Will buying a home make you happy?

This may seem like a silly question to ask on a blog called househuntvictoria. Most of my readers are looking to purchase a home or have already done so. Presumably that’s because you’ve made the determination that buying has or will improve your life in some way.

However what does the evidence tell us about owning versus renting? First we want to examine how our housing can affect happiness. There is a good review of the literature here in Chapter 5 of a 2016 thesis titled Housing and Happiness: an empirical study. I’ve also drawn on an excellent episode from the Rational Reminder podcast for this brief review.

Fundamentally, housing affects happiness via its physical characteristics as well as impact on psycho-social and financial aspects of your life.

From its physical characteristics, housing that isn’t adequate in size or comfort (too cold/hot/damp/moldy/noisy), or isn’t suitable (overcrowded/lacking privacy) has a negative impact on happiness and wellbeing. The CMHC has a measure of some of these factors and determines that households living in homes that are in poor repair (inadequate) or overcrowded (unsuitable) are in Core Housing Need. Proximity to noise (like living on a busy road) and long commutes in heavy traffic also negatively impact happiness and are often an outcome of housing choices (drive ’til you qualify).

Housing is both a physical as well as a positional good. That is it conveys social standing and people tend to derive happiness from their housing quality in relation to that of others. Buying or renting a larger or nicer house than your peers will increase your happiness, but it goes the other way as well. A paper called the McMansion Effect found that especially for owners of already large houses, a neighbour building an even larger house reduced the satisfaction they derived from their own home. This effect was increased the closer the new mansion was to their own home and motivated owners to upgrade their own home in response.

Another important psychological effect of housing is on your sense of autonomy and control which are important for happiness. On the one hand owning a home gives you additional control over your living situation, in that there is no landlord to kick you out. On the other hand ownership can impair labor mobility and lead to longer commutes. There is also an effect on how people spend their time, with one study indicating owners spent less time on active leisure and with friends (positively associated with happiness) and more time on compulsory activities like housework. However that same time could be used by owners to make customizations to a home and increase their sense of control and security.

Financial success and stability are strongly correlated with both happiness and housing. Increasing income leads to increased happiness (both experiential and reflective) even if gains in happiness slow down as income increases. Housing can both cause financial stress (paying a large mortgage or rent) and lead to wealth changes from changes in house price.

So what does the research say about the happiness of owners vs renters?

In short, it is decidedly mixed. While owners as a group are clearly happier than renters, that effect seems to mostly or entirely go away when adjusting for factors like income, health, and housing quality. The paper American Dream or the American Delusion studied women’s happiness related to home ownership and found no increase in happiness from ownership. Another study of homeownership happiness in Switzerland also found no increase in happiness from ownership, in fact homeowners were slightly less happy than renters in that sample. A German study from 2014 found homeownership lead to greater happiness, but not if the owners were financially stretched. In fact this seems to be a theme in the research, with multiple other studies confirming that affordability of the home, whether rented or owned seems to be a larger factor than the actual tenure, with owners and renters in housing that requires more than 30% of their income being less likely to be happy.

Overall through my reading of some of the research it seems all things equal there may be a minor positive effect on happiness from homeownership. However several studies indicate that people expect a much bigger increase in happiness from purchasing a home than they actually end up getting.

What about in Victoria?

I haven’t found any studies on happiness and home ownership in the Canadian context, and it’s important to remember that other countries can have very different ownership rates, rental stock and situations, and real estate price trajectories.

Key amongst those for many European countries is a much more secure and established rental housing stock, with accompanying strong tenant protections that give renters a security of tenure that is similar to owners. That is far from the case in BC, where we essentially stopped building purpose built rentals after the 70s, and relied on investors to provide rental housing. While those investors filled the gap in rental housing, they tend to hold rental properties for much shorter periods than institutional or non-profit owners and have the ability to evict tenants at any time by claiming the space for family use. The result is that about 15% of renters reported being forced to move on their most recent move, compared to only 2.5% of owners. The average tenant will see a large increase in security and control over their home from buying, and reap the associated increase in happiness.

The other major difference is the astonishing long run rate of house price appreciation in our market. That goes both ways for owner happiness. Owners that bought years ago are likely gaining a strong happiness boost from the increased wealth, while people needing to stretch their affordability to buy into the current market may suffer from the financial stress and see a decrease in happiness. The permanence of that stress would then depend on whether prices keep increasing, and how limiting the debt is in the meantime.

In conclusion, the research indicates that home ownership likely has either no or only a minor impact on increasing happiness, with other factors playing much larger roles. However with the way our market is structured to systematically favour ownership through favourable tax treatment for owners set against poor support for tenants, there’s likely a far stronger relationship between happiness and ownership in Victoria, BC, and much of Canada. Regardless of where the market goes, it seems like this is a playing field that could use a lot more levelling.

New post: https://househuntvictoria.ca/2021/11/16/how-many-homes-do-we-need

Right now the best 5 year rate if you are refinancing I see is 2.1% and if you are looking to get a HELOC it is 2.35%?

And if you sell your home next year are you getting any return on the investment in the $300k garden suite? If not, when does it make enough money to justify the investment? Is it at least 7%/year because, if not, why wouldn’t you just invest in stocks instead then?

I’d say a basement suite is worth borrowing for in most cases, but I’m not sure a garden suite is unless it is for family. It is not just about the interest payment, it is also about how much it increases house value vs. build cost and hassle. Basement suite is much less of a hassle.

If garden suite is bringing in $2,500 per month = $30,000 year and $300,000 @ 1.3% = $3,900 in interest per year.

Just Jack!

‘Whoeveriwanttocallmyself

grateful for your “free” advice. thinking a tear down and new builds in a ok neighborhood. Looked into bylaws and it seems ok to get a duplex on it. the problem is that I want to hold on to new duplex and keep renting out of both of them to maximize the ROI for that asset.( which is currently under performed as it is not in a good shape in my opinion, collecting rent for 1800 for ages, mortgages are being paid off, and got it around 400k a few years back ). Asked a few realtors and they want me to sell it out for 900k NOW. I am contemplating to sell v.s. build out and keep renting those two units out… Do you think it make financial sense to add “illegal suites” on too the half-duplex? and yes, it got plenty of room to add that 700-900 sqft to it if

it makes sense.

Does a roof warranty transfer after a home sale?

Also who installs metal roofs in Victoria / Westshore I imagine it’s not many companies? Thanks!

There already is a study on the economics garden suites/basement suites and missing middle housing commissioned by the City of Victoria I think – was posted here some time back and maybe someone has the link.

The conclusion was that they don’t make economic sense for developers. That is, a developer could not buy a single family home, install a garden or basement suite, and expect to make a profit or break even.

For a home owner to build a garden suite, the rent will take more than ten years to pay back in today’s dollars. They do make sense if you have adult parents/children willing to invest in this for part ownership – way cheaper than trying to buy otherwise.

I would say basement or main floor suites in a finished home are a different story for most homeowners. They can make the cost back in less than three years and in many cases you will recoup 100% of the cost on sale if you are your own contractor.

I’d say that even in upscale areas many people are going to be looking for a place to have a caregiver later in life, or a space for an adult child.

Does adding a suite also add value to the property? I was looking into the effect on value of adding a granny suite at the back of a property and I got mixed results as to whether or not the property value increases. It seems to depend on the neighborhood. Installing a suite or garden suite has nominal effect in the higher end neighborhoods. I’m guessing those that those that live in these neighborhoods are more concerned about their privacy and enjoyment of their property rather than the additional rental income.

Intuitively this doesn’t make sense to most home owners in that they just spent $250,000 to $350,000 building a garden suite and the value of their property may not increase, as they are equating cost to market value. Similarly if you have a finished basement and decide to install a suite there may be no increase or only a nominal increase in your property’s market value depending on the neighborhood. As you are trading off privacy and enjoyment for income.

Of course this could be different if you are an investor and not personally living at the property. Then you’re not concerned about the loss of privacy and enjoyment of the property by your tenants. Your concern is to maximise profit on the investment.

I would also add that there just isn’t enough data available on garden suites to come to a definitive answer. My free advise (and that’s what it is worth) is if you are contemplating putting in a garden suite is to compare the value of a one-storey home (no basement) in your neighborhood with a suited basement home having a similar main floor area with the one-story (rancher) home. All else being equal, the difference between the two should equate to the contributory value of the proposed garden suite. In lower or middle income neighborhoods where buyers are stressed financially to get into the market and need the additional income then the contributory value of the garden suite could be shown as a function of its rental income. In accounting terms that’s known as your pay back period expressed in months. As a rule of thumb multiple the monthly income by a factor of 36 to 48 months.

If the proposed garden suite has a potential income of say $2,500 per month. Then the contributory value, to the property, of the garden suite would be in the range of $90,000 to $120,000. But the cost to build it will in the range of $250,000. This “back of the envelope” calculation would tell you not to build a garden suite as it isn’t economically a good investment. However when it comes to housing other emotional issues come in to play. As you might want that garden suite for a family member such as your grandparents or adult children. Then the costs of construction may not be that important to you.

In any case before venturing into building a garden suite you should make sure you have lots of equity in your home today as you may have difficulty in obtaining financing if you have little wiggle room in your loan to value ratio. As a guess I would say your current mortgage should not be more than 50 percent of your home’s value.

But of course your mileage may vary.

Luxury taxes under various names, e.g. excise taxes, have been around a lot longer than income tax and used to be a primary source of income for governments.

As for administration of the new “luxury” taxes, all the items concerned are already subject to GST so there’s no extra work involved other than changing a few lines of code.

Public servants have had raises at less than inflation for a decade plus. They’re not the boogeyman you make them out to be.

Once big brother opens the door to a luxury tax there could be no stopping them. Maybe coming soon jewelers will have to charge an extra tax when that big rock of a diamond costs the guy over $15K for his girls engagement ring. Or maybe the first marriage could be exempt but not the second one for a ring purchase. Maybe the furniture store will have to charge the extra tax on any sofa costing over $6K, and the appliance store charging for any stove having two ovens and costing over $2K. Guess they will be hiring more public servants to help administer it all.

‘marko

build some duplexes as per bylaw and throw in some “illegal suites” after and call it a day versus spending next 5 years trying to rezone

~~~

Just wondering having that 900sqft illegal’s suite , does it add more value to the sale price? or does it help with the buyer to qualify for the crazy mortgage ? Looking forward to your thoughts

Thank you

Our new luxury tax begins January 1, 2022. Applies to cars, boats and aircraft. Should they have included $2 million plus houses?

Average rents up 20% yoy. Seems like a rental crisis to me. https://www.cheknews.ca/its-kind-of-a-perfect-storm-average-rent-in-victoria-up-nearly-20-per-cent-since-october-2020-912202/

Monday numbers:

Sales: 310 (down 22% from same week last year)

New lists: 315 (down 26%)

Inventory: 954 (down 53%)

new post tonight.

Here’s the latest report from the CMHC on the residential mortgage market https://www.cmhc-schl.gc.ca/en/blog/2021/new-report-residential-mortgages-shows-30-year-low-arrears

Hi there, this seems like a good place to ask this question: can anyone tell me where to find information on the average fixed term on Canadian mortgages, the average interest rates being paid on these mortgages, the portion of mortgages that are fixed vs variable, etc.? Looking for detailed information on the makeup of Canadian mortgages. Thanks!

Also, thanks barrister – your point re: terms lower than 5 years made good sense. Didn’t know those were available.

Leo are we seeing sales prices recently trending much higher vs assessed values than what we saw in the past couple of months. Some of these recent sales are 45, 50, 60 percent above assessed. I’m shaking my head. Wow. Something has to give pretty darn soon. All I see is risk right now.

Sold $952k

Saanich bans condo conversions if rental vacancy rate is less then 4% which I believe has basically always been the case

I think you’re right. Province needs to step in. Either that or people need to revolt or both.

4007 Malton: $1.24M

4081 Malton: $1.348M

Still looking for sold price on 4007 malton?

Also 4081 malton?

Anyone?

Before the oil slump, many such buildings in Alberta were converted to condos and many units were sold to BC investors. You can see a lot of them for sale today. particularly in sketchy parts of Edmonton. Alberta has no restrictions on condo conversions.

Perhaps policies in BC restricting condo conversions make a difference.

Job security

+1, month six of trying to finish a side walk to no where in the Oaklands area. Brand new completely finished house sitting vacant as can’t finish sidewalk to get occupancy. Thanks COV. Just to hook up hydro took 5 visits by COV and 5 by BC Hydro bickering over how much of a branch needed to be cut off some shitty city tree so we could get power. Of course, I had to be the middle person…impossible for BC Hydro engineer to call the COV arborist and sort it out.

Friend owns two large lots in Vic West (8,000 sq/ft each) that he wants to attempt to rezone to duplexes with suites….he literally can’t get in touch with anyone from COV either via email or voice. for the last month. lve told ihm build some duplexes as per bylaw and throw in some illegal suites after and call it a day versus spending next 5 years trying to rezone.

Project I am working on in Colwood I have spent $150,000 so far on consultant reports, rezoning application still not submitted.

The reason I bought another pre-sale recently is as you said this is going to get a lot worse before there is enough appetite for things to change. The more I get involved in development the more I become bullish on real estate. Bureaucracy is such a massive supply restraint plus throw in immigration and low interest rates I don’t see how things will get better in next 5, 10, 15 years.

@ Frank

1 beds Start @ 550sq

2 beds @ 900sq

Finishing is pretty nice, not new condo nice but almost.

Stainless appliances

Washer/dryer

Quartz countertops & tiled backsplashes

Vinyl plank flooring in the main living areas with carpet in the bedrooms

Tile floors in the bathrooms (not heated)

Baseboard elec heat, no AC

The more and more I deal with the COV, the more I realize this supply issue is going to get a lot worse before it gets better, just wait until the renoviction bylaw gets pushed through, and all these 70’s apartments turn into bigger slums then they already are.

Frank, if you look at CMHC’s housing market information portal, they have data on the number of pbr units and you can see how the numbers have changed over time. That should give you some idea, although I don’t know how accurate their data is which I think is based on a survey.

Converting an existing rental building is unlikely because most pbr buildings are cheaply built bare bones pre-1980 wood frame construction.

Demolition and redevelopment into condos absolutely happens. This was a big issue around Metrotown awhile back.

Viclandlord- With less than a ninety units, it won’t make much of a dent in demand. Any idea on the level of finish in the suites and the sizes? Looks like a nice place, not many developers going to produce anything basic in this market. Victoria isn’t a place for average income earners anymore. That’s becoming a huge problem in most major centres. Could create a real class divide in North America, probably already has.

Any idea how many apartment blocks were converted to condos in the last 20-30 years?

I had pre registered to view this new rental building 3 months ago, they have a show suite finished, with the building ready for occupancy Feb 1.

1 beds starting at 1950 +parking $115, +utilities, +storage

2 beds starting at 2750+

The whole top floor penthouses are not priced, you put what you are willing to pay on the application.

The kicker, I tried to get a spot to view the show suite two days after they released times, all of Nov is completely booked and they are not booking anymore showings at this time. Absolutely mind blowing.

https://devonproperties.com/beacon-on-the-park/

I’ve written plenty of posts on construction and the resurgence in the rental side.

Rental construction is currently high, but was almost zero for 4 decades so there is a big hole to dig out of on the purpose built rental side.

Since 1991 we added about 2000 purpose built rentals to the total stock (additions minus retirements to Oct 2020) while population grew by about 110,000.

Not as bad as Vancouver though, they added only 50 purpose built rentals in 30 years while population grew by a million

Everything I’ve read on this site regarding apartments suggested that apartment construction was nonexistent in Victoria. Someone please clarify, thanks.

Real life problem I see is someone who has owned a 1980s home for 40 years and wants to downsize wants to downsize to a large newer condo with a view, not a 1980s condo. Once you factor in transaction fees there is no pile of cash left over so a lot of sellers are like “screw it, I am staying put.” if sellers were willing, on average, to downsize from 80s dated house to 80s condo then there would be a pile of cash involved.

Also, if you do your own yard work/light maintenance SFH is going to be slightly cheaper on a monthly cashflow basis versus condo and strata fees.

Majority of projects under construction right now are apartment blocks, not condos. Tons of reasons to build apartments such as CMHC financing <1% with great terms.

It has gotten to the point where Langford is trying to encourage developers to go back to condos as it has been all apartments last few years.

If a major appliance goes in a condo, the owner has to deal with it, in an apartment, the building owner has to replace it for the tenant, plus all other repairs. Another reason not to build apartments.

In BC residential properties all pay at the same rate, whether they be SFH, condo, or PBR. In fact the PBR would most likely pay less taxes than a similar condo building because its assessed value would be lower.

Condos don’t make sense. You pay a ton of money for one , you pay property taxes, and high monthly condo fees. Plus, you can be on the hook for any major repairs to the entire building. Probably cheaper to stay in your house. Why would a developer build an apartment block when they can build condos and never be responsible for future major repairs? Maybe that explains the shortage of apartments. Probably pays lower property taxes than an apartment building also. Makes me wonder if condos are a ripoff. I would never buy one.

Cant speak for all boomers and maybe not even the majority but condo living is not everyone’s cup of tea. I rented a condo here about eight years ago when I was house hunting and I really did not like the experience. For a lot of boomers it is not a choice between owning their home and doing holidays. They do both. Strangely, I enjoy mowing my lawn and working in the green house. Not sharing a wall with my neighbours is also a joy. Besides in these days of Covid it is nice having a full gym in my basement and not having to share an elevator with Typhoid Mary.

So, wasn’t saying anything about pushing people out of their homes. Right now it’s a once in a lifetime cash windfall (that avoids taxes) for folks a lot closer to end rather than the start. It just seems like the time to take the money and run. Sure they can’t buy something the same or bigger, but why would they, apartment and condo living with a pile of cash seems like a good thing and play as much as you can because death is coming quickly.

The debt side of this should be fun to watch. As much as people have taken rates that are locked in for 5 years and kicking the can down the road, many do short term variable rates (investors and those just wanting that extra points off their rates). As those climb, combined with folks that maintain lifestyles tied to borrowing should force some more properties on the market in the must sell mode.

As for boomers cashing out their single family homes: Someone is missing the fact that there is no place for them to move to. Add taxing primary residence capital gains and homes would rarely come up for sale. Houses are a unique asset class in that most are occupied for decades and might come up for sale once or twice every 50 years. The existing supply cannot meet the current demand, pushing people out of their homes solves nothing. The only solution is to build more houses.

You’re missing the elephant in the “insane housing market” room. It isn’t boomers, it’s millennials on both the buying and selling side. They love SFH, especially homes in areas that promote wellness and healthy living. As you can see, there are 92 million millennials trying to buy 77 million boomers’ homes. Not enough to go around. Hence, the insanity.

https://www.forbes.com/sites/theyec/2021/06/01/how-millennials-are-changing-the-mortgage-and-home-buying-market/?sh=32e12457690b

“Millennials are having an impact on the market, and it’s not just buyers. A Zillow study found that about half of all buyers are under the age of 36 and about half of the sellers are under 41. “

“Millennials are the largest generation in U.S. history, according to the U.S. Census Bureau. There are 92 million of them, compared to 77 million baby boomers, the previous largest age group.”

“In their home-buying decisions, neighborhood quality and safety ranked highest for millennials and healthy homes ranked closely below, followed by closeness to open space, walking trails and activities, all of which point to the health potential of communities.“

588 Phelps Ave, 8 days on market, and listed at $879,800.

I’m surprise to see SFH that is listed under $900k in our market.

Was it engineered for a bidding war?

How much was it excepted offer for?

Given they used the same photos from last year, I doubt it.

Market is beyond insane right now.

Maybe they done a $200-300k upgrade during that time?

2000 Dotcom, 2008 financial crisis, 2020 Pandemic … now runaway inflation?

Have to wonder if not these insane prices right now, what would convince those holding housing assets to decide to list and take their profits? For boomers, why wouldn’t they cash out? Or did the pandemic make all the geezers terrified of condos, assisted living communities and old folks homes…

In one year, this house increased in value by an average SFH in Calgary.

https://www.joesamson.com/blog/calgary-real-estate-market-statistics/

Seems high to me. Increase at 27% yoy would put the home at 1.469 – 1.8 is $331k higher than the benchmark appreciation would put it at You don’t usually get appreciation on renovations like you do on land so that means that even if $150k was put into the house there is an extra $181k above what you’d expect to see if you broke even on that – and most renovations do not.

https://www.vreb.org/media/attachments/view/doc/stats_release_2021_10/pdf/stats_release_2021_10.pdf

4424 Houlihan listed last year for 44 days at 1,134,900….no sale, listing cancelled. Re-listed two days ago and sold today for $1,627,000.

1501 Eric sold October 16th, 2020 for $1,156,500.

Just resold this morning for $1,800,000.

That is insane.

‘

‘

‘

Sounds about right, if they put 150K (including labour) into it then its up about 32%, market is up 25-30% in the last year, after they pay transfer taxes, real estate fees etc .. most likely made about 25% which about what the TSX is up this year.

When we moved late last year into a so-called luxury home I felt we over paid by about 45K due to their incompetent agent, that’s long been forgotten with a 30% increase in the estimated value, although i would be thrilled if housing prices collapsed.

Mt. Tolmie- Not to mention Venezuela, Cuba, N. Korea, etc… Don’t people realize that the citizens suffer under these regimes while the government officials live in luxury and rob the country of its riches. The people in power would only benefit from the land. Please leave well enough alone, the corruption in government is mind boggling.

Would one who has the knowledge please let me know what 4007 Malton sold for?

Thank you

That is insane. It seems like it has been updated, but for 650k extra that is big bump up. Windfall profits like this really devalue working for a living in a regular job.

1501 Eric sold October 16th, 2020 for $1,156,500.

Just resold this morning for $1,800,000.

That is insane.

It amazes me that people want communism/marxism after seeing the failure that was the Soviet Union.

On BNN: 4.4 million Americans quit their jobs in September. Not sure of the percentage, but many of them retired and are not coming back to the workforce. Most of them probably boomers. My friend retired 3 years ago, he was CFO of a heavy equipment company. They had to retain his services for two years on a part time basis before they could find 3 people to replace him.

The CEO of Home Capital Group just made a couple good points on BNN. He said that homes are no longer a place to lay your head at night and raise a family. They have become your workplace and a place to school our children thanks to the pandemic and technology. That might be the path we’re headed on, which makes homeownership a necessity. Families need more room to accommodate a workplace, classroom , gym and at times a care home for elderly parents. He also stated that investors make up a very small part of their business, the greater majority being single family owners.

It is not. We have public and private land with a long history of rule development around the concepts of ownership. Public lands are held for the public good. Private lands are private property. Makes no sense to convert private land to a concept of public good. What makes sense is to curb appreciation and provide a huge influx of publicly funded low income and rent geared to income and coopeartive secure housing for those who cannot afford to own a SFH. A side effect will likely be a mitigation of the pressures that are causing appreciation and an increase in the societal value of rental housing in lieu of ownership for many.

Have no idea what this means.

Soaring inflation means tougher wage talks, Canadian unions warn

https://www.bnnbloomberg.ca/soaring-inflation-means-tougher-wage-talks-canadian-unions-warn-1.1680930

B.C. nurses’ contract ends March 31, 2022, and teachers’ contract ends June 30, 2022.

Rich Coleman-If all investment properties were forced onto the market I seriously doubt it would solve anything, in fact I believe it would make things worse. They are already occupied and would not increase supply as the tenants have to live somewhere. Rental housing is essential, I simply have to look at the needs of my tenants to understand that renting is their only option. For some people the need is temporary and to remove that option would create huge problems for them.

The problem is lack of supply. The solution is massive rental complexes and towering apartment buildings, something the NIMBY’s do not want. I don’t know how much influence citizens have in making the decisions necessary to approve such developments, but it appears that no one is anxious to proceed. The powers that be might be the ones hampering the supply problem to maintain Victoria’s exclusivity. I’m sure there are lots of people not in favour of densification.

‘It’s disgusting’: Legal professionals outraged as Dye & Durham sharply hikes prices for critical software

https://docdro.id/Osc6lA8

https://www.theglobeandmail.com/business/article-its-disgusting-legal-professionals-outraged-as-dye-durham-sharply/?ref=premium

I think it may help to think of the housing problem as not just a supply and demand issue, but rather a moral issue. Yes, you can make tons of money on real estate. But is it good for society? It is a moral problem. Your profit on housing comes at an expense to other people who need a place to live.

The bottom line is that the disorder won’t go away with more supply or less demand to coordinate private decisions. It will only be sorted out with a clearer understanding of Land as a uniquely public good. Land is, in fact, what defines the public realm as a territory of jurisdiction. The maximum response is Singapore-style land nationalization. But we could probably suffice with less extreme policy options that have the effect of removing land/property as an asset class that investors would want to put in their portfolio to begin with.

I’m sharing this comment that I read below the financial post article I shared below, because I think it is very insightful.

“The price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.” David Ricardo, “Law of Rent,” 1809

The disorder in our property markets derives from confusion about the role of Land. We treat land as if it was analogous to capital. Another asset that can be produced and used to store value following the principles of supply & demand. Both conceptually and in concrete accounting terms, we do not distinguish Land as a unique factor separate from Labour or Capital.

All of this has its own history. The classical economists understood it and focused on eliminating rents and the power of land owners. But in the late 19c, land was subsumed into capital with the marginalist revolution. Old school Georgists like Mason Gaffney and folks like Josh Ryan Collins have the details.

It bothers me greatly when people on here make comments such as Victoria prices are justified because we have the best weather in Canada and everyone wants to live here. Victoria is a great place to live, but don’t be fooled in thinking that it is the center of the universe.

https://financialpost.com/investing/david-rosenberg-canada-second-frothiest-housing-market

David Rosenberg thinks Canada has the second worst housing situation in the world?

My takeaway: Foreign investors are starting to think the Canadian dollar is no longer a safe investment because of Canada’s economic dependence on its doomed housing market.

Frank, more often than not it is first time buyers that the most likely to be in trouble if there is serious rate increases. A close friend of mine who is with one of the big six banks was saying that they ran a computer model of what might happen if rates hit 6% three years from now and it was not a pretty picture, He also pointed out that this would hit us a lot harder than the US since most Americans have a 30 year term.

I am just going by what he said but on the face of it it makes sense.

New downtown Victoria hotel gets council OK

https://www.timescolonist.com/local-news/new-hotel-coming-to-downtown-victoria-4750513

Barrister- I don’t think renewals are stress tested. If you want to increase your mortgage to take advantage of increased value, that would be stress tested. As an example, I renewed in July for three years at 1.89% so I’m good for 2.5 years and suspect to pay a higher rate in the future. Meanwhile, my weekly payments are reducing the principal considerably.

Frank, you also have to factor in the number of two and three year terms as well as the variables. I suspect that most homeowners will manage a renewal fine as long as it is within the parameters of the stress test, More of an impact with first time buyers. On the other hand a three point increase would have some interesting results.

One of my mates is near set to rent out his house and live in his van.

“ That should have read fifty per cent of mortgages will renew in the next 2 and a half years. my proof reader was asleep.”

You’re not saying much at all though. There’s little or no market for mortgage terms over 5 years (sadly), so of course roughly half of mortgages would come due in half of the average 5-year term.

The interesting part, and this would be a great future topic for a post from Leo, is how the average term remaining differs from that 50% mark, over that 2.5-year period.

I would be willing to bet it’s far less than 50%, given the frenzied activity over the past 2 years vs the previous 3, and also given the fact that anyone who renewed at significantly higher rates pre-pandemic could have refinanced at the lower rates and locked in for a new term.

The actual average remaining term, and the average rates that homeowners are paying, will have huge implications for how quickly and how severely any rate hikes impact the market.

Too late now but no reason not to when the new assessments come out. The process is well documented on the BC assessment site

$1.225 mil

Inflation is always zero in real terms actually. 🙂

Does anyone have eyes on the sale price for 1838 San Juan? That one sold fast.

Also, I’d appreciate input on appealing my BC assessment. Based on similar square footage and property size, my place seems to be 100-150k higher than neighbouring properties. Is there any reason not to appeal and attempt to lower my assessed value? It seems that the evidence is clearly laid out by the comparables in their own database. Thanks

That should have read fifty per cent of mortgages will renew in the next 2 and a half years. my proof reader was asleep.

QT- Predictions don’t require reasons, they’re predictions, that’s all. State your predictions and we’ll compare in 12 months. Neither of us will be 100% right. I’m assuming my view of the future so I can adjust my investments accordingly. At some point the stock market will come down to something resembling reality. It is simply overvalued, especially if interest rates increase.

35 years ago I assumed that real estate would increase in value, given the inevitable increase in population and changing demographics. I guessed that one right. It was no guarantee, things could have gone the other way. Maybe it’s just dumb luck. In the end it’s all a gamble.

Please give me reasons that stock market drop 20% if rate increase of 2-2.5% next year, because I would love to learn to protect my portfolio.

What make you think cryptocurrencies aren’t crazy now? And, why wouldn’t cryptocurrencies price crater if the money supply is tighten?

IMHO, in time of difficulty people tend to be more reserved and store money where they think that are safe, such as bond, precious metal, real estate, banking, and commodity. And, in the end value stocks will out perform the rest of the market during a money supply tightening.

I have the feeling that cryptocurrencies will crater if the money supply is tighten once robinhood type of investors ran out of money and have to dip into their gambling fund/s.

The Era of Easy Money may be coming to an end. Price increases, rising wages, and government spending are not good for interest rates. I predict an increase of 2-2.5% in the next year. Not devastating but painful for some. Prices on the Island will probably slow but not suffer much of a decline. Quality properties will still be in demand. However, rental demand could increase, if that’s even possible.

The stock markets will probably drop up to 20% and precious metals will finally move higher. Cryptocurrencies may go crazy.

Frank, it is late and I am not into doing advanced detailed math for you at this point. For a start, over 5% of mortgages will be renewing within the next two and a half years, It is only the people who got their mortgage this month that have five years left. Bear in mind that most US mortgages have a thirty year TERM, and yes I mean they dont need to renew for thirty years, the housing crash was caused by a relatively small percentage of home owners getting into trouble.

A comparatively minor increase of 3 or 4 points (which is what inflation is running at in real terms ) could both restrict buyers ability to buy while at the same time pushing others to sell.

I dont do predictions but I do feel concern.

I lived down in that area of James bay for a few years. It’s great if you focus most of your time downtown with work and going out. Not too busy during the winter months and the Sea wall and Beacon Hill park right there quick run or a walk. The bad, it’s a headache to get in and out of for doing things away from downtown (add 30 minutes to your escape time on weekends), there’s always street closures for some kind of event and not to mention slow traffic for getting around horses. Summer, always jammed with tourist types and a bit of night noise from the folks meandering from the bars to the beach. Without a doubt, the coldest area in Victoria year round with perpetual sea breeze and the random inversions that will roll in off the water that only sit over James Bay, making 10 degrees colder than spots just a few blocks away that remain in the sun. Hope this helps your process. Others might have different perspectives, but that is mine from my few years in that area.

307 – 535 Heatherdale Lane

Asking: $675,000 Sold: $692,000

Would anyone be able to post what 534 Heatherdale sold for?

I paid $1M for my house Aug 2020. I rented the upstairs for a year for $2600+utilities, and am moving up there now and renting the downstairs for 1900+utilities.

If I can own a home for $4000 mortgage, and rent it out for $4500 with all utilities covered, why wouldn’t everyone who has the credit be buying house after house after house?

That is why housing is appreciating so fast. Yes, there is a supply crunch. Yes, there is red tape. But to truly understand why, just look at the realities facing those with the means to buy.

That’s also why it won’t stop when interest rates rise… all the frenzied buying of the past year has locked in mortgages for at least 5 years, and all the rentals in those houses are hugely profitable.

So if inventory doesn’t start rising until that situation is sorted… FIVE YEARS FROM NOW… when will this ‘big short’ start crashing down upon us, barrister?? 7 years? 10?

2957 Shakespeare- Talk about lipstick on a pig.

Any one have any thoughts on 19 San Jose? Nice area..

I am getting that feeling in the pit of my stomach that it may be time to rewatch “The Big Short” again.

1.3M for 2957 Shakespeare.

4,600 square foot lot. Assessed at 756K. That’s a breathtaking amount of money.

Shakespeare is killing it in 2021

Yowza – 50% over assessed. But if you’ve experienced the joys of Victoria/Saanich traffic over the last few days you can see why the location is top notch.

3755 Ascot : $1.35M

In 1990, 5-year fixed (posted) mortgage rate in Canada was 14.25%.

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Ouch! On a $1m mortgage, that would be $142,500 mortgage interest per year.

this time it’s different.

If some kind sould would list the sale price of 3755 Ascot Drive it would be appreciated, thanks.

https://nationalpost.com/news/canada/canadas-unhinged-housing-market-captured-in-one-chart

U.S. inflation rate jumps to highest level since 1990, at 6.2%

https://www.cbc.ca/news/business/inflation-u-s-october-1.6243781

Seriously?

https://www.realtor.ca/real-estate/23808423/1930-casa-marcia-cres-saanich-gordon-head

That can’t be right where ICBC is not providing any coverage, such as in this case where the driver did not have ICBC coverage and there is no uninsured motorist coverage?

ICBC’s switch to no-fault reduced my insurance bill by $32 a month. Personally, I’ll gladly take those concrete savings today (and going forward) in exchange for not being able to sue in an unlikely future situation.

As for third-party liability, I wrote to Rob Carrick about seven years ago asking him what he recommends. He told me that someone in the insurance biz told him that $1M is OK for driving in Canada but $2M is better if you’ll be driving in the U.S.

Ice cubes are an under-appreciated factor in happiness. Granted we did just have to spend $2500 for the resumption of refrigeration and ice-cubification so everything has its cost.

Also great timing on that condo buy

When I bought my condo last year I went from paying $1500 in rent for a one bedroom to about $1400 for a two bedroom all in. Calculating in costs of special levies & appliances probably does make the cost of ownership higher, but at least my fridge makes ice cubes now, and I feel like its cheaper.

“Yes, you could sue them, good luck with that, blood out of a stone, etc.” – not anymore. The BC Government quietly passed a law that takes away the right to sue if you are not at fault -this applies to injury and vehicle damage and death.

“Mortgages pre-approval holds surge as economists foresee rate hikes”. “1 in 4 entrepreneurs in Canada looking to sell or close their business.”

Something you may want to know about ICBC insurance. While on my motorcycle last week I was rear ended by a car. It was at an intersection and a very low rate of speed so everyone was uninjured. Police came and took down the particulars. Turns out the fellow who ran into me, while admitting fault, was test driving the car with an eye to buying it. And the owner of the car had put on a set of plates from another vehicle he owned. Consequently it wasn’t insured and ICBC won’t pay for my $5000 motorcycle was just wrecked. And I didn’t have collision on the bike because I mistakenly thought that ICBC would pay if it wasn’t my fault. So if you don’t have collision on your vehicle and get hit by someone who isn’t insured you are on the hook for all the damage to your own vehicle. Yes, you could sue them, good luck with that, blood out of a stone, etc. Oh, and did I mention underinsured motorist protection from ICBC was done away with in May this year.

Maybe a bit of an exaggeration on average but waterfront place next to my friends on Shawnigan that went for 617k in 2019 resold this spring for 2 million.

“Then my friends that own waterfront properties at Shawinigan/Cowichan that have somehow 2.5x in value during covid ”

Have waterfront properties really gone up this much during Covid?

That is sad. I live in a condo and I have friends that live in $2 to $3 million houses….if anything them living in expensive houses makes me more satisfied knowing I don’t have to go out and do yard work/maintenance/etc.

Then my friends that own waterfront properties at Shawinigan/Cowichan that have somehow 2.5x in value during covid and are now $2 million why would I care I still enjoy them for free like I did previously when my friends invite me. It isn’t like I wake up and think ohhh crap “I’ll never been able to afford waterfront at Shawinigan” my level of happiness is reduced.

Good points, thanks. For me, the third party liability is cheap enough to still be worth it for out of province driving.

Yes, me too.

ICBC is no-fault now so if you lose control of your car and knock a branch off and you injure someone that person cannot sue you even if you paralyze them and leave them brain dead – insurance or not. If you go to Alberta, Ontario or anywhere in the USA, however, the right to sue still is available for injured victims of cars so you get extra insurance then when you travel or leave the province. Only exception is if you are criminally convicted of drunk or dangerous driving – which is rare these days too as they just suspend your license and impound the car. Not sure why we even need car insurance now with the NDP’s no-fault – except by law you are forced to pay money to ICBC for really nothing.

Best to run, though, if you see an out of control maniac driver coming for you.

$2m or $5m third parry liability is cheap…it’s the collision/comprehensive/etc. I skip.

Danbrook One engineer was unqualified for Langford high-rise project, investigators find

https://vancouverisland.ctvnews.ca/danbrook-one-engineer-was-unqualified-for-langford-high-rise-project-investigators-find-1.5658793

If that knocks a branch off the tree injuring someone, you might want $5m liability.

Looks City of Victoria is going to start making reconciliation payments on New Assessed Revenue as part of the Lekwungen Land

Acknowledgement another cost to drive up the cost of new development. Really should be left to the province and feds, city of Victoria keeps getting involved in issues outside their scope.

No. Debt repayment isn’t considered as savings by stats can or any other official measure of savings rate. Your car payments aren’t savings and neither are your mortgage equity payments.

https://www.investopedia.com/terms/s/savings-rate.asp

No, savings is by definition income minus expenses. https://www.investopedia.com/terms/s/savings.asp

Mortgages and other loans are considered an obligation and therefore an expense.

=======

Don’t confuse this with discussions here on the HH forum where mortgage equity payments are described as being like forced savings. They can be considered like savings, but they are not savings according to statscan and are not included Canada Savings rate calculation.

warning, you cannot buy out a leased Tesla anymore (they force you to return it)

That being said when I leased you could buy a Tesla out and I’ve always leased (assuming you can buy out) as it gives you so much more in terms of options.

The only disadvantage with leasing is you have to get the full array of insurance (which is what most people do anyway) and that was running me around $1,800/year. After buyout I just roll with bare bones ICBC it’s around $750 per year. Theory there is if I drive it into a tree well I drove it into a tree. Not worried about theft, etc.

Marko, I watched one of your videos in which you mentioned that you leased your Model S, then bought it at the end of the lease.

Just curious, what was the financial rationale behind leasing rather than buying (initially)?

Heard that Wal- Mart truck drivers in the U.S. are being offered $87,000us and a signing bonus.

I think you’re assuming a single income earner per household. Two spouses each earning $70K with no deductions or credits (which is highly atypical) would have a total tax bill (fed+prov) of $24,547.

https://www.taxtips.ca/calculators/canadian-tax/canadian-tax-calculator.htm

Yes it does. Savings, by definition, is income minus consumption. Debt repayment is not consumption.

Good point. So $99,000 average after-tax BC income in the stats can sourced 2020 chart.

Using BC tax rates, and assuming spouses with equal income, that would be $125,000 average pre tax household income in BC. It’s no wonder homes are so expensive here.- people can afford them! And BCers still managed to pay the high mortgages, high rents, all other expenses and still managed to save $10,000. And of course that “savings” number doesn’t include forced savings through mortgage equity payments. Add that in, and the average BC homeowner is saving about $10-20 k more on top of that. And that’s before the house appreciation. And we are told that we are in an affordability crisis!

But Leo, your affordability charts use average incomes way less than that don’t they? What gives?

Do note that’s disposable income. Quebec has the highest taxes in Canada. Note also that provinces with older populations (such as Quebec) will have lower average incomes simply because the working age population is smaller.

Interesting chart. I didn’t realize how far Quebec incomes ($76k) are behind other provinces like BC ($99k) and ROC ($94k).

Also, I’d expect Victoria income to be higher than the BC average ($99k). Does Victoria average income typically exceed the BC average?

Right, these huge savings numbers show how much money we save when there’s nothing to spend it on. It would be interesting to know how much of that saving was people saving their “emergency, compassionate” government handouts like CERB.

As Leo pointed out, you have to normalize other factors to see what effect home ownership has on anything.

Sure most criminals aren’t homeowners, but most criminals are poor and have major life problems, which obviously makes it difficult to own in the first place. If I sold my house and rented I don’t think I’d go out and mug someone and I doubt any of you would either.

There is research to support that homeowners are less likely to be the victims or the perpetrators of certain crimes. OTOH much white collar crime is committed by homeowners. And of course some of the most notorious crimes in history at the level of genocide have been led and orchestrated by homeowners.

Somewhere out there is a homeowner with poor self esteem.

And savings rates

2020 incomes by province

I believe home ownership provides stability and conveys a certain amount of responsibility to the community. I doubt many criminals are responsible home owners. Any statistics out there on how many criminals are owners? Homeowners have something to lose if they commit a crime. Incarceration and loss of income would inevitably result in receivership. People with the credit rating to afford one are not going to have a criminal record. A home owner generally has a higher standing in society ie. stable employment, advanced education, and no criminal record. Of course there are exceptions, as we know many drug dealers invest their proceeds into property. You would think that a system could be devised that verifies the source of large sums of money. If everyone was a responsible home owner there would be little crime.

Buying a home will not make you happy, you have to feel good about yourself to be able to buy a home.

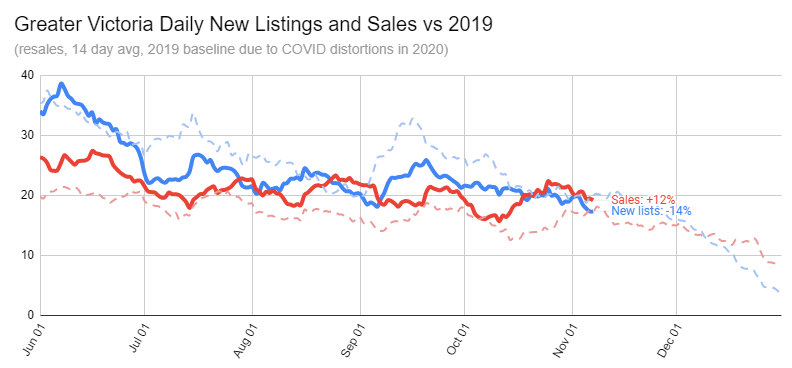

No great change in the market. We’ve had more sales than new listings for a couple weeks now which is very unusual for this time of year.

Inventory down again to 53% below last year’s levels. Anything worthwhile being listed is still being snapped up.