / low balanced market territory, does that mean prices are about to take off again? It’s worth serious consideration, and if you’re in the market for a detached house that you can afford I would err on the side of jumping sooner rather than later for reasons I’ve discussed. Worth remembering that normally with months of inventory around 4, we have seen substantial price gains around 10%/year (the anomaly of last year’s price drops at 2 months of inventory are clearly seen).

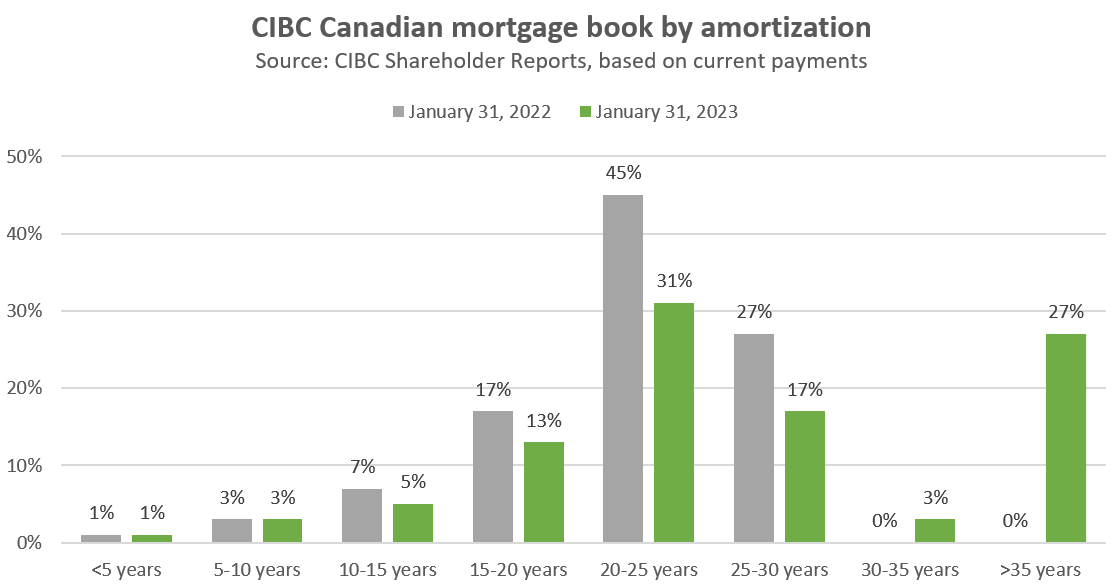

But the idea that the shock is over is also not entirely true. Last fall I was concerned about trigger rates for variable mortgages which make up about a third of outstanding balances. I was puzzled somewhat by the fact that there seemed to be no sign of distress amongst owners, despite many facing huge increases in their monthly payments. Well recent bank financial statements have shed some light on that mystery. Instead of actually increasing their payments, it seems the large majority of borrowers and lenders have decided to kick the can down the road and let their amortizations run wild instead. CIBC disclosed that a full 27% of their mortgage book was at amortizations of over 35 years, up from 0% just a year ago. In fact as a proportion of balances, over 70% of variable morgages are not paying down any principal at all and so have effectively infinite amortization.

The TD mortgage book looks much the same, only Scotiabank has been pushing payments up and keeping variable borrowers in line. What does it mean? Well just as with fixed mortgage holders, most variable mortgage holders have not actually felt the full brunt of rising rates. Instead they are extending amortizations and hoping that by the time renewal comes around rates will have fallen again. Unclear how many simply can’t afford the higher payments to keep their amortizations on track, but it’s clear we don’t yet know how well existing owners will respond to the sharp rise in rates because most haven’t been tested yet.

So despite healthy market conditions, the concern of rising rates is far from in the past. As I’ve mentioned for some time now though, don’t expect substantial price weakness in the short term. The renewal shock will nip at more owners every month which should lead to some more new listings, but I suspect we will need to see a rise in unemployment before we see a bigger shift in the market.

New post: https://househuntvictoria.ca/2023/03/06/no-rapid-rate-relief/

One could certainly look to the retirees as propping up the market, but there is a 20 year trough for those born between 1961 to 1981 who are now between 61 to 42 years today. That means fewer retirees will likely be coming to Victoria relative to the last decade.

The next housing boom may not occur until 2045 when the next boom in retirees is likely to happen.

From: https://financialpost.com/real-estate/mortgages/private-mortgage-risk-flagged-regulators-growth-shadow-banking

At first you don’t succeed, get a sketchier mortgage..

The only smoke being blown is Frank with his constant immigration rants.

People have always wanted to live in Victoria that hasn’t changed. What has changed is the demand for housing at the higher interest rates from prospective purchasers. According to RBC, mortgage applications are down 40% in January and February.

In a conventional economic cycle, pent-up demand builds during recessions alongside high rates of consumers saving money. At this point, central banks will typically attempt to breathe life back into the economy by lowering interest rates and encouraging people to spend more, paving the way for all the pent-up demand that has accumulated to be unleashed. It’s not easy to accurately measure pent-up demand because it is a fairly inexact science. One way is to look at how long people are holding real estate. The longer people hold off purchasing a home the more pent-up demand increases.

There is a difference between those that want to own a home and those that can afford a home. So how are you calculating “pent-up demand” ? Those that want or those that can?

Since we are not in or out of a recession and the savings rate as at Dec 2022 was 5.8% was below the long term rate of 5.99% I would say that anyone saying that there is pent-up demand is just blowing smoke up your arse.

Lots of retirees will move here as always, but they also die after 10-20 years. Over a 20 year period, this will nit contribute to additional demand. Only population increase, especially younger folks, will increase the demand over the long term.

Lots of retired boomers are still having to care for elderly parents (or parent) and have put off relocating. Even if their parents are in care homes, they are compelled to stay nearby to check on their wellbeing knowing the care homes are under staffed. Expect a steady flow of retirees to relocate to B.C. for years to come. Fortunately most will be looking for condos.

Question, as always, is how many and at what price.

I feel like only certain market segments are suffering from lack of inventory. Older 2 bed/2 bath condos 500 to 600k seeing lots of multiples and decent updates $1 million to $1.2 million SFH in the core with basement suite seeing multiples.

Other market segments seems like enough inventory but not enough demand.

Side note, I’ve been involved in two higher end condo sales in Vic West in last 10 days….both buyers retirees from Alberta that had been staying 1 to 2 months in Victoria last 5 +/- years. Despite the doom and gloom it would appear people still want to move here.

Less people trading houses.

This seems to be the opposite of “pent up demand”.

Seems like sales are suffering from the dip in new listings as well. Just need more inventory.

Not sure about the term softening. March will end with substantially more sales than February. The pace of sales per day hasn’t been increasing the way it normally does throughout spring but it will increase. Too early to make an accurate guess but I will guess 650 sales for the month. By next Monday I’ll be able to come in a little more accurate.

So sales have been softening up since mid Feb

It was interesting to read through the various posts about the difference, if any, in value between a bare land strata lot and a vacant building lot. While many believe that there is a simple solution, this type of analysis is difficult as there are many factors to consider, assumptions, and adjustments to be made, and after doing a lot of analysis the final answer may not determinable as it lays within the margin of error in the data. In fact it may not be a value issue at all as it effects on the bundle of rights, that give a property value, is one of taxation which the owner of an individual lot does not retain. The bare land strata fee may be just another form of a tax on land for the upkeep of the common property.

I Leo S, goes ahead and does an analysis, It would be an interesting paper to read as there are so many factors to consider going right down to the basics of what gives a property value in the first place which are the rights given to a land owner. Anytime that one is dealing with a diminishment in value, this is the stuff that makes interesting court cases.

Month to date numbers:

Sales: 66 (down 45% VS same time last year)

New lists: 181 (Down 6%)

Inventory: 1854 (up 106%)

Just a few days here so don’t think too much about the % values.

All I can say is good luck getting 2.5K for that place let alone 5K.

Perfect description of the situation. Thanks.

When the no-client full-fee realtors quit and move on, I wonder how many of them go on to become no-client full-fee financial planners? 🙂

Tough to know as I’ve never tracked my hours and I have a genuine interest in real estate. Even when I am away every day I’ll review every single new listing, sale, and price decrease. Not because I have to, but I find it interesting. While some agents would classify staying on top of everything work and research it is something I do for fun; therefore, how to classify in terms of hours per week.

I don’t sell in Croatia but lately when I am there I’ll research the market and walk around and make real estate videos for fun. This one I made (in Croatian) is almost up to 2,000 views -> https://www.youtube.com/watch?v=Und6Hla44Dw

It would be a better question to ask someone who does real estate with a pure job to make a living mindset.

Meal schedule best to ask my mom, 4 days a week with day 1 posted below, and I’ll pull a Trump on my tax returns 🙂

Day 1

1) 4 x Flat Bench Press (2×10 light, 2×10 max)

2) 4 x 10 Tricep Extension

3a) 3 x 14 Flat Bench Flys

3b) 3 x 10 Decline Push-up

4a) 3 x 10 Over Head Tricep Extension

4b) 3 x 14 Dips

5a) 4 x 10 Goblet Squat

5b) 4 x 30 second plank

Newbuyer, check here: https://www.canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c4-moving-expenses.html#toc8

It says you can only deduct an expense for a year it is actually paid in, so it would have to be claimed on 2022 income tax, but whether it would matter that there was a lag, I don’t know. It is quite common to rent for a bit before buying in a new location, and the market was certainly tough to get in so it seems logical, but maybe a call to CRA for clarity would be wise.

https://www.usedvictoria.com/real-estate-rentals/39688794

My word! $5K a month! Student digs are getting pretty pricey. $2,500 a bedroom.

Marko – Could you provide your daily meal schedule, workout plans and tax returns going back to 1987……..thanks in advance

Marko, over your career, on average, how many hours per week do you work? Please include all time spent driving, texting, phoning, e-mailing, paper shuffling, etc.

I am curious to know.

I have a feeling no one is going to want to pay me hundreds of dollars upfront to do a market assessment on their home when there are 1604 realtors willing to do it at no cost myself included (on a commission structure).

Friendly- You should grab Marko’s offer before he changes his mind, I would.

Let’s say a realtor, who hasn’t made a sale in over 3 months, and has been working with several prospective buyers, finds a property that 3or 4 of them want to put an offer on. How does the realtor advise his clients? How difficult is it to pass their clients to another realtor? Do they split the commission with the other agent after doing most of the leg work? Quite the conundrum.

I would work for $150/hr but that starts with a $500 retainer the minute you make a phone call for me to come look at your property. I arrived at a listing presentation yesterday in Broadmead at 4:22 pm and left at 6:52 pm, I think I got it but not sure, sellers had lots of questions. On a per hr basis I would want to be compensated for $500 +/- for that (it also took me 20 minutes to get there and 20 minutes to get back).

The per hour concept is great in theory, but I don’t know how it would work in reality sending people invoices every month when their property hasn’t sold. Would certainly weed out a lot of overpricing. In the end I think the consumer would have an issue with the model, not agents charging $150-$200/hr.

From: https://www.canadianmortgagetrends.com/2023/03/rbc-saw-a-40-decline-in-mortgage-originations-in-q1/

Doesn’t bode well for any kind of spring take off for real estate sales. Just need that inventory to start growing again.

Even a combination of hrs. spent and commission? Realtors must be plush $!!

I moved to Victoria in 2021 for work but wasn’t able to purchase until late 2022. In 2021 we claimed moving expenses related to selling our home in Alberta. Does anyone know if it is possible to claim land transfer tax as a moving expense in 2022, a year after moving? What kind of justification would make sense? Reality is that the market was tough and we couldn’t find anything we could afford and succeed on an offer before that point, even though we were actively looking. Thanks for any advice you can share. Been following this blog since I moved and always enjoy the content and comments

Thanks for the feedback, I do not disagree. Can I ask this another way? Marco… you are one of the top 10 realtors in Victoria.. or close.. my point is I know most of those top 10 and if I was listing .. unfortunately for the other 1490 realtors, I would list with one of the top 10…… Not going to happen… Marco how much per hr. would you charge me to sell my house? I am ok with $500/hr or $5000/hr. but I doubt you will think like that. I am not going to pay you for your education. I pay Layers $420/hr. for their education. There has to be a realtor out there that will work for a fee??

With 1600 realtors and let’s assume 6400 sales, that would average out to 4 listings per agent. Also assume another 4 sales for the realtor representing buyers, then each agent could average 8 transactions a year. Is that enough to live on? I have no idea what each transaction nets realtors, but with average transactions around $700.000-$800,000 (condos,SFH, townhouses), it might be sufficient.

If you disclose to both parties and they are both okay with it I suppose but its a dumb way to do things imo. Whenever it has happened to me I’ve referred one of the two parties to a different realtor.

This year we will probably lose 200 to 250 realtors by the end of the year. Head scratcher for me is none exiting due to failure to succeed will try something different before they fail like offering per hour services, mere postings, cash back to buyers, etc.

For example, if you have nothing going on mere postings are a great lead generator. Typically when the mere posting seller sells they use the mere posting listing agent to buy.

Now out of 1604 agents find another local agent than myself and my colleauge Matt Bourque offering mere postings. Makes zero sense.

Can one realtor present offers on the same property from 2 different buyers?

A good idea. But likely will mostly hear from out-of-work realtors offering you full-fee services, instead of what you’re asking for (per hour). Same thing happens with supposed “fee-for-service” financial planners, that still want to hook you up for a 1-2% commission each year, and not be happy with the hourly fee.

You can’t blame the RE industry for this though. The problem is out-of-work realtors not taking advantage of the opportunities they can get, and preferring to sit and earn nothing.

In any event, if you do post an ad looking for $/hour RE agents, please let us know the results!

From TD WebBroker.

I added my largest ETF holding ZQQ that produced +304.20% in 10 years to the chart below, along with Nasdaq, Dow, VTI, and XIU.

Where did you get yours data?

Perhaps you should pay more scrutiny to how the data is portray by brokers (cherry pick anyone?).

If you care to try, Google also have comparison option on Google Finance page that you can plug in stock and ETF, but it doesn’t have 10 years comparison.

Throw up a request on Vancouver Island Housing Market FB page. There are currently 1604 licenced real-estate agents with the VREB and there is only enough work for about 400 so I am sure you’ll get a lot of PMs.

CIBC reports that 20% of its residential mortgages are currently in negative amortization (mortgage payment is less than interest charge, so mortgage balance owing increases). https://www.theglobeandmail.com/business/article-mortgage-negative-amortizations-cibc/

Ones that I am aware of are entities that operate in the 9 to 10 figure deal range

The last two Walmart stores are closing within Portland’s city limits. However, there are still 12 stores in the suburbs of the city. Sucks for the inner city low income residents who do most of their shopping there. Crime is the major factor. Also hundreds of jobs lost for nearby residents. That only contributes to the poverty in inner cities, and more people turning to dealing drugs.

There were a few bare land stratas built in Langford where the only thing shared was / is a septic field. The septic field is the only “common property”. The field is separate and each owner has a share in that property….often over 1/2 acre itself in size. Most of those stratas owners are now on a main sewer line. So now there is a good possibility that that land can be sold and the strata dissolved.

2wheels, Saanich’s proposed budget was released this week, on March 1st. Proposed 6.8% property tax increase along with some other increases. Including all municipal taxes and utilities, an average homeowner is projected to pay about $286 more in 2023.

https://www.saanich.ca/EN/main/local-government/strategic-and-financial-planning-1/the-financial-plan.html?fbclid=IwAR09jHSLZXiUmBfKJIaBq7gq2Z3sphTkX91bKoAUc2AnzzUaJzaKM0FjQOw

Yes, in an efficient market this is reflected in the hourly rate.

“Interesting story, Walmart is closing all its stores in the City of Portland primarily because of the crime and druggies )are we not modelling ourselves after Portland).”

While inequality is bad in Canada, it is not as bad as in the US. Our Gini index is much lower (33 vs 42). It may be due to Canada’s socialistic bent and universal healthcare (however bad it is). Our petty crime is mostly limited to downtown area.

“Friendly” …you mentioned if anyone knows of a real estate agent who works by the hour.

Did you mean all the hours the agent has spent over the past years perfecting his skills as well?

For example: People often ask me how long it takes me to do a painting. I always say 55+years….and more often than not….. they are willing to pay:)

Interesting article on rental housing by Michael Geller in the Tyee.

He points out some of the ways past governments have tried various ways to encourage building of rental units at a more modest cost to the tenant.

It’s quite clear that supply is the key. It’s just that many sides of the political spectrum just can’t agree on how best to do that. It’s not easy as often a choice is made for the short term politically gain instead of a long term gain. (Do you want one banana now or if you wait….I’ll be able to give you two banana’s tomorrow)

Anyway, I feel it is worth a good read…… with an open mind.

https://thetyee.ca/Opinion/2023/02/21/Case-Against-Vacancy-Controls-Vancouver/

Interesting story, Walmart is closing all its stores in the City of Portland primarily because of the crime and druggies )are we not modelling ourselves after Portland).

Wonder if we might start losing a few of our downtown retailors for the same reasons. While I feel sorry for the downtown merchants we avoid shopping or going to restaurants downtown these days. Wonder if that might be a growing trend.

Does the sale of 320 Linden have significance? I would guess a few people might look. ~priced ~$200+ K below assessed value?

They dropped their only open house today? Is it sold already? Any idea of bidders ?

Why do realtors not work by the hour? They will in the Future!

I don’t know where you’re getting those numbers from, but the 10 year total return for XUI is 8.72% annually, which means $100 invested 10 years ago would be worth $231 today.

Your point is that looking back 10 years some indexes have done better than others? Well that’s always the case, but you can’t go back in time and pick the winner. Which is why I cover all the bases.

10 years:

Nasdaq +260.29%

VTI +153.57%

Dow +131.93

XIU +67.91%

Add:

ZQQ (Nasdaq-100 ETF) +304.20%

“Insider contacts tell me saanich is in preliminary discussions with some big players (national/international entities) on housing development.”

VicReanalyst, I’ve heard the same. “Big names” was what I was told. Since I don’t know any of the names, I have no clue who they are. Well located piece of public property. No matter who’s involved, it’s going to be an exciting redevelopment when it finally happens. At the rate Saanich moves, it’s years away. Guess: at least 10.

“Second point, not specific to you, but surveillance (my “dog cam” was accidently on and I heard what they said) I find to be incredibly counter productive. Every buyer/buyer’s agent is going to have a different opinion, typically just frustrates sellers and doesn’t improve the odds of a sale in any shape way or form.”

You’re 100% on that Marko, it’s frustrating and counterproductive. I don’t want to know what’s said & I don’t ever want to hear feedback from the buyer’s realtors. The doorbell convinced us to be less willing to instantly disrupt our existence for a showing. Not leaving at a moments notice. One realtor did a very short notice showing & had her clients just stand outside and listen to hear that our neighbourhood was quiet. It seems they been disagreeing about the area’s noise levels.

As for strata – it is massively variable, how much expense the fee adds overall. Our fee is very low & through it I’m paying less for services than my freehold rental property a couple of blocks away is paying. We figure we’re saving money.

Also hold VTI. Actually my largest holding in CAD terms.

Month-end 3-Month total YTD 1-yr 3-yr 5-yr 10-yr Since inception 05/24/2001

VTI (Market price)

-2.33% -1.67% 4.42% -8.19% 11.71% 9.34% 11.82% 7.67%

VTI (NAV )

-2.33% -1.72% 4.40% -8.23% 11.67% 9.35% 11.82% 7.67%

Benchmark

-2.33% -1.72% 4.41% -8.22% 11.69% 9.36% 11.83% 7.69%

I am looking for a real-estate agent that gets paid by the hour in Victoria? If anyone knows any good options, please let me know.

Might want to compare it with Nasdaq and Dow composite.

How times has changed.

This is exactly what the ecowarriors wished for greater amount policies and red tapes.

“tree preservation coordinators at $98k/year” Seems that trees are used as an excuse to stop housing & farming.

https://www.timescolonist.com/local-news/central-saanich-farmers-in-battle-with-council-over-removal-of-trees-6641419

Disguised as a news story, CTV-business is running a sales pitch for a usurious reverse-mortgage company, even going so far as to include a link to apply. Nowhere in the “ad” was there any mention of the costs & fees, or interest rates charged. Shameless!

https://twitter.com/GraphicMatt/status/1631703977900355585

The article talks a lot about increased property taxes which seniors are presumably unable to pay but doesn’t mention the availability of deferral.

Assessment shock: Island property bought for $4,000 now assessed at $2.1 million

https://www.saanichnews.com/news/assessment-shock-island-property-bought-for-4000-now-assessed-at-2-1-million/

Sounds crazy, but I think that’s 11% annualized.

With stories of significant property tax increases in Langford and Vancouver, does anyone have knowledge if Saanich has reason to do the same? Or is the situation more stable in Saanich? Thanks

The strata discount will depend on the value of the house and strata amount, but the mortgage rate will have a big effect. To find the value of the strata house, I would do the reverse of the mortgage payment calculation.

First, set up a mortgage payment calculation for an equivalent freehold house (how much would you pay if there was no strata fee?). Then reduce the monthly payment amount by the monthly strata fee, and back calculate the value of the house. My guess is that, on average, the discount would 3 – 5% and I would add an extra 1 – 2% for the future unknown increases in strata fee.

I mean purely economically let’s say you have a bare land strata at $50/month or $600/year.

Present value is the payment divided by the difference between the discount rate and growth rate.

PV = PMT/ (i-g).

So say the strata grows at inflation of 3% and your alternative investment would yield 7%.

PV = $600/(7%-3%) = $15,000

So your $50/month bare land strata should be $15k cheaper than the equivalent freehold. Maybe people irrationally dislike stratas and that doubles, but still $30k on a million dollar house, not $100-$150k

Most likely a cashflow issue for the developer as the construction loan comes due.

I can’t figure this one out and I follow pre-sale developments quite closely. There is one condo project possibly in Langford that recently completed but the current re-sales are above the pre-sale contracts.

That being said there is almost nothing out there were the pre-sale condo contract is above current market value; therefore, if the buyers couldn’t complete it was a qualifying issue and not an appraisal issues. The developer grabs the 15% to 20% deposit and sells the unit at market value which is going to be at minimum equivalent to the failed to complete contract. It might be annoying for the developer as it is more work; however, they shouldn’t be out financially. And if 10% is the anecdote the reality is probably 5 to 7% failure to complete.

Projects such as the Pearl where people are up >20% on the contract worst case scenario even if a buyer can’t qualify they will get private money at 10% interest and flip the unit.

Build. You’ll prob hear about it in 6 months if it’s got legs and progresses to the next phase.

I wouldn’t waste your time, too much variability as you note. My gut feel is 1 to 5%.

I think he is wrong, but this why I never leave honest feedback anymore when the listing agent asks . Just don’t have the energy. Once a listing agent emailed me for feedback and I replied honestly (poor layout, etc.) and the seller googled my name, found my cell, phoned me, and reamed me out about how I could insult their home in such a manner. When I am asked for feedback now I just say “beautiful home, but not for my clients.”

***note saying you reamed anyone out, just a bit of anecdote

Second point, not specific to you, but surveillance (my “dog cam” was accidently on and I heard what they said) I find to be incredibly counter productive. Every buyer/buyer’s agent is going to have a different opinion, typically just frustrates sellers and doesn’t improve the odds of a sale in any shape way or form.

Someone asked me to do an analysis once on impact of bare land strata on values. I didn’t think there was enough data (and too much variability amongst properties) to come up with a usable answer so I never did it. Maybe I should take another look. But 10-15% discount seems way too high.

Like what?

Insider contacts tell me saanich is in preliminary discussions with some big players (national/international entities) on housing development.

Thanks Marko. Our bare land strata 1990 home is on the market, small cul de sac where everyone feels like it’s freehold as the strata is so basic/only restriction is no parking on the tiny road. A realtor showing the house told their client the other day at our doorbell that the house would sell for 10-15% than a freehold of the same nature would & I’d never heard that before. He was telling them not to buy strata as he was opening my front door, which is quite off putting for the buyer & to me lol.

XIU, my largest holding. I’m OK with this:

The government wants people to be spenders so they don’t feel alone. I see no sign of prudent spending by the government any time in the future. Maybe that’s what some Canadian citizens want, constant handouts.

If they are investing in a manner that is sensible for most people they are doing about as well/as poorly as the market in general.

With the market 10% off all time highs it’s not that painful a time to be an equity investor, particularly if you have been investing steadily for the last few decades.

Not sure how I feel about it, big picture (obviously lenders doing what is in their best interest). As I mentioned a few weeks ago go drive through Kettle Creek and note the cars on the driveways. We just keep encouraging this type of consumer behaviour by accommodating. It is like the government doesn’t want people to be prudent savers, they want spenders financed by debt.

Meh….the dividends keep rolling in. Knock on wood none of my holdings have cut their dividend and some have increased their dividend. It is like a rental property. You don’t see much year to year or even in five years. Principal re-payment, rent increases, value appreciation certainly noticeable when you get into 10-15-20 yrs. With investing if you buy really boring stuff and re-invest the dividends into more boring stuff it tends to do well long term.

and they will quietly ignore that two tree preservation coordinators they will have to hire to work the new tree bylaw at $98k/year each.

Looks like the City of Victoria was at $91k/year back in 2021 for tree preservation coordinator staffers -> https://www.victoria.ca/assets/City~Hall/Documents/2021%20Statement%20of%20Financial%20Information.pdf

Like Stu or not, Langford to get a dose of reality coming up real fast and of course the new council will spend the next four years blaming Stu each year they table a large property tax increase. If you are going to bring in a tree bylaw that is going to hamper development and require additional staff, that’s cool, but don’t complain about taxes then.

You’ll notice this is another Abstract Development. If it isn’t Abstract, it is Aryze.

Note what Leo posted in the previous thread

So basically, the middle class (staffers at Saanich/Victoria and elected council members) put in procedures and policies that create for an insane barrier to entry where we basically have Abstract and Aryze dominating the townhome/wood-framed condo market. I think both companies own around 20 to 30 development properties each in Greater Victoria.

Why? Because two hard-working carpenters, electrician, plumbers, whatever, etc., do not have the resources to wait 6 years for a rezoning that barely passes. They could probably swing 2 or 3 houses, but the 6 years is a different story. When you have 20 to 30 properties you’ll always get 2 to 3 through every year.

Then the middle-class bitch about the wealth gap. Well no s*** the owners of Abstract and Aryze are going to be extremely wealth when no one else has the resources to gamble with the rezoning process.

I have nothing against Abstract and Aryze as they have had to battle to where they are and it is well deserved success, but it would be a better marketplace if more smaller builders/developers with less overhead could participate.

Not close in my opinion; I would say 1 to 5%? I lived on a three lot bare land strata (we each had 1/2 acre but a common lane). I would defintively prefer to be on freehold; however, I wouldn’t rule out the perfect home if it was on a bare land strata especially newer where you don’t have to worry about the sewer/water/etc. main rupturing. All things equal defintively avoid bare land strata and go freehold as the discount is minimal.

Question for Marko… do SFH on bare land strata sell at a 10-15% discount compared to the same home that’s freehold?

So… they’re paying rent to the banks without any rental protections, and putting down a bunch of money for that privilege.

And they have to pay all the expenses, and they owe more every month…

UVic announces 4 per cent budget cuts across the board

https://www.cheknews.ca/uvic-announces-4-per-cent-budget-cuts-across-the-board-1143014/

Reminds me of “exploding mortgages” south of the border.

https://www.theglobeandmail.com/business/article-mortgage-negative-amortizations-cibc/

“Damn you beat me to it Leo, LMAO I was about to give Rodger a lesson on how lending works!!

You guys are looking at Balance Sheet. I am looking at the Income Statement and Cash Flow Statement.

https://www.ctvnews.ca/business/scotiabank-rethinking-strategy-as-results-hit-by-high-funding-costs-expense-growth-1.6292491

BNS profit went down from $2.74 B to $1.77 B from last year and the primary reason is the funding cost. Their Net Income Margin also slightly went down (from 2.2 to 2.1), and this will keep going down until the interest rates start to go down.

https://twitter.com/j_mcelroy/status/1631348616626331675

Damn you beat me to it Leo, LMAO I was about to give Rodger a lesson on how lending works!!

Vancouver has the lowest property taxes relative to ownership costs and rents in Canada. Even if the total tax bill went up 10% – and it won’t because school taxes are a big part of the bill – I don’t think it would get many people to sell or move.

Rising rates and falling prices are another story.

Leo, you’re like a robot — you don’t look at your portfolio; your house is just a house, etc. Do you have emotions? 🙂

Landlords at some point would transfer the cost to the tenants or get out of the rental business altogether. More people at 55 and over are likely to look into property tax deferment. But, I don’t think it would affect sales.

Their fixed book is at those rates, but their variable book is at current rates. The fact that it’s not being amortized just means they get more money in the end (assuming no widespread losses)

“Variable rate mortgages have always been prime based so not sure I follow your logic here.

My point was that the VRM payments have been pushed further into the future by not adjusting the payments for interest rate changes (increasing the amortization term) – Extend and pretend that everything is OK. Future payments are uncertain, especially in a recession. But banks’ funding costs have gone up much higher in the last 12 months. They are paying 4.5 – 5.0% for GICs but mortgage payments are coming in at 1.5 – 3.0%.

Oh I already tweeted about it and spoke at the meeting in support of staff’s recommendation. Total disconnect between staff that is following the new provincial guidance (that OCP compliant projects should bypass public hearing) and council that is stuck in old ways and wants to retain control over every little detail.

And for what? Everyone can waste another 5 hours talking about height and parking and then council will approve it because it’s exactly the kind of project envisioned in the shelbourne valley action plan.

Well invested in stocks and happy with them as I think the stock market will rebound faster than real estate

I note the option to expand cities is conspicuously absent.

That said, Eby announced yesterday that there will be no new development in the province.

That’s because they all sold their stocks at the peak. 😉

probably going as well as the equity portion of whatever retirement portfolio you have?

Variable rate mortgages have always been prime based so not sure I follow your logic here.

Fine. 7-8% annualized return since inception. I literally never think about it or look at it other than when I add money a couple times a year.

City taxes are only a little more than half the tax bill though.

@Introvert – better than last year. I just do the couch potato index investing thing but I’m 95% equities and it’s been a wild ride the last year or so. Between my variable rate mortgage and the stock market, I’m a bit more anxious every day than last year about our family’s financial situation. But hey – I think there is going to be an even better sale on stocks this year than last year so I’ll continue to buy as I’m in it for the long run. I do keep myself up at night wondering why I didn’t lock in at 2.3% a year ago, but hindsight, 20/20, sunk costs etc, all I can do it plan better moving forward. I’m guessing that the broader stock market is in for more losses this year as the reality of the (even if it’s relatively shallow) recession weighs in. I don’t think the market has priced in all the recession and negative outcomes coming this year and next yet.

People haven’t mentioned how their stocks are doing for a while now. How are things going? 🙂

“Incorrect, NIM is not negative. you do realize that when a lender provides a 5 year fixed mortgage at 1.7% in 2020, it is hedged right?

My comment is specific to VRM. The banks are getting low interest payments relative to their funding costs.

LMAO

Banks are punished because people might default on their loans and loans are assets on their balance sheet and that asset gets devalued. Not because they lent out at lower rates couple of years ago and rates are higher now.

Vancouver property taxes going up 10.7% will probably motivate more people to sell, and look to the Island to relocate.

Incorrect, NIM is not negative. you do realize that when a lender provides a 5 year fixed mortgage at 1.7% in 2020, it is effectively hedged right?

Canadian RE has been kicking the can from 2008. Unlike the US RE, we never had a reckoning in 2008, which could have reset the market to sanity. The result is that our market is double the price relative to incomes. The current RE owners will pay the price for this.

“It benefits the lenders as now they can obtain interest payments from borrowers for longer and if they have the view that RE will always go up in the long run then the value of their collateral is also expected to increase providing security against any defaults. The Bank would rather you never pay off your mortgage if you haven’t noticed……

It is not without pain for the banks. The banks’ Net Interest Margin received (on paper) is negative as their borrowing costs are much higher than interest payments from mortgages. Much of the interest payments are pushed to future receivables, and these are always uncertain. That’s the reason, the bank stocks are punished after reporting the earnings. If we enter a recession, banks will lose half their value as future receivables may not be paid in full.

In its first-quarter earnings release, CIBC said that of its $72-billion variable-rate mortgage portfolio with an amortization over 35 years, $52 billion “relates to mortgages in which all of the fixed contractual payments are currently being applied to interest” as of January 31. For those whose payments can’t meet their contractual payment obligations, that amount is being re-applied to the principal, the bank said.

Patriots I would agree i think rates just normalized In time asset prices will just get baked in at these borrowing costs

From the article:

What character? There’s literally a parking lot for buses right there.

Put a 1 in front of today’s rates and we’ll start talking about extreme highs.

More news that will make Leo’s head explode:

Six-storey Shelbourne condo complex goes to public hearing after neighbours call for more discussion

“It’s very clear tonight, the public has an interest in having a public hearing,” said Coun. Colin Plant.

“I think it’s important that sometimes when the public says ‘We’re uncomfortable with this’ that we listen.”

https://www.timescolonist.com/local-news/six-storey-shelbourne-condo-complex-goes-to-public-hearing-after-neighbours-call-for-more-discussion-6634908

It benefits the lenders as now they can obtain interest payments from borrowers for longer and if they have the view that RE will always go up in the long run then the value of their collateral is also expected to increase providing security against any defaults. The Bank would rather you never pay off your mortgage if you haven’t noticed……

The HELOC loans aren’t designed to help borrowers, they are designed as a means for the lender to get more interest income that is secured by collateral (i.e. the house)

Yeah I don’t actually disagree with what the lenders are doing here. They want to keep people paying their mortgages and it’s a good thing that fewer people are being forced out of their homes. But that doesn’t change the facts.

It’s like a game of “chicken”. We’ll see who can kick the can the furthest, the banks and borrowers, or the BoC.

You would think, but then people so often elect governments that are not in their best interest (see current city, provincial, and federal governments).

From a pharmacist??

Just in time for the recession around the corner. Hopefully inflation is kicked by then, otherwise they get high rates and nothing to pay them with.

They’re not hiding anything for existing borrowers, they’re just allowing them to pay interest for longer.

Excellent article. I really dont expect us to see the impact on variable rate mortgage holders for about another year. About 25 per cent of mortgages come up for renewal every year and that when the rubber hits the road for most people. But I suspect that the vast majority of mortgage holders will be fine although rather stretched. The question becomes how many people on the margins will have to sell and will it be enough to have any noticeable impact. Personally I have no idea and partially it will be impacted by further rate hikes down the road.

Leo I think you’re spot on with this analysis.

The truth is that mortgage carrying costs for new buyers are still at extreme highs.

The expectation has been that as mortgages roll over this year and next that distressed sellers would floor the market. However, the decision by banks to prolong amortizations may mask this fundamental shift.

However, the odds that sales volumes and prices will rise back into bill market territory in the near term are virtually zero, so long as rates stay high and prices fail to fall substantially.

Banks may be happy to hide the interest payments for several years for borrowers with existing loans, but you can be damn sure they will collect every penny of interest from anyone who signs on to a new loan right now!

As a result, we could be stuck in a the doldrums for quite some time.

To my earlier comment re presale buyers unable to complete. About 10% according to this anecdote

5 year yield ripping. Seems not so long ago there was a real chance insured mortgage would start with a 3.

https://www.timescolonist.com/local-news/langford-considers-big-tax-hike-not-enough-firefighters-pool-could-close-without-bigger-subsidy-6634877

Good article as usual Leo, increasing the amortization is quite a game changer. All that inventory that might have been put up will sit in the sidelines, exacerbating the low inventory. It is great that these people can stay in their homes, but it does somewhat circumvent the market.