Dec 19 Market Update: New listings pull back

During the runup in prices last year, we saw a dearth of new listings as sellers decided that they would rather stay on the ride of rising values, while upgraders were scared away by the horrible buying conditions which could have left them unable to get back into the market if they sold. That changed when the market peaked, and new listings activity got back to normal.

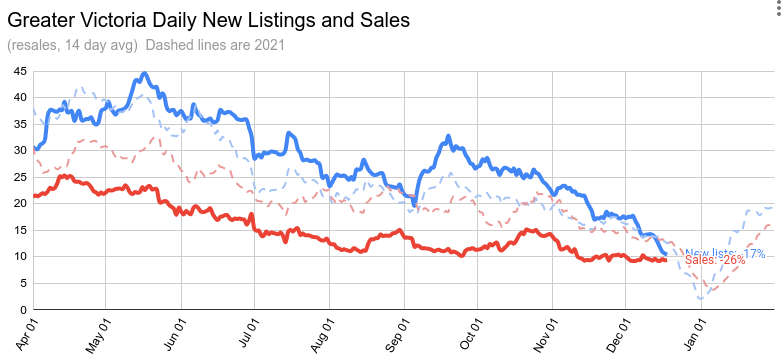

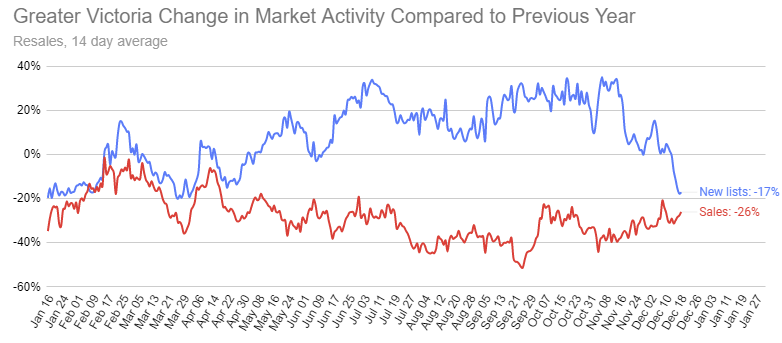

In the fall with owners coming under pressure from rising rates causing huge increases in mortgage payments, I was looking to new listings rates to see if there was evidence of owners offloading especially investment properties that may no longer be cashflowing with higher costs. However listings stayed at normal levels all fall and in the latter half of November they dropped down to even with the year ago pace. In the last two weeks they fell further, to 17% below the same period last December. Last December was no banner month for new listings either, coming in 7% below the 10 year average.

My one caution would be that it’s the slowest month of the year for new listings and it doesn’t take a lot of listings hitting or not hitting the market to change the percentages. This is the time of year when listings fall off a cliff anyway, and that being shifted by a few days can paint a misleading picture. This is not yet a trend, but something to watch as we start the new year and get into traditionally active months for new inventory. I’ve mentioned a few times that our current balance in favour of buyers is extremely fragile with inventory remaining low. Any increase in sales (or pullback in new listings) can stabilize the market. That precarious balance will continue until we build substantially more inventory.

Less is new in sales, which are continuing down substantially from the year ago pace.

| December 2022 |

Dec

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 47 | 138 | 223 | 438 | |

| New Listings | 87 | 204 | 292 | 399 | |

| Active Listings | 2035 | 1975 | 1869 | 652 | |

| Sales to New Listings | 54% | 68% | 76% | 110% | |

| Sales YoY Change | -24% | -21% | -27% | ||

| Months of Inventory | 1.5 | ||||

Prices meanwhile look pretty much unchanged from November, with the median detached property selling for 4% over current assessed value while the median condo is going for 10% over.

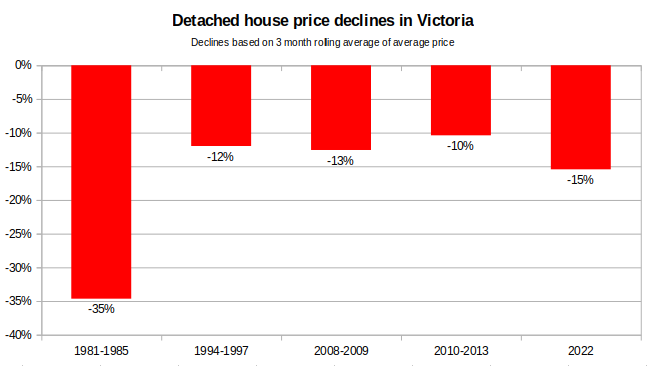

Speaking of prices, 2022 has seen the second largest decline in prices since 1978 when the monthly price data starts. Actual declines are likely a bit more (~18%) but it’s partially obscured by the 3 month average this chart is based on.

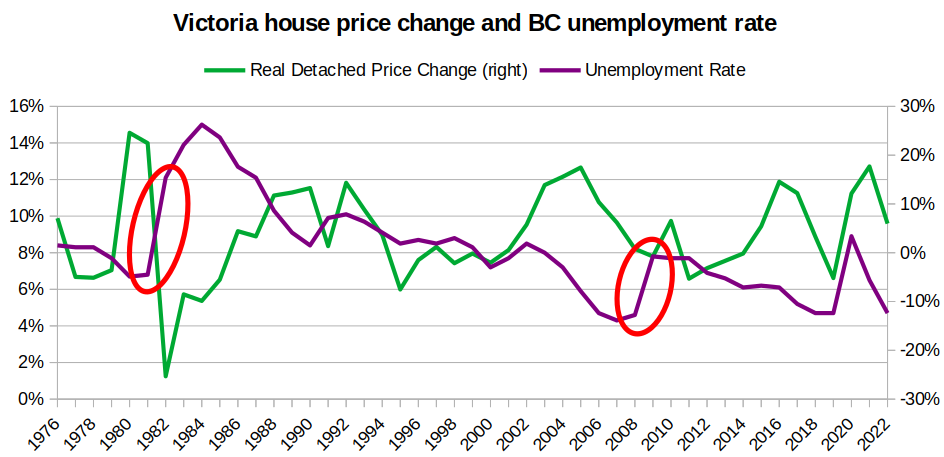

Either way it’s still well below the decline we saw in the early 80s, which makes sense given that affordability was also much worse back then. However one thing that is unique about this decline is that even though it has been extremely sharp similar to what we saw in 1981 and 2008, so far it has not been paired with a matching deterioration of the labour market. Both in the early 80s and during the great financial crisis the broader economy was in active meltdown while the real estate market was taking a dive. However so far the economy is holding up strong, with BC unemployment dropping from an average of 6.5% in 2021 to 4.7% this year while the housing market experienced one of the most rapid deteriorations we’ve ever seen.

A strong labour market can paper over many real estate problems. Negative carry is common in our investment market and investors are conditioned to wait out declines in the hopes of a rapid bounceback in values. That has worked out very well for owners in the past, but it depends on people having jobs to fill in temporary periods of negative cash flow. Markets are already pricing in rate cuts next year which could also underpin the real estate market, but that seems unlikely to happen unless the economy weakens substantially (and thus pushes up unemployment). The goal of central banks is always to tame inflation without killing the economy, but historically it has always taken a recession to do so. It’s probably not different now, but given the weirdness of the pandemic economics I don’t think we’re done being surprised either.

What do you think? Will we see a spike in unemployment next year or will labour shortages act as a buffer and keep employment high?

Moved to next post.

New post: 2023 forecasts!

https://househuntvictoria.ca/2022/12/27/2023-predictions/

Thank you one and all for answers regarding my strata question and it seems to provide a good answer subject to any restrictions that might be passed. I will of coarse get a further opinion from Mullin DeMeo once the bylaw is passed and all the details are available..

Freedom: Exactly what is wrong with you? That was my direct question and it was specific to the missing middle. Thank you for the answer. Near as I can tell, and while I still think this is bad policy, it has added probability close to a million more to the property that we were intending to sell anyway. Well, silver lining for the kids. There really is no trick question here and Marko, in particular, thank you for your thoughts.

In the old days, homeless people were sentenced to two years servitude for the first offense (being homeless), and death for the second offense. So now is much better for homeless people than previously. But obviously lots of work still to do. https://en.wikipedia.org/wiki/Homelessness_in_the_United_States

Here’s a chart of global poverty which ought to cheer you up… “ the poverty rate has dropped from 53 percent in 1981 to 17 percent in 2011 – representing the most rapid reduction in poverty in world history.” And it continues to fall, thanks to all of the advances you seem unwilling to acknowledge.

https://ourworldindata.org/poverty

Yes, it is terrible that some people still in poverty. But 1/10 of previous. And of course there is more to do, so it becomes zero. But that doesn’t take away from the amazing human achievements that have taken place to make this happen, despite a rising world population.

And this reduction had occurred in every continent and area of the world. Here’s current data for that —> https://blogs.worldbank.org/opendata/april-2022-global-poverty-update-world-bank

Here’s a chart of “ Global poverty rate over time.”. I expect you will see it as “visual diarrhea”.

Yup, I don’t think there are any restrictions on ownership structure

From successful old man thats seen lots in his life talking about the average persons situation in this day and age compared to years ago, to a class war of homeless vs billionaires. Did someone get a jump to conclusions mat for Christmas?

Agreed. The gems and the info from insider contacts is pretty easy to filter through.

I’m sorry, but you seem to have confused verbal diarrhea for “words of wisdom”. The fact that the average person lives better today doesn’t mean that a homeless person’s complaints are rooted in envy. But it’s not surprising a billionaire would like to think that.

I don’t see how you would not be able to strata title the units. Plenty of duplexes, triplexes, sixplexes, etc. that are strata titled currently. If the MMHI does not have a covenant that everything has to be rental under MMHI (which I haven’t seen indicated anywhere) I don’t see why builders and developers won’t have the option of either strata or rental. You could also strata the units and rent them out too and sell them individually at a later date.

Big picture, who cares? Housing is housing. Whether owned or rented it will provide a roof over someones head that doesn’t involve driving out to Sooke.

Barrister – I do not know the answer, but I would be surprised if the units could not be strata titled. The goal here is to provide more affordable housing, whether it be rental or ownership.

Some zoning bylaws specifically forbid strata titling – suites in houses or garden suites, for example. A multiplex would typically be strata titled. Someone I know built what the CoV considers a triplex (although it was really a side-by-side duplex where one side had a basement suite), and that was fine to strata title. Apparently it was quite expensive (10k) to get it done by a lawyer.

I would think whatever the rules the developer needs to follow wrt selling (or renting) before the MMHI should be the same after MMHI, as there is no specific mention on changing any of these rules in MMHI.

Now you have it, please leave MMHI alone and proceed asking the direct question, if you are really interested in knowing the rules.

Freedom L My point after MMHI is passed can the developer sell the individual townhouses as individual strata units or will the six townhouses simply be considered one building and only available for rental by the owner.

There is no point or trick question here. I just want to know if after the passing of the MMHI whether the individual units permitted can be made into strata units by the developer without any further permission from the city.

But that question has little/nothing to do with MMHI.

Okay. Then why not just ask the question directly? Why mix the question up with MMHI? That mixup really made your questions confusing.

Freedom I dont have a point, this is not a trick question. I dont know how it works now with a lot zoned for lets say a triplex. Does the developer get to simply decide to make it a strata or does it evolve further permission from the city. Strata and zoning rules in BC are not my expertise so I am hoping to get some basic information here.

As things stand now if a lot in the city is already zoned for 12 units does the developer get to elect whether he builds strata or rentals? This may seem obvious to you but I am having trouble getting a clear answer.

Barrister, I really don’t understand your questions.

A townhouse/houseplex is a townhouse/houseplex and is a townhouse/houseplex, the same strata/rental rules should stand and apply, be it built before MMHI or afterwards, be it part of MMHI or not.

So what exactly is your point? Some more “MMHI inside info” from “your RE agent” that no one else knows about?

Unless I missed something I didn’t see any material that MMHI has to be rentals?

Isn’t part of the point of MMHI that buyers have a more affordable entry point? (aka strata units).

Marko: Sorry I put that badly, after the MMHI is passed amd it permits a sixplex or six townhouses can the developer simply elect to strata the individual units or do they all have to be rentals. Put another way, will the developer have to get any further zoning approval to turn these units into strata and sell them individually.

Hope that is clearer.

A legal non-conforming use which means the improvements will have to have a permit from city hall.

Which means that if the building is substantially destroyed ,by say a fire, you won’t be able to rebuild a multi-family building unless you get the permit approved once again.

This is going to cause problems obtaining financing if you need the income from non permitted suites to qualify for a mortgage. There may also be a problem with obtaining home insurance too.

There will be no re-zoning?

Marko, you seem to be the best informed about the MMHI. When they are rezoning the lot foe a sixplex or townhouses does the developer have the right to sell them as individual strata units or do they have to be rentals. Thanks in advance.

Even if the individual was confusing with floor space ratio it would still be incorrect.

That or the city! I was referring to the discussion around a statement that the site coverage allowed would be 90% which we all agree was incorrect. I was wondering out loud if perhaps he had been confusing site coverage with floor space ratio.

How does site coverage of 1.1 look….you encroach on the neighbours property?

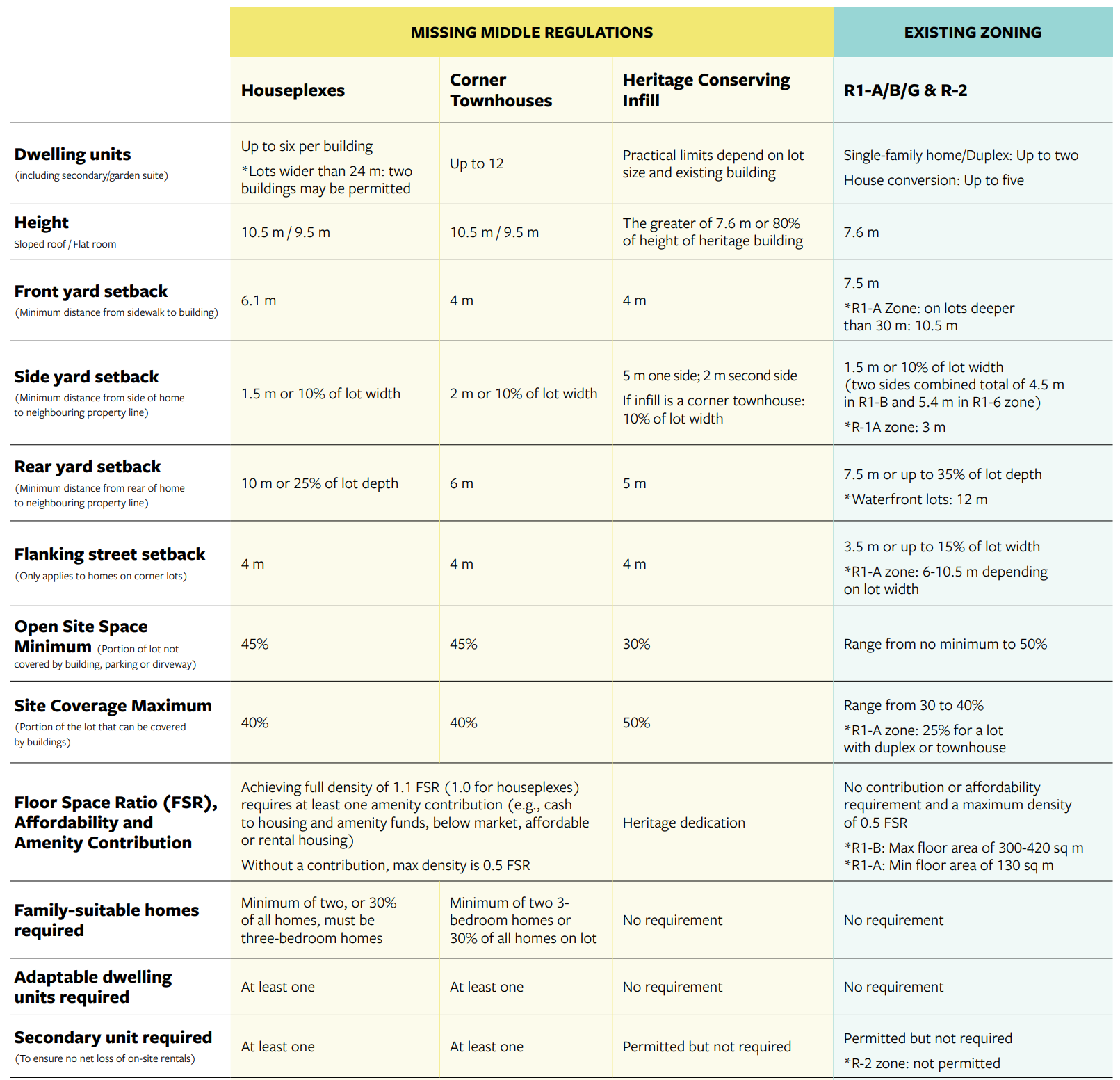

Looking at the chart Leo posted on MM constraints it looks like you are allowed a floor space ratio of 1.0 or 1.1 if you provide a kickback to the city. Could that be what Barrister’s Real Estate agent was thinking of and mistakenly referred to it as site coverage?

I ton of overtime would likely put them into the 220k-240k hh range. If working in the hospital (nightshift and weekend differentials plus stats) you don’t t need a ton of overtime to hit close to 100k these days.

I think most public sector union employees are capped at the 90k mark excluding overtime. But there are also union dues and db pension deductions so take home pay is going to be considerably less than a private sector employee with the same salary.

People should really use take home pay as a benchmark for affordability.

The relevant cohort is prospective first-time buyers in Victoria, dual income household. Using an overall Canada average would be misleading, as it includes students, retirees etc.

For example, I’d expect many of the HHers here are close to, or over that. $75K a year per person isn’t a high hurdle these days.

I suppose nurses can work a ton of OT if they wanted to given the shortage?

He didn’t mean “everybody” to literally mean every single person. Was your point as trivial as that? “Everybody” means “humanity” in this context.

You’re a house hunter. If someone offered you a free Oak Bay SFH. But in return, you irrevocably could never use the internet for life, would you take them up on that? If that’s a no, that shows how powerful and useful advances like internet have been. Something like the internet has been created, that’s more valuable to you than a house. That’s what Charlie Munger is referring to.

The numbers seem off to me as well. Two nurses at 200k hh income would be top 1%?

Apparently two mini-sweeper incomes with the COV are top 5%. Two COV gardeners (no offense to gardeners) are top 5%

https://www.victoria.ca/assets/City~Hall/Documents/2021%20Statement%20of%20Financial%20Information.pdf

These are numbers before everyone gets a 10-12% raise over next few years.

I have used 2020 income distribution for households. More current info has TOP 5% around $162K.

https://www.thekickassentrepreneur.com/household-income-percentile-calculator-for-canada/

You can get ~4.5% with a high ratio insured mortgage.

Is 150k hh income really top 5% in the country?

For that townhouse ($670K) in GH, if a buyer is getting a mortgage ($537K) with 10% down, 25Y amortz, 5.50% Fixed, a lender would consider the following:

Mortgage: $3,270

1/2 of Strata Fee: $250

Heating: $100

Property Tax: $200

Insurance: $200

TOTAL: $4,020

https://www.cmhc-schl.gc.ca/en/consumers/owning-a-home/mortgage-management/mortgage-planning-tips-cmhc

Using the 32% of Gross Income rule from CMHC, the Gross Income needs to be: $12,500 per month or $150,000 PER YEAR.

The buyer will have to be in the TOP 5% of all Canadian households to own this 1970s townhouse. You can play with some numbers, but still the buyer needs to be in the TOP 10% in income. The only way I can see this changing is the price come down (likely) or the interest rate come down (unlikely for 6-12 months).

There is also the Total Debt to Gross Income rule of 40%. When you add the credit card debt, car payment, etc. , it further eliminates more people from buying this property.

Currently, the banks are paying close attention to the rules, their own assessment of the property, as CMHC and other insurance companies will not pay any for insurance claims that had falsified information.

You could do similar calculation for an investor with 20% down, and you will notice that the investor would be negative $1000 cash flow per month, even if the rent is $3,500.

This is demonstrably false. Anyone who would say this isn’t thinking very hard.

Words of wisdom from Warren Buffet’s business partner, Charlie Munger, age 98. He’s right about the “envy” part. Many people aren’t happy when things improve overall, if somebody still has more than they do.

https://www.cnbc.com/2022/12/27/charlie-munger-stop-complaining-about-wealth-inequality-life-quality.html

“ Stop complaining, says billionaire investor Charlie Munger: ‘Everybody’s five times better off than they used to be’‘

“I can’t change the fact that a lot of people are very unhappy and feel very abused after everything’s improved by about 600%, because there’s still somebody else who has more,” Munger said.”

I dont remember anyone actually ever saying that under the MMHI that it would be strata units that you could buy. A number of persons seemed to assume that the townhouses could be individually bought but I dont recall anyone actually pointing out the provision for strata opposed to all these units being just rentals?

I am sure someone here knows whether we are talking just rental units or are we talking strata as well.

Agree with helping adult children earlier than later if it fosters greater independence ie. education/housing. We already do this.

I absolutely believe that almost everyone else is worse at growing my money than I am. I’ve spent the time to learn how to do it and have a track record to support this and the big one – personal vested interested and responsibility. No-one is going to be more interested in growing your money than you unless they are getting a benefit from it personally, which likely devalues the good you can do. And in terms of future vs. current utility, I do believe in my case the future utility will be higher in terms of greater good and it will be more efficient.

I don’t really care about what I can’t control. I can make sure it is invested wisely until then and for them via help with housing and school. I can also set up a trust for grandchildren for the same purposes.

Yes. The need will still be there.

I’m sure they could use it now and we do donate already at a much lower than lifetime legacy level, but I am also sure of my own ability to leverage capital for present and future value.

Bill and Melinda Gates have 200 billion. That kind of money is governmental level. I’d set up a foundation too to make sure it is put to effective current and future use. In terms of growing it, at some point it does become ridiculous and an administrative nightmare to leverage future value for present worth and be sure it will be utilized well. And with that level of funding, you can directly control how it is used.

I’m nowhere near this level and will continue at my relatively modest pace and will probably not die with zero.

Serious question (looking for knowledgably source). If the lot is redeveloped into either six townhouses or into a sixplex can these units, as of right under the MMH be sold as individual strata units or do they have to be a single unit (single title) of rentals only?

I think townhouses would be much more popular if we have the true “freehold” (i.e. no strata and strata fee) ones as in ONT, but the true freehold townhouse is very very rare in #YYJ.

I have had rental suites in 2 of my past houses. Never again after a run of terrible tenants. I have also run a 3 suite BnB. Also never again but certainly would do that rather than long term rental. Paying Capital gains on the sale of those houses stung a little. I prefer having my SFD house all to myself these days even though its half the size overall but same amount of personal space. I would take the Townhouse over the SFD with tenant any day

I never said the theory doesn’t make sense.

The issue is finding a $900k house that is turnkey read to reliably generate $2k a month in income currently.

VicREanalyst, that makes sense to me. $2,000 a month rent will service $300,000 in financing. You could buy a $700K townhouse or a million dollar house with a suite.

Out of all those examples you posted, only the Susan Marie plc one looks like some potential. The other ones don’t look like they are turnkey ready to reliably generate 2k to 2.9k a month. P.s. I have looked at the one by royal oak in person and no thanks.

And I do get your point, my point is that the market currently isn’t there yet, I am pretty sure it will get there in 2023 where you can get cashflow neurtral properties with 20% down.

I’ve sold places from 40,000 feet above the Atlantic 🙂 Email + Docusign truly is mind boggling. Even when I started in 2010 I had to drive over to get clients’ initials if they didn’t have a scanner and I don’t remember wifi on planes back then.

I have family members with 2 to 6 kids living in condos and I don’t see them as any unhappier than those living here in SFHs.

Yet again, here is my cousin Ivana talking about living with two kids in 532 sq/ft -> https://youtu.be/bndG02UvDLg?t=32

+1

The opportunities these days are incredible. The simple emergence of the internet, all the world information in your pocket enabling work wirelessly from anywhere is simply mind boggling. You could be sitting in a cabin in the wilderness, fueled by solar panels and Starlink, managing your hands-off, multi-million dollar business. I know people doing that, except for the wilderness part.

Nothing “remotely” like that was possible in previous generations.

To me, a good measure of “opportunity” would be an answer to this question:

Q. If I lost everything I have today, but still had my knowledge and skills, could I become successful again?

Marko, the SFH might make more sense to you if you have had six kids.

Great post Rush. Thanks.

Currently on realtor 5 bed house with 2 bed suite

https://www.realtor.ca/real-estate/25018394/3321-susan-marie-pl-colwood-triangle

https://househuntvictoria.ca/2022/12/19/dec-19-market-update-new-listings-pull-back/#comments

here is one for under 800k (though with 2 bathrooms for the whole house)

https://www.realtor.ca/real-estate/25036017/2789-sooke-rd-langford-walfred

Here is one for 1 million with a 3 bdrm suite:

https://www.realtor.ca/real-estate/25107376/4263-craigo-park-way-saanich-royal-oak

here is one that sold in Saanich for less than 900K:

https://www.pembertonholmes.com/listing/Saanich-West-BC/3998-Interurban-Rd/20jub?_ga=2.245472192.595593450.1672094966-1529919853.1672094966

I’m sure i could dig more up if i was realtor but it was not my intent to get deep into the weeds on it (my fault for going too detailed).

My point is you can buy a TH for 700k or you can buy a home for 900k-1 million with a suite that produces 2k to 2900 a month. the 200-300k difference accounts for 1000-1500 in straight mortgage costs but you make up more than that on the suite income.

Don’t get my wrong – there are other financial considerations. Obviously a house has more costs than the townhouse but some (or all) of that may be offset with the rent. You also need the down payment for the house which is costing another 25-35kish in closing costs (but you should also consider the value say in ten years as both appreciate). Also if you were factoring the same down payment for both that reduces the TH mortgage more than the difference in price.

As I said I am making $500/month for 10 minutes of work as a result of a spin-off from a YouTube video. It is like my 6th or 7th source of income. Doubt these opportunities existed 40 years ago.

Even 10 yrs ago I would go travelling for 2 months and I would leave my condo vacant. Now I go travelling and I cash in as a result of Airbnb/other platforms.

Even investing is a piece of cake these days. Pretty sure 40 yrs ago you couldn’t log into your phone and buy some CIBC stock with a few clicks paying 6.21% dividend.

Seems like everywhere you look these days there is an opportunity imo.

If you want to work a government job with flex Fridays and not be bothered to do or think about anything in your free time then yea maybe that Oak Bay SFH white picket fence is out of reach.

Right now you can go out of highschool into nursing school and come out at 22 yrs old with the option of working where ever you want, from casual to full time plus a ton of overtime, you can opt to work in Victoria and buy a 1 bed condo or you could choose to go to Edmonton and buy a SFH, or you can be a travel nurse, or you can pretty much do whatever you want. Things change but I can’t see there NOT being a critical shortgage of nurses/doctors/health care workers in my lifetime. Same with trades.

The “societal problem” is that single income nurse can no longer buy a SFH in Victoria, but is having a SFH that big of a deal in the grand scheme of things? I live in a 1,000 sq/ft condo which I consider huge personally. I am perfectly happy. Building has a gym to work out, we have insane outdoor beauty on Vancouver Island which is free to access, I’ve travelled to over 40 countries. To me all of that far outweights some chase for a SFH where there are more bathrooms than occupants. I personally don’t understand the obsession with SFHs.

I’m not buying that. A traditional middle class lifestyle was a lot more attainable back then. If that’s not what you mean by opportunity, what it is supposed to mean?

BC Government + large institutional employeement + IT. I doubt tradespeople or business owners make up a large % of HHV.

Patrick, It doesn’t matter which generation we are speaking about or which decade. It has always been wants versus needs.

But I don’t think those opportunities add up to making life easier for most young people, and that’s the developing societal problem. I suspect that while the expanse of opportunities (eg. types of jobs & careers & entrepeneur opportunities that exist today that never existed before e.g. tech) is vastly greater than when I was young, what it takes to earn a ‘living wage’ is now much higher. Especially taking into account housing in the ‘living wage’. And sure, like Patrick one could say well maybe it’s more about ‘wants’ than ‘needs’ and therefore there’s no real ‘crisis’, but I think for society as a whole the goal posts have moved significantly with housing being the main contributor.

I have not dug into stats to show or disprove this, so yes, it’s just my bias I guess, and my context is mostly Vancouver and Victoria. Eg my in-laws bought a nice single-family house in Port Moody as their first home for $17k (now maybe $1.3 million or so), single earner working retail. Eg we bought our first single-family house (ok this was in Calgary) for $88k, and e.g. we once lived in West Van and our neighbour single-family house (today worth about $3.5 million) was owned by a single-earner retired postal worker. Sure, it’s all anecdotal.

Intuitively speaking VicReanalyst I would agree with you that the Westshore could see a larger decrease, percentage wise, relative to the inner core. However, the Westshore has dramatically transformed itself, as the quality and age of housing is different than what is available in the core. The inner core location may be better as illustrated in the higher land prices paid but the value of the building improvements in the core is lower than the Westshore. Generally speaking one pays more for a plot of land in the core but from what I have seen is that the difference is the value of the improvements (utility) is in favor of the Westshore.

It isn’t as simple as trading off locations. You are also trading off new or near new housing, subdivisions, schools and shopping in the Westshore for an older stock of housing in Victoria. It would have been much clearer to make that same statement when the quality of housing was similar in both areas as it was in the 1980’s and 1990’s.

I kinda of think it’s a flip of a coin this time around as one is trading off location against utility.

Yes, there are 990,000 vacant jobs in Canada (double previous years), and the average offered starting wage is $24. That means about half of them are above $24. A double income household of $24/hour is $96,000 per year. Which puts them in the game for buying a below average price starter home.

Difference between garbage opinions and just straight up posting false information.

My point is that there is a lot more opportunity today to get ahead versus 20-30-40 years ago. Even bottom of the barrel opportunties today such as skipthedishes courier is better than having to do fliers every Friday/Saturday. I think people just look at the negatives, not all the positives that have come about with technology/internet.

Lots of househunters here can afford the $669k family-suitable 4bdr 1,500 sq foot Gordon head townhouse. Three have already replied here indicating that, and specifying various reasons they’re holding out for something better (covered garage, suite, newer build, detached house, cheaper price ).

— So these people are telling us “the house I want is unaffordable”. Thats not a housing crisis.

— That’s different than “the minimum house my family needs is unaffordable”… that would be a housing crisis.

What I learn from this unsold townhouse (and others like it), is that many househunters here are just facing an issue of “wants vs needs” – not a housing crisis.

The interest rate forecasts were pretty funny. No one could even come close to imagining the rate increases we saw this year.

Predictions are hard, especially about the future.

I don’t really have a narrative other than in my opinion if there is a severe downturn then westshore will be much more impacted from both house prices and rent. As such I am not interested in buying a rental property there. But feel free to post a 900k house with a 2k rental suite there if you find it. I am sure it will appeal to some others here.

As you know they exist there. ‘not interested in anything but brand new builds with water front because it suits my narrative.’

I apologize the 90% lot coverage was not correct but I was quoting my RE agent which is no excuse for not checking the numbers. Glad that I was called out on it. Have a good year

everyone.

Like a 2k rental suite in a 900k house which implies around ~4.5 to 5k for the whole house? Lol jk. But seriously post a link if you do find one, not interested in the westshore though.

I haven’t noticed a big difference in garbage per capita in posts on hhv in the last 6 years. Does anyone remember Hawk? Sometimes we have people that just talk about the direction of the market without a lot of facts to back it up. There might be more posts these days which will have more ‘garbage’ and ‘gems’ but I think basically it’s been the same. Anyone who posts garbage usually gets called out on it.

I thought the current debate was middle class housing? So someone needs to define what that is.

I’m quite curious – what is the profile of the readership on this blog in terms of family income? Has this ever been surveyed by you, Leo?

If it all boils down to financial capacity to purchse, I guess I would like to know how valid the assertion is from those below suggesting that the hypothetical average HHVer feel they should have an SFD versus the townhome in GH.

Patrick should reclassify what middle class income is in victoria then. He was saying pre-tax 120k can afford this while raising a family but your example is 160k.

Marko, Canada has always offered a lot of opportunities for immigrants and those born here alike. Well since WWII anyway. Fine and well to talk about it but that’s ducking the issue – we have a housing crisis that’s the result of bad policies and it needs to be fixed. It’s not the result of individuals not working hard enough.

Don’t want to beat my own drum, but I say that as someone who bought a house – my first property – in Vancouver on one income with no help from anyone.

Good for you – I think most immigrants will do what it takes to get ahead. When we first moved to Canada, my parents got a crazy good deal on a house in a wealthy neighbourhood, but we had no real spending money. Then one of the things we did was make goggles for Speedo – it’s funny, but it’s true. We got boxes of goggle parts delivered to the house and the family operated a sort of assembly line production in the basement for a couple of hours most days after school. Makes me laugh now, but actually these were pretty good family times as I recall.

I agree. With an aging population and massive pools of pension savings it seems like the coming years should offer good returns on working and mediocre returns on money

Most exciting time of the year on HHV.

Re discussion below and things being tough for the current generation. Housing affordability certainly sucks and has deteriorated but today there is also a ton of opportunity out there as well. We came to Victoria in 1994 and my parents (accountant and navel architect) had trouble finding work in housekeeping and construction, respectively. My mom cleaned at car dealerships at first, then after 6 months got a job at a hotel and then after two years got a job as a housekeeper at the hospital which was considering a huge success for us. Even when I was in highschool 2002-2004 I remember having a job up Thrifty’s was a huge deal.

My father and I use to drive to Port Renfrew in a 30 year old truck to pick slate from sides of logging roads. Probably not legal but would make $200-$300 in a day. Every Friday night we collated fliers, every Saturday we delivered these collated fliers. I think we made like $120/week or similar off the two flier routes. PennySaver had this hall where people would come to collate fliers my dad would go to. You got paid by the number of packages you collate. It usually went from 7pm-11pmish or around Christmas time well into the morning. You would make $60-90 collating fliers and that was a lot back then. They had a scoreboard of who collated the most 🙂 My dad says some Dave guy was always #1.

Today, I make approx. $500/month as a spin-off of some YouTube video I randomly made years ago. I spend maybe 10 minute a month for this $500/month. This past year I went away for a few months and AirBnbed my primary residence for $14.2k. I don’t think we ever made that much combined delivering fliers for years.

Not to mention if you want to work there is endless work out there and I don’t think that will change going forward (maybe a brief blip as a result of a recession). Or you can just make money of a great idea, which wasn’t really easily feasible back in the day.

Sadly true, some people just like to perpetualy complain without facts.

Some of it very eloquently expressed and with an air of authority, but BS nonetheless.

I see this in my business every day. Once I had a couple in their 80s buy a three flight of stairs to front door walk-up style townhome. The thing is they were completely with it, is it my job to point out they could have hip/knee and other medical problems that maybe at their age three flights of stairs to the main door is not the best idea?

My oncologist (+PHD) cousin and his family doctor wife (+PHD) would die for this townhome in Croatia as it would be a huge upgrade over their condo. World class oncologist too. Training in Vienna and work experience in Canada too (Department of Radiation Oncology, University of Toronto (UT DRO) and Princess Margaret Cancer Centre University Health Network, etc.)

Here in Victoria, I’ll bring back my mini-sweeper example. 73k/year (this was before the wage growth). So now probably 80k/year x 2 = 160k is two mini-sweeper incomes. The cabins in these mini-sweepers have A/C as well. They can swing the townhome two doctors, one a specialist can’t in Croatia.

I just rented out a 430 sq.ft. condo in Vic West for $1,750/month and my parents rented a room in their basement suite for $1,000/month which puts the entire small low ceiling height suite at $2,000/month.

Number on inquiries definitively down from peak, but still possible to find quality tenants even at these insane prices.

40% vs 90% site coverage, close enough 🙂

As I’ve mentioned recently the amount of false information being posted in the last year on HHV is through the roof. In the previous 15 years on HHV we’ve had differing opinions but there was never so much blatantly false info being posted.

LMAO, these are all numbers Patrick quoted.

Get those predictions ready… New post with predictions likely Tuesday.

2023 sales, fourth quarter detached and condo prices, inventory, and BoC rate

Correct. I’ve posted this before, but in case anyone is interested in the facts:

Source: https://ehq-production-canada.s3.ca-central-1.amazonaws.com/b53fb24e8e78d67fb56bd67e840f633459ccd001/original/1658776555/7f1e17a7a3ba2e7831bcc15203c64fbb_MM_22_boards_36_x_48_FINAL_DIGITAL_July_25.pdf (the engage Victoria site where this doc normally lives is currently down)

He does not. Because he made up the 90%.

Lol, this post actually speaks for itself as clearly home ownership is not for you because that’s not a lot of money. Patrick is right, that townhouse is the perfect representation of the entitlement HHV/YYJ people have in regards to housing.

Unlikely you will be able to get a 900k place with a 2 bedroom suite currently. in the spring maybe, but not right now.

Barrister – do you have a link or reference for this? Last time I looked at the proposal this was not the case.

After checking marketplace that would be on the high side. Let’s say 2000 and buy a 900k place instead of a million. Same numbers.

Merry Christmas to all. hopefully a wonderful day for everybody.

Just two examples wrt rent: my friends rent out a 2bed 750 sqft (with in-floor heating and dishwasher) legal basement suite in their $2M+ house near Clover Point for $2200, while their daughter rented out her $600K 640 sqft 1bed condo on Johnson (with ocean and mountain view) for $2400.

Merry Xmas to All.

Sixplexes are good, actually.

But why wait? Might as well give it away before that point when both you and the recipient will get more utility from it.

That’s true if you assume that everyone else must be worse at growing the money. And growing the money for what? Let’s say you leave your kids $10M. Are you expecting them to spend it? Or grow it more for their kids? At what point do you expect the kids to make a different choice and benefit from the money instead of saving and growing it further?

If it’s going to a charity then is it really better to deprive the charity of the money until you die? Or could they use it now, perhaps with an endowment they may leverage it much further than you ever could. That rationale could also be used to counter any charitable giving. Why is Bill Gates giving away his money when surely he could grow it better than anyone and then give away more when he’s dead?

Anyway, I thought it was interesting to think about.

Fair enough. Also, what are you referring to here “ just saying that a 2bdrm rental will get 2500‘.

I have never made that assumption. Perhaps you’re thinking of someone else.

Yes, I agree with all this, and thanks for the elaboration.

See next msg

I view money as a valuable tool in and of itself. I don’t think I could embrace a philosophy that did not consider highest and best use to include legacy uses based on a plan that exceeds one lifetime. This can be kids, grandkids, or charity. I just don’t think that leftover money is wasted once you have enough if you allocate what you don’t need to a good purpose after you pass.

Seems to ignore how the economic snowball works. If you are really good at growing your money and you have enough for your needs, I’d say allocate some during your lifetime for kids and use your skills to leave more behind for good purposes.

Yep. Amazing to me how little this is discussed.

Because they would need 100k plus for down payment and probably another $1200 a month after property taxes, this shrinks the pool of people substantially….. Why are you asking these basic questions?

Also, no one is getting $2500 for a suite in a sub million house unless the owner is living in the suite.

How come you think people have $2,500 to rent a suite in your sub $1 million house.

But no one has $3,500/month to buy the $669k 4bdr townhouse? Where average $1,500/month of that mortgage payment goes to equity.

I was a pt work from home parent for most of my kids pre-adult lives. Classroom volunteer and pac rep. I don’t under-value what a parent does – it was definitely my primary focus. I just don’t think it should be gendered and, ideally , it should be shared or negotiated. It is a loss for a father not to be able to spend time with the kids if he wants this.

If we are looking back to the “good ol’ days” where only the father worked and the mother stayed home and a single income bought a house, I don’t think we should gloss over the downsides for either party. My options were way bigger than the generation before and I suspect my quality of life is much higher overall.

In terms of divorce, the stats speak for themselves – a 50% risk is significant. In the days of one working spouse mother who stayed home had few choices and was vulnerable to staying in an unworkable situation or to poverty in the wake of marriage breakdown. This is why our divorce laws are still skewed towards spousal support of women – it was an unfair lot.

It seems to me that you are interpreting my statements through a lens that doesn’t fully grasp how limited the options for women were, and how this impacted their quality of life. What I am trying to convey is that an affordable house pales in comparison for me as a woman when I consider the limitations of that era.

Patrick, they are allowed to build three story condo apartments with 90% lot couverage on every residential lot. And I agree it is very diffenrent in places in the the US where they have to build family sized townhouse units and duplexes.

Wrong. Missing middle doesn’t work like that. First it’s supply and demand. Take a house out and build a 6plex and in a decade these changes will help supply and take pressure off rents and purchasing.

2nd if you tear down a home and build a new one they are often selling for 2 million plus which is harder to make up over a 1 million dollar townhouse. My example was 300k.

Never said that just saying that a 2bdrm rental will get 2500 and that makes up the 1500 difference in the MTG costs and pockets you 1000 for the extra housing costs.

I think we were typing at the same time.

I did add this: I

— However, I must admit the cynical side of me sees your point. In that, apartments are much more profitable, and developers would prefer to do that than actual MMH.

In answer to your question, yes developers will build apartments if they can.

But the MMH I’ve read about are tightly zoned, and they cannot build apartments. Those were in US cities. For example, in Portland they’ve outlawed “slate housing” and insist that the homes built have a “face” (windows and doors) looking out to the street like a house does. I haven’t followed Victoria closely. So I don’t know what building types they are allowing. It would be absurd for them to allow many apartments, and call that MMH.

Patrick, I dont disagree with your definition but the proposed bylaw in Victoria allows the developer to pick what he builds and the simple economics of profit means that in almost every case the most profitable build for the developer is condos or apartment rental units usually one or two bedroom. Once the MMH is passed the city has no say in what is build.

I am trying to figure ourt if you are really misundering or you are being disingenious. No developer in his right mind is going to build townhouses when apartment or condo units are a lot more profitable.

Actually I always thought more townhouses were a good idea and if the zoning required developers to actually build more family sized townhouses I would be supportive. By the way, I know what the general term means and you know that I know what it generally refers to and I strongly suspect that you are aware that our bylaw that is pbeing passed lets developers pick what they will build and the simply economics is that condos are a hell of a lot more profitable than townhouses.

But you go ahead and tell me why a developer would chose to make less profit by building townhouses than a low rise condo building. It is not a matter of being cynical it is simple profit for developers.

It is not a matter of being cynical but rather this is intentional and is the end product of a very well funded and clever campaign by developers who have strongly supported politicians that have spun this more than my dryer spins my laundry.

Sorry, I am just tired of listening to people talk about townhouse being build for families when this is not what is about to happen. I am really sorry that the voters did not insist that the bylaw forced family sized duplexes or townhouses to be build by developers instead of more million dollor condos.

How about a smart person as yourself studies this definition and picture.

“ “Missing middle” is a commonly-used term that refers to the range of housing types that fit between single-family detached homes and mid-to-high-rise apartment buildings. Examples include duplexes, triplexes, townhomes, and more. ”

However, I must admit the cynical side of me sees your point. In that, apartments are much more profitable, and developers would prefer to do that than actual MMH.

It doesn’t seem you’re considering the contribution of stay-at-home mums. At least not in that post. To the kids and family in general. And instead focusing on economically preparing yourself for a divorce.

Patrick, you have a point except no one is going to be building townhouses. They will be building three or four story condo apartments. Maximum profit is in apartment units and that is what will be built under the missing middle.

I am still amazed that smart people such as yourself still might think that the MMH is about building family units or townhouses.

Nothing too revolutionary, but three things I took away from it:

Then again, we could:

—completely ignore un-sold $669k 4 bdr 1,500 sq. foot Gordon Head townhouses.

—- Though many househunters here can afford them, pretend they cannot. After all, the 4th bedroom doesn’t have a window, and the parking space isn’t covered.

— And instead, declare a “crisis”.

—- And tear down a livable SFH, hand deconstruct it, and replace it with three $1 million step 5 townhomes after 2-3 years construction.

That somehow should improve affordability and help climate change. And make things better for the person who wants a SFH, by removing one from stock.

Lol no kidding

Golly I hope that 1500 square foot Gordon Head townhouse doesn’t sell. As long as it’s still available there is no crisis!!

Relax everybody!

Thanks!

I looked at it quickly and will probably read it. Seems like the biggest points are spend money on experiences, don’t leave anything behind, and help your kids when they are 20-40?

I strongly agree with helping adult kids between 20-40 if you can.

Also agree with creating memories as a priority. Don’t agree you need to spend lots to do this. I have a hard time picturing what I would spend more money on that would be worth it to me. Maybe the book has some good ideas.

I don’t agree with spend it all before you die. Money makes money and I worked hard to have some capital that can be used that way.

Houses have definitely become more expensive. No question.

Of course, housing is only one factor in quality of life and there are still options for secure housing. I do agree there needs to be much more purpose built affordable rental stock.

On the other hand, as a woman, my life is way better than my mother or aunts or grandmothers were in terms of occupational options and wage parity. I experienced relatively few barriers. As someone who is business and academically inclined, I’ll take that over being limited by my gender from the get go but getting to stay home in a 2500-3000 square foot house paid for by someone else. Talk about being vulnerable to a poor partner choice, divorce or death of a spouse…

You are assuming a million dollar house doesn’t require repairs, maintenance and insurance that is covered under strata fees?

LMAO your post speaks for itself, 3k plus mortgage add in another 600 plus of strata and property tax on top of that on 120k pre tax salary while raising couple of kids. lmao, does that sound like a fun time for the middle class?

Just out of curiosity do you consider the 3 bdr 1,500 square foot, 3 level Gordon head $669k townhome to be an example of these unaffordable homes ? Or is it affordable but unsuitable?

Not sure what your point is. My comments weren’t about my kids (I help them as I can, including with housing), it was a societal comment on how quickly housing is becoming more and more unaffordable. Missing middle isn’t a panacea for someone who wants a single family home and my comment wasn’t intended as such.

That’s great. Another HHVer with all kinds of options that are even better than this townhome. So maybe we don’t need to tear down neighbourhood SFH detached homes to make missing middle homes after all.

Instead, we can just wait for fussy buyers like Fatigued and Rush-4-Life to make up their minds on what homes to buy.

And fair enough, a” not a 4th bedroom” by definition, because of no window. But a useful room nonetheless.

I don’t think it’s demand for three bedroom as it is affordability. Condo 3 bedrooms are as much as a townhome and often more.

As for the townhome in question its a 3 bedroom as the 4th doesn’t have a window. And the $500 strata fee is definitely not compelling.

Lastly the thing about a 700k townhouse is by the time you pay strata it’s actually cheaper (or at least similar) to get a million dollar house with a suite.

No need to do that. You could afford it, but choose not to buy it. That’s understandable.

At least I am reassured that people in your situation apparently have a current (or prospective) housing situation that is better than this.

For me, the existence of an unsold (57 days), affordable 4bdr 1,500 sq.ft townhouse in core Victoria like this is a “canary in the coal mine” indicating that things aren’t as bad as some people make out.

And Merry Christmas to you Fatigued Buyer

TIL $669k and a 480/mo strata is not alot of money and every house hunter in Victoria is fussy and entitled for not buying it. Guess I’ll stop complaining now. Thanks papa Patrick! Merry Christmas!

Wait a second. We are told that there has been a fundamental failure of society to provide housing for families. Requiring urgent intervention by government. Yet, here we have a 1900 sq. Foot 4 bdr, 3 level townhouse in Gordon Head. In the core of one of the most expensive cities in Canada.

For $669,000 which is $3,013 mortgage. Affordable to many househunters here. Including many that are lobbying for us to build missing middle, which would build newer versions of townhomes like this. Except smaller and for $1 million.

But “Oh, the included parking space doesn’t have a garage. And it was built in 1973, with upgraded bathrooms”.

So not a single family household buys it (listed for 57 days) Instead they come on HHV and throw a pity party – playing the victim by telling us that there is nothing affordable for their family to live in Victoria.

That tells me what we have is “fussy buyers”, that just want more.

Anyway, a family with about $120k family income can get a decent 4 bdr family town home to live in Victoria after all. And society is so sorry your included parking space isn’t covered.

The people that are rejecting this unit should join the next housing protest, making signs that show what they’re complaining about….

“ PARKING SPACES MUST BE COVERED”

“UPGRADED BATHROOMS ARE NOT SUITABLE FOR FAMILIES”

Because it’s old and has no garage parking. 500k then someone will take it.

If there was a real demand for three bedrooms the developers would put them in condo towers. It is unlikely that the developers will build anything other than one and two bedroom unit apartments in the missing middle lots. More profitable than townhouses or even three bedroom condos. What we will get is just more low rise condos. There is nothing that says that they have to build townhouses or family style homes; they will build what is most profitable.

shh … it is a trade secret 😉

Why is there a perceived need for $1 million townhomes with 3 bedrooms, when there’s 4bdr townhomes for $669k with no takers for 2 months? I get that it’s a 1970s era, but still $331k cheaper, and it’s big (1,500 sq ft)

https://www.realtor.ca/real-estate/25014088/50-4061-larchwood-dr-saanich-gordon-head

I think people still want detached homes. Not missing middle.

My insider contacts are telling me that sub 300/sft

The missing middle are town homes with three bedrooms and would be larger than condos. Enough room for mom, dad and two kids. Prices start at around a million, but they have no suite to help with the mortgage. That’s not that good of a choice for a young family.

You simply can not build missing middle housing in Victoria. It’s too expensive. Yet the city is filled with lots of pre 1970 homes that would be considered missing middle, some with suites.

The solution for the missing middle is not to build more housing but to look at the existing housing. The government could make it harder for investors to buy properties that are suitable for home occupation. Maybe these older homes that are being bought as investment properties should have to pay GST on their purchase? For a Gordon Head home that could mean the difference of $25,000 or $50,000 depending on the number of rental suites. That might be enough to discourage investors buying in the missing middle market. This is different than building which is increasing supply. What this is doing is changing demand. Less competition for starter and missing middle homes should mean lower prices.

This is kind of like what the new demolition practices are doing. This additional cost is a form of a tax on builders and it has resulted in the increased supply of starter homes on the market and longer times for this class of real estate to sell. And in some cases a dramatic drop in price.

We’ve shafted the builders. Why not shaft the investors too?

Your reccomend solution:

iii) building missing middle.

To state the obvious, building missing middle is expected to make single family homes more scarce, expensive and out of reach. You should explain that to your “ exasperated” kids. And then help them to buy a detached home ASAP.

That’s a really good attitude. It doesn’t change the fact though that in just a few short generations, western society has moved (i) first, from single income earner family owning single family home being the norm, to (ii) then requiring dual income earners to support the same thing, and then (iii) to dual income earners no longer being able to support the same thing, ie. single family home becoming more and more out of reach. I don’t think that speaks well of our society’s advancements, and all the younger people out there exasperatedly trying to explain this to their comfortably esconced parents (of which I’m one) have a pretty good point.

Then you add to that the ‘solution’ of people like me helping the kids to buy a home — yes of course that makes sense, but again for society as a whole I don’t think it’s that great as it just creates this sort of ‘entitled’ class.

But ok, on a practical level, what is there in response to this other than (i) younger people adjusting expectations, (ii) older people pitching in more, and (iii) building missing middle.

Anyways – happy Xmas to all

Freedom. I am guessing that it sounds like about ten years of after tax income for the average working person, maybe more. How does that compare with the cost of a same sized house back in 1950? With better power tools and computers it should be less than 1950. Is it?

One of the stats kings here probably knows.

Just finished this book, thought it might be interesting for you Totoro: https://www.amazon.ca/Die-Zero-Getting-Your-Money/dp/0358099765

Bit of a different spin on the FIRE ideas.

I am not Marko, but I guess it would cost between $675K to $750K, give and take.

Ho Ho Ho

Barrister:

And also Barrister:

Anyhoo, equating a better life with more living space is foolish imo. I’ve lived in big and small and it is not the size of the house that determines quality of life for me (past a certain minimum).

My quality of life is way better than my parents, and the house we raised our children in is half the size of theirs. It was objectively much easier for me to attain my goals in my generation (gen x) than it was in theirs (boomers) and this is largely due to technological change and greater access to information. And yes, housing is way more expensive, but interest rates were way lower for much of this time.

Going forward, I’m not sure what will happen with quality of life given climate change.

People definitely can.

But, the real issue here is not about the actual size, but more about the local peer pressure/image, i.e. the feeling and anguish comparing to other families in your city. So if Zach S lives in HongKong, their family would be fine and happily able to make do with a 2 bed condo, be it 500 or 600 sqft.

BTW, given another 100 or so years, if nothing too bad happens, maybe most people in Victoria then would happily live in a 1000 or less square feet space, be it a condo or a MMH.

Totoro is quite right, you peasants should learn to do with less than your parents have had and be grateful for the crumbs. Making life better for the next generation was grandpa’s foolish idea.

I am curious as to what the cost of building a SFD home of 2,200 sq. feet, EXCLUDING THE COST OF LAND, but including the costs of servicing the land and all government fees is in greater Victoria at this point? I dont mean luxury but a decent build.

Maybe somebody like Marko has a real insight into costing. Actually assume it is a step code five since we are moving into that shortly.

How about this one? You say your budget is “pretty large”. This one would have a $3,031 per month mortgage.

4 bdr townhouse, 3 levels, 1922 square feet (1500 sq. Ft fully finished) $669,000 , 4061 Larchwood in Gordon Head

On market 57 days, so no bidding war.

20% down. $535k mortgage 5yr term @ 4.75 % = $3,036 per month. That’s 36% of household income of $ 100,000

Over the 25 year term, 44% of all mortgage payments go towards equity (savings).

https://www.realtor.ca/real-estate/25014088/50-4061-larchwood-dr-saanich-gordon-head

“ COME ONE, COME ALL! This outstanding Lambrick Park-Gordon Head townhome is perfect for young families, first time buyers, students, upsizers or downsizers. Featuring 4 bedrooms, 3 bathrooms, an open living/dining area, a large kitchen with breakfast nook, 3 bedrooms on the upper level, a primary bedroom with 4pce ensuite, plus a huge laundry/storage room and 4th bedroom/office without a window on the lower level. Fresh Paint, upgraded bathrooms, and tasteful updates make this home ready to move in. Outside this bright end unit townhome, you get a 450 sqft South East facing patio for happy hours, summer BBQ’s or to simply relax the day away. This pet friendly, rentable, well run complex has recently replaced the roof and upgraded to vinyl thermo windows. All located just steps to parks & Gordon Rec Centre, a bike ride away from UVic & shopping, or just a 15 min drive or bus ride to Beautiful Downtown Victoria. (25931983)”

You identified that you did not like this, not that people in general couldn’t make do, or thrive for that matter. Average living space for a family in Hong Kong is 484 square feet, for example. In Western Europe most families are raised in homes from 800-1100 square feet in size.

I think having ground access with kids is preferable, but it is not “required”. The biggest issue for me with living in a condo with kids would be noise transfer among units, not space. Concrete buildings are much better for this but we don’t have a lot of them.

You can learn to live in less space – most of the world already does.

https://shrinkthatfootprint.com/how-big-is-a-house/#:~:text=In%20fact%20in%20the%20range%20from%2030-45%20m,27%20m%202%20%28291%20ft%202%29%20per%20person.

March 2008 was in fact the top of the market. Prices started falling rapidly for the remainder of 2008. As I pointed out just days ago, the market was rescued by the unprecedented drop in interest rates by the BoC and intervention by the Harper government. And yes I didn’t see that coming. And I was wrong about how long those low rates would last.

Well now we have the chance to see what will happen with a return to normal interest rates. I sense a certain bravado out there that the higher rates won’t matter. Well we will see. As for myself, I’m a homeowner with no debt and money in the bank so I can just sit back and watch.

The National Bank dataset describes the income multiple needed to pay for a mortgage with 20% equity down.

As you can see, the typical median household in Victoria would not qualify for a mortgage on a condo today with only 20% down. That’s not buyers of SFHs. That’s condos.

Most condos in Victoria are 1 and 2 bedrooms. We tried living in a 2 bedroom with our family and it wasn’t enough space. It goes without saying that most families need something larger than a condo, it doesn’t have to be a detached dwelling but it will typically require more than 2 bedrooms.

A family who bought a property in Victoria at todays prices, who are half way through their 25 year repayment cycle, would be expected to have ~40% equity owing.

At todays interest rates, if this family had to review, we can saw that this roughly translates to a 57/2= 28.5% of median family income for a condo. That’s a 1 or 2 bedroom unit!

And corresponding estimates would be 107/2= 53.5% of median family income for all non condo dwellings (includes townhouses, duplexes and SFHs).

Well we already identified that most families won’t be able to make do with a 2 bed condo, so in all likelihood they will be spending much closer to the non condo figure of 53.5% of median income on that mortgage.

This all seems to be splitting hairs however.

You haven’t built a case that affordability in 2003 is somehow relevant to the current situation with any actual data from 2022.

Would you mind to cite some modern stats for us to review? I’ve shared some of mine.

As for your assumptions about my personal situation, perhaps you should refrain from coming to conclusions without any data.

What I can tell you is that when we moved into our current townhouse in Sept 2022 (out of necessity), I had spent about 6 months looking at comparable units to buy or rent in our neighbourhood.

And I’ve kept an eye on available units for 3 months since. Despite the extremely high rent we pay, we are still spending about $1500 per month less than we would have on non recoverable costs from mortgage interest, taxes and strata fees if we had bought a similar unit in our neighbourhood. Add in the principal payments and the comparison is not even close.

(If you locked in at 2.5% fixed a year and a half ago, I know it’s a different situation, but this is reality of 4% and 5% interest rates with current costs.)

Further, I’m not sure if you’ve even looked at house listings in Victoria recently? There’s slim pickings out there if you need more than 2 bedrooms. Personally, our budget is pretty large but I can tell you that affordability to buy a home right now is extremely tight for any families earning the median income in this city. That’s true even if you bring a 50% down payment from the sale of your last property.

I don’t think you could say the same thing in 2003. But please, bring out some more recent data to prove me wrong.

Indeed Barrister!

Merry Christmas all!

Barrister ya they do up ave nice this time of year hood for the Christmas spirit cheers

It seems like this is the ref stopping the fight. That’s fine with me, I don’t need to wait for a 10 count.

Maybe we can put away the knives at this point. I really enjoyed all the Christmas lights in Oak Bay this evening. But do be careful the roads are a bit tricky out there.

This one is a complete mic drop and watching Patriotz respond in 2023 from this point forward will be continuously laughable 14 years of wrong, not 21 lol

Patrick absolutely destroying Patriotz in the comments section today is this blogs early Xmas present

You called 2001 the “beginning of the bubble”, all I did was quote that. But OK, I’m fine with calling it the market bottom, what’s the difference? Because it doesn’t much matter when we date the start of the bubble, as the relevant point is that you’ve been predicting the END of the bubble since 2008. That’s 14 years of being wrong, not 21.

And this wasn’t subtle “I think prices will fall”, it was some nasty schadenfreude like …

“Patriotz: March 2008: The people buying today are the wannabees and poseurs, who are going to be the nouveau poor.“

http://vancouvercondo.info/2008/03/another-bc-condo-project-stalls.html

Seems to me you’re still waiting and hoping for that “nouveau poor” prediction to occur. Or have I also misunderstood these thousands of posts you’ve made here on HHV?

Maybe you could point me to something even slightly bullish in your extensive 14 year posting history in housing forums. Something that indicates that the bubble is over.

Hopefully that’s a “softball” question for you to hit out of the park.

5 year bond yield breaching 3.2 again…

I have told you before that I was talking about the market bottom in 2001. You know, when prices started going up after the declines of the late 1990’s. But go ahead and ignore me again.

And I learned this only in retrospect looking at historical data, because I wasn’t following the market in 2001, as I was a longstanding homeowner.

You are describing year 1 of first-time buying and owning a house. I understand why this is most interesting to a house hunter. But very few people in our society are in year 1 of owning their first house. Probably 1% of people

It gets easier each subsequent year of home ownership. Because your income rises (with inflation) and your mortgage payments don’t (assuming rates stay constant). And your equity rises.

For example, someone in year 15 of a mortgage has likely seen:

— their incomes rise by 40% and their mortgage payment staying constant (assuming constant rate)

—- their mortgage balance has shrunk in half. With mortgage equity now at 50%.

—- the house has likely risen in value by 40% (through inflation), adding to the 50% mortgage equity.

So why don’t you quote the good times of “year 15” of affordability. Why only talk about the hard times in “year 1”?

There are buyers for every home for sale, so obviously there are enough people who get into year 1. And yah, it’s probably “hard” for the first few years. Not hard like your grandparents likely had it. or most people in the history of the world have had it. And not so hard that many people are defaulting on mortgages. But hard compared to other things in our lives, that have become much easier over time. And yes, hard does mean that you throw most of your money at housing in the early years, and then you start coasting in the later years.

Face reality. You are :

– trying to buy a detached house in Victoria, one of the highest priced cities in Canada, and considered to be one of the best sites in the world to live in.

– detached houses are falling as a % of housing stock. only net 95 SFH additions of core homes in Victoria/oak bay/Saanich per year to house the 5,000 arrivals.

– facing record size buying cohort of millennials like you,, augmented by imported millennials through immigration

– with great incomes and a desire to own in the core, with no commutes

So yes. The situation is “different” than 2003 which was different than 1950 and 1900.

If you tell me it is impossible for you to find any home to buy in Victoria I might agree with you that for you “now” is worse than before. But I suspect that you’re the typical HHVer that limits their search to buying an endangered species: a SFH in the Victoria core.

Sorry, the link is here, page 14: https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/logement/housing-affordability.pdf

I might agree with you on this if we were discussing “how much the average Canadian pays for housing in 2003”. Unfortunately, I wasn’t in a position to buy housing at that time and I suspect a large majority of the people on this forum weren’t either. Additionally, the average family spending on housing is biased down by people who own their homes outright and who therefore don’t have mortgages.

I think you will agree that the more relevant data relates to housing affordability for new and recent home buyers in Victoria, BC in 2022.

As an example, take the data from the National Bank Housing Affordability survey from Q3 2022 in Victoria. They estimate costs relative to median incomes for a condo would be at 57% of income, and non-condo housing would cost 107% of income.

Clearly, the current situation is far different than what your data set from 2003 describes.

I didn’t say the post was made in 2001. His forum post was made 14 years ago ( in 2008), referring to “the beginning of the bubble in 2001”. And that one reason for this was “ Remember interest rates were a lot lower in 2001 than in 1987.”

So we have the same schtick now. Just add 20 years and copy/paste the same posts.

Here’s the post … you can search to find the quotes listed above.

http://vancouvercondo.info/2008/10/lower-mainland-home-prices-drop-below-2007-levels.html

“So I suppose that you being wrong for 21 years isn’t an issue for you”

I don’t think any of the housing forums existed 21 years ago.

You’ve been on various housing forums for many years telling people we are in a bubble that was about to burst. For example, you made a post where you declared the housing bubble began in 2001. (I’ll post the link if you want). Those buyers in 2001 are in year 21 of their mortgages, close to being mortgage free on a $1m+ asset. Assuming they ignored your advice.

Apparently being wrong for 21 years isn’t an “issue” for you, and the only issue is “now”. So let’s talk about “now”

It doesn’t matter what a new buyer has to pay now. It matters what a new buyer is able to pay now. For this, you need to look beyond income, price and mortgage payment. You need to look at all household expenses. Because many have gone way down, such as food and apparel. As I documented in my post, with data. And yes, house prices are high now. But people are able to pay them (record low mortgage delinquency). No “issue” there.

If you have done that in 2003, you would have realized that we weren’t in a housing bubble, using the chart I posted . Instead of spending thousands hours on housing forums telling people we are in a housing bubble that started in 2001. Which apparently you think is still the case.

Seriously 2003? More importantly, the data appears to be averages across all households. There was a major decline in interest rates over the two previous decades, which reduced housing expenses for those who had already bought.

The issue is what a new buyer has to pay now, not what someone who bought in the past is paying. Unless you have a time machine.

This isn’t the outcome that I described, because:

—- the improvements (2003 vs 1950) didn’t “simply free up income to be reallocated to housing“‘ . , As outlined in my post, the income freed up (25%) far exceeded the increased amount (6%) that went into housing. Leaving an additional 19% to be spent on something else . Like the “leisure etc” wish list you put in your post . Or saved. https://househuntvictoria.ca/2022/12/19/dec-19-market-update-new-listings-pull-back/#comment-96686

—-Furthermore, historically 40-70% of all mortgage payments go towards principal, and those are assets like savings.

So that is why it is good news.

And is a big reason that the average household in Victoria is a millionaire. https://victoria.citified.ca/news/1-one-million-thats-the-average-net-worth-of-a-victoria-resident/

I’m not sure I understand the case you make here.

The “good news” of the last 60 years of productivity improvements is that these advances free up income to spend on the things that improve our quality of life: leisure, improved workplace standards, better tools and technology, clean energy, medicine and health care, research and development, better education, more social services… you name it.

If productivity simply frees up income to be reallocated to housing, particularly when a large part of the increased housing cost is land price inflation (not better quality or larger homes) this isn’t good news. This is more like the sort of zero sum economic system that we should be working very hard to avoid.

As a result, I think it’s a mistake to shrug aside the recent decline in housing affordability by pointing out how other aspects of our living standards have improved over the same period of time.

Ya, it was listed a couple of months ago after it bought it in the summer. They did an interior paint and nothing else and pulled it from the market pretty quick. Now it looks like they tossed in an Ikea kitchen and painted the exterior and are shooting for another $250k over what they asked for in the initial flip attempt. Best of luck to them.

Providing birth control was formally illegal in Canada until 1969, although it was often provided under other pretenses.

No, I have never made that assumption. Perhaps you’re thinking of someone else.

It was very difficult to get birth control pills (for the purpose of birth control and not regulating your cycle), from your GP until late 1963. The use for this purpose got into full swing around 1966.

Patrick, you are assuming that the boomers moving here do so at 65. That’s not been my experience. Most boomers that I have met have moved here to be close to their grand children and are more likely to be in their mid 50’s not their mid 60’s

Most every boomer who moves to Victoria is a “boomer who hasn’t bought already” in the Victoria market. And in fact many will and do buy. Providing a positive effect to our Victoria housing market. Especially since many arrive cashed-up. My street is full of these ROCers.

Racing against the clock to unload this flip

https://www.realtor.ca/real-estate/25109227/824-monterey-ave-oak-bay-south-oak-bay

Nowhere near that many. Closer to 400K. However Canada did have a very large net intake of non-permanent residents, for example international students who almost disappeared during the pandemic and are now returning. Likewise temporary workers. The dropoff in non-permanent residents during the pandemic was largely responsible for the smallest population growth rate in decades.

You’re a full decade off there Barrister. The peak of the baby boom was 1960 in Canada. That peak boomer cohort is age 62 in 2022. You might want to re-read that source that told you otherwise.

https://evidencenetwork.ca/the-canadian-baby-boom-years-are-different-from-the-u-s/

The Canadian baby boom years are different from the U.S. While it is fairly accurate to define the U.S. baby boom as having taken place in the period between 1946 and 1964, that is definitely not true for Canada. When one graphs the number of live births in Canada, it is quite clear that the “boom” years went from 1952 to 1965 (inclusive). Those are also the only years in Canadian history when live births in Canada exceeded 400,000. Interestingly, the number of live births in Canada has not exceeded 400,000 since 1965 despite our rapidly growing base population.

See chart of births per year, the peak year of 1960 is highlited. You can see the boomer spike, and also the smaller millennial spike (peaking in 1990). Of course we import millennials now via immigration, so their numbers are boosted to approach boomer numbers.

I think Barrister is right Frank. What ended the Baby Boom was the birth control pill which was introduced in the very early 1960’s.

Wrong Barrister, peak baby boomers were born in 1957, and are now turning 65. Our government is also encouraging seniors to stay in their home since they are incapable of providing adequate care home facilities. They also can’t find enough people to work in these facilities if they existed. Also just saw on BNN that Canada took in 800,000 immigrants this year. Next year I predict over one million.

Here it is:

I believe I read somewhere that the baby boomers are now dying as quickly as they are retiring. The baby boomers were heavily weighted to the late forties and early fifties in terms of numbers.

Patriotz that’s an interesting point.

Baby boomers have acquired considerable investment properties. At some age the issue of self managing these rentals become tedious and I would suspect that most boomers will sell off their rentals and enjoy their wealth. The first of them are now in their mid to late 70’s.

This could be a future trend.

Boomers who haven’t bought already never will. I don’t know whether the boomers are collectively net sellers yet, but it’s inevitable that they will be before long.

🙂

Langford adopts tree protection bylaw

https://www.timescolonist.com/local-news/langford-adopts-tree-protection-bylaw-6284547

I actually agree with Frank this time (for a change 😉 ) wrt housing impact of people living longer.

Remember that 65 yr old today is part of the baby boomer.

It is not only that we live longer, but the Size of our baby boomer generation does make a difference on the housing market.

Also It is not only that we live longer, but we also live healthier so many old people now stay in their own home until the very end.