October: Another month of broken records in Victoria

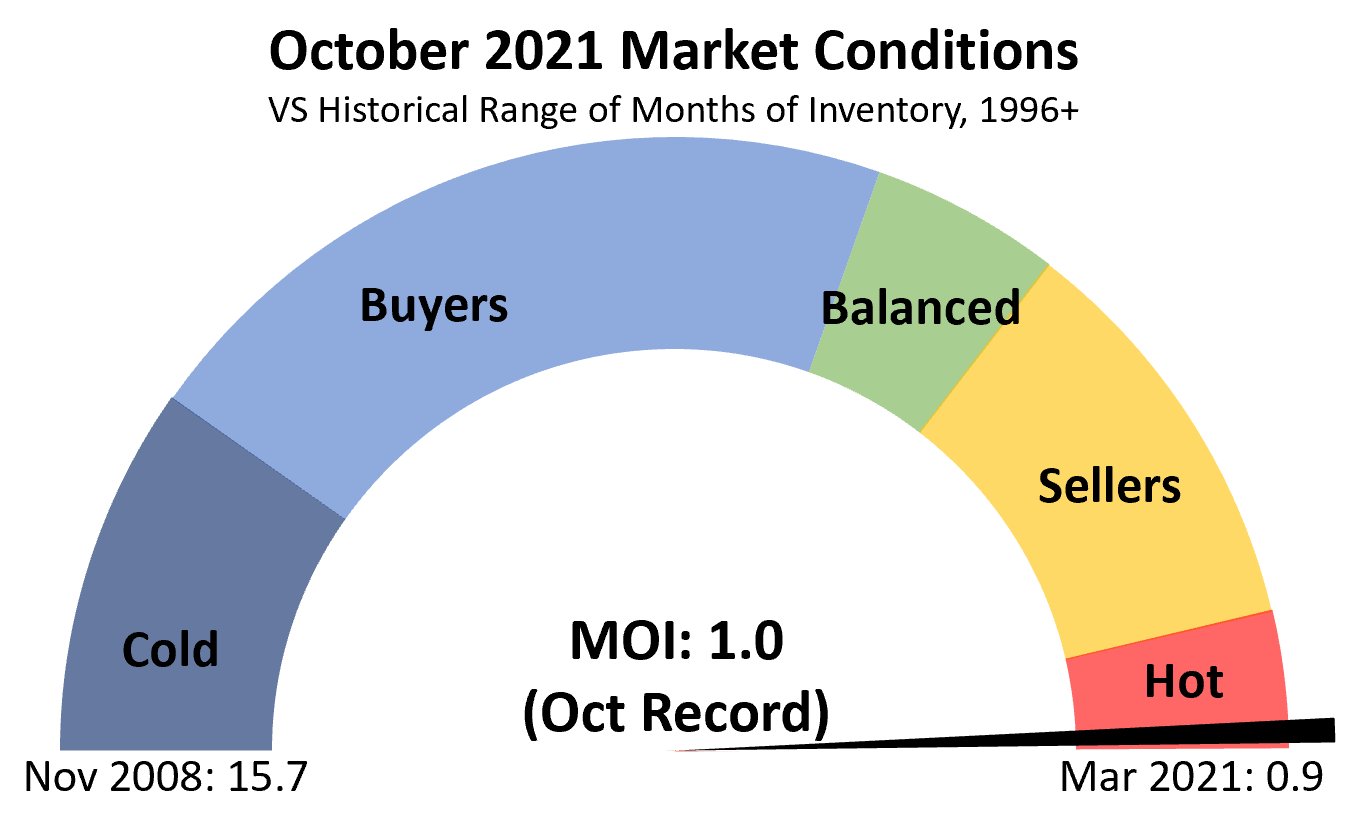

After a brief slowdown in the market during the summer, we’ve been on an upward trajectory again since August and in October the market again broke records in several categories. The lowest inventory on record combined with continued strong sales gave us the lowest months of inventory for any October, which drove prices accross the board to record highs. October was within a hair of the hottest market on record, beaten only slightly by March of this year.

It’s not that sales are the highest we’ve ever seen. The 745 sales in October were far down from the 1163 we saw in March and 21% below last October. However the dropoff in new listings since July hasn’t helped the situation, and with inventory still at half of last year’s levels the market remains extremely tilted.

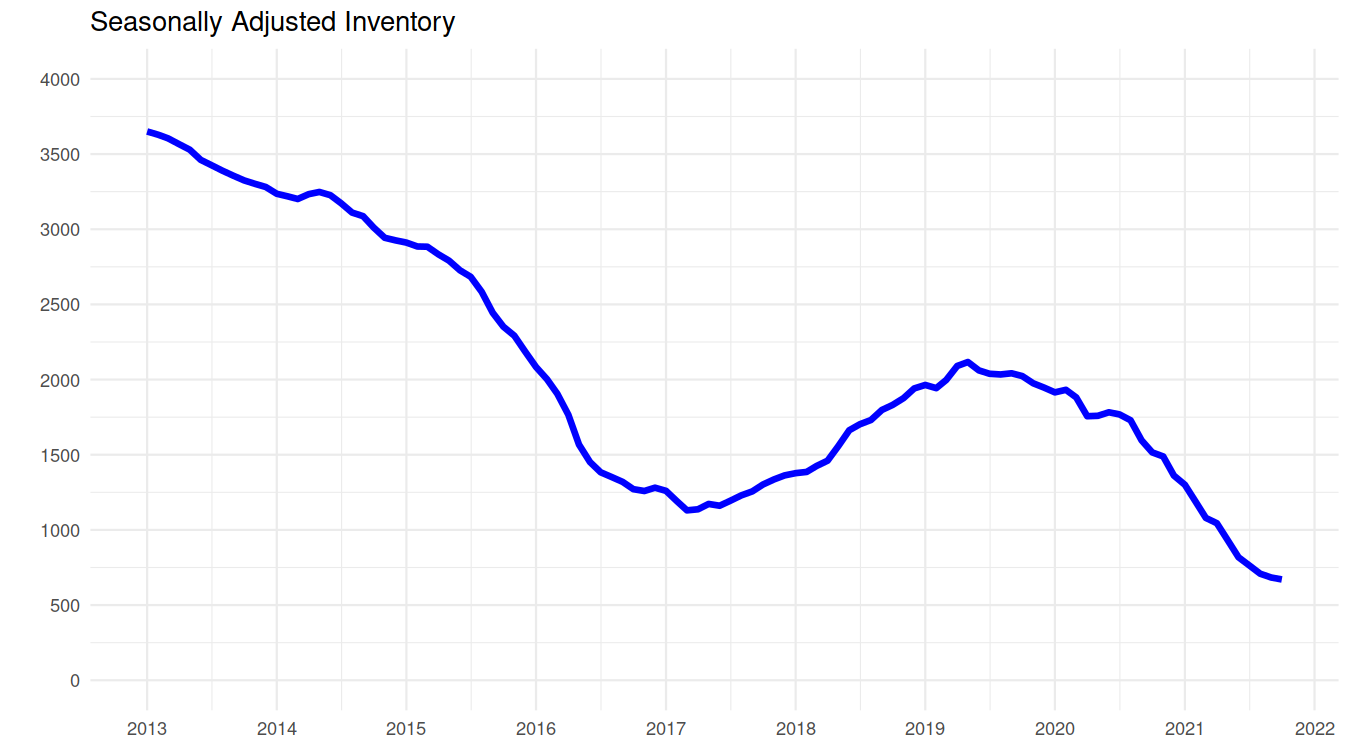

Although active listings continued to decline from September, we seem to at least be levelling out in the decline. I wouldn’t be surprised to see a small uptick in the seasonally adjusted figures in November and December. Not because inventory will actually increase (it will continue falling) but because it seems hard to believe it will fall as much as it normally does in these months. Given some listings are simply always unrealistically priced, it’s hard to believe we will drop much further than where we already are. November and December are usually slow periods in the market where only the truly motivated sellers are active and deals are more likely to be found. This year will be an exception though and opportunistic sellers will likely still find plenty of leftover buyers to absorb any new listings.

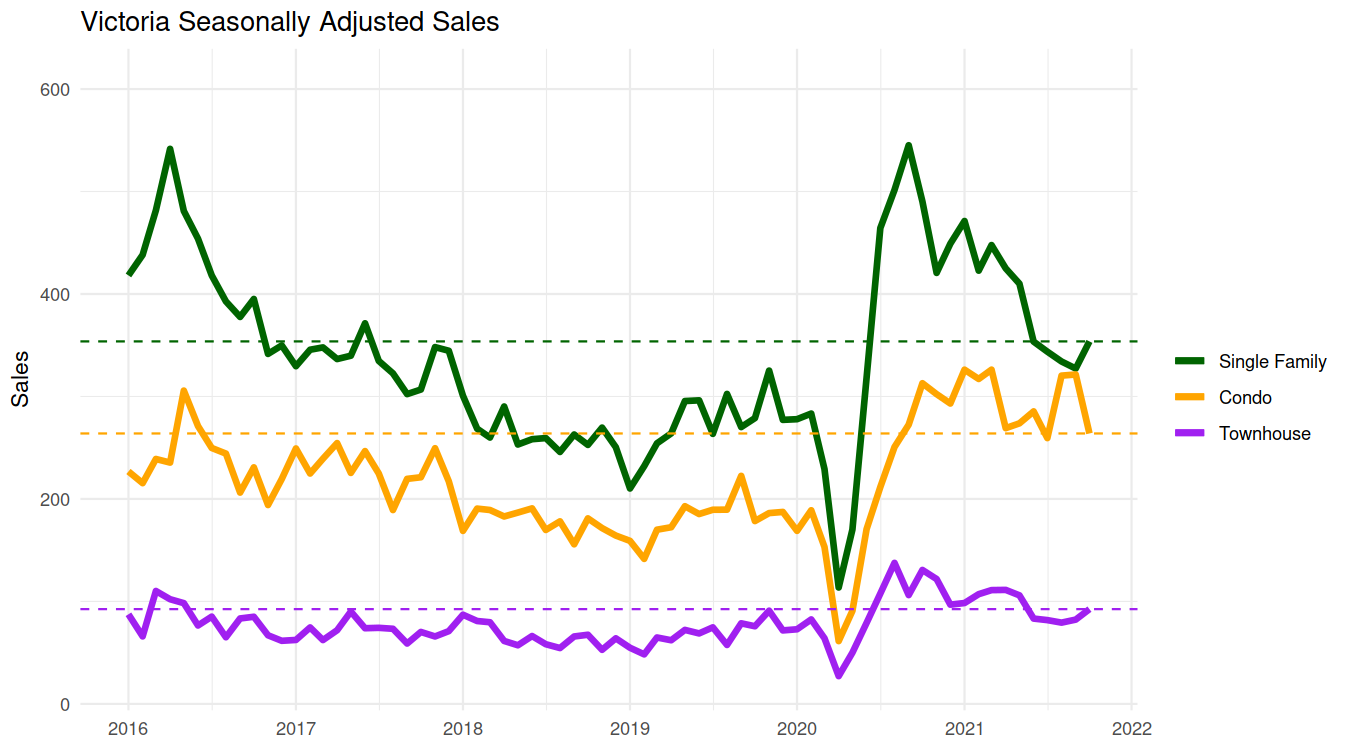

Sales are little changed from September, with a small increase in single family and townhouse sales offset by a drop in condos. All three are still above pre-pandemic levels and condo sales remain very strong. There really isn’t much point in looking too closely at these numbers, because there simply isn’t enough inventory to know what the true level of demand really is if there were enough to buy (even at these prices).

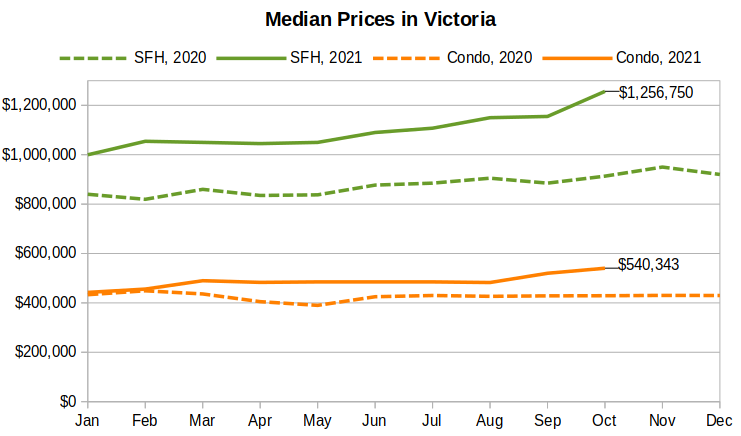

As a result of those market conditions, prices took a big step up in October, with the median single family home cracking $1.2M, a jump of six figures from September. Median prices are of course volatile month to month, but clearly the ultrahot market conditions are still putting a lot of upward pressure on prices. Condos and townhouses also hit record high prices in October. Even manufactured homes have been booming, with the average price up 70% since 2019.

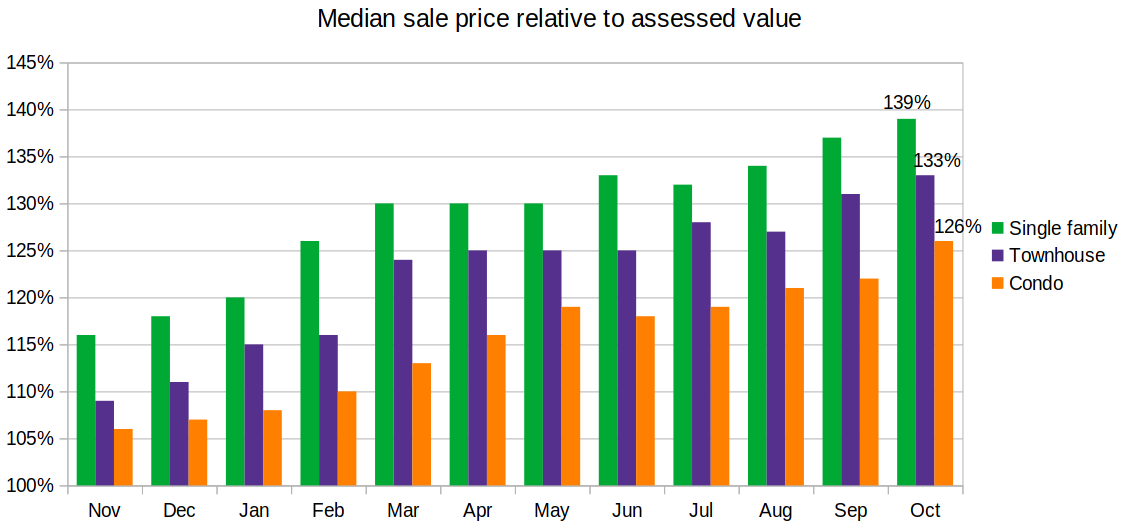

Relative to assessed values, the picture looks the same. The median single family home sold for 39% above last July’s valuation, townhouses went for 33% over, and condos for 26%. Whatever resistance strained affordability had on the detached side it seems it was no match for the reinvigorated market. Third quarter buyer origin figures should be out soon, but out of town buyers made up 27% of buyers in the second quarter, getting close to the high of 28% reached in 2016. The large majority of buyers are still locals, but if most of the out of towners are going into detached houses they could make up around half of those sales. That’s certainly enough to have an impact in the face of our extreme inventory constraints.

Will the price escalation continue? Well in the last article I looked at our sensitivity to rising interest rates, concluding that a 1% rise would strain affordability to around the highest we’ve seen it historically before the market turned, and a 2% increase would put us into uncharted territory. Well the bond market – responding partially to the pullback in quantiative easing – has been on a tear lately and shot back up to pre-pandemic levels.

That hasn’t been felt in the market yet with buyers operating on pre-approvals of existing rates, but the last time bonds were at this level, fixed rates were around 2.6%, so expect more rate increases in the coming weeks. Of course variable rates are still low and buyers can simply jump over to those to continue the party. However with inflation running hot (have you noticed the price jumps at Costco?) and the Bank of Canada both expected and expecting to raise rates several times next year, that may be a risky jump. I bet the strange world of pandemic economics are far from over, and I suspect some will regret going into that world with sky high debt levels.

New post: https://househuntvictoria.ca/2021/11/08/will-buying-a-home-make-you-happy/

Not sure if this is common knowledge, but when I went to get a mortgage on my owner-built, a few of the lenders refused without 3rd party insurance (which was crazy expensive). I ended up finding some lenders that didn’t care, but would be a good footnote for your study guide Marko.

Yes, it is remarkable that someone is interested in a house and grounds like that. Maybe they could’ve rented it to Meg and Harry.

Third email today re owner-builder exam…..based on the complete non-sense owner builder exam can’t wait to see how this cooling off period plays out 🙂

More people would have sold/rented before it took effect, we don’t know the actual numbers. The new census data next year may give a bit of a clue there.

I don’t disagree that the spec tax is not nearly enough to solve any of our housing problems. I support it anyway because it’s one less bogeyman that can be used as an explanation for why we have a housing shortage.

Right, that number got reduced from 900 vacant to 800 vacant last time I checked. Which is 100 less homes defined as vacant under the odd and complex definitions of vacant , but doesn’t represent 100 homes back on the market for full time rentals or new ownership. It could be partial year rentals, other loopholes, or just the owner living it in himself (since many vacant homes are people in the process of moving and retiring here). Or “satellite families” becoming “normal families” when their Canadian citizenship comes through, and like magic their house isn’t considered vacant anymore.

What is surprising is that you look at that tiny number, and use it in response to a question about “have you noticed less speculation in the market?” By “have you noticed”, I mean when you drive down the streets, do you say “oh look at all the houses for sale, must be more of the vacant homes coming on the market”. I sure don’t.

Victoria needs 2,000 new homes per year to keep up with population, probably 10,000 more to catch up with current demand. These kinds of big numbers lead many people (other than you) to conclude that the spec tax reducing vacant homes by 100 is insignificant, and a flop.

The spec tax is primarily a vacancy tax, which is also speculation of a sort (almost no one would buy a vacation home to leave mostly empty if they expected the value to drop). Most people though when they think speculation think of flippers. It hasn’t reduced flippers because it was never meant to do so. It has reduced people buying secondary properties and leaving them empty (a different kind of speculation).

Every owner is part speculator.

The house looks a bit over the top in some ways on Mt. Newton. It will be interesting to see what it goes for or if it is just too much for anybody.

Who even wants to live like that?

What do you mean by “probably” here?

The question was “Have you noticed less speculation going on in the Victoria housing market since the spec tax was introduced?”.

To be clear, it seems your statement is that there is “probably” less speculation going on now (2021) than before (2018)? That would be news to the many HH’ers here that are blaming a rise in investor buyers for part of this run up, including some with radical proposals to reduce the numbers of investor buyers.

I had a comment about peak realtors but i am wondering if you say ‘ouch’ because they are still high given the inventory?

Ouch those sales numbers

New post tonight.

Probably. The counterfactual is even more demand with the same supply

Hardly. Have you noticed less speculation going on in the Victoria housing market since the spec tax was introduced?

So it works is what you’re saying?

‘Strong indications’ that cruise ships will be back in a big way next year, Victoria harbour authority says

https://vancouverisland.ctvnews.ca/strong-indications-that-cruise-ships-will-be-back-in-a-big-way-next-year-victoria-harbour-authority-says-1.5655967

Brilliant recycling of old ideas, such as Folk Fest, Symphony Splash, Victoria Music Fest, etc…, however the strategy failed to mention how to address the homeless at the parks.

Kudos to Lisa Helps and Victoria council and their announced “Music Strategy”. Instead of CRB handouts, musicians should be offered incentives like this to work and perform in Victoria.

https://www.cheknews.ca/victoria-aims-to-become-new-hub-global-destination-for-music-with-first-ever-strategy-907546/

https://www.victoria.ca/assets/Departments/Parks~Rec~Culture/Culture/Music/Victoria%20Music%20Strategy%202021.pdf

Supply and demand… Interest Rates will fix the supply and demand curve… Low interest rates is pretty much free money…..

The Spec. Tax in BC has only moved money to the USA . That’s where I own a vacation home in Las Vegas instead of Victoria.

Sold $1.4M

Any update on 985 Eagle Reach Leo? It’s had a sold sticker on the sign since before the 3pm Friday cut off.

Thanks Patrick for the article that specifies the problem with Canada’s lack of housing supply: a lack of housing! Coupled with rampant immigration, anyone not in the real estate market is screwed.

The idea that eliminating rental investment properties would fix this problem is ludicrous. My current tenants needed a place to live while waiting for their house to be built after selling their house. Without the availability of a rental property, I don’t know what other options they had. They stayed for 2 years and have given notice. My new tenant is a recently divorced professional mother of two who sold their South Oak Bay home and desperately wanted to stay in the area. There will always be circumstances that require rental housing and people are fortunate to have access to investment properties. Life is never cut and dry.

My apologies. I did not read that correctly online.

For comparison:

3275 Campion is a very similar estate also in the ALR but not farm status. 8 acres.

Land value: $2.926M

Buildings: $3.7M

So what is 20 acres of land worth? 5 million? More? They are saving $20,000 to $30,000 a year in taxes on that Mt. Newton Cross property.

They do have farm status

Assessment: Land: $344,000

Buildings: $3.5M

They are getting a massive break on their taxes. Tens of thousands a year.

2019: “The median net worth for families with employer sponsored pension plans is nearly 7 times higher than those without one.” The median net family worth in 2019 with EPP was $633,300. It was $91,200 for families without one.

OK, you prefer to refer to middle income quintiles, so let’s look at those numbers, since they are shown by income quintiles at the statscan link I added.

This shows that between 2010 and 2019, middle income quintiles also saw their financial wealth rising faster than their real estate wealth. On the link below, look at the row entitled “Financial assets to non-financial assets ratio”. You’ll see that it was 79% in 2010 and rose steadily to 86%. in 2019. That means that, LESS of their wealth is in real estate, not more. The opposite of your claim. And this applies to the middle income quintiles that you expected to show the biggest shift to MORE real estate wealth.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610058901&pickMembers%5B0%5D=2.4&cubeTimeFrame.startYear=2010&cubeTimeFrame.endYear=2019&referencePeriods=20100101%2C20190101

Newton Cross….. At least for the present the owners can come and go wearing a mask and no one will know who they are. What will they do when masks go away and everyone can see who lives there?

I looked at those interiors an hour ago and my eyes are still tearing.

You think we should set aside all the stats from the past 30 years and put the focus on the period from 1900 to 1981?

How is Jim Pattison’s wealth relevant to the analysis at all? Look at medians if you have concerns about averages. And don’t forget to factor in any rise in net worth due to home equity doesn’t mean a corresponding reduction in value of or investment in non-residential assets. Also, I would say the internet has actually resulted in increasing amounts of stock investing among my peers.

And you can see the impact of home ownership on net worth if you look at net worth across provinces. This doesn’t mean people are investing less in other assets.

Your point being?

The table presents data from 1999 and 2016 showing the average value of assets and liabilities owned by Canadian households with middle incomes — to be precise, households with after-tax incomes falling in the third quintile (i.e., the third fifth) of household incomes. The amounts are expressed in inflation-adjusted 2016 dollars.

https://financialpost.com/opinion/who-says-canadas-middle-class-is-in-trouble-certainly-not-household-wealth-data

Pretty minimal reduction if you don’t have farm status – which they don’t. Being in the alr is of limited tax value without this – they paid $20,722 in property taxes in 2020.

As usual, aggregate statistics don’t tell the whole story, because ownership of financial assets is highly skewed toward the wealthy. What % of Jim Pattision’s net worth is in his house do you think? On the other hand, many middle class households have many times their net worth in their house.

Also your time frame is too short. You should be going back to the turn of the century at least, because the shift away from financial assets and toward housing for the middle class was well established a decade ago. Ideally back to 1981.

OK, you’re making a specific claim, without supporting data, that the MIX of our household assets has had a HUGE shift from financial towards non financial assets . That is not supported by data. According to statscan, non financial (real estate )assets as a share of total stayed remarkably steady from 2010 to 2019, representing 41% of total assets during that period.

Financial assets (non real estate) as a % actually rose a little (52%-53%) . Moreover , according to statscan table, the ratio of financial to non financial assets for Canadians INCREASED from 109% to 114% during the period measured (2010-2019).

Which contradicts your “I’ve said it before, and I’ll say it again” claim above.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610058901&pickMembers%5B0%5D=2.1&cubeTimeFrame.startYear=2010&cubeTimeFrame.endYear=2019&referencePeriods=20100101%2C20190101

Hope everyone is happy your tax dollars are subsidizing this estate (I mean super productive farmland we need for food security) to keep their taxes artificially low

https://www.rew.ca/properties/3622494/1700-mt-newton-cross-road-central-saanich-bc

Oh sure, the well known definition

Communism – noun – catch all bogeyman for things I disagree with

No couldn’t make it had another meeting. I think some homes for living folks were on

It has always been this way though. The trade off is that if you have benefitted from the last four decades in the housing market you are that much closer to death. Sorry to be morbid, but assets and investments appreciate over time – only problem is we have expiration dates. Buying power doesn’t buy you more time and perhaps we need to accept that at the end of it all if you invest you are going to be better off – for a while – and maybe that is not something to begrudge others for.

I do agree with you about more houses in less space. Secure housing is a need, not a want.

I asked the question about Step Code 3 vs 5 and the COV Planner said that wasn’t his department, classic.

Then you had frustrated people that have been priced out of the market with their concerns like existing owners cashing in as a result of increased land value, developers making money, etc. Someone asked if the elderly have been consulted, etc. All I can say is the COV council is a reflection of the people that elect them.

Leo, did you call in to the missing middle consultation/information session?

Sounds like this is what some people are advocating:

” Canada’s bloated RE sector is absorbing investment that should be going into productive and sustainable industries. ”

But I’ve said it before, and I’ll say it again. Household assets have undergone a huge shift away from ownership in industry (though pension plans, RRSP’s and the like) toward real estate, mainly primary residences. Many households now depend on the latter as their primary retirement plan. A country cannot prosper by citizens selling houses to each other.

Only if prices don’t go down. And another factor that isn’t talked about enough – the inequitable distribution of housing investment. As I’ve said before, one major thing wrong with our housing market is that it’s geared toward those who are already adequately housed, because they are the ones who have benefited from the falling rates and rising prices of the last four decades and have the buying power. That’s how we can have one of the biggest housing sectors in the world and at the same time be short of housing for those who really need it.

This is particularly evident in the Victoria market, which has a very large number of detached houses owned by small households.

What we need is more units with less square footage per unit – but still big enough for families – and less land per unit, not more megahouses. But you’ve already heard that from others on this forum.

So the proposed “cooling-off period” = the death of the unconditional offer?

Cooling-off period is useful for pre-sale deals, as home inspection and mortgage approval clauses don’t apply to a pre-sale (unless one can find a lender willing to a rate years ahead of lending).

The government could just make home inspection and mortgage approval clauses mandatory for all re-sale deals, that should be easy enough for people to back out of bad deals, and help cooling down the market a bit.

Red tapes, costs, plus return of investment in real estate is much lower than stocks, therefore capitals follow where there is ease of business and better ROI.

Adding more red tapes to the situation is not going to solve the housing crisis.

And just having a healthy vacancy rate would mean that rents don’t skyrocket too, plus renting would feel a lot more secure. Right now owning just gives a lot more stability for a family in most cases.

The one annoying thing about this cool off period is it will bring back letters/family photos with buyers trying to convince the seller that they are the most likely offer not abort and I personally think letters should be banned (in order to help a seller avoid selecting a buyer based on the buyer’s race, color, religion, sex, sexual orientation, national origin, marital status or familial status)

I can also see sellers asking for more information like pre-approvals, bank statements, etc., or buyers providing a ton of this information voluntarily to gain an advantage.

Difficult to say how this all will play out but if there is no consequence/penalty for aborting it is going to be a complete shitshow, until the market slows down.

“Bloated” is your characterization, but almost everyone agrees that there is a need for more home construction, which means much higher investment in real estate.

Some fun facts supporting that…

The real estate market also functioned perfectly fine for years with the ability of buyers and sellers to enter into a mutually agreed upon unconditional offer.

Unconditional offers aren’t the problem, the market dynamic is.

Yes I see this as similar to the homeless situation. Wasn’t fair not to allow camping if there aren’t enough shelter spaces. Then shelter spaces were made available and park camping ended.

If we built enough purpose built rentals it would make sense to discourage investors, at least in the detached market that is fundamentally supply limited. Until we do the reality is a lot of rental supply comes from private investors

It could if private sellers aren’t subject to the mandatory cooling period

I offered my property to my tenants in 2017 and they turned me down. They couldn’t afford it. It has since doubled, oops. Now they really can’t afford it. Renters magically becoming able to purchase a house just because it comes up for sale is irrational thinking.

The article you linked does not say this. It says that the zoning restrictions are a problem and looks at what NZ and California have done to encourage densification as an answer to higher prices and low supply. I don’t believe that home buying has been removing investments that should have been going elsewhere. Many businesses are started with home equity, especially now.

That said, young people can’t afford a 1.5 million dollar house and we can’t keep going like this. In desirable areas the new norm is not going to be a SFH in the core. We, likely many other countries, likely need to shift to townhouses/apartments in high demand areas. I think we should be looking at what is happening in California and be careful not to follow them to this before we do something about it:

https://www.bloomberg.com/graphics/2019-california-housing-crisis/

As for the home that went from 765,000 to 1.5 million in nine years, that is 7.8% appreciation a year not adjusted for inflation. It is a lot. I think a capital gains tax on all homes would be a better approach along with a massive investment in affordable purpose-built rentals using the new tax and zoning that allows infill. It would slow the market, create more supply, and likely make renting more attractive.

Loss to existing homeowners all right, but it would be good for the economy. Canada’s bloated RE sector is absorbing investment that should be going into productive and sustainable industries. It’s also impeding efficient use of labour. Granted there would be a short term shock returning to normalcy.

Sky-high housing prices aren’t just a problem for aspiring homeowners. They’re a drag on Canada’s economy

They wouldn’t have to go anywhere, because there would be nobody to sell the rental properties to except renters. Not that I’m advocating this measure mind you.

I really dont see the problem with a one week cooling off period during which time a buyer could do their inspection of the house. For those with short memories this was pretty well how all offers were about eight years ago and prior. Home inspections were done after the offer was accepted and you had a week to get that done usually and you could back out during that week simply because you did not like what was in the inspection.

The real estate market functioned perfectly fine for years with the standard inspection condition occurring after a agreed upon price. In this tight market I just cannot see someone trying to haggle an owner down over minor things. It would work fine, just like it always did before.

On an interesting note. My old home just came on the market at 1.5 million. I sold it in 2012 for $765,000. I figured they must have done some work to justify the 50% increase in price but no, not a thing, not even new paint only new appliances. No one but investors could keep up with this rate of inflation in home prices. I feel so sad for young people trying to survive here, so I am all for home prices falling including my own.

Because our rental vacancy rate is 2% and we are not going to convert all renters to owners by banning second home ownership. We would, in my opinion, be better off increasing stable, affordable rentals for those on lower incomes. Do this through a capital gains tax on all owned housing and low priced long term land leases of public lands.

No-one ignores this imo. Even when houses were more affordable re. purchase price vs income a lot of people could not afford a home. Historically, at least 40% of the population have been renters. If you now erode the net value of homes to the point that almost everyone can afford one, even those with low wages/assets, it is going to be a huge economic loss to existing homeowners and the economy overall.

Not sure what the difference is between a home with a rental suite and owning a condo and a rental condo? Is the second banned?

Again, those in lower paying jobs are not going to be able to afford a home and the maintenance that comes along with it, especially since we are turning into a depreciating or stagnant asset. A lot of people would just be better off renting in this type of market and we should probably have public funding for this type of secure, affordable, rental housing like they do in other countries.

I used to be a low income renter. I’m in favor of increasing opportunity but there is a lot people can do differently to get what they want.

Because the house they live in would just disappear?

It is pretty simple if there was a will/common sense. Approve COV missing middle initiative, tweak it so it actually is economically feasible like removing Step Code 5 requirement, hand “deconstruct” and all the other non-sense BS. Waive all building permit fees/ DCCs in exchange cover 20 year rental covenant and you would see 4 to 6 unit townhomes popping up on corner lots all over the place. If someone wants to do build for sale just charge building permit and DCCs.

Not only would you provide housing but you would increase the tax base.

“Like the owner-builder exam policy they brought in? Zero evidence of any sort of problem to bring it in, but hey why not. One more department and more government jobs.”

Nope, I am in agreement with you on this one being pretty much useless. Then again, who was it intended to serve?

And renters would have nowhere to go. Plus there would be workarounds, like transferring to a PTT exempt family member. This has a lot of unintended and unfair consequences like the example uu gave.

And I agree that we need way more three bedroom purpose built affordable rentals. These should be part of government program of some sort and perhaps built on public lands.

Governments don’t bring in effective measures because they would necessarily result in lower prices, and most homeowners as well as many major economic players don’t want lower prices.

If cratering real estate prices would guarantee a government’s re-election you bet they would do it.

Like the owner-builder exam policy they brought in? Zero evidence of any sort of problem to bring it in, but hey why not. One more department and more government jobs.

The idea that the government is going to find a viable solution to the housing shortage is not rational. They are not that intelligent, nobody is. Everyone cannot live on the Island, the fact that lots of financially established people are migrating there is unfortunate for local residents. Maybe a moat could be built around the Island, oh wait, there already is one. I still think high immigration levels are the main problem.

“The cooling off period has many unintended consequences. You’ll have buyers tying up multiple properties in hot markets.”

The legislation hasn’t been drafted, and there would be ways to deter this, i.e., with fines, penalties or compensation requirements. One good thing about having a professional public service, is they take care of the drafting of Government Bills and figuring out the policy details. The alternative would be to allow politicians to draft their own legislation, and if you’ve ever read a private members’ Bill, that is a truly terrifying thought.

“~20% of homes are owned by investors. ”

In Beijing, local residents are allowed to having multiple properties. 2nd property must have 60% payment for average size condo unit and minimum 80% payment for anything larger. 3rd+ properties must be cash payment. For none local residents, they need live in Beijing for at least five years to allow have a single property only. It’s not a perfect solution, but imagine the outcomes if BC adopted this policy!

“The idea would be to force people to own one home, even if they’ve rented out the second home? So someone like Marko would need to sell all rented condos. If so, Can’t an idea like that just be called inane and dangerous, instead of treating it seriously.”

I don’t think anyone is treating it seriously Patrick. It’s a bad idea, but I think the point was that it would immediately flood the market with a bunch of supply and eliminate investor demand, which would cause prices to go somewhere other than up.

Not going to lie, yes. It creates even more inefficiency in an already super inefficient industry.

Problem with even more inefficiency is I don’t think it will help introduce competition into the marketplace.

Yes, prices would collapse and we would have a super great economy where everyone works a government job with benefits and a pension and has one picket fence home.

People don’t understand that capitalism benefits society on average. The individual working 60-80 hours with no pension to buy and fix up a rental property instead of working 37.5 hours with a pension benefits everyone.

Also, for even something like housing creation people have to take risks whether they be financial, health, etc. Just look at all the deaths downtown in the last 12 months. Death at Custom House (guy fell off scafolding), death at Yates on Yates (piece of plywood landed on a guy), etc.

Everyone working a safe government job living in one Oak Bay SFH is not reality.

“uu” also provided an excellent example.

It’s gonna create a ton more (unpaid) work for realtors, by the looks of it.

If due diligence is the primary objective a much better way to do it for would be to legislate 7-day minimum delay on offers with no bully offers allowed with reasonable access for inspections during the 7 days.

The cooling off period has many unintended consequences. You’ll have buyers tying up multiple properties in hot markets. You’ll have buyers continuing to shop around during the cooling off period (how would you feel as the seller?). It is going to put buyers working with newer agents at a huge disadvantage (i.e., you have two offers and one is represented by an agent who has done 1000 transactions and one by and agent who has done 10).

I’ve talked about it in many of my videos over the years but there is a good reason why sellers take substantially less money, on average, for unconditional offers.

I had a seller this year (immaculate house owned for 25 yrs) that was super super stressed out about the selling process. When we were listing the property she noted…if someone comes in unconditional I’ll take a lot less in exchange for not to have to deal with stress of waiting for conditions to be lifted (house sold conditionally and inspection was perfect so she wasn’t trying to hide anything, just stressed). You have to remember buyers come back and nickel and dime after the inspection, etc., which is totally fine but some sellers find that extremely stressful/frustrating.

It’s kind of like buying a car for me. If I am buying an EV I would pay $50,000 to buy it through a dealership and I would pay $52,000 to buy the same car online because I don’t want to deal with the aggrevation/time of a dealership. I would rather be $2,000 out than have to deal with your average dealership people.

The idea would be to force people to own one home, even if they’ve rented out the second home? So someone like Marko would need to sell all rented condos. If so, Can’t an idea like that just be called inane and dangerous, instead of treating it seriously.

Yep. The industry will freak out but life will go on. Maybe it adds a week to getting most homes sold even in a hot market. Not the end of the world that you can no longer make a $1M+ sale in 2 days.

~20% of homes are owned by investors. I guarantee you if those are all forced onto the market at once house prices would collapse.

Still an active listing. Offers today by 3PM looks like.

Personally I think the cooling off period is a good idea, from a consumer protection perspective. As others have mentioned, it’s not likely to have an impact on prices, but it will hopefully avoid people buying homes they probably shouldn’t (mouldy basements, structural issues).

There’s so many sub-standard older homes that need a lot of (expensive) work in the CRD. 7 days gives enough time for a purchaser to sit down and think through if it’s really worth it.

But it’s not going to do anything for prices, and might even make them higher as people don’t need to gamble on the condition of a place being “ok enough.”

Anyone know what 985 Eagle Reach sold for? Was listed for 1.35M less than a week ago.

Thanks

“Certainly collapse house prices”?? IMO, None of the ideas mentioned would affect house prices much if at all.

In predicting future house prices, nothing is certain. Prices are booming across Canada, including investment properties (subject to capital gains on sale) and in provinces without home ownership grant. The BC homeowner grant is tiny, about $600 per year. This and the other tax tweaks mentioned are hardly worth consideration as a means to “collapse house prices”.

So there is a fortunate couple in their mid 30’s with two great paying government jobs, bringing in $180K per year. Thanks to their parents they have no education loans to pay back, and received $100K from them to help with their down payment on a $750K home purchased 3 years ago. The house is now worth $1.2M.

Then there is the single guy also in his mid 30’s, has a fairly good paying job, ($60K per yr), but is in the private sector with no pension or any of the other perks/benefits of a gov’t position. He didn’t get the $100K and only has the single income coming in plus he is also paying off his tuition loans. So, he purchased two condominiums three years ago also. He paid $300K each for them. He lives in the one and rents out the other. So now he gets a bit of income from the rental. He also considers that rental as his eventual “retirement pension”. He is ambitious and takes responsibility for himself for his future.

But now the government is coming after him. He is being forced to sell that second condo. Sure seems fair, right? There are a myriad of scenarios that would cost thousands of people/couples in this province to suffer an incredible financial downfall if the government tried to implement this.

We need more 3 bedroom rental accommodations to be built in this city.

I think one of the biggest contributing factors creating our housing shortage is the number of couples splitting up and the number of singles in society today. I know lots of long time marriages that seem to fall apart later in life, necessitating one of them to find a place to live.

Stop trying to social engineer our society just so you can get a better deal on a house.

About 5,000 people from the rest of Canada move to Victoria per year. Victoria needs 2,000 additional homes PER YEAR to accommodate them.

The spec tax found 1,000 “vacant second homes” in Victoria. If we dispensed with the rule of law and expropriated these 1,000 homes, that’s a ONE TIME gain of a 1,000 homes.

Looking at these numbers, the housing supply needle will never be moved by obsessing with people with second homes. Many of those second homes are for legitimate reasons, summarized as “life gets complicated”.

Not only do we need more housing for all these new immigrants, we also need more: hospitals, schools, roads, water sources, sewers, prisons, firehalls , police stations, internet infrastructure, public transit, grocery stores (and groceries), energy such as electricity and gas (gasp), the list goes on. Housing and more people require additional infrastructure which costs trillions. Our idiotic government officials are oblivious to this.

Doesn’t matter if people rent or own or it’s free housing or whatever. >400k immigrants + >100k = >500k heads additional need a roof over their head every year. Second part it is proven that not that many places are actually vacant….i.e. we can’t flush out further vacant places with more policies like the spec tax as there aren’t that many to flush.

I like this idea. The number of homes on the market would rocket, the prices would drastically reduce and many of those renters could become home owners. Win win for the little guy!

Those things would certainly collapse house prices and I think perfectly fine if we as a society want to reduce some of the current extraordinary subsidies we provide for home ownership.

But it won’t address the housing shortage. Forgetting about tenure we currently have a shortage on both the resale side and the rental side and few empty homes. When you say we need to reduce demand, the demand simplifies down to people.

There definitely is a supply problem Rich. We have net migration in that doesn’t match supply of both homes and purpose built rentals, especially affordable rentals geared to income. If you have data and research to refute this it would be great to see it. This has already been analyzed here in prior posts which you may have missed.

There is more demand for homes then there is supply. That is obvious! However, the problem is not the limited supply. The problem is that there is too much demand! Demand is the problem. Supply is not the problem!

What the government needs to do is put policies in place to reduce and discourage speculative demand. Turn housing from a speculative commodity back in a basic human need.

This can be done by eliminating tax benefits, introducing new taxes, eliminating the principal residence exemption, eliminating the home owner grant, etc.

An even more radical yet effective solution would be for the government to limit home ownership to 1 home per adult Canadian resident couple or permanent residents couple (common law or married). Force multiple home owners to sell or have their secondary homes expropriated.

Or we can keep the existing state of affairs going and watch our society slowly crumble. The choice is ours!

The plan is getting lots of holes poked through it…

Province to introduce cooling-off periods for home buying

https://www.timescolonist.com/local-news/province-to-introduce-cooling-off-periods-for-home-buying-4724925

I can understand pricing a property low if it had no renovations or upgrades for decades. However, any recently renovated property should be priced at market value. It’s unfortunate that houses requiring major renovations sell for an inflated price, but the location might be the priority, not the condition.

The industry is ridiculous.

Meh I think it’s good they’re at least thinking about it. This won’t do much except perhaps protect a few people from wildly overpaying but they also just waived the requirement for a public hearing for OCP compliant projects and said its the first in a series of steps on housing. Minister Eby has been dropping hints that they’re looking at stepping in on zoning.

The real rates don’t really matter. Rates go up it drops buying power immediately but income gains take time to raise it back up

I was licenced in 2010 and I never came across an unconditional offer until sometime in late 2015, five plus years and over 350 successful transactions into my career. The root cause of unconditional offers and all this non-sense is the imbalance in the market place. Too much demand, not enough supply. Once again the government has come up with another brilliant idea that will not address the supply problem.

I agree there are issues with the sales process; however, there are other ways to approach it imo. For example, I would crack down on price baiting and some other stuff. If a property sells 20% over asking the listing agent needs to submit a CMA to a panel of how he or she came up with the list price and if they cannot support their artificially low list price $25,000 fine. I am betting 10-15 offers scenarios would quickly dissipate.

Right now a lot of properties with an obvious market value of $1.2 to $1.4 are being listed for $995,000-$1,099,000….like common. Makes the industry look ridicolous.

Great in theory, would never work in real life. It is only Thursday and I already have three scenarios this week that would fall into a sea of gray. For example, buyer had property scanned by reputable company for an oil tank that found an anomaly (possible oil tank). Seller has a different reputable company scan that says “definitively no tank.” Buyer says sorry, not happy with that, etc.

Not to mention inspection means a lot more than just home inspection…scan for oil tank, scope of drain tiles, confirmation of property boundaries (survey), record from local authorities, septic systems, well, issues associated with archaeological sites, etc.

Inspections also can’t confirm presence of mold, or not, asbestos content, or not, etc., and realistically no seller is going to allow a bunch of samples from their home to be sent of for asbestos testing.

You would be surprised with what I see on the frontlines every day.

It is going to be interesting if there are zero avenues to differentiate a serious buyer from a tire kicker and there is a huge difference between tire kicking a pre-sale versus a privately owned property, imo. Pre-sale buyer walks away, developer simply re-markets it for the same price as pre-sales don’t go over asking price and off you go.

Assuming 20% down, 25 year mortgage, your buying power falls 16%, for the same monthly mortgage payment.

This would likely lead to lower prices, but likely a price fall less than 16%. For example, for people paying all cash, there is no change of buying power. If prices only drop 8%, and the first time buyer has lost 16% buying power, the first time buyer affordability has worsened compared to the big down payment buyer. Interest rate increases hit FTB the hardest.

The legislation would be meaningless if it did not void such a clause. Would the existing condo pre-sale cooling off period mean anything if the developer got to keep the deposit?

Consumer protections are a good idea, and are especially needed in this house buying frenzy. Yes, let them inspect it and walkaway if there are material problems found.

The seller could protect his interests by having a professional inspection done himself pre sale, and showing it to prospective buyers. If he did that, the law could be that the buyers inspection would need to differ materially from the inspection he saw before buying it. But if the pre-sale inspection described a roof problem, the buyer can’t walk away with an inspection showing that roof problem.

Could encourage more people to sell unrepresented. Would it apply to them?

Other than trolling sellers I don’t see what the purpose would be in throwing out a huge offer on a place you don’t intend to buy (and then presumably paying for an inspection too).

I would like to see how that would play out in court. But, my feeling is that the buyer must have reasonable claim/s to back out of the deal with out penalties beside siting cold feet.

It is totally different. You almost never have bidding wars on pre-sales condos and you are backing out of a deal with a sophisticated seller (the developer).

I personally like the 7 day recession period for presale condos, could be a total disaster for re-sales depending on how it is implemented.

Or it may encourage people to throw out dumb numbers and then just collapse the offer.

I wonder if one way to get around it will be to write in the deposit is non-refundable even if the buyer exercises to cooling off period to abort.

Fortunately Leo’s solve that math problem already with his affordability graphs.

Definitely. Totally different strategy required.

That said, right now buyers have a number of levers they can employ to get their bids accepted. They can waive financing, waive inspection, bigger deposit, go totally unconditional. When conditions are no longer a lever to be employed, the only lever is price and it may encourage higher offers as the way to compete.

Certainly if anyone is hoping this will bring down prices they will be disappointed. But it’s worth investigating merely from the consumer protection standpoint. One would suspect the market will be cooling off by itself around that time and government can pat themselves on the back for that too.

defi is the internet in the 90s. Lots of people buying into something they know nothing about.

Which one is Amazon, and which one is Pets.com, we’ll have to wait to find out.

Did it have any significant effect in the pre sale condo space?

I think it may affect blind bidding, but not much else.

Could be. Whether or not crypto or defi has utility doesn’t mean anything about the value of bitcoin or ethereum or dogecoin which is what people are actually betting on.

This cooling off period could be a game changer in how real estate is bought and sold in BC.

I believe the reference was to hyper inflation, which means you add a zero to prices in a short time, i.e. in an order of months. No I don’t think we’re going to get that. Indeed I think it’s unlikely we’ll even get to circa 1980 inflation because central banks will act sooner, knowing the past outcome. And that means higher interest rates.

As far as wages go, I do understand there is some upward pressure in minimum wage jobs. But these are not the people buying real estate.

Here’s a math problem. Let’s say that due to increased inflation mortgage rates go from 2% to 4%, and annual wage increases go from 2% to 4%. So real mortgage rates stay the same and real wages stay the same. What does that do to buying power?

Fair enough. I think of cryptos like collectibles, similar to baseball cards, with no intrinsic value. I think they will rise in price until governments inevitably put a stop to it, like they did to gold by outlawing private ownership of gold in 1933 in the USA. https://en.wikipedia.org/wiki/Executive_Order_6102

This is from https://www.michaeljamesonmoney.com, a nice resource for calm and sober reflections on investing. If people pinned this up on their fridge there might be a few less headless chickens running around open houses.

His investments were primarily in vanilla equity ETFs and 20% fixed income.

@Patrick

What I mean is that government back banks and banks except gold, and the same can’t be said for cryptocurrencies.

Rescind period protect buyers from misrepresent information/materials and perhaps eliminate curbs bidding wars, but doesn’t protect the buyer from cold feet. And, sellers can always ask for higher deposit to protect them from remorse buyers.

Not sure what you are referring to, but there is no currency anywhere convertible to gold. Are you referring to gold reserves? Other than that, I don’t know what t means to say that a government is backing gold.

https://twitter.com/RobShaw_BC/status/1456336545846202389

Fiat currencies and gold are back by governments, and cryptocurrencies backed by no one or failed states. Until a government with credibility backed it own digital currency then at that time we may have a legitimacy digital currency that hold value. Otherwise all cryptocurrencies at the moment are speculative ponzi schemes and only worth money while the scheme is still running, but will worth nothing when it reach its end of life.

Not long ago you disagreed with me when I said that we will see high inflation/hyper inflation due to money printing, and now once again you are saying that wages are not going up. But, here we are looking at 4.4% inflation rate that is doubling the past couple of decades average, and entry level dishwashers are getting $50K a year salary.

Not sure why you think limiting the supply makes it collapse. With fiat currencies it is OVER supply by money printing that makes them collapse. Limiting supply makes the price rise, as it has for gold for rhe last 2,000+ years.

Not sure why that is significant, because money also has no yield. If you’re getting a yield on money, you have transferred ownership to someone else who promises to repay you + a yield. That” yield” does exist for Bitcoin where you can lend it out for interest, and there are funds and many Bitcoin investors that do exactly that.

The returns to those selling bitcoin come solely from those buying bitcoin. That’s a ponzi scheme by definition.

@Former Landlord: While I am not a fan of bitcoin (although to me it’s a mind blowing technical masterpiece), I think you are incorrect about their being no incentive for miners to keep the system going. Transaction blocks will still need to be confirmed and fees will be distributed for that. But I think no one really knows what will happen. I’d agree that it’s insanely risky, but ponzi scheme? No way. Here’s a good resource discussing what might happen when they run out: https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/

Bitcoin is designed to collapse on itself, since at some point no more bitcoins can be mined and there will be no incentive for miners to keep the system going. They would have to switch to a model in which they charge transaction fees making it less efficient system. This would probably result in less competition and a single entity taking control of it, turning it into a centralized system with no added value to existing money systems.

This is still a long way away so everyone is trying to ride it on the way up and get out before it collapses like all ponzi schemes are designed.

Not really familiar with how other cryptocurrencies are designed so there may be better designed ones out there. Inherently they are either centralized or decentralized. And for the decentralized ones there has to be some incentive for administrators built in to keep it going. I doubt anyone has come of with an incentive scheme that will last forever without debasing the value of the currency.

I’m not sure that crypto is a decentralized ponzi scheme. It is a radical shift from our current monetary system and outside of government regulation which can’t be the case forever. I found this podcast interesting as an introduction, whatever other critiques there may be: https://podcasts.podinstall.com/sam-harris-making-sense-sam-harris/202109010111-259-reckoning-come.html

Wonder where they will build once Langford is full.

True. Should have said chasing returns.

Crypto is a decentralized ponzi scheme there is no doubt about it. That doesn’t mean it won’t deliver years of outsized returns, it’s just not for me.

True. Although with all this money printing, currencies (cash) share many of the attributes of ponzi schemes.

You can eliminate much of that risk by buying Canadian based bitcoin ETF shares – trades like any other stock. Like BTCX.U The portfolio manager is Gemini (owned by Winklevoss twins, as seen in the movie “Social Network”) and it’s audited by Ernst and Young. Only 0.4% MER fee, so you’d get about the same returns as the nerd next door holding bitcoin in a cold wallet.

I have no interest in cryptocurrency, however I’m afraid I may be missing the boat. At my age that ship has sailed and I’ll leave that “asset” class to the tech savvy. My biggest fear is loosing the “money” to some glitch in the system or being hacked. One should ask themselves: Would I accept an offer on my house in bitcoin? I wouldn’t.

History isn’t repeating itself. The 70s and early 80s had rapidly increasing household incomes due to wage settlements outpacing inflation and the transition from one to two income earners. Plus at the start of the runup in the late 60s you had better affordability at higher interest rates, and much lower household debt relative to incomes.

Crypto has no yield. People have given up on yield and moved on to pure speculation,or ponzi schemes if you want to be less polite.

I guess I was wrong, there is a lot of land in Canada, so long as you want to pay $38 for a head of lettuce. Think people.

Thanks Marko. I think your comments will help the whole developers’ space a lot.. They will not stop building as there is profit to be made. On the site note, Would you say the return of capital is better if you where building infills? ( NOT in Victoria)

Interest might go up, but for now I just saw True North advertised 5 year variable at 1.09% that not going to help driving down housing price.

This is a generic floorplan that was also used a lot in the Westhills. There is no reason there should be a huge supply crunch on a simple house in the middle of no where that could be mass built in a factory and popped onto a foundation on a 3,000 sq/ft lot. Problem is all the red tape at various levels of government prevents this.

Re: land not readily available – thetruesize.com is a great way to visualize that

5 years ago I mentioned that people should look at SFH in Sooke if they couldn’t afford to purchase a SFH in the core. A starter home can be had for less than $400K, and $450k would easily get one into a new house, but many people on this board was insulted that I suggested such an absurd idea.

Now, suddenly a small 1 bedroom condo that costs more became a great deal with no oppositions.

Vancouver island 31,285 km², population 846,278.

Germany + France = 990,120 km², combine population is 159.63 million.

And, BC land area is 944,735 km² with a population of 5.1 million.

To me housing is expensive because of NIMBY policies, green initiatives, and excessive amount of money printing.

If history repeat it self it could take more than a decade of inflation, run away housing price, and rising interest rates like the 70s to early 80s before the housing market tank.

15 days ago there were some ok opportunities but is has dried up. You have some units at the Mod for $419,900+GST.

A1 floorplan at https://nestbychard.com/floorplans/ at $426,900+50k for parking. (this was 2 weeks ago, not sure if they have parking left).

This isn’t too bad, but no parking and completion next year (too soon for me) https://www.realtor.ca/real-estate/23662442/205-369-tyee-rd-victoria-victoria-west

I ended up buying a one bedroom at Pacific House in Esquimalt.

Problem is when there is an ok buy most people hestiate and the opportunity slips. Post from someone on Vibrant Victoria today regarding the Pearl Project which at one point has 1 bedroom units with parking for $411k…..and no prices aren’t still around the same now that the project is under construction.

Makes sense Marko.

Prices are very high but it’s also worth considering that they are high everywhere. Equities, bonds, real estate, valuations on everything is pointing to lower future returns but at the same time inflation is high so sitting in cash also doesn’t seem a great plan. Understandable why people are going nuts speculating in crypto, it’s just a desperate search for yield.

I think we’re setting up for a long grinding stagnation in all kinds of investments, but who knows that could come next year or not for a few more.

Everyone brings these points up, but other than losing your job everything applies to a re-sale as well? The only advantage to buying a re-sale and losing your job in three years versus buying a pre-sale a losing your job in three years prior to completion is you are pencilled in for a mortgage and you don’t need to qualify at time of job loss, but you still have to make the payments.

I’ve personally bought 10 pre-sales in Victoria, 2 in Croatia and every single unit has been delivered how I expected it, or much better. There are strategies to avoid disappointment you can implement. For example, don’t buy below a transitional floor (where the layouts above you change) as that increases the risk of bulkheads, etc. Tons of other things to look for. Here is a video I made this summer of what I look for in Croatia when I am buying pre-sales to avoid disappointment on completion -> https://www.youtube.com/watch?v=c-7W-Z4cpa0&t In Victoria I look for other things.

Having been involved in 100s of pre-sales with clients this is the absolute worst case scenario I’ve seen in my career. My client bought a pre-sale condo downtown Victoria in 2016 for $289,900. 500 sq/ft with a 40 sq/ft balcony. In 2018 we received a letter that the developer, due to arcitechtual issues, has to eliminate the balcony for the unit. The developer offered my client to return the deposit; however, the problem was the market had appreciated where it didn’t make sense to take the deposit back. My client decided to complete on the unit, opted not to sue the developer, and we sold the unit for $369k completed with no balcony. So my client was royally screwed over by the developer, but it still ended up okay.

Beyond that I don’t have any nightmare stories and and I am guessing this is on a sample size of 150 to 200 pre-sale transactions.

Expect massive completion/possession delays, but I love delays personally as statistically allows more time for market appreciation. If you are buying something to live in the huge delays are a pain. When I buy pre-sales on of the factors for me is which one will take the longest (longer the better).

2 I’ve re-adjusted my expectations on only buying cash flow positive pre-sales. For the time being I am willing to consider cash flow neutral or slightly cash flow negative. Reason behind this is at these interest rates it is getting a little ridiculous not to factor in principal repayment.

Run the numbers on principal repayment between 1.3% and 3%, it is a massive difference. When interest rates go back-up again, I won’t accept cash flow neutral anymore, but for the time being I will.

You are 100% correctly quoting me. A lot of factors changed but I’ll go through a couple of them.

Condo medians VREB

March – $486,250

April – $489,000

May – $478,000

June – 485,000

Jul – $484,950

Aug – $482,500

Sept – $517,900

October – $545,895

You’ll note in my video I made this spring were I wasn’t buying pre-sales as they were not at a discount compared to tangible product, often more expensive. Also, of note is unlike Vancouver, even in the hottest of hot markets pre-sales in Victoria typical don’t sell out in a day or a week. It takes a year or longer even in a hot market. Developers slowly trickle up the pre-sale prices over the course of the one- or two-year sales process. They aren’t changing prices on a weekly basis.

So, I pulled the trigger on a pre-sale last week as there were a few pre-sales out there in-line with March-August (developers had not adjusted their prices yet) re-sale tangible prices; however, the market went up 13% so I felt I was able to pick something up slight lower than current tangible market.

“land is not readily available”

Fact checks:

England -area: 130k km2, population 56M,

France – area: 632K km2, population 67M,

Canada – area: 9900k km2 population 38M,

Umm… Really we were probably one more lost offer away from moving out of this Province or spiralling into a pretty terrible mental state, we were mostly there already after househunting throughout this awful year and losing bids on previous places and having gone through a renoviction. Felt like a huge chasm between us and our homeowner peers grew wider every week and we needed to be on the other side.

We’ve been in our new home for 2m now and I’m just starting to feel happy about it, the first bit of time here was just relief we were no longer looking. I hope you find something and are able to stay but it’s terrible out there.

No, because they physically exist and your financing parameters are set at the time you make the commitment to buy.

Sure prices can go down or interest rates can go up after you buy any property. But as I pointed out, changing parameters on a pre-sale can put you in the position of being unable to close.

So assuming I am buying a pre-sale and understand the risks (and I do while balancing the many positives that I mentioned) which projects in Victoria would you look at?

Am I missing something?

“Prices might go down. Or, interest rates might go up, or you lose your job, or you need a bigger DP (see first sentence), but you are still required to close and the developer will sue the pants off you if you don’t.

Also the sales contract is often full of loopholes that allow the developer to cut corners that you didn’t expect.

It’s called offloading risk. From the developer to you.”

Is that not true with real estate investment properties generally? You may buy a lemon of a houseor prices could crash or rates could go up or you could lose a tenant or you could lose your job. I mean there are risks with doing nothing, too.

This whole situation with housing makes me nauseous and sad at times. We bought in April. It felt good at the time. Some days I’m happy but lately quite upset when I see families like ours having to look to other pastures and potentially relocate. Great people who I would like to have as my neighbors and add value to our communities.

Bummed

I’m not going to lie Cad, it’s rough.. lol.. I reviewed my 2 offers I made in the summer trying to see where I could have done something else, but it came down to there was no way I could have guessed what the winning bids were because they were so random. For the one we went 117k over ask and the other winner was 135k over ask. Now I look, and things are just hysterical. I believe the last stage is acceptance…lol… I am going to roll my downpayment that I have been holding in quick cash positions into investments and fully focus on finding work elsewhere and relocate the family.

Patrick- You are correct, demand for housing in developed countries around the world is insane. The explanation may be simple- mass migration. Millions of people from war torn, impoverished countries and climate change making highly populated areas uninhabitable, are fleeing out of necessity. Billions live in unsanitary shanty towns where protection from the elements is not as crucial as in northern regions. To survive in Canada requires a weatherproof structure and a source of reliable heat. This is not cheap and the land is not readily available, let alone the investment to service new areas. We should be thankful for what we have and realize we cannot accommodate hundreds of million of people. It still wouldn’t make a dent if we could. All these world leaders gathering to fight climate change and not one mention of overpopulation. I just don’t get it.

https://nationalpost.com/news/world/zillow-shuts-home-flipping-business-as-pricing-algorithms-overpay-and-cause-big-losses

This is an interesting event to watch from several perspectives:

Prices might go down. Or, interest rates might go up, or you lose your job, or you need a bigger DP (see first sentence), but you are still required to close and the developer will sue the pants off you if you don’t.

Also the sales contract is often full of loopholes that allow the developer to cut corners that you didn’t expect.

It’s called offloading risk. From the developer to you.

Personally, I am moving some of my sideline cash into another pre-sale purchase.

I feel like this should be immediately followed by: kids don’t try this at home, you are not Marko Juras

Why not?

Buying a pre-sale is not a bad way to invest in real estate. You avoid the bidding wars – it’s take it or leave it and maybe get some extras like premium flooring. You don’t need a home inspection or make an unconditional offer without one. You get a brand new property upon completion with warranty.

You have the time to get your ducks in a row to arrange for a downpayment etc. You don’t need to get a tenant right away or pay property taxes/strata right away. You don’t have a mortgage showing on your finances right away.

You still get leverage to a rising market. If it falls, you can hold on, complete the sale and wait and rent out a brand new unit.

Am I missing something?

What projects are people here buying pre-sales in? I have been looking at the Pearl myself but haven’t pulled the trigger. Bought two pre-sales in Vancouver and the surrounding suburbs a year ago but could be persuaded to buy a Victoria pre-sale for my next purchase.

The real estate insanity 2020-21 is a global phenomenon, not just in Victoria or Canada for that matter. It is seen in most of the developed world, Europe, Asia, the Americas etc. While it is tempting to look at local issues (“people are realizing how awesome it is here”), it seems that bigger forces are in play. For example, Sudbury prices are up 38% YOY, (perhaps more for houses with a nice view of the smelter) and many other places up more than Victoria – Turkey, New Zealand, South Korea, Paris, Rome, Berlin to name a few.

Noone saw this coming, or knows why it happened. Lowered interest rates and money printing are main theories. Implication here without fundamental reasons for the price rises, there could be falling prices just as easily.

It’s hard to imagine, but if Victoria prices were to simply fall back to January 2020 levels that’s about a 35% drop from here. With inflation at 4%, interest rates should be 6%. Mentioning those types of numbers is usually described as “trying to scare people”.

Seems like something broken in global housing market as described in this np article. https://financialpost.com/news/economy/the-global-housing-market-is-broken-and-its-dividing-entire-countries

Deadline for filing was just pushed back by a year. Ridiculous

1021 Gala Crt: 3 bed 3 bath house on a 3000 sq ft lot in happy valley just sold for $953,000! And I was upset about these crossing the 750k line last year, now they are pushing 1 million? Is this a 953k house? Cool loft but nothing else about this stands out. How awful, I definitely have survivors syndrome and feel for anyone looking to buy right now.

I might be mistaken but there seems to be only about 250 SFH for sale in greater Victoria. I know it is November but not exactly a huge selection.

What I mean is that Helps (and other local politicians) might be more likely to push through a massive, controversial re-zoning if she’s not running again. I think a similar thing happened in recent years in Van.

You may not like Helps but many of her potential replacements are far more NIMBY than she is. Helps has been one of the consistently more pro-development voices on the current council.

Long term I think the initiative will add some good townhouse/duplex etc options in CoV neighbourhoods. Conditions are ripe for an initiative like this to gain support. Lisa Helps not running for re-election doesn’t hurt. But it will be gradual/slow. If I was a prospective buyer, I wouldn’t sit around waiting for this. Things like interest rates and the economy will have a much bigger impact on prices.

I feel like this should be immediately followed by: kids don’t try this at home, you are not Marko Juras

I don’t think this market fully appreciates what $100 oil and $12 natgas is going to do to the cost of living – most obviously transportation & heating.

These are the input costs that go into everything… including fertilizer production for growing food, etc.

This, combined with a historic supply chain crunch that’s artificially limiting supply for virtually everything else is in my view setting up a perfect storm for a recession.

There comes a point where prices simply get rejected.

*pre sales, not presages.

Marko funny to hear you are looking at pre sales again… just today I was perusing a couple and a voice in my head said “yeah but Marlo on HHV keeps talking about how there are no deals in presages any more.” Haha, true story. Sorry if I’m misquoting you, but haven’t you been down on them in several recent comments? If you don’t mind, what’s changed for you since writing that? And which developments are you looking at? I like the townhouses on Washington. Overlooked area for obvious reasons, and a new/unknown developer. Not sure.

Cheers

I’ll try to join. For me it comes down to a simple thing: is it just as easy or easier to build the missing middle as the single family house. That should be the criteria

The tenants I had with pets were the best tenants I ever had. They were so grateful to have a place with their 2 big dogs, that they did most of the maintenance on the house themselves the 4 years the rented from us.

Just factor in that you will need to fix some things between tenants and you could end up with great tenants. However, in the current environment it sounds like landlords already have great choice.

If you don’t do that, you won’t find a place. It’s that hard. You just have to apply and show them a picture of your adorable cat and hope they make an exception.

On the spectrum of a Mazda 3 to a Dodge Ram they drive something much closer to the Mazda. Your screening Q’s were great, thank you for sharing them it was easy to remove applicants for not answering them

The anti mask drove a Bronco

Personally, I am moving some of my sideline cash into another pre-sale purchase. I am betting on sustained very high immigration numbers and municipalities not getting their shit together for the next 15-25 yrs and inventory being severely restricted and extremely expensive to actually build anything.

If the market does slow down because of rising interest rates new construction will collapse due to the fixed red tape and supply will be restricted yet again within a couple of years. In my opinion, there is no appetite to solve the housing crisis with tangible solutions. It’s all political posturing non-sense…….perfect example being the City of Victoria Missing Middle Initiative. I would be willing to bet $ that we don’t see a physical product as a result of this “initiative” in the next 5 years.

BC Government no better, agenda just seems to be created more non-sense so they can hire more public servants…wasn’t the Land Owner Transparency Registry suppose to do something? Prices up 25% since it was implemented. Can’t wait for the next idea/another department to oversee the idea.

What model of car does the tenant drive? 🙂

+1, I’ve developed my own over the years just based on experiences…like for example, I’ve had several tenants forgot to set up BC Hydro a few times so I’ve added a term about that in the addendum, etc.

Tenant agrees not to smoke in the unit (the entire building is a non-smoking building).

Tenant agrees that he or she does not have any pets and will not acquire any pets during the length of the tenancy.

Tenant agrees not to grow or smoke cannabis products inside the unit.

Tenant agrees to set up electricity account (BC Hydro) starting……….

etc..etc..

and then I have the tenant sign the addedum with all the additional terms. It isn’t bulletproof by any means, but just another layer.

Our experience renting our suite was exciting and stressful. Now that we’re on the other side and have a tenant I do not have regrets about not using a property manager, but I definitely would have paid Marko $200 to vet applicants when we posted the ad, that was the hardest part.

Posting on used Vic and student focused websites was a bust. We got a ton of applications after listing the ad on Facebook marketplace.

Facebook marketplace is a pain to deal with, you cannot list an email within the ad, so it was a lot of vetting over messenger or providing email by DM. What’s great about Facebook though is you get to see their public posts and reach your own conclusions about suitability.

Only met a handful in-person and a few via Zoom; I was surprised one showed up without a mask, 1.5yrs into the pandemic. And also surprised how many people with pets applied to a no-pets ad but I guess these are extra hard times if you have an animal.

I joined Landlord BC on advice, it was $200 and I found out their application etc forms cannot be pre-filled and then saved / emailed as they are protected docs, so I was a bit peeved about that. Ended up using the prov. Government forms which are better IMO and less snarky / slumlord. We wrote our own addendums. Maybe my membership will come in handy if we run into issues later but for the time being it has not been an asset.

Ad was up for about a week, listed a bit below market rent. We got 90 replies, signed the best one. Wish me luck

Probably makes sense for many, but most things can be done remotely now. I self-managed our place that was 600km away.

“My neighbours daughter, a very nice young lady, has decided that her solution to the housing crisis is to marry rich. Wedding is next summer but they just bought a house in the Uplands. Maybe not a bad place for a starter home?”

‘

‘

We looked around in the Uplands before we bought in late 2020 but found that a lot of the homes were very dated or tear downs, we found the sun exposure later in day was poor due to east facing slope and who wants to look after a 1/2 acre lot.

Leo, would love for you to ask some questions tomorrow -> https://www.eventbrite.ca/e/ask-a-planner-session-two-victorias-missing-middle-housing-initiative-tickets-190535214957

“ We’ve never used a property manager”

makes sense if you live 2000 km away from the property! Frank is in MB I believe.

We’ve never used a property manager. For 10% of the rents I’d rather manage myself as it more than pays for any maintenance or repairs required.

Right now all you need to do is post your listing for a few hours and turn it off to rent it. You’ll have at least five qualified applicants. Set a two-hour window to show. Vet those who apply and offer. Whole process including condition inspection takes about five hours. Chances are that you will only have to do this once every 2-3 years.

Property management scope is also limited. They typically don’t oversee appliance replacement or major repairs for the 10% fee so you still have to do these things anyway.

If you are not comfortable with the rental process might be worth it. I’ve often thought property management seems like a good business to be in given the return for effort.

My neighbours daughter, a very nice young lady, has decided that her solution to the housing crisis is to marry rich. Wedding is next summer but they just bought a house in the Uplands. Maybe not a bad place for a starter home?

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-pay-attention-to-the-bond-markets-tantrum/

Is the 40 year party of declining rates finally over?

My tenant gave notice yesterday, hope my property manager can handle the onslaught of inquiries. This is when having one is worth every penny of their fees.

VREB stats, October 2021 Benchmark Price, Greater Victoria:

$1,021,400 – SFH

$741,400 – Townhouse

$540,000 – Condo

https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf