2023 Predictions

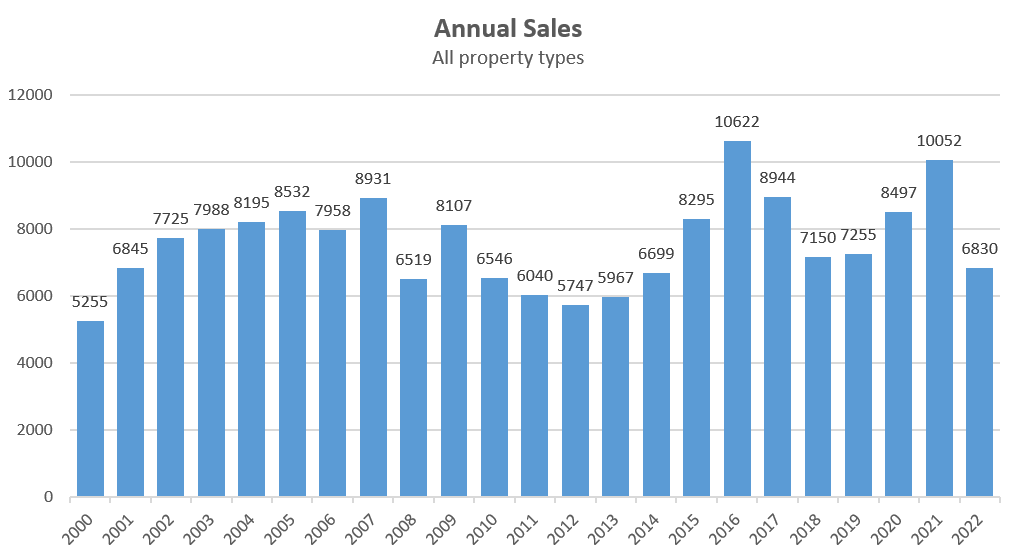

Well we’re closing out another year and what a tumultuous one it was, swinging from epic bidding wars and mania to rapid rate increases driving the biggest drop in prices the Victoria market has seen in 40 years. As regular readers know, every year we make predictions on this blog for what will happen in the real estate market, but unlike any other forecasters, we actually review those predictions a year later and see just how close or (more likely) far off they were. One than being entertaining, the point of this retrospective is to remind people that though there are some metrics that correlate with future market prices, that doesn’t make the market predictable in any meaningful way on a short time scale. Nearly every year forecasters are surprised by something that few or none predicted.

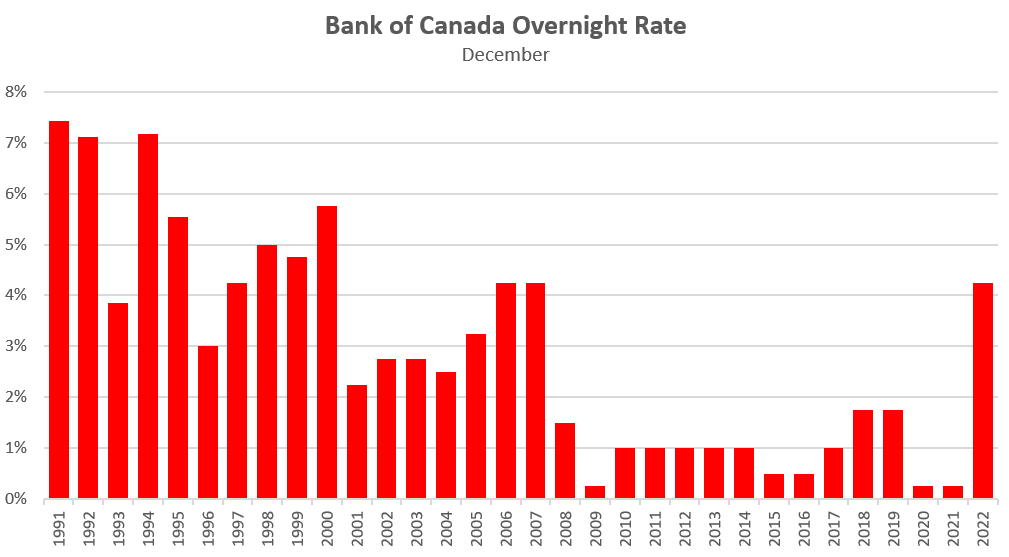

This year was another one where no one saw what was coming, which is that interest rates absolutely clobbered the market. Out of 65 predictions, not a single person guessed that the Bank of Canada overnight rate would end the year up a staggering 4%. But before we get into that, here are all the predictions for 2022 from a year ago.

| Name | Annual Sales | Q4 Single Family Median | Q4 Condo Median | Inventory (Dec) | BoC Rate |

|---|---|---|---|---|---|

| Leo | 7400 | $1,300,000 | $605,000 | 1400 | 0.75% |

| Aaron Vaillancourt | 9125 | $1,126,000 | $592,500 | 2150 | 1.00% |

| Jr | 8450 | $1,310,000 | $602,000 | 793 | 0.31% |

| Jaysteve | 7200 | $1,525,000 | $675,000 | 750 | 1.65% |

| Shawn Dhanda | 7750 | $1,340,000 | $615,000 | 1200 | 0.50% |

| Carl | 8889 | $1,275,000 | $599,000 | 1200 | 0.50% |

| Frank | 6500 | $1,500,000 | $650,000 | 800 | 1.00% |

| Karen | 9100 | $1,100,000 | $500,000 | 1000 | 0.75% |

| Magnus | 9000 | $1,250,000 | $570,000 | 2650 | 1.00% |

| caveat emptor | 9500 | $1,350,000 | $599,999 | 1300 | 0.75% |

| levelmaterial | 9000 | $1,250,000 | $650,000 | 1000 | 0.75% |

| Small Time Developer | 9500 | $1,295,000 | $590,000 | 770 | 0.75% |

| Marko Juras | 8000 | $1,275,000 | $585,000 | 1200 | 0.50% |

| AM | 8500 | $1,375,000 | $605,000 | 700 | 0.75% |

| Dane | 9400 | $1,350,000 | $720,000 | 1134 | 0.50% |

| Megan | 8250 | $1,000,000 | $540,000 | 700 | 0.75% |

| boosicaboos | 9000 | $1,400,000 | $650,000 | 900 | 0.75% |

| The Underwriter | 6000 | $1,369,000 | $690,000 | 1000 | 0.75% |

| DuranDuran | 7000 | $1,210,000 | $579,000 | 850 | 0.75% |

| Lee Chambers | 7200 | $1,325,000 | $612,000 | 950 | 1.25% |

| gwac | 9000 | $1,400,000 | $700,000 | 800 | 0.50% |

| Rob W | 9750 | $1,450,000 | $650,000 | 700 | 0.55% |

| Dave T | 9000 | $1,400,000 | $700,000 | 600 | 1.00% |

| Potsticker | 0.70% | ||||

| Bluebird | 10000 | $1,240,000 | $560,000 | 900 | 0.50% |

| Mike Grace | 7500 | $1,175,000 | $575,000 | 1000 | 0.50% |

| NE14T | 9058 | $1,543,500 | $687,350 | 512 | 0.50% |

| Patrick | 8500 | $1,350,000 | $610,000 | 800 | 0.75% |

| Steve H | 7000 | $1,100,000 | $535,000 | 1800 | 0.75% |

| FatiguedBuyer | 8100 | $1,350,000 | $625,000 | 750 | 0.75% |

| numbers hack | 6500 | $1,475,000 | $625,000 | 400 | 0.50% |

| Boris | 9000 | $1,380,000 | $670,000 | 1000 | 1.00% |

| Laurie | 11,500 | $1,350,000 | $499,000 | 825 | 0.75% |

| Melissa | 8600 | $1,222,000 | $600,000 | 600 | 0.75% |

| Mt. Tolmie Foothills | 12000 | $1,100,000 | $550,000 | 1500 | 0.75% |

| iTz Nordic | 1200 | $1,350,000 | $630,000 | 1000 | 0.75% |

| Manocorp | 11000 | $1,400,000 | $595,000 | 800 | 0.50% |

| David | 7200 | $1,395,550 | $644,955 | 1025 | 0.80% |

| Eric | 8605 | $1,305,000 | $620,000 | 1000 | 0.75% |

| alexandracdn | 9800 | $1,359,000 | $636,000 | 600 | 0.75% |

| mcd80 | 8500 | $1,350,000 | $620,000 | 1000 | 0.50% |

| ZoiLivia | 9610 | $1,390,000 | $800,000 | 560 | 0.25% |

| Elderly Millennial | 8200 | $1,350,000 | $650,000 | 1200 | 0.50% |

| Baba Yetu | 10000 | $1,100,000 | $475,000 | 1000 | 1.75% |

| Jijesh | 7235 | $1,133,000 | $580,350 | 1456 | 1.25% |

| Talon | 9428 | $1,312,550 | $584,000 | 888 | 1.25% |

| Will P | 6500 | $1,500,000 | $700,000 | 800 | 0.75% |

| Cadborosaurus | 6500 | $1,250,000 | $520,000 | 2000 | 0.50% |

| Silky | 8500 | $1,400,000 | $565,000 | 700 | 1.25% |

| MyCurrentObsession | $1,358,500 | ||||

| Deryk Houston | 8500 | $1,459,000 | $640,000 | 700 | |

| Frank.the.tank | 8000 | $1,500,000 | $650,000 | 1300 | 0.50% |

| Newhomebuyer | 7600 | $1,420,000 | $655,000 | 1300 | 1.00% |

| brent | 7800 | $1,310,000 | $610,000 | 1300 | 0.75% |

| Rick Maher | 7000 | $1,050,000 | $725,000 | 500 | 0.75% |

| Hs | $1,350,000 | $600,000 | 950 | 0.50% | |

| Misha S | 9000 | $1,400,000 | $640,000 | 800 | 0.50% |

| Marc Trot | 8850 | $1,155,000 | $535,500 | 1362 | 1.00% |

| Shef | 7000 | $1,400,000 | $625,000 | 1100 | 1.00% |

| Josh moto | 9245 | $1,330,000 | $589,000 | 490 | 0.50% |

| Fox | 431 | $1,600,000 | $750,000 | 174 | 0.25% |

| Ira Willey | 10000 | $1,450,000 | $800,000 | 500 | 1.00% |

| Sakthi | 10500 | $1,200,000 | $600,000 | 500 | 0.50% |

| Tomie Thomas | 10890 | $1,289,000 | $608,000 | 750 | 1.00% |

| Tox Dioxin | 8550 | $1,450,000 | $640,000 | 750 | 1.00% |

The median guess for each was:

Sales: 8525

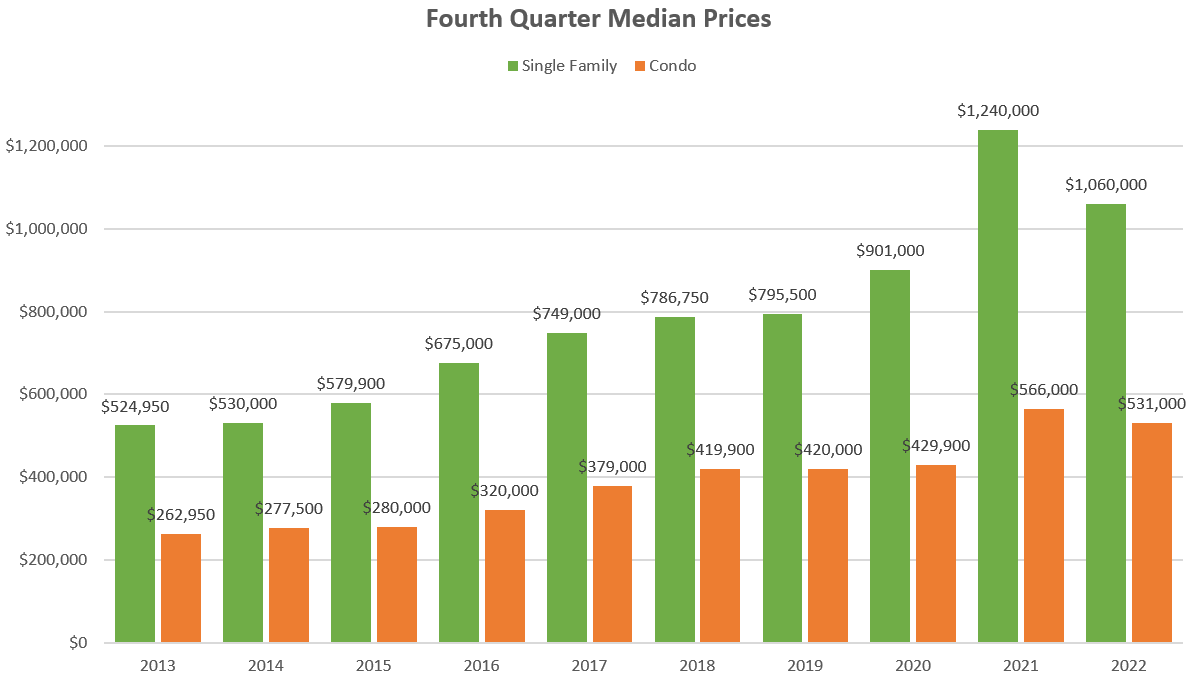

Single Family Median (Q4): $1,350,000

Condo Median (Q4): $612,000

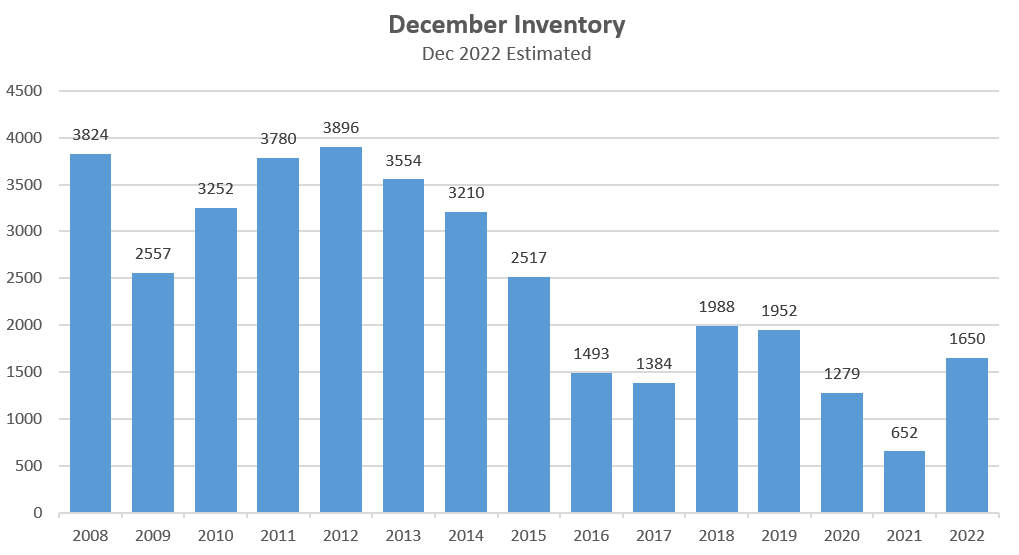

December Inventory: 900

Bank of Canada Rate: 0.75%

And though we have a couple days of sales left, we’re close enough to estimate the actual values for this year which are:

Sales: 6830

Single Family Median (Q4): $1,060,000

Condo Median (Q4): $531,000

December Inventory: 1650 (subject to a bit more uncertainty until we get the final count of cancelled listings)

Bank of Canada Rate: 4.25%

As you can see the typical prediction was way off again this year, with nearly everyone (including yours truly) predicting that rates would rise only slightly and prices would remain high. That said, the closest guesses on sales were DuranDuran, Steve H, Rick Maher, and Shef, all predicting 7000 sales. On single family prices the winner is Rick Maher with a guess of $1,050,000. Steve H got the closest to actual condo prices with a guess of $535,000, while Mt. Tolmie Foothills and Steve H were closest on inventory with the winner depending on the exact final figure. Everyone lost on rates, with the top guess of 1.75% still being wildly below reality.

The overall winner is Steve H, who got quite close on sales, prices, and inventory. Congrats! Please keep your speech to a minimum.

2023 Predictions

Last year I noted that one of the big risks to the market was government action. I was thinking more of interventions in the market rather than the huge rate hikes we saw, but the government did act, with both the provincial and federal governments making several housing related announcements. However while the provincial supply-side talk is promising, and short term actions like lifting rental and age restrictions will affect the market, others like the federal foreign buyers tax and provincial rescission period won’t move the needle. The action we saw in 2022 also took a lot of risk of further action off the table. Though we may get a flipping tax federally or provincially, that won’t have an appreciable impact. Meanwhile we haven’t heard a word about potentially impactful measures like an increase in the down payment requirements for investors.

Last year I said that fundamentals like incomes and affordability still mattered to the local market, even though that was hard to see after 18 months of rapid price increases partially driven by a jump in wealthy out of town buyers. However 2022 proved how critical those factors really are, with rising rates crushing buying power for a large group of buyers and prices dropping to compensate. The wealthy kept buying, but they aren’t enough to sustain the entire market. In order to see a recovery, we need ordinary buyers to return to the market and that can only happen if they can afford to do so. Some help has already come in terms of price declines which counteracted rising rates while incomes rose and inflation ate at prices. However we’re still some ways from affordability returning and would need to see some combination of further price drops, a rise in incomes, or drop in rates to bring it back.

Without further ado, here are my predictions for 2023, along with the historical values to help you make similar predictions:

- Sales: 5800. I believe a bit of activity will return from current levels but the market will stay sluggish all year. Without the high sales we saw last spring, total sales will end up similar to the slow market from a decade ago.

- Single family Q4 2023 median: $999,999. I believe single family prices will essentially stabilize very close to current levels in 2023 (the November median price was just under a million). Not necessarily because we are at the ultimate bottom for prices, but I think the magnitude of the decline we’ve already seen will bring some buyers back, while a stabilization in rates will mean that the shock the market endured is at an end. I also think that prices will be extremely sticky below a million dollars. Anything above a million needs $200,000 down which is a huge step for buyers when the bank of mom and dad is a lot more skeptical, and they can’t count on free money from an ever escalating market. Below the seven figure mark I think there is sufficient demand to keep buyers in the game with the rest of the economy still quite supportive. I believe a more severe second leg down in detached prices would require either rates to keep increasing, or a recession with substantially higher unemployment rates. I don’t expect the former in 2023, and I think the latter if it does happen won’t really bite until the following year.

- Condo Q4 2023 median: $495,000. Condos I believe will be slightly weaker than detached next year, reversing the trend from 2022. Weaker demand from investors struggling with cash flow, and poor affordability will push down prices. However high rents will go some way to supporting the market until the second half of the year when I think unemployment will start to rise from a weakening economy and reduced pressure from population growth. A relatively high level of apartment completions in 2023 should also help reduce pressure from still relatively low inventory levels. The provincial changes to strata rules may cause some more listings and sales churn but shouldn’t move prices as a whole.

- Inventory: 2400. I believe inventory will continue to grow in 2023, though not quite as quickly as it did this year.

- Bank of Canada rate: 4.5% I think there will be one more quarter point bump in January before the central bank feels confident that the economy is sufficiently slowing. By March inflation will start to fall quite quickly and further rate hikes will not be necessary. While I think the economy will weaken or fall into recession in the second half of the year, I don’t think we will see rate cuts until 2024. Just as they were slow to act in raising rates, I think a spooked central bank will want to ensure their work is done before letting off the brake.

Again we’re doing the same predictions in the Vancouver Island Housing Market Facebook group, so to facilitate collecting responses, I’ve set up a survey.

Click here to submit your predictions for 2023

What do you think will happen in our housing market this year? Leave your prediction for sales, single family price, condo price, inventory, and interest rates using the form above, then drop them in the comments below to discuss. What else do you expect to happen in 2023?

New post for final December numbers: https://househuntvictoria.ca/2023/01/03/december-the-end-of-a-tumultuous-year/

So your saying no one was able to leave China in 2022 other than illegal human trafficking? Wow thanks for that insight!

I won’t call leaping to your death from your apartment balcony frustration. Sorry, China doesn’t provide the data on how many people opted for this escape route.

So basically no, gotcha.

Yes, the Chinese weren’t able to travel as freely during Covid years. And the surge of interest of Chinese in emigrating to Canada is well documented, such as this dec 13, 2022 Vancouver sun article. So much that the Chinese government controlled search engine (Baidu) suspended use of the search term “immigration to Canada” in April 2022.

https://vancouversun.com/opinion/columnists/douglas-todd-chinese-interest-in-emigrating-to-canada-jumps-28-times

“ Chinese interest in emigrating to Canada jumps 28 times

Analysis: The explosion of queries in China about immigrating to Canada is an expression of frustration with the Communist regime”

“China’s most popular internet search engine experienced a 28-times surge in residents looking up the terms “conditions to immigrate to Canada” during the populous country’s severe COVID-19 pandemic lockdowns.

According to an internal Canadian immigration department report obtained under access to information requests by a Vancouver immigration lawyer, the search engine Baidu saw soaring interest in “immigration to Canada” and “immigration” before it suspended use of the terms in April.

In an unusually candid memo, an unnamed Hong Kong office staff member recounts with regret how she is having to say goodbye to many of her friends because they are taking advantage of their long-held Canadian passports to permanently move to Canada.

Vancouver immigration lawyer Richard Kurland, who obtained the documents, said Chinese nationals’ sudden leap in wanting to emigrate to Canada reflects their frustration”

100% with you on this one, Deryk.

“Many of us here are so fortunate to have what we have.”

….isn’t that the truth!

I know I do thank all the people who have supported my work for many years. I feel blessed every day.

It is not easy out there for many people. I don’t know how they face the end of each month.

Keep an eye out for someone who needs your help and try to do what you can to help.

Have a good year.

Ahh the immigration boogeyman again. Are you able to confirm that people in China were not able to travel to Canada up until now?

LMAO

Lots of doom and gloom out there for sure. What some are forgetting is that we are 2 years away from elections in the U. S. and Canada. No one wins an election in a recession, so I also predict that inflation will magically go down to 2-3 % and interest rates will follow.

After 3 years of draconian lockdowns in China, the citizens are finally free to travel. I can’t imagine how many Chinese people want to escape their country. The wealthy will try to get their riches out of the country, maybe they already have through one of the thousands of cryptocurrencies that exist. They will figure out a way around the foreign buyers ban, either through relatives that already live here or through bogus businesses. I understand that the ban excludes recreation properties.

I also predict that the war in Europe spills over to other countries and creates even more refugees. Canada remains one of a few safe havens in the world and I don’t think our government will put up many barriers. Lots of problems out there and few places to run and hide.

Not all older people are rich for sure. I helped a couple of (male) seniors today by requesting on-line for them the $500 one time Canada Housing Benefit. For seniors to receive this benefit, they must have had an income of $20K or below last year and paid at least a 3rd of their income for rent. The renter must also report the name and phone number of their landlord. Many of us here are so fortunate to have what we have.

Someone has to be the most bullish or one of the most bullish in a survey though. Leo may I suggest you use mortgage rates instead of BoC rates for the basis of prediction. You could have a situation where the BoC rate is 3% but still have both fixed and variable mortgage at 5% or higher like currently (excluding CHMC insured).

I believe that might be the most bullish prediction to date

After consulting my astrologist, palm reader, and two Gypsies with a camel named Fred, I’ve arrived at these predictions:

SFH-$1.25 million.

Condos- $550,000.

Total sales- 7200

Inventory- 1300

Interest rate- 3%

Final December sales: 320 (down 27%)

New lists: 361 (down 10%)

Inventory: 1688 (up 159%)

New post tomorrow evening.

There is a correlation between the assessments and market value. However the mistake most people make is to find three or four homes that have sold and then derive a Sales to Assessment ratio and apply that to their assessments. Most of the time that will not work as individual properties vary quite a bit from each other.

To make the sales to assessment ratio meaningful, you need to have a lot more house sales that occurred in a small geographical area. 40 sales is usually fine, but a hundred or two hundred is better. Then you can calculate the low, the high and the median ratios. If your home is similar to the median or typical house then the median ratio should be very close and you can apply that to your assessment to give an estimate of value for your home. Otherwise you have to consider if your home is better or worse than the typical. Then the only thing that you can determine is if your home value lays between the median to the high end of the data or if your home is inferior to the typical then the value would lay between the median to the low end of the sales to assessment ratio.

At the very best the ratio can only provide a cross check to your home’s value. It is a good cross check to the opinion that your real estate agent or appraiser provides to you. I think it is a piece of information that you should ask your agent and appraiser to provide along with their comparison of properties that have sold.

The assessment can be quite off.

18 2070 Amelia sold for $440,000 but the current assessment is $631,300

112 21 Conard sold for $432,500 but the current assessment is $402,400

So why is there such a difference?

It has to do with the value that the assessment authority has assigned to the strata lot. Unlike detached homes where a value for the lot can be determined through vacant land sales, sales of vacant strata lots don’t exist. Vacant strata lots do not trade in the market place. The assessment authority therefore has to assign a hypothetical value to the strata lot. Their best guess. And sometimes they guess wrong.

Which begs the question, why does the assessment authority provide a strata lot value at all? It isn’t derived from the marketplace so why show one? The answer is that BC Assessment is legislated to provide one. The assessments are used for a variety of other reasons than just for taxation. The assessment authority sells their information to other parties that need a breakdown between land and improvements, such as insurance companies. The fire department uses the assessments to determine the loss from a fire. If we had an earthquake or Tsunami the assessments would used to determine the extent of the damages to the city.

And incidentally, during an appeal of your property assessment you can not argue that either the land is incorrect or the building value is incorrect. You may only argue an appeal on the total amount.

No need to argue at all, just compare the assessment details with the house and let the facts speak for themselves, when you buy or sell.

Right, and sometimes for reno with permit. e.g. Our house was a total rebuild with all the permits when we bought it in 2009. BC assessment has correct finished sizes, but missed out one bath (and 2 beds) for whatever reason. We didn’t bother to complain, since the assessment for 2009 was the same as our purchase price. But maybe we should when we are ready to sell.

So I would think inaccuracy is a common issue with the assessments.

The assessments, in my opinion, are generally the only point of reference a buyer or seller makes use of before enlisting the service of a professional real estate agent or appraiser. It’s one of the first questions that most prospective purchasers and sellers ask about a property. “How accurate are the assessments to what the home is worth”

Because of this heavy reliance, the assessments do have a potential to create value based on expectations when they are first published. So it is possible for homes to initially sell for slightly higher at first, but as more properties sell during the course of the year both buyers and sellers will adjust to the market and temper their expectations.

The media can also play an important role too. How the media choses to spin the new assessments can have an effect on how much reliance both buyer and seller place on them. And I expect lots of news stories this month as real estate is on most people’s minds these days.

Generally bad news sells better than good news.

A shortage of listings led to a rapid increase in prices during the first quarter of 2022 with multiple offers presented over the asking prices. Market prices stabilized during the second quarter of 2022 due to quantitative tightening increases in mortgage interest rates. The third quarter of 2022 has had further interest rate increases, resulting in softening of market prices as the number of sales declined, the average days-on-market increased, and the months of inventory increased. This resulted in the market place transitioning from a market heavily in favor of sellers to a more balanced position between buyers and sellers. The fourth quarter had further quantitative tightening measures with home prices returning to the levels in the last half of 2021.

It really depends on the data the assessment authority had to work with at the time to estimate a value as at July 1, 2022. In general if your home is in a built up area of similar housing to yours with lots of transactions during the year then they would have had more information and your market value would likely be close to the assessed actual value. If you have an atypical property or live in a neighborhood that has had few sales during 2022 then the difference will be larger.

If you own a half side of a duplex in the core or if you have acreage, waterfront, or a substantially different house in age, condition and size than most of the homes in your area then there is greater chance that the assessment will differ significantly from current market prices. For condominiums with views, the problem has always been to determine what that view adds to the home’s value. So that will depend on what floor the condo is on, the direction of the view and what type of view. ie City, Mountain, Water.

The assessment authority does a really good job of estimating value for properties in BC. In a stable market 90 percent of properties sell within 10 percent of their assessed value. That would be a B+ or an A on any exam. It’s that last 10 percent of properties which is the problem.

Nothing wrong with appealing your assessment. If it isn’t resolved immediately then you would go before an informal appeal board made up of everyday people. It takes about 30 minutes, you’ll give your reasons and the assessor will give their reasons of what the fair and equitable value of your property would have been as at July 1, 2022.

Seems too low. And at any rate, individual assessments aren’t that useful anyway. Lots of properties out there with unpermitted renovations, unauthorized suites, etc.

Would love a post at some point in January about the potential impact of these new elevated assessments.

Does it play into the sellers hands? Or, other owners that were on the fence about selling now want to list, thinking they can sell for the assessed value, creating more inventory?

Or is it basically a nothing burger and we shouldn’t read too much into it?

For context, my family and I moved here from Vancouver a year ago. We are hoping to buy a SFH……probably pull the trigger at some point in 2023.

.

In general, the listing prices now would likely be closer to the new assessments than before. But if the assessment doesn’t reflect reno/addition, why would anyone list it at or below the assessment? For a bidding war?

Not as a rule. The median detached property is going for just a couple percent over (2022) assessment, while most condos are still going above assessment.

On an individual property the assessment is not particularly meaningful, you are better off using comparable sales to set the listing price.

For the new 2023 assessments the median place should be below assessment, but that still leaves properties selling for above.

Yes, listing above assessments would be considered too high. Listings should be 15%-20% below assessed value (tho many will argue assessed and house prices don’t correlate).

So would listing above assessment right now be considered too high

Lmao I have to admit that was a good one!

You know what’s going to be more interesting than RE this year? The used car market!

Should be an interesting year for real estate here in Victoria.

What a first sentence to return with Debt Monster. It’s laughable and very telling. So sorry you didn’t pick up a shell yourself and decided to just run away instead.

Consider the following; “The bitterness of poor quality remains long after the sweetness of low price is forgotten” a quote frequently attributed to Benjamin Franklin, which has been adopted as a mantra by many companies in today’s society.

@freedom, I was curious about your comment re: earthquake damage being limited when the house is on bedrock.

I reviewed a couple of technical papers and and it seems like home construction and age, severity and type of quake are the main factors in how much damage is done.

This study has some comments about the probability of damage from an insurance perspective:

https://www.frontiersin.org/articles/10.3389/fbuil.2019.00128/full

They note: “The considerations of the soft site conditions generally lead to increases in annual expected damage ratio and damage occurrence probability.” So it’s certainly worse to be on loose ground.

Here’s a Victoria-specific study on what happens if the “big one” would hit:

https://www.researchgate.net/publication/333238449_Spatiotemporal_Seismic_Risk_Assessment_of_Wood-frame_Houses_in_Victoria_Canada_under_M9_Megathrust_Subduction_Sequences

Many of the studies seem to be based on a UBC model of 4 different houses with good, fair (typical after 1970) and poor resistance (built prior to 1970). You can guess which type is pretty common in Victoria.

In any case it doesn’t seem like the assessment of being on bedrock or not is a good foundation for assessing earthquake risk.

Introvert, I’ve found over the years that all home insurers are kind of slow to pick up changes I’ve told them about. My current insurer, I sometimes have to tell them a couple of things more than once before they make the change, though I think with the current one it’s just because they’re super busy. I don’t know what TD Meloche does nowadays, but I switched from them to current one (Gore, via A.W. Jones in town) precisely because communications with TD Meloche were always just over the phone, and I was uncomfortable not having it in writing. All my communications with A.W. Jones are by emails which I print off for that reason.

While on point of insurance, I think one of the cheapest form of extra insurance you can get for home-related things is WCB. We have WCB coverage for people who come to do work around the house. You report once a year in arrears. So we keep a list of everyone who comes to the house and how much we paid them and then when it’s time to report we first go on the WCB website and print out “clearance letters” (confirming coverage) for all of the service-providers who have such coverage (and by the way, when doing that, you find out very quickly that some who say they have it are in reality in arrears or otherwise not covered). Then pay based on the un-covered ones.

The WCB payment usually ends up being no more than about $200 per year. I think it’s excellent peace of mind. I’m not convinced our house insurance or umbrella otherwise covers this, or not in terms of avoiding problems to the same extent.

This is what the missing middle needs:

Thanks for your post on this. Your longer explanation makes sense to me. Just for our own assessment, though it was up disproportionately, I think the absolute $ amount is fair enough based on comps (which are admittedly few and far between), so I don’t intend to fight it. Think the property was under-assessed before

Happy New Year to everyone and may this year bring you adventure, joy and love.

Our house insurance increase for the past few years here, if that makes others feel better 😉 . Note we have been with the same insurer since 2009, no major update, and no earthquake coverage (the house sits on bedrock):

2019: +12%, 2020: +28%, 2021: +25%, 2022: +26%

When I asked, they said the increases were due to the high cost of recent increasing natural disasters (flood, forest fire, storms, etc) in the region, and we would have paid even higher if we were a new customer, or with other insurers. I have checked around since 2020, and they are right.

So we would likely just take whatever they charge us this year, and hope the increase would not be too much higher than 25%.

Correct. They just calmly mention to you that you likely weren’t insured after all for the last several years. Of course, no premium refund, .

Would you appeal an assessment if everything is right except the number of bedrooms? My house was pretty much completely renovated the year prior to my purchase, and what was the bathroom became the laundry room, (used to be in the kitchen), the bathroom then moved into the 3rd and smallest bedroom so it is a two-bedroom now, not three. I’ve always been afraid to because I figured if they knew the house had a newly renovated kitchen and bathroom (done without permits) that the assessment would actually go up rather than down which would be the hope in an appeal. I’ve also known I want to sell it at some point so it seems like having a higher assessment could be beneficial. I don’t feel the number is ever too far off from what it would fetch if I put it on the market. The assessment now is what I was thinking of asking for it in the summer.

Yes. And I phoned them to update my file after my tenant left. But apparently telling them that my tenant was no longer living in my — according to them unfinished — basement wasn’t enough to trigger any alarm bells that their info was incorrect.

I find this so disturbing because a) my trusted insurance company seems to be incompetent, and b) insurance companies look for any excuse not to pay out a claim — and until a few hours ago, they had a glaring one.

They do, but the insurance company should be smart enough to know that. Anyway didn’t you take the suite back?

Yeah I corrected some square footage data in my favour when we bought the place 10 years ago and it saved us a couple hundred in taxes a year since then

Nah, not worth the time and trouble.

As far as I can tell, all the info they have on my property is correct (UNLIKE ANOTHER ORGANIZATION WHICH SHALL NOT BE MENTIONED).

Argh!

Received my home insurance renewal papers in the mail. Upon reviewing my policy, I see that it says: “REMINDER — Did you finish your basement? According to our records, the basement of your home at xxxxx is unfinished. Please let us know if this changes…”

Um, yeah, my basement is finished, which I told you in 2009, when I set up my insurance with you.

Phoned. They’re like, Yup, your finished basement is news to us. So I asked to review all my other info and I discovered that they think my property is a duplex, not a SFH. The agent, a bit perplexed, says, “Well, most of the property information we have on our customers comes from a third party.”

The only thing I can think is that StatsCan classifies SFHs with a tenanted suite as duplexes (if I’m not mistaken).

Anyway… TD Meloche Monnex is not instilling confidence at the moment. It’s a shame — I’ve been with them for 13 years.

I’m thinking about shopping my insurance — and I might — but each time I’ve done that in the past I’ve learned that TDMM was the lowest cost.

North Saanich is a tough area for BC Assessment. Very little data and what data was available during 2022 is scattered over a large land area with significant variation in the improvements and the land. It’s a very tough area to assess.

I am looking at a water front property that has had a 30 percent increase or some $600,000 in its assessment. The new assessment is wrong and I have a good idea of where the BC Assessment calculation went off the rails. Their computer application to determine land value is not capable of differentiating between wooded and cleared land or infill lots from newly created lots within subdivisions having underground services.

Each assessor has a portfolio of about 20,000 properties that they are responsible for. It is impossible for them to complete a detailed analysis on each one. And sometimes the specialty properties, such as water front, can go screaming off the mark. That’s why the appeal process is so necessary.

Those that have water front in North Saanich are likely to be shocked with their new assessment. So I expect a lot of appeals in North Saanich for those properties that are atypical.

Introvert, if home owners feel that their assessment is inaccurate they should appeal. The appeal process is vital to provide fair and equitable assessments in BC. Errors do happen and if left uncorrected may compound over time.

Sometimes BC assessment has the data on the property wrong. Age, house size, lot size or how it is classified. If that information is left uncorrected then future assessments may also be affected. Sometimes it is just a typo. The data entry clerk inputted an extra zero to either the land or improvement value that made a $100,000 condo assessed at $1,000,000.

Yikes, assessment up 18.8% in Saanich. Same as our neighbour, who had two sales in the past two years that seem to show the jump is accurate.

The municipalities will be working with the new assessment roll to determine tax rates for the different asset classes. Although your assessment may have gone up, that doesn’t necessarily mean that your property taxes will increase proportionately.

If you disagree with your property assessed value, as at July 1, 2022, you may appeal the valuation. Those that appeal the assessment do so by themselves in front of an informal tribunal of ordinary citizens. A few hire a Real Estate Appraiser to provide documentation or to present the appeal to the board. Generally speaking, for residential properties, the cost of the appraiser ends up being more than the savings on your tax bill.

You can launch an appeal and a later time chose not to proceed.

well, we’re up 24% vs. average 12% in North Saanich, so the rest of you guys can stop complaining now!! Ughh my taxes are going to jump big time…

I’m up a whopping 15.7%. If Saanich is up by 11%, that’s not good news for my property taxes.

Oh well. A few years ago, my assessment was lower than everybody else’s and my taxes went down. I guess it’s all evening out…

I went up about seven in city of Victoria where average seems to be 8.5

Seems so. Our home is +11.45%, about the same as Saanich average (~+11%); The condo (for family) is +9.353%, slightly more than Victoria average, but happy to pay (tax) for their good work on bike lanes which we use all year around.

Happy New Year to you and to All. May 2023 bring us peace and happiness!

Up 7% here.

Interesting. Looks like average of about +10%

Thanks freedom_2008.

Here is average property assessment increases by municipality, courtesy of @garry-oak on reddit Victoria

9% for me. Hoping that is below average in my municipality.

Nothing like that 10 year bond being below the 5 year bond as well and not just that 2 year… It’s too bad the 10 year bond isn’t better reflected in the 10 year mortgage rates.

Right, mine down 1%, and same with the other houses on my street.

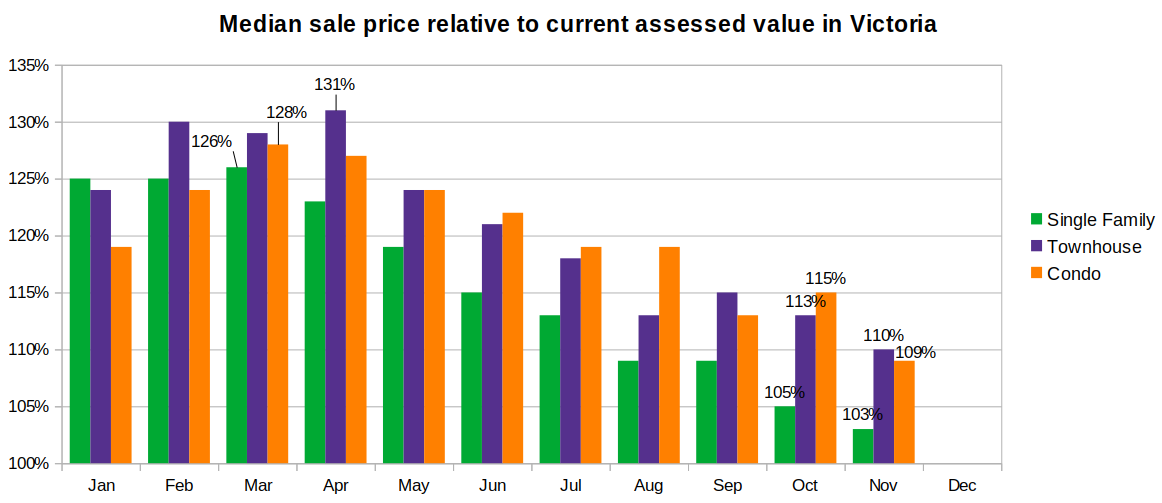

Leo’s chart indicates average SFH was selling 12% above assessment in July, so we would expect average assessment up 12%.

Interesting to hear if others are seeing 12%.

Of course, I won’t complain if the average us up12% and I’m down 1%. Seems like that means lower taxes for me to pay.

My Victoria assessment is only up 5%, Ladysmith up 16%.

Thought Rosenbergs commentary was interesting – he did not write off the possibility of rate cuts in the second half of the year. Quite contrary to most economists.

New assessments are up

David Rosenberg gives a gloomy forecast, severe recession for Canada coming in 2023.

https://www.bnnbloomberg.ca/david-rosenberg-a-bleak-outlook-for-2023-1.1856725

Doesn’t look like Canada wide affordability has improved since the peak, despite a 21% fall in house prices. Since affordability is measured at monthly mortgage payment for a new buyer, assuming 20% down. (And it doesn’t assume that you’re able to put more than 20% down with the lower price. If it did, you’d save a little – $200 a month).

…graphic from BNN Bloomberg. Showing that, despite Canada average house price falling 21% from Feb to August 2022, mortgage payment has stated about the same. ($3756 in Feb. vs $3650 in August ).

So almost no improvement in affordability (since affordability is measured as fixed 20% down payment).

Most likely true for sure VicRE. A lot went off market recently. If they decide to re-list then the Jan/Feb numbers will probably reflect this. But still, today there are 71 more listings with the same criteria as on 7 Apr. So that is somewhat revealing.

I have a feeling this will get picked up by the media so atleast the explanation will be on TV!

My insider realtor contacts told me that quite a few clients cancelled their listings during December and plan to relist in the new year. So if that is true then the Dec numbers would be understated.

Criteria for below: SFH, Full Duplex and Half Duplex; $650K – $1,999,000; in Colwood, Esquimalt, O.B; Saanich East and West; Victoria; Langford & View Royal

For those of you that are interested, here are my pcs listing numbers since Apr of 2022:

Apr: 193

May: 295

June: 374

July: 417

Aug: 397

Sept: 367

Oct: 417

Nov: 356 &

30 Dec: 264

I only have shown one day out of each month but of course numbers fluctuated day to day.

Nice work!

On BNN: average first time home buyer age, now 36.

CIBC, bank with the most residential mortgage exposure, the stock price has given up all its pandemic price gains. Very interested to see the loan loss reserve on their Q1 call (Q4 2022 increased over 4.6x compared to Q4 2021). Q4 ended in Oct so still a couple rate hikes that hasn’t filtered through yet, not to mention more fixed rate mortgages rolling over at over 5%.

Quelle surprise! I was least wrong 🙂

Look at those interest rate predictions! Humble pie indeed…

It will also confuse the lenders as most use the assessed value to approve low loan to value mortgages. They will no longer have a base line under the assumption that the property is worth at or above the assessed value.

Right. They should include a copy of your sales-to-assessment chart. Of course in 2023 your new charts will likely be switching to a new baseline there, where current SFH values will be about 90% of the new (july 2022) assessments.

Whew both kids still alive despite installed murdercurtains

Thanks, Leo. The lack of selection might have something to do with these new regulations:

Health Canada set to enforce new rules on corded window blinds

https://calgary.ctvnews.ca/health-canada-set-to-enforce-new-rules-on-corded-window-blinds-1.5883132

blinds.ca 5 years later they are still perfect. Looking at the website now though they seem to have substantially less selection. Back then there were dozens of options for blinds.

They will reflect sale prices from July, in other words increases of some 13-19% on average. Going to confuse a lot of sellers in the new year. Good luck realtors explaining why you need to list at well below assessed value.

We had bought and had our blinds cut from Home Depot, very affordable.

Hi Leo. About a year ago you wrote this, and I’m wondering what company you ordered from. Thanks.

And if anyone else wants to chime in with a suggestion, please do.

I’m waiting for the new assessment values to see how far off they are from reality. Any guesses?

1240 Princess Ave I assume? However, when new builds like this sit on the market with no bites (it is ugly but potentially 3 separate suits in addition to the main house for both air bnb and long term rentals) it seems hard for builders to turn a profit at $250/sqft.

https://www.realtor.ca/real-estate/24957820/976-milner-ave-saanich-lake-hill

Good points whatever

Those that take the risk receive the rewards.

A lot with potential only but without an approved application to city hall is just a large lot. If there are no approvals, studies completed, land surveys performed, cost to develop determined, or a preliminary lot approval then the seller will not get more than just a regular lot. It’s the developer that gets the rewards for their time and risk, not the seller. A property with potential may have greater salability over that of another lot, but not a significant increase in value.

The seller of a property with only potential is taking no risk that the property will be approved. Of course there are exceptions but they tend to be rare being situated in areas under intense re-development because the developer’s risk is lower. One forgotten buried oil tank that has been leaking fuel can turn a profit into a loss.

SFH $1.1 mil.

Condos $550,000

Sales 7000

December Inventory 1900

BoC rate 3.75%

I expect sale and prices to pick up in 2023

An absolutely prime MMHI SFH (corner lot, no trees, flat, short walk to downtown) sold yesterday for $770k. Probably what the property is worth with zero MMHI potential. MMHI is going to do absolutely nothing other than MAYBE increase the value of teardowns, a bit.

MMHI is 6 units max, not 50. A builder can’t drop $1.2 million for a livable house to build a sixplex. That is not how real life works unfortunately.

Barrister, I have looked too and found nothing.

“But the plans were on display…”

“On display? I eventually had to go down to the cellar to find them.”

“That’s the display department.”

“With a flashlight.”

“Ah, well, the lights had probably gone.”

“So had the stairs.”

“But look, you found the notice, didn’t you?”

“Yes,” said Arthur, “yes I did. It was on display in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.”

-Hitchhiker’s Guide to the Galaxy

I am a bit surprised that I have not been given any real details as to the actual policy of strata under the MMHI. I would have guess that the MMHI would have addressed this in great specifics as to the proposed developments. So if anyone has it ( I am guessing it must be out there) I would love to get the material.

The reason that I am assuming that it has been covered is that it makes a real difference to what is being allowed. For example, in regard to a six plex if you are allowed to strata the units then you can sell them as individual units. Otherwise I am guessing that the six units are effectively restricted to being rental units (the rare exception being a suit for the owner of the building). There must have been some direction about this in the MMHI before council. So if anyone knows of an actual document that has a specific reference to strata please post it.

Freedom: I dont think that they will let me subdivide the lot into two seperate legal parcels but if i read the MMHI material correctly they may allow it to remain one legal parcel that is actually allowed to be two strata lots. It may sound like a fine distinction but significant. Again this under the assumption that the MMHI grants the absolute right to strata the property.

This is why I was asking whether anyone actually had specific details as to the policy of strata under the missing middle.

Now I see your point/angle: you are not for MMHI but you want to leverage it, if possible.

I don’t think there is anything metioned about subdivision as part of the action in MMHI, so whatever the rules city used to refuse you before are likely to stand and have little to do with MMHI. But I guess it doesn’t hurt to try with professional help, if you really want it and if your health and resources permit.

Not sure if I agree but that is fine. The general public has only caught wind that RE is going down in the last month and half, so I expect more downward pressure in the near term. Has anyone done a calculation of the % of income increased required to offset the rising carrying cost of houses?

I believe just like past downturns, the bottom will not be in until a period of cashflow neutrality for SFH with 20% down. This has played out in 2014, early 2019 and spring/summer 2020.

Never been accused of being shy before… So, here are some numbers out of my (Who’s Line is it Anyways) random points generator.

SFD median: range 800k to 900k

Condo median: 450k to 500k

Sales: 4800

Inventory: peaking between 3200 and 3700

BoC rate: peaking between 5.5% and 6.5% (mostly counter to some assertions saying that 4% inflation is the new 2% and even if inflation withers, rates will likely continue to climb until there is decent slack in the labour market and wage growth significantly decreases).

Sorry, I meant for BoC rate to be @ 4.75 in the 4th quarter of 2023 and not 3.75. Just not used to looking at 4.25 yet I guess. But then……at this juncture particularly, everything is purely a guess.

City refused to subdivide both for me and for a previous owner. Might be different this time around but it becomes easier if MMHI is passed I suspect. in that it might not require any city approval to turn the lot into a two strata property.

Anyway, I suspect it will be passed in January and then I can get the lawyers working on it.

Forget MMHI Barrister – I think you’re getting too caught up with how that might translate to your property. It really comes down to the zoning and bylaws in play for your property. If you have the street frontage (I know you’re on the corner and have a lane) and have the site area required for the zoning, and no restrictive covenants due to the heritage designation, you might be able to subdivide.

I would look for a consultant or RE lawyer. Maybe someone like CitySpaces?

SFH: $985

Condo: $540

Inventory: 1900

Sales: 6500

BoC: 3.75

There are two forces at play for prices, I don’t see it as simple as “it doesn’t jive”

—-Historically, in the periods I’ve looked at, rising rates have been usually associated with higher house prices. For example, the 1970s when rates rose and prices tripled. Prices then fell in the 1980s, when rates were falling and there was recession/unemployment.

—-because there are two forces at play. The rising rates lower prices (higher mortgages). But rising rates are also are seen in good economies and with inflation – so rising incomes – which tend to raise prices.

,- —-But, This time it’s different in that we are starting from very high house prices, so maybe we won’t see it repeated like that.

——bullish for house prices: Incomes are rising at about 7%/year. Nominal GDP/capita (highly co-related with house prices) at about 7%/year.

—- bearish for house prices: “recession is imminent”, according to stock market, many economists and business leaders. US housing data is dismal.

—- I’m with the bulls. I think the good times are going to keep-on-rollin’, so I expect SFH prices to rise this year, by about 10%.

VicRE: I believe that I dropped the average price of condos (or at least I thought I did). But I suspect that SFD will increase in spite of higher interest rates. You are right in that it seems contradictory and not rational. We are simply not expanding the number of SFH as fast as the population is growing so the purchasers might represent a greater income percentile.

But I am very likely wrong. Have a happy new year.

These numbers don’t jive. 1% higher interest rate compared to now yet higher prices?

@patriotz, agreed with your numbers wrt price/rent. But in that particular case, the condo (with 3.5yr remaining on a ~2% rate mortgage) was bought for personal use and rented out temporarily for one year now, as I was told by my friend.

Sales: 7000

Single Family Median (Q4): $1,100,000

Condo Median (Q4): $550,000

December Inventory: 2,000

Band of Canada Rate: 3.25%

Peter, I absolutely agree that I dont want to waste too much time. But with a good real estate lawyer my guess is that a plan of bare land strata, if the same is allowed as of right under the MMHI , should not be too much trouble. I have no intention of developing the land myself. Just sell of the house and sell off the lot separately.

But your advise is spot on, if it turns into a headache I will just dump it.

Barrister, though this isn’t the type of advice you’ve asked for, I’ll go on a limb. I assume (you can correct me) that you’re a reasonably well-off, retired lawyer, you will have some inkling of how involved a severance/stratification is likely to get, even if you stop short of getting involved in the development part. My question/advice: given what you’ve said about your health, do you seriously want to waste even a moment of your energy/life going down this road?

In your situation as I imagine it from the outside looking in, I’d do just about anything other than that. Even if it means something drastic like selling the whole package (well-marketed to reference the development potential) and downsizing, or whatever is next for you.

Sorry, my 2 cents only.

I find it is extremely difficult for people to guess medians for the whole year because it doesn’t actually represent prices at any given time. I see this all the time with economists and other forecasters doing annual predictions and all the comments are confused because they think it’s a prediction from todays prices, not the average in all of 2022

More logical just to ask people to predict what prices will be like a year from now. The reason I use fourth quarter rather than Dec 2023 is because you need at least 3 months worth of data to smooth out some of the noise in prices. Inventory is less noisy so we can use December

Patrick – for Umms predictions see Debt Monster’s

Barrister: Do you have any adult children who can assist you and your wife with this? Or maybe think about going to a real estate lawyer whose expertise is in small property development. They can perhaps get you on the right track. Sometimes one has to spend money to make money. Good luck.

Marko: Did my explanation as to where I am getting the increase in value make sense to you? Perhaps I am totally miscalculating or missing something important. I am also not sure how to go about marketing this property. Do I strata first, sell house first. Offer both on the market in case a developer wants to severe a larger piece off the property to actually build townhouses. I am not actually clear on what a building lot is worth? Am I better off severing off 6000 sq. ft or make it larger at 8000 sq feet?

And this is actually were I think a RE agent with some real smarts would help in terms of advice. As those who know me here on Househunt are probably aware, my health is in serious decline and help with this sale is needed.

Would not mind getting some recommendations for a very knowledgeable RE agent. But not one that is just looking for a fast listing. I need someone willing to do some research and actually provide me with good advice based on facts.

Absent from your post were your prediction numbers… don’t be shy!

Dec. 28, 2022: Day 1 of what should become global wireless low-cost internet.

Today (Dec 28, 2022) marks an important (yet under-reported) scientific achievement, day 1 of a new generation of communication of direct satellite to your pocket smartphone (e.g. iphone). SpaceX today successfully launched 54 Gen2 Starlink satellites, that are for the first-time capable of communicating with smartphones. Almost every telco in the world wants in on this (50 have applied already), and T-mobile is the first one to get it, so it will only work in the USA (or someone in Canada with a t-mobile phone). But it is expected to to come to Canada’s telcos and most of the rest of the world by mid 2024.

Simply incredible. And likely to have significant effects throughout society, who knows maybe even affecting the housing market (e.g. by accelerating “work from anywhere”). Because within 5 years, this is expected to be a global internet cloud supplying low-cost internet to anyone, anywhere with a smartphone.

People here complain that the USA doesn’t manufacture anything. Maybe so, but they come up with revolutionary new things like global low-cost internet for all (with a smartphone)

“SpaceX launched the first batch of a new generation of Starlink satellites into orbit early Wednesday (Dec. 28)”

https://www.space.com/spacex-starlink-satellites-5-1-group-launch

Besides being able to handle more traffic, Gen2 satellites can beam service directly to smartphones, SpaceX founder Elon Musk has said.

https://spacenews.com/spacex-requests-permission-for-direct-to-smartphone-service/

“At full deployment, this hosted payload will enable SpaceX to provide full and continuous coverage of the Earth within +58° to -58° latitude by mid-2024,” Wesson said.

SpaceX has so far only announced a partnership to use spectrum from T-Mobile to provide a direct-to-smartphone service in the United States.”

https://www.t-mobile.com/news/un-carrier/t-mobile-takes-coverage-above-and-beyond-with-spacex

You can read about the details of the T-Mobile service here. Since they only launched 54 satellites (2% of the final total), they’re starting with text only, and will add voice and data as they launch more (2500 more) satellites;

“The important thing about this is that it means there are no dead zones anywhere in the world for your cell phone,” said SpaceX Chief Engineer Elon Musk. “We’re incredibly excited to do this with T-Mobile.”

Sales: 5725

Single Family Median (Q4): $945,500

Condo Median (Q4): $525,000

December Inventory: 2,250

Band of Canada Rate: 3.5

My Basic Fiction (Ouija) Story is:

Why Sales (SFH) Number?: Inflation is ‘higher for longer’ due to i) wage gains which continue north of 4% (yoy) throughout 2023, making Tiff & Co unhappy, ii) service sector inflation which is more obstinate than expected, while corporate profits (embedded in pricing) are protected. So Bank of Canada hews close to 4.5% for most of the year, till the end. Curiously, despite the above wage scenario, unemployment grows from 3.5% in GVicA today into the 4’s by yearend. (Interesting that my $945,500 guess (nominal Dec 2023 $’s) actually represents about $855K in March 2022 $’s ….. if I’ve got that right, using approx. 10% CPI change between those two points in time).

Why Sales (Condo) Number?: Because Marko says so :~)

Why Inventory Number?: Steady increase in inventory as some investor cash flow turns more negative, horizon profits more distant, and the squeeze becomes unacceptable. More folks come to accept the new price paradigm than in 2022 and ‘regular life events’ push more product on the market than 2022. Ooh, and the elevated ‘housing starts’ of 2021/2022 leak with greater flow into the market as completed supply.

Why BoC Rate:? Total flyer on this! Guessing there will be a ‘Black Swan Event’ by late 2023 (international financial system crack (think something more serious than autumn gilts meltdown) or geopolitical (take your pick). Policy makers take the well trodden path to lower interest rates, but lowering ‘only’ 1-2%, due to inflation implications.

Thank you Leo for keeping this going and the hard work it represents. Happy New Year.

Umm really nice read I’m there too

Somebody needs to be totally wrong and it might as well be me. My guesses are almost always wrong.

BofC rate 5.25

Sales 6700

SFH 1.2 mil.

Condos 460

Inventory 2300

If any of the above is right it will be a fluke.

Happy New Year to one and all. Make time for friends and family and add a little joy to someone’s life.

Well, I am just going to have to stay on the message that I have been going with since the start of the pandemic housing growth. The pandemic growth was an anomaly because of a unique convergence of factors that led to low inventory and massive stimulus causing the housing market to detach from reality. It’s nice to see that we don’t have the folks saying that interest rates can’t go up and inflation isn’t an issue like we did a year ago. So, as for the upcoming market in 2023: we will see an increase in the overnight BoC rate in 2 of the 3 announcements between now and May. This will continue to stop first time buyers from entering the market along with the amateur investor class. Move up buyers will find themselves trapped seeking yesterday’s prices for what they believe they need to purchase their next property, resulting in limited sales in that segmant as well. Additionally, the HELOC hereos will be less willing to sprinkle gifts to family members or use the HELOC debt to invest in real estate themselves when looking at an 8% interest rate and little capital or equity return expected over the next several years. By the end of the Spring market, the remainder of the pandemic gains will be given back as inventory returns to historic norms. However, as summer sets in, the impacts of over borrowing and the interest rates increases from the prior year will start to be felt with the recession, resulting in a greater number of “must sells” that will lead to inventory increasing past historic norms and greater negative price pressure through summer and fall.

While i don’t share that prediction, it is pleasant to think about a market where half of Victoria SFH are less than $650K, with a big inventory to choose from.

Sales: 5,700

SFH: $875k

BOC rate: 4.50% – 4.75%

Condos: $450k

Inventory: 2,700

There’s a brave prediction!

Personally I feel like if we experience that kind of decline (39% from current – more from the peak) it would play out over several years not happen in one year.

Rodger- I’m pretty sure Marko is referring to a total dollar value of sales, not number of sales.

Sales: 5,000

SFD Price: $850,000

Condo Price: $450,000

Dec. Inventory: 3,000

BoC Rate: 4.5%

2022 Sales of 6,830 (above graph) does not jive with the claim of 2nd highest year of sales ever claimed by some in this group. My guess of 5,000 for 2023 will be decades-low, and it includes lender-forced sales, investors’ sales, as well as sales of failed pre-cons that have to be re-sold by the developer.

SFD price will start another leg down for 20% down from here, mainly because it will be harder to qualify, lack of savings for down payment, requirement of increased capital buffer for banks, heightened scrutiny of mortgage applications, lower assessment by banks, etc.

Condos will do better (only 15% down from here) as this will be the main avenue for ownership for a bigger portion of the population.

Inventory will rise due to distressed sales by investors (as rents drop due to lower population – flight of RE labor, tech slowdown, and moves to Alberta) but still be constrained due to difficulty of upward mobility for current owners.

Inflation will not come down to 2% until 2024, keeping the policy interest rate elevated. Even with the high policy rate, CAD will drop to 0.65 USD per CAD as oil drops to $60.

Thanks to Leo for running this forum and Happy New Year to All 🙂

“Why did Canadians take out 359 million dollars in mortgages in October with sub 1 year terms”

They may have opted for short term money as they are intending to sell in the next 12 months. I suspect investors that have bought in the last three or five years are contemplating selling in 2023.

My thoughts are that the majority of buyers today are putting down very large down payments in order to keep the mortgage payments reasonable. This has caused the number of sales to decline as those that don’t have the means to make a large down payment are not able to purchase.

So I am not expecting the spring market to have a significant rally in the number of house sales. I suspect 2023 is going to be one of the lowest levels in number of sales in the last decade while inventory continues to build to over 7 months. It is going to take a longer time to sell a house in 2023 even if well priced with the days-on-market reaching into the 60 to 90 level. And sellers are going to have to make concessions to effect a sale such as paying the buyers’ closing costs or paying for a new roof or furnace. The 2023 market will be strongly in favor of buyers who are going to have more negotiation power than they have held for a very long time.

Starting in late 2023 we may see more houses selling under duress circumstances as those home owners due to personal reasons are forced to sell. I figure, the market for 2023 will be stagnate with moderate price declines. And it is going to be a frustrating market for sellers and buyers in that there will an increased need for more bridge financing. Most new construction is going to come to a stand still as contractors are not likely to build on speculation of finding a buyer.

Rents are a tough one to figure out. Going way out on a limb on this one but Victoria might have a net loss in population as the job prospects shrivel up as home owners cut back on discretionary spending and the level unemployment increases in the trades.

Since I was looking at boats this weekend, I will use this analogy. 2023 will be a market in the doldrums with no wind to fill the sails.

Sometimes, I think that some of the people on this blog are like the people on the beach collecting shells when the tide goes way, way out before the tsunami.

The higher interest rates are really just beginning their impact on the markets and Real Estate companies are doing their best to quell the fears out there.

Leo S: “Here’s a puzzler. Why did Canadians take out 359 million dollars in mortgages in October with sub 1 year terms at an average interest rate of 7.02% when you can get a 5 year fixed or variable around 5%?”

It’s because rate impacted homeowners truly believed the nonsense that rates will subside next year and they will be able to get top price in the spring market. They will beg, borrow and steal the extra money required for those payments so they can make it to the mythical “return to normal” in the New Year.

The spring market will be witheringly slow and listings will pile up as buyers stay on the sidelines. This will undoubtedly be the start of the next leg down in prices. SFD median prices are down just about 20% already. To quote Leo S: “The price declines we’ve had are unprecedented with such low months of inventory and inventory.”

Why is that happening? Perhaps, investors that were going to buy if prices dropped 10% are waiting for further drops, perhaps new buyers can see the direction of the market or maybe it’s just as simple as nobody can afford the prices at the current interest rates. Besides, where can they get the down payment required? The banks of Mom and Dad are currently trying to reconcile their new heloc payments resulting from the gifts to their children. Declining equity just doesn’t speak to oversized generosity.

The pain is just starting.

This is the future.

Sales: 5500

SFH: $650,000

BOC rate: 5.25%

Condos: $325,000

Inventory: 3100

I probably missed it but what geographical area are we talking about? Are we including all the West Shore and Sooke, also the whole peninsula including Sidney?

My last year prediction was a big swing-and-a-miss, but let’s try again….

Sales: 6500

SFH: $1.1 m. (Up 10%)

BOC rate: 4%

Condos: $525,000

Inventory: 1900

Marko: should I be giving you a call or is Rockland not an area you deal with? I suspect that it would be easiest to sell the severed part as a simply building lot and not for MMHI units necessarily.

Got it. Thanks.

I am saying teardowns that are ideal for MMHI are not moving at 800kish. 133k is the price per door for the land.

Marko and Freedom: My questions were not designed to make any point whatsoever but were specifically designed to try to figure out if one was allowed to strata a property under the missing middle proposals. I am not making any argument about this one way or the other. I tried to get this information from the city and ran into a brick wall. The answer I was hoping for is that you could strata which indeed appears to be the case although the definite answer awaits the final passage. So Freedom, as an engineer I hope you can understand that I am just trying to figure out the actual facts here, nothing else.

Marko, my property is in a rather unique situation and does not reflect the situation in virtually all the rest of the city. Thanks for asking. As some on here know, I own a very large property in Rockland and because of the historical designation severing the land was rejected by the city in the past. I am estimating that under the MMHI I will be able to severe a 7000 sq foot building lot (second story ocean views, ) for a second house without really reducing the value of the main house by very much if at all by means of having the property turned into two strata lots. The existing house would still sit on a almost 20,000 sq. foot lot. Marko thank you for posting that chart since it deals with historic homes in detail.

Please note that I stated close to a million since I am doing rough guesses as to the value of a building lot. I am looking at this as a simple sale for a house lot, The significance of the MMHI is that it allows me to severe a lot from my property which had been denied previously. Being able to get my lot turned into two strata lots is the real issue that I am exploring.

I do appreciate all the answers that I got from everybody both here and on VV. Having said that I would note that I have not seen anything in the actual city documentation that specifically states that properties have an absolute right to be turned into strata units but rather the opinions seem to be extrapolated from the treatment of existing properties which strikes me as probably correct.

Marko I know that you tend to specialize mostly in condos but if you want to look at the property and provide me with your opinion as to value and a marketing plan I am open to the idea since the agent that had been recommended to me seems a bit erratic and perhaps overwhelmed with personal problems.

But I do appreciate the responses since what I got by way of clarification from my city councilor was that she cant talk about the missing middle and is not allowed to tell me anything at this time. Just about the same response from the city building department.

6 units for $800k ($133k each)… What would they rent for? ie) what’s the catch… sounds too good to be true…

6 unit sixplex, fsr 1.0.

Marko,

Could you please elaborate on this? Are you referring to 6 units, and of what?

freedom_2008:

If those are the going numbers, it’s a gross rental yield of 4.8% or price/rent of 250 on a depreciating structure with negligible land value. I don’t think that’s sustainable with current interest rates. Now this particular unit may not have that kind of money owing so I’m not claiming this owner will be in trouble, but prices are determined at the margin.

If rents don’t go up (and I don’t think they will appreciably in a slowdown) and interest rates don’t go down, you’d need a 20% decline in price to get price/rent down to 200 which I think is the maximum sustainable ratio. May not happen in just one year but I would expect 10% at the least.

i went with the the shot in the dark play – higher interest rates (6%), inventory and lower prices (825K – which seems crazy but doesn’t even bring us back to 2019). Too much competition in and around Leo’s guesses haha.

Never good at predictions, but here are my numbers entered for 2023 (based on Leo’s 2022 numbers):

6000 for sales, $1M for SDFs, $500K for condos, 2000 inventory and 4.5% BOC rate

Sales: 6400; I think the sun will come out come April, the world will not end, buyers with $ will continue to realize what an attractive city Victoria is and sales will stabilize. I personally have a tough time picturing below 6000 sales for the year even thought that will be the pace for the first 3-4 months.

Single Family Median (Q4): $960,000; 4% drop from here. Same conclusion as Leo, can’t see too much movement without higher interest rates or the BC Gov/Military/Uvic/BC Ferries/everyone else doing some mass layoffs.

Condo Median (Q4): $525,000; disagree with Leo. I think condos will hold in there. Affordability has improved, past the insurance/strata fees crisis, etc.

December Inventory: 2500; I think we hit 3,000 for the first time in years in May and then it seasonally tapers down.

Bank of Canada Rate: 4.50%; same guess as everyone else.

I will throw out a random interest rate prediction/guess. 5-year bond market stabilizes around 3%, the big banks have a mortgage war in the spring and we see 5 year fixed rates as low as 4.3% from the big banks and perhaps as low as 3.99% for special products. I would also not be surprised if bond market went north of 4%.

Barrister, I am a retired engineer and prefer objective fact based discussion on an important subject as MMHI, regardless if one is for or against it.

Barrrister, you asked the exact same question earlier on VV -> https://vibrantvictoria.ca/forum/index.php?/topic/7137-missing-middle-housing-initiative-mmhi-in-the-city-of-victoria/page-73

You got very good answers that made sense, then you asked the same question on HHV, and got the same answers. Not sure what your angle is, like you want us to say no strata units won’t be allowed?

For the millionth time you keep making these claims re value, care to share the numbers? Land acquisition, construction costs, gross revenue from the sales to support any of your claims?

There are prime MMHI properties right now NOT selling at 800k (133k/door) so not sure how your property goes from x million to x +1 million secondary to MMHI.

Second best year ever on record in terms of sales volume; therefore, second best year ever in terms of gross commissions. The only agents in trouble are those that adapted their lifestyle to a 2021 income. The remainder will just put a little less away in their PREC/HoldCo. Even at 6000 sales for 2023, hypothetically, and slightly lower prices, it will be a very strong year (all-time) in terms of gross commissions.

Since we predict the total number of sales for the entire year, I feel we should be calculating median sale price for the 6800 properties sold during the entire year. I realize the rules of the game are to predict where the market is at the end of the year, I don’t think that accurately represents the actual 2022 market activity. Like Marko related earlier, even though realtors are not making much money at this time of the year, they still had one of their best years ever. 2023 will obviously start slowly, but could end red hot. Basically what I am asking is: What was the median sale price of the 6800 properties (broken down into their appropriate categories) sold in 2022.

I wonder what happened to Michael. He was one of the site’s biggest bulls – and totally won the prediction game once or twice pre-pandemic, back when no one could believe median sfh price could ever go over $1M.

Good times, I always enjoy the annual guessing game. I did ok on guessing sales slowing but didn’t figure out the mechanism would be high (relatively speaking) interest rates.

My predictions for 2023:

BoC: 4.5

Sfh price: 960k

Sales: 5700

Condo price: 465k

Inventory: 3300

It feels a bit like 2010 all over again, minus the unemployment (so far). I predict a continued soft market; agree with Caveat on first rate drops by next fall.

Everybody has been always been wrong except for Hawk.. This time it is different. Hmmm maybe not ..my kids can now buy condos hmm are you sure? ( yes, and that is a sweeping generalization, I like peoples lack of appreciation for sweeping generalizations)

Bank of Canada rate – 4.25 – One more bump up, then the first cut in fall of 2023

SFH median – 950K

Condo median – 475 K

Prices reflect continued blowing off of the CoVid froth but not a real crash.

Inventory- 2650 – bit of a WAG, I think Leo is in the right ballpark but I can’t pick the same number 🙂

Sales – 6000 – very low considering the growth in population and housing stock

Wow – collectively our predictions were terrible. Obviously in Dec 2021 we were all still taking the BoC at its word